EXHIBIT 99.2

Published on December 4, 2015

Axalta Coating Systems Ltd. Analyst & Investor Day December 4, 2015 Exhibit 99.2

PROPRIETARYAXALTA COATING SYSTEMS 2 Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to sales, adjusted EBITDA, interest expense, normalized tax rate, diluted shares, cost and productivity savings, capital expenditures, plant expansions, working capital, return on invested capital, free cash flow and growth. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward- looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including EBITDA, adjusted EBITDA and net debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Our use of the terms EBITDA, adjusted EBITDA and net debt may differ from that of others in our industry. EBITDA and adjusted EBITDA should not be considered as alternatives to net income (loss), operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. EBITDA, adjusted EBITDA and net debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. Legal Notices

PROPRIETARYAXALTA COATING SYSTEMS 3 Key Messages For The Day Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders

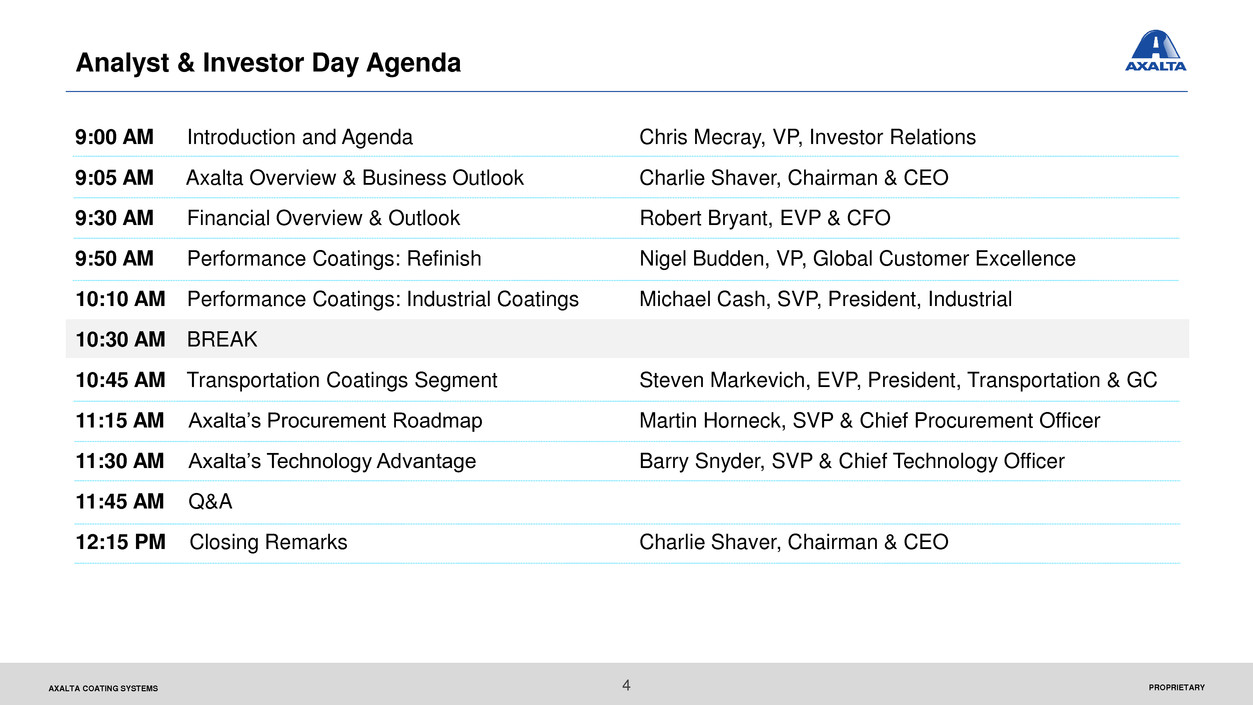

PROPRIETARYAXALTA COATING SYSTEMS 4 9:00 AM Introduction and Agenda Chris Mecray, VP, Investor Relations 9:05 AM Axalta Overview & Business Outlook Charlie Shaver, Chairman & CEO 9:30 AM Financial Overview & Outlook Robert Bryant, EVP & CFO 9:50 AM Performance Coatings: Refinish Nigel Budden, VP, Global Customer Excellence 10:10 AM Performance Coatings: Industrial Coatings Michael Cash, SVP, President, Industrial 10:30 AM BREAK 10:45 AM Transportation Coatings Segment Steven Markevich, EVP, President, Transportation & GC 11:15 AM Axalta’s Procurement Roadmap Martin Horneck, SVP & Chief Procurement Officer 11:30 AM Axalta’s Technology Advantage Barry Snyder, SVP & Chief Technology Officer 11:45 AM Q&A 12:15 PM Closing Remarks Charlie Shaver, Chairman & CEO Analyst & Investor Day Agenda

Axalta Overview and Business Outlook Charlie Shaver Chairman & CEO

PROPRIETARYAXALTA COATING SYSTEMS 6 Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders Key Messages For The Day

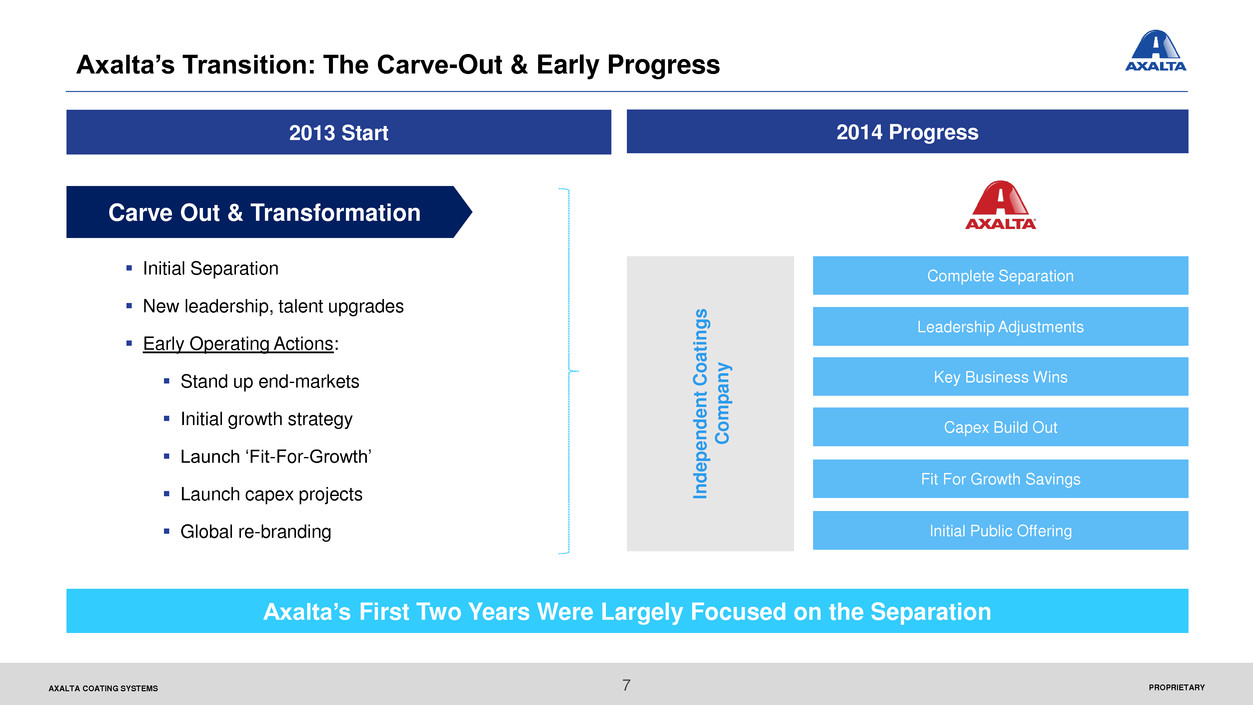

PROPRIETARYAXALTA COATING SYSTEMS Axalta’s Transition: The Carve-Out & Early Progress Axalta’s First Two Years Were Largely Focused on the Separation Initial Separation New leadership, talent upgrades Early Operating Actions: Stand up end-markets Initial growth strategy Launch ‘Fit-For-Growth’ Launch capex projects Global re-branding In d e p e n d e n t C o at in g s C o m p a n y Carve Out & Transformation Complete Separation Leadership Adjustments Key Business Wins Fit For Growth Savings Capex Build Out 2013 Start 2014 Progress Initial Public Offering 7

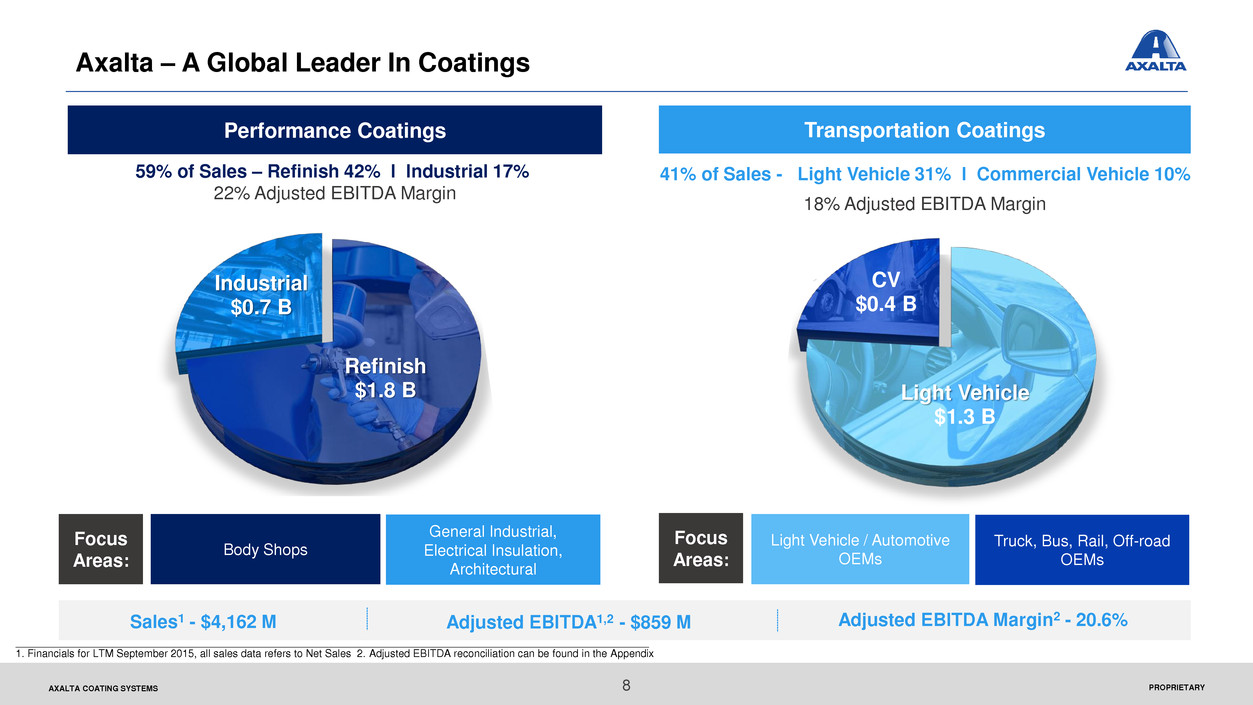

PROPRIETARYAXALTA COATING SYSTEMS Refinish $1.8 B Industrial $0.7 B Body Shops Light Vehicle $1.3 B CV $0.4 B Performance Coatings General Industrial, Electrical Insulation, Architectural Transportation Coatings Sales1 - $4,162 M Adjusted EBITDA1,2 - $859 M Adjusted EBITDA Margin2 - 20.6% Light Vehicle / Automotive OEMs Truck, Bus, Rail, Off-road OEMs 59% of Sales – Refinish 42% l Industrial 17% 22% Adjusted EBITDA Margin Focus Areas: Focus Areas: 41% of Sales - Light Vehicle 31% l Commercial Vehicle 10% 18% Adjusted EBITDA Margin ____________________________________________________________________________________________________________ 1. Financials for LTM September 2015, all sales data refers to Net Sales 2. Adjusted EBITDA reconciliation can be found in the Appendix 8 Axalta – A Global Leader In Coatings

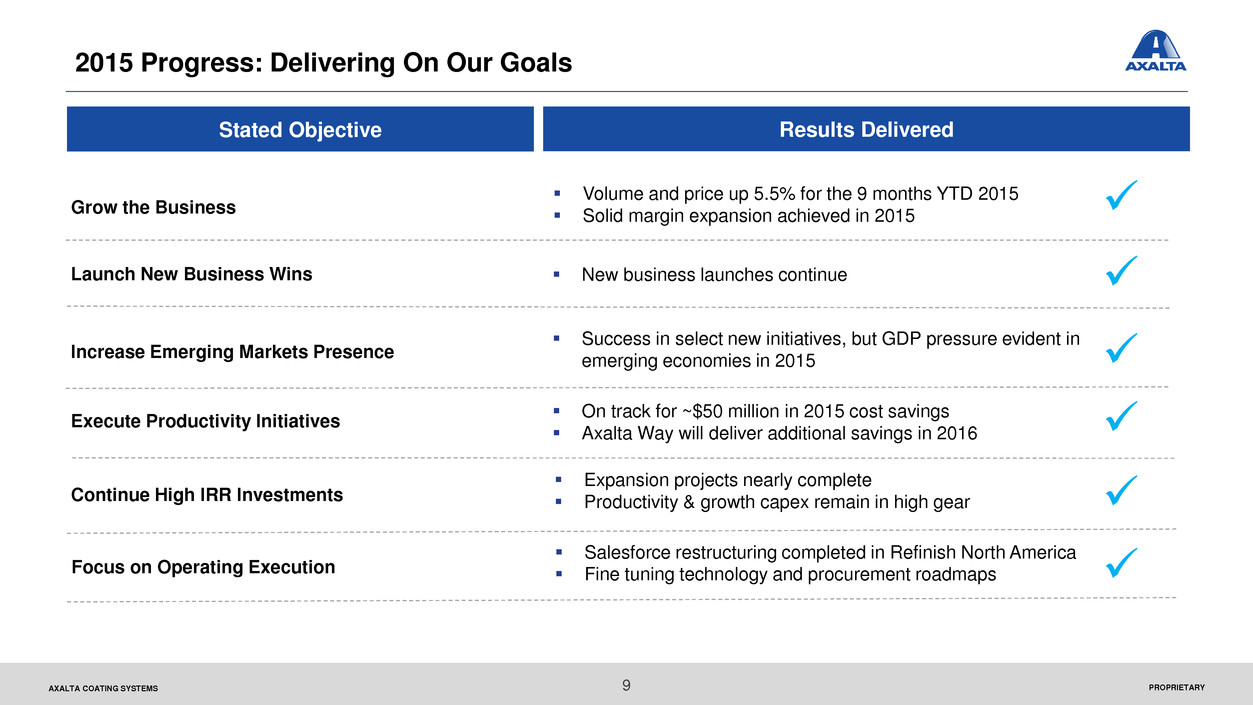

PROPRIETARYAXALTA COATING SYSTEMS Stated Objective Results Delivered Grow the Business Execute Productivity Initiatives Launch New Business Wins Increase Emerging Markets Presence Volume and price up 5.5% for the 9 months YTD 2015 Solid margin expansion achieved in 2015 On track for ~$50 million in 2015 cost savings Axalta Way will deliver additional savings in 2016 New business launches continue Success in select new initiatives, but GDP pressure evident in emerging economies in 2015 Continue High IRR Investments Expansion projects nearly complete Productivity & growth capex remain in high gear 9 2015 Progress: Delivering On Our Goals Focus on Operating Execution Salesforce restructuring completed in Refinish North America Fine tuning technology and procurement roadmaps

PROPRIETARYAXALTA COATING SYSTEMS 10 Axalta Operates Fundamentally Strong Businesses A Global Leader in Our Markets Significant Competitive Advantages A Service-Led Business Model Structurally Attractive End Markets Highly Variable Cost Structure; Low Capital Intensity

PROPRIETARYAXALTA COATING SYSTEMS 11 A Global Leader In Our Markets Axalta’s Global Scale Enables Market Leadership ____________________________ 1. Mexico is included in Latin America 2. Includes 9 JV facilities. 36 manufacturing facilities 46 customer training sites 7 technology centers ~12,800 employees selling into 130+ countries North America1 34% Sales Latin America1 14% of Sales Asia Pacific 17% of Sales EMEA 35% of Sales Manufacturing Facility2 Technology Center

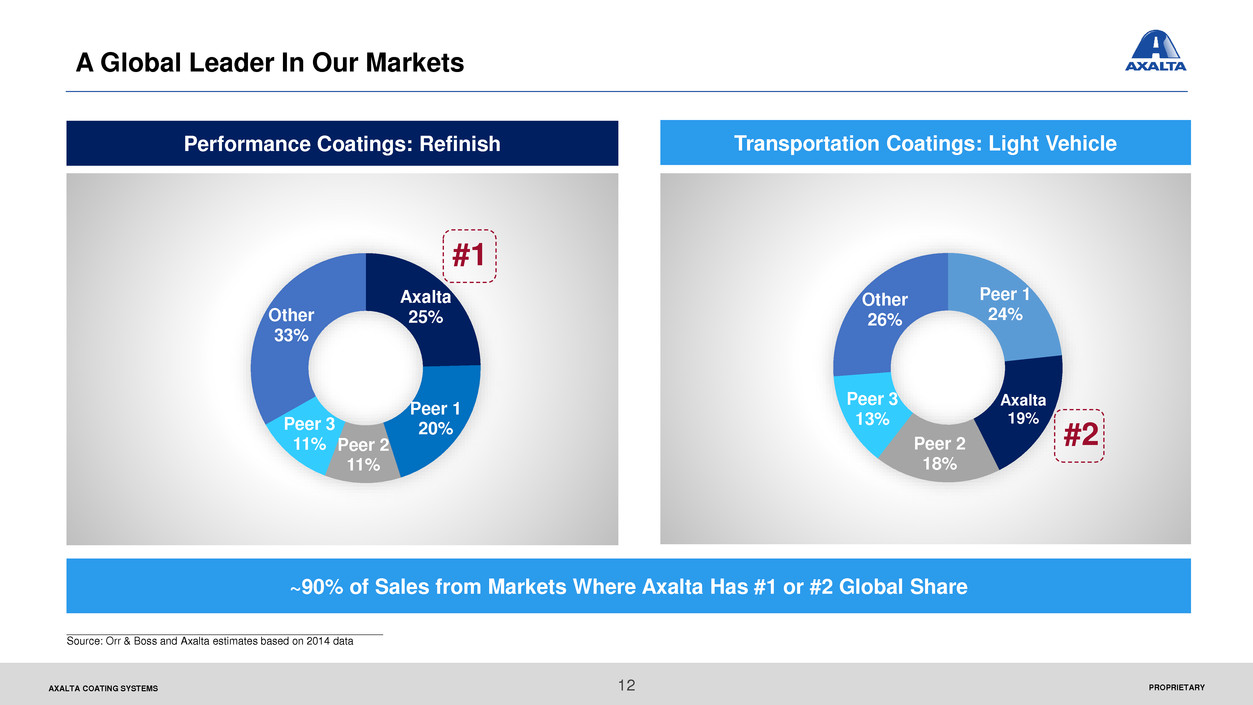

PROPRIETARYAXALTA COATING SYSTEMS Peer 1 24% Axalta 19% Peer 2 18% Peer 3 13% Other 26% 12 A Global Leader In Our Markets ~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share Axalta 25% Peer 1 20% Peer 2 11% Peer 3 11% Other 33% Performance Coatings: Refinish Transportation Coatings: Light Vehicle #1 ______________________________________________________ Source: Orr & Boss and Axalta estimates based on 2014 data #2

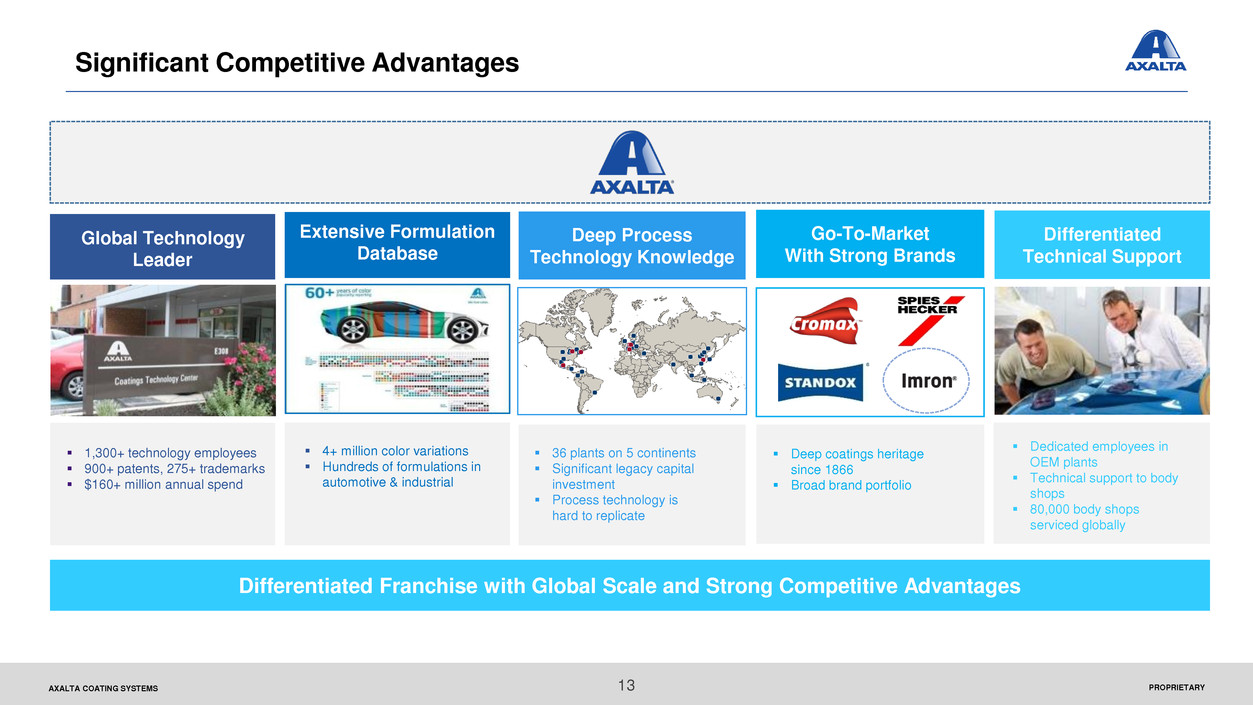

PROPRIETARYAXALTA COATING SYSTEMS 13 Significant Competitive Advantages Differentiated Franchise with Global Scale and Strong Competitive Advantages 4+ million color variations Hundreds of formulations in automotive & industrial Deep coatings heritage since 1866 Broad brand portfolio 1,300+ technology employees 900+ patents, 275+ trademarks $160+ million annual spend 36 plants on 5 continents Significant legacy capital investment Process technology is hard to replicate Dedicated employees in OEM plants Technical support to body shops 80,000 body shops serviced globally Global Technology Leader Extensive Formulation Database Deep Process Technology Knowledge Go-To-Market With Strong Brands Differentiated Technical Support

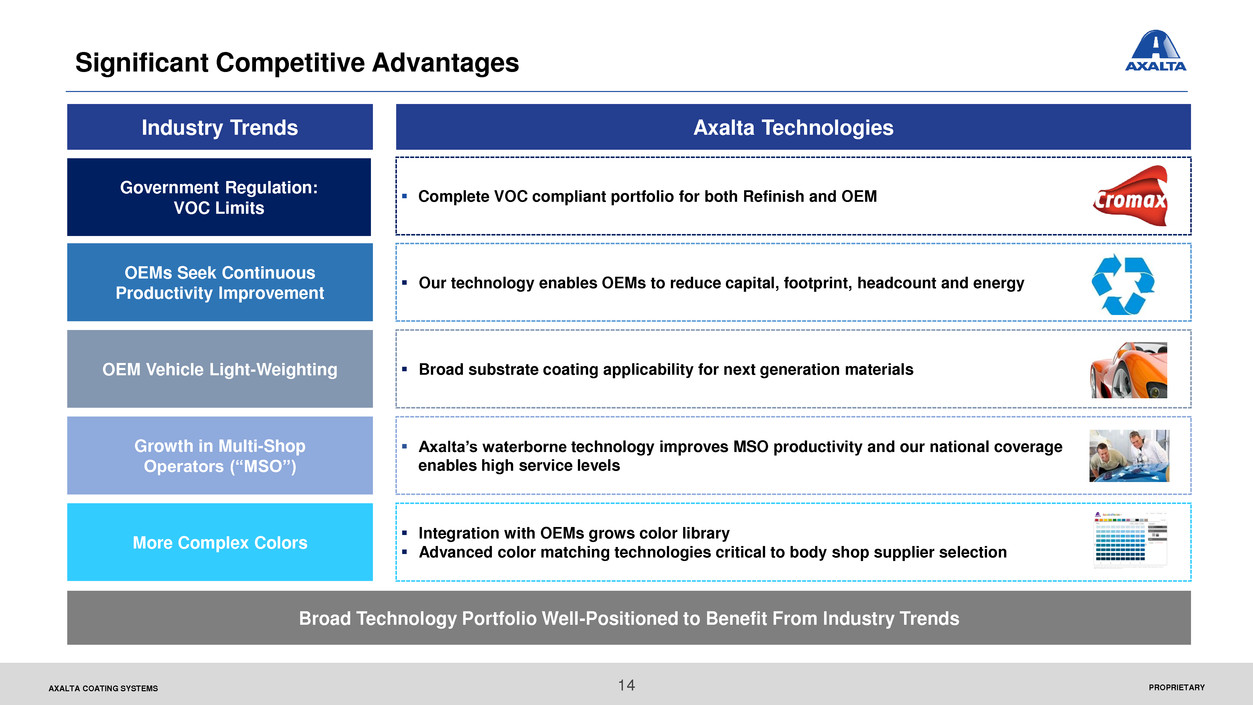

PROPRIETARYAXALTA COATING SYSTEMS Industry Trends Axalta Technologies OEM Vehicle Light-Weighting Broad substrate coating applicability for next generation materials Growth in Multi-Shop Operators (“MSO”) Axalta’s waterborne technology improves MSO productivity and our national coverage enables high service levels 14 Significant Competitive Advantages More Complex Colors Integration with OEMs grows color library Advanced color matching technologies critical to body shop supplier selection Our technology enables OEMs to reduce capital, footprint, headcount and energy OEMs Seek Continuous Productivity Improvement Government Regulation: VOC Limits Complete VOC compliant portfolio for both Refinish and OEM Broad Technology Portfolio Well-Positioned to Benefit From Industry Trends

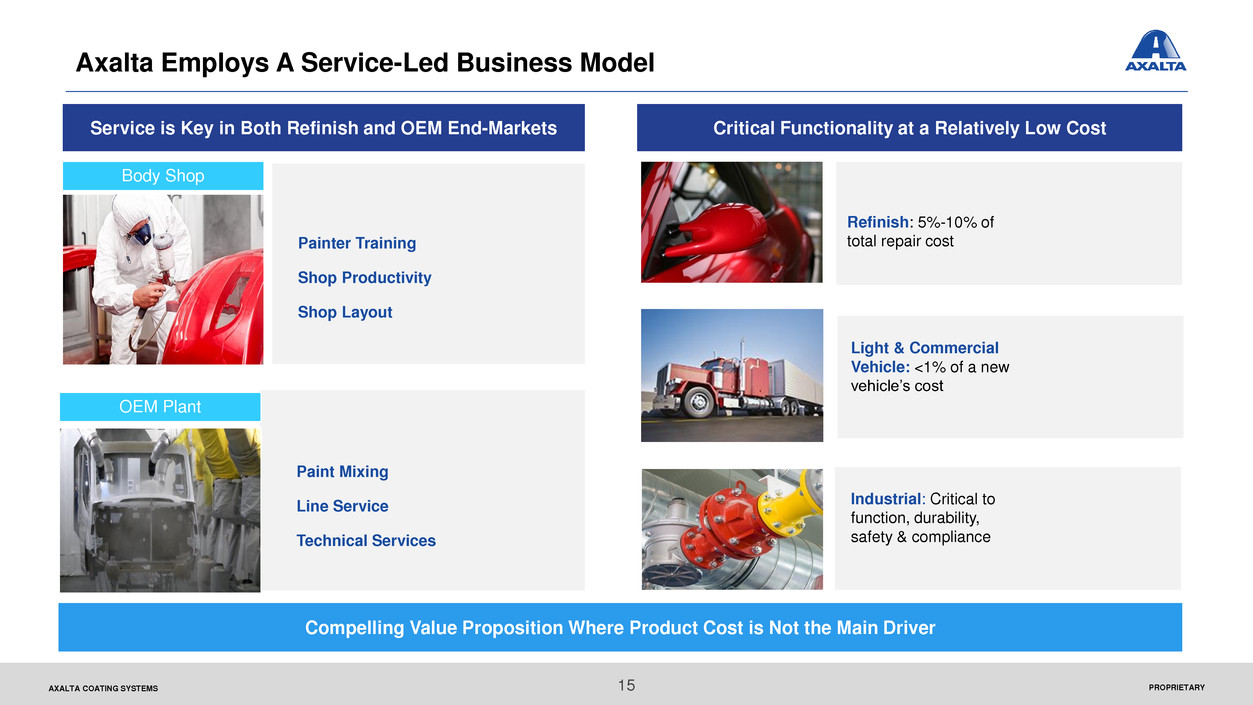

PROPRIETARYAXALTA COATING SYSTEMS 15 Axalta Employs A Service-Led Business Model Critical Functionality at a Relatively Low Cost 1 Compelling Value Proposition Where Product Cost is Not the Main Driver Light & Commercial Vehicle: <1% of a new vehicle’s cost Industrial: Critical to function, durability, safety & compliance Refinish: 5%-10% of total repair cost Body Shop OEM Plant Service is Key in Both Refinish and OEM End-Markets Painter Training Shop Productivity Shop Layout Paint Mixing Line Service Technical Services

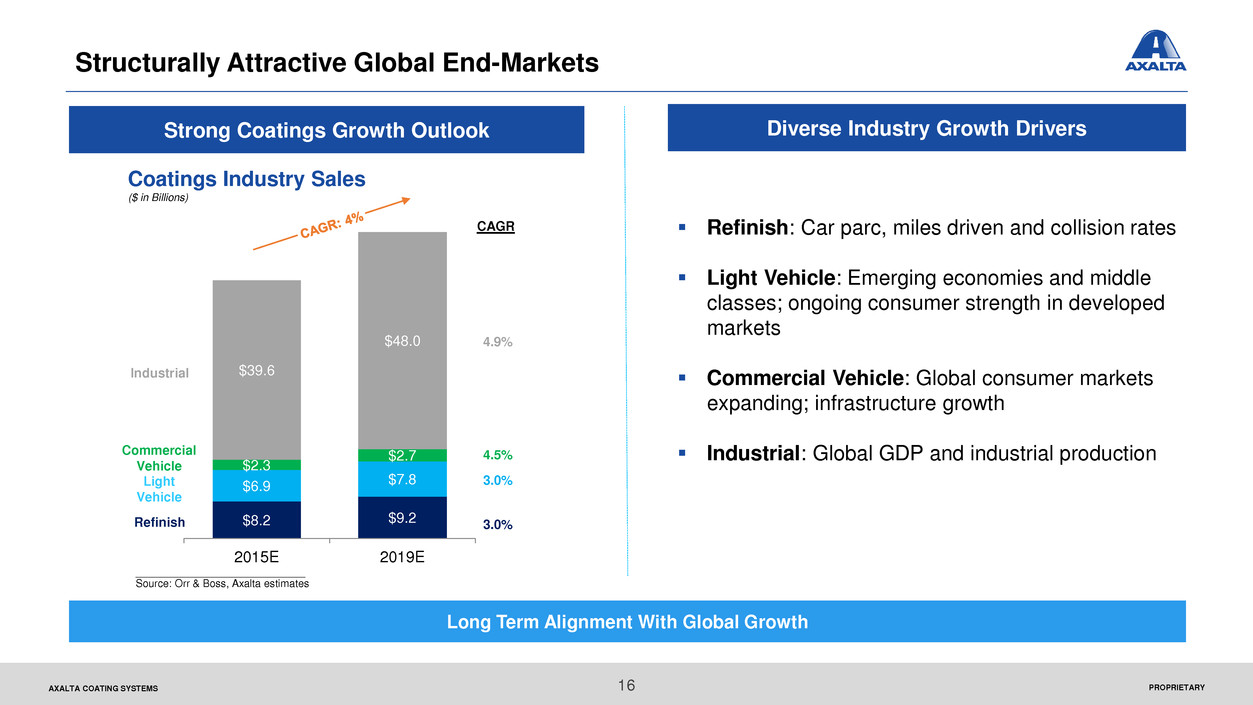

PROPRIETARYAXALTA COATING SYSTEMS 16 Structurally Attractive Global End-Markets Strong Coatings Growth Outlook Long Term Alignment With Global Growth Refinish: Car parc, miles driven and collision rates Light Vehicle: Emerging economies and middle classes; ongoing consumer strength in developed markets Commercial Vehicle: Global consumer markets expanding; infrastructure growth Industrial: Global GDP and industrial production Diverse Industry Growth Drivers Commercial Vehicle Light Vehicle Refinish Industrial 4.9% 4.5% 3.0% 3.0% CAGR Coatings Industry Sales ($ in Billions) _____________________________ Source: Orr & Boss, Axalta estimates $8.2 $9.2 $6.9 $7.8 $2.3 $2.7 $39.6 $48.0 2015E 2019E

PROPRIETARYAXALTA COATING SYSTEMS 17 Highly Variable Cost Structure And Low Capital Intensity ~50% of COGS come from variable raw material inputs Utilize temporary labor to enable wage structure flexibility Toggle other costs as needed in a downturn, including both variable and semi-fixed Low Capital Intensity Capex at $150 million is 3.7% of sales, but only 1.4% for maintenance capex Batch production process is inherently flexible Capacity additions are very modular to minimize stranded cost impacts Variable Cost Structure Well Positioned to React to Cyclical Downturns

PROPRIETARYAXALTA COATING SYSTEMS 18 Key Messages For The Day Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders

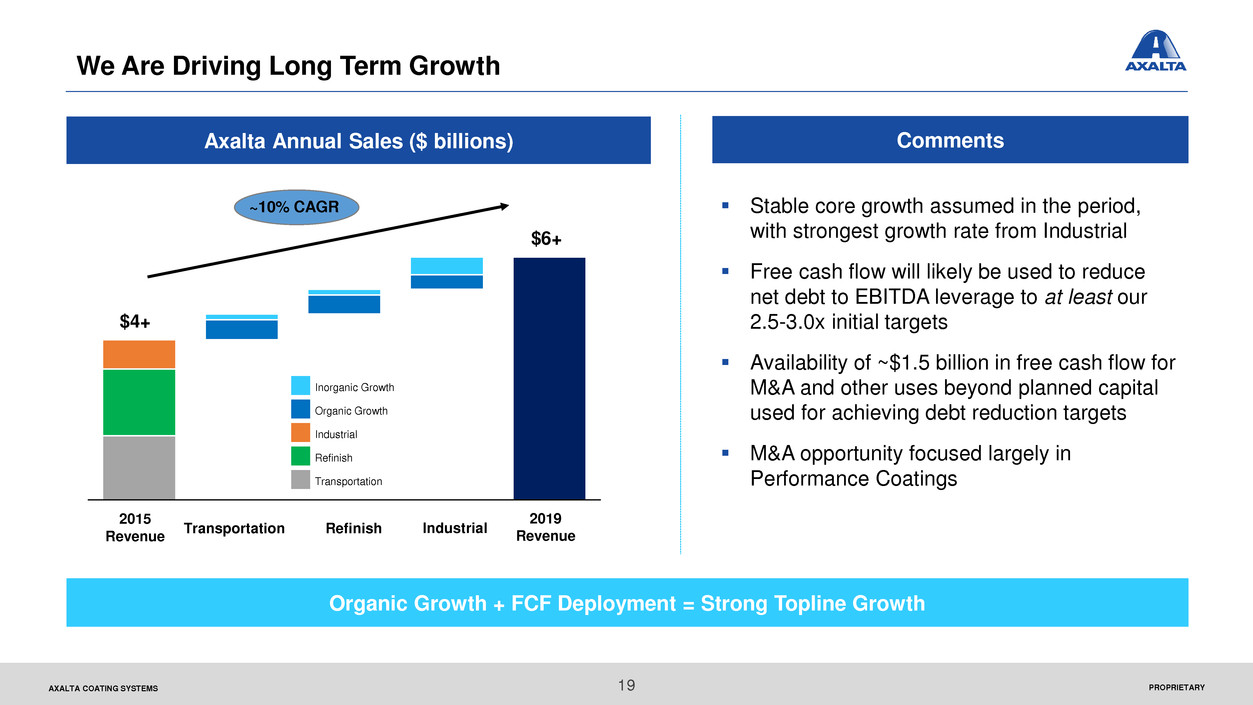

PROPRIETARYAXALTA COATING SYSTEMS 19 We Are Driving Long Term Growth 1.65 1.72 Organic Growth + FCF Deployment = Strong Topline Growth Stable core growth assumed in the period, with strongest growth rate from Industrial Free cash flow will likely be used to reduce net debt to EBITDA leverage to at least our 2.5-3.0x initial targets Availability of ~$1.5 billion in free cash flow for M&A and other uses beyond planned capital used for achieving debt reduction targets M&A opportunity focused largely in Performance Coatings CommentsAxalta Annual Sales ($ billions) IndustrialRefinish ~10% CAGR 2019 Revenue 0.45 Transportation 2015 Revenue $6+ $4+ Inorganic Growth Organic Growth Industrial Refinish Transportation

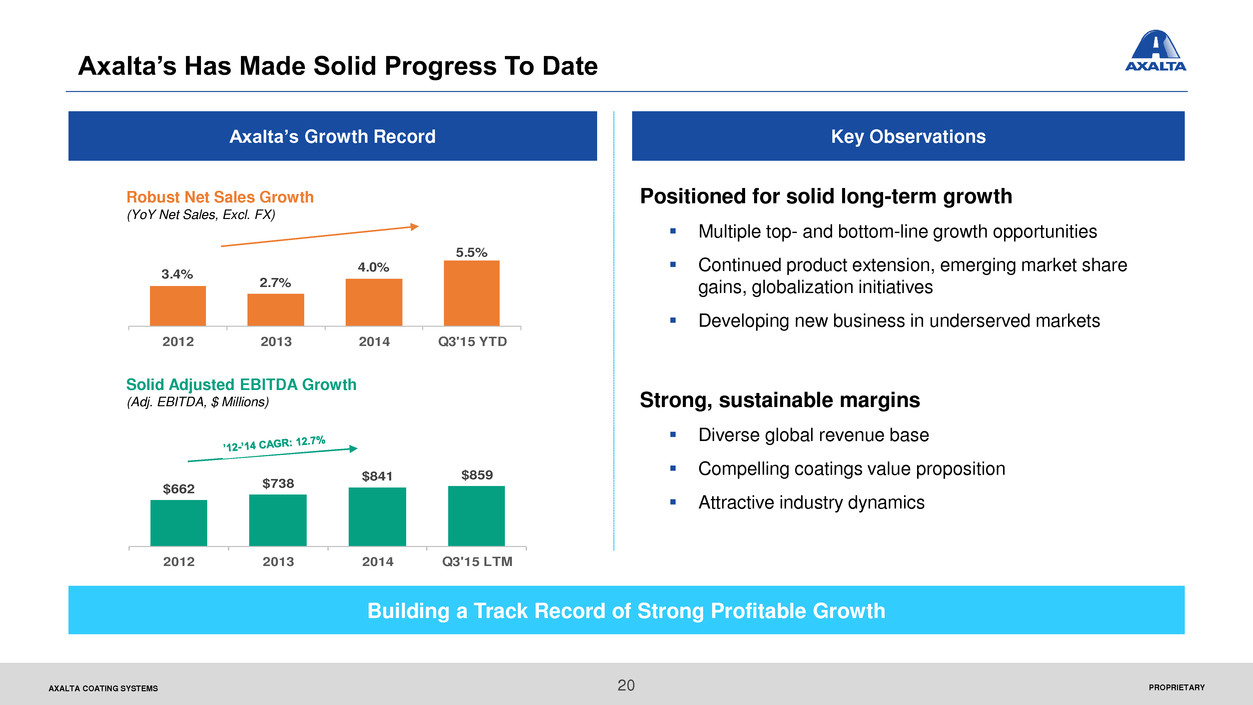

PROPRIETARYAXALTA COATING SYSTEMS 3.4% 2.7% 4.0% 5.5% 2012 2013 2014 Q3'15 YTD Axalta’s Has Made Solid Progress To Date Key Observations Building a Track Record of Strong Profitable Growth Axalta’s Growth Record Robust Net Sales Growth (YoY Net Sales, Excl. FX) Solid Adjusted EBITDA Growth (Adj. EBITDA, $ Millions) Positioned for solid long-term growth Multiple top- and bottom-line growth opportunities Continued product extension, emerging market share gains, globalization initiatives Developing new business in underserved markets Strong, sustainable margins Diverse global revenue base Compelling coatings value proposition Attractive industry dynamics $662 $738 $841 $859 2012 2013 2014 Q3'15 LTM 20

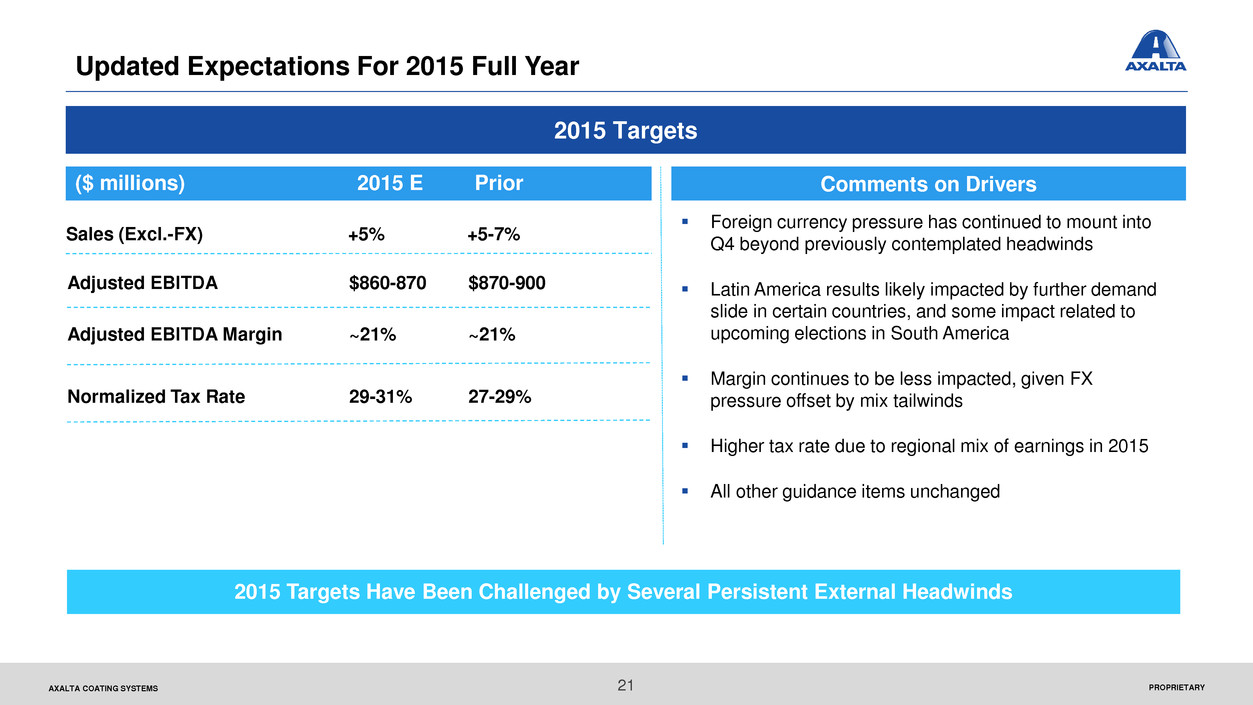

PROPRIETARYAXALTA COATING SYSTEMS Updated Expectations For 2015 Full Year 2015 Targets Have Been Challenged by Several Persistent External Headwinds Foreign currency pressure has continued to mount into Q4 beyond previously contemplated headwinds Latin America results likely impacted by further demand slide in certain countries, and some impact related to upcoming elections in South America Margin continues to be less impacted, given FX pressure offset by mix tailwinds Higher tax rate due to regional mix of earnings in 2015 All other guidance items unchanged 2015 Targets ($ millions) 2015 E Prior Sales (Excl.-FX) +5% +5-7% Adjusted EBITDA Margin ~21% ~21% Adjusted EBITDA $860-870 $870-900 Normalized Tax Rate 29-31% 27-29% Comments on Drivers 21

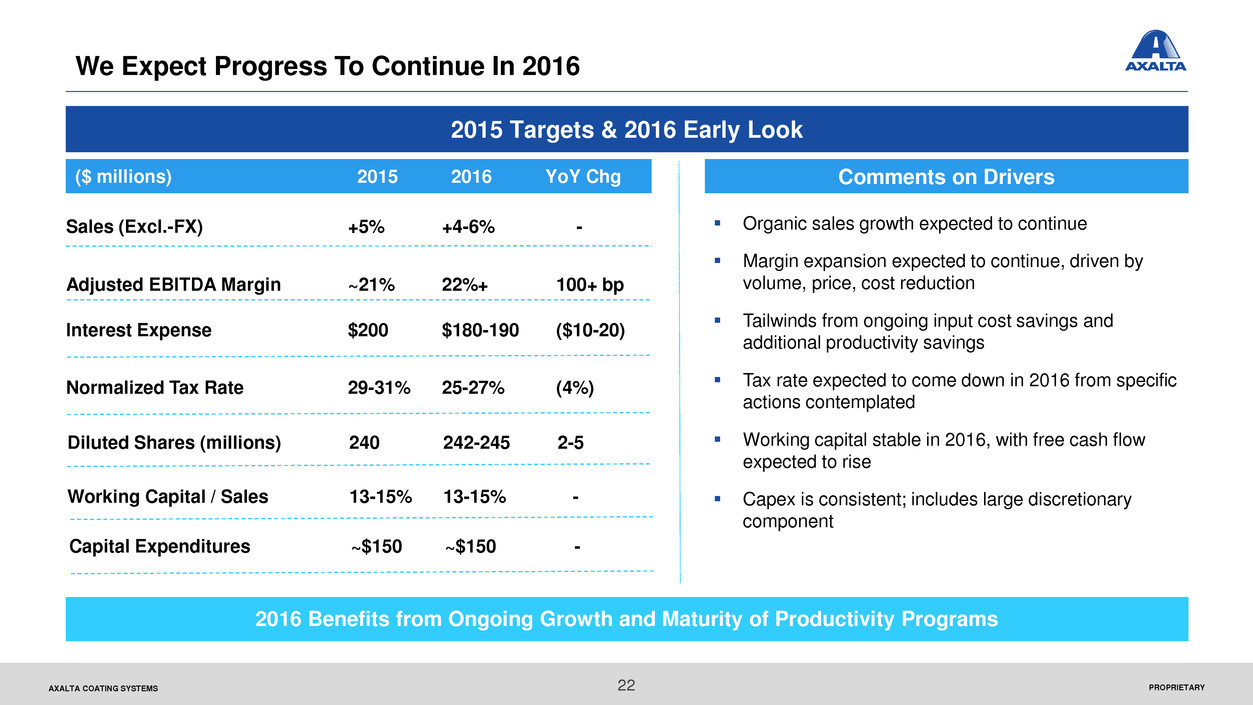

PROPRIETARYAXALTA COATING SYSTEMS We Expect Progress To Continue In 2016 2016 Benefits from Ongoing Growth and Maturity of Productivity Programs Organic sales growth expected to continue Margin expansion expected to continue, driven by volume, price, cost reduction Tailwinds from ongoing input cost savings and additional productivity savings Tax rate expected to come down in 2016 from specific actions contemplated Working capital stable in 2016, with free cash flow expected to rise Capex is consistent; includes large discretionary component 2015 Targets & 2016 Early Look ($ millions) 2015 2016 YoY Chg Sales (Excl.-FX) +5% +4-6% - Working Capital / Sales 13-15% 13-15% - Adjusted EBITDA Margin ~21% 22%+ 100+ bp Normalized Tax Rate 29-31% 25-27% (4%) Diluted Shares (millions) 240 242-245 2-5 Comments on Drivers Capital Expenditures ~$150 ~$150 - Interest Expense $200 $180-190 ($10-20) 22

PROPRIETARYAXALTA COATING SYSTEMS 23 Key Messages For The Day Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders

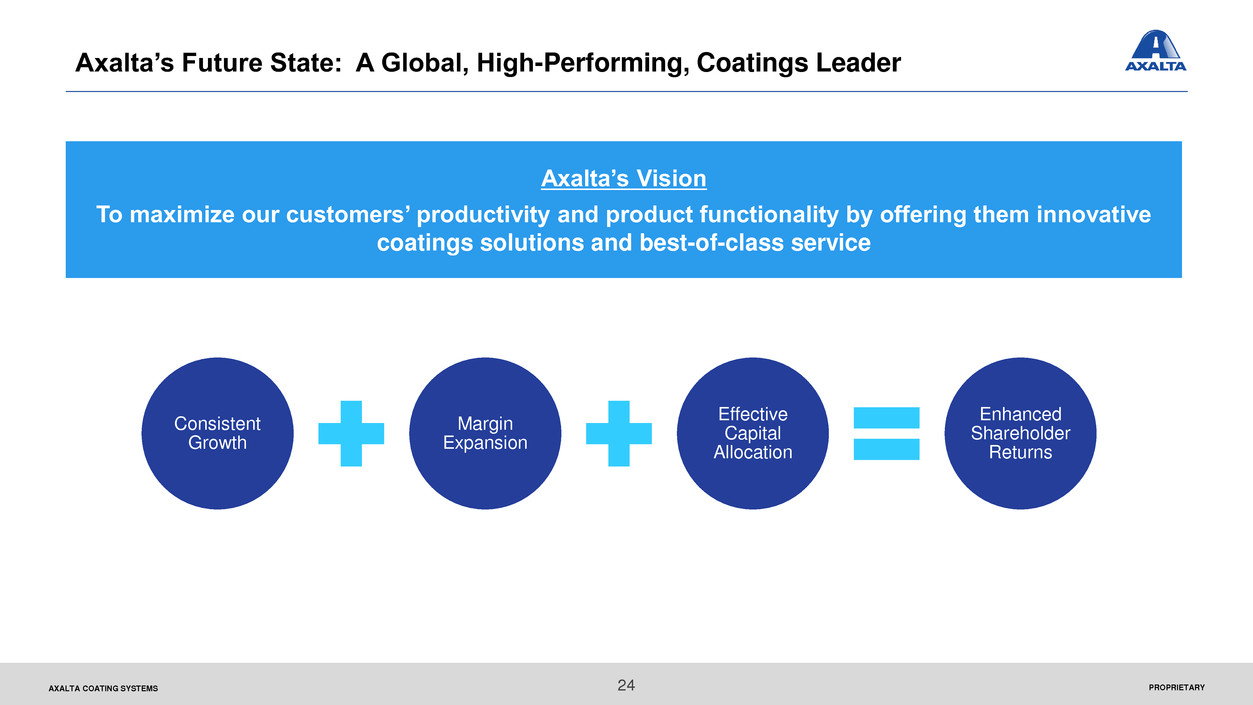

PROPRIETARYAXALTA COATING SYSTEMS Axalta’s Future State: A Global, High-Performing, Coatings Leader Consistent Growth Margin Expansion Effective Capital Allocation Enhanced Shareholder Returns Axalta’s Vision To maximize our customers’ productivity and product functionality by offering them innovative coatings solutions and best-of-class service 24

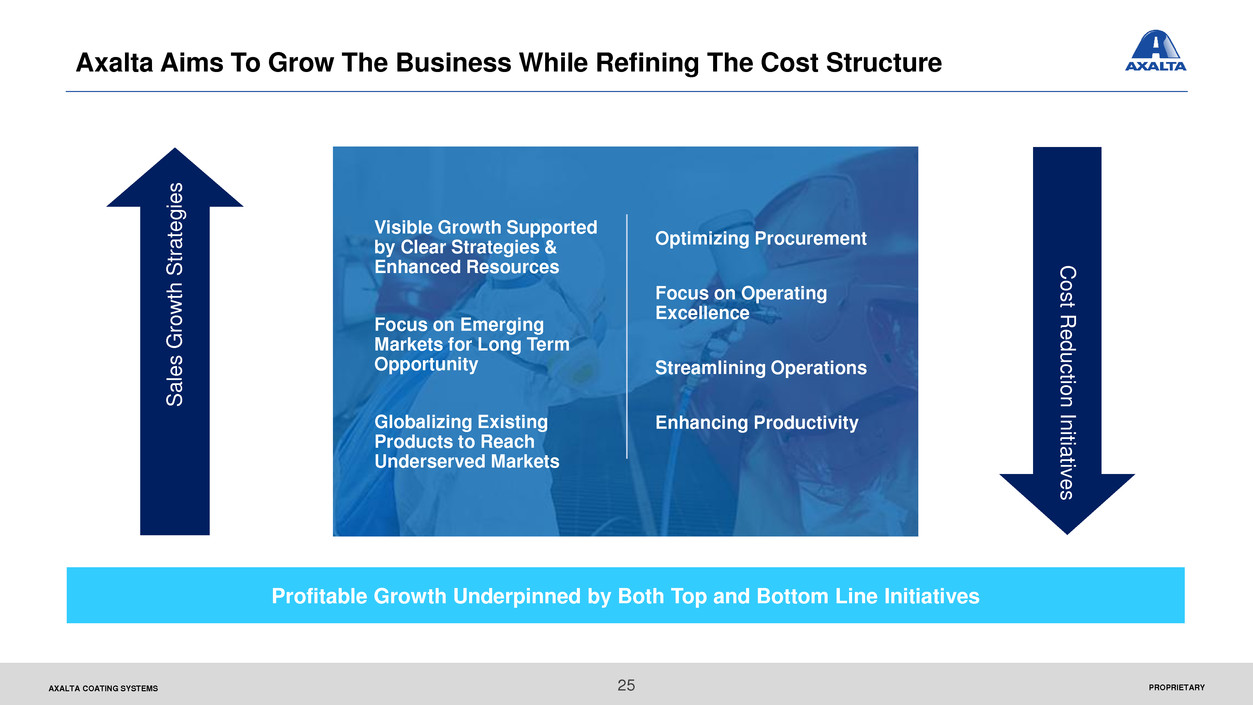

PROPRIETARYAXALTA COATING SYSTEMS 25 Axalta Aims To Grow The Business While Refining The Cost Structure Visible Growth Supported by Clear Strategies & Enhanced Resources Focus on Emerging Markets for Long Term Opportunity Globalizing Existing Products to Reach Underserved Markets Optimizing Procurement Focus on Operating Excellence Streamlining Operations Enhancing Productivity Sa le s G ro w th Strateg ie s Co s t Redu c tion In itiat iv e s Profitable Growth Underpinned by Both Top and Bottom Line Initiatives

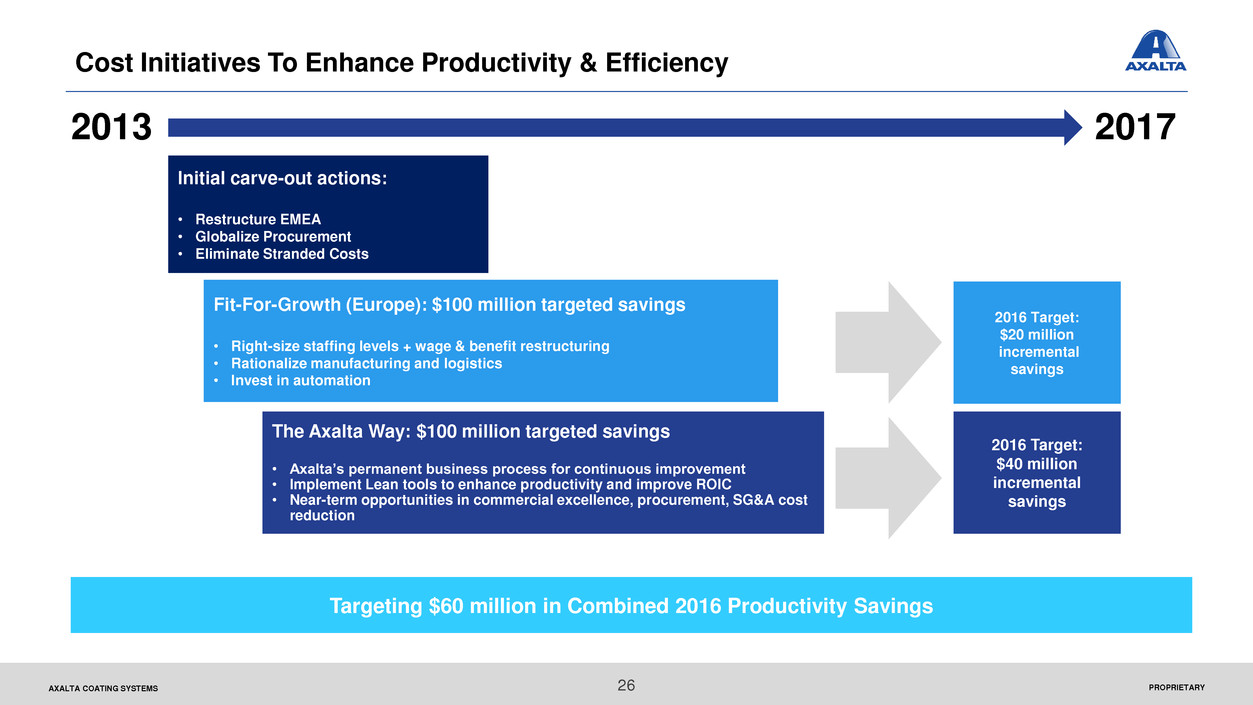

PROPRIETARYAXALTA COATING SYSTEMS 26 Cost Initiatives To Enhance Productivity & Efficiency Fit-For-Growth (Europe): $100 million targeted savings • Right-size staffing levels + wage & benefit restructuring • Rationalize manufacturing and logistics • Invest in automation Initial carve-out actions: • Restructure EMEA • Globalize Procurement • Eliminate Stranded Costs The Axalta Way: $100 million targeted savings • Axalta’s permanent business process for continuous improvement • Implement Lean tools to enhance productivity and improve ROIC • Near-term opportunities in commercial excellence, procurement, SG&A cost reduction 2013 2017 2016 Target: $40 million incremental savings 2016 Target: $20 million incremental savings Targeting $60 million in Combined 2016 Productivity Savings

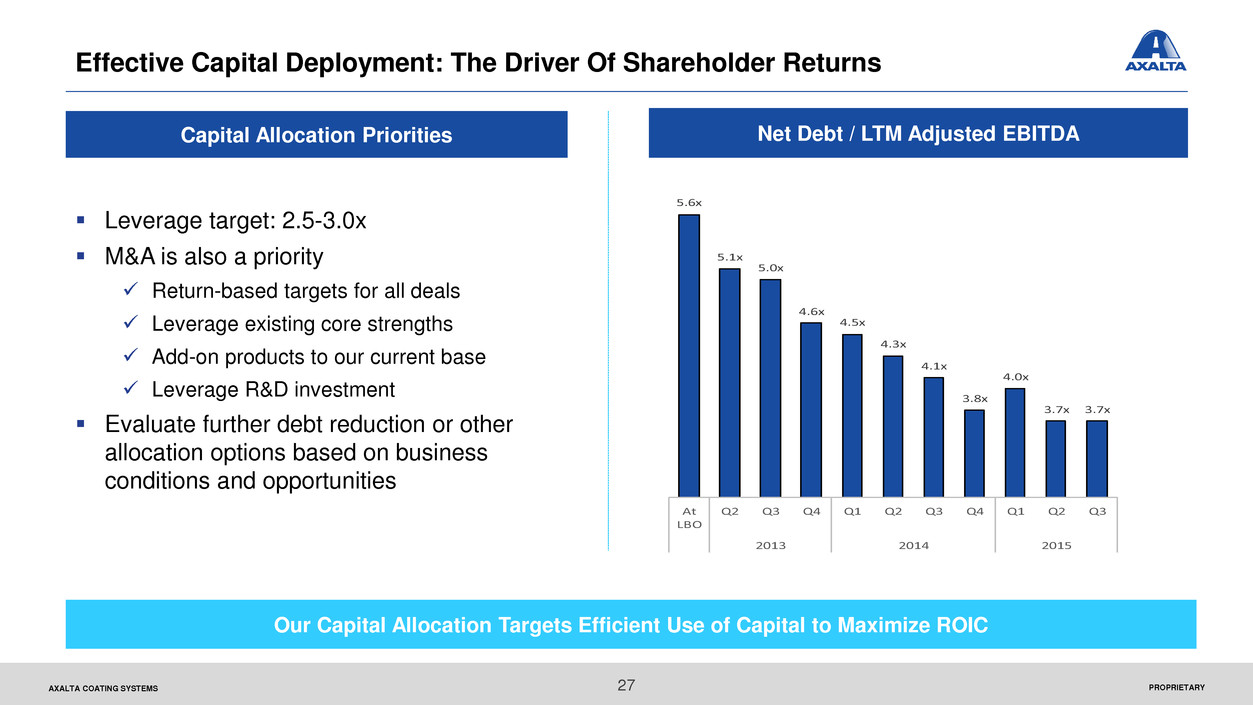

PROPRIETARYAXALTA COATING SYSTEMS 5.6x 5.1x 5.0x 4.6x 4.5x 4.3x 4.1x 3.8x 4.0x 3.7x 3.7x At LBO Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2013 2014 2015 27 Effective Capital Deployment: The Driver Of Shareholder Returns Capital Allocation Priorities Our Capital Allocation Targets Efficient Use of Capital to Maximize ROIC Net Debt / LTM Adjusted EBITDA Leverage target: 2.5-3.0x M&A is also a priority Return-based targets for all deals Leverage existing core strengths Add-on products to our current base Leverage R&D investment Evaluate further debt reduction or other allocation options based on business conditions and opportunities

PROPRIETARYAXALTA COATING SYSTEMS 28 Key Messages For The Day Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders

PROPRIETARYAXALTA COATING SYSTEMS 29 Axalta’s Evolution Is Grounded In Fundamental Goals Leverage our culture of accountability and focus on operational excellence Axalta’s Strategy Grow in targeted industrial coatings segments via organic growth and selective acquisitions Move into attractive adjacencies by leveraging our global technology, process and service capabilities Grow with our market-leading products and services in existing markets

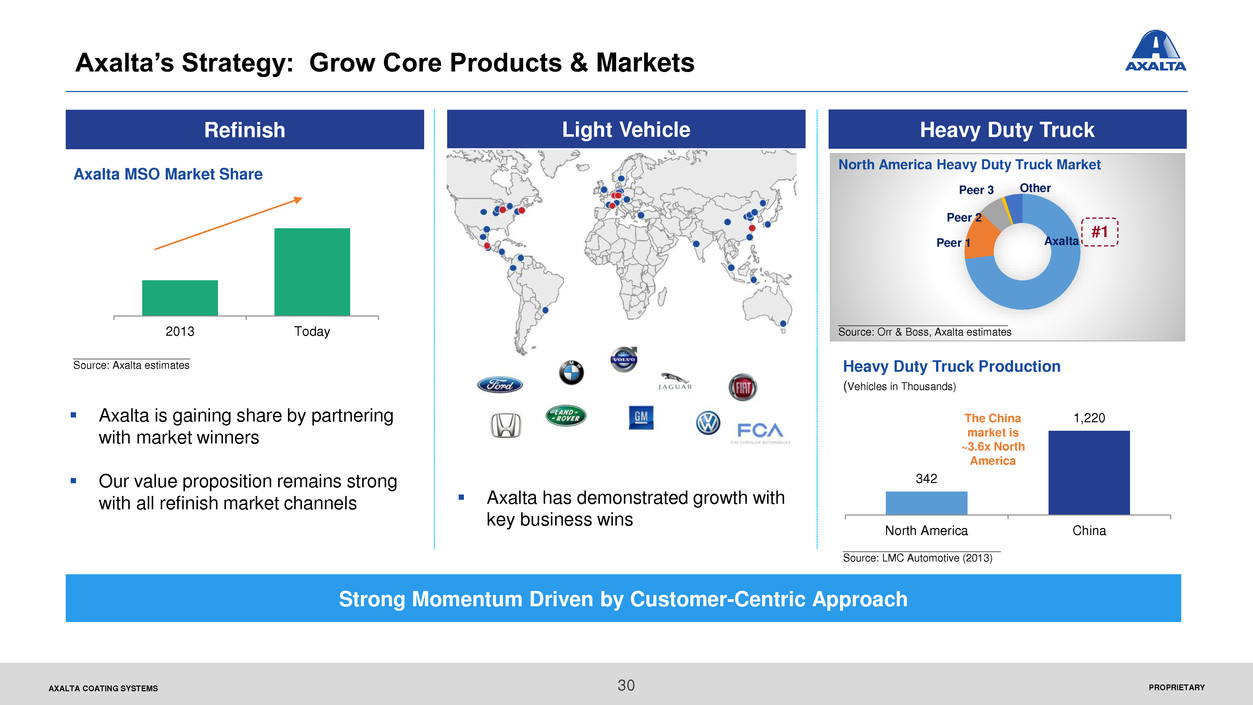

PROPRIETARYAXALTA COATING SYSTEMS 30 Axalta’s Strategy: Grow Core Products & Markets Refinish ____________________ Source: Axalta estimates Strong Momentum Driven by Customer-Centric Approach Axalta MSO Market Share 2013 Today Light Vehicle Axalta is gaining share by partnering with market winners Our value proposition remains strong with all refinish market channels Heavy Duty Truck AxaltaPeer 1 Peer 2 Peer 3 Other #1 North America Heavy Duty Truck Market (Vehicles in Thousands) Heavy Duty Truck Production 342 1,220 North America China The China market is ~3.6x North America _____________________________ Source: Orr & Boss, Axalta estimates ___________________________ Source: LMC Automotive (2013) Axalta has demonstrated growth with key business wins

PROPRIETARYAXALTA COATING SYSTEMS $14.3 $15.6 $17.1 $18.5 $20.1 2014E 2015E 2016E 2017E 2018E Emerging Markets, 31% 31 Axalta’s Strategy: Accelerate Growth In Emerging Markets China Example Light Vehicles, Per 1,000 People China Car Parc (thousands) 743 263 230 129 61 19 United States Central & Eastern Europe Mexico Brazil China India Damaged Vehicles Per 1M km Driven (2011) Axalta 2015E Net Sales Emerging Market Growth Coatings Market ($ Billions) Significant Emerging Markets Growth Opportunity Significant Opportunity Rapid growth of middle-classes in emerging economies Increased vehicle penetration per capita Expansion of car parc Elevated collision rates vs. developed markets United States Brazil China___________________________Source: Orr & Boss (2014) _________________________________________ Source: LMC Automotive (2013), World Bank (2013) ____________________ Source: Axalta estimates ___________________________ Source: LMC Automotive (2013) 50 62 77 93 110 129 149 170 193 217 2008A 2011A 2014E 2017E

PROPRIETARYAXALTA COATING SYSTEMS Architectural 32 Axalta’s Strategy: Targeted Industrial Coatings Expansion Growth from Leveraging Our Product Portfolio in Underserved Markets Strong product portfolio in powder, liquid, and e-coat Implemented global end-market business structure to capitalize on opportunities Leveraging existing technology and enhanced sales organization to grow A Broad Industrial Portfolio Electrical Insulation Agricultural, Construction, & Earthmoving Equipment (ACE) Oil & Gas

PROPRIETARYAXALTA COATING SYSTEMS Axalta’s Strategy: Focus On Operating Excellence Balanced manufacturing footprint and capacity Ongoing productivity investments Salesforce reorganization R&D / Technology enablers Enhanced IT tools Procurement roadmap Process improvement Leadership and Culture The tone is set; focus on growth and profitability Independence and accountability is freeing…and infectious Quality leaders in every region and end-market Supporting and educating our people Strive to maintain a strong core talent base Continue to refine and add talent deeper in the organization Operations Employees Feel the Effect of Our Focus and Accountability 33

Financial Overview and Outlook Robert Bryant EVP & CFO

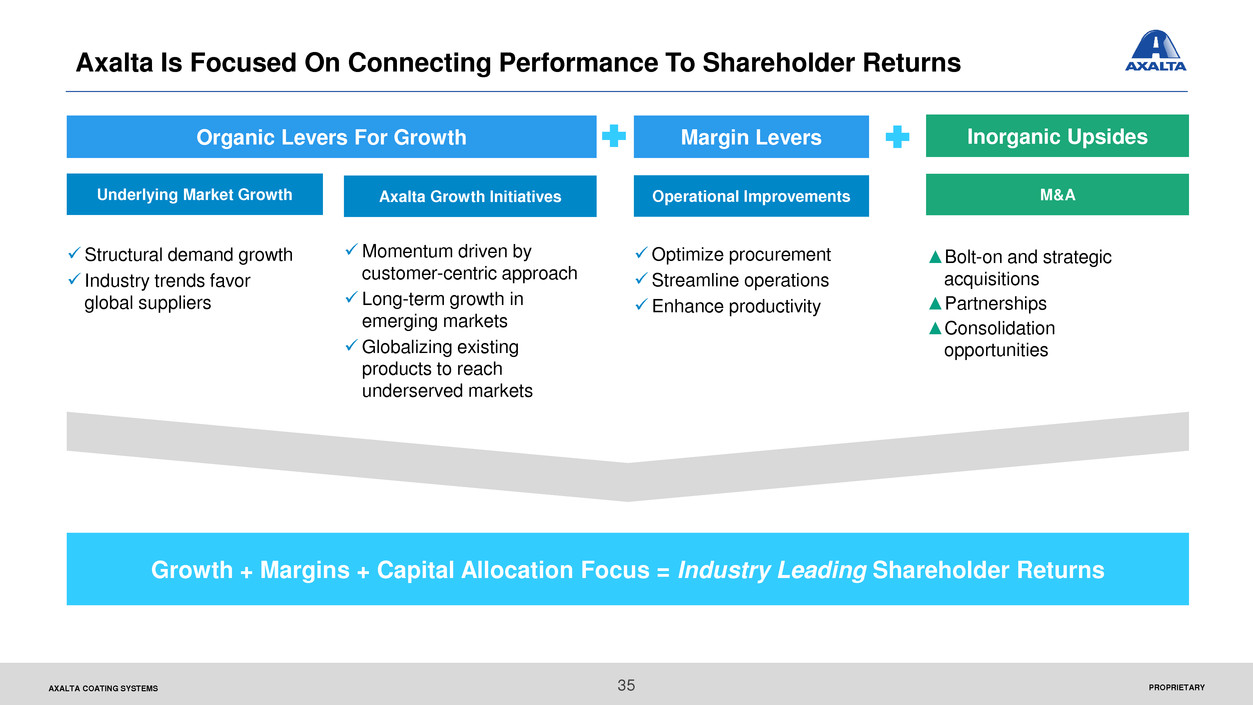

PROPRIETARYAXALTA COATING SYSTEMS 35 Axalta Is Focused On Connecting Performance To Shareholder Returns Underlying Market Growth Axalta Growth Initiatives Operational Improvements M&A Structural demand growth Industry trends favor global suppliers Momentum driven by customer-centric approach Long-term growth in emerging markets Globalizing existing products to reach underserved markets Optimize procurement Streamline operations Enhance productivity ▲Bolt-on and strategic acquisitions ▲Partnerships ▲Consolidation opportunities Organic Levers For Growth Inorganic UpsidesMargin Levers Growth + Margins + Capital Allocation Focus = Industry Leading Shareholder Returns

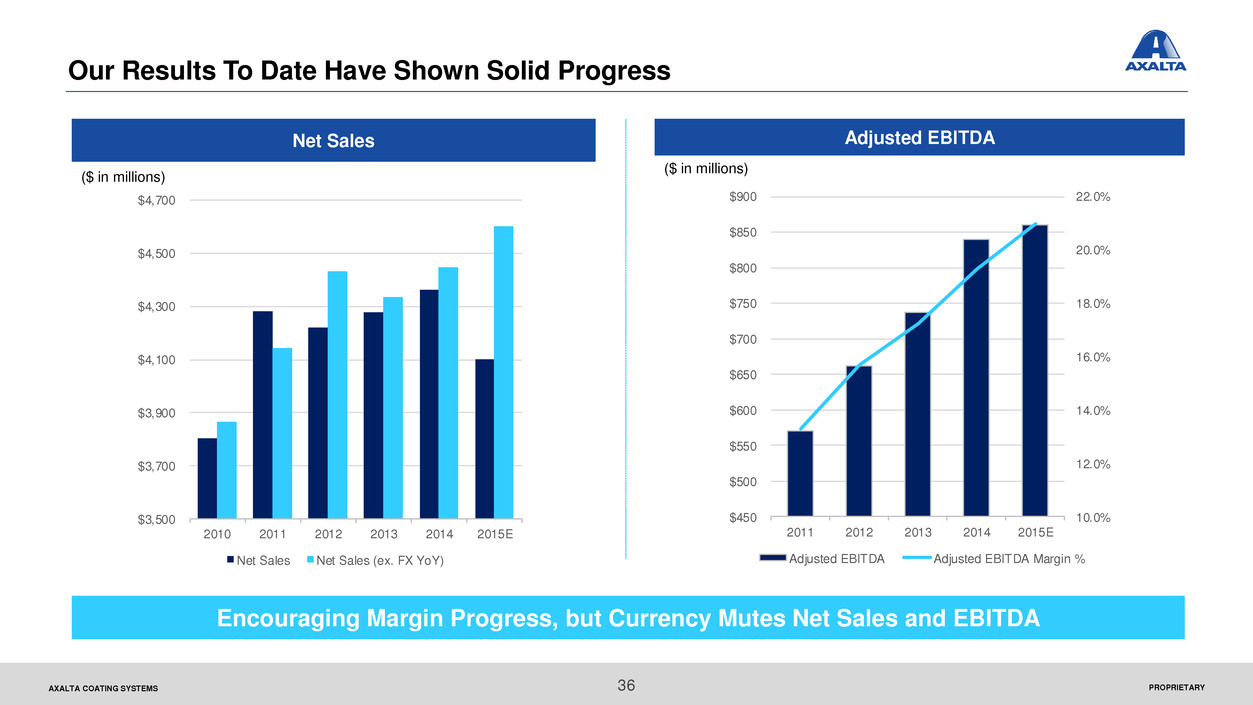

PROPRIETARYAXALTA COATING SYSTEMS Our Results To Date Have Shown Solid Progress Encouraging Margin Progress, but Currency Mutes Net Sales and EBITDA Net Sales Adjusted EBITDA ($ in millions) ($ in millions) 36 $3,500 $3,700 $3,900 $4,100 $4,300 $4,500 $4,700 2010 2011 2012 2013 2014 2015E Net Sales Net Sales (ex. FX YoY) 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% $450 $500 $550 $600 $650 $700 $750 $800 $850 $900 011 2012 2013 2014 2015E Adju ted EBITDA Adjusted EBITDA Margin %

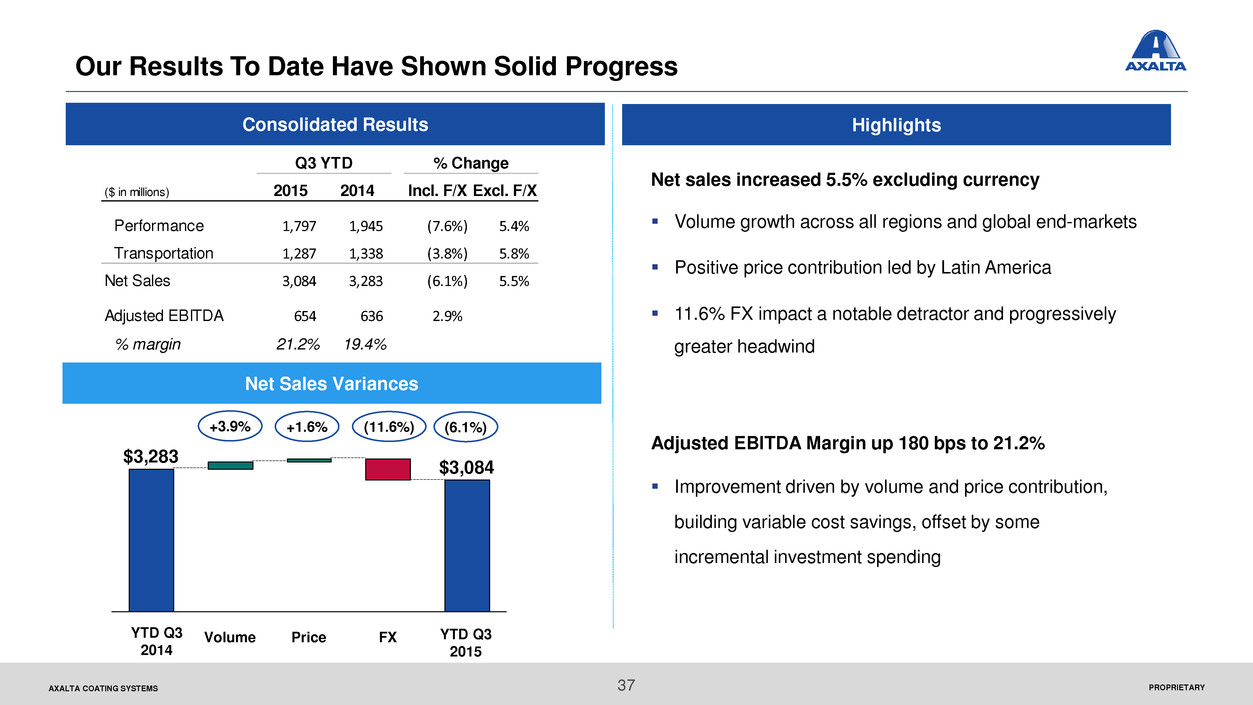

PROPRIETARYAXALTA COATING SYSTEMS Our Results To Date Have Shown Solid Progress Net sales increased 5.5% excluding currency Volume growth across all regions and global end-markets Positive price contribution led by Latin America 11.6% FX impact a notable detractor and progressively greater headwind Adjusted EBITDA Margin up 180 bps to 21.2% Improvement driven by volume and price contribution, building variable cost savings, offset by some incremental investment spending Consolidated Results Net Sales Variances +3.9% +1.6% (11.6%) (6.1%) $3,084 $3,283 YTD Q3 2015 FXPriceYTD Q3 2014 Volume ($ in millions) 2015 2014 Incl. F/X Excl. F/X Performance 1,797 1,945 (7.6%) 5.4% Transportation 1,287 1,338 (3.8%) 5.8% Net Sales 3,084 3,283 (6.1%) 5.5% Adjusted EBITDA 654 636 2.9% % margin 21.2% 19.4% Q3 YTD % Change Highlights 37

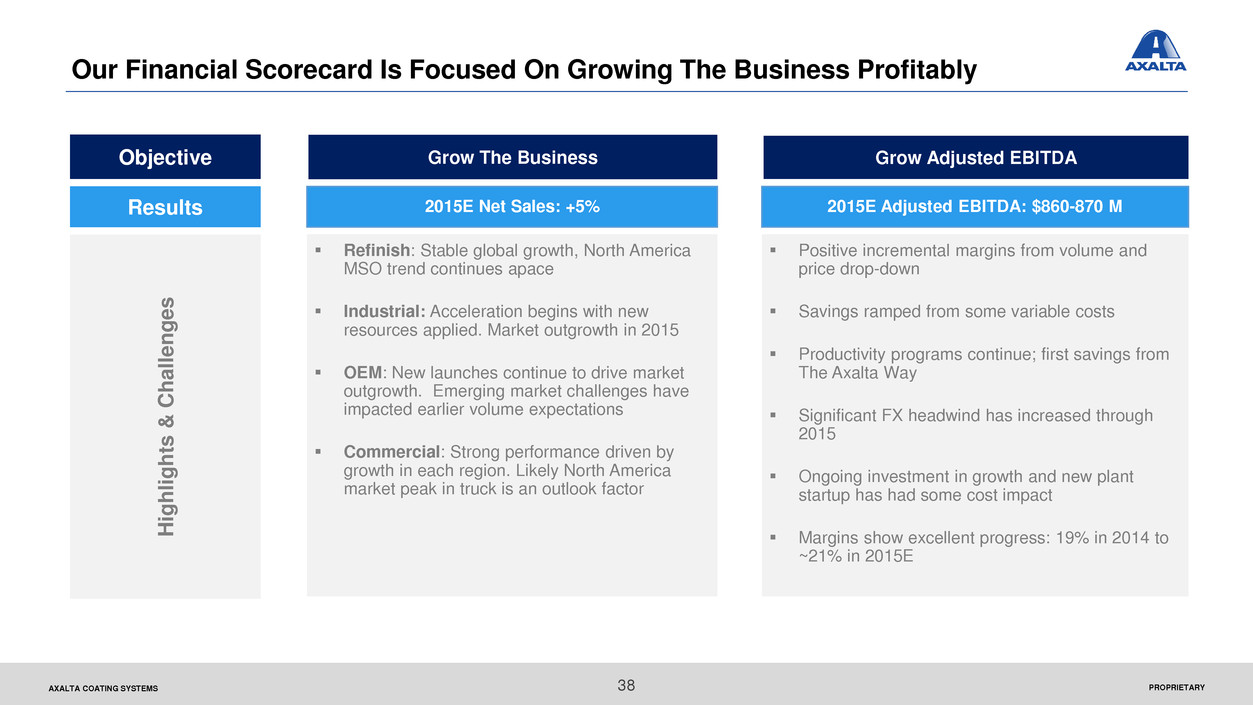

PROPRIETARYAXALTA COATING SYSTEMS 38 Our Financial Scorecard Is Focused On Growing The Business Profitably Grow The Business Grow Adjusted EBITDA 2015E Net Sales: +5% Refinish: Stable global growth, North America MSO trend continues apace Industrial: Acceleration begins with new resources applied. Market outgrowth in 2015 OEM: New launches continue to drive market outgrowth. Emerging market challenges have impacted earlier volume expectations Commercial: Strong performance driven by growth in each region. Likely North America market peak in truck is an outlook factor 2015E Adjusted EBITDA: $860-870 M Positive incremental margins from volume and price drop-down Savings ramped from some variable costs Productivity programs continue; first savings from The Axalta Way Significant FX headwind has increased through 2015 Ongoing investment in growth and new plant startup has had some cost impact Margins show excellent progress: 19% in 2014 to ~21% in 2015E Objective Results Hig h lig h ts & Challen g e s

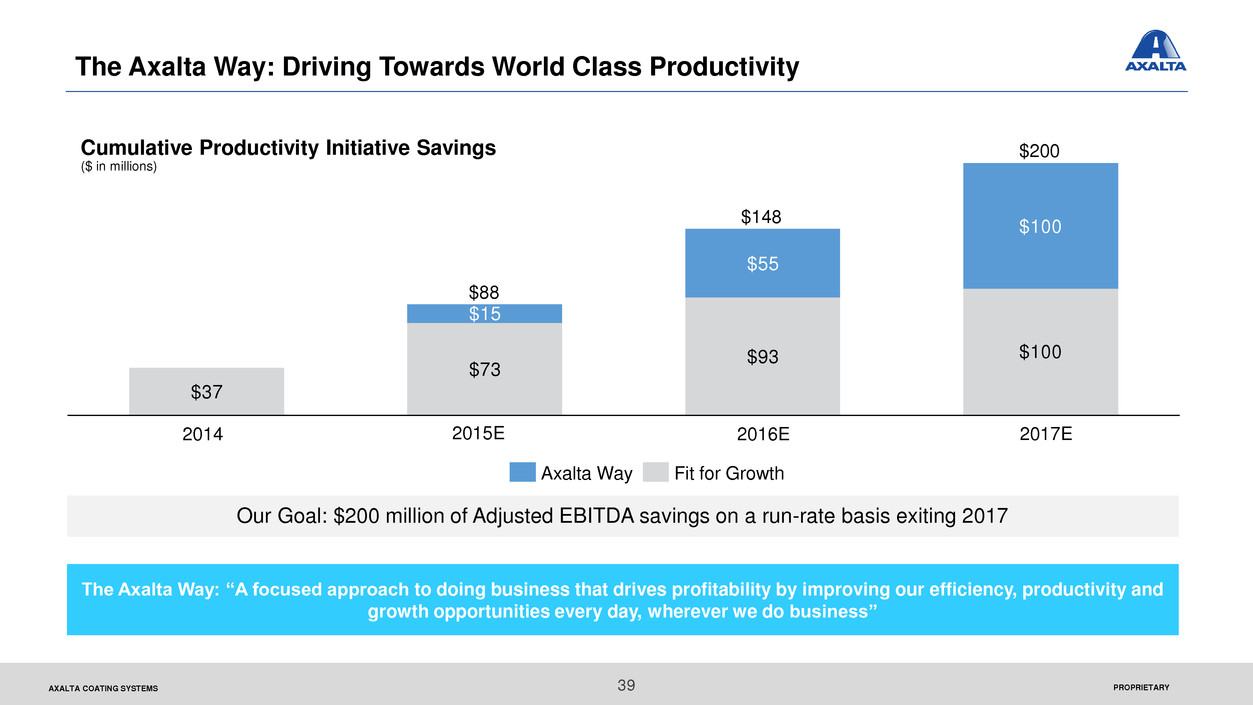

PROPRIETARYAXALTA COATING SYSTEMS The Axalta Way: Driving Towards World Class Productivity Our Goal: $200 million of Adjusted EBITDA savings on a run-rate basis exiting 2017 Cumulative Productivity Initiative Savings ($ in millions) The Axalta Way: “A focused approach to doing business that drives profitability by improving our efficiency, productivity and growth opportunities every day, wherever we do business” 39 2017E2015E 2016E2014 Fit for GrowthAxalta Way $37 $73 $93 $100 $55 $100 $15 $88 $200 $148

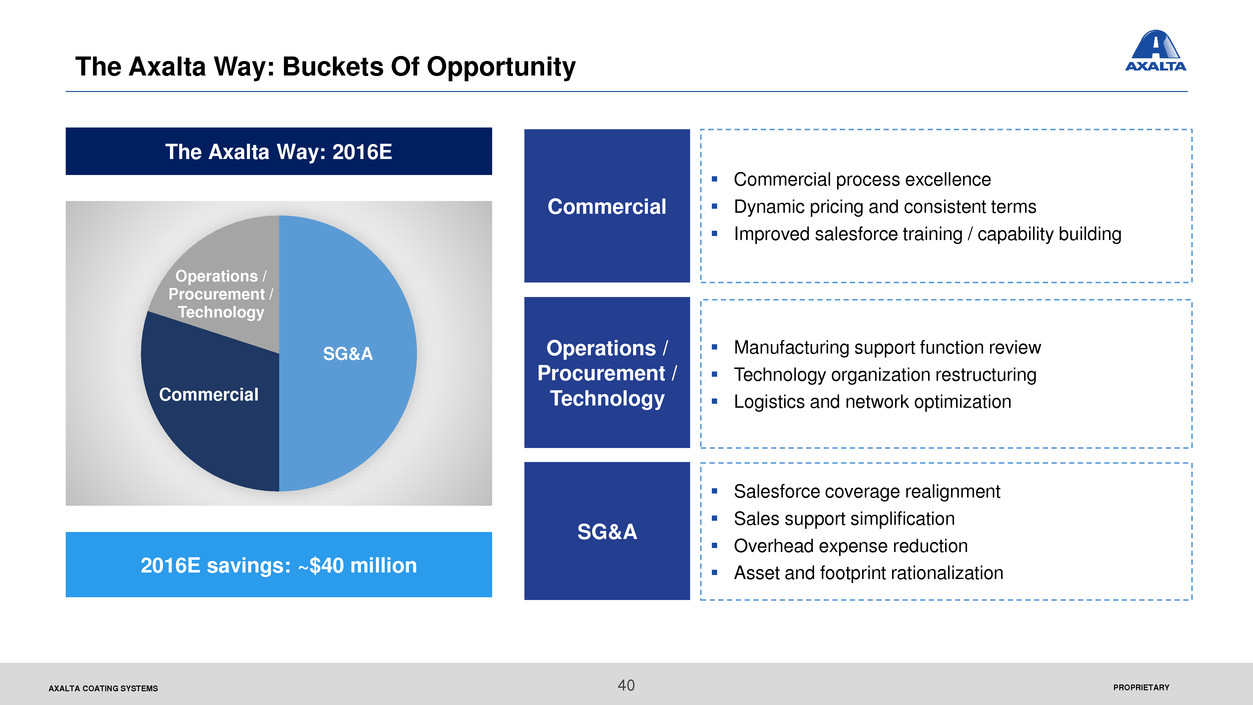

PROPRIETARYAXALTA COATING SYSTEMS The Axalta Way: Buckets Of Opportunity Commercial process excellence Dynamic pricing and consistent terms Improved salesforce training / capability building The Axalta Way: 2016E 2016E savings: ~$40 million Commercial Operations / Procurement / Technology SG&A Manufacturing support function review Technology organization restructuring Logistics and network optimization Salesforce coverage realignment Sales support simplification Overhead expense reduction Asset and footprint rationalization 40 SG&A Commercial Operations / Procurement / Technology

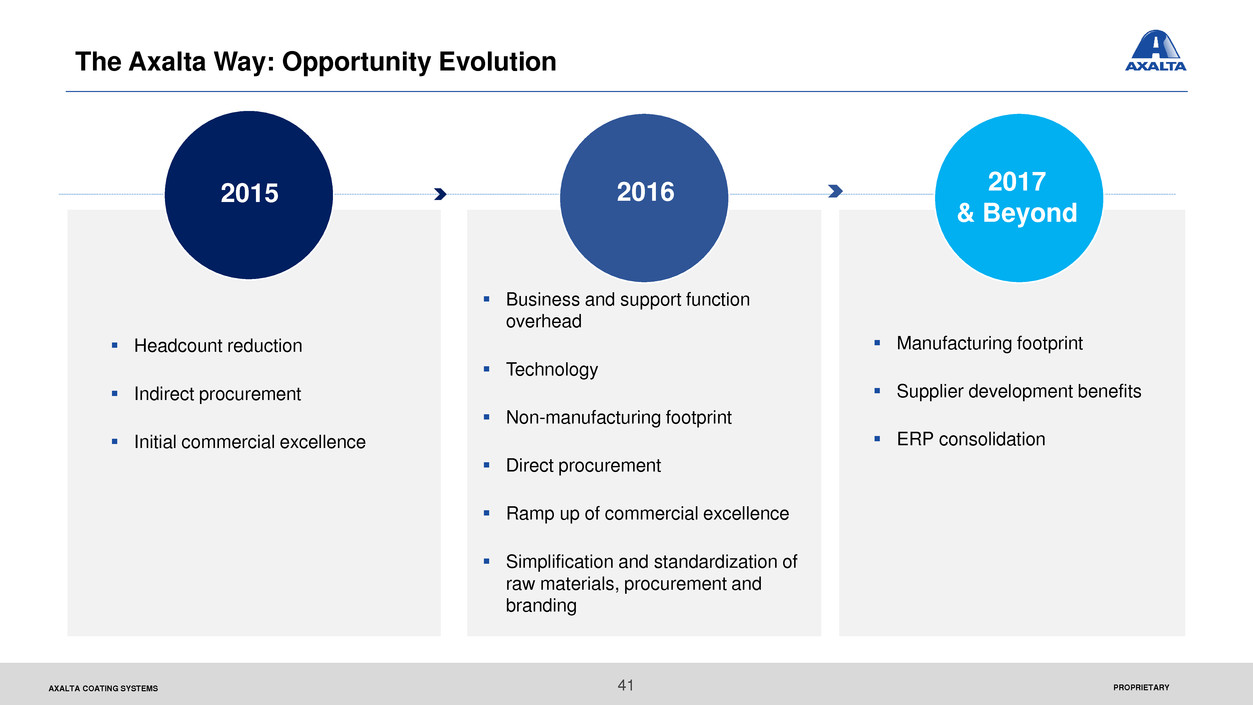

PROPRIETARYAXALTA COATING SYSTEMS 41 The Axalta Way: Opportunity Evolution Headcount reduction Indirect procurement Initial commercial excellence Business and support function overhead Technology Non-manufacturing footprint Direct procurement Ramp up of commercial excellence Simplification and standardization of raw materials, procurement and branding Manufacturing footprint Supplier development benefits ERP consolidation 2015 2016 2017 & Beyond

PROPRIETARYAXALTA COATING SYSTEMS 42 Our Financial Guiding Principles Managing the Capital: Capex Prioritization Metrics-Based Management: Driving the Business with Data Capital Allocation: Improved ROIC Financial Optimization

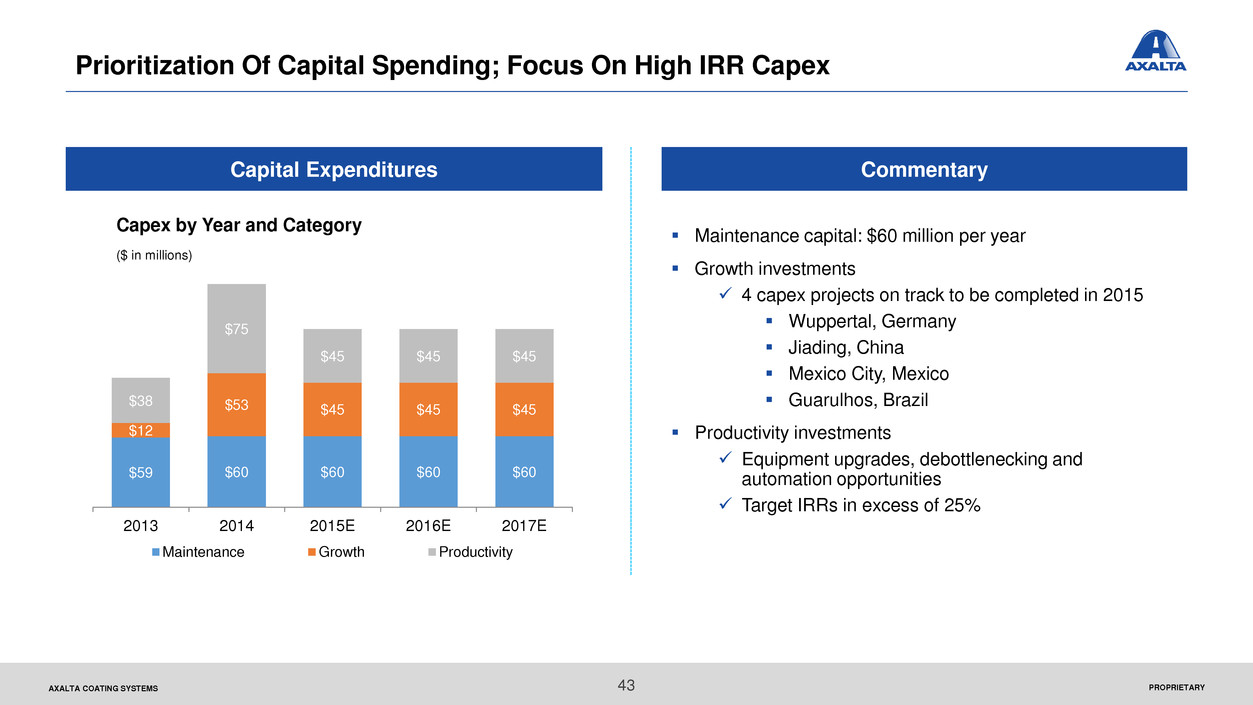

PROPRIETARYAXALTA COATING SYSTEMS Prioritization Of Capital Spending; Focus On High IRR Capex Maintenance capital: $60 million per year Growth investments 4 capex projects on track to be completed in 2015 Wuppertal, Germany Jiading, China Mexico City, Mexico Guarulhos, Brazil Productivity investments Equipment upgrades, debottlenecking and automation opportunities Target IRRs in excess of 25% Capital Expenditures Capex by Year and Category ($ in millions) Commentary 43 $59 $60 $60 $60 $60 $12 $53 $45 $45 $45 $38 $75 $45 $45 $45 2013 2014 2015E 2016E 2017E Maintenance Growth Productivity

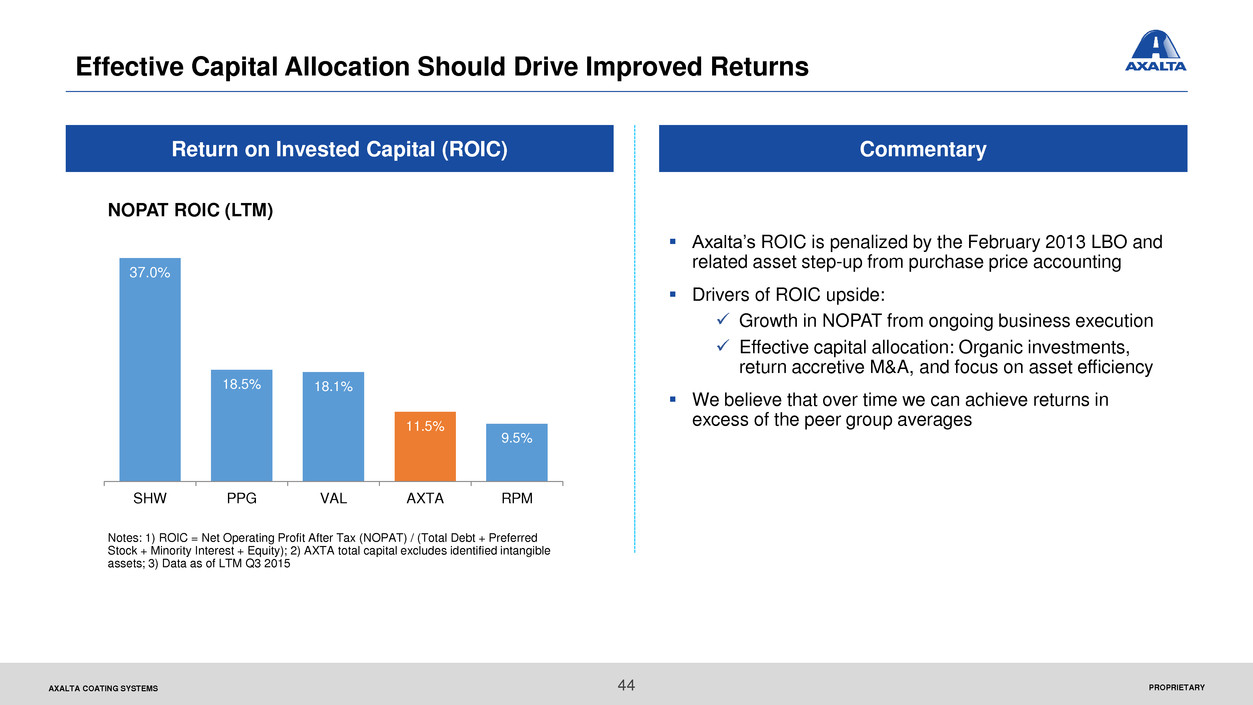

PROPRIETARYAXALTA COATING SYSTEMS Effective Capital Allocation Should Drive Improved Returns Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred Stock + Minority Interest + Equity); 2) AXTA total capital excludes identified intangible assets; 3) Data as of LTM Q3 2015 Axalta’s ROIC is penalized by the February 2013 LBO and related asset step-up from purchase price accounting Drivers of ROIC upside: Growth in NOPAT from ongoing business execution Effective capital allocation: Organic investments, return accretive M&A, and focus on asset efficiency We believe that over time we can achieve returns in excess of the peer group averages Return on Invested Capital (ROIC) Commentary NOPAT ROIC (LTM) 44 37.0% 18.5% 18.1% 11.5% 9.5% SHW PPG VAL AXTA RPM

PROPRIETARYAXALTA COATING SYSTEMS Capital Allocation: Driving Returns With Best Uses Of Excess Cash Flow Organic growth options: Generally the “highest and best use” In-plant productivity investment Growth with existing markets with strong incremental margins M&A: Discipline is key to improve returns 4 year cumulative free cash flow available after debt reduction: $1.5+ billion Tactical, lower risk, smaller “tuck-ins” and immediate adjacencies Overall consideration for both immediate IRR and long term growth goals Debt repayment: Accretive at current rates Target investment grade rating as debt leverage is reduced and other factors Process: Balance absolute returns with risk-adjusted return, and feedback on shareholder risk tolerance Other potential uses: Board to consider in time Dividends and buybacks will be considered once our leverage goals are realized Total Shareholder Return (TSR) Model 45

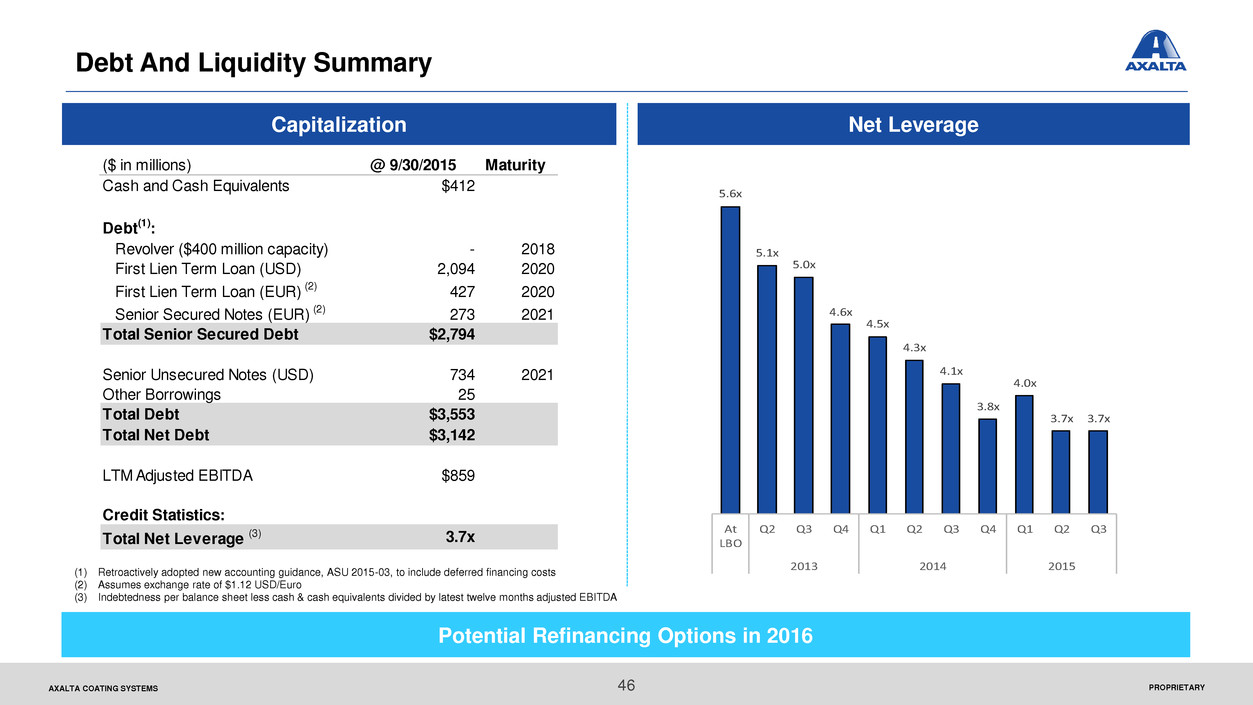

PROPRIETARYAXALTA COATING SYSTEMS 5.6x 5.1x 5.0x 4.6x 4.5x 4.3x 4.1x 3.8x 4.0x 3.7x 3.7x At LBO Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2013 2014 2015 Capitalization 46 Debt And Liquidity Summary (1) Retroactively adopted new accounting guidance, ASU 2015-03, to include deferred financing costs (2) Assumes exchange rate of $1.12 USD/Euro (3) Indebtedness per balance sheet less cash & cash equivalents divided by latest twelve months adjusted EBITDA Net Leverage ($ in millions) @ 9/30/2015 Maturity Cash and Cash Equivalents $412 Debt(1): Revolver ($400 million capacity) - 2018 First Lien Term Loan (USD) 2,094 2020 First Lien Term Loan (EUR) (2) 427 2020 Senior Secured Notes (EUR) (2) 273 2021 Total Senior Secured Debt $2,794 Senior Unsecured Notes (USD) 734 2021 Other Borrowings 25 Total Debt $3,553 Total Net Debt $3,142 LTM Adjusted EBITDA $859 Credit Statistics: Total Net Leverage (3) 3.7x Potential Refinancing Options in 2016

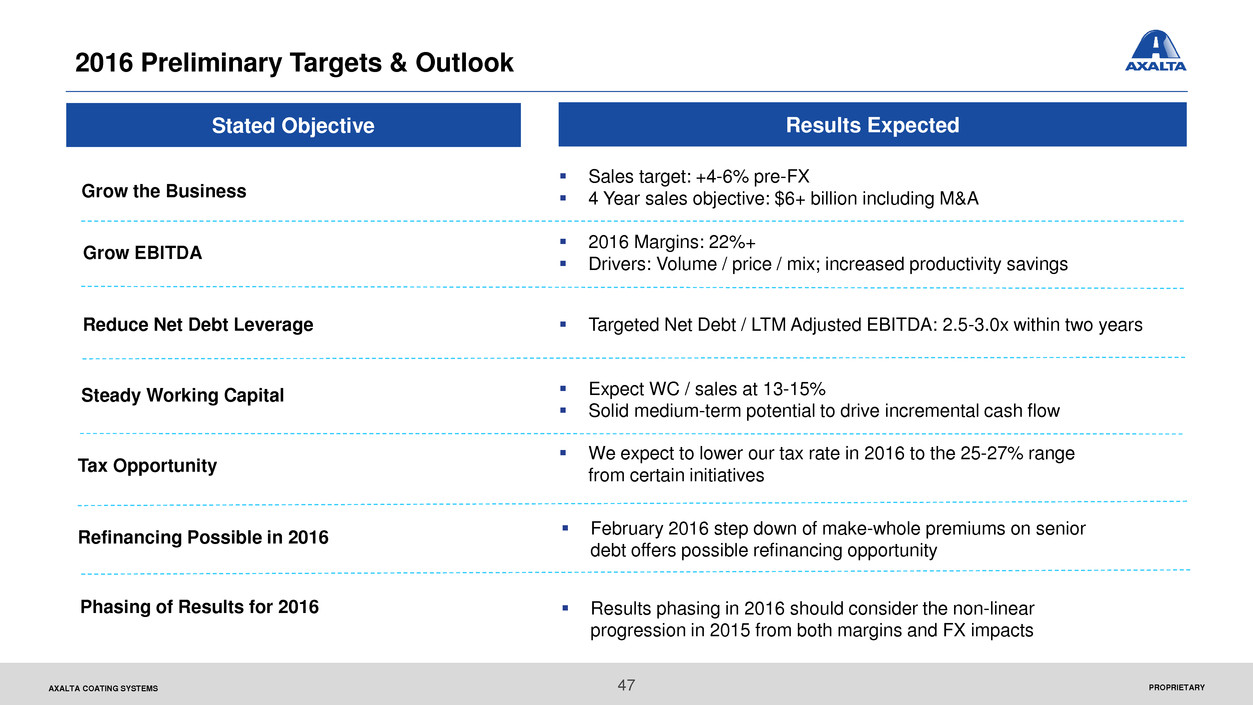

PROPRIETARYAXALTA COATING SYSTEMS Stated Objective Results Expected Grow the Business Steady Working Capital Grow EBITDA Reduce Net Debt Leverage Sales target: +4-6% pre-FX 4 Year sales objective: $6+ billion including M&A Expect WC / sales at 13-15% Solid medium-term potential to drive incremental cash flow 2016 Margins: 22%+ Drivers: Volume / price / mix; increased productivity savings Targeted Net Debt / LTM Adjusted EBITDA: 2.5-3.0x within two years Tax Opportunity We expect to lower our tax rate in 2016 to the 25-27% range from certain initiatives 47 2016 Preliminary Targets & Outlook Refinancing Possible in 2016 February 2016 step down of make-whole premiums on senior debt offers possible refinancing opportunity Phasing of Results for 2016 Results phasing in 2016 should consider the non-linear progression in 2015 from both margins and FX impacts

PROPRIETARYAXALTA COATING SYSTEMS Summary Of Our Investment Case Axalta operates a fundamentally strong set of businesses The Refinish business provides Axalta with a strong foundation We still have many layers of self-help to execute We believe we can outgrow the market in each business over coming years Our top-line, margins, and incremental investments should drive stronger ROIC for shareholders 48

Performance Coatings: Refinish Nigel Budden VP, Global Customer Excellence

PROPRIETARYAXALTA COATING SYSTEMS The global refinish market is structurally growing and well consolidated End-market growth ~3% per year through 2019 The top four players hold two-thirds global market share We are a global leader; refinish provides a strong foundation for Axalta #1 player globally with 25% market share Portfolio of next-generation technology products Strong profitability driven by positive market dynamics Axalta has transformed its business and we see significant growth opportunities Multi-shop operator (MSO) alignment in North America is driving growth Emerging markets are expected to drive long-term demand Axalta has a more customer-focused face to the market Axalta Refinish Investment Summary 50

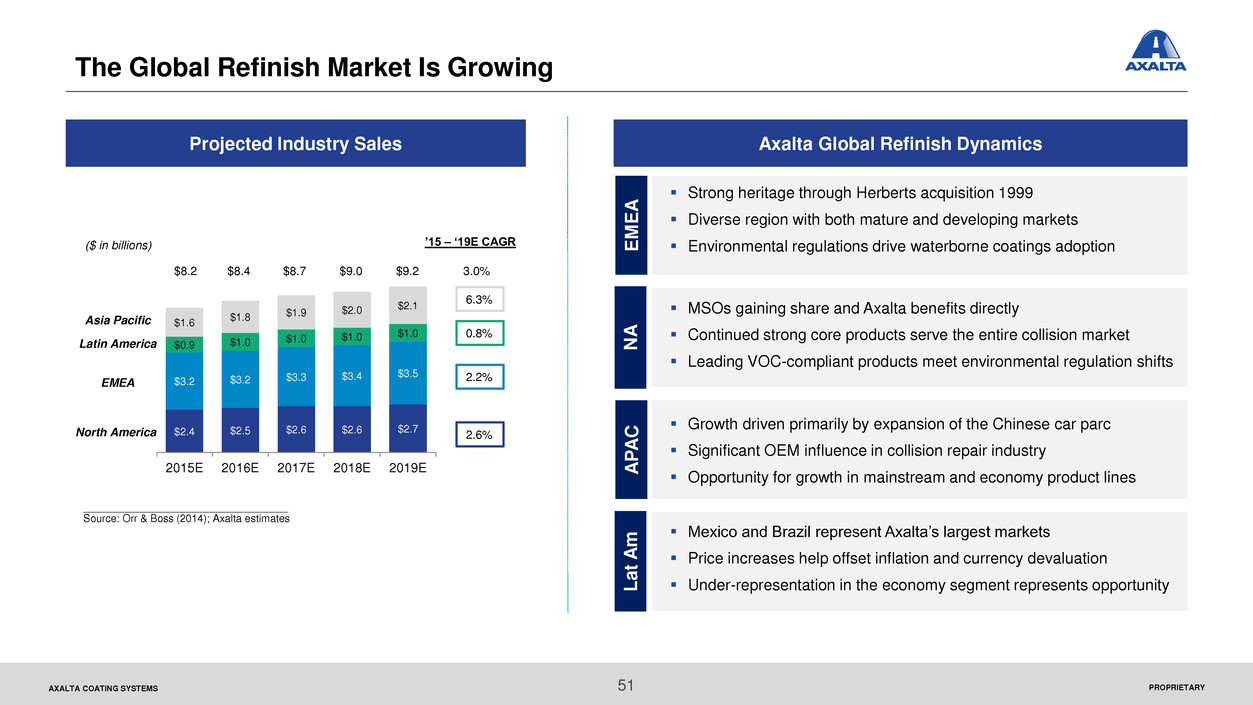

PROPRIETARYAXALTA COATING SYSTEMS The Global Refinish Market Is Growing Projected Industry Sales ($ in billions) Asia Pacific EMEA North America 6.3% 0.8% 2.2% 2.6%$2.4 $2.5 $2.6 $2.6 $2.7 $3.2 $3.2 $3.3 $3.4 $3.5 $0.9 $1.0 $1.0 $1.0 $1.0 $1.6 $1.8 $1.9 $2.0 $2.1 2015E 2016E 2017E 2018E 2019E ’15 – ‘19E CAGR ___________________________________ Source: Orr & Boss (2014); Axalta estimates Latin America $8.2 $8.4 $8.7 $9.0 $9.2 3.0% Axalta Global Refinish Dynamics Strong heritage through Herberts acquisition 1999 Diverse region with both mature and developing markets Environmental regulations drive waterborne coatings adoption MSOs gaining share and Axalta benefits directly Continued strong core products serve the entire collision market Leading VOC-compliant products meet environmental regulation shifts Growth driven primarily by expansion of the Chinese car parc Significant OEM influence in collision repair industry Opportunity for growth in mainstream and economy product lines Mexico and Brazil represent Axalta’s largest markets Price increases help offset inflation and currency devaluation Under-representation in the economy segment represents opportunity E M E A N A A P A C La t A m 51

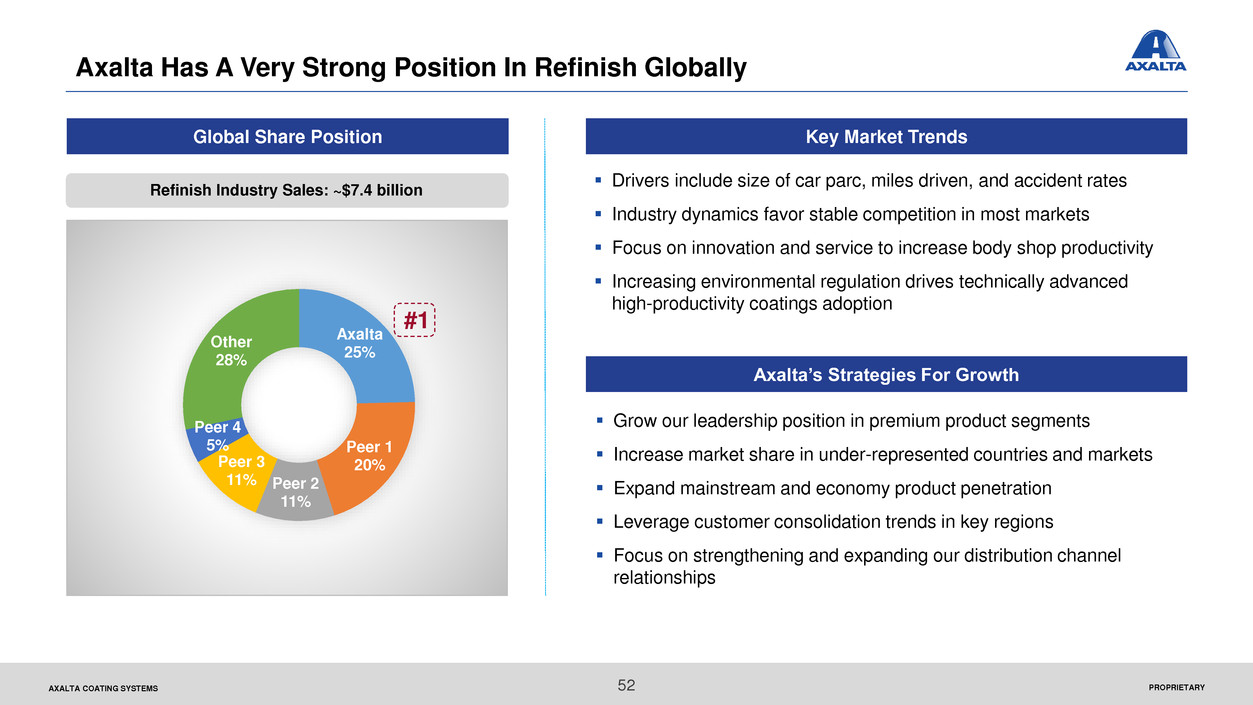

PROPRIETARYAXALTA COATING SYSTEMS Axalta Has A Very Strong Position In Refinish Globally Global Share Position Key Market Trends Axalta 25% Peer 1 20% Peer 2 11% Peer 3 11% Peer 4 5% Other 28% Refinish Industry Sales: ~$7.4 billion #1 Drivers include size of car parc, miles driven, and accident rates Industry dynamics favor stable competition in most markets Focus on innovation and service to increase body shop productivity Increasing environmental regulation drives technically advanced high-productivity coatings adoption Grow our leadership position in premium product segments Increase market share in under-represented countries and markets Expand mainstream and economy product penetration Leverage customer consolidation trends in key regions Focus on strengthening and expanding our distribution channel relationships Axalta’s Strategies For Growth 52

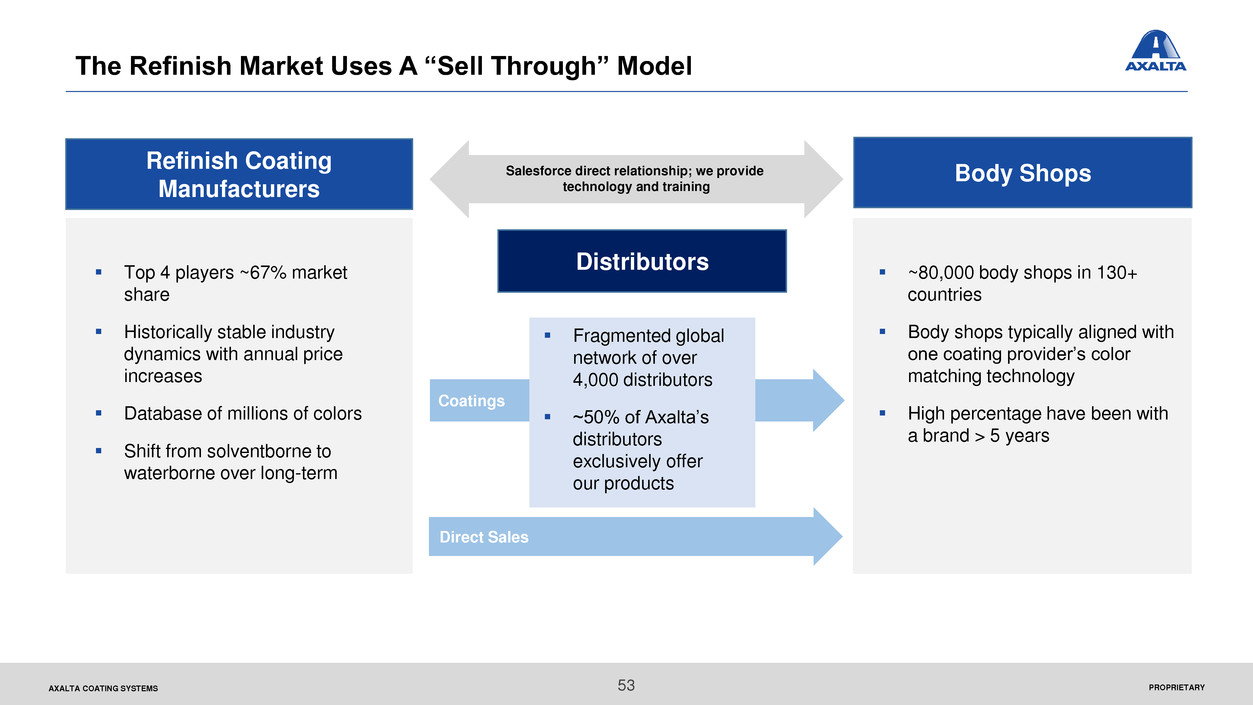

PROPRIETARYAXALTA COATING SYSTEMS Direct Sales Coatings The Refinish Market Uses A “Sell Through” Model Top 4 players ~67% market share Historically stable industry dynamics with annual price increases Database of millions of colors Shift from solventborne to waterborne over long-term Fragmented global network of over 4,000 distributors ~50% of Axalta’s distributors exclusively offer our products ~80,000 body shops in 130+ countries Body shops typically aligned with one coating provider’s color matching technology High percentage have been with a brand > 5 years Salesforce direct relationship; we provide technology and training 53 Refinish Coating Manufacturers Body Shops Distributors

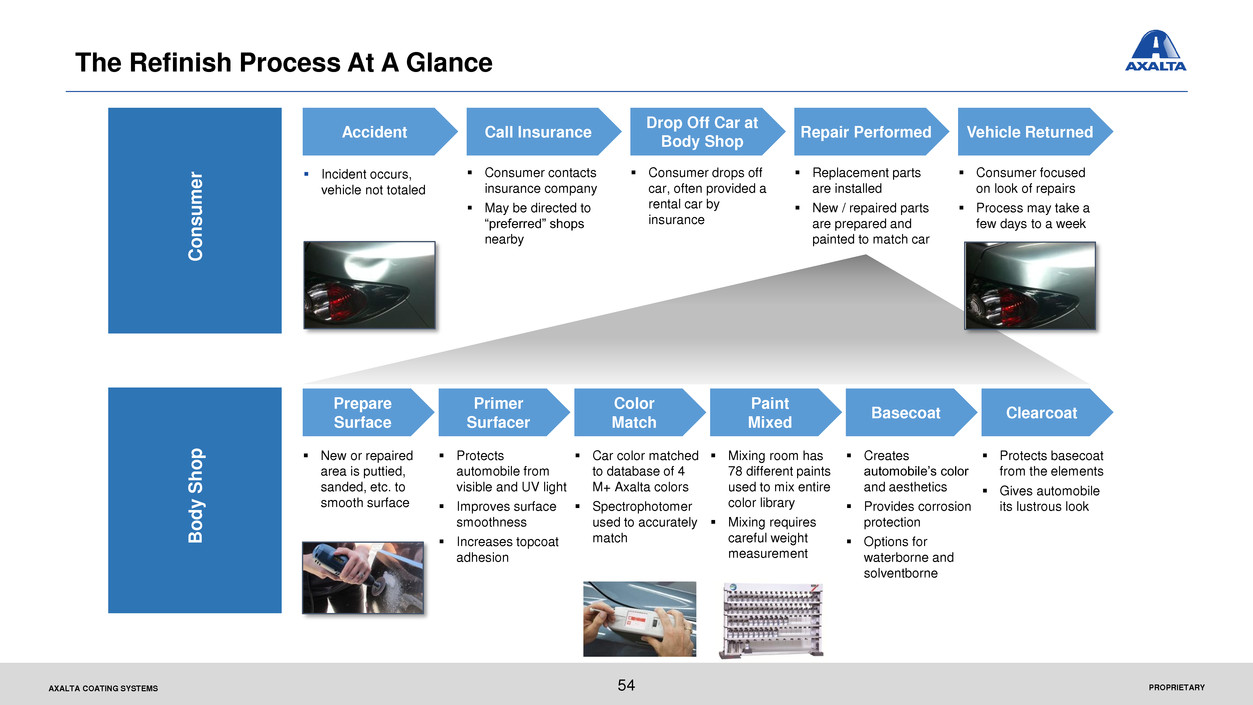

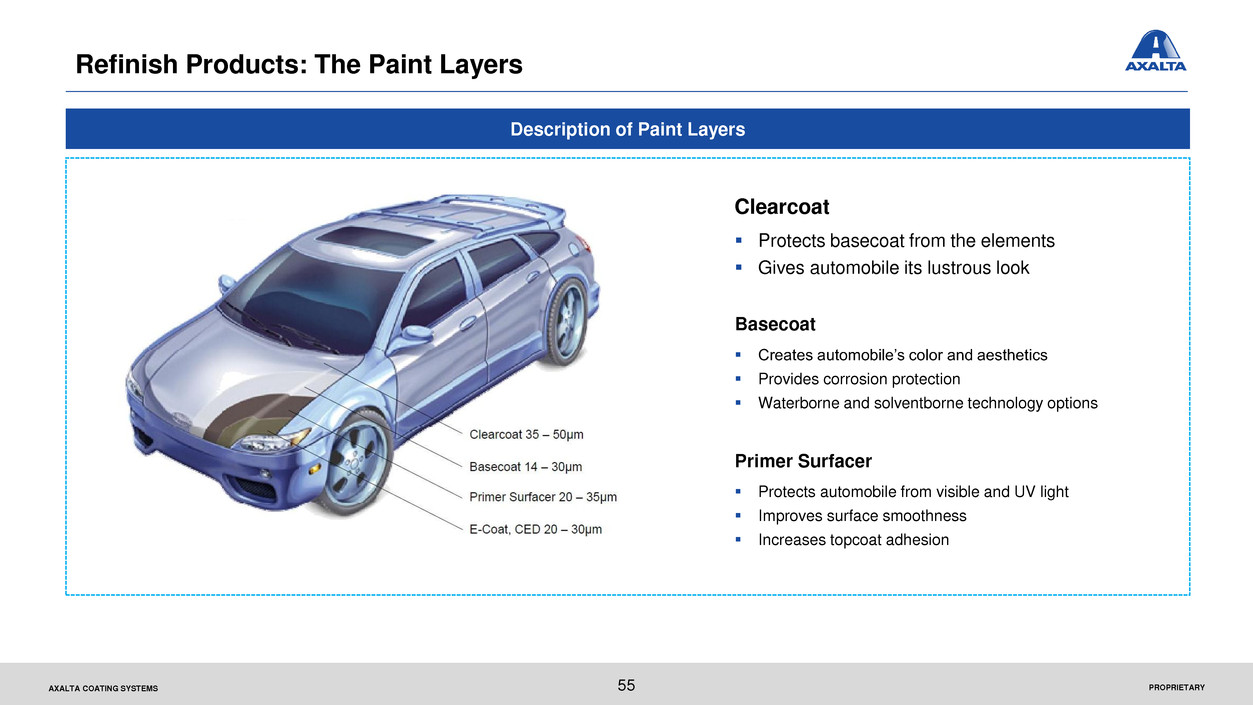

PROPRIETARYAXALTA COATING SYSTEMS The Refinish Process At A Glance Incident occurs, vehicle not totaled C o n s u me r B o d y Sh o p Consumer contacts insurance company May be directed to “preferred” shops nearby Consumer drops off car, often provided a rental car by insurance Accident Call Insurance Drop Off Car at Body Shop Repair Performed Vehicle Returned Replacement parts are installed New / repaired parts are prepared and painted to match car Consumer focused on look of repairs Process may take a few days to a week Prepare Surface Primer Surfacer Color Match Paint Mixed Basecoat Clearcoat New or repaired area is puttied, sanded, etc. to smooth surface Protects automobile from visible and UV light Improves surface smoothness Increases topcoat adhesion Car color matched to database of 4 M+ Axalta colors Spectrophotomer used to accurately match Mixing room has 78 different paints used to mix entire color library Mixing requires careful weight measurement Creates automobile’s color and aesthetics Provides corrosion protection Options for waterborne and solventborne Protects basecoat from the elements Gives automobile its lustrous look 54

PROPRIETARYAXALTA COATING SYSTEMS 55 Refinish Products: The Paint Layers Clearcoat Protects basecoat from the elements Gives automobile its lustrous look Basecoat Creates automobile’s color and aesthetics Provides corrosion protection Waterborne and solventborne technology options Primer Surfacer Protects automobile from visible and UV light Improves surface smoothness Increases topcoat adhesion Description of Paint Layers

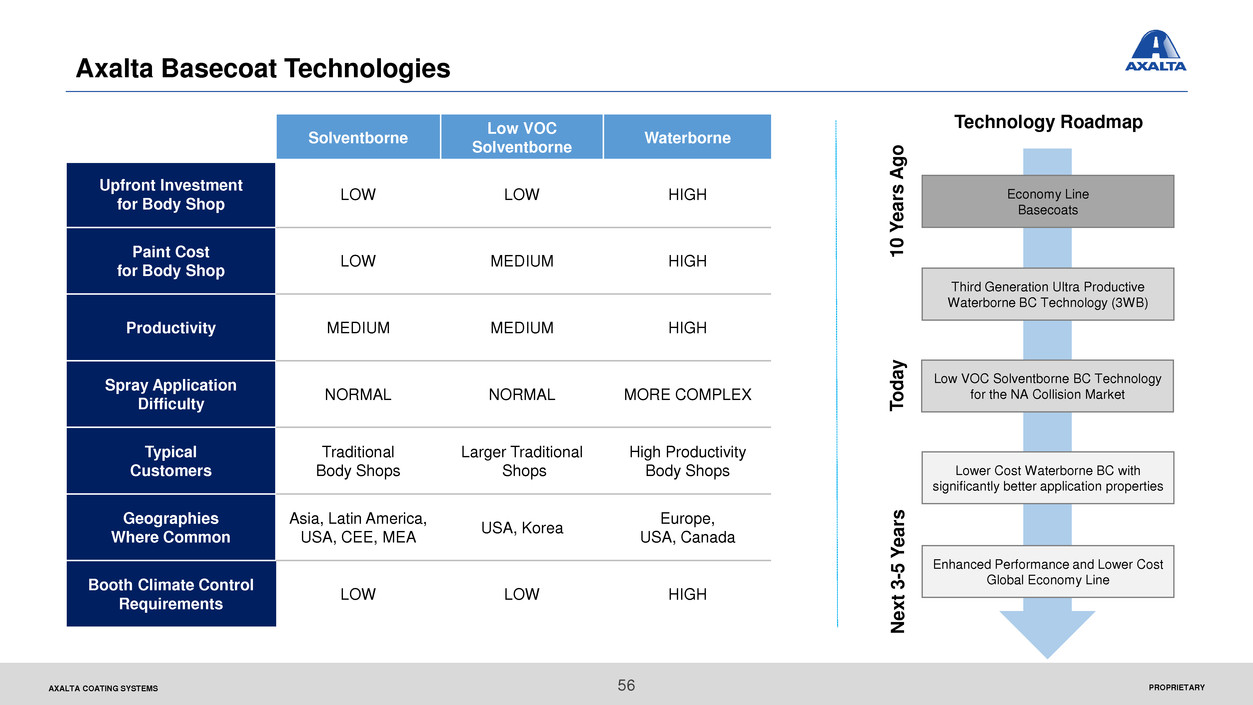

PROPRIETARYAXALTA COATING SYSTEMS Axalta Basecoat Technologies Solventborne Low VOC Solventborne Waterborne Upfront Investment for Body Shop LOW LOW HIGH Paint Cost for Body Shop LOW MEDIUM HIGH Productivity MEDIUM MEDIUM HIGH Spray Application Difficulty NORMAL NORMAL MORE COMPLEX Typical Customers Traditional Body Shops Larger Traditional Shops High Productivity Body Shops Geographies Where Common Asia, Latin America, USA, CEE, MEA USA, Korea Europe, USA, Canada Booth Climate Control Requirements LOW LOW HIGH Lower Cost Waterborne BC with significantly better application properties Low VOC Solventborne BC Technology for the NA Collision Market Enhanced Performance and Lower Cost Global Economy Line Third Generation Ultra Productive Waterborne BC Technology (3WB) Economy Line Basecoats T o d a y N ext 3 -5 Y ea rs 10 Y ea rs A g o Technology Roadmap 56

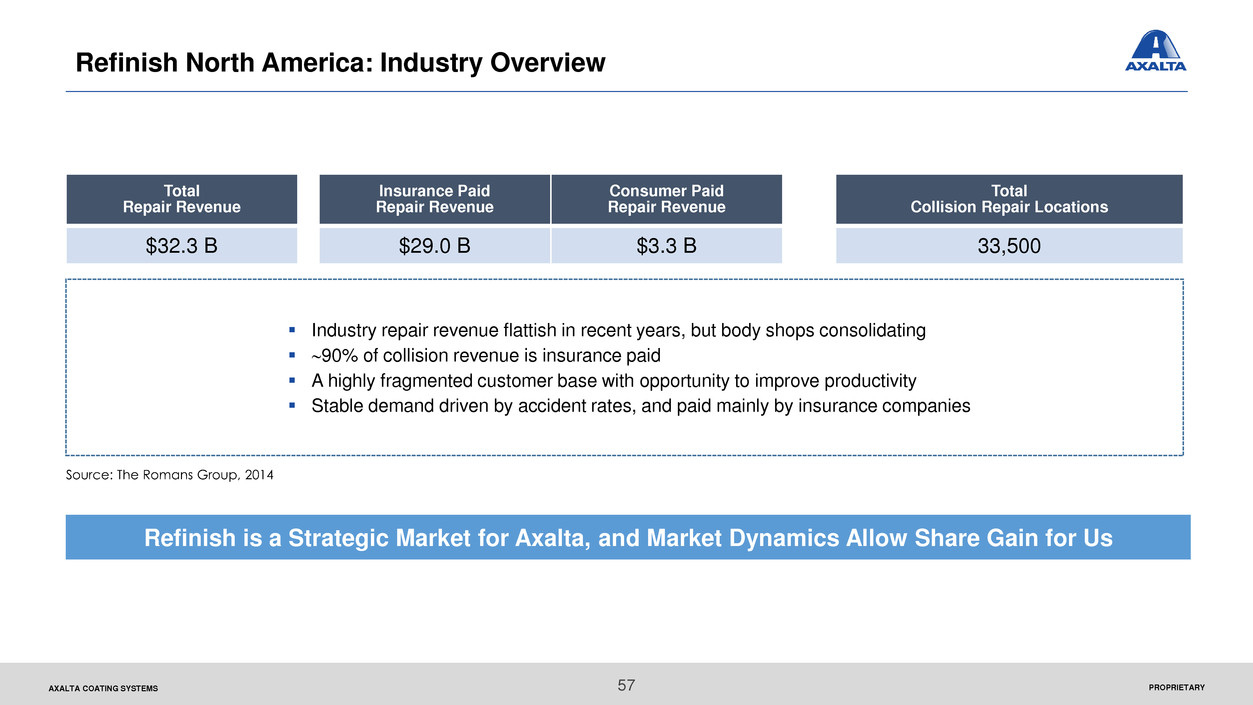

PROPRIETARYAXALTA COATING SYSTEMS Industry repair revenue flattish in recent years, but body shops consolidating 90% of collision revenue is insurance paid A highly fragmented customer base with opportunity to improve productivity Stable demand driven by accident rates, and paid mainly by insurance companies Refinish North America: Industry Overview Total Repair Revenue Insurance Paid Repair Revenue Consumer Paid Repair Revenue Total Collision Repair Locations $32.3 B $29.0 B $3.3 B 33,500 Source: The Romans Group, 2014 57 Refinish is a Strategic Market for Axalta, and Market Dynamics Allow Share Gain for Us

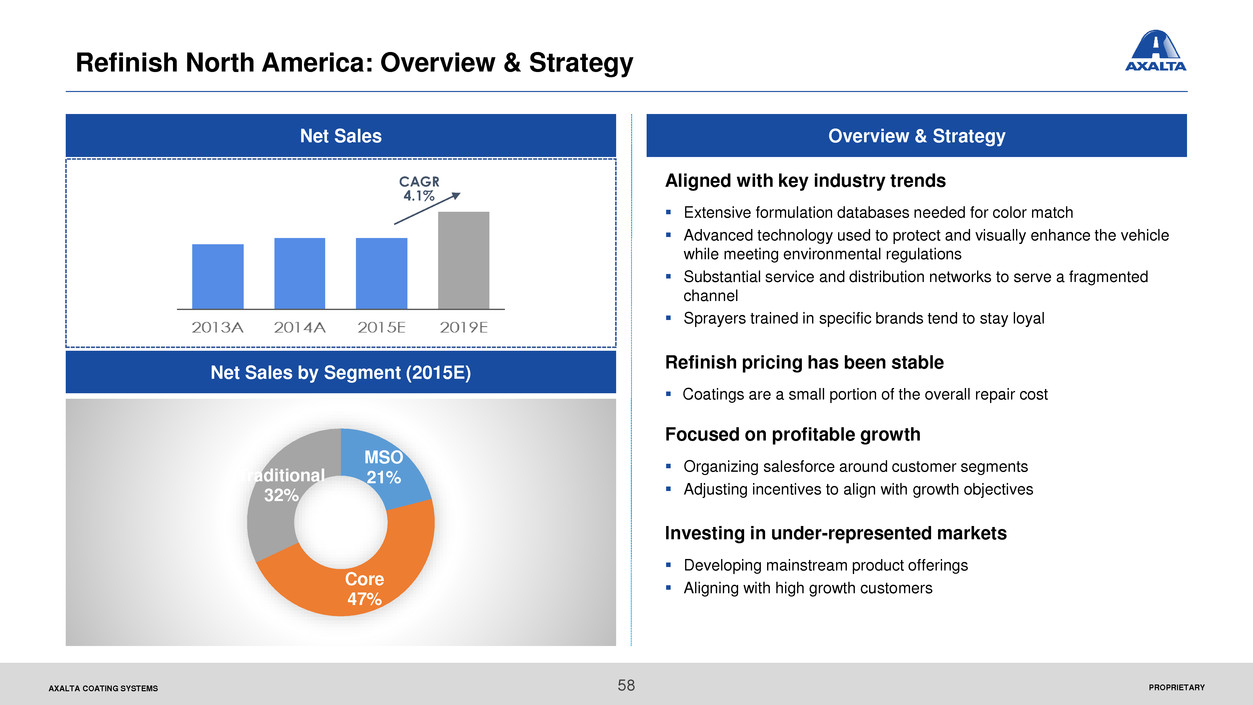

PROPRIETARYAXALTA COATING SYSTEMS Refinish North America: Overview & Strategy Overview & Strategy Aligned with key industry trends Extensive formulation databases needed for color match Advanced technology used to protect and visually enhance the vehicle while meeting environmental regulations Substantial service and distribution networks to serve a fragmented channel Sprayers trained in specific brands tend to stay loyal Refinish pricing has been stable Coatings are a small portion of the overall repair cost Focused on profitable growth Organizing salesforce around customer segments Adjusting incentives to align with growth objectives Investing in under-represented markets Developing mainstream product offerings Aligning with high growth customers Net Sales Net Sales by Segment (2015E) CAGR 4.1% MSO 21% Core 47% Traditional 32% 58

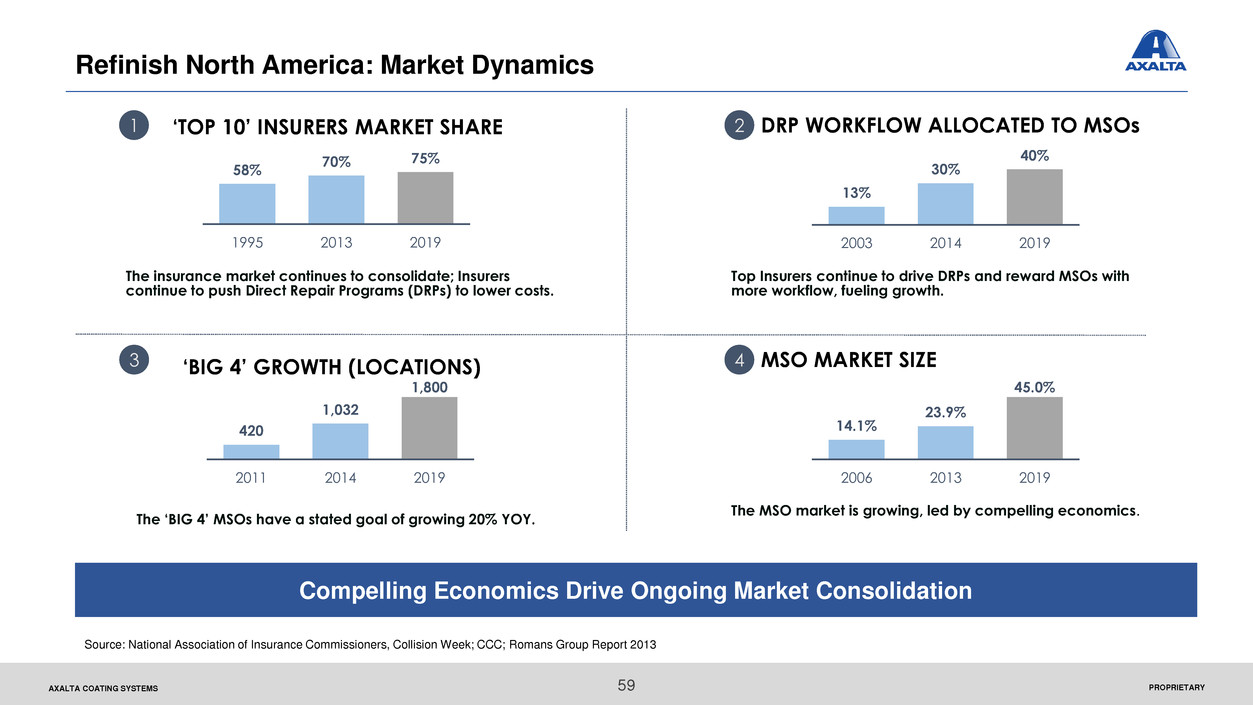

PROPRIETARYAXALTA COATING SYSTEMS ‘BIG 4’ GROWTH (LOCATIONS) DRP WORKFLOW ALLOCATED TO MSOs Refinish North America: Market Dynamics 58% 70% 75% 1995 2013 2019 1 ‘TOP 10’ INSURERS MARKET SHARE The insurance market continues to consolidate; Insurers continue to push Direct Repair Programs (DRPs) to lower costs. 13% 30% 40% 2003 2014 2019 2 Top Insurers continue to drive DRPs and reward MSOs with more workflow, fueling growth. 420 1,032 1,800 2011 2014 2019 3 The ‘BIG 4’ MSOs have a stated goal of growing 20% YOY. MSO MARKET SIZE 14.1% 23.9% 45.0% 2006 2013 2019 4 The MSO market is growing, led by compelling economics. 59 Compelling Economics Drive Ongoing Market Consolidation Source: National Association of Insurance Commissioners, Collision Week; CCC; Romans Group Report 2013

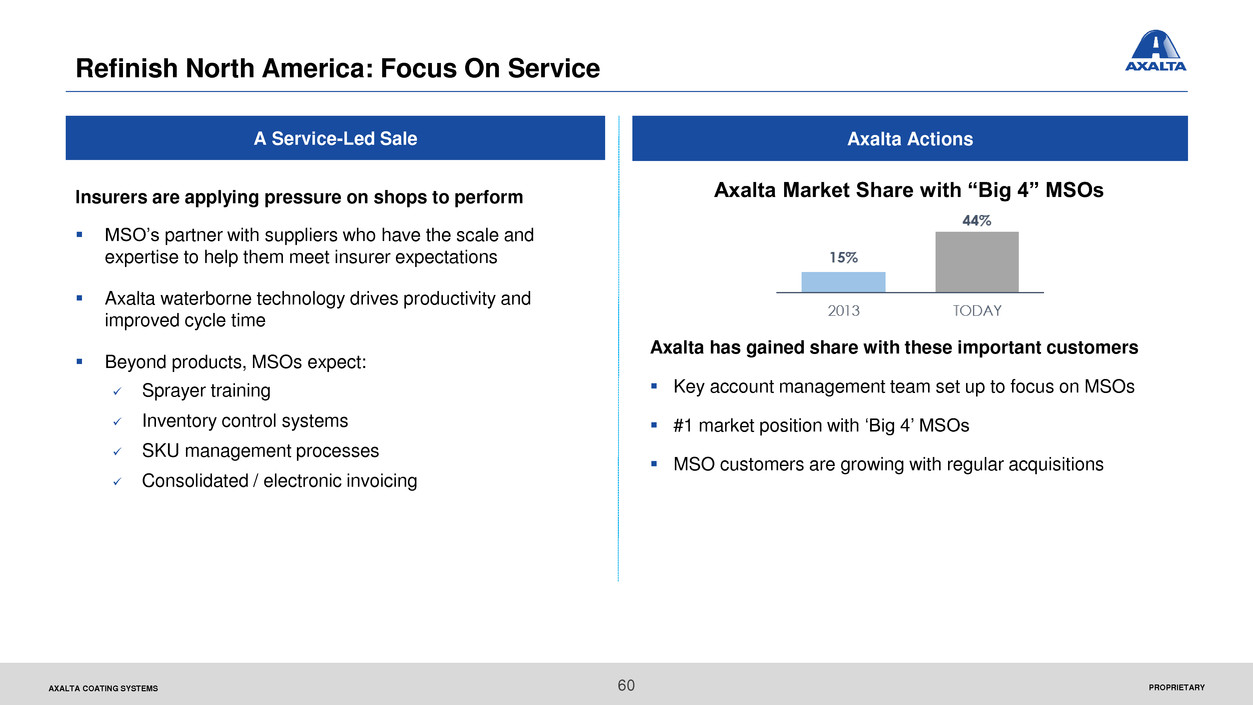

PROPRIETARYAXALTA COATING SYSTEMS Axalta Actions Axalta Market Share with “Big 4” MSOs Axalta has gained share with these important customers Key account management team set up to focus on MSOs #1 market position with ‘Big 4’ MSOs MSO customers are growing with regular acquisitions Refinish North America: Focus On Service A Service-Led Sale Insurers are applying pressure on shops to perform MSO’s partner with suppliers who have the scale and expertise to help them meet insurer expectations Axalta waterborne technology drives productivity and improved cycle time Beyond products, MSOs expect: Sprayer training Inventory control systems SKU management processes Consolidated / electronic invoicing 60

PROPRIETARYAXALTA COATING SYSTEMS Refinish EMEA: A Foundational Business For Axalta 61 A Leader In The Region A Proven Strategy The largest global refinish market (~$2.5 B) Axalta is an EMEA refinish leader, including highly productive and innovative products, a strong distribution network, and premier brands Demand is mixed, with strength in Western Europe but variable trends in the rest of EMEA Insurers are directing repairs to reduce repair cost, similar to North America Increasing demand for mainstream & economy products Gain share in less penetrated markets Expand distribution channels and lower channel costs Opportunity in CES for Axalta to gain share and expand products offered in mainstream markets Grow share in MEA sub-region M&A is a focus for the region to expand our business both horizontally and vertically

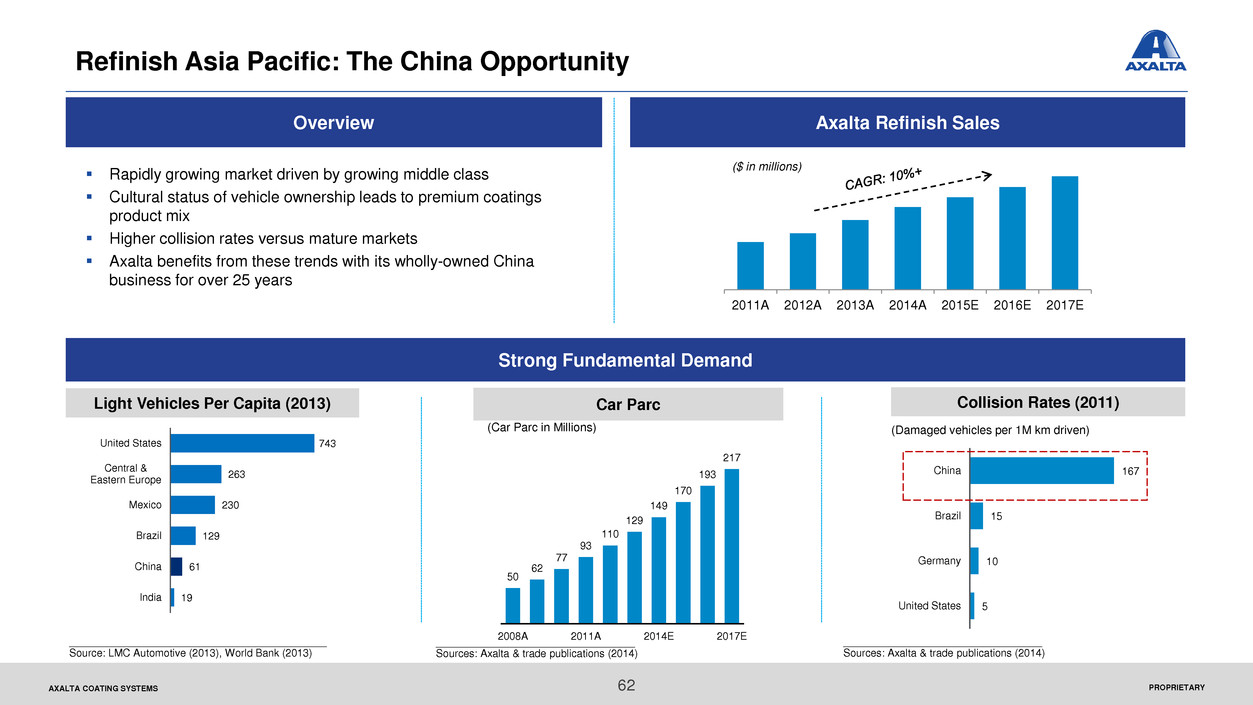

PROPRIETARYAXALTA COATING SYSTEMS Refinish Asia Pacific: The China Opportunity Overview Axalta Refinish Sales Strong Fundamental Demand Light Vehicles Per Capita (2013) Car Parc Collision Rates (2011) (Car Parc in Millions) 2011A 2012A 2013A 2014A 2015E 2016E 2017E 50 62 77 93 110 129 149 170 193 217 2008A 2011A 2014E 2017E __________________________________ Sources: Axalta & trade publications (2014) (Damaged vehicles per 1M km driven) 167 15 10 5 China Brazil Germany United States ($ in millions) Rapidly growing market driven by growing middle class Cultural status of vehicle ownership leads to premium coatings product mix Higher collision rates versus mature markets Axalta benefits from these trends with its wholly-owned China business for over 25 years 62 743 263 230 129 61 19 United States Cent al & Eastern Europe Mexico Brazil China India ____________________________________________ Source: LMC Automotive (2013), World Bank (2013) __________________________________ Sources: Axalta & trade publications (2014)

PROPRIETARYAXALTA COATING SYSTEMS Refinish Latin America: Building On A Market Leadership Position 63 A Leader In The Region A Proven Strategy A $900 M regional Refinish market Axalta is the market leader in premium coatings We have a substantial share with high productivity body shops We are growing with the MSO´s and OEM aftermarket programs leveraging our strong global brands Axalta is a leader in green technology Top position in waterborne in the region Cromax Pro is projected to grow solidly, leveraging our reputation as the premier productivity enabler Expand in underserved regions and countries Expand our distribution network Leverage existing premium products and brands Leverage our local manufacturing footprint Target and grow new segments

PROPRIETARYAXALTA COATING SYSTEMS Axalta Refinish Summary 64 A global market leader in a great business Strong market presence enables expansion across all regions Technology innovation supports competitiveness Refinish benefits from favorable market dynamics Positive drivers support projected 3% growth through 2019 Fragmented customer base and consolidated players favor stable competition Axalta has significant ongoing opportunities for growth Continue to grow with all refinish channels in North America Increase share in under-represented markets in EMEA Increasing presence in emerging markets, especially China

Performance Coatings: Industrial Coatings Michael Cash SVP, President, Industrial

PROPRIETARYAXALTA COATING SYSTEMS Axalta’s industrial coatings markets are projected to grow 5% through 2019 The market is highly fragmented with broad-based demand drivers Industrial coatings are adopting more environmentally-friendly coatings Axalta is a relatively small player today Focused on niche technologies serving a wide range of applications Currently strongest in general industrial powders and electrical insulation applications Axalta has invested to better pursue growth opportunities Disparate regional businesses now consolidated under centralized management New global leadership team is focused on leveraging our strengths and developing new products Our strategy targets above-market growth rates Industrial Coatings Investment Summary 66

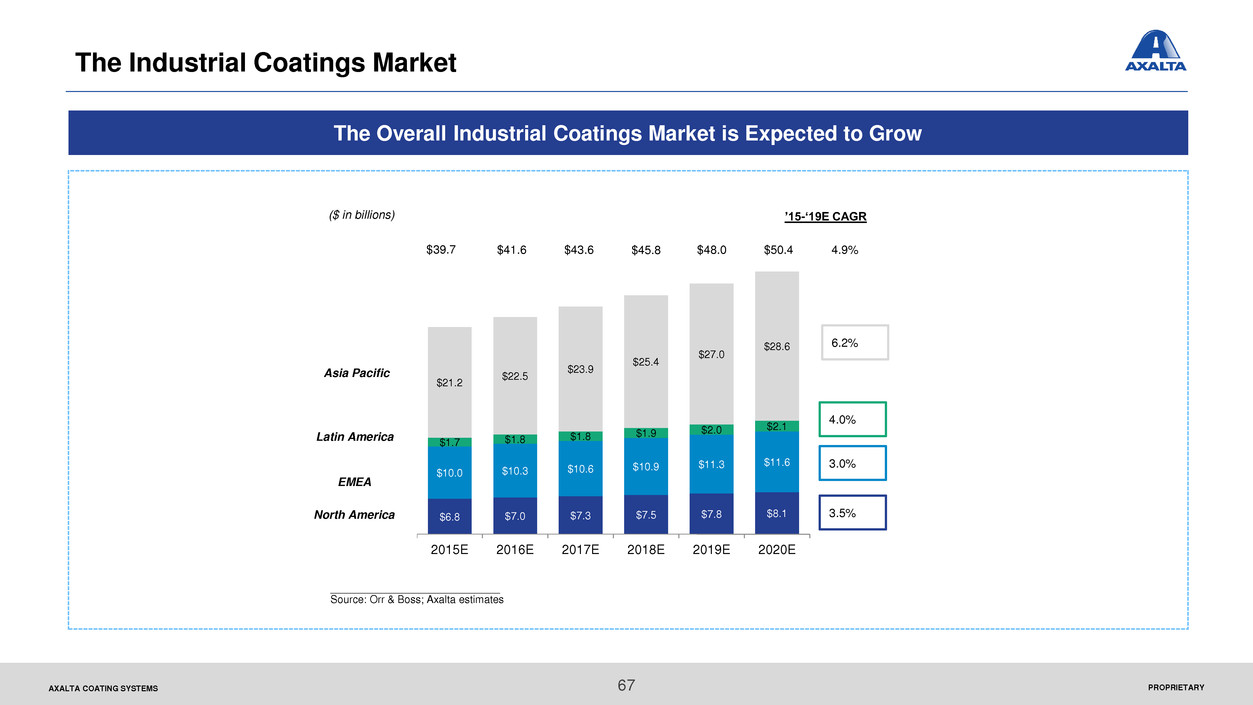

PROPRIETARYAXALTA COATING SYSTEMS ’15-‘19E CAGR($ in billions) Asia Pacific EMEA North America 6.2% 4.0% 3.0% 3.5% 4.9% $6.8 $7.0 $7.3 $7.5 $7.8 $8.1 $10.0 $10.3 $10.6 $10.9 $11.3 $11.6 $1.7 $1.8 $1.8 $1.9 $2.0 $2.1 $21.2 $22.5 $23.9 $25.4 $27.0 $28.6 2015E 2016E 2017E 2018E 2019E 2020E $50.4 _____________________________ Source: Orr & Boss; Axalta estimates Latin America $48.0$45.8$43.6$39.7 $41.6 The Overall Industrial Coatings Market is Expected to Grow The Industrial Coatings Market 67

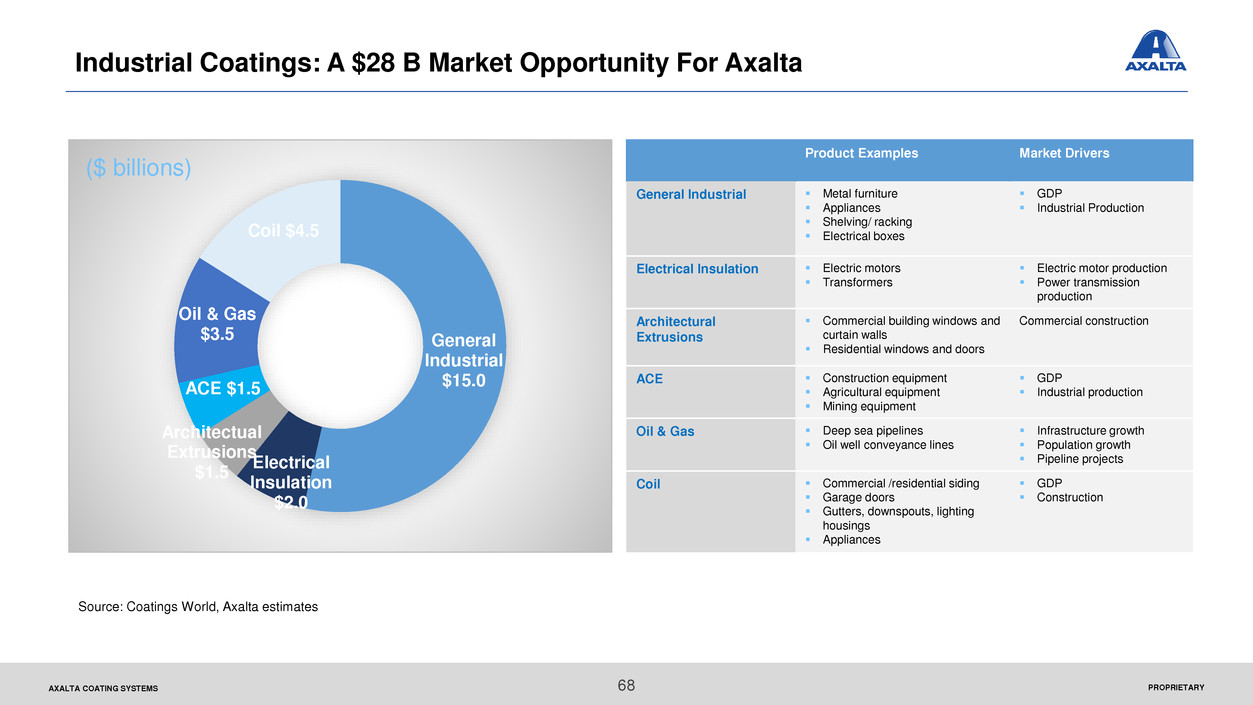

PROPRIETARYAXALTA COATING SYSTEMS General Industrial $15.0 Electrical Insulation $2.0 Architectual Extrusions $1.5 ACE $1.5 Oil & Gas $3.5 Coil $4.5 Industrial Coatings: A $28 B Market Opportunity For Axalta Product Examples Market Drivers General Industrial Metal furniture Appliances Shelving/ racking Electrical boxes GDP Industrial Production Electrical Insulation Electric motors Transformers Electric motor production Power transmission production Architectural Extrusions Commercial building windows and curtain walls Residential windows and doors Commercial construction ACE Construction equipment Agricultural equipment Mining equipment GDP Industrial production Oil & Gas Deep sea pipelines Oil well conveyance lines Infrastructure growth Population growth Pipeline projects Coil Commercial /residential siding Garage doors Gutters, downspouts, lighting housings Appliances GDP Construction Source: Coatings World, Axalta estimates ($ billions) 68

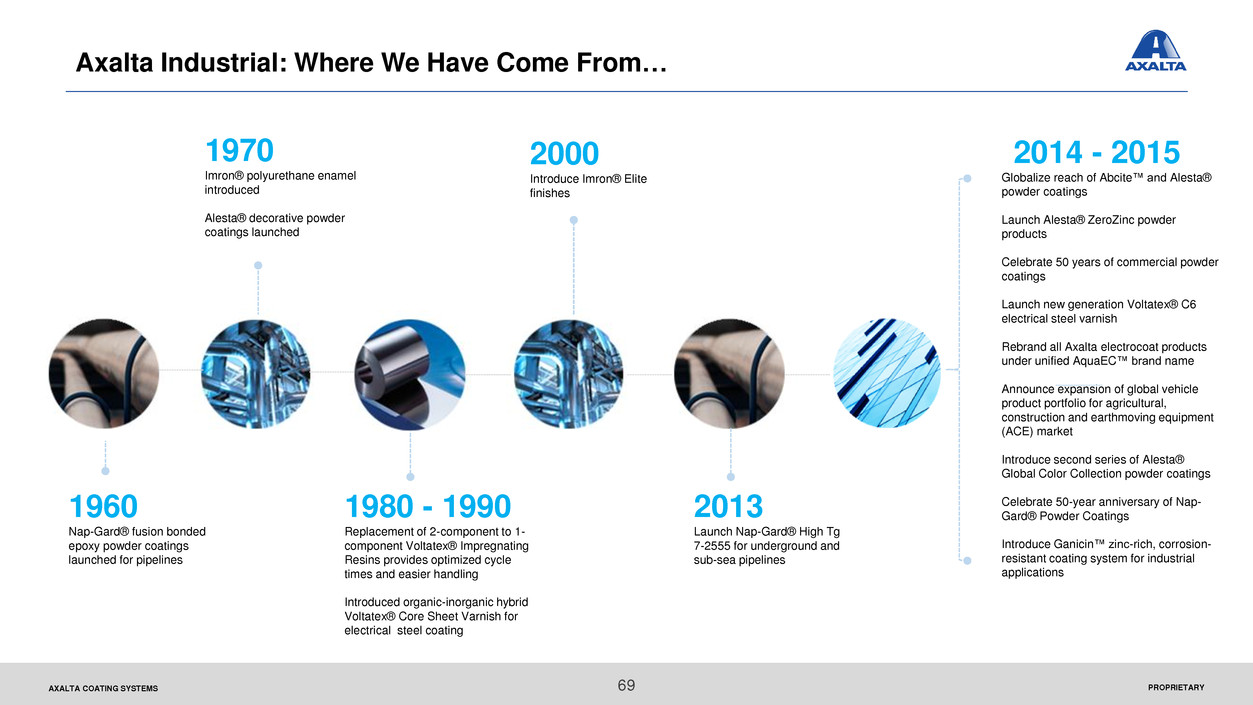

PROPRIETARYAXALTA COATING SYSTEMS 2014 - 2015 Globalize reach of Abcite™ and Alesta® powder coatings Launch Alesta® ZeroZinc powder products Celebrate 50 years of commercial powder coatings Launch new generation Voltatex® C6 electrical steel varnish Rebrand all Axalta electrocoat products under unified AquaEC™ brand name Announce expansion of global vehicle product portfolio for agricultural, construction and earthmoving equipment (ACE) market Introduce second series of Alesta® Global Color Collection powder coatings Celebrate 50-year anniversary of Nap- Gard® Powder Coatings Introduce Ganicin™ zinc-rich, corrosion- resistant coating system for industrial applications 1960 Nap-Gard® fusion bonded epoxy powder coatings launched for pipelines 2000 Introduce Imron® Elite finishes 1970 Imron® polyurethane enamel introduced Alesta® decorative powder coatings launched 1980 - 1990 Replacement of 2-component to 1- component Voltatex® Impregnating Resins provides optimized cycle times and easier handling Introduced organic-inorganic hybrid Voltatex® Core Sheet Varnish for electrical steel coating 2013 Launch Nap-Gard® High Tg 7-2555 for underground and sub-sea pipelines Axalta Industrial: Where We Have Come From… 69

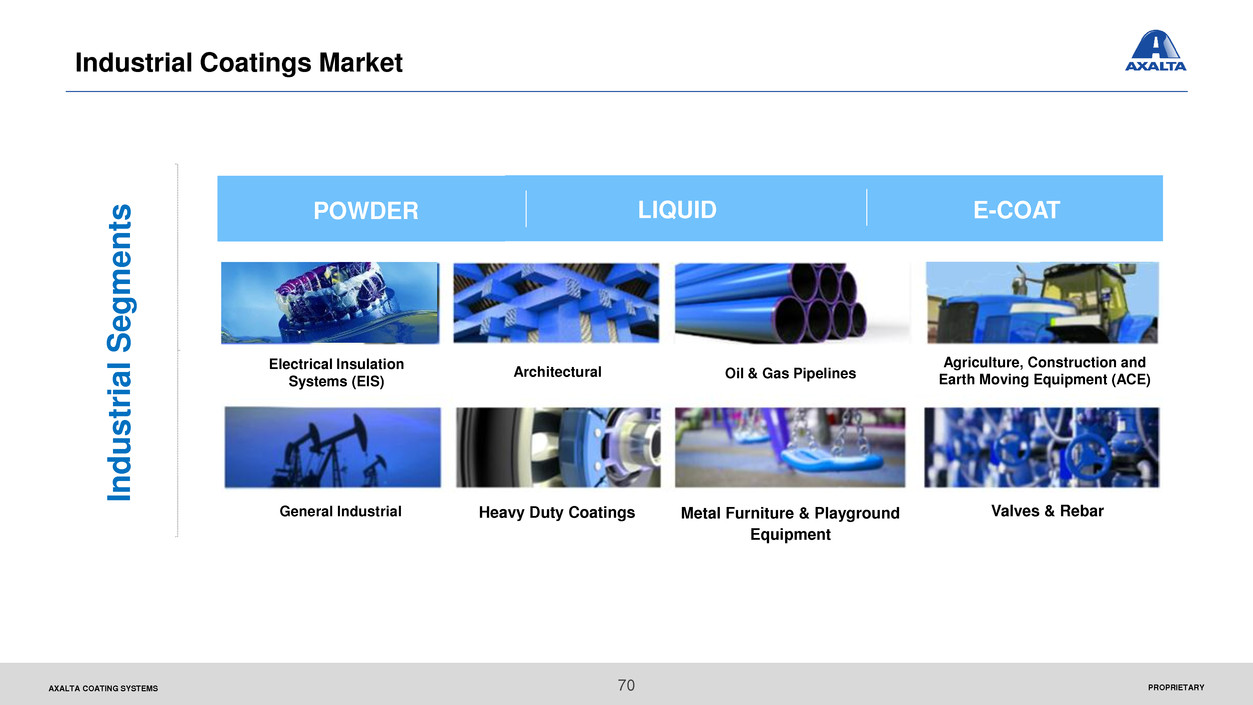

PROPRIETARYAXALTA COATING SYSTEMS Architectural Industr ial S e gment s Electrical Insulation Systems (EIS) Oil & Gas Pipelines Agriculture, Construction and Earth Moving Equipment (ACE) General Industrial Heavy Duty Coatings Metal Furniture & Playground Equipment Valves & Rebar LIQUIDPOWDER E-COAT Industrial Coatings Market 70

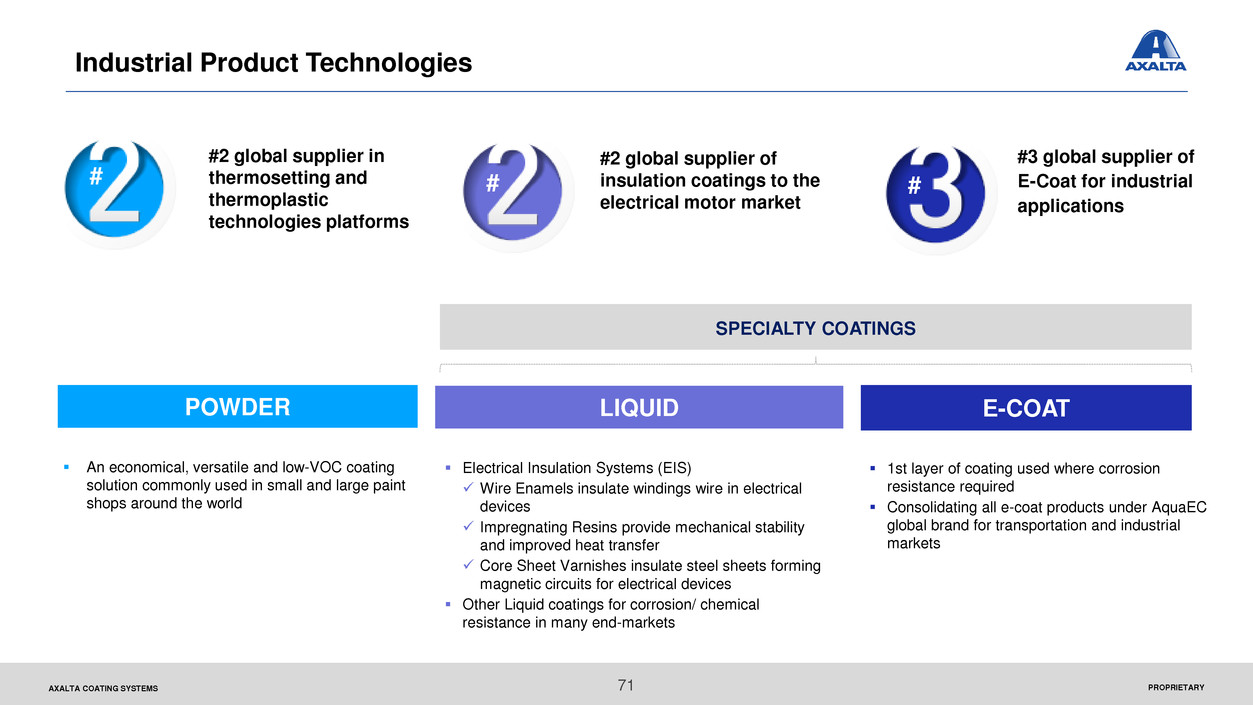

PROPRIETARYAXALTA COATING SYSTEMS An economical, versatile and low-VOC coating solution commonly used in small and large paint shops around the world POWDER LIQUID E-COAT SPECIALTY COATINGS Electrical Insulation Systems (EIS) Wire Enamels insulate windings wire in electrical devices Impregnating Resins provide mechanical stability and improved heat transfer Core Sheet Varnishes insulate steel sheets forming magnetic circuits for electrical devices Other Liquid coatings for corrosion/ chemical resistance in many end-markets 1st layer of coating used where corrosion resistance required Consolidating all e-coat products under AquaEC global brand for transportation and industrial markets #2 global supplier in thermosetting and thermoplastic technologies platforms #2 global supplier of insulation coatings to the electrical motor market #3 global supplier of E-Coat for industrial applications # ## Industrial Product Technologies 71

PROPRIETARYAXALTA COATING SYSTEMS Live application support Durability & corrosion protection Lean manufacturing and quick response Diverse set of technologies: E-Coat, Powder, Liquid Ability to service customers consistently in all parts of the world What Industrial Coatings Customers Value 72

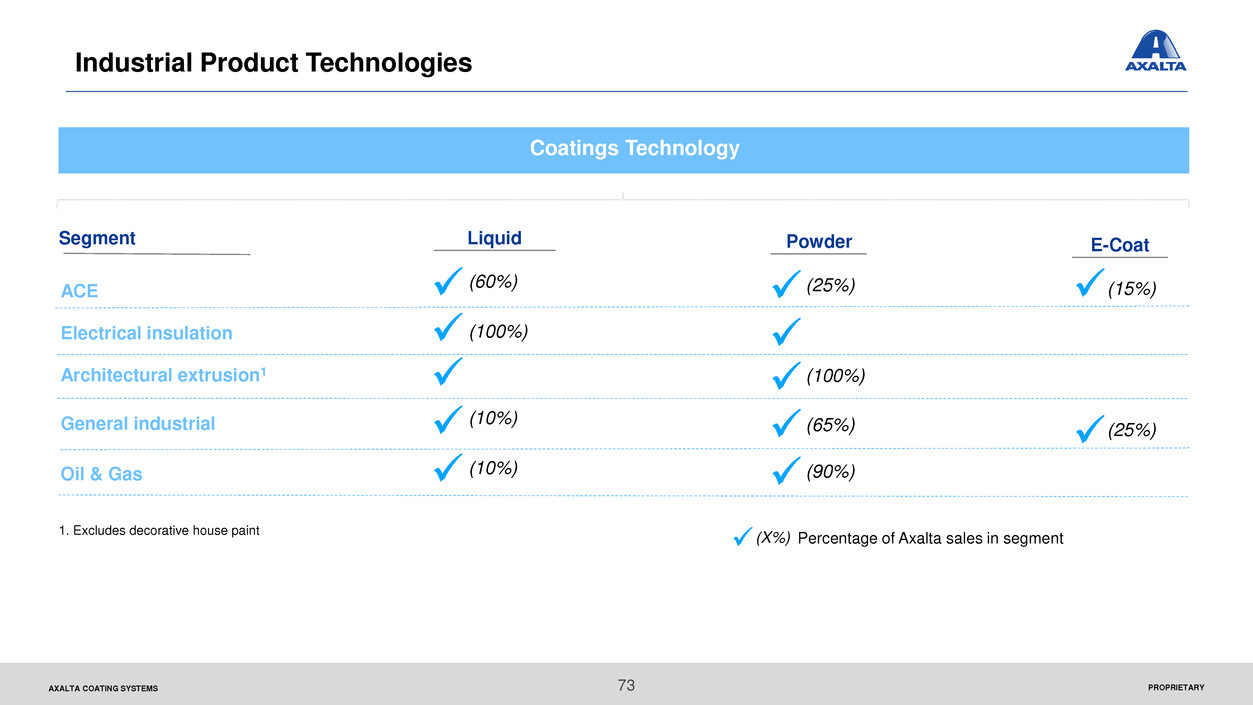

PROPRIETARYAXALTA COATING SYSTEMS Segment Coatings Technology 1. Excludes decorative house paint (X%) Percentage of Axalta sales in segment Architectural extrusion1 General industrial Oil & Gas ACE Electrical insulation E-Coat (25%) (15%) PowderLiquid (10%) (10%) (100%) (60%) (90%) (65%) (25%) (100%) Industrial Product Technologies 73

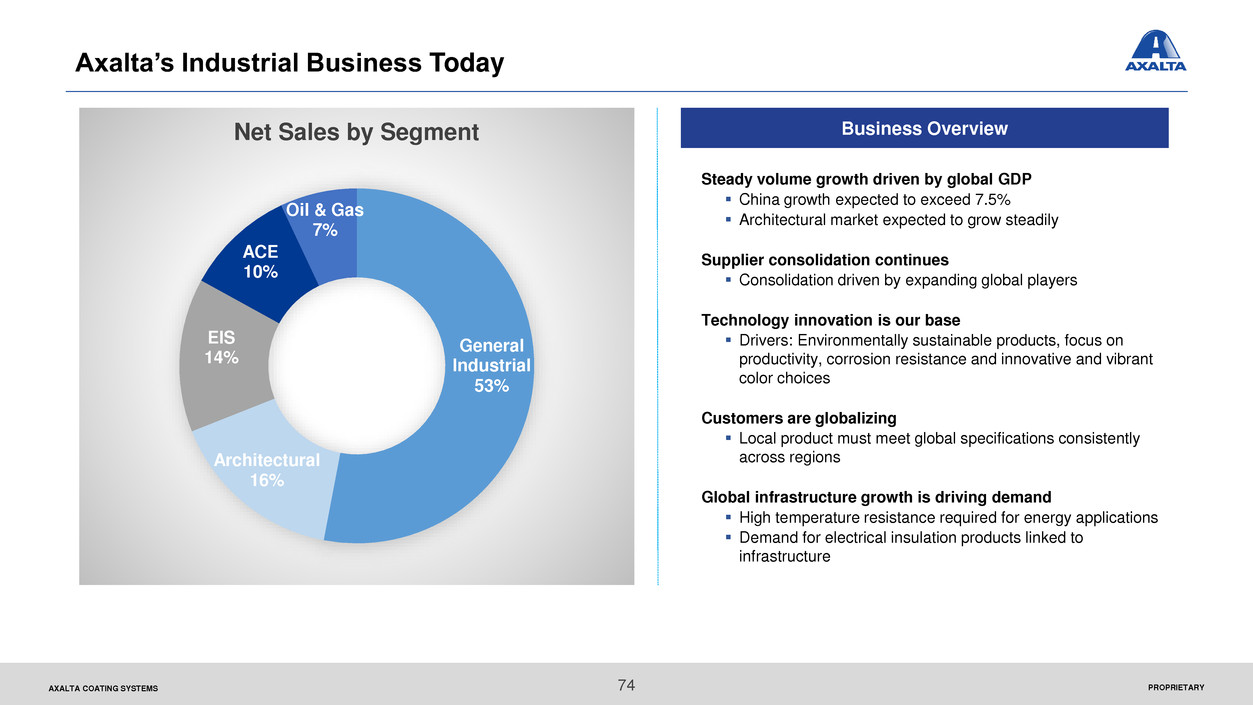

PROPRIETARYAXALTA COATING SYSTEMS General Industrial 53% Architectural 16% EIS 14% ACE 10% Oil & Gas 7% Net Sales by Segment Business Overview Steady volume growth driven by global GDP China growth expected to exceed 7.5% Architectural market expected to grow steadily Supplier consolidation continues Consolidation driven by expanding global players Technology innovation is our base Drivers: Environmentally sustainable products, focus on productivity, corrosion resistance and innovative and vibrant color choices Customers are globalizing Local product must meet global specifications consistently across regions Global infrastructure growth is driving demand High temperature resistance required for energy applications Demand for electrical insulation products linked to infrastructure Axalta’s Industrial Business Today 74

PROPRIETARYAXALTA COATING SYSTEMS South AfricaMexico Colombia United Kingdom China USA Brazil IndiaAustralia Venezuela Guatemala Indonesia Malaysia Sweden GermanyArgentina Axalta Industrial Coatings: Manufacturing Sites 75

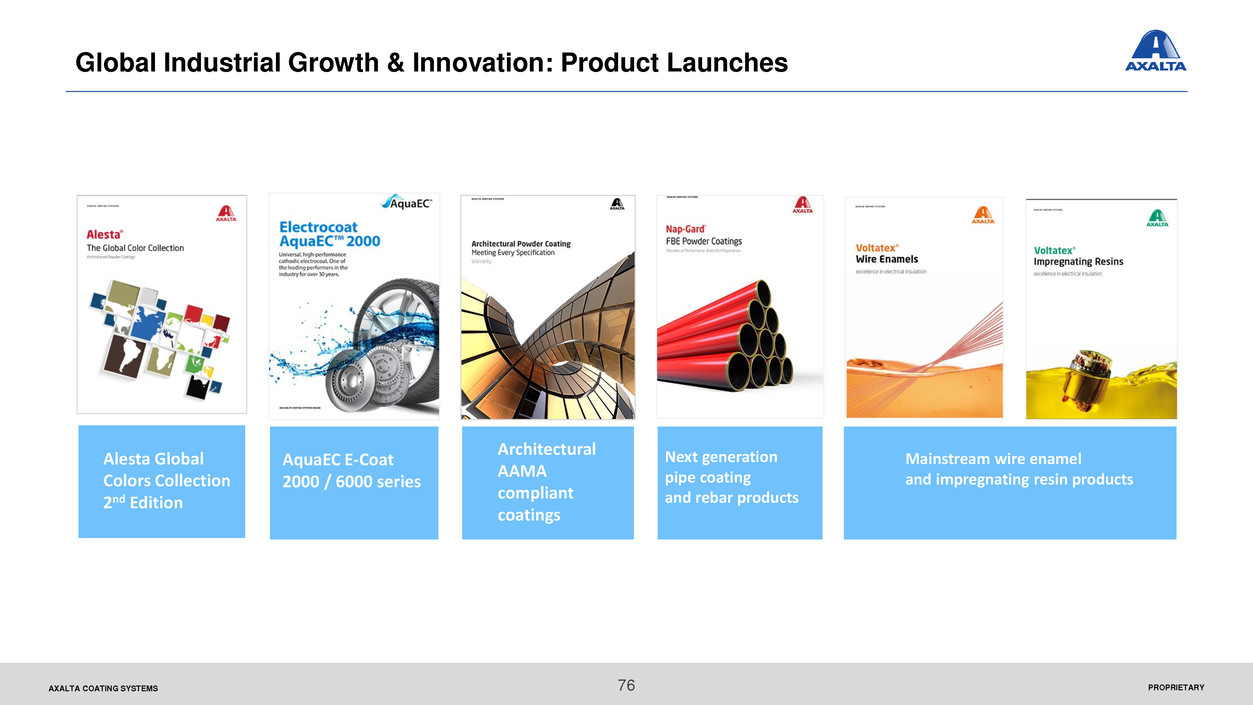

PROPRIETARYAXALTA COATING SYSTEMS AquaEC E-Coat 2000 / 6000 series Alesta Global Colors Collection 2nd Edition Global Industrial Growth & Innovation: Product Launches Architectural AAMA compliant coatings Next generation pipe coating and rebar products Mainstream wire enamel and impregnating resin products 76

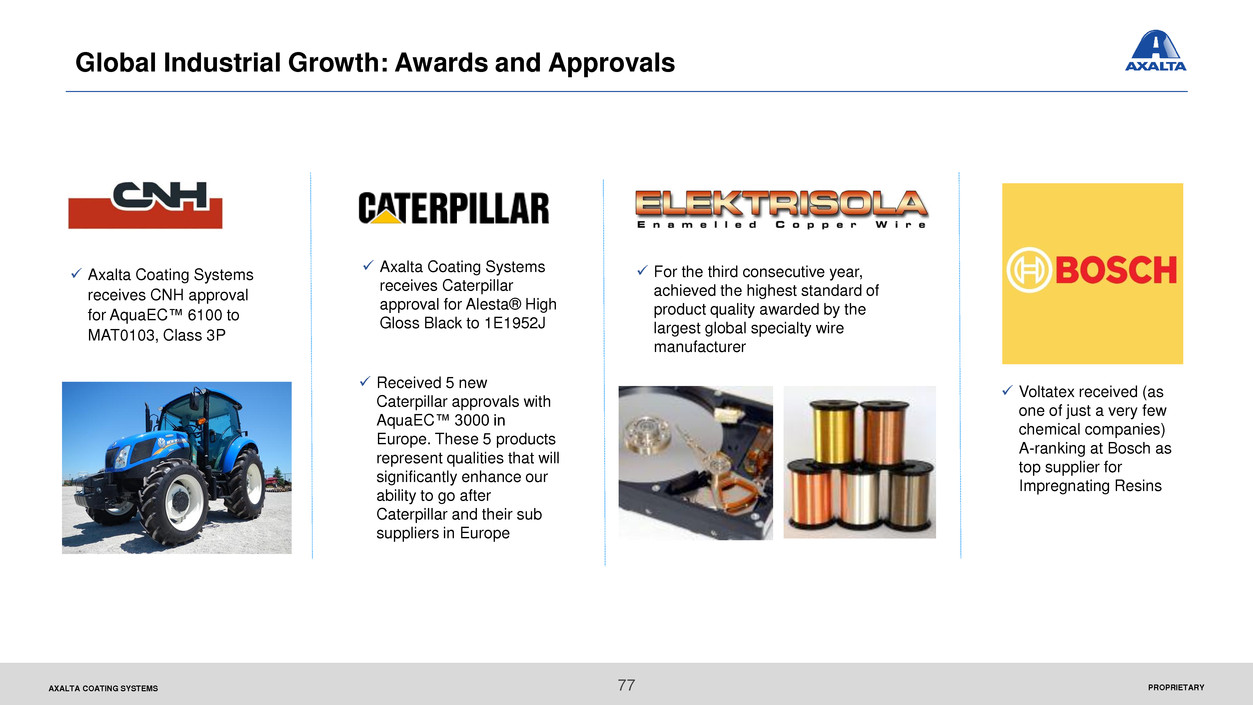

PROPRIETARYAXALTA COATING SYSTEMS Global Industrial Growth: Awards and Approvals Received 5 new Caterpillar approvals with AquaEC™ 3000 in Europe. These 5 products represent qualities that will significantly enhance our ability to go after Caterpillar and their sub suppliers in Europe Axalta Coating Systems receives CNH approval for AquaEC™ 6100 to MAT0103, Class 3P Axalta Coating Systems receives Caterpillar approval for Alesta® High Gloss Black to 1E1952J Voltatex received (as one of just a very few chemical companies) A-ranking at Bosch as top supplier for Impregnating Resins For the third consecutive year, achieved the highest standard of product quality awarded by the largest global specialty wire manufacturer 77

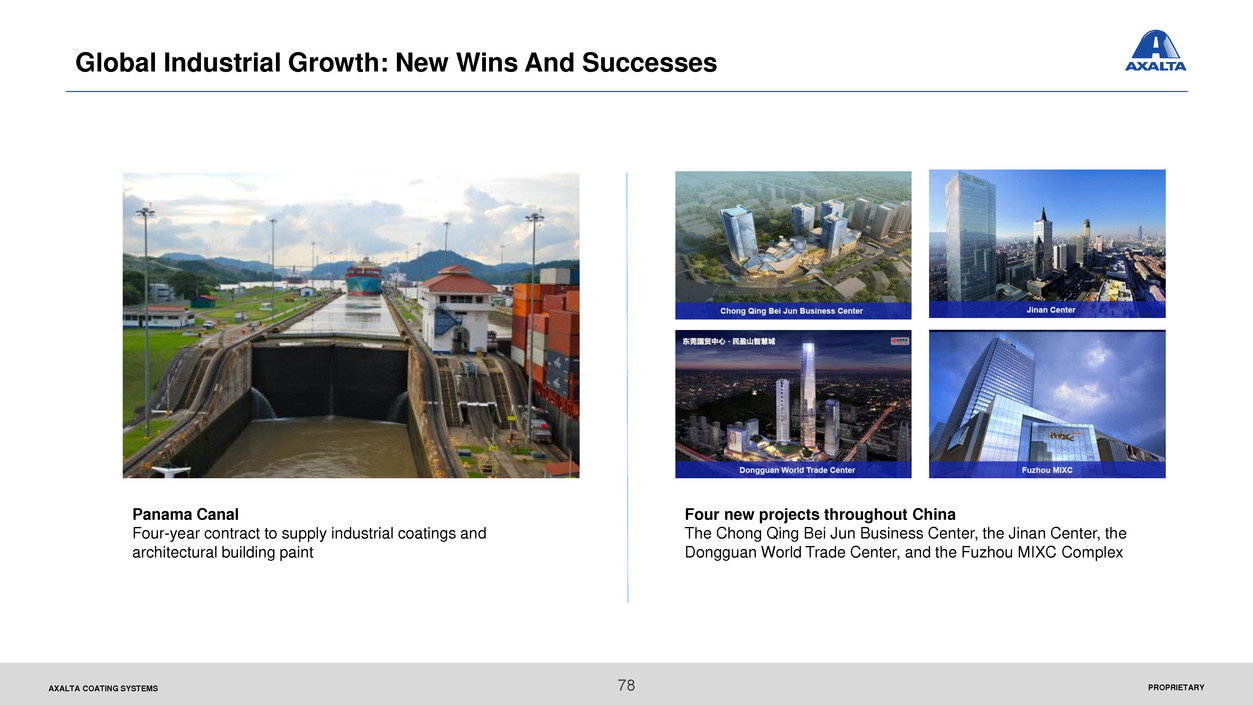

PROPRIETARYAXALTA COATING SYSTEMS Global Industrial Growth: New Wins And Successes Four new projects throughout China The Chong Qing Bei Jun Business Center, the Jinan Center, the Dongguan World Trade Center, and the Fuzhou MIXC Complex Panama Canal Four-year contract to supply industrial coatings and architectural building paint 78

PROPRIETARYAXALTA COATING SYSTEMS Weber Won six colors for Weber’s Q series grills First time a Hi-Temp powder technology produced such unique colors Leveraged Q series success to win Weber’s Hi-Temp frame business Shanghai Electric Group One of the largest mechanical and electrical equipment manufacturing enterprises in China Winona PVD Coatings Partner with Winona PVD Coatings in creating bright wheels solution for the Ford F-150 trucks Global Industrial Growth: New Wins And Successes 79

PROPRIETARYAXALTA COATING SYSTEMS Growth Priorities & Strategies Axalta Industrial: Where We Are Going… Agriculture, Construction & Earth Moving Equipment (ACE) Expand approval portfolio with all 3 technologies Utilize global footprint to target new business in all regions Architectural Market our powder coatings to architects (an environmentally friendly alternative) Expand color range to compete with liquid alternatives Electrical Insulation Systems (EIS) Continue to build global capability Target sub-segments with above average growth rates Oil & Gas Build on leading technology position for exterior pipe coatings Establish strong global network to service end users / specifiers General Industrial Accelerate globalization of key GI sub-segments Develop industry leadership in high durability, corrosion – resistant coatings 80

PROPRIETARYAXALTA COATING SYSTEMS Summary Of Key Messages 81 Industrial coatings represents a great growth engine opportunity Our growth will be both organic and acquisition-driven We are building on strengths in technology and market access We have built a customer-centric industrial sales organization Our technology and responsiveness are the keys to winning

Transportation Coatings Overview Steven R. Markevich EVP, President Transportation Coatings and Greater China

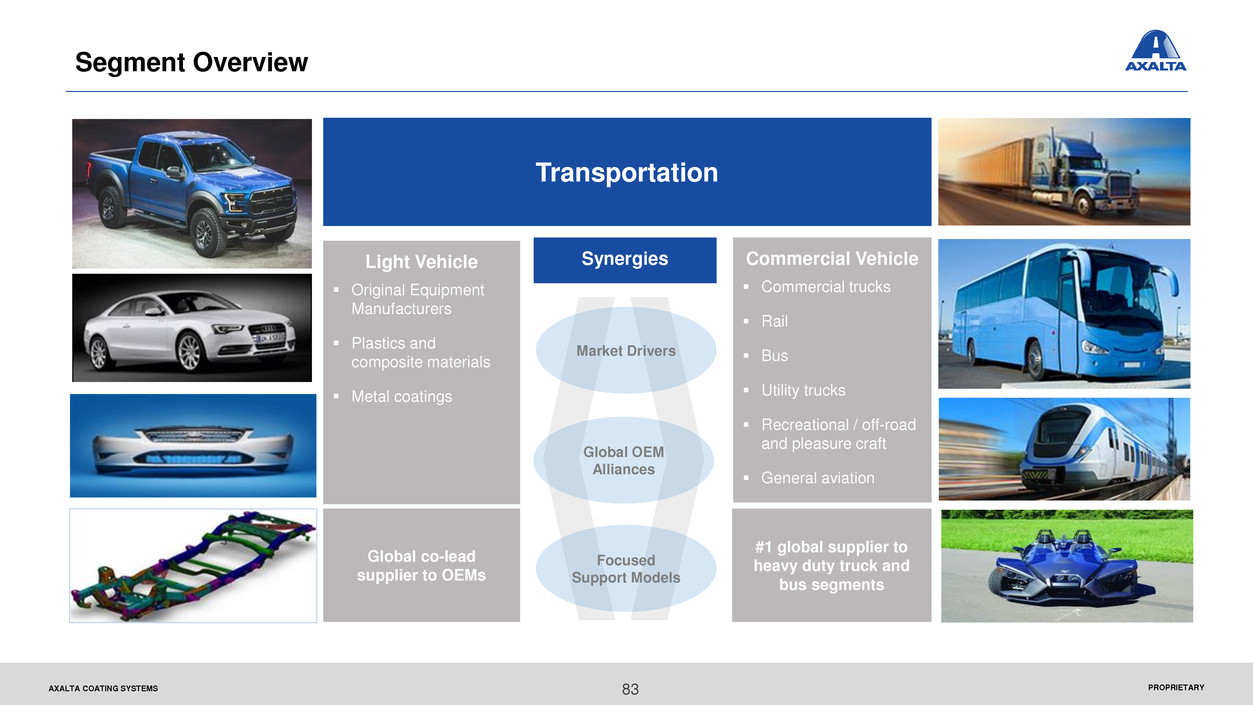

PROPRIETARYAXALTA COATING SYSTEMS Segment Overview Global co-lead supplier to OEMs Transportation Light Vehicle Original Equipment Manufacturers Plastics and composite materials Metal coatings #1 global supplier to heavy duty truck and bus segments Commercial Vehicle Commercial trucks Rail Bus Utility trucks Recreational / off-road and pleasure craft General aviation 83 Synergies Global OEM Alliances Focused Support Models Market Drivers

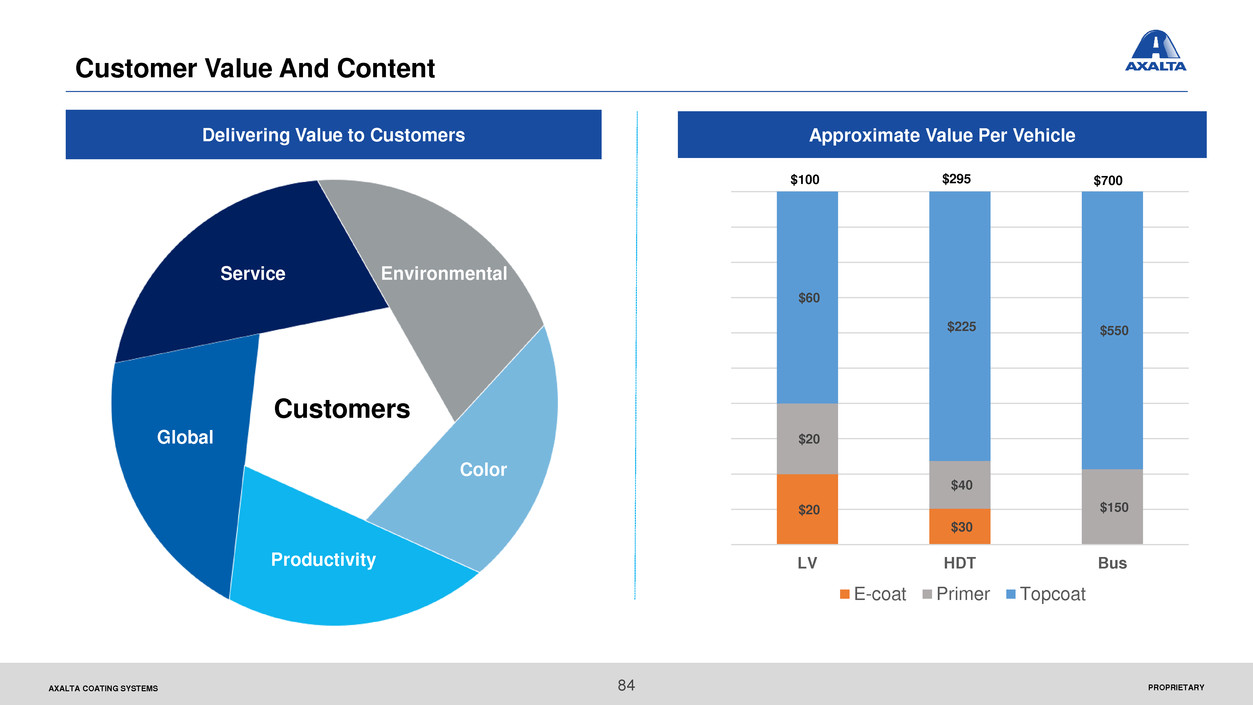

PROPRIETARYAXALTA COATING SYSTEMS Customer Value And Content Approximate Value Per Vehicle Customers Global 84 Productivity Color Service Environmental Delivering Value to Customers $20 $30 $20 $40 $150 $60 $225 $550 LV HDT Bus E-coat Primer Topcoat $100 $295 $700

PROPRIETARYAXALTA COATING SYSTEMS 19% global light vehicle market share with strong OEM relationships in all regions #1 player globally in heavy duty truck and bus Extensive portfolio of technologies fit for purpose in each market Showing results to date through business wins and global launches Strong earnings contribution underscores focus on profitable growth Capacity investments to support growth in all regions Moved from regional structure to global leadership Improved alignment with strategic and underserved customers Building capability and footprint in high growth regions Expanding global brand strategy Demand drivers include Global GDP Vehicle replacement cycles Growth in emerging markets Infrastructure spending 85 Transportation Summary The global transportation market is projected to grow ~3.4% CAGR through 2019 Axalta is actively transforming its business for profitable growth Axalta is a leading global OEM coatings provider Progress to date has been strong

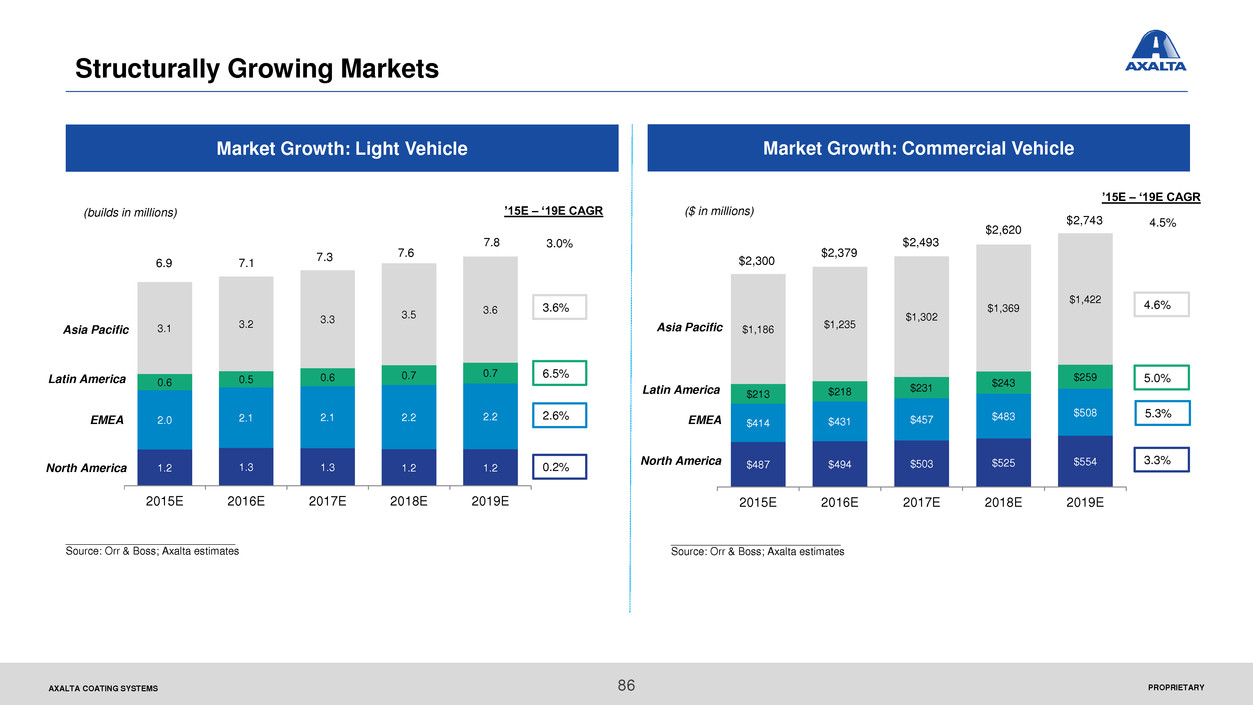

PROPRIETARYAXALTA COATING SYSTEMS Structurally Growing Markets 86 Market Growth: Light Vehicle Market Growth: Commercial Vehicle _____________________________ Source: Orr & Boss; Axalta estimates Asia Pacific Latin America EMEA North America 3.6% 6.5% 2.6% 0.2% 3.0% 1.2 1.3 1.3 1.2 1.2 2.0 2.1 2.1 2.2 2.2 0.6 0.5 0.6 0.7 0.7 3.1 3.2 3.3 3.5 3.6 2015E 2016E 2017E 2018E 2019E (builds in millions) 7.8 ’15E – ‘19E CAGR 7.67.3 7.16.9 ($ in millions) Asia Pacific EMEA North America 4.6% 5.0% 5.3% 3.3% 4.5% $487 $494 $503 $525 $554 $414 $431 $457 $483 $508 $213 $218 $231 $243 $259 $1,186 $1,235 $1,302 $1,369 $1,422 2015E 2016E 2017E 2018E 2019E ’15E – ‘19E CAGR $2,743 _____________________________ Source: Orr & Boss; Axalta estimates Latin America $2,620 $2,493 $2,379 $2,300

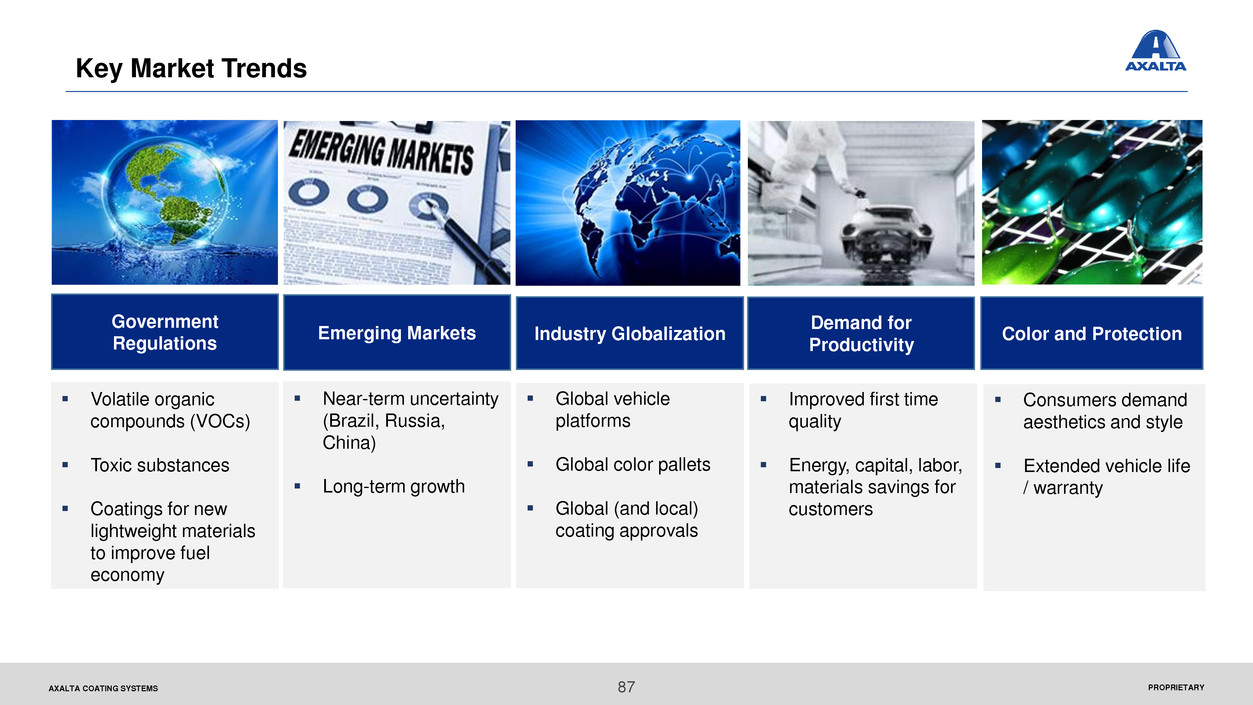

PROPRIETARYAXALTA COATING SYSTEMS 87 Key Market Trends Volatile organic compounds (VOCs) Toxic substances Coatings for new lightweight materials to improve fuel economy Government Regulations Emerging Markets Industry Globalization Demand for Productivity Color and Protection Near-term uncertainty (Brazil, Russia, China) Long-term growth Global vehicle platforms Global color pallets Global (and local) coating approvals Improved first time quality Energy, capital, labor, materials savings for customers Consumers demand aesthetics and style Extended vehicle life / warranty

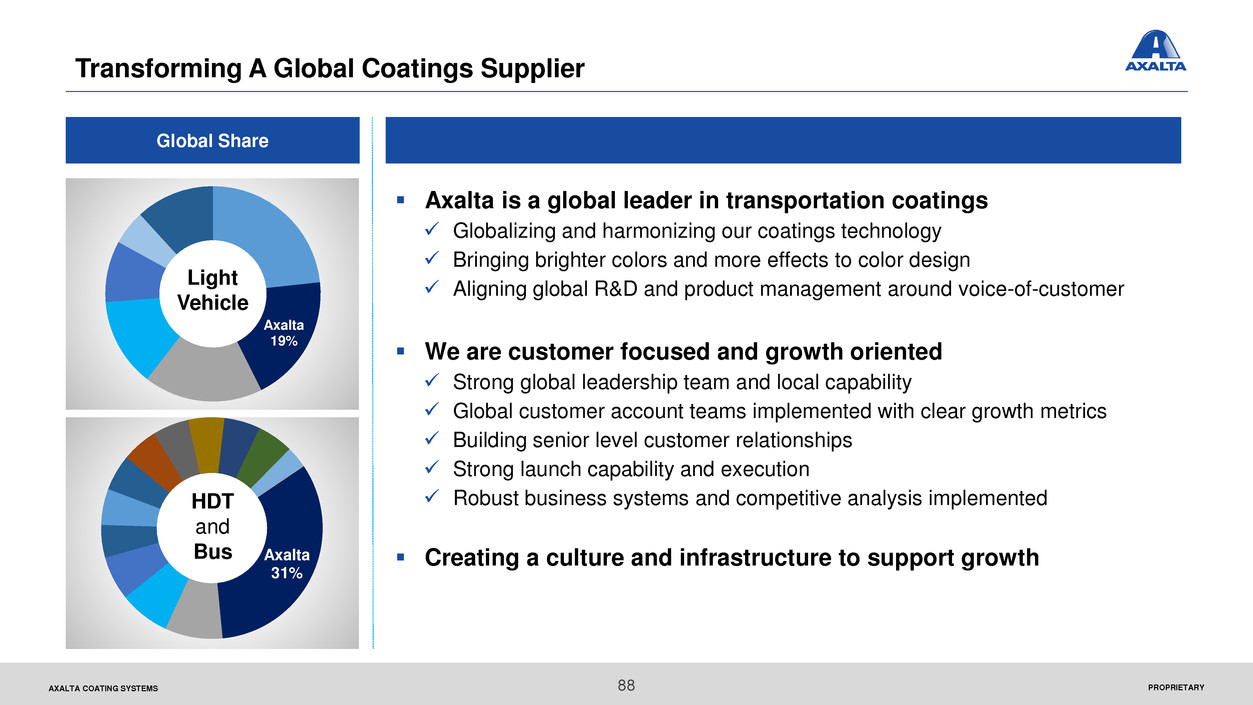

PROPRIETARYAXALTA COATING SYSTEMS Axalta 19% Transforming A Global Coatings Supplier Global Share 88 Axalta 31% Axalta is a global leader in transportation coatings Globalizing and harmonizing our coatings technology Bringing brighter colors and more effects to color design Aligning global R&D and product management around voice-of-customer We are customer focused and growth oriented Strong global leadership team and local capability Global customer account teams implemented with clear growth metrics Building senior level customer relationships Strong launch capability and execution Robust business systems and competitive analysis implemented Creating a culture and infrastructure to support growth HDT and Bus Light Vehicle

PROPRIETARYAXALTA COATING SYSTEMS Vision Is Above-Market Growth Gain share with existing customers Grow underserved customers and regions Align product technology to evolving customer and market needs Increase content per vehicle Leverage “what good looks like” into new regions, customers and markets Strategies Key Tactics / Programs Build capabilities in global and regional roles Expand decorative and functional coatings Best-in-class line service excellence Localize supply chain ensuring competitive cost structure Drive complexity management discipline The Axalta Way: “run it like we own it” 89

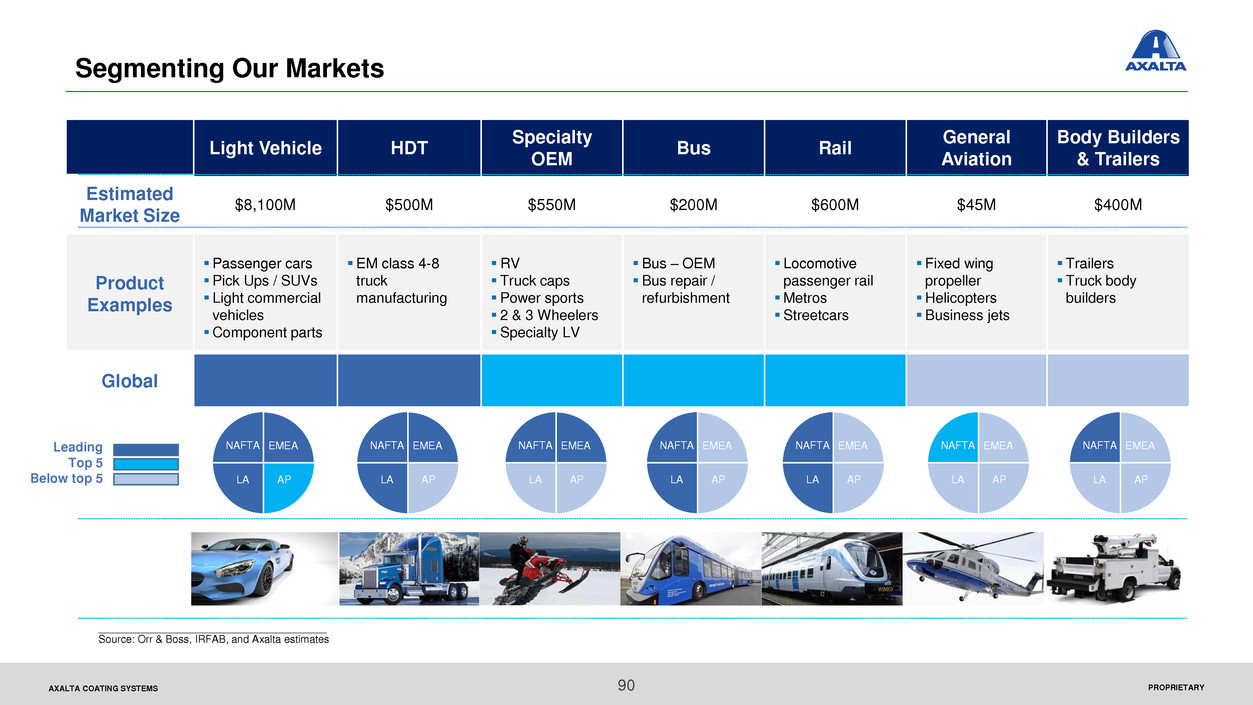

PROPRIETARYAXALTA COATING SYSTEMS Segmenting Our Markets Light Vehicle HDT Specialty OEM Bus Rail General Aviation Body Builders & Trailers Estimated Market Size $8,100M $500M $550M $200M $600M $45M $400M Product Examples Passenger cars Pick Ups / SUVs Light commercial vehicles Component parts EM class 4-8 truck manufacturing RV Truck caps Power sports 2 & 3 Wheelers Specialty LV Bus – OEM Bus repair / refurbishment Locomotive passenger rail Metros Streetcars Fixed wing propeller Helicopters Business jets Trailers Truck body builders Global EMEA APLA NAFTA EMEA APLA NAFTA EMEA APLA NAFTAEMEA APLA NAFTA _______________________________________ Source: Orr & Boss, IRFAB, and Axalta estimates Leading Top 5 Below top 5 EMEA APLA NAFTA EMEA APLA NAFTA EMEA APLA NAFTA 90

PROPRIETARYAXALTA COATING SYSTEMS 91 We Are Growing With Segment Specific Strategies In Our Target Markets China expansion to mainstream and economy segments Leverage high speed rail success SprayFlex FS interior floor coatings Leverage global accounts Gain share in tier part suppliers China growth via Kinlita JV China HDT volume is three times NA Leverage Imron® branded offering Differentiation through strong HDT color leverage Developing a segment-focused distribution strategy Grow in automotive parts market China expansion through domestic OEMs AP expansion beyond China Gain approvals with underserved customers Strengthen service capability Expand 2-wheeler success in Brazil to other regions Leverage Imron® branded offering Segment-focused color strategy Light Vehicle Specialty OEM General Aviation Heavy Duty Truck (HDT) Bus and Rail Body Builders / Trailers Leverage approvals with Textron, Gulfstream, etc. Expand color palette for high value applications Align Imron® brands and offerings to segment Strategic alignments and capabilities

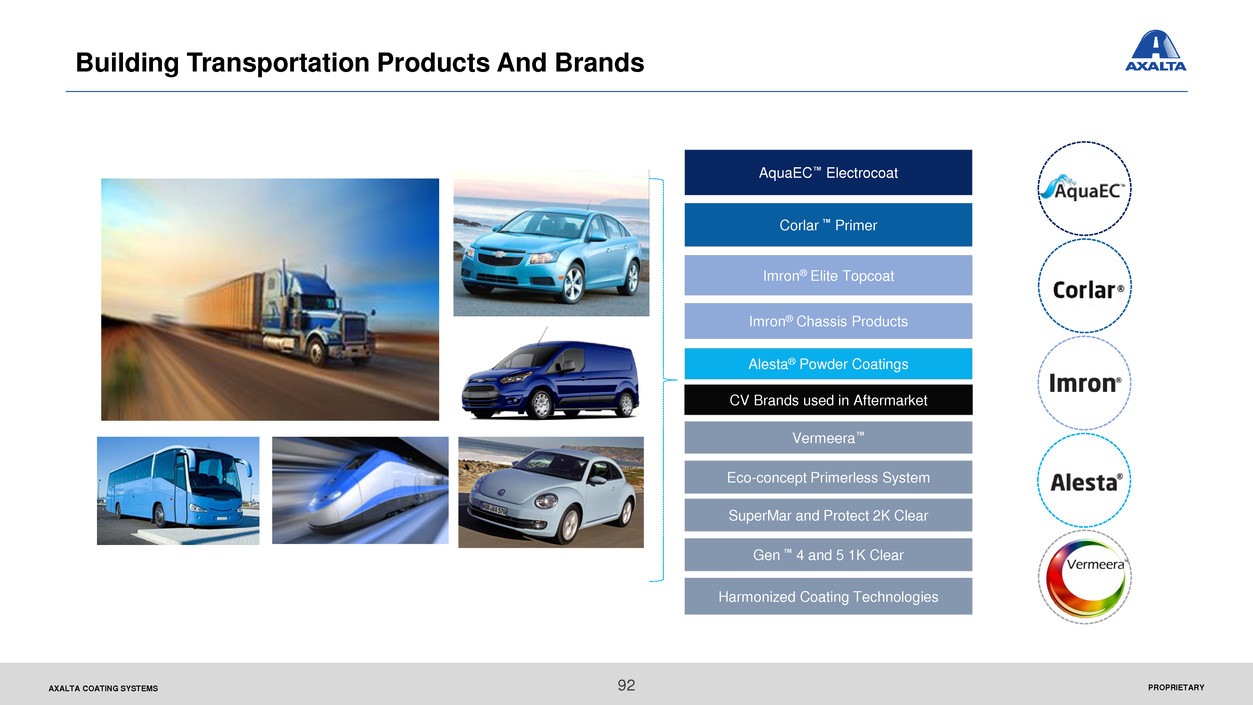

PROPRIETARYAXALTA COATING SYSTEMS Corlar ™ Primer AquaEC™ Electrocoat Alesta® Powder Coatings Imron® Chassis Products Imron® Elite Topcoat CV Brands used in Aftermarket 92 Eco-concept Primerless System Vermeera™ SuperMar and Protect 2K Clear Gen ™ 4 and 5 1K Clear Harmonized Coating Technologies Building Transportation Products And Brands

PROPRIETARYAXALTA COATING SYSTEMS 93 We Have Enablers To Meet Our Growth Goals Step change improvement in customer productivity Color palette expansion Corrosion enhancements in undercoats Lower mainstream and economy products Expand consolidated process for all markets Meet future regulatory requirements › Lower VOC content › Reduce hazardous materials › Support light-weighting targets Global partnerships and targeted investments to sell market leading products in new and expanding regions Announced new facility investments Existing joint ventures Geographic ExpansionProduct Development › China › Mexico › Argentina › Brazil › India › Japan › South Africa › Russia › China

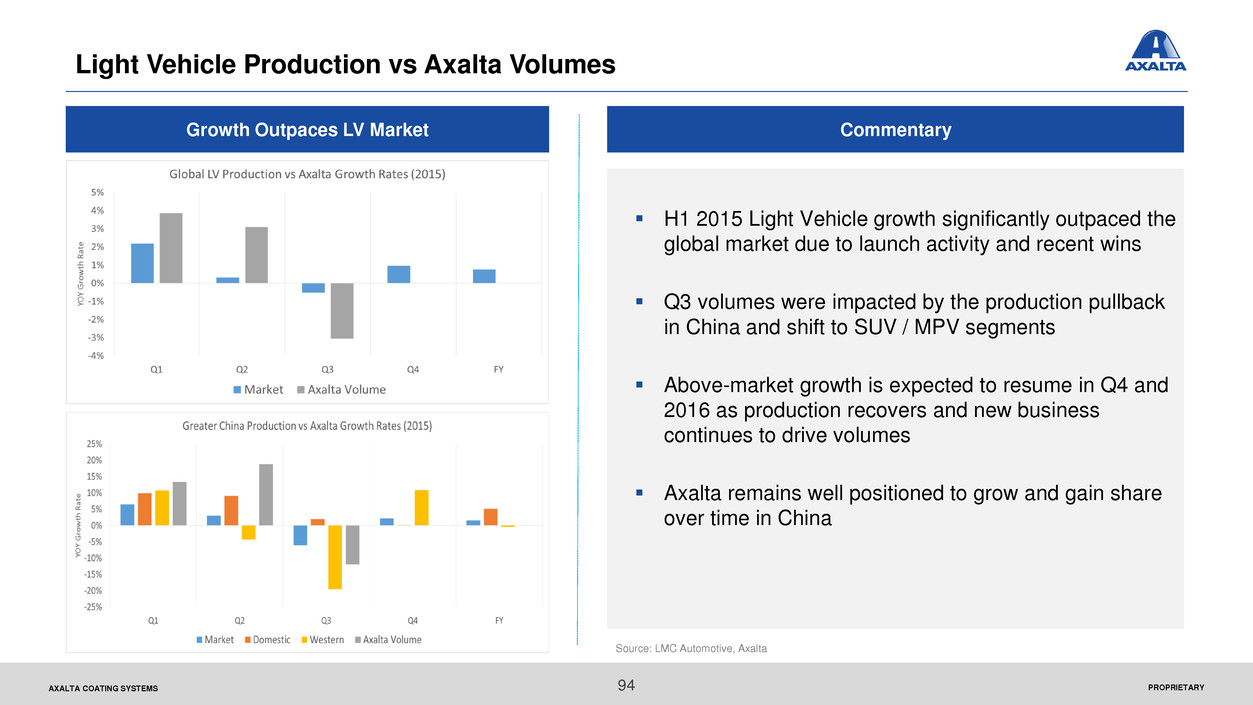

PROPRIETARYAXALTA COATING SYSTEMS 94 Light Vehicle Production vs Axalta Volumes CommentaryGrowth Outpaces LV Market H1 2015 Light Vehicle growth significantly outpaced the global market due to launch activity and recent wins Q3 volumes were impacted by the production pullback in China and shift to SUV / MPV segments Above-market growth is expected to resume in Q4 and 2016 as production recovers and new business continues to drive volumes Axalta remains well positioned to grow and gain share over time in China Source: LMC Automotive, Axalta

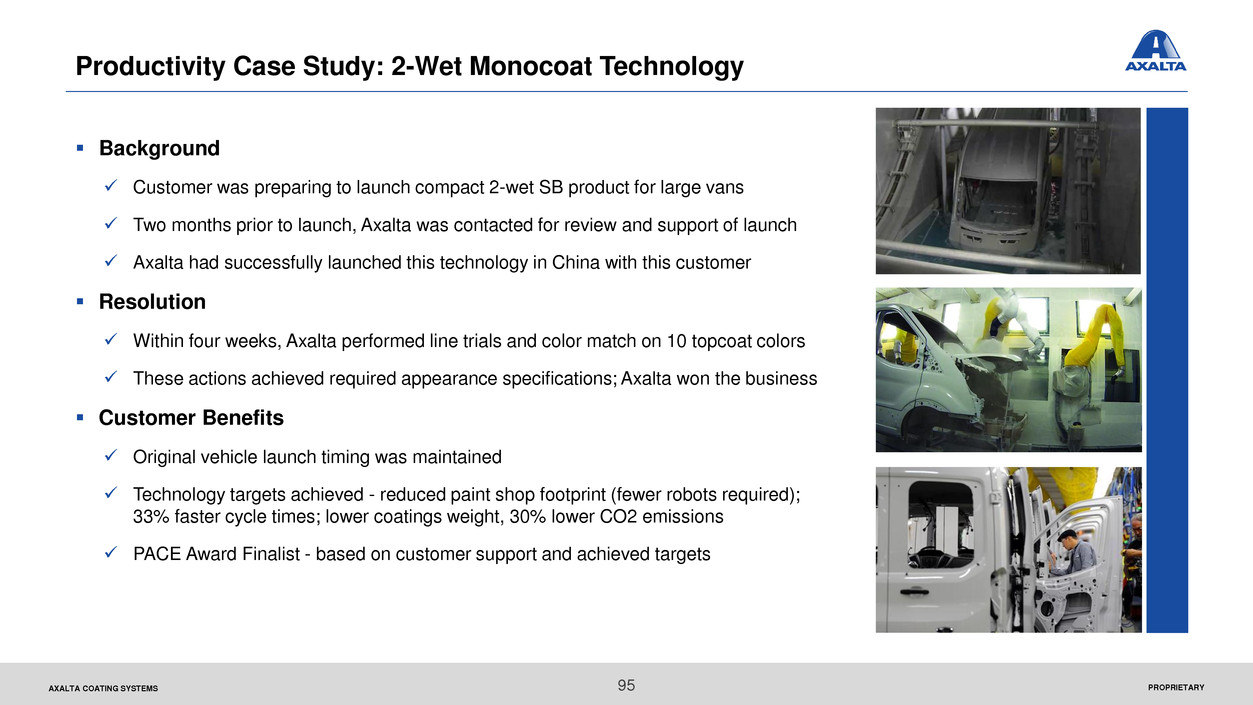

PROPRIETARYAXALTA COATING SYSTEMS Productivity Case Study: 2-Wet Monocoat Technology Background Customer was preparing to launch compact 2-wet SB product for large vans Two months prior to launch, Axalta was contacted for review and support of launch Axalta had successfully launched this technology in China with this customer Resolution Within four weeks, Axalta performed line trials and color match on 10 topcoat colors These actions achieved required appearance specifications; Axalta won the business Customer Benefits Original vehicle launch timing was maintained Technology targets achieved - reduced paint shop footprint (fewer robots required); 33% faster cycle times; lower coatings weight, 30% lower CO2 emissions PACE Award Finalist - based on customer support and achieved targets 95

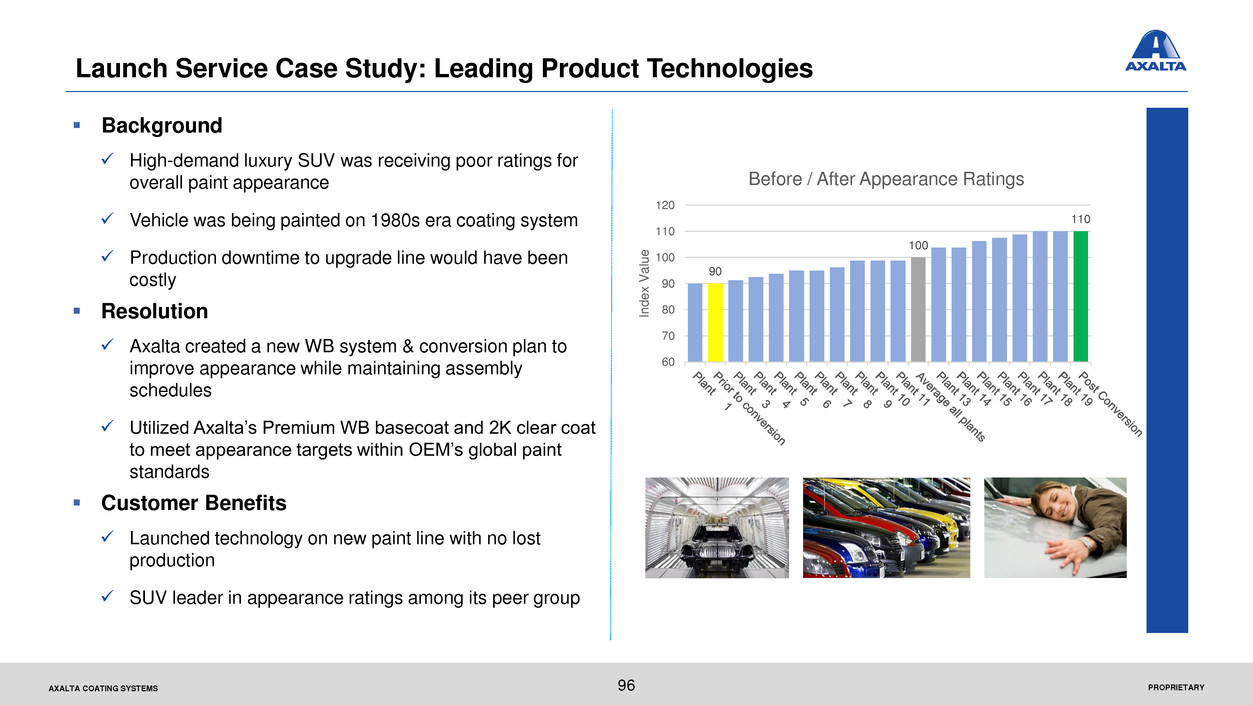

PROPRIETARYAXALTA COATING SYSTEMS 96 Launch Service Case Study: Leading Product Technologies Background High-demand luxury SUV was receiving poor ratings for overall paint appearance Vehicle was being painted on 1980s era coating system Production downtime to upgrade line would have been costly Resolution Axalta created a new WB system & conversion plan to improve appearance while maintaining assembly schedules Utilized Axalta’s Premium WB basecoat and 2K clear coat to meet appearance targets within OEM’s global paint standards Customer Benefits Launched technology on new paint line with no lost production SUV leader in appearance ratings among its peer group 90 100 110 60 70 80 90 100 110 120 In d e x V a lu e Before / After Appearance Ratings

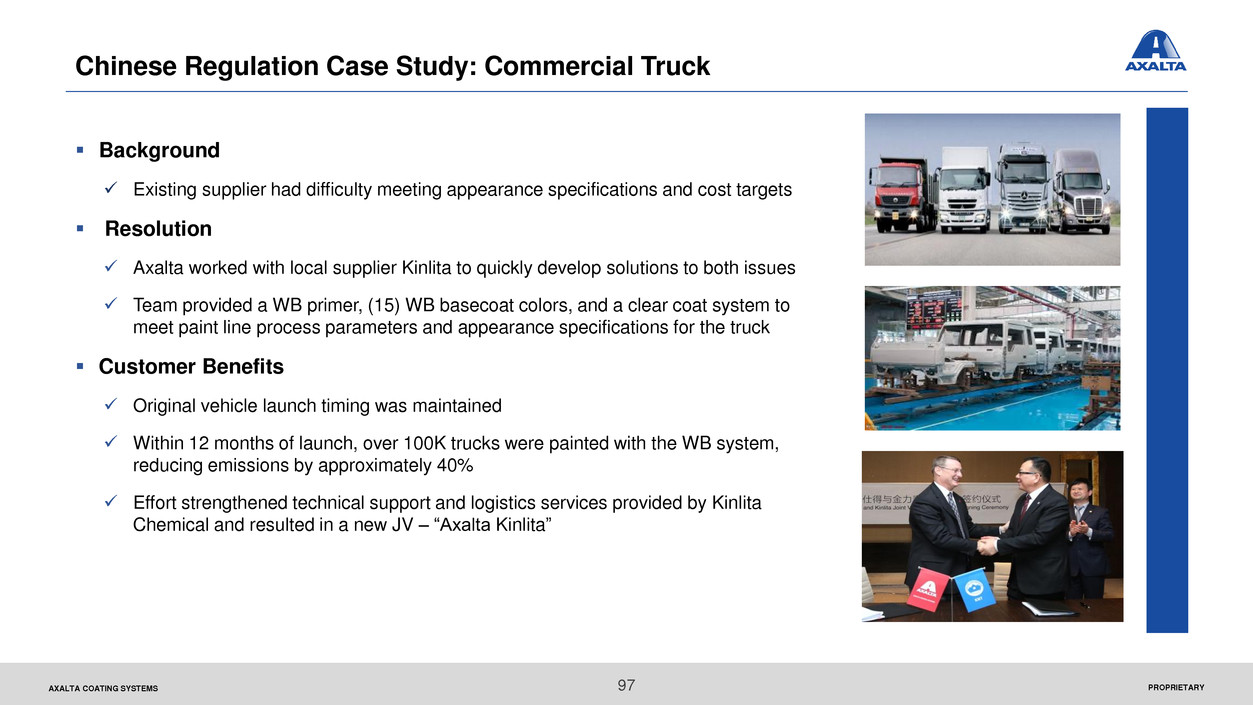

PROPRIETARYAXALTA COATING SYSTEMS Chinese Regulation Case Study: Commercial Truck Background Existing supplier had difficulty meeting appearance specifications and cost targets Resolution Axalta worked with local supplier Kinlita to quickly develop solutions to both issues Team provided a WB primer, (15) WB basecoat colors, and a clear coat system to meet paint line process parameters and appearance specifications for the truck Customer Benefits Original vehicle launch timing was maintained Within 12 months of launch, over 100K trucks were painted with the WB system, reducing emissions by approximately 40% Effort strengthened technical support and logistics services provided by Kinlita Chemical and resulted in a new JV – “Axalta Kinlita” 97

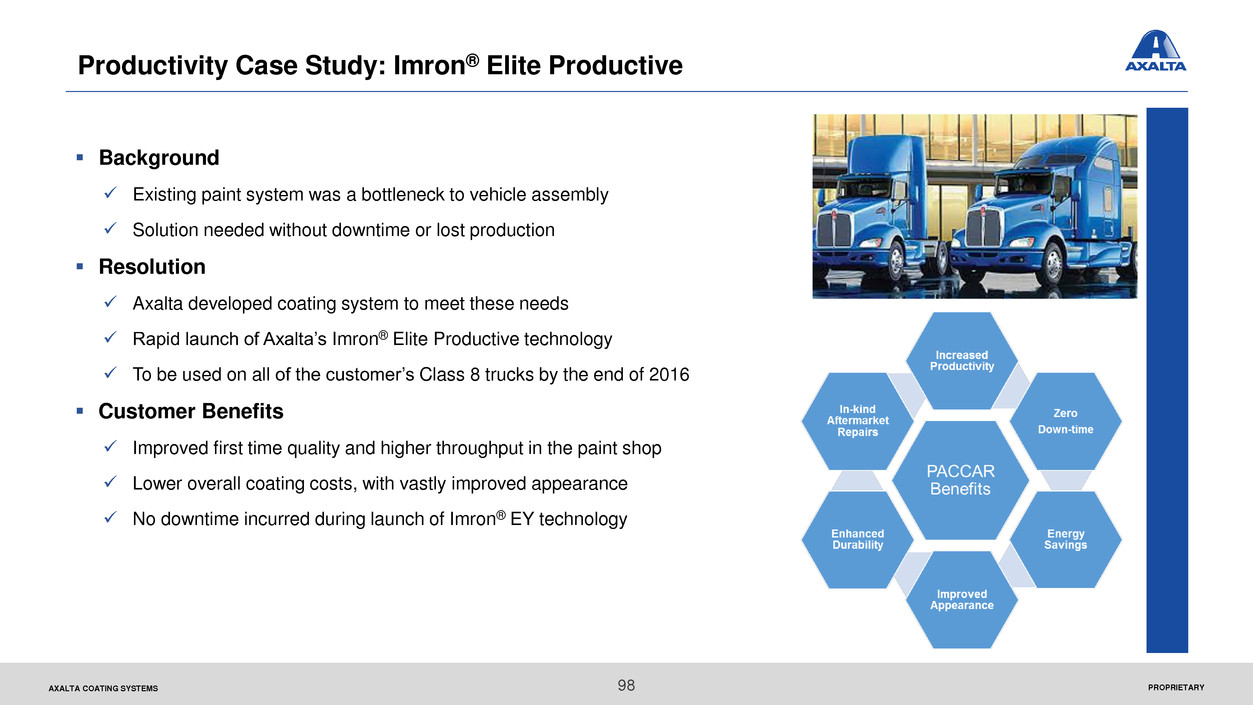

PROPRIETARYAXALTA COATING SYSTEMS Background Existing paint system was a bottleneck to vehicle assembly Solution needed without downtime or lost production Resolution Axalta developed coating system to meet these needs Rapid launch of Axalta’s Imron® Elite Productive technology To be used on all of the customer’s Class 8 trucks by the end of 2016 Customer Benefits Improved first time quality and higher throughput in the paint shop Lower overall coating costs, with vastly improved appearance No downtime incurred during launch of Imron® EY technology Productivity Case Study: Imron® Elite Productive 98

PROPRIETARYAXALTA COATING SYSTEMS 99 Transition To Growth: Customer Recognition GM Supplier of the Year China National Coatings Industry Top 100 Award Honda Preferred Supplier Quality Excellence Awards in Germany, China China National Coatings Industry Top 100 Enterprises Award Aligned Business Framework Best Supplier Quality Performance 2014 Supplier of the Year Best Supplier in Brazil Supplier Excellence in Brazil North American Daimler Masters of Quality Award Daimler Masters of Quality

PROPRIETARYAXALTA COATING SYSTEMS 100 Summary Of Key Messages The global transportation market is projected to grow ~3.4% CAGR through 2019 Axalta is actively transforming its business for profitable growth Axalta is a leading global OEM coatings provider Progress to date has been strong

Axalta’s Procurement Roadmap Martin Horneck SVP, Chief Procurement Officer

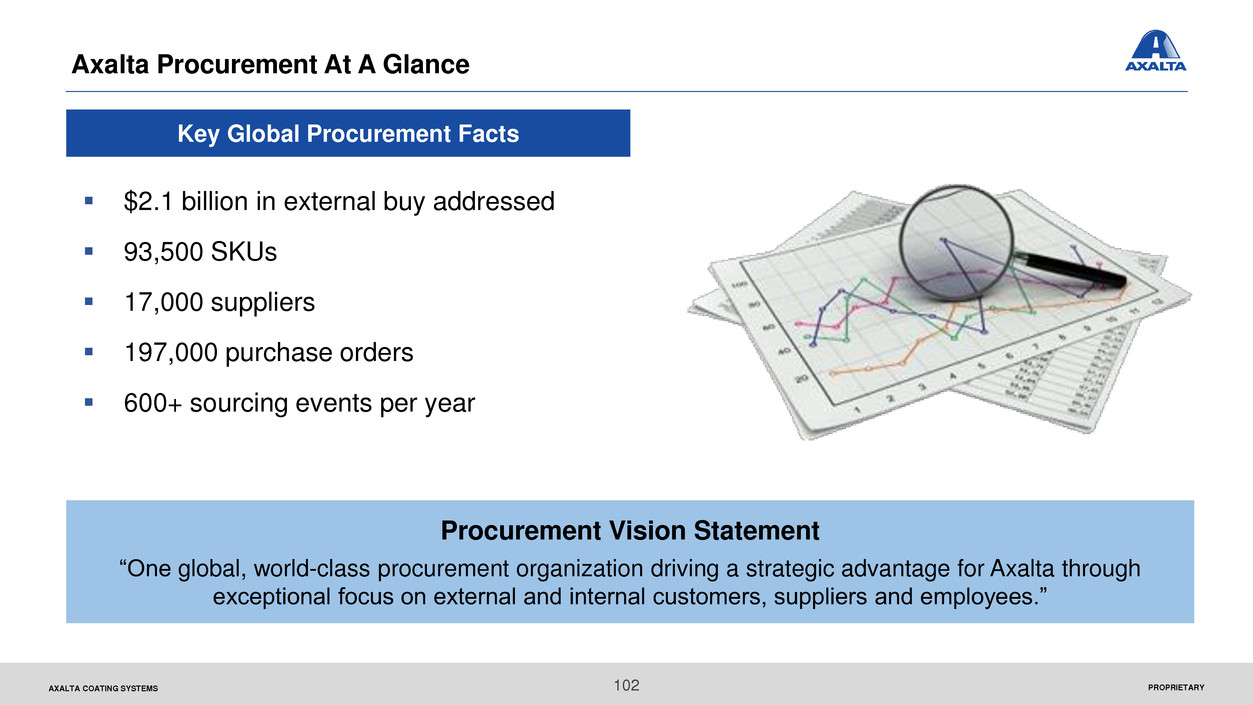

PROPRIETARYAXALTA COATING SYSTEMS Axalta Procurement At A Glance $2.1 billion in external buy addressed 93,500 SKUs 17,000 suppliers 197,000 purchase orders 600+ sourcing events per year Procurement Vision Statement “One global, world-class procurement organization driving a strategic advantage for Axalta through exceptional focus on external and internal customers, suppliers and employees.” Key Global Procurement Facts 102

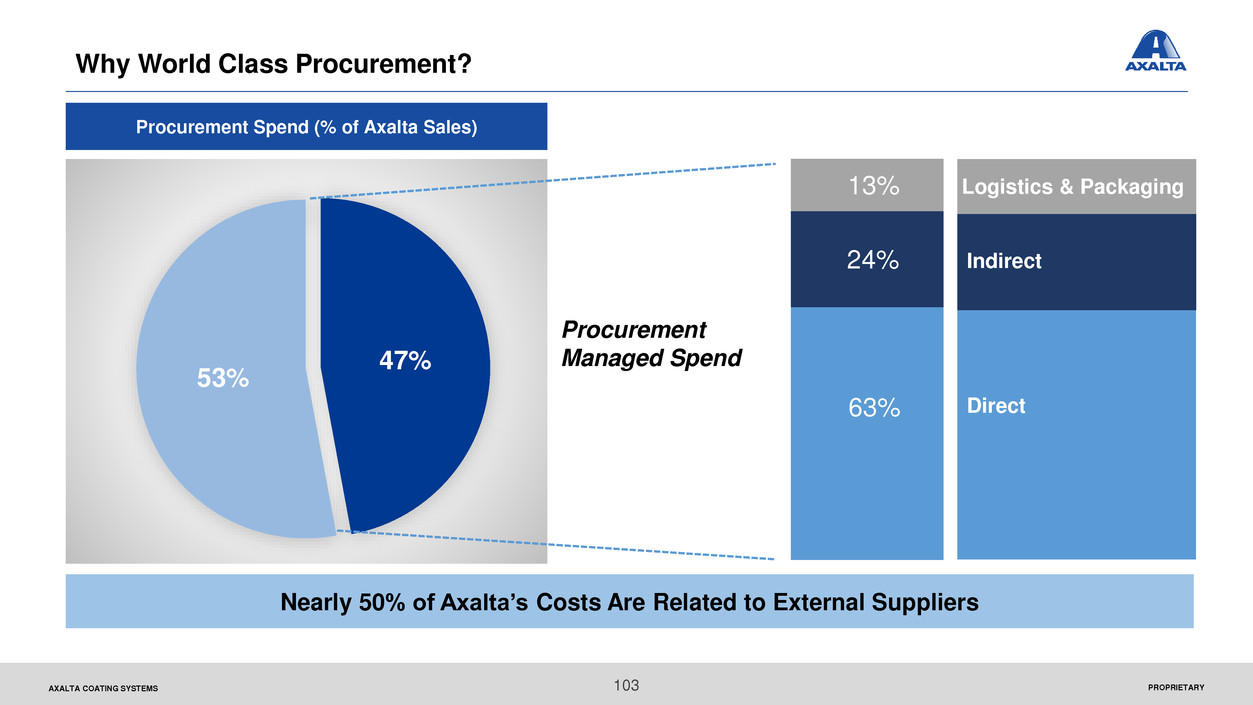

PROPRIETARYAXALTA COATING SYSTEMS 47% 53% Why World Class Procurement? Nearly 50% of Axalta’s Costs Are Related to External Suppliers Logistics & Packaging 13% Indirect 24% Direct Materials 63% Procurement Spend (% of Axalta Sales) Procurement Managed Spend Logistics & Packaging Indirect Direct63% 24% 13% 103

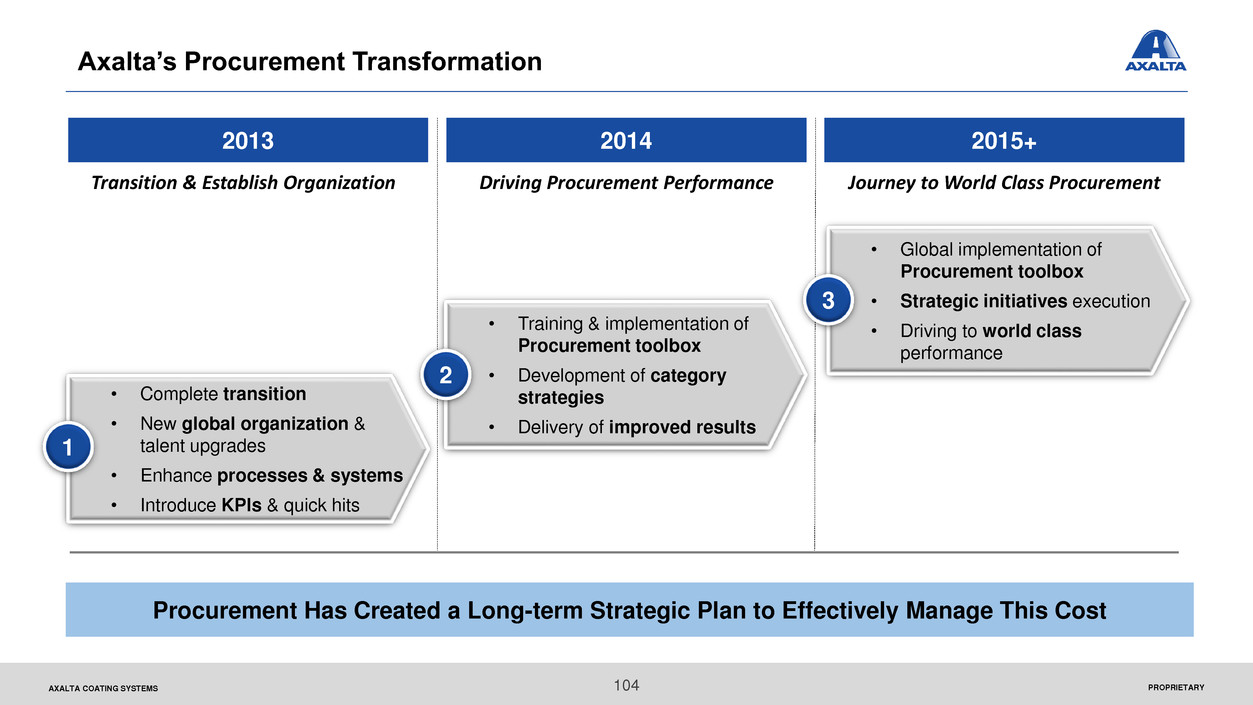

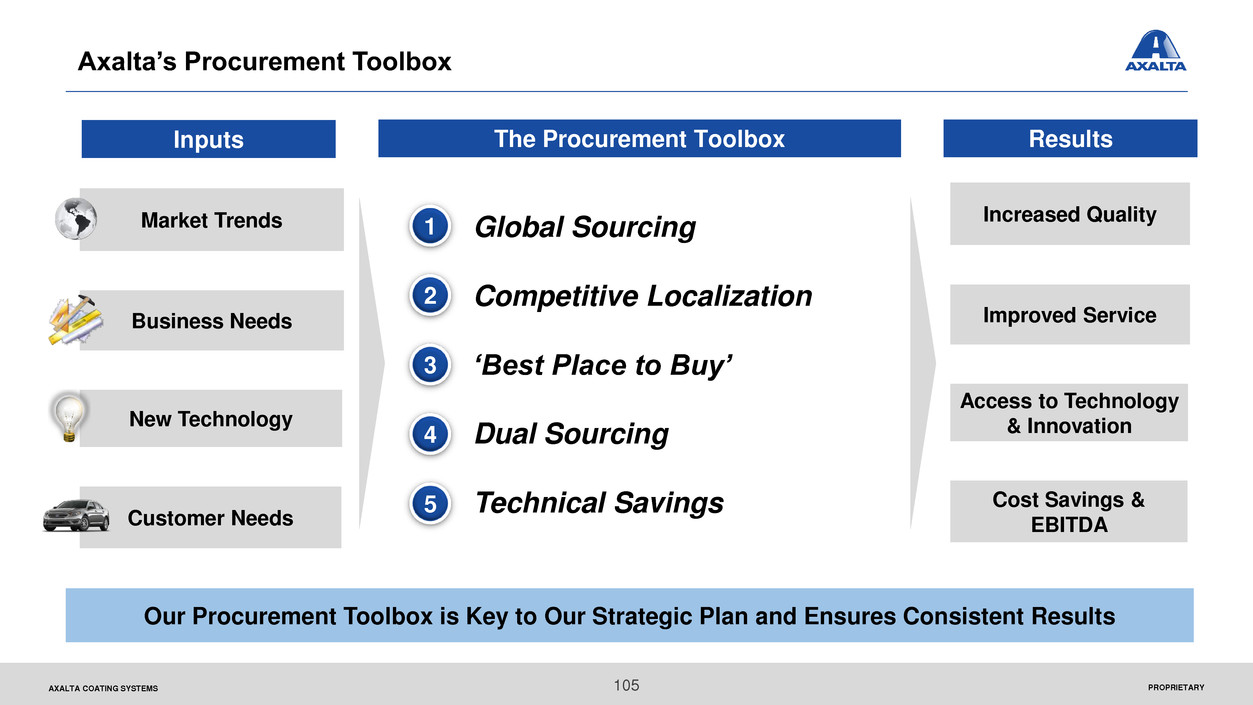

PROPRIETARYAXALTA COATING SYSTEMS Axalta’s Procurement Transformation 2013 2014 2015+ Driving Procurement Performance Journey to World Class ProcurementTransition & Establish Organization • Complete transition • New global organization & talent upgrades • Enhance processes & systems • Introduce KPIs & quick hits • Training & implementation of Procurement toolbox • Development of category strategies • Delivery of improved results • Global implementation of Procurement toolbox • Strategic initiatives execution • Driving to world class performance Procurement Has Created a Long-term Strategic Plan to Effectively Manage This Cost 1 2 3 104

PROPRIETARYAXALTA COATING SYSTEMS The Procurement ToolboxInputs Results Increased Quality Improved Service Access to Technology & Innovation Cost Savings & EBITDA Our Procurement Toolbox is Key to Our Strategic Plan and Ensures Consistent Results Axalta’s Procurement Toolbox Market Trends Business Needs New Technology Customer Needs Global Sourcing Competitive Localization ‘Best Place to Buy’ Dual Sourcing Technical Savings 1 2 3 4 5 105

PROPRIETARYAXALTA COATING SYSTEMS Direct Materials Cost Modelling Global Price Benchmarking 1 3 Procurement Strategic Initiatives Business Collaboration Matched Pairs 2 4 Strategic Procurement Initiatives Drive Incremental Value For Axalta Raw material price aligned to shifts in markets Cross-functional teaming to achieve new business opportunities Comparing global price differences and identifying the ‘best place to buy’ Alignment with Technology to pursue joint improvement opportunities 106

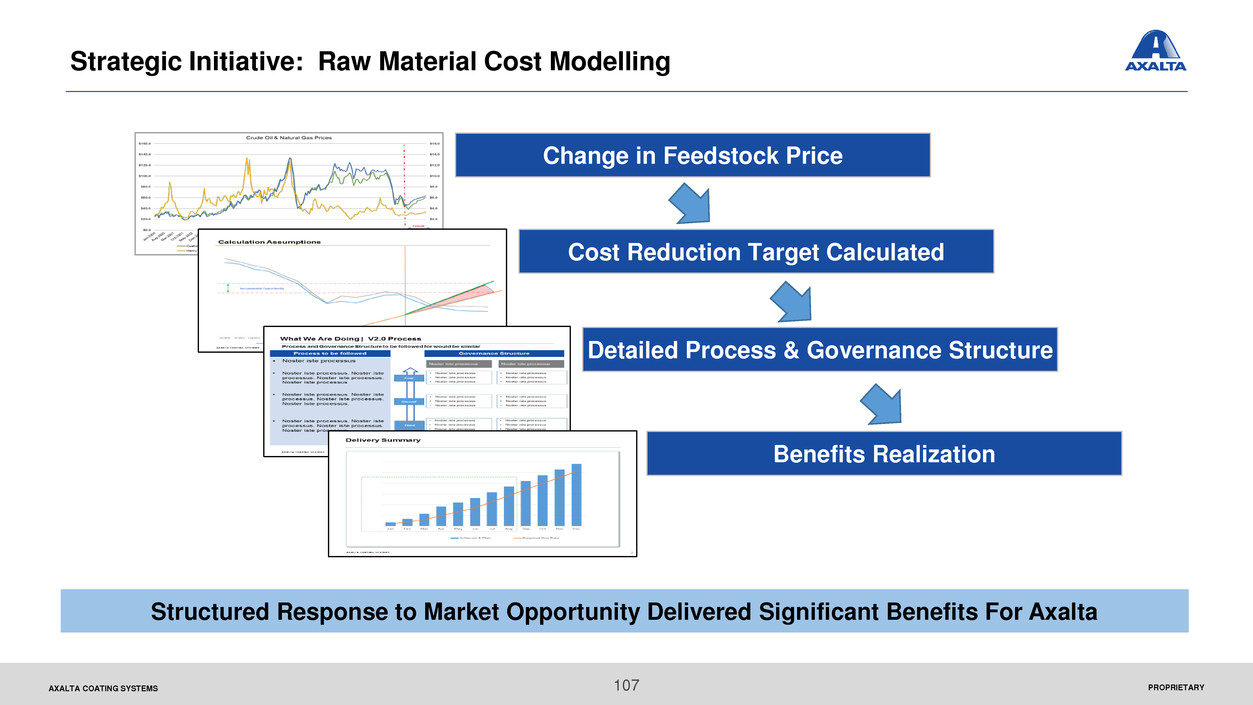

PROPRIETARYAXALTA COATING SYSTEMS Structured Response to Market Opportunity Delivered Significant Benefits For Axalta Strategic Initiative: Raw Material Cost Modelling Change in Feedstock Price Cost Reduction Target Calculated Detailed Process & Governance Structure Benefits Realization 107

PROPRIETARYAXALTA COATING SYSTEMS Procurement is Enabling Growth by Strengthening Commercial Pursuits Strategic Initiative Case Study – Business Collaboration Phase Objectives & Outcomes Business Goal Axalta goal to increase market share in North American electrical insulation market The Challenge Significant new customer set aggressive price targets Raw material input costs are largest opportunity Actions Taken Cross functional team formed with Business Units, Operations and Procurement to identify pricing improvement options Negotiations with key suppliers to reduce cost in advance of volume increase Business Results 30% lower raw materials price enabled business win Top line growth and increased global market share 1 2 3 4 108

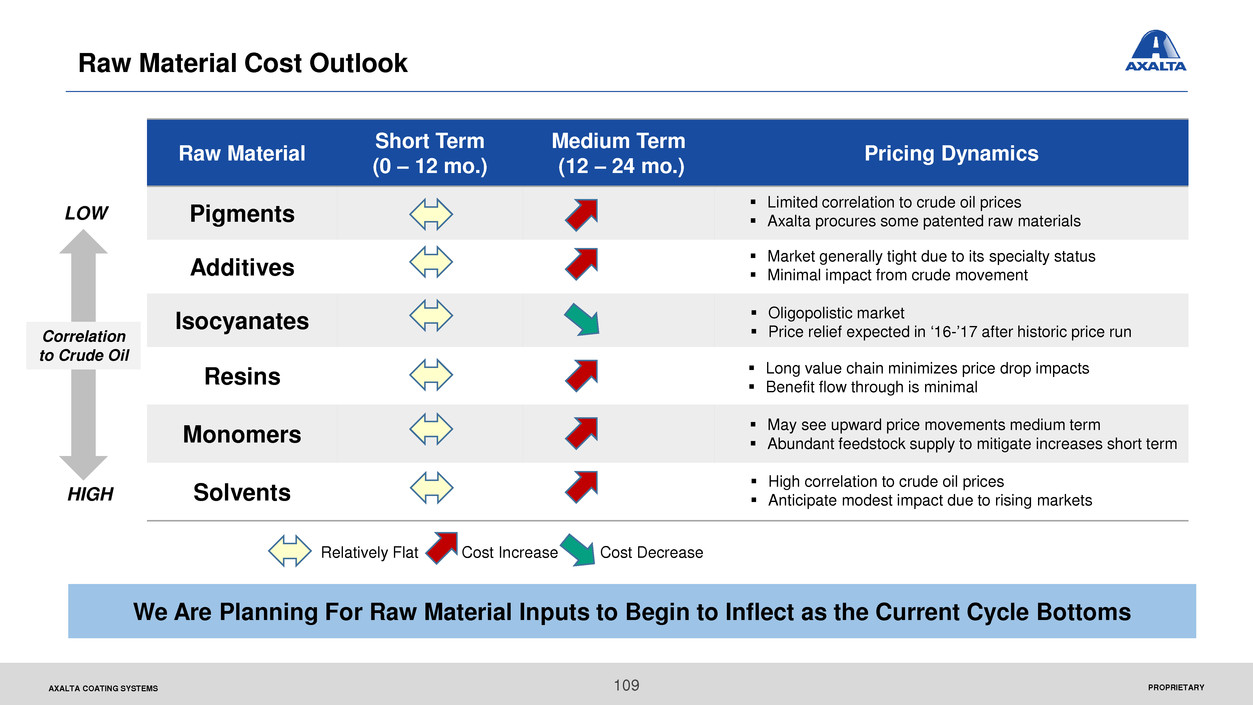

PROPRIETARYAXALTA COATING SYSTEMS Raw Material Short Term (0 – 12 mo.) Medium Term (12 – 24 mo.) Pricing Dynamics Pigments Additives Isocyanates Resins Monomers Solvents Cost IncreaseRelatively Flat Cost Decrease Limited correlation to crude oil prices Axalta procures some patented raw materials Market generally tight due to its specialty status Minimal impact from crude movement Oligopolistic market Price relief expected in ‘16-’17 after historic price run Long value chain minimizes price drop impacts Benefit flow through is minimal High correlation to crude oil prices Anticipate modest impact due to rising markets May see upward price movements medium term Abundant feedstock supply to mitigate increases short term Raw Material Cost Outlook We Are Planning For Raw Material Inputs to Begin to Inflect as the Current Cycle Bottoms LOW HIGH Correlation to Crude Oil 109

PROPRIETARYAXALTA COATING SYSTEMS Summary Of Key Messages 110 Procurement manages largest cost block for Axalta Transformation plan developed to create a world class procurement process Procurement toolbox implemented to ensure value delivery We are leading strategic initiatives to improve Axalta’s bottom line

Axalta’s Technology Advantage Barry Snyder SVP, Chief Technology Officer

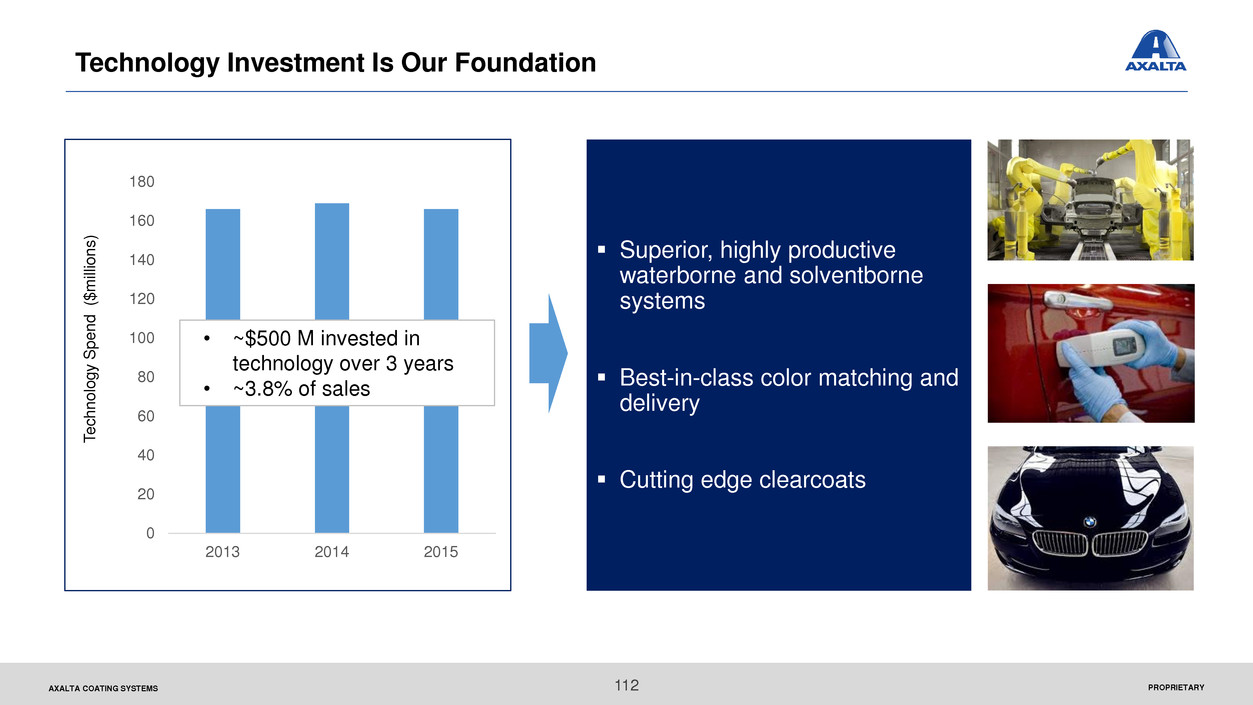

PROPRIETARYAXALTA COATING SYSTEMS 112 Superior, highly productive waterborne and solventborne systems Best-in-class color matching and delivery Cutting edge clearcoats 0 20 40 60 80 100 120 140 160 180 2013 2014 2015 T e c h n o lo g y S p e n d ( $ m ill io n s ) • ~$500 M invested in technology over 3 years • ~3.8% of sales Technology Investment Is Our Foundation

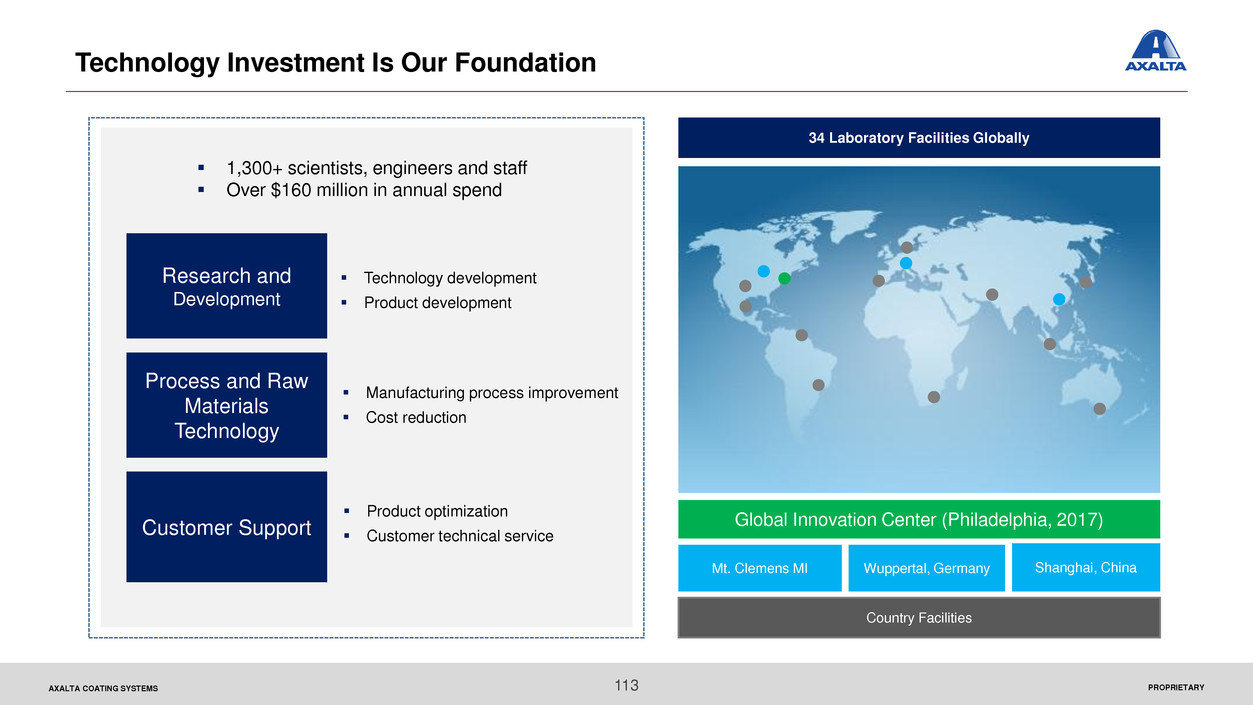

PROPRIETARYAXALTA COATING SYSTEMS Research and Development Process and Raw Materials Technology Customer Support 1,300+ scientists, engineers and staff Over $160 million in annual spend Shanghai, China Global Innovation Center (Philadelphia, 2017) Wuppertal, GermanyMt. Clemens MI Country Facilities 34 Laboratory Facilities Globally Technology development Product development Product optimization Customer technical service Manufacturing process improvement Cost reduction 113 Technology Investment Is Our Foundation

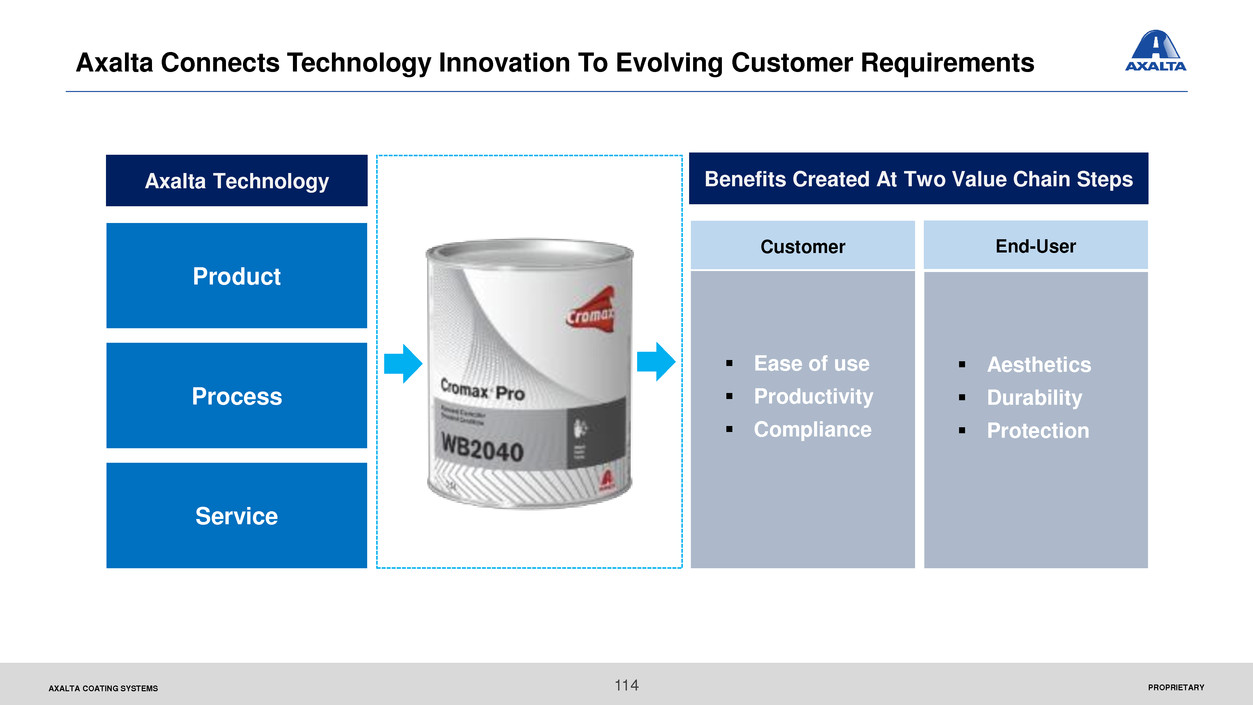

PROPRIETARYAXALTA COATING SYSTEMS 114 Customer End-User Ease of use Productivity Compliance Aesthetics Durability Protection Product Benefits Created At Two Value Chain StepsAxalta Technology Process Service Axalta Connects Technology Innovation To Evolving Customer Requirements

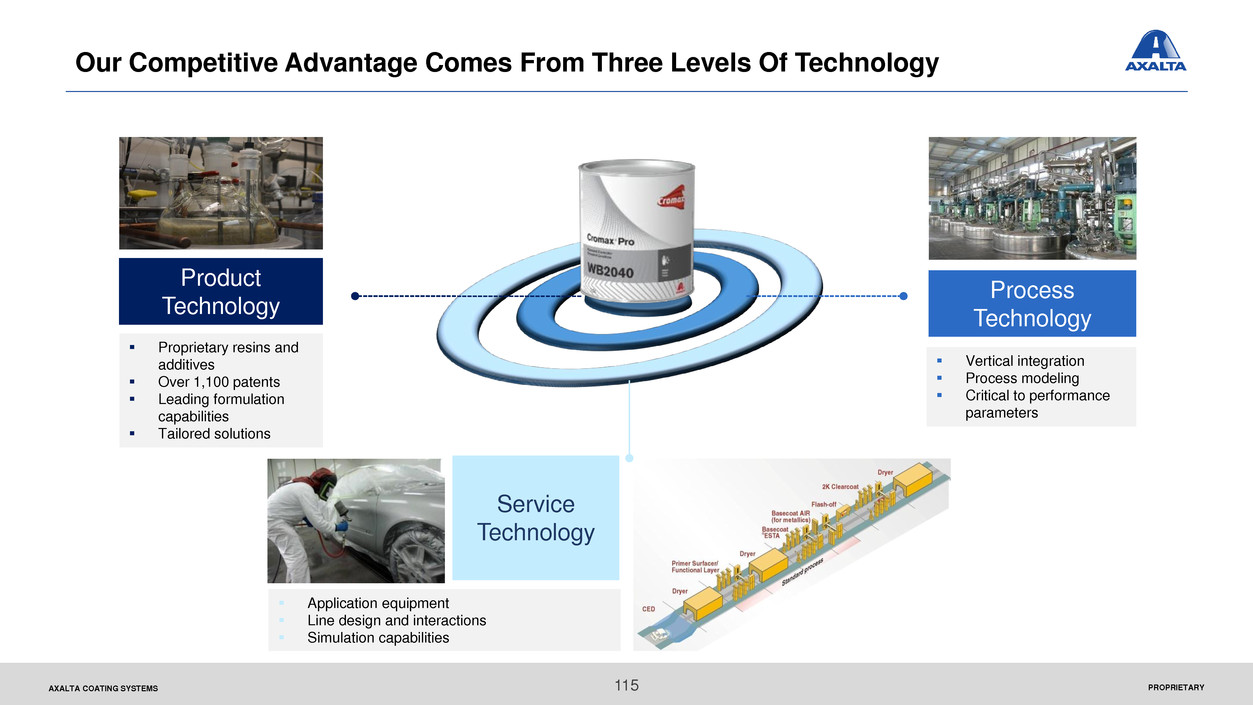

PROPRIETARYAXALTA COATING SYSTEMS Process Technology Service Technology Product Technology Proprietary resins and additives Over 1,100 patents Leading formulation capabilities Tailored solutions Application equipment Line design and interactions Simulation capabilities Vertical integration Process modeling Critical to performance parameters 115 Our Competitive Advantage Comes From Three Levels Of Technology

PROPRIETARYAXALTA COATING SYSTEMS 116 Set up for success Facilities Capabilities Tools and processes High-impact project portfolio Strategic balance Product technology roadmaps Metrics Leverage core strengths Color Chemistry Customer productivity Expand capabilities New applications Emerging technologies World-Class Infrastructure Invest in Key Technologies Process Technology Manufacturing costs Product quality Raw Materials Access new sources New formulation concepts Complexity Management Product Simplification Expand Competitive Advantage Strategy Aligns Capabilities With Targeted Business Opportunities

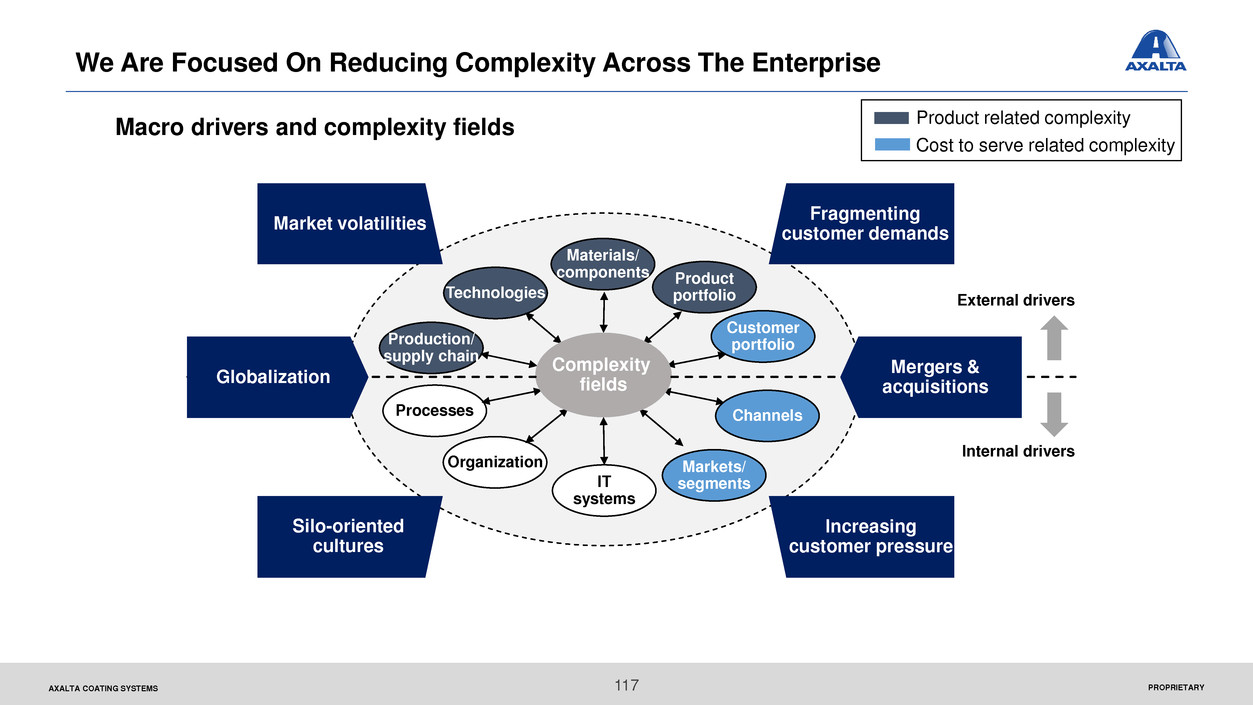

PROPRIETARYAXALTA COATING SYSTEMS Macro drivers and complexity fields Processes Production/ supply chain Technologies Customer portfolio IT systems Materials/ components Organization Channels Markets/ segments Product portfolio Complexity fields Mergers & acquisitions Globalization External drivers Internal drivers Market volatilities Fragmenting customer demands Silo-oriented cultures Increasing customer pressure Product related complexity Cost to serve related complexity 117 We Are Focused On Reducing Complexity Across The Enterprise

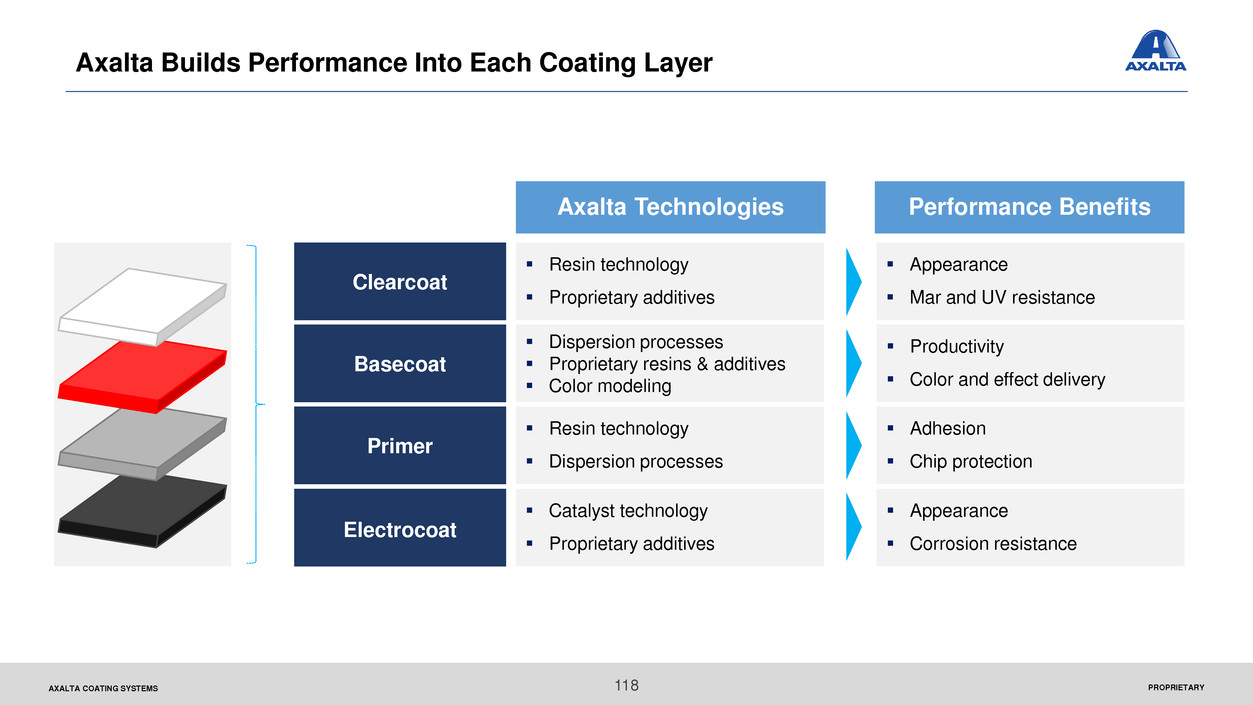

PROPRIETARYAXALTA COATING SYSTEMS Clearcoat Basecoat Primer Electrocoat Appearance Mar and UV resistance Productivity Color and effect delivery Adhesion Chip protection Appearance Corrosion resistance Resin technology Proprietary additives Dispersion processes Proprietary resins & additives Color modeling Catalyst technology Proprietary additives Resin technology Dispersion processes Axalta Technologies Performance Benefits 118 Axalta Builds Performance Into Each Coating Layer

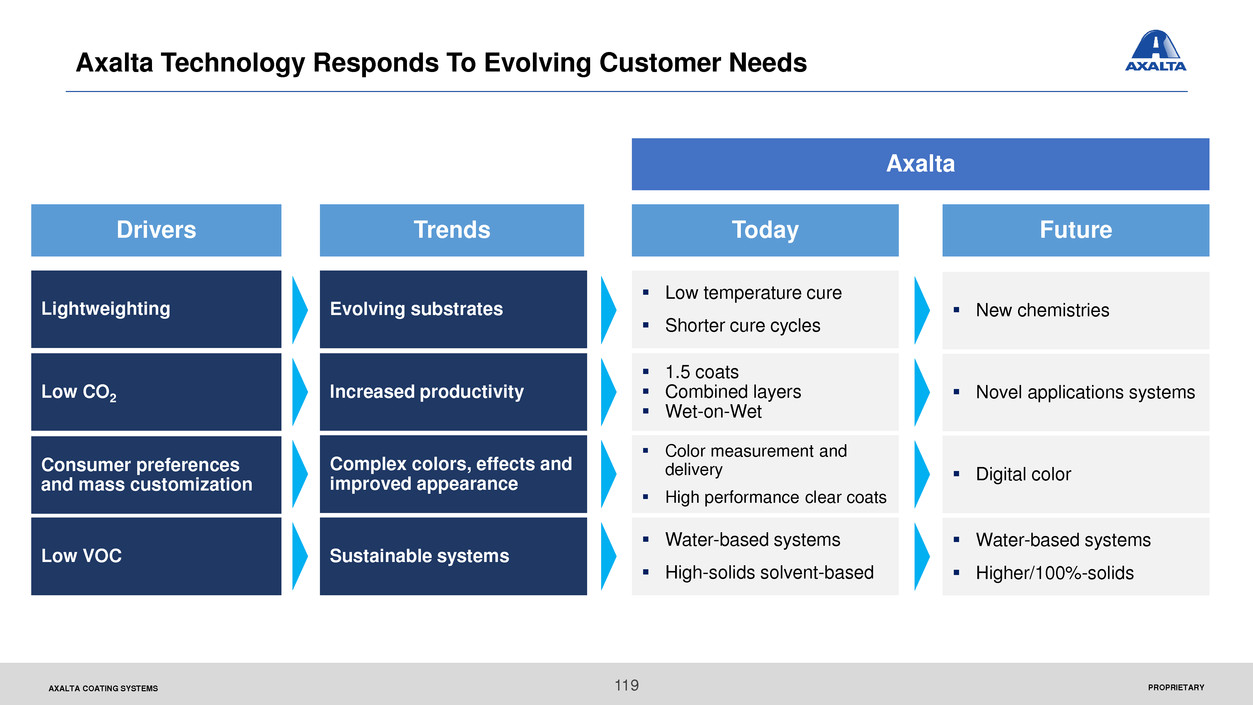

PROPRIETARYAXALTA COATING SYSTEMS Low temperature cure Shorter cure cycles 1.5 coats Combined layers Wet-on-Wet Color measurement and delivery High performance clear coats Water-based systems High-solids solvent-based Evolving substrates Increased productivity Sustainable systems Complex colors, effects and improved appearance New chemistries Novel applications systems Digital color Water-based systems Higher/100%-solids Today Future Lightweighting Low CO2 Low VOC Consumer preferences and mass customization Drivers Trends Axalta 119 Axalta Technology Responds To Evolving Customer Needs

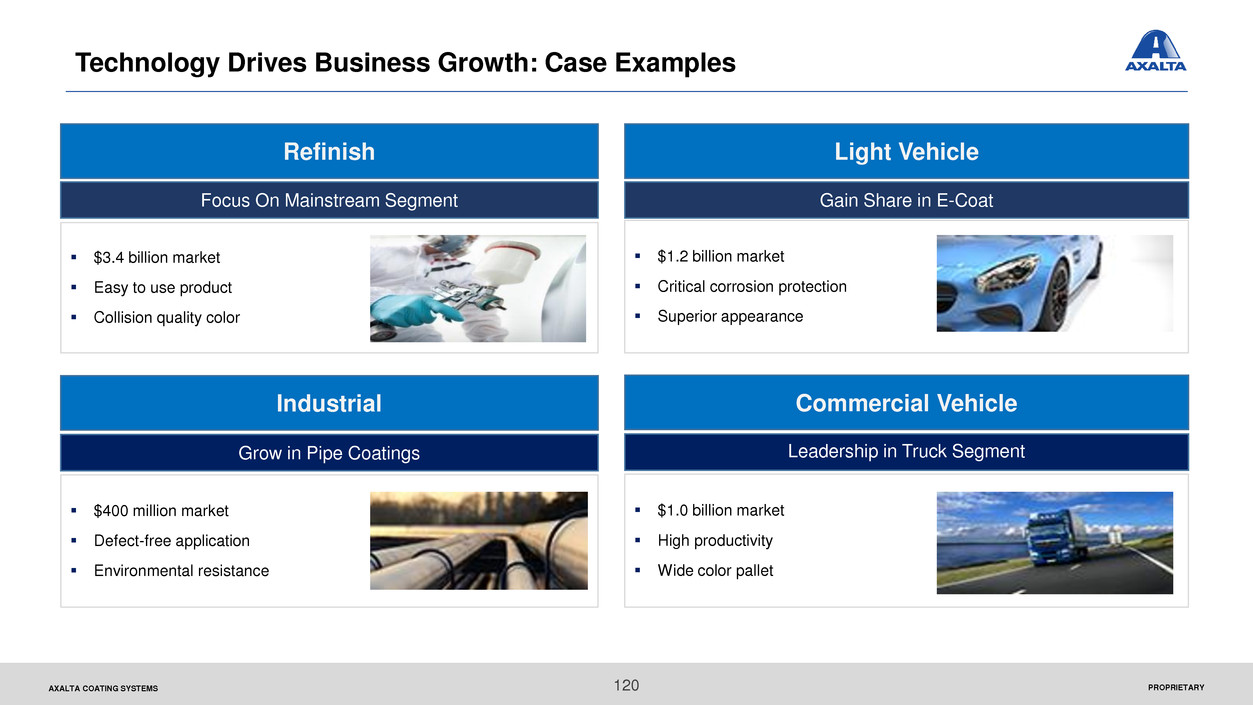

PROPRIETARYAXALTA COATING SYSTEMS $3.4 billion market Easy to use product Collision quality color Focus On Mainstream Segment Refinish $1.2 billion market Critical corrosion protection Superior appearance Gain Share in E-Coat Light Vehicle $1.0 billion market High productivity Wide color pallet Leadership in Truck Segment Commercial VehicleIndustrial Grow in Pipe Coatings $400 million market Defect-free application Environmental resistance 120 Technology Drives Business Growth: Case Examples

PROPRIETARYAXALTA COATING SYSTEMS Refinish Industrial Coatings National Rule (U.S.) Low VOC Audurra Refinish Accessory Products Chroma Lamp Multiple line extensions within our refinish brand families including putties, undercoats, basecoat mixing colors and clearcoats Regional introductions or line extensions of products and application tools 121 Axalta Technology Is Driving Regular Product Launches

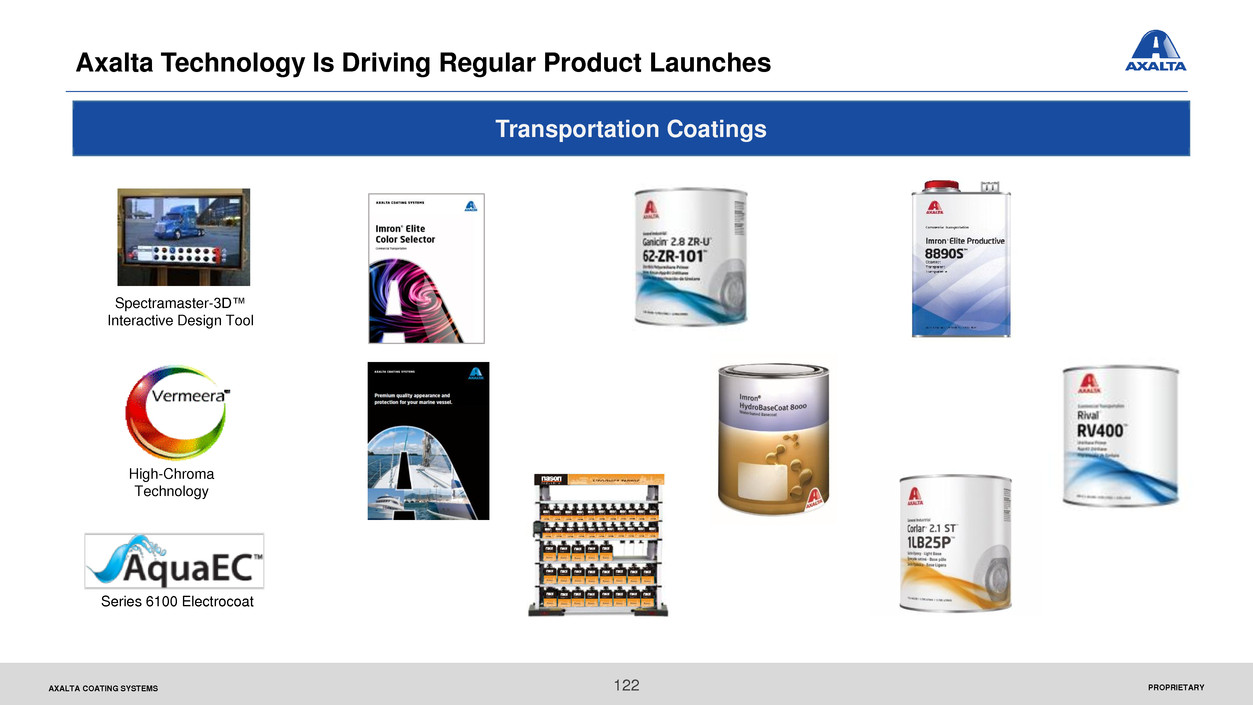

PROPRIETARYAXALTA COATING SYSTEMS Transportation Coatings Spectramaster-3D™ Interactive Design Tool High-Chroma Technology Series 6100 Electrocoat 122 Axalta Technology Is Driving Regular Product Launches

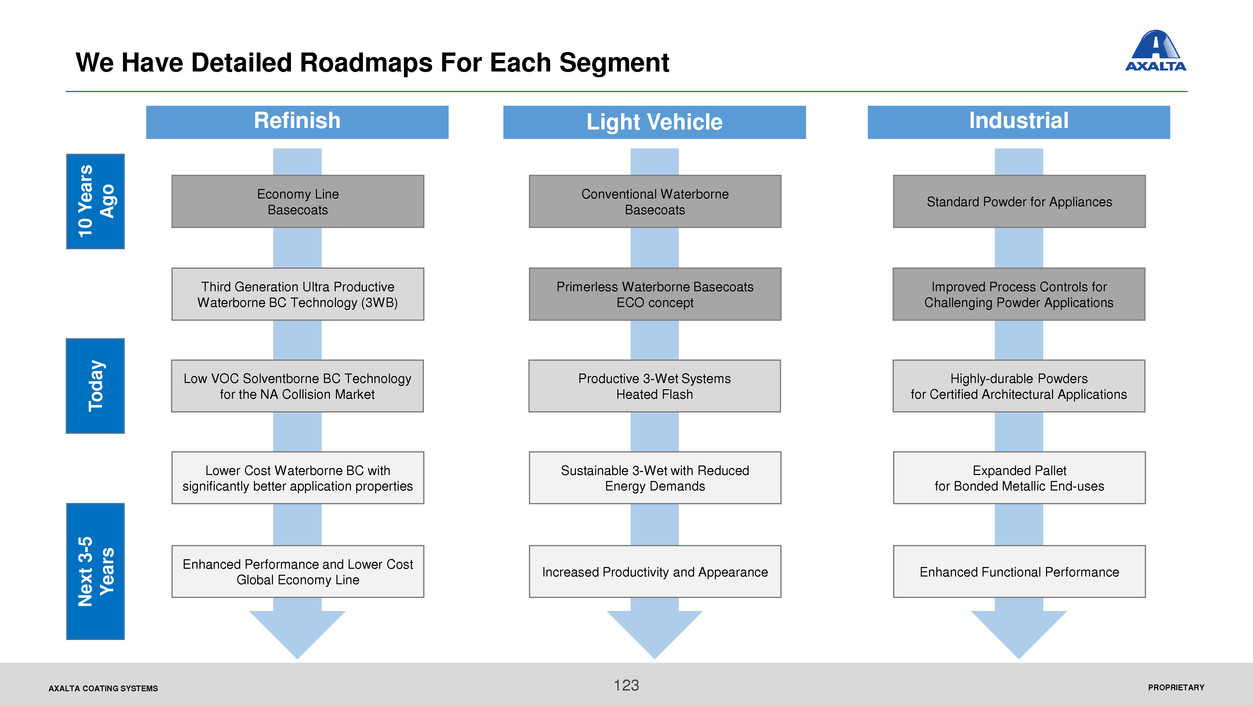

PROPRIETARYAXALTA COATING SYSTEMS Lower Cost Waterborne BC with significantly better application properties Low VOC Solventborne BC Technology for the NA Collision Market Enhanced Performance and Lower Cost Global Economy Line Third Generation Ultra Productive Waterborne BC Technology (3WB) Economy Line Basecoats T o d a y N ext 3 -5 Y ea rs 10 Y ea rs A g o Refinish Sustainable 3-Wet with Reduced Energy Demands Productive 3-Wet Systems Heated Flash Increased Productivity and Appearance Primerless Waterborne Basecoats ECO concept Conventional Waterborne Basecoats Light Vehicle Expanded Pallet for Bonded Metallic End-uses Improved Process Controls for Challenging Powder Applications Enhanced Functional Performance Highly-durable Powders for Certified Architectural Applications Standard Powder for Appliances Industrial 123 We Have Detailed Roadmaps For Each Segment

PROPRIETARYAXALTA COATING SYSTEMS Technology investment is our foundation Axalta connects technology innovation to evolving customer requirements Axalta builds performance into each coating layer Technology drives business growth Summary Of Key Messages 124

QUESTIONS & ANSWERS

PROPRIETARYAXALTA COATING SYSTEMS 126 Key Messages For The Day Axalta continues its transition from an operating segment to an independent, high-performing company Axalta has made significant progress towards its goals, but there is far more still to come We have multiple paths to create value including top line growth, improved productivity and efficiency, and effective capital deployment Our strategy for profitable growth is directed towards enhanced return on capital for shareholders

APPENDIX

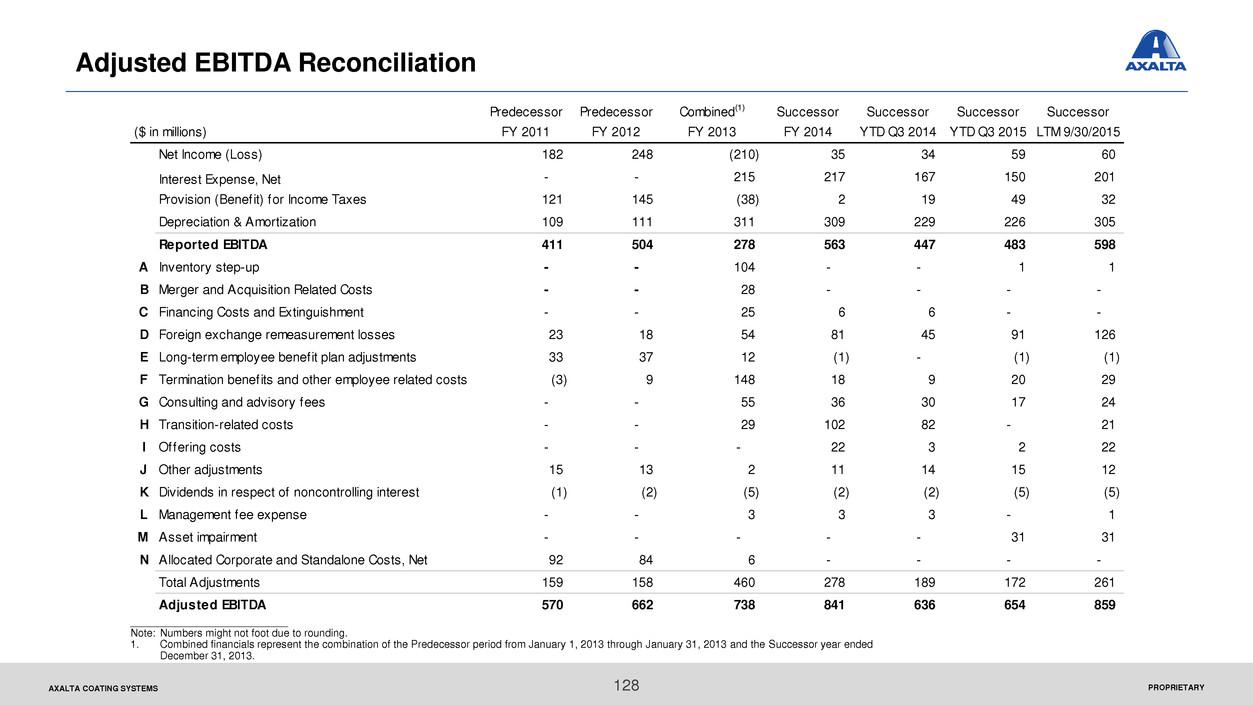

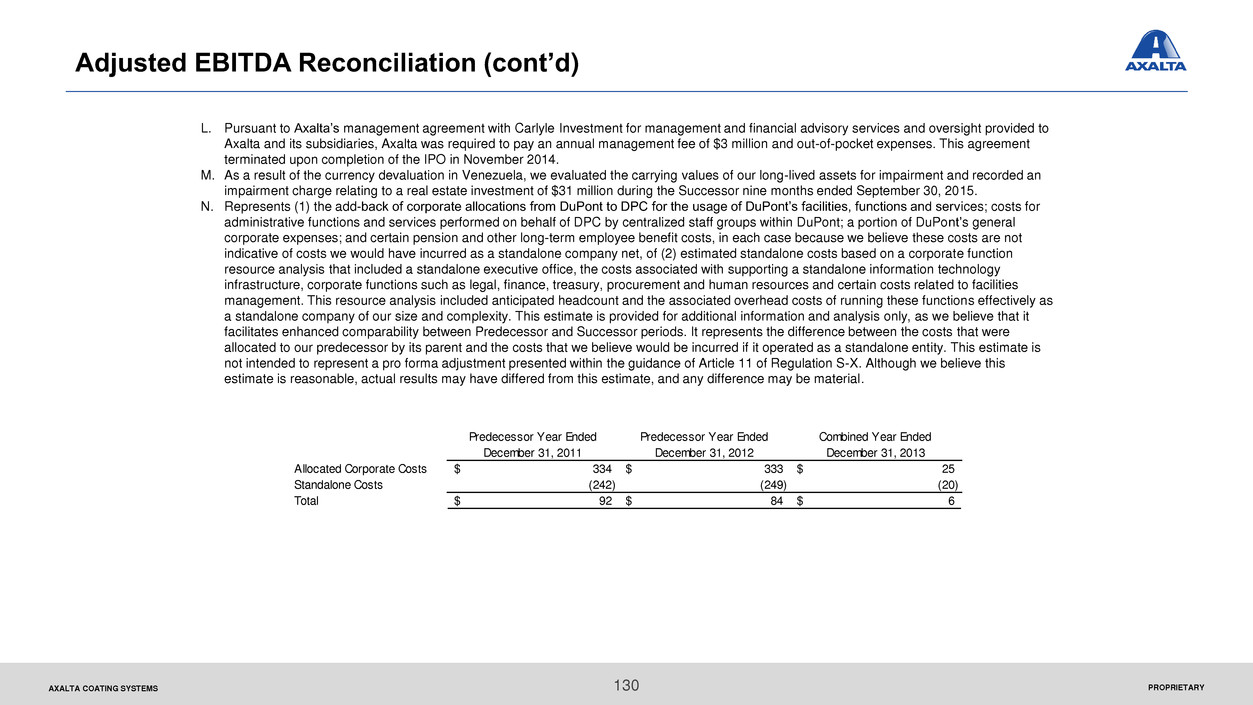

PROPRIETARYAXALTA COATING SYSTEMS Adjusted EBITDA Reconciliation 128 ___________________________ Note: Numbers might not foot due to rounding. 1. Combined financials represent the combination of the Predecessor period from January 1, 2013 through January 31, 2013 and the Successor year ended December 31, 2013. Predecessor Predecessor Combined(1) Successor Successor Successor Successor ($ in millions) FY 2011 FY 2012 FY 2013 FY 2014 YTD Q3 2014 YTD Q3 2015 LTM 9/30/2015 Net Income (Loss) 182 248 (210) 35 34 59 60 Interest Expense, Net - - 215 217 167 150 201 Provision (Benefit) for Income Taxes 121 145 (38) 2 19 49 32 Depreciation & Amortization 109 111 311 309 229 226 305 Reported EBITDA 411 504 278 563 447 483 598 A Inventory step-up - - 104 - - 1 1 B Merger and Acquisition Related Costs - - 28 - - - - C Financing Costs and Extinguishment - - 25 6 6 - - D Foreign exchange remeasurement losses 23 18 54 81 45 91 126 E Long-term employee benefit plan adjustments 33 37 12 (1) - (1) (1) F Termination benefits and other employee related costs (3) 9 148 18 9 20 29 G Consulting and advisory fees - - 55 36 30 17 24 H Transition-related costs - - 29 102 82 - 21 I Offering costs - - - 22 3 2 22 J Other adjustments 15 13 2 11 14 15 12 K Dividends in respect of noncontrolling interest (1) (2) (5) (2) (2) (5) (5) L Management fee expense - - 3 3 3 - 1 M Asset impairment - - - - - 31 31 N Allocated Corporate and Standalone Costs, Net 92 84 6 - - - - Total Adjustments 159 158 460 278 189 172 261 Adjusted EBITDA 570 662 738 841 636 654 859