EXHIBIT 99.1

Published on February 22, 2017

2017 Capital Markets Day

Technology Drives Axalta’s Performance

February 22, 2017

Axalta Coating Systems

Exhibit 99.1

2 PROPRIETARYAXALTA COATING SYSTEMS

Legal Notices

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2017 financial

projections, including execution on our 2017 goals as well as 2017 net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, working capital, depreciation and amortization,

diluted shares outstanding, cost savings, contributions from acquisitions, and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,”

“expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our

experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the

assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-

looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any

forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not

limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX,

EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying

trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense, (ii) the impact of certain non-cash, nonrecurring or other items that are included in net income and EBITDA that we do not consider

indicative of our ongoing performance and (iii) certain unusual or nonrecurring items impacting results in a particular period. We believe that making such adjustments provides investors meaningful information to understand our operating

results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in

our industry. Net sales excluding FX, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP as measures of

operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be

considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated

in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the

information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses,

gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a

measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly

comparable financial measure calculated in accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

3 PROPRIETARYAXALTA COATING SYSTEMS

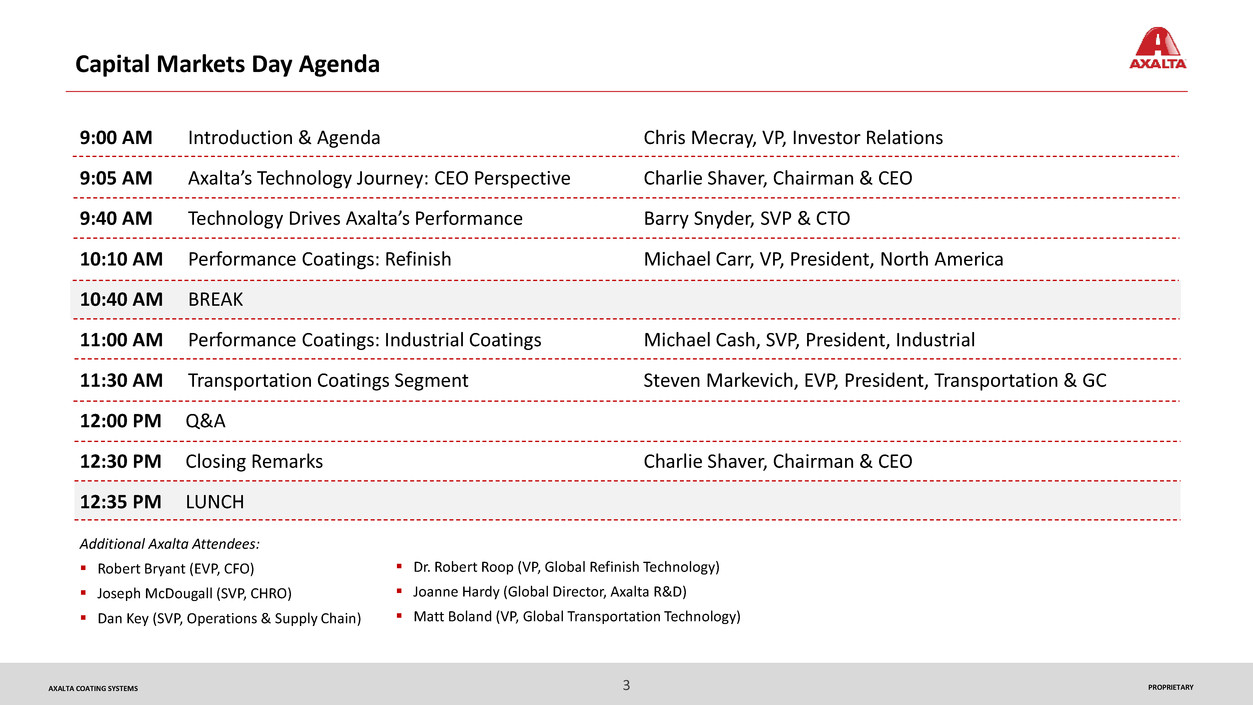

Capital Markets Day Agenda

9:00 AM Introduction & Agenda Chris Mecray, VP, Investor Relations

9:05 AM Axalta’s Technology Journey: CEO Perspective Charlie Shaver, Chairman & CEO

9:40 AM Technology Drives Axalta’s Performance Barry Snyder, SVP & CTO

10:10 AM Performance Coatings: Refinish Michael Carr, VP, President, North America

10:40 AM BREAK

11:00 AM Performance Coatings: Industrial Coatings Michael Cash, SVP, President, Industrial

11:30 AM Transportation Coatings Segment Steven Markevich, EVP, President, Transportation & GC

12:00 PM Q&A

12:30 PM Closing Remarks Charlie Shaver, Chairman & CEO

12:35 PM LUNCH

Additional Axalta Attendees:

Robert Bryant (EVP, CFO)

Joseph McDougall (SVP, CHRO)

Dan Key (SVP, Operations & Supply Chain)

Dr. Robert Roop (VP, Global Refinish Technology)

Joanne Hardy (Global Director, Axalta R&D)

Matt Boland (VP, Global Transportation Technology)

Axalta’s Technology Journey:

The CEO Perspective

Charles W. Shaver

Chairman and CEO

5 PROPRIETARYAXALTA COATING SYSTEMS

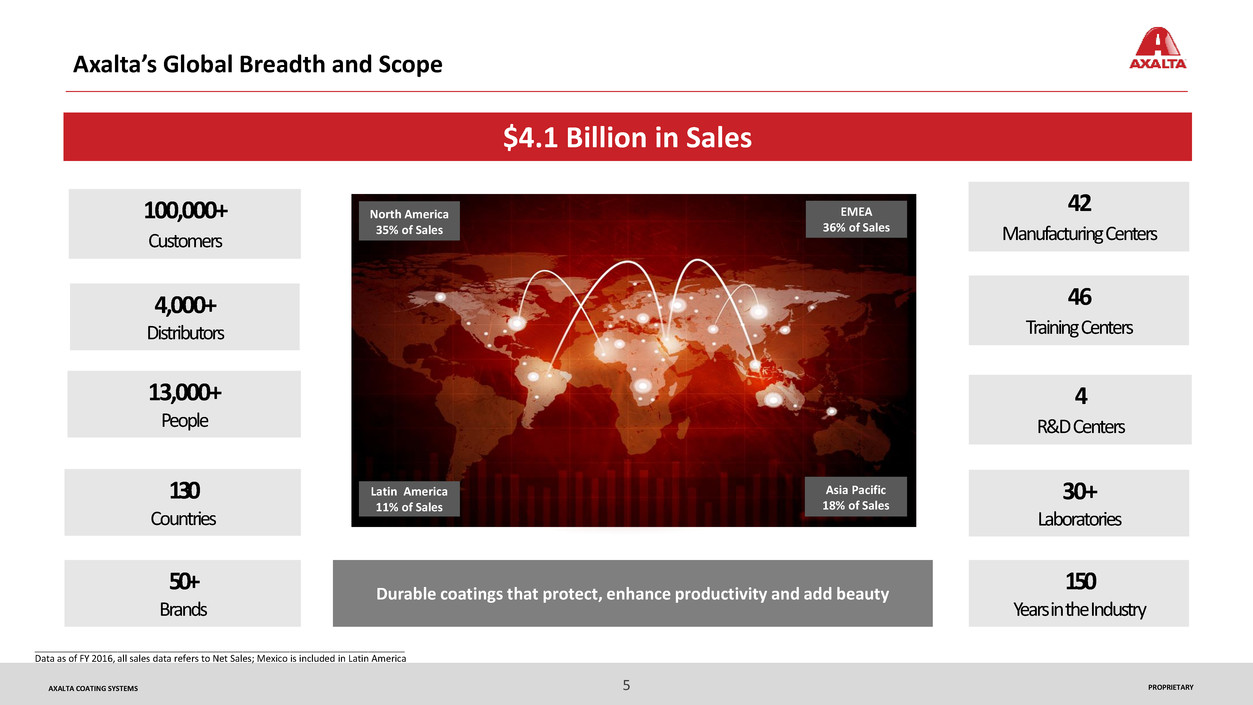

Axalta’s Global Breadth and Scope

$4.1 Billion in Sales

13,000+

People

42

ManufacturingCenters

130

Countries

4

R&DCenters

46

TrainingCenters

100,000+

Customers

4,000+

Distributors

30+

Laboratories

150

Years in the Industry

50+

Brands

Durable coatings that protect, enhance productivity and add beauty

North America

35% of Sales

EMEA

36% of Sales

Latin America

11% of Sales

Asia Pacific

18% of Sales

_______________________________________________________________________

Data as of FY 2016, all sales data refers to Net Sales; Mexico is included in Latin America

6 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Customer Focused Organization

• Global and local customers

• Global Axalta strategy

• Strong regional execution

• Global OEM customers

• Global Axalta strategies and support teams

• Regionally specific aspects of customer support

SEGMENTS

END

MARKETS

Automotive OEMs

Coatings for plastic & composite

materials

Automotive interiors

Heavy duty trucks

Rail

Bus

Utility trucks

Recreational vehicles

Construction / mining

Cranes

Marine

General industrial powders

Electrical insulation systems

Architectural & decorative

Oil & gas & utility pipelines

Valves & rebar

Automotive sub-components

Metal furniture & playground

Agricultural, construction and

earth moving equipment (ACE)

Coil / extruded metal

Multi-shop operators

Independent body shops

Auto dealership groups

COMMERCIAL VEHICLE

TRANSPORTATION COATINGSPERFORMANCE COATINGS

LIGHT VEHICLEINDUSTRIALREFINISH

• Regional & local customers

• Regional Axalta strategies

• Strong local execution

AXALTA

STRUCTURE

7 PROPRIETARYAXALTA COATING SYSTEMS

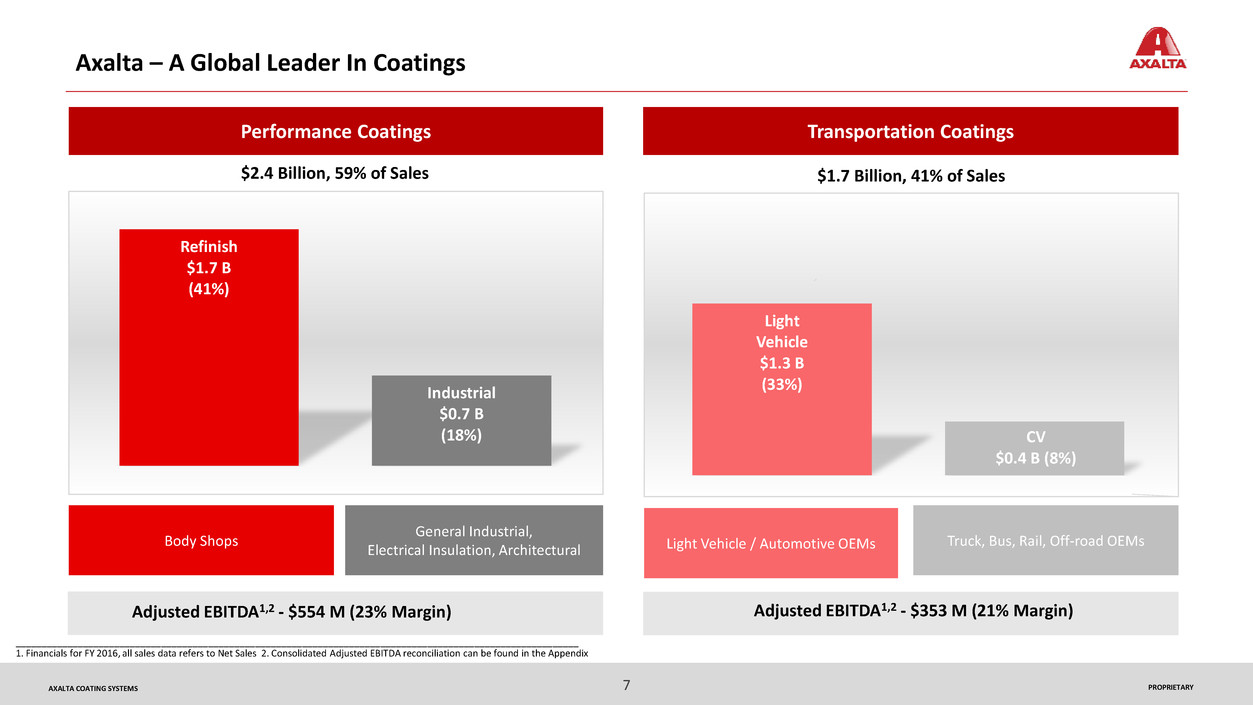

Refinish

$1.7 B

(41%)

Industrial

$0.7 B

(18%)

Body Shops

Light

Vehicle

$1.3 B

(33%)

CV

$0.4 B (8%)

Performance Coatings

General Industrial,

Electrical Insulation, Architectural

Transportation Coatings

Adjusted EBITDA1,2 - $554 M (23% Margin) Adjusted EBITDA1,2 - $353 M (21% Margin)

Light Vehicle / Automotive OEMs Truck, Bus, Rail, Off-road OEMs

____________________________________________________________________________________________________________

1. Financials for FY 2016, all sales data refers to Net Sales 2. Consolidated Adjusted EBITDA reconciliation can be found in the Appendix

Axalta – A Global Leader In Coatings

$2.4 Billion, 59% of Sales $1.7 Billion, 41% of Sales

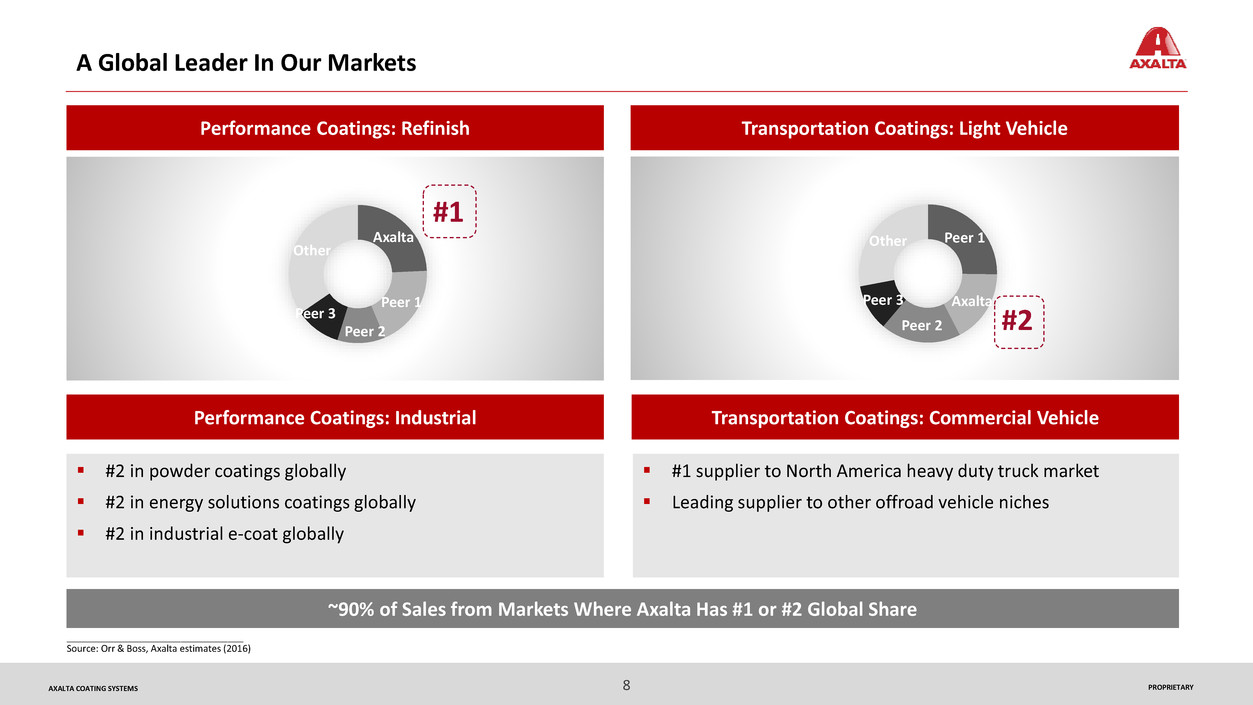

8 PROPRIETARYAXALTA COATING SYSTEMS

Peer 1

Axalta

Peer 2

Peer 3

Other

A Global Leader In Our Markets

~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share

Axalta

Peer 1

Peer 2

Peer 3

Other

Performance Coatings: Refinish Transportation Coatings: Light Vehicle

#1

__________________________________

Source: Orr & Boss, Axalta estimates (2016)

#2

Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle

#2 in powder coatings globally

#2 in energy solutions coatings globally

#2 in industrial e-coat globally

#1 supplier to North America heavy duty truck market

Leading supplier to other offroad vehicle niches

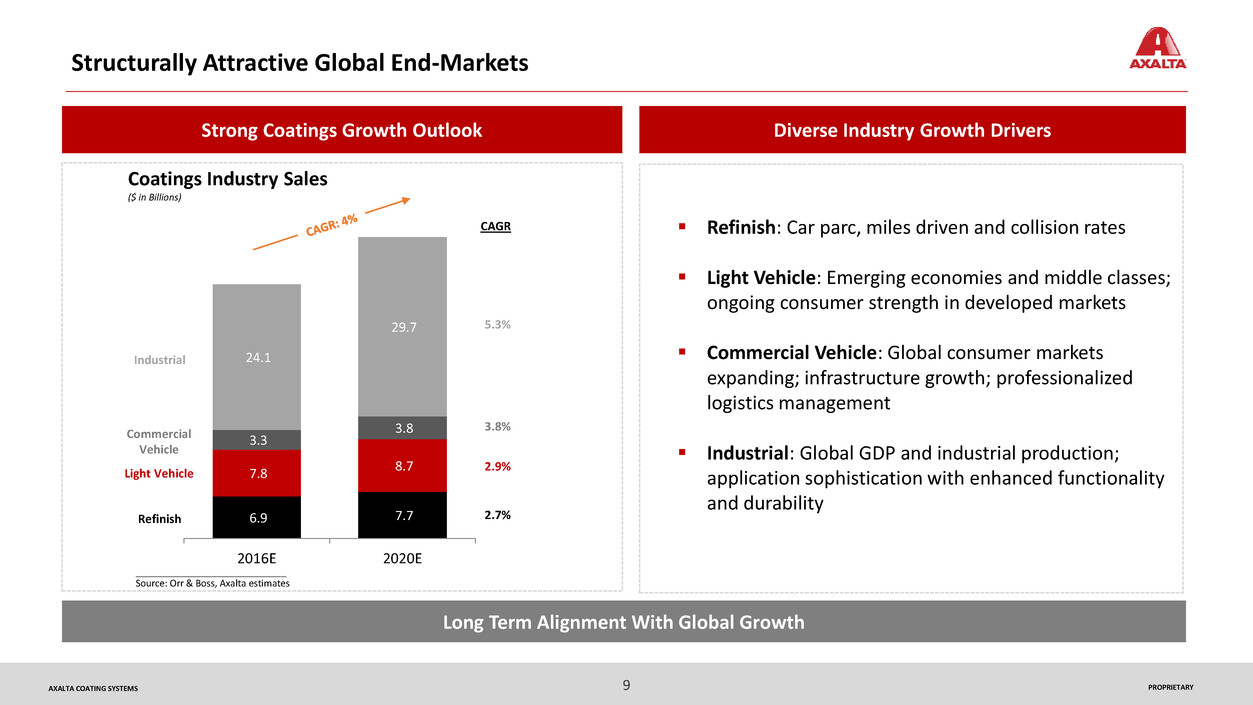

9 PROPRIETARYAXALTA COATING SYSTEMS

Structurally Attractive Global End-Markets

Strong Coatings Growth Outlook

Long Term Alignment With Global Growth

Refinish: Car parc, miles driven and collision rates

Light Vehicle: Emerging economies and middle classes;

ongoing consumer strength in developed markets

Commercial Vehicle: Global consumer markets

expanding; infrastructure growth; professionalized

logistics management

Industrial: Global GDP and industrial production;

application sophistication with enhanced functionality

and durability

Diverse Industry Growth Drivers

Commercial

Vehicle

Light Vehicle

Refinish

Industrial

5.3%

3.8%

2.9%

2.7%

CAGR

Coatings Industry Sales

($ in Billions)

_____________________________

Source: Orr & Boss, Axalta estimates

6.9 7.7

7.8

8.7

3.3

3.8

24.1

29.7

2016E 2020E

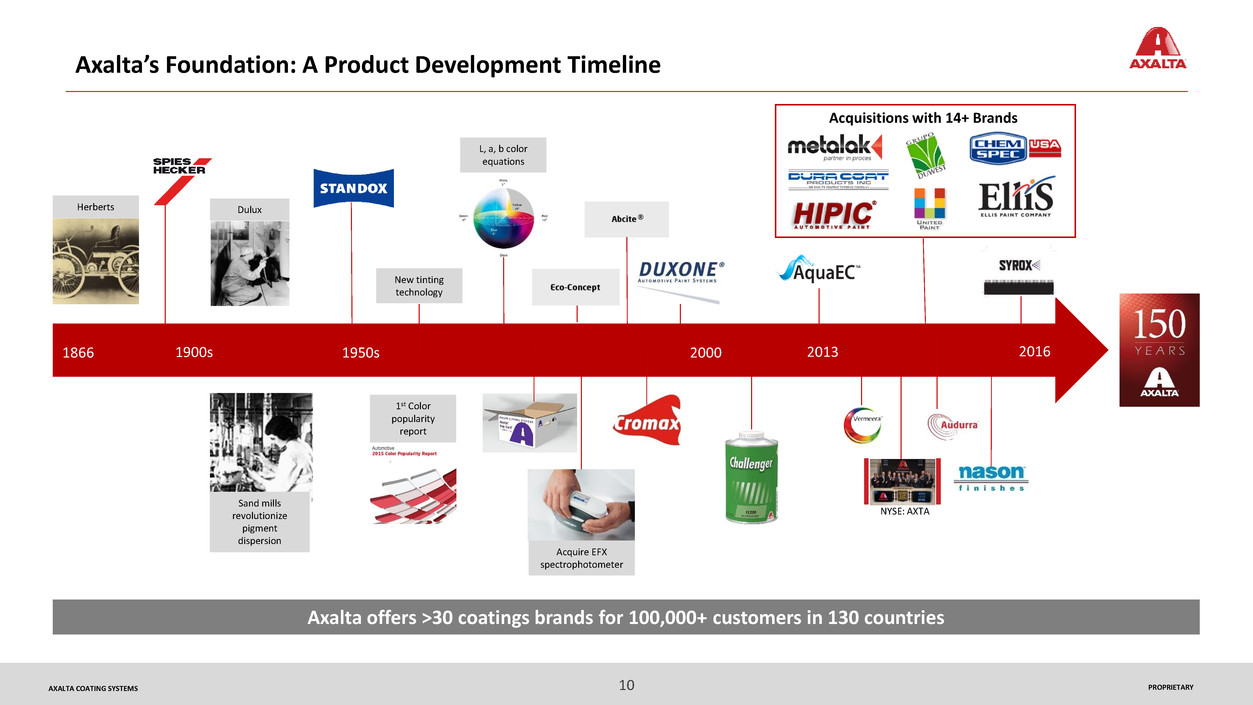

10 PROPRIETARYAXALTA COATING SYSTEMS

NYSE: AXTA

Axalta’s Foundation: A Product Development Timeline

1866 2016

Herberts Dulux

Sand mills

revolutionize

pigment

dispersion

New tinting

technology

1900s 2000 20131950s

1st Color

popularity

report

L, a, b color

equations

Acquire EFX

spectrophotometer

Axalta offers >30 coatings brands for 100,000+ customers in 130 countries

Acquisitions with 14+ Brands

2

0

1

4

11 PROPRIETARYAXALTA COATING SYSTEMS

Key Achievements in 2016

Grow the Business

Productivity Initiatives Improve Cost Structure

Focus on Operating Improvement

Extend Core Strengths & Globalize

Net sales growth 4% ex-currency, including acquisitions

Outgrew our end-markets

Exceeded expectations with $64 million in combined

2016 cost savings

Success in refining our operating model

Extend our strong global foundation

Continue High IRR Investments

Productivity & growth capex remain in high gear - $136 M

spend in 2016A

Active M&A Pipeline

Completed 6 bolt-on M&A deals completed in our core end-

markets

FCF & Debt Paydown A Priority Leverage ratios lowered to 3.0x (2.5-3.0x goal) ahead of

schedule

Stated Objective Results

12 PROPRIETARYAXALTA COATING SYSTEMS

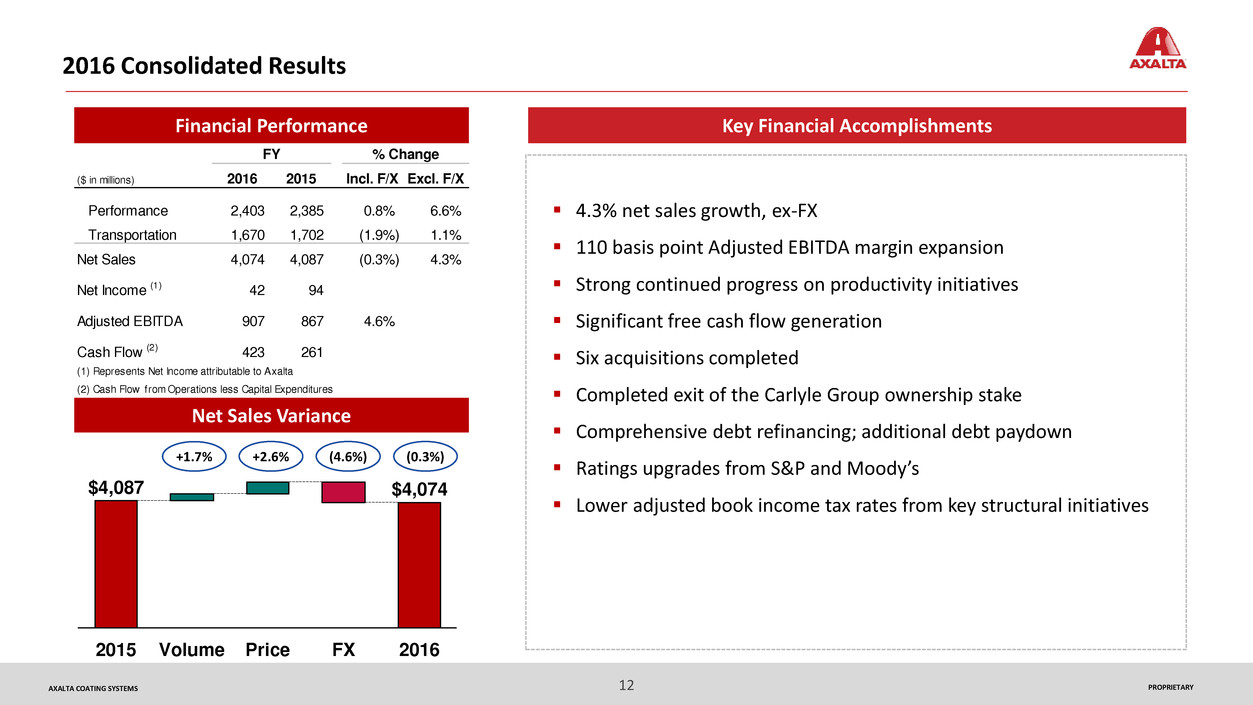

2016 Consolidated Results

Financial Performance

Net Sales Variance

20162015

$4,074$4,087

PriceVolume FX

+1.7% +2.6% (4.6%) (0.3%)

4.3% net sales growth, ex-FX

110 basis point Adjusted EBITDA margin expansion

Strong continued progress on productivity initiatives

Significant free cash flow generation

Six acquisitions completed

Completed exit of the Carlyle Group ownership stake

Comprehensive debt refinancing; additional debt paydown

Ratings upgrades from S&P and Moody’s

Lower adjusted book income tax rates from key structural initiatives

Key Financial Accomplishments

($ in millions) 2016 2015 Incl. F/X Excl. F/X

Performance 2,403 2,385 0.8% 6.6%

Transportation 1,670 1,702 (1.9%) 1.1%

Net Sales 4,074 4,087 (0.3%) 4.3%

Net Income (1) 42 94

Adjusted EBITDA 907 867 4.6%

Cash Flow (2) 423 261

(1) Represents Net Income ttributable to Axalta

(2) Cash Flow from Operations less Capital Expenditures

FY % Change

13 PROPRIETARYAXALTA COATING SYSTEMS

2016 Highlights

Wins

28 million OEM vehicles painted

100+ OEM coating systems launched

900+ new Industrial accounts

Continued gains with multi-shop and independent

refinish customers

Products

225+ new products, line extensions or fit-for-

purpose technology applications

Added 15+ brands from acquisitions

Recognition

Multiple customer awards for technology, service

and support

Customer and industry awards for innovation and

sustainable technologies

6100 Hydropon

14 PROPRIETARYAXALTA COATING SYSTEMS

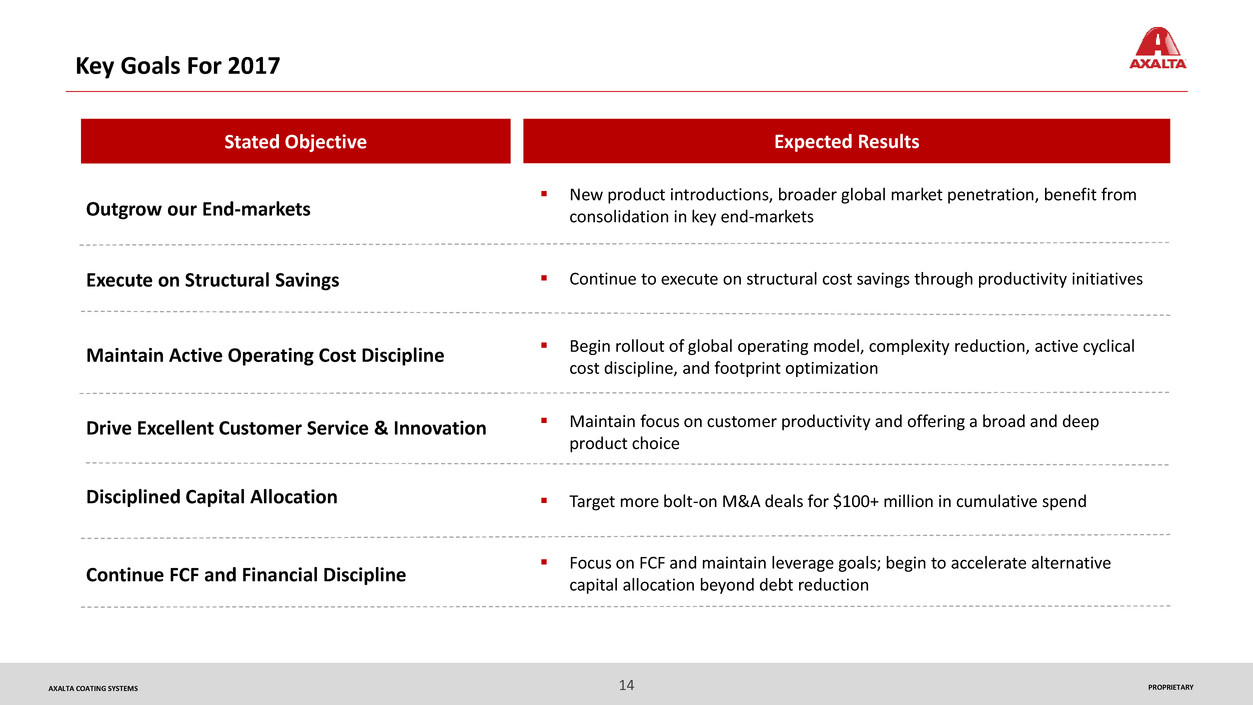

Key Goals For 2017

Outgrow our End-markets

Stated Objective Expected Results

Drive Excellent Customer Service & Innovation

Maintain Active Operating Cost Discipline

Execute on Structural Savings

Disciplined Capital Allocation

Continue FCF and Financial Discipline

New product introductions, broader global market penetration, benefit from

consolidation in key end-markets

Begin rollout of global operating model, complexity reduction, active cyclical

cost discipline, and footprint optimization

Continue to execute on structural cost savings through productivity initiatives

Target more bolt-on M&A deals for $100+ million in cumulative spend

Focus on FCF and maintain leverage goals; begin to accelerate alternative

capital allocation beyond debt reduction

Maintain focus on customer productivity and offering a broad and deep

product choice

15 PROPRIETARYAXALTA COATING SYSTEMS

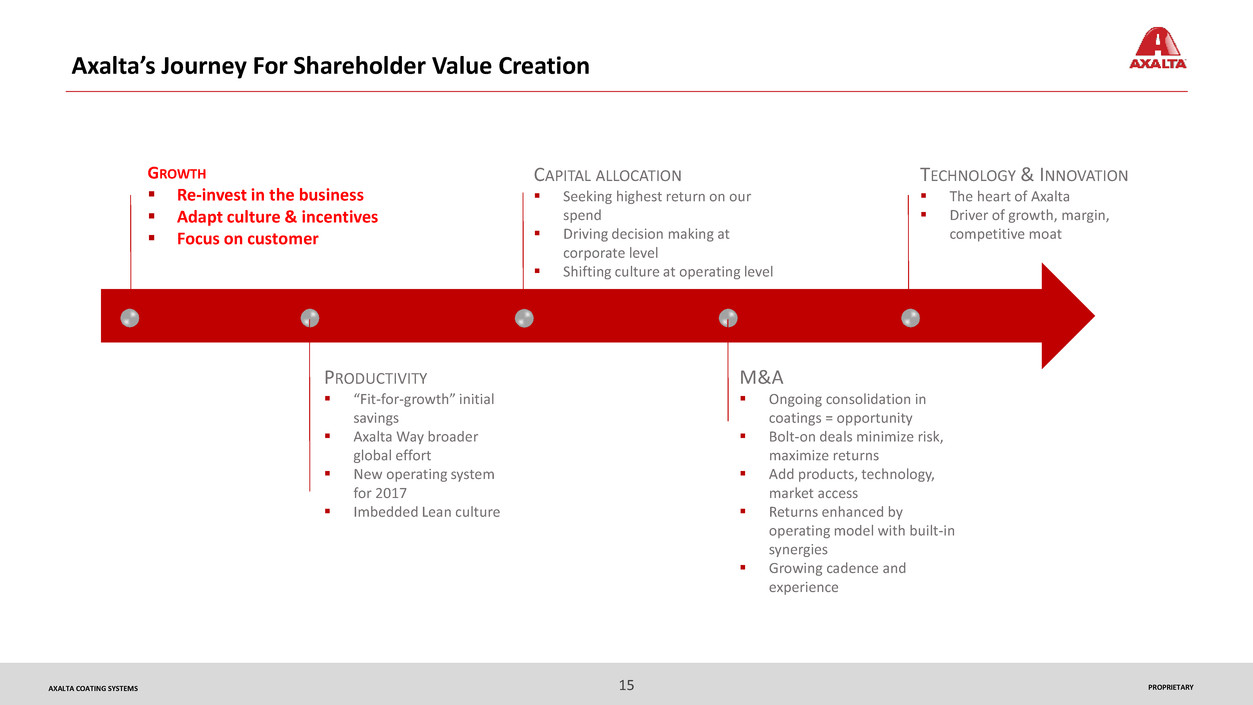

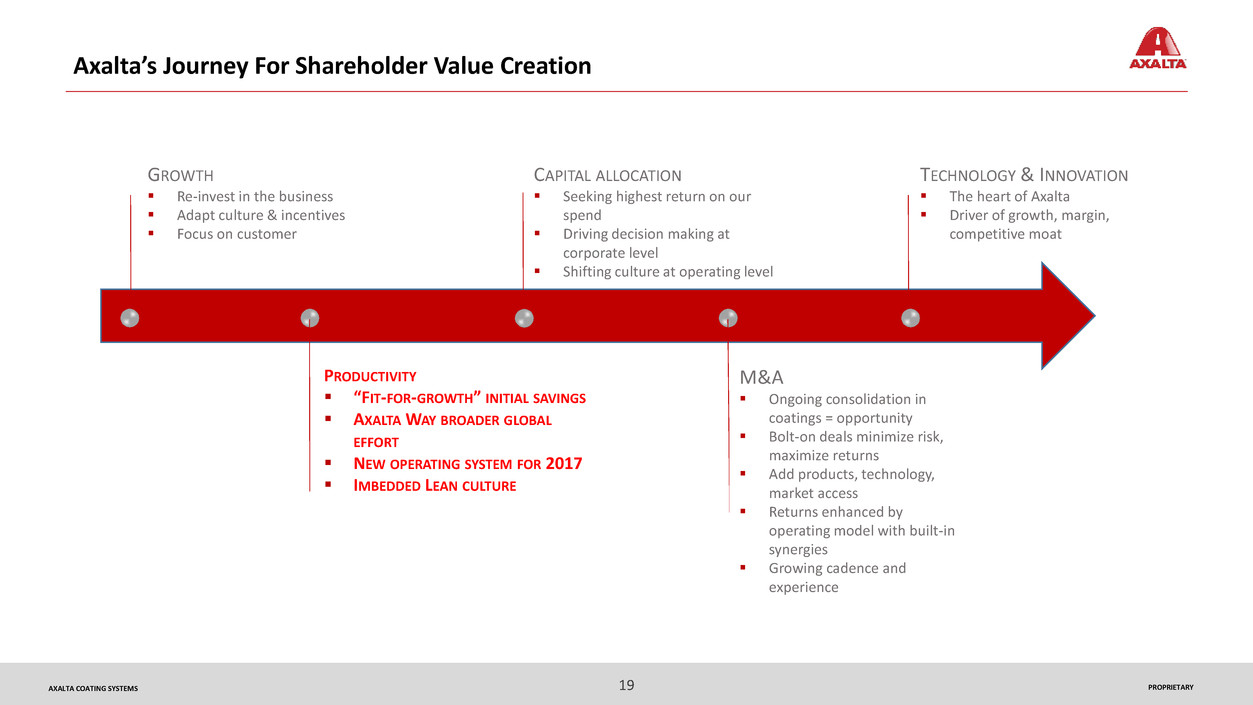

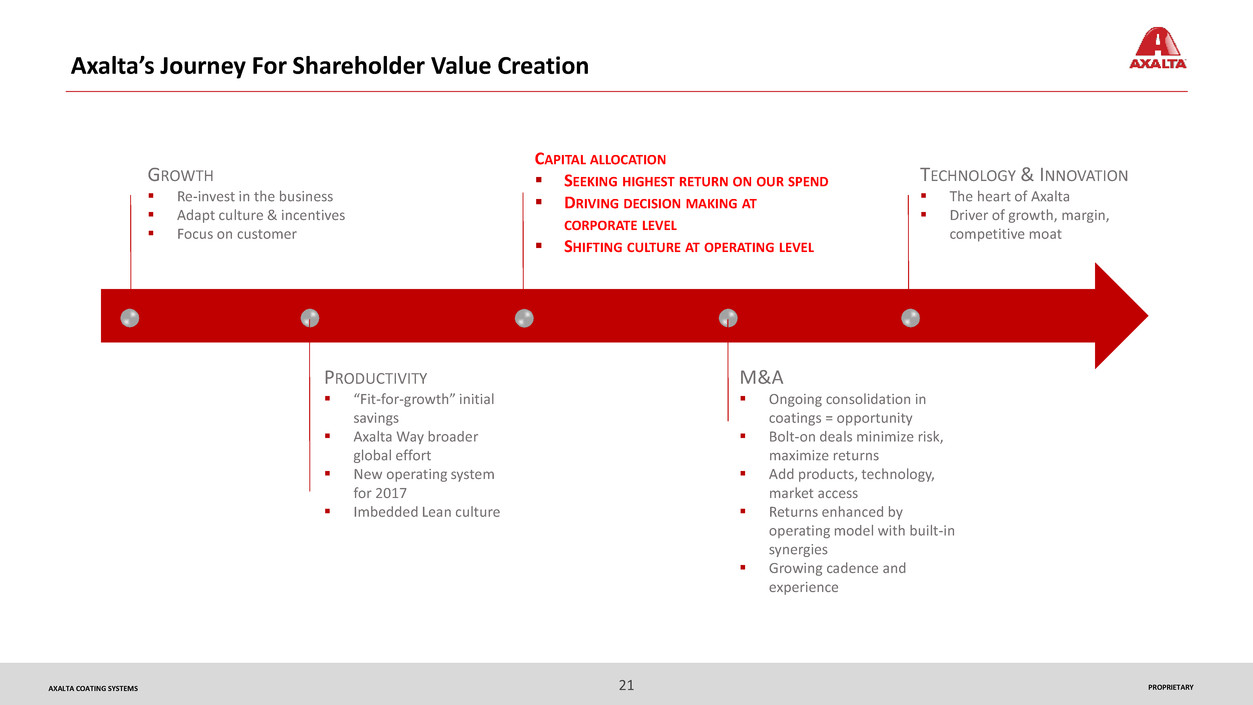

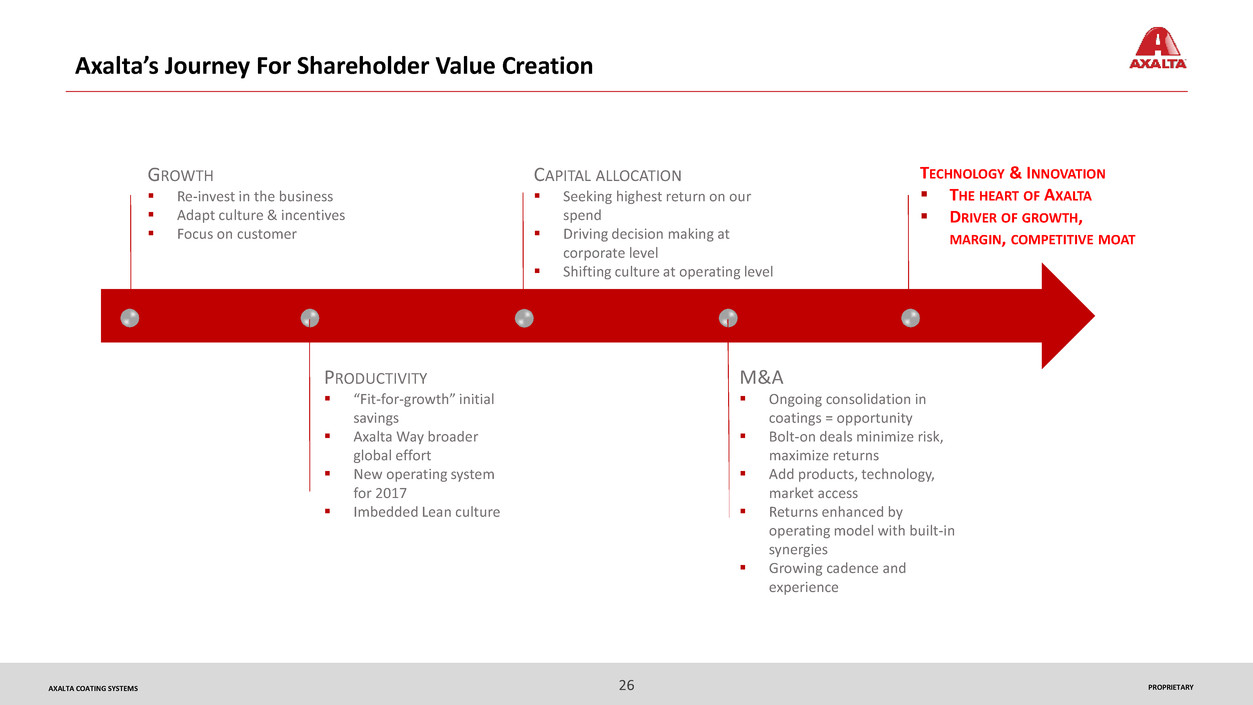

Axalta’s Journey For Shareholder Value Creation

GROWTH

Re-invest in the business

Adapt culture & incentives

Focus on customer

PRODUCTIVITY

“Fit-for-growth” initial

savings

Axalta Way broader

global effort

New operating system

for 2017

Imbedded Lean culture

M&A

Ongoing consolidation in

coatings = opportunity

Bolt-on deals minimize risk,

maximize returns

Add products, technology,

market access

Returns enhanced by

operating model with built-in

synergies

Growing cadence and

experience

CAPITAL ALLOCATION

Seeking highest return on our

spend

Driving decision making at

corporate level

Shifting culture at operating level

TECHNOLOGY & INNOVATION

The heart of Axalta

Driver of growth, margin,

competitive moat

16 PROPRIETARYAXALTA COATING SYSTEMS

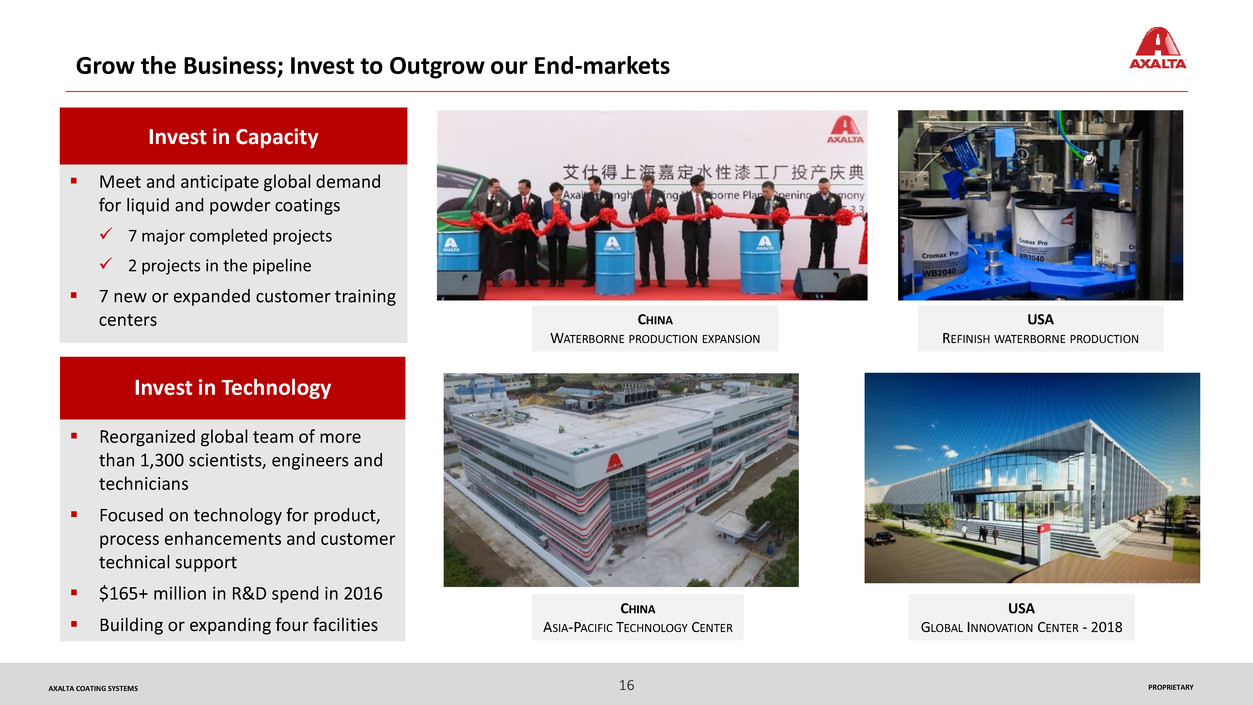

Grow the Business; Invest to Outgrow our End-markets

Invest in Technology

Invest in Capacity

Meet and anticipate global demand

for liquid and powder coatings

7 major completed projects

2 projects in the pipeline

7 new or expanded customer training

centers

Reorganized global team of more

than 1,300 scientists, engineers and

technicians

Focused on technology for product,

process enhancements and customer

technical support

$165+ million in R&D spend in 2016

Building or expanding four facilities

CHINA

WATERBORNE PRODUCTION EXPANSION

USA

REFINISH WATERBORNE PRODUCTION

CHINA

ASIA-PACIFIC TECHNOLOGY CENTER

USA

GLOBAL INNOVATION CENTER - 2018

17 PROPRIETARYAXALTA COATING SYSTEMS

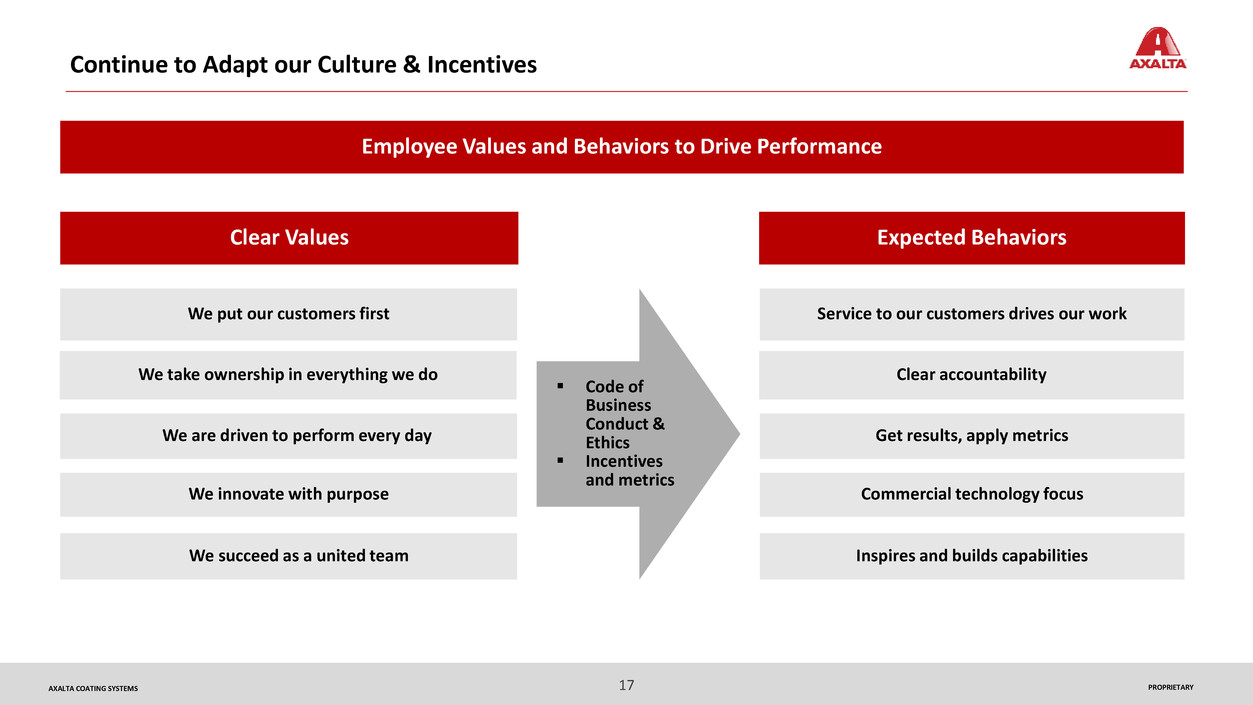

Continue to Adapt our Culture & Incentives

Employee Values and Behaviors to Drive Performance

We are driven to perform every day

We innovate with purpose

We succeed as a united team

We put our customers first

We take ownership in everything we do

Clear Values

Get results, apply metrics

Commercial technology focus

Inspires and builds capabilities

Service to our customers drives our work

Clear accountability

Expected Behaviors

Code of

Business

Conduct &

Ethics

Incentives

and metrics

18 PROPRIETARYAXALTA COATING SYSTEMS

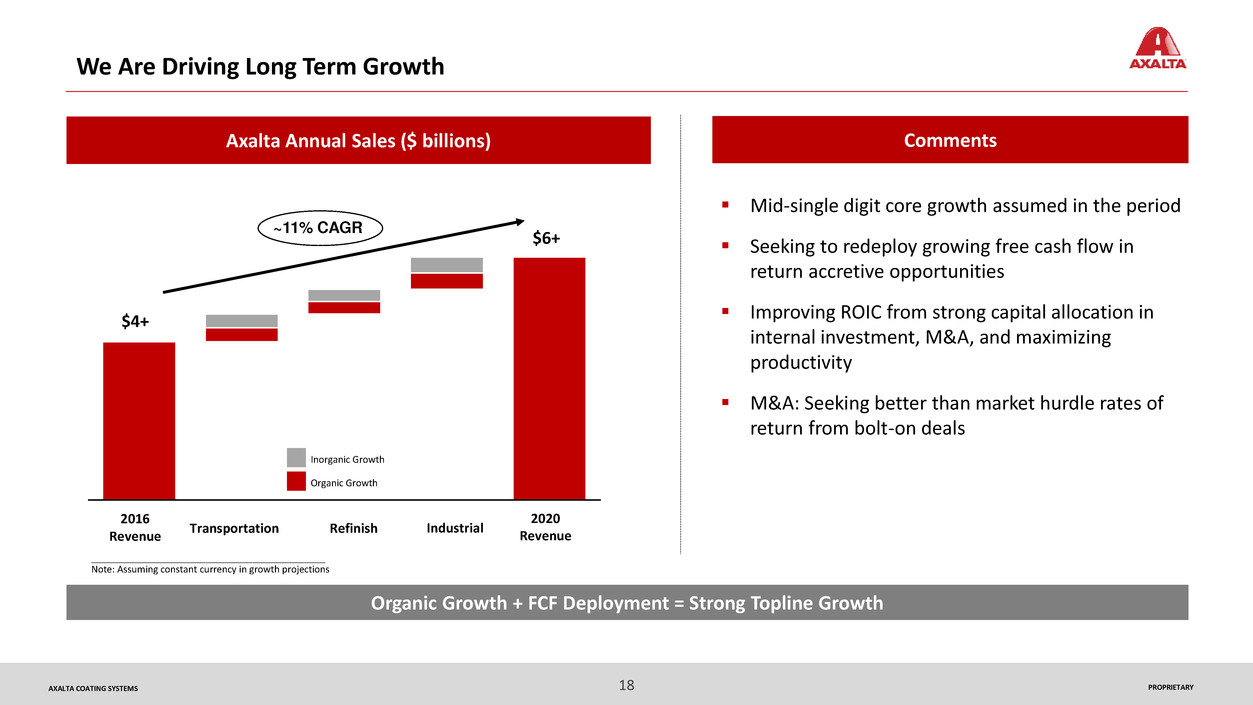

We Are Driving Long Term Growth

1.65

1.72

Organic Growth + FCF Deployment = Strong Topline Growth

Mid-single digit core growth assumed in the period

Seeking to redeploy growing free cash flow in

return accretive opportunities

Improving ROIC from strong capital allocation in

internal investment, M&A, and maximizing

productivity

M&A: Seeking better than market hurdle rates of

return from bolt-on deals

CommentsAxalta Annual Sales ($ billions)

0.45

IndustrialRefinish

~11% CAGR

2020

Revenue

Transportation

2016

Revenue

$6+

$4+

Inorganic Growth

Organic Growth

_____________________________________________

Note: Assuming constant currency in growth projections

19 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Journey For Shareholder Value Creation

GROWTH

Re-invest in the business

Adapt culture & incentives

Focus on customer

PRODUCTIVITY

“FIT-FOR-GROWTH” INITIAL SAVINGS

AXALTA WAY BROADER GLOBAL

EFFORT

NEW OPERATING SYSTEM FOR 2017

IMBEDDED LEAN CULTURE

M&A

Ongoing consolidation in

coatings = opportunity

Bolt-on deals minimize risk,

maximize returns

Add products, technology,

market access

Returns enhanced by

operating model with built-in

synergies

Growing cadence and

experience

CAPITAL ALLOCATION

Seeking highest return on our

spend

Driving decision making at

corporate level

Shifting culture at operating level

TECHNOLOGY & INNOVATION

The heart of Axalta

Driver of growth, margin,

competitive moat

20 PROPRIETARYAXALTA COATING SYSTEMS

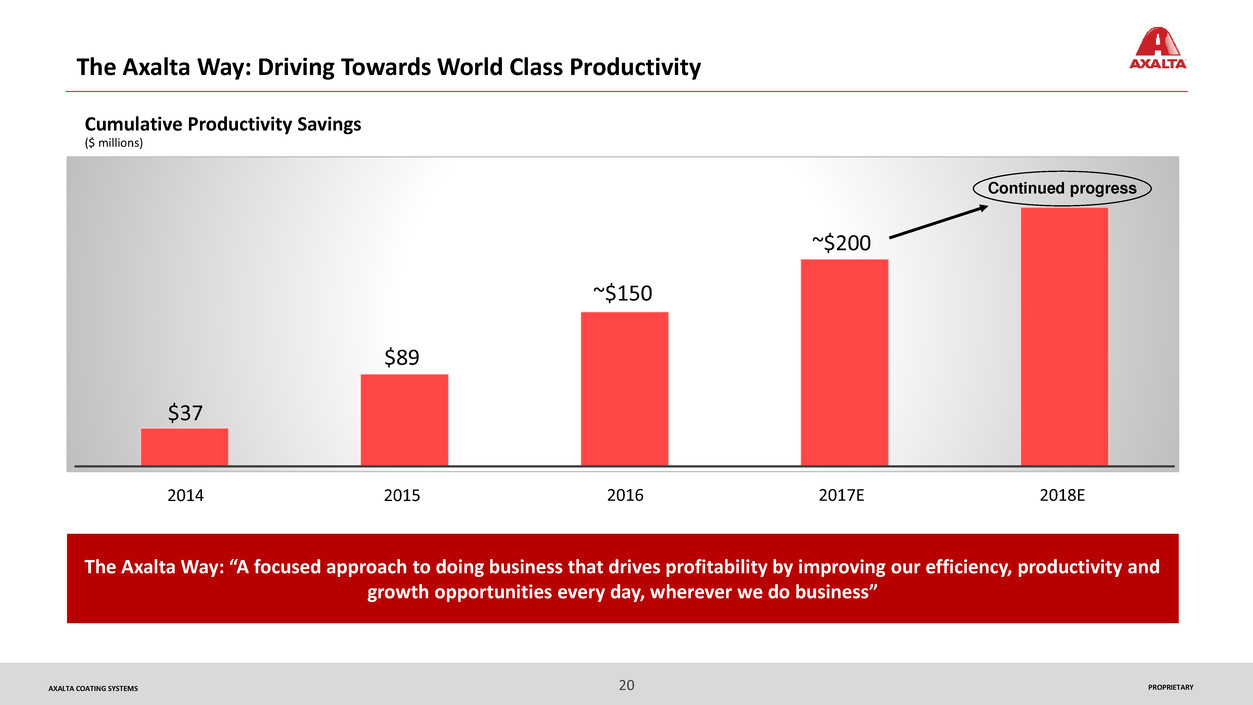

The Axalta Way: Driving Towards World Class Productivity

Cumulative Productivity Savings

($ millions)

The Axalta Way: “A focused approach to doing business that drives profitability by improving our efficiency, productivity and

growth opportunities every day, wherever we do business”

2017E20162015 2018E2014

~$150

$89

~$200

$37

Continued progress

21 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Journey For Shareholder Value Creation

GROWTH

Re-invest in the business

Adapt culture & incentives

Focus on customer

PRODUCTIVITY

“Fit-for-growth” initial

savings

Axalta Way broader

global effort

New operating system

for 2017

Imbedded Lean culture

M&A

Ongoing consolidation in

coatings = opportunity

Bolt-on deals minimize risk,

maximize returns

Add products, technology,

market access

Returns enhanced by

operating model with built-in

synergies

Growing cadence and

experience

CAPITAL ALLOCATION

SEEKING HIGHEST RETURN ON OUR SPEND

DRIVING DECISION MAKING AT

CORPORATE LEVEL

SHIFTING CULTURE AT OPERATING LEVEL

TECHNOLOGY & INNOVATION

The heart of Axalta

Driver of growth, margin,

competitive moat

22 PROPRIETARYAXALTA COATING SYSTEMS

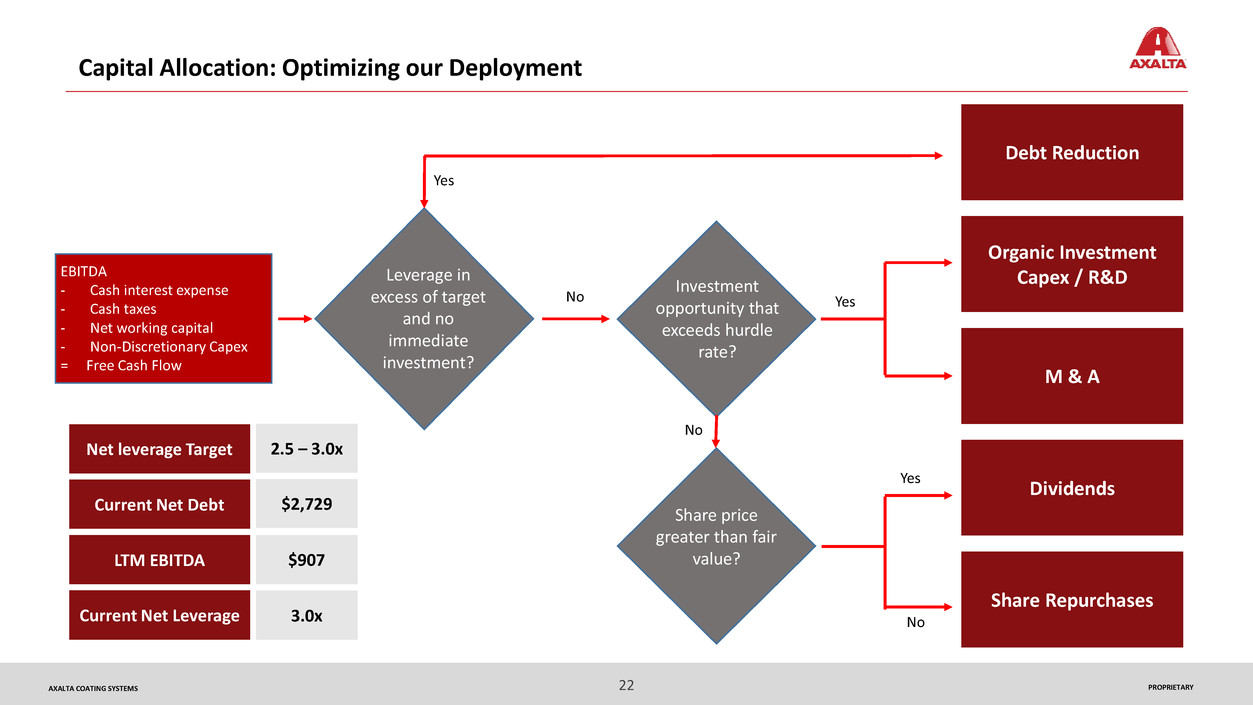

Capital Allocation: Optimizing our Deployment

Debt Reduction

Organic Investment

Capex / R&D

M & A

Dividends

Share Repurchases

Leverage in

excess of target

and no

immediate

investment?

Investment

opportunity that

exceeds hurdle

rate?

Share price

greater than fair

value?

EBITDA

- Cash interest expense

- Cash taxes

- Net working capital

- Non-Discretionary Capex

= Free Cash Flow

No

No

Yes

Yes

Yes

No

Net leverage Target

Current Net Debt

LTM EBITDA

Current Net Leverage

2.5 – 3.0x

$2,729

$907

3.0x

23 PROPRIETARYAXALTA COATING SYSTEMS

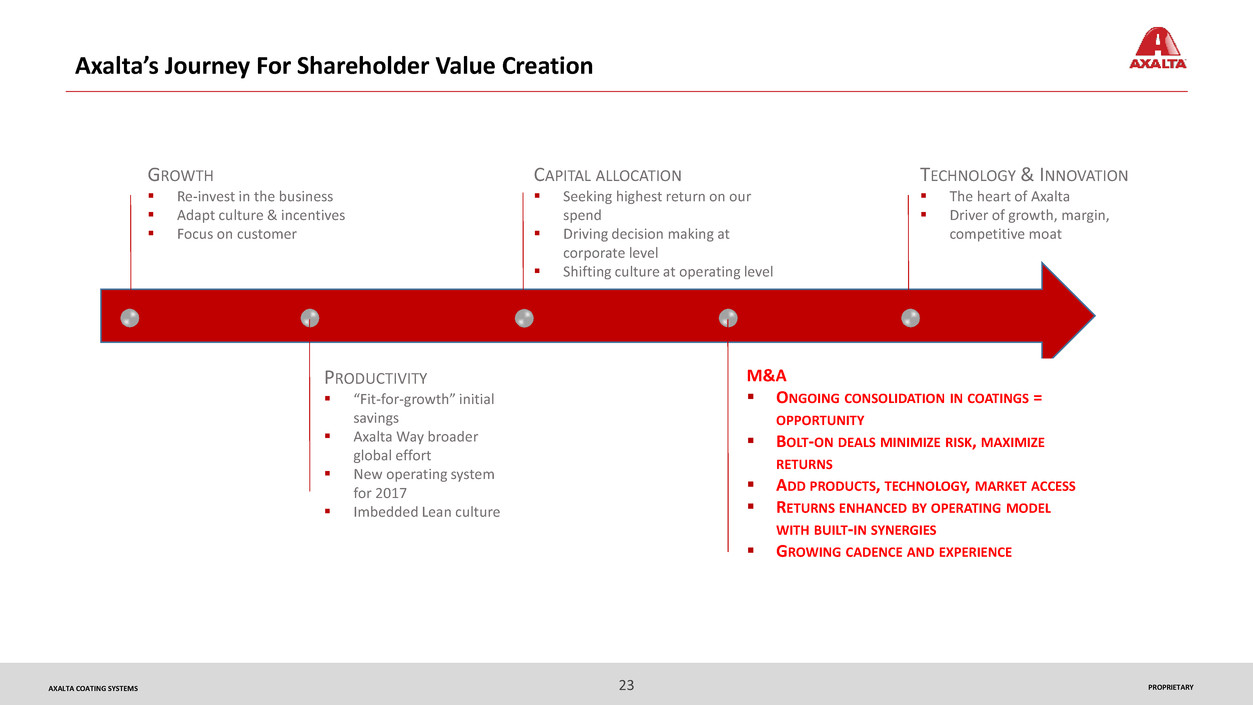

Axalta’s Journey For Shareholder Value Creation

GROWTH

Re-invest in the business

Adapt culture & incentives

Focus on customer

PRODUCTIVITY

“Fit-for-growth” initial

savings

Axalta Way broader

global effort

New operating system

for 2017

Imbedded Lean culture

M&A

ONGOING CONSOLIDATION IN COATINGS =

OPPORTUNITY

BOLT-ON DEALS MINIMIZE RISK, MAXIMIZE

RETURNS

ADD PRODUCTS, TECHNOLOGY, MARKET ACCESS

RETURNS ENHANCED BY OPERATING MODEL

WITH BUILT-IN SYNERGIES

GROWING CADENCE AND EXPERIENCE

CAPITAL ALLOCATION

Seeking highest return on our

spend

Driving decision making at

corporate level

Shifting culture at operating level

TECHNOLOGY & INNOVATION

The heart of Axalta

Driver of growth, margin,

competitive moat

24 PROPRIETARYAXALTA COATING SYSTEMS

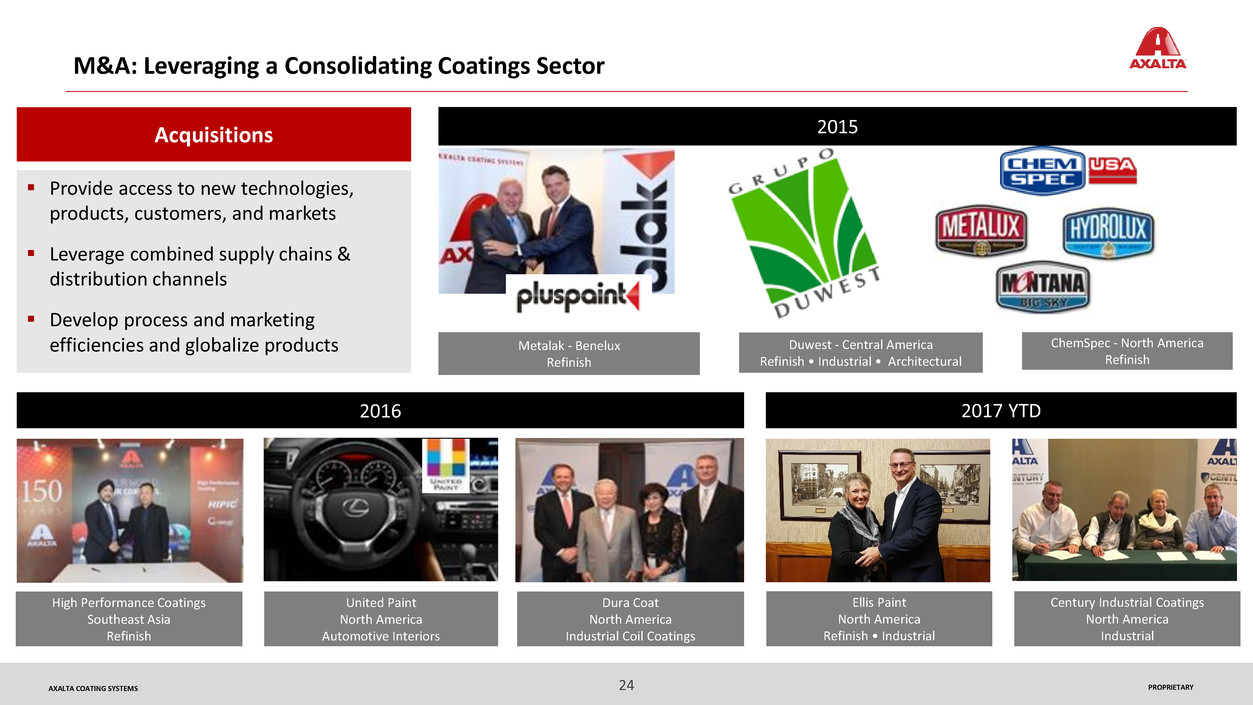

Metalak - Benelux

Refinish

ChemSpec - North America

Refinish

High Performance Coatings

Southeast Asia

Refinish

Duwest - Central America

Refinish • Industrial • Architectural

Dura Coat

North America

Industrial Coil Coatings

United Paint

North America

Automotive Interiors

2016

M&A: Leveraging a Consolidating Coatings Sector

Acquisitions

Provide access to new technologies,

products, customers, and markets

Leverage combined supply chains &

distribution channels

Develop process and marketing

efficiencies and globalize products

Ellis Paint

North America

Refinish • Industrial

2015

Century Industrial Coatings

North America

Industrial

2017 YTD

25 PROPRIETARYAXALTA COATING SYSTEMS

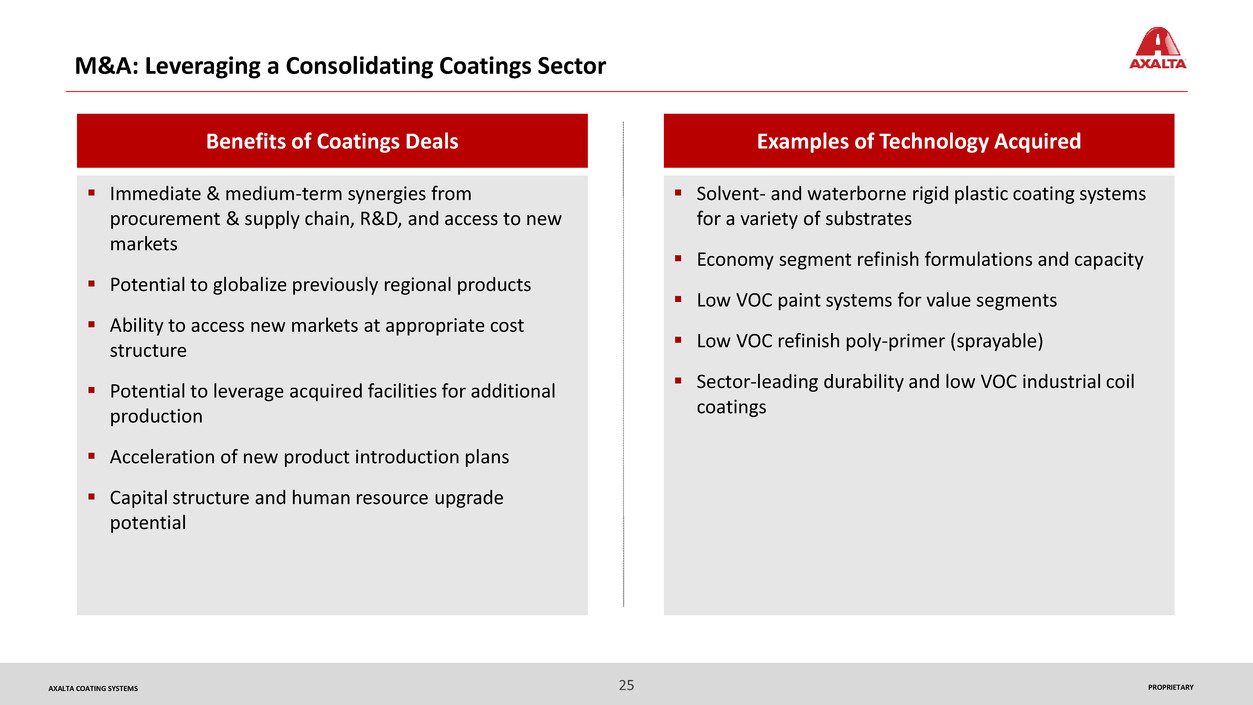

M&A: Leveraging a Consolidating Coatings Sector

Examples of Technology Acquired

Solvent- and waterborne rigid plastic coating systems

for a variety of substrates

Economy segment refinish formulations and capacity

Low VOC paint systems for value segments

Low VOC refinish poly-primer (sprayable)

Sector-leading durability and low VOC industrial coil

coatings

Benefits of Coatings Deals

Immediate & medium-term synergies from

procurement & supply chain, R&D, and access to new

markets

Potential to globalize previously regional products

Ability to access new markets at appropriate cost

structure

Potential to leverage acquired facilities for additional

production

Acceleration of new product introduction plans

Capital structure and human resource upgrade

potential

26 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Journey For Shareholder Value Creation

GROWTH

Re-invest in the business

Adapt culture & incentives

Focus on customer

PRODUCTIVITY

“Fit-for-growth” initial

savings

Axalta Way broader

global effort

New operating system

for 2017

Imbedded Lean culture

M&A

Ongoing consolidation in

coatings = opportunity

Bolt-on deals minimize risk,

maximize returns

Add products, technology,

market access

Returns enhanced by

operating model with built-in

synergies

Growing cadence and

experience

CAPITAL ALLOCATION

Seeking highest return on our

spend

Driving decision making at

corporate level

Shifting culture at operating level

TECHNOLOGY & INNOVATION

THE HEART OF AXALTA

DRIVER OF GROWTH,

MARGIN, COMPETITIVE MOAT

27 PROPRIETARYAXALTA COATING SYSTEMS

Significant Competitive Advantages

Differentiated Franchise with Global Scale and Strong Competitive Advantages

• 4+ million color variations

• Hundreds of formulations in

automotive & industrial

Deep coatings heritage

since 1866

Broad global brand

portfolio

• 1,200+ technology employees

• 800+ patents, 275+

trademarks

• $165+ million annual spend

42 plants on 5 continents

Significant legacy capital

investment

Process technology is

hard to replicate

Dedicated employees in OEM

plants

Technical support to body

shops

Technology Innovation

Extensive Formulation

Database

Deep Process Technology

Knowledge

Go-To-Market

With Strong Brands

Differentiated Technical

Support

Product Process Distribution & Technical Services

28 PROPRIETARYAXALTA COATING SYSTEMS

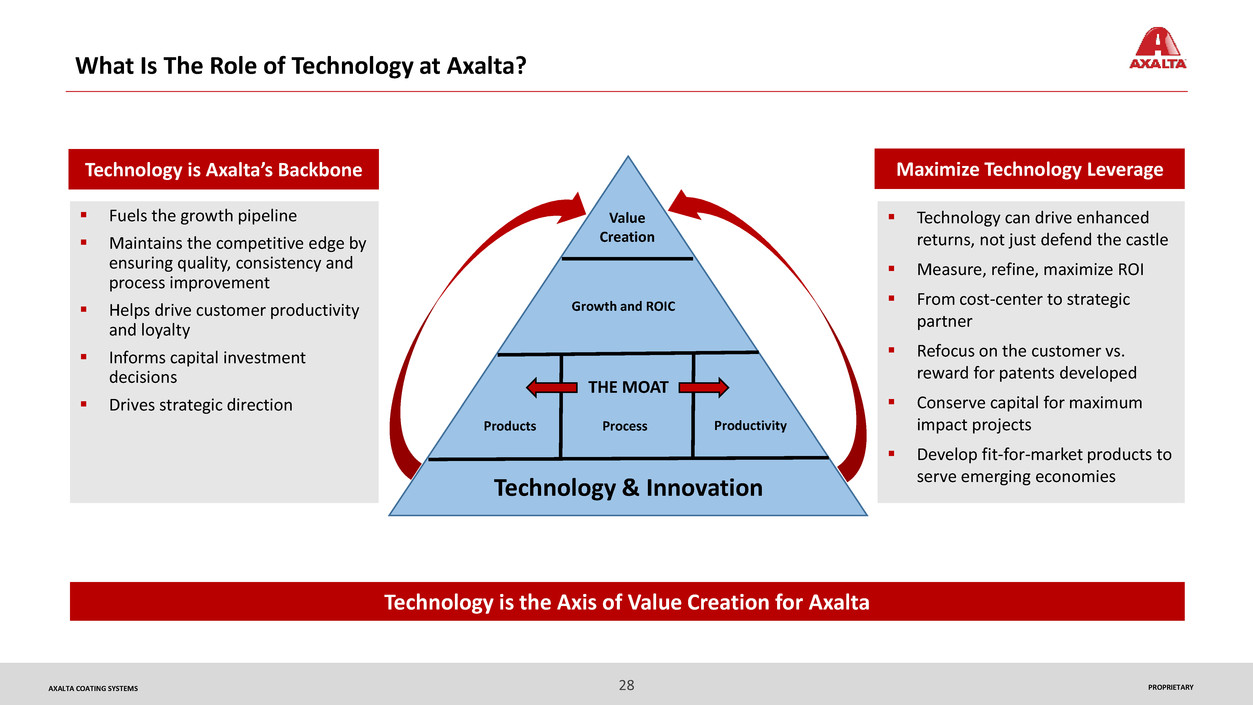

What Is The Role of Technology at Axalta?

2013 2014

2016

June

2014

Technology & Innovation

Products Process Productivity

Value

Creation

Technology is the Axis of Value Creation for Axalta

Technology can drive enhanced

returns, not just defend the castle

Measure, refine, maximize ROI

From cost-center to strategic

partner

Refocus on the customer vs.

reward for patents developed

Conserve capital for maximum

impact projects

Develop fit-for-market products to

serve emerging economies

Fuels the growth pipeline

Maintains the competitive edge by

ensuring quality, consistency and

process improvement

Helps drive customer productivity

and loyalty

Informs capital investment

decisions

Drives strategic direction

Growth and ROIC

THE MOAT

Technology is Axalta’s Backbone Maximize Technology Leverage

29 PROPRIETARYAXALTA COATING SYSTEMS

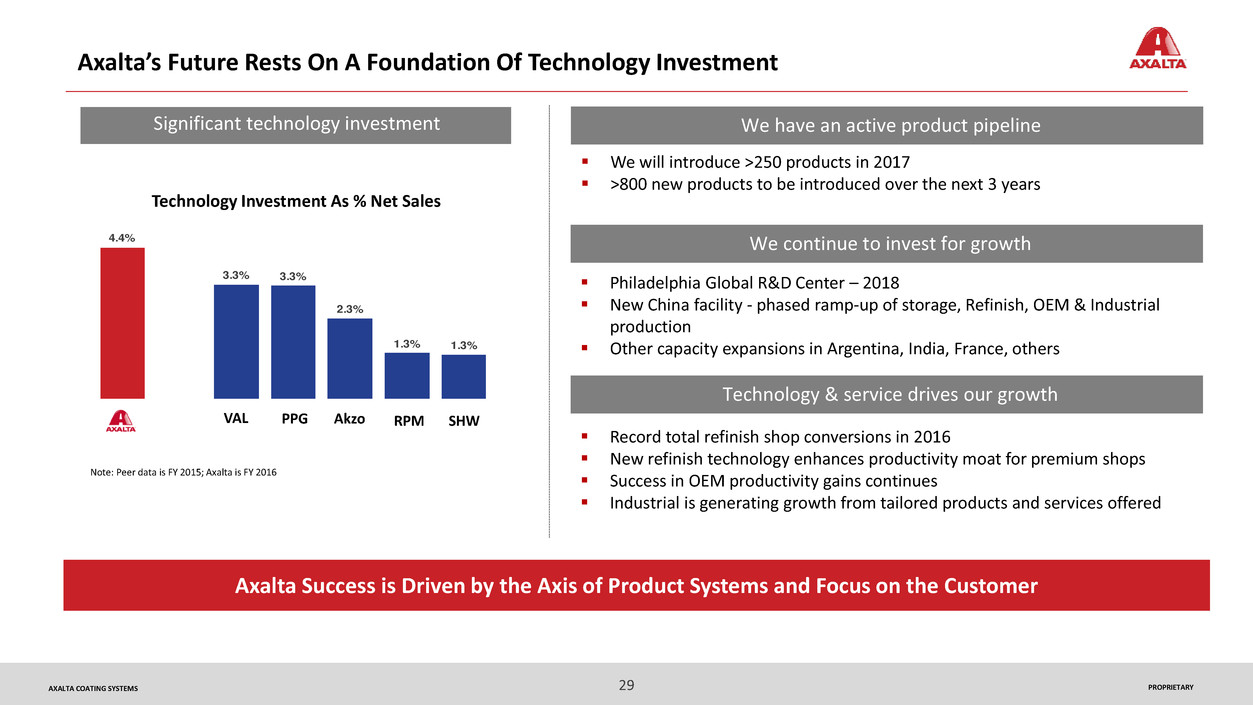

Axalta’s Future Rests On A Foundation Of Technology Investment

Axalta Success is Driven by the Axis of Product Systems and Focus on the Customer

We have an active product pipelineSignificant technology investment

Note: Peer data is FY 2015; Axalta is FY 2016

We will introduce >250 products in 2017

>800 new products to be introduced over the next 3 years

Philadelphia Global R&D Center – 2018

New China facility - phased ramp-up of storage, Refinish, OEM & Industrial

production

Other capacity expansions in Argentina, India, France, others

Record total refinish shop conversions in 2016

New refinish technology enhances productivity moat for premium shops

Success in OEM productivity gains continues

Industrial is generating growth from tailored products and services offered

PPG Akzo RPM SHW

We continue to invest for growth

Technology & service drives our growth

4.4%

3.3% 3.3%

2.3%

1.3% 1.3%

VAL

Technology Investment As % Net Sales

Thank You

Technology Drives Axalta’s Performance

Barry Snyder

SVP, Chief Technical Officer

32 PROPRIETARYAXALTA COATING SYSTEMS

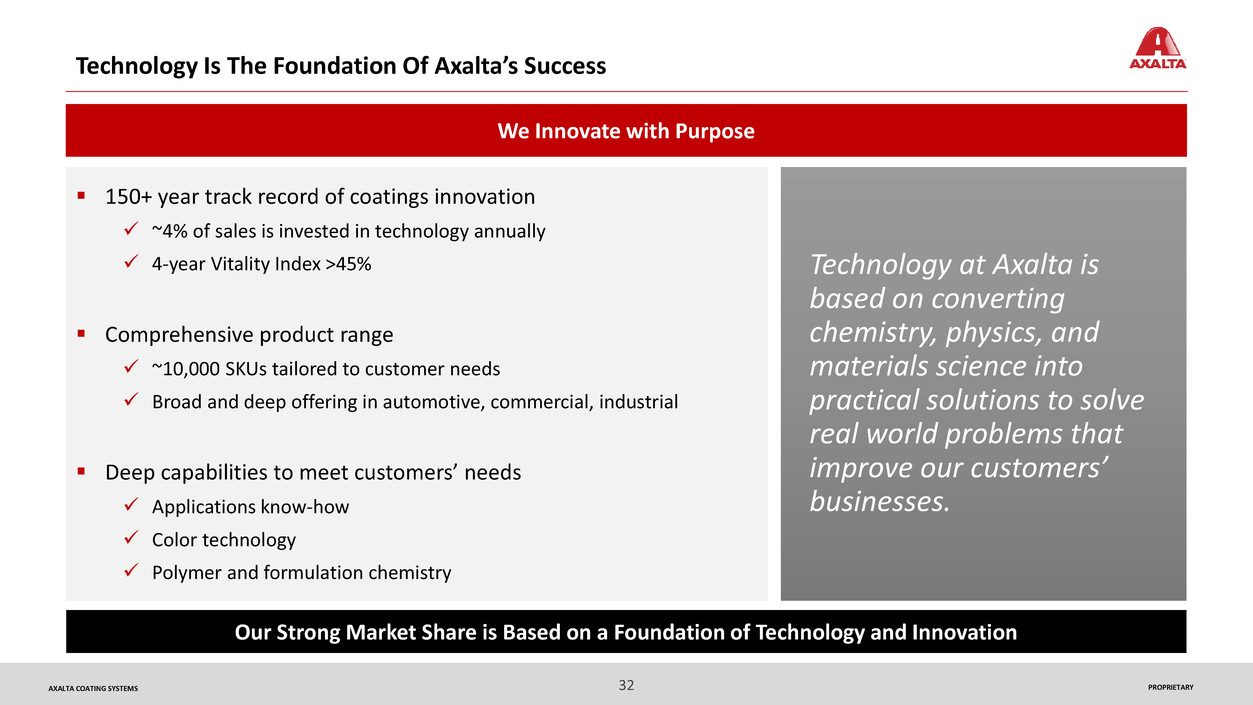

Technology Is The Foundation Of Axalta’s Success

150+ year track record of coatings innovation

~4% of sales is invested in technology annually

4-year Vitality Index >45%

Comprehensive product range

~10,000 SKUs tailored to customer needs

Broad and deep offering in automotive, commercial, industrial

Deep capabilities to meet customers’ needs

Applications know-how

Color technology

Polymer and formulation chemistry

Our Strong Market Share is Based on a Foundation of Technology and Innovation

We Innovate with Purpose

Technology at Axalta is

based on converting

chemistry, physics, and

materials science into

practical solutions to solve

real world problems that

improve our customers’

businesses.

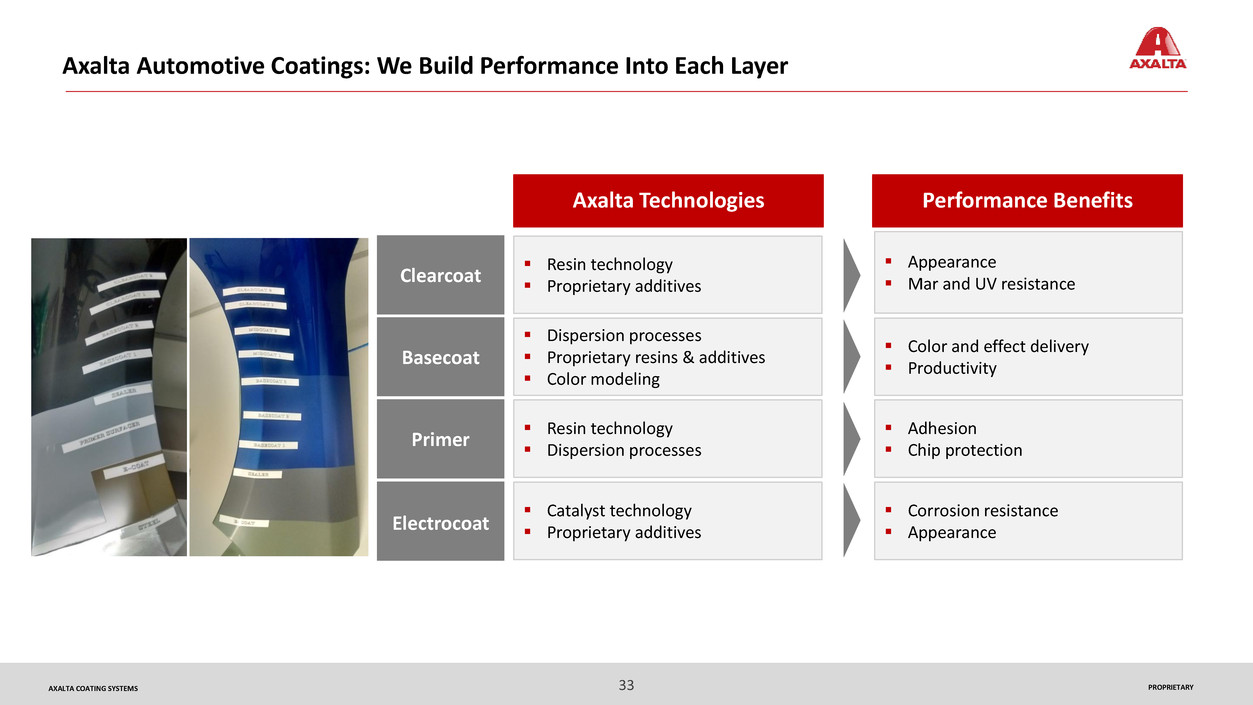

33 PROPRIETARYAXALTA COATING SYSTEMS

Clearcoat

Basecoat

Primer

Electrocoat

Axalta Automotive Coatings: We Build Performance Into Each Layer

Appearance

Mar and UV resistance

Color and effect delivery

Productivity

Adhesion

Chip protection

Corrosion resistance

Appearance

Resin technology

Proprietary additives

Dispersion processes

Proprietary resins & additives

Color modeling

Catalyst technology

Proprietary additives

Resin technology

Dispersion processes

Axalta Technologies Performance Benefits

34 PROPRIETARYAXALTA COATING SYSTEMS

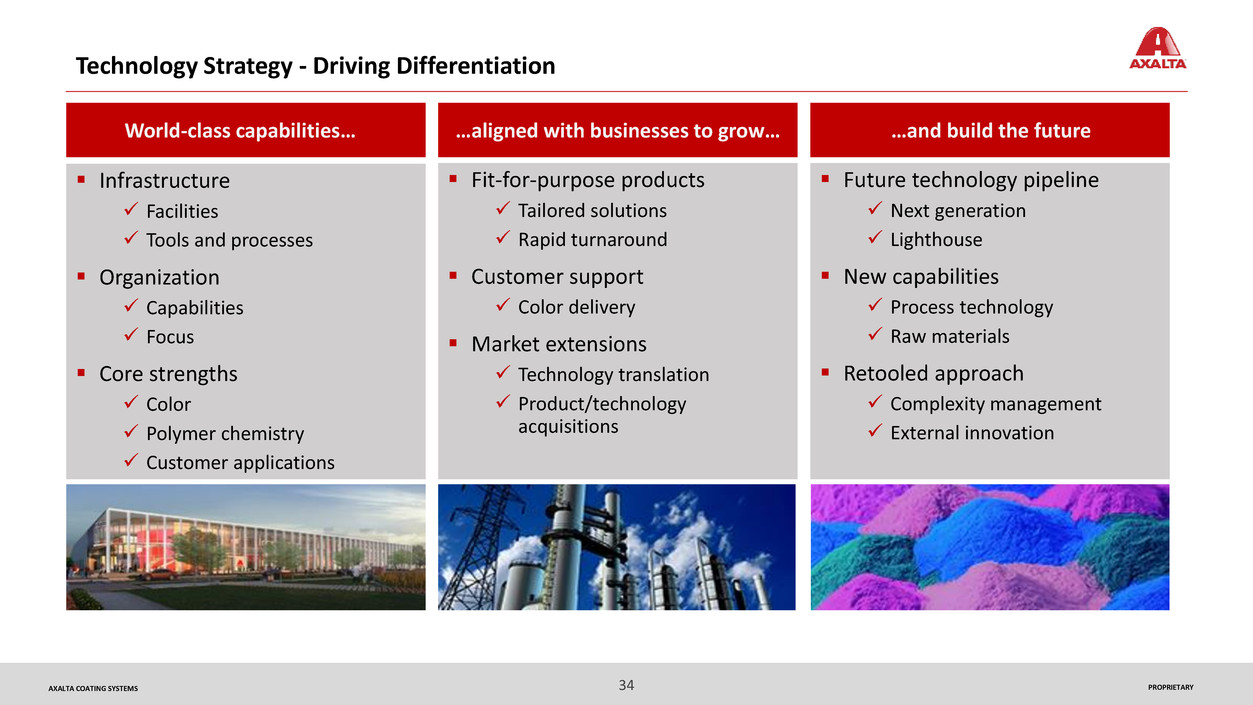

Technology Strategy - Driving Differentiation

Infrastructure

Facilities

Tools and processes

Organization

Capabilities

Focus

Core strengths

Color

Polymer chemistry

Customer applications

Fit-for-purpose products

Tailored solutions

Rapid turnaround

Customer support

Color delivery

Market extensions

Technology translation

Product/technology

acquisitions

World-class capabilities… …aligned with businesses to grow…

Future technology pipeline

Next generation

Lighthouse

New capabilities

Process technology

Raw materials

Retooled approach

Complexity management

External innovation

…and build the future

35 PROPRIETARYAXALTA COATING SYSTEMS

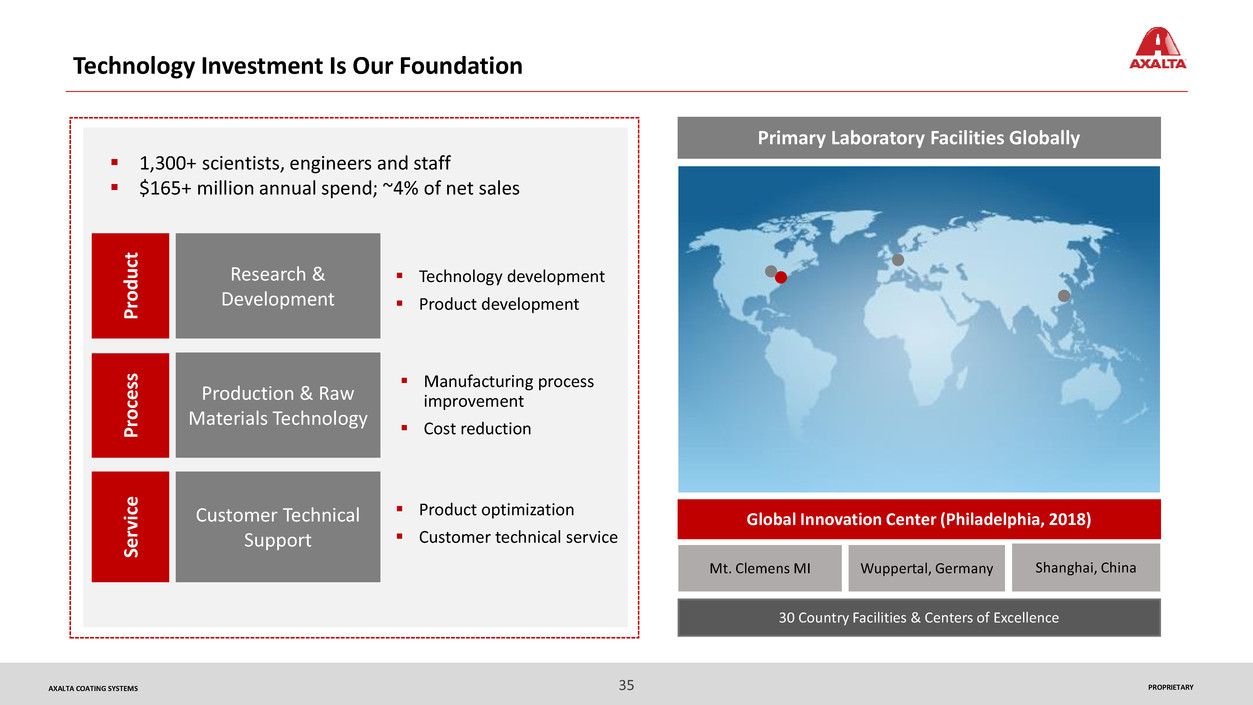

Research &

Development

Production & Raw

Materials Technology

Customer Technical

Support

Technology Investment Is Our Foundation

1,300+ scientists, engineers and staff

$165+ million annual spend; ~4% of net sales

Shanghai, China

Global Innovation Center (Philadelphia, 2018)

Wuppertal, GermanyMt. Clemens MI

30 Country Facilities & Centers of Excellence

Primary Laboratory Facilities Globally

Technology development

Product development

Product optimization

Customer technical service

Manufacturing process

improvement

Cost reduction

P

ro

d

u

ct

P

ro

ces

s

Se

rvi

ce

36 PROPRIETARYAXALTA COATING SYSTEMS

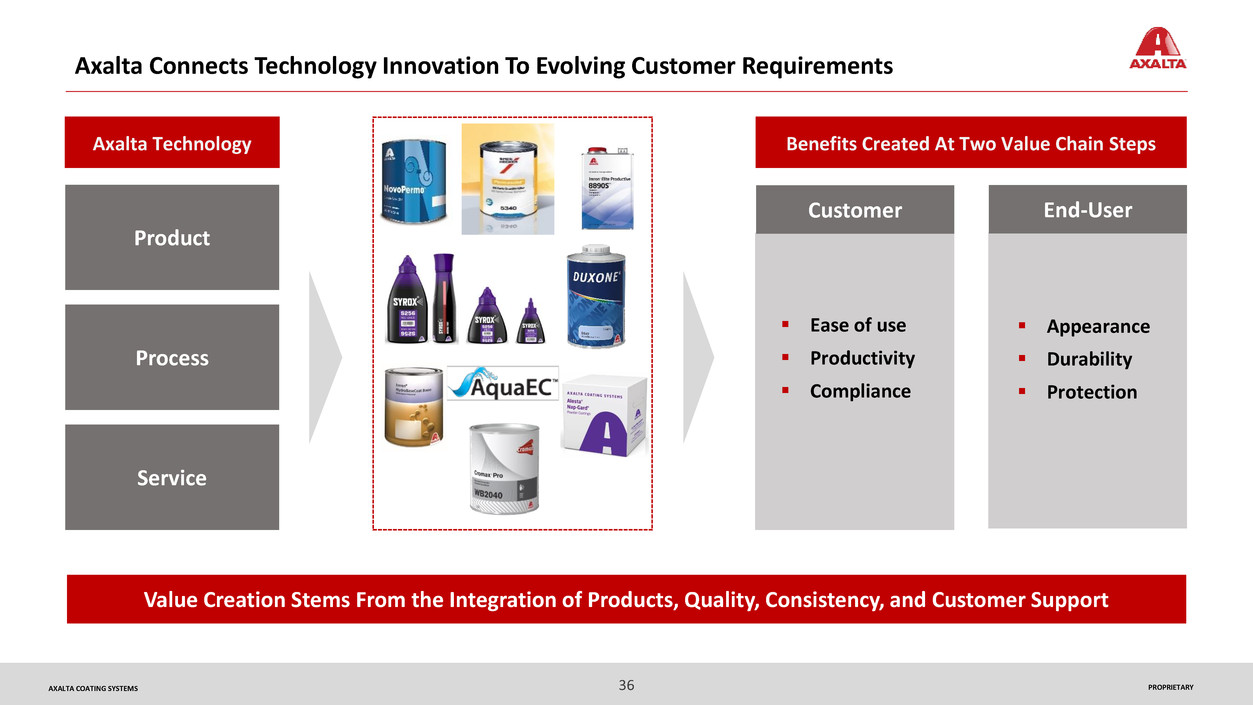

Axalta Connects Technology Innovation To Evolving Customer Requirements

Customer End-User

Ease of use

Productivity

Compliance

Appearance

Durability

Protection

Product

Benefits Created At Two Value Chain StepsAxalta Technology

Process

Service

Value Creation Stems From the Integration of Products, Quality, Consistency, and Customer Support

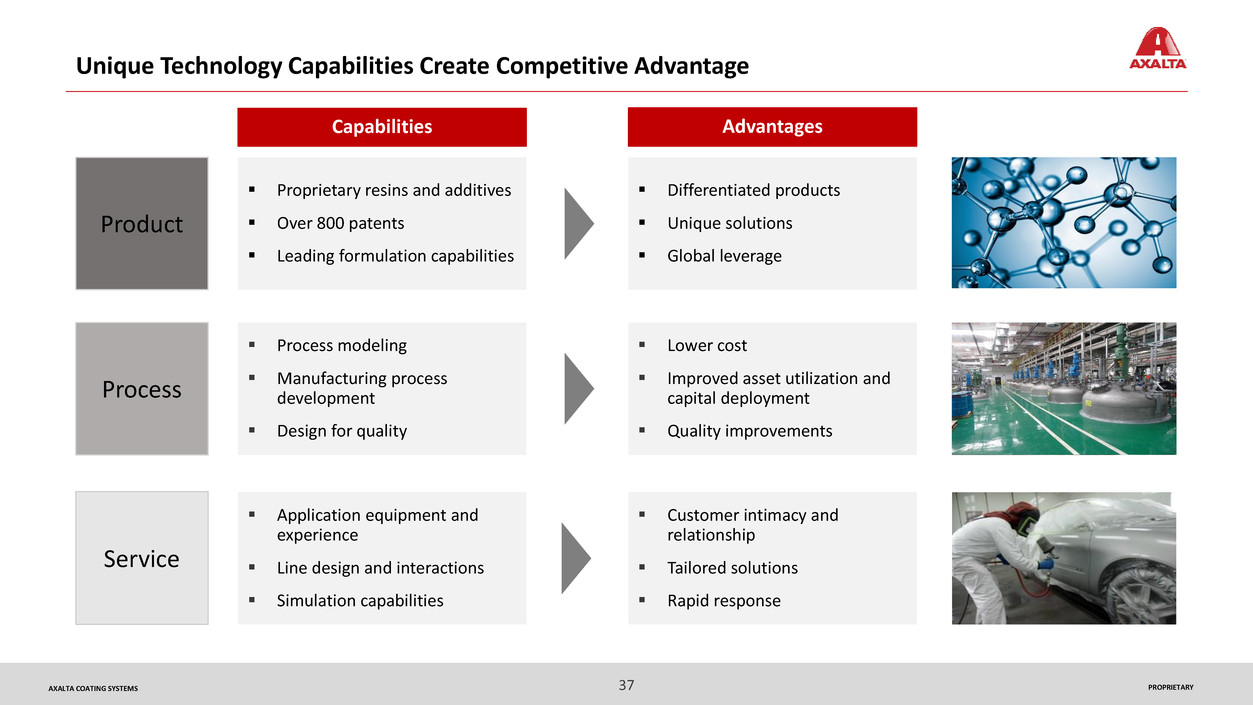

37 PROPRIETARYAXALTA COATING SYSTEMS

Proprietary resins and additives

Over 800 patents

Leading formulation capabilities

Process modeling

Manufacturing process

development

Design for quality

Application equipment and

experience

Line design and interactions

Simulation capabilities

Unique Technology Capabilities Create Competitive Advantage

Advantages

Process

Service

Product

Differentiated products

Unique solutions

Global leverage

Lower cost

Improved asset utilization and

capital deployment

Quality improvements

Customer intimacy and

relationship

Tailored solutions

Rapid response

Capabilities

38 PROPRIETARYAXALTA COATING SYSTEMS

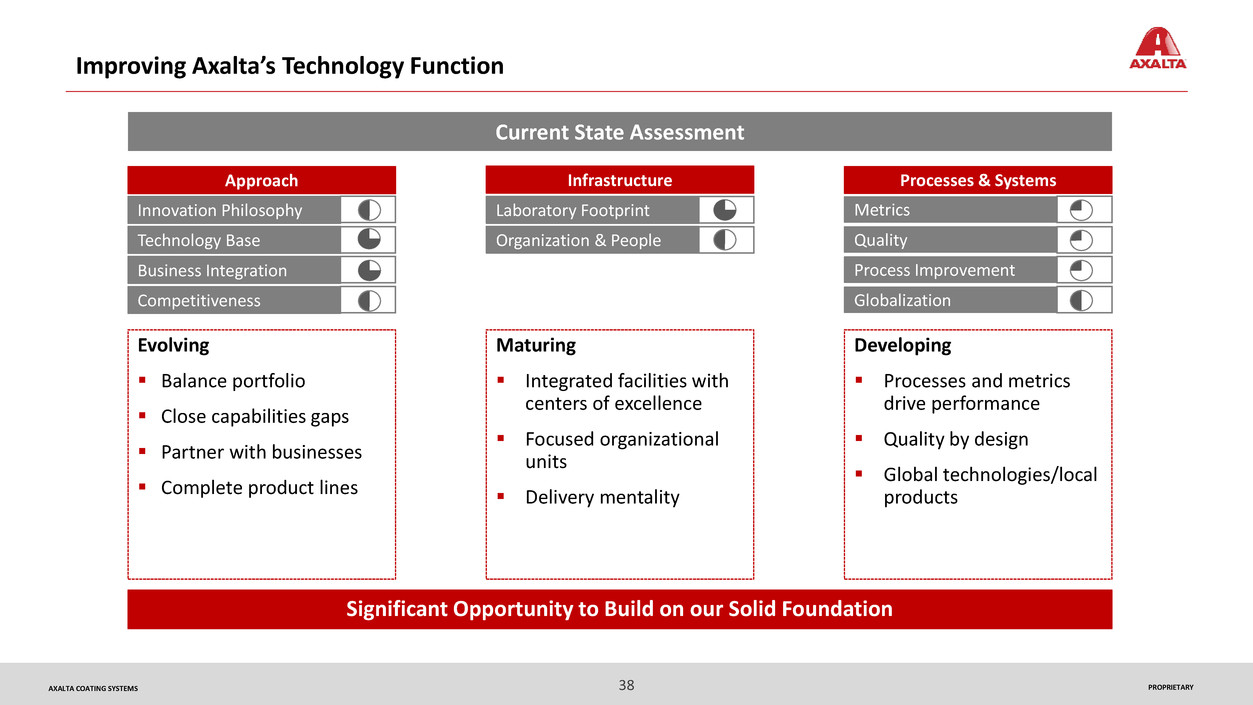

Improving Axalta’s Technology Function

Innovation Philosophy Laboratory Footprint

Organization & People

Metrics

Quality

Process Improvement

GlobalizationCompetitiveness

Technology Base

Business Integration

Infrastructure Processes & SystemsApproach

Evolving

Balance portfolio

Close capabilities gaps

Partner with businesses

Complete product lines

Maturing

Integrated facilities with

centers of excellence

Focused organizational

units

Delivery mentality

Developing

Processes and metrics

drive performance

Quality by design

Global technologies/local

products

Current State Assessment

Significant Opportunity to Build on our Solid Foundation

39 PROPRIETARYAXALTA COATING SYSTEMS

The Axalta Way: Improving Technology Capabilities and Operations

Portfolio Management

Project Management

Change Management

Integrated Facilities

Global Platforms

Complexity Management

Flawless Launch

Design for Quality

Processes Productivity Output

Shanghai, China Technology Center

40 PROPRIETARYAXALTA COATING SYSTEMS

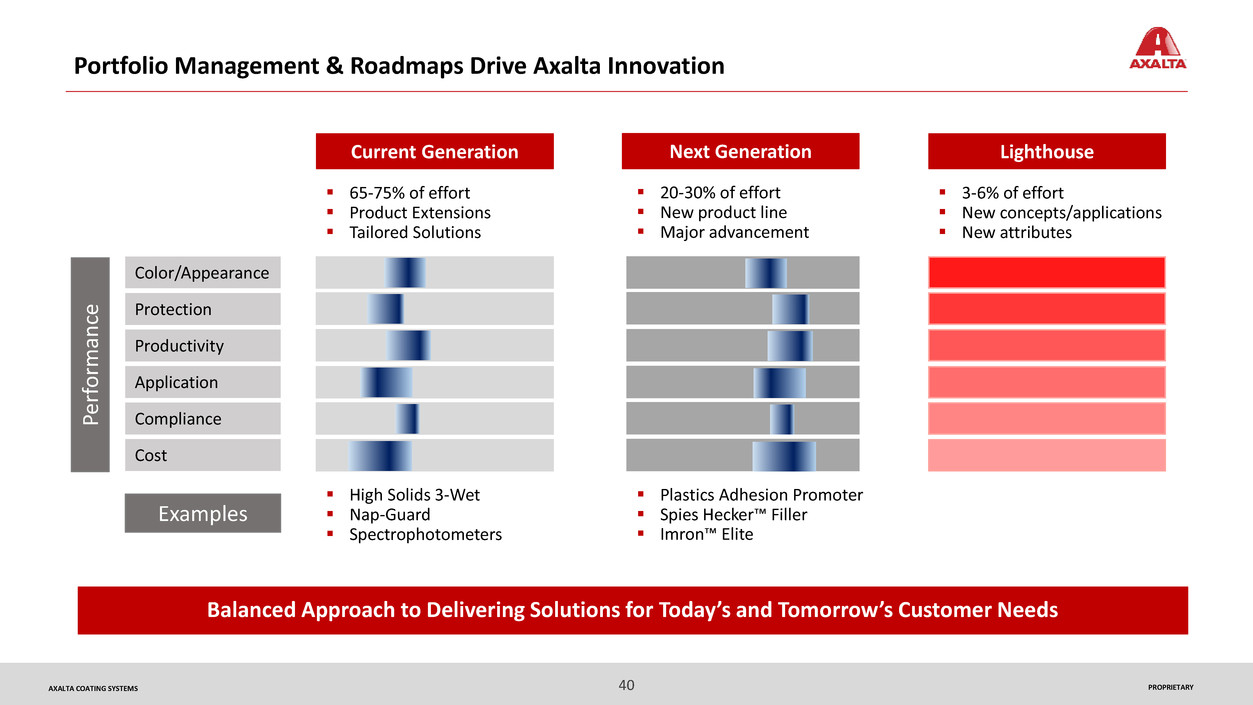

Portfolio Management & Roadmaps Drive Axalta Innovation

Balanced Approach to Delivering Solutions for Today’s and Tomorrow’s Customer Needs

Color/Appearance

Protection

Productivity

Application

Compliance

Cost

Current Generation Next Generation Lighthouse

65-75% of effort

Product Extensions

Tailored Solutions

20-30% of effort

New product line

Major advancement

3-6% of effort

New concepts/applications

New attributes

Per

forma

n

ce

High Solids 3-Wet

Nap-Guard

Spectrophotometers

Plastics Adhesion Promoter

Spies Hecker™ Filler

Imron™ Elite

Examples

41 PROPRIETARYAXALTA COATING SYSTEMS

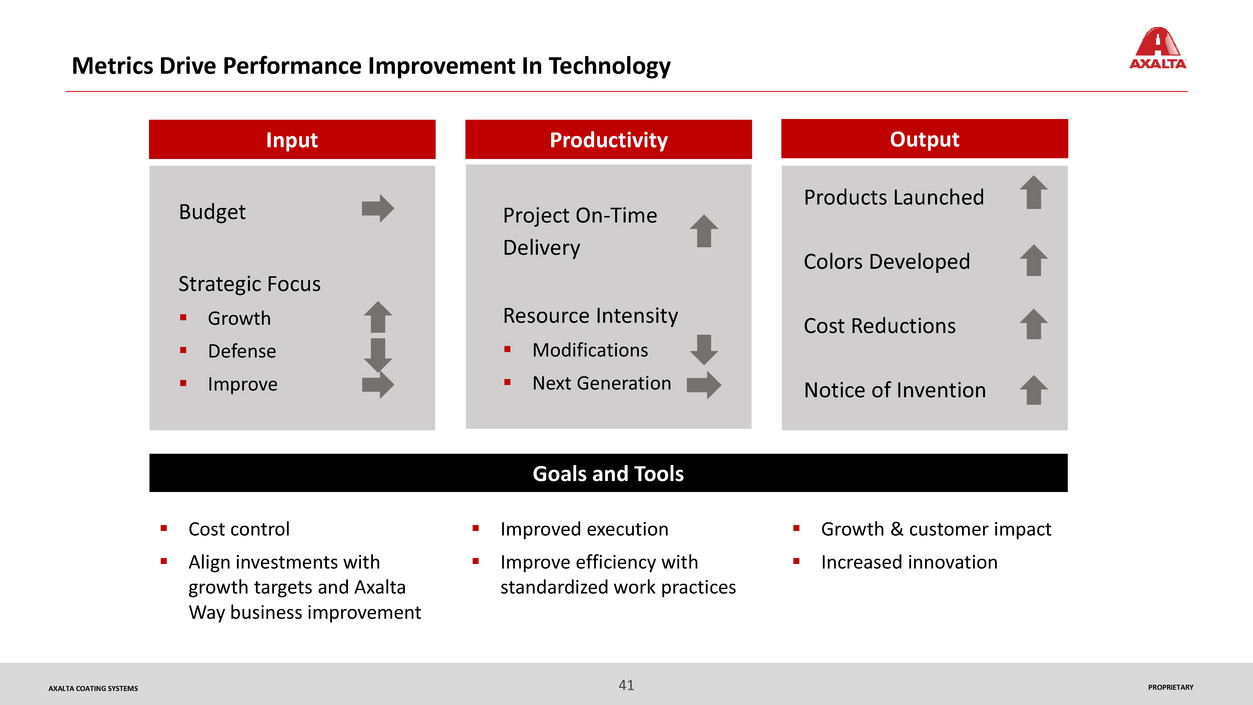

Metrics Drive Performance Improvement In Technology

Cost control

Align investments with

growth targets and Axalta

Way business improvement

Input Productivity Output

Budget

Strategic Focus

Growth

Defense

Improve

Project On-Time

Delivery

Resource Intensity

Modifications

Next Generation

Improved execution

Improve efficiency with

standardized work practices

Products Launched

Colors Developed

Cost Reductions

Notice of Invention

Growth & customer impact

Increased innovation

Goals and Tools

42 PROPRIETARYAXALTA COATING SYSTEMS

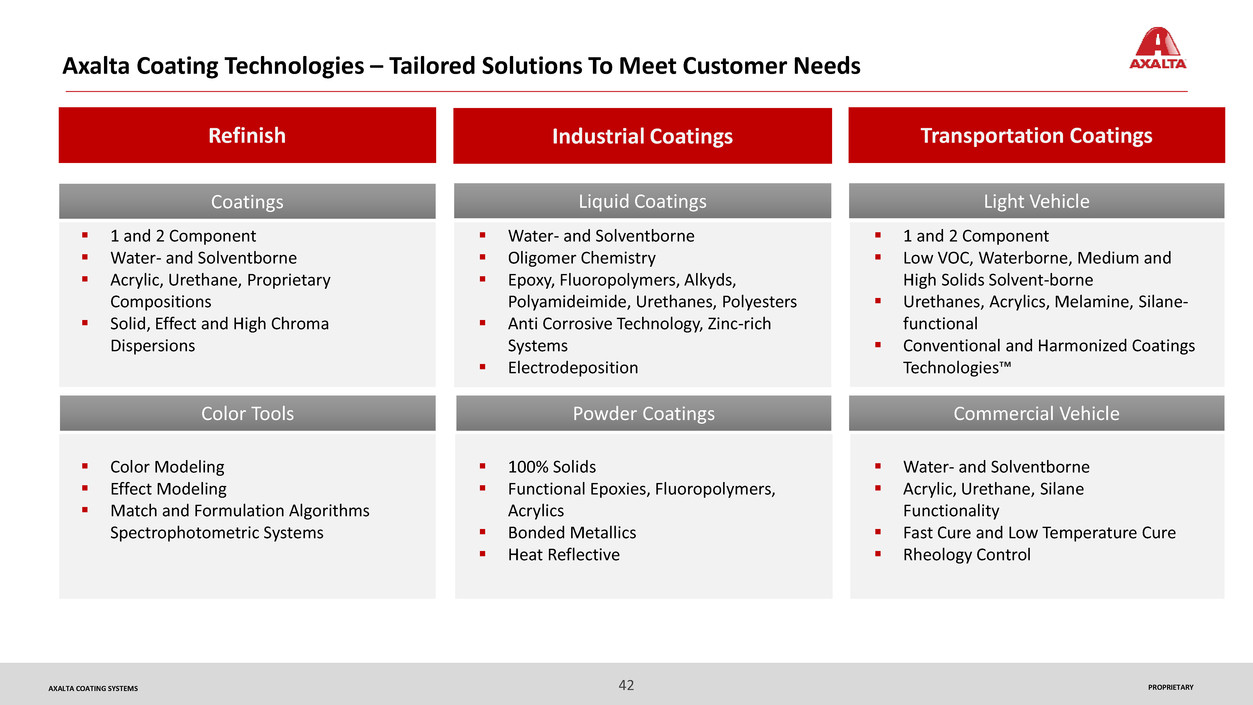

Refinish Industrial Coatings

Coatings

Axalta Coating Technologies – Tailored Solutions To Meet Customer Needs

Transportation Coatings

Liquid Coatings Light Vehicle

Color Tools Powder Coatings Commercial Vehicle

Color Modeling

Effect Modeling

Match and Formulation Algorithms

Spectrophotometric Systems

100% Solids

Functional Epoxies, Fluoropolymers,

Acrylics

Bonded Metallics

Heat Reflective

Water- and Solventborne

Acrylic, Urethane, Silane

Functionality

Fast Cure and Low Temperature Cure

Rheology Control

1 and 2 Component

Low VOC, Waterborne, Medium and

High Solids Solvent-borne

Urethanes, Acrylics, Melamine, Silane-

functional

Conventional and Harmonized Coatings

Technologies™

Water- and Solventborne

Oligomer Chemistry

Epoxy, Fluoropolymers, Alkyds,

Polyamideimide, Urethanes, Polyesters

Anti Corrosive Technology, Zinc-rich

Systems

Electrodeposition

1 and 2 Component

Water- and Solventborne

Acrylic, Urethane, Proprietary

Compositions

Solid, Effect and High Chroma

Dispersions

43 PROPRIETARYAXALTA COATING SYSTEMS

Refinish Industrial Coatings

Axalta Technology Is Driving Hundreds Of Product Launches

Transportation Coatings

Series 6100 Electrocoat

Low VOC

Solventborne

Basecoat

Mainstream Easy Application Waterborne Basecoat

Economy Basecoat

Ultra Productive

Primer

Premium Clear Coat

Plastics and Interiors Carbon Fiber Coatings

Polishing System

High Chroma Colors

Productive Coating Systems

44 PROPRIETARYAXALTA COATING SYSTEMS

Technology investment is our foundation

Axalta connects technology innovation to evolving customer

requirements

Axalta builds performance into each coating layer

Technology drives business growth, enhanced returns, and

protects our competitive moat

Technology Summary

Thank You

Refinish Technology

Michael Carr

VP, President, North America

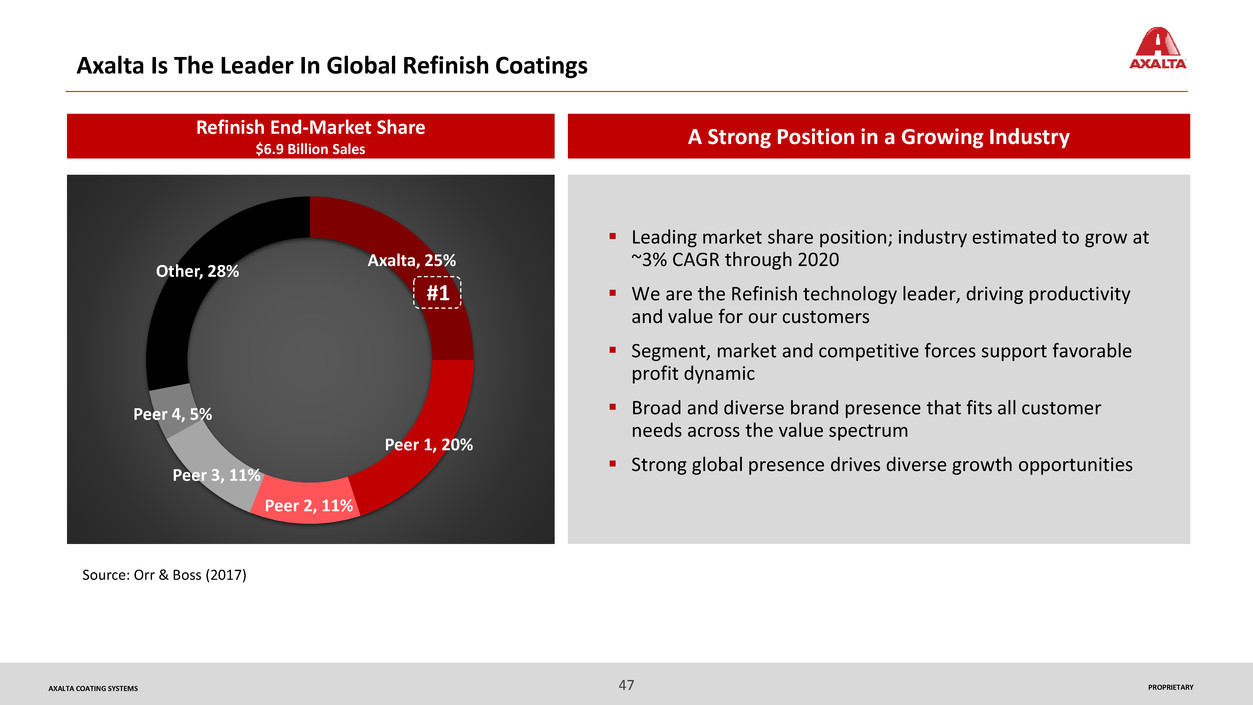

47 PROPRIETARYAXALTA COATING SYSTEMS

Axalta, 25%

Peer 1, 20%

Peer 2, 11%

Peer 3, 11%

Peer 4, 5%

Other, 28%

Axalta Is The Leader In Global Refinish Coatings

#1

Refinish End-Market Share

$6.9 Billion Sales

A Strong Position in a Growing Industry

Leading market share position; industry estimated to grow at

~3% CAGR through 2020

We are the Refinish technology leader, driving productivity

and value for our customers

Segment, market and competitive forces support favorable

profit dynamic

Broad and diverse brand presence that fits all customer

needs across the value spectrum

Strong global presence drives diverse growth opportunities

Source: Orr & Boss (2017)

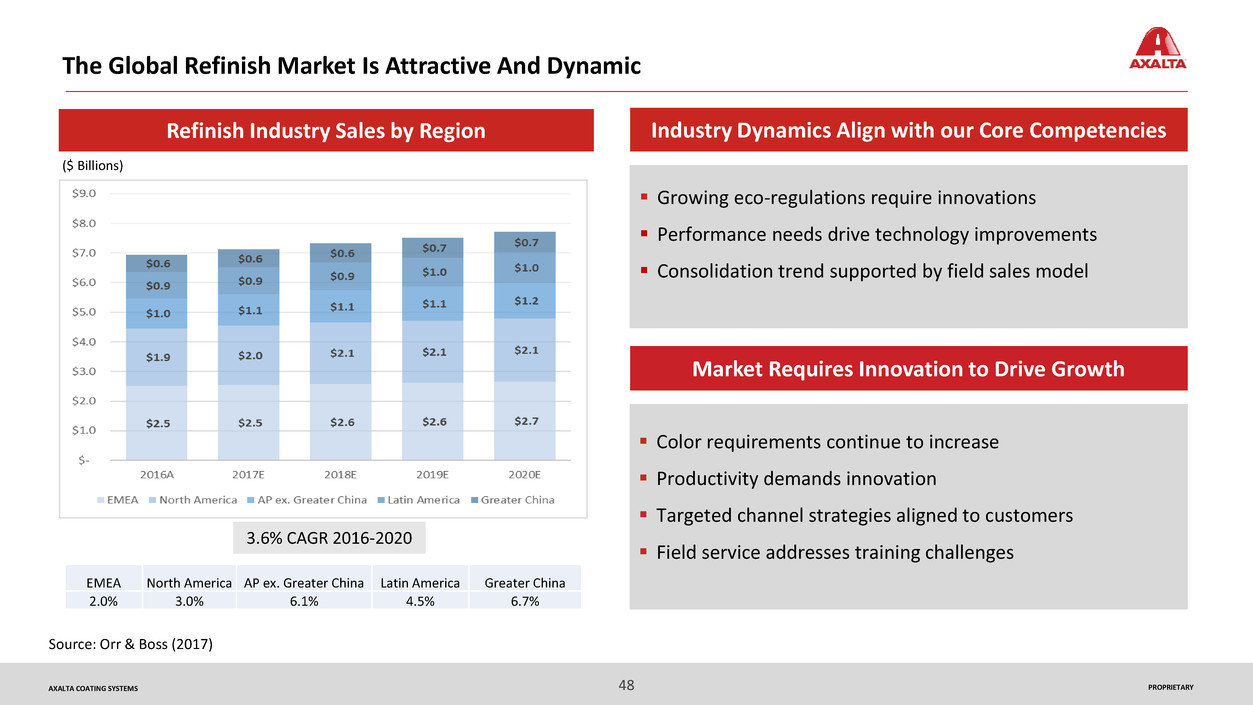

48 PROPRIETARYAXALTA COATING SYSTEMS

The Global Refinish Market Is Attractive And Dynamic

Growing eco-regulations require innovations

Performance needs drive technology improvements

Consolidation trend supported by field sales model

Industry Dynamics Align with our Core Competencies

Market Requires Innovation to Drive Growth

Color requirements continue to increase

Productivity demands innovation

Targeted channel strategies aligned to customers

Field service addresses training challenges

Refinish Industry Sales by Region

3.6% CAGR 2016-2020

Source: Orr & Boss (2017)

EMEA North America AP ex. Greater China Latin America Greater China

2.0% 3.0% 6.1% 4.5% 6.7%

($ Billions)

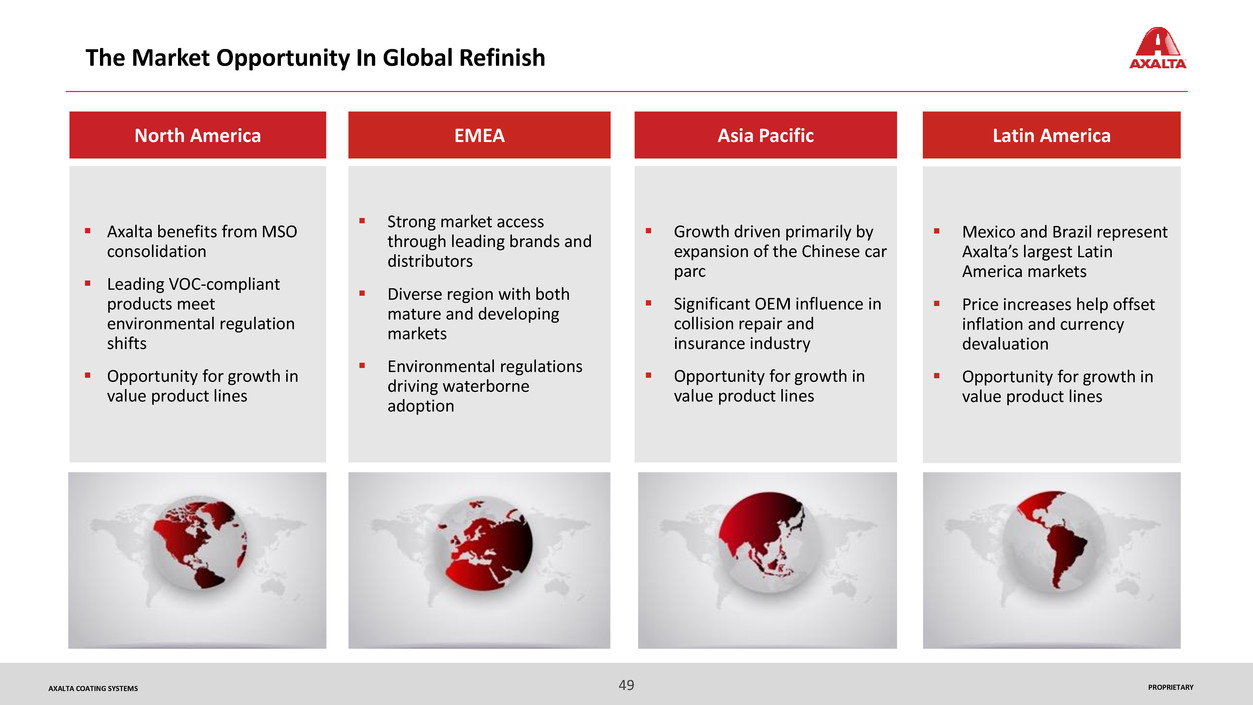

49 PROPRIETARYAXALTA COATING SYSTEMS

Strong market access

through leading brands and

distributors

Diverse region with both

mature and developing

markets

Environmental regulations

driving waterborne

adoption

North America EMEA

Axalta benefits from MSO

consolidation

Leading VOC-compliant

products meet

environmental regulation

shifts

Opportunity for growth in

value product lines

Growth driven primarily by

expansion of the Chinese car

parc

Significant OEM influence in

collision repair and

insurance industry

Opportunity for growth in

value product lines

Mexico and Brazil represent

Axalta’s largest Latin

America markets

Price increases help offset

inflation and currency

devaluation

Opportunity for growth in

value product lines

Asia Pacific Latin America

The Market Opportunity In Global Refinish

50 PROPRIETARYAXALTA COATING SYSTEMS

The Refinish Process At A Glance

Consumer

Body Shop

Accident Call Insurance Car to Body Shop Repair Performed Vehicle Returned

Prepare Surface Primer Surfacer

Color

Match

Basecoat Clearcoat

Paint

Mixed

Customer Satisfaction Depends on Quick, High-Quality, Cost-Effective Repairs

51 PROPRIETARYAXALTA COATING SYSTEMS

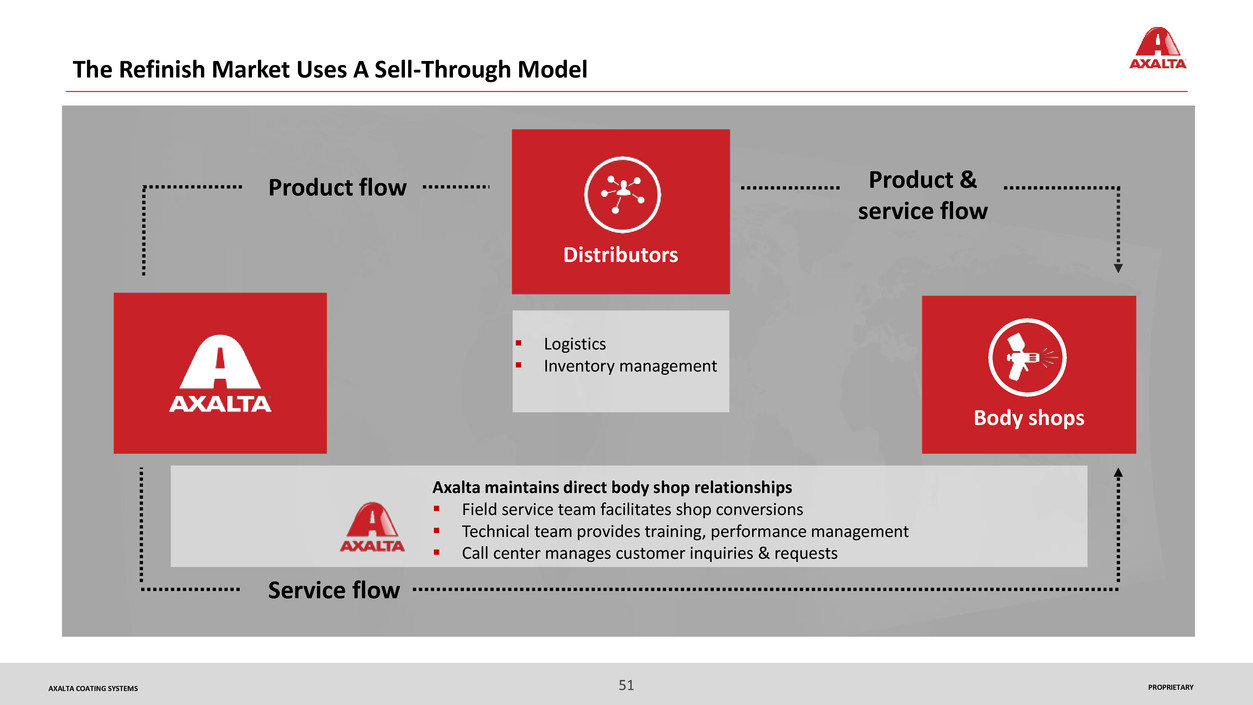

The Refinish Market Uses A Sell-Through Model

Axalta maintains direct body shop relationships

Field service team facilitates shop conversions

Technical team provides training, performance management

Call center manages customer inquiries & requests

Product flow

Service flow

Product &

service flow

Distributors

Body shops

Logistics

Inventory management

52 PROPRIETARYAXALTA COATING SYSTEMS

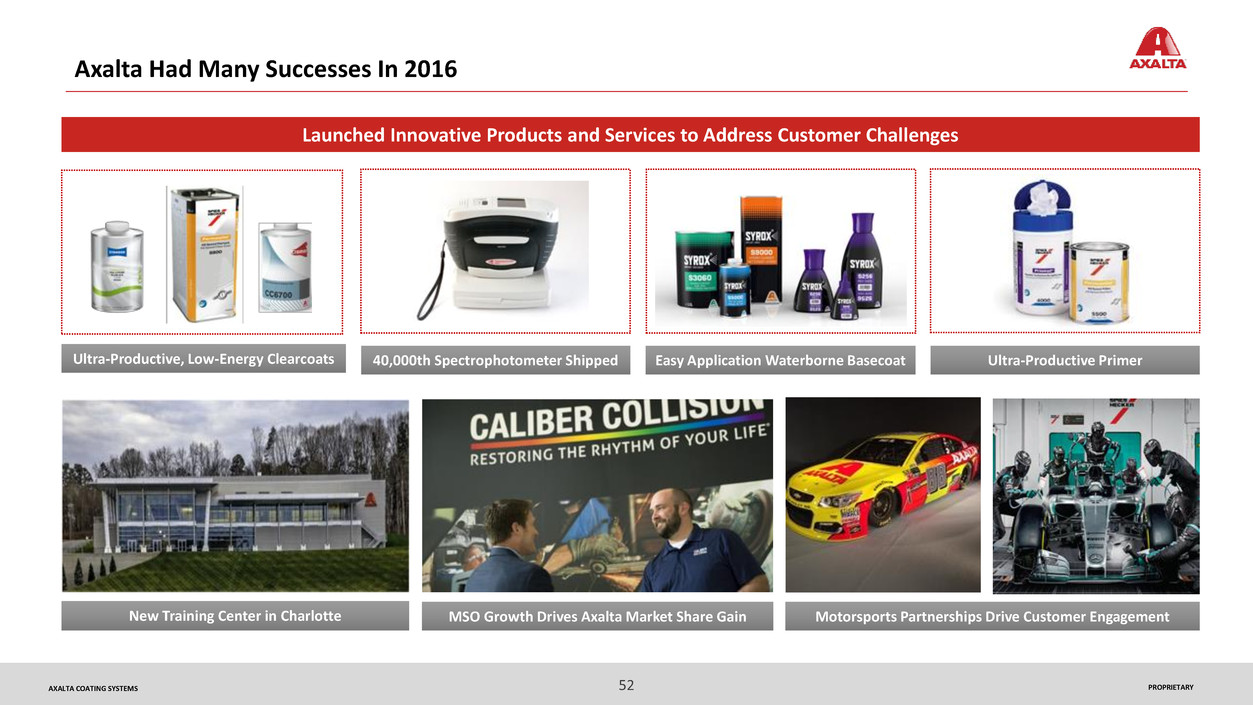

Axalta Had Many Successes In 2016

Ultra-Productive, Low-Energy Clearcoats Ultra-Productive PrimerEasy Application Waterborne Basecoat40,000th Spectrophotometer Shipped

MSO Growth Drives Axalta Market Share GainNew Training Center in Charlotte Motorsports Partnerships Drive Customer Engagement

Launched Innovative Products and Services to Address Customer Challenges

53 PROPRIETARYAXALTA COATING SYSTEMS

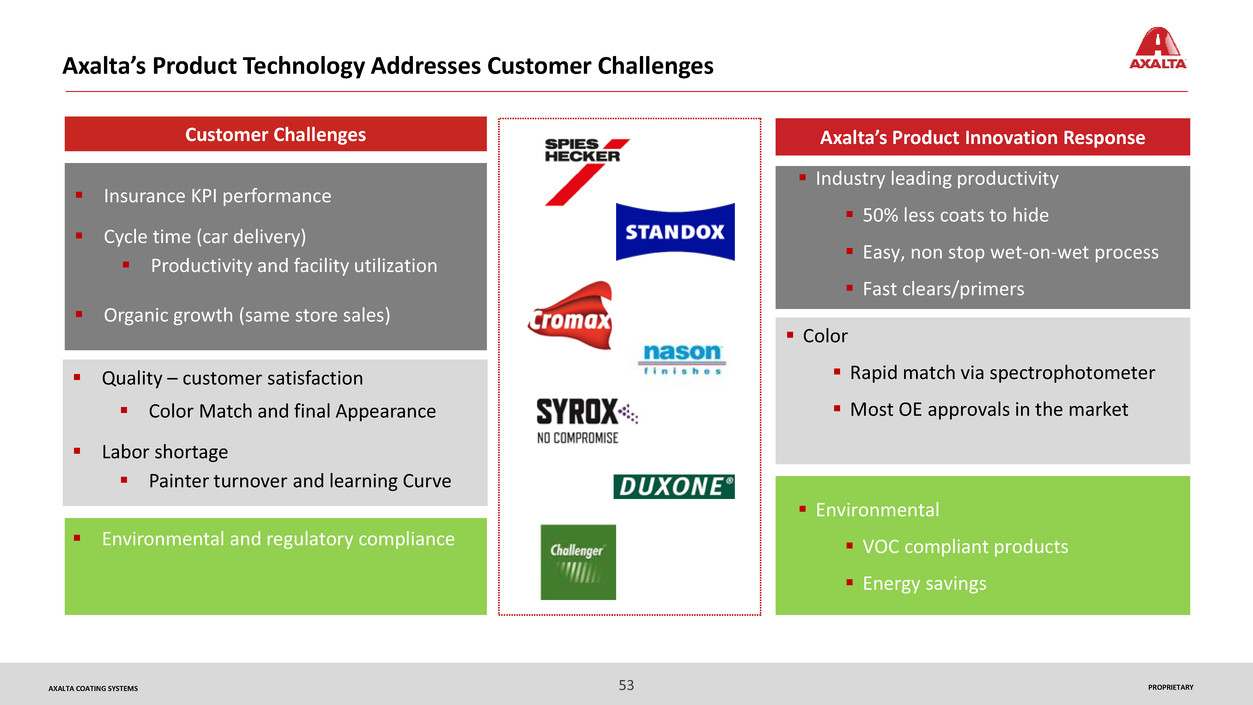

Insurance KPI performance

Cycle time (car delivery)

Productivity and facility utilization

Organic growth (same store sales)

Customer Challenges Axalta’s Product Innovation Response

Quality – customer satisfaction

Color Match and final Appearance

Labor shortage

Painter turnover and learning Curve

Environmental and regulatory compliance

Axalta’s Product Technology Addresses Customer Challenges

Industry leading productivity

50% less coats to hide

Easy, non stop wet-on-wet process

Fast clears/primers

Environmental

VOC compliant products

Energy savings

Color

Rapid match via spectrophotometer

Most OE approvals in the market

54 PROPRIETARYAXALTA COATING SYSTEMS

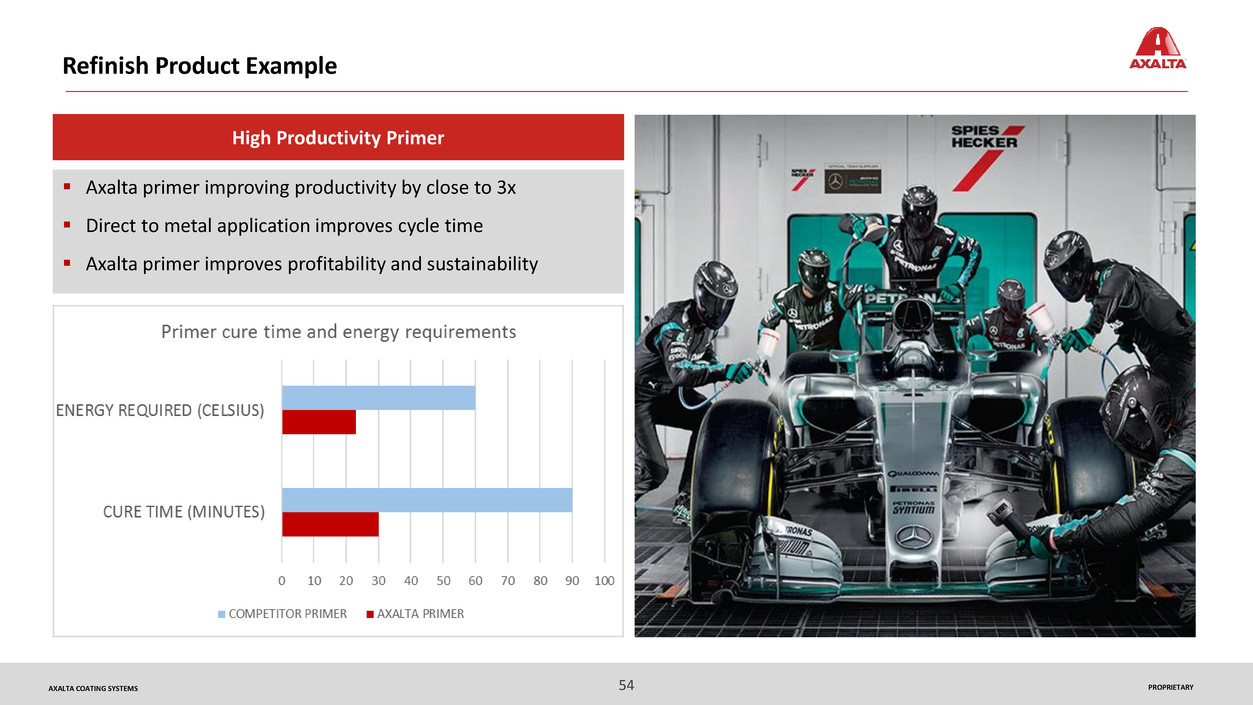

Refinish Product Example

High Productivity Primer

Axalta primer improving productivity by close to 3x

Direct to metal application improves cycle time

Axalta primer improves profitability and sustainability

55 PROPRIETARYAXALTA COATING SYSTEMS

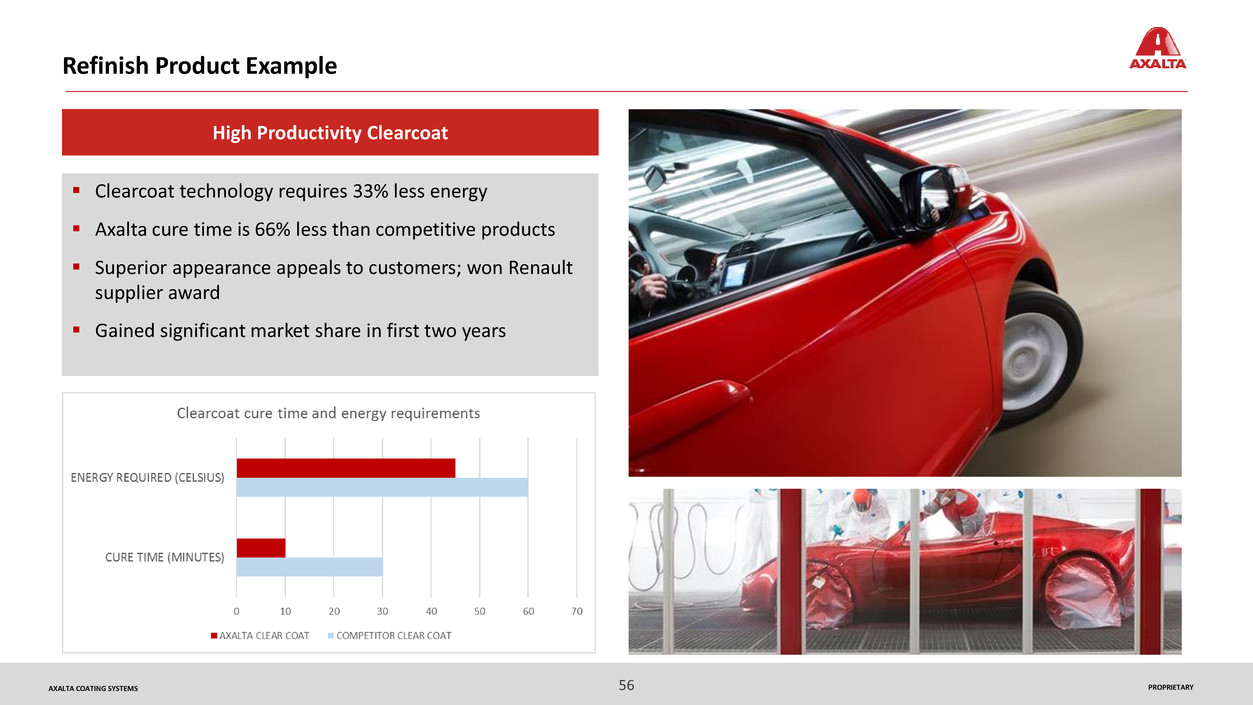

56 PROPRIETARYAXALTA COATING SYSTEMS

Refinish Product Example

Clearcoat technology requires 33% less energy

Axalta cure time is 66% less than competitive products

Superior appearance appeals to customers; won Renault

supplier award

Gained significant market share in first two years

High Productivity Clearcoat

57 PROPRIETARYAXALTA COATING SYSTEMS

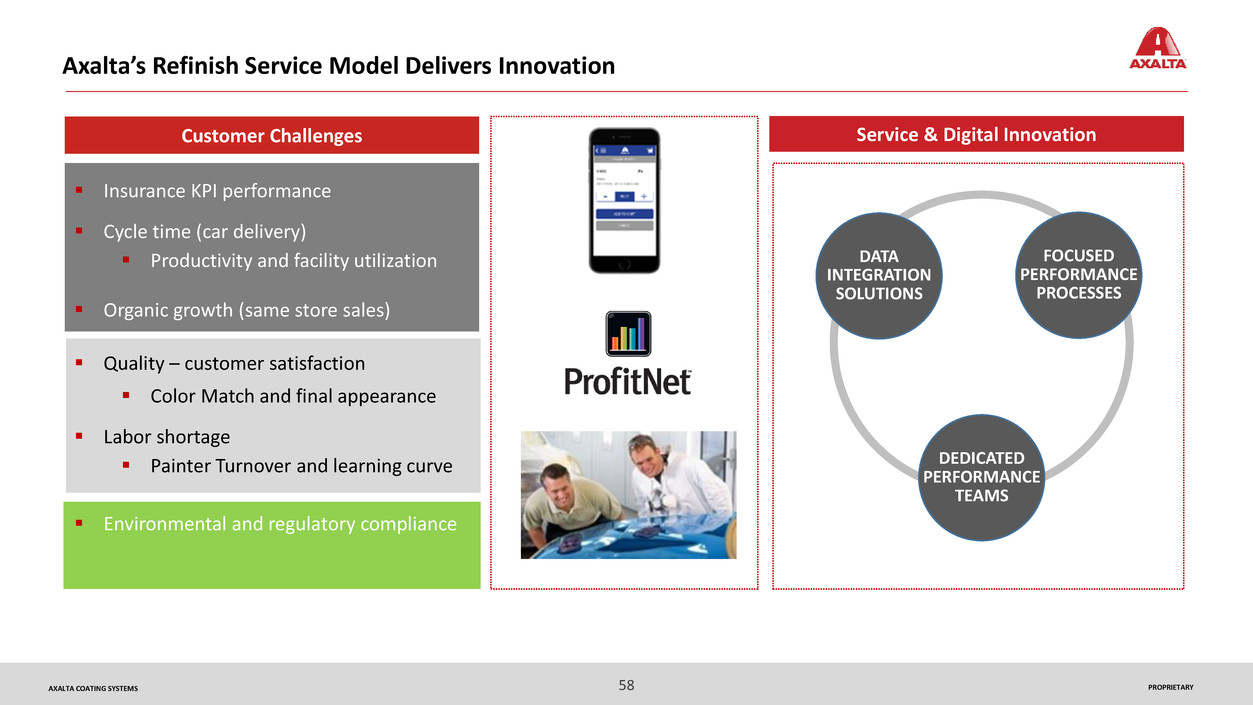

58 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Refinish Service Model Delivers Innovation

Customer Challenges Service & Digital Innovation

DATA

INTEGRATION

SOLUTIONS

FOCUSED

PERFORMANCE

PROCESSES

DEDICATED

PERFORMANCE

TEAMS

Insurance KPI performance

Cycle time (car delivery)

Productivity and facility utilization

Organic growth (same store sales)

Quality – customer satisfaction

Color Match and final appearance

Labor shortage

Painter Turnover and learning curve

Environmental and regulatory compliance

59 PROPRIETARYAXALTA COATING SYSTEMS

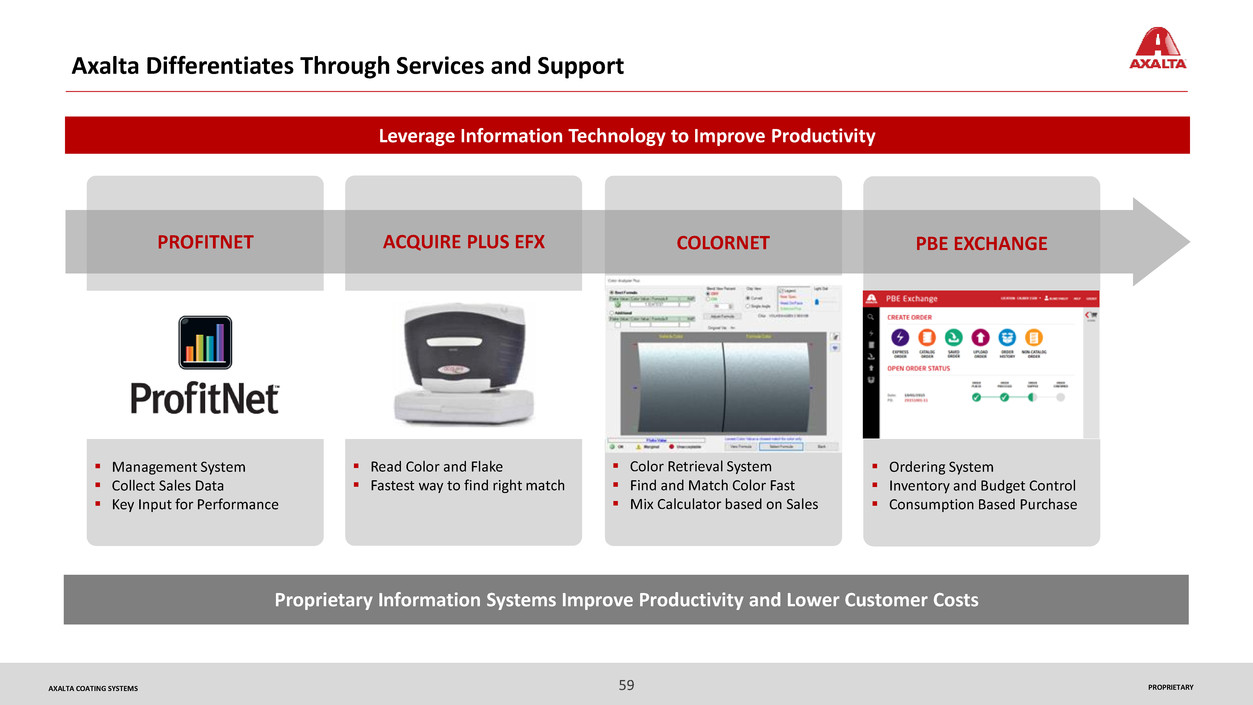

Axalta Differentiates Through Services and Support

Leverage Information Technology to Improve Productivity

Management System

Collect Sales Data

Key Input for Performance

Color Retrieval System

Find and Match Color Fast

Mix Calculator based on Sales

Ordering System

Inventory and Budget Control

Consumption Based Purchase

Proprietary Information Systems Improve Productivity and Lower Customer Costs

Read Color and Flake

Fastest way to find right match

PROFITNET COLORNET PBE EXCHANGEACQUIRE PLUS EFX

60 PROPRIETARYAXALTA COATING SYSTEMS

Refinish Service Example

Most critical customer attribute

Simple color retrieval for painters

Improves cycle time and productivity

Best in Class spectrophotometers allow fast,

easy access to color formulas

Color Match

61 PROPRIETARYAXALTA COATING SYSTEMS

62 PROPRIETARYAXALTA COATING SYSTEMS

Axalta Differentiates Through Services and Support

In Shop or On Demand

Tailored Content by Customer

Technical and Business

Online Content with Usage

Focus on Account Management

Act on data not collect data

Process and Product Usage

Productivity and Consumption

AREAS OF FOCUS

Performance Dashboard

Real Time Data Collection

Drive Resource Deployment

P&M SCORECARD RESOURCES TRAINING

P&M Profitability

SOPs Implementation

Estimatics Improvement

Top Line Sales Growth

End Customer Focused Performance Management Process

Uniform Shop Management, Training Processes, and the Largest Technical Sales Force

63 PROPRIETARYAXALTA COATING SYSTEMS

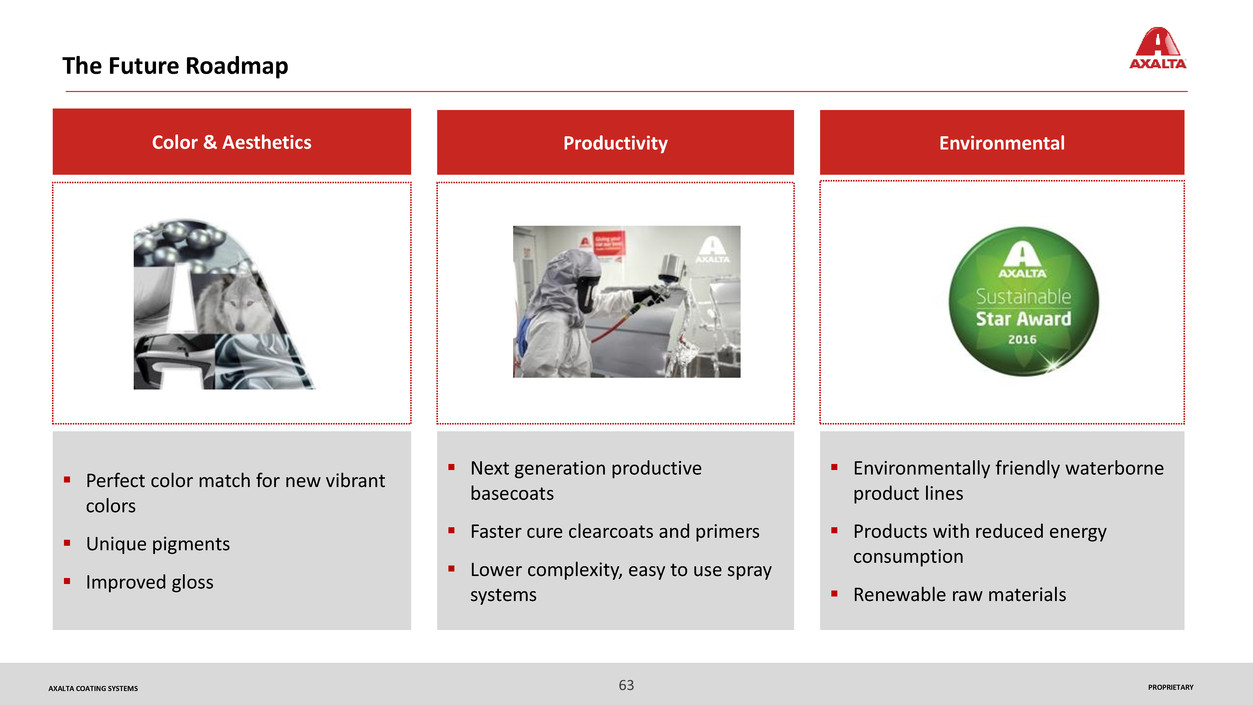

The Future Roadmap

Today10 Years Ago

Productivity Environmental Color & Aesthetics

Perfect color match for new vibrant

colors

Unique pigments

Improved gloss

Next generation productive

basecoats

Faster cure clearcoats and primers

Lower complexity, easy to use spray

systems

Environmentally friendly waterborne

product lines

Products with reduced energy

consumption

Renewable raw materials

64 PROPRIETARYAXALTA COATING SYSTEMS

M&A Activities and Accomplishments

Global M&A is a key component of the Axalta growth strategy

Target profile: Attractive, bolt-on businesses offering new technology, incremental channels and/or expanded

market access

Targeted M&A To Complement Organic Growth

65 PROPRIETARYAXALTA COATING SYSTEMS

Refinish Summary

Axalta is the global market leader in the

growing refinish market

Our strong market presence enables growth

opportunities in every region

Innovative product technology differentiates

Axalta and drives body shop productivity

Customer-focused service offering addresses

evolving body shop challenges

Targeted M&A complements organic growth

Thank You

Performance Coatings: Industrial

Michael Cash

SVP, President, Industrial

68 PROPRIETARYAXALTA COATING SYSTEMS

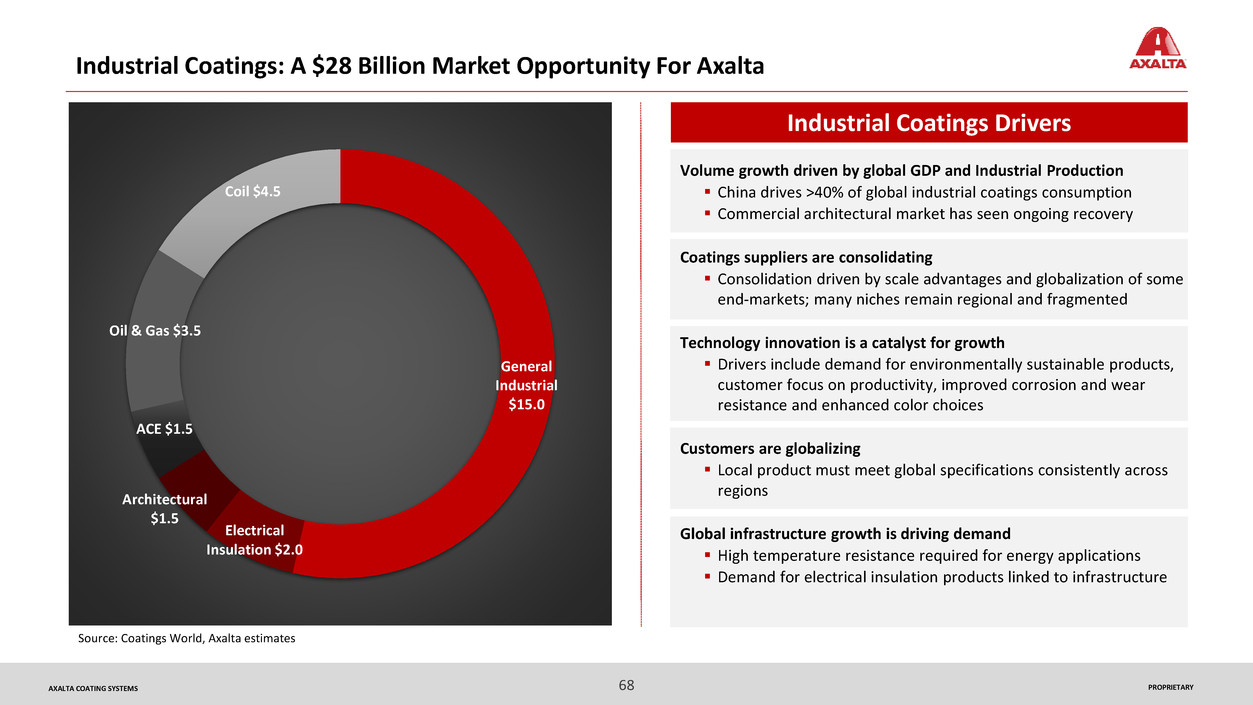

Industrial Coatings: A $28 Billion Market Opportunity For Axalta

Industrial Coatings Drivers

Volume growth driven by global GDP and Industrial Production

China drives >40% of global industrial coatings consumption

Commercial architectural market has seen ongoing recovery

Coatings suppliers are consolidating

Consolidation driven by scale advantages and globalization of some

end-markets; many niches remain regional and fragmented

Technology innovation is a catalyst for growth

Drivers include demand for environmentally sustainable products,

customer focus on productivity, improved corrosion and wear

resistance and enhanced color choices

Customers are globalizing

Local product must meet global specifications consistently across

regions

Global infrastructure growth is driving demand

High temperature resistance required for energy applications

Demand for electrical insulation products linked to infrastructure

General

Industrial

$15.0

Electrical

Insulation $2.0

Architectural

$1.5

ACE $1.5

Oil & Gas $3.5

Coil $4.5

Source: Coatings World, Axalta estimates

69 PROPRIETARYAXALTA COATING SYSTEMS

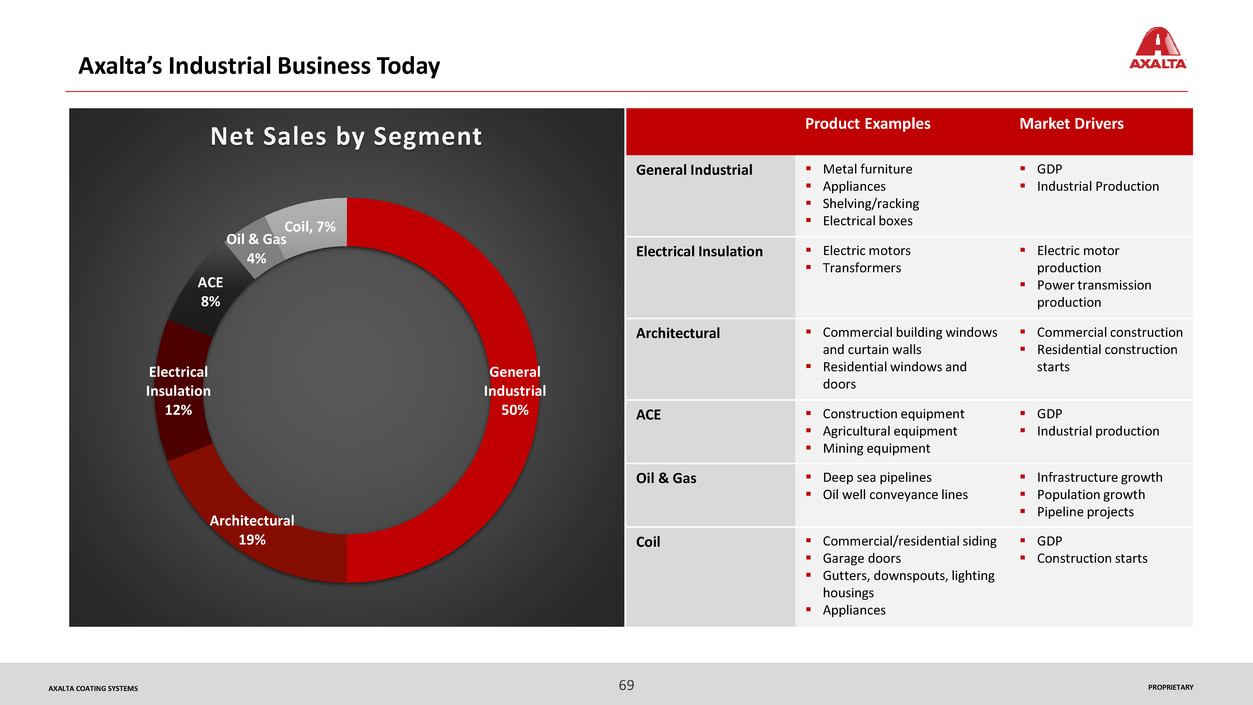

Axalta’s Industrial Business Today

Product Examples Market Drivers

General Industrial Metal furniture

Appliances

Shelving/racking

Electrical boxes

GDP

Industrial Production

Electrical Insulation Electric motors

Transformers

Electric motor

production

Power transmission

production

Architectural Commercial building windows

and curtain walls

Residential windows and

doors

Commercial construction

Residential construction

starts

ACE Construction equipment

Agricultural equipment

Mining equipment

GDP

Industrial production

Oil & Gas Deep sea pipelines

Oil well conveyance lines

Infrastructure growth

Population growth

Pipeline projects

Coil Commercial/residential siding

Garage doors

Gutters, downspouts, lighting

housings

Appliances

GDP

Construction starts

($ billions)

General

Industrial

50%

Architectural

19%

Electrical

Insulation

12%

ACE

8%

Oil & Gas

4%

Coil, 7%

Net Sales by Segment

70 PROPRIETARYAXALTA COATING SYSTEMS

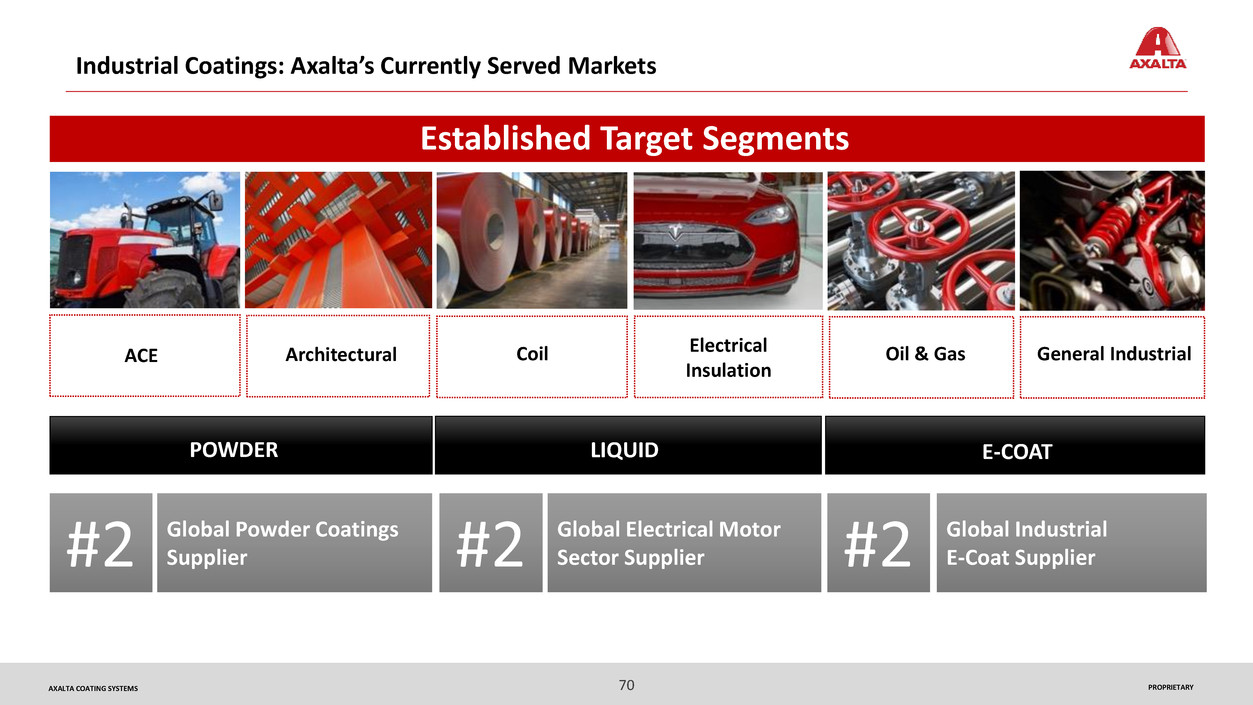

Industrial Coatings: Axalta’s Currently Served Markets

Established Target Segments

Architectural Electrical

Insulation

Oil & GasACE General IndustrialCoil

LIQUIDPOWDER E-COAT

#2 Global Powder Coatings Supplier #2 Global Electrical Motor Sector Supplier #2 Global Industrial E-Coat Supplier

71 PROPRIETARYAXALTA COATING SYSTEMS

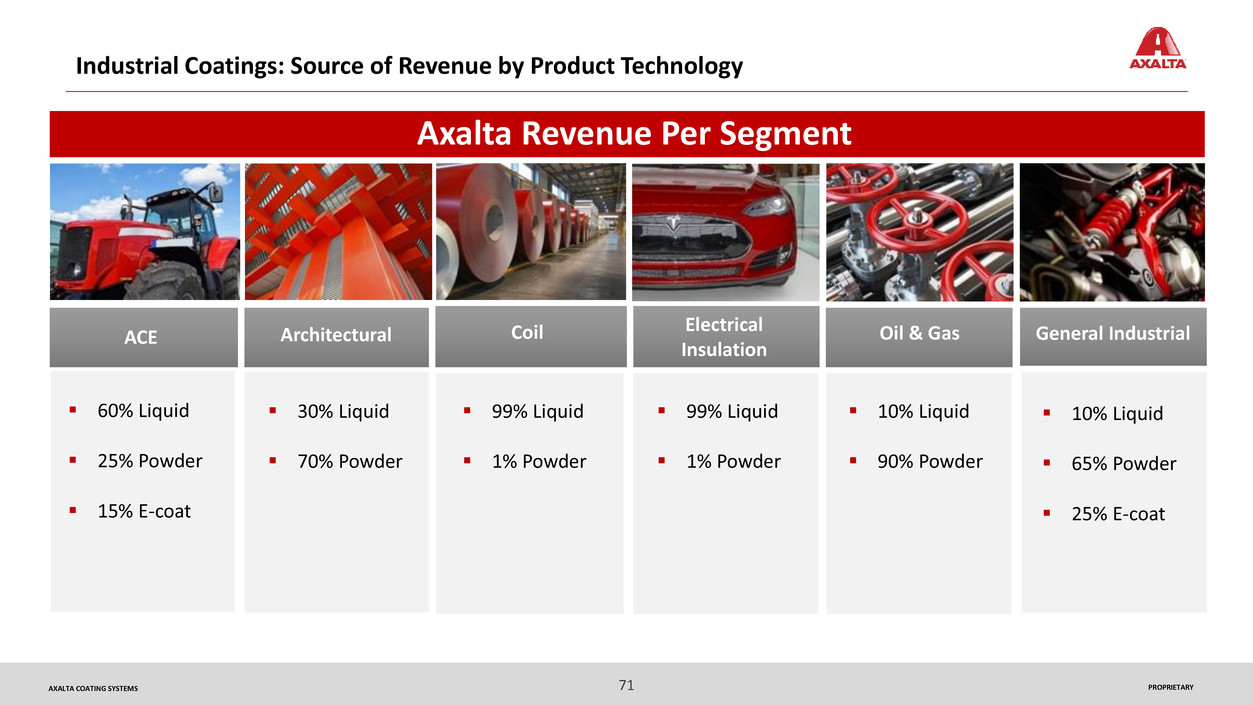

Industrial Coatings: Source of Revenue by Product Technology

Axalta Revenue Per Segment

Architectural Electrical

Insulation

Oil & GasACE General IndustrialCoil

60% Liquid

25% Powder

15% E-coat

30% Liquid

70% Powder

99% Liquid

1% Powder

99% Liquid

1% Powder

10% Liquid

90% Powder

10% Liquid

65% Powder

25% E-coat

72 PROPRIETARYAXALTA COATING SYSTEMS

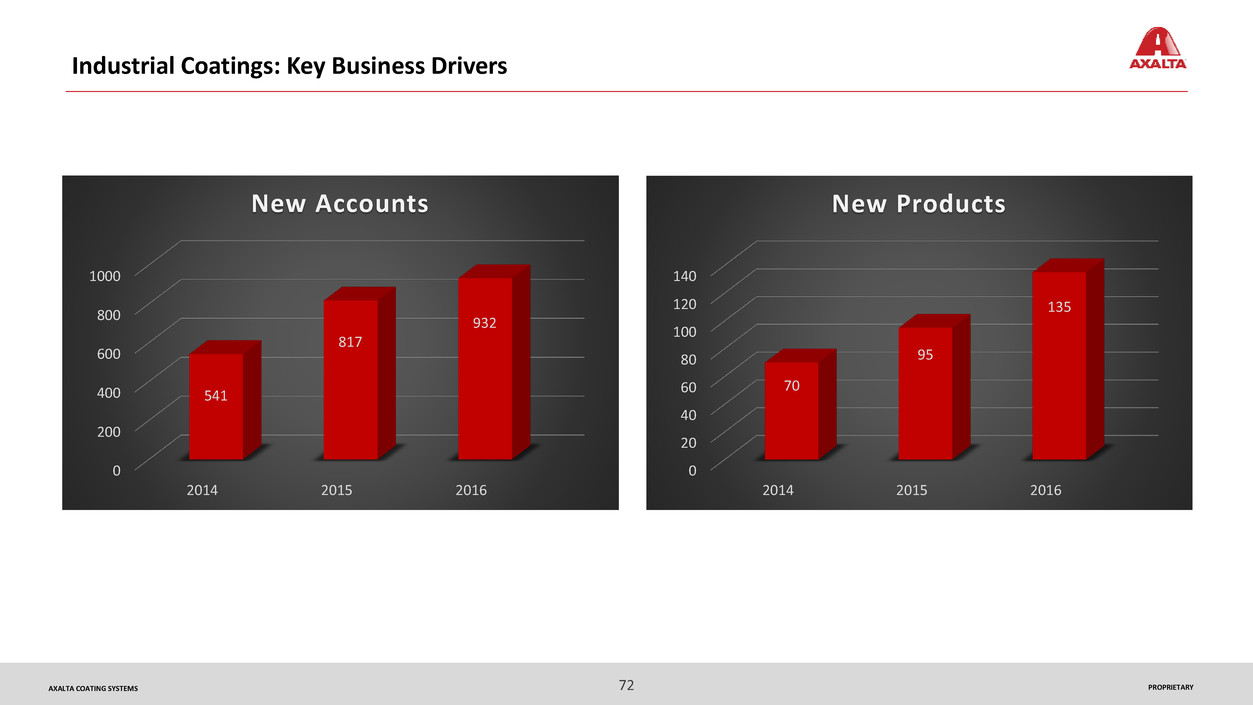

Industrial Coatings: Key Business Drivers

0

200

400

600

800

1000

2014 2015 2016

541

817

932

New Accounts

0

20

40

60

80

100

120

140

2014 2015 2016

70

95

135

New Products

73 PROPRIETARYAXALTA COATING SYSTEMS

Our Competitive Advantages: The Moat

Product innovation to meet

exacting customer specs

Wide range of sustainable

product solutions

Breadth of technology for

OEM’s and sub-suppliers

Fit-for-purpose products

Product Process Service

Global reach, scale and

consistency

Streamlined technical

approval and launch

process

Rapid response time

Highly engaged technical

service team

Sales teams considered

partners in customer

objectives

74 PROPRIETARYAXALTA COATING SYSTEMS

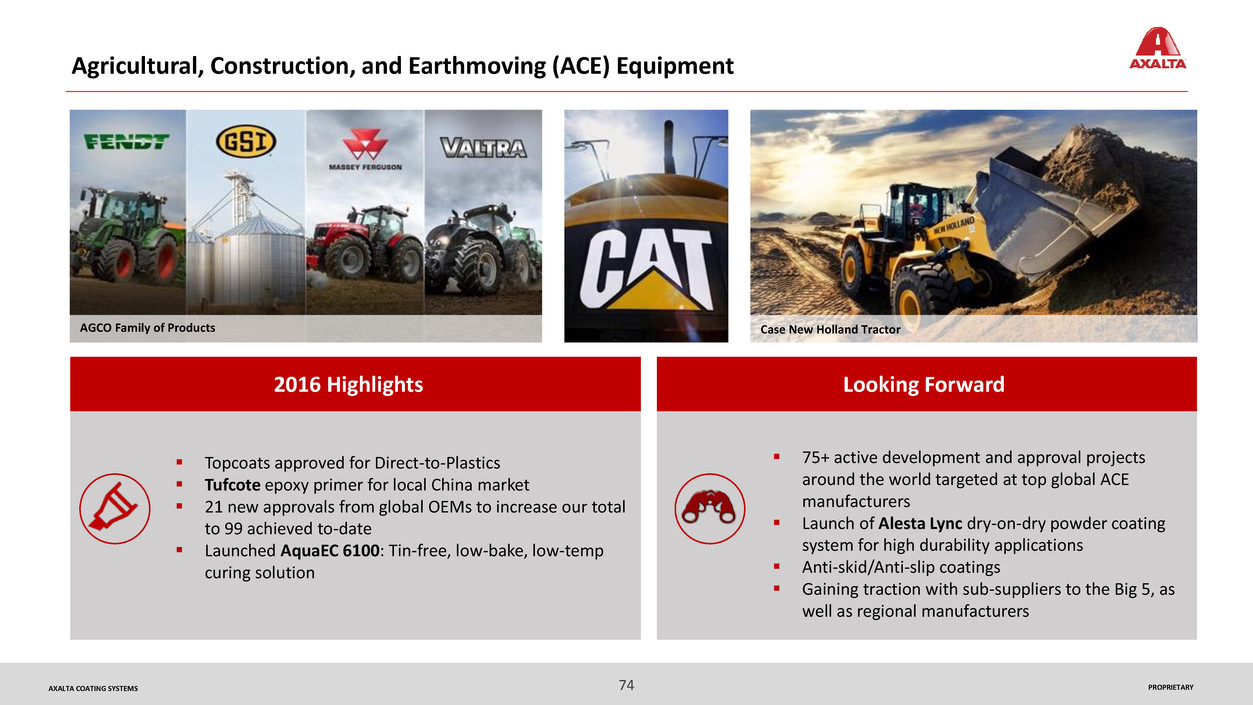

Agricultural, Construction, and Earthmoving (ACE) Equipment

#

Topcoats approved for Direct-to-Plastics

Tufcote epoxy primer for local China market

21 new approvals from global OEMs to increase our total

to 99 achieved to-date

Launched AquaEC 6100: Tin-free, low-bake, low-temp

curing solution

75+ active development and approval projects

around the world targeted at top global ACE

manufacturers

Launch of Alesta Lync dry-on-dry powder coating

system for high durability applications

Anti-skid/Anti-slip coatings

Gaining traction with sub-suppliers to the Big 5, as

well as regional manufacturers

2016 Highlights Looking Forward

AGCO Family of Products Case New Holland Tractor

75 PROPRIETARYAXALTA COATING SYSTEMS

Oil & Gas

Adapted Abcite technology to supply to water pipe

projects (Berlin)

Successfully launched Nap-Gard ID internal pipe coating

Awarded Pakistan 3LPE project due to global

responsiveness

Launched Procor HS (Pemex)

Awarded pipeline projects for CNPC in China

100% solids liquid epoxy for pipeline applications

3-Layer PP primer for deep water pipelines

Expanding our liquid protective coatings offering

Higher temperature resistant pipe coatings for

transmission pipelines

2016 Highlights Looking Forward

FBE Powder Coated PipeSinopec PlantADM Transport Tanks Sui Northern Gas Pipelines

76 PROPRIETARYAXALTA COATING SYSTEMS

77 PROPRIETARYAXALTA COATING SYSTEMS

Electrical Insulation

#

Maintained flow of product innovation - 50 active

development projects

Built leading position in the Electric Vehicle (EV) market

Introduced two new impregnating resin product lines,

including Voltahyd, the first waterborne IR line on the

market

Commercialized Voltatex formvar wire enamel product

line

Build upon innovation leadership with:

Waterborne impregnating resin for stator

application

Low formaldehyde C3 electrical steel coating

Corona resistant wire enamel

Introducing Voltaprem impregnating resin for high

voltage application

FBE powder magnet wire insulation

2016 Highlights Looking Forward

Sam Dong Production PlantSany Wind Turbines REA Magnet Wire Coating

78 PROPRIETARYAXALTA COATING SYSTEMS

General Industrial

#

Coated Rio Olympic torches which became

inspiration for Alesta Iconica collection

Introduced next-gen Nap-Gard FBE Rebar products

Expanded offering for metal auto parts

Awarded business for unique two-layer application

of our AquaEC 6100 and Aqua EC 5100 technology

Launched FlexBase plastic coating system

NSF approval for AquaEC 6100

Powder primer launch for automotive OEM body

Powder clear coat for aluminum wheels

Damage-resistant rebar coating

Waterborne epoxy one-layer system for metal auto parts

2016 Highlights Looking Forward

Rio 2016 Olympic Torch Ameristar Fences Schutt Sports HelmetsRoberti Rattan Outdoor Furniture

79 PROPRIETARYAXALTA COATING SYSTEMS

80 PROPRIETARYAXALTA COATING SYSTEMS

Architectural

King Abdulaziz International AirportSignature Tower in Kuala Lumpur

Launched Global Warranty program for Alesta

Awarded 25+ major building projects around the world

Acquired brands to add liquid technology to our

architectural portfolio

Investment in France and China facilities to create world-

class bonded metallic capability

Anodic color range

Sublimation products

Broader powder and liquid portfolio of product

solutions for Architects

Introduce designed Alesta Iconica collection of

colors, which will be produced in new bonding

facilities

2016 Highlights Looking Forward

81 PROPRIETARYAXALTA COATING SYSTEMS

82 PROPRIETARYAXALTA COATING SYSTEMS

Coil Coatings

#

Introduced Kryptstone wrinkle finishes for steel

roofing

Launched high durability acrylic system DurAcryl

and became leading supplier of coil coatings in the

truck, trailer and RV siding industry

Spray PVDF for improved flow and ease of

application

Introduced high reflectance lighting white products

Launched high gloss Durapon 70 product line

Anti-mottling PVDF coating

HS Spray PVDF

Ceranamel XT-40 super polyester coating

Universal primer system

Leverage our global capability to launch Dura Coat

technology and products to other regions

Hydropon innovative waterborne PVDF coating system

2016 Highlights Looking Forward

Alcoa Aluminum PanelsCalgary Hospital Durapon 70Schneider Transport Trailer Precoat Metals Lighting White Products

83 PROPRIETARYAXALTA COATING SYSTEMS

84 PROPRIETARYAXALTA COATING SYSTEMS

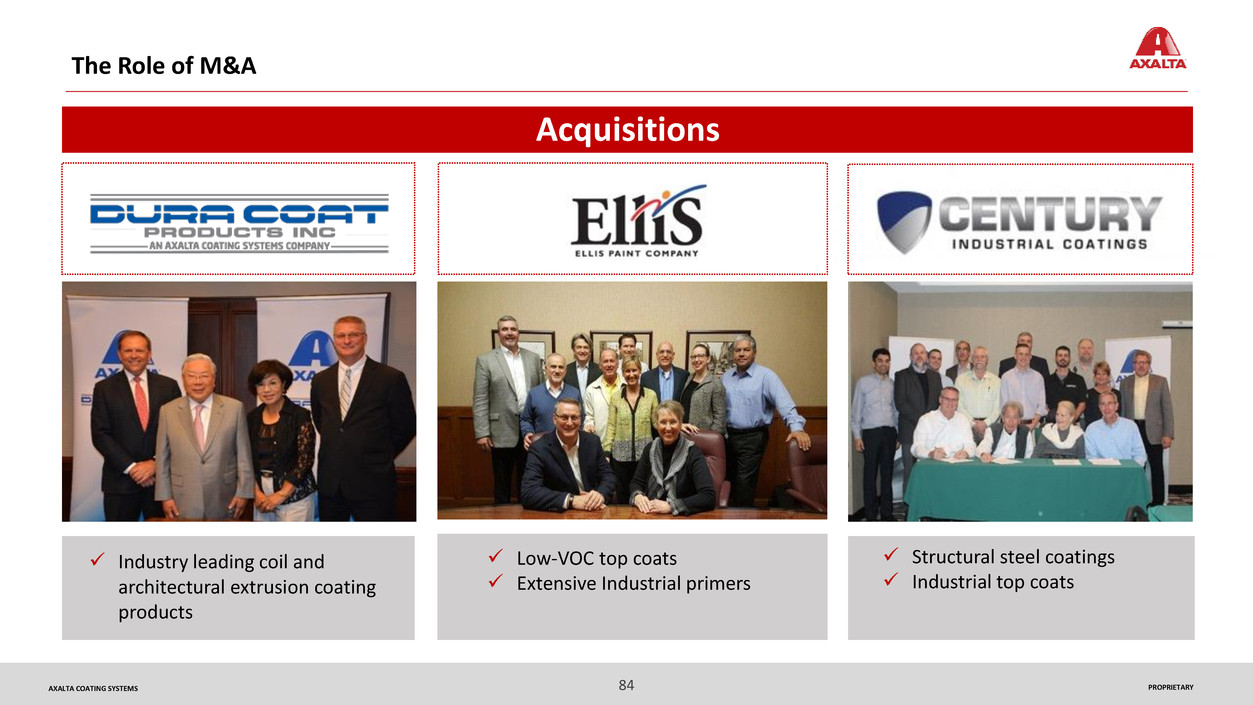

The Role of M&A

Industry leading coil and

architectural extrusion coating

products

Low-VOC top coats

Extensive Industrial primers

Structural steel coatings

Industrial top coats

Acquisitions

85 PROPRIETARYAXALTA COATING SYSTEMS

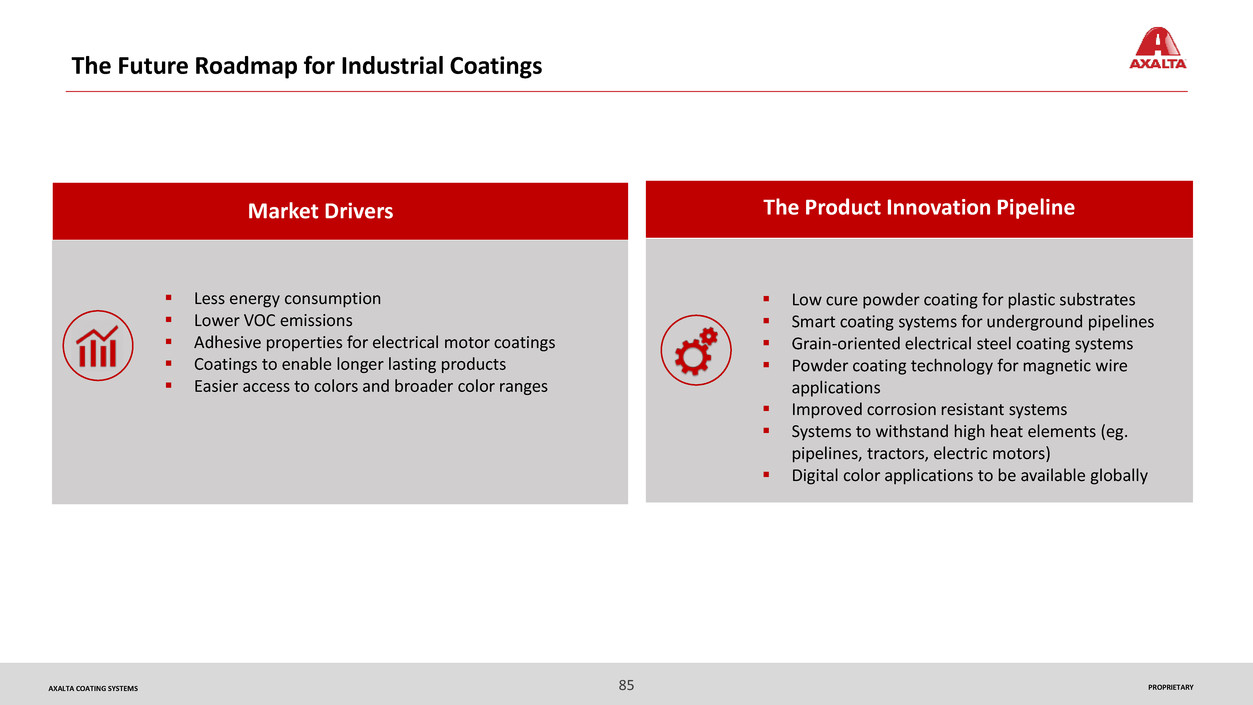

The Future Roadmap for Industrial Coatings

Less energy consumption

Lower VOC emissions

Adhesive properties for electrical motor coatings

Coatings to enable longer lasting products

Easier access to colors and broader color ranges

Low cure powder coating for plastic substrates

Smart coating systems for underground pipelines

Grain-oriented electrical steel coating systems

Powder coating technology for magnetic wire

applications

Improved corrosion resistant systems

Systems to withstand high heat elements (eg.

pipelines, tractors, electric motors)

Digital color applications to be available globally

Market Drivers The Product Innovation Pipeline

Thank You

Transportation Coatings

Steven R. Markevich

EVP, President, Transportation and Greater China

88 PROPRIETARYAXALTA COATING SYSTEMS

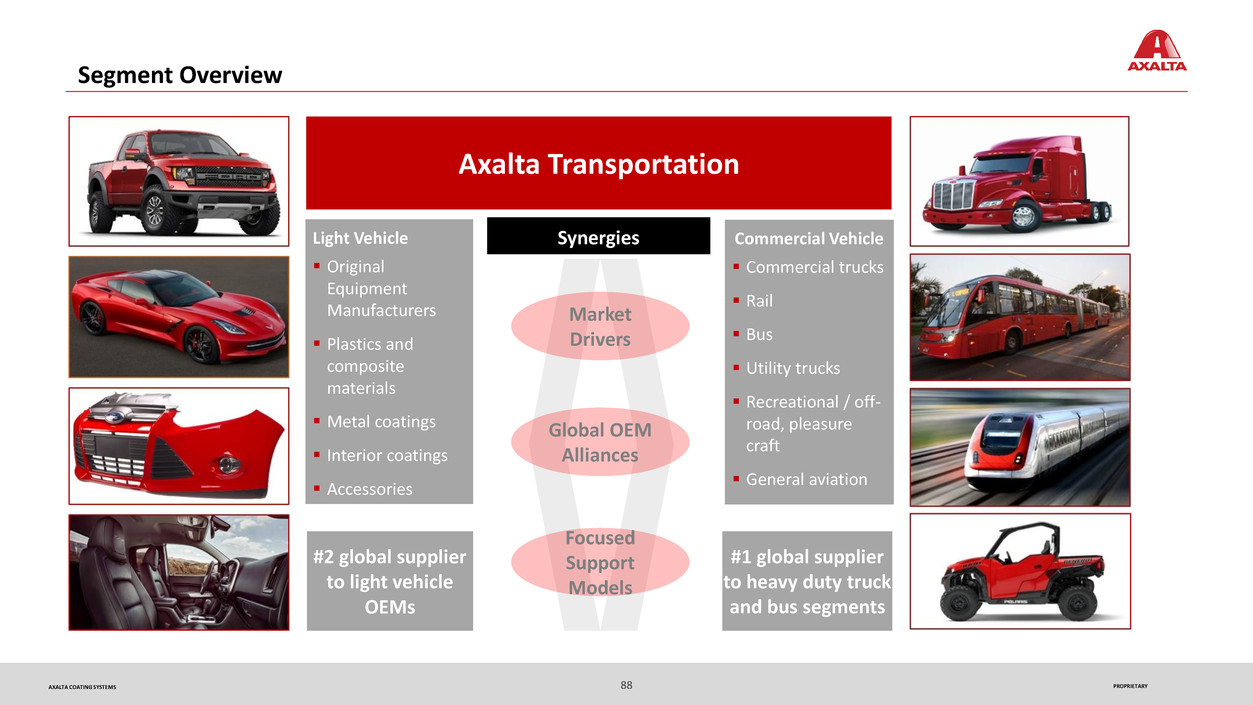

Segment Overview

#2 global supplier

to light vehicle

OEMs

Axalta Transportation

Light Vehicle

Original

Equipment

Manufacturers

Plastics and

composite

materials

Metal coatings

Interior coatings

Accessories

#1 global supplier

to heavy duty truck

and bus segments

Commercial Vehicle

Commercial trucks

Rail

Bus

Utility trucks

Recreational / off-

road, pleasure

craft

General aviation

Synergies

Global OEM

Alliances

Focused

Support

Models

Market

Drivers

89 PROPRIETARYAXALTA COATING SYSTEMS

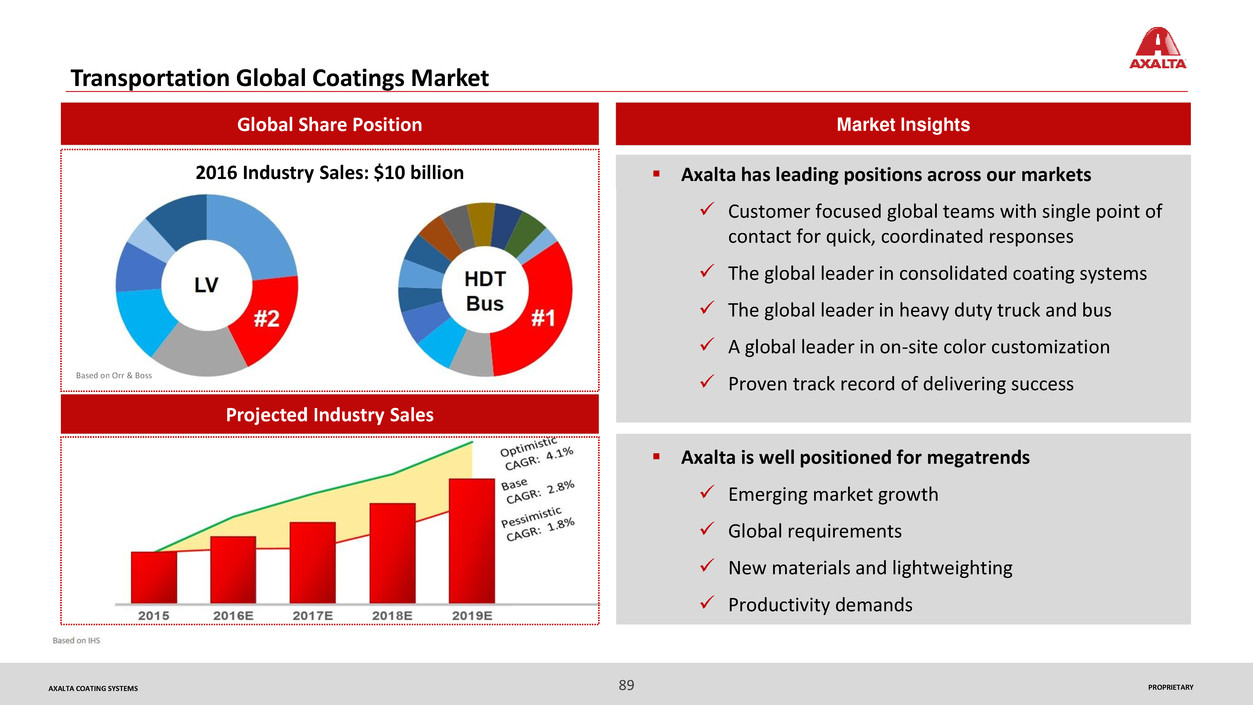

Market InsightsGlobal Share Position

Projected Industry Sales

2016 Industry Sales: $10 billion

Transportation Global Coatings Market

Axalta has leading positions across our markets

Customer focused global teams with single point of

contact for quick, coordinated responses

The global leader in consolidated coating systems

The global leader in heavy duty truck and bus

A global leader in on-site color customization

Proven track record of delivering success

Axalta is well positioned for megatrends

Emerging market growth

Global requirements

New materials and lightweighting

Productivity demands

Based on Orr & Boss

90 PROPRIETARYAXALTA COATING SYSTEMS

Our Vision Is Above Market Growth

Gain share with existing customers

Grow underserved regions and customers including

JOEMs, KOEMs, domestic OEMs

Redefine and increase content per vehicle

Leverage “what good looks like” into new regions,

customers and markets

Align product technology to evolving customer and

market needs including VOC, ambient flash, more

M&A in adjacent markets (interior, components, etc.)

Strategies Key Tactics / Programs

Build capabilities in global and regional roles

Expand customer and third party relationships

Fit-for-purpose decorative and functional coatings

Localize supply chain ensuring competitive cost structure

Best-in-class Line Service Excellence

Drive complexity management discipline

Axalta Way: “Run it like we own it”

91 PROPRIETARYAXALTA COATING SYSTEMS

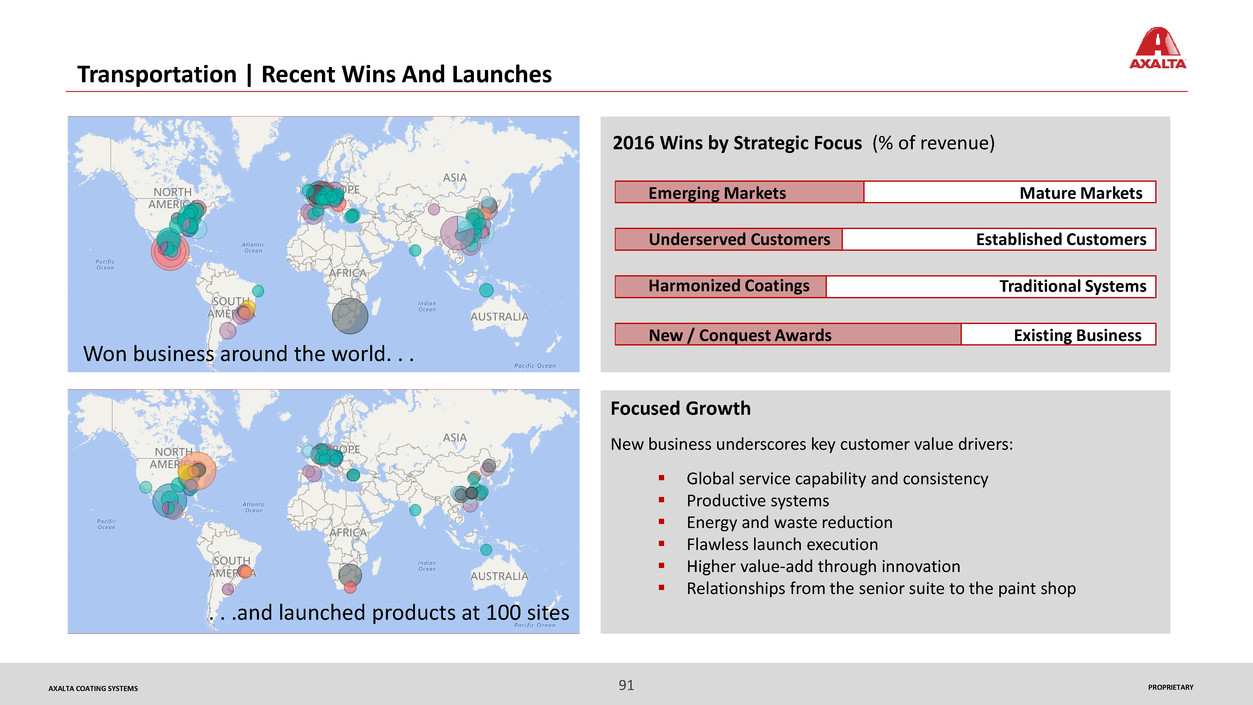

Transportation | Recent Wins And Launches

Won business around the world. . .

. . .and launched products at 100 sites

Focused Growth

New business underscores key customer value drivers:

Global service capability and consistency

Productive systems

Energy and waste reduction

Flawless launch execution

Higher value-add through innovation

Relationships from the senior suite to the paint shop

2016 Wins by Strategic Focus (% of revenue)

Emerging Markets

Underserved Customers

Harmonized Coatings

New / Conquest Awards

Mature Markets

Established Customers

Traditional Systems

Existing Business

92 PROPRIETARYAXALTA COATING SYSTEMS

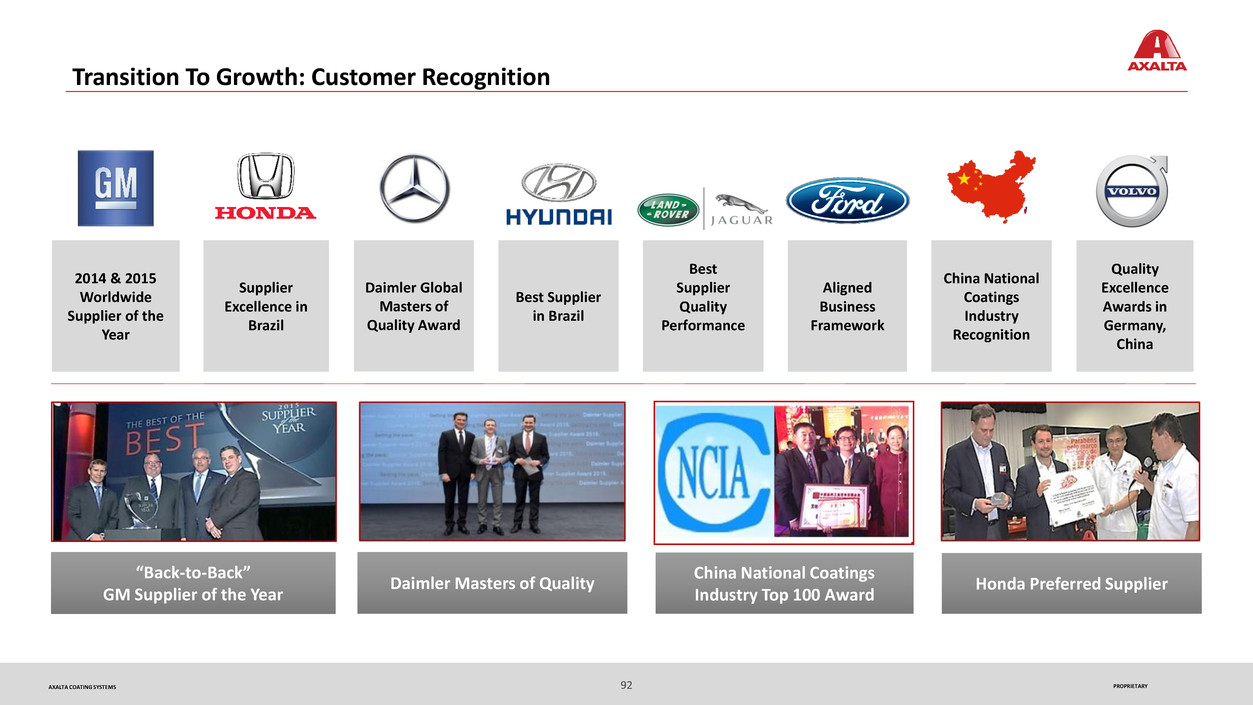

Transition To Growth: Customer Recognition

China National Coatings

Industry Top 100 Award

Honda Preferred Supplier

Quality

Excellence

Awards in

Germany,

China

China National

Coatings

Industry

Recognition

Aligned

Business

Framework

Best

Supplier

Quality

Performance

2014 & 2015

Worldwide

Supplier of the

Year

Best Supplier

in Brazil

Supplier

Excellence in

Brazil

Daimler Global

Masters of

Quality Award

Daimler Masters of Quality

“Back-to-Back”

GM Supplier of the Year

93 PROPRIETARYAXALTA COATING SYSTEMS

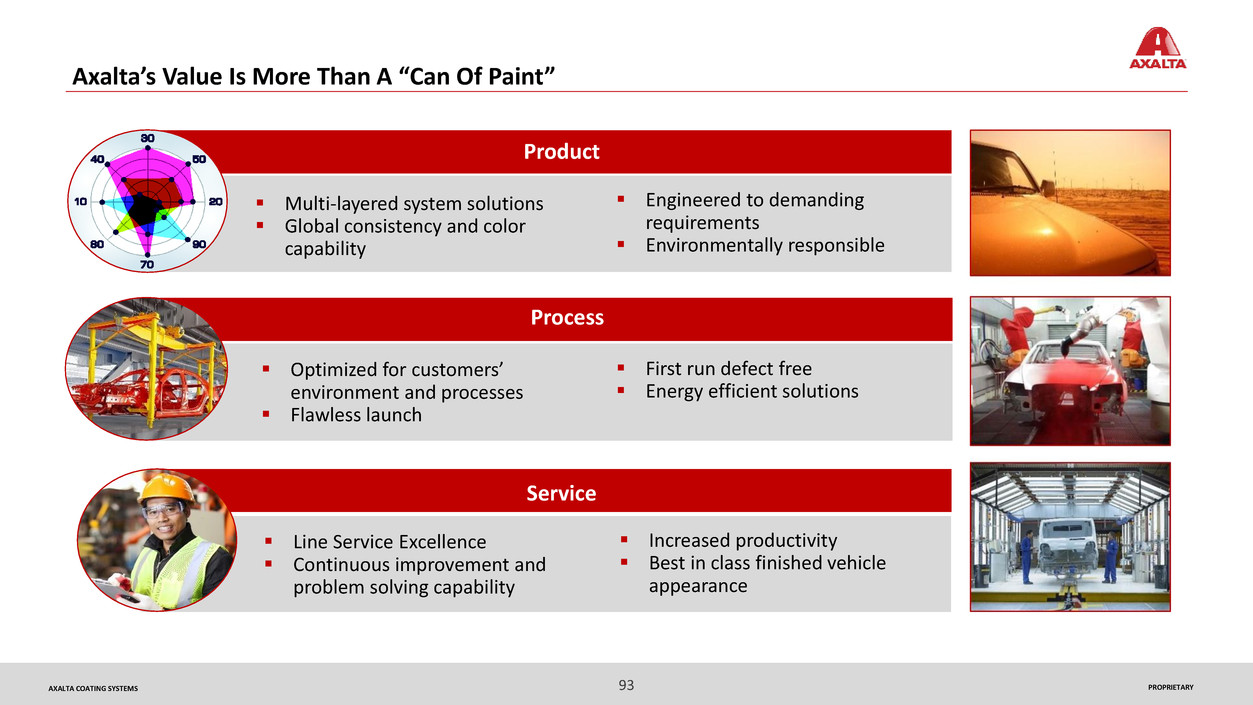

Line Service Excellence

Continuous improvement and

problem solving capability

Optimized for customers’

environment and processes

Flawless launch

Axalta’s Value Is More Than A “Can Of Paint”

Multi-layered system solutions

Global consistency and color

capability

Product

Engineered to demanding

requirements

Environmentally responsible

Process

Service

First run defect free

Energy efficient solutions

Increased productivity

Best in class finished vehicle

appearance

94 PROPRIETARYAXALTA COATING SYSTEMS

Axalta Value Proposition Case Studies

95 PROPRIETARYAXALTA COATING SYSTEMS

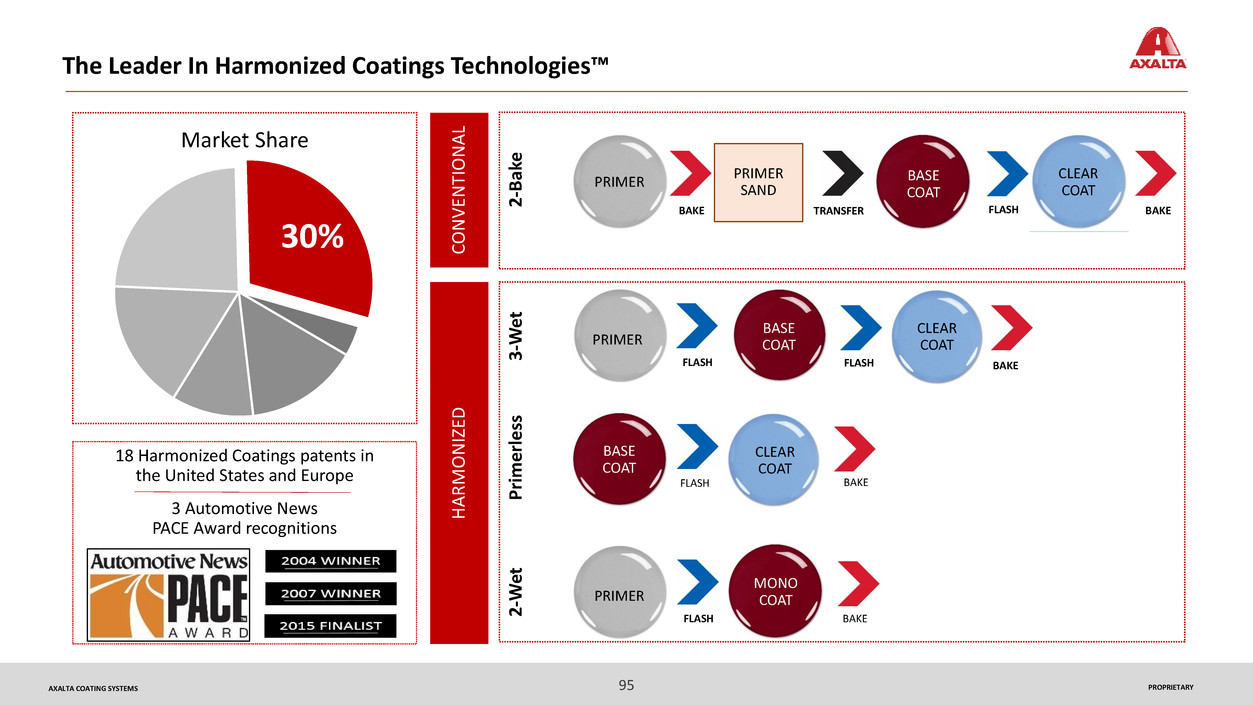

30%

18 Harmonized Coatings patents in

the United States and Europe

3 Automotive News

PACE Award recognitions

The Leader In Harmonized Coatings Technologies™

CLEAR

COAT

BASE

COAT

PRIMER

SAND

PRIMER

BAKE TRANSFER FLASH BAKE

3-WET

BASECOAT

(2nd Coat)

BASE

COATPRIMER

FLASH FLASH BAKE

CLEAR

COAT

P

ri

m

erles

s

BASE

COAT

FLASH

CLEAR

COAT

BAKE

PRIMER

FLASH

MONO

COAT

BAKE

HAR

M

O

N

IZ

ED

3

-W

et

Market Share

C

O

N

VE

N

TIO

N

A

L

2

-W

et

2

-Ba

ke

96 PROPRIETARYAXALTA COATING SYSTEMS

High Solid Solvent borne 3-Wet: Video

97 PROPRIETARYAXALTA COATING SYSTEMS

Harmonized Coatings Technologies Drive Efficiency In China

3-Wet technology jointly developed with the customer

30% reduction in material consumption

50% reduction in VOC emissions

Lowered energy consumption

Earned SURCAR 2016 award for environmental footprint

including air emissions

GLOBALLY PROVEN

SYSTEM

SEVEN U.S.

PATENTS

ELIMINATES PRIMER OVEN

AND SANDING DECK

REMOVES 50%

PRIMER APPLICATORS

20% ENERGY

REDUCTION

98 PROPRIETARYAXALTA COATING SYSTEMS

Brand Color

Favorite from past

Favorite object

Select from Axalta

library of colors

Formula library

Color formulating

algorithms

Proprietary

formula software

Engineered

intermediates

Standard process

Strict quality

criteria

Quick delivery

Sprayed in

customer system

Original Equipment

standards

Axalta Provides Mass Color Customization Solutions

We use science to help our customers deliver color and confidence to their consumers

Premium product

Meets consumer

needs

Repair product

readily available

Color Selected Custom Formulation Coating Manufactured Vehicle Painted Custom Results

99 PROPRIETARYAXALTA COATING SYSTEMS

Imron Elite EY- Video

100 PROPRIETARYAXALTA COATING SYSTEMS

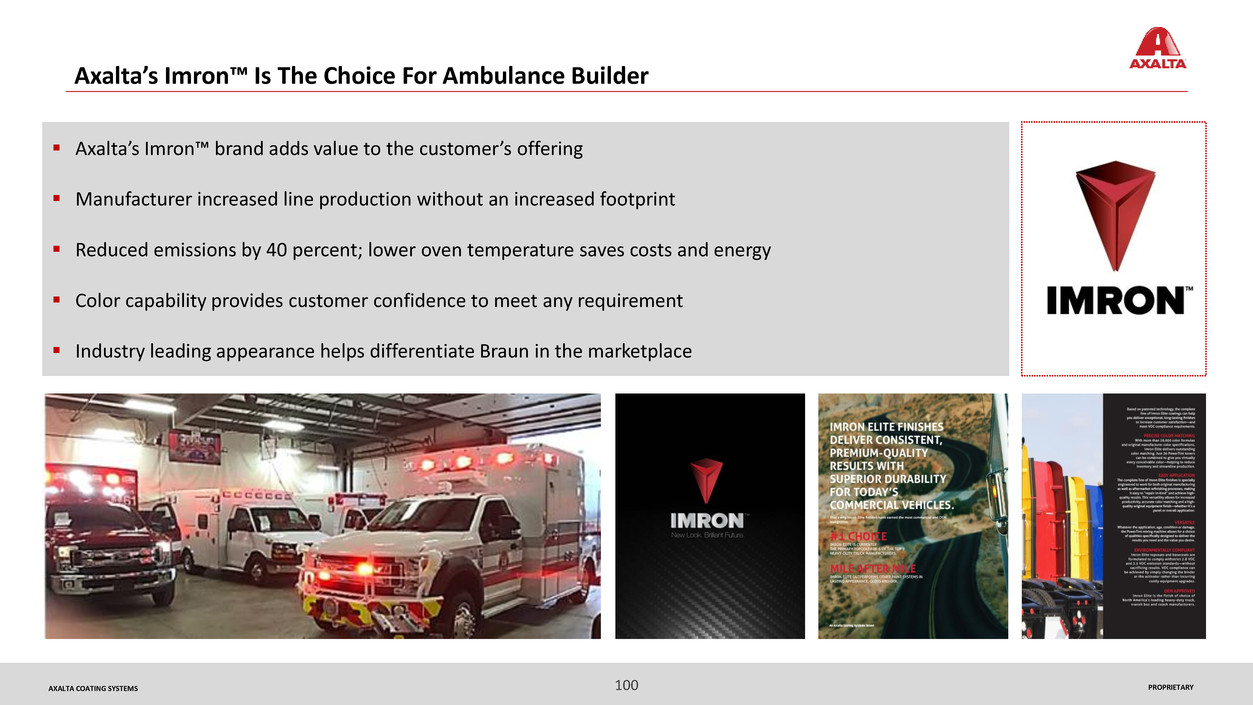

Axalta’s Imron™ Is The Choice For Ambulance Builder

Axalta’s Imron™ brand adds value to the customer’s offering

Manufacturer increased line production without an increased footprint

Reduced emissions by 40 percent; lower oven temperature saves costs and energy

Color capability provides customer confidence to meet any requirement

Industry leading appearance helps differentiate Braun in the marketplace

101 PROPRIETARYAXALTA COATING SYSTEMS

Electrodeposition coating is one of the most efficient coating methods

Provides excellent coverage to all metallic parts of the vehicle

AquaEC™ brand family meets the needs of today’s transportation customers

Excellent throw power

Formulated to meet regulations

Excellent edge protection

Reduced energy and material consumption

Less waste generation

Corrosion Resistance For Lasting Protection

102 PROPRIETARYAXALTA COATING SYSTEMS

Aqua-EC

103 PROPRIETARYAXALTA COATING SYSTEMS

AquaEC™ Performance

Tin-free formulation

Lower cure temperature saved energy

Less waste water generated

Lower bake off losses

Less residual dust created in ovens

Fewer defects

Clean edges

Improved yield

Lower emissions

Many benefits recognized by our customers

104 PROPRIETARYAXALTA COATING SYSTEMS

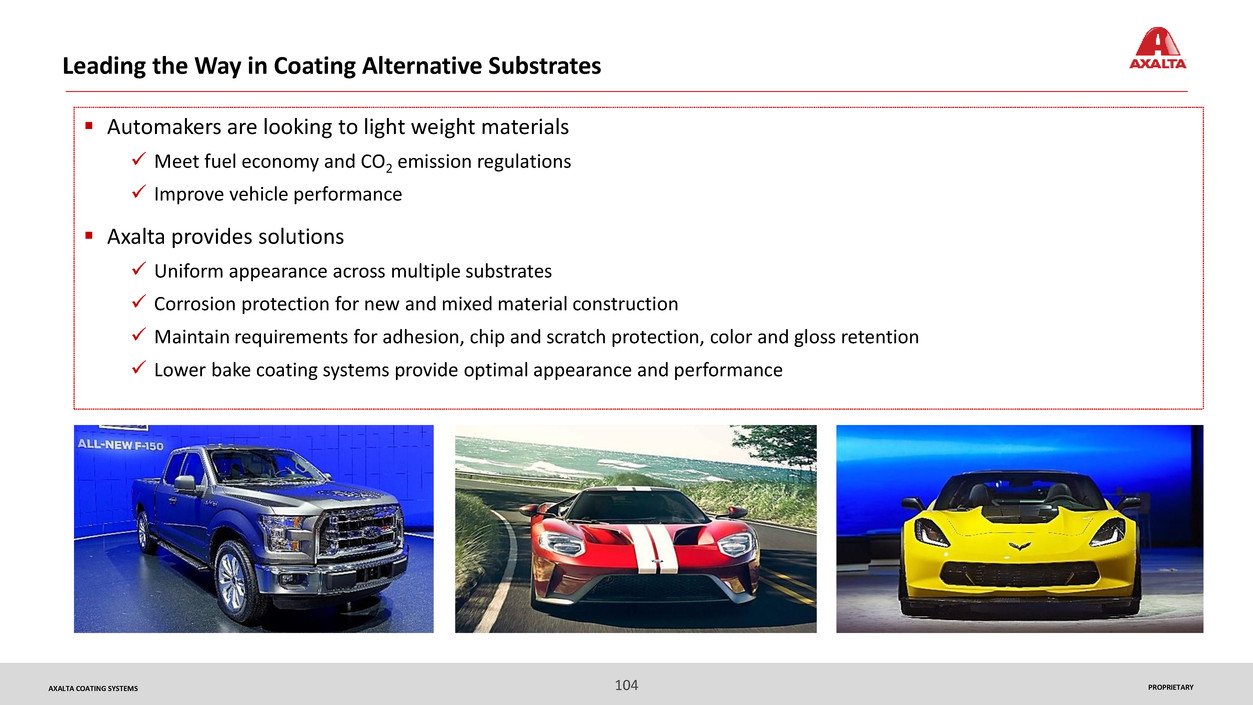

Automakers are looking to light weight materials

Meet fuel economy and CO2 emission regulations

Improve vehicle performance

Axalta provides solutions

Uniform appearance across multiple substrates

Corrosion protection for new and mixed material construction

Maintain requirements for adhesion, chip and scratch protection, color and gloss retention

Lower bake coating systems provide optimal appearance and performance

Leading the Way in Coating Alternative Substrates

105 PROPRIETARYAXALTA COATING SYSTEMS

Coatings for Lightweight Substrates: Video

106 PROPRIETARYAXALTA COATING SYSTEMS

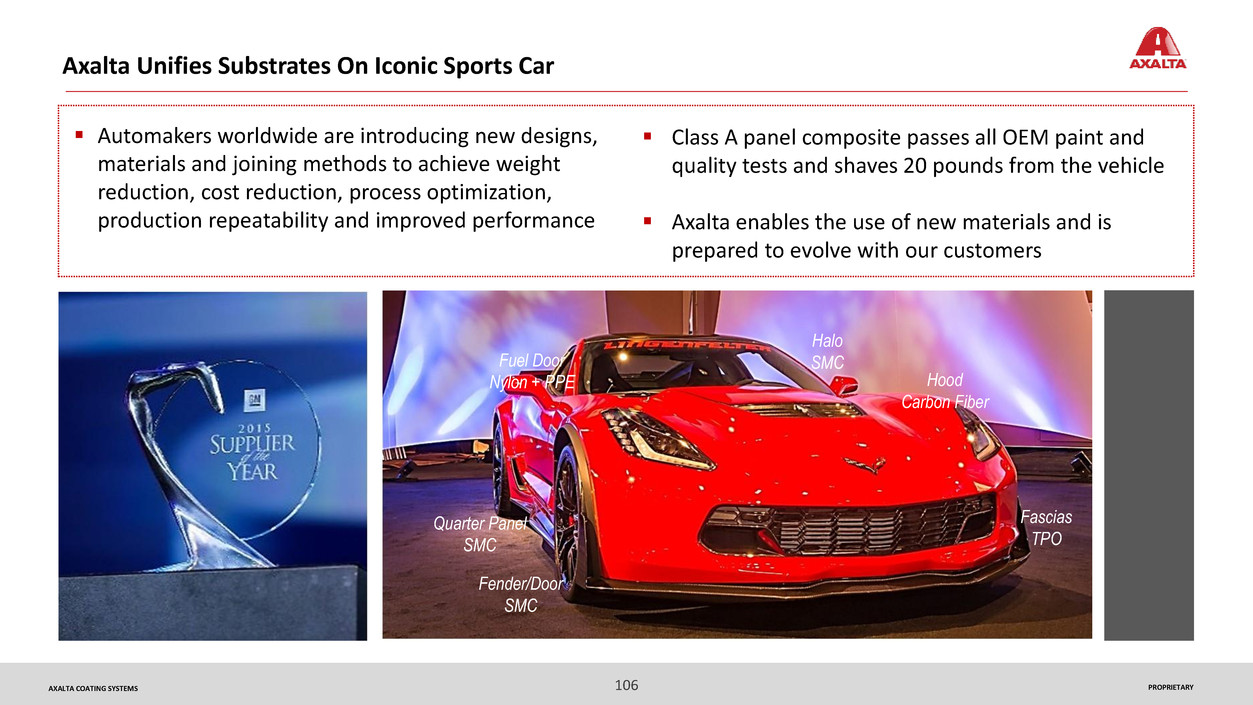

Axalta Unifies Substrates On Iconic Sports Car

Automakers worldwide are introducing new designs,

materials and joining methods to achieve weight

reduction, cost reduction, process optimization,

production repeatability and improved performance

Fuel Door

Nylon + PPE

Halo

SMC

Hood

Carbon Fiber

Fascias

TPO

Quarter Panel

SMC

Fender/Door

SMC

Class A panel composite passes all OEM paint and

quality tests and shaves 20 pounds from the vehicle

Axalta enables the use of new materials and is

prepared to evolve with our customers

107 PROPRIETARYAXALTA COATING SYSTEMS

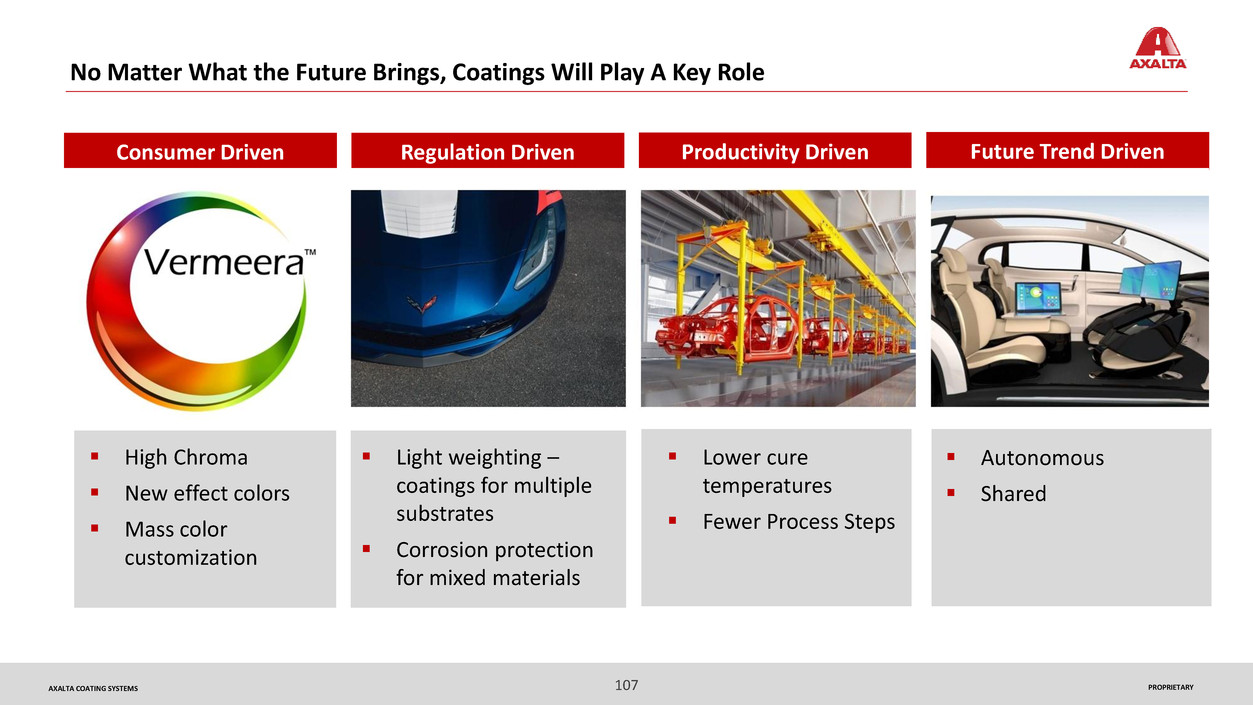

No Matter What the Future Brings, Coatings Will Play A Key Role

Autonomous

Shared

High Chroma

New effect colors

Mass color

customization

Light weighting –

coatings for multiple

substrates

Corrosion protection

for mixed materials

Lower cure

temperatures

Fewer Process Steps

Consumer Driven Regulation Driven Productivity Driven Future Trend Driven

108 PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s advanced

coatings technologies

will enable growth and

value creation

Recent wins and awards

are evidence of success

Leading global

transportation coatings

systems provider

Strong products and

great service drive

customer value

Transportation Summary

AXALTA COATING SYSTEMS

Thank you

Appendix

111 PROPRIETARYAXALTA COATING SYSTEMS

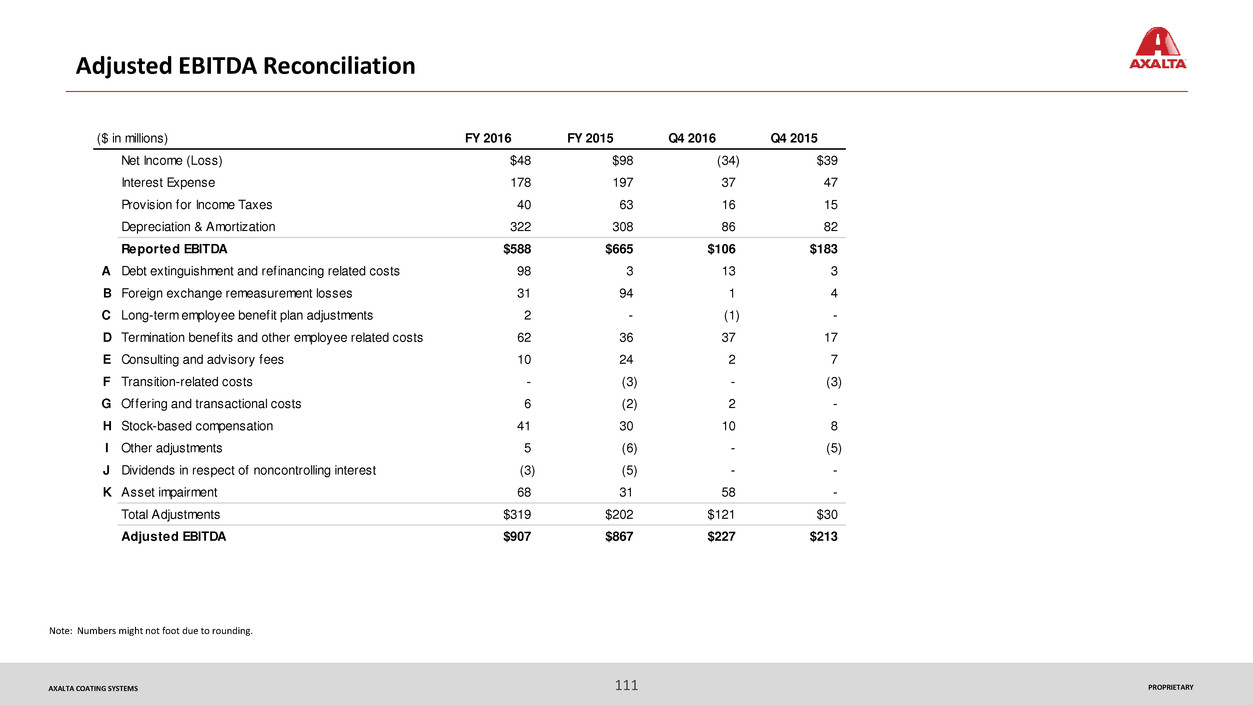

Adjusted EBITDA Reconciliation

Note: Numbers might not foot due to rounding.

($ in millions) FY 2016 FY 2015 Q4 2016 Q4 2015

Net Income (Loss) $48 $98 (34) $39

Interest Expense 178 197 37 47

Provision for Income Taxes 40 63 16 15

Depreciation & Amortization 322 308 86 82

Reported EBITDA $588 $665 $106 $183

A Debt extinguishment and refinancing related costs 98 3 13 3

B Foreign exchange remeasurement losses 31 94 1 4

C Long-term employee benefit plan adjustments 2 - (1) -

D Termination benefits and other employee related costs 62 36 37 17

E Consulting and advisory fees 10 24 2 7

F Transition-related costs - (3) - (3)

G Offering and transactional costs 6 (2) 2 -

H Stock-based compensation 41 30 10 8

I Other adjustments 5 (6) - (5)

J Dividends in respect of noncontrolling interest (3) (5) - -

K Asset impairment 68 31 58 -

Total Adjustments $319 $202 $121 $30

Adjusted EBITDA $907 $867 $227 $213

112 PROPRIETARYAXALTA COATING SYSTEMS

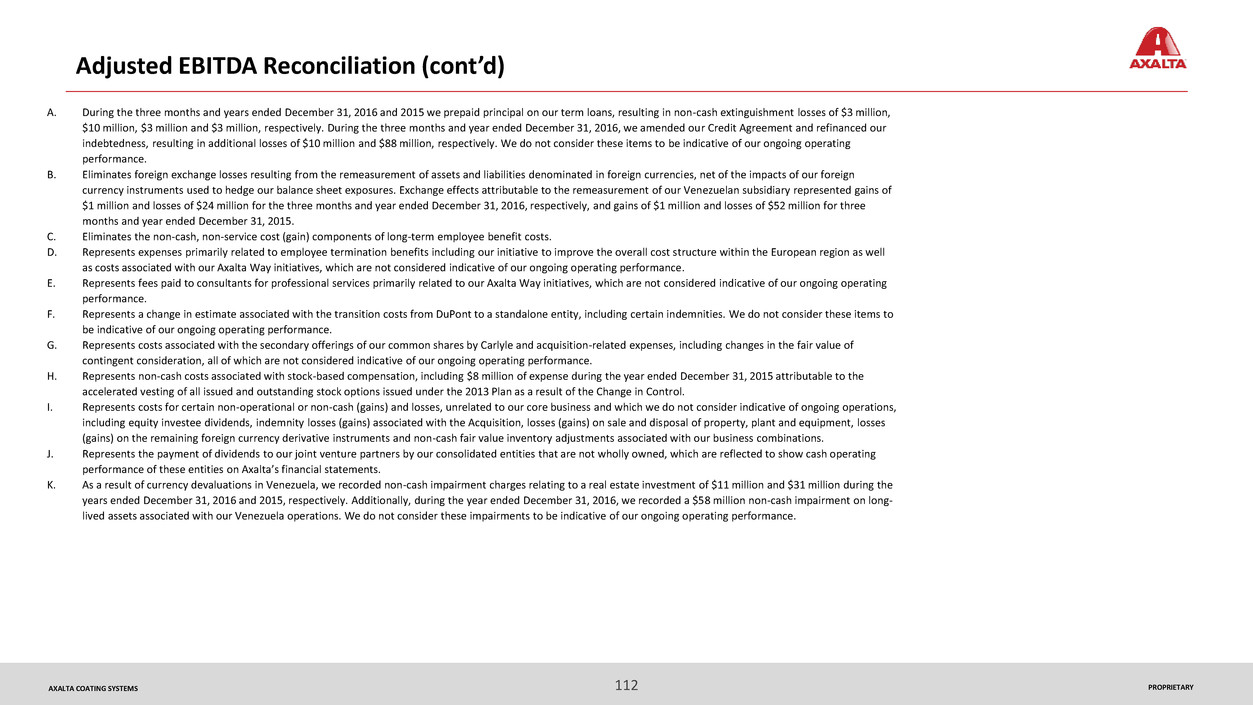

Adjusted EBITDA Reconciliation (cont’d)

A. During the three months and years ended December 31, 2016 and 2015 we prepaid principal on our term loans, resulting in non-cash extinguishment losses of $3 million,

$10 million, $3 million and $3 million, respectively. During the three months and year ended December 31, 2016, we amended our Credit Agreement and refinanced our

indebtedness, resulting in additional losses of $10 million and $88 million, respectively. We do not consider these items to be indicative of our ongoing operating

performance.

B. Eliminates foreign exchange losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of the impacts of our foreign

currency instruments used to hedge our balance sheet exposures. Exchange effects attributable to the remeasurement of our Venezuelan subsidiary represented gains of

$1 million and losses of $24 million for the three months and year ended December 31, 2016, respectively, and gains of $1 million and losses of $52 million for three

months and year ended December 31, 2015.

C. Eliminates the non-cash, non-service cost (gain) components of long-term employee benefit costs.

D. Represents expenses primarily related to employee termination benefits including our initiative to improve the overall cost structure within the European region as well

as costs associated with our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance.

E. Represents fees paid to consultants for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our ongoing operating

performance.

F. Represents a change in estimate associated with the transition costs from DuPont to a standalone entity, including certain indemnities. We do not consider these items to

be indicative of our ongoing operating performance.

G. Represents costs associated with the secondary offerings of our common shares by Carlyle and acquisition-related expenses, including changes in the fair value of

contingent consideration, all of which are not considered indicative of our ongoing operating performance.

H. Represents non-cash costs associated with stock-based compensation, including $8 million of expense during the year ended December 31, 2015 attributable to the

accelerated vesting of all issued and outstanding stock options issued under the 2013 Plan as a result of the Change in Control.

I. Represents costs for certain non-operational or non-cash (gains) and losses, unrelated to our core business and which we do not consider indicative of ongoing operations,

including equity investee dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses

(gains) on the remaining foreign currency derivative instruments and non-cash fair value inventory adjustments associated with our business combinations.

J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned, which are reflected to show cash operating

performance of these entities on Axalta’s financial statements.

K. As a result of currency devaluations in Venezuela, we recorded non-cash impairment charges relating to a real estate investment of $11 million and $31 million during the

years ended December 31, 2016 and 2015, respectively. Additionally, during the year ended December 31, 2016, we recorded a $58 million non-cash impairment on long-

lived assets associated with our Venezuela operations. We do not consider these impairments to be indicative of our ongoing operating performance.