S-3ASR: Automatic shelf registration statement of securities of well-known seasoned issuers

Published on May 24, 2016

Table of Contents

As filed with the Securities and Exchange Commission on May 24, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AXALTA COATING SYSTEMS LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 98-1073028 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Two Commerce Square

2001 Market Street

Suite 3600

Philadelphia, Pennsylvania 19103

(855) 547-1461

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Michael F. Finn

Senior Vice President, General Counsel and Corporate Secretary

Axalta Coating Systems Ltd.

Two Commerce Square

2001 Market Street

Suite 3600

Philadelphia, Pennsylvania 19103

(855) 547-1461

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Patrick H. Shannon, Esq.

Jason M. Licht, Esq.

Latham & Watkins LLP

555 Eleventh Street, NW

Washington, D.C. 20004

(202) 637-2200

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

|

||||

| Title of each class of securities to be registered |

Amount to be registered/ proposed maximum offering price per unit/ proposed maximum aggregate offering price |

Amount of registration fee |

||

| Common Shares, $1.00 par value per share |

(1) | (2) | ||

|

|

||||

|

|

||||

| (1) | An unspecified number of shares is being registered as may from time to time be offered at unspecified prices. |

| (2) | In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of the entire registration fee. |

Table of Contents

PROSPECTUS

Axalta Coating Systems Ltd.

Common Shares

The selling shareholders to be named in a prospectus supplement may offer and sell our common shares from time to time in amounts, at prices and on terms that will be determined at the time of the offering.

This prospectus describes the general manner in which our common shares may be offered and sold by the selling shareholders. The specific manner in which common shares may be offered and sold will be described in a supplement to this prospectus. Information about the selling shareholders, including the relationship between the selling shareholders and us, will also be included in the applicable prospectus supplement.

Selling shareholders that are affiliates of Axalta Coating Systems Ltd. may be deemed to be underwriters within the meaning of the Securities Act of 1933, as amended (the Securities Act), and, as a result, may be deemed to be offering common shares, indirectly, on our behalf.

The common shares may be sold at a fixed price or prices, which may be changed, at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at a negotiated price. The common shares offered by this prospectus and the accompanying prospectus supplement may be offered by the selling shareholders directly to purchasers or to or through underwriters, brokers or dealers or other agents. The prospectus supplement for each offering will describe in detail the plan of distribution for that offering and will set forth the names of any underwriters, brokers or dealers or agents involved in the offering and any applicable fees, commissions or discount arrangements. You should carefully read this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference herein or therein, before you invest in our common shares.

INVESTING IN OUR COMMON SHARES INVOLVES RISKS. SEE THE RISK FACTORS SECTION BEGINNING ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT AND THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AND THEREIN CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR COMMON SHARES.

Our common shares are listed on the New York Stock Exchange (the NYSE) under the symbol AXTA. On May 23, 2016, the last reported sale price of our common shares on the NYSE was $27.72 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 24, 2016.

Table of Contents

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 10 | ||||

| 17 | ||||

| 23 | ||||

| 28 | ||||

| 28 |

Table of Contents

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the SEC), as a well-known seasoned issuer as defined in Rule 405 under the Securities Act, using a shelf registration process. By using a shelf registration statement, the selling shareholders to be named in a supplement to this prospectus may, from time to time, sell common shares in one or more offerings. Each time that the selling shareholders sell common shares, we will provide a prospectus supplement to this prospectus that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any common shares, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the headings Where You Can Find More Information and Incorporation by Reference.

We are responsible only for the information contained or incorporated by reference in this prospectus, any accompanying prospectus supplement and in any related free writing prospectus we prepare or authorize. Neither we nor the selling shareholders have authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. We and the selling shareholders will not make an offer to sell these common shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

THIS PROSPECTUS MAY NOT BE USED TO SELL ANY OF OUR COMMON SHARES UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of the common shares to and between residents and non-residents of Bermuda for exchange control purposes provided our common shares remain listed on an appointed stock exchange, which includes the NYSE. In granting such consent, the Bermuda Monetary does not accept any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

When we refer to Axalta, we, our, us and the Company in this prospectus, we mean Axalta Coating Systems Ltd. and its consolidated subsidiaries, unless otherwise specified.

We own or otherwise have rights to the trademarks, copyrights and service marks, including those mentioned in this prospectus, used in conjunction with the marketing and sale of our products and services. This prospectus includes trademarks, such as Abcite®, Alesta®, AquaEC®, AudurraTM, Centari®, ChallengerTM, ChemophanTM, Colornet®, Corlar®, Cromax®, Cromax Mosaic®, DuxoneTM, Harmonized Coating TechnologiesTM, Imron®, Imron EliteTM, Imron ExcelProTM, LutophenTM, Nap-Gard®, Nason®, Rival®, Spies Hecker®, Standox®, StollaquidTM, SyntopalTM, SyroxTM, VermeeraTM and Voltatex®, which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks and tradenames referred to in this prospectus may appear without the ® or symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and tradenames.

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. Information filed with the SEC by us can be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information by mail from the Public Reference Room of the SEC at prescribed rates. Further information on the operation of the SECs Public Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

These periodic and current reports and all amendments to those reports are also available free of charge on the investor relations page of our website at http://ir.axaltacs.com. We have included our website address throughout this filing as textual references only. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SECs Public Reference Room in Washington, D.C. or through the SECs website, as provided above.

The SECs rules allow us to incorporate by reference information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), between the date of this prospectus and the termination of the offering of the common shares to which this prospectus relates. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed filed with the SEC or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

We incorporate by reference the documents set forth below that have previously been filed with the SEC:

| | Our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 29, 2016. |

| | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, filed with the SEC on April 28, 2016. |

| | The portions of our Definitive Proxy Statement on Schedule 14A that were deemed filed with the SEC on March 22, 2016. |

| | Our Current Report on Form 8-K, filed with the SEC on May 5, 2016. |

2

Table of Contents

| | The description of our common shares contained in our registration statement on Form 8-A, filed with the SEC on November 7, 2014 (File No. 001-36733) and any amendment or report filed with the SEC for the purpose of updating such description. |

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the common shares to which this prospectus relates, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may obtain any of the documents incorporated by reference in this prospectus on the SECs website at http://www.sec.gov or request a copy of any or all of the documents referred to above which have been incorporated by reference (other than exhibits, unless they are specifically incorporated by reference in the documents) at no cost to the requester by writing or telephoning us at the following address:

Axalta Coating Systems Ltd.

Two Commerce Square

2001 Market Street

Suite 3600

Philadelphia, Pennsylvania 19103

Attention: Investor Relations

(855) 547-1461

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

3

Table of Contents

We are a leading global manufacturer, marketer and distributor of high performance coatings systems. Based on market information from 2014, we generate approximately 90% of our revenue in markets where we hold the #1 or #2 global market position, including the #1 position in our core automotive refinish end-market with approximately a 25% global market share. We have a 150-year heritage in the coatings industry and are known for manufacturing high-quality products with well-recognized brands supported by market-leading technology and customer service. Over the course of our history we have remained at the forefront of our industry by continually developing innovative coatings technologies designed to enhance the performance and appearance of our customers products, while improving their productivity and profitability.

Our diverse global footprint of 38 manufacturing facilities, four technology centers, 46 customer training centers and approximately 12,800 employees allows us to meet the needs of customers in over 130 countries. We serve our customer base through an extensive sales force and technical support organization, as well as through approximately 4,000 independent, locally-based distributors. Our scale and strong local presence are critical to our success, allowing us to leverage our technology portfolio and customer relationships globally while meeting customer demands locally.

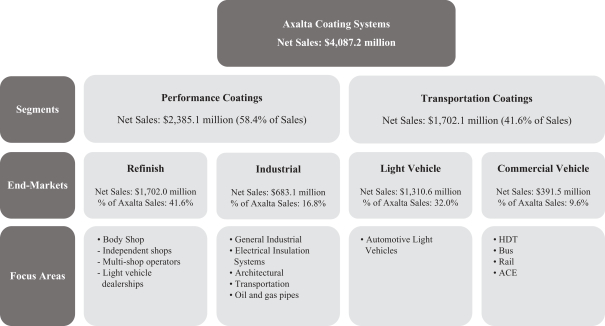

Our business is organized into two segments, Performance Coatings and Transportation Coatings, serving four end-markets globally as highlighted below.

Note: Table above reflects numbers for the year ended December 31, 2015.

4

Table of Contents

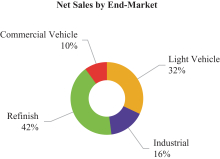

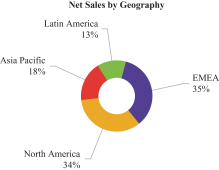

Net sales for our four end-markets and four regions for the year ended December 31, 2015 are highlighted below:

|

|

Note: Latin America includes Mexico

Axalta Coating Systems Ltd., a Bermuda exempted company formed at the direction of an affiliate of The Carlyle Group L.P. (Carlyle), was incorporated on August 24, 2012 for the purpose of consummating the acquisition of DuPont Performance Coatings (DPC), a business formerly owned by E. I. du Pont de Nemours and Company, including certain assets of DPC and all of the capital stock and other equity interests of certain entities engaged in the DPC business (the Acquisition). Axalta, through its wholly owned indirect subsidiaries, acquired DPC on February 1, 2013.

Our principal executive offices are located at Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, Pennsylvania 19103 and our telephone number is (855) 547-1461. Our website is http://www.axaltacs.com. The contents of our website are not part of this prospectus.

We maintain a registered office in Bermuda at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The telephone number of our registered office is (441) 295-5950.

5

Table of Contents

Investment in our common shares involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, as well as the risk factors and other information contained in the applicable prospectus supplement, before acquiring any such common shares. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered shares.

6

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This prospectus and any accompanying prospectus supplement include and incorporate forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) which reflect our current views with respect to future events and financial performance. These forward-looking statements are identified by their use of such terms and phrases as intend, goal, estimate, expect, project, projections, plans, anticipate, should, could, would, designed to, foreseeable future, believe, think, scheduled, outlook, suggest, target, may, will, forecast, guidance and similar expressions. This list of indicative terms and phrases is not intended to be all-inclusive.

These statements are subject to various risks and uncertainties, many of which are outside our control, including, without limitation:

| | adverse developments in economic conditions and, particularly, in conditions in the automotive and transportation industries; |

| | volatility in the capital, credit and commodities markets; |

| | our inability to successfully execute on our growth strategy; |

| | risks associated with our non-U.S. operations; |

| | currency-related risks; |

| | increased competition; |

| | risks of the loss of any of our significant customers or the consolidation of multi-shop operators, distributors and/or body shops; |

| | our reliance on our distributor network and third-party delivery services for the distribution and export of certain of our products; |

| | price increases or interruptions in our supply of raw materials; |

| | failure to develop and market new products and manage product life cycles; |

| | litigation and other commitments and contingencies; |

| | significant environmental liabilities and costs as a result of our current and past operations or products, including operations or products related to our business prior to the Acquisition; |

| | unexpected liabilities under any pension plans applicable to our employees; |

| | risk that the insurance we maintain may not fully cover all potential exposures; |

| | failure to comply with the anti-corruption laws of the United States and various international jurisdictions; |

| | failure to comply with anti-terrorism laws and regulations and applicable trade embargoes; |

| | business disruptions, security threats and security breaches; |

| | our ability to protect and enforce intellectual property rights; |

| | intellectual property infringement suits against us by third parties; |

| | our substantial indebtedness; |

| | our ability to obtain additional capital on commercially reasonable terms; |

| | our ability to realize the anticipated benefits of any acquisitions and divestitures; |

| | our joint ventures ability to operate according to our business strategy should our joint venture partners fail to fulfill their obligations; |

7

Table of Contents

| | the risk of impairment charges related to goodwill, identifiable intangible assets and fixed assets; |

| | our ability to recruit and retain the experienced and skilled personnel we need to compete; |

| | work stoppages, union negotiations, labor disputes and other matters associated with our labor force; |

| | terrorist acts, conflicts, wars and natural disasters that may materially adversely affect our business, financial condition and results of operations; |

| | transporting certain materials that are inherently hazardous due to their toxic nature; |

| | weather conditions that may temporarily reduce the demand for some of our products; |

| | reduced demand for some of our products as a result of improved safety features on vehicles and insurance company influence; |

| | the amount of the costs, fees, expenses and charges related to being a public company; |

| | any statements of belief and any statements of assumptions underlying any of the foregoing; |

| | Carlyles ability to control our common shares; |

| | other factors disclosed in our most recent Annual Report on Form 10-K and our other filings with the SEC; and |

| | other factors beyond our control. |

In addition, important factors included or incorporated in this prospectus and any accompanying prospectus supplement, particularly under the heading Risk Factors, among others, could cause actual results to differ materially from those indicated by forward-looking statements made herein and presented elsewhere by management from time to time. We do not undertake an obligation to update any forward-looking statements to reflect future events or circumstances.

8

Table of Contents

We will not receive any proceeds from the sale of our common shares by the selling shareholders.

9

Table of Contents

The following description of our share capital summarizes certain provisions of our amended memorandum of association and our amended and restated bye-laws. Such summaries do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of our amended memorandum of association and amended and restated bye-laws, copies of which have been incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. Prospective investors are urged to read the exhibits for a complete understanding of our amended memorandum of association and amended and restated bye-laws.

General

We are an exempted company incorporated under the laws of Bermuda. We are registered with the Registrar of Companies in Bermuda under registration number 46832. We were incorporated on August 24, 2012 under the name Flash Bermuda Co. Ltd. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda.

The objects of our business are unrestricted, and the Company has the capacity of a natural person. We can therefore undertake activities without restriction on our capacity.

Since our incorporation, other than (i) an increase in our authorized share capital to 1,000,000,000 shares on August 5, 2013 and (ii) the completion of a bonus issue of 0.69 of a share for every common share in issue as at October 28, 2014, rounded down to the nearest whole share, which was effectuated on October 28, 2014 in connection with our initial public offering, there have been no material changes to our share capital, mergers, amalgamations or consolidations of us or any of our subsidiaries, no material changes in the mode of conducting our business, no material changes in the types of products produced or services rendered. On May 9, 2013, we changed our name from Flash Bermuda Co. Ltd. to Axalta Coating Systems Bermuda Co., Ltd., and on August 8, 2014, we changed our name from Axalta Coating Systems Bermuda Co., Ltd. to Axalta Coating Systems Ltd. There have been no bankruptcy, receivership or similar proceedings with respect to us or our subsidiaries.

There have been no public takeover offers by third parties for our common shares nor any public takeover offers by us for the shares of another company that have occurred during the last or current financial years.

Our common shares are listed on the NYSE under the symbol AXTA.

Initial settlement of our common shares will take place on the closing date of this offering through The Depository Trust Company (DTC) in accordance with its customary settlement procedures for equity securities registered through DTCs book-entry transfer system. Each person beneficially owning common shares registered through DTC must rely on the procedures thereof and on institutions that have accounts therewith to exercise any rights of a holder of the common shares.

Share Capital

Our authorized share capital consists of issued common shares, par value $1.00 per share, and undesignated shares, par value $1.00 per share, that our Board of Directors is authorized to designate from time to time as common shares or as preference shares. As of March 31, 2016, there were 238,503,149 common shares issued and outstanding, excluding 11,560,430 common shares issuable upon exercise of options, 1,426,051 common shares issuable pursuant to unvested restricted stock units and including 1,049,087 common shares issuable pursuant to unvested restricted stock awards and 346,377 common shares issuable pursuant to unvested performance share awards granted as of March 31, 2016, and no preference shares issued and outstanding. All of our issued and outstanding common shares are fully paid.

10

Table of Contents

Pursuant to our amended and restated bye-laws, subject to the requirements of the NYSE and to any resolution of the shareholders to the contrary, our Board of Directors is authorized to issue any of our authorized but unissued shares. There are no limitations on the right of non-Bermudians or non-residents of Bermuda to hold or vote our shares.

Common Shares

Holders of common shares have no pre-emptive, redemption, conversion or sinking fund rights. Holders of common shares are entitled to one vote per share on all matters submitted to a vote of holders of common shares. Unless a different majority is required by law or by our amended and restated bye-laws, resolutions to be approved by holders of common shares require approval by a simple majority of votes cast at a meeting at which a quorum is present.

In the event of our liquidation, dissolution or winding up, the holders of common shares are entitled to share equally and ratably in our assets, if any, remaining after the payment of all of our debts and liabilities, subject to any liquidation preference on any issued and outstanding preference shares.

Preference Shares

Pursuant to Bermuda law and our amended and restated bye-laws, our Board of Directors may, by resolution, establish one or more series of preference shares having such number of shares, designations, dividend rates, relative voting rights, conversion or exchange rights, redemption rights, liquidation rights and other relative participation, optional or other special rights, qualifications, limitations or restrictions as may be fixed by the Board of Directors without any further shareholder approval. Such rights, preferences, powers and limitations, as may be established, could have the effect of discouraging an attempt to obtain control of the company.

Dividend Rights

Under Bermuda law, a company may not declare or pay dividends if there are reasonable grounds for believing that: (i) the company is, or would after the payment be, unable to pay its liabilities as they become due; or (ii) the realizable value of its assets would thereby be less than its liabilities. Under our amended and restated bye-laws, each common share is entitled to dividends if, as and when dividends are declared by our Board of Directors, subject to any preferred dividend right of the holders of any preference shares.

Any cash dividends payable to holders of our common shares listed on the NYSE will be paid to American Stock Transfer & Trust Company, LLC, our paying agent in the United States for disbursement to those holders.

Variation of Rights

If at any time we have more than one class of shares, the rights attaching to any class, unless otherwise provided for by the terms of issue of the relevant class, may be varied either: (i) with the consent in writing of the holders of 75% of the issued shares of that class; or (ii) with the sanction of a resolution passed by a majority of the votes cast at a general meeting of the relevant class of shareholders at which a quorum consisting of at least two persons holding or representing one-third of the issued shares of the relevant class is present. Our amended and restated bye-laws specify that the creation or issue of shares ranking equally with existing shares will not, unless expressly provided by the terms of issue of existing shares, vary the rights attached to existing shares. In addition, the creation or issue of preference shares ranking prior to common shares will not be deemed to vary the rights attached to common shares or, subject to the terms of any other class or series of preference shares, to vary the rights attached to any other class or series of preference shares.

11

Table of Contents

Transfer of Shares

Our Board of Directors may, in its absolute discretion and without assigning any reason, refuse to register the transfer of a share on the basis that it is not fully paid. Our Board of Directors may also refuse to recognize an instrument of transfer of a share unless it is accompanied by the relevant share certificate and such other evidence of the transferors right to make the transfer as our Board of Directors shall reasonably require. Subject to these restrictions, a holder of common shares may transfer the title to all or any of his common shares by completing a form of transfer in the form set out in our amended and restated bye-laws (or as near thereto as circumstances admit) or in such other common form as our Board of Directors may accept. The instrument of transfer must be signed by the transferor and transferee, although in the case of a fully paid share our Board of Directors may accept the instrument signed only by the transferor.

Where our shares are listed or admitted to trading on any appointed stock exchange, such as the NYSE, they will be transferred in accordance with the rules and regulations of such exchange.

Meetings of Shareholders

Under Bermuda law, a company is required to convene at least one general meeting of shareholders each calendar year, which we refer to as the annual general meeting. However, the shareholders may by resolution waive this requirement, either for a specific year or period of time, or indefinitely. When the requirement has been so waived, any shareholder may, on notice to the company, terminate the waiver, in which case an annual general meeting must be called. We have chosen not to waive the convening of an annual general meeting.

Bermuda law provides that a special general meeting of shareholders may be called by the Board of Directors of a company and must be called upon the request of shareholders holding not less than 10% of the paid-up capital of the company carrying the right to vote at general meetings. Bermuda law also requires that shareholders be given at least five days advance notice of a general meeting, but the accidental omission to give notice to any person does not invalidate the proceedings at a meeting. Our amended and restated bye-laws provide that our Board of Directors may convene an annual general meeting and the chairman or a majority of our directors then in office may convene a special general meeting. Under our amended and restated bye-laws, at least 14 days notice of an annual general meeting or ten days notice of a special general meeting must be given to each shareholder entitled to vote at such meeting. This notice requirement is subject to the ability to hold such meetings on shorter notice if such notice is agreed: (i) in the case of an annual general meeting, by all of the shareholders entitled to attend and vote at such meeting; or (ii) in the case of a special general meeting, by a majority in number of the shareholders entitled to attend and vote at the meeting holding not less than 95% in nominal value of the shares entitled to vote at such meeting. Subject to the rules of the NYSE, the quorum required for a general meeting of shareholders is two or more persons present in person at the start of the meeting and representing in person or by proxy in excess of 50% of all issued and outstanding common shares.

Access to Books and Records and Dissemination of Information

Members of the general public have a right to inspect the public documents of a company available at the office of the Registrar of Companies in Bermuda. These documents include a companys amended and restated memorandum of association, including its objects and powers, and certain alterations to the amended and restated memorandum of association. The shareholders have the additional right to inspect the bye-laws of the company, minutes of general meetings and the companys audited financial statements, which must be presented in the annual general meeting. The register of members of a company is also open to inspection by shareholders and by members of the general public without charge. The register of members is required to be open for inspection for not less than two hours in any business day (subject to the ability of a company to close the register of members for not more than thirty days in a year). A company is required to maintain its share register in Bermuda but may, subject to the provisions of the Companies Act 1981 (Companies Act) establish a branch register outside of Bermuda. A company is required to keep at its registered office a register of directors and officers that is open for

12

Table of Contents

inspection for not less than two hours in any business day by members of the public without charge. Bermuda law does not, however, provide a general right for shareholders to inspect or obtain copies of any other corporate records.

Election and Removal of Directors

Our amended and restated bye-laws provide that our Board of Directors shall consist of such number of directors as the Board of Directors may determine. Our Board of Directors currently consists of nine directors. Pursuant to the terms of our principal stockholders agreement, as amended, we are prohibited from increasing the number of directors until such time as Carlyle owns, in the aggregate, less than five percent of our outstanding common shares. Our Board of Directors is divided into three classes that are, as nearly as possible, of equal size. Each class of directors is elected for a three-year term of office, but the terms are staggered so that the term of only one class of directors expires at each annual general meeting. At each succeeding annual general meeting, successors to the class of directors whose term expires at the annual general meeting are elected for a three-year term.

A shareholder holding not less than 10% in nominal value of the common shares in issue may propose for election as a director someone who is not an existing director or is not proposed by our Board of Directors. Where a Director is to be elected at an annual general meeting, notice of any such proposal for election must be given not less than 90 days nor more than 120 days before the anniversary of the last annual general meeting prior to the giving of the notice or, in the event the annual general meeting is called for a date that is not less than 30 days before or after such anniversary the notice must be given not later than ten days following the earlier of the date on which notice of the annual general meeting was posted to shareholders or the date on which public disclosure of the date of the annual general meeting was made. Where a Director is to be elected at a special general meeting, that notice must be given not later than 7 days following the earlier of the date on which notice of the special general meeting was posted to shareholders or the date on which public disclosure of the date of the special general meeting was made.

A director may be removed, only with cause, by the shareholders, provided notice of the shareholders meeting convened to remove the director is given to the director. The notice must contain a statement of the intention to remove the director and a summary of the facts justifying the removal and must be served on the director not less than 14 days before the meeting. The director is entitled to attend the meeting and be heard on the motion for his removal.

Proceedings of Board of Directors

Our amended and restated bye-laws provide that our business is to be managed and conducted by our Board of Directors. Bermuda law permits individual and corporate directors and there is no requirement in our bye-laws or Bermuda law that directors hold any of our shares. There is also no requirement in our amended and restated bye-laws or Bermuda law that our directors must retire at a certain age.

The compensation of our directors is determined by the Board of Directors, and there is no requirement that a specified number or percentage of independent directors must approve any such determination. Our directors may also be paid all travel, hotel and other reasonable out-of-pocket expenses properly incurred by them in connection with our business or their duties as directors.

A director who discloses a direct or indirect interest in any contract or arrangement with us as required by Bermuda law is not entitled to vote in respect of any such contract or arrangement in which he or she is interested unless the chairman of the relevant meeting of the Board of Directors determines that such director is not disqualified from voting.

13

Table of Contents

Indemnification of Directors and Officers

Section 98 of the Companies Act provides generally that a Bermuda company may indemnify its directors, officers and auditors against any liability which by virtue of any rule of law would otherwise be imposed on them in respect of any negligence, default, breach of duty or breach of trust, except in cases where such liability arises from fraud or dishonesty of which such director, officer or auditor may be guilty in relation to the company. Section 98 further provides that a Bermuda company may indemnify its directors, officers and auditors against any liability incurred by them in defending any proceedings, whether civil or criminal, in which judgment is awarded in their favor or in which they are acquitted or granted relief by the Supreme Court of Bermuda pursuant to Section 281 of the Companies Act.

Our amended and restated bye-laws provide that we shall indemnify our officers and directors in respect of their actions and omissions, except in respect of their fraud or dishonesty, and that we shall advance funds to our officers and directors for expenses incurred in their defense upon receipt of an undertaking to repay the funds if any allegation of fraud or dishonesty is proved. Our amended and restated bye-laws provide that the shareholders waive all claims or rights of action that they might have, individually or in right of the company, against any of the companys directors or officers for any act or failure to act in the performance of such directors or officers duties, except in respect of any fraud or dishonesty of such director or officer. Section 98A of the Companies Act permits us to purchase and maintain insurance for the benefit of any officer or director in respect of any loss or liability attaching to him in respect of any negligence, default, breach of duty or breach of trust, whether or not we may otherwise indemnify such officer or director. We have purchased and maintain a directors and officers liability policy for such purpose.

Amendment of Memorandum of Association and Bye-laws

Bermuda law provides that the memorandum of association of a company may be amended by a resolution passed at a general meeting of shareholders. Our amended and restated bye-laws provide that no bye-law shall be rescinded, altered or amended, and no new bye-law shall be made, unless it shall have been approved by a resolution of our Board of Directors and by a resolution of our shareholders including the affirmative vote of a majority of all votes entitled to be cast on the resolution.

Under Bermuda law, the holders of an aggregate of not less than 20% in nominal value of a companys issued share capital or any class thereof have the right to apply to the Supreme Court of Bermuda for an annulment of any amendment of the memorandum of association adopted by shareholders at any general meeting, other than an amendment that alters or reduces a companys share capital as provided in the Companies Act. Where such an application is made, the amendment becomes effective only to the extent that it is confirmed by the Supreme Court of Bermuda. An application for an annulment of an amendment of the memorandum of association must be made within 21 days after the date on which the resolution altering the companys memorandum of association is passed and may be made on behalf of persons entitled to make the application by one or more of their number as they may appoint in writing for the purpose. No application may be made by shareholders voting in favor of the amendment.

Amalgamations and Mergers

The amalgamation or merger of a Bermuda company with another company or corporation (other than certain affiliated companies) requires the amalgamation or merger agreement to be approved by the companys Board of Directors and by its shareholders. Unless the companys bye-laws provide otherwise, the approval of 75% of the shareholders voting at such meeting is required to approve the amalgamation or merger agreement, and the quorum for such meeting must be two or more persons holding or representing more than one-third of the issued shares of the company.

Under Bermuda law, in the event of an amalgamation or merger of a Bermuda company with another company or corporation, a shareholder of the Bermuda company who did not vote in favor of the amalgamation

14

Table of Contents

or merger and who is not satisfied that fair value has been offered for such shareholders shares may, within one month of notice of the shareholders meeting, apply to the Supreme Court of Bermuda to appraise the fair value of those shares.

Shareholder Suits

Class actions and derivative actions are generally not available to shareholders under Bermuda law. The Bermuda courts, however, would ordinarily be expected to permit a shareholder to commence an action in the name of a company to remedy a wrong to the company where the act complained of is alleged to be beyond the corporate power of the company or illegal, or would result in the violation of the companys memorandum of association or bye-laws. Furthermore, consideration would be given by a Bermuda court to acts that are alleged to constitute a fraud against the minority shareholders or, for instance, where an act requires the approval of a greater percentage of the companys shareholders than that which actually approved it.

When the affairs of a company are being conducted in a manner that is oppressive or prejudicial to the interests of some part of the shareholders, one or more shareholders may apply to the Supreme Court of Bermuda, which may make such order as it sees fit, including an order regulating the conduct of the companys affairs in the future or ordering the purchase of the shares of any shareholders by other shareholders or by the company.

Our amended and restated bye-laws contain a provision by virtue of which our shareholders waive any claim or right of action that they have, both individually and on our behalf, against any director or officer in relation to any action or failure to take action by such director or officer, except in respect of any fraud or dishonesty of such director or officer. We have been advised by the SEC that in the opinion of the SEC, the operation of this provision as a waiver of the right to sue for violations of federal securities laws would likely be unenforceable in U.S. courts.

Capitalization of Profits and Reserves

Pursuant to our amended and restated bye-laws, our Board of Directors may (i) capitalize any part of the amount of our share premium or other reserve accounts or any amount credited to our profit and loss account or otherwise available for distribution by applying such sum in paying up unissued shares to be allotted as fully paid bonus shares pro rata (except in connection with the conversion of shares) to the shareholders; or (ii) capitalize any sum standing to the credit of a reserve account or sums otherwise available for dividend or distribution by paying up in full, partly paid or nil paid shares of those shareholders who would have been entitled to such sums if they were distributed by way of dividend or distribution.

Registrar or Transfer Agent

A register of holders of the common shares is maintained by Codan Services Limited in Bermuda, and a branch register is maintained in the United States by American Stock Transfer & Trust Company, LLC, which serves as branch registrar and transfer agent.

Untraced Shareholders

Our amended and restated bye-laws provide that our Board of Directors may forfeit any dividend or other monies payable in respect of any shares that remain unclaimed for six years from the date when such monies became due for payment. In addition, we are entitled to cease sending dividend warrants and checks by post or otherwise to a shareholder if such instruments have been returned undelivered to, or left uncashed by, such shareholder on at least two consecutive occasions or, following one such occasion, reasonable enquires have failed to establish the shareholders new address. This entitlement ceases if the shareholder claims a dividend or cashes a dividend check or a warrant.

15

Table of Contents

Certain Provisions of Bermuda Law

We have been designated by the Bermuda Monetary Authority as a non-resident for Bermuda exchange control purposes. This designation allows us to engage in transactions in currencies other than the Bermuda dollar, and there are no restrictions on our ability to transfer funds (other than funds denominated in Bermuda dollars) in and out of Bermuda or to pay dividends to U.S. residents who are holders of our common shares.

The Bermuda Monetary Authority has given its consent for the issue and free transferability of all of the common shares that are the subject of this offering to and between residents and non-residents of Bermuda for exchange control purposes, provided our shares remain listed on an appointed stock exchange, which includes the NYSE. Approvals or permissions given by the Bermuda Monetary Authority do not constitute a guarantee by the Bermuda Monetary Authority as to our performance or our creditworthiness. Accordingly, in giving such consent or permissions, the Bermuda Monetary Authority shall not be liable for the financial soundness, performance or default of our business or for the correctness of any opinions or statements expressed in this prospectus. Certain issues and transfers of common shares involving persons deemed resident in Bermuda for exchange control purposes require the specific consent of the Bermuda Monetary Authority.

In accordance with Bermuda law, share certificates are only issued in the names of companies, partnerships or individuals. In the case of a shareholder acting in a special capacity (for example as a trustee), certificates may, at the request of the shareholder, record the capacity in which the shareholder is acting. Notwithstanding such recording of any special capacity, we are not bound to investigate or see to the execution of any such trust.

16

Table of Contents

BERMUDA COMPANY CONSIDERATIONS

Our corporate affairs are governed by our memorandum of association and bye-laws and by the corporate law of Bermuda. The provisions of the Companies Act, which applies to us, differ in certain material respects from laws generally applicable to U.S. companies incorporated in the State of Delaware and their stockholders. The following is a summary of significant differences between the Companies Act (including modifications adopted pursuant to our bye-laws) and Bermuda common law applicable to us and our shareholders and the provisions of the General Corporation Law of the State of Delaware applicable to U.S. companies organized under the laws of Delaware and their stockholders.

| Bermuda |

Delaware |

|

| Shareholder meetings |

||

| May be called by the board of directors and must be called upon the request of shareholders holding not less than 10% of the paid-up capital of the company carrying the right to vote at general meetings. |

May be held at such time or place as designated in the certificate of incorporation or the bylaws, or if not so designated, as determined by the board of directors. |

|

| The chairman may convene a special general meeting. |

||

| May be held in or outside Bermuda. |

May be held in or outside of Delaware. |

|

| Notice: |

Notice: |

|

| Shareholders must be given at least five days advance notice of a general meeting, but the unintentional failure to give notice to any person does not invalidate the proceedings at a meeting. |

Written notice shall be given not less than ten nor more than 60 days before the meeting. |

|

| Our bye-laws require that shareholders must be given at least 14 days notice of an annual general meeting or 10 days notice of a special general meeting. |

||

| Notice of general meetings must specify the place, the day and hour of the meeting and in the case of special general meetings, the general nature of the business to be considered. |

Whenever stockholders are required to take any action at a meeting, a written notice of the meeting shall be given which shall state the place, if any, date and hour of the meeting, and the means of remote communication, if any. |

|

| Shareholders voting rights |

||

| Shareholders may act by written consent to elect directors. Shareholders may not act by written consent to remove a director or auditor. |

With limited exceptions, stockholders may act by written consent to elect directors unless prohibited by the certificate of incorporation. |

|

| Generally, except as otherwise provided in the bye-laws, or the Companies Act, any action or resolution requiring approval of the shareholders may be passed by a simple majority of votes cast. Any person authorized to vote may authorize another person or persons to act for him or her by proxy. |

Any person authorized to vote may authorize another person or persons to act for him or her by proxy. |

|

17

Table of Contents

| Bermuda |

Delaware |

|

| The voting rights of shareholders are regulated by a companys bye-laws and, in certain circumstances, by the Companies Act. The bye-laws may specify the number to constitute a quorum and if the bye-laws permit, a general meeting of the shareholders of a company may be held with only one individual present if the requirement for a quorum is satisfied. |

For stock corporations, the certificate of incorporation or bylaws may specify the number to constitute a quorum, but in no event shall a quorum consist of less than one-third of shares entitled to vote at a meeting. In the absence of such specifications, a majority of shares entitled to vote shall constitute a quorum. |

|

| Our bye-laws provide that when a quorum is once present in general meeting it is not broken by the subsequent withdrawal of any shareholders. |

When a quorum is once present to organize a meeting, it is not broken by the subsequent withdrawal of any stockholders. |

|

| The bye-laws may provide for cumulative voting, although our bye-laws do not. |

The certificate of incorporation may provide for cumulative voting. |

|

| The amalgamation or merger of a Bermuda company with another company or corporation (other than certain affiliated companies) requires the amalgamation or merger agreement to be approved by the companys board of directors and by its shareholders. Unless the companys bye-laws provide otherwise, the approval of 75% of the shareholders voting at such meeting is required to approve the amalgamation or merger agreement, and the quorum for such meeting must be two or more persons holding or representing more than one-third of the issued shares of the company. |

Any two or more corporations existing under the laws of the state may merge into a single corporation pursuant to a board resolution and upon the majority vote by stockholders of each constituent corporation at an annual or special meeting. |

|

| Every company may at any meeting of its board of directors sell, lease or exchange all or substantially all of its property and assets as its board of directors deems expedient and in the best interests of the company to do so when authorized by a resolution adopted by the holders of a majority of issued and outstanding shares of a company entitled to vote. |

Every corporation may at any meeting of the board sell, lease or exchange all or substantially all of its property and assets as its board deems expedient and for the best interests of the corporation when so authorized by a resolution adopted by the holders of a majority of the outstanding stock of a corporation entitled to vote. |

|

| Any company that is the wholly owned subsidiary of a holding company, or one or more companies which are wholly owned subsidiaries of the same holding company, may amalgamate or merge without the vote or consent of shareholders provided that the approval of the board of directors is obtained and that a director or officer of each such company signs a statutory solvency declaration in respect of the relevant company. |

Any corporation owning at least 90% of the outstanding shares of each class of another corporation may merge the other corporation into itself and assume all of its obligations without the vote or consent of stockholders; however, in case the parent corporation is not the surviving corporation, the proposed merger shall be approved by a majority of the outstanding stock of the parent corporation entitled to vote at a duly called stockholder meeting. |

|

| Any mortgage, charge or pledge of a companys property and assets may be authorized without the consent of shareholders subject to any restrictions under the bye-laws. |

Any mortgage or pledge of a corporations property and assets may be authorized without the vote or consent of stockholders, except to the extent that the certificate of incorporation otherwise provides. |

|

18

Table of Contents

| Bermuda |

Delaware |

|

| Directors | ||

| The board of directors must consist of at least one director.

The number of directors is fixed by board of directors according to our bye-laws, and any changes to such number must be approved by the board of directors in accordance with our bye-laws.

Removal:

Under our bye-laws, any or all directors may be removed only with cause by the holders of a majority of the shares entitled to vote at a special meeting convened and held in accordance with the bye-laws for the purpose of such removal. |

The board of directors must consist of at least one member.

Number of board members shall be fixed by the bylaws, unless the certificate of incorporation fixes the number of directors, in which case a change in the number shall be made only by amendment of the certificate of incorporation.

Removal:

Any or all of the directors may be removed, with or without cause, by the holders of a majority of the shares entitled to vote unless the certificate of incorporation otherwise provides.

In the case of a classified board, stockholders may effect removal of any or all directors only for cause. |

|

| Duties of directors |

||

| The Companies Act authorizes the directors of a company, subject to its bye-laws, to exercise all powers of the company except those that are required by the Companies Act or the companys bye-laws to be exercised by the shareholders of the company. Our bye-laws provide that our business is to be managed and conducted by our Board of Directors. At common law, members of a board of directors owe a fiduciary duty to the company to act in good faith in their dealings with or on behalf of the company and exercise their powers and fulfill the duties of their office honestly. This duty includes the following essential elements:

a duty to act in good faith in the best interests of the company;

a duty not to make a personal profit from opportunities that arise from the office of director;

a duty to avoid conflicts of interest; and

a duty to exercise powers for the purpose for which such powers were intended. |

Under Delaware law, the business and affairs of a corporation are managed by or under the direction of its board of directors. In exercising their powers, directors are charged with a fiduciary duty of care to protect the interests of the corporation and a fiduciary duty of loyalty to act in the best interests of its stockholders. The duty of care requires that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under this duty, a director must inform himself of, and disclose to stockholders, all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage. This duty prohibits self-dealing by a director and mandates that the best interest of the corporation and its stockholders take precedence over any interest possessed by a director, officer or controlling shareholder and not shared by the stockholders generally. |

|

19

Table of Contents

| Bermuda |

Delaware |

|

| The Companies Act imposes a duty on directors and officers of a Bermuda company:

to act honestly and in good faith with a view to the best interests of the company; and

to exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

The Companies Act also imposes various duties on directors and officers of a company with respect to certain matters of management and administration of the company. Under Bermuda law, directors and officers generally owe fiduciary duties to the company itself, not to the companys individual shareholders, creditors or any class thereof. Our shareholders may not have a direct cause of action against our directors. |

In general, actions of a director are presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Should such evidence be presented concerning a transaction by a director, a director must prove the procedural fairness of the transaction, and that the transaction was of fair value to the corporation. |

|

| Takeovers | ||

| An acquiring party is generally able to acquire compulsorily the common shares of minority holders of a company in the following ways:

By a procedure under the Companies Act known as a scheme of arrangement. A scheme of arrangement could be effected by obtaining the agreement of the company and of holders of common shares, representing in the aggregate a majority in number and at least 75% in value of the common shareholders present and voting at a court ordered meeting held to consider the scheme of arrangement. The scheme of arrangement must then be sanctioned by the Bermuda Supreme Court. If a scheme of arrangement receives all necessary agreements and sanctions, upon the filing of the court order with the Registrar of Companies in Bermuda, all holders of common shares could be compelled to sell their shares under the terms of the scheme of arrangement.

By acquiring pursuant to a tender offer 90% of the shares or class of shares not already owned by, or by a nominee for, the acquiring party (the offeror), or any of its subsidiaries. If an offeror has, within four months after the making of an offer for all the shares or class of shares not owned by, or by a nominee for, the offeror, or any of its subsidiaries, obtained the |

Delaware law provides that a parent corporation, by resolution of its board of directors and without any stockholder vote, may merge with any subsidiary of which it owns at least 90% of each class of its capital stock. Upon any such merger, and in the event the parent corporate does not own all of the stock of the subsidiary, dissenting stockholders of the subsidiary are entitled to certain appraisal rights.

Delaware law also provides, subject to certain exceptions, that if a person acquires 15% of voting stock of a company, the person is an interested stockholder and may not engage in business combinations with the company for a period of three years from the time the person acquired 15% or more of voting stock. |

|

20

Table of Contents

| Bermuda |

Delaware |

|

| approvalof the holders of 90% or more of all the shares to which the offer relates, the offeror may, at any time within two months beginning with the date on which the approval was obtained, by notice compulsorily acquire the shares of any nontendering shareholder on the same terms as the original offer unless the Supreme Court of Bermuda (on application made within a one- month period from the date of the offerors notice of its intention to acquire such shares) orders otherwise. |

||

| Where the acquiring party or parties hold not less than 95% of the shares or a class of shares of the company, by acquiring, pursuant to a notice given to the remaining shareholders or class of shareholders, the shares of such remaining shareholders or class of shareholders. When this notice is given, the acquiring party is entitled and bound to acquire the shares of the remaining shareholders on the terms set out in the notice, unless a remaining shareholder, within one month of receiving such notice, applies to the Supreme Court of Bermuda for an appraisal of the value of their shares. This provision only applies where the acquiring party offers the same terms to all holders of shares whose shares are being acquired. |

||

| Dissenters rights of appraisal | ||

| A dissenting shareholder (that did not vote in favor of the amalgamation or merger) of a Bermuda exempted company is entitled to be paid the fair value of his or her shares in an amalgamation or merger. |

With limited exceptions, appraisal rights shall be available for the shares of any class or series of stock of a corporation in a merger or consolidation.

The certificate of incorporation may provide that appraisal rights are available for shares as a result of an amendment to the certificate of incorporation, any merger or consolidation or the sale of all or substantially all of the assets. |

|

| Dissolution | ||

| Under Bermuda law, a solvent company may be wound up by way of a shareholders voluntary liquidation. Prior to the company entering liquidation, a majority of the directors shall each make a statutory declaration, which states that the directors have made a full enquiry into the affairs of the company and have formed the opinion that the company will be able to pay its debts within a period of 12 months of the commencement of the winding up and must file the statutory declaration |

Under Delaware law, a corporation may voluntarily dissolve (i) if a majority of the board of directors adopts a resolution to that effect and the holders of a majority of the issued and outstanding shares entitled to vote thereon vote for such dissolution; or (ii) if all stockholders entitled to vote thereon consent in writing to such dissolution. |

|

21

Table of Contents

| Bermuda |

Delaware |

|

| withthe Registrar of Companies in Bermuda. The general meeting will be convened primarily for the purposes of passing a resolution that the company be wound up voluntarily and appointing a liquidator. The winding up of the company is deemed to commence at the time of the passing of the resolution. |

||

| Shareholders derivative actions | ||

| Class actions and derivative actions are generally not available to shareholders under Bermuda law. Bermuda courts, however, would ordinarily be expected to permit a shareholder to commence an action in the name of a company to remedy a wrong to the company where the act complained of is alleged to be beyond the corporate power of the company or illegal, or would result in the violation of the companys memorandum of association or bye-laws. Furthermore, consideration would be given by a Bermuda court to acts that are alleged to constitute a fraud against the minority shareholders or, for instance, where an act requires the approval of a greater percentage of the companys shareholders than that which actually approved it. |

In any derivative suit instituted by a stockholder of a corporation, it shall be averred in the complaint that the plaintiff was a stockholder of the corporation at the time of the transaction of which he complains or that such stockholders stock thereafter devolved upon such stockholder by operation of law. |

|

22

Table of Contents

The selling shareholders may offer and sell the common shares covered by this prospectus from time to time in one or more transactions, including without limitation:

| | directly to one or more purchasers; |

| | through agents; |

| | to or through underwriters, brokers or dealers; or |

| | through a combination of any of these methods. |

In addition, the manner in which the selling shareholders may sell some or all of the common shares covered by this prospectus includes any method permitted by law, including, without limitation, through:

| | a block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion of the block, as principal, in order to facilitate the transaction; |

| | purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account; |

| | ordinary brokerage transactions and transactions in which a broker solicits purchasers; or |

| | privately negotiated transactions. |

The selling shareholders may also enter into hedging transactions. For example, the selling shareholders may:

| | enter into transactions with a broker-dealer or affiliate thereof in connection with which such broker-dealer or affiliate will engage in short sales of the common shares pursuant to this prospectus, in which case such broker-dealer or affiliate may use common shares received from the selling shareholders to close out its short positions; |

| | sell common shares short and redeliver such shares to close out the short positions; |

| | enter into option or other types of transactions that require the selling shareholders to deliver common shares to a broker-dealer or an affiliate thereof, who will then resell or transfer the common shares under this prospectus; or |

| | loan or pledge the common shares to a broker-dealer or an affiliate thereof, who may sell the loaned shares or, in an event of default in the case of a pledge, sell the pledged shares pursuant to this prospectus. |

The common shares covered by this prospectus may be sold:

| | on a national securities exchange; |

| | in the over-the-counter market; or |

| | in transactions otherwise than on an exchange or in the over-the-counter market, or in any combination of these distribution channels. |

In addition, the selling shareholders may enter into derivative or hedging transactions with third parties, or sell common shares not covered by this prospectus to third parties in privately negotiated transactions. In connection with such a transaction, the third parties may sell common shares covered by and pursuant to this prospectus and an applicable prospectus supplement or pricing supplement, as the case may be. If so, the third party may use common shares borrowed from the selling shareholders or others to settle such sales and may use common shares received from the selling shareholders to close out any related short positions. The selling shareholders may also loan or pledge common shares covered by this prospectus and an applicable prospectus

23

Table of Contents

supplement to third parties, who may sell the loaned common shares or, in an event of default in the case of a pledge, sell the pledged common shares pursuant to this prospectus and the applicable prospectus supplement or pricing supplement, as the case may be.

A prospectus supplement with respect to each offering of common shares will state the terms of the offering of the common shares, including:

| | the name or names of any participating underwriters, brokers, dealers or agents and the amounts of common shares underwritten or purchased by each of them, if any; |

| | the public offering price or purchase price of the common shares and the net proceeds to be received by the selling shareholders from the sale; |

| | any delayed delivery arrangements; |

| | any underwriting discounts, commissions or agency fees and other items constituting underwriters, brokers, dealers or agents compensation; |

| | any discounts or concessions allowed or reallowed or paid to dealers; |

| | any securities exchange or markets on which the common shares may be listed; and |

| | other material terms of the offering. |

The offer and sale of the common shares described in this prospectus by the selling shareholders, the underwriters or the third parties described above may be effected from time to time in one or more transactions, including privately negotiated transactions, either:

| | at a fixed price or prices, which may be changed; |

| | at market prices prevailing at the time of sale; |

| | at prices related to the prevailing market prices; or |

| | at negotiated prices. |

In addition to selling its common shares under this prospectus, a selling shareholder may:

| | transfer its common shares in other ways not involving a market maker or established trading markets, including directly by gift, distribution, or other transfer; |

| | sell its common shares under Rule 144 or Rule 145 of the Securities Act rather than under this prospectus, if the transaction meets the requirements of Rule 144 or Rule 145; or |

| | sell its common shares by any other legally available means. |

General

Any public offering price and any discounts, commissions, concessions or other items constituting compensation allowed or reallowed or paid to underwriters, dealers, agents or remarketing firms may be changed from time to time. Any selling shareholders, underwriters, dealers, agents and remarketing firms that participate in the distribution of the offered common shares may be underwriters as defined in the Securities Act. Any discounts or commissions they receive from the selling shareholders and any profits they receive on the resale of the offered common shares may be treated as underwriting discounts and commissions under the Securities Act. The selling shareholders will identify any underwriters, agents or dealers and describe their commissions, fees or discounts in the applicable prospectus supplement or pricing supplement, as the case may be.

The selling shareholders and other persons participating in the sale or distribution of the common shares will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including

24

Table of Contents

Regulation M. This regulation may limit the timing of purchases and sales of any of the common shares by the selling shareholders or any other person. The anti-manipulation rules under the Exchange Act may apply to sales of common shares in the market and to the activities of the selling shareholders and any affiliates of the selling shareholders. Furthermore, Regulation M may restrict the ability of any person engaged in the distribution for a period of up to five business days before the distribution. These restrictions may affect the marketability of the common shares and the ability of any person or entity to engage in market-making activities with respect to the common shares.

The selling shareholders are not restricted as to the price or prices at which they may sell the common shares. Sales of such common shares may have an adverse effect on the market price of the common shares. Moreover, it is possible that a significant number of common shares could be sold at the same time, which may have an adverse effect on the market price of the common shares.

We cannot assure you that the selling shareholders will sell all or any portion of the common shares offered hereby.

Underwriters and Agents

If underwriters are used in a sale, they will acquire the offered common shares for their own account. The underwriters may resell the offered common shares in one or more transactions, including negotiated transactions. These sales may be made at a fixed public offering price or prices, which may be changed, at market prices prevailing at the time of the sale, at prices related to such prevailing market prices or at negotiated prices. The selling shareholders may offer the common shares to the public through an underwriting syndicate or through a single underwriter. The underwriters in any particular offering will be named in the applicable prospectus supplement or pricing supplement, as the case may be.

Unless otherwise specified in connection with any particular offering of common shares, the obligations of the underwriters to purchase the offered common shares will be subject to certain conditions contained in an underwriting agreement that we and the applicable selling shareholders will enter into with the underwriters at the time of the sale to them. The underwriters will be obligated to purchase all of the offered common shares if any of the common shares are purchased, unless otherwise specified in connection with any particular offering of common shares. Any initial offering price and any discounts or concessions allowed, reallowed or paid to dealers may be changed from time to time.