EXHIBIT 99.2

Published on April 28, 2016

A X A L T A C O A T I N G S Y S T E M S Q1 2016 FINANCIAL RESULTS April 28, 2016 Exhibit 99.2

AXALTA COATING SYSTEMS Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2016 financial projections, including execution on our 2016 goals as well as 2016 net sales, Adjusted EBITDA, Adjusted EBITDA margin, income tax rate, as adjusted, capital expenditures, net working capital and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Our use of the terms constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt may differ from that of others in our industry. Constant currency net sales, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. 2 Legal Notices

AXALTA COATING SYSTEMS Q1 2016 Highlights Strong Q1 financial results Q1 2016 net sales up 3.0% versus Q1 2015, ex-currency Adjusted EBITDA of $195 million, up 7.0% YoY Adjusted EBITDA margin of 20.4% versus 18.4% in Q1 2015 Operating progress highlights Mexico project completed for expanded resin production capacity Productivity improvement initiatives meeting or exceeding plan Balance sheet & cash flow improvement Free cash flow use narrows considerably versus Q1 2015; on plan for improved cash flow for full year 2016 $100 million debt pre-payment made in April; over $800 million in liquidity available Results on track to meet our projections 4-6% net sales growth ex-currency $900-940 million Adjusted EBITDA Continued operational progress – new capacity and productivity actions taking hold Continued Industrial growth (ex-FX) against a slow end-market backdrop 2016 volume growth driven by expected share gains in Refinish, Industrial, and Light Vehicle 3

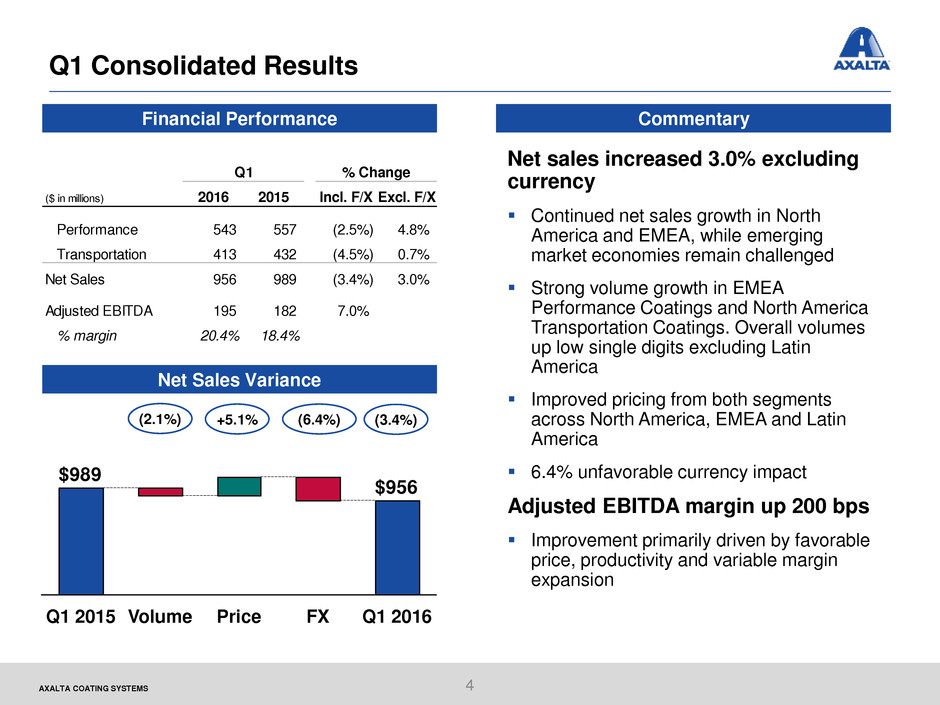

AXALTA COATING SYSTEMS Q1 Consolidated Results Financial Performance Commentary Net Sales Variance (2.1%) +5.1% (6.4%) (3.4%) $956 $989 Q1 2016 FX Price Q1 2015 Volume 4 Net sales increased 3.0% excluding currency Continued net sales growth in North America and EMEA, while emerging market economies remain challenged Strong volume growth in EMEA Performance Coatings and North America Transportation Coatings. Overall volumes up low single digits excluding Latin America Improved pricing from both segments across North America, EMEA and Latin America 6.4% unfavorable currency impact Adjusted EBITDA margin up 200 bps Improvement primarily driven by favorable price, productivity and variable margin expansion ($ in millions) 2016 2015 Incl. F/X Excl. F/X Performance 543 557 (2.5%) 4.8% Transportation 413 432 (4.5%) 0.7% Net Sales 956 989 (3.4%) 3.0% Adjusted EBITDA 195 182 7.0% % margin 20.4% 18.4% Q1 % Change

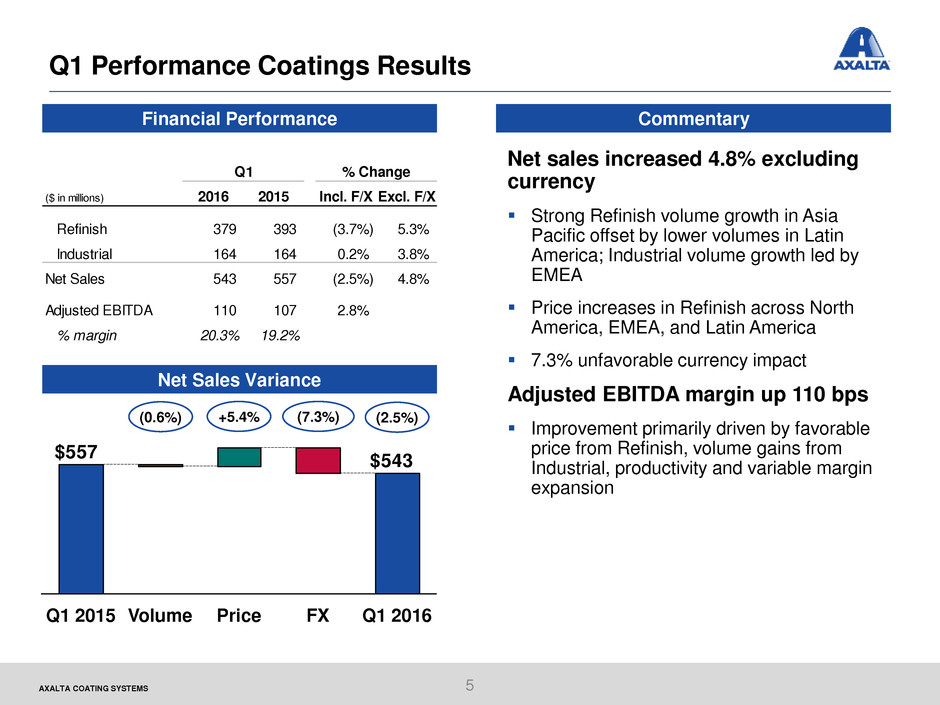

AXALTA COATING SYSTEMS Q1 Performance Coatings Results Financial Performance Commentary Net Sales Variance (0.6%) +5.4% (7.3%) (2.5%) $543 $557 Q1 2016 Q1 2015 Volume FX Price 5 Net sales increased 4.8% excluding currency Strong Refinish volume growth in Asia Pacific offset by lower volumes in Latin America; Industrial volume growth led by EMEA Price increases in Refinish across North America, EMEA, and Latin America 7.3% unfavorable currency impact Adjusted EBITDA margin up 110 bps Improvement primarily driven by favorable price from Refinish, volume gains from Industrial, productivity and variable margin expansion Q1 ($ in millions) 2016 2015 Incl. F/X Excl. F/X Refinish 379 393 (3.7%) 5.3% Industrial 164 164 0.2% 3.8% Net Sales 543 557 (2.5%) 4.8% Adjusted EBITDA 110 107 2.8% % margin 20.3% 19.2% % Change

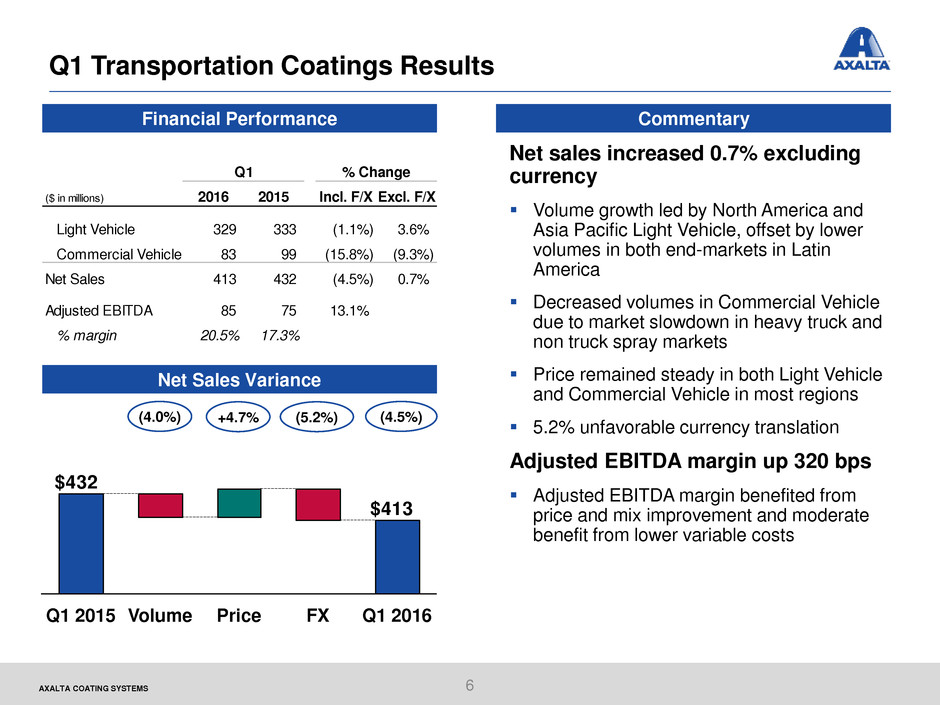

AXALTA COATING SYSTEMS Q1 Transportation Coatings Results Financial Performance Commentary Net Sales Variance (4.0%) +4.7% (4.5%) $413 $432 Q1 2015 Q1 2016 Price FX Volume 6 Net sales increased 0.7% excluding currency Volume growth led by North America and Asia Pacific Light Vehicle, offset by lower volumes in both end-markets in Latin America Decreased volumes in Commercial Vehicle due to market slowdown in heavy truck and non truck spray markets Price remained steady in both Light Vehicle and Commercial Vehicle in most regions 5.2% unfavorable currency translation Adjusted EBITDA margin up 320 bps Adjusted EBITDA margin benefited from price and mix improvement and moderate benefit from lower variable costs (5.2%) ($ in millions) 2016 2015 Incl. F/X Excl. F/X Light Vehicle 329 333 (1.1%) 3.6% Commercial Vehicle 83 99 (15.8%) (9.3%) Net Sales 413 432 (4.5%) 0.7% Adjusted EBITDA 85 75 13.1% % margin 20.5% 17.3% Q1 % Change

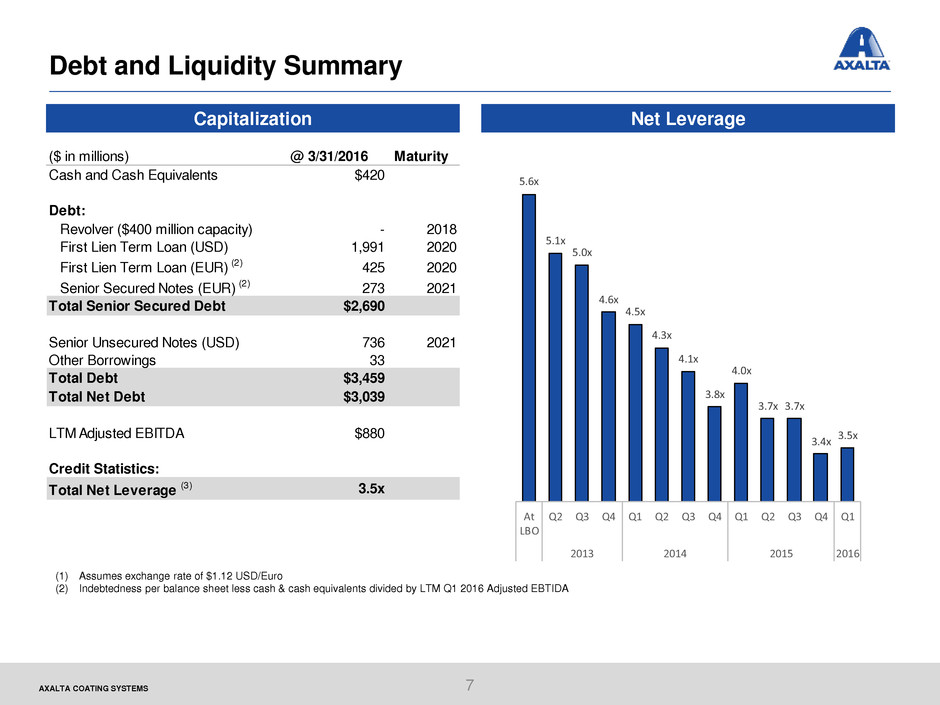

AXALTA COATING SYSTEMS Debt and Liquidity Summary Capitalization 7 Net Leverage 5.6x 5.1x 5.0x 4.6x 4.5x 4.3x 4.1x 3.8x 4.0x 3.7x 3.7x 3.4x 3.5x At LBO Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2013 2014 2015 2016 ($ in millions) @ 3/31/2016 Maturity Cash and Cash Equivalents $420 Debt: Revolver ($400 million capacity) - 2018 First Lien Term Loan (USD) 1,991 2020 First Lien Term Loan (EUR) (2) 425 2020 Senior Secured Notes (EUR) (2) 273 2021 Total Senior Secured Debt $2,690 Senior Unsecured Notes (USD) 736 2021 Other Borrowings 33 Total Debt $3,459 Total Net Debt $3,039 LTM Adjusted EBITDA $880 Credit Statistics: Total Net Leverage (3) 3.5x (1) Assumes exchange rate of $1.12 USD/Euro (2) Indebtedness per balance sheet less cash & cash equivalents divided by LTM Q1 2016 Adjusted EBTIDA

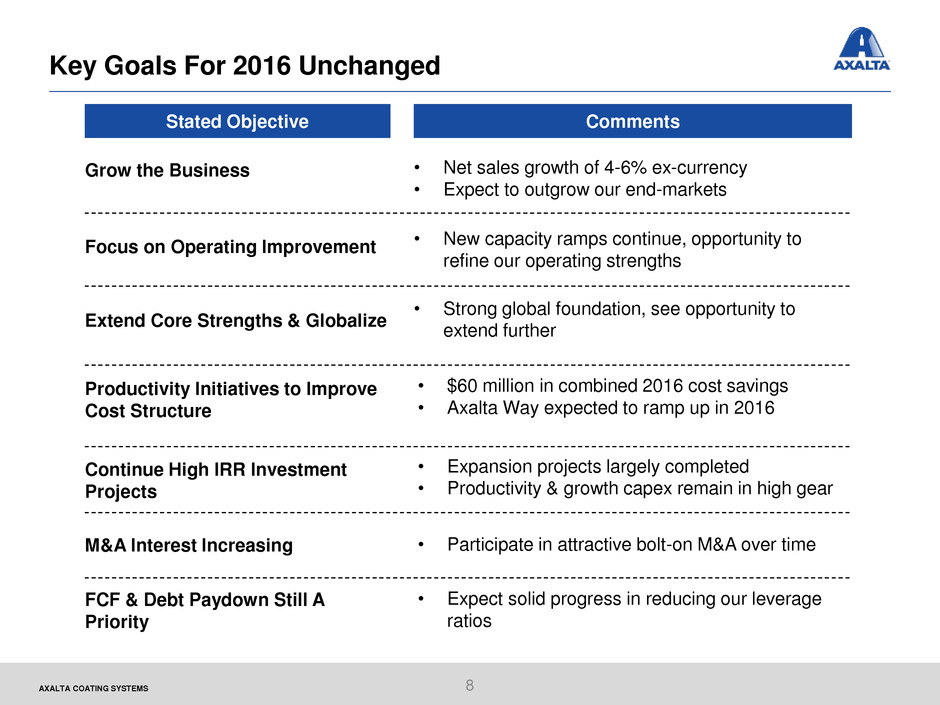

AXALTA COATING SYSTEMS Key Goals For 2016 Unchanged Stated Objective Comments Grow the Business Productivity Initiatives to Improve Cost Structure Focus on Operating Improvement Extend Core Strengths & Globalize • Net sales growth of 4-6% ex-currency • Expect to outgrow our end-markets • $60 million in combined 2016 cost savings • Axalta Way expected to ramp up in 2016 • New capacity ramps continue, opportunity to refine our operating strengths • Strong global foundation, see opportunity to extend further Continue High IRR Investment Projects • Expansion projects largely completed • Productivity & growth capex remain in high gear 8 M&A Interest Increasing • Participate in attractive bolt-on M&A over time FCF & Debt Paydown Still A Priority • Expect solid progress in reducing our leverage ratios

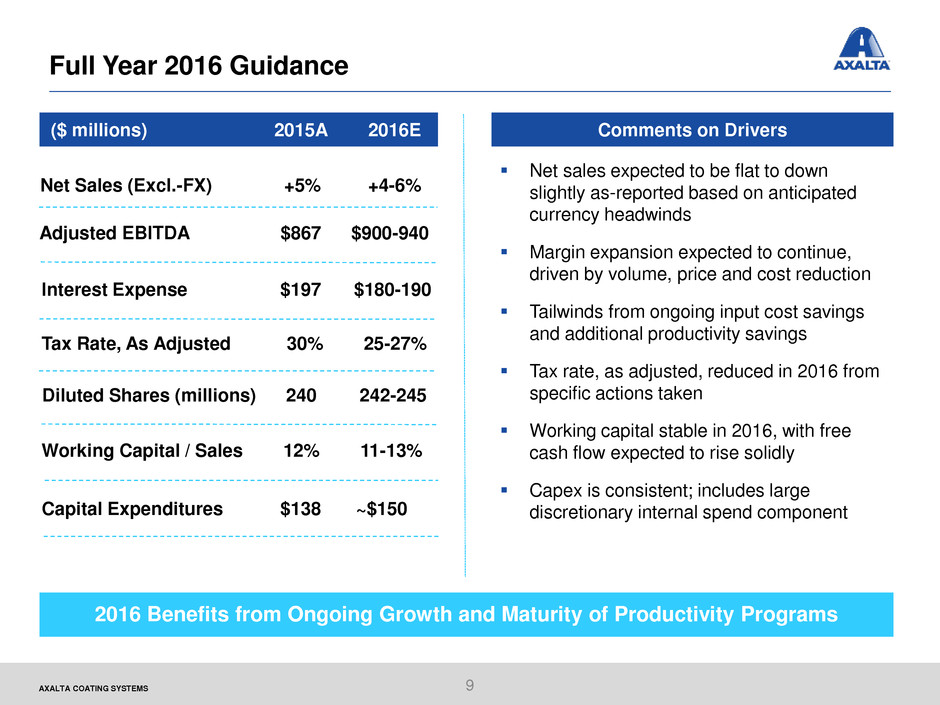

AXALTA COATING SYSTEMS Full Year 2016 Guidance 9 2016 Benefits from Ongoing Growth and Maturity of Productivity Programs Net sales expected to be flat to down slightly as-reported based on anticipated currency headwinds Margin expansion expected to continue, driven by volume, price and cost reduction Tailwinds from ongoing input cost savings and additional productivity savings Tax rate, as adjusted, reduced in 2016 from specific actions taken Working capital stable in 2016, with free cash flow expected to rise solidly Capex is consistent; includes large discretionary internal spend component ($ millions) 2015A 2016E Net Sales (Excl.-FX) +5% +4-6% Working Capital / Sales 12% 11-13% Tax Rate, As Adjusted 30% 25-27% Diluted Shares (millions) 240 242-245 Comments on Drivers Capital Expenditures $138 ~$150 Interest Expense $197 $180-190 Adjusted EBITDA $867 $900-940

Appendix

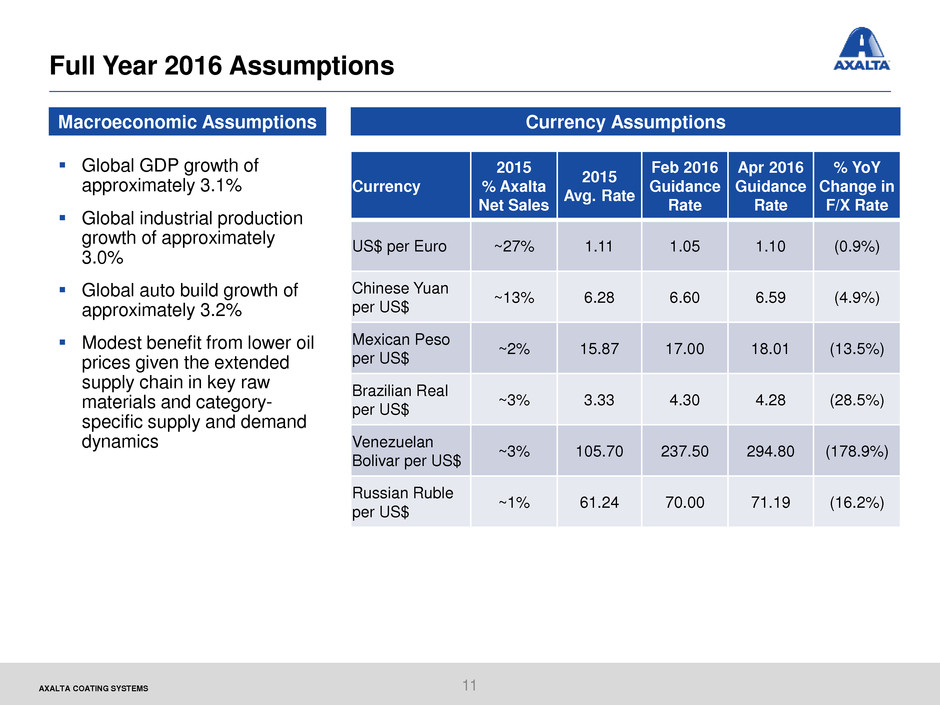

AXALTA COATING SYSTEMS Full Year 2016 Assumptions Global GDP growth of approximately 3.1% Global industrial production growth of approximately 3.0% Global auto build growth of approximately 3.2% Modest benefit from lower oil prices given the extended supply chain in key raw materials and category- specific supply and demand dynamics Currency 2015 % Axalta Net Sales 2015 Avg. Rate Feb 2016 Guidance Rate Apr 2016 Guidance Rate % YoY Change in F/X Rate US$ per Euro ~27% 1.11 1.05 1.10 (0.9%) Chinese Yuan per US$ ~13% 6.28 6.60 6.59 (4.9%) Mexican Peso per US$ ~2% 15.87 17.00 18.01 (13.5%) Brazilian Real per US$ ~3% 3.33 4.30 4.28 (28.5%) Venezuelan Bolivar per US$ ~3% 105.70 237.50 294.80 (178.9%) Russian Ruble per US$ ~1% 61.24 70.00 71.19 (16.2%) Currency Assumptions Macroeconomic Assumptions 11

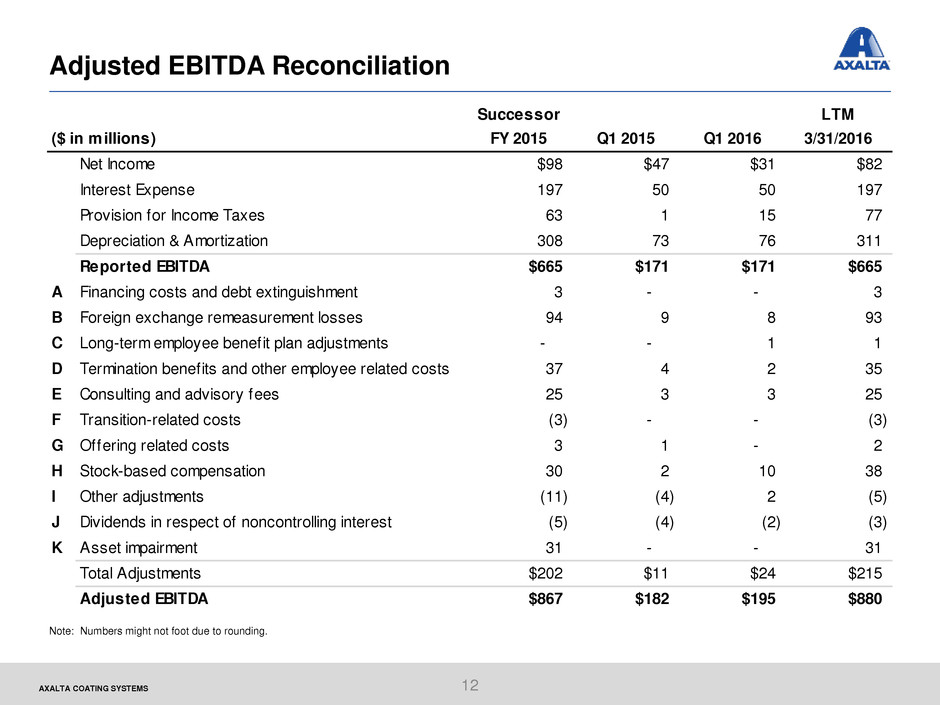

AXALTA COATING SYSTEMS Adjusted EBITDA Reconciliation Note: Numbers might not foot due to rounding. 12 Successor LTM ($ in millions) FY 2015 Q1 2015 Q1 2016 3/31/2016 Net Income $98 $47 $31 $82 Interest Expense 197 50 50 197 Provision for Income Taxes 63 1 15 77 Depreciation & Amortization 308 73 76 311 Reported EBITDA $665 $171 $171 $665 A Financing costs and debt extinguishment 3 - - 3 B Foreign exchange remeasurement losses 94 9 8 93 C Long-term employee benefit plan adjustments - - 1 1 D Termination benefits and other employee related costs 37 4 2 35 E Consulting and advisory fees 25 3 3 25 F Transition-related costs (3) - - (3) G Offering related costs 3 1 - 2 H Stock-based compensation 30 2 10 38 I Other adjustments (11) (4) 2 (5) J Dividends in respect of noncontrolling interest (5) (4) (2) (3) K Asset impairment 31 - - 31 Total Adjustments $202 $11 $24 $215 Adjusted EBITDA $867 $182 $195 $880

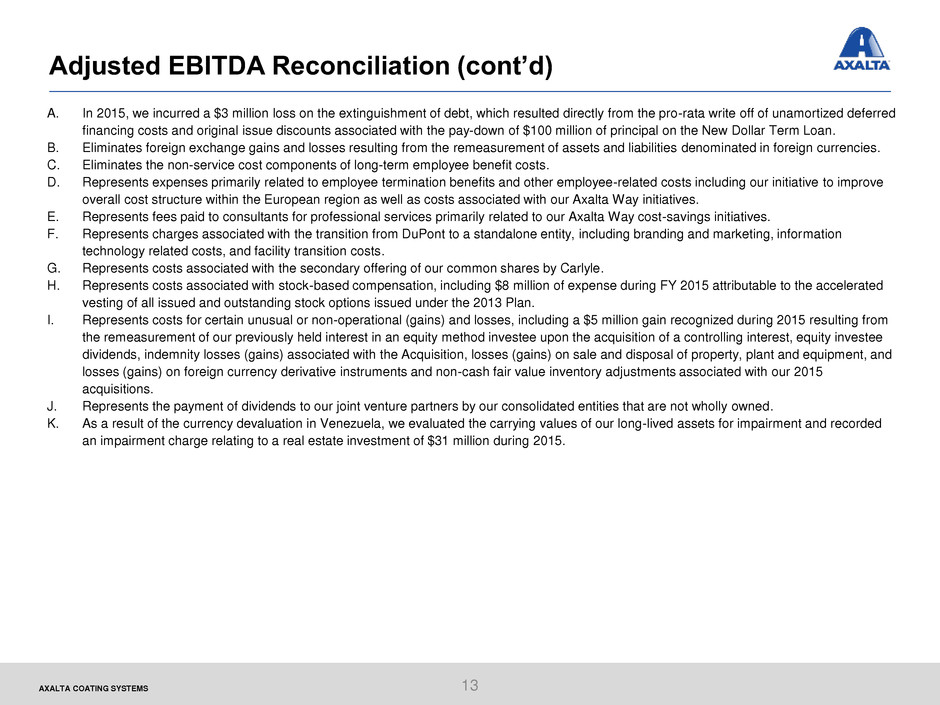

AXALTA COATING SYSTEMS Adjusted EBITDA Reconciliation (cont’d) A. In 2015, we incurred a $3 million loss on the extinguishment of debt, which resulted directly from the pro-rata write off of unamortized deferred financing costs and original issue discounts associated with the pay-down of $100 million of principal on the New Dollar Term Loan. B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies. C. Eliminates the non-service cost components of long-term employee benefit costs. D. Represents expenses primarily related to employee termination benefits and other employee-related costs including our initiative to improve overall cost structure within the European region as well as costs associated with our Axalta Way initiatives. E. Represents fees paid to consultants for professional services primarily related to our Axalta Way cost-savings initiatives. F. Represents charges associated with the transition from DuPont to a standalone entity, including branding and marketing, information technology related costs, and facility transition costs. G. Represents costs associated with the secondary offering of our common shares by Carlyle. H. Represents costs associated with stock-based compensation, including $8 million of expense during FY 2015 attributable to the accelerated vesting of all issued and outstanding stock options issued under the 2013 Plan. I. Represents costs for certain unusual or non-operational (gains) and losses, including a $5 million gain recognized during 2015 resulting from the remeasurement of our previously held interest in an equity method investee upon the acquisition of a controlling interest, equity investee dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, and losses (gains) on foreign currency derivative instruments and non-cash fair value inventory adjustments associated with our 2015 acquisitions. J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned. K. As a result of the currency devaluation in Venezuela, we evaluated the carrying values of our long-lived assets for impairment and recorded an impairment charge relating to a real estate investment of $31 million during 2015. 13

Thank you