DEF 14A: Definitive proxy statements

Published on April 24, 2024

Table of Contents

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☒ | Definitive Proxy Statement. |

| ☐ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to §240.14a-12. |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Notice of 2024 Annual General Meeting

of Members and Proxy Statement

Axalta Coating Systems Ltd.

Thursday, June 6, 2024 at 10:00 a.m., eastern time

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF MEMBERS TO BE HELD ON JUNE 6, 2024:

The Notice of Internet Availability of Proxy Materials, Notice of Annual General

Meeting of Members, Proxy Statement and Annual Report are available at

www.proxydocs.com/AXTA

Table of Contents

| Axalta Coating Systems Ltd. 1050 Constitution Avenue Philadelphia, PA 19112

April 24, 2024 |

|

|

Dear Fellow Axalta Shareholders:

2023 was a strong year for Axalta. Our global team collectively achieved records in both annual net sales and Adjusted EBITDA. And we worked together to further position Axalta for sustainable growth into the future. Yet we are not standing still and our team continues to build on this momentum. We believe that we are just beginning to unlock the value of Axalta as we remain committed to innovating smarter surface solutions for better living and a sustainable future.

It is our pleasure to invite you to attend Axalta’s 2024 Annual General Meeting of Members, which will be held in person on June 6, 2024 at 10:00 a.m., eastern time, at our Corporate Headquarters & Global Innovation Center located in Philadelphia, Pennsylvania.

You will find information regarding the matters to be voted upon in the attached Notice of 2024 Annual General Meeting of Members and Proxy Statement. We are sending our shareholders, referred to as “members” under Bermuda law, a notice regarding the availability of this Proxy Statement, our 2023 Annual Report to Members and other proxy materials via the Internet. This electronic process gives you fast, convenient access to the materials and reduces the impact on the environment and our printing and mailing costs. You may request a paper copy of these materials using one of the methods described in the Notice of the 2024 Annual General Meeting of Members and Proxy Statement.

Whether or not you are able to join the meeting, it is important that your common shares be represented and voted at the Annual General Meeting. Please follow the voting instructions provided in the Notice of Internet Availability of Proxy Materials. If you requested printed versions by mail, these printed proxy materials also include the proxy card or voting instruction form for the Annual General Meeting.

Thank you for being a shareholder and for your support of our company.

Sincerely, |

|

Rakesh Sachdev Non-Executive Board Chair |

Chris Villavarayan Chief Executive Officer and President |

Table of Contents

AXALTA COATING SYSTEMS LTD.

1050 Constitution Avenue

Philadelphia, PA 19112

| Notice of 2024 Annual General Meeting |

| Time and Date: 10:00 a.m., eastern time, on Thursday, June 6, 2024 |

Place: Axalta Corporate Headquarters & Global Innovation Center, 1050 Constitution Avenue, Philadelphia, PA 19112, U.S.A. |

Who Can Vote:

Only holders of our common shares at the close of business on April 12, 2024, the record date, will be entitled to receive notice of, and to vote at, the Annual General Meeting.

Annual Report:

Our 2023 Annual Report to Members accompanies but is not part of this Proxy Statement.

Proxy Voting:

Your Vote is Important. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Annual General Meeting. Promptly voting your shares via the Internet, by telephone or by signing, dating and returning your proxy card or voting instruction form will save the Company the expense and extra effort of additional solicitation. If you wish to vote by mail, for those receiving printed copies of the proxy materials we have enclosed an envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the Annual General Meeting, as your proxy is revocable at your option. You may revoke your proxy at any time before it is voted by delivering to the Company a subsequently executed proxy or a written notice of revocation or by voting at the Annual General Meeting.

Items of Business:

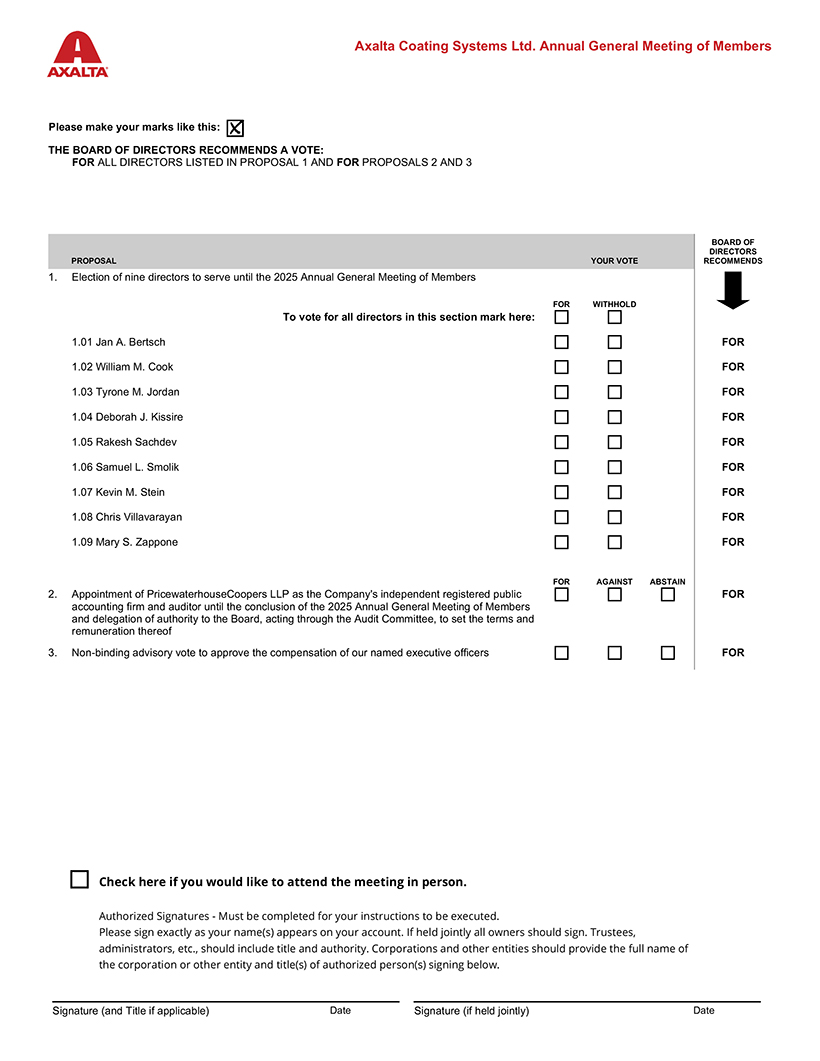

| • | Election of nine directors to serve until the 2025 Annual General Meeting of Members; |

| • | Appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2025 Annual General Meeting of Members and delegation of authority to the Board of Directors of the Company, acting through the Audit Committee, to set the terms and remuneration thereof; |

| • | Non-binding advisory vote to approve the compensation of our named executive officers; and |

| • | To transact any other business that may properly come before the Annual General Meeting. |

Date of Mailing:

A Notice of Internet Availability of Proxy Materials or this Proxy Statement is first being mailed to shareholders on or about April 24, 2024.

BY ORDER OF THE BOARD OF DIRECTORS,

Sincerely,

Alex Tablin-Wolf

Senior Vice President, General Counsel &

Corporate Secretary

April 24, 2024

Table of Contents

TABLE OF CONTENTS

2024 PROXY STATEMENT i

Table of Contents

PROXY SUMMARY

This proxy statement (the “Proxy Statement”) and accompanying proxy materials are being furnished to the members (referred to herein as “shareholders” or “members”) of Axalta Coating Systems Ltd., a Bermuda exempted company (the “Company,” “Axalta,” “we,” “our” and “us”), in connection with the solicitation of proxies by the board of directors of the Company (the “Board” or the “Board of Directors”) for use at the 2024 Annual General Meeting of Members, and at any adjournment or postponement thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of 2024 Annual General Meeting of Members. This summary highlights information contained elsewhere in this Proxy Statement and in the Company’s 2023 Annual Report (which includes the Company’s Form 10-K for the year ended December 31, 2023). For more complete information about these topics, please review the Company’s complete Proxy Statement and 2023 Annual Report. Please also see the Questions and Answers section beginning on page 80 for important information about proxy materials, voting, Company documents and communications.

| 2024 Annual General Meeting |

||||||

| Date: | Thursday, June 6, 2024 | Place: | Axalta Corporate Headquarters & Global Innovation Center 1050 Constitution Avenue Philadelphia, PA 19112, U.S.A. |

|||

| Time: | 10:00 a.m., eastern time | |||||

| Record Date: | April 12, 2024 | |||||

Note Regarding Forward-Looking Statements

Many statements made in this Proxy Statement are not statements of historical fact, including statements about our beliefs and expectations, and are “forward-looking statements” within the meaning of federal securities laws and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan, strategies and capital structure, as well as our 2030 ESG Goals (as defined below) and related initiatives. These statements often include words such as “future,” “potential,” “plan,” “seek,” “want,” “priority,” “expected,” “believe,” “intend,” “goal,” “estimates,” “targets,” “projections,” “can,” “committed,” “should,” “could,” “would,” “may,” “will,” and “strategy,” and the negative of these words or other comparable or similar terminology. We base these forward-looking statements or projections on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances and at such time. As you read and consider this Proxy Statement you should understand that these statements are not guarantees of performance or results. The forward-looking statements and projections are subject to and involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, industry, strategy, financing activities or actual results to differ materially. More information on potential factors that could affect our financial results is available in the “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in other documents that we have filed with, or furnished to, the Securities and Exchange Commission (“SEC”), and you should not place undue reliance on these forward-looking statements or projections. Although we believe that these forward-looking statements and projections are based on reasonable assumptions at the time they are made, you should be aware that many factors, including, but not limited to, those described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, could affect our actual financial results or results of operations and could cause actual results to differ materially from those expressed in the forward-looking statements and projections. These forward-looking statements should not be construed by you to be exhaustive and are made only as of the date of this Proxy Statement. We undertake no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise.

2024 PROXY STATEMENT 1

Table of Contents

PROXY SUMMARY

| Proposals |

Board Recommendation |

|||

| 1 | Election of nine directors to serve until the 2025 Annual General Meeting of Members

• The director nominees have a diverse set of backgrounds, characteristics and skills relevant to the leadership of the Board and oversight of the Company

• All of our non-employee directors are independent

See pages 10-19 for more information |

FOR ☑ | ||

| 2 | Appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2025 Annual General Meeting of Members and delegation of authority to the Board, acting through the Audit Committee, to set the terms and remuneration thereof

• Independent firm

• Significant industry, global audit and financial reporting expertise

See pages 38-39 for more information |

FOR ☑ | ||

| 3 | Non-binding advisory vote to approve the compensation of our named executive officers

• Strong alignment of executive pay with Company performance

• Oversight of compensation program by our fully independent Compensation Committee with assistance of its independent compensation consultant

See page 41 for more information |

FOR ☑ | ||

2 AXALTA COATING STSTEMS

Table of Contents

PROXY SUMMARY

Our Company

Axalta is a leading global manufacturer, marketer and distributor of high-performance coatings systems with more than 150 years of experience in the coatings industry. Axalta serves customers in over 140 countries and has more than 100,000 customers within our four end-markets of Refinish, Industrial, Light Vehicle and Commercial Vehicle.

During 2023, our actions advanced our unified purpose and set of values that we adopted in 2022 in coordination with our Board of Directors, senior leadership team and stakeholders throughout the Company.

Together, our purpose and values support our commitments to our stakeholders, including our employees, customers and shareholders, and unites us as ONE Axalta. ONE Axalta is a mindset where we focus on what is best for the overall organization, align and execute on our top priorities, act with speed and urgency, prioritize and simplify to eliminate unnecessary complexities, and break down silos and tackle our biggest challenges. We believe that focus on the ONE Axalta mindset enabled us to achieve strong results in 2023 and we believe positions us well for future success.

2024 PROXY STATEMENT 3

Table of Contents

PROXY SUMMARY

Our Board of Director Nominees

| Name |

Age | Occupation | Standing Committees and Leadership Roles |

Other Public Company Boards |

||||||||

| Director Nominees |

||||||||||||

| Rakesh Sachdev |

68 | Former chief executive officer | • Non-Executive Board Chair |

3 | ||||||||

| Jan A. Bertsch |

67 | Former financial executive | • Audit |

2 | ||||||||

| • Compensation |

||||||||||||

| William M. Cook |

70 | Former chief executive officer | • Audit |

1 | ||||||||

| • Compensation (Chair) |

||||||||||||

| Tyrone M. Jordan |

62 | Former business executive | • Environment, Health, Safety & Sustainability |

2 | ||||||||

| • Nominating & Corporate Governance |

||||||||||||

| Deborah J. Kissire |

66 | Former accounting firm partner | • Compensation |

3 | ||||||||

| • Nominating & Corporate Governance (Chair) |

||||||||||||

| Samuel L. Smolik |

71 | Former operations executive | • Environment, Health, Safety & Sustainability (Chair) |

0 | ||||||||

| • Nominating & Corporate Governance |

||||||||||||

| Kevin M. Stein |

58 | Chief executive officer | • Environment, Health, Safety & Sustainability |

1 | ||||||||

| • Nominating & Corporate Governance |

||||||||||||

| Chris Villavarayan |

53 | Chief Executive Officer and President of Axalta |

1 | |||||||||

| Mary S. Zappone |

59 | Chief executive officer | • Audit |

0 | ||||||||

| • Environment, Health, Safety & Sustainability |

||||||||||||

As previously announced, Steven M. Chapman and Robert M. McLaughlin are not standing for re-election to the Board at the Annual Meeting.

4 AXALTA COATING STSTEMS

Table of Contents

PROXY SUMMARY

Balanced Mix of Skills, Experiences and Other Characteristics

Our director nominees comprise a diverse group of individuals that we believe provide dedicated and effective oversight of the Company. The following matrix summarizes the skills that the Board considers to be of primary importance, at this time, to the effective oversight of the Company and illustrates how our director nominees represent such skills. Each director nominee is asked to self-identify skills based on having senior/executive management responsibility for the performance, or direct oversight of, the applicable skill. The skills identified are not an exhaustive list of all skills that are required for the Board’s effective oversight of the Company, nor an exhaustive list of all skills that each director nominee offers. The Nominating & Corporate Governance Committee frequently reviews the individual and collective skills and other characteristics of our Board, including, among others, the skills and characteristics shown below, to ensure that the Board has an appropriate mix of skills and perspectives to oversee the advancement of the Company’s business objectives. We added three new directors to the Board in 2023 and believe that our director nominees have the skills, experience, expertise, diversity, tenure and independence needed to oversee the Company’s long-term strategic growth.

2024 PROXY STATEMENT 5

Table of Contents

PROXY SUMMARY

6 AXALTA COATING STSTEMS

Table of Contents

PROXY SUMMARY

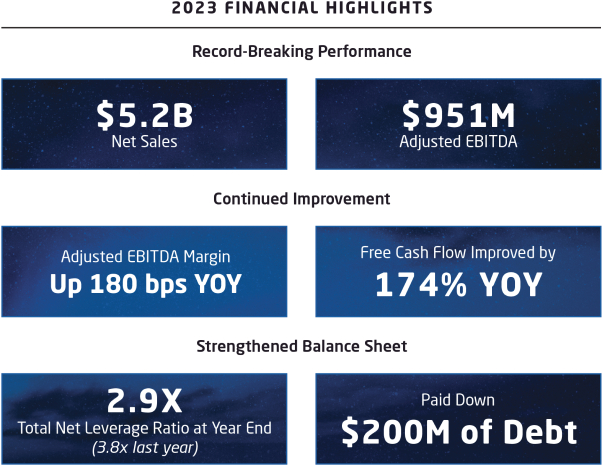

2023 Financial and Operating Highlights

Certain figures in this graphic are rounded for presentation purposes.

2023 saw strong overall performance with certain key metrics breaking Company records after a difficult 2022 in which we were challenged by macroeconomic headwinds, including significant inflationary pressures. The team was able to drive marked improvement in 2023 through continued focus on price and productivity. We again strengthened our balance sheet and made meaningful productivity investments into the business. The following are several financial and non-financial highlights from 2023:

| • | Net sales were $5.2 billion, up 6.1% versus 2022, primarily driven by positive price-mix contributions from all end-markets, partially offset by modest volume declines. This represents a record annual net sales result for Axalta. |

| • | Net income totaled $269 million versus $192 million in 2022 and Adjusted EBITDA(1) improved to $951 million from $811 million in 2022, a 17.3% increase, each driven by strong price-mix growth and variable cost deflation offset by higher labor expense and costs |

| related to productivity investments. This represents a record annual Adjusted EBITDA result for Axalta. |

| • | Adjusted EBITDA margin(1) of 18.4% improved by 180 basis points year-over-year, with solid contributions from both segments. |

| • | Cash provided by operating activities of $575 million and free cash flow(1) of $447 million represented a 95.8% and 174% improvement, respectively, over last year’s results, driven by higher operating profit and targeted working capital reductions stemming from mid-year productivity initiatives. |

| • | Diluted earnings per share was $1.21 compared to $0.86 in 2022, while adjusted diluted earnings per share (Adjusted Diluted EPS(1)) for 2023 improved to $1.57 from $1.48 for 2022. |

| • | We returned $50 million to shareholders through share repurchases during the year under our Board-approved share repurchase plan. |

2024 PROXY STATEMENT 7

Table of Contents

PROXY SUMMARY

| • | We achieved success in capital markets and M&A activities including the following: |

| ¡ | Reduced gross debt by $200 million through voluntary prepayments on term loan debt and achieved a total net leverage ratio(1)(2) of 2.9x at year end, down from 3.8x at the end of 2022 |

| ¡ | Repriced term loan to reduce interest rate spread from 3.00% to 2.50% |

| ¡ | Refinanced 2025 senior notes with new $500 million senior notes due in 2031 |

| ¡ | Acquired André Koch AG, a long-term distribution partner of our Refinish business in Switzerland |

| (1) | Adjusted EBITDA, Adjusted EBITDA margin, free cash flow, Adjusted Diluted EPS and total net leverage ratio are not financial measures presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Please see Appendix A for more information on certain of these non-GAAP financial measures, including certain reconciliations to the most directly comparable financial measures calculated in accordance with GAAP. Beginning with the fourth quarter of 2023, we replaced Adjusted EBIT with Adjusted EBITDA as one of our primary performance metrics, with Adjusted Diluted EPS remaining as the other primary performance metric. |

| (2) | Total net leverage ratio is total debt minus cash and cash equivalents divided by Adjusted EBITDA for the last twelve months. |

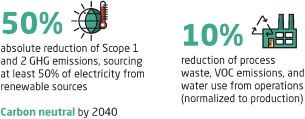

Environmental, Social and Governance Highlights

We recognize that environmental, social and governance (“ESG”) matters are important to long-term shareholder value and we are committed to purposeful ESG practices that are aligned with our strategy, including the following highlights:

| • | Board Independence – eight of our nine director nominees are non-employee directors and are independent under New York Stock Exchange (“NYSE”) listing standards. Our current Chief Executive Officer (“CEO”) is the only non-independent member of our Board. In addition, the non-executive Chair of the Board (“Board Chair”) and all members of each of the Board’s standing committees are independent directors. |

| • | Board Diversity – our directors are committed to bringing a diverse set of perspectives and experiences to the Board and six of our nine director nominees are diverse. Three of our nine director nominees are females and three are racially/ethnically diverse. |

| • | Sustainability Report and ESG Goals – we published our 2020-2022 Sustainability Report in August 2023 (“Sustainability Report”). Our Sustainability Report provided updates on a variety of ESG matters at Axalta, including certain updates regarding our 2030 ESG goals, which we released in January of 2022 (“2030 ESG Goals”), which are described in greater detail below, and comprise ten commitments linked to three pillars: Planet Solutions; Business Solutions; and People Solutions. Our 2030 ESG Goals are aligned with a targeted selection of the United Nations Sustainable Development Goals. Axalta has also set a goal for the Company’s operations to be carbon neutral by 2040. |

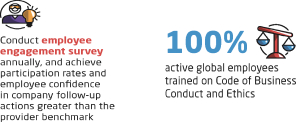

| • | Human Capital and Diversity – the Board and management are committed to driving the continued evolution of our human capital practices. We have invested in organization-wide learning and leadership development programs, and we are committed to increasing the diversity of our leadership, as reflected by two of our 2030 ESG Goals – to have 30% of management positions globally filled by women and to |

| have, in the U.S., 30% of our management positions filled by individuals from underrepresented racial and ethnic groups. |

| • | Succession Planning – the Company actively engages in developing a pipeline of internal talent with differing backgrounds and experience to assume key leadership positions. We recently refreshed our succession planning processes for our Executive Committee, senior leadership team and other key positions in the organization. The Board has also discussed emergency succession in the event that one of our key executives becomes unable or unwilling to serve. Similarly, the Nominating & Corporate Governance Committee regularly discusses Board composition and succession matters, including an emergency succession for the Board. |

| • | Board Refreshment – our Board refreshment continued in 2023 with the addition of two new independent Directors. Kevin Stein, who is the CEO of TransDigm Group Incorporated, is a seasoned public company CEO who has driven significant shareholder value creation and has deep manufacturing experience. Mary Zappone, the CEO of Sundyne LLC, has significant expertise across a wide range of industrial sectors, including chemicals, energy infrastructure, manufacturing and distribution. |

| • | Strong Environment, Health and Safety Performance – Axalta is committed to protecting the environment and the health and safety of our workers. Our global Responsible Care® Management System (RC14001) is certified, which demonstrates that all elements of the Responsible Care® Management System are successfully implemented globally, including with respect to environment, health, safety, process safety, product safety, security and sustainability. The Board maintains a standing committee, the Environment, Health, Safety & Sustainability (“EHS&S”) Committee, that is responsible for oversight of the Company’s policies, performance, strategy and compliance matters related to environment, health, safety, human rights and sustainability. |

8 AXALTA COATING STSTEMS

Table of Contents

PROXY SUMMARY

| • | Code of Business Conduct and Ethics – the Company maintains a Code of Business Conduct and Ethics, which was refreshed in September 2023. The Code of Business Conduct and Ethics is provided in 14 languages and applies to all of our directors and employees, including our executive officers and senior financial and accounting officers. Our entire global |

| team receives annual training on, and certifies that they have read and understand, the Code of Business Conduct and Ethics. |

Please see the Environmental, Social and Governance Matters section beginning on page 31 for additional information about our ESG practices.

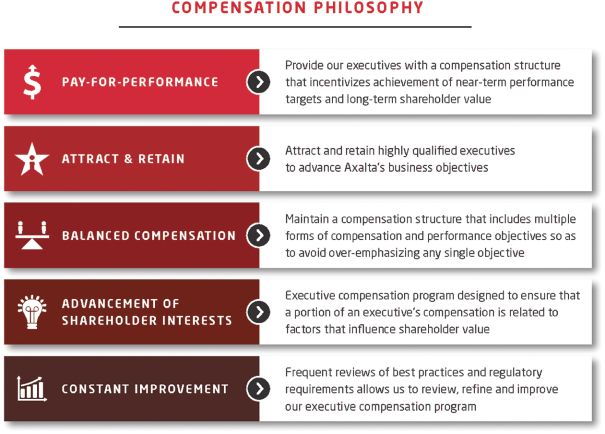

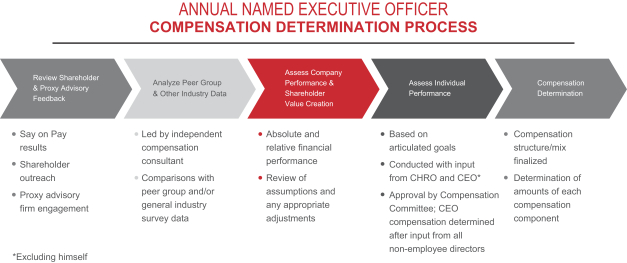

Executive Compensation Highlights

We maintain several guiding principles with respect to the Company’s executive compensation programs, and review our compensation programs on an ongoing basis to ensure that market and regulatory best practices, as well as input from our shareholders, are considered and addressed, including:

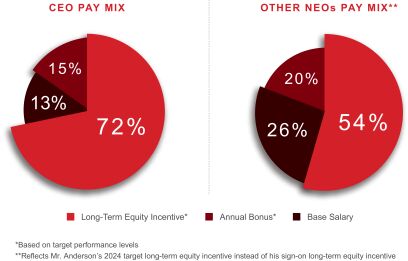

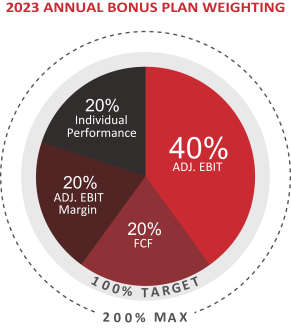

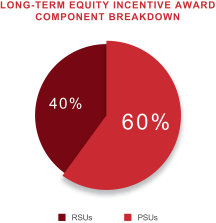

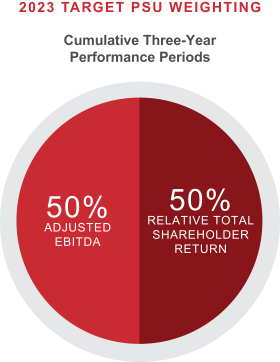

| • | Performance-Based Compensation – a significant amount of our executive officers’ compensation is performance-based, including awards of performance-based stock in 2023 tied to our achievement of Adjusted EBITDA targets and total shareholder return relative to the S&P 400 MidCap Index over a three-year period. The 2023 performance-based stock awards comprise approximately 60% of the target grant date fair value of the 2023 long-term equity awards granted to executive officers. |

| • | Significant At-Risk Pay – we believe that a significant portion of our named executive officers’ (“NEOs”) compensation should be earned based on the Company’s performance. As set forth in more detail in “Compensation Discussion and Analysis – Pay For Performance” below, 87% of our CEO’s target pay and, on average, 74% of our other NEOs’ target pay was at risk in 2023 (i.e., annual performance-based compensation and long-term equity incentive awards). |

| • | Incentive Compensation Recoupment Policies – effective December 2023, the Compensation Committee adopted a clawback policy, which applies to certain of the Company’s executive officers (as defined in the NYSE rules), to comply with rules |

| recently adopted by the SEC and NYSE. In accordance with such rules, recoupment under this clawback policy is triggered by the requirement to restate previously issued financial statements under certain circumstances. The Company maintains another incentive compensation recoupment policy that applies to all members of our Executive Committee and certain other members of our senior leadership team, which is triggered by a financial restatement as well as certain other circumstances, including violations of certain Company policies, such as the Code of Business Conduct and Ethics. |

| • | Hedging and Pledging Prohibited – the Company’s insider trading policy, which was updated in 2023 to reflect revised SEC rules on trading plans and other matters, prohibits our officers, directors and employees from pledging their common shares as collateral, holding common shares in a margin account or engaging in hedging or short sale transactions in our common shares. |

| • | Equity Plan Design Features – our equity plan includes minimum 12-month vesting periods (subject to certain exceptions) and prohibitions on liberal share recycling, option repricing and payment of dividends until the related award vests. |

| • | Double Trigger Vesting Provisions – our equity plan also provides double trigger vesting provisions for long-term equity awards in the event of a Change-in-Control (as defined below). |

2024 PROXY STATEMENT 9

Table of Contents

| Proposal 1 |

Election of nine directors to serve until the 2025 Annual General Meeting of Members

☑ The Board recommends a vote FOR each of the director nominees

• The director nominees have a diverse set of backgrounds, characteristics and skills relevant to the leadership of the Board and oversight of the Company

• All of our non-employee director nominees are independent

|

|||

Our Board of Directors currently consists of eleven directors, nine of whom are proposed for election as directors at the Annual Meeting to serve until the Annual General Meeting of Members in 2025, or until the earliest of each such director’s death, resignation or removal. As previously disclosed, current directors Steven M. Chapman and Robert M. McLaughlin notified the Company that they did not intend to stand for re-election at the Annual Meeting and therefore are not proposed for election. While the Board currently consists of 11 directors, the Board has reduced the size of the Board to nine directors, effective immediately after the Annual Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. In addition to the information provided in the matrix on page 6, information regarding our director nominees’ professional experience, education, skills, age and other relevant information is set forth below.

The nominees are presently serving as directors of the Company, and they have agreed to stand for re-election. However, if for any reason any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that shares represented by the accompanying proxy will be voted for the election of a substitute nominee designated by our Board, or, alternatively, the Board may determine to leave the vacancy temporarily unfilled.

10 AXALTA COATING STSTEMS

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

Nominees for Election as Directors to Serve Until the 2025 Annual General Meeting of Members

|

Rakesh Sachdev

Age: 68

Axalta Board Service

• Tenure: 3 years (August 2020) • Non-Executive Board Chair

Independent |

|

Professional Experience

| • | Served as interim CEO and President of Axalta from August 2022 through December 2022 |

| • | Former Chief Executive Officer of Platform Specialty Products Corporation, now renamed Element Solutions Inc., a leading global specialty chemicals company |

| • | Former President and Chief Executive Officer of Sigma-Aldrich Corporation, a leading global life sciences and technology company, prior to its acquisition by Merck KGaA |

Education

| • | Bachelor’s degree in Mechanical Engineering from the Indian Institute of Technology, Delhi |

| • | M.S. in Mechanical Engineering from the University of Illinois at Urbana-Champaign |

| • | MBA from Indiana University |

Relevant Skills

| • | Extensive experience in the management of public and private chemical, industrial and life sciences businesses |

| • | Significant expertise in finance, strategy and international business transactions |

Other

| • | Chairman of the Board of Directors of Regal Rexnord Corporation (NYSE: RRX), a global manufacturer of motors, bearings, gearing, conveyor technologies, blowers, electric components and couplings |

| • | Member of the Board of Directors of Edgewell Personal Care Company (NYSE: EPC), a leading consumer products manufacturer |

| • | Member of the Board of Directors of Herc Holdings Inc. (NYSE: HRI), a leading equipment rental company |

| • | Senior Advisor to New Mountain Capital, a private equity company |

2024 PROXY STATEMENT 11

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Jan A. Bertsch

Age: 67

Axalta Board Service

• Tenure: 1 year (September 2022) • Audit Committee • Compensation Committee

Independent |

|

Professional Experience

| • | Former Senior Vice President and Chief Financial Officer of Owens-Illinois, Inc. (now O-I Glass), a manufacturer of container glass and packaging products |

| • | Former Executive Vice President and Chief Financial Officer of Sigma-Aldrich Corporation, a leading global life sciences and technology company, prior to its acquisition by Merck KGaA |

| • | Previously held positions of increasing authority at BorgWarner, Chrysler, Visteon Corp. and Ford Motor Company |

Education

| • | Bachelor’s degree in Finance from Wayne State University |

| • | MBA from Eastern Michigan University |

Relevant Skills

| • | Substantial experience in all aspects of financial management and strategic planning in a public company environment |

| • | Significant expertise in information technology |

| • | Significant experience in the automotive industry |

Other

| • | Chair of the Board of Directors of BWX Technologies, Inc. (NYSE: BWXT), a manufacturing and engineering innovator that provides nuclear solutions for global security, clean energy, environmental remediation, nuclear medicine and space exploration |

| • | Member of the Board of Directors of Regal Rexnord Corporation (NYSE: RRX), a global manufacturer of motors, bearings, gearing, conveyor technologies, blowers, electric components and couplings |

| • | Formerly an independent member of the Board of Directors of Meritor, Inc., a global supplier of a broad range of integrated systems, modules and components to original equipment manufacturers and the aftermarket for the commercial vehicle, transportation and industrial sectors, prior to its acquisition by Cummins Inc. in August 2022 |

12 AXALTA COATING STSTEMS

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

William M. Cook

Age: 70

Axalta Board Service

• Tenure: 4 years (May 2019) • Audit Committee • Compensation Committee (Chair)

Independent |

|

Professional Experience

| • | Former Executive Chairman, President, Chief Executive Officer and Chief Financial Officer of Donaldson Company, Inc. (NYSE: DCI), an international manufacturer of filtration systems and replacement parts |

| • | Began career at Ford Motor Company as a financial analyst |

Education

| • | Bachelor’s degree in business management and MBA from Virginia Polytechnic Institute and State University |

Relevant Skills

| • | Significant business, financial and organizational leadership skills, with deep familiarity in international industrial business gained while serving in senior executive roles for Donaldson Company, Inc. over a 35-year career |

| • | Extensive experience serving as a public company board member |

| • | Substantial board experience relevant to the coatings industry |

Other

| • | Member of the Board of Directors of Mativ Holdings, Inc. (NYSE: MATV) (formerly Neenah, Inc.), an international manufacturer of paper and packaging |

| • | Director of Virginia Tech Corps of Cadets Advisory Board |

| • | Former director of IDEX Corporation, a leading manufacturer of fluidic systems and specialty engineered products |

| • | Former director of The Valspar Corporation, a global leader in the paints and coatings industry until its 2017 acquisition by The Sherwin-Williams Company |

| • | Former director of Donaldson Company, Inc. |

2024 PROXY STATEMENT 13

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Tyrone M. Jordan

Age: 62

Axalta Board Service

• Tenure: 2 years (June 2021) • Environment, Health, Safety & Sustainability Committee • Nominating & Corporate Governance Committee

Independent |

|

Professional Experience

| • | Former President and Chief Operating Officer of DURA Automotive Systems, a leading supplier of electric/hybrid systems, advanced-driver assistance systems, mechatronics, lightweight structural systems and luxury trim systems for all premier automotive brands |

| • | Former Executive Vice President, Global Operations and Customer Experience of General Motors |

| • | Former Global Senior Vice President, Operations and Supply Chain, Aerospace Systems, of United Technologies Corporation |

Education

| • | Bachelor’s degree in Pre-Law from Eastern Michigan University |

| • | Bachelor of applied science degree in Industrial Engineering Technology from Purdue University |

| • | Executive Aerospace & Defense Master of Business Administration (ADMBA) in Operations, Strategy & Finance from the University of Tennessee |

Relevant Skills

| • | Significant operational, financial and technology experience |

| • | Deep experience in the automotive industry |

| • | Broad experience serving as a public company board member |

Other

| • | Member of the Board of Directors of Oshkosh Corporation (NYSE: OSK), a leading industrial company that designs and builds specialty trucks, military vehicles, truck bodies, airport fire apparatus and access equipment |

| • | Member of the Board of Directors of TPI Composites, Inc. (NASDAQ: TPIC), a leading manufacturer of composite wind blades and related precision molding and assembly systems |

| • | Former member of the Board of Directors of Trinity Industries, Inc. (NYSE: TRN), a premier provider of railcar products and services |

| • | Former director of Cooper Tire & Rubber Company, a company that specializes in the design, manufacture, marketing, and sales of replacement automobile and truck tires, from January 2021 until its acquisition by The Goodyear Tire & Rubber Company in June 2021 |

| • | Dean’s Advisory Board of the College of Business of Eastern Michigan University |

14 AXALTA COATING STSTEMS

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Deborah J. Kissire

Age: 66

Axalta Board Service

• Tenure: 7 years (December 2016) • Compensation Committee • Nominating & Corporate Governance Committee (Chair)

Independent |

|

Professional Experience

| • | Former Vice Chair and Regional Managing Partner at Ernst & Young LLP (“EY”), and member of the Americas Executive Board and Global Practice Group |

| • | Previously held other senior positions at EY, including Vice Chair and Regional Managing Partner for the East Central and Mid-Atlantic Regions and U.S. Vice Chair of Sales and Business Development |

Education

| • | Bachelor’s degree in Accounting from Texas State University |

Relevant Skills

| • | Extensive experience in the financial oversight of public companies |

| • | Experience launching new business and practice areas and leading acquisitions, business unit consolidations and successful integrations |

| • | Expertise in financial reporting, audit process, U.S. taxation, governance, mergers and acquisitions, transaction integration and human capital management |

Other

| • | Member of the Board of Directors of Cable One, Inc. (NYSE: CABO), a leading American cable and Internet service provider |

| • | Member of the Board of Directors of Celanese Corporation (NYSE: CE), a global technology and specialty materials company |

| • | Member of the Board of Directors of Omnicom Group Inc. (NYSE: OMC), a global marketing and corporate communications holding company based in the U.S. |

2024 PROXY STATEMENT 15

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Samuel L. Smolik

Age: 71

Axalta Board Service

• Tenure: 7 years (September 2016) • Environment, Health, Safety & Sustainability Committee (Chair) • Nominating & Corporate Governance Committee

Independent |

|

Professional Experience

| • | Former Senior Vice President – Americas Manufacturing and other senior positions at LyondellBasell Industries, one of the world’s largest plastics, chemical and refining companies |

| • | Former Vice President – Global Downstream Health, Safety, Security and Environment at Royal Dutch Shell |

| • | Former Vice President, Global Environment, Health, Safety and Security and other positions of increasing responsibility at The Dow Chemical Company |

Education

| • | Bachelor’s degree in Chemical Engineering from The University of Texas at Austin |

Relevant Skills

| • | Extensive experience in global operations and environmental, health and safety matters in the oil and petrochemicals industry |

| • | Leadership experience from working internationally in numerous countries and cultures |

| • | Significant experience working with government agencies and non-governmental organizations |

| • | Considerable experience in sustainable development and corporate social responsibility |

Other

| • | Previously active with American Fuel & Petrochemical Manufacturers Association and American Chemistry Council |

| • | Former director of Evergreen Industrial Services, a premier provider of industrial and environmental services |

| • | Member of The University of Texas at Austin Engineering Advisory Board, the Antwerp International School Foundation, where he is Chairman of the Board of Directors, and Ducks Unlimited, the leading wetlands conservation organization in North America, where he serves on the Board of Directors of Ducks Unlimited, Inc. and Ducks Unlimited de Mexico |

16 AXALTA COATING STSTEMS

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Kevin M. Stein

Age: 58

Axalta Board Service

• Tenure: <1 year (September 2023) • Environment, Health, Safety & Sustainability Committee • Nominating & Corporate Governance Committee

Independent |

|

Professional Experience

| • | Current President and CEO of TransDigm Group Incorporated (NYSE: TDG), a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today |

| • | Formerly was Chief Operating Officer and President at TransDigm after serving as Chief Operating Officer of TransDigm’s Power and Controls segment |

| • | Prior to joining TransDigm, served in a variety of senior leadership roles at Precision Castparts Corporation (now a division of Berkshire Hathaway) |

| • | Formerly served as a division president for both of Cooper Industries and Tyco Electronics/Raychem Corporation |

Education

| • | Bachelor’s degree in Chemistry from Hobart College |

| • | Master’s and Ph.D in Inorganic Chemistry from Stanford University |

Relevant Skills

| • | Significant operational and management experience with complex global organizations within the manufacturing sector |

| • | Significant and diverse business experience |

Other

| • | Member of the board of directors of TransDigm, where he is also the President and Chief Executive Officer |

| • | Former member of the Board of Directors of Perimeter Solutions SA (NYSE: PRM) |

2024 PROXY STATEMENT 17

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Chris Villavarayan

Age: 53

Axalta Board Service

• Tenure: 1 year (January 2023) |

|

Professional Experience

| • | Chief Executive Officer and President of Axalta |

| • | Former Chief Executive Officer and President of Meritor, Inc. (“Meritor”), a global supplier of a broad range of integrated systems, modules and components to original equipment manufacturers and the aftermarket for the commercial vehicle, transportation and industrial sectors, until October 2022. Meritor was acquired by Cummins Inc. in August 2022 |

| • | Previously held other senior positions at Meritor, including Executive Vice President and Chief Operating Officer, overseeing Meritor’s global operations for both its business units, Global Truck and Aftermarket & Industrial; executive oversight through board leadership of Meritor’s four largest joint ventures; Senior Vice President and President – Global Truck, with responsibility for leading P&L across Meritor’s global truck business; and President –Americas, managing multiple businesses across portfolios as leader of Meritor’s North and South America businesses |

Education

| • | Bachelor’s degree in civil engineering from McMaster University |

| • | Completed the Wharton Executive Education Advanced Finance Program at the University of Pennsylvania |

Relevant Skills

| • | Significant operational and management experience with complex global organizations within the industrial sector and the automotive industry |

| • | Expertise in product development and manufacturing |

Other

| • | Member of the Board of Directors of Franklin Electric Co., Inc. (NASDAQ: FELE), a leading global provider of systems and components for moving water and fuel |

| • | Former member of the Board of Directors of Focus: HOPE, a Detroit-based, non-profit organization |

| • | Former member of the Board of Directors of Meritor |

18 AXALTA COATING STSTEMS

Table of Contents

PROPOSAL NO. 1: ELECTION OF NINE DIRECTORS

|

Mary S. Zappone

Age: 59

Axalta Board Service

• Tenure: <1 year (October 2023) • Audit Committee • Environment, Health, Safety & Sustainability Committee

Independent |

|

Professional Experience

| • | Current Chief Executive Officer of Sundyne LLC, a private company and a global leader in the design and manufacture of mission critical pumps and compressors for the chemicals, industrials, and energy markets, including renewables and decarbonization |

| • | Prior to joining Sundyne, served as Chief Executive Officer of Brace Industrial Group, Inc., a leading provider of specialty industrial construction services |

| • | Prior to Brace, served as President and Chief Executive Officer of Service Champ, Inc., a specialty distributor of consumable automotive aftermarket maintenance parts and accessories |

| • | Prior to Service Champ, served as President and Chief Executive Officer of RecoverCare LLC, a leading provider of healthcare equipment |

| • | Previously held leadership roles at Alcoa, Tyco International, General Electric, Exxon and McKinsey & Co. |

Education

| • | Bachelor’s degree in Chemical Engineering from Johns Hopkins University |

| • | MBA in Finance from Columbia Business School |

Relevant Skills

| • | Significant operational and management experience with complex global organizations within several industries |

| • | Significant and diverse business experience |

Other

| • | Former member of the Board of Directors of Avantax Inc., a leading provider of tax-focused financial planning and wealth management services |

| The Board of Directors recommends a vote “FOR” the election of each of the director nominees to serve until the 2025 Annual General Meeting. Election of each director nominee to our Board of Directors requires the affirmative vote of a plurality of votes cast at the Annual Meeting. Withhold votes, abstentions and broker non-votes will have no effect on the outcome of the vote.

|

||

2024 PROXY STATEMENT 19

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Policies on Corporate Governance

Our Board believes that strong corporate governance is important to ensure that our business is managed for the long-term benefit of our shareholders. We have adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees, including our executive officers and senior financial and accounting officers, which is available at www.axalta.com/corporate/en_US/about-axalta/values. In the event that the Company amends or waives any of the provisions of the Code of Business Conduct and Ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller that relates to any element of the definition of ‘code of ethics’ enumerated in Item 406(b) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company intends to

disclose these actions on the Company’s website identified in the preceding sentence. The Board has also adopted Corporate Governance Guidelines, which cover topics including, among other things, director qualification criteria, continuing director education and succession planning. Copies of the current versions of the Code of Business Conduct and Ethics and the Corporate Governance Guidelines are available on our website at https://ir.axalta.com/corporate-governance/governance-documents and will also be provided upon request to any person without charge. Requests should be made in writing to our Corporate Secretary at Axalta Coating Systems Ltd., 1050 Constitution Avenue, Philadelphia, PA 19112, or by telephone at (855) 547-1461.

Board Leadership Structure

The Board of Directors does not have a set policy with respect to the separation of the offices of the Board Chair and the CEO, as the Board believes it is in the best interests of the Company and our shareholders to make that determination based on the particular circumstances affecting the Company, as well as the membership of the Board.

The Board regularly evaluates whether the roles of Board Chair and CEO should be separate. The Board believes it is important to retain flexibility on this issue and that it should be considered as part of the Board’s broader oversight and succession planning process. At this time, the Board believes that the separation of the Board Chair and CEO positions is in the best interests of the Company and its shareholders and other stakeholders. The Board has formalized its expectations for the Board Chair, including the following:

| • | Provides leadership and direction on Board operations |

| • | Coordinates the activities of the independent directors |

| • | Chairs Board meetings and executive sessions of the directors both with and without the CEO |

| • | Enables the independent directors to raise suggestions, issues and concerns, including with respect to meeting topics/agendas |

| • | Acts as a spokesperson for the Board in appropriate circumstances, which may include engagements with shareholders, proxy advisors and other relevant stakeholders |

| • | Facilitates discussion in between Board meetings as needed |

| • | Serves as the principal liaison between the independent directors and management |

| • | Briefs and provides feedback to the CEO on relevant issues from the Board, including those arising in executive sessions |

| • | Provides counsel regularly to the CEO and as needed to other members of management |

We believe that our board leadership structure, with Mr. Villavarayan serving as CEO and Mr. Sachdev as non-executive Board Chair, allows Mr. Villavarayan to focus primarily on our vision, business strategy and operations, while leveraging Mr. Sachdev’s experience and perspectives to lead our Board.

20 AXALTA COATING STSTEMS

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Board Role in Strategy Oversight

The Board is responsible for overseeing the Company’s strategy, operations and results in order to drive long-term value for our shareholders. The Board conducts an in-depth review of the Company’s near-and long-term strategic plan on an annual basis and receives regular updates on the strategic plan, as well as various operating matters, throughout the course of the year. During the in-depth review, which may be held over several days, the Board discusses with senior management the Company’s strategic plan, both with respect to the entire enterprise and each of the Company’s end-markets and covering the Company’s

near-and longer-term priorities and goals. The Board also discusses our strategy, operations and results in executive sessions, with and without our CEO in attendance. In addition, each of the Board’s standing committees regularly reviews and discusses with management topics that are critical to the success of our strategic plan. We believe that the Board’s oversight of our strategy is comprehensive and effectively holds management accountable to develop a strategic plan that positions the Company to deliver long-term shareholder value.

Board Role in Risk Oversight

In addition to its strategic oversight, the Board provides overall risk oversight focusing on the most significant risks facing our Company. Our finance function, which reports to our CEO through the Chief Financial Officer, has day-to-day management responsibility for our enterprise risk management (“ERM”) processes. Such processes include an annual survey that is intended to identify potential key risks facing our business, including the likelihood and severity of such risks on a standalone basis and after any mitigating actions we may employ.

The survey is also intended to assess how quickly such risks might impact our business. In addition, our risk management team, within our finance function, together with a cross-functional management committee, facilitates projects that are designed to mitigate our key risks, each of which is managed by business and/or functional leaders. The ERM processes are reviewed annually by both the Audit Committee and our full Board. The Board and the Audit Committee discuss with management the Company’s overall risk profile as well

2024 PROXY STATEMENT 21

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

as the key risks that are identified from the Company’s ERM processes, including risks related to operations, supply chain, cybersecurity and human capital management, as well as macroeconomic risks. In addition, the Board, together with its standing committees, oversees the risk management processes that are implemented by our executives to determine whether these processes are functioning effectively and are consistent with our strategy as well as best practices. The Board’s role in risk oversight has not had a significant effect on its leadership structure, although we believe our current leadership structure, with Mr. Sachdev serving as non-executive Board Chair and Mr. Villavarayan serving as CEO, enhances the Board’s effectiveness in risk oversight by allowing Mr. Villavarayan to manage risks while collaborating with Mr. Sachdev and the Board to oversee the risks facing the Company.

The Audit Committee is tasked with overseeing our financial risks and risk management policies. The Audit Committee is also specifically tasked with reviewing our compliance with legal and regulatory requirements and any related compliance policies and programs with management, our independent auditors and our legal counsel, as appropriate. Members of our management who have responsibility for designing and implementing our risk management processes regularly meet with the Audit Committee, and the Audit Committee is updated on a regular basis on relevant and significant risk areas. In addition, the Audit Committee oversees cybersecurity risks facing the Company, which are also regularly reviewed by the full Board. As part of this oversight, the Audit Committee receives regular updates from management throughout the year on the status of various cybersecurity matters, including recent developments, evolving standards, vulnerability assessments, third-party and independent reviews, the

overall threat environment, technological trends, global employee training and efforts to enhance the Company’s cybersecurity capabilities and preparedness. We maintain cybersecurity insurance with coverage for security incident response expenses, certain losses due to network security failures, investigation expenses, privacy liability and certain third-party liability. The EHS&S Committee is tasked with overseeing management’s monitoring and enforcement of the Company’s policies to protect the health and safety of employees, contractors, customers, the public and the environment, as well as overseeing other sustainability matters, including human rights, and quality matters. The Compensation Committee oversees risks associated with executive and employee compensation and human capital management matters, and the Nominating & Corporate Governance Committee oversees risks associated with corporate governance matters.

In addition to the Board’s oversight of ERM processes discussed above, the full Board considers specific risk topics, including risks related to CEO and management succession planning, risks associated with our business plan, strategies and capital structure and other significant risks that merit review and discussion by the Board. In addition, the Board receives reports from the committee chairs on risks overseen by their respective committees and discusses with members of our management the risks involved with their respective areas of responsibility. The Board is also informed by management throughout the year, as appropriate, of trends, developments and other matters that could adversely affect our risk profile or other aspects of our business. As provided in our Corporate Governance Guidelines, all directors have access to management and the Company’s employees, including in connection with the exercise of their risk oversight.

Board Role in ESG Oversight

The Board oversees ESG matters generally as part of its oversight of our business strategy and risk management, and the Board’s standing committees each oversee specific ESG matters, risks and goals that fall within their respective areas of responsibility. For example: the Audit Committee has oversight responsibility for compliance matters; the Compensation Committee has oversight responsibility for human capital management matters, including diversity and inclusion; the EHS&S Committee has oversight responsibility for environmental, health, safety and sustainability matters; and the Nominating & Corporate Governance Committee has oversight responsibility for ensuring that Axalta maintains strong governance practices. As part of this effort, the Nominating & Corporate Governance Committee also regularly discusses the Company’s ESG practices and disclosures, in terms of both the current ESG landscape

and potential developments, in order to ensure that all relevant ESG matters are overseen by the Board and its standing committees and communicated to our shareholders and other stakeholders. The Board and its standing committees regularly discuss with management a variety of ESG topics that are significant to our business and stakeholders. As highlighted in the Board skills matrix above, each director nominee has self-identified relevant experience in, or overseeing, one or more ESG areas, including corporate governance, sustainability and environmental matters and human capital management matters, which we believe allows the Board to effectively oversee the discrete ESG issues, both individually and collectively, that are relevant to our business. Execution of the Company’s ESG strategy is overseen and carried out by the Company’s senior management team.

22 AXALTA COATING STSTEMS

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Director Independence

Our Corporate Governance Guidelines require that the Board be composed of a majority of directors who are “independent” under applicable NYSE rules and state the Board’s belief that a substantial majority of directors should be independent. Our Board has affirmatively determined that each of our directors, other than Mr. Villavarayan, has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and therefore qualifies as “independent” under the applicable NYSE listing standards.

In reaching this determination, the Board considers all known relevant facts and circumstances about any relationship bearing on the independence of a director (or nominee, if applicable). The Board also considers transactions and arrangements entered into in the ordinary course, including the purchase or sale of products and services and the making of charitable donations, between the Company and its subsidiaries and any other organization where a director (or nominee, if applicable) or an immediate family member may have relationships pertinent to the independence determination.

| Director Identification, Recruitment and Nominations | ||

|

When the Board or the Nominating & Corporate Governance Committee has identified the need to add a new Board member, whether as a result of a vacancy on our Board or otherwise, the Nominating & Corporate Governance Committee will initiate a search. The Nominating & Corporate Governance Committee Chair leads the search and will seek input from relevant stakeholders, including other directors and management, in order to identify the best possible candidates given the current and future needs of the Board and the Company. The Nominating & Corporate Governance Committee may also, from time to time, engage a search firm to identify director candidates, and the committee has sole authority to retain and terminate any such firm. Members of the Nominating & Corporate Governance Committee and other members of the Board, including the Board Chair and the CEO, will interview and evaluate each potential director candidate based on the qualifications discussed below, and, ultimately, the Nominating & Corporate Governance Committee will recommend to the Board the appointment of any suitable director candidates. A third-party search firm identified Mr. Stein and Ms. Zappone as suitable director candidates for the Company.

The Nominating & Corporate Governance Committee also considers director nominees recommended by our shareholders. A shareholder who wishes to recommend a director candidate for consideration by the Nominating & Corporate Governance Committee should send the recommendation to our Corporate Secretary at Axalta Coating Systems Ltd., 1050 Constitution Avenue, Philadelphia, PA 19112, who will then forward it to the Nominating & Corporate Governance Committee. The recommendation must include a description of the candidate’s qualifications for Board service, including all of the information that would be required to be disclosed pursuant to Item 404 of Regulation S-K (as amended from time to time) promulgated by the SEC, the candidate’s written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the shareholder and the candidate for more information. A shareholder who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the Nominating & Corporate Governance Committee as a nominee, must comply with the notice procedures set forth in our Bye-laws and applicable SEC requirements. See “Shareholder Proposals for the Company’s 2025 Annual General Meeting of Members” for more information on these procedures.

The Nominating & Corporate Governance Committee will consider and evaluate persons recommended by the shareholders in the same manner as it considers and evaluates other potential directors, including incumbent directors. |

|

2024 PROXY STATEMENT 23

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Director Qualifications

The Board believes that its membership should consist of persons with sufficiently diverse and independent backgrounds and with the relevant expertise required to serve as a director of the Company. The Nominating & Corporate Governance Committee is tasked with ensuring that the Board meets this objective and is responsible for reviewing the qualifications of potential director candidates and recommending to the Board candidates to be nominated for election to the Board. Our Corporate Governance Guidelines, which are available on our website as described above, set forth criteria that the Nominating & Corporate Governance Committee may consider when evaluating a director candidate for membership on the Board of Directors. These criteria include, among others: professional experience; education; skills; diversity; differences of viewpoint; other individual qualities and attributes that will positively contribute to the Board, including integrity and high ethical standards; experience with business administration processes and principles; ability to express opinions, ask difficult questions and make informed, independent judgments; significant experience in at least one specialty area; and the ability to devote sufficient time to prepare for and attend Board meetings. The Nominating & Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee.

Our Nominating & Corporate Governance Committee also considers the mix of backgrounds (including diversity characteristics) and qualifications of the directors and the challenges and needs of the Company to ensure that the Board of Directors has the necessary

experience, knowledge, abilities and makeup to effectively perform its responsibilities. The Board asks its current members, as well as prospective director candidates in connection with any search, to self-identify their individual skill sets and diversity characteristics, including, but not limited to, gender, racial or ethnic background, sexual orientation or identity, disabilities and military service. While the Board does not have a specific written diversity policy, it believes that overall diversity of directors is important to the Board’s overall functioning and considers diversity when evaluating director candidates and in director searches.

The average tenure of our director nominees is approximately four years, none of our director nominees has a tenure longer than approximately eight years, and seven of our nine director nominees were appointed since 2019. The Nominating & Corporate Governance Committee considers Board tenure and refreshment as additional relevant criteria in its identification, consideration and recommendation of director candidates.

When considering whether our directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focuses primarily on each person’s background and experience as reflected in the matrix on page 6 and the information discussed in each of the directors’ individual biographies set forth in “Proposal No. 1: Election of Nine Directors to Serve Until the 2025 Annual General Meeting of Members.”

Limitations on Other Board and Audit Committee Service

To ensure all directors are able to devote sufficient time to perform their duties, our Corporate Governance Guidelines provide for certain limitations on the service of our directors:

| • | Additional Public Company Boards or Audit Committees – directors may not serve on more than four public company boards of directors or more than three audit committees (in each case including the Company). |

| • | Age Limit – no director will be nominated for re-election or reappointed to the Board after reaching the age of 75 unless an affirmative request is made by the Board for that director to continue service. |

Directors must notify the Board Chair when their principal occupation changes, and the Nominating & Corporate Governance Committee will review the circumstances regarding the change to determine whether continued Board membership is appropriate. In addition, Directors are required to advise the Board Chair and the Chair of the Nominating & Corporate Governance Committee in advance of accepting other company directorships or audit committee or compensation committee assignments. Management and the Nominating & Corporate Governance Committee track the outside board and committee service of Directors and the Nominating & Corporate Governance Committee reviews and discusses such matters when appropriate or necessary.

24 AXALTA COATING STSTEMS

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Board Composition

Our Board currently consists of eleven directors who are elected annually, with Mr. Sachdev serving as non-executive Board Chair. As previously disclosed, current directors Steven M. Chapman and Robert M. McLaughlin informed the Company that they did not intend to stand for re-election at the Annual Meeting and therefore are not proposed for election at the Annual Meeting. The number of directors on our Board may be modified from time to time by our Board of Directors in accordance with our Bye-laws. Any directors appointed by the Board to fill vacancies, whether as a result of an

increase in the size of the Board or otherwise, would serve only until the next election at an Annual General Meeting of Members or until a director’s earlier death, resignation or removal.

The Nominating & Corporate Governance Committee regularly reviews the composition of the Board and its committees, including periodically reviewing the directors’ self-identified skill sets and characteristics, in connection with its ongoing assessment of current and future needs of the Board.

Director Orientation and Continuing Education

We have a process for onboarding and orienting new directors and for providing continuing education to our Board members. As part of our director orientation program, new directors participate in one-on-one introductory meetings with Axalta’s business and functional leaders and are briefed on the Company’s strategic plans, financial statements and processes and key issues, as well as the Company’s governance and compliance policies and procedures. We encourage and

pay for our directors to attend continuing education programs on ESG matters, compliance and other critical issues associated with a director’s service on a public company board, as well as site visits to our facilities. Our Board and committees also receive educational programming through guest speakers and presentations on substantive issues during Board and committee meetings and other Board events.

Board Meetings, Attendance and Executive Sessions

Directors are expected to spend the time needed and to meet as frequently as necessary to properly fulfill their oversight responsibilities. The Board and its committees meet on a regularly scheduled basis during the year to review our strategy, financial and operational performance, risks, ESG matters and other significant developments affecting us and to act on matters requiring Board approval. The Board and its committees also hold special meetings when an important matter between scheduled meetings requires Board and/or committee review or action. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings and meetings of committees on which they serve. In addition, all directors are expected to attend our Annual General Meeting of Members. All of the

then-current directors attended the 2023 Annual General Meeting of Members.

In general, the independent directors meet in executive session, without the presence of management, in conjunction with regular meetings of the Board and its committees. The Board Chair presides over Board executive sessions with the committee chairs presiding over the sessions of their respective committees. The Board Chair and committee chairs provide feedback from such executive sessions to the CEO and management as appropriate.

During 2023, the Board held 7 formal meetings, and all directors attended 75% or more of the meetings of the Board and committees on which they served that were held during their respective tenures in 2023.

2024 PROXY STATEMENT 25

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Board Evaluation Process

Our Board believes that a comprehensive evaluation of our Board and its committees enhances their effectiveness. Each of the Board’s standing committees conducts an annual self-evaluation to determine whether it has complied with its responsibilities under our Bye-laws, its committee charter and applicable laws and regulations. The Nominating & Corporate Governance Committee oversees an annual evaluation of the Board and each of its standing committees to assess effectiveness and areas for improvement.

Each year, the Nominating & Corporate Governance Committee discusses and approves the process for the annual Board and committee evaluation to ensure the evaluation effectively assesses the performance of the Board and its committees at that time. The Nominating & Corporate Governance Committee may vary the evaluation process based on the Company’s strategy, the needs of the Board and other relevant factors. For 2023, and historically, the Board and committee evaluation was led by the Company’s General Counsel, under the direction of the Nominating & Corporate Governance Committee.

The 2023 self-evaluation, which is summarized by the accompanying graphic, solicited director feedback on, among other things, the following topics:

| • | Board and committee composition, including skills, background, diversity and experience, among other items; |

| • | The Board’s oversight of strategy, ESG matters, including with respect to human capital matters, the Company’s enterprise risk management processes and succession planning; |

| • | The quality of Board and committee participation, processes and meeting agendas/materials; |

| • | Whether and how well each committee has performed the responsibilities in its charter; |

| • | Areas where the Board and committees should increase their focus; |

| • | Satisfaction with time allocated for topics and encouragement of open discussion and communication; and |

| • | Access to management, experts and internal and external resources. |

The 2023 self-evaluation culminated in an anonymized, aggregated report prepared by the General Counsel that was provided to, and discussed with, the Board. As in prior years, certain changes were made to the Board and committee practices based on the 2023 self-evaluation.

Examples of such changes over the years include: increased and more structured time for executive sessions; and streamlined meeting presentations to focus on key issues to allow more time for, and to foster deeper, discussion.

26 AXALTA COATING STSTEMS

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

Board Committees

Our Board of Directors oversees the management of our business and affairs as provided by Bermuda law and conducts its business through its meetings and its four standing committees: Audit Committee; Compensation Committee; Nominating & Corporate Governance Committee; and EHS&S Committee. In addition, from time to time, other committees may be established under the Board’s direction when necessary or advisable to address specific issues.

Each of the standing committees operates under a charter that was approved by our Board, copies of which are available on our website at www.axalta.com.

Set forth below is the current membership and descriptions of each of the standing committees, with the number of meetings held during the year ended December 31, 2023 in parentheses:

|

Audit Committee (8)

Robert McLaughlin Jan Bertsch Steven Chapman William Cook Mary Zappone |

• Responsible for assisting the Board of Directors in overseeing our accounting and financial reporting processes and other internal control processes, the audits and integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm, our Code of Business Conduct and Ethics, and the performance of our internal audit function.

• Oversees financial risks, cybersecurity risks and the Company’s risk management policies.

• Appoints and oversees our independent registered public accounting firm, including pre-approval of non-audit services.

• Mr. McLaughlin was appointed as the chair of the Audit Committee in April 2014. Ms. Bertsch has been appointed to succeed Mr. McLaughlin as the chair of the Audit Committee effective as of June 2024.

• The Board of Directors has determined that Messrs. McLaughlin and Cook and Mmes. Bertsch and Zappone are each an “audit committee financial expert” as such term is defined under the applicable regulations of the SEC and have the requisite accounting or related financial management expertise and financial sophistication under the applicable rules and regulations of the NYSE.

• The Board of Directors has also determined that each committee member is independent under Rule 10A-3 under the Exchange Act and the NYSE listing standards for purposes of service on the Audit Committee.

• Mr. McLaughlin joined the Audit Committee in April 2014, Mr. Cook in May 2019, Mr. Chapman in July 2020, Ms. Bertsch in September 2022 and Ms. Zappone in October 2023. |

|

|

Compensation Committee (7)

William Cook Jan Bertsch Deborah Kissire Robert McLaughlin |

• Responsible for reviewing and approving the compensation philosophy and practices for the Company, reviewing and approving all forms of compensation and benefits to be provided to our Chief Executive Officer, our other executive officers and the Board of Directors, and reviewing and overseeing the administration of our equity incentive plans.

• Responsible for the oversight of the Company’s human capital management matters, including the Company’s diversity and inclusion efforts.

• Our executive compensation processes and the role of the Compensation Committee, our executive officers, and management in the compensation process are each described under the heading “Compensation Discussion and Analysis – Compensation Governance: Oversight and Administration of the Executive Compensation Program” in this Proxy Statement.

• Mr. Cook was appointed as the chair of the Compensation Committee in January 2023.

• The Board of Directors has determined that each committee member is independent under the NYSE listing standards for purposes of service on the Compensation Committee.

• Ms. Kissire joined the Compensation Committee in December 2016, Mr. McLaughlin in January 2017, Mr. Cook in September 2022 and Ms. Bertsch in June 2023. |

|

2024 PROXY STATEMENT 27

Table of Contents

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

|

Nominating & Corporate Governance Committee (5)

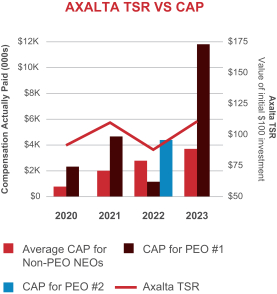

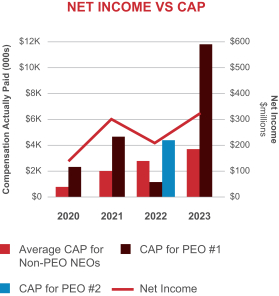

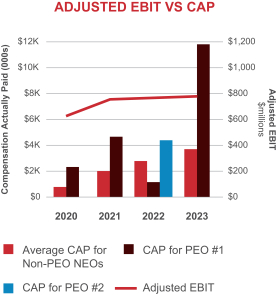

Deborah Kissire Tyrone Jordan Samuel Smolik Kevin Stein |