EX-99.2

Published on March 11, 2015

March

11, 2015 Axalta Coating Systems Ltd.

Q4 & Full Year 2014 Conference Call

Exhibit 99.2 |

Axalta Coating Systems

Ltd.

Notice Regarding Forward Looking Statements,

Non-GAAP Financial Measures and Defined Terms

2

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain

forward-looking statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, including those relating to 2015 net sales, Adjusted EBITDA, tax rate, capital expenditures and

net working capital. Any forward-looking statements involve risks, uncertainties and assumptions.

These statements often include words such as believe, expect,

anticipate, intend, plan, estimate, target, project, forecast, seek, will, may, should, could,

would, or similar expressions. These statements are based on certain assumptions

that we have made in light of our experience in the industry and our perceptions of historical

trends, current conditions, expected future developments and other factors we believe are appropriate under the

circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying

these statements are reasonable as of the date hereof, investors are cautioned not to place

undue reliance on these statements. We do not have any obligation to and do not intend to

update any forward-looking statements included herein, which speak only as of the date hereof. You

should understand that these statements are not guarantees of future performance or

results. Actual results could differ materially from those described in any forward-looking statements

contained herein or the oral remarks made in connection herewith as a result of a variety of factors,

including known and unknown risks and uncertainties, many of which are beyond our

control. Non-GAAP Financial Measures

The

historical financial information included in this presentation includes financial information that is not presented in accordance with generally

accepted accounting principles in the United States (GAAP), including EBITDA and Adjusted

EBITDA. Management uses these non-GAAP financial measures in the analysis of our financial

and operating performance because they assist in the evaluation of underlying trends in our

business. Our use of the terms EBITDA and Adjusted EBITDA may differ from that of others in our

industry. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income

(loss), operating income or any other performance measures derived in accordance with GAAP as

measures of operating performance or operating cash flows or as measures of liquidity. EBITDA and Adjusted EBITDA have important

limitations as analytical tools and should be considered in conjunction with, and not as substitutes

for, our results as reported under GAAP. This presentation includes a reconciliation of certain

non-GAAP financial measures with the most directly comparable financial measures calculated in

accordance with GAAP.

Defined Terms

All

capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange

Commission.

|

Axalta Coating

Systems Ltd.

3

Axalta

A Leader in Coatings

Segments

Performance

Coatings

59% of Sales

Transportation Coatings

41% of Sales

End-

Markets

Focus

Areas

Body Shops

Electrical

Insulation,

Architectural,

Oil and Gas,

General

Industrial

Net

Sales

1

$4,362 million

Adjusted

EBITDA

1,2

$841 million

Adjusted

EBITDA

Margin

3

19.3%

Light Vehicle /

Automotive

OEMs

Heavy Duty

Truck, Bus,

Rail,

Agriculture &

Construction

OEMs

(42% of Sales)

(17% of Sales)

(32% of Sales)

(9% of Sales)

Refinish

Industrial

Light

Vehicle

Commercial

Vehicle

____________________________

1.

Financials for FY 2014.

2.

Adjusted EBITDA reconciliation can be found in the Appendix of this presentation.

3.

Adjusted EBITDA Margin is defined as Adjusted EBITDA as a percentage of reported net sales.

|

Axalta Coating Systems

Ltd.

Q4 & Full Year 2014 Highlights

4

Solid Q4 2014 results across both segments

Net sales up 5% compared to 2013, excluding currency, with volume and price growth

in both segments; reported net sales down 1% as a result of negative

currency movements

Adjusted EBITDA of $205 million, representing a 19.0% margin, was up 4% compared to

2013 and was Axaltas seventh straight quarter of YoY growth

Strong Performance in 2014

Net

sales

up

4%

YoY,

excluding

2%

of

negative

currency;

reported

net

sales

up

2%

Adjusted EBITDA up 14.0% YoY with increases in both segments; EBITDA margin of

19.3%, represents YoY increase of 210bps

Completed all remaining transitions from DuPont

Successfully completed IPO in November 2014

Strong

balance

sheet

with

net

leverage

ratio

of

4.0x

at

December

31,

2014

Significant progress on previously announced capital expansions

Jiading

expansion

fully

operational

with

opening

ceremonies

last

week

Germany

project

expected

to

be

operational

in

1H

2015

and

Mexico

at

the

end

of

2015

Continued momentum into 2015 despite currency headwinds and challenging

economic environment in Latin America |

Axalta Coating Systems

Ltd.

Q4 2014 Consolidated Results

5

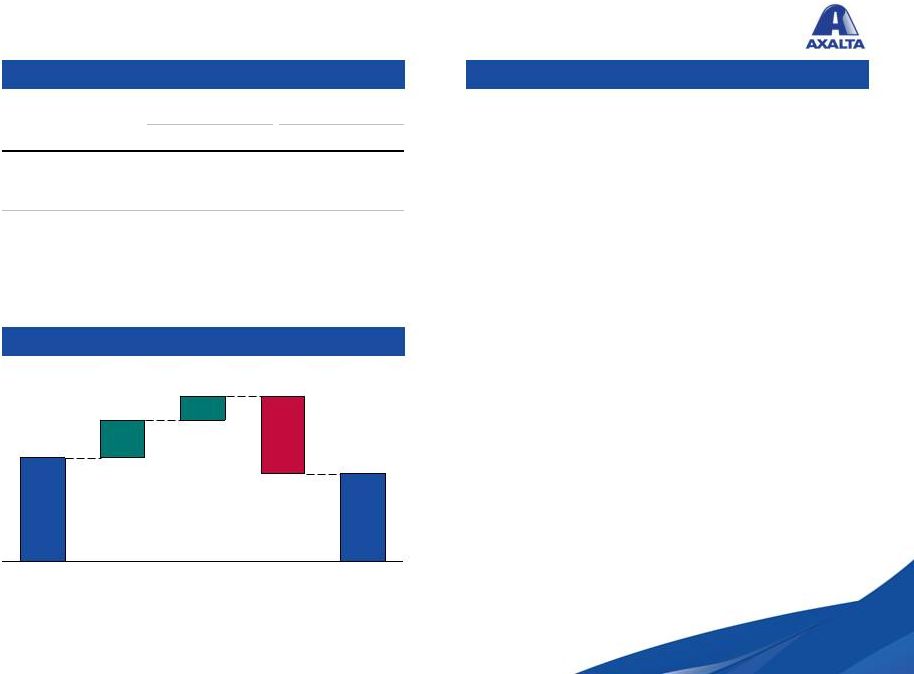

Financial Performance

Net sales increased 5.1% YoY,

excluding currency

Volume growth in North America, Latin

America and Asia Pacific while EMEA

volumes were slightly down

Moderate price increases in select regions

Over 6% unfavorable currency impact, driven

primarily by Euro and currencies in Latin

America

Adjusted EBITDA margin of 19.0%,

representing an increase of 90bps YoY

Higher sales through volume and price

delivered Adjusted EBITDA growth

Since the acquisition, Adjusted EBITDA has

achieved seven consecutive quarters of YoY

growth

Commentary

$1,079

Volume

Q4 2013

FX

Price

Q4 2014

Net Sales Variance

+3.1%

+2.0%

-6.4%

-1.3%

($ in millions)

2014

2013

Incl. F/X

Excl. F/X

Performance

640

645

(0.8%)

6.3%

Transportation

438

448

(2.1%)

3.2%

Net Sales

1,079

1,093

(1.3%)

5.1%

Adjusted EBITDA

205

197

3.7%

% margin

19.0%

18.1%

Q4

% Change

$1,093 |

Axalta Coating Systems

Ltd.

Q4 2014 Performance Coatings Results

6

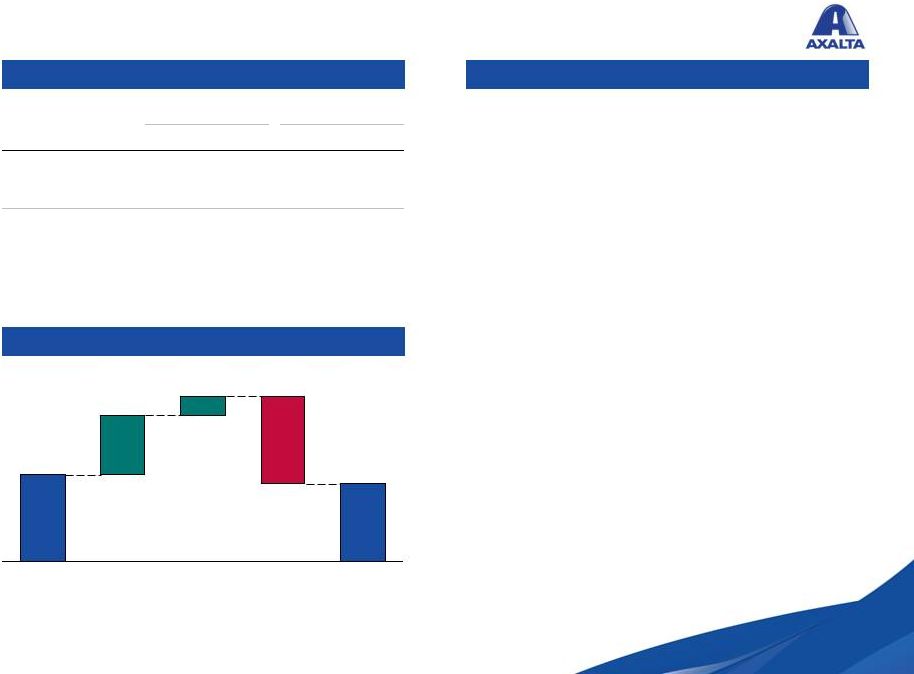

Financial Performance

Refinish experienced increased volume

across all regions except for EMEA

Industrial volumes increased across all

regions

7% unfavorable currency impact

Increased volume and price offset by

increased costs from investing in future

growth

Commentary

Q4 2013

Q4 2014

Price

FX

Volume

Net Sales Variance

+4.8%

+1.5%

-7.1%

-0.7%

($ in millions)

2014

2013

Incl. F/X

Excl. F/X

Refinish

466

467

(0.1%)

7.6%

Industrial

174

178

(2.4%)

2.9%

Net Sales

640

645

(0.8%)

6.3%

Adjusted EBITDA

138

140

(1.5%)

% margin

21.5%

21.7%

Q4

% Change

Adjusted EBITDA margin of 21.5%,

down slightly YoY

Net sales increased 6.3% YoY,

excluding currency

$640

$645 |

Axalta Coating Systems

Ltd.

Q4 2014 Transportation Coatings Results

7

Financial Performance

Commentary

Net sales increased 3.2% YoY,

excluding currency

$438

$448

FX

Q4 2014

Q4 2013

Volume

Price

Net Sales Variance

+0.6%

+2.6%

-5.3%

-2.1%

($ in millions)

2014

2013

Incl. F/X

Excl. F/X

Light Vehicle

339

353

(3.9%)

1.4%

Commercial Vehicle

99

95

4.8%

10.2%

Net Sales

438

448

(2.1%)

3.2%

Adjusted EBITDA

67

57

16.4%

% margin

15.2%

12.8%

Q4

% Change

Light vehicle volume increases in Asia Pacific

offset by lower volume in Latin America from

challenging economic conditions and North

America due to downtime at certain customer

plants

Commercial Vehicle net sales showed strong

growth in North America, Latin America and

Asia Pacific

5% unfavorable currency impact

Increase in Adjusted EBITDA attributable to

higher price points on new launches and cost

saving operational improvement initiatives

Adjusted EBITDA margin of 15.2%,

representing an increase of 240bps YoY |

Axalta Coating Systems

Ltd.

($ in millions)

2014

2013

Incl. F/X

Excl. F/X

Performance

2,585

2,512

2.9%

5.0%

Transportation

1,777

1,765

0.6%

2.5%

Net Sales

4,362

4,277

2.0%

4.0%

Adjusted EBITDA

841

738

14.0%

% margin

19.3%

17.2%

Full Year

% Change

FY 2014 Consolidated Results

8

Financial Performance

Net sales increased 4.0% YoY, excluding

currency

Net sales volume growth in North America and

Asia Pacific partially offset by decreased

volume in EMEA and Latin America due to

challenging economic conditions

All regions exhibited price increases, which

included actions in Latin America to offset

inflation and currency devaluation

2% unfavorable currency impact

Adjusted EBITDA margin of 19.3%,

representing an increase of 210bps YoY

Adjusted EBITDA growth primarily a result of

top line growth and cost improvement initiatives

Continued Adjusted EBITDA margin

improvement

Commentary

Net Sales Variance

FX

Volume

Price

2013

2014

+1.2%

+2.8%

-2.0%

+2.0%

(1)

(1) Pro Forma 2013, including $5.7 million cost savings benefit in the Predecessor

Period. $4,362

$4,277 |

Axalta Coating Systems

Ltd.

Update on Transition-Related and One-Time Costs

Transition-related expenses from separation from DuPont are now complete.

Q4 expenses

primarily

related

to

the

remainder

of

our

IT

transition

and

stabilization

as

well

as completion of rebranding requirements

Incurred restructuring expenses associated with (1) our previously announced

productivity initiatives and (2) new actions in Latin America during Q4 in response

to a challenging economic environment

Incurred incremental one-time costs associated with the IPO (including

termination of sponsor management fee)

9

Impact on Statement of Operations

($ in millions)

Q1 2014

Q2 2014

Q3 2014

Q4 2014

FY 2014

Termination benefits and other

employee-related costs

$3

$3

$3

$9

$18

Consulting and advisory fees

13

8

9

7

36

Transition-related costs

14

34

34

21

102

IPO-related expenses

-

-

3

19

22

Total Expense

$30

$44

$49

$56

$179 |

Axalta Coating Systems

Ltd.

Debt and Liquidity Summary

10

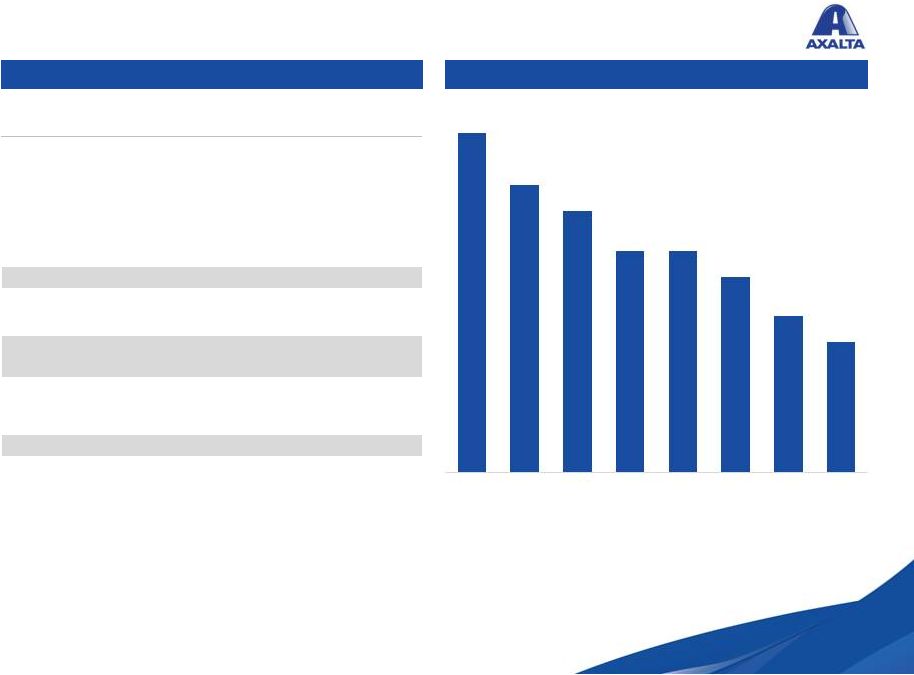

Net Leverage

Capitalization

($ in millions)

@ 12/31/2014

Maturity

Cash and Cash Equivalents

$382

Debt:

Revolver ($400 capacity)

-

2018

First Lien Term Loan (USD)

2,166

2020

First Lien Term Loan (EUR)

(1)

481

2020

Senior Secured Notes (EUR)

(1)

305

2021

Total Senior Secured Debt

$2,952

Senior Unsecured Notes (USD)

750

2021

Notes Payable and Other Borrowings

13

Total Debt

$3,715

Total Net Debt

$3,333

Adjusted EBITDA

$841

Credit Statistics:

Total Net Leverage

4.0x

(1) Assumes exchange rate of $1.2208 USD/Euro.

Note: Excludes unamortized original issue discount.

5.6x

5.2x

5.0x

4.7x

4.7x

4.5x

4.2x

4.0x

At LBO

Q2 '13

Q3 '13

Q4 '13

Q1 '14

Q2 '14

Q3 '14

Q4 '14 |

Axalta Coating Systems

Ltd.

Full Year 2015 Guidance

11

We intend to provide annual guidance in Q1 and update it quarterly

Excluding F/X, net sales are expected to increase 5% to 7% versus 2014 while net

sales including F/X are expected to be flat to slightly down YoY

Increase across all regions and end-markets excluding F/X

Performance Coatings: Driven by increased volumes as well as selective price

increases

Transportation Coatings: Driven primarily by the launch of Light Vehicle

business previously won and strong momentum in our Commercial Vehicle

end-market

F/X represents a significant headwind, particularly in Q1 2015 as the US Dollar

strengthened throughout 2014 into 2015

We expect to generate Adjusted EBITDA of $860 million to $900 million

Driven by increased sales and continued savings from our optimization

initiatives

Continued strong Adjusted EBITDA margins of approximately 20%

Expect

2H

of

2015

to

be

stronger

in

light

of

new

capacity

coming

online

Normalized effective tax rate of 27% to 29%

Capital expenditures of approximately $150 million, of which ~60% is anticipated

for growth projects

Net working capital, excluding transition-related items which were expensed

previously, is expected to be in the range of 13% to 15% of net sales

|

Axalta Coating Systems

Ltd.

Full Year 2015 Assumptions

12

Currency

% Axalta

Net Sales

2014

Avg. Rate

2015 Avg.

Guidance

Rate

% Change

in F/X Rate

US$ per Euro

~30%

1.33

1.10

(17.3%)

Chinese Yuan

per US$

~11%

6.17

6.25

(1.3%)

Mexican Peso

per US$

~6%

13.33

15.00

(12.5%)

Brazilian Real

per US$

~5%

2.36

2.90

(22.9%)

Venezuelan

Bolivar per US$

~3%

8.91

25.00

(180.6%)

Russian Ruble

per US$

~2%

38.48

65.00

(68.9%)

Global GDP growth of approximately 3%

Global industrial production of

approximately 4%

Global auto build growth of approximately

3%

Modest benefit from lower oil prices given

extended supply chain and category

specific supply and demand dynamics

Currency Assumptions

Macroeconomic Assumptions |

Axalta Coating Systems

Ltd.

Strong Earnings Momentum with Potential Upside

13

Underlying Market Growth

Axalta Growth Initiatives

Operational Improvements

Attractive Potential Upside

Strong underlying demand growth

Robust industry trends favor

global suppliers

Strong momentum driven by

customer-centric approach

Accelerating growth in emerging

markets

Globalizing existing products to

reach underserved markets

Optimize procurement

Streamline operations

Enhance productivity

Bolt-on acquisitions

Partnerships

Consolidation opportunities

Ongoing Initiatives

Future

Today |

Appendix |

Adjusted EBITDA Reconciliation

15

(1)

The Pro Forma results for the year ended December 31, 2013 represent the addition

of the Predecessor period January 1 through January 31, 2013 and the

Successor year ended December 31, 2013. The Pro Forma results reflect the

Acquisition and the associated Financing as if they had occurred on January 1, 2013,

in accordance with Article 11 of Regulation S-X. The Pro Forma results do

not reflect the actual results we would have achieved had the Acquisition been

completed as of January 1, 2013 and are not indicative of our future results of

operations. ($ in millions)

Pro Forma

FY 2013

Predecessor

January 1,

through

January 31,

2013

Successor

FY 2013

Successor

FY 2014

Successor

Q4 2013

Successor

Q4 2014

Net Income (Loss)

(107)

$9

(219)

$35

(47)

$1

Interest Expense

235

-

215

217

62

51

Provision (Benefit) for Income Taxes

(1)

7

(45)

2

(11)

(16)

Depreciation & Amortization

327

10

301

309

73

80

EBITDA

(1)

$454

$26

$252

$563

$77

$116

A

Inventory Step Up

-

-

104

-

-

-

B

Merger & Acquisition Related Costs

-

-

28

-

-

-

C

Financing Costs and Extinguishment

-

-

25

6

-

-

D

Foreign exchange remeasurement (gains) losses

34

5

49

81

(1)

36

E

Long-term employee benefit plan adjustments

12

2

9

(1)

5

(1)

F

Termination benefits and other employee related costs

148

-

148

18

83

9

G

Consulting and advisory fees

55

-

55

36

21

7

H

Transition-related costs

29

-

29

102

13

21

I

IPO-related costs

-

-

-

22

-

19

J

Other adjustments

2

-

2

11

(1)

(2)

K

Dividends in respect of noncontrolling interest

(5)

-

(5)

(2)

(1)

(1)

L

Management fee expense

3

-

3

3

1

1

M

Allocated corporate and standalone costs, net

6

-

-

-

-

-

Total Adjustments

$284

$7

$447

$278

$120

$89

Adjusted EBITDA

$738

$33

$699

$841

$197

$205

Note: Numbers might not foot due to rounding

Axalta Coating Systems

Ltd. |

Axalta Coating Systems

Ltd.

Adjusted EBITDA Reconciliation (contd)

16

A.

During the Successor year ended December 31, 2013, we recorded a non-cash fair value adjustment

associated with our acquisition accounting for inventories. These amounts increased cost of

goods sold by $104 million.

B.

In connection with the Acquisition, we incurred $28 million of merger and acquisition costs during the

Successor years ended December 31, 2013. These costs consisted primarily of investment banking,

legal and other professional advisory services costs.

C.

On August 30, 2012, we signed a debt commitment letter, which included the Bridge Facility. Upon the

issuance of the Senior Notes and the entry into the Senior Secured Credit Facilities, the

commitments under the Bridge Facility terminated. Commitment fees related to the Bridge

Facility of $21 million and associated fees of $4 million were expensed upon the payment and termination of the

Bridge Facility. In connection with the amendment to the Senior Secured Credit Facilities in February

2014, we recognized $3 million of costs during the Successor year ended December 31, 2014. In

addition to the credit facility amendment, we also incurred a $3 million loss on extinguishment

of debt recognized during the Successor year ended December 31, 2014, which resulted directly from

the pro-rata write off of unamortized deferred financing costs and original issue discounts

associated with the pay-down of $100.0 million of principal on the New Dollar Term Loan.

D.

Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and

liabilities denominated in foreign currencies, including a $19 million loss related to the

acquisition date settlement of a foreign currency contract used to hedge the variability of

Euro-based financing.

E.

For the Successor years ended December 31, 2014 and 2013, eliminates the non-service cost

components of employee benefit costs. Additionally, we deducted a pension curtailment gain of $7

million recorded during the Successor year ended December 31, 2014. For the Predecessor period

January 1, 2013 through January 31, 2013, eliminates (1) all U.S. pension and other long-term employee

benefit costs that were not assumed as part of the Acquisition and (2) the non-service cost

component of the pension and other long- term employee benefit costs for the foreign pension

plans that were assumed as part of the Acquisition.

F.

Represents expenses primarily related to employee termination benefits, including our initiative to

improve the overall cost structure within the European region, and other employee-related

costs. Termination benefits include the costs associated with our headcount initiatives for

establishment of new roles and elimination of old roles and other costs associated with cost saving opportunities that

were related to our transition to a standalone entity.

G.

Represents fees paid to consultants, advisors, and other third-party professional organizations

for professional services rendered in conjunction with the transition from DuPont to a

standalone entity.

H.

Represents charges associated with the transition from DuPont to a standalone entity, including

branding and marketing, information technology related costs, and facility transition costs.

|

Axalta Coating Systems

Ltd.

Adjusted EBITDA Reconciliation (contd)

17

Predecessor Period

from January 1, 2013

through

January 31, 2013

Allocated corporate costs

$

25.4

Standalone costs

(19.7)

Total

$

5.7

I.

Represents costs associated with the IPO including a $13 million payment to terminate consulting

agreement (see note L).

J.

Represents costs for certain unusual or non-operational (gains) and losses and the

non-cash impact of natural gas and currency hedge losses allocated to DPC by DuPont,

stock-based compensation, asset impairments, equity investee dividends, indemnity (income)

losses associated with the Acquisition, gains resulting from amendments to long-term benefit plans

and loss (gain) on sale and disposal of property, plant and equipment.

K.

Represents the payment of dividends to our joint venture partners by our consolidated entities that

are not wholly owned.

L.

Pursuant to Axaltas management agreement with Carlyle Investment Management, L.L.C., an

affiliate of Carlyle, for management and financial advisory services and oversight provided to

Axalta and its subsidiaries, Axalta was required to pay an annual management fee of $3 million

and out-of-pocket expenses. This agreement was terminated upon completion of the IPO.

M.

Represents (1) the add-back of corporate allocations from DuPont to DPC for the usage of

DuPonts facilities, functions and services; costs for administrative functions and

services performed on behalf of DPC by centralized staff groups within DuPont; a portion of

DuPonts general corporate expenses; and certain pension and other long-term employee benefit

costs, in each case because we believe these costs are not indicative of costs we would have

incurred as a standalone company net, of (2) estimated standalone costs based on a corporate

function resource analysis that included a standalone executive office, the costs associated with supporting a

standalone information technology infrastructure, corporate functions such as legal, finance,

treasury, procurement and human resources and certain costs related to facilities management.

This resource analysis included anticipated headcount and the associated overhead costs of

running these functions effectively as a standalone company of our size and complexity. This estimate is

provided for additional information and analysis only, as we believe that it facilitates enhanced

comparability between Predecessor and Successor periods. It represents the difference between

the costs that were allocated to our predecessor by its parent and the costs that we believe

would be incurred if it operated as a standalone entity. This estimate is not intended to represent a pro forma

adjustment presented within the guidance of Article 11 of Regulation S-X. Although we believe this

estimate is reasonable, actual results may have differed from this estimate, and any difference

may be material.

|

|