S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on September 25, 2014

Table of Contents

As filed with the Securities and Exchange Commission on September 24, 2014

Registration No. 333-198271

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AXALTA COATING SYSTEMS LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 2851 | 98-1073028 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Two Commerce Square

2001 Market Street

Suite 3600

Philadelphia, Pennsylvania 19103

(855) 547-1461

(Address, including zip code, and telephone number, including area code, of the registrants principal executive offices)

Michael F. Finn

Senior Vice President and General Counsel

Axalta Coating Systems Ltd.

Two Commerce Square

2001 Market Street

Suite 3600

Philadelphia, Pennsylvania 19103

(855) 547-1461

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Patrick H. Shannon Jason M. Licht Latham & Watkins LLP 555 Eleventh Street, NW Washington, D.C. 20004 (202) 637-2200 |

Craig F. Arcella Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, NY 10019 (212) 474-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of large accelerated filer, accelerated filer, and smaller reporting company in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ Large accelerated filer | ¨ Accelerated filer | x Non-accelerated filer | ¨ Smaller reporting company |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated September 24, 2014

PROSPECTUS

Shares

Axalta Coating Systems Ltd.

Common Shares

This is Axalta Coating Systems Ltd.s initial public offering. We are selling common shares in this offering. The selling shareholders named in this prospectus, including affiliates of The Carlyle Group (Carlyle), are selling shares of our common shares in this offering.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for our common shares. We will apply for listing of our common shares on the under the symbol .

Investing in the common shares involves risks that are described in the Risk Factors section beginning on page 21 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

The underwriters may also purchase up to an additional common shares from the selling shareholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus. We will not receive any of the proceeds from the sale of common shares by the selling shareholders in this offering, including from any exercise by the underwriters of their option to purchase additional common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common shares will be ready for delivery on or about , 2014.

| Citigroup | Goldman, Sachs & Co. | Deutsche Bank Securities | J.P. Morgan | |||

| BofA Merrill Lynch | Barclays | Credit Suisse | Morgan Stanley | |||

The date of this prospectus is , 2014.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 21 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 51 | ||||

| Unaudited Pro Forma Condensed Combined and Consolidated Financial Information |

54 | |||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

65 | |||

| 108 | ||||

| 110 | ||||

| 129 | ||||

| 136 | ||||

| 152 | ||||

| 155 | ||||

| 157 | ||||

| 164 | ||||

| 166 | ||||

| 172 | ||||

| 176 | ||||

| 182 | ||||

| 182 | ||||

| 182 | ||||

| 182 | ||||

| F-1 | ||||

We are responsible only for the information contained in this prospectus and in any related free-writing prospectus we prepare or authorize. We and the selling shareholders have not, and the underwriters have not, authorized anyone to give you any other information and take no responsibility for any other information that others may give you. We and the selling shareholders are offering to sell, and seeking offers to buy, the common shares only in jurisdictions where offers and sales are permitted.

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of the common shares to and between residents and non-residents of Bermuda for exchange control purposes provided our common shares remain listed on an appointed stock exchange, which includes . In granting such consent, neither the Bermuda Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

i

Table of Contents

MARKET, INDUSTRY AND OTHER DATA

This prospectus includes estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms or other independent sources such as Orr & Boss, Inc. (Orr & Boss) and LMC Automotive (LMC Automotive), and our own estimates based on our managements knowledge of and experience in the market sectors in which we compete. Although we believe them to be accurate, we have not independently verified market and industry data from third-party sources. This information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in industry research and surveys of market size.

References to market share are based on sales generated in the relevant market. Except as otherwise noted, market position data is derived from Orr & Boss and/or management estimates.

References to EMEA refer to Europe, the Middle East and Africa. References to Latin America include Mexico and references to North America exclude Mexico.

References to emerging markets refer collectively to Latin America (including Mexico) and Asia (excluding Japan).

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

TRADEMARKS

We own or otherwise have rights to the trademarks, service marks, copyrights and trade names, including those mentioned in this prospectus, used in conjunction with the marketing and sale of our products and services. This prospectus includes trademarks, such as Alesta®, Abcite®, Aqua EC®, Centari®, Chemolit®, Chemophan®, Corlar®, CorMax®, Cromax®, Cromax Mosaic®, ExcelPro®, Imron®, Imron Elite®, Lutopen®, Nap-Gard®, Nason®, Rival®, Standox®, Spies Hecker®, Stollaqua®, Stollaquid®, Syntopal®, Voltatex®, Voltron®, Eco-Concept, 3-Wet and 2-Wet Monocoat, which are protected under applicable intellectual property laws and are our property and the property of our subsidiaries. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks, service marks and trade names referred to in this prospectus may appear without the ® or symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under Risk Factors, Selected Historical Financial Information and Managements Discussion and Analysis of Financial Condition and Results of Operations, and our financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. On February 1, 2013, Axalta Coating Systems Ltd. (ACS) acquired from E. I. du Pont de Nemours and Company (DuPont) all of the capital stock, other equity interests and assets of certain entities that, together with their subsidiaries, comprised the DuPont Performance Coatings business (DPC), which is referred to herein as the Acquisition. Following the Acquisition, we renamed our business Axalta Coating Systems (Axalta). References herein to the Company, we, us, our and our company refer to ACS and its consolidated subsidiaries. References herein to fiscal year refer to our fiscal years, which end on December 31. References herein to the LTM Period refer to the twelve months ended June 30, 2014. See Summary Historical and Pro Forma Financial Information. References herein to the financial measures EBITDA and Adjusted EBITDA refer to financial measures that do not comply with generally accepted accounting principles in the United States (U.S. GAAP). For information about how we calculate EBITDA and Adjusted EBITDA, see footnote 3 to the table under the heading Summary Historical and Pro Forma Financial Information.

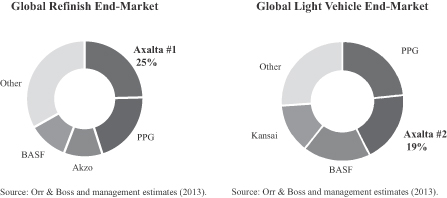

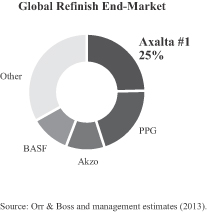

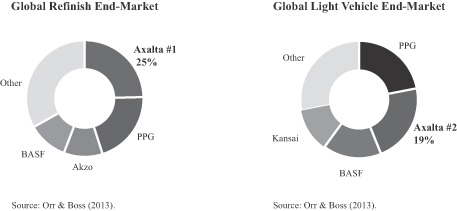

Our Company

We are a leading global manufacturer, marketer and distributor of high performance coatings systems. We generate approximately 90% of our revenue in markets where we hold the #1 or #2 global market position, including the #1 position in our core automotive refinish end-market with approximately a 25% global market share. We have a nearly 150-year heritage in the coatings industry and are known for manufacturing high-quality products with well-recognized brands supported by market-leading technology and customer service. Over the course of our history we have remained at the forefront of our industry by continually developing innovative coatings technologies designed to enhance product performance and appearance, while improving customer productivity and profitability.

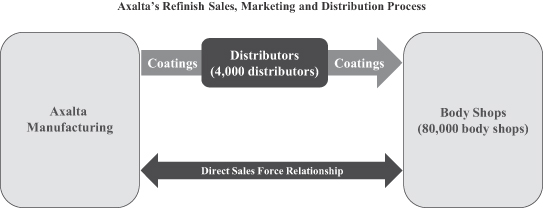

Our diverse global footprint of 35 manufacturing facilities, 7 technology centers, 45 customer training centers and approximately 12,650 employees allows us to meet the needs of customers in over 130 countries. We serve our customer base through an extensive sales force and technical support organization, as well as through over 4,000 independent, locally based distributors. Our scale and strong local presence are critical to our success, allowing us to leverage our technology portfolio and customer relationships globally while meeting customer demands locally.

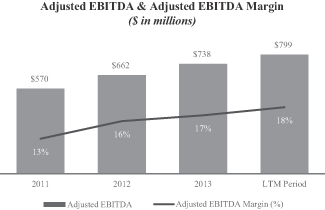

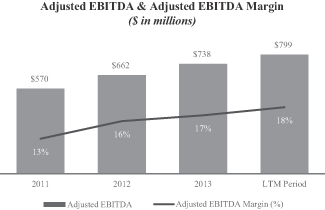

For the LTM Period, our net sales were $4,342 million, Adjusted EBITDA was $799 million, or 18.4% of net sales, and net income was $3 million. We have renewed the organizations focus on profitable growth, achieving year-over-year net sales and Adjusted EBITDA growth for each of the five full quarters following the Acquisition. Additionally, we have undertaken several transformational initiatives that we believe have laid the foundation for future growth, resulting in significant new business wins, many of which we expect to contribute to sales beginning in 2015. We have also begun implementing several EBITDA enhancement initiatives that we believe will drive meaningful earnings growth over the next several years. As of June 30, 2014, we had cash of $350 million and outstanding indebtedness of $3,905 million, which may limit the availability of financial resources to pursue our growth initiatives.

1

Table of Contents

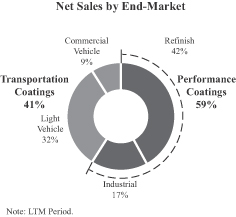

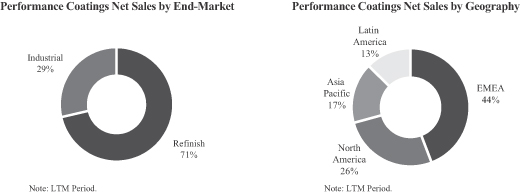

Our business is organized into two segments, Performance Coatings and Transportation Coatings, serving four end-markets globally as highlighted below:

|

|

Performance Coatings

Through our Performance Coatings segment we provide high-quality liquid and powder coatings solutions to a fragmented and local customer base. We are one of only a few suppliers with the technology to provide precise color matching and highly durable coatings systems. The end-markets within this segment are refinish and industrial as described below.

Refinish End-Market (#1 global market position): We provide waterborne and solventborne coatings to approximately 80,000 independent body shops, dealers and multi-shop operators (MSOs) to facilitate high-quality, efficient automotive collision repairs. Our advanced color matching technology and library of over four million color variations comprise an advanced color system that enables body shops to refinish vehicles regardless of vehicle brand, color, age, or original paint supplier.

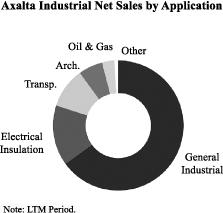

Industrial End-Market: We provide a wide range of liquid and powder coatings to customers who use them in diverse applications, including industrial machinery, electrical insulation, automotive components, architectural cladding and fittings, appliances, outdoor furniture and oil & gas pipelines. Our coatings are often used under severe operating conditions and require high performance such as high mechanical resistance, corrosion protection, elasticity and colorfastness.

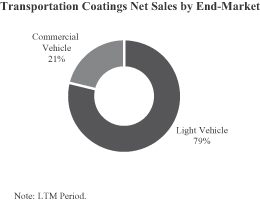

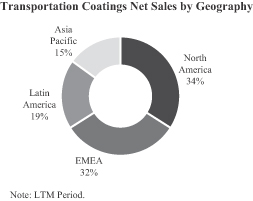

Transportation Coatings

Through our Transportation Coatings segment, we provide advanced coatings technologies to original equipment manufacturers (OEMs) of light and commercial vehicles. These increasingly global customers require a high level of technical support coupled with cost-effective, environmentally responsible coatings systems that can be applied with a high degree of precision, consistency and speed.

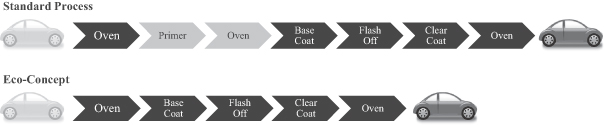

Light Vehicle End-Market (#2 global market position): We provide light vehicle OEMs and Tier 1 component suppliers a full range of waterborne and solventborne coatings systems that are a critical, integrated step in the vehicle assembly process. We compete and win new business on the basis of our quality, service and proprietary products that generate significant energy and cost savings for our customers while enhancing productivity and first pass quality. Our global capabilities and focus on technology enable us to provide our global customers with next-generation offerings to enhance appearance, durability and corrosion protection and comply with increasingly strict environmental regulations.

2

Table of Contents

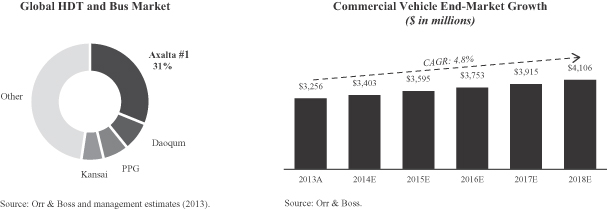

Commercial Vehicle End-Market: We provide liquid coatings to commercial vehicle OEMs, including those in the heavy duty truck (HDT), bus, rail and agricultural and construction equipment (ACE) markets, as well as related markets such as trailers, recreational vehicles and personal sport vehicles. As the #1 global supplier in both the HDT and bus markets, we meet the demands of our customers with an extensive offering of over 70,000 colors.

Transformational Initiatives

Since the Acquisition, we have migrated from a business segment of DuPont to an independent global company exclusively focused on coatings. We have completed the separation from DuPont and implemented several initiatives designed to unlock our businesss full potential, including:

| | Enhanced Senior Leadership Team: We have augmented our management team with world-class talent and significant end-market expertise, with 12 of our 17 most senior managers joining since the Acquisition, including our CEO and CFO. We have also recruited key regional and local managers with both operational and commercial leadership experience. |

| | Implemented New Customer Strategies: We have realigned our resources to more effectively meet the varying demands of our customers. In end-markets characterized by large global customers such as light and commercial vehicle OEMs, we transitioned from a regional to a global management and sales model. In the refinish end-market, we have reorganized our sales force to target and meet the needs of additional customers in high-growth areas of the market. |

| | Aligned Incentives: We have implemented a performance-based compensation structure that closely aligns the interests of our global leadership team with those of our shareholders. We have also transitioned to a more incentive-based compensation structure for our global sales force designed to increase their focus on profitable growth. |

| | Investing for Growth: As an independent company, we are able to focus our time and capital exclusively on coatings. As a result, we are pursuing investments with attractive returns such as low-risk capacity expansion projects in China, Germany, Mexico and Brazil that will position us to grow with our customers. We are also investing in operational improvement initiatives such as the realignment of our European manufacturing operations as well as growing our sales force in emerging markets and end-markets where we are currently underrepresented. |

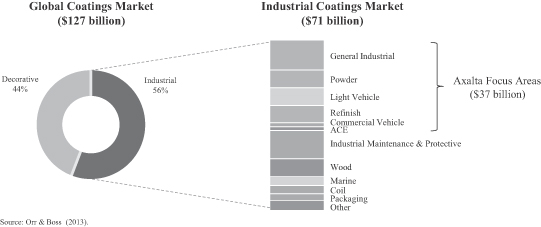

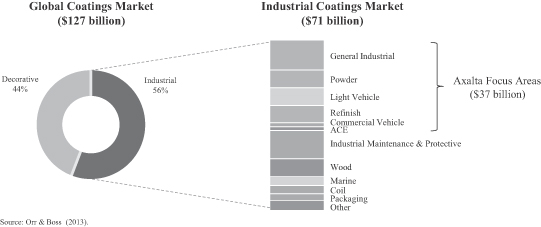

Our Industry

In 2013, we were the fourth largest supplier in the $127 billion global coatings industry as measured by sales, according to Orr & Boss. The global coatings industry is characterized by multiple end-markets and applications. Market participants include a few global coatings suppliers and many smaller, regionally focused suppliers that maintain a presence in select product categories and local markets.

3

Table of Contents

Within the broad global coatings market, we focus on the automotive refinish, light vehicle, commercial vehicle and industrial end-markets, which Orr & Boss estimates to collectively represent $37 billion of annual sales. The chart below illustrates the composition of the global coatings industry by application and indicates the end-markets in which we participate:

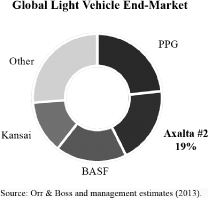

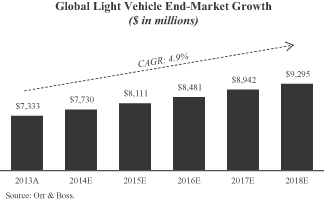

We operate in attractive end-markets, with the top four suppliers collectively holding an estimated 67% market share in the automotive refinish end-market and 74% market share in the light vehicle end-market. This structure is a result of few suppliers having the technological capabilities, global manufacturing footprint, efficient supply chain and overall scale to meet customer needs. These characteristics allow global coatings providers to serve customers locally while continuing to leverage global innovation, product platforms, relationships and best practices.

The refinish, industrial, light vehicle and commercial vehicle end-markets are collectively expected to grow at a compound annual growth rate (CAGR) of 5.8%, or $12.2 billion, from 2013 to 2018, according to Orr & Boss. This growth is due to specific end-market drivers as well as key industry trends, which favor large multi-national suppliers, including:

| | Increasingly stringent environmental regulations: Evolving regulations in all major geographies have placed limits on the emission of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). As a result, customers are shifting toward regulation-compliant, low-VOC solventborne and waterborne coatings. Few coatings suppliers have the technology and products to meet these increasingly stringent requirements. |

| | Global procurement model: Multi-national light vehicle OEMs are increasingly utilizing global procurement teams to stipulate product specifications and color standardization requirements, which are implemented at the local level. These customers select coatings providers on the basis of their ability to consistently deliver advanced technological solutions on a global basis. |

| | Increased efficiency: Customers are encouraging coatings manufacturers to invest in new product offerings that require fewer application steps, resulting in lower capital and energy costs. |

| | Vehicle light-weighting: With more stringent vehicle emissions and fuel consumption regulations, light vehicle OEMs are focused on reducing vehicle weight to improve fuel economy. This is driving the need for new, and frequently multiple, substrates on the exterior of the vehicle. Historically, OEMs have manufactured vehicles primarily with steel components but are now increasingly incorporating other materials, including aluminum, carbon fiber and plastics. These materials often require specialized primers and low-temperature curing formulations to achieve uniform appearance, color and finish. |

4

Table of Contents

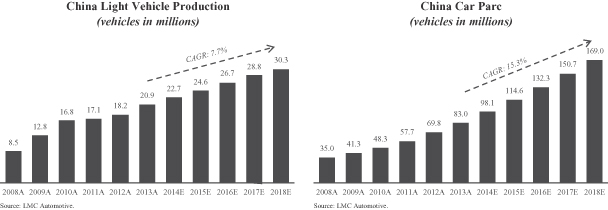

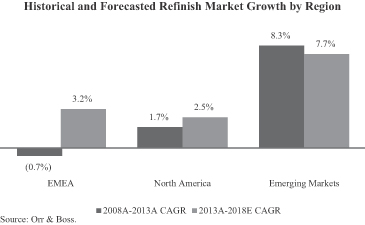

| | Emerging market growth: Emerging market demand in our end-markets is expected to grow at a CAGR of approximately 8.4% from 2013 to 2018, according to Orr & Boss. This is primarily due to increased government infrastructure spending and increased middle class consumption, which will increase the car parc (the number of vehicles in use). As per-capita wealth expands, consumers are also demanding higher-quality products, driving demand for more advanced coatings systems in these markets. |

Performance Coatings

Refinish

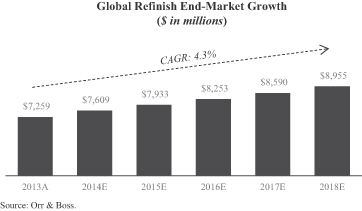

The refinish end-market represented an estimated $7.3 billion in 2013 global sales, according to Orr & Boss. Sales in this end-market are driven by the number of vehicle collisions and owners propensity to repair their vehicles. The number of vehicle collisions in a given market is primarily determined by the size of the car parc and the aggregate number of miles driven in that market. The global automotive refinish end-market is expected to grow at a CAGR of approximately 4.3% from 2013 to 2018, with emerging markets expected to grow at a CAGR of approximately 7.7% over the same period, according to Orr & Boss.

Refinish products are critical to vehicle appearance and customer satisfaction but typically represent a small percentage of the overall cost of repair. As a result, body repair shop operators are most focused on coatings brands with a strong track record of performance and reliability. Such brands offer exact color matching technologies, productivity enhancements, regulatory compliance, consistent quality and ongoing technical support in order to facilitate timely repairs that restore a damaged vehicles appearance to its original condition.

Industrial

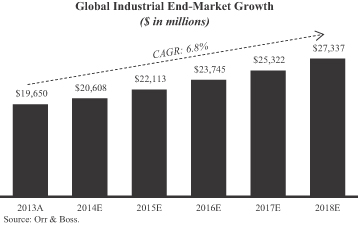

The industrial end-market represented an estimated $19.7 billion in 2013 global sales and is forecasted to grow at a CAGR of approximately 6.8% from 2013 to 2018, according to Orr & Boss. This end-market is comprised of liquid and powder coatings with demand driven by a wide variety of macroeconomic factors, such as growth in GDP and industrial production. Customers select industrial coatings based on protection, durability and appearance.

Transportation Coatings

Light Vehicle

The light vehicle end-market represented an estimated $7.3 billion in 2013 global sales and is expected to grow at a CAGR of approximately 4.9% from 2013 to 2018, according to Orr & Boss. Sales in this end-market are driven by new vehicle production, which is expected to grow in both the developed markets and the emerging markets. Light vehicle production growth is expected to be highest in emerging markets where OEMs plan to open 67 new assembly plants between 2014 and 2017.

Light vehicle OEMs select coatings providers on the basis of their global ability to deliver advanced technological solutions that improve exterior appearance and durability and provide long-term corrosion protection. Customers also look for suppliers that can enhance process efficiency to reduce overall manufacturing costs and provide on-site technical support. Rigorous environmental and durability testing as well as engineering approvals are also key criteria used by global light vehicle OEMs when selecting coatings providers.

Commercial Vehicle

The commercial vehicle end-market represented an estimated $3.3 billion in 2013 global sales and is expected to grow at a CAGR of approximately 4.8% from 2013 to 2018, according to Orr & Boss. Sales in this end-market

5

Table of Contents

are generated from a variety of applications including non-automotive transportation (e.g., HDT, bus and rail) and ACE. This end-market is primarily driven by global commercial vehicle production, which is influenced by overall economic activity, government infrastructure spending, equipment replacement cycles and evolving environmental standards.

Commercial vehicle OEMs select coatings providers on the basis of their ability to deliver extensive color libraries and advanced technological solutions that improve exterior appearance, protection and durability while meeting stringent environmental requirements.

Our Competitive Strengths

Leading positions in attractive end-markets

We are a global leader in manufacturing, marketing and distributing advanced coatings systems with approximately 90% of our revenue generated in markets where we hold the #1 or #2 global market position. We are one of only a small number of global coatings suppliers in each of our end-markets, which positions us favorably in an industry where global scale is a competitive advantage.

Market-leading refinish business driven by recurring aftermarket sales: We are the leading coatings supplier to the global automotive refinish end-market where we hold an estimated 25% share and the top four global suppliers hold an estimated 67% share. This end-market has consistently grown across economic cycles as the overall rate of collisions and repairs are not highly cyclical. Our refinish products offer quality, durability and superior color technology supported by a large color formula library that enables customers to precisely match colors. We supply our fragmented customer base of approximately 80,000 body shops through a global network of over 4,000 independent local distributors. Furthermore, body shops utilize our color matching system, inventory replacement process and training capabilities, which foster brand loyalty and have historically resulted in a high customer retention rate.

Well positioned in light vehicle end-market poised for growth: We are the second largest coatings provider to the global light vehicle end-market, which is expected to grow at a CAGR of approximately 4.9% from 2013 to 2018, according to Orr & Boss. In this end-market, the top four suppliers hold an estimated 74% share. We have developed a full complement of unique consolidated coating systems. These integrated solutions include our Eco-Concept, 3-Wet and 2-Wet Monocoat products that provide our customers with advanced, environmentally responsible systems that eliminate either a coatings layer or steps in the coatings process, thereby increasing productivity and reducing energy costs. In addition, we offer our customers on-site technical services as well as just-in-time product delivery. We are an integrated part of our customers assembly lines,

6

Table of Contents

which allows our technical support teams to improve operating efficiency and provide real-time performance feedback to our formulating chemists and manufacturing teams. We have been awarded new business in 26 OEM plants globally since the beginning of 2013, demonstrating the strength of our competitive positioning. We expect to recognize sales from the majority of these new contracts in 2015, although we cannot make any assurances regarding the amount of revenue or profit our new business awards will generate in the future.

Sustainable competitive advantages driven by global scale, established brands and technology

We believe we are one of only a few coatings providers that have the scale, manufacturing capabilities, brand reputation and technology to meet the purchasing criteria that are most critical to our customers on a global basis.

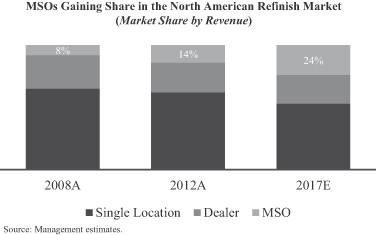

Our extensive manufacturing and distribution networks as well as our high-caliber technical capabilities enable us to meet customers volume and service requirements without interruption. Our global footprint also enables us to react quickly to changing local dynamics while leveraging our overall scale to cost-effectively develop and deliver leading edge technologies and solutions. In refinish, our scale gives us the ability to convert a large number of body shops to our systems in a short period of time, which has been a key competitive advantage in the growing North American MSO segment. Additionally, our scale and technical abilities enable us to meet the needs of our multi-national light vehicle customers, who increasingly require dedicated global account teams and high-quality, advanced coatings systems that can be applied consistently to global vehicle platforms.

Branding is another key factor that customers consider when choosing a coatings provider. Customers typically look to established brands when making their purchase decisions in our refinish, industrial and commercial vehicle end-markets. We have an extensive portfolio of established brands that leverage our advanced technology and a nearly 150-year heritage including our flagship global brand families of Cromax, Standox, Spies Hecker and Imron liquid products, our Alesta and Nap-Gard powder products and our Voltatex electrical insulation coatings.

Our technology is also a key competitive advantage. Our technology portfolio includes over 1,800 patents issued or pending and includes key assets such as our extensive color database and color matching technology, advanced multi-substrate formulations, process technology and VOC-compliant products. We also benefit from technology synergies across our end-markets. The colors, coatings properties and multi-substrate formulations we develop as a light vehicle coatings manufacturer help us sustain our leading refinish market position as we leverage insights from new light vehicle coatings to help develop innovative refinish coatings in the future.

Diverse revenue base

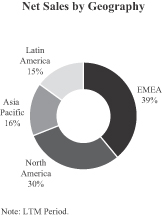

We generate our revenue from diverse end-markets, customers and geographies, which has historically reduced the financial impact of any single end-market, customer or region and limited the impact of economic cycles. Net sales in our end-markets of refinish, light vehicle, industrial and commercial vehicle represented 42%, 32%, 17% and 9% of net sales during the LTM Period, respectively. We also serve a globally diverse and highly fragmented customer base, with no single customer representing more than 7.6% of our net sales and our top ten customers representing approximately 31% of our net sales during the LTM Period. The percentage of our revenue generated by our top customers, however, may increase as we grow our sales to the light vehicle end-market. Additionally, we generated approximately 39% of our net sales in EMEA, 30% in North America, 16% in Asia Pacific and 15% in Latin America during the LTM Period.

7

Table of Contents

Strong financial performance and cash flow characteristics

We have an attractive financial profile with gross margins of 34.3% and Adjusted EBITDA margins of 18.4% for the LTM Period.

The refinish end-market serves as the foundation of our financial profile, representing 42% of our consolidated net sales for the LTM Period. Our track record of consistent price increases driving strong Adjusted EBITDA performance and low levels of maintenance capital expenditures has allowed us to consistently generate strong cash flows that we are re-investing in the business to position us for future earnings growth.

We have generated year-over-year net sales and Adjusted EBITDA growth for each of the five full quarters since the Acquisition, driven in part by the initial impact of our transformational growth initiatives. In addition, we have implemented numerous initiatives intended to reduce our fixed and variable costs and improve working capital productivity. We believe that these initiatives will continue to generate significant cost savings in the future, although we cannot make any assurances regarding the amount of cost savings these initiatives will generate. Many are in their early stages of implementation and have only recently begun to contribute to our financial results.

Experienced management team

We have augmented our management team with world-class talent and meaningful end-market expertise, with 12 of our 17 most senior managers joining since the Acquisition. This team has added new and diverse perspectives to the business from a range of industries. Our management team is led by our CEO, Charlie Shaver, who has over 34 years of chemical and global operating experience, including most recently President and CEO of TPC Group. He is supported by a senior management team comprised of global, regional and country focused leaders with diverse backgrounds and skill sets. The management team has extensive international experience with a strong track record of improving operations and executing strategic growth initiatives, including mergers and acquisitions.

Our Business Strategy

Pursue and execute new business wins in high-growth areas of our end-markets

We have aligned our resources to better serve the high-growth areas of our refinish and light vehicle end-markets. In the North American refinish end-market, we have created dedicated sales, conversion and service

8

Table of Contents

teams to serve MSOs, which are gaining share in the North American collision repair market by reducing insurance company costs and providing consistently high customer satisfaction. Through new business wins with MSO customers, we have become a leading coatings provider to the North American MSO market, which we expect to grow from 14% of the North American collision repair market in 2012 to 24% by 2017. We are targeting growth opportunities with both existing MSO and new MSO accounts and believe that we are well positioned to gain additional market share as a result of our dedicated account teams, high productivity offerings and broad distribution network.

We have been awarded new business in 26 OEM plants globally since the beginning of 2013, with 16 of these plants located in China, where OEMs are rapidly expanding production to meet increasing demand for new vehicles. We expect that many of these new contracts will begin generating sales in 2015. Our success in this end-market has been driven by a new leadership team that has restructured our organization to mirror the increasingly global focus of OEMs. We will continue to pursue new business by leveraging our proprietary manufacturing processes, our broad range of VOC-compliant coatings and our substantial sales and technical support organizations.

Accelerate growth in emerging markets

We have a strong presence in emerging markets, which generated 30% of our sales during the LTM Period. These markets are characterized by increasing levels of vehicle production, a growing car parc, an expanding middle class and GDP growth above the global average, all of which drive greater demand for coatings. We believe that we are well positioned to capitalize on this increasing demand with local manufacturing facilities and extensive sales and technical service teams dedicated to these markets. In China, where we have operated a wholly owned business for 30 years, we are expanding our sales force and investing in new plant capacity, including a $50 million waterborne capacity expansion at our Jiading facility, which we expect to come on line in early 2015. We are also in the process of expanding our production capacity in Mexico and Brazil to drive future earnings growth.

|

Globalize existing product lines

Since the Acquisition, we have identified significant opportunities to leverage our existing products across geographies. For example, we are the market leader in the North American HDT market, but only recently began serving the Chinese market, which produces nearly four times the number of heavy duty trucks produced in the United States. This initiative has generated early positive results; for example, in 2014 we began serving Foton Daimler, one of the largest truck manufacturers in the region, with our high performance waterborne coatings. In

9

Table of Contents

refinish, we are leveraging legacy formulations from developed markets to satisfy growing mainstream demand in emerging markets. We also intend to pursue similar geographic opportunities with several of our other industrial and commercial vehicle product offerings.

Invest in high-return projects to drive earnings growth

We are in the early stages of implementing several initiatives that we believe will continue to generate significant earnings growth, including establishing a global procurement organization, realigning our European manufacturing operations and investing capital in growth projects with high expected returns. Since the Acquisition, we have built a global procurement organization, which is executing several programs to reduce costs by streamlining inputs, reducing the number of sole-sourced raw materials and partnering with new, high-quality suppliers to meet our purchasing needs. These programs are in their early stages and we believe they will continue to generate significant earnings growth over the next several years. In Europe, we are investing to upgrade, automate and re-align disparate manufacturing operations to bring the regions cost structure in line with the rest of the world and better position us to meet increasing local demand. We believe that these European investments, which we began in 2014, will generate approximately $100 million of incremental Adjusted EBITDA by 2017. Finally, we believe we have significant opportunities to pursue high return projects identified since the Acquisition. These include capacity expansion projects in China, Germany, Mexico and Brazil and productivity initiatives from which we expect to benefit over the next several years.

Maintain and further develop technology leadership

We will continue to build on our nearly 150-year heritage of developing market-leading technology. We leverage our intimate customer relationship and network of customer training centers to align product innovation with customer needs. For example, in the North American refinish end-market we have recently launched Cromax Mosaic, a new VOC-compliant solventborne coatings line, to complement our broad waterborne coatings portfolio. Body shops have embraced this product, which enables them to meet environmental regulations while using existing application equipment and techniques. We have a robust pipeline of over 80 new product innovations, the majority of which we intend to launch over the next two years, including several products focused on emerging markets. Similarly in the light vehicle end-market, our proprietary 3-Wet, Eco-Concept, 2-Wet monocoat systems and high throw electrocoat products have generated new customer wins as OEMs seek to increase efficiency and reduce costs. We believe this commitment to new product development will help us maintain our technology leadership and strong market position.

Risks Related to Our Business

Investing in our common shares involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common shares. There are several risks related to our business and our ability to leverage our strengths described elsewhere in this prospectus that are described under Risk Factors elsewhere in this prospectus. Among these important risks are the following:

| | adverse developments in economic conditions and, particularly, in conditions in the automotive and transportation industries and our other end-markets; |

| | risks of losing any of our significant customers or the consolidation of MSOs, distributors and/or body shops; |

| | our ability to successfully execute our growth strategy and leverage our strengths; |

| | risks associated with our non-U.S. operations and global scale; |

| | currency-related risks; |

10

Table of Contents

| | increased competition; |

| | price increases or interruptions in our supply of raw materials; |

| | failure to develop and market new products and manage product life cycles; |

| | litigation and other commitments and contingencies; |

| | our substantial indebtedness; |

| | Carlyles ability to control our common shares; and |

| | other risks and uncertainties, including those listed under the caption Risk Factors. |

Our Principal Shareholders

Our principal shareholders are certain investment funds affiliated with Carlyle.

Founded in 1987, Carlyle is a global alternative asset manager and one of the worlds largest global private equity firms with approximately $203 billion of assets under management across 126 funds and 139 fund of funds vehicles as of June 30, 2014. Carlyle invests across four segmentsCorporate Private Equity, Real Assets, Global Market Strategies and Fund of Funds Solutionsin Africa, Asia, Australia, Europe, the Middle East, North America and South America. In addition to the industrials & transportation industry, Carlyle has expertise in various industries, including aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, technology & business services and telecommunications & media. Carlyle employs more than 1,600 employees, including more than 750 investment professionals, in 40 offices across six continents.

Company Information

Axalta Coating Systems Ltd. was incorporated pursuant to the laws of Bermuda on August 24, 2012. Our principal executive offices are located at Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, Pennsylvania 19103, and our telephone number is (855) 547-1461. Our website address is www.axaltacoatingsystems.com. Information on, or accessible through, our website is not part of this prospectus, nor is such content incorporated by reference herein.

We maintain a registered office in Bermuda at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The telephone number of our registered office is (441) 295-5950.

11

Table of Contents

The Offering

| Common shares offered by us |

common shares. |

| Common shares offered by the selling shareholders |

common shares. |

| Selling shareholders |

The selling shareholders identified in Principal and Selling Shareholders. |

| Common shares outstanding after this offering |

common shares. |

| Option to purchase additional shares |

The selling shareholders have granted the underwriters a 30-day option from the date of this prospectus to purchase up to additional common shares at the initial public offering price, less underwriting discounts and commissions. |

| Use of proceeds |

We estimate the proceeds to us from this offering will be approximately $ million, based on an assumed public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any net proceeds from the sale of common shares by the selling shareholders, including from any exercise by the underwriters of their option to purchase additional common shares. We intend to use the net proceeds from this offering, plus cash on hand, for the repayment of indebtedness and to pay fees and expenses. See Use of Proceeds for additional information. |

| Dividend policy |

We do not currently pay and do not currently anticipate paying dividends on our common shares following this offering. Any declaration and payment of future dividends to holders of our common shares may be limited by restrictive covenants in our debt agreements, and will be at the sole discretion of the board of directors of ACS (our Board of Directors), and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that our Board of Directors deems relevant. See Dividend Policy, Managements Discussion and Analysis of Financial Condition and Results of OperationsLiquidity and Capital ResourcesIndebtedness and Description of Share Capital. |

| Proposed stock exchange symbol |

. |

| Risk factors |

See Risk Factors beginning on page 21 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common shares. |

12

Table of Contents

The number of our common shares to be outstanding after completion of this offering is based on common shares outstanding as of , 2014, which includes common shares to be sold by the selling shareholders and excludes:

| | common shares issuable upon the exercise of options outstanding at a weighted average exercise price of $ per share; and |

| | common shares reserved for issuance under our 2014 Incentive Plan (the 2014 Plan), which we plan to adopt in connection with this offering. |

Unless we specifically state otherwise, all information in this prospectus assumes:

| | no exercise of the option to purchase additional common shares by the underwriters; |

| | an initial offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus; |

| | the filing of our amended and restated memorandum of association and the adoption of our amended and restated bye-laws immediately prior to the closing of this offering; and |

| | the completion of a -for- split of our common shares in connection with the filing of our amended and restated memorandum of association. |

13

Table of Contents

Summary Historical and Pro Forma Financial Information

The following table sets forth summary historical and pro forma financial information of Axalta. As a result of the Acquisition, we applied acquisition accounting whereby the purchase price paid was allocated to the acquired assets and liabilities at fair value. The financial reporting periods presented are as follows:

| | The years ended December 31, 2011 and 2012 and the period from January 1, 2013 through January 31, 2013 (Predecessor periods) reflect the combined results of operations of the DPC business. |

| | The year ended December 31, 2013 and the six-month periods ended June 30, 2013 and 2014 (Successor periods) reflect the consolidated results of operations of Axalta, which includes the effects of acquisition accounting commencing on the acquisition date of February 1, 2013 and the effects of the financing of the Acquisition commencing on February 1, 2013 and the refinancing of our Senior Secured Credit Facilities (as defined under Capitalization) that was consummated and commenced on February 3, 2014 (collectively referred to herein as the Financing). |

| | The pro forma year ended December 31, 2013 and the pro forma six months ended June 30, 2013 reflect the combined historical results of operations of the DPC business for the period from January 1, 2013 through January 31, 2013 and Axalta for the year ended December 31, 2013 and for the six months ended June 30, 2013, as adjusted for the pro forma effects of certain transactions as described in Unaudited Pro Forma Condensed Combined and Consolidated Financial Information. |

| | The pro forma six month period ended June 30, 2014 reflects consolidated results of operations of Axalta for the six month period ended June 30, 2014, adjusted to give pro forma effect to certain transactions as described in Unaudited Pro Forma Condensed Combined and Consolidated Financial Information. |

The historical results of operations and cash flow data for the six months ended June 30, 2013 and 2014 and the historical balance sheet data as of June 30, 2014 presented below were derived from our Successor unaudited financial statements and the related notes thereto included elsewhere in this prospectus. As of and for the Successor period of August 24, 2012 (inception) through December 31, 2012, the Successor had no operations or activity, other than merger and acquisition costs of $29.0 million, which consisted primarily of investment banking, legal and other professional advisory services costs. The historical financial data for the period January 1, 2013 through January 31, 2013 for the DPC business is included elsewhere in this prospectus.

The historical results of operations data and cash flow data for the year ended December 31, 2013 and the historical balance sheet data as of December 31, 2013 presented below were derived from our Successor audited financial statements and the related notes thereto included elsewhere in this prospectus. The historical combined financial data for the years ended December 31, 2011 and 2012 and the historical balance sheet data as of December 31, 2012 presented below have been derived from the Predecessor audited combined financial statements and the related notes thereto for the DPC business included elsewhere in this prospectus.

Our historical financial data and that of the DPC business are not necessarily indicative of our future performance, nor does such data reflect what our financial position and results of operations would have been had we operated as an independent publicly traded company during the periods shown. The unaudited pro forma financial data presented below was derived from our unaudited financial statements for the six months ended June 30, 2013 and 2014 and related notes thereto, our audited financial statements for the year ended December 31, 2013 and the related notes thereto and the audited financial statements of the DPC business for the period from January 1, 2013 through January 31, 2013 and the related notes thereto, each of which are included elsewhere in this prospectus.

14

Table of Contents

Our unaudited pro forma statements of operations data are presented for the six months ended June 30, 2014 and 2013 and the year ended December 31, 2013 assuming:

| | the Acquisition was completed on January 1, 2013; |

| | the Financing was completed on January 1, 2013; and |

| | this initial public offering (the Offering), but not the use of proceeds therefrom, was completed on January 1, 2013. |

The unaudited pro forma balance sheet data is presented assuming this offering was completed on June 30, 2014.

We have also presented summary unaudited pro forma consolidated financial data for the twelve-month period ended June 30, 2014, which does not comply with U.S. GAAP (this period is referred to elsewhere in this prospectus as the LTM Period). This data has been calculated by subtracting the pro forma unaudited statements of operations and cash flow data for the six-month period ended June 30, 2013 from the pro forma statements of operations and cash flow data for the year ended December 31, 2013 and then adding the pro forma statements of operations and cash flow data for the six-month period ended June 30, 2014 included elsewhere in this prospectus. We have presented this financial data because we believe it provides our investors with useful information to assess our recent performance.

The unaudited pro forma information set forth below is based upon available information and assumptions that we believe are reasonable. The unaudited pro forma information is for illustrative and informational purposes only and is not intended to represent or be indicative of what our financial condition or results of operations would have been had the above transactions occurred on the dates indicated. The unaudited pro forma information also should not be considered representative of our future financial condition or results of operations. You should read the information contained in this table in conjunction with Selected Historical Financial Information, Unaudited Pro Forma Condensed Combined and Consolidated Financial Information, Capitalization, Managements Discussion and Analysis of Financial Condition and Results of Operations and the historical audited and unaudited financial statements and the related notes thereto included elsewhere in this prospectus.

15

Table of Contents

| Predecessor | Successor | Pro forma | ||||||||||||||||||||||||||||||||||||||||||

|

Year Ended December 31, |

January 1 through January 31, |

Year Ended December 31, |

Six Months Ended June 30, |

Year Ended December 31, |

Six Months Ended June 30, |

12 Months Ended June 30, |

||||||||||||||||||||||||||||||||||||||

| (dollars and shares in |

2011 | 2012 | 2013 | 2013 | 2013 | 2014 | 2013 | 2013 | 2014 | 2014 | ||||||||||||||||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||||||||||||||||||||||

| Net sales |

$ | 4,281.5 | $ | 4,219.4 | $ | 326.2 | $ | 3,951.1 | $ | 1,783.6 | $ | 2,174.0 | $ | 4,277.3 | $ | 2,109.8 | $ | 2,174.0 | $ | 4,341.5 | ||||||||||||||||||||||||

| Other revenue |

34.3 | 37.4 | 1.1 | 35.7 | 13.7 | 14.7 | 36.8 | 14.8 | 14.7 | 36.7 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total revenue |

4,315.8 | 4,256.8 | 327.3 | 3,986.8 | 1,797.3 | 2,188.7 | 4,314.1 | 2,124.6 | 2,188.7 | 4,378.2 | ||||||||||||||||||||||||||||||||||

| Cost of goods sold(1) |

3,074.5 | 2,932.6 | 232.2 | 2,772.8 | 1,327.6 | 1,446.0 | 2,909.0 | 1,463.8 | 1,446.0 | 2,891.2 | ||||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses(2) |

869.1 | 873.4 | 70.8 | 1,040.6 | 397.0 | 497.3 | 1,113.6 | 470.0 | 497.3 | 1,140.9 | ||||||||||||||||||||||||||||||||||

| Research and development expenses |

49.6 | 41.5 | 3.7 | 40.5 | 18.5 | 23.4 | 44.2 | 22.2 | 23.4 | 45.4 | ||||||||||||||||||||||||||||||||||

| Amortization of acquired intangibles |

| | | 79.9 | 38.0 | 42.4 | 86.5 | 44.9 | 42.4 | 84.0 | ||||||||||||||||||||||||||||||||||

| Merger and acquisition related expenses |

| | | 28.1 | 28.1 | | | | | | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Operating income (loss) |

322.6 | 409.3 | 20.6 | 24.9 | (11.9 | ) | 179.6 | 160.8 | 123.7 | 179.6 | 216.7 | |||||||||||||||||||||||||||||||||

| Interest expense, net |

0.2 | | | 228.3 | 96.8 | 119.9 | 225.2 | 106.7 | 116.7 | 235.2 | ||||||||||||||||||||||||||||||||||

| Bridge financing commitment fees |

| | | 25.0 | 25.0 | | | | | | ||||||||||||||||||||||||||||||||||

| Other expense (income), net |

20.2 | 16.3 | 5.0 | 48.5 | 59.1 | 2.9 | 31.0 | 43.4 | (1.8 | ) | (14.2 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Income (loss) before income taxes |

302.2 | 393.0 | 15.6 | (276.9 | ) | (192.8 | ) | 56.8 | (95.4 | ) | (26.4 | ) | 64.7 | (4.3 | ) | |||||||||||||||||||||||||||||

| Provision (benefit) for income taxes |

120.7 | 145.2 | 7.1 | (46.5 | ) | (6.4 | ) | 10.0 | | 38.2 | 11.0 | (27.2 | ) | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net income (loss) |

181.5 | 247.8 | 8.5 | (230.4 | ) | (186.4 | ) | 46.8 | (95.4 | ) | (64.6 | ) | 53.7 | 22.9 | ||||||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests |

2.1 | 4.5 | 0.6 | 6.0 | 2.3 | 2.6 | 6.6 | 2.9 | 2.6 | 6.3 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net income (loss) attributable to controlling interests |

$ | 179.4 | $ | 243.3 | $ | 7.9 | $ | (236.4 | ) | $ | (188.7 | ) | $ | 44.2 | $ | (102.0 | ) | $ | (67.5 | ) | $ | 51.1 | $ | 16.6 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Per share data: |

||||||||||||||||||||||||||||||||||||||||||||

| Earnings (loss) per share: |

||||||||||||||||||||||||||||||||||||||||||||

| Basic and diluted |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| Weighted average shares outstanding, basic and diluted |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||||||||||||||||||||||||||

| Cash flows from: |

||||||||||||||||||||||||||||||||||||||||||||

| Operating activities |

$ | 236.2 | $ | 388.8 | $ | (37.7 | ) | $ | 376.8 | $ | 161.6 | $ | 13.7 | |||||||||||||||||||||||||||||||

| Investing activities |

(116.6 | ) | (88.2 | ) | (8.3 | ) | (5,011.2 | ) | (4,872.2 | ) | (102.8 | ) | ||||||||||||||||||||||||||||||||

| Financing activities |

(125.1 | ) | (290.6 | ) | 43.0 | 5,098.1 | 5,095.8 | (12.2 | ) | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

108.7 | 110.7 | 9.9 | 300.7 | 140.6 | 152.9 | 327.3 | 167.5 | 152.9 | 312.7 | ||||||||||||||||||||||||||||||||||

| Capital expenditures |

82.7 | 73.2 | 2.4 | 107.3 | 23.4 | 100.8 | 109.7 | 25.8 | 100.8 | 184.7 | ||||||||||||||||||||||||||||||||||

| Adjusted EBITDA(3) |

570.1 | 661.8 | 38.4 | 699.0 | 307.5 | 407.8 | 737.6 | 346.1 | 407.8 | 799.3 | ||||||||||||||||||||||||||||||||||

16

Table of Contents

| Predecessor | Pro Forma Successor | |||||||||||||||||

| Year Ended December 31, |

Year Ended December 31, |

12 Months Ended June 30, |

||||||||||||||||

| (dollars in millions) |

2011 | 2012 | 2013 | 2014 | ||||||||||||||

| Selected annual financial data: |

||||||||||||||||||

| Net sales |

$ | 4,281.5 | $ | 4,219.4 | $ | 4,277.3 | $ | 4,341.5 | ||||||||||

| Net income (loss) |

$ | 181.5 | $ | 247.8 | $ | (95.4 | ) | $ | 22.9 | |||||||||

| Adjusted EBITDA(3) |

$ | 570.1 | $ | 661.8 | $ | 737.6 | $ | 799.3 | ||||||||||

| Predecessor | Successor | |||||||||||||||||

| December 31, | December 31, | June 30, 2014 | ||||||||||||||||

| (dollars in millions) |

2012 | 2013 | Actual | Pro Forma | ||||||||||||||

| Balance sheet data (at end of period): |

||||||||||||||||||

| Cash and cash equivalents |

$ | 28.7 | $ | 459.3 | $ | 350.3 | $ | 333.1 | ||||||||||

| Working capital(4) |

605.2 | 952.2 | 971.4 | 954.2 | ||||||||||||||

| Total assets |

2,878.6 | 6,728.3 | 6,691.8 | 6,677.6 | ||||||||||||||

| Debt, net of discount |

0.2 | 3,923.6 | 3,904.8 | 3,904.8 | ||||||||||||||

| Net debt(5) |

(28.5 | ) | 3,464.3 | 3,554.5 | 3,571.7 | |||||||||||||

| Total liabilities |

1,181.6 | 5,528.0 | 5,451.9 | 5,451.9 | ||||||||||||||

| Total stockholders equity/combined equity |

1,697.0 | 1,200.3 | 1,239.9 | 1,225.7 | ||||||||||||||

| (1) | In the Successor six-month period ended June 30, 2013 and year ended December 31, 2013, cost of goods sold included the impact of $103.7 million attributable to the increase in inventory value resulting from the fair value adjustment associated with our acquisition accounting for inventories. |

| (2) | Selling, general and administrative expense included transition-related expenses of $46.5 million, $56.8 million and $231.5 million for the Successor six-month periods ended June 30, 2013 and 2014, and the Successor year ended December 31, 2013, respectively. Additionally, during the Predecessor periods ended December 31, 2011 and 2012, $(2.5) million and $0.7 million in employee separation and asset related costs (income) were recorded, respectively. |

| (3) | To supplement our financial information presented in accordance with U.S. GAAP, we use the following additional non-GAAP financial measures to clarify and enhance an understanding of past performance: EBITDA and Adjusted EBITDA. We believe that the presentation of these financial measures enhances an investors understanding of our financial performance. We further believe that these financial measures are useful financial metrics to assess our operating performance from period-to-period by excluding certain items that we believe are not representative of our core business. We use certain of these financial measures for business planning purposes and in measuring our performance relative to that of our competitors. We utilize Adjusted EBITDA as the primary measure of segment performance. |

EBITDA consists of net income (loss) before interest, taxes, depreciation and amortization. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense, (ii) the impact of certain non-cash, nonrecurring or other items that are included in net income and EBITDA that we do not consider indicative of our ongoing operating performance and (iii) certain unusual or nonrecurring items impacting results in a particular period. In addition, for the Predecessor periods, Adjusted EBITDA gives pro forma effect to the difference between the Predecessor allocated costs and the estimated standalone costs. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis.

We believe these financial measures are commonly used by investors to evaluate our performance and that of our competitors. However, our use of the terms EBITDA and Adjusted EBITDA may vary from that of others in our industry. These financial measures should not be considered as alternatives to operating income (loss), net income (loss), earnings per share or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance or as measures of liquidity.

17

Table of Contents

EBITDA and Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under U.S. GAAP. Some of these limitations are:

| | EBITDA and Adjusted EBITDA: |

| | exclude certain tax payments; |

| | do not reflect our expenditures, or future requirements, for capital expenditures or contractual commitments; |

| | do not reflect the significant interest expense or principal payments on our debt, including the Senior Secured Credit Facilities and the Senior Notes (as defined under Capitalization); and |

| | contain certain estimates for periods prior to the Acquisition of standalone costs; |

| | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any expenditures for such replacements; and |

| | other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures. |

We compensate for these limitations by using EBITDA and Adjusted EBITDA along with other comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. Such U.S. GAAP measurements include operating income (loss), net income (loss), earnings per share and other performance measures.

In evaluating these financial measures, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items.

18

Table of Contents

The following table reconciles net income (loss) to EBITDA and Adjusted EBITDA for the periods presented:

| Predecessor | Successor | Pro forma | ||||||||||||||||||||||||||||||||||||||||||

|

Year Ended December 31, |

January 1 through January 31, |

Year Ended December 31, |

Six Months Ended June 30, |

Year Ended December 31, |

Six Months Ended June 30, |

12 Months Ended June 30, |

||||||||||||||||||||||||||||||||||||||

| (dollars in millions) |

2011 | 2012 | 2013 | 2013 | 2013 | 2014 | 2013 | 2013 | 2014 | 2014 | ||||||||||||||||||||||||||||||||||

| Net income (loss) |

$ | 181.5 | $ | 247.8 | $ | 8.5 | $ | (230.4 | ) | $ | (186.4 | ) | $ | 46.8 | $ | (95.4 | ) | $ | (64.6 | ) | $ | 53.7 | $ | 22.9 | ||||||||||||||||||||

| Interest expense, net |

0.2 | | | 228.3 | 96.8 | 119.9 | 225.2 | 106.7 | 116.7 | 235.2 | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes |

120.7 | 145.2 | 7.1 | (46.5 | ) | (6.4 | ) | 10.0 | | 38.2 | 11.0 | (27.2 | ) | |||||||||||||||||||||||||||||||

| Depreciation and amortization |

108.7 | 110.7 | 9.9 | 300.7 | 140.6 | 152.9 | 327.3 | 167.5 | 152.9 | 312.7 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| EBITDA |

411.1 | 503.7 | 25.5 | 252.1 | 44.6 | 329.6 | 457.1 | 247.8 | 334.3 | 543.6 | ||||||||||||||||||||||||||||||||||

| Inventory step-up(a) |

| | | 103.7 | 103.7 | | | | | | ||||||||||||||||||||||||||||||||||

| Merger and acquisition related costs(b) |

| | | 28.1 | 28.1 | | | | | | ||||||||||||||||||||||||||||||||||

| Financing fees(c) |

| | | 25.0 | 25.0 | 3.1 | | | | | ||||||||||||||||||||||||||||||||||

| Foreign exchange remeasurement losses (gains)(d) |

23.4 | 17.7 | 4.5 | 48.9 | 59.6 | (14.5 | ) | 34.0 | 44.7 | (14.5 | ) | (25.2 | ) | |||||||||||||||||||||||||||||||

| Long-term employee benefit plan adjustments(e) |

32.8 | 36.9 | 2.3 | 9.5 | 3.0 | 4.5 | 11.8 | 5.3 | 4.5 | 11.0 | ||||||||||||||||||||||||||||||||||

| Termination benefits and other employee related costs(f) |

(2.6 | ) | 8.6 | 0.3 | 147.5 | 17.2 | 5.9 | 147.8 | 17.5 | 5.9 | 136.2 | |||||||||||||||||||||||||||||||||

| Consulting and advisory fees(g) |

| | | 54.7 | 21.9 | 20.7 | 54.7 | 21.9 | 20.7 | 53.5 | ||||||||||||||||||||||||||||||||||

| Transition-related costs(h) |

| | | 29.3 | 7.4 | 47.5 | 29.3 | 7.4 | 47.5 | 69.4 | ||||||||||||||||||||||||||||||||||

| Other adjustments(i) |

14.7 | 12.6 | 0.1 | 2.3 | (0.2 | ) | 11.0 | 2.4 | (0.1 | ) | 11.0 | 13.5 | ||||||||||||||||||||||||||||||||

| Dividends in respect of noncontrolling interest(j) |

(1.0 | ) | (1.9 | ) | | (5.2 | ) | (4.1 | ) | (1.6 | ) | (5.2 | ) | (4.1 | ) | (1.6 | ) | (2.7 | ) | |||||||||||||||||||||||||

| Management fee expense(k) |

| | | 3.1 | 1.3 | 1.6 | | | | | ||||||||||||||||||||||||||||||||||

| Allocated corporate and standalone costs, net(l) |

91.7 | 84.2 | 5.7 | | | | 5.7 | 5.7 | | | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted EBITDA |

$ | 570.1 | $ | 661.8 | $ | 38.4 | $ | 699.0 | $ | 307.5 | $ | 407.8 | $ | 737.6 | $ | 346.1 | $ | 407.8 | $ | 799.3 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| (a) | During the Successor six months ended June 30, 2013 and year ended December 31, 2013, we recorded a non-cash fair value adjustment associated with our acquisition accounting for inventories. These amounts increased cost of goods sold by $103.7 million. |

| (b) | In connection with the Acquisition, we incurred $28.1 million of merger and acquisition costs during the Successor six months ended June 30, 2013 and year ended December 31, 2013. These costs consisted primarily of investment banking, legal and other professional advisory services costs. |

| (c) | On August 30, 2012, we signed a debt commitment letter, which included an interim credit facility (the Bridge Facility). Upon the issuance of the Senior Notes and the entry into the Senior Secured Credit Facilities, the commitments under the Bridge Facility terminated. Commitment fees related to the Bridge Facility of $21.0 million and associated fees of $4.0 million were expensed upon payment and the termination of the Bridge Facility. In connection with the refinancing of the Senior Secured Credit Facilities in February 2014 (discussed further in Note 22 to the audited consolidated and combined financial statements included elsewhere in this prospectus), we recognized $3.1 million of costs. |

| (d) | Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, including a $19.4 million loss related to the Acquisition date settlement of a foreign currency contract used to hedge the variability of Euro-based financing. |

| (e) | For the Successor six months ended June 30, 2013 and 2014 and year ended December 31, 2013, eliminates the non-service cost components of employee benefits costs. For the Predecessor period January 1, 2013 through January 31, 2013, eliminates (1) all U.S. pension and other long-term employee benefit costs that were not assumed as part of the Acquisition and (2) the non-service cost component of the pension and other long-term employee benefit costs for the foreign pension plans that were assumed as part of the Acquisition. |

| (f) | Represents expenses primarily related to employee termination benefits, including our initiative to improve our overall cost structure within the European region, and other employee-related costs. Termination benefits include the costs associated with our headcount initiatives for establishment of new roles and elimination of old roles and other costs associated with cost-saving opportunities that were related to our transition to a standalone entity. |

19

Table of Contents

| (g) | Represents fees paid to consultants, advisors and other third-party professional organizations for professional services rendered in conjunction with the transition from DuPont to a standalone entity. |

| (h) | Represents charges associated with the transition from DuPont to a standalone entity, including branding and marketing, information technology related costs and facility transition costs. |

| (i) | Represents costs for certain unusual or non-operational losses and the non-cash impact of natural gas and currency hedge losses allocated to DPC by DuPont, stock-based compensation, asset impairments, equity investee dividends, indemnity income and losses associated with the Acquisition, and loss (gain) on sale and disposal of property, plant and equipment. |

| (j) | Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned. |

| (k) | Pursuant to Axaltas consulting agreement with Carlyle Investment Management, L.L.C., an affiliate of Carlyle, for management and financial advisory services and oversight provided to Axalta and its subsidiaries, Axalta is required to pay an annual consulting fee of $3.0 million and reimburse Carlyle Investment Management, L.L.C. for its out-of-pocket expenses. We expect that this agreement will terminate upon the completion of this offering. |

| (l) | Represents (1) the add-back of corporate allocations from DuPont to DPC for the usage of DuPonts facilities, functions and services; costs for administrative functions and services performed on behalf of DPC by centralized staff groups within DuPont; a portion of DuPonts general corporate expenses; and certain pension and other long-term employee benefit costs, in each case because we believe these costs are not indicative of costs we would have incurred as a standalone company net, of (2) estimated standalone costs based on a corporate function resource analysis that included a standalone executive office, the costs associated with supporting a standalone information technology infrastructure, corporate functions such as legal, finance, treasury, procurement and human resources and certain costs related to facilities management. This resource analysis included anticipated headcount and the associated overhead costs of running these functions effectively as a standalone company of our size and complexity. Although we believe this estimate is reasonable, actual results may have differed from this estimate, and any difference may be material. See Forward-Looking Statements and Risk FactorsRisks Related to our Business. |

| Predecessor Year Ended December 31, 2011 |

Predecessor Year Ended December 31, 2012 |

Predecessor Period from January 1, 2013 through January 31, 2013 |

||||||||||

| Allocated corporate costs |

$ | 333.5 | $ | 333.3 | $ | 25.4 | ||||||

| Standalone costs |

(241.8 | ) | (249.1 | ) | (19.7 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 91.7 | $ | 84.2 | $ | 5.7 | ||||||

|

|

|

|

|

|

|

|||||||

| (4) | Working capital is defined as current assets less current liabilities. |

| (5) | Net debt is defined as debt, net of discount, less cash and cash equivalents. |

20

Table of Contents

An investment in our common shares involves a high degree of risk. You should consider carefully the following risks, together with the other information contained in this prospectus, before you decide whether to buy our common shares. If any of the events contemplated by the following discussion of risks should occur, our business, results of operations, financial condition and cash flows could suffer significantly. As a result, the market price of our common shares could decline, and you may lose all or part of the money you paid to buy our common shares. The following is a summary of all the material risks known to us.

Risks Related to our Business

Risks Related to Execution of our Strategic and Operating Plans

Our business performance is impacted by economic conditions and, particularly, by conditions in the light and commercial vehicle end-markets. Adverse developments in the global economy, in regional economies or in the light and commercial vehicle end-markets could adversely affect our business, financial condition and results of operations.