DEF 14A: Definitive proxy statements

Published on March 21, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant o

|

Check the appropriate box:

|

o

|

Preliminary Proxy Statement.

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

|

|

☒

|

Definitive Proxy Statement.

|

|

o

|

Definitive Additional Materials.

|

|

o

|

Soliciting Material Pursuant to §240.14a-12.

|

AXALTA COATING SYSTEMS LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(6)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(7)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(8)

|

Filing Party:

|

|

|

|

|

|

|

(9)

|

Date Filed:

|

|

|

|

|

Notice of 2019 Annual General Meeting

of Members and Proxy Statement

Axalta Coating Systems Ltd.

Wednesday, May 1, 2019 at 1:00 p.m., local time

Convene, 2001 Market Street, 2nd Floor, Philadelphia, PA 19103

|

Axalta Coating Systems Ltd.

|

|

|

Two Commerce Square

|

|

|

2001 Market Street, Suite 3600

|

|

|

Philadelphia, PA 19103

March 21, 2019 |

|

|

|

|

In 2019, we will continue to focus on profitability, improving operating execution, and increased accountability across the company, while delivering on our four strategic imperatives: people, innovation, growth and performance. |

Dear Fellow Shareholder:

Axalta continued to perform as a global leader in the coatings industry in 2018. Our overall financial results for the year reflected strong execution by our team despite headwinds from inflation, foreign exchange and the automotive markets. Our company continues to demonstrate strength and the ability to grow even in challenging market conditions. In 2018, we introduced over 250 new products across Axalta, beating our target for the third year in a row. To ensure we continue to deliver innovative new products that our customers demand, we officially opened the Axalta Global Innovation Center (GIC) in November – the world’s largest R&D center dedicated to coatings and color. Each of our business segments are serviced from the GIC, and we remain more committed than ever to delivering new products such as Cromax® EZ, Imron® 3.5 and Eleglas™, which were all major product launches for Axalta in 2018. In 2019, we will continue to focus on profitability, improving operating execution, and increased accountability across the company, while delivering on our four strategic imperatives: people, innovation, growth and performance. We expect another successful year for Axalta. You are cordially invited to learn more about our business and progress on our strategic plan at our 2019 Annual General Meeting of Members to be held on Wednesday, May 1, 2019 at 1:00 p.m., local time, at Convene, 2001 Market Street, 2nd Floor, Philadelphia, PA 19103. You will find information regarding the matters to be voted upon in the attached Notice of the 2019 Annual General Meeting and Proxy Statement. We are sending our shareholders, referred to as members under Bermuda law, a notice regarding the availability of this Proxy Statement, our 2018 Annual Report to Members and other proxy materials via the Internet. This electronic process gives you fast, convenient access to the materials and reduces the impact on the environment and our printing and mailing costs. You may request a paper copy of these materials using one of the methods described in the Notice. Whether or not you attend in person, it is important that your common shares be represented and voted at the Annual General Meeting. Please follow the voting instructions provided in the Notice of Internet Availability of Proxy Materials. If you requested printed versions by mail, these printed proxy materials also include the proxy card or voting instruction form for the Annual General Meeting. You are, of course, welcome to attend the Annual General Meeting and vote in person, even if you have previously returned your proxy card or voted over the Internet or by telephone. |

|

|

Sincerely,

|

|

|

|

|

|

|

|

Charles W. Shaver

Chairman of the Board |

Robert W. Bryant

Chief Executive Officer |

AXALTA COATING SYSTEMS LTD.

Two Commerce Square

2001 Market Street, Suite 3600

Philadelphia, PA 19103

|

|

|

Notice of 2019 Annual General Meeting

|

|

|

| Time and Date: | Place: |

| 1:00 p.m., local time, on Wednesday, May 1, 2019 | Convene, 2001 Market Street, 2nd Floor, Philadelphia, PA 19103 |

Who Can Vote:

Only holders of our common shares at the close of business on March 8, 2019, the record date, will be entitled to receive notice of, and to vote at, the Annual General Meeting.

Annual Report:

Our 2018 Annual Report to Members accompanies but is not part of this Proxy Statement.

Proxy Voting:

Your Vote is Important. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card or voting instruction form will save the Company the expenses and extra work of additional solicitation. If you wish to vote by mail, for those receiving printed copies of the proxy materials we have enclosed an envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option. You may revoke your proxy at any time before it is voted by delivering to the Company a subsequently executed proxy or a written notice of revocation or by voting in person at the Annual General Meeting.

Items of Business:

| • | To elect two Class II directors for terms ending at the 2021 Annual General Meeting of Members; |

| • | To appoint PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2020 Annual General Meeting of Members and to delegate authority to the Board of Directors of the Company, acting through the Audit Committee, to set the terms and remuneration thereof; |

| • | To approve, on a non-binding advisory basis, the compensation paid to our named executive officers; and |

| • | To transact any other business that may properly come before the Annual General Meeting. |

Date of Mailing:

A Notice of Internet Availability of Proxy Materials or this Proxy Statement is first being mailed to shareholders on or about March 21, 2019.

BY ORDER OF THE BOARD OF DIRECTORS,

|

Sincerely,

|

|

|

|

|

Tabitha R. Oman

|

Jared T. Zane

|

|

Vice President, Interim General Counsel &

Chief Compliance Officer |

Deputy General Counsel & Interim Corporate Secretary

|

|

March 21, 2019

|

|

This proxy statement (this Proxy Statement) and accompanying proxy materials are being furnished to the shareholders (referred to herein as shareholders or members) of Axalta Coating Systems Ltd., a Bermuda exempted company (the Company or Axalta), in connection with the solicitation of proxies by the board of directors of the Company (the Board or the Board of Directors) for use at the 2019 Annual General Meeting of Members, and at any adjournment or postponement thereof (the Annual Meeting), for the purposes set forth in the accompanying Notice of 2019 Annual General Meeting. This summary highlights information contained elsewhere in this Proxy Statement and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. For more complete information about these topics, please review the Company’s complete Proxy Statement and Annual Report on Form 10-K. Please also see the Questions and Answers section beginning on page 66 for important information about proxy materials, voting, the Annual Meeting, Company documents and communications.

|

2019 Annual General Meeting

|

|||

|

Date:

|

Wednesday, May 1, 2019

|

Place:

|

Convene

|

|

Time:

|

1:00 p.m., local time

|

|

2001 Market Street, 2nd Floor

|

|

Record Date:

|

March 8, 2019

|

|

Philadelphia, PA 19103

|

|

Proposals

|

Board

Recommendation |

||

|

1

|

Election of two Class II directors to serve until the 2021 Annual General Meeting of Members

|

FOR ☑

|

|

|

|

|||

|

•

|

Both of the Class II nominees bring significant experience and skills relevant to leadership of the Company.

|

||

|

|

|||

|

•

|

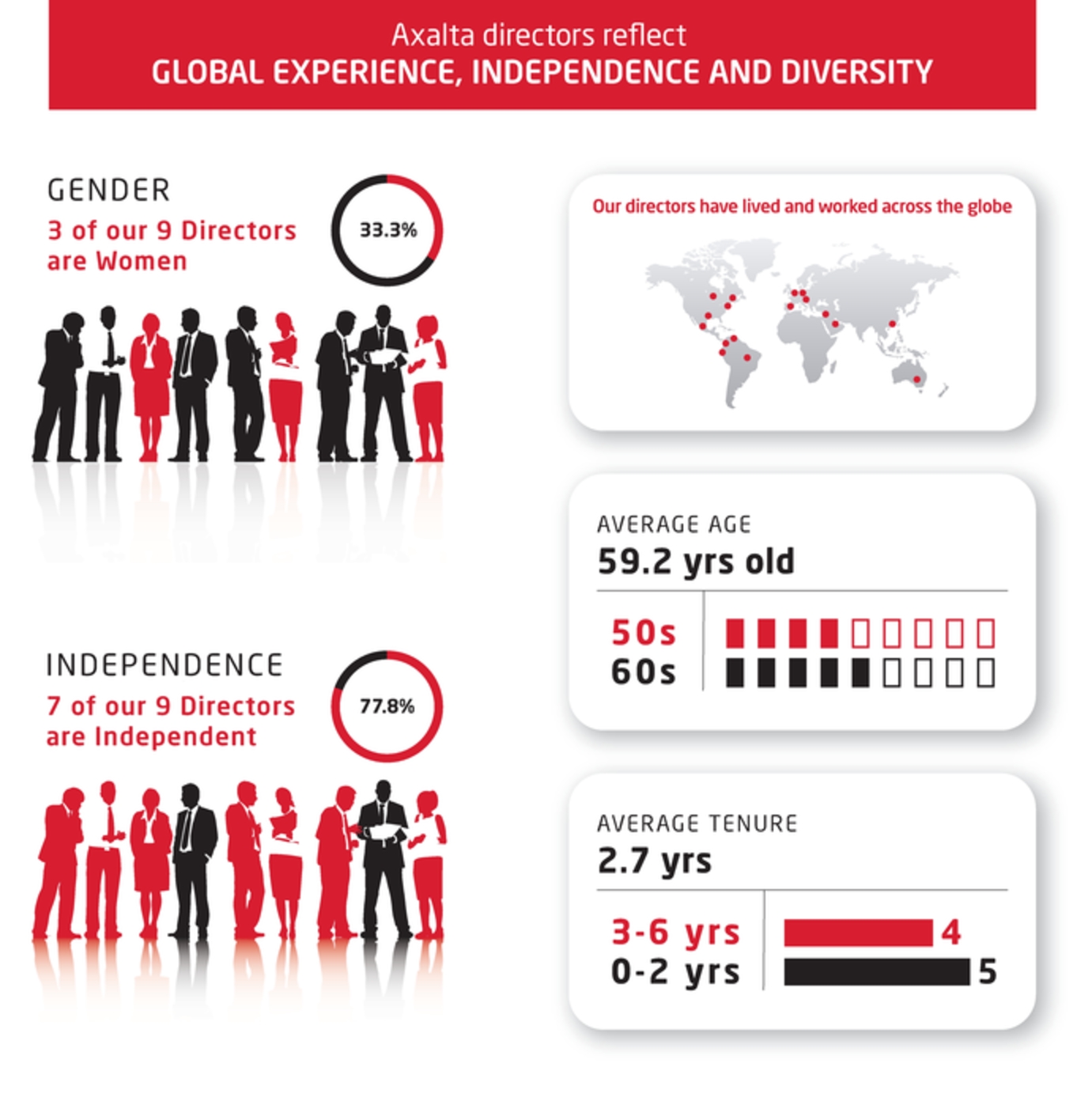

Seven of our nine directors are independent, including both Class II nominees.

|

||

|

|

|||

|

•

|

Our Board’s strong commitment to ethical behavior, corporate governance and business conduct is evidenced by the developments overseen by the Board during the last six years.

|

||

|

|

|||

|

|

|||

|

2

|

Appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2020 Annual General Meeting of Members and delegation of authority to the Board, acting through the Audit Committee, to set the terms and remuneration thereof

|

FOR ☑

|

|

|

|

|||

|

•

|

Independent firm.

|

||

|

|

|||

|

•

|

Significant industry and financial reporting expertise.

|

||

|

|

|||

|

|

|||

|

3

|

Non-binding advisory vote to approve the compensation paid to our named executive officers

|

FOR ☑

|

|

|

|

|||

|

•

|

Strong commitment to align executive pay with Company performance on short- and long-term bases.

|

||

|

|

|||

|

•

|

Oversight of program by independent Compensation Committee with assistance of independent compensation consultant.

|

||

|

|

|||

|

See page 33 for more information

|

|||

|

|

|

|

2019 PROXY STATEMENT

|

1

|

|

|

|

PROXY SUMMARY

|

Name

|

Age

|

Occupation

|

Committees or

Leadership Roles |

Other Public

Company Boards |

|

|

Class II Director Nominees

|

|||||

|

Deborah J. Kissire

|

61

|

Retired accounting firm partner

|

•

|

Compensation

|

2

|

|

|

|

|

•

|

Nominating & Corporate Governance (Chair)

|

|

|

|

|||||

|

Elizabeth C. Lempres

|

58

|

Retired consulting firm partner

|

•

|

Compensation (Chair)

|

1

|

|

|

|

|

•

|

Nominating & Corporate Governance

|

|

|

Class II Directors Not Continuing in Office

|

|||||

|

Andreas C. Kramvis

|

66

|

Operating Partner with AEA Investors

|

•

|

Audit

|

1

|

|

|

|

|

•

|

Environment, Health, Safety & Sustainability

|

|

|

Class I and Class III Directors Continuing in Office

|

|||||

|

Robert W. Bryant

|

50

|

Chief Executive Officer and President of Axalta

|

|

|

0

|

|

|

|||||

|

Robert M. McLaughlin

|

61

|

Retired financial executive

|

•

|

Audit (Chair)

|

1

|

|

|

|

|

•

|

Compensation

|

|

|

|

|||||

|

Samuel L. Smolik

|

65

|

Retired operations executive

|

•

|

Environment, Health, Safety & Sustainability (Chair)

|

0

|

|

|

|

|

•

|

Nominating & Corporate Governance

|

|

|

|

|||||

|

Charles W. Shaver

|

60

|

Chairman and Chief Executive Officer of Nouryon

|

•

|

Chairman of the Board

|

1

|

|

|

|||||

|

Mark Garrett

|

56

|

Chief Executive Officer of Marquard & Bahls

|

•

|

Presiding Director

|

1

|

|

|

|

•

|

Audit

|

|

|

|

|

|

|

•

|

Compensation

|

|

|

|

|

|

•

|

Environment, Health, Safety & Sustainability

|

|

|

|

|||||

|

Lori J. Ryerkerk

|

56

|

Retired operations executive

|

•

|

Audit

|

0

|

|

|

|

|

•

|

Nominating & Corporate Governance

|

|

|

|

|

|

2

|

AXALTA COATING SYSTEMS

|

|

|

|

PROXY SUMMARY

Axalta accomplished a great deal in 2018 in the face of several headwinds. Notably:

| • | Net sales were $4,670 million, up 7.3% versus 2017, driven by acquisition contribution as well as price and product mix benefits. |

| • | Net income improvement was driven by the absence of impacts from U.S. tax reform and deconsolidation of our Venezuelan operations. Adjusted EBITDA was $937 million, an increase of 5.9% versus 2017, despite incremental foreign exchange headwinds and higher inflation than planned.(1) |

| • | Incremental global pricing actions and substantial productivity gains enabled Axalta to hold margins nearly constant for the year in spite of input cost inflation and a slowdown in select coatings markets in China. |

| • | Overall strong operating cash flow of $496 million for 2018 and free cash flow(2) of $362 million. We returned $254 million to shareholders through share repurchases in 2018; in addition we deployed $110 million on M&A transactions during the year. |

| • | Our Refinish business remains a global leader and continued to gain share in 2018. Net sales growth in the |

|

|

|

|

2019 PROXY STATEMENT

|

3

|

|

|

|

PROXY SUMMARY

business was driven by strong price and product mix improvement. Our Industrial business experienced solid organic growth, benefiting from significant investment in innovation and marketing support in recent years. Also, our Transportation Coatings segment responded well to challenging market conditions.

| • | Operational highlights include progress on relocating production from our Belgium facility as well as the opening of new research technology centers and powder coatings capacity upgrades in multiple locations. |

| • | We continued our leading commitment to investment in research and development, and introduced over 250 new products across Axalta in 2018, beating our target for the third year in a row. |

| (1) | For reconciliation to GAAP, please see Reconciliation of Net Income to EBITDA and Adjusted EBITDA on pages 38-39 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission on February 26, 2019. |

| (2) | Defined as cash flow from operations plus interest proceeds from net investment hedges less capital expenditures. |

The Company is committed to meeting the highest standards of ethical behavior, corporate governance and business conduct. This commitment has led the Company to implement the following practices:

| • | Board Independence – seven of our nine directors are independent under New York Stock Exchange (NYSE) listing standards. Our Chairman (and former CEO) and our current Chief Executive Officer are the only non-independent members of our Board. In addition, all members of each Board committee are independent. |

| • | Board Diversity – our directors are committed to bringing a diverse set of perspectives and experiences to the leadership of Axalta; we currently have three female directors serving on the Board and chairing two of the Board’s standing committees. |

| • | Board Declassification – in 2018, our shareholders approved the elimination of our classified board structure over a three-year transition period, such that beginning in 2021 all directors will be elected annually. |

| • | Independent Presiding Director – in 2018, the Board appointed a Presiding Director to chair Board meetings in the Chairman’s absence, preside over executive sessions of independent directors, and be available for consultation with our shareholders. |

| • | Independent Directors Meetings – independent directors typically meet in executive sessions following each regularly scheduled Board meeting, without management or the Chairman present. |

| • | Annual Board and Committee Self-Evaluations – each year, the Nominating & Corporate Governance Committee administers self-evaluations of the Board and its committees, including an assessment of Board and committee composition and director performance. |

| • | Board Orientation and Training – new directors participate in an extensive orientation program with members of Axalta’s senior management. The Company also provides training to the Board on key governance and management topics on a regular basis by guest speakers and Company experts, as well as various corporate and governance updates throughout the year. In addition, Board members attend outside trainings on topics relevant to their Board responsibilities. |

| • | Stock Ownership Guidelines for Directors and Executive Officers – the Company has adopted stock ownership guidelines for directors and executive officers. Each of the directors and executive officers satisfies the stock ownership guidelines or is within the grace period provided by the guidelines to achieve compliance. |

| • | Succession Planning and Diversity – the Company and the Board actively engage in developing a pipeline of internal talent with differing backgrounds and experience to assume key executive positions and increase the diversity of our management. Our Compensation Committee has also reviewed an emergency succession management plan in the event that one of our key executives becomes unable or unwilling to serve. |

| • | Environment, Health, Safety & Sustainability (EHS&S) Committee – the Board maintains a standing committee responsible for the Company’s policies, performance, strategy and compliance matters related to the environment, health, safety and sustainability. |

| • | Limits on Public Company Board Service – the Board has established limits on the number of public company boards and audit committees on which our directors may serve. |

|

|

|

|

4

|

AXALTA COATING SYSTEMS

|

|

|

|

PROXY SUMMARY

We maintain several guiding principles with respect to our executive compensation, and review our compensation programs on an ongoing basis to ensure that market and regulatory best practices are considered and addressed, including:

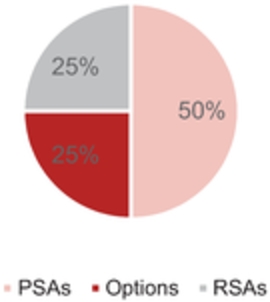

| • | Performance-Based Compensation – the Company relies heavily on performance-based compensation for executive officers, including (1) annual incentive compensation, which for 2018 incorporated increased profitability metric weighting and (2) awards of performance-based stock in 2018 tied to our total shareholder return relative to the S&P 500, which comprise approximately half of the grant date fair value of the 2018 long-term equity awards granted to executive officers. |

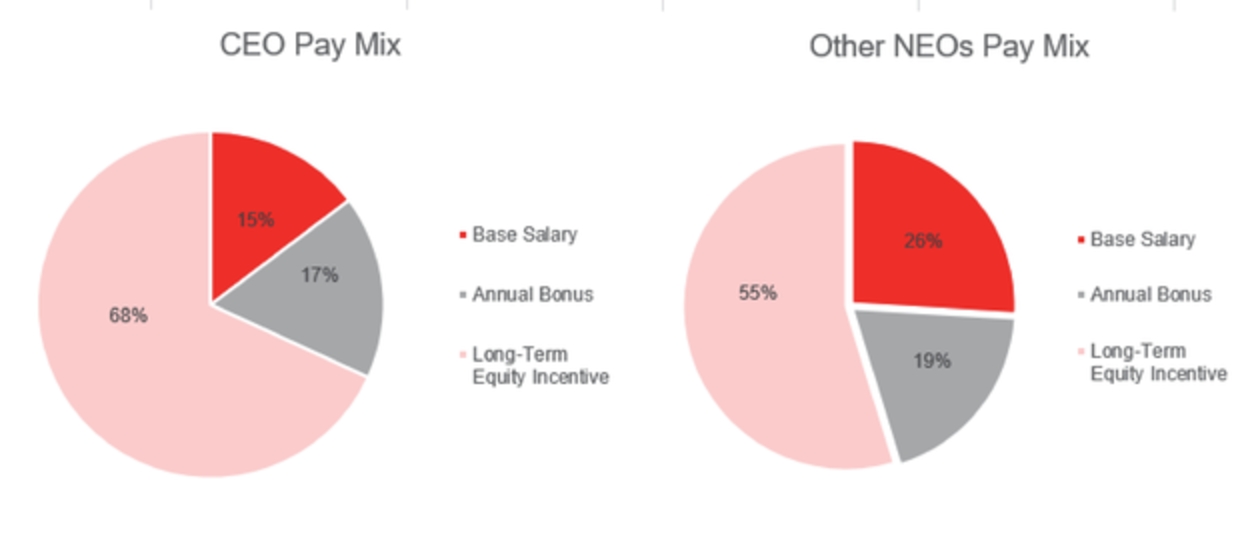

| • | Significant At-Risk Pay – 85% of our Chief Executive Officers’ pay and 74% of our other named executive officers’ pay was at risk in 2018 (i.e., annual performance-based compensation and long-term equity incentive awards). |

| • | Incentive Compensation Recoupment Policy – the Company’s clawback policy provides that the |

Compensation Committee may require reimbursement of incentive compensation awarded to an executive officer if the Company is required to restate its financial results as a result of the executive officers misconduct.

| • | Hedging and Pledging Prohibited – the Company’s insider trading policy prohibits our officers, directors and employees from pledging their common shares as collateral or engaging in hedging or short sale transactions in our common shares. |

| • | Equity Plan Design Changes – in 2018, in connection with an increase in available shares under our equity plan, we amended the plan to include minimum 12-month vesting periods (subject to certain exceptions) and prohibitions on liberal share recycling practices, option repricing and payment of dividends until the related award vests. |

| • | Double-Trigger Vesting Provisions – our equity plan provides double-trigger vesting provisions in the event of a change-in-control for long-term equity awards. |

|

|

|

|

2019 PROXY STATEMENT

|

5

|

|

|

|

|

Proposal

1 |

Election of two Class II directors to serve until the 2021 Annual General Meeting of Members

|

|

|

|

|

☑ The Board recommends a vote FOR each of the director nominees.

|

|

|

|

|

|

• Both of the Class II nominees bring significant experience and skills relevant to leadership of the Company.

|

|

|

|

|

|

• Seven of our nine directors are independent, including both Class II nominees.

|

|

|

|

|

|

• Our Board’s strong commitment to ethical behavior, corporate governance and business conduct is evidenced by the developments overseen by the Board during the last six years.

|

Our Board of Directors currently consists of nine directors divided into three classes with staggered three-year terms, so that the term of one class expires at each Annual General Meeting of Members. At our Annual General Meeting of Members in 2018 (the 2018 Annual Meeting), our shareholders approved our Second Amended and Restated Bye-laws (Bye-laws) which eliminate our classified board structure over a three-year transition period. In accordance with this transition plan, the two nominees listed below will be proposed for election as Class II directors at the Annual Meeting to serve until the Annual General Meeting of Members in 2021, or until their successors are duly elected or until the earliest of their death, resignation or removal. Information regarding our directors professional experience, education, skills, ages and other relevant information (as of March 8, 2019) is set forth below.

There are three Class II directors presently serving as directors of the Company and two of the Class II directors, Ms. Kissire and Ms. Lempres, have been nominated and have agreed to stand for reelection. Mr. Kramvis, the third Class II director, informed the Company in January 2019 that he did not intend to stand for reelection due to his other commitments and his term will end at the Annual Meeting, which will result in one vacancy in Class II. The Board has not nominated any individual to fill this vacancy at this time.

In addition, if for any reason any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that shares represented by the accompanying proxy will be voted for the election of a substitute nominee designated by our Board of Directors, or, alternatively, the Board may determine to leave the vacancy temporarily unfilled.

|

|

|

|

6

|

AXALTA COATING SYSTEMS

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

Nominees for Election as Class II Directors with Terms Expiring at the 2021 Annual General Meeting of Members

|

|

|

|

Deborah J. Kissire

|

|

|

|

|

Age: 61

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 2 years (December 2016)

• Nominating & Corporate Governance Committee (Chair) • Compensation Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Former Vice Chair and Regional Managing Partner at Ernst & Young LLP (EY), and member of the Americas Executive Board and Global Practice Group. She previously held other senior positions including Vice Chair and Regional Managing Partner for East Central and Mid-Atlantic Regions and U.S. Vice Chair of Sales and Business Development |

| • | Certified Public Accountant |

Education

| • | Bachelor’s degree in Accounting from Texas State University |

Relevant Skills

| • | Extensive experience in the financial oversight of public companies |

| • | Experience launching new business and practice areas and leading acquisitions, business unit consolidations and successful integrations |

| • | Strategic thinker and problem solver, with expertise in financial reporting, audit process, U.S. taxation, governance, mergers and acquisitions, transaction integration, diversity and inclusiveness |

Other

| • | Member of the Board of Directors of Cable One, Inc. (NYSE: CABO), a leading American cable and internet service provider |

| • | Member of the Board of Directors of Omnicom Group Inc. (NYSE: OMC), a global marketing and corporate communications holding company based in the U.S. |

| • | Inducted into the Washington Business Hall of Fame; recognized in the Washington Business Journal’s list of ‘Women Who Mean Business’; named as one of Washingtonian’s ‘150 Most Powerful People in Washington, D.C.’ and featured multiple times on Washingtonian’s list of the ‘100 Most Powerful Women in Washington, D.C.’ |

|

|

|

|

2019 PROXY STATEMENT

|

7

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

|

|

|

|

Elizabeth C. Lempres

|

|

|

|

|

Age: 58

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 1 year (April 2017)

• Compensation Committee (Chair) • Nominating & Corporate Governance Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Former Senior Partner, member of the Board of Directors, and leader of Global Private Equity and Principal Investing Practice at McKinsey & Company, as well as other senior positions including leader of Global Consumer Practice, Managing Partner of the firm’s Boston office, Global Compensation Policy Committee and chair of committees responsible for partner evaluation and hiring lateral partners |

| • | Former Systems Engineer at IBM |

| • | Participated in GE’s Edison Engineering Development Program with its Gas Turbine Division |

Education

| • | Bachelor’s degree in Engineering from Dartmouth College |

| • | MBA from Harvard Business School, and designated a Baker Scholar |

Relevant Skills

| • | Career focus on performance transformation, with deep experience in driving organic and inorganic growth and implementing new business models |

| • | Substantial experience in consulting across multiple sectors, including industrial products, consumer products, retail, financial services, health care and technology, and leading work in 15 countries across North America, Latin America, Europe, Asia and Africa |

Other

| • | Member of the Board of Directors of Great-West Lifeco (TSX: GWO), an international financial services company |

| • | Member of the Board of Directors of Culligan International, a leader in residential, office, commercial and industrial water treatment |

| • | Member of the Board of Directors of MIO Partners, an independent investment office serving McKinsey & Company pension plans |

| • | Trustee of Dartmouth College and member of the Board of Advisors at Dartmouth College’s Thayer School of Engineering |

The Board of Directors recommends a vote FOR the election of both of the Class II directors to serve until the 2021 Annual General Meeting. Election of the nominees to our Board of Directors requires the affirmative vote of a plurality of votes cast at the Annual Meeting.

|

|

|

|

8

|

AXALTA COATING SYSTEMS

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

Class II Directors with Terms Expiring at the 2019 Annual General Meeting of Members

|

|

|

|

Andreas C. Kramvis

|

|

|

|

|

Age: 66

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 4 years (July 2014)

• Audit Committee • Environment, Health, Safety & Sustainability Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Operating Partner with AEA Investors |

| • | Former Vice Chairman of Honeywell International, focused on critical aspects for the achievement of the company’s Five Year Plan, as well as other senior positions including President and CEO of Honeywell Performance Materials and Technologies and Honeywell’s Environmental and Combustion Controls businesses |

Education

| • | Graduate of Cambridge University, studying engineering and specializing in electronics |

| • | MBA from Manchester Business School |

Relevant Skills

| • | Extensive experience regarding the management of public and private companies with a global scope across five different industries |

Other

| • | Member of the Board of Directors of Aptar Group (NYSE: ATR), a market leader in dispensers for the packaging industry |

| • | Member of the Boards of Directors of two companies in the AEA Investors’ portfolio: Excelitas Technologies (Chairman) and NES Global Talent |

| • | Past Chairman of the Society of Chemical Industry and past Board Member and Executive Committee Member of the American Chemistry Council |

| • | Recipient of the 2017 SCI Chemical Industry Medal |

| • | Author of Transforming the Corporation: Running a Business in the 21st Century, which demonstrates how to systematically transform a business for high performance |

|

|

|

|

2019 PROXY STATEMENT

|

9

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

Continuing Class I Directors with Terms Expiring at the 2021 Annual General Meeting of Members

|

|

|

|

Robert W. Bryant

|

|

|

|

|

Age: 50

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: <1 year (December 2018)

|

|

|

|

|

|

|

|

Professional Experience

| • | Chief Executive Officer and President of Axalta |

| • | Former Executive Vice President and Chief Financial Officer of Axalta |

| • | Former Senior Vice President and Chief Financial Officer of Roll Global LLC |

| • | Former Executive Vice President of Strategy, New Business Development, and Information Technology at Grupo Industrial Saltillo, S.A.B. de C.V. |

| • | Former President of Bryant & Company, which he founded in 2001 |

| • | Other prior positions include serving as Managing Principal with Texas Pacific Group’s Newbridge Latin America, L.P., a Senior Associate with Booz Allen Hamilton Inc. and an Assistant Investment Officer with the International Finance Corporation |

| • | Began career at Credit Suisse First Boston in the Mergers & Acquisitions Group |

Education

| • | Bachelor’s degree in Economics from the University of Florida |

| • | MBA from Harvard Business School |

Relevant Skills

| • | Substantial and diverse business and management experience across multiple industries and geographies |

| • | Significant experience in financial management, mergers and acquisitions, and strategic planning of public and private companies |

| • | Extensive knowledge of the Company’s operations in his current role as Chief Executive Officer and former role as Chief Financial Officer |

Other

| • | Serves on the Board of Directors of the American Coatings Association |

|

|

|

|

10

|

AXALTA COATING SYSTEMS

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

|

|

|

|

Robert M. McLaughlin

|

|

|

|

|

Age: 61

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 4 years (April 2014)

• Audit Committee (Chair) • Compensation Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Former Senior Vice President and Chief Financial Officer and other senior positions of Airgas, Inc., a leading U.S. supplier of industrial, medical and specialty gases, and hardgoods, such as personal protective equipment, welding equipment and other related products |

| • | Former Vice President of Finance for Asbury Automotive Group |

| • | Former Vice President of Finance and other senior financial positions at Unisource Worldwide, Inc. |

| • | Began career at Ernst & Young LLP |

| • | Certified Public Accountant |

Education

| • | Bachelor’s degree in Accounting from University of Dayton |

Relevant Skills

| • | Significant and diverse business experience |

| • | Substantial experience in all aspects of financial management and strategic planning in a public company environment |

Other

| • | Member of the Board of Directors of Beacon Roofing Supply, Inc. (NASDAQ: BECN), the largest distributor of residential and non-residential roofing materials in the U.S. |

|

|

|

|

2019 PROXY STATEMENT

|

11

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

|

|

|

|

Samuel L. Smolik

|

|

|

|

|

Age: 65

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 2 years (September 2016)

• Environment, Health, Safety & Sustainability Committee (Chair) • Nominating & Corporate Governance Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Former Senior Vice President – Americas Manufacturing and other senior positions at LyondellBasell Industries, one of the world’s largest plastics, chemical and refining companies |

| • | Former Vice President – Global Downstream Health, Safety, Security and Environment at Royal Dutch Shell |

| • | Former Vice President, Global Environment, Health, Safety and Security and other positions of increasing responsibility at The Dow Chemical Company |

Education

| • | Bachelor’s degree in Chemical Engineering from The University of Texas at Austin |

Relevant Skills

| • | Extensive experience in global operations and environmental, health and safety matters in the oil and petrochemicals industry |

| • | Leadership experience from working internationally with numerous countries and cultures |

| • | Significant experience working with government agencies and non-governmental organizations |

| • | Considerable experience in the sustainable development and corporate social responsibility fields |

Other

| • | Member of the Board of Directors of Evergreen North America Industrial Services, a leading provider of environmental and industrial cleaning solutions |

| • | Previously active with American Fuel & Petrochemical Manufacturers Association and American Chemistry Council |

| • | Involved with a number of community, education and other nonprofit organizations including The University of Texas at Austin Engineering Advisory Board, the Antwerp International School Foundation where he is Chairman of the Board of Directors, and Ducks Unlimited, the leading wetlands conservation organization in North America, where he serves on the Board of Directors of Ducks Unlimited, Inc. and Ducks Unlimited de Mexico |

|

|

|

|

12

|

AXALTA COATING SYSTEMS

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

Continuing Class III Directors with Terms Expiring at the 2020 Annual General Meeting of Members

|

|

|

|

Charles W. Shaver

|

|

|

|

|

Age: 60

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 6 years (February 2013)

• Chairman of the Board |

|

|

|

|

|

|

|

Professional Experience

| • | Chairman and Chief Executive Officer of Nouryon, a privately-held specialty chemicals producer |

| • | Former Chief Executive Officer and President of Axalta |

| • | Over 35 years of leadership roles in the global petrochemical, oil and gas industry |

| • | Former operating executive for Golden Gate Capital and The Carlyle Group |

| • | Former CEO and President of the TPC Group from 2004 to April 2011 |

| • | Former Vice President and General Manager for General Chemical, a division of Gentek, from 2001 through 2004 |

| • | Former Vice President and General Manager for Arch Chemicals from 1999 through 2001 |

| • | Served in a series of operational, engineering and business positions with The Dow Chemical Company from 1980 through 1996 |

Education

| • | Bachelor’s degree in Chemical Engineering from Texas A&M University |

Relevant Skills

| • | Extensive experience in the management of public and private companies in the chemical and materials industries |

| • | Deep knowledge of the Company’s operations in his current role as Chairman and former role as Chief Executive Officer |

Other

| • | Chairman of the Board of Directors of U.S. Silica (NYSE: SLCA), a leading producer of silica sand and other industrial minerals |

| • | Member of the Board of Directors of Atotech, an international specialty chemicals company |

| • | Formerly on the Board of Directors of Taminco, Inc., a global specialty chemicals company (2012-2014) |

| • | Extensive background of leadership roles in a variety of industry organizations, including the American Coatings Association Board of Directors (former Chairman) and Executive Committee, the American Chemistry Council Board of Directors and Finance Committee, and the National Petrochemical and Refiners Association Board and Executive Committee |

| • | Serves on the President’s Council and is a major supporter of Ducks Unlimited, the leading wetlands conservation organization in the U.S. |

|

|

|

|

2019 PROXY STATEMENT

|

13

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

|

|

|

|

Mark Garrett

|

|

|

|

|

Age: 56

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 2 years (June 2016)

• Presiding Director • Audit Committee • Compensation Committee • Environment, Health, Safety & Sustainability Committee |

|

|

|

|

|

Independent

|

|

Professional Experience

| • | Chief Executive Officer of Marquard & Bahls, a leading partner in energy supply, trading and logistics |

| • | Former Chairman of the Executive Board and Chief Executive of Borealis AG, a leading provider of innovative solutions in the fields of polyolefins, base chemicals and fertilizers |

| • | Former Vice Chairman at Abu Dhabi Polymers Company Ltd. (Borouge ADP), a leading provider of innovative, value-creating plastics solutions, established in a joint venture with Abu Dhabi National Oil Company (ADNOC) |

| • | Former Executive Vice President Water and Paper Treatment, member of the Executive Committee and other positions of increasing responsibility at Ciba Specialty Chemicals |

Education

| • | Bachelor’s degree in Economics from the University of Melbourne in Australia |

| • | Graduate Diploma of Applied Information Systems from the Royal Melbourne Institute of Technology |

Relevant Skills

| • | Extensive experience in the management of multinational public and private companies |

| • | Deep knowledge of the chemicals industry as well as European and global markets |

Other

| • | Member of the Board of Directors of Umicore (EBR: UMI), a global materials technology and recycling group |

| • | Member of the Board of Directors of Nova Chemicals, one of the world’s leading suppliers of plastics and chemicals |

|

|

|

|

14

|

AXALTA COATING SYSTEMS

|

|

|

|

PROPOSAL NO. 1: ELECTION OF TWO CLASS II DIRECTORS

|

|

|

|

Lori J. Ryerkerk

|

|

|

|

|

Age: 56

|

|

|

|

|

|

Axalta Board Service

|

|

|

|

|

|

• Tenure: 3 years (October 2015)

• Audit Committee • Nominating & Corporate Governance Committee |

|

|

|

|

|

Independent

|

|

| • | Former Executive Vice President, Global Manufacturing of Royal Dutch Shell (Shell), responsible for all Shell Refining and Chemical assets globally, both Shell-operated and joint ventures, with a total crude oil processing capacity of 3.1 million barrels per day and chemical sales volume of 17 million tonnes per year |

| • | Previously Shell’s Regional Vice President, Manufacturing, Europe and Africa |

| • | Prior leadership roles with Exxon Mobil Corporation and Hess Corporation |

Education

| • | Bachelor’s degree in Chemical Engineering from Iowa State University |

Relevant Skills

| • | More than three decades experience working in the refining and chemicals manufacturing businesses of multinational corporations |

| • | Deep technical and commercial expertise gained through a variety of operational and senior leadership roles in Refining and Chemicals Manufacturing, Power Generation, and other groups including Supply, Economics and Planning, HSSE and Public Affairs/Government Relations |

| • | Strong international background having lived and led teams in Europe and Asia |

| • | Accomplished at growing and optimizing business performance, strategic planning and resolving complex international issues |

| • | Led a team of 30,000 people, employees and contractors at refineries and chemical sites around the world |

Other

| • | Member of the Board of Advisors for Catalyst Inc., a national nonprofit that advocates for inclusive workplaces for women |

| • | Recipient of the Houston Business Journal’s Women in Energy Leadership Award |

|

|

|

|

2019 PROXY STATEMENT

|

15

|

|

|

|

Our Board believes that strong corporate governance is important to ensure that our business is managed for the long-term benefit of our shareholders. We have adopted a Code of Business Conduct and Ethics that applies to all of our employees and directors, including our executive officers and senior financial and accounting officers. We have also adopted Corporate Governance Guidelines. Copies of the current versions of the Code of Business

Conduct and Ethics and the Corporate Governance Guidelines are available on our website and will also be provided upon request to any person without charge. Requests should be made in writing to our Corporate Secretary at Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103, or by telephone at (855) 547-1461.

The Board of Directors does not have a set policy with respect to the separation of the offices of Chairman of the Board and Chief Executive Officer (CEO), as the Board believes it is in the best interests of the Company and our shareholders to make that determination based on the position and direction of the Company and the membership of the Board. The Board regularly evaluates whether the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee of the Company. The Board believes these issues should be considered as part of the Boards broader oversight and succession planning process.

In 2018, in connection with Mr. Shavers stepping down as our Chief Executive Officer, the Board separated the position of Chairman from the position of Chief Executive Officer, with Mr. Shaver continuing as non-executive Chairman and Mr. Bryant now serving as our Chief Executive Officer. The Board believes that the separation of the Chairman and CEO positions is in the best interests of our Company and shareholders at this time because it allows Mr. Bryant to devote his time and attention to the day-to-day operations of the Company, while Mr. Shaver provides leadership of our Board as well as executive guidance and support through his experience as our former CEO.

In addition, our Corporate Governance Guidelines require that when the Chairman of the Board is also the Chief Executive Officer or otherwise employed by the Company, or at any other time the Board deems it advisable, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, shall appoint a Presiding Director from the independent directors. The Corporate Governance Guidelines provide that the Presiding Director will:

| • | chair Board meetings in the Chairman’s absence; |

| • | preside over executive sessions of independent directors, and provide feedback and perspective to the Chairman about the matters discussed in executive sessions; and |

| • | be available for consultation with our shareholders. |

Mark Garrett has served as our Presiding Director since February 2018. As our former CEO, Mr. Shaver is not yet independent under NYSE listing standards and therefore the Board has determined that Mr. Garrett should continue to serve as Presiding Director to provide independent guidance and supplement Mr. Shavers leadership as Chairman.

|

|

|

|

16

|

AXALTA COATING SYSTEMS

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

While risk management is primarily the responsibility of our executive team, the Board provides overall risk oversight focusing on the most significant risks facing our Company. The Board annually reviews the Companys overall risk profile and assesses specific key business or functional risk areas during Board meetings throughout the year. The Board also oversees the risk management processes that are implemented by our executives to determine whether these processes are functioning as intended and are consistent with our business and strategy as well as best practices. The Board executes its oversight responsibility for risk management directly and through its committees. The Boards role in risk oversight has not had a significant effect on its leadership structure, although we believe our current leadership structure, with Mr. Shaver serving as Chairman, Mr. Bryant serving as Chief Executive Officer, and Mr. Garrett serving as the independent Presiding Director, enhances the Boards effectiveness in risk oversight.

The Audit Committee is specifically tasked with reviewing our compliance with legal and regulatory requirements and any related compliance policies and programs with management, our independent auditors and our legal counsel, as appropriate. The Audit Committee is also tasked with reviewing our financial risks and risk management policies. Members of our management who have

responsibility for designing and implementing our risk management processes regularly meet with the Audit Committee, and the Audit Committee is updated on a regular basis on relevant and significant risk areas. In addition, the Audit Committee oversees cybersecurity risks facing the Company, which are also regularly reviewed by the full Board. The EHS&S Committee is tasked with overseeing managements monitoring and enforcement of the Companys policies to protect the health and safety of employees, contractors, customers, the public and the environment. The Compensation Committee and the Nominating & Corporate Governance Committee oversee risks associated with executive and employee compensation and corporate governance matters, respectively.

The full Board considers specific risk topics, including risks involved with CEO and management succession planning, risk-related issues pertaining to laws and regulations enforced by the United States and foreign government regulators, and risks associated with our business plan, strategies and capital structure. In addition, the Board receives reports from members of our management that include discussions of the risks and exposures involved with their respective areas of responsibility, and the Board is routinely informed of developments that could affect our risk profile or other aspects of our business.

Our Corporate Governance Guidelines require that the Board be comprised of a majority of directors who are independent under applicable NYSE rules, and state the Boards belief that a substantial majority of directors should be independent. Our Board has determined that all of our directors other than Messrs. Shaver and Bryant are independent under the NYSE listing standards.

In reaching such determination, the Board considered the fact that Ms. Lempres currently serves on the Board of Directors of MIO Partners, a privately-held asset manager serving McKinsey & Company partners and the McKinsey retirement fund which is operated separately from McKinseys consulting business, and that the Company has and may continue to engage McKinsey for strategic

consulting services on an arms-length basis, and did so prior to Ms. Lempres joining the Board. In addition, the Board considered the fact that Mr. Smolik serves on the Ducks Unlimited Conservation Programs Committee and the Boards of Directors of Ducks Unlimited, Inc. and Ducks Unlimited de Mexico on a volunteer basis, and that the Company provides annual corporate support to Ducks Unlimited and Ducks Unlimited de Mexico at a level well below 2% of the organizations gross revenues, and did so prior to Mr. Smolik joining the Board. In each case, the Board considered the magnitude and nature of these relationships and determined that they did not impair the independence of Ms. Lempres or Mr. Smolik.

|

|

|

|

2019 PROXY STATEMENT

|

17

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Director Recruitment and Nominations

The Nominating & Corporate Governance Committee will consider director nominees recommended by our shareholders. A shareholder who wishes to recommend a director candidate for consideration by the Nominating & Corporate Governance Committee should send the recommendation to our Corporate Secretary at Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103, who will then forward it to the Nominating & Corporate Governance Committee. The recommendation must include a description of the candidates qualifications for board service, including all of the information that would be required to be disclosed pursuant to Item 404 of Regulation S-K (as amended from time to time) promulgated by the Securities and Exchange Commission (SEC), the candidates written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the shareholder and the candidate for more information. A shareholder who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the Nominating & Corporate Governance Committee as a nominee, must comply with the notice procedures set forth in our Bye-laws. See Shareholder Proposals for the Companys 2020 Annual General Meeting of Members for more information on these procedures.

The Nominating & Corporate Governance Committee will consider and evaluate persons recommended by the shareholders in the same manner as it considers and evaluates other potential directors.

The Nominating & Corporate Governance Committee is responsible for reviewing the qualifications of potential director candidates and recommending to the Board candidates to be nominated for election to the Board of Directors. Our Corporate Governance Guidelines, which are available on our website as described above, set forth criteria that the Nominating & Corporate Governance Committee will consider when evaluating a director candidate for membership on the Board of Directors. These criteria are as follows: professional experience; education; skill; diversity; differences of viewpoint; and other

individual qualities and attributes that will positively contribute to the Board, including integrity and high ethical standards; experience with business administration processes and principles; ability to express opinions, ask difficult questions and make informed, independent judgments; significant experience in at least one specialty area; ability to devote sufficient time to prepare for and attend Board meetings; and diversity with respect to other characteristics. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee.

|

|

|

|

18

|

AXALTA COATING SYSTEMS

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Nominating & Corporate Governance Committee also considers the mix of backgrounds and qualifications, and the challenges and needs, of the directors to ensure that the Board of Directors has the necessary experience, knowledge and abilities to perform its responsibilities effectively. While diversity and variety of experiences and viewpoints represented on the Board are always considered, the Board believes that a director nominee should not be chosen nor excluded solely or largely because of race, religion, national origin, sex, sexual orientation or disability.

As Axalta has only been a stand-alone company since February 2013, none of our directors has a tenure longer than approximately six years. However, the Nominating & Corporate Governance Committee considers Board tenure

and refreshment as additional relevant criteria in its identification, consideration and recommendation of director candidates.

When considering whether our directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focused primarily on each persons background and experience as reflected in the information discussed in each of the directors individual biographies set forth in Proposal No. 1: Election of Two Class II Directors. We believe that our directors provide an appropriate diversity of experience and skills for the size and nature of our business.

Our Corporate Governance Guidelines provide for certain limitations on the service of our directors:

| • | Occupation Changes – Directors must notify the Chairman of the Board when their principal occupation changes, and the Nominating & Corporate Governance Committee will review the circumstances regarding such change to determine whether continued Board membership is appropriate. |

| • | Additional Public Company Boards or Audit Committees – Directors may not serve on more than five public company boards of directors or more than three audit committees. |

| • | Age Limit – No director will be nominated for reelection to the Board after reaching the age of 75 unless an affirmative request is made by the Board for that director to continue service. |

Our Board currently consists of nine directors, with Mr. Shaver serving as Chairman of the Board.

The number of directors on our Board may be modified from time to time by our Board of Directors in accordance with our Bye-laws.

Under our current Bye-laws, until our Annual General Meeting of Members in 2021, our Board is divided into three classes whose directors serve three-year terms expiring in successive years. Directors hold office until their successors have been duly elected and qualified or until the earliest of their respective death, resignation or removal. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Under the transition plan to eliminate our classified board structure, as approved by shareholders at the 2018 Annual Meeting, Class I directors elected at the 2018 Annual Meeting, the nominees for election as Class II directors at this years Annual Meeting and the nominees for election as Class III directors at the Annual General Meeting of Members in 2020 will each serve terms expiring at the Annual General Meeting of Members in 2021. At that time, our classified board structure will expire and the entire Board will be elected annually. Any directors appointed by the Board to fill vacancies after such time would serve only until the next election of directors by the shareholders or until a directors earlier death, resignation or removal.

We have a process for onboarding and orienting new directors and for providing continuing education to our Board members. As part of our director orientation program, new directors participate in one-on-one introductory meetings with Axaltas business and functional leaders and are briefed on the Companys

strategic plans, financial statements and key issues, as well as the Companys governance and compliance policies and procedures. We provide our directors quarterly corporate governance updates via our legal department. In addition, we identify and pay for our directors to attend continuing education programs on corporate governance,

|

|

|

|

2019 PROXY STATEMENT

|

19

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

compliance and other critical issues associated with a directors service on a public company board, as well as site visits to our facilities around the world. Our Board also

receives training through guest speakers and substantive issue presentations during Board and committee meetings and other Board events.

Directors are expected to spend the time needed and to meet as frequently as necessary to properly fulfill their responsibilities. The Board meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings and meetings of committees on which they serve. In addition, all directors are invited, but not required, to attend our

Annual General Meeting of Members. All of our current directors attended the 2018 Annual Meeting.

In general, the Board reserves time during each regularly scheduled meeting to allow the non-employee directors to meet without management and also to allow the independent directors to meet alone in executive session. During these executive sessions without the Chairman, the Presiding Director presides over the discussion.

During 2018, the Board met eight times. All directors attended 75% or more of the meetings of the Board and committees on which they served.

Our Board believes that a comprehensive evaluation process enhances the effectiveness of our Board and committees. Therefore, our Board and each of our standing committees conducts an annual evaluation to determine whether it has complied with its responsibilities under our Bye-laws, the committee charter and applicable laws and regulations and whether it is functioning effectively. The evaluations are overseen by the Nominating & Corporate Governance Committee and consider, among other things, the following topics:

| • | Board and committee composition, including skills, background and experience; |

| • | Satisfaction with director performance, including that of Board and committee chairs in those positions; |

| • | The quality of the Board participation, process and meeting agendas/materials; |

| • | Whether and how well each committee has performed the responsibilities in its charter; |

| • | Areas where the Board and committees should increase their focus; |

| • | Satisfaction with time allocated for topics and encouragement of open discussion and communication; |

| • | The current committee structure and whether any new committees should be established; and |

| • | Access to management, experts and internal and external resources. |

|

|

|

|

20

|

AXALTA COATING SYSTEMS

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors directs the management of our business and affairs as provided by Bermuda law and conducts its business through its meetings and its four standing committees: Audit Committee, Compensation Committee, Nominating & Corporate Governance Committee, and Environment, Health, Safety & Sustainability Committee. In addition, from time to time, other committees may be established under the Boards direction when necessary or advisable to address specific issues. In August 2018, the Board of Directors eliminated its Executive Committee, which had authority to exercise the powers of the Board between regularly scheduled Board

meetings but had met infrequently over the past two years, so that all relevant matters would be brought before the full Board.

Each of the standing committees operates under a charter that was approved by our Board of Directors, copies of which are available on our website at www.axalta.com.

Set forth below is the current membership and descriptions of each of the standing committees, with the number of meetings held during the year ended December 31, 2018 in parentheses:

|

|

|

|

|

Audit

Committee (6) Robert McLaughlin (Chair) Mark Garrett Andreas Kramvis Lori Ryerkerk |

•

|

Responsible for assisting the Board of Directors in overseeing our accounting and financial reporting processes and other internal control processes, the audits and integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm, our Code of Business Conduct and Ethics and the performance of our internal audit function.

|

|

•

|

Appoints and oversees our independent registered public accounting firm, including pre-approval of non-audit services.

|

|

|

•

|

Mr. McLaughlin was appointed as the Chair of the Audit Committee in April 2014.

|

|

|

•

|

The Board of Directors has determined that Messrs. McLaughlin, Garrett and Kramvis are each an audit committee financial expert as such term is defined under the applicable regulations of the SEC and have the requisite accounting or related financial management expertise and financial sophistication under the applicable rules and regulations of the NYSE.

|

|

|

•

|

The Board of Directors has also determined that each committee member is independent under Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act) and the NYSE listing standards, for purposes of the Audit Committee.

|

|

|

•

|

All members of the Audit Committee are able to read and understand fundamental financial statements, are familiar with finance and accounting practices and principles, and are financially literate.

|

|

|

|

|

|

|

|

|

|

2019 PROXY STATEMENT

|

21

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

|

|

|

|

|

Compensation

Committee (16) Elizabeth Lempres (Chair) Mark Garrett Deborah Kissire Robert McLaughlin |

•

|

Responsible for reviewing and approving the compensation philosophy and practices for the Company, reviewing and approving all forms of compensation and benefits to be provided to our Chief Executive Officer, our other executive officers and the Board of Directors, and reviewing and overseeing the administration of our equity incentive plans.

|

|

•

|

Our executive compensation processes and the role of the Compensation Committee, our executive officers and management in the compensation process are each described under the heading Compensation, Discussion and Analysis — Compensation Governance: Oversight and Administration of the Executive Compensation Program in this Proxy Statement.

|

|

|

•

|

Ms. Lempres was appointed as the Chair of the Compensation Committee in January 2019. Messrs. Kramvis and McLaughlin each served as Chairs of the Compensation Committee during 2018.

|

|

|

•

|

The Board of Directors has determined that each committee member is independent under the NYSE listing standards for purposes of the Compensation Committee.

|

|

|

|

|

|

|

|

|

|

|

Nominating &

Corporate Governance Committee (8) Deborah Kissire (Chair) Elizabeth Lempres Lori Ryerkerk Samuel Smolik |

•

|

Responsible for identifying and recommending director candidates for election to our Board of Directors and reviewing the Board’s committee structure and recommending membership of the committees.

|

|

•

|

Reviews and recommends the Company’s Corporate Governance Guidelines and makes recommendations to the Board regarding other governance matters, including the Company’s Memorandum of Association, Bye-laws and committee charters.

|

|

|

•

|

Oversees the annual self-evaluations of the Board.

|

|

|

•

|

Ms. Kissire was appointed as the Chair of the Nominating & Corporate Governance Committee in December 2016.

|

|

|

•

|

The Board of Directors has determined that each committee member is independent under the NYSE listing standards for purposes of the Nominating & Corporate Governance Committee.

|

|

|

|

|

|

|

|

|

|

|

Environment,

Health, Safety & Sustainability Committee (5) Samuel Smolik (Chair) Mark Garrett Andreas Kramvis |

•

|

Responsible for the oversight and review of the Company’s policies, performance and strategy related to the environment, health, safety and sustainability.

|

|

•

|

Reviews compliance issues and material proceedings regarding environmental, health, safety and sustainability matters.

|

|

|

•

|

Mr. Smolik was appointed as the Chair of the EHS&S Committee in February 2017.

|

|

|

|

|

|

|

|

|

|

22

|

AXALTA COATING SYSTEMS

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board and management team understand the benefits of regular engagement with our shareholders in order to maintain awareness of their perspectives on Axalta and matters affecting the Company.

Our shareholder engagement efforts allow the Board to:

| • | consider the viewpoints of our shareholders in connection with its oversight of management and the Company; |

| • | discuss key developments in our business including our strategy and performance; and |

| • | assess issues that may impact our business, corporate activities and governance practices. |

How We Engage

| • | We provide institutional investors and equity analysts with opportunities to engage with, and provide feedback to, the Company’s management. |

| • | Our management participates in industry conferences, one-on-one investor meetings and non-deal roadshows. |

| • | Between March 2018 and March 2019, we engaged with investors representing approximately 80% of our shareholder base (based on share ownership), attended 14 industry conferences and conducted 7 non-deal road shows. |

Outcomes from Shareholder Feedback

Some tangible examples of the results of our shareholder outreach efforts over the past several years include:

| • | Increased our financial disclosures to help investors better understand our business. |

| • | Amended our Bye-laws to declassify our Board. |

| • | Enhanced our executive compensation disclosures including additional detail with respect to the design and selection of performance metrics under our long-term equity incentive awards. |

| • | Updated the performance share component of our annual long-term equity incentive program to include internal financial metrics on profitability and return on invested capital while also retaining relative total shareholder return as a modifying component. |

|

|

|

|

2019 PROXY STATEMENT

|

23

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board is committed to meeting the highest standards of ethical behavior, corporate governance and business conduct. The following summary highlights the

governance and compensation developments overseen by the Board since our November 2014 initial public offering (IPO).

|

|

Governance Actions

|

Compensation Actions

|

||

|

2015

|

•

|

Appointed our first female director to our Board

|

•

|

Replaced our named executive officers’ pre-IPO employment agreements with Executive Restrictive Covenant and Severance Agreements to standardize various terms and conditions

|

|

•

|

Formalized our annual Board and director evaluation process

|

|||

|

2016

|

•

|

Adopted stock ownership guidelines for non-employee directors

|

•

|

Introduced performance-based equity awards as a significant component (50%) of our annual equity grants for senior executives, reducing reliance on time-vested equity

|

|

•

|

Appointed 3 new independent directors, including one woman, and became a fully-independent Board (other than our CEO)

|

|||

|

2017

|

•

|

Established our EHS&S Committee

|

•

|

Adopted an incentive compensation recoupment (clawback) policy

|

|

•

|

Increased stock ownership guidelines for non-employee directors

|

|||

|

•

|

Completed the transition from our directors appointed by Carlyle, including the appointment of our third female director

|

|||

|

2018

|

•

|

Appointed an independent Presiding Director

|

•

|

Revised our equity plan to include minimum vesting periods (subject to certain exceptions), alignment of dividend payments with award vesting, and prohibitions on liberal share recycling and option repricing

|

|

•

|

Established formal limits on other public company board and audit committee service

|

|||

|

•

|

Initiated the elimination of our classified Board over a 3-year transition period

|

|||

|

•

|

Separated the roles of Chairman and CEO

|

•

|

Updated equity award agreements to include non-compete and non-solicitation restrictions

|

|

|

•

|

Eliminated the Executive Committee of the Board

|

|||

|

2019

|

•

|

Appointed Ms. Lempres as Chair of the Compensation Committee, our second female director in a Board leadership position

|

•

|

Revised our performance share plan to include profitability and return on invested capital financial metrics while retaining relative total shareholder return as a modifying component

|

|

•

|

Revised annual bonus plan metrics to align with new external reporting emphasis

|

|||

|

|

|

|

24

|

AXALTA COATING SYSTEMS

|

|

|

|

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company actively engages in succession planning in order to ensure that it has a strong pipeline of internal executive talent. The Board of Directors and its committees regularly review succession plans for the Chief Executive Officer and other members of senior management, including plans for emergency scenarios. The Board and its committees also regularly assess the staffing of the Companys key leadership positions to identify and develop employees for such positions.

In addition, the Company holds an annual senior leadership development program to recognize the Companys emerging leaders from around the globe and to connect them with peers and senior executives of the Company. The Company seeks the best person for every open role and strives to identify candidates from differing backgrounds and with experience and perspectives to continue to enhance the diversity of our management team.