EXHIBIT 99.2

Published on February 10, 2016

A X A L T A C O A T I N G S Y S T E M S Q4 & FULL YEAR 2015 FINANCIAL RESULTS FEBRUARY 10, 2016 Exhibit 99.2

AXALTA COATING SYSTEMS Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2016 financial projections, including execution on our 2016 goals as well as 2016 net sales, Adjusted EBITDA, Adjusted EBITDA margin, income tax rate, as adjusted, capital expenditures, plant expansions, net working capital and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward- looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Our use of the terms constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt may differ from that of others in our industry. Constant currency net sales, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income (loss), operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. 2 Legal Notices

AXALTA COATING SYSTEMS Q4 & Full Year 2015 Highlights Strong Q4 financial results Q4 2015 net sales up 4.5% versus Q4 2014, ex-currency Performance Coatings: 3.6% volume growth and 1.2% price increases Adjusted EBITDA of $213 million, up 4.0% YoY; Adjusted EBITDA margin of 21.2% versus 19.0% in Q4 2014 Operating progress continues on track Four major capacity expansions largely complete; on time and on budget Completed three small M&A transactions $52 million combined savings for 2015 from productivity improvement initiatives Balance sheet & cash flow outcomes positive $100 million debt pre-payment completed in Q4 2015 Q4 2015 FCF of $192 million underscores strong finish for the year Leverage reduced to 3.4x (net debt to 2015 Adjusted EBITDA); over $850 million in liquidity available FY 2015 results met our goals 5.3% net sales growth ex-currency 3.2% Adjusted EBITDA growth despite significant currency headwinds Operational progress was substantial – new capacity added, productivity actions taking hold 3

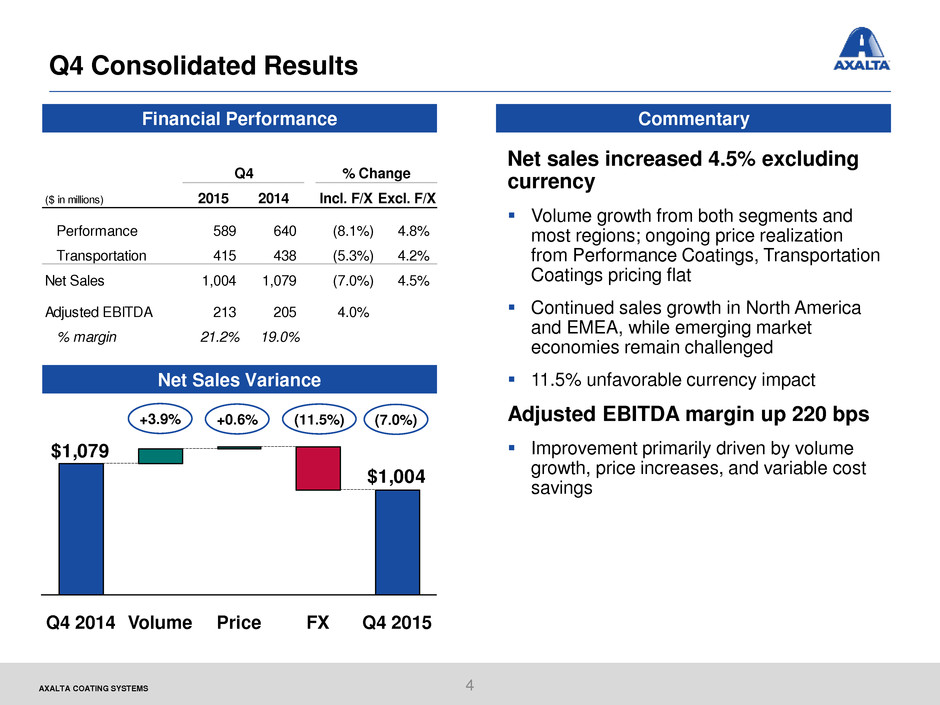

AXALTA COATING SYSTEMS Q4 Consolidated Results Financial Performance Commentary Net Sales Variance +3.9% +0.6% (11.5%) (7.0%) $1,004 $1,079 Q4 2015 FX Price Q4 2014 Volume 4 Net sales increased 4.5% excluding currency Volume growth from both segments and most regions; ongoing price realization from Performance Coatings, Transportation Coatings pricing flat Continued sales growth in North America and EMEA, while emerging market economies remain challenged 11.5% unfavorable currency impact Adjusted EBITDA margin up 220 bps Improvement primarily driven by volume growth, price increases, and variable cost savings ($ in millions) 2015 2014 Incl. F/X Excl. F/X Performance 589 640 (8.1%) 4.8% Transportation 415 438 (5.3%) 4.2% Net Sales 1,004 1,079 (7.0%) 4.5% Adjusted EBITDA 213 205 4.0% % margin 21.2% 19.0% Q4 % Change

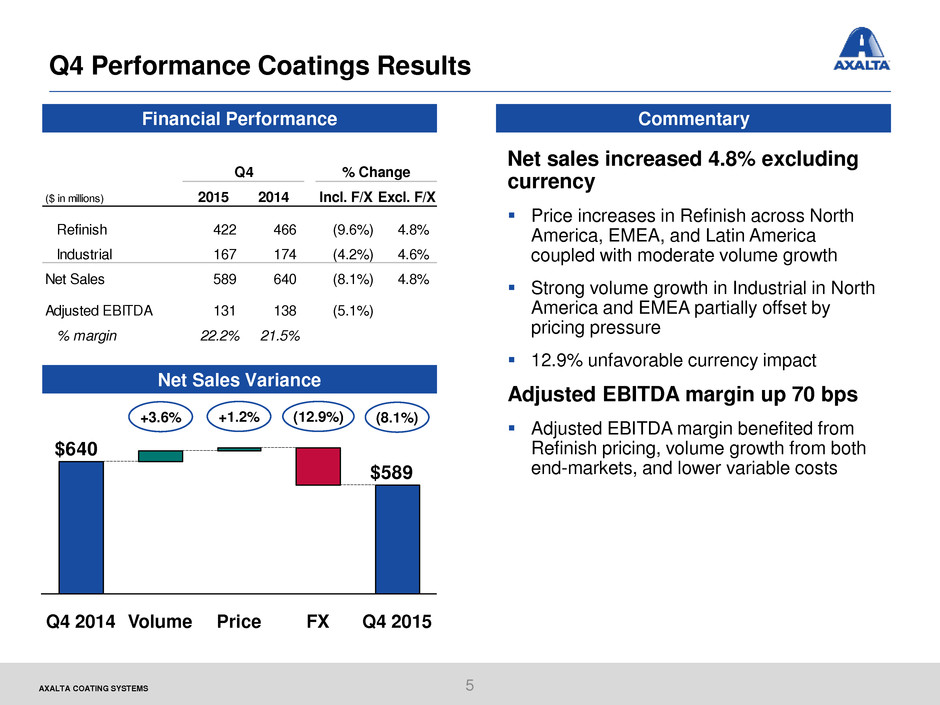

AXALTA COATING SYSTEMS Q4 Performance Coatings Results Financial Performance Commentary Net Sales Variance +3.6% +1.2% (12.9%) (8.1%) $589 $640 Q4 2015 Q4 2014 Volume FX Price 5 Net sales increased 4.8% excluding currency Price increases in Refinish across North America, EMEA, and Latin America coupled with moderate volume growth Strong volume growth in Industrial in North America and EMEA partially offset by pricing pressure 12.9% unfavorable currency impact Adjusted EBITDA margin up 70 bps Adjusted EBITDA margin benefited from Refinish pricing, volume growth from both end-markets, and lower variable costs Q4 ($ in millions) 2015 2014 Incl. F/X Excl. F/X Refinish 422 466 (9.6%) 4.8% Industrial 167 174 (4.2%) 4.6% Net Sales 589 640 (8.1%) 4.8% Adjusted EBITDA 131 138 (5.1%) % margin 22.2% 21.5% % Change

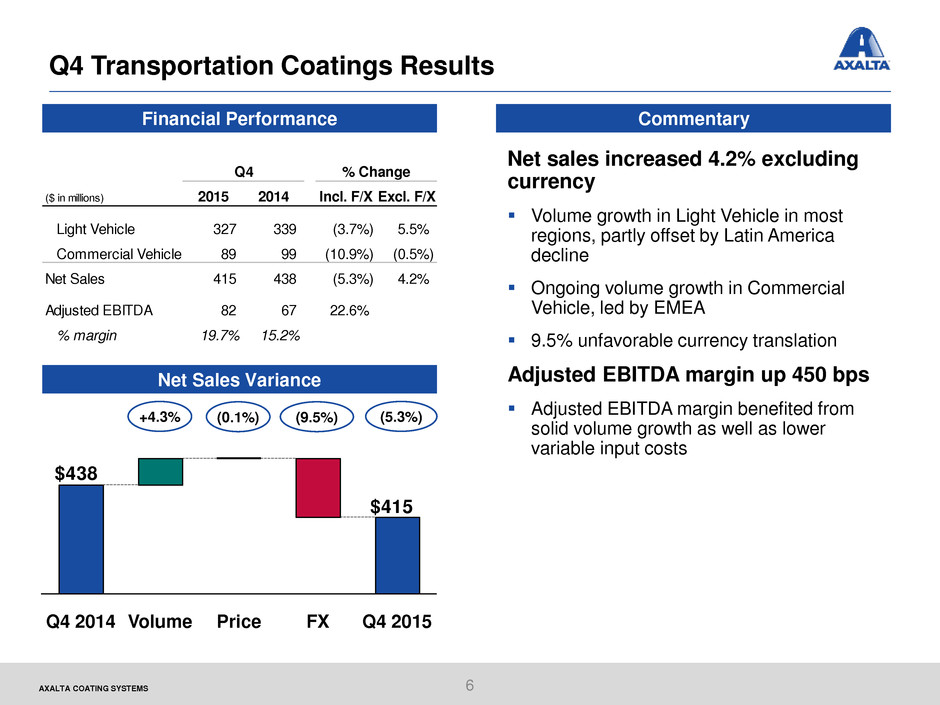

AXALTA COATING SYSTEMS Q4 Transportation Coatings Results Financial Performance Commentary Net Sales Variance +4.3% (0.1%) (5.3%) $415 $438 Volume Q4 2015 Price FX Q4 2014 6 Net sales increased 4.2% excluding currency Volume growth in Light Vehicle in most regions, partly offset by Latin America decline Ongoing volume growth in Commercial Vehicle, led by EMEA 9.5% unfavorable currency translation Adjusted EBITDA margin up 450 bps Adjusted EBITDA margin benefited from solid volume growth as well as lower variable input costs (9.5%) ($ in millions) 2015 2014 Incl. F/X Excl. F/X Light Vehicle 327 339 (3.7%) 5.5% Commercial Vehicle 89 99 (10.9%) (0.5%) Net Sales 415 438 (5.3%) 4.2% Adjusted EBITDA 82 67 22.6% % margin 19.7% 15.2% Q4 % Change

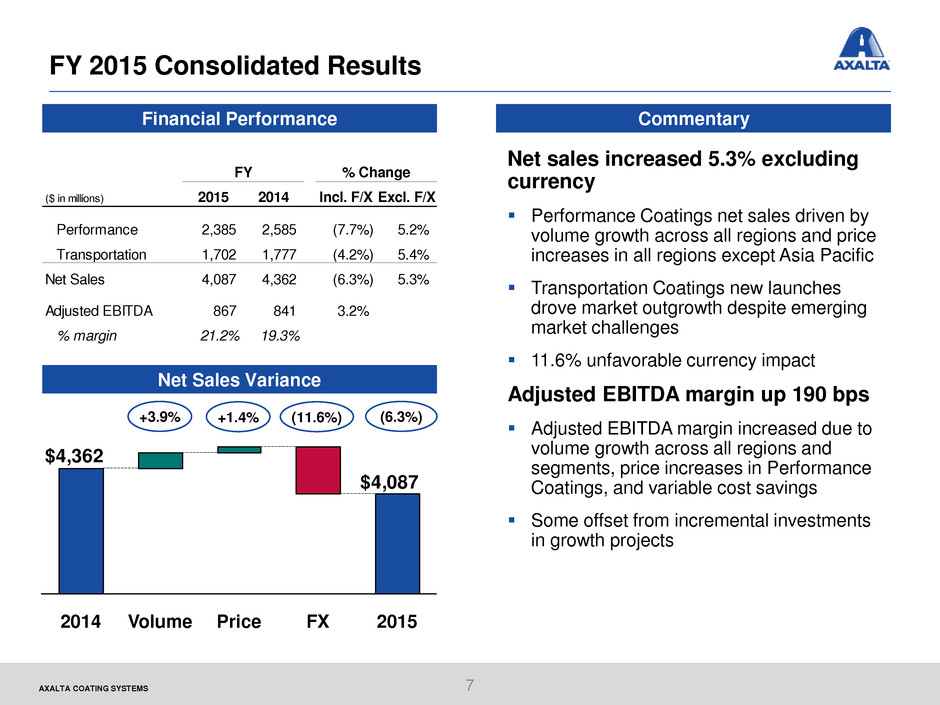

AXALTA COATING SYSTEMS FY 2015 Consolidated Results Financial Performance Commentary Net Sales Variance +3.9% +1.4% (11.6%) (6.3%) $4,087 $4,362 2015 FX Volume Price 2014 7 Net sales increased 5.3% excluding currency Performance Coatings net sales driven by volume growth across all regions and price increases in all regions except Asia Pacific Transportation Coatings new launches drove market outgrowth despite emerging market challenges 11.6% unfavorable currency impact Adjusted EBITDA margin up 190 bps Adjusted EBITDA margin increased due to volume growth across all regions and segments, price increases in Performance Coatings, and variable cost savings Some offset from incremental investments in growth projects ($ in millions) 2015 2014 Incl. F/X Excl. F/X Performance 2,385 2,585 (7.7%) 5.2% Transportation 1,702 1,777 (4.2%) 5.4% Net Sales 4,087 4,362 (6.3%) 5.3% Adjusted EBITDA 867 841 3.2% % margin 21.2% 19.3% FY % Change

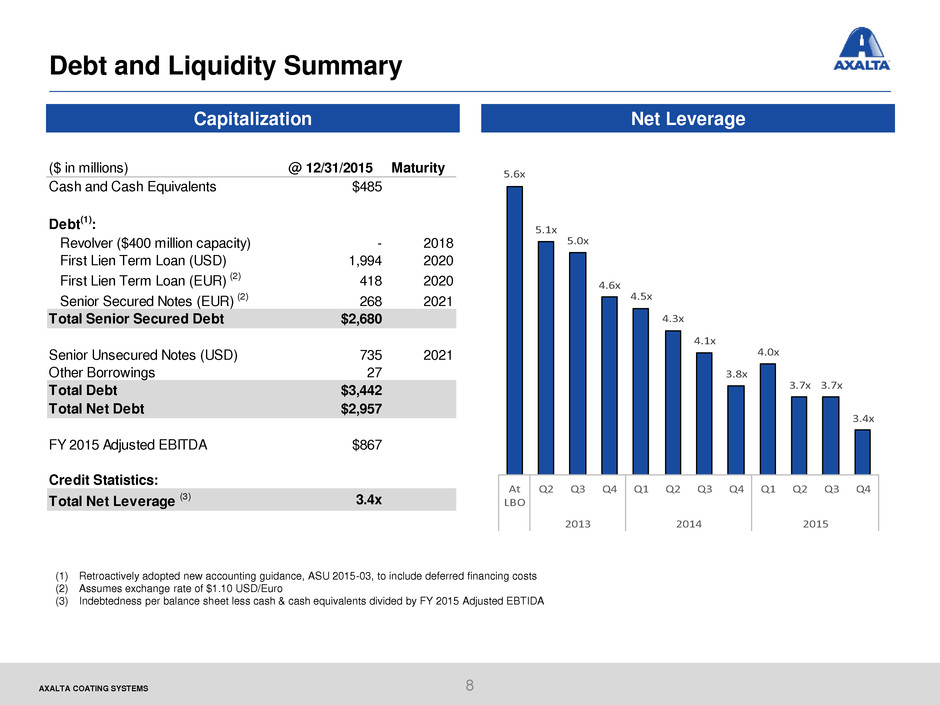

AXALTA COATING SYSTEMS 5.6x 5.1x 5.0x 4.6x 4.5x 4.3x 4.1x 3.8x 4.0x 3.7x 3.7x 3.4x At LBO Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2013 2014 2015 Debt and Liquidity Summary Capitalization 8 (1) Retroactively adopted new accounting guidance, ASU 2015-03, to include deferred financing costs (2) Assumes exchange rate of $1.10 USD/Euro (3) Indebtedness per balance sheet less cash & cash equivalents divided by FY 2015 Adjusted EBTIDA Net Leverage ($ in millions) @ 12/31/2015 Maturity Cash and Cash Equivalents $485 Debt(1): Revolver ($400 million capacity) - 2018 First Lien Term Loan (USD) 1,994 2020 First Lien Term Loan (EUR) (2) 418 2020 Senior Secured Notes (EUR) (2) 268 2021 Total Senior Secured Debt $2,680 Senior Unsecured Notes (USD) 735 2021 Other Borrowings 27 Total Debt $3,442 Total Net Debt $2,957 FY 2015 Adjusted EBITDA $867 Credit Statistics: Total Net Leverage (3) 3.4x

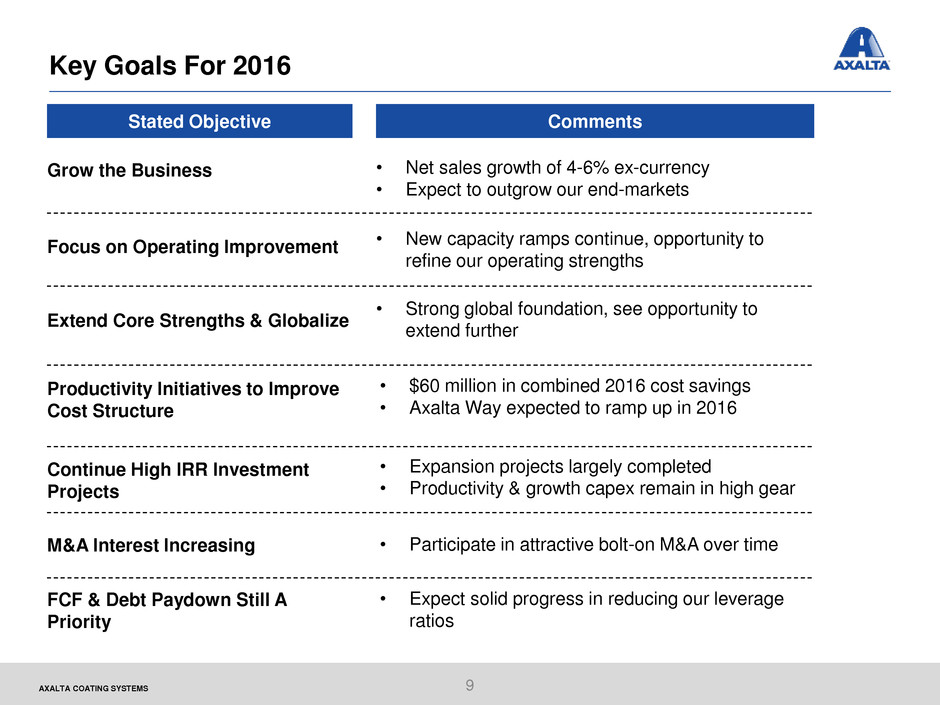

AXALTA COATING SYSTEMS Key Goals For 2016 Stated Objective Comments Grow the Business Productivity Initiatives to Improve Cost Structure Focus on Operating Improvement Extend Core Strengths & Globalize • Net sales growth of 4-6% ex-currency • Expect to outgrow our end-markets • $60 million in combined 2016 cost savings • Axalta Way expected to ramp up in 2016 • New capacity ramps continue, opportunity to refine our operating strengths • Strong global foundation, see opportunity to extend further Continue High IRR Investment Projects • Expansion projects largely completed • Productivity & growth capex remain in high gear 9 M&A Interest Increasing • Participate in attractive bolt-on M&A over time FCF & Debt Paydown Still A Priority • Expect solid progress in reducing our leverage ratios

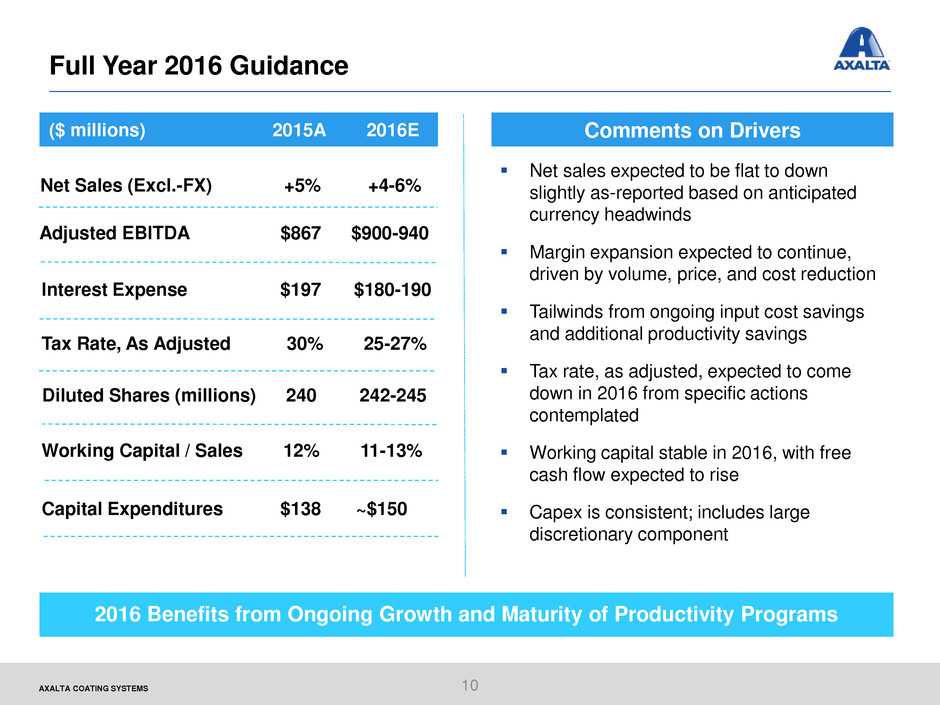

AXALTA COATING SYSTEMS Full Year 2016 Guidance 10 2016 Benefits from Ongoing Growth and Maturity of Productivity Programs Net sales expected to be flat to down slightly as-reported based on anticipated currency headwinds Margin expansion expected to continue, driven by volume, price, and cost reduction Tailwinds from ongoing input cost savings and additional productivity savings Tax rate, as adjusted, expected to come down in 2016 from specific actions contemplated Working capital stable in 2016, with free cash flow expected to rise Capex is consistent; includes large discretionary component ($ millions) 2015A 2016E Net Sales (Excl.-FX) +5% +4-6% Working Capital / Sales 12% 11-13% Tax Rate, As Adjusted 30% 25-27% Diluted Shares (millions) 240 242-245 Comments on Drivers Capital Expenditures $138 ~$150 Interest Expense $197 $180-190 Adjusted EBITDA $867 $900-940

Appendix

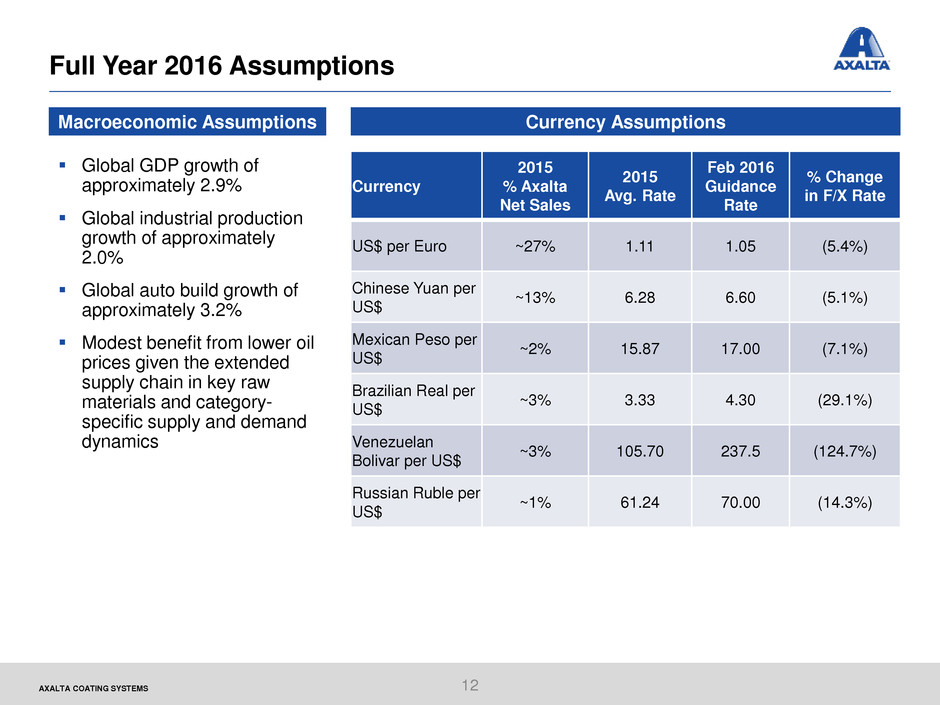

AXALTA COATING SYSTEMS Full Year 2016 Assumptions Global GDP growth of approximately 2.9% Global industrial production growth of approximately 2.0% Global auto build growth of approximately 3.2% Modest benefit from lower oil prices given the extended supply chain in key raw materials and category- specific supply and demand dynamics Currency 2015 % Axalta Net Sales 2015 Avg. Rate Feb 2016 Guidance Rate % Change in F/X Rate US$ per Euro ~27% 1.11 1.05 (5.4%) Chinese Yuan per US$ ~13% 6.28 6.60 (5.1%) Mexican Peso per US$ ~2% 15.87 17.00 (7.1%) Brazilian Real per US$ ~3% 3.33 4.30 (29.1%) Venezuelan Bolivar per US$ ~3% 105.70 237.5 (124.7%) Russian Ruble per US$ ~1% 61.24 70.00 (14.3%) Currency Assumptions Macroeconomic Assumptions 12

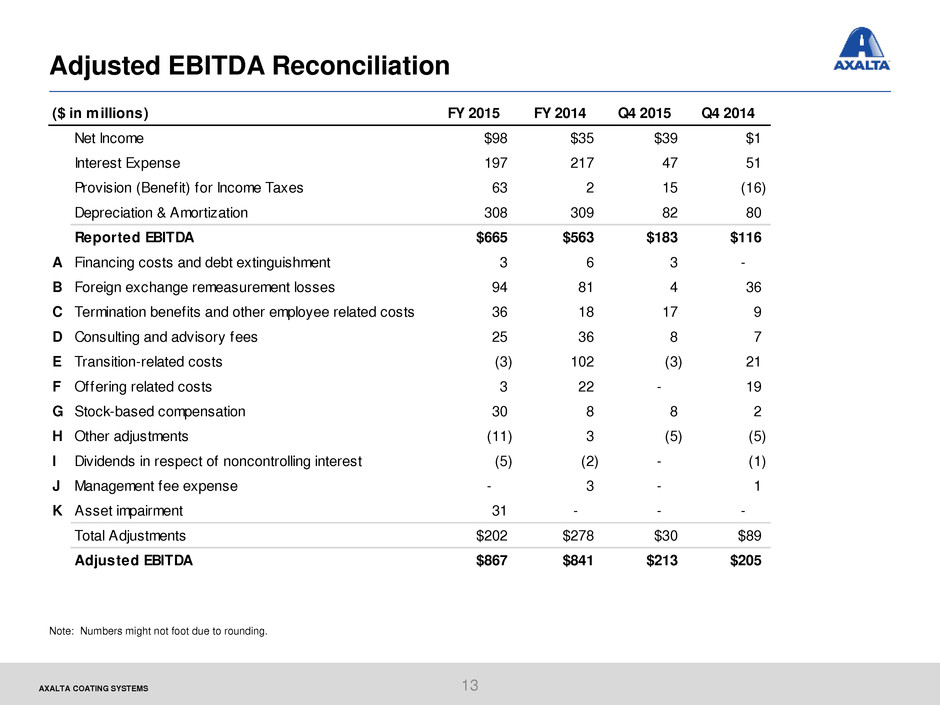

AXALTA COATING SYSTEMS Adjusted EBITDA Reconciliation Note: Numbers might not foot due to rounding. 13 ($ in millions) FY 2015 FY 2014 Q4 2015 Q4 2014 Net Income $98 $35 $39 $1 Interest Expense 197 217 47 51 Provision (Benefit) for Income Taxes 63 2 15 (16) Depreciation & Amortization 308 309 82 80 Reported EBITDA $665 $563 $183 $116 A Financing costs and debt extinguishment 3 6 3 - B Foreign exchange remeasurement losses 94 81 4 36 C Termination benefits and other employee related costs 36 18 17 9 D Consulting and advisory fees 25 36 8 7 E Transition-related costs (3) 102 (3) 21 F Offering related costs 3 22 - 19 G Stock-based compensation 30 8 8 2 H Other adjustments (11) 3 (5) (5) I Dividends in respect of noncontrolling interest (5) (2) - (1) J Management fee expense - 3 - 1 K Asset impairment 31 - - - Total Adjustments $202 $278 $30 $89 Adjusted EBITDA $867 $841 $213 $205

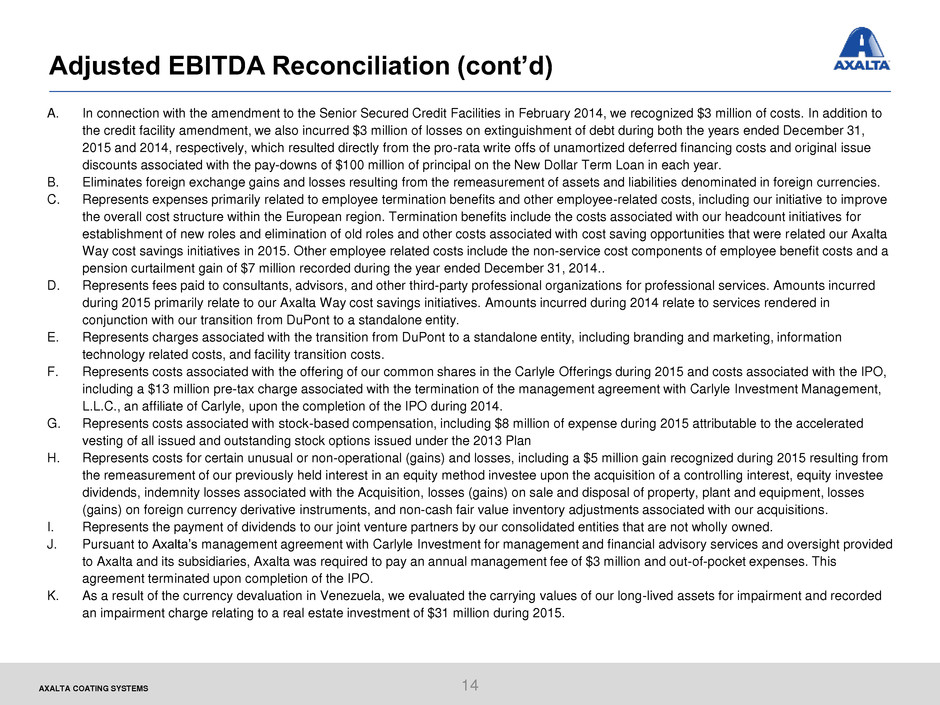

AXALTA COATING SYSTEMS Adjusted EBITDA Reconciliation (cont’d) A. In connection with the amendment to the Senior Secured Credit Facilities in February 2014, we recognized $3 million of costs. In addition to the credit facility amendment, we also incurred $3 million of losses on extinguishment of debt during both the years ended December 31, 2015 and 2014, respectively, which resulted directly from the pro-rata write offs of unamortized deferred financing costs and original issue discounts associated with the pay-downs of $100 million of principal on the New Dollar Term Loan in each year. B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies. C. Represents expenses primarily related to employee termination benefits and other employee-related costs, including our initiative to improve the overall cost structure within the European region. Termination benefits include the costs associated with our headcount initiatives for establishment of new roles and elimination of old roles and other costs associated with cost saving opportunities that were related our Axalta Way cost savings initiatives in 2015. Other employee related costs include the non-service cost components of employee benefit costs and a pension curtailment gain of $7 million recorded during the year ended December 31, 2014.. D. Represents fees paid to consultants, advisors, and other third-party professional organizations for professional services. Amounts incurred during 2015 primarily relate to our Axalta Way cost savings initiatives. Amounts incurred during 2014 relate to services rendered in conjunction with our transition from DuPont to a standalone entity. E. Represents charges associated with the transition from DuPont to a standalone entity, including branding and marketing, information technology related costs, and facility transition costs. F. Represents costs associated with the offering of our common shares in the Carlyle Offerings during 2015 and costs associated with the IPO, including a $13 million pre-tax charge associated with the termination of the management agreement with Carlyle Investment Management, L.L.C., an affiliate of Carlyle, upon the completion of the IPO during 2014. G. Represents costs associated with stock-based compensation, including $8 million of expense during 2015 attributable to the accelerated vesting of all issued and outstanding stock options issued under the 2013 Plan H. Represents costs for certain unusual or non-operational (gains) and losses, including a $5 million gain recognized during 2015 resulting from the remeasurement of our previously held interest in an equity method investee upon the acquisition of a controlling interest, equity investee dividends, indemnity losses associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses (gains) on foreign currency derivative instruments, and non-cash fair value inventory adjustments associated with our acquisitions. I. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned. J. Pursuant to Axalta’s management agreement with Carlyle Investment for management and financial advisory services and oversight provided to Axalta and its subsidiaries, Axalta was required to pay an annual management fee of $3 million and out-of-pocket expenses. This agreement terminated upon completion of the IPO. K. As a result of the currency devaluation in Venezuela, we evaluated the carrying values of our long-lived assets for impairment and recorded an impairment charge relating to a real estate investment of $31 million during 2015. 14

Thank you