Regularly throughout fiscal year 2021, the Audit Committee reviewed and discussed with management, including internal audit, and PwC, with and without management present, the Company’s progress in the testing and evaluation of its internal control over financial reporting and discussed the results of their respective audit examinations and the overall quality of the Company’s financial reporting. The Audit Committee also met separately with the Company’s Senior Vice President and Chief Financial Officer, as well as the Company's Senior Vice President and General Counsel. The Audit Committee also discussed and reviewed with management and the Company’s internal auditors the Company’s enterprise-wide risk assessment as well as cyber and information security risks generally.

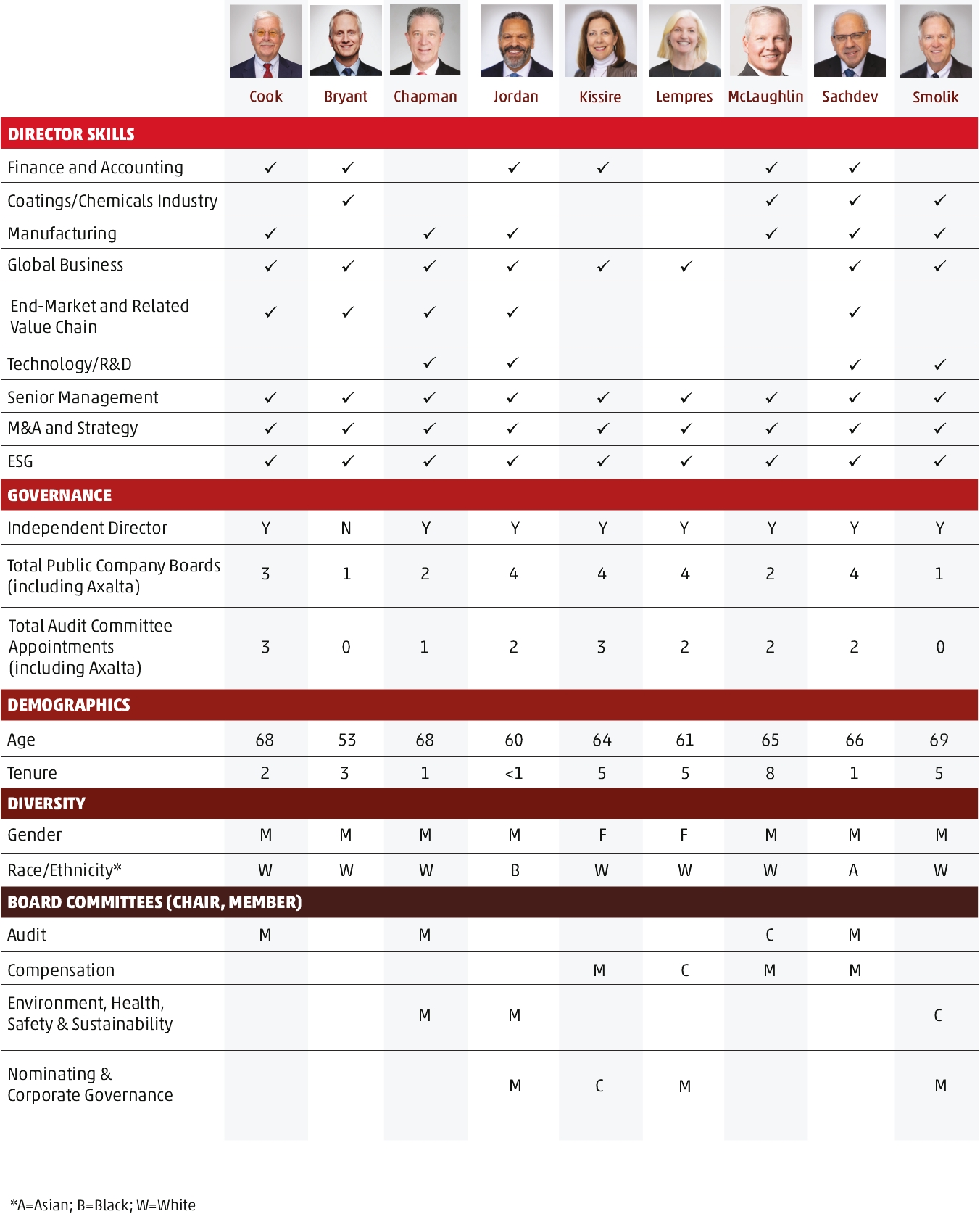

The Audit Committee consists of four directors, Messrs. McLaughlin, Chapman, Cook and Sachdev, each of whom satisfies the independence requirements promulgated by the SEC and applicable NYSE rules. The Board has determined that each of Messrs. McLaughlin, Cook and Sachdev are audit committee financial experts as defined by the rules of the SEC.

This report confirms that the Audit Committee has: (i) reviewed and discussed the audited financial statements for the year ended December 31, 2021 with management and the Company’s independent registered public accounting firm, PwC, which included reviewing and discussing the reasonableness of significant estimates and judgments and the clarity of the disclosures related to critical accounting estimates and critical audit matters; (ii) discussed with PwC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board, or the “PCAOB,” and the SEC; (iii) reviewed the written disclosures and letters from PwC as required by the rules of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence; and (iv) discussed with PwC its independence from the Company.

The Audit Committee has considered whether the provision of non-audit professional services rendered by PwC, and disclosed elsewhere in this Proxy Statement, is compatible with maintaining its independence.

Based upon the above review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for the year ended December 31, 2021 be included in the Company’s Annual Report on Form 10-K for filing with the SEC.

Respectfully submitted,

AUDIT COMMITTEE

Robert M. McLaughlin (Chair)

Steven M. Chapman

William M. Cook

Rakesh Sachdev