EXHIBIT 99.1

Published on August 10, 2016

Axalta Coating Systems Ltd.

Investor Presentation

Third Quarter 2016

Exhibit 99.1

PROPRIETARYAXALTA COATING SYSTEMS 2

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995,

including those relating to 2016 financial projections, including execution on our 2016 goals as well as 2016 net sales, Adjusted EBITDA, Adjusted EBITDA margin, interest expense, income tax

rate, as adjusted, diluted shares, capital expenditures, depreciation and amortization, working capital, cost savings and related assumptions. Any forward-looking statements involve risks,

uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,”

“could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends,

current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and

analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not

intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or

results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of

factors, including known and unknown risks and uncertainties, many of which are beyond our control.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States

(“GAAP”), including constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial

and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense, (ii)

the impact of certain non-cash or other items that are included in net income and EBITDA that we do not consider indicative of our ongoing performance and (iii) certain unusual items impacting

results in a particular period. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business

trends on a period-to-period basis. Our use of the terms constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt may differ from that of others in our industry.

Constant currency net sales, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income, operating income or any other performance measures derived

in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow and

Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a

reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. The company does not provide a reconciliation for

non-GAAP estimates on a forward-looking basis where it is unable to provide a meaningful or accurate calculation or estimate of reconciling items and the information is not available without

reasonable effort.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets,

forecasts, and prior year financial results, providing a measure that management believes reflects the Company’s core operating performance. As we do not measure segment operating

performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

Legal Notices

PROPRIETARYAXALTA COATING SYSTEMS

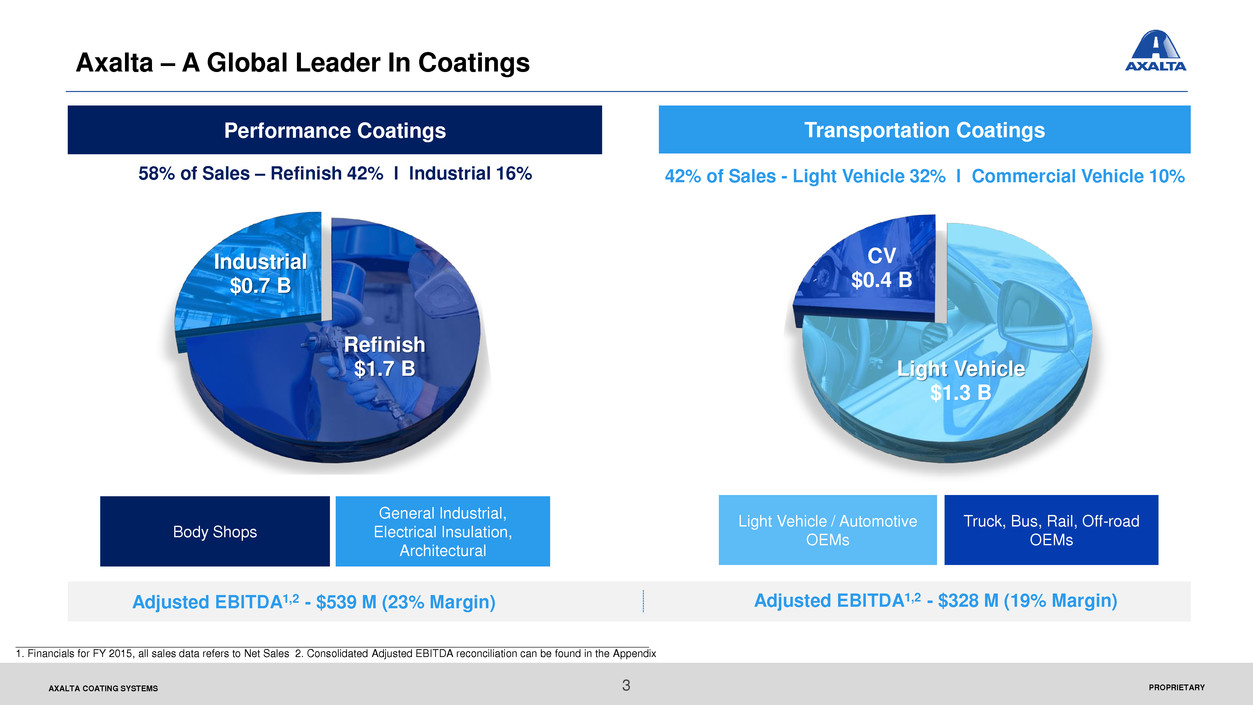

Refinish

$1.7 B

Industrial

$0.7 B

Body Shops

Light Vehicle

$1.3 B

CV

$0.4 B

Performance Coatings

General Industrial,

Electrical Insulation,

Architectural

Transportation Coatings

Adjusted EBITDA1,2 - $539 M (23% Margin) Adjusted EBITDA1,2 - $328 M (19% Margin)

Light Vehicle / Automotive

OEMs

Truck, Bus, Rail, Off-road

OEMs

58% of Sales – Refinish 42% l Industrial 16% 42% of Sales - Light Vehicle 32% l Commercial Vehicle 10%

____________________________________________________________________________________________________________

1. Financials for FY 2015, all sales data refers to Net Sales 2. Consolidated Adjusted EBITDA reconciliation can be found in the Appendix

3

Axalta – A Global Leader In Coatings

AXALTA COATING SYSTEMS

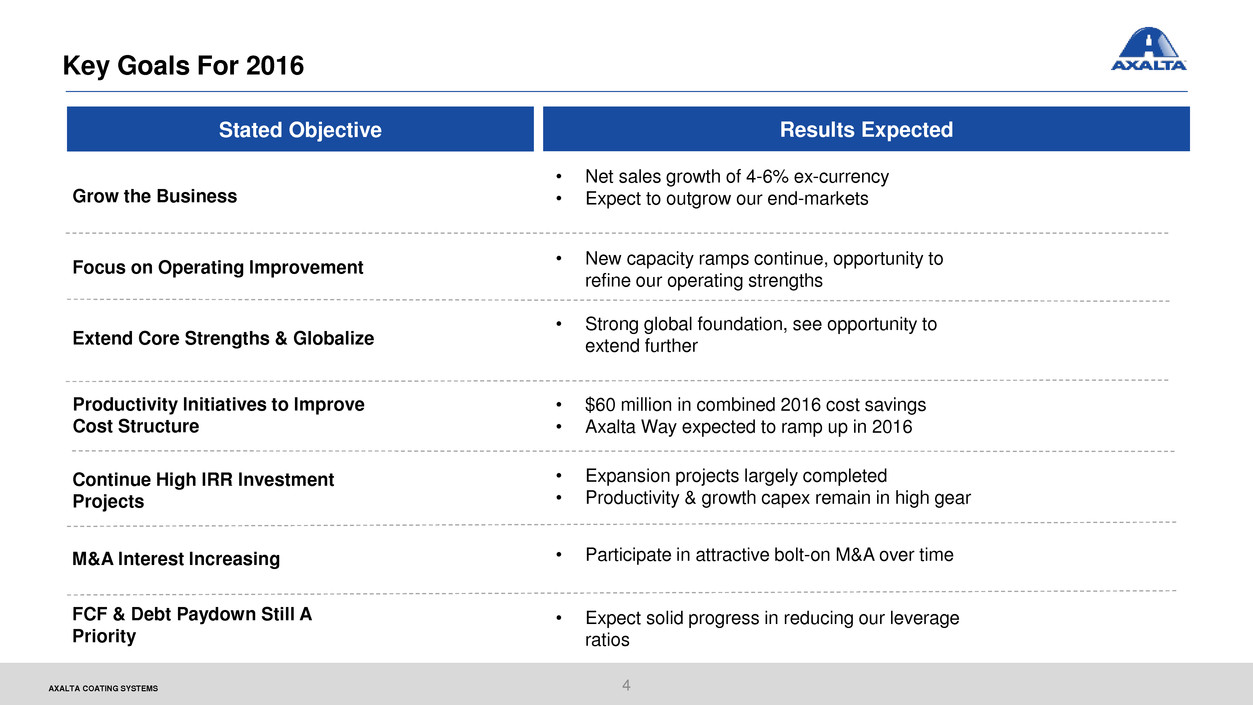

Key Goals For 2016

Grow the Business

Productivity Initiatives to Improve

Cost Structure

Focus on Operating Improvement

Extend Core Strengths & Globalize

• Net sales growth of 4-6% ex-currency

• Expect to outgrow our end-markets

• $60 million in combined 2016 cost savings

• Axalta Way expected to ramp up in 2016

• New capacity ramps continue, opportunity to

refine our operating strengths

• Strong global foundation, see opportunity to

extend further

Continue High IRR Investment

Projects

• Expansion projects largely completed

• Productivity & growth capex remain in high gear

4

M&A Interest Increasing • Participate in attractive bolt-on M&A over time

FCF & Debt Paydown Still A

Priority

• Expect solid progress in reducing our leverage

ratios

Stated Objective Results Expected

PROPRIETARYAXALTA COATING SYSTEMS 5

Axalta Operates Fundamentally Strong Businesses

A Global Leader in Our Markets

Significant Competitive Advantages

A Service-Led Business Model

Structurally Attractive End Markets

Highly Variable Cost Structure; Low Capital Intensity

PROPRIETARYAXALTA COATING SYSTEMS 6

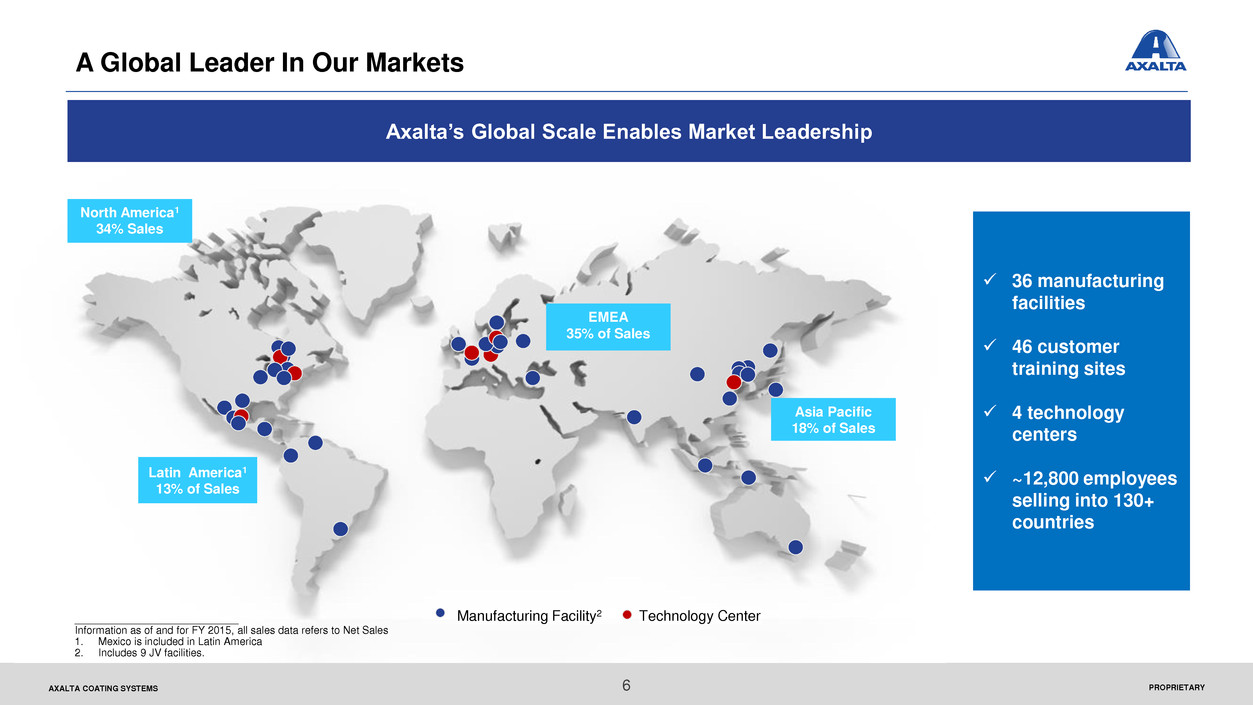

A Global Leader In Our Markets

Axalta’s Global Scale Enables Market Leadership

____________________________

Information as of and for FY 2015, all sales data refers to Net Sales

1. Mexico is included in Latin America

2. Includes 9 JV facilities.

36 manufacturing

facilities

46 customer

training sites

4 technology

centers

~12,800 employees

selling into 130+

countries

North America1

34% Sales

Latin America1

13% of Sales

Asia Pacific

18% of Sales

EMEA

35% of Sales

Manufacturing Facility2 Technology Center

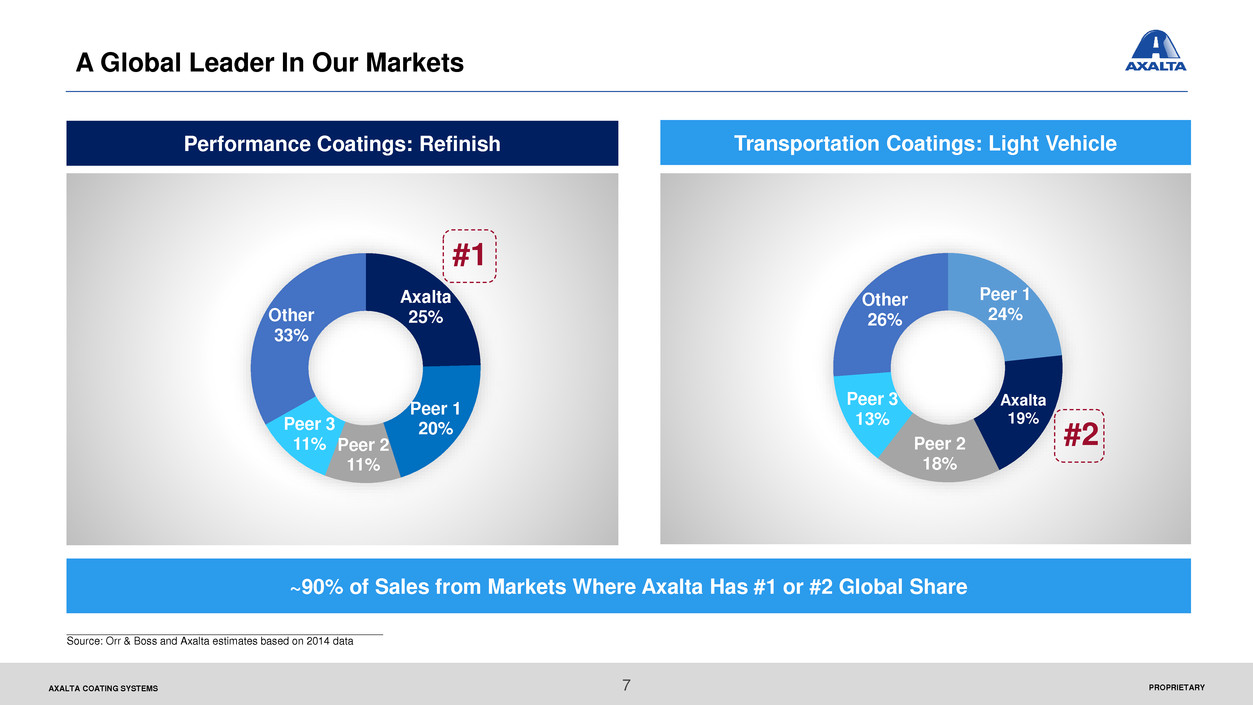

PROPRIETARYAXALTA COATING SYSTEMS

Peer 1

24%

Axalta

19%

Peer 2

18%

Peer 3

13%

Other

26%

7

A Global Leader In Our Markets

~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share

Axalta

25%

Peer 1

20%

Peer 2

11%

Peer 3

11%

Other

33%

Performance Coatings: Refinish Transportation Coatings: Light Vehicle

#1

______________________________________________________

Source: Orr & Boss and Axalta estimates based on 2014 data

#2

PROPRIETARYAXALTA COATING SYSTEMS 8

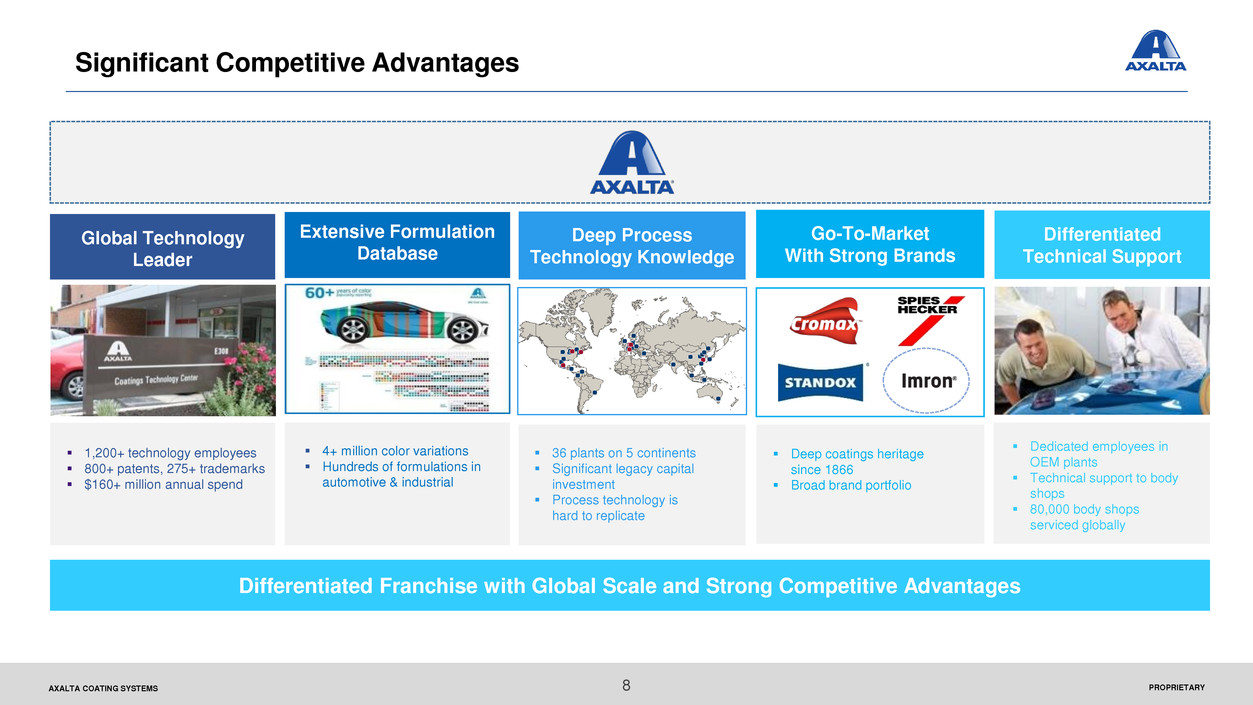

Significant Competitive Advantages

Differentiated Franchise with Global Scale and Strong Competitive Advantages

4+ million color variations

Hundreds of formulations in

automotive & industrial

Deep coatings heritage

since 1866

Broad brand portfolio

1,200+ technology employees

800+ patents, 275+ trademarks

$160+ million annual spend

36 plants on 5 continents

Significant legacy capital

investment

Process technology is

hard to replicate

Dedicated employees in

OEM plants

Technical support to body

shops

80,000 body shops

serviced globally

Global Technology

Leader

Extensive Formulation

Database

Deep Process

Technology Knowledge

Go-To-Market

With Strong Brands

Differentiated

Technical Support

PROPRIETARYAXALTA COATING SYSTEMS

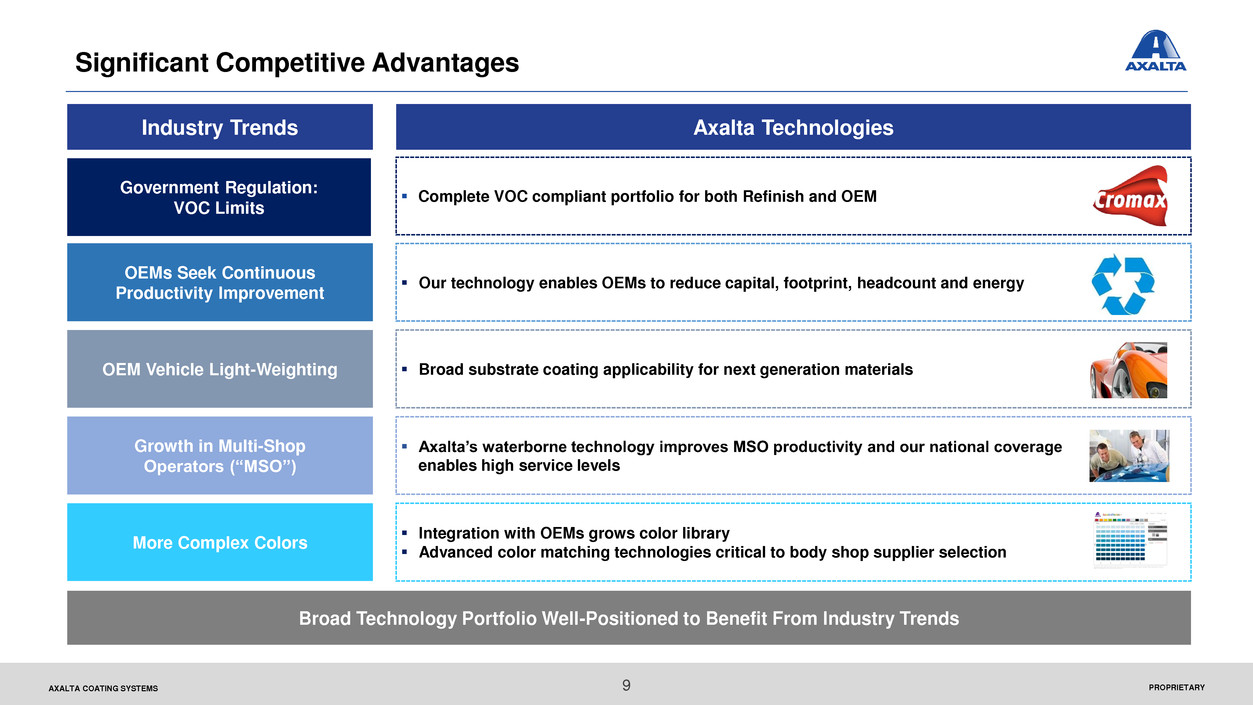

Industry Trends Axalta Technologies

OEM Vehicle Light-Weighting Broad substrate coating applicability for next generation materials

Growth in Multi-Shop

Operators (“MSO”)

Axalta’s waterborne technology improves MSO productivity and our national coverage

enables high service levels

9

Significant Competitive Advantages

More Complex Colors

Integration with OEMs grows color library

Advanced color matching technologies critical to body shop supplier selection

Our technology enables OEMs to reduce capital, footprint, headcount and energy

OEMs Seek Continuous

Productivity Improvement

Government Regulation:

VOC Limits

Complete VOC compliant portfolio for both Refinish and OEM

Broad Technology Portfolio Well-Positioned to Benefit From Industry Trends

PROPRIETARYAXALTA COATING SYSTEMS 10

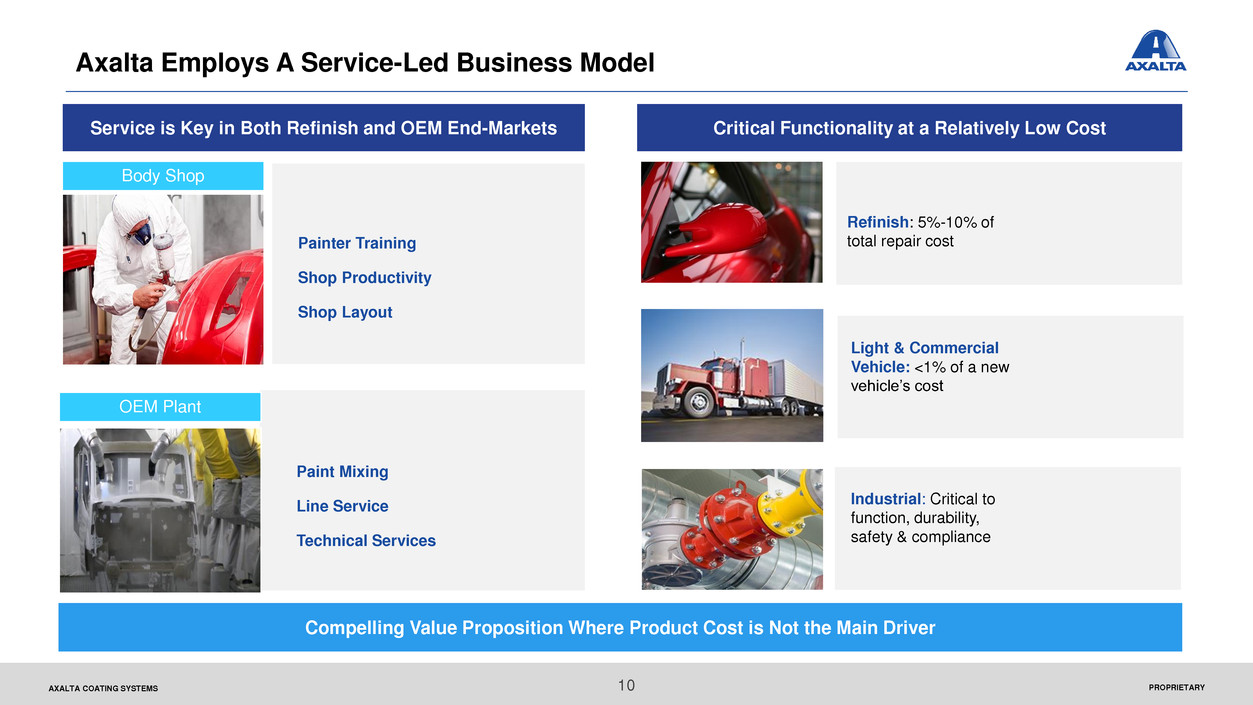

Axalta Employs A Service-Led Business Model

Critical Functionality at a Relatively Low Cost

1

Compelling Value Proposition Where Product Cost is Not the Main Driver

Light & Commercial

Vehicle: <1% of a new

vehicle’s cost

Industrial: Critical to

function, durability,

safety & compliance

Refinish: 5%-10% of

total repair cost

Body Shop

OEM Plant

Service is Key in Both Refinish and OEM End-Markets

Painter Training

Shop Productivity

Shop Layout

Paint Mixing

Line Service

Technical Services

PROPRIETARYAXALTA COATING SYSTEMS 11

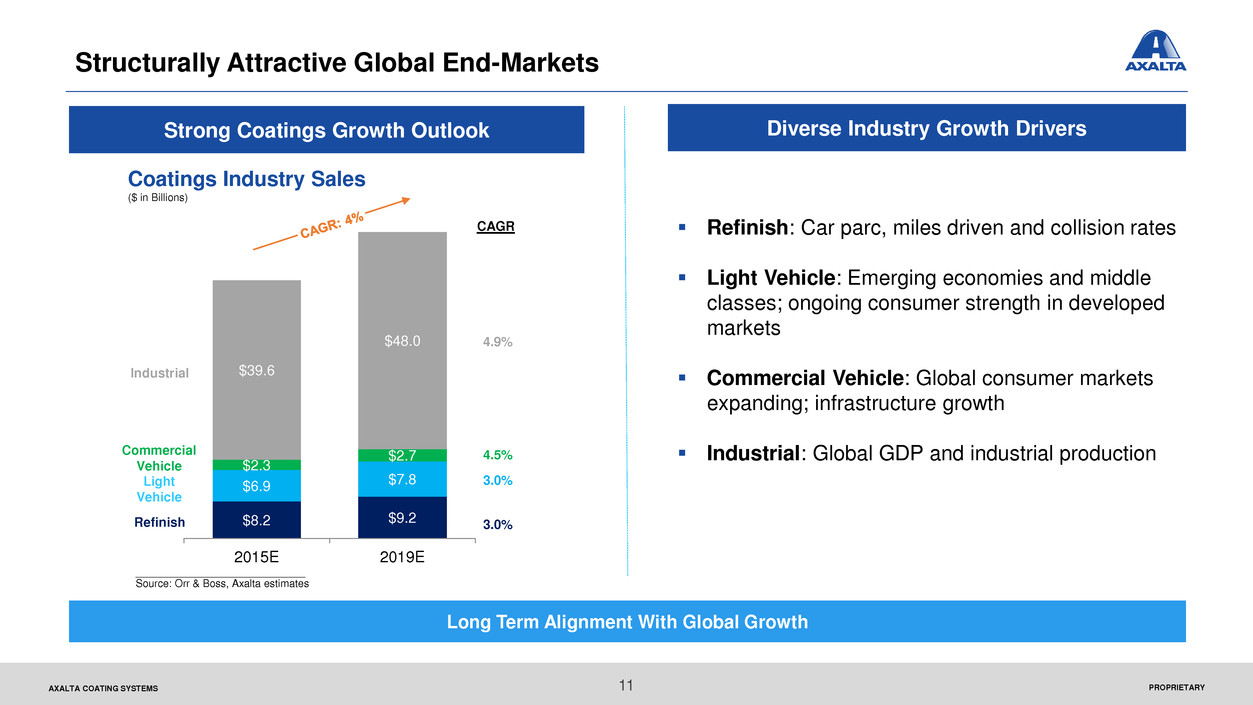

Structurally Attractive Global End-Markets

Strong Coatings Growth Outlook

Long Term Alignment With Global Growth

Refinish: Car parc, miles driven and collision rates

Light Vehicle: Emerging economies and middle

classes; ongoing consumer strength in developed

markets

Commercial Vehicle: Global consumer markets

expanding; infrastructure growth

Industrial: Global GDP and industrial production

Diverse Industry Growth Drivers

Commercial

Vehicle

Light

Vehicle

Refinish

Industrial

4.9%

4.5%

3.0%

3.0%

CAGR

Coatings Industry Sales

($ in Billions)

_____________________________

Source: Orr & Boss, Axalta estimates

$8.2 $9.2

$6.9 $7.8

$2.3

$2.7

$39.6

$48.0

2015E 2019E

PROPRIETARYAXALTA COATING SYSTEMS 12

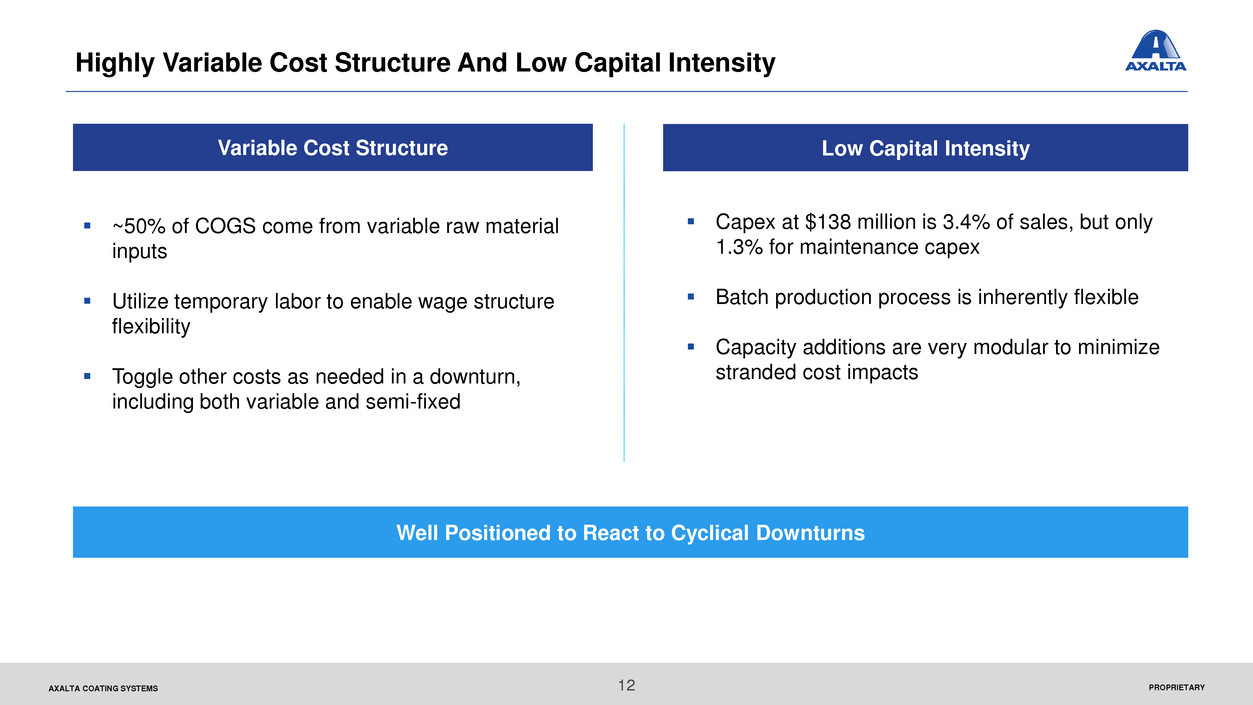

Highly Variable Cost Structure And Low Capital Intensity

~50% of COGS come from variable raw material

inputs

Utilize temporary labor to enable wage structure

flexibility

Toggle other costs as needed in a downturn,

including both variable and semi-fixed

Low Capital Intensity

Capex at $138 million is 3.4% of sales, but only

1.3% for maintenance capex

Batch production process is inherently flexible

Capacity additions are very modular to minimize

stranded cost impacts

Variable Cost Structure

Well Positioned to React to Cyclical Downturns

PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Future State: A Global, High-Performing, Coatings Leader

Consistent

Growth

Margin

Expansion

Effective

Capital

Allocation

Enhanced

Shareholder

Returns

Axalta’s Vision

To maximize our customers’ productivity and product functionality by offering them innovative

coatings solutions and best-of-class service

13

PROPRIETARYAXALTA COATING SYSTEMS 14

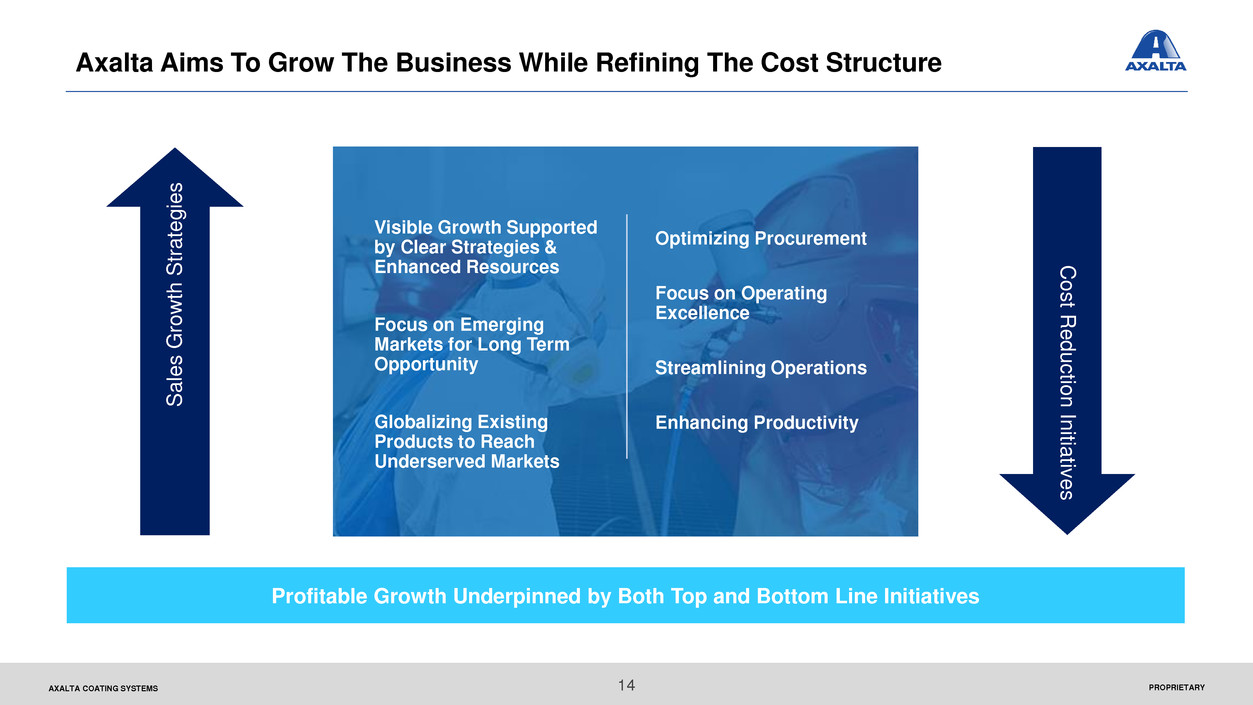

Axalta Aims To Grow The Business While Refining The Cost Structure

Visible Growth Supported

by Clear Strategies &

Enhanced Resources

Focus on Emerging

Markets for Long Term

Opportunity

Globalizing Existing

Products to Reach

Underserved Markets

Optimizing Procurement

Focus on Operating

Excellence

Streamlining Operations

Enhancing Productivity

Sa

le

s

G

ro

w

th

Strateg

ie

s

Co

s

t Redu

c

tion In

itiat

iv

e

s

Profitable Growth Underpinned by Both Top and Bottom Line Initiatives

PROPRIETARYAXALTA COATING SYSTEMS 15

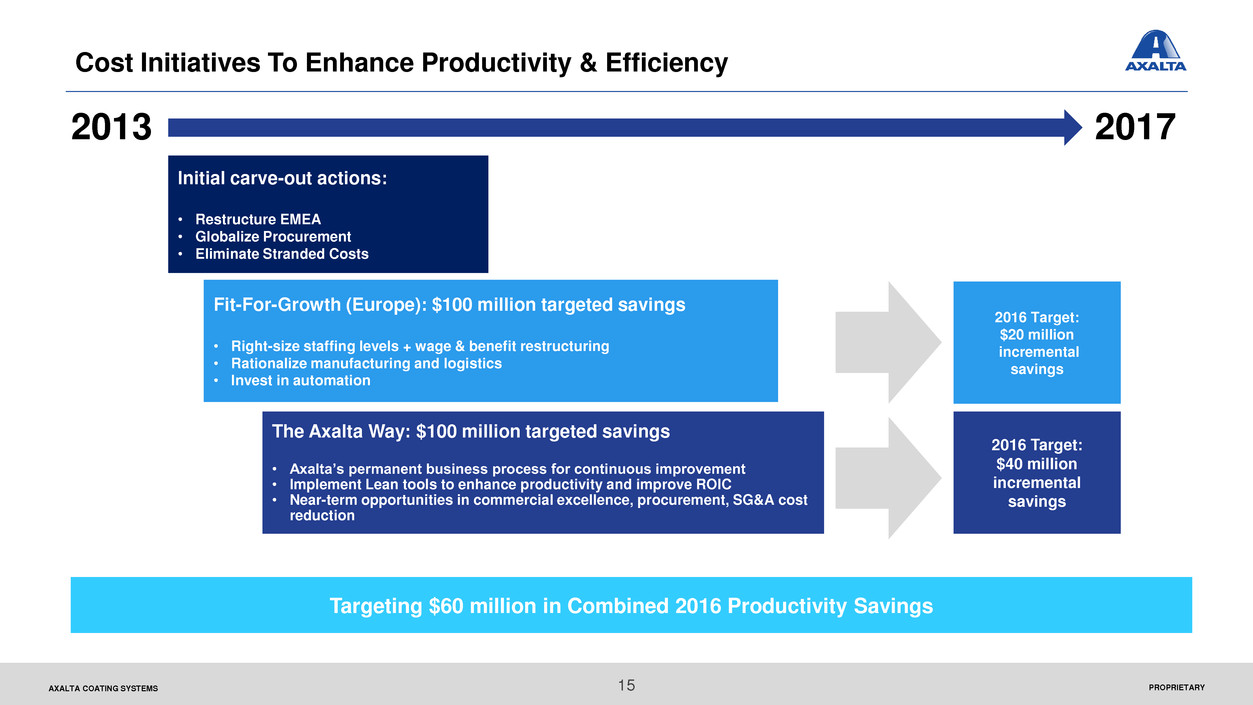

Cost Initiatives To Enhance Productivity & Efficiency

Fit-For-Growth (Europe): $100 million targeted savings

• Right-size staffing levels + wage & benefit restructuring

• Rationalize manufacturing and logistics

• Invest in automation

Initial carve-out actions:

• Restructure EMEA

• Globalize Procurement

• Eliminate Stranded Costs

The Axalta Way: $100 million targeted savings

• Axalta’s permanent business process for continuous improvement

• Implement Lean tools to enhance productivity and improve ROIC

• Near-term opportunities in commercial excellence, procurement, SG&A cost

reduction

2013 2017

2016 Target:

$40 million

incremental

savings

2016 Target:

$20 million

incremental

savings

Targeting $60 million in Combined 2016 Productivity Savings

PROPRIETARYAXALTA COATING SYSTEMS 16

Axalta’s Evolution Is Grounded In Fundamental Goals

Leverage our culture of accountability and focus on operational excellence

Axalta’s Strategy

Grow in targeted industrial coatings segments via organic growth and selective acquisitions

Move into attractive adjacencies by leveraging our global technology, process and service capabilities

Grow with our market-leading products and services in existing markets

PROPRIETARYAXALTA COATING SYSTEMS 17

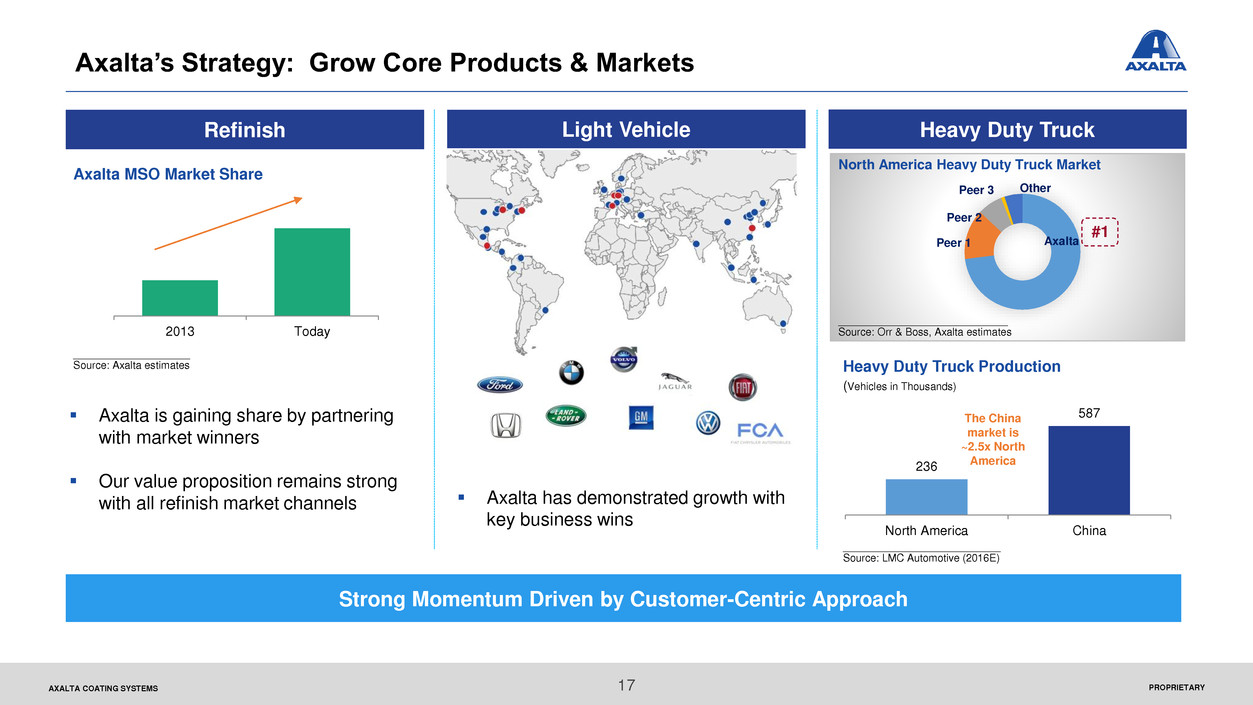

Axalta’s Strategy: Grow Core Products & Markets

Refinish

____________________

Source: Axalta estimates

Strong Momentum Driven by Customer-Centric Approach

Axalta MSO Market Share

2013 Today

Light Vehicle

Axalta is gaining share by partnering

with market winners

Our value proposition remains strong

with all refinish market channels

Heavy Duty Truck

AxaltaPeer 1

Peer 2

Peer 3 Other

#1

North America Heavy Duty Truck Market

(Vehicles in Thousands)

Heavy Duty Truck Production

236

587

North America China

The China

market is

~2.5x North

America

_____________________________

Source: Orr & Boss, Axalta estimates

___________________________

Source: LMC Automotive (2016E)

Axalta has demonstrated growth with

key business wins

PROPRIETARYAXALTA COATING SYSTEMS

$14.3 $15.6

$17.1 $18.5

$20.1

2014E 2015E 2016E 2017E 2018E

Emerging

Markets,

31%

18

Axalta’s Strategy: Accelerate Growth In Emerging Markets

China Example

Light Vehicles, Per 1,000 People China Car Parc

(thousands)

743

263

230

129

61

19

United States

Central &

Eastern Europe

Mexico

Brazil

China

India

Damaged Vehicles Per 1M km Driven

(2011)

Axalta 2015 Net Sales Emerging Market Growth

Coatings Market

($ Billions)

Significant Emerging Markets Growth Opportunity

Significant Opportunity

Rapid growth of middle-classes in emerging

economies

Increased vehicle penetration per capita

Expansion of car parc

Elevated collision rates vs. developed

markets

United States

Brazil

China___________________________Source: Orr & Boss (2014)

_________________________________________

Source: LMC Automotive (2013), World Bank (2013)

____________________

Source: Axalta estimates

___________________________

Source: LMC Automotive (2016)

70

87

103

123

144

165

186

208

230

252

2010A 2013A 2016E 2019E

PROPRIETARYAXALTA COATING SYSTEMS

Architectural

19

Axalta’s Strategy: Targeted Industrial Coatings Expansion

Growth from Leveraging Our Product Portfolio in Underserved Markets

Strong product portfolio in powder, liquid, and e-coat

Implemented global end-market business structure to capitalize on opportunities

Leveraging existing technology and enhanced sales organization to grow

A Broad Industrial Portfolio

Electrical Insulation

Agricultural, Construction,

& Earthmoving Equipment

(ACE)

Oil & Gas

PROPRIETARYAXALTA COATING SYSTEMS

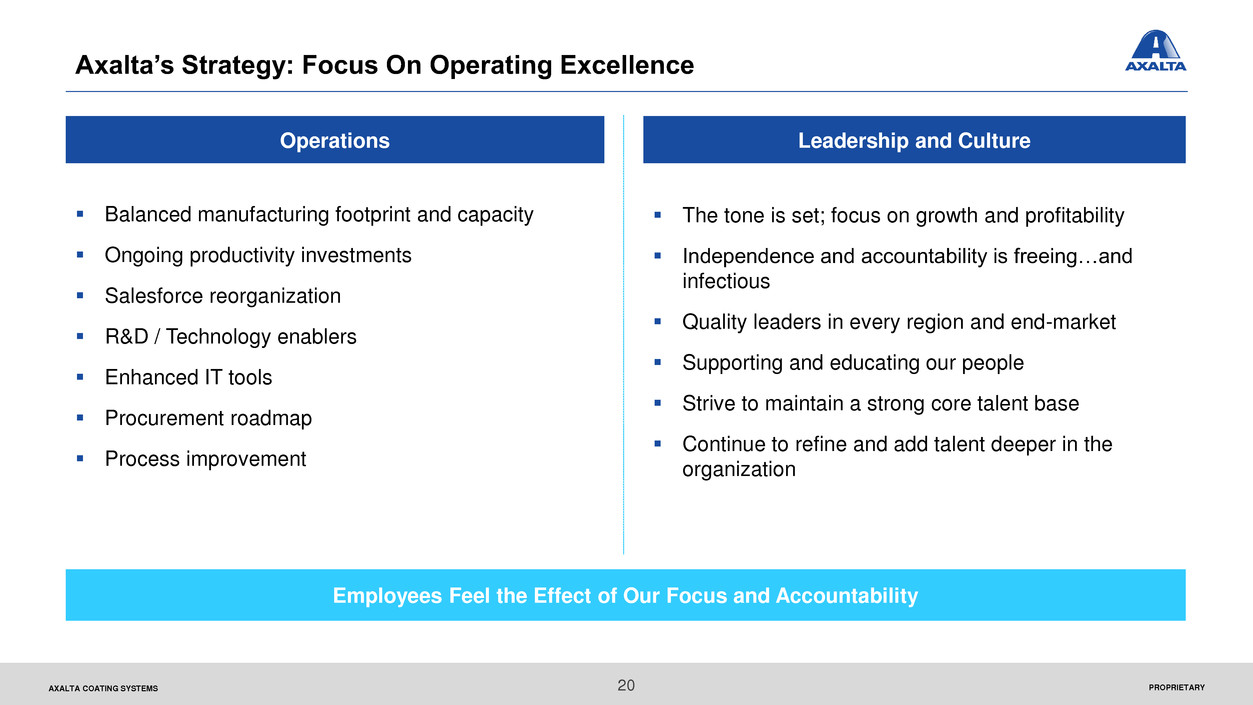

Axalta’s Strategy: Focus On Operating Excellence

Balanced manufacturing footprint and capacity

Ongoing productivity investments

Salesforce reorganization

R&D / Technology enablers

Enhanced IT tools

Procurement roadmap

Process improvement

Leadership and Culture

The tone is set; focus on growth and profitability

Independence and accountability is freeing…and

infectious

Quality leaders in every region and end-market

Supporting and educating our people

Strive to maintain a strong core talent base

Continue to refine and add talent deeper in the

organization

Operations

Employees Feel the Effect of Our Focus and Accountability

20

Financial Overview

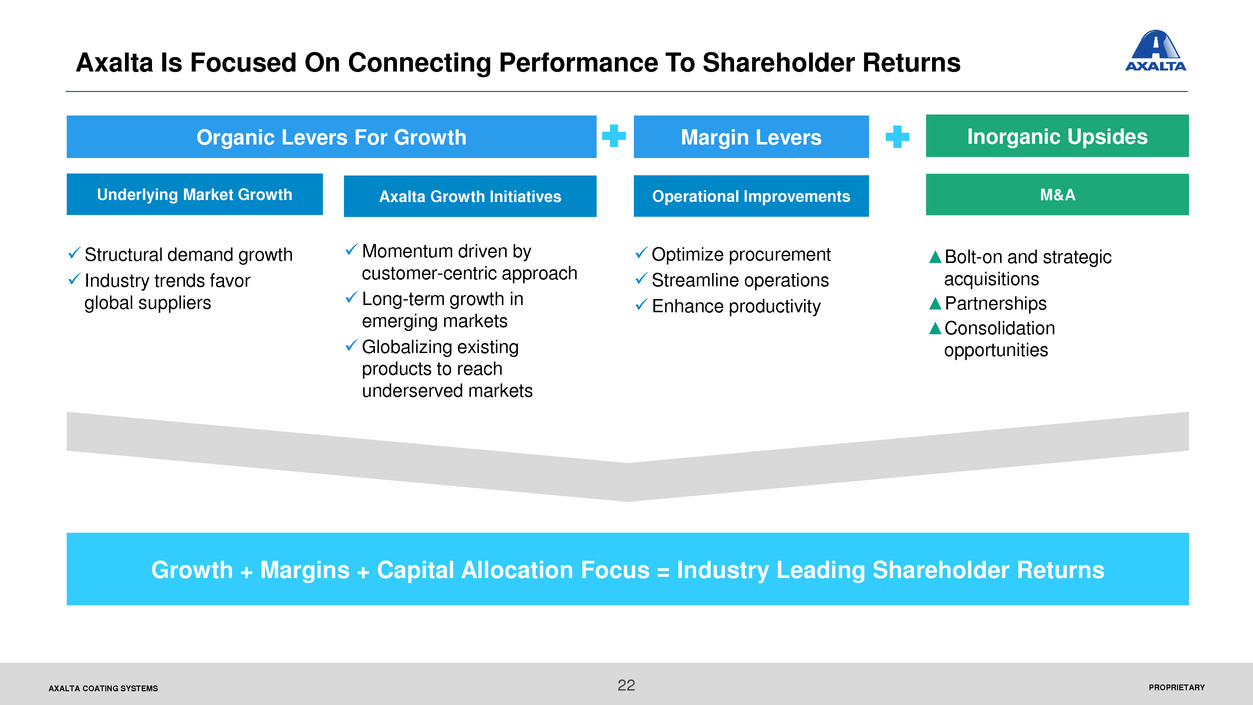

PROPRIETARYAXALTA COATING SYSTEMS 22

Axalta Is Focused On Connecting Performance To Shareholder Returns

Underlying Market Growth Axalta Growth Initiatives Operational Improvements M&A

Structural demand growth

Industry trends favor

global suppliers

Momentum driven by

customer-centric approach

Long-term growth in

emerging markets

Globalizing existing

products to reach

underserved markets

Optimize procurement

Streamline operations

Enhance productivity

▲Bolt-on and strategic

acquisitions

▲Partnerships

▲Consolidation

opportunities

Organic Levers For Growth Inorganic UpsidesMargin Levers

Growth + Margins + Capital Allocation Focus = Industry Leading Shareholder Returns

PROPRIETARYAXALTA COATING SYSTEMS

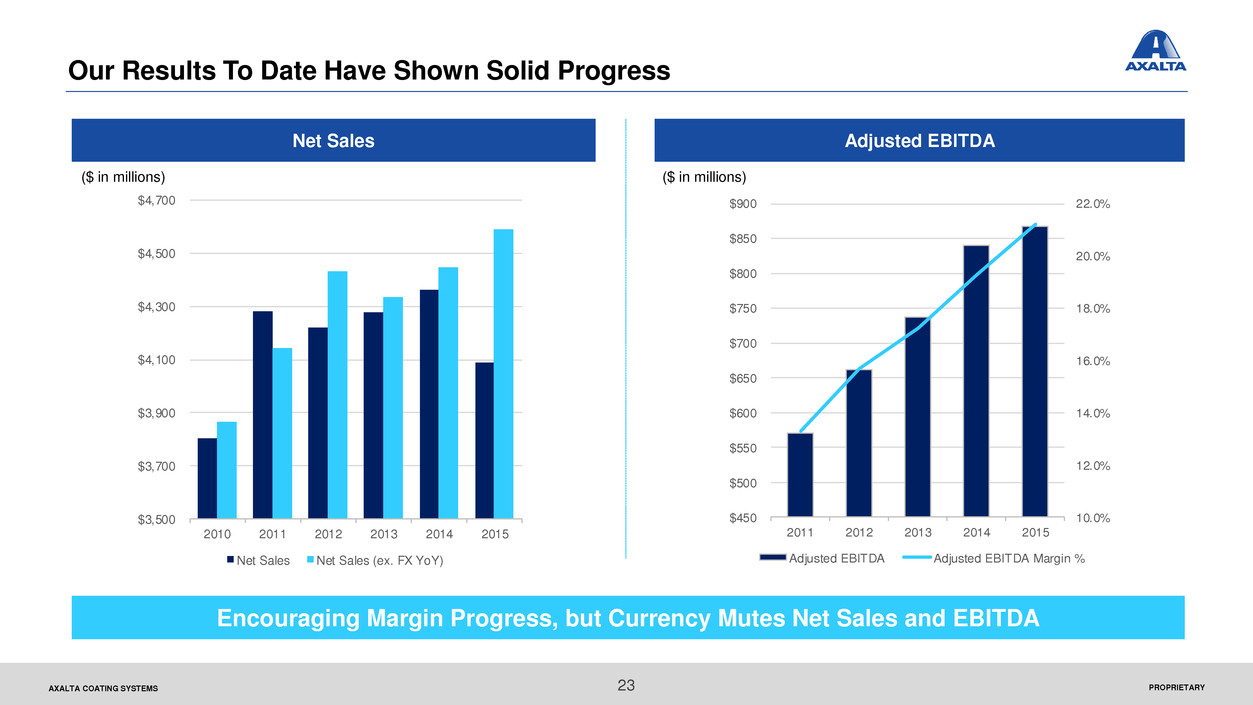

Our Results To Date Have Shown Solid Progress

Encouraging Margin Progress, but Currency Mutes Net Sales and EBITDA

Net Sales Adjusted EBITDA

($ in millions) ($ in millions)

23

$3,500

$3,700

$3,900

$4,100

$4,300

$4,500

$4,700

2010 2011 2012 2013 2014 2015

Net Sales Net Sales (ex. FX YoY)

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

$450

$500

$550

$600

$650

$700

$750

$800

$850

$900

011 2012 2013 2014 2015

Adju ted EBITDA Adjusted EBITDA Margin %

AXALTA COATING SYSTEMS

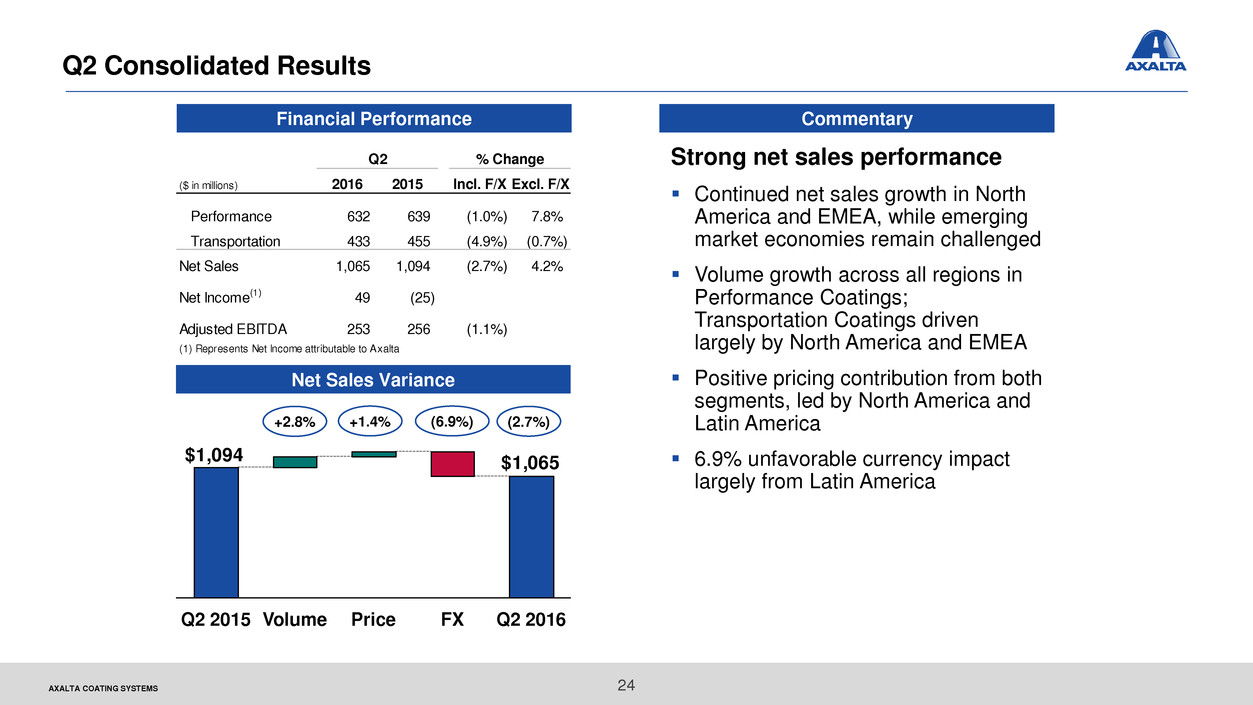

Q2 Consolidated Results

Financial Performance Commentary

24

Strong net sales performance

Continued net sales growth in North

America and EMEA, while emerging

market economies remain challenged

Volume growth across all regions in

Performance Coatings;

Transportation Coatings driven

largely by North America and EMEA

Positive pricing contribution from both

segments, led by North America and

Latin America

6.9% unfavorable currency impact

largely from Latin America

($ in millions) 2016 2015 Incl. F/X Excl. F/X

Performance 632 639 (1.0%) 7.8%

Transportation 433 455 (4.9%) (0.7%)

Net Sales 1,065 1,094 (2.7%) 4.2%

Net Income(1) 49 (25)

Adjusted EBITDA 253 256 (1.1%)

(1) Represents Net Income attributable to xalta

Q2 % Change

+2.8% +1.4% (6.9%) (2.7%)

$1,065 $1,094

Q2 2016FXVolume PriceQ2 2015

Net Sales Variance

PROPRIETARYAXALTA COATING SYSTEMS

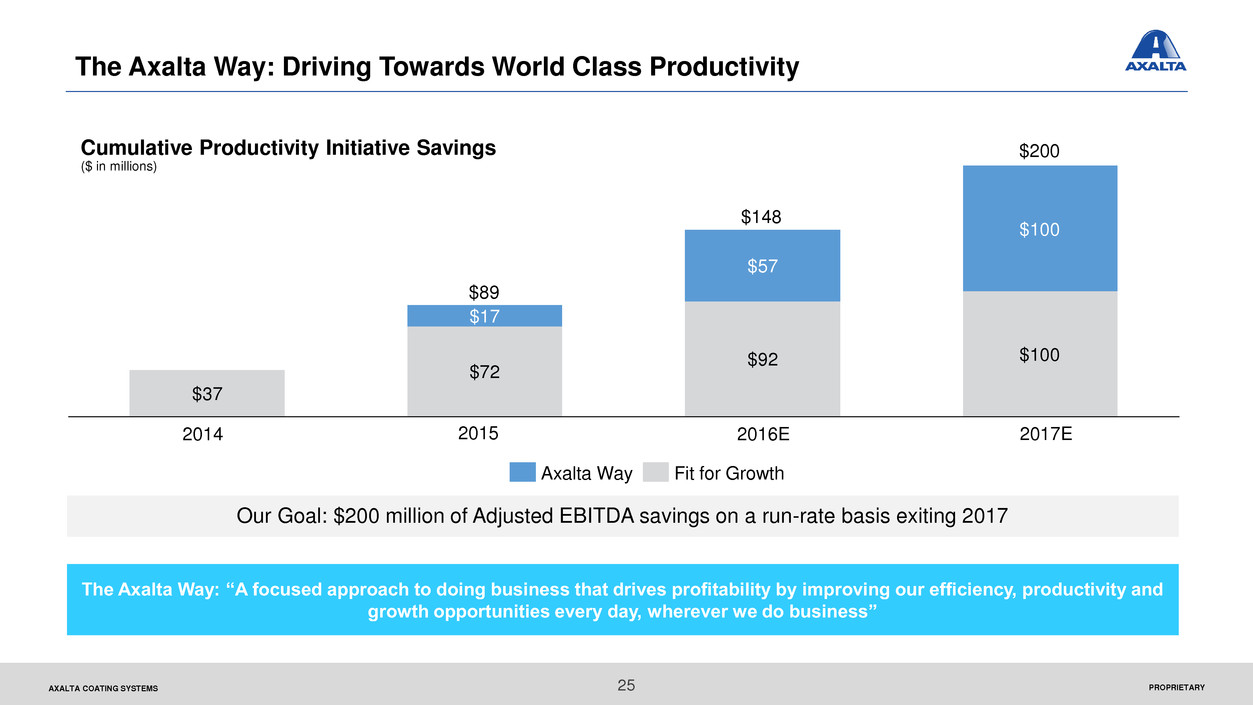

The Axalta Way: Driving Towards World Class Productivity

Our Goal: $200 million of Adjusted EBITDA savings on a run-rate basis exiting 2017

Cumulative Productivity Initiative Savings

($ in millions)

The Axalta Way: “A focused approach to doing business that drives profitability by improving our efficiency, productivity and

growth opportunities every day, wherever we do business”

25

2017E2015 2016E2014

Fit for GrowthAxalta Way

$37

$72

$92 $100

$57

$100

$17

$89

$200

$148

PROPRIETARYAXALTA COATING SYSTEMS 26

Our Financial Guiding Principles

Managing the Capital:

Capex Prioritization

Metrics-Based

Management: Driving the

Business with Data

Capital Allocation:

Improved ROIC

Financial Optimization

PROPRIETARYAXALTA COATING SYSTEMS

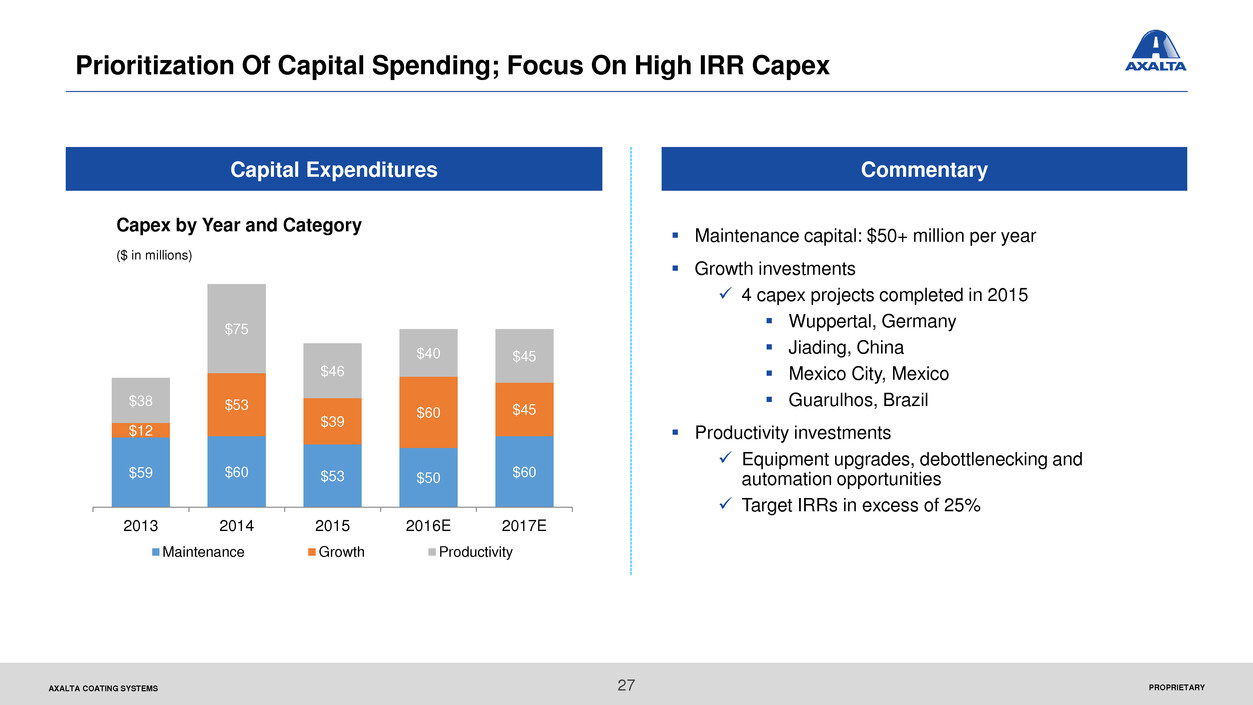

Prioritization Of Capital Spending; Focus On High IRR Capex

Maintenance capital: $50+ million per year

Growth investments

4 capex projects completed in 2015

Wuppertal, Germany

Jiading, China

Mexico City, Mexico

Guarulhos, Brazil

Productivity investments

Equipment upgrades, debottlenecking and

automation opportunities

Target IRRs in excess of 25%

Capital Expenditures

Capex by Year and Category

($ in millions)

Commentary

27

$59 $60 $53 $50 $60

$12

$53

$39

$60 $45

$38

$75

$46

$40 $45

2013 2014 2015 2016E 2017E

Maintenance Growth Productivity

PROPRIETARYAXALTA COATING SYSTEMS

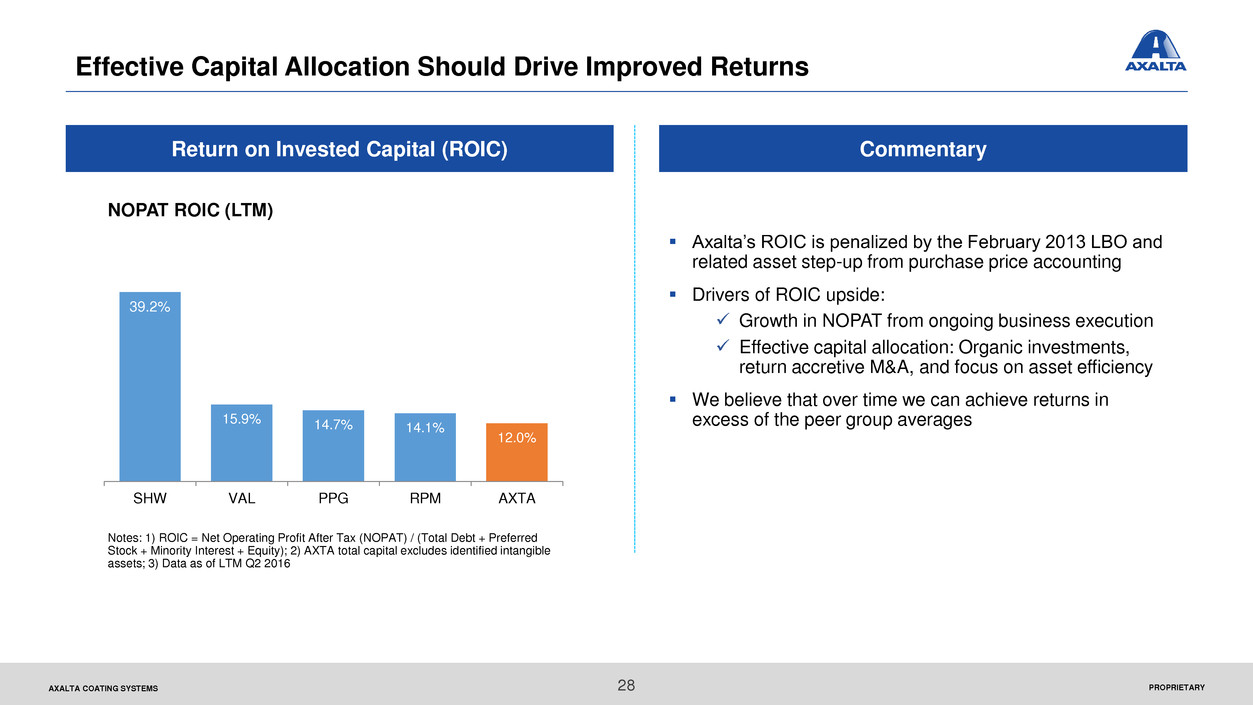

Effective Capital Allocation Should Drive Improved Returns

Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred

Stock + Minority Interest + Equity); 2) AXTA total capital excludes identified intangible

assets; 3) Data as of LTM Q2 2016

Axalta’s ROIC is penalized by the February 2013 LBO and

related asset step-up from purchase price accounting

Drivers of ROIC upside:

Growth in NOPAT from ongoing business execution

Effective capital allocation: Organic investments,

return accretive M&A, and focus on asset efficiency

We believe that over time we can achieve returns in

excess of the peer group averages

Return on Invested Capital (ROIC) Commentary

NOPAT ROIC (LTM)

28

39.2%

15.9% 14.7% 14.1%

12.0%

SHW VAL PPG RPM AXTA

PROPRIETARYAXALTA COATING SYSTEMS

Capital Allocation: Driving Returns With Best Uses Of Excess Cash Flow

Organic growth options: Generally the “highest and best use”

In-plant productivity investment

Growth with existing markets with strong incremental margins

M&A: Discipline is key to improve returns

4 year cumulative free cash flow available after debt reduction: $1.5+ billion

Tactical, lower risk, smaller “tuck-ins” and immediate adjacencies

Overall consideration for both immediate IRR and long term growth goals

Debt repayment: Accretive at current rates

Target investment grade rating as debt leverage is reduced and other factors

Process: Balance absolute returns with risk-adjusted return, and feedback on shareholder risk tolerance

Other potential uses: Board to consider in time

Dividends and buybacks will be considered once our leverage goals are realized

Total Shareholder Return (TSR) Model

29

PROPRIETARYAXALTA COATING SYSTEMS

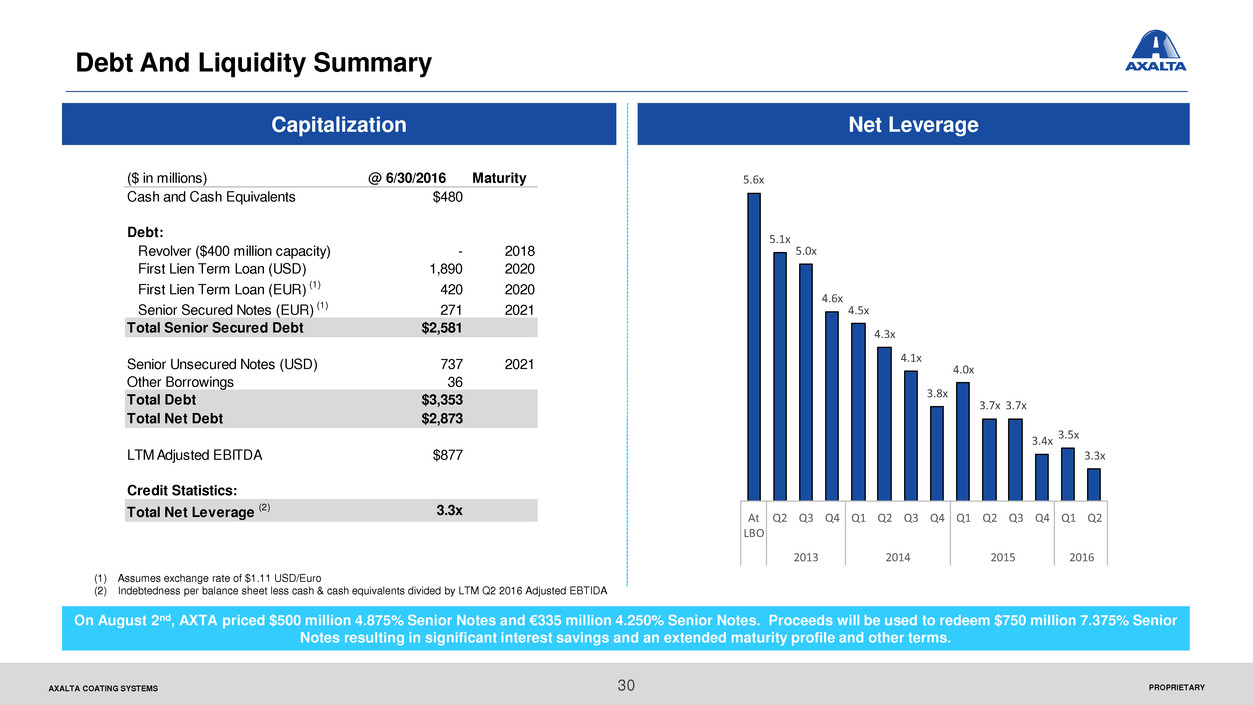

Capitalization

30

Debt And Liquidity Summary

Net Leverage

(1) Assumes exchange rate of $1.11 USD/Euro

(2) Indebtedness per balance sheet less cash & cash equivalents divided by LTM Q2 2016 Adjusted EBTIDA

($ in millions) @ 6/30/2016 Maturity

Cash and Cash Equivalents $480

Debt:

Revolver ($400 million capacity) - 2018

First Lien Term Loan (USD) 1,890 2020

First Lien Term Loan (EUR) (1) 420 2020

Senior Secured Notes (EUR) (1) 271 2021

Total Senior Secured Debt $2,581

Senior Unsecured Notes (USD) 737 2021

Other Borrowings 36

Total Debt $3,353

Total Net Debt $2,873

LTM Adjusted EBITDA $877

Credit Statistics:

Total Net Leverage (2) 3.3x

5.6x

5.1x

5.0x

4.6x

4.5x

4.3x

4.1x

3.8x

4.0x

3.7x 3.7x

3.4x

3.5x

3.3x

At

LBO

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2013 2014 2015 2016

On August 2nd, AXTA priced $500 million 4.875% Senior Notes and €335 million 4.250% Senior Notes. Proceeds will be used to redeem $750 million 7.375% Senior

Notes resulting in significant interest savings and an extended maturity profile and other terms.

AXALTA COATING SYSTEMS

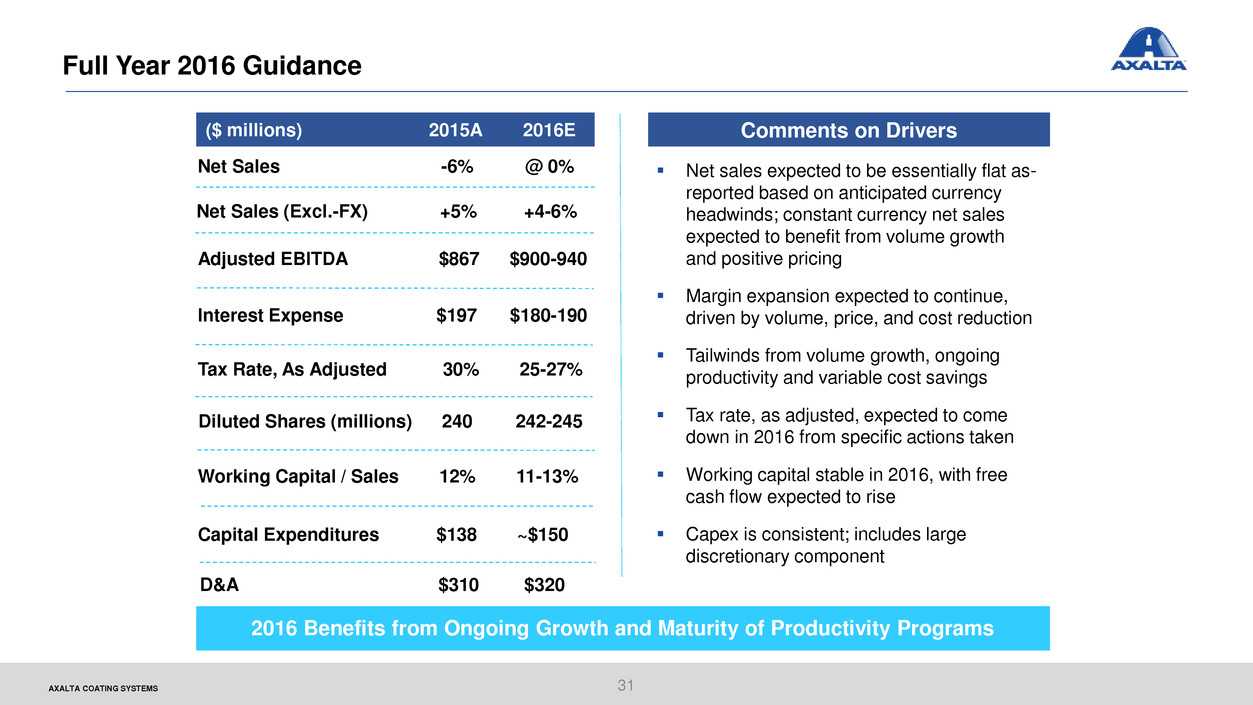

Full Year 2016 Guidance

31

2016 Benefits from Ongoing Growth and Maturity of Productivity Programs

Net sales expected to be essentially flat as-

reported based on anticipated currency

headwinds; constant currency net sales

expected to benefit from volume growth

and positive pricing

Margin expansion expected to continue,

driven by volume, price, and cost reduction

Tailwinds from volume growth, ongoing

productivity and variable cost savings

Tax rate, as adjusted, expected to come

down in 2016 from specific actions taken

Working capital stable in 2016, with free

cash flow expected to rise

Capex is consistent; includes large

discretionary component

($ millions) 2015A 2016E Comments on Drivers

Net Sales (Excl.-FX) +5% +4-6%

Working Capital / Sales 12% 11-13%

Tax Rate, As Adjusted 30% 25-27%

Diluted Shares (millions) 240 242-245

Capital Expenditures $138 ~$150

Interest Expense $197 $180-190

Adjusted EBITDA $867 $900-940

D&A $310 $320

Net Sales -6% @ 0%

Performance Coatings: Refinish

PROPRIETARYAXALTA COATING SYSTEMS

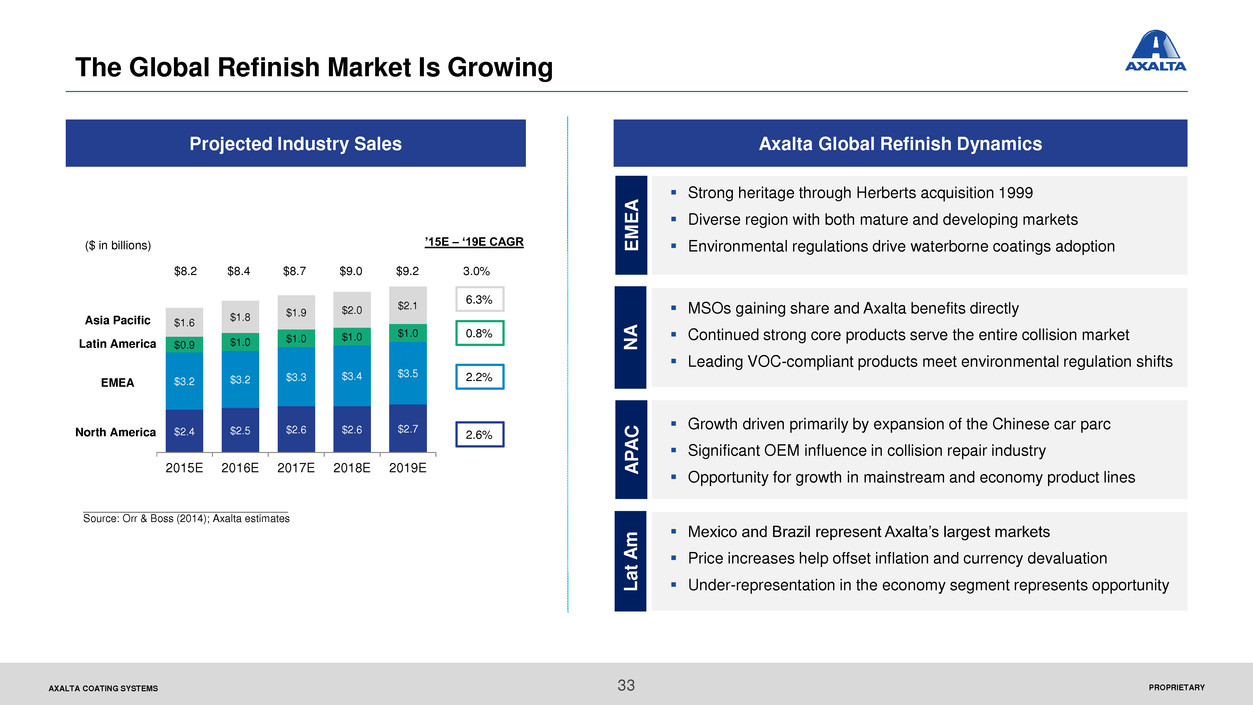

The Global Refinish Market Is Growing

Projected Industry Sales

($ in billions)

Asia Pacific

EMEA

North America

6.3%

0.8%

2.2%

2.6%$2.4 $2.5 $2.6 $2.6

$2.7

$3.2 $3.2 $3.3

$3.4 $3.5

$0.9 $1.0

$1.0 $1.0

$1.0

$1.6

$1.8 $1.9

$2.0 $2.1

2015E 2016E 2017E 2018E 2019E

’15E – ‘19E CAGR

___________________________________

Source: Orr & Boss (2014); Axalta estimates

Latin America

$8.2 $8.4 $8.7 $9.0 $9.2 3.0%

Axalta Global Refinish Dynamics

Strong heritage through Herberts acquisition 1999

Diverse region with both mature and developing markets

Environmental regulations drive waterborne coatings adoption

MSOs gaining share and Axalta benefits directly

Continued strong core products serve the entire collision market

Leading VOC-compliant products meet environmental regulation shifts

Growth driven primarily by expansion of the Chinese car parc

Significant OEM influence in collision repair industry

Opportunity for growth in mainstream and economy product lines

Mexico and Brazil represent Axalta’s largest markets

Price increases help offset inflation and currency devaluation

Under-representation in the economy segment represents opportunity

E

M

E

A

N

A

A

P

A

C

La

t

A

m

33

PROPRIETARYAXALTA COATING SYSTEMS

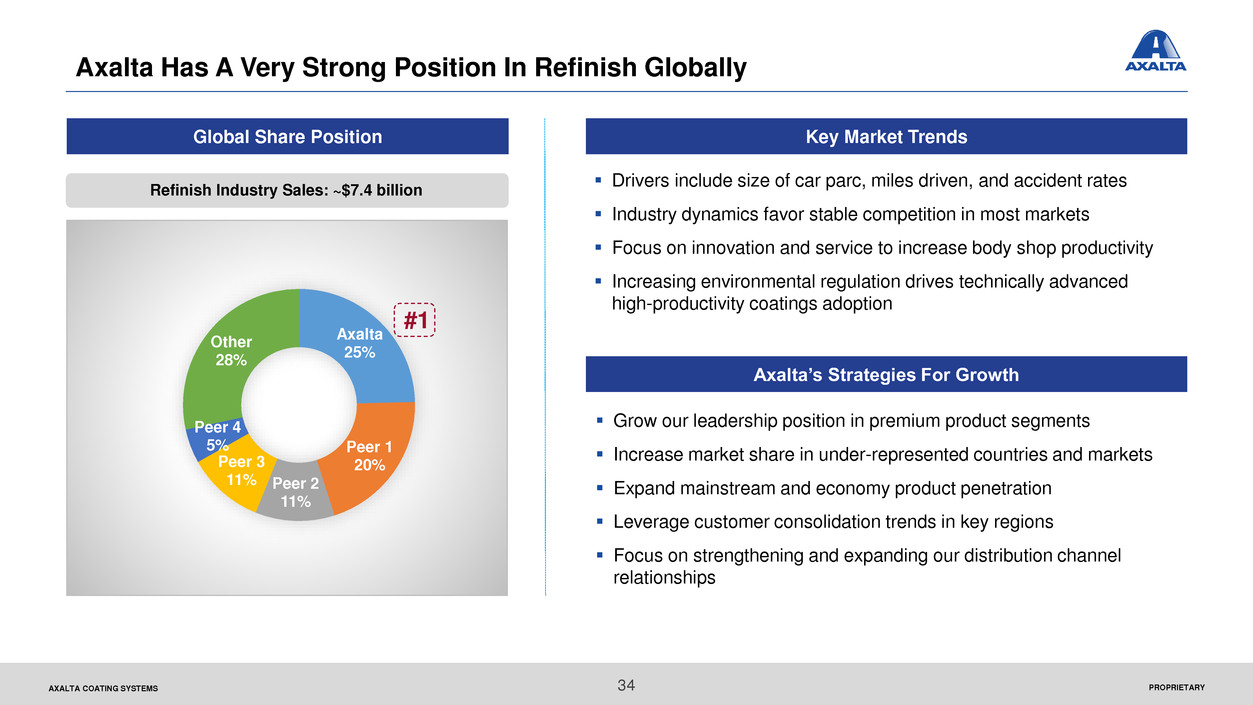

Axalta Has A Very Strong Position In Refinish Globally

Global Share Position Key Market Trends

Axalta

25%

Peer 1

20%

Peer 2

11%

Peer 3

11%

Peer 4

5%

Other

28%

Refinish Industry Sales: ~$7.4 billion

#1

Drivers include size of car parc, miles driven, and accident rates

Industry dynamics favor stable competition in most markets

Focus on innovation and service to increase body shop productivity

Increasing environmental regulation drives technically advanced

high-productivity coatings adoption

Grow our leadership position in premium product segments

Increase market share in under-represented countries and markets

Expand mainstream and economy product penetration

Leverage customer consolidation trends in key regions

Focus on strengthening and expanding our distribution channel

relationships

Axalta’s Strategies For Growth

34

PROPRIETARYAXALTA COATING SYSTEMS 35

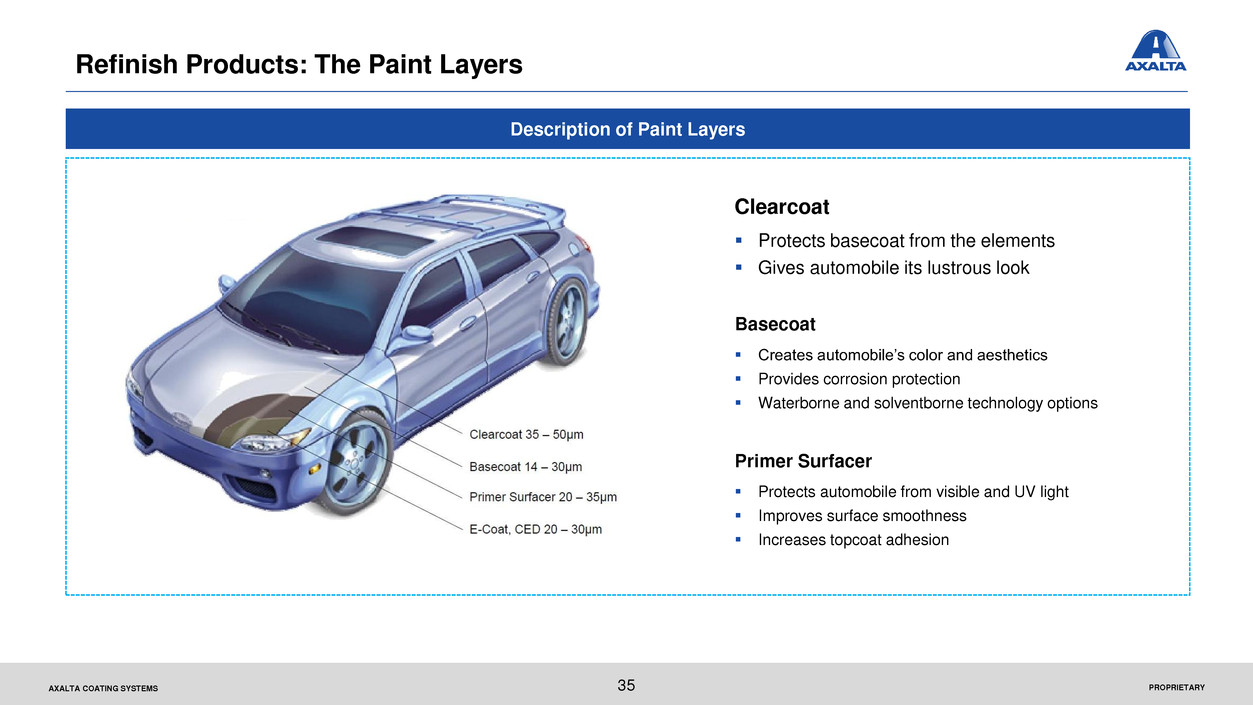

Refinish Products: The Paint Layers

Clearcoat

Protects basecoat from the elements

Gives automobile its lustrous look

Basecoat

Creates automobile’s color and aesthetics

Provides corrosion protection

Waterborne and solventborne technology options

Primer Surfacer

Protects automobile from visible and UV light

Improves surface smoothness

Increases topcoat adhesion

Description of Paint Layers

Performance Coatings: Industrial Coatings

PROPRIETARYAXALTA COATING SYSTEMS

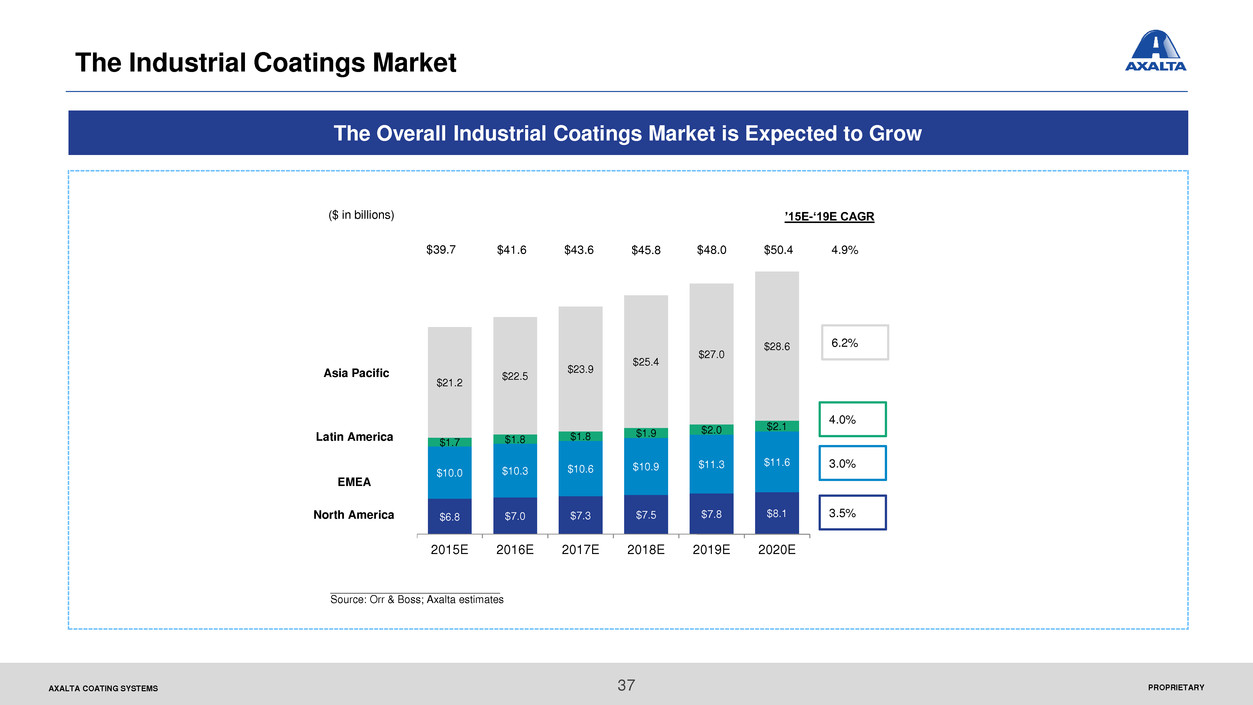

’15E-‘19E CAGR($ in billions)

Asia Pacific

EMEA

North America

6.2%

4.0%

3.0%

3.5%

4.9%

$6.8 $7.0 $7.3 $7.5 $7.8 $8.1

$10.0 $10.3 $10.6

$10.9 $11.3 $11.6

$1.7 $1.8

$1.8 $1.9

$2.0 $2.1

$21.2

$22.5

$23.9

$25.4

$27.0

$28.6

2015E 2016E 2017E 2018E 2019E 2020E

$50.4

_____________________________

Source: Orr & Boss; Axalta estimates

Latin America

$48.0$45.8$43.6$39.7 $41.6

The Overall Industrial Coatings Market is Expected to Grow

The Industrial Coatings Market

37

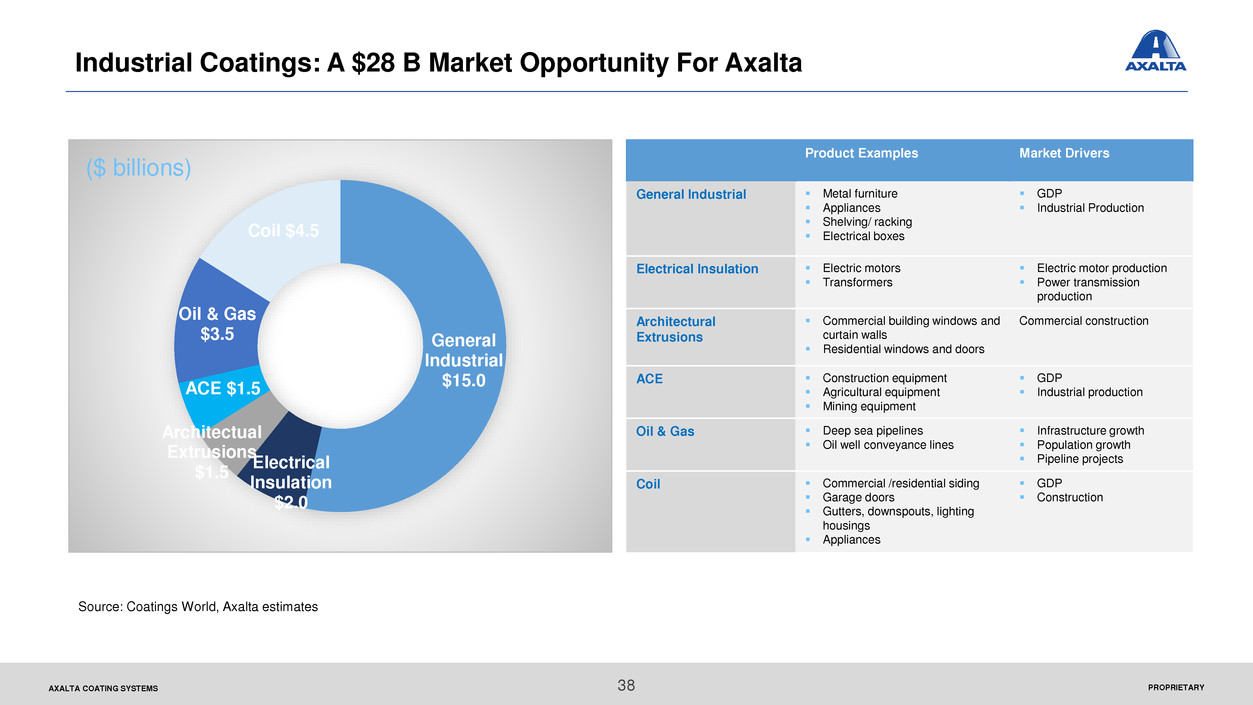

PROPRIETARYAXALTA COATING SYSTEMS

General

Industrial

$15.0

Electrical

Insulation

$2.0

Architectual

Extrusions

$1.5

ACE $1.5

Oil & Gas

$3.5

Coil $4.5

Industrial Coatings: A $28 B Market Opportunity For Axalta

Product Examples Market Drivers

General Industrial Metal furniture

Appliances

Shelving/ racking

Electrical boxes

GDP

Industrial Production

Electrical Insulation Electric motors

Transformers

Electric motor production

Power transmission

production

Architectural

Extrusions

Commercial building windows and

curtain walls

Residential windows and doors

Commercial construction

ACE Construction equipment

Agricultural equipment

Mining equipment

GDP

Industrial production

Oil & Gas Deep sea pipelines

Oil well conveyance lines

Infrastructure growth

Population growth

Pipeline projects

Coil Commercial /residential siding

Garage doors

Gutters, downspouts, lighting

housings

Appliances

GDP

Construction

Source: Coatings World, Axalta estimates

($ billions)

38

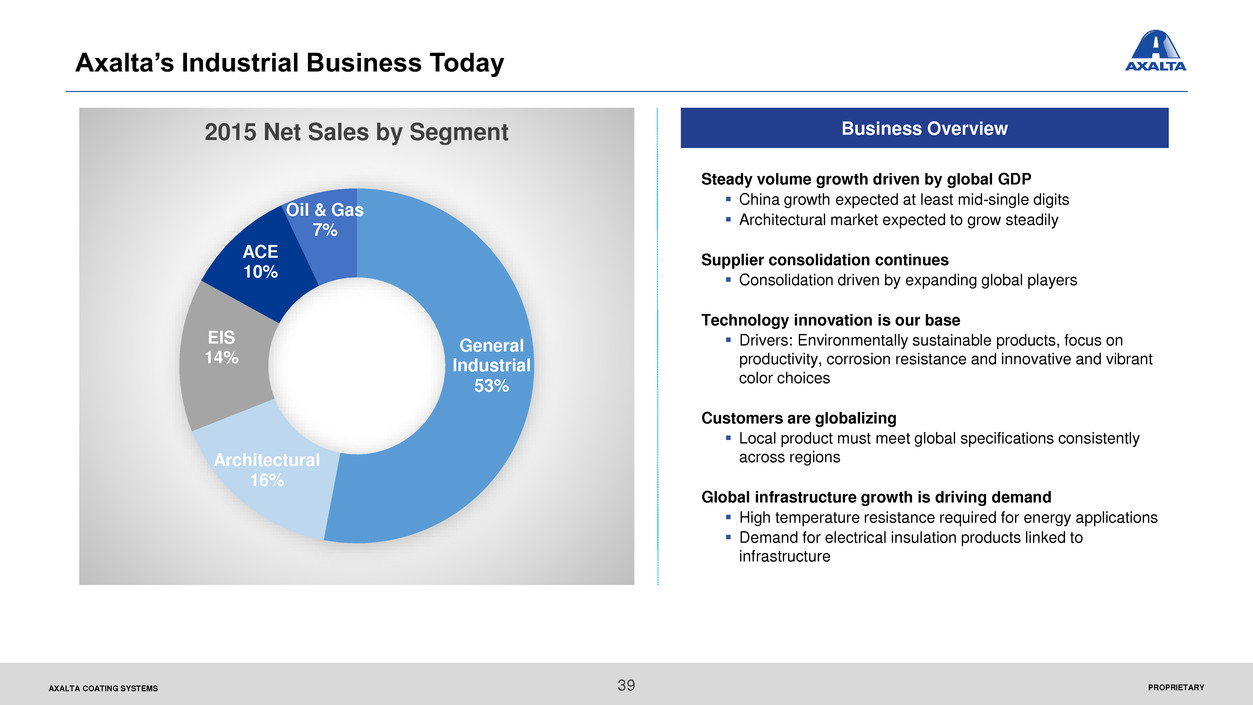

PROPRIETARYAXALTA COATING SYSTEMS

General

Industrial

53%

Architectural

16%

EIS

14%

ACE

10%

Oil & Gas

7%

2015 Net Sales by Segment Business Overview

Steady volume growth driven by global GDP

China growth expected at least mid-single digits

Architectural market expected to grow steadily

Supplier consolidation continues

Consolidation driven by expanding global players

Technology innovation is our base

Drivers: Environmentally sustainable products, focus on

productivity, corrosion resistance and innovative and vibrant

color choices

Customers are globalizing

Local product must meet global specifications consistently

across regions

Global infrastructure growth is driving demand

High temperature resistance required for energy applications

Demand for electrical insulation products linked to

infrastructure

Axalta’s Industrial Business Today

39

PROPRIETARYAXALTA COATING SYSTEMS

Growth Priorities & Strategies

Axalta Industrial: Where We Are Going…

Agriculture, Construction

& Earth Moving Equipment

(ACE)

Expand approval portfolio

with multiple coatings

technologies

Utilize global footprint to

target new business in all

regions

Architectural

Market our powder

coatings to architects

(an environmentally

friendly alternative)

Expand color range to

compete with liquid

alternatives

Electrical Insulation Systems

(EIS)

Continue to build global

capability

Target sub-segments with

above average growth rates

Oil & Gas

Build on leading

technology position for

exterior pipe coatings

Establish strong global

network to service end

users / specifiers

General Industrial

Accelerate globalization

of key GI sub-segments

Develop industry

leadership in high

durability, corrosion –

resistant coatings

40

Transportation Coatings Overview

PROPRIETARYAXALTA COATING SYSTEMS

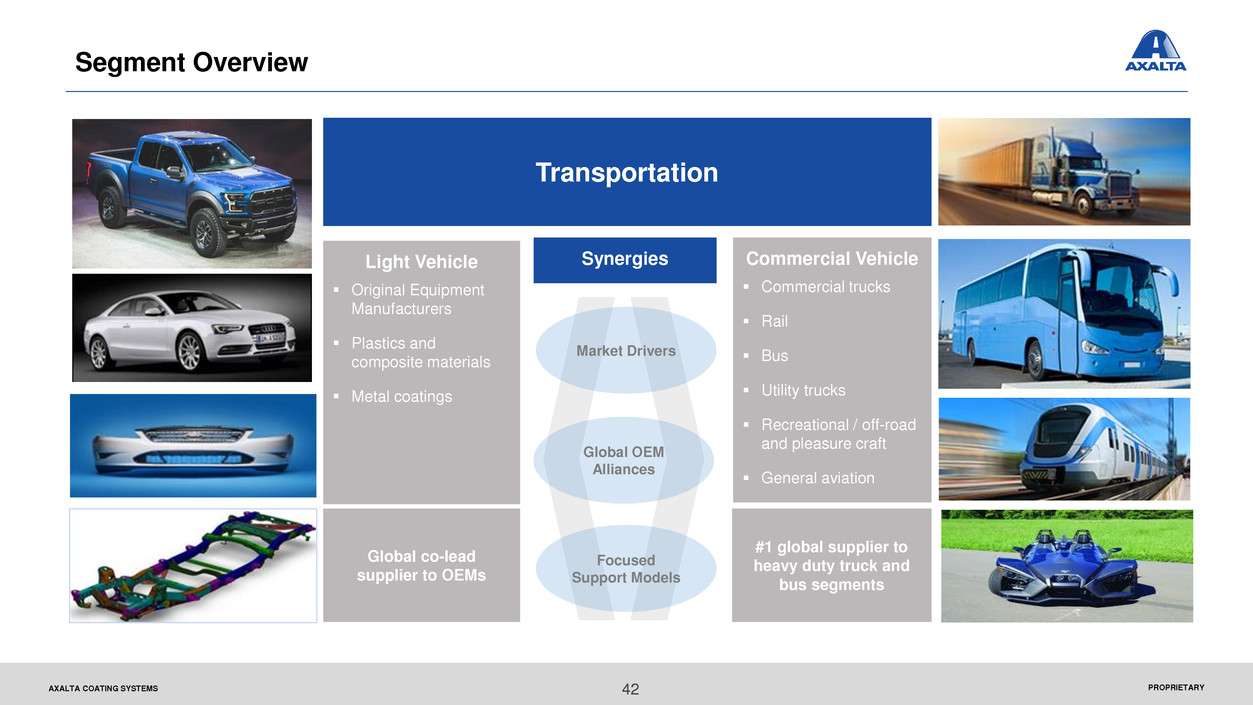

Segment Overview

Global co-lead

supplier to OEMs

Transportation

Light Vehicle

Original Equipment

Manufacturers

Plastics and

composite materials

Metal coatings

#1 global supplier to

heavy duty truck and

bus segments

Commercial Vehicle

Commercial trucks

Rail

Bus

Utility trucks

Recreational / off-road

and pleasure craft

General aviation

42

Synergies

Global OEM

Alliances

Focused

Support Models

Market Drivers

PROPRIETARYAXALTA COATING SYSTEMS

19% global light vehicle market

share with strong OEM

relationships in all regions

#1 player globally in heavy duty

truck and bus

Extensive portfolio of technologies

fit for purpose in each market

Showing results to date through

business wins and global

launches

Strong earnings contribution

underscores focus on profitable

growth

Capacity investments to support

growth in all regions

Moved from regional structure to

global leadership

Improved alignment with strategic

and underserved customers

Building capability and footprint in

high growth regions

Expanding global brand strategy

Demand drivers include

Global GDP

Vehicle replacement cycles

Growth in emerging markets

Infrastructure spending

43

Transportation Summary

The global transportation market

is projected to grow ~3.4% CAGR

through 2019

Axalta is actively transforming its

business for profitable growth

Axalta is a leading global OEM

coatings provider

Progress to date has been

strong

PROPRIETARYAXALTA COATING SYSTEMS

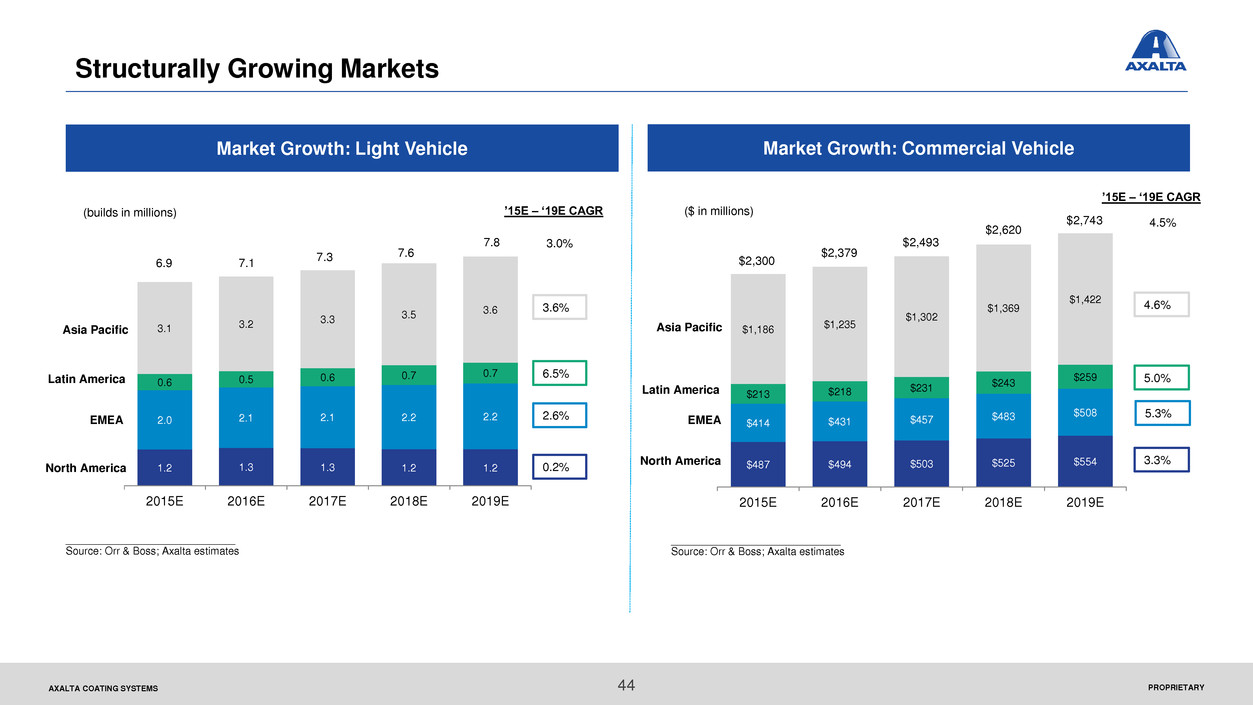

Structurally Growing Markets

44

Market Growth: Light Vehicle Market Growth: Commercial Vehicle

_____________________________

Source: Orr & Boss; Axalta estimates

Asia Pacific

Latin America

EMEA

North America

3.6%

6.5%

2.6%

0.2%

3.0%

1.2 1.3 1.3 1.2 1.2

2.0 2.1 2.1 2.2 2.2

0.6 0.5 0.6

0.7 0.7

3.1 3.2

3.3 3.5

3.6

2015E 2016E 2017E 2018E 2019E

(builds in millions)

7.8

’15E – ‘19E CAGR

7.67.3

7.16.9

($ in millions)

Asia Pacific

EMEA

North America

4.6%

5.0%

5.3%

3.3%

4.5%

$487 $494 $503 $525 $554

$414 $431 $457

$483 $508

$213 $218

$231 $243

$259

$1,186 $1,235

$1,302

$1,369

$1,422

2015E 2016E 2017E 2018E 2019E

’15E – ‘19E CAGR

$2,743

_____________________________

Source: Orr & Boss; Axalta estimates

Latin America

$2,620

$2,493

$2,379

$2,300

PROPRIETARYAXALTA COATING SYSTEMS 45

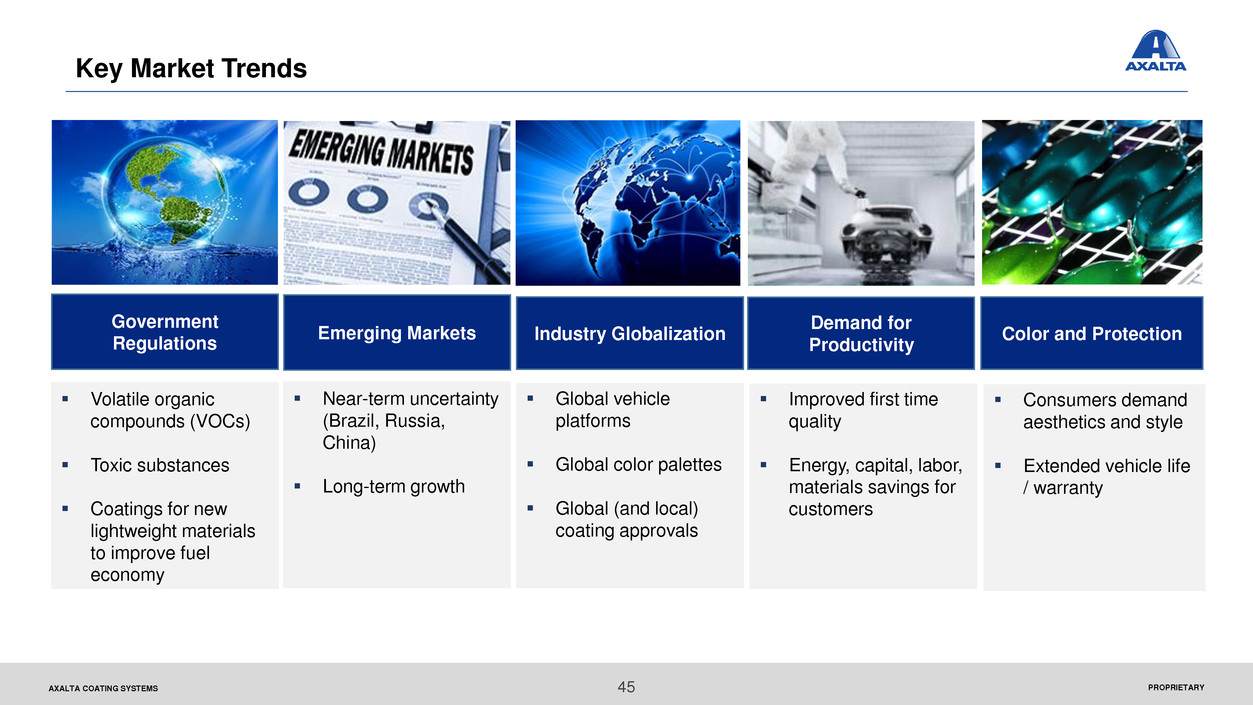

Key Market Trends

Volatile organic

compounds (VOCs)

Toxic substances

Coatings for new

lightweight materials

to improve fuel

economy

Government

Regulations

Emerging Markets Industry Globalization

Demand for

Productivity

Color and Protection

Near-term uncertainty

(Brazil, Russia,

China)

Long-term growth

Global vehicle

platforms

Global color palettes

Global (and local)

coating approvals

Improved first time

quality

Energy, capital, labor,

materials savings for

customers

Consumers demand

aesthetics and style

Extended vehicle life

/ warranty

PROPRIETARYAXALTA COATING SYSTEMS

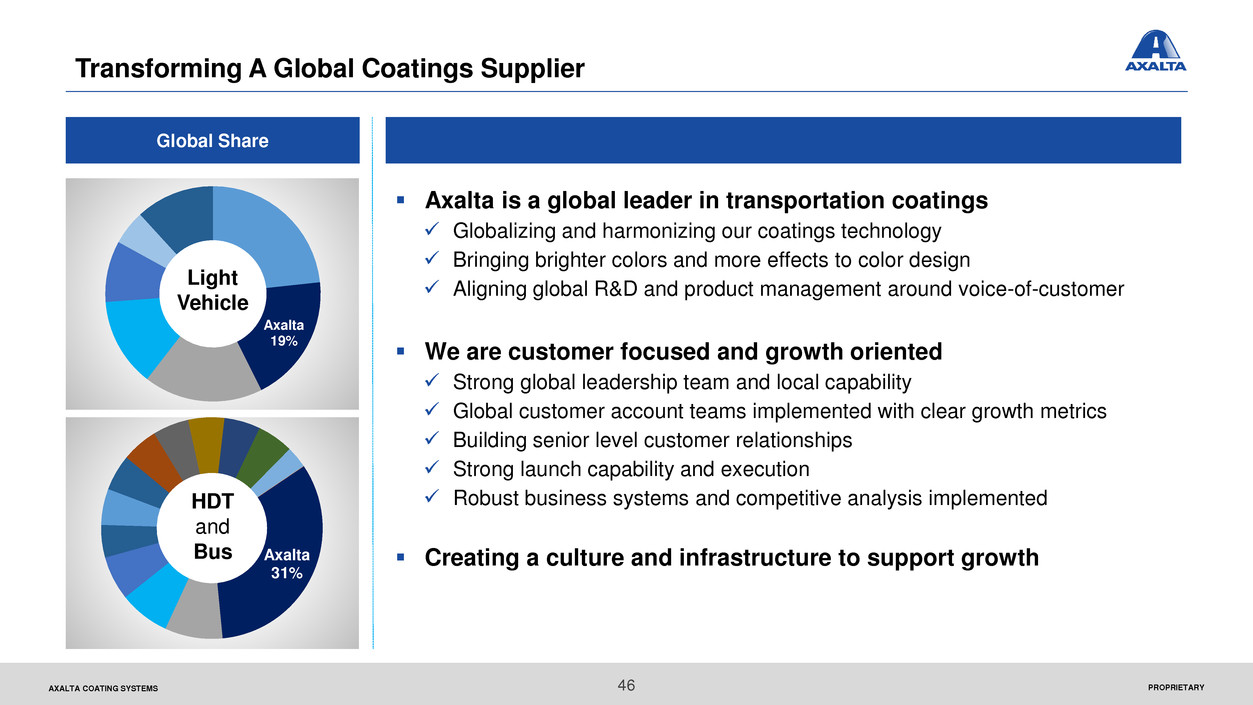

Axalta

19%

Transforming A Global Coatings Supplier

Global Share

46

Axalta

31%

Axalta is a global leader in transportation coatings

Globalizing and harmonizing our coatings technology

Bringing brighter colors and more effects to color design

Aligning global R&D and product management around voice-of-customer

We are customer focused and growth oriented

Strong global leadership team and local capability

Global customer account teams implemented with clear growth metrics

Building senior level customer relationships

Strong launch capability and execution

Robust business systems and competitive analysis implemented

Creating a culture and infrastructure to support growth

HDT

and

Bus

Light

Vehicle

PROPRIETARYAXALTA COATING SYSTEMS

Vision Is Above-Market Growth

Gain share with existing customers

Grow underserved customers and regions

Align product technology to evolving

customer and market needs

Increase content per vehicle

Leverage “what good looks like” into new

regions, customers and markets

Strategies Key Tactics / Programs

Build capabilities in global and regional roles

Expand decorative and functional coatings

Best-in-class line service excellence

Localize supply chain ensuring competitive

cost structure

Drive complexity management discipline

The Axalta Way: “run it like we own it”

47

PROPRIETARYAXALTA COATING SYSTEMS

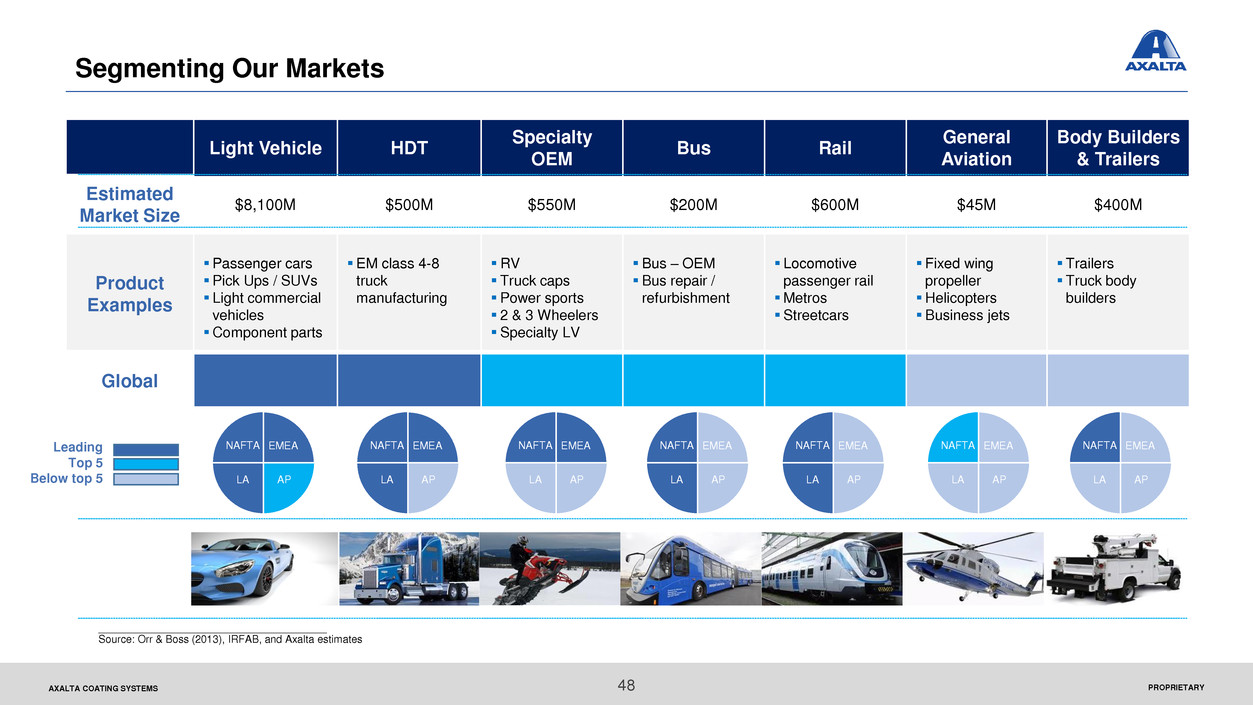

Segmenting Our Markets

Light Vehicle HDT

Specialty

OEM

Bus Rail

General

Aviation

Body Builders

& Trailers

Estimated

Market Size

$8,100M $500M $550M $200M $600M $45M $400M

Product

Examples

Passenger cars

Pick Ups / SUVs

Light commercial

vehicles

Component parts

EM class 4-8

truck

manufacturing

RV

Truck caps

Power sports

2 & 3 Wheelers

Specialty LV

Bus – OEM

Bus repair /

refurbishment

Locomotive

passenger rail

Metros

Streetcars

Fixed wing

propeller

Helicopters

Business jets

Trailers

Truck body

builders

Global

EMEA

APLA

NAFTA EMEA

APLA

NAFTA EMEA

APLA

NAFTAEMEA

APLA

NAFTA

_______________________________________

Source: Orr & Boss (2013), IRFAB, and Axalta estimates

Leading

Top 5

Below top 5

EMEA

APLA

NAFTA EMEA

APLA

NAFTA EMEA

APLA

NAFTA

48

PROPRIETARYAXALTA COATING SYSTEMS 49

We Are Growing With Segment Specific Strategies In Our Target Markets

China expansion to mainstream and economy

segments

Leverage high speed rail success

SprayFlex FS interior floor coatings

Leverage global accounts

Gain share in tier part suppliers

China growth via Kinlita JV

China HDT volume is three times NA

Leverage Imron® branded offering

Differentiation through strong HDT color leverage

Developing a segment-focused distribution

strategy

Grow in automotive parts market

China expansion through domestic OEMs

AP expansion beyond China

Gain approvals with underserved customers

Strengthen service capability

Expand 2-wheeler success in Brazil to other regions

Leverage Imron® branded offering

Segment-focused color strategy

Light Vehicle

Specialty OEM

General Aviation

Heavy Duty Truck (HDT)

Bus and Rail

Body Builders / Trailers

Leverage approvals with Textron, Gulfstream, etc.

Expand color palette for high value applications

Align Imron® brands and offerings to segment

Strategic alignments and capabilities

APPENDIX

AXALTA COATING SYSTEMS

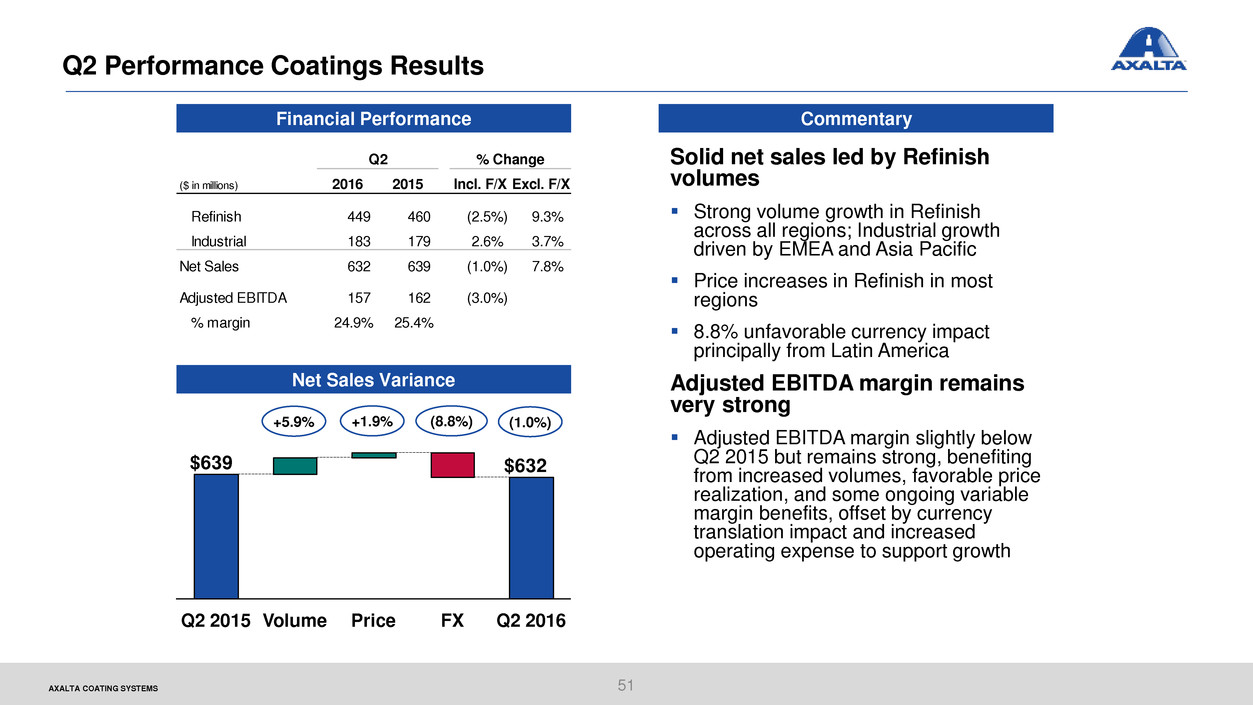

Q2 Performance Coatings Results

Financial Performance Commentary

Net Sales Variance

51

Solid net sales led by Refinish

volumes

Strong volume growth in Refinish

across all regions; Industrial growth

driven by EMEA and Asia Pacific

Price increases in Refinish in most

regions

8.8% unfavorable currency impact

principally from Latin America

Adjusted EBITDA margin remains

very strong

Adjusted EBITDA margin slightly below

Q2 2015 but remains strong, benefiting

from increased volumes, favorable price

realization, and some ongoing variable

margin benefits, offset by currency

translation impact and increased

operating expense to support growth

Q2

($ in millions) 2016 2015 Incl. F/X Excl. F/X

Refinish 449 460 (2.5%) 9.3%

Industrial 183 179 2.6% 3.7%

Net Sales 632 639 (1.0%) 7.8%

Adjusted EBITDA 157 162 (3.0%)

% margin 24.9% 25.4%

% Change

+5.9% +1.9% (8.8%) (1.0%)

$632 $639

Price Q2 2016FXQ2 2015 Volume

AXALTA COATING SYSTEMS

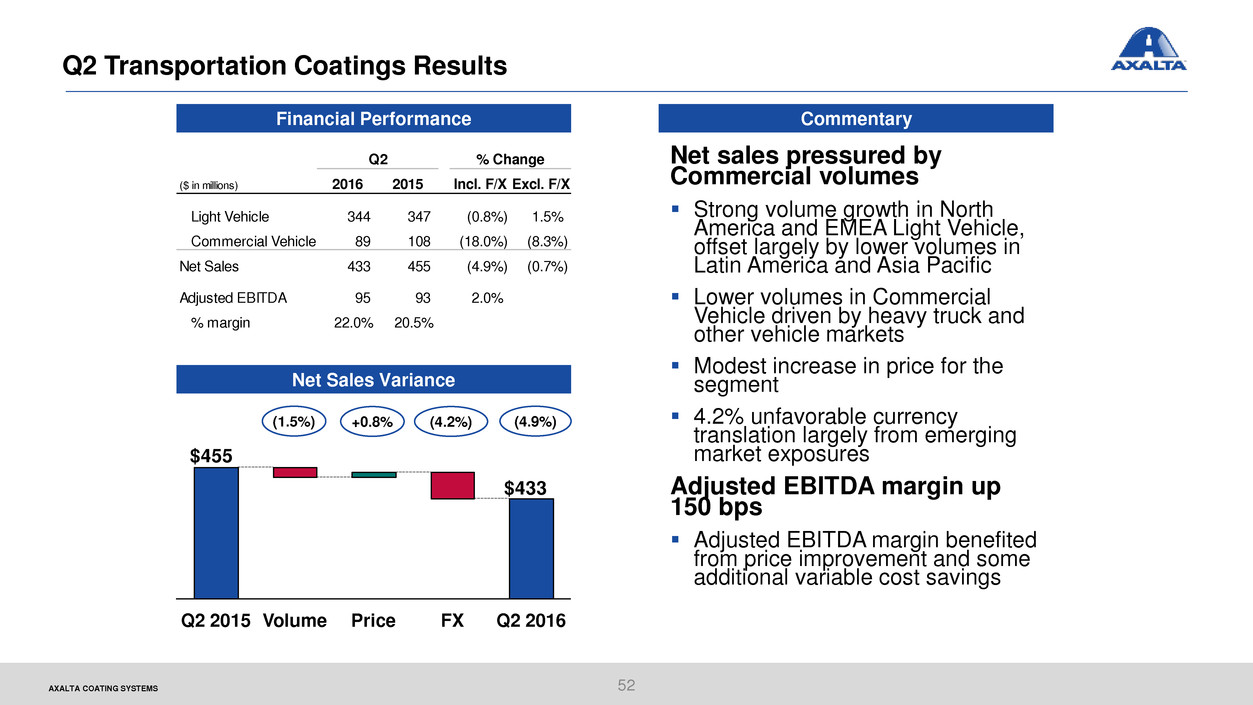

Q2 Transportation Coatings Results

Financial Performance

Net Sales Variance

52

Commentary

Net sales pressured by

Commercial volumes

Strong volume growth in North

America and EMEA Light Vehicle,

offset largely by lower volumes in

Latin America and Asia Pacific

Lower volumes in Commercial

Vehicle driven by heavy truck and

other vehicle markets

Modest increase in price for the

segment

4.2% unfavorable currency

translation largely from emerging

market exposures

Adjusted EBITDA margin up

150 bps

Adjusted EBITDA margin benefited

from price improvement and some

additional variable cost savings

($ in millions) 2016 2015 Incl. F/X Excl. F/X

Light Vehicle 344 347 (0.8%) 1.5%

Commercial Vehicl 89 108 (18.0%) (8.3%)

Net Sales 433 455 (4.9%) (0.7%)

Adjusted EBITDA 95 93 2.0%

% margin 22.0% 20.5%

Q2 % Change

(1.5%) +0.8% (4.9%)

$433

$455

Q2 2015 Q2 2016Price FXVolume

(4.2%)

PROPRIETARYAXALTA COATING SYSTEMS

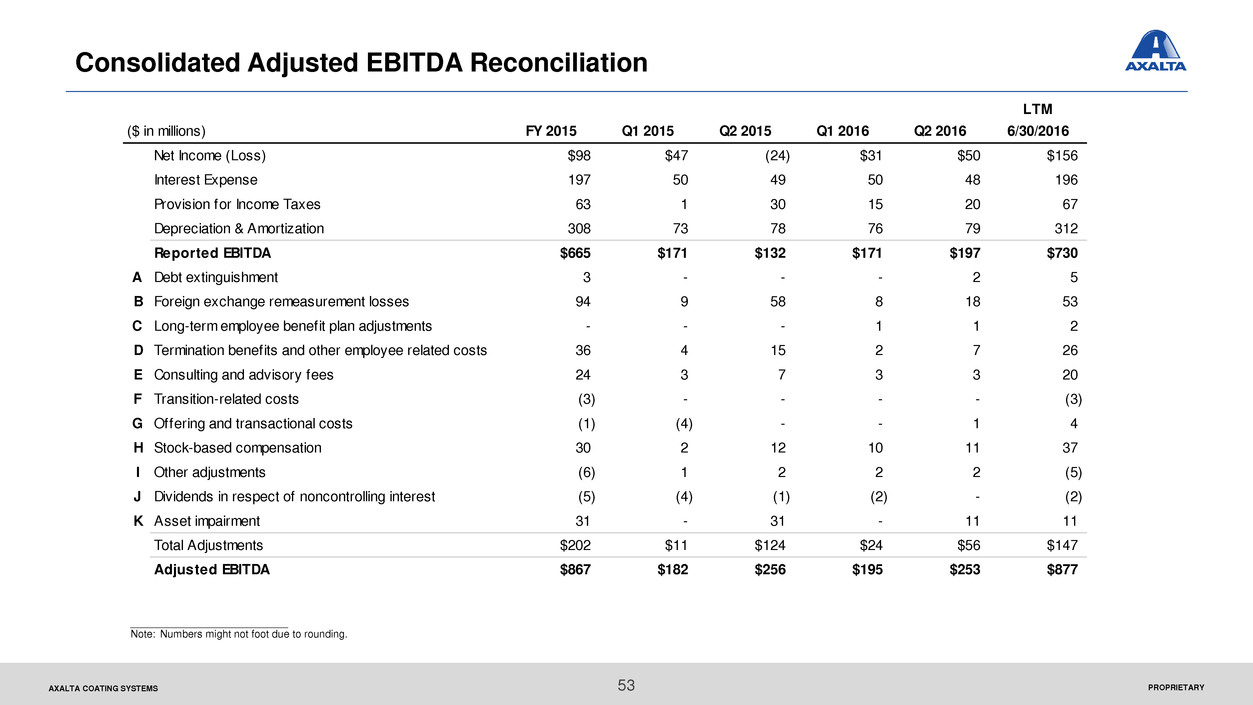

Consolidated Adjusted EBITDA Reconciliation

53

___________________________

Note: Numbers might not foot due to rounding.

LTM

($ in millions) FY 2015 Q1 2015 Q2 2015 Q1 2016 Q2 2016 6/30/2016

Net Income (Loss) $98 $47 (24) $31 $50 $156

Interest Expense 197 50 49 50 48 196

Provision for Income Taxes 63 1 30 15 20 67

Depreciation & Amortization 308 73 78 76 79 312

Reported EBITDA $665 $171 $132 $171 $197 $730

A Debt extinguishment 3 - - - 2 5

B Foreign exchange remeasurement losses 94 9 58 8 18 53

C Long-term employee benefit plan adjustments - - - 1 1 2

D Termination benefits and other employee related costs 36 4 15 2 7 26

E Consulting and advisory fees 24 3 7 3 3 20

F Transition-related costs (3) - - - - (3)

G Offering and transactional costs (1) (4) - - 1 4

H Stock-based compensation 30 2 12 10 11 37

I Other adjustments (6) 1 2 2 2 (5)

J Dividends in respect of noncontrolling interest (5) (4) (1) (2) - (2)

K Asset impairment 31 - 31 - 11 11

Total Adjustments $202 $11 $124 $24 $56 $147

Adjusted EBITDA $867 $182 $256 $195 $253 $877

PROPRIETARYAXALTA COATING SYSTEMS 54

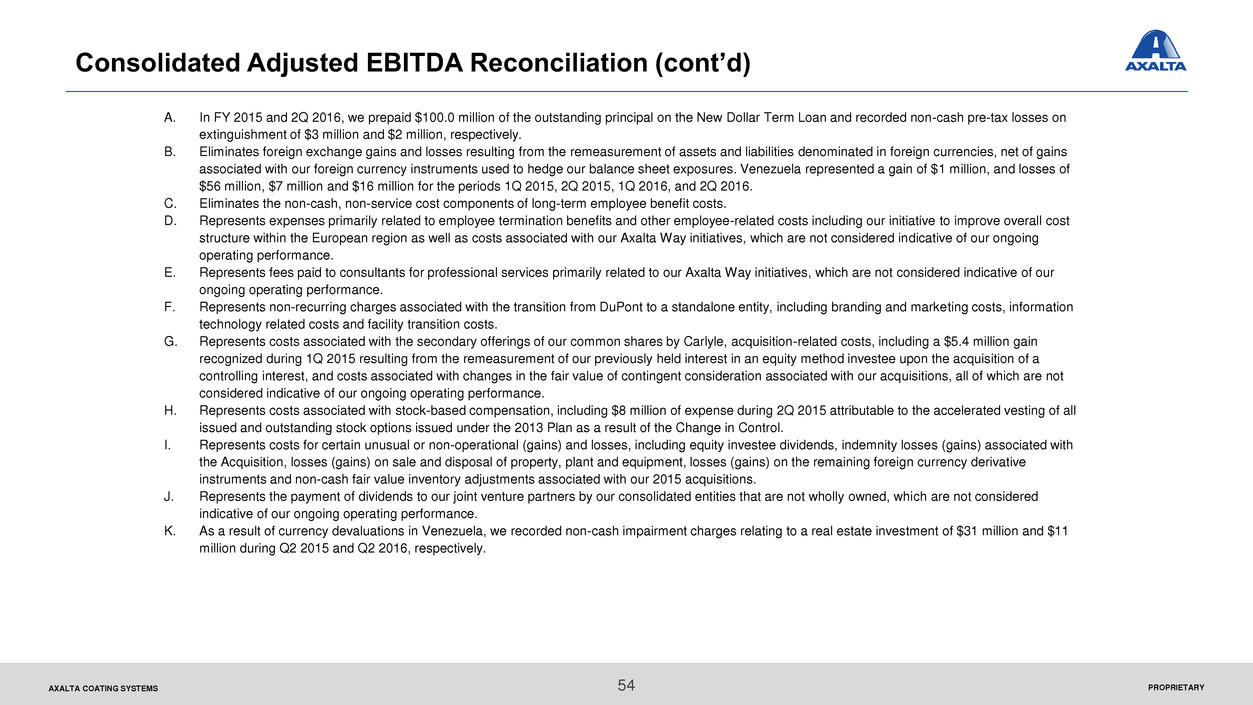

Consolidated Adjusted EBITDA Reconciliation (cont’d)

A. In FY 2015 and 2Q 2016, we prepaid $100.0 million of the outstanding principal on the New Dollar Term Loan and recorded non-cash pre-tax losses on

extinguishment of $3 million and $2 million, respectively.

B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of gains

associated with our foreign currency instruments used to hedge our balance sheet exposures. Venezuela represented a gain of $1 million, and losses of

$56 million, $7 million and $16 million for the periods 1Q 2015, 2Q 2015, 1Q 2016, and 2Q 2016.

C. Eliminates the non-cash, non-service cost components of long-term employee benefit costs.

D. Represents expenses primarily related to employee termination benefits and other employee-related costs including our initiative to improve overall cost

structure within the European region as well as costs associated with our Axalta Way initiatives, which are not considered indicative of our ongoing

operating performance.

E. Represents fees paid to consultants for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our

ongoing operating performance.

F. Represents non-recurring charges associated with the transition from DuPont to a standalone entity, including branding and marketing costs, information

technology related costs and facility transition costs.

G. Represents costs associated with the secondary offerings of our common shares by Carlyle, acquisition-related costs, including a $5.4 million gain

recognized during 1Q 2015 resulting from the remeasurement of our previously held interest in an equity method investee upon the acquisition of a

controlling interest, and costs associated with changes in the fair value of contingent consideration associated with our acquisitions, all of which are not

considered indicative of our ongoing operating performance.

H. Represents costs associated with stock-based compensation, including $8 million of expense during 2Q 2015 attributable to the accelerated vesting of all

issued and outstanding stock options issued under the 2013 Plan as a result of the Change in Control.

I. Represents costs for certain unusual or non-operational (gains) and losses, including equity investee dividends, indemnity losses (gains) associated with

the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses (gains) on the remaining foreign currency derivative

instruments and non-cash fair value inventory adjustments associated with our 2015 acquisitions.

J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned, which are not considered

indicative of our ongoing operating performance.

K. As a result of currency devaluations in Venezuela, we recorded non-cash impairment charges relating to a real estate investment of $31 million and $11

million during Q2 2015 and Q2 2016, respectively.

Thank you!

Investor Contact:

Chris Mecray, VP IR

Christopher.Mecray@axaltacs.com

215-255-7970