EXHIBIT 99.2

Published on August 3, 2017

Axalta Coating Systems

Q2 2017 FINANCIAL RESULTS

August 3, 2017

Exhibit 99.2

AXALTA COATING SYSTEMS

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995, including those relating to 2017 financial projections, including execution on our 2017 goals as well as 2017 net sales, net sales excluding FX, Adjusted EBITDA,

interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding, cost savings, contributions from

acquisitions, raw material cost increases, and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include

words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions.

These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions,

expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and

analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any

obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements

are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral

remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including,

but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on

Form 10-K for the year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in

the United States (“GAAP”), including net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt.

Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in

our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense, (ii) the impact of certain non-cash, nonrecurring or other items that are

included in net income and EBITDA that we do not consider indicative of our ongoing performance and (iii) certain unusual or nonrecurring items impacting results in a particular

period. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business

trends on a period-to-period basis. Adjusted Net Income shows the adjusted value of Net Income attributable to controlling interests after removing the items that are determined

by management to be unusual or nonrecurring in nature or items that we do not consider indicative of our ongoing operating performance. Our use of the terms net sales

excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales

excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net sales, net income, operating income or any

other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding

FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be

considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial

measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net

sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information

necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the

impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project

those items and they may have a substantial and unpredictable impact on our US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison

to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure

segment operating performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in

accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

2

Legal Notices

AXALTA COATING SYSTEMS

Q2 2017 Highlights

Q2 financial results

Net sales of $1,088.5 million – driven primarily by 6.5% acquisition contribution

Net loss attributable to Axalta of $20.8 million versus $50.7 million of income in Q2 2016,

driven by Venezuela deconsolidation and M&A transaction and integration costs

Adjusted net income attributable to Axalta of $75.4 million versus $83.7 million in Q2 2016

Adjusted EBITDA of $227.2 million versus $251.1 million in Q2 2016

Operating & innovation progress highlights

Opened Asia Pacific Technology Center in Shanghai; opened new training centers in North

Carolina and Dubai; opened new India headquarters

Honored with Supplier of the Year award from GM and supplier award from Honda in Brazil

Key new Industrial product introductions within our Colar®, Alesta®, and Durapon 70™ brands

to extend product reach in new markets

Balance sheet & cash flow progress

Free Cash Flow generation: $73.7 million versus $174.8 million last year

Upsized and refinanced USD Term Loans to finance Q2 2017 acquisitions and reduce cost of

debt while extending maturities

Capital deployment & M&A activity

Closed on three acquisitions including the North American Industrial Wood Coatings business

from Valspar and Spencer Coatings Group in the U.K.

Initiated share repurchase program by purchasing $8.3 million of shares

3

AXALTA COATING SYSTEMS 4

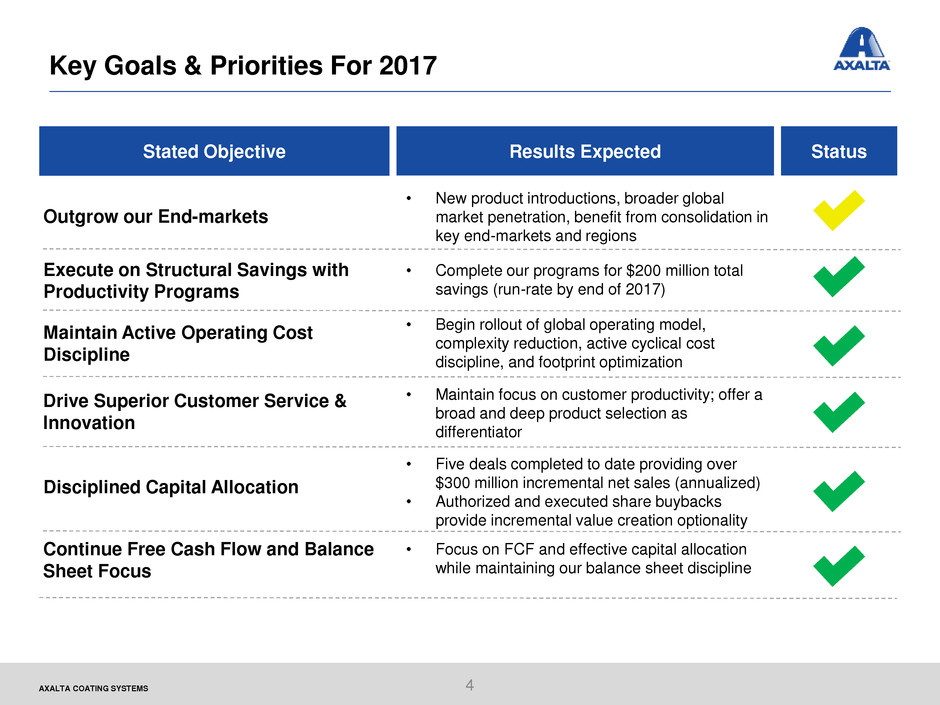

Key Goals & Priorities For 2017

Outgrow our End-markets

Drive Superior Customer Service &

Innovation

Maintain Active Operating Cost

Discipline

Execute on Structural Savings with

Productivity Programs

• New product introductions, broader global

market penetration, benefit from consolidation in

key end-markets and regions

• Begin rollout of global operating model,

complexity reduction, active cyclical cost

discipline, and footprint optimization

• Complete our programs for $200 million total

savings (run-rate by end of 2017)

Disciplined Capital Allocation

• Five deals completed to date providing over

$300 million incremental net sales (annualized)

• Authorized and executed share buybacks

provide incremental value creation optionality

Continue Free Cash Flow and Balance

Sheet Focus

• Focus on FCF and effective capital allocation

while maintaining our balance sheet discipline

Stated Objective Results Expected

• Maintain focus on customer productivity; offer a

broad and deep product selection as

differentiator

Status

AXALTA COATING SYSTEMS

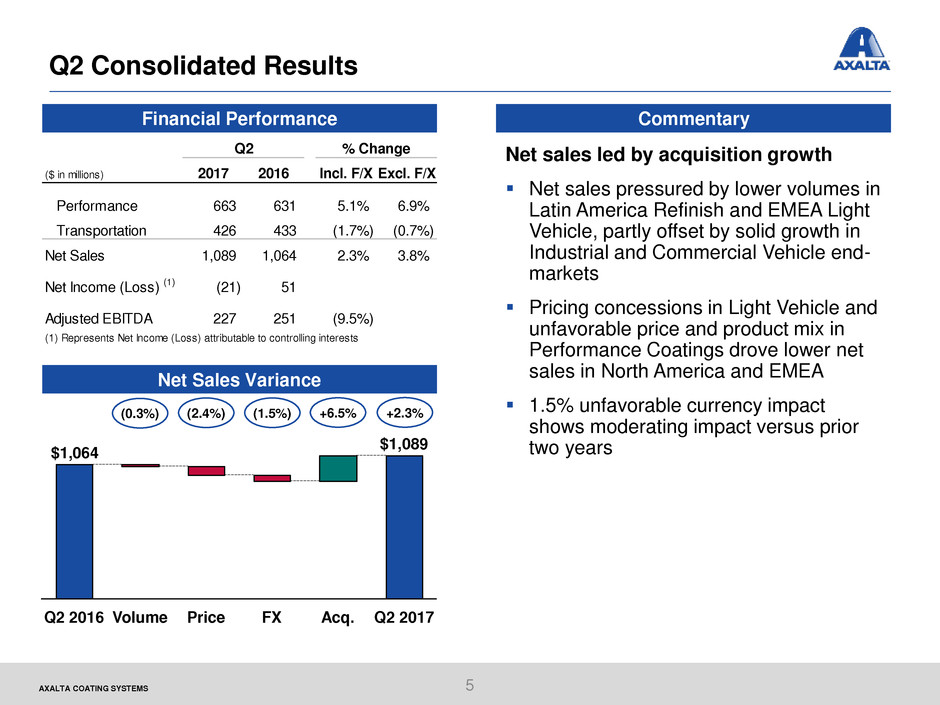

Q2 Consolidated Results

Financial Performance Commentary

Net Sales Variance

$1,064

Price Acq. Q2 2017

$1,089

FXQ2 2016 Volume

5

Net sales led by acquisition growth

Net sales pressured by lower volumes in

Latin America Refinish and EMEA Light

Vehicle, partly offset by solid growth in

Industrial and Commercial Vehicle end-

markets

Pricing concessions in Light Vehicle and

unfavorable price and product mix in

Performance Coatings drove lower net

sales in North America and EMEA

1.5% unfavorable currency impact

shows moderating impact versus prior

two years

(0.3%) (2.4%) (1.5%) +6.5% +2.3%

($ in millions) 2017 2016 Incl. F/X Excl. F/X

Performance 663 631 5.1% 6.9%

Transportation 426 433 (1.7%) (0.7%)

Net Sales 1,089 1,064 2.3% 3.8%

Net Income (Loss) (1) (21) 51

Adjusted EBITDA 227 251 (9.5%)

(1) Represents Net Income (Loss) attributable to controlling interests

Q2 % Change

AXALTA COATING SYSTEMS

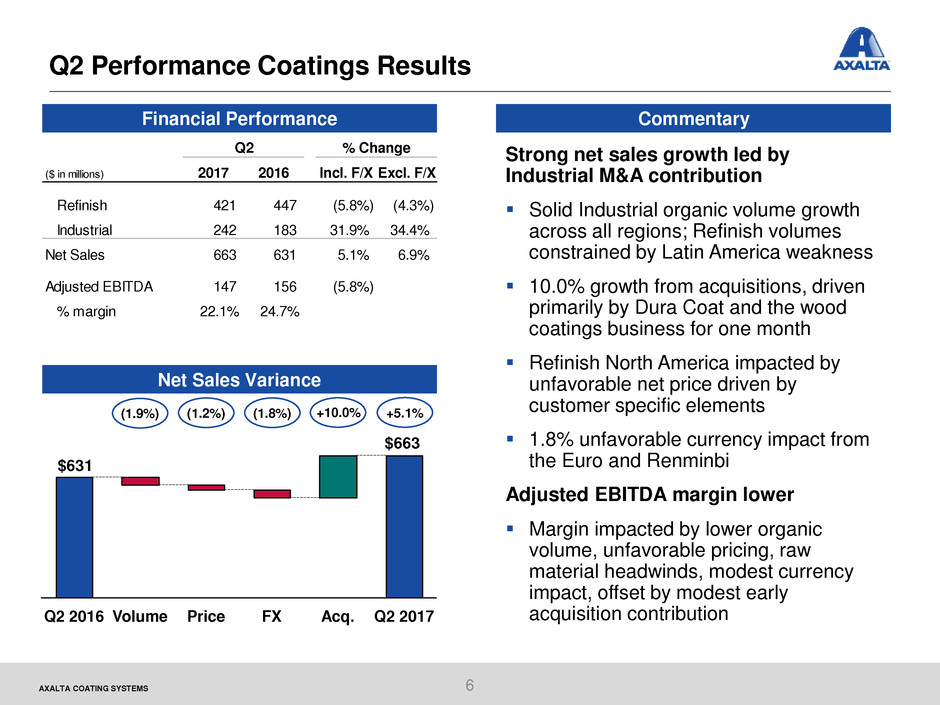

Q2 Performance Coatings Results

Financial Performance Commentary

Net Sales Variance

6

Strong net sales growth led by

Industrial M&A contribution

Solid Industrial organic volume growth

across all regions; Refinish volumes

constrained by Latin America weakness

10.0% growth from acquisitions, driven

primarily by Dura Coat and the wood

coatings business for one month

Refinish North America impacted by

unfavorable net price driven by

customer specific elements

1.8% unfavorable currency impact from

the Euro and Renminbi

Adjusted EBITDA margin lower

Margin impacted by lower organic

volume, unfavorable pricing, raw

material headwinds, modest currency

impact, offset by modest early

acquisition contribution

$663

$631

Q2 2017Acq.PriceVolume FXQ2 2016

(1.9%) (1.2%) (1.8%) +5.1%+10.0%

Q2

($ in millions) 2017 2016 Incl. F/X Excl. F/X

Refinish 421 447 (5.8%) (4.3%)

Industrial 242 183 31.9% 34.4%

Net Sales 663 631 5.1% 6.9%

Adjusted EBITDA 147 156 (5.8%)

% margin 22.1% 24.7%

% Change

AXALTA COATING SYSTEMS

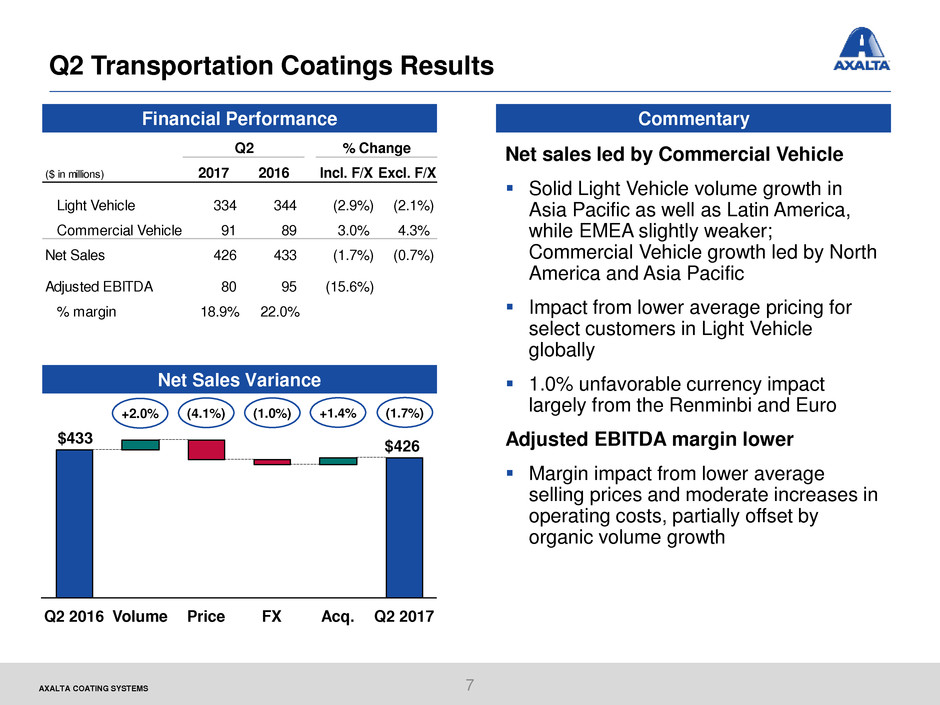

Q2 Transportation Coatings Results

Financial Performance Commentary

Net Sales Variance

7

Net sales led by Commercial Vehicle

Solid Light Vehicle volume growth in

Asia Pacific as well as Latin America,

while EMEA slightly weaker;

Commercial Vehicle growth led by North

America and Asia Pacific

Impact from lower average pricing for

select customers in Light Vehicle

globally

1.0% unfavorable currency impact

largely from the Renminbi and Euro

Adjusted EBITDA margin lower

Margin impact from lower average

selling prices and moderate increases in

operating costs, partially offset by

organic volume growth

$426

$433

Q2 2016 Q2 2017FX Acq.PriceVolume

+2.0% (4.1%) (1.0%) +1.4% (1.7%)

($ in millions) 2017 2016 Incl. F/X Excl. F/X

Light Vehicle 334 344 (2.9%) (2.1%)

Commercial Vehicle 91 89 3.0% 4.3%

Net Sales 426 433 (1.7%) (0.7%)

Adjusted EBITDA 80 95 (15.6%)

% margin 18.9% 22.0%

Q2 % Change

AXALTA COATING SYSTEMS

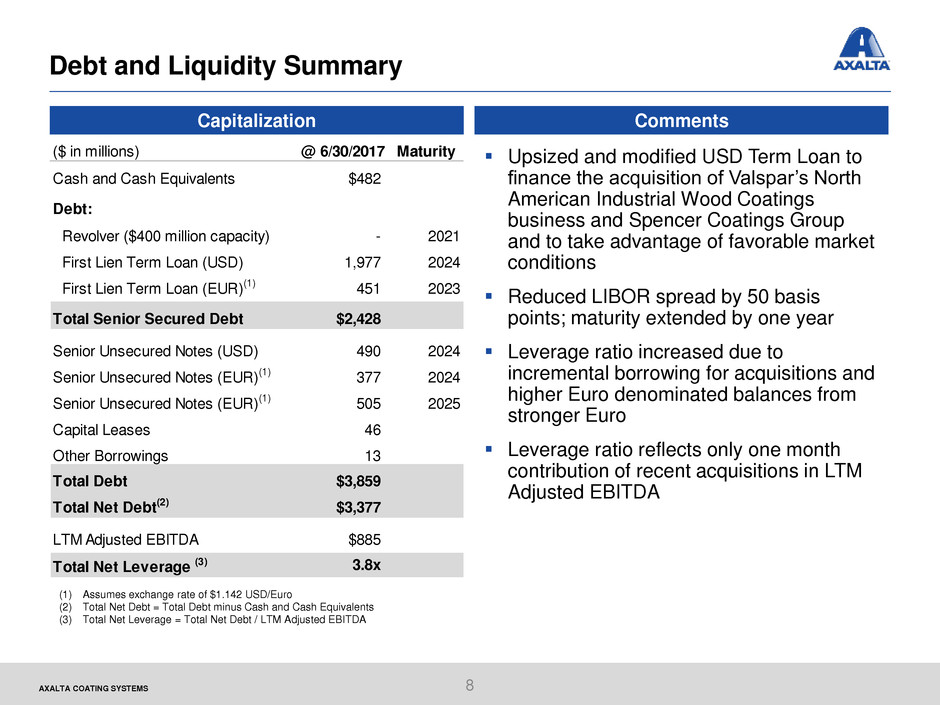

Debt and Liquidity Summary

Capitalization

8

Comments

Upsized and modified USD Term Loan to

finance the acquisition of Valspar’s North

American Industrial Wood Coatings

business and Spencer Coatings Group

and to take advantage of favorable market

conditions

Reduced LIBOR spread by 50 basis

points; maturity extended by one year

Leverage ratio increased due to

incremental borrowing for acquisitions and

higher Euro denominated balances from

stronger Euro

Leverage ratio reflects only one month

contribution of recent acquisitions in LTM

Adjusted EBITDA

(1) Assumes exchange rate of $1.142 USD/Euro

(2) Total Net Debt = Total Debt minus Cash and Cash Equivalents

(3) Total Net Leverage = Total Net Debt / LTM Adjusted EBITDA

($ in millions) @ 6/30/2017 Maturity

Cash and Cash Equivalents $482

Debt:

Revolver ($400 million capacity) - 2021

First Lien Term Loan (USD) 1,977 2024

First Lien Term Loan (EUR)(1) 451 2023

Total Senior Secured Debt $2,428

Senior Unsecured Notes (USD) 490 2024

Senior Unsecured Notes (EUR)(1) 377 2024

Senior Unsecured Notes (EUR)(1) 505 2025

Capital Leases 46

Other Borrowings 13

Total Debt $3,859

Total Net Debt(2) $3,377

LTM Adjusted EBITDA $885

Total Net Leverage (3) 3.8x

AXALTA COATING SYSTEMS

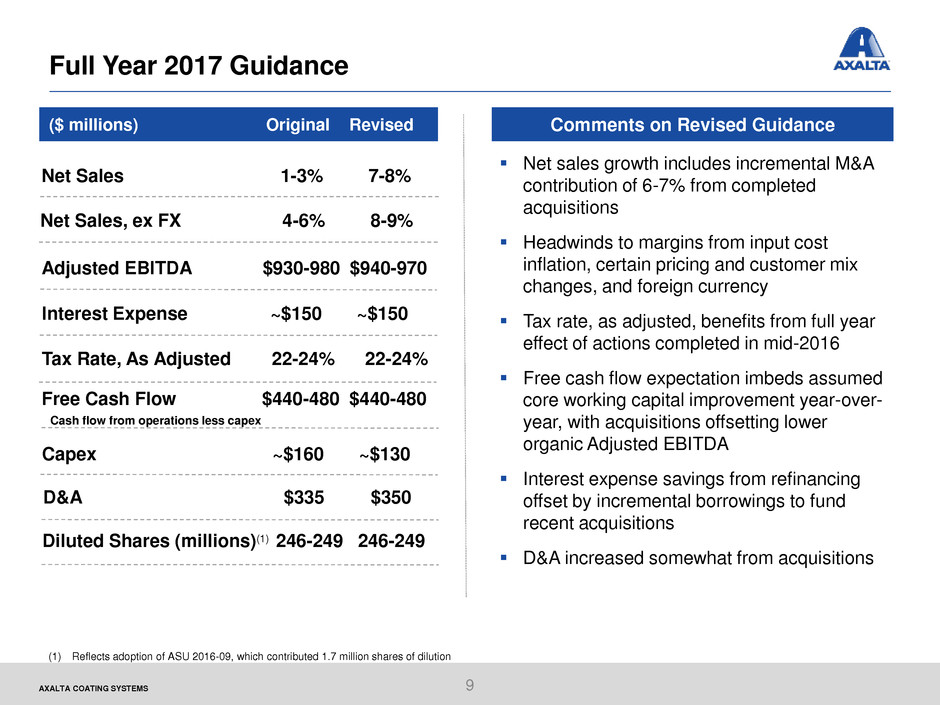

Full Year 2017 Guidance

Net sales growth includes incremental M&A

contribution of 6-7% from completed

acquisitions

Headwinds to margins from input cost

inflation, certain pricing and customer mix

changes, and foreign currency

Tax rate, as adjusted, benefits from full year

effect of actions completed in mid-2016

Free cash flow expectation imbeds assumed

core working capital improvement year-over-

year, with acquisitions offsetting lower

organic Adjusted EBITDA

Interest expense savings from refinancing

offset by incremental borrowings to fund

recent acquisitions

D&A increased somewhat from acquisitions

($ millions) Original Revised

Net Sales, ex FX 4-6% 8-9%

Tax Rate, As Adjusted 22-24% 22-24%

Free Cash Flow $440-480 $440-480

Cash flow from operations less capex

Comments on Revised Guidance

Interest Expense ~$150 ~$150

Adjusted EBITDA $930-980 $940-970

Net Sales 1-3% 7-8%

Capex ~$160 ~$130

9

Diluted Shares (millions)(1) 246-249 246-249

D&A $335 $350

(1) Reflects adoption of ASU 2016-09, which contributed 1.7 million shares of dilution

Appendix

AXALTA COATING SYSTEMS

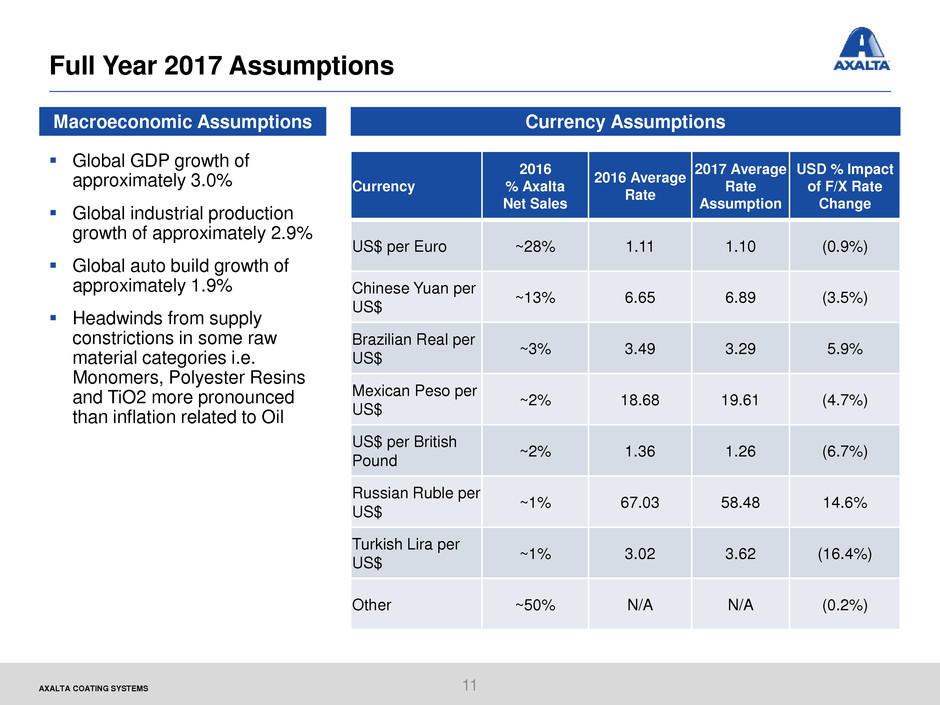

Full Year 2017 Assumptions

Global GDP growth of

approximately 3.0%

Global industrial production

growth of approximately 2.9%

Global auto build growth of

approximately 1.9%

Headwinds from supply

constrictions in some raw

material categories i.e.

Monomers, Polyester Resins

and TiO2 more pronounced

than inflation related to Oil

Currency

2016

% Axalta

Net Sales

2016 Average

Rate

2017 Average

Rate

Assumption

USD % Impact

of F/X Rate

Change

US$ per Euro ~28% 1.11 1.10 (0.9%)

Chinese Yuan per

US$

~13% 6.65 6.89 (3.5%)

Brazilian Real per

US$

~3% 3.49 3.29 5.9%

Mexican Peso per

US$

~2% 18.68 19.61 (4.7%)

US$ per British

Pound

~2% 1.36 1.26 (6.7%)

Russian Ruble per

US$

~1% 67.03 58.48 14.6%

Turkish Lira per

US$

~1% 3.02 3.62 (16.4%)

Other ~50% N/A N/A (0.2%)

Currency AssumptionsMacroeconomic Assumptions

11

AXALTA COATING SYSTEMS

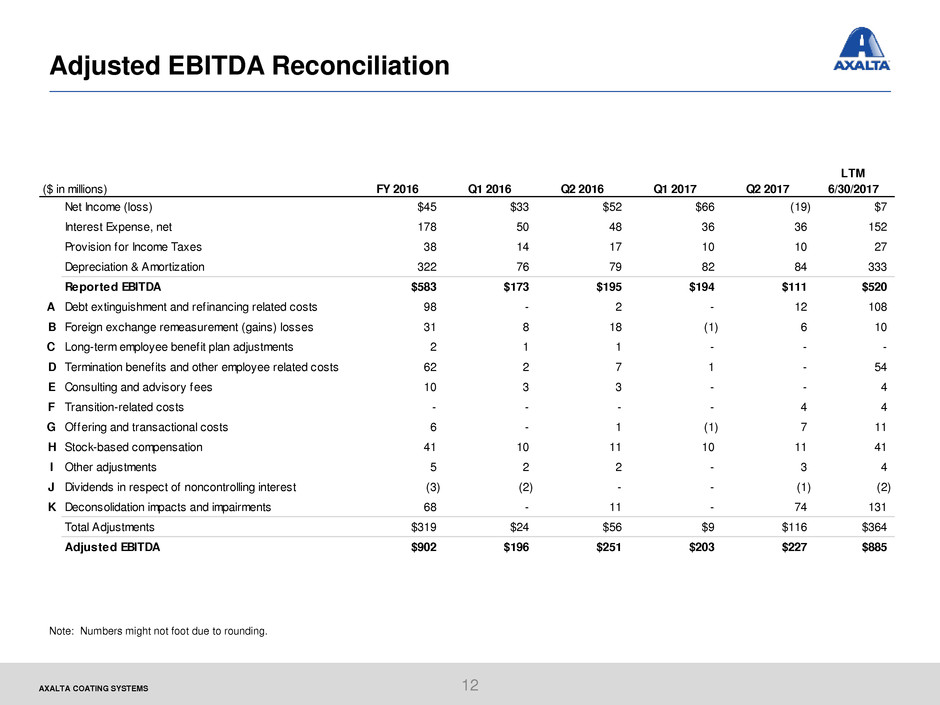

Adjusted EBITDA Reconciliation

Note: Numbers might not foot due to rounding.

12

($ in millions) FY 2016 Q1 2016 Q2 2016 Q1 2017 Q2 2017

LTM

6/30/2017

Net Income (loss) $45 $33 $52 $66 (19) $7

Interest Expense, net 178 50 48 36 36 152

Provision for Income Taxes 38 14 17 10 10 27

Depreciation & Amortization 322 76 79 82 84 333

Reported EBITDA $583 $173 $195 $194 $111 $520

A Debt extinguishment and refinancing related costs 98 - 2 - 12 108

B Foreign exchange remeasurement (gains) losses 31 8 18 (1) 6 10

C Long-term employee benefit plan adjustments 2 1 1 - - -

D Termination benefits and other employee related costs 62 2 7 1 - 54

E Consulting and advisory fees 10 3 3 - - 4

F Transition-related costs - - - - 4 4

G Offering and transactional costs 6 - 1 (1) 7 11

H Stock-based compensation 41 10 11 10 11 41

I Other adjustments 5 2 2 - 3 4

J Dividends in respect of noncontrolling interest (3) (2) - - (1) (2)

K Deconsolidation impacts and impairments 68 - 11 - 74 131

Total Adjustments $319 $24 $56 $9 $116 $364

Adjusted EBITDA $902 $196 $251 $203 $227 $885

AXALTA COATING SYSTEMS

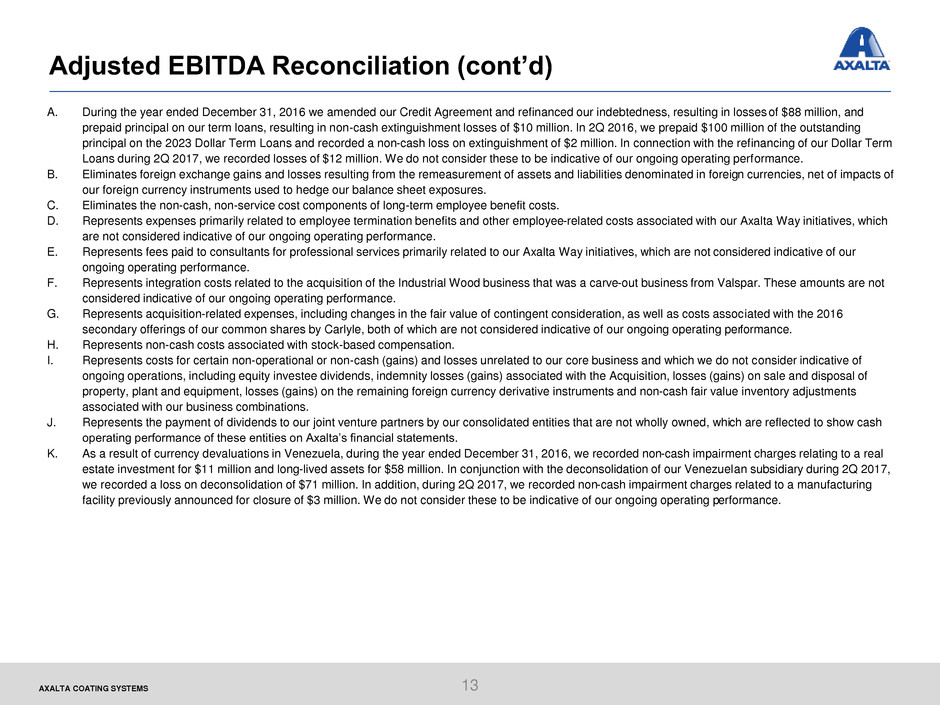

Adjusted EBITDA Reconciliation (cont’d)

13

A. During the year ended December 31, 2016 we amended our Credit Agreement and refinanced our indebtedness, resulting in losses of $88 million, and

prepaid principal on our term loans, resulting in non-cash extinguishment losses of $10 million. In 2Q 2016, we prepaid $100 million of the outstanding

principal on the 2023 Dollar Term Loans and recorded a non-cash loss on extinguishment of $2 million. In connection with the refinancing of our Dollar Term

Loans during 2Q 2017, we recorded losses of $12 million. We do not consider these to be indicative of our ongoing operating performance.

B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of

our foreign currency instruments used to hedge our balance sheet exposures.

C. Eliminates the non-cash, non-service cost components of long-term employee benefit costs.

D. Represents expenses primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which

are not considered indicative of our ongoing operating performance.

E. Represents fees paid to consultants for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our

ongoing operating performance.

F. Represents integration costs related to the acquisition of the Industrial Wood business that was a carve-out business from Valspar. These amounts are not

considered indicative of our ongoing operating performance.

G. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, as well as costs associated with the 2016

secondary offerings of our common shares by Carlyle, both of which are not considered indicative of our ongoing operating performance.

H. Represents non-cash costs associated with stock-based compensation.

I. Represents costs for certain non-operational or non-cash (gains) and losses unrelated to our core business and which we do not consider indicative of

ongoing operations, including equity investee dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of

property, plant and equipment, losses (gains) on the remaining foreign currency derivative instruments and non-cash fair value inventory adjustments

associated with our business combinations.

J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned, which are reflected to show cash

operating performance of these entities on Axalta’s financial statements.

K. As a result of currency devaluations in Venezuela, during the year ended December 31, 2016, we recorded non-cash impairment charges relating to a real

estate investment for $11 million and long-lived assets for $58 million. In conjunction with the deconsolidation of our Venezuelan subsidiary during 2Q 2017,

we recorded a loss on deconsolidation of $71 million. In addition, during 2Q 2017, we recorded non-cash impairment charges related to a manufacturing

facility previously announced for closure of $3 million. We do not consider these to be indicative of our ongoing operating performance.

AXALTA COATING SYSTEMS

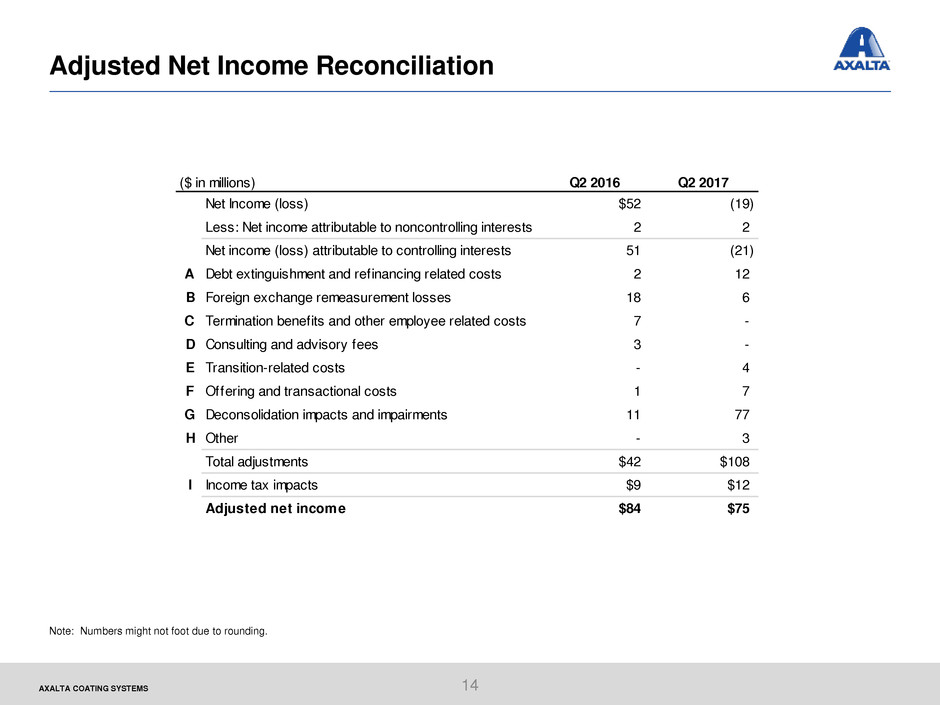

Adjusted Net Income Reconciliation

Note: Numbers might not foot due to rounding.

14

($ in millions) Q2 2016 Q2 2017

Net Income (loss) $52 (19)

Less: Net income attributable to noncontrolling interests 2 2

Net income (loss) attributable to controlling interests 51 (21)

A Debt extinguishment and refinancing related costs 2 12

B Foreign exchange remeasurement losses 18 6

C Termination benefits and other employee related costs 7 -

D Consulting and advisory fees 3 -

E Transition-related costs - 4

F Offering and transactional costs 1 7

G Deconsolidation impacts and impairments 11 77

H Other - 3

Total adjustments $42 $108

I Income tax impacts $9 $12

Adjusted net income $84 $75

AXALTA COATING SYSTEMS

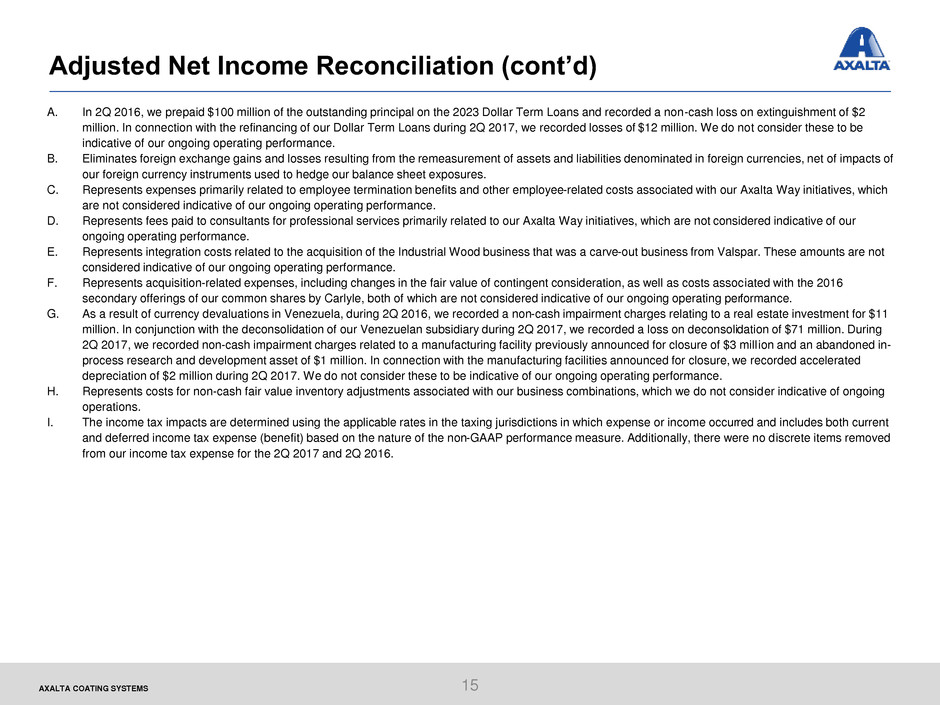

Adjusted Net Income Reconciliation (cont’d)

15

A. In 2Q 2016, we prepaid $100 million of the outstanding principal on the 2023 Dollar Term Loans and recorded a non-cash loss on extinguishment of $2

million. In connection with the refinancing of our Dollar Term Loans during 2Q 2017, we recorded losses of $12 million. We do not consider these to be

indicative of our ongoing operating performance.

B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of

our foreign currency instruments used to hedge our balance sheet exposures.

C. Represents expenses primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which

are not considered indicative of our ongoing operating performance.

D. Represents fees paid to consultants for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our

ongoing operating performance.

E. Represents integration costs related to the acquisition of the Industrial Wood business that was a carve-out business from Valspar. These amounts are not

considered indicative of our ongoing operating performance.

F. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, as well as costs associated with the 2016

secondary offerings of our common shares by Carlyle, both of which are not considered indicative of our ongoing operating performance.

G. As a result of currency devaluations in Venezuela, during 2Q 2016, we recorded a non-cash impairment charges relating to a real estate investment for $11

million. In conjunction with the deconsolidation of our Venezuelan subsidiary during 2Q 2017, we recorded a loss on deconsolidation of $71 million. During

2Q 2017, we recorded non-cash impairment charges related to a manufacturing facility previously announced for closure of $3 mill ion and an abandoned in-

process research and development asset of $1 million. In connection with the manufacturing facilities announced for closure, we recorded accelerated

depreciation of $2 million during 2Q 2017. We do not consider these to be indicative of our ongoing operating performance.

H. Represents costs for non-cash fair value inventory adjustments associated with our business combinations, which we do not consider indicative of ongoing

operations.

I. The income tax impacts are determined using the applicable rates in the taxing jurisdictions in which expense or income occurred and includes both current

and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure. Additionally, there were no discrete items removed

from our income tax expense for the 2Q 2017 and 2Q 2016.

Thank you

Investor Relations Contact:

Chris Mecray

Christopher.Mecray@axaltacs.com

215-255-7970