EX-99.2

Published on November 18, 2025

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L Exhibit 99.2 A Global Coatings Leader November 2025

COLOR PALETTE Text 50 56 62 Important Disclosures Title bar/Bullets 0 81 146 General restrictions ACCENTS This communication is not for release, publication, or distribution, in whole or in part, in or into, directly or indirectly, any jurisdiction in which such release, publication, or distribution would be unlawful. 0 109 81 190 This communication is not a prospectus and the information in this communication is not intended to be complete. This communication is for informational purposes only and is not intended to be and shall not constitute a solicitation of any vote or approval, or 1 146 255 an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or an invitation or recommendation to subscribe for, acquire or buy securities of AkzoNobel or Axalta or any other financial products or securities, in any place or jurisdiction, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except 205 255 by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended (the “Securities Act”). 0 133 2 10 139 Any decision to purchase, subscribe for, otherwise acquire, sell or otherwise dispose of any securities must be made only on the basis of the information contained in and incorporated by reference into the prospectus with respect to the shares to be allotted by 0 130 AkzoNobel in the proposed transaction once published. A prospectus in relation to the proposed transaction described in this communication is expected to be published in due course. 139 218 3 197 255 The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, AkzoNobel and Axalta disclaim any responsibility or liability for the violation of any such restrictions by any person. Neither AkzoNobel, nor Axalta, nor any of their advisors assume any responsibility for any violation by any person of any of 246 251 these restrictions. Shareholders of AkzoNobel and Axalta, respectively, with any doubt as to their position should consult an appropriate professional advisor without delay. 137 208 4 32 166 This communication is addressed to and directed only at, persons who are outside the United Kingdom or, in the United Kingdom, at persons who are: (i) persons having professional experience in matters relating to investments falling within Article 19(5) of 122 202 the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), (ii) persons falling within Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it may otherwise lawfully be communicated pursuant to the Order (all such 183 227 5 persons together being referred to as, “Relevant Persons”). This communication is directed only at Relevant Persons. Other persons should not act or rely on this communication or any of its contents. Any investment or investment activity to which this 66 178 communication relates is available only to Relevant Persons and will be engaged in only with such persons. Solicitations resulting from this communication will only be responded to if the person concerned is a Relevant Person. 168 233 Additional Information and Where to Find It 38 156 6 154 224 In connection with the proposed transaction between AkzoNobel and Axalta, AkzoNobel will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4, which will include a proxy statement of Axalta that also constitutes a prospectus with respect to the shares to be offered by AkzoNobel in the proposed transaction. The definitive proxy statement/prospectus will be sent to the shareholders of Axalta. Each of AkzoNobel and Axalta will also file other relevant 30 146 documents in connection with the proposed transaction. This communication is not a substitute for any registration statement, proxy statement/prospectus or other documents AkzoNobel and/or Axalta may file with the SEC or any other competent regulator in 124 213 Hyperlink connection with the proposed transaction. This communication does not contain all the information that should be considered concerning the proposed transaction and is not intended to form the basis of any investment decision or any other decision in respect 153 234 of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS, STOCKHOLDERS AND SHAREHOLDERS OF AKZONOBEL AND AXALTA ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY 0 98 THE PROXY STATEMENT/PROSPECTUS, AS APPLICABLE, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN Followed 80 205 CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT AKZONOBEL, AXALTA, THE PROPOSED TRANSACTION AND RELATED Hyperlink 117 255 MATTERS. The registration statement and proxy statement/prospectus and other relevant documents filed by AkzoNobel and Axalta with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC from Axalta’s investor relations webpage at https://ir.axalta.com/sec-filings/all-sec-filings or from AkzoNobel’s investor relations webpage TABLE at https://www.akzonobel.com/en/investors. 50 Lines 56 The contents of this communication should not be construed as financial, legal, business, investment, tax or other professional advice. Each recipient should consult with its own professional advisors for any such matter and advice. 62 Participants in the Solicitation 0 This communication is not a solicitation of proxies in connection with the proposed transaction. However, under SEC rules, AkzoNobel, Axalta and certain of their respective directors and executive officers and other members of their respective management Highlights 81 and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in 146 connection with the proposed transaction, including a description of their direct or indirect interests in the proposed transaction, by security holdings or otherwise, will be set forth in the proxy statement/prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors and executive officers of Axalta is contained in Axalta’s proxy statement for its 2025 annual meeting of stockholders, filed with the SEC April 22, 2025, its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 13, 2025, subsequent statements of beneficial ownership on file with the SEC, including the Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 or Annual Statements of Beneficial Ownership on Form 5 filed with the SEC on: 2/19/2025, 2/19/25, 2/19/2025, 2/19/25, 2/19/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 8/5/2025, 8/18/2025, 8/21/2025, 9/23/2025 and 9/23/2025, and other filings made from time to time with the SEC. Information about AkzoNobel’s supervisory board members and members of the board of management is set forth in AkzoNobel’s latest annual report, as filed with the AFM, the Dutch trader register and on its website at https://www.akzonobel.com/en/investors/results-center, and as updated from time to time via filings made by AkzoNobel with the AFM. Additional information regarding the interests of persons who may, under the rules of the SEC, be deemed participants in the solicitation of Axalta security holders in connection with the proposed transaction, which may, in some cases, be different than those of Axalta’s shareholders generally, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus and other relevant materials when they are filed with the SEC. These documents can be obtained free of charge from the sources indicated above. 2

COLOR PALETTE Text 50 56 62 Important Disclosures (Cont’d) Title bar/Bullets 0 81 146 Market data ACCENTS Information provided herein as it relates to the market environment in which each of AkzoNobel and Axalta operate or any market developments or trends is based on data and reports prepared by third parties and/or AkzoNobel or Axalta based on internal information and information derived from such third-party sources. Third party industry publications, studies and surveys generally state that the data contained therein have been obtained from sources believed to be reliable, but that there is no guarantee of 0 109 81 190 the accuracy or completeness of such data. 1 146 255 Cautionary Statement Concerning Forward-Looking Statements 205 255 This communication contains forward-looking statements as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, regarding, 0 133 2 among other things, statements about management’s expectations of AkzoNobel’s and Axalta’s future operating and financial performance, product development, market position, and business strategy. Such forward-looking statements can sometimes be 10 139 identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “potential,” “seeks,” “aims,” “projects,” “predicts,” “is optimistic,” “intends,” “plans,” “estimates,” “targets,” “anticipates,” “continues” or 0 130 other comparable terms or negatives of these terms, but not all forward-looking statements include such identifying words. You are cautioned not to rely on these forward-looking statements. Forward-looking statements are based upon current plans, 139 218 3 estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or 197 255 anticipated by such forward-looking statements. We can give no assurance that such plans, estimates or expectations will be achieved and therefore, actual results may differ materially from any plans, estimates or expectations in such forward-looking statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include: a condition to the closing of the proposed transaction may not be satisfied; the occurrence of any event that can give rise to 246 251 termination of the proposed transaction; a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; AkzoNobel and Axalta are unable to achieve the synergies 137 208 4 and value creation contemplated by the proposed transaction; AkzoNobel and Axalta are unable to promptly and effectively integrate their businesses; management’s time and attention is diverted on transaction related issues; the possibility that competing 32 166 offers or acquisition proposals may be made; disruption from the proposed transaction makes it more difficult to maintain business, contractual and operational relationships; the credit ratings of AkzoNobel or Axalta decline following the proposed transaction; 122 202 legal proceedings are instituted against AkzoNobel or Axalta, including resulting expense or delay; AkzoNobel or Axalta is unable to retain or hire key personnel; the communication or the consummation of the proposed acquisition has a negative effect on the 183 227 5 market price of the capital stock of AkzoNobel or Axalta or on AkzoNobel’s or Axalta’s operating results; evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions, in the Netherlands, the United States and 66 178 elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics (e.g., the coronavirus (COVID-19) pandemic), geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade and policy changes associated with the current or subsequent United States or Netherlands administration; the ability of AkzoNobel or Axalta to successfully recover from a disaster or other business continuity problem due to a hurricane, flood, 168 233 earthquake, terrorist attack, war, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural or man-made event, including the ability to function remotely during long-term disruptions; the impact of public health crises, 38 156 6 154 224 such as pandemics and epidemics and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets, including any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down or similar actions and policies; actions by third parties, including government agencies; the risk that disruptions from the proposed transaction will 30 146 harm AkzoNobel’s or Axalta’s business, including current plans and operations and/or divert management’s attention from AkzoNobel’s or Axalta’s ongoing business operations; certain restrictions during the pendency of the acquisition that may impact 124 213 Hyperlink AkzoNobel’s or Axalta’s ability to pursue certain business opportunities or strategic transactions; AkzoNobel’s or Axalta’s ability to meet expectations regarding the accounting and tax treatments of the proposed transaction; the risks and uncertainties 153 234 discussed in AkzoNobel’s latest annual report as filed with the AFM, the Dutch trader register and on its website at https://www.akzonobel.com/en/investors/results-center; and the risks and uncertainties discussed in the “Risk Factors” and “Management’s 0 98 Discussion and Analysis of Financial Condition and Results of Operations” sections in Axalta’s reports filed with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy Followed 80 205 statement/prospectus. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future Hyperlink 117 255 performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Except as required by law, neither AkzoNobel nor Axalta assumes any obligation to update or revise the information contained herein, which TABLE speaks only as of the date hereof. 50 Lines 56 Non-GAAP and Non-IFRS Financial Measures 62 This communication contains certain non-GAAP financial measures and/or non-IFRS financial measures that AkzoNobel and Axalta believe are helpful in understanding the anticipated strategic and financial benefits of the proposed transaction. AkzoNobel's and Axalta's management regularly use a variety of financial measures that are not in accordance with GAAP or IFRS for forecasting, budgeting and measuring financial performance. The non-GAAP financial measures and/or non-IFRS financial measures are 0 not meant to be considered in isolation or as a substitute for comparable GAAP or IFRS measures. While AkzoNobel and Axalta believe that these non-GAAP financial measures and/or non-IFRS financial measures provide meaningful information to help Highlights 81 shareholders understand the anticipated strategic and financial benefits of the proposed transaction, there are limitations associated with the use of these non-GAAP financial measures and/or non-IFRS financial measures. These non-GAAP financial 146 measures and/or non-IFRS financial measures are not prepared in accordance with GAAP or IFRS, are not reported by all of AkzoNobel’s or Axalta’s competitors and may not be directly comparable to similarly titled measures of AkzoNobel’s or Axalta’s competitors due to potential differences in the exact method of calculation. 3

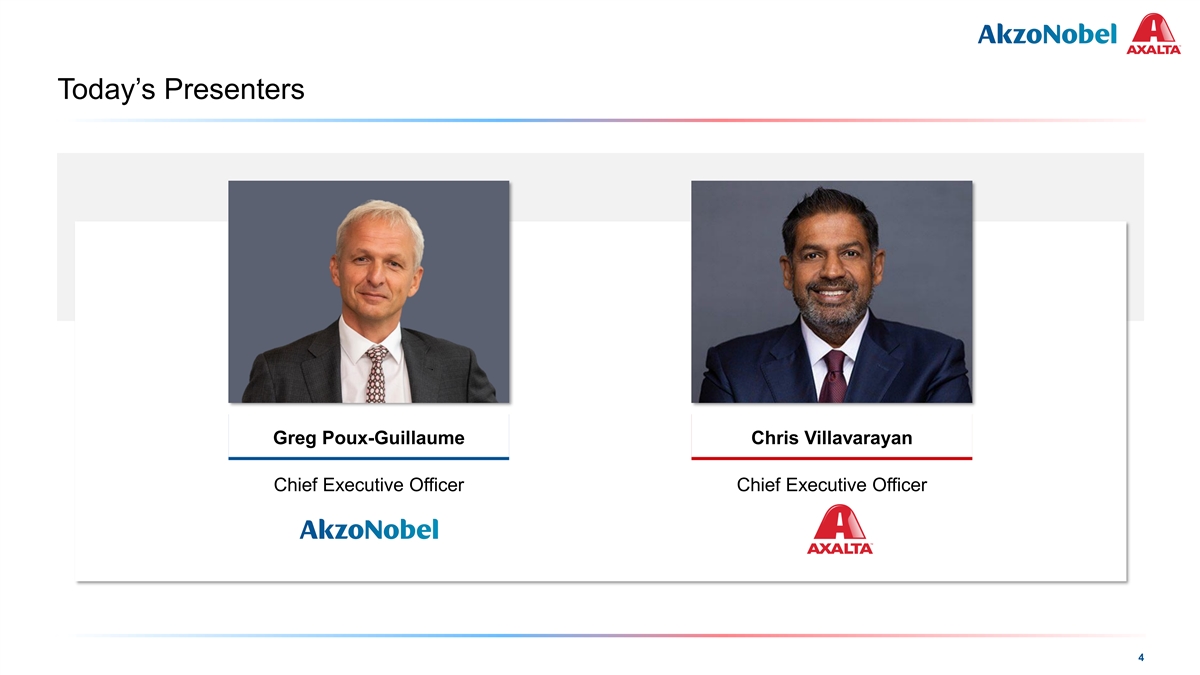

COLOR PALETTE Text 50 56 62 Today’s Presenters Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 205 255 0 133 2 10 139 0 130 139 218 3 197 255 246 251 137 208 4 32 166 122 202 183 227 5 66 178 168 233 38 156 6 154 224 30 146 124 213 Hyperlink 153 234 0 98 Followed 80 205 Hyperlink 117 255 Greg Poux-Guillaume Chris Villavarayan TABLE 50 Lines 56 62 Chief Executive Officer Chief Executive Officer 0 Highlights 81 146 4

COLOR PALETTE Text 50 56 62 Creating a Premier Global Coatings Company Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 Outstanding Value Creation through actionable well-defined cost and operational synergies of ~$600mm 205 255 0 133 2 10 139 0 130 139 218 3 197 255 Top-Tier Portfolio with leading positions across key end-markets and globally recognized brands 246 251 137 208 Compelling 4 32 166 122 202 ~$25bn 183 227 5 66 178 Combination Extensive Scale bringing global capabilities to local customers 168 233 38 156 6 154 224 Delivers 30 146 124 213 Hyperlink Significant 153 234 0 98 Cutting-Edge R&D and innovation platform delivering growth and superior customer value Followed Strategic and 80 205 Hyperlink 117 255 Financial TABLE 50 Lines 56 Benefits 62 Enhanced Financial Profile with strong EBITDA margins and robust cash flow generation 0 Highlights 81 146 Financial Flexibility to support investment grade credit rating, and strategic and capital allocation priorities Note: ~$25Bn based on the combined unadjusted enterprise values of both AkzoNobel and Axalta as of 14 November 2025 5

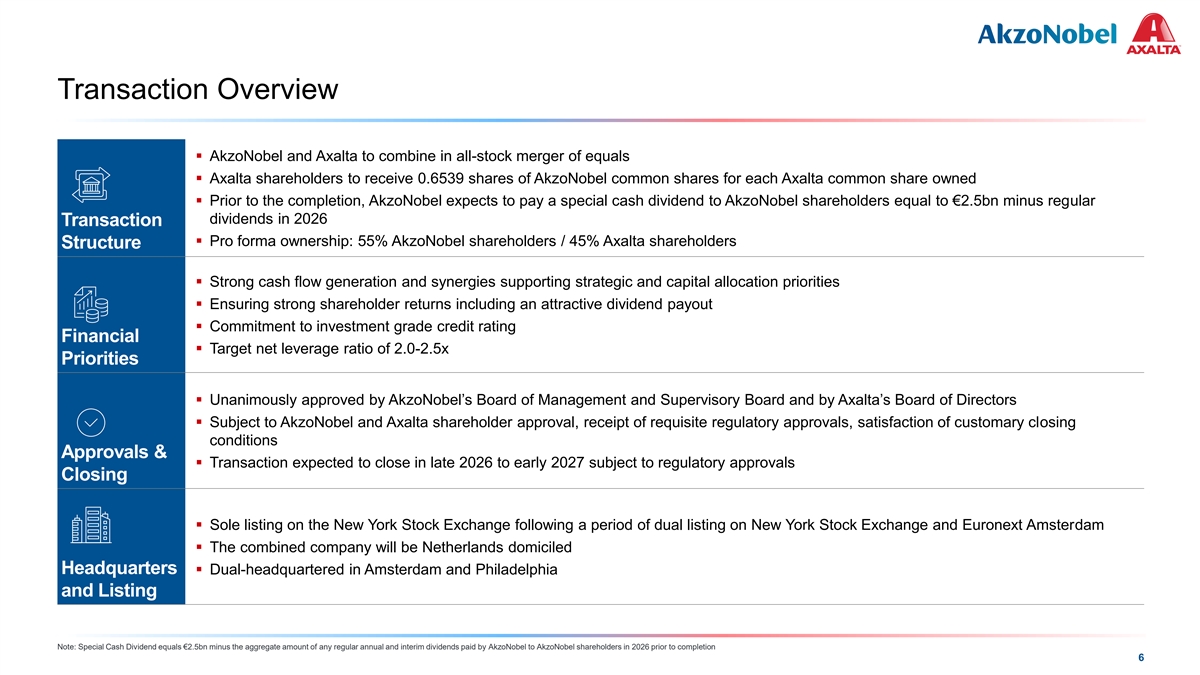

COLOR PALETTE Text 50 56 62 Transaction Overview Title bar/Bullets 0 81 146 ACCENTS 0 109 ▪ AkzoNobel and Axalta to combine in all-stock merger of equals 81 190 1 146 255 ▪ Axalta shareholders to receive 0.6539 shares of AkzoNobel common shares for each Axalta common share owned 205 255 0 133 2 ▪ Prior to the completion, AkzoNobel expects to pay a special cash dividend to AkzoNobel shareholders equal to €2.5bn minus regular 10 139 dividends in 2026 Transaction 0 130 139 218 3 ▪ Pro forma ownership: 55% AkzoNobel shareholders / 45% Axalta shareholders 197 255 Structure 246 251 137 208 4 32 166▪ Strong cash flow generation and synergies supporting strategic and capital allocation priorities 122 202 ▪ Ensuring strong shareholder returns including an attractive dividend payout 183 227 5 66 178 ▪ Commitment to investment grade credit rating 168 233 Financial 38 156 6 ▪ Target net leverage ratio of 2.0-2.5x 154 224 Priorities 30 146 124 213 Hyperlink 153 234 ▪ Unanimously approved by AkzoNobel’s Board of Management and Supervisory Board and by Axalta’s Board of Directors 0 98 Followed 80 205 ▪ Subject to AkzoNobel and Axalta shareholder approval, receipt of requisite regulatory approvals, satisfaction of customary closing Hyperlink 117 255 conditions TABLE Approvals & 50▪ Transaction expected to close in late 2026 to early 2027 subject to regulatory approvals Lines 56 Closing 62 0 Highlights 81 146 ▪ Sole listing on the New York Stock Exchange following a period of dual listing on New York Stock Exchange and Euronext Amsterdam ▪ The combined company will be Netherlands domiciled Headquarters ▪ Dual-headquartered in Amsterdam and Philadelphia and Listing Note: Special Cash Dividend equals €2.5bn minus the aggregate amount of any regular annual and interim dividends paid by AkzoNobel to AkzoNobel shareholders in 2026 prior to completion 6

COLOR PALETTE Text 50 56 62 Two Iconic Industry Leaders Coming Together Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 205 255 0 133 2 10 139 0 130 139 218 3 197 255 246 251 137 208 4 32 166 122 202 Established Established 183 227 5 66 178 1792 1866 168 233 38 156 6 154 224 $11.6bn $1.6bn 33,200 130 70 $5.3bn $1.1bn 13,000+ 43 21 30 146 124 213 Hyperlink Revenue Adj. EBITDA Employees Manufacturing R&D Facilities Revenue Adj. EBITDA Employees Manufacturing R&D Facilities 153 234 Sites Sites 0 98 Followed 80 205 Hyperlink 117 255 TABLE 50 + Lines 56 62 0 • Strong reputation in Powder, Industrial, Aerospace, and Decorative • Delivering excellence in Refinish and Automotive OEM coatings Highlights 81 serving a broad range of end-markets partnering with 90,000+ body shops and 14 of Top 15 Global OEMs 146 • Sustainability-driven innovation focused on delivering exceptional • Industry-leading innovations that solve customers’ business problems value to customers with 23 prestigious R&D Awards over the past five years Note: Financial figures represent 2024A metrics. Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable. AkzoNobel financials converted to USD from EUR at FX rate of 1.08 EUR/USD equivalent to the average exchange rate between 01-Jan-2024 and 31-Dec-24. Non-financial figures as of latest available 7

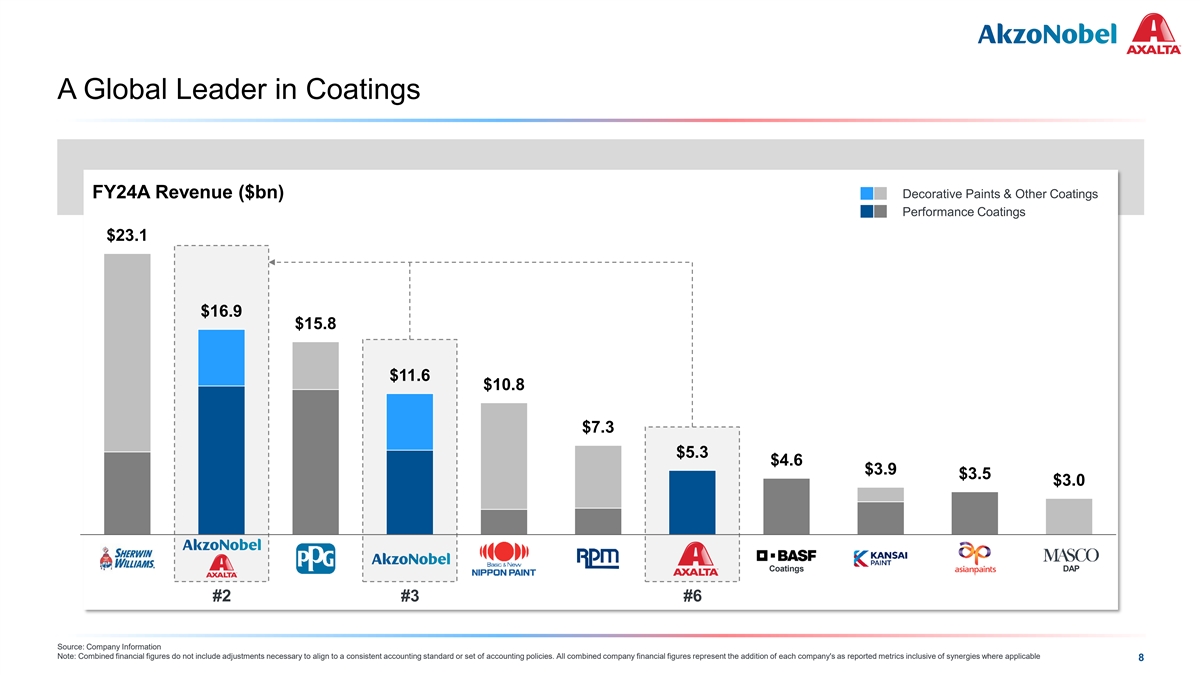

COLOR PALETTE Text 50 56 62 A Global Leader in Coatings Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 205 255 Decorative Paints & Other Coatings FY24A Revenue ($bn) 0 133 2 10 139 Performance Coatings 0 130 139 218 $23.1 3 197 255 246 251 137 208 4 32 166 122 202 183 227 5 $16.9 66 178 $15.8 168 233 38 156 6 154 224 30 146 $11.6 124 213 Hyperlink $10.8 153 234 0 98 Followed 80 205 Hyperlink $7.3 117 255 TABLE $5.3 $4.6 50 $3.9 Lines 56 $3.5 $3.0 62 0 Highlights 81 146 Coatings DAP #2 #3 #6 Source: Company Information Note: Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable 8

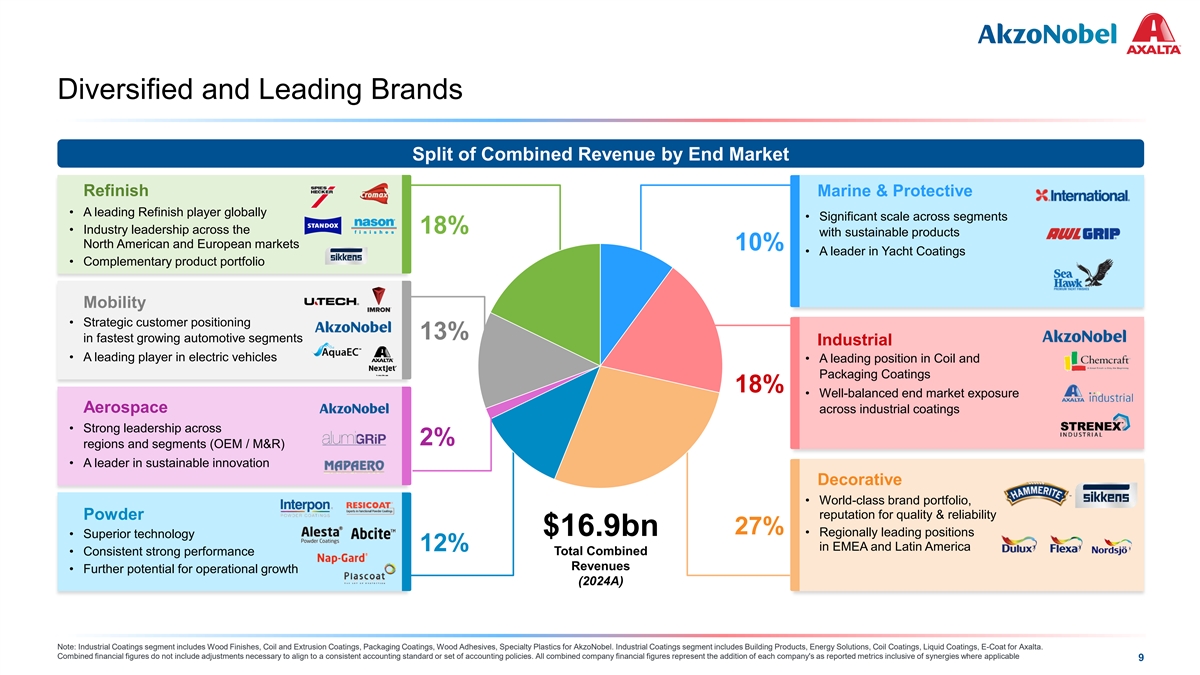

COLOR PALETTE Text 50 56 62 Diversified and Leading Brands Title bar/Bullets 0 81 146 ACCENTS 0 109 Split of Combined Revenue by End Market 81 190 1 146 255 205 255 Refinish Marine & Protective 0 133 2 10 139 • A leading Refinish player globally • Significant scale across segments 0 130 18% • Industry leadership across the with sustainable products 139 218 3 North American and European markets 197 255 10% • A leader in Yacht Coatings • Complementary product portfolio 246 251 137 208 4 32 166 122 202 Mobility 183 227 5 66 178 • Strategic customer positioning 13% 168 233 in fastest growing automotive segments Industrial 38 156 6 154 224 • A leading player in electric vehicles • A leading position in Coil and 30 146 Packaging Coatings 124 213 Hyperlink 18% 153 234 • Well-balanced end market exposure Aerospace 0 98 across industrial coatings Followed 80 205 Hyperlink • Strong leadership across 117 255 2% regions and segments (OEM / M&R) TABLE 50 • A leader in sustainable innovation Lines 56 Decorative 62 • World-class brand portfolio, 0 Highlights 81 reputation for quality & reliability Powder 146 27% $16.9bn • Regionally leading positions • Superior technology 12% in EMEA and Latin America • Consistent strong performance Total Combined Revenues • Further potential for operational growth (2024A) Note: Industrial Coatings segment includes Wood Finishes, Coil and Extrusion Coatings, Packaging Coatings, Wood Adhesives, Specialty Plastics for AkzoNobel. Industrial Coatings segment includes Building Products, Energy Solutions, Coil Coatings, Liquid Coatings, E-Coat for Axalta. Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable 9

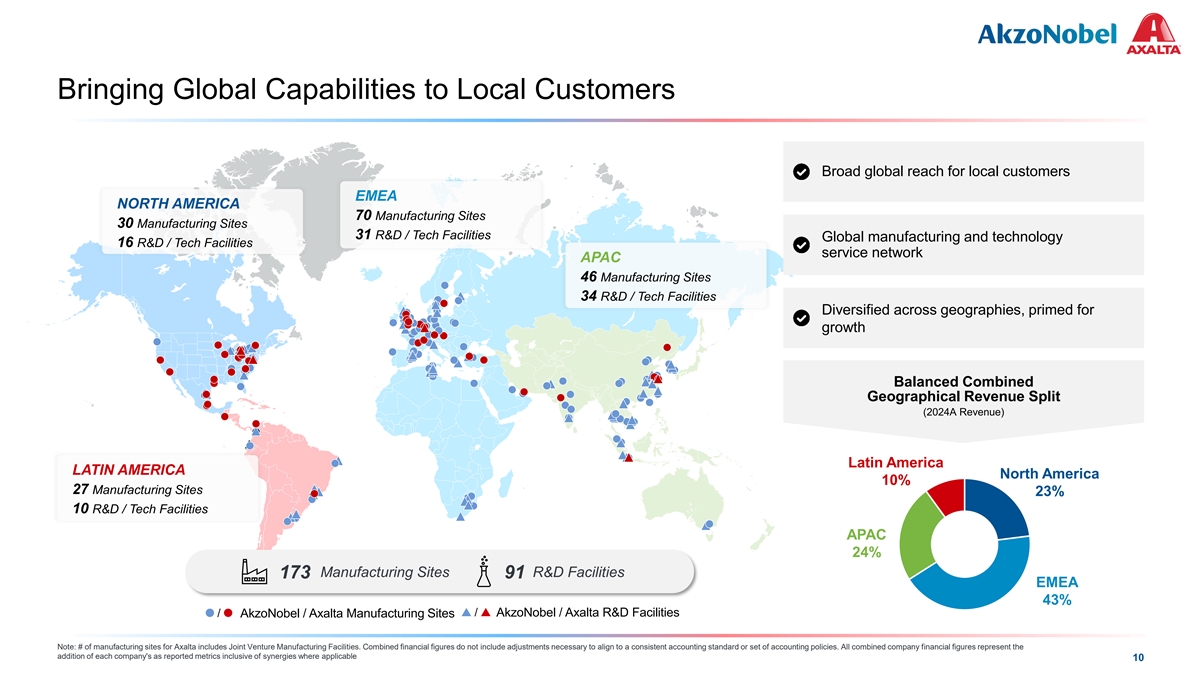

COLOR PALETTE Text 50 56 62 Bringing Global Capabilities to Local Customers Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 Broad global reach for local customers 205 255 EMEA 0 133 2 NORTH AMERICA 10 139 70 Manufacturing Sites 30 Manufacturing Sites 0 130 139 218 31 R&D / Tech Facilities 3 Global manufacturing and technology 16 R&D / Tech Facilities 197 255 service network APAC 246 251 137 208 4 46 Manufacturing Sites 32 166 34 R&D / Tech Facilities 122 202 183 227 Diversified across geographies, primed for 5 66 178 growth 168 233 38 156 6 154 224 30 146 124 213 Balanced Combined Hyperlink 153 234 Geographical Revenue Split 0 98 (2024A Revenue) Followed 80 205 Hyperlink 117 255 TABLE 50 Latin America LATIN AMERICA Lines 56 North America 10% 62 27 Manufacturing Sites 23% 0 10 R&D / Tech Facilities Highlights 81 146 APAC 24% Manufacturing Sites R&D Facilities 173 91 EMEA 43% ˜ / ˜p / p AkzoNobel / Axalta R&D Facilities AkzoNobel / Axalta Manufacturing Sites Note: # of manufacturing sites for Axalta includes Joint Venture Manufacturing Facilities. Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable 10

COLOR PALETTE Text 50 56 62 Accelerating Growth With Leading & Sustainable Technologies Title bar/Bullets 0 81 146 ACCENTS 0 109 Accelerated Innovation Platform… …Underpinning Industry-leading Technologies 81 190 1 146 255 Selected Innovation Case Studies for AkzoNobel and Axalta 205 255 ~2.5% of 0 133 2 Sales 10 139 Lower Curing Temperature Powder Coatings 0 130 Combined Annual R&D Spend ~$400mm 139 218✓ First architectural range curing at 150°C 3 197 255 ✓ Cuts energy use by up to 20% 246 251 Low-cure Powder 137 208 4 ✓ Enables coating on non-metal substrates 32 166 Coatings 122 202 183 227 5 Fully Automated Mixing Machine 66 178 168 233 Research Fellows, Scientists and Engineers ✓ Fully automated mixing system ~4,200 38 156 6 154 224 ✓ Increases color mixing accuracy and color match 30 146 Irus Mix✓ Drives labor optimization, reduces waste and saves materials 124 213 Hyperlink 153 234 0 98 Followed 80 205 First Chromate Free Aerospace Coatings Hyperlink 117 255 ✓ Patented lithium and magnesium-based tech Granted and Pending Patent Applications ~3,200 TABLE ✓ Excellent corrosion protection without hexavalent chromium 50 Chromate Free Lines 56 ✓ Compatible with direct-to-metal and all pre-treatments 62 Coatings 0 Highlights 81 Next Generation of Paint Application Technology 146 ✓ Digital Paint Technology for precise application of tutone Global R&D Centers for Local Customer Needs 91 ✓ Enables graphic finishes without the need for masking NextJet ✓ Increase throughput and up to 70% reduction in total application cost Note: Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable 11

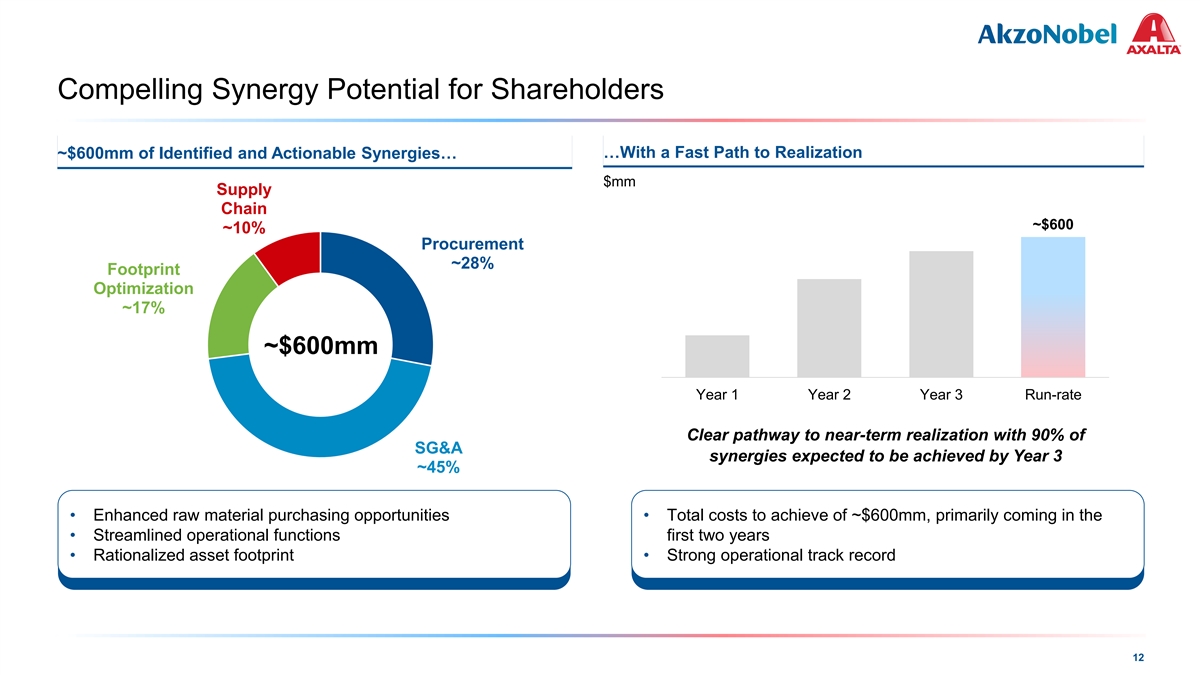

COLOR PALETTE Text 50 56 62 Compelling Synergy Potential for Shareholders Title bar/Bullets 0 81 146 ACCENTS 0 109 ~$600mm of Identified and Actionable Synergies… …With a Fast Path to Realization 81 190 1 146 255 $mm 205 255 Supply 0 133 2 10 139 Chain ~$600 0 130 ~10% 139 218 3 197 255 Procurement 246 251 ~28% Footprint 137 208 4 32 166 Optimization 122 202 183 227 ~17% 5 66 178 168 233 38 156 6 ~$600mm 154 224 30 146 124 213 Hyperlink 153 234 Year 1 Year 2 Year 3 Run-rate 0 98 Followed 80 205 Hyperlink 117 255 Clear pathway to near-term realization with 90% of TABLE SG&A synergies expected to be achieved by Year 3 50 ~45% Lines 56 62 0 Highlights 81 • Enhanced raw material purchasing opportunities • Total costs to achieve of ~$600mm, primarily coming in the 146 • Streamlined operational functions first two years • Rationalized asset footprint • Strong operational track record 12

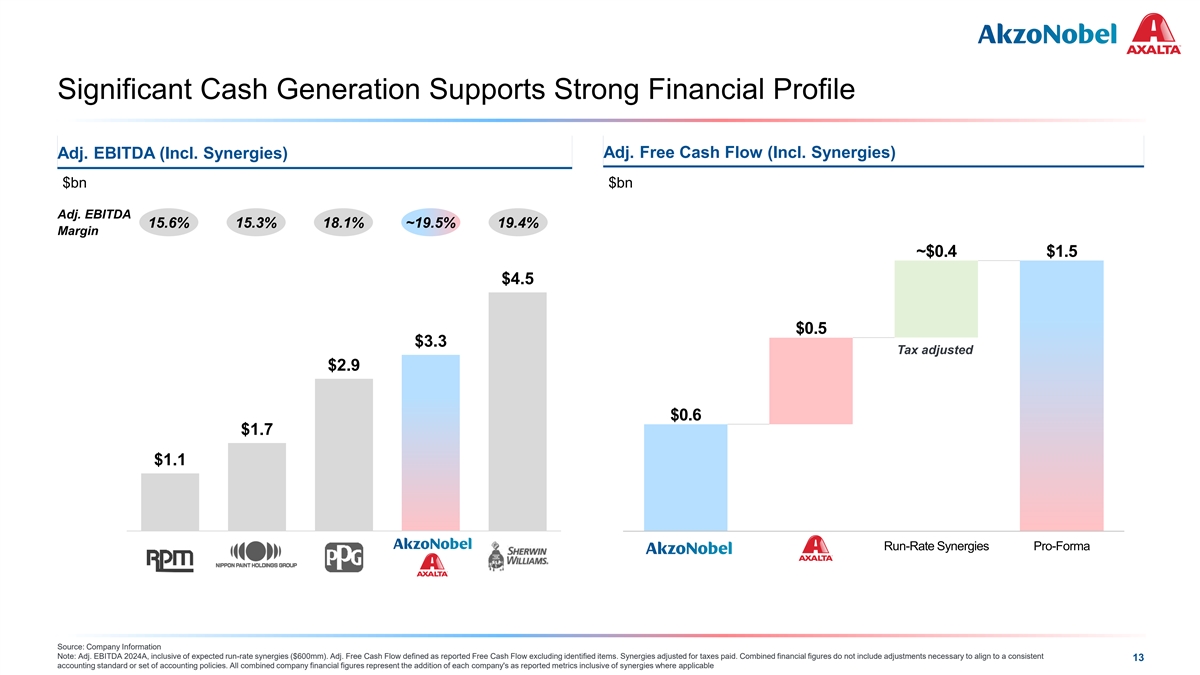

COLOR PALETTE Text 50 56 62 Significant Cash Generation Supports Strong Financial Profile Title bar/Bullets 0 81 146 ACCENTS 0 109 Adj. EBITDA (Incl. Synergies) Adj. Free Cash Flow (Incl. Synergies) 81 190 1 146 255 $bn $bn 205 255 0 133 2 10 139 Adj. EBITDA 15.6% 15.3% 18.1% ~19.5% 19.4% 0 130 Margin 139 218 3 197 255 ~$0.4 $1.5 246 251 137 208 4 $4.5 32 166 122 202 183 227 5 66 178 $0.5 168 233 $3.3 38 156 6 Tax adjusted 154 224 $2.9 30 146 124 213 Hyperlink 153 234 0 98 Followed $0.6 80 205 Hyperlink 117 255 $1.7 TABLE $1.1 50 Lines 56 62 0 Highlights 81 146 Run-Rate Synergies Pro-Forma Source: Company Information Note: Adj. EBITDA 2024A, inclusive of expected run-rate synergies ($600mm). Adj. Free Cash Flow defined as reported Free Cash Flow excluding identified items. Synergies adjusted for taxes paid. Combined financial figures do not include adjustments necessary to align to a consistent 13 accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable

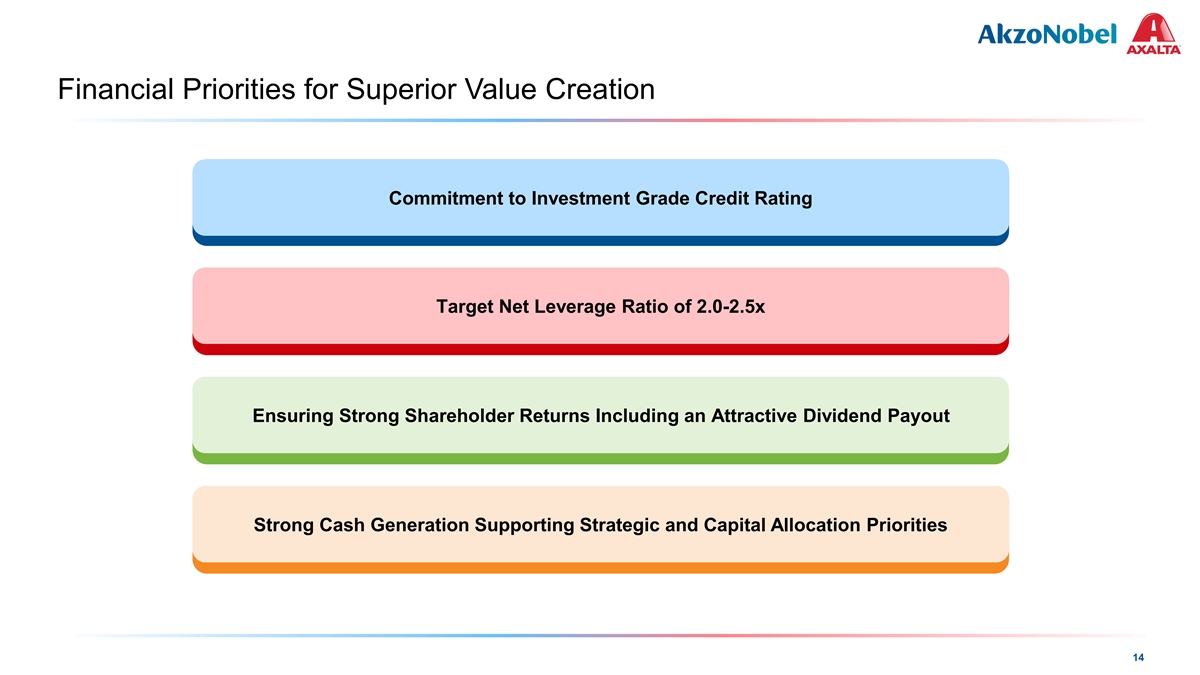

COLOR PALETTE Text 50 56 62 Financial Priorities for Superior Value Creation Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 205 255 0 133 2 Commitment to Investment Grade Credit Rating 10 139 0 130 139 218 3 197 255 246 251 137 208 4 32 166 122 202 Target Net Leverage Ratio of 2.0-2.5x 183 227 5 66 178 168 233 38 156 6 154 224 30 146 124 213 Hyperlink 153 234 0 98 Followed Ensuring Strong Shareholder Returns Including an Attractive Dividend Payout 80 205 Hyperlink 117 255 TABLE 50 Lines 56 62 0 Highlights 81 146 Strong Cash Generation Supporting Strategic and Capital Allocation Priorities 14

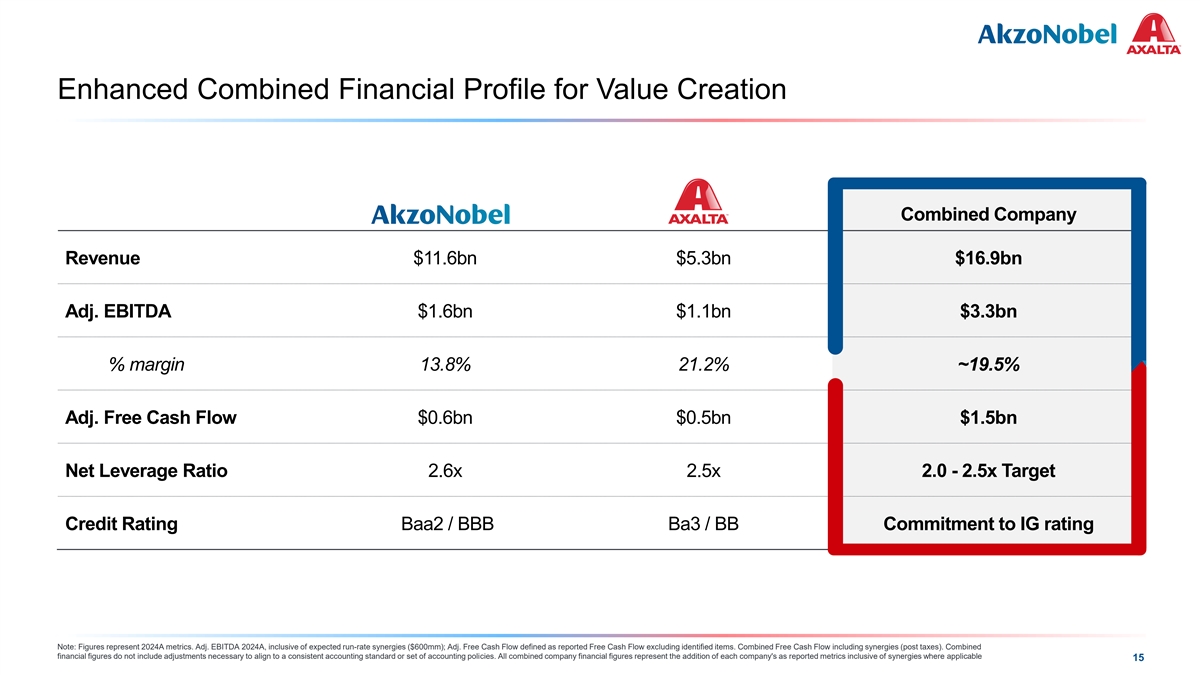

COLOR PALETTE Text 50 56 62 Enhanced Combined Financial Profile for Value Creation Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 205 255 0 133 2 10 139 Combined Company 0 130 139 218 3 197 255 Revenue $11.6bn $5.3bn $16.9bn 246 251 137 208 4 32 166 122 202 183 227 5 Adj. EBITDA $1.6bn $1.1bn $3.3bn 66 178 168 233 38 156 6 154 224 % margin 13.8% 21.2% ~19.5% 30 146 124 213 Hyperlink 153 234 0 98 Followed 80 205 Adj. Free Cash Flow $0.6bn $0.5bn $1.5bn Hyperlink 117 255 TABLE 50 Net Leverage Ratio 2.6x 2.5x 2.0 - 2.5x Target Lines 56 62 0 Highlights 81 146 Credit Rating Baa2 / BBB Ba3 / BB Commitment to IG rating Note: Figures represent 2024A metrics. Adj. EBITDA 2024A, inclusive of expected run-rate synergies ($600mm); Adj. Free Cash Flow defined as reported Free Cash Flow excluding identified items. Combined Free Cash Flow including synergies (post taxes). Combined financial figures do not include adjustments necessary to align to a consistent accounting standard or set of accounting policies. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable 15

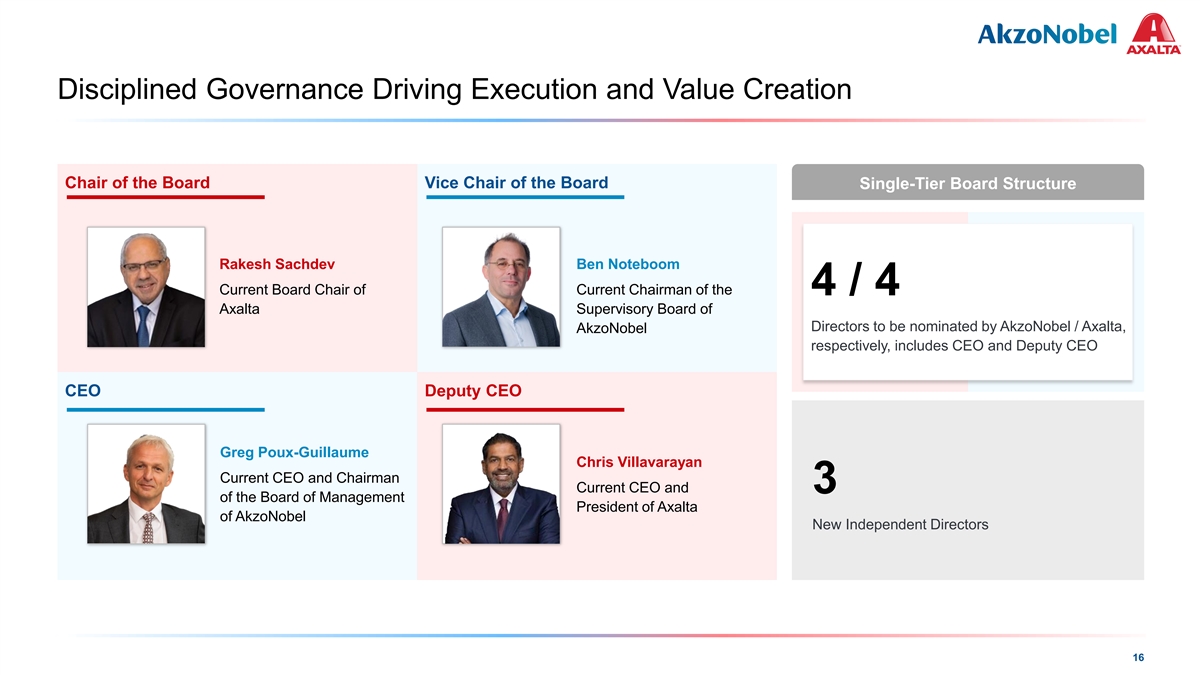

COLOR PALETTE Text 50 56 62 Disciplined Governance Driving Execution and Value Creation Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 Chair of the Board Vice Chair of the Board Single-Tier Board Structure 205 255 0 133 2 10 139 0 130 139 218 3 197 255 246 251 Rakesh Sachdev Ben Noteboom 137 208 4 32 166 Current Board Chair of Current Chairman of the 4 / 4 122 202 183 227 Axalta Supervisory Board of 5 66 178 Directors to be nominated by AkzoNobel / Axalta, AkzoNobel 168 233 38 156 respectively, includes CEO and Deputy CEO 6 154 224 30 146 124 213 Hyperlink 153 234 CEO Deputy CEO 0 98 Followed 80 205 Hyperlink 117 255 TABLE Greg Poux-Guillaume Chris Villavarayan 50 Lines 56 Current CEO and Chairman 62 Current CEO and 3 of the Board of Management 0 President of Axalta Highlights 81 of AkzoNobel 146 New Independent Directors 16

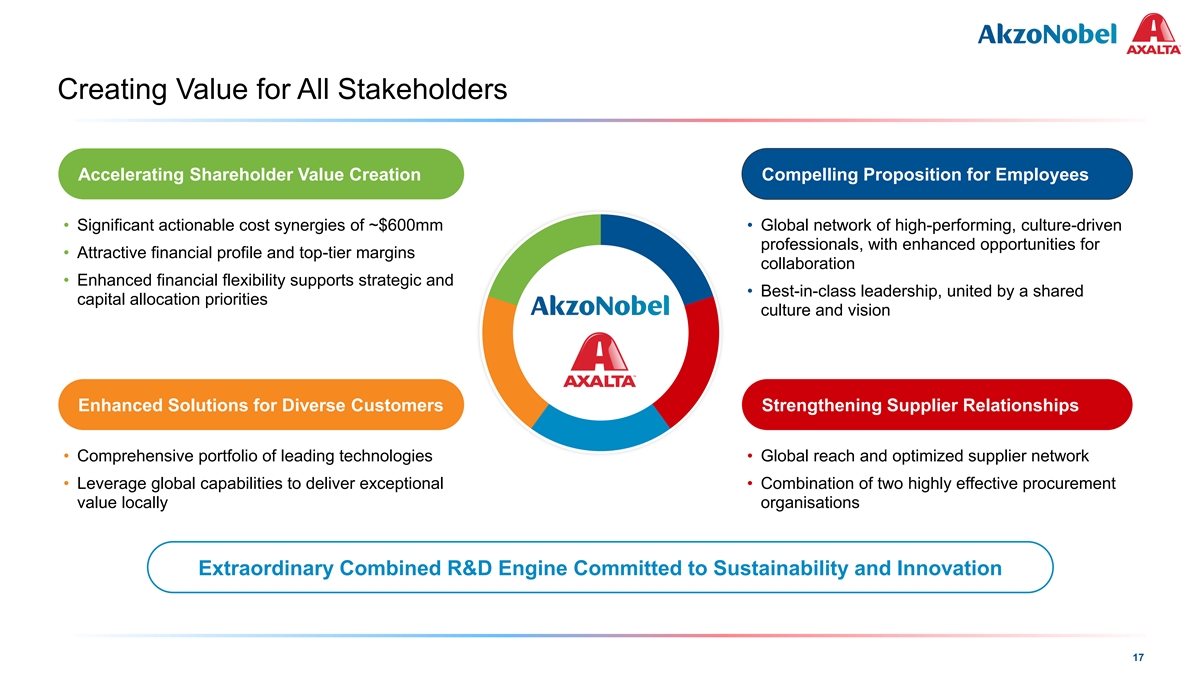

COLOR PALETTE Text 50 56 62 Creating Value for All Stakeholders Title bar/Bullets 0 81 146 ACCENTS 0 109 81 190 1 146 255 Accelerating Shareholder Value Creation Compelling Proposition for Employees 205 255 0 133 2 10 139 0 130 • Significant actionable cost synergies of ~$600mm • Global network of high-performing, culture-driven 139 218 3 197 255 professionals, with enhanced opportunities for • Attractive financial profile and top-tier margins 246 251 collaboration 137 208 4 • Enhanced financial flexibility supports strategic and 32 166 • Best-in-class leadership, united by a shared 122 202 capital allocation priorities 183 227 5 culture and vision 66 178 168 233 38 156 6 154 224 30 146 124 213 Hyperlink 153 234 Enhanced Solutions for Diverse Customers Strengthening Supplier Relationships 0 98 Followed 80 205 Hyperlink 117 255 TABLE • Comprehensive portfolio of leading technologies • Global reach and optimized supplier network 50 Lines 56 62 • Leverage global capabilities to deliver exceptional • Combination of two highly effective procurement 0 value locally organisations Highlights 81 146 Extraordinary Combined R&D Engine Committed to Sustainability and Innovation 17

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L Q & A

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L AkzoNobel Investor Contact Axalta Investor Contact Kenny Chae Colleen Lubic Kenny.Chae@AkzoNobel.com Colleen.Lubic@Axalta.com