EXHIBIT 99.1

Published on August 24, 2017

Axalta Coating Systems Ltd.

Investor Presentation

Second Quarter 2017

Exhibit 99.1

PROPRIETARYAXALTA COATING SYSTEMS 2

Legal Notices

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating

to 2017 financial projections, including execution on our 2017 goals as well as 2017 net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures,

depreciation and amortization, diluted shares outstanding, cost savings, contributions from acquisitions, raw material cost increases, and related assumptions. Any forward-looking statements involve risks,

uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,”

or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future

developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of

the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak

only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking

statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including,

but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended

December 31, 2016 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017 and June 30, 2017.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”),

including net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and

operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense, (ii) the impact of certain

non-cash, nonrecurring or other items that are included in net income and EBITDA that we do not consider indicative of our ongoing performance and (iii) certain unusual or nonrecurring items impacting results in a

particular period. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period

basis. Our use of the terms net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales excluding FX, EBITDA,

Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating

performance or operating cash flows or as measures of liquidity. Net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools

and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly

comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow or tax

rate, as adjusted, as-reported on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For

example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or

project those items and they may have a substantial and unpredictable impact on our US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year

financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this

non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

PROPRIETARYAXALTA COATING SYSTEMS

2014-2017

November 2014 IPO (NYSE: AXTA)

Expand capacity in China, Germany,

Mexico and Brazil

Build Asia-Pacific Technology Center in

Shanghai

Acquire Valspar’s Wood business (N.A.),

Dura Coat (U.S.), Spencer (U.K.) & other

smaller transactions

Announce Global Innovation Center in

Philadelphia, PA

Announce investment in India to double

capacity

Introduce Ganicin™ corrosion-resistant

coating system for industrial applications

Launch AquaEC 6100

Enhance powder coating facility in

Montbrison, France

Introduce SyroxTM mainstream waterborne

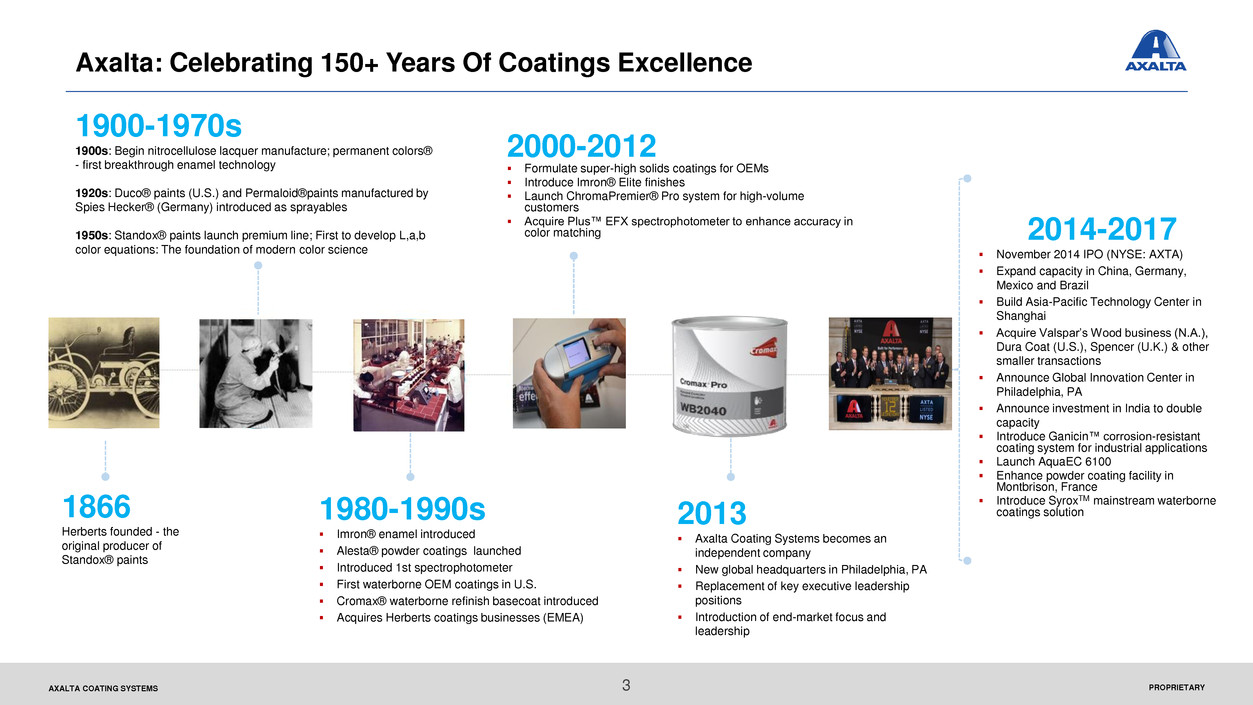

coatings solution1866

Herberts founded - the

original producer of

Standox® paints

2000-2012

Formulate super-high solids coatings for OEMs

Introduce Imron® Elite finishes

Launch ChromaPremier® Pro system for high-volume

customers

Acquire Plus™ EFX spectrophotometer to enhance accuracy in

color matching

1900-1970s

1900s: Begin nitrocellulose lacquer manufacture; permanent colors®

- first breakthrough enamel technology

1920s: Duco® paints (U.S.) and Permaloid®paints manufactured by

Spies Hecker® (Germany) introduced as sprayables

1950s: Standox® paints launch premium line; First to develop L,a,b

color equations: The foundation of modern color science

1980-1990s

Imron® enamel introduced

Alesta® powder coatings launched

Introduced 1st spectrophotometer

First waterborne OEM coatings in U.S.

Cromax® waterborne refinish basecoat introduced

Acquires Herberts coatings businesses (EMEA)

2013

Axalta Coating Systems becomes an

independent company

New global headquarters in Philadelphia, PA

Replacement of key executive leadership

positions

Introduction of end-market focus and

leadership

Axalta: Celebrating 150+ Years Of Coatings Excellence

2

0

1

4

3

PROPRIETARYAXALTA COATING SYSTEMS

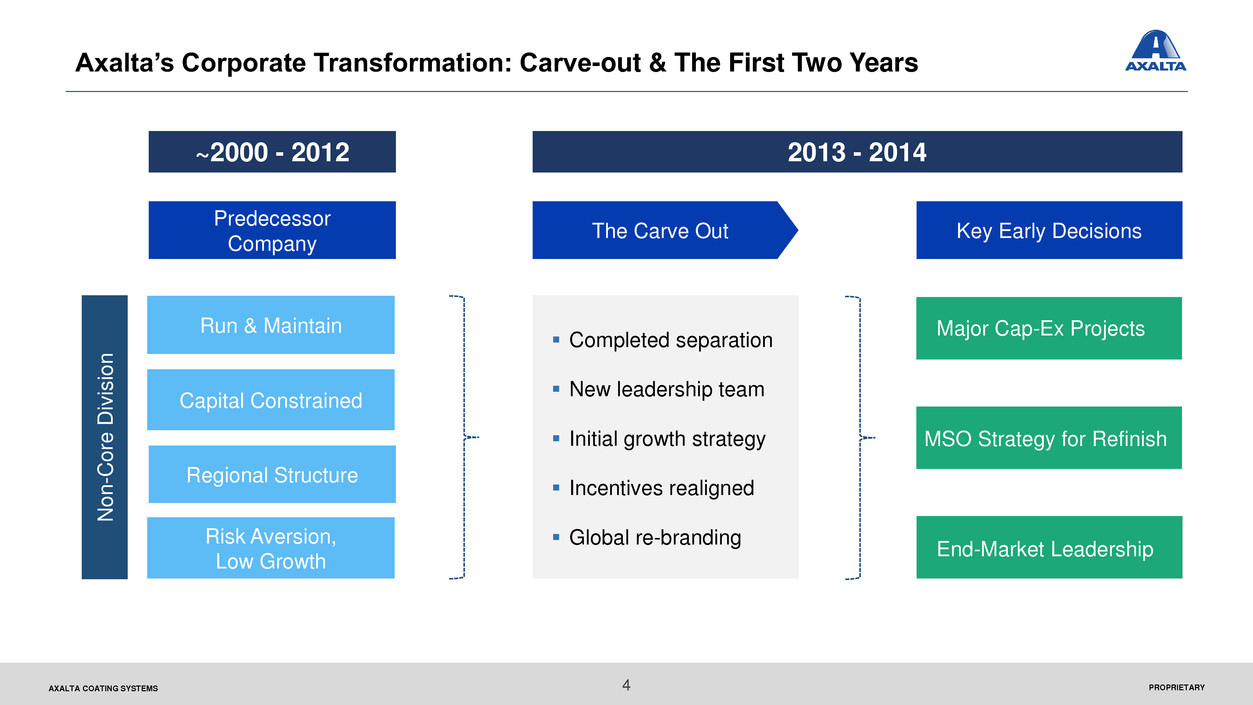

Axalta’s Corporate Transformation: Carve-out & The First Two Years

Completed separation

New leadership team

Initial growth strategy

Incentives realigned

Global re-branding

N

o

n

-Core

D

iv

is

io

n

The Carve Out

Run & Maintain

Regional Structure

Capital Constrained

Risk Aversion,

Low Growth

Predecessor

Company

~2000 - 2012 2013 - 2014

4

Major Cap-Ex Projects

MSO Strategy for Refinish

End-Market Leadership

Key Early Decisions

PROPRIETARYAXALTA COATING SYSTEMS

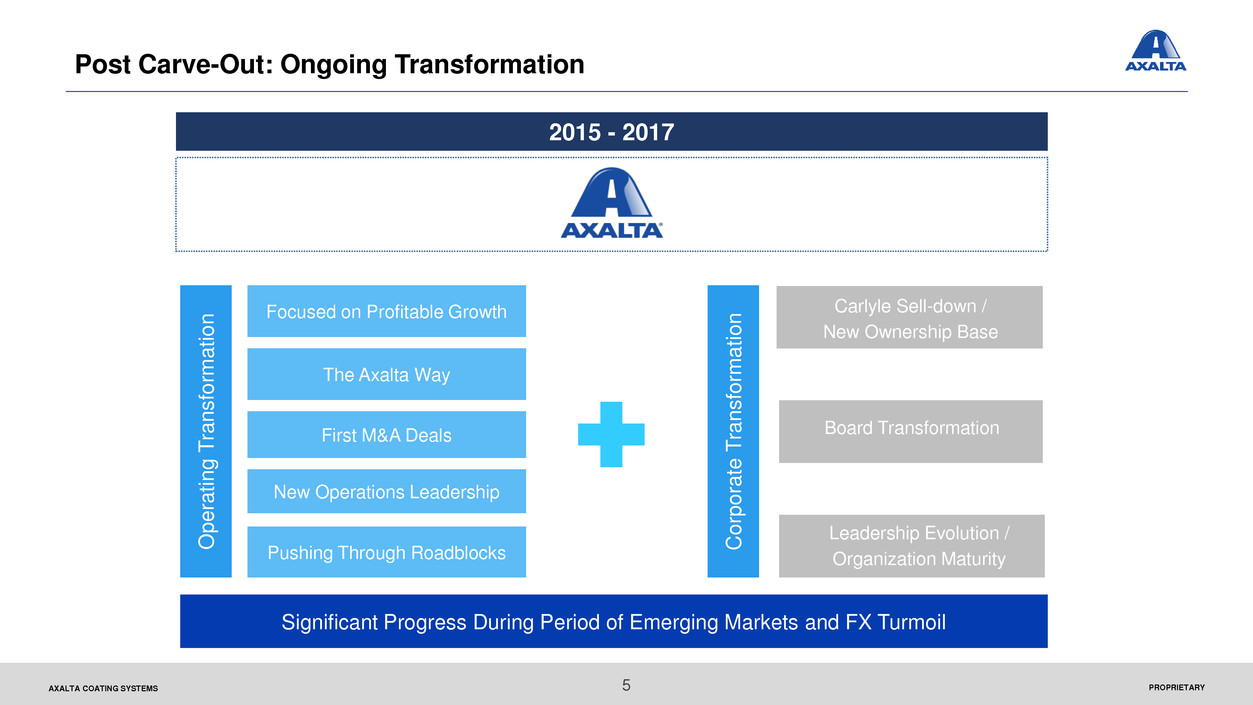

Post Carve-Out: Ongoing Transformation

O

perati

n

g

T

ransformat

io

n Focused on Profitable Growth

The Axalta Way

First M&A Deals

Pushing Through Roadblocks

New Operations Leadership

2015 - 2017

5

Carlyle Sell-down /

New Ownership Base

Board Transformation

Leadership Evolution /

Organization Maturity

Significant Progress During Period of Emerging Markets and FX Turmoil

Corpo

rate

T

ransformat

io

n

PROPRIETARYAXALTA COATING SYSTEMS

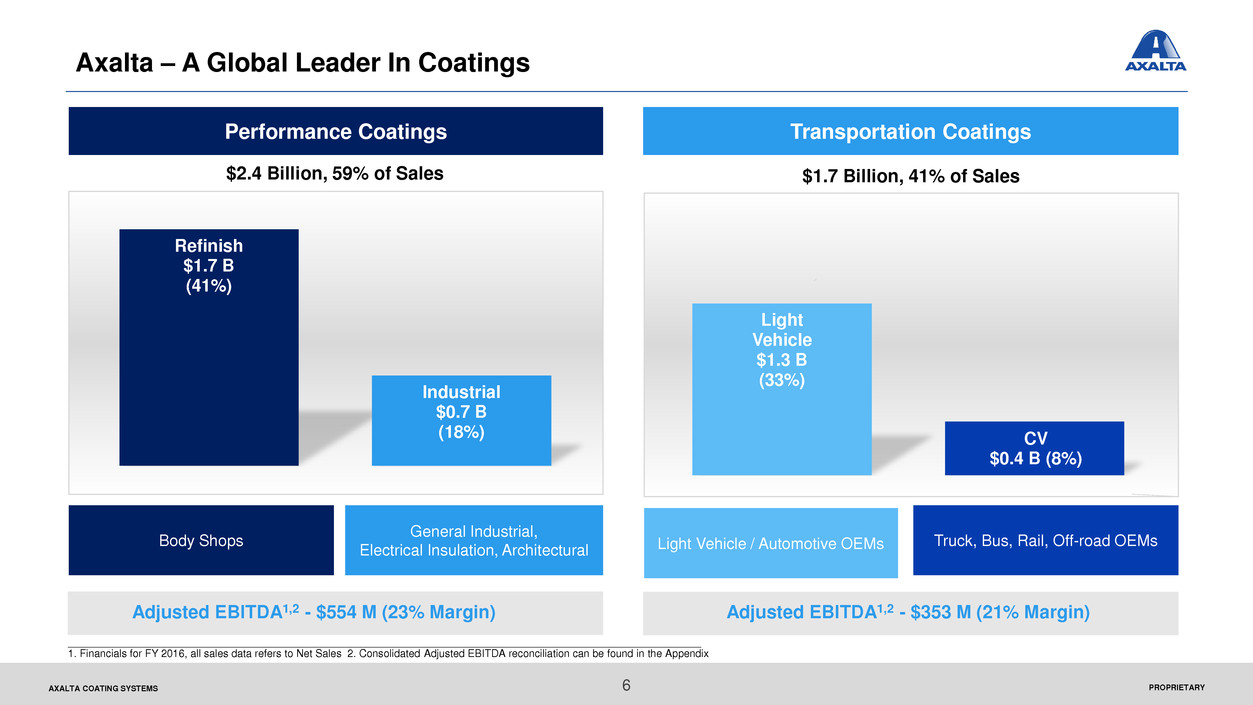

Refinish

$1.7 B

(41%)

Industrial

$0.7 B

(18%)

Body Shops

Light

Vehicle

$1.3 B

(33%)

CV

$0.4 B (8%)

Performance Coatings

General Industrial,

Electrical Insulation, Architectural

Transportation Coatings

Adjusted EBITDA1,2 - $554 M (23% Margin) Adjusted EBITDA1,2 - $353 M (21% Margin)

Light Vehicle / Automotive OEMs Truck, Bus, Rail, Off-road OEMs

____________________________________________________________________________________________________________

1. Financials for FY 2016, all sales data refers to Net Sales 2. Consolidated Adjusted EBITDA reconciliation can be found in the Appendix

Axalta – A Global Leader In Coatings

$2.4 Billion, 59% of Sales $1.7 Billion, 41% of Sales

6

PROPRIETARYAXALTA COATING SYSTEMS

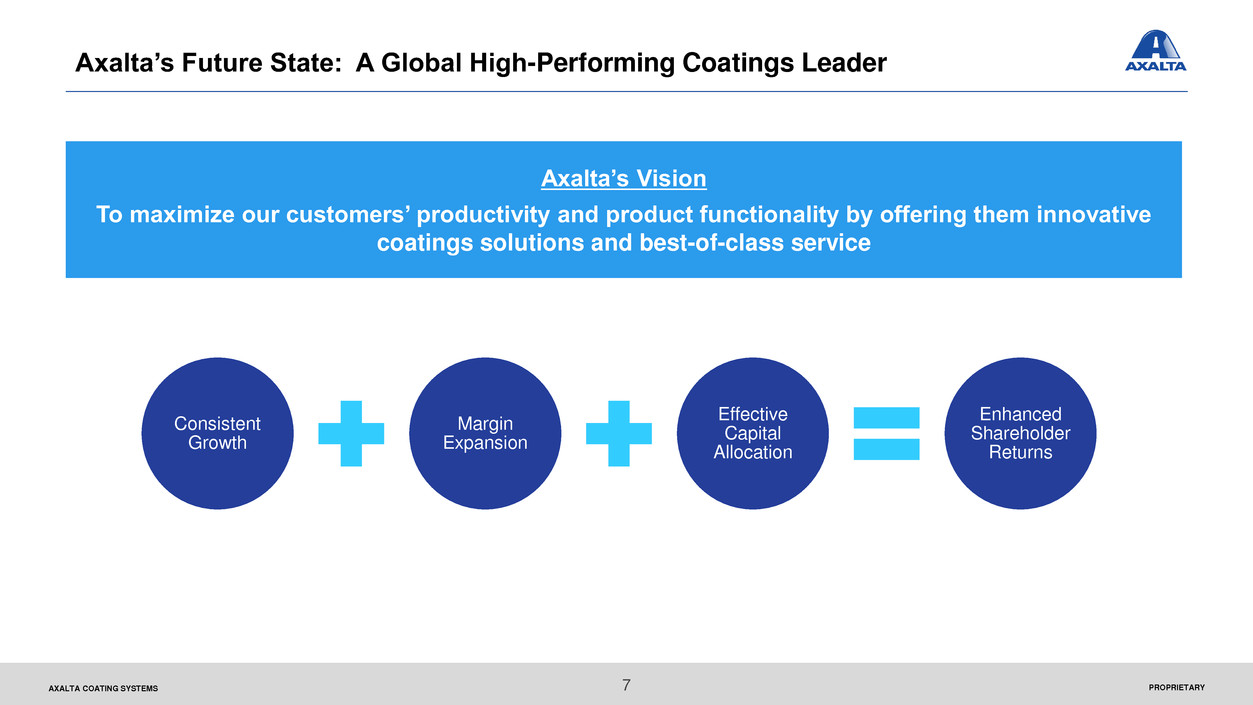

Axalta’s Future State: A Global High-Performing Coatings Leader

Consistent

Growth

Margin

Expansion

Effective

Capital

Allocation

Enhanced

Shareholder

Returns

Axalta’s Vision

To maximize our customers’ productivity and product functionality by offering them innovative

coatings solutions and best-of-class service

7

PROPRIETARYAXALTA COATING SYSTEMS

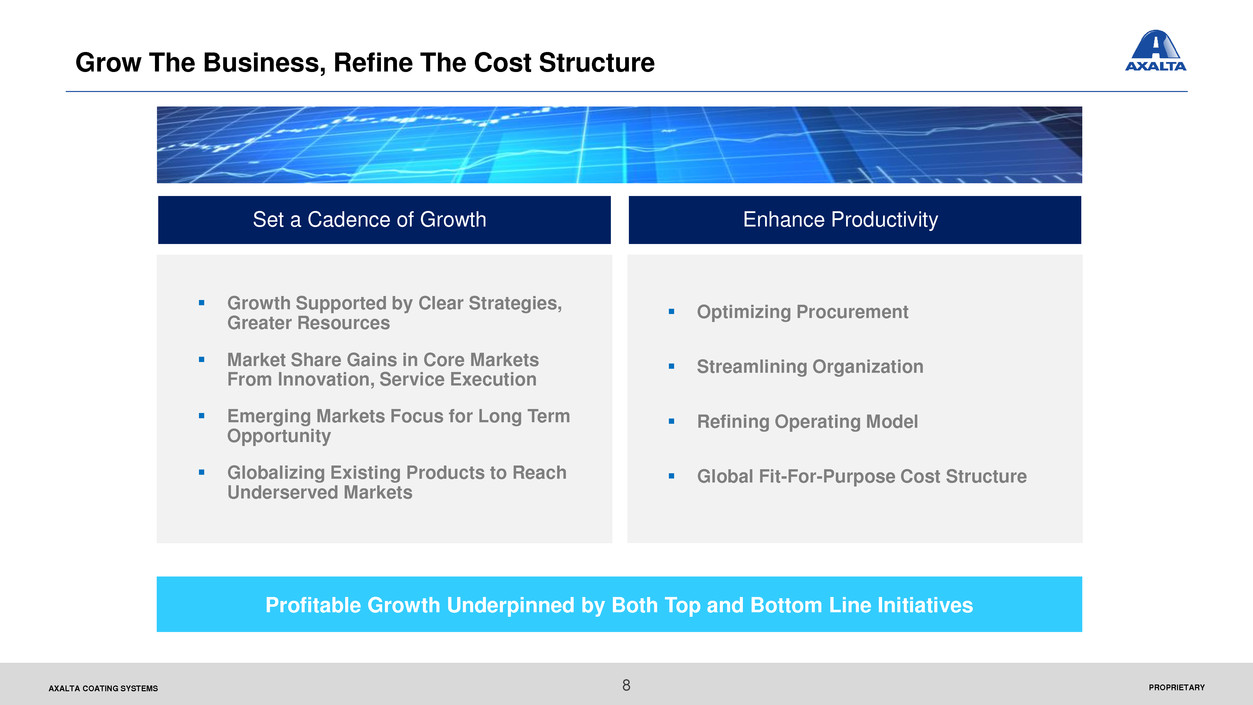

Grow The Business, Refine The Cost Structure

Growth Supported by Clear Strategies,

Greater Resources

Market Share Gains in Core Markets

From Innovation, Service Execution

Emerging Markets Focus for Long Term

Opportunity

Globalizing Existing Products to Reach

Underserved Markets

Optimizing Procurement

Streamlining Organization

Refining Operating Model

Global Fit-For-Purpose Cost Structure

Profitable Growth Underpinned by Both Top and Bottom Line Initiatives

8

Enhance ProductivitySet a Cadence of Growth

PROPRIETARYAXALTA COATING SYSTEMS

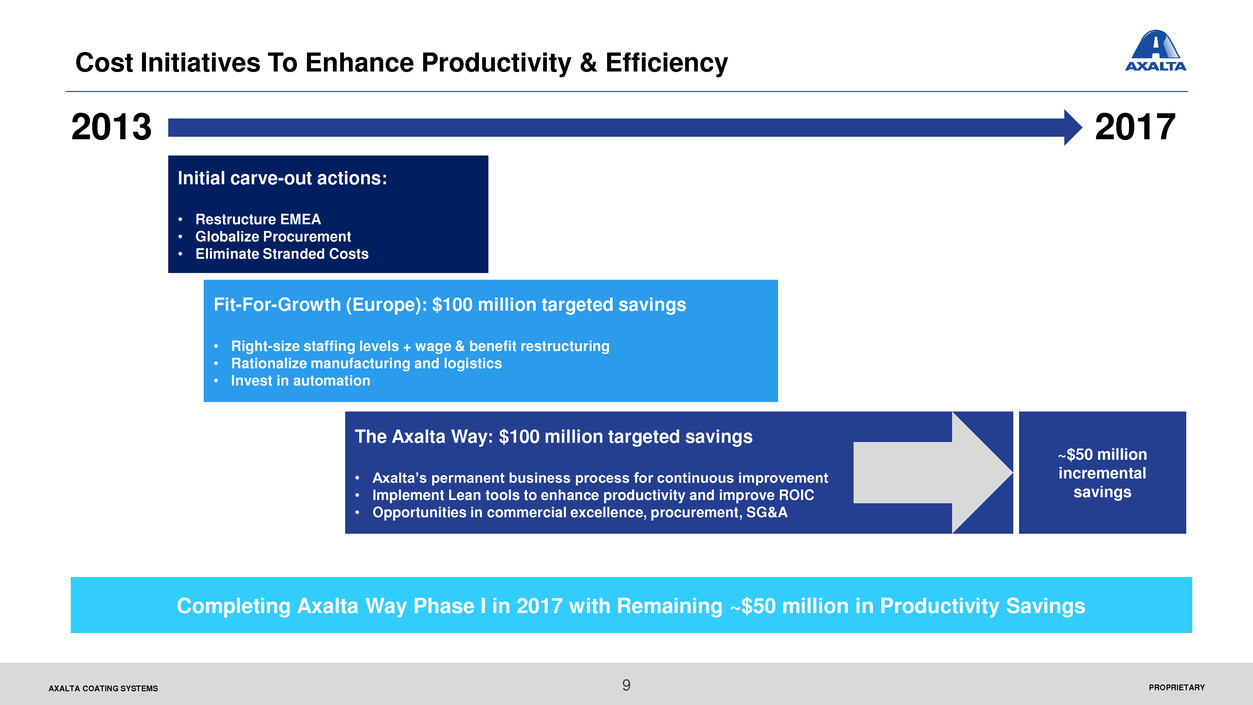

Cost Initiatives To Enhance Productivity & Efficiency

Fit-For-Growth (Europe): $100 million targeted savings

• Right-size staffing levels + wage & benefit restructuring

• Rationalize manufacturing and logistics

• Invest in automation

Initial carve-out actions:

• Restructure EMEA

• Globalize Procurement

• Eliminate Stranded Costs

The Axalta Way: $100 million targeted savings

• Axalta’s permanent business process for continuous improvement

• Implement Lean tools to enhance productivity and improve ROIC

• Opportunities in commercial excellence, procurement, SG&A

2013 2017

~$50 million

incremental

savings

Completing Axalta Way Phase I in 2017 with Remaining ~$50 million in Productivity Savings

9

PROPRIETARYAXALTA COATING SYSTEMS

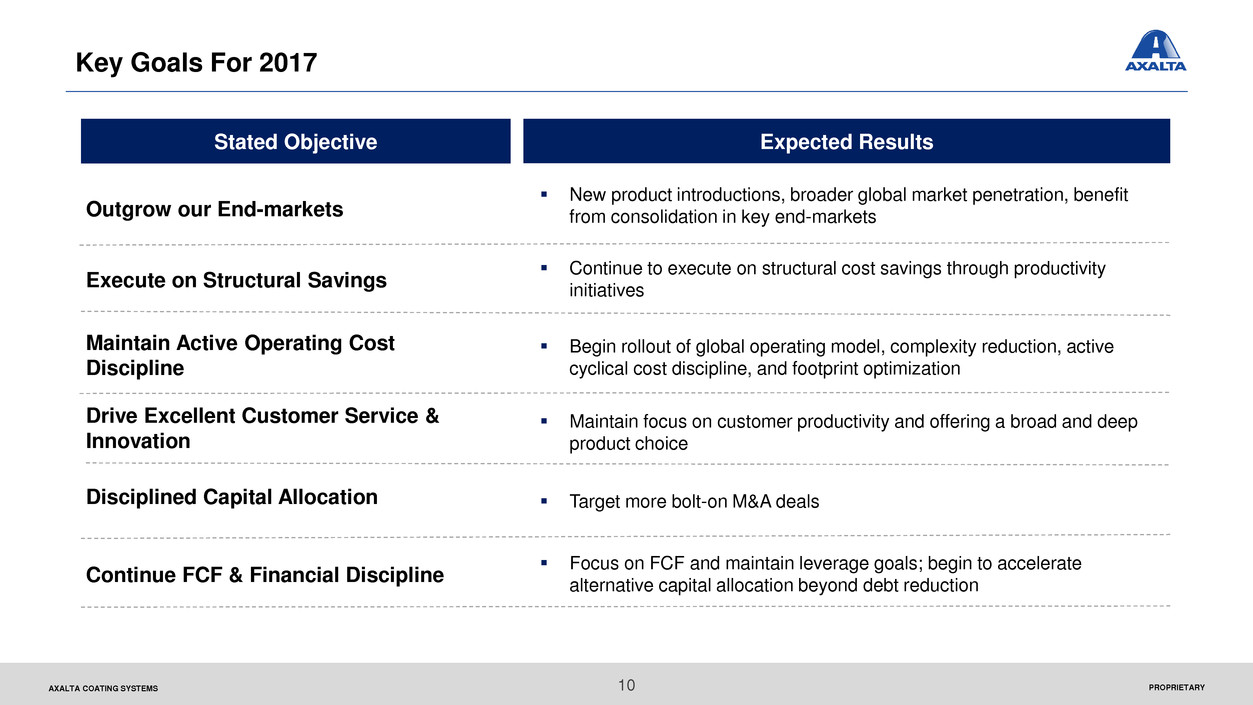

Key Goals For 2017

Outgrow our End-markets

Stated Objective Expected Results

Drive Excellent Customer Service &

Innovation

Maintain Active Operating Cost

Discipline

Execute on Structural Savings

Disciplined Capital Allocation

Continue FCF & Financial Discipline

New product introductions, broader global market penetration, benefit

from consolidation in key end-markets

Begin rollout of global operating model, complexity reduction, active

cyclical cost discipline, and footprint optimization

Continue to execute on structural cost savings through productivity

initiatives

Target more bolt-on M&A deals

Focus on FCF and maintain leverage goals; begin to accelerate

alternative capital allocation beyond debt reduction

Maintain focus on customer productivity and offering a broad and deep

product choice

10

PROPRIETARYAXALTA COATING SYSTEMS

Axalta Operates Fundamentally Strong Businesses

Global Market Leadership Positions

Significant Competitive Advantages

A Service-Led Business Model

Structurally Attractive Global End Markets

Highly Variable Cost Structure & Low Capital Intensity

11

PROPRIETARYAXALTA COATING SYSTEMS

Global Market Leadership Positions

Axalta’s Global Scale Enables Market Leadership

_______________________________________________

Information as of FY 2016, all sales data refers to Net Sales

1. Mexico is included in Latin America

2. Includes 12 JV facilities.

50 manufacturing

facilities

48 customer

training sites

4 technology

centers

~13,600

employees, ~130

countries

North America1

35% Sales

Latin America1

11% of Sales

Asia Pacific

18% of Sales

EMEA

36% of Sales

Manufacturing Facility2 Technology Center

12

PROPRIETARYAXALTA COATING SYSTEMS

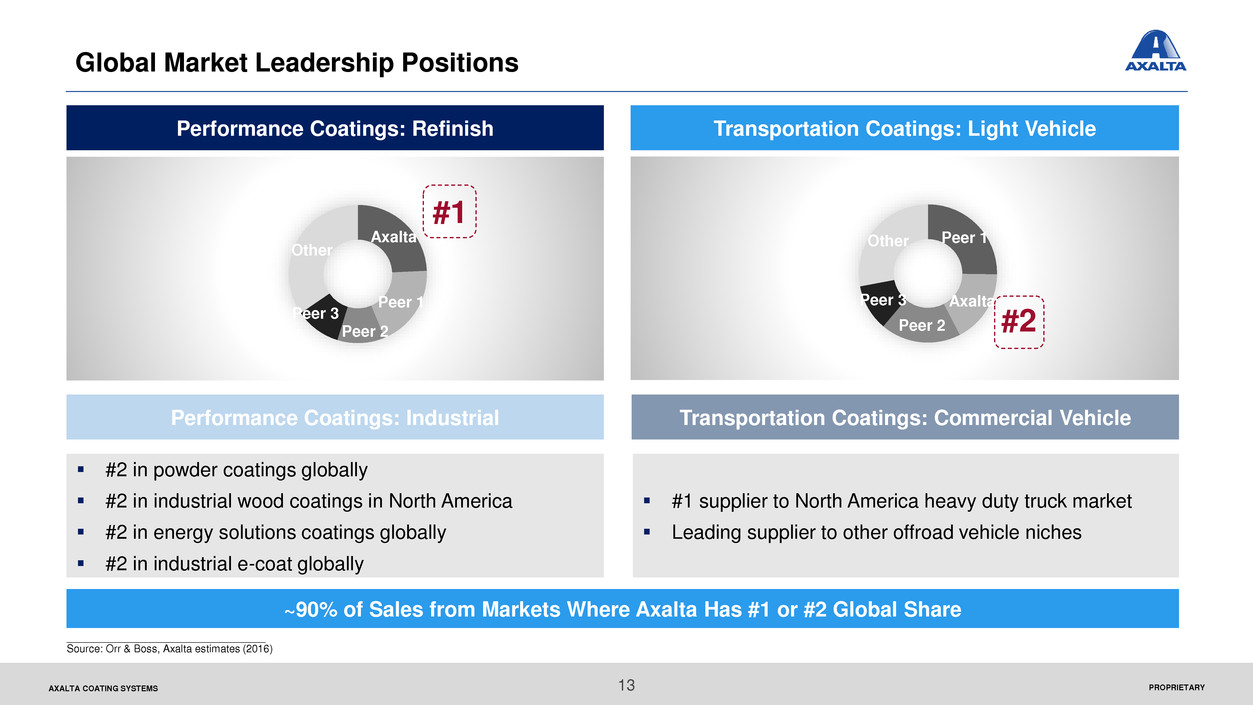

Global Market Leadership Positions

Peer 1

Axalta

Peer 2

Peer 3

Other

~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share

Axalta

Peer 1

Peer 2

Peer 3

Other

Performance Coatings: Refinish Transportation Coatings: Light Vehicle

#1

__________________________________

Source: Orr & Boss, Axalta estimates (2016)

#2

Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle

#2 in powder coatings globally

#2 in industrial wood coatings in North America

#2 in energy solutions coatings globally

#2 in industrial e-coat globally

#1 supplier to North America heavy duty truck market

Leading supplier to other offroad vehicle niches

13

PROPRIETARYAXALTA COATING SYSTEMS

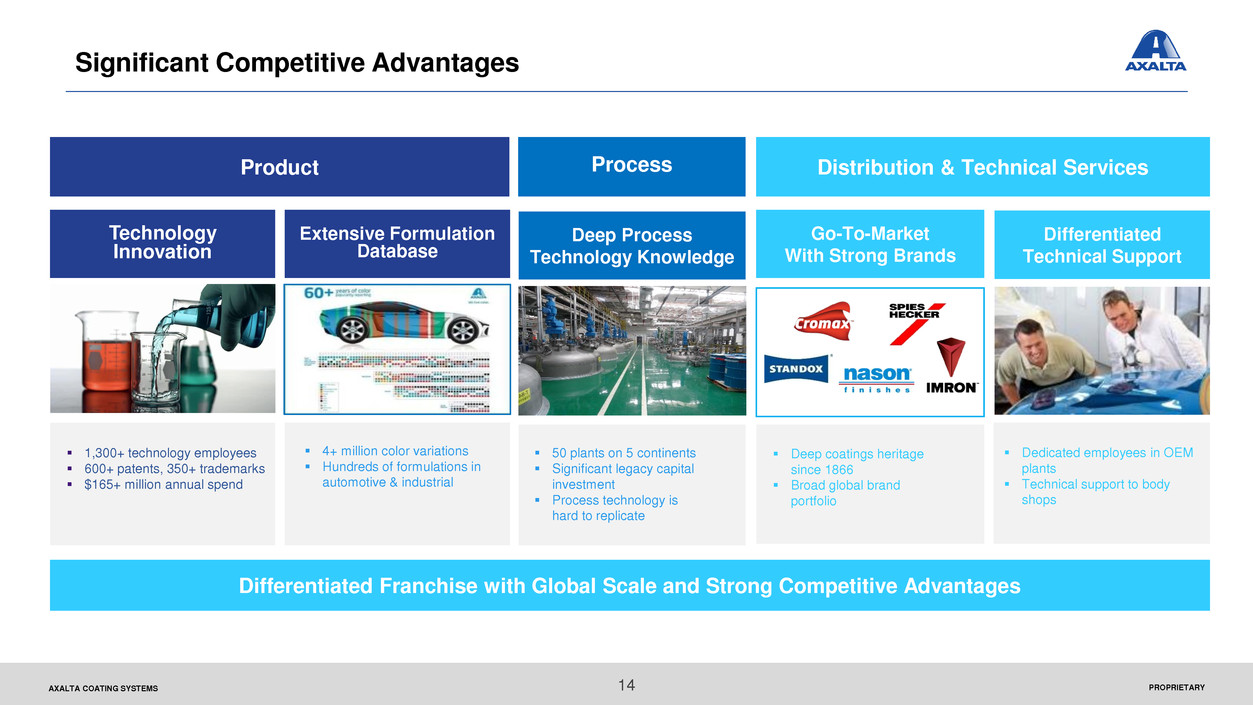

Significant Competitive Advantages

Differentiated Franchise with Global Scale and Strong Competitive Advantages

4+ million color variations

Hundreds of formulations in

automotive & industrial

Deep coatings heritage

since 1866

Broad global brand

portfolio

1,300+ technology employees

600+ patents, 350+ trademarks

$165+ million annual spend

50 plants on 5 continents

Significant legacy capital

investment

Process technology is

hard to replicate

Dedicated employees in OEM

plants

Technical support to body

shops

Technology

Innovation

Extensive Formulation

Database

Deep Process

Technology Knowledge

Go-To-Market

With Strong Brands

Differentiated

Technical Support

Product Process Distribution & Technical Services

14

PROPRIETARYAXALTA COATING SYSTEMS

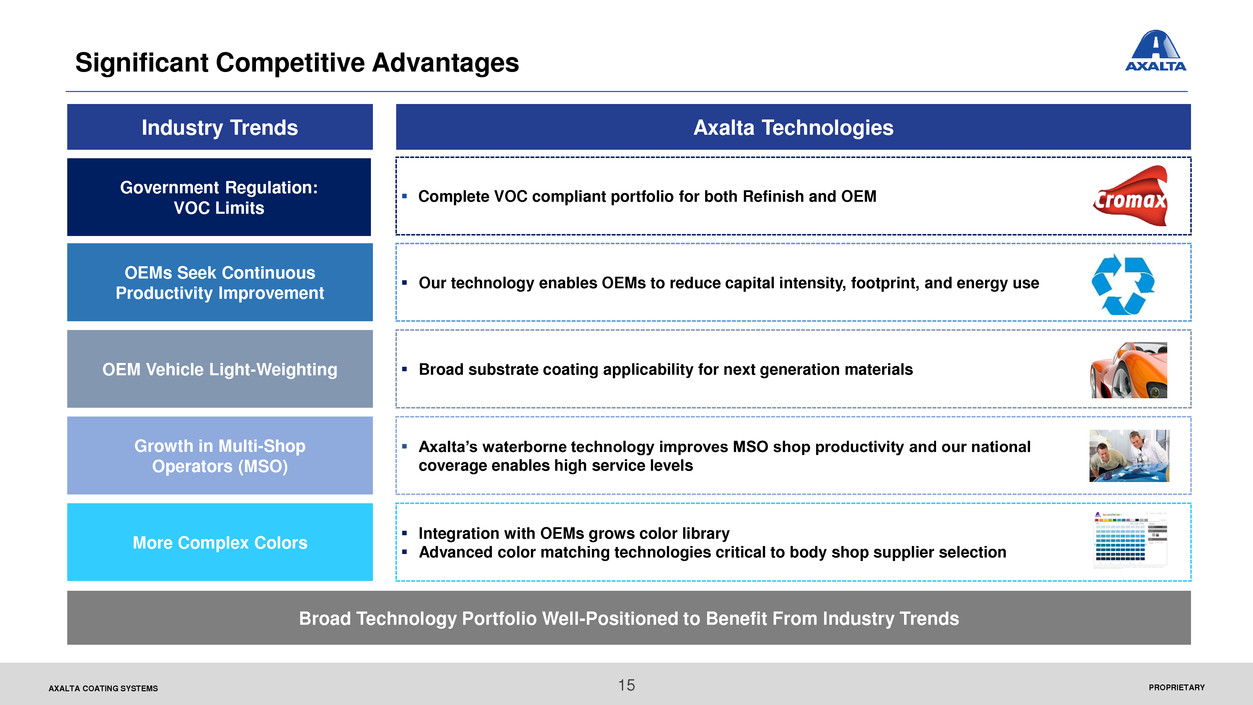

Industry Trends Axalta Technologies

OEM Vehicle Light-Weighting Broad substrate coating applicability for next generation materials

Growth in Multi-Shop

Operators (MSO)

Axalta’s waterborne technology improves MSO shop productivity and our national

coverage enables high service levels

Significant Competitive Advantages

More Complex Colors

Integration with OEMs grows color library

Advanced color matching technologies critical to body shop supplier selection

Our technology enables OEMs to reduce capital intensity, footprint, and energy use

OEMs Seek Continuous

Productivity Improvement

Government Regulation:

VOC Limits

Complete VOC compliant portfolio for both Refinish and OEM

Broad Technology Portfolio Well-Positioned to Benefit From Industry Trends

15

PROPRIETARYAXALTA COATING SYSTEMS

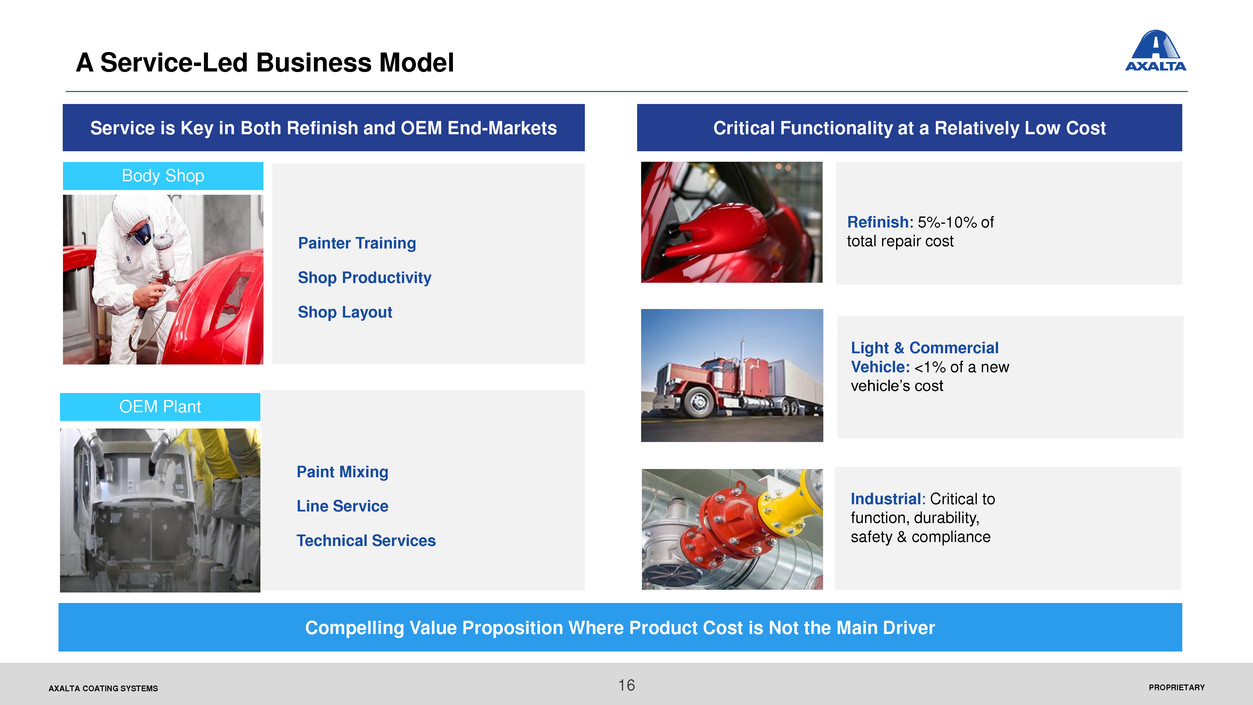

A Service-Led Business Model

Critical Functionality at a Relatively Low Cost

1

Compelling Value Proposition Where Product Cost is Not the Main Driver

Light & Commercial

Vehicle: <1% of a new

vehicle’s cost

Industrial: Critical to

function, durability,

safety & compliance

Refinish: 5%-10% of

total repair cost

Body Shop

OEM Plant

Service is Key in Both Refinish and OEM End-Markets

Painter Training

Shop Productivity

Shop Layout

Paint Mixing

Line Service

Technical Services

16

PROPRIETARYAXALTA COATING SYSTEMS

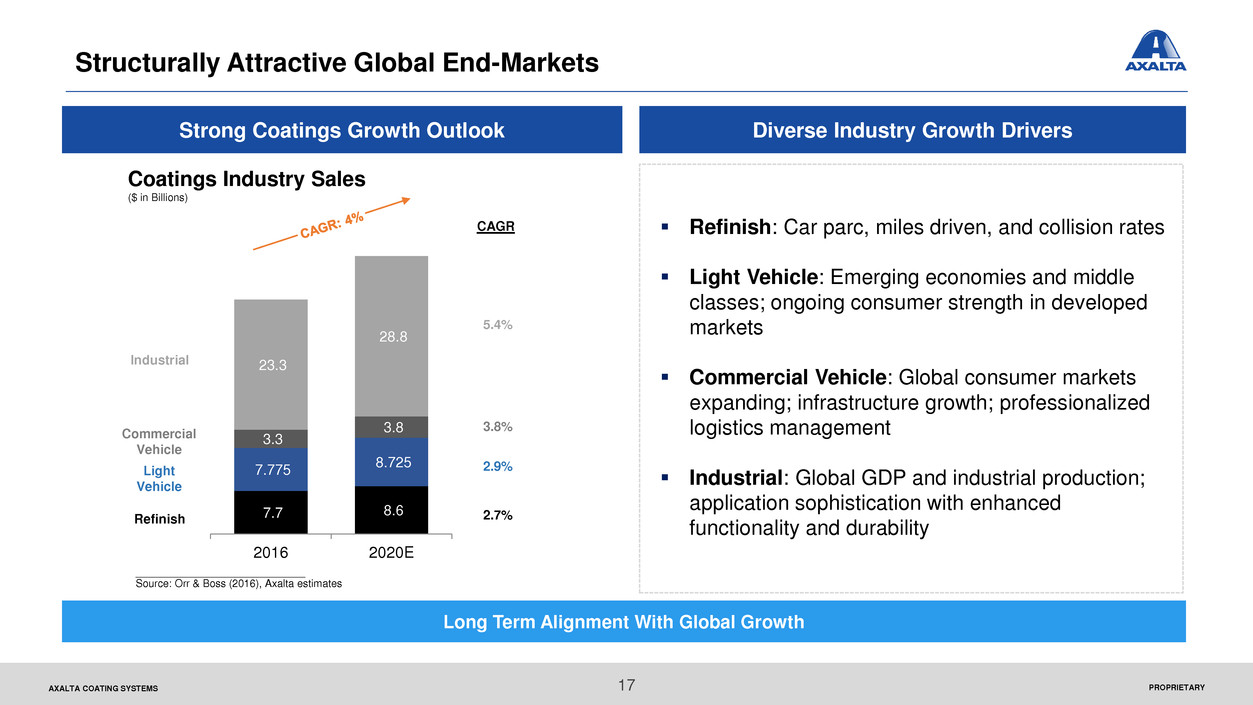

Structurally Attractive Global End-Markets

Strong Coatings Growth Outlook

Long Term Alignment With Global Growth

Refinish: Car parc, miles driven, and collision rates

Light Vehicle: Emerging economies and middle

classes; ongoing consumer strength in developed

markets

Commercial Vehicle: Global consumer markets

expanding; infrastructure growth; professionalized

logistics management

Industrial: Global GDP and industrial production;

application sophistication with enhanced

functionality and durability

Diverse Industry Growth Drivers

Commercial

Vehicle

Light

Vehicle

Refinish

Industrial

5.4%

3.8%

2.9%

2.7%

CAGR

Coatings Industry Sales

($ in Billions)

_____________________________

Source: Orr & Boss (2016), Axalta estimates

7.7 8.6

7.775

8.725

3.3

3.8

23.3

28.8

2016 2020E

17

PROPRIETARYAXALTA COATING SYSTEMS

Highly Variable Cost Structure & Low Capital Intensity

~45-55% of COGS come from variable raw

material inputs

Utilize temporary labor to enable wage structure

flexibility

Toggle other costs as needed in a downturn,

including both variable and semi-fixed

Low Capital Intensity

Capex at $136 million is 3.3% of sales, but only

1.2% for maintenance capex

Batch production process is inherently flexible

Capacity additions are very modular to minimize

stranded cost impacts

Variable Cost Structure

Well Positioned to React to Cyclical Downturns

18

PROPRIETARYAXALTA COATING SYSTEMS

Axalta’s Evolution Is Grounded In Fundamental Goals

Focus on operational excellence and foster a culture of accountability

Axalta’s Strategy

Grow in targeted industrial coatings segments via organic growth and selective acquisitions

Move into attractive adjacencies by leveraging our global technology and service capabilities

Grow in existing markets with our industry-leading products and services

19

PROPRIETARYAXALTA COATING SYSTEMS

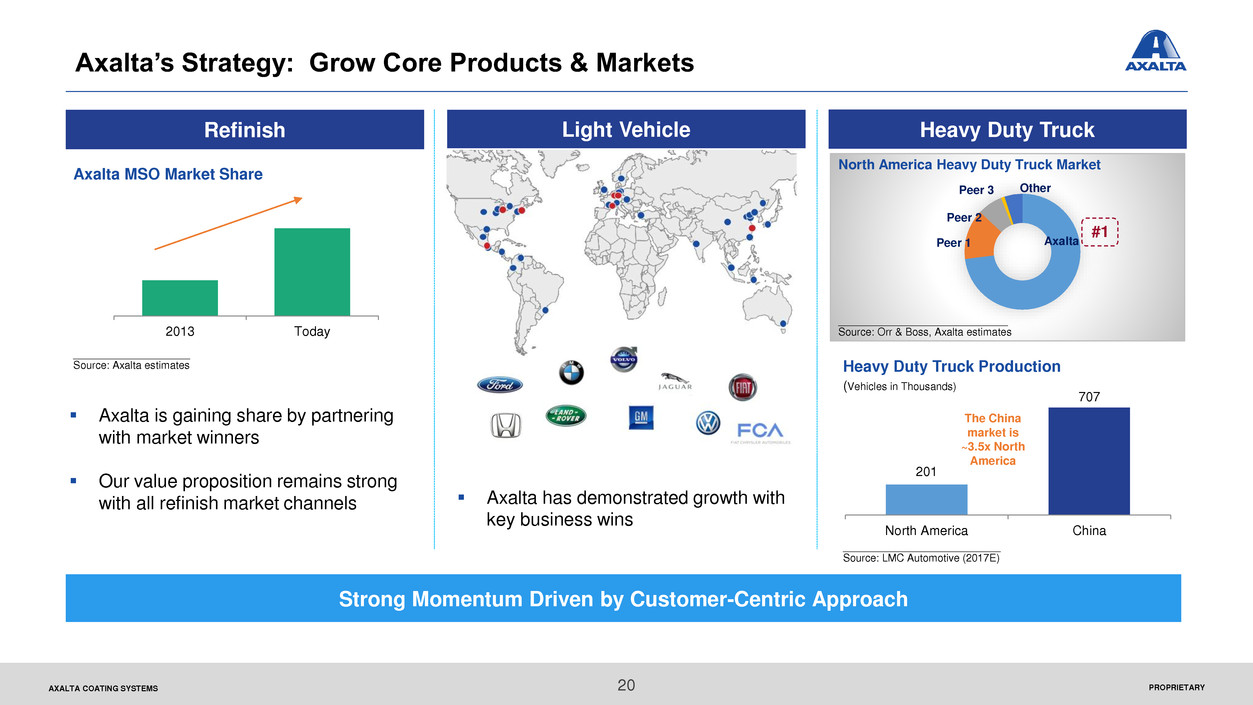

Axalta’s Strategy: Grow Core Products & Markets

Refinish

____________________

Source: Axalta estimates

Strong Momentum Driven by Customer-Centric Approach

Axalta MSO Market Share

2013 Today

Light Vehicle

Axalta is gaining share by partnering

with market winners

Our value proposition remains strong

with all refinish market channels

Heavy Duty Truck

AxaltaPeer 1

Peer 2

Peer 3 Other

#1

North America Heavy Duty Truck Market

(Vehicles in Thousands)

Heavy Duty Truck Production

201

707

North America China

The China

market is

~3.5x North

America

_____________________________

Source: Orr & Boss, Axalta estimates

___________________________

Source: LMC Automotive (2017E)

Axalta has demonstrated growth with

key business wins

20

PROPRIETARYAXALTA COATING SYSTEMS

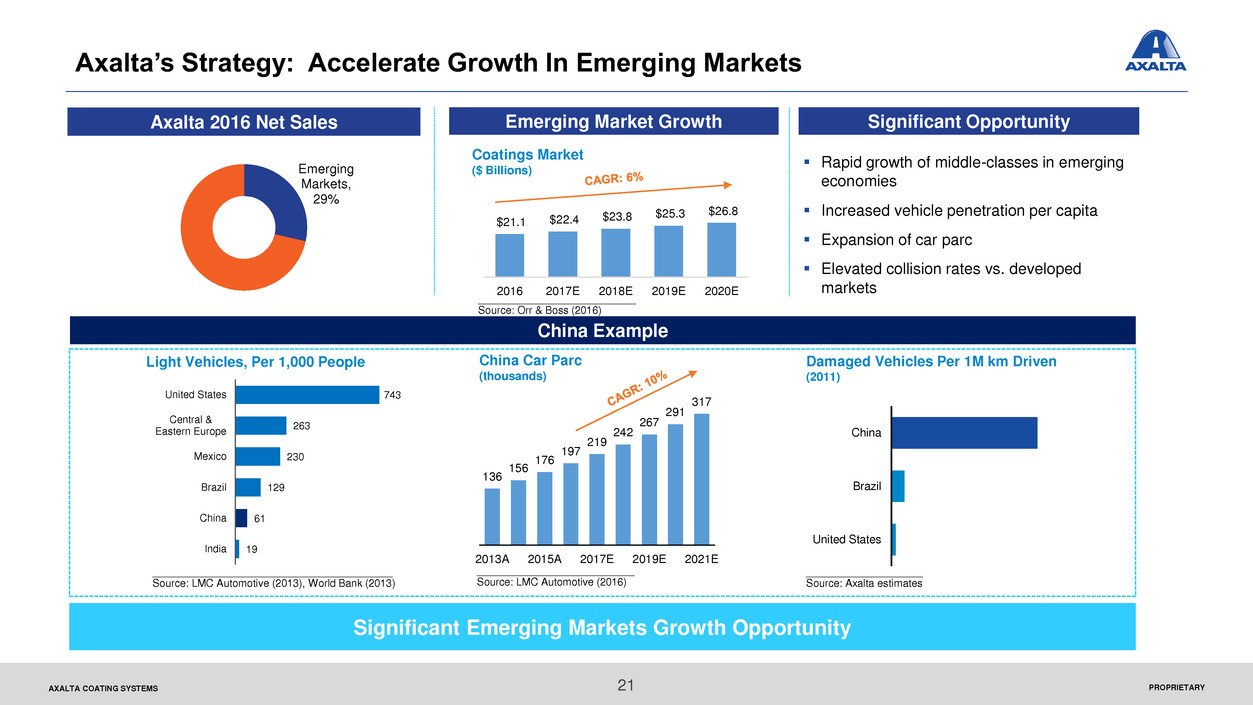

Emerging

Markets,

29%

Axalta’s Strategy: Accelerate Growth In Emerging Markets

China Example

Light Vehicles, Per 1,000 People China Car Parc

(thousands)

743

263

230

129

61

19

United States

Central &

Eastern Europe

Mexico

Brazil

China

India

Damaged Vehicles Per 1M km Driven

(2011)

Axalta 2016 Net Sales Emerging Market Growth

Coatings Market

($ Billions)

Significant Emerging Markets Growth Opportunity

Significant Opportunity

Rapid growth of middle-classes in emerging

economies

Increased vehicle penetration per capita

Expansion of car parc

Elevated collision rates vs. developed

markets

United States

Brazil

China___________________________Source: Orr & Boss (2016)

_________________________________________

Source: LMC Automotive (2013), World Bank (2013)

____________________

Source: Axalta estimates

___________________________

Source: LMC Automotive (2016)

$21.1 $22.4 $23.8

$25.3 $26.8

2016 2017E 2018E 2019E 2020E

21

136

156

176

197

219

242

267

291

317

2013A 2015A 2017E 2019E 2021E

PROPRIETARYAXALTA COATING SYSTEMS

Architectural

Axalta’s Strategy: Targeted Industrial Coatings Expansion

Growth from Leveraging Our Product Portfolio in Underserved Markets

Strong product portfolio in wood, powder, liquid, and e-coat

Implemented global end-market business structure to capitalize on opportunities

Leveraging existing technology and enhanced sales organization to grow

A Broad Industrial Portfolio

Electrical

Insulation

Agricultural,

Construction, &

Earthmoving (ACE)

Oil & Gas Coil

22

Industrial

Wood

PROPRIETARYAXALTA COATING SYSTEMS

Ongoing productivity – The Axalta Way

Operating system design and rollout

R&D / Innovation enablers

Salesforce refinement & investment

Balanced manufacturing footprint

Enhanced IT tools

Complexity reduction

Leadership & Culture

Tone set by senior leaders

Independence with accountability

Leadership stabilized across the matrix

Supporting and educating our people

Talent roadmaps to sustain and grow

Refining the culture deeper in the company

Organization & Operations

Employees Feel the Effect of Our Focus and Accountability

23

Axalta’s Strategy: Focus On Operating Excellence

Financial Overview

PROPRIETARYAXALTA COATING SYSTEMS

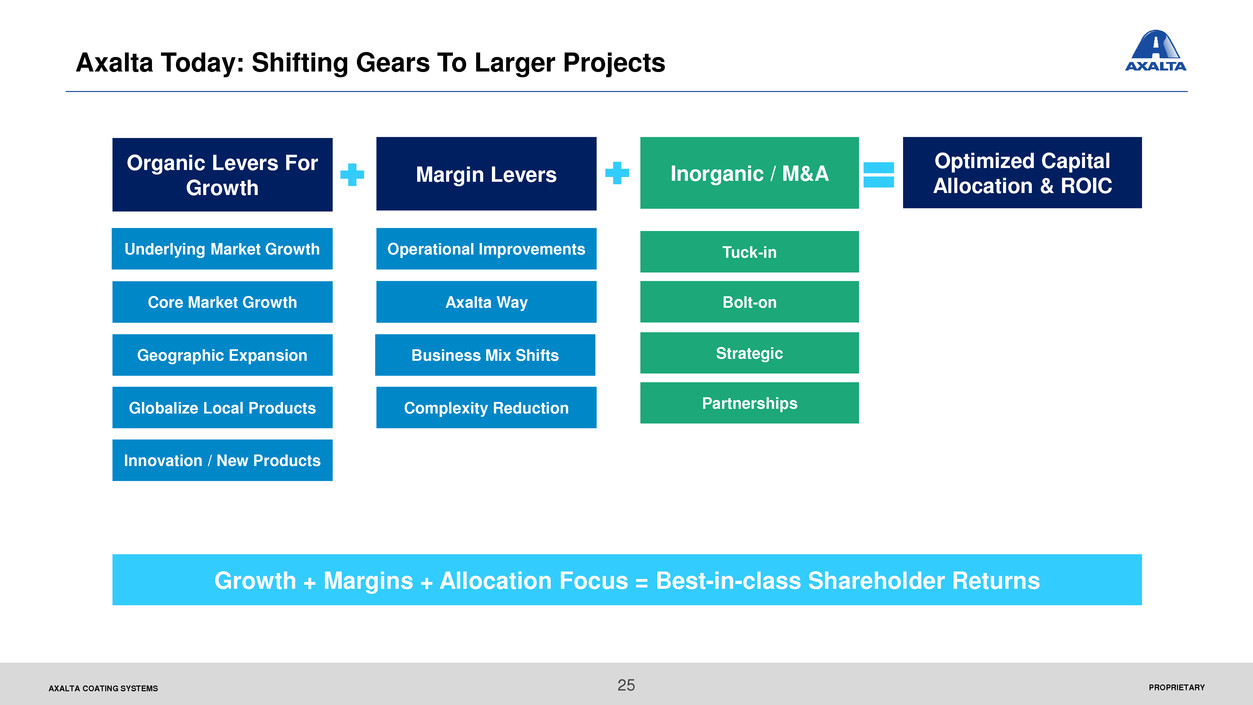

Axalta Today: Shifting Gears To Larger Projects

Underlying Market Growth

Core Market Growth

Operational Improvements Tuck-in

Organic Levers For

Growth

Inorganic / M&AMargin Levers

Growth + Margins + Allocation Focus = Best-in-class Shareholder Returns

25

Optimized Capital

Allocation & ROIC

Axalta Way Bolt-on

Strategic

Partnerships

Geographic Expansion

Globalize Local Products

Innovation / New Products

Business Mix Shifts

Complexity Reduction

AXALTA COATING SYSTEMS

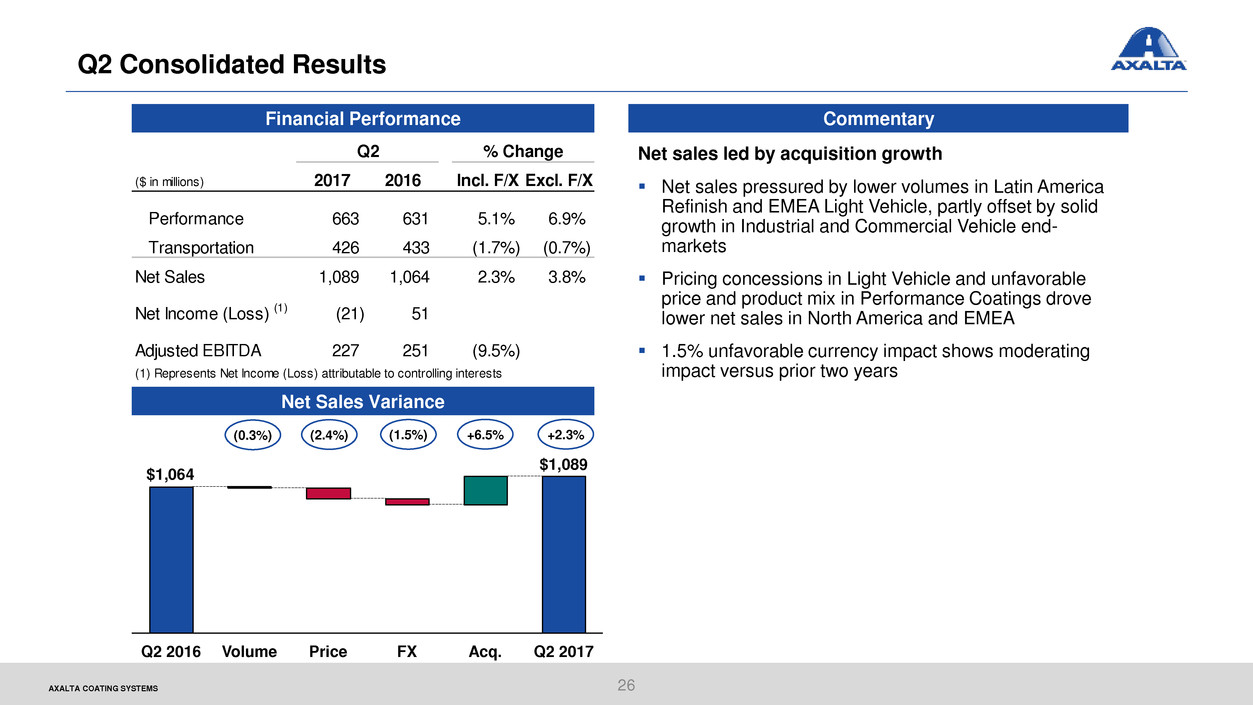

Q2 Consolidated Results

Commentary

26

Net sales led by acquisition growth

Net sales pressured by lower volumes in Latin America

Refinish and EMEA Light Vehicle, partly offset by solid

growth in Industrial and Commercial Vehicle end-

markets

Pricing concessions in Light Vehicle and unfavorable

price and product mix in Performance Coatings drove

lower net sales in North America and EMEA

1.5% unfavorable currency impact shows moderating

impact versus prior two years

Financial Performance

($ in millions) 2017 2016 Incl. F/X Excl. F/X

Performance 663 631 5.1% 6.9%

Transportation 426 433 (1.7%) (0.7%)

Net Sales 1,089 1,064 2.3% 3.8%

Net Income (Loss) (1) (21) 51

Adjusted EBITDA 227 251 (9.5%)

(1) Represents Net Income (L s ) attributable to controlling interests

Q2 % Change

Net Sales Variance

$1,064

$1,089

Q2 2017Acq.PriceVolume FXQ2 2016

(0.3%) (2.4%) (1.5%) +6.5% +2.3%

PROPRIETARYAXALTA COATING SYSTEMS

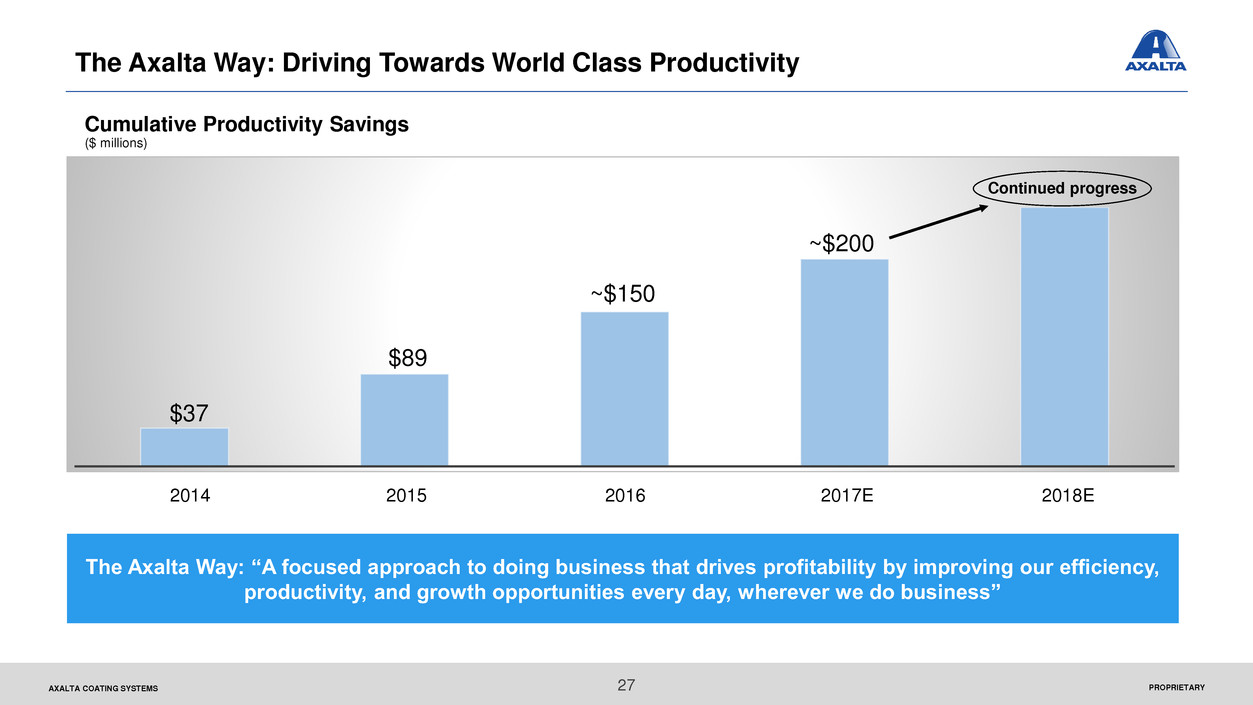

Cumulative Productivity Savings

($ millions)

The Axalta Way: “A focused approach to doing business that drives profitability by improving our efficiency,

productivity, and growth opportunities every day, wherever we do business”

2017E20162015 2018E2014

~$150

$89

~$200

$37

Continued progress

27

The Axalta Way: Driving Towards World Class Productivity

PROPRIETARYAXALTA COATING SYSTEMS

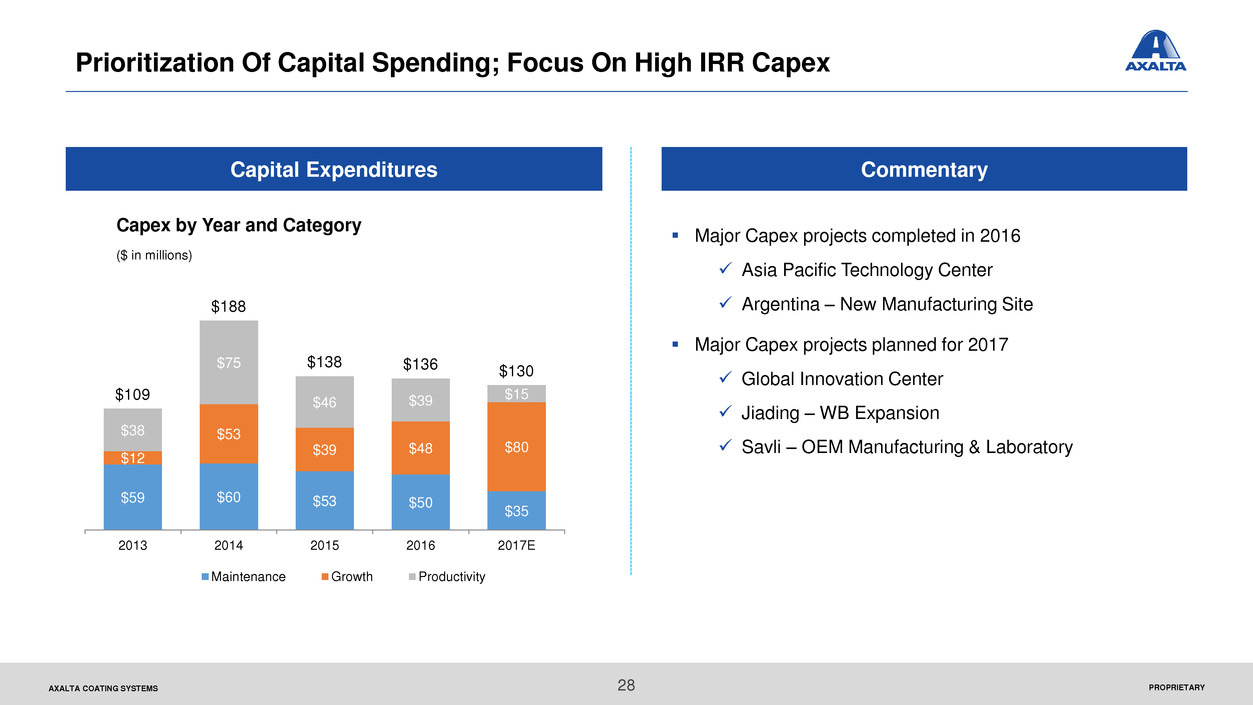

Major Capex projects completed in 2016

Asia Pacific Technology Center

Argentina – New Manufacturing Site

Major Capex projects planned for 2017

Global Innovation Center

Jiading – WB Expansion

Savli – OEM Manufacturing & Laboratory

Capital Expenditures

Capex by Year and Category

($ in millions)

Commentary

$59 $60 $53 $50

$35

$12

$53

$39 $48 $80

$38

$75

$46 $39

$15 $109

$188

$138 $136 $130

2013 2014 2015 2016 2017E

Maintenance Growth Productivity

28

Prioritization Of Capital Spending; Focus On High IRR Capex

PROPRIETARYAXALTA COATING SYSTEMS

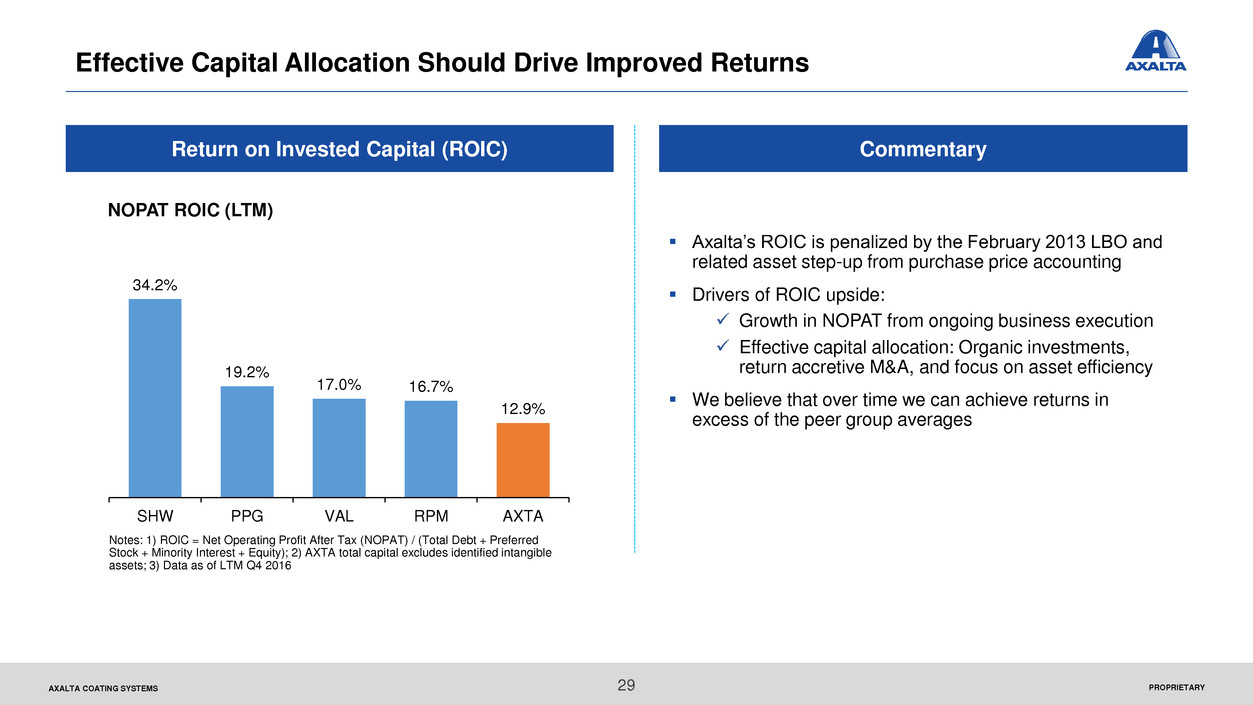

Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred

Stock + Minority Interest + Equity); 2) AXTA total capital excludes identified intangible

assets; 3) Data as of LTM Q4 2016

Axalta’s ROIC is penalized by the February 2013 LBO and

related asset step-up from purchase price accounting

Drivers of ROIC upside:

Growth in NOPAT from ongoing business execution

Effective capital allocation: Organic investments,

return accretive M&A, and focus on asset efficiency

We believe that over time we can achieve returns in

excess of the peer group averages

Return on Invested Capital (ROIC) Commentary

NOPAT ROIC (LTM)

34.2%

19.2%

17.0% 16.7%

12.9%

SHW PPG VAL RPM AXTA

29

Effective Capital Allocation Should Drive Improved Returns

PROPRIETARYAXALTA COATING SYSTEMS

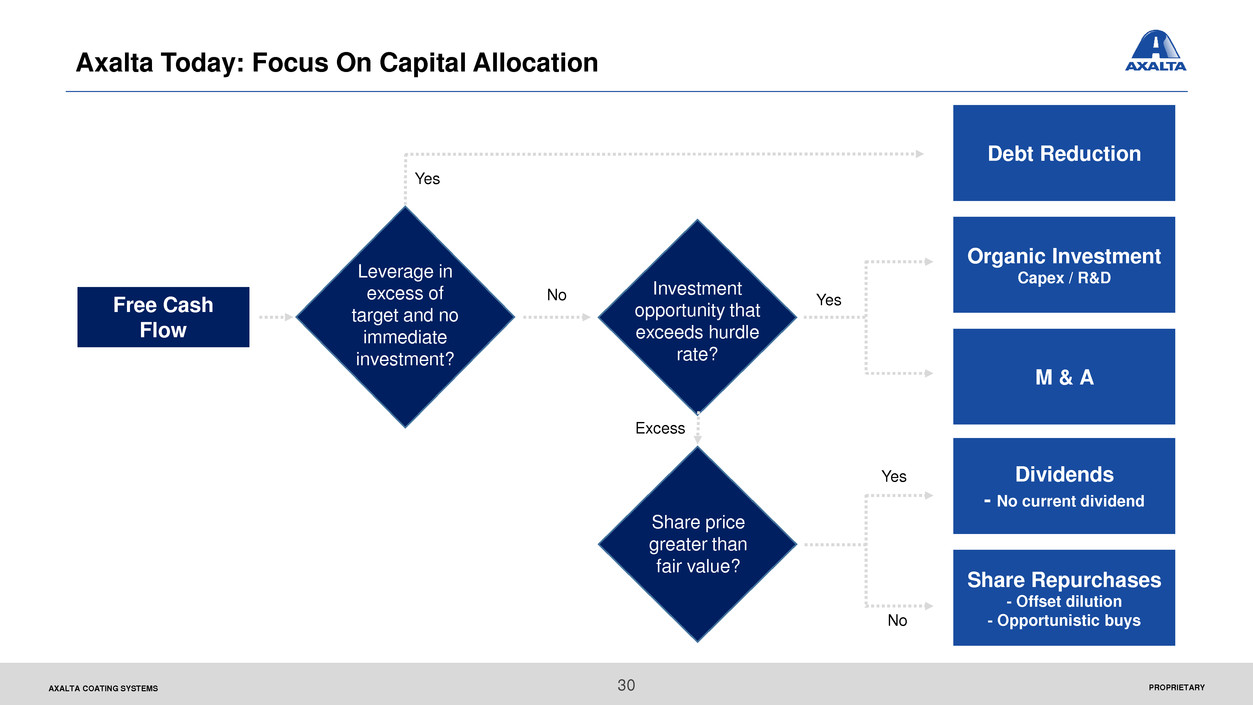

Debt Reduction

Organic Investment

Capex / R&D

M & A

Dividends

- No current dividend

Share Repurchases

- Offset dilution

- Opportunistic buys

Leverage in

excess of

target and no

immediate

investment?

Investment

opportunity that

exceeds hurdle

rate?

Share price

greater than

fair value?

Free Cash

Flow

No

Excess

Yes

Yes

Yes

No

30

Axalta Today: Focus On Capital Allocation

AXALTA COATING SYSTEMS

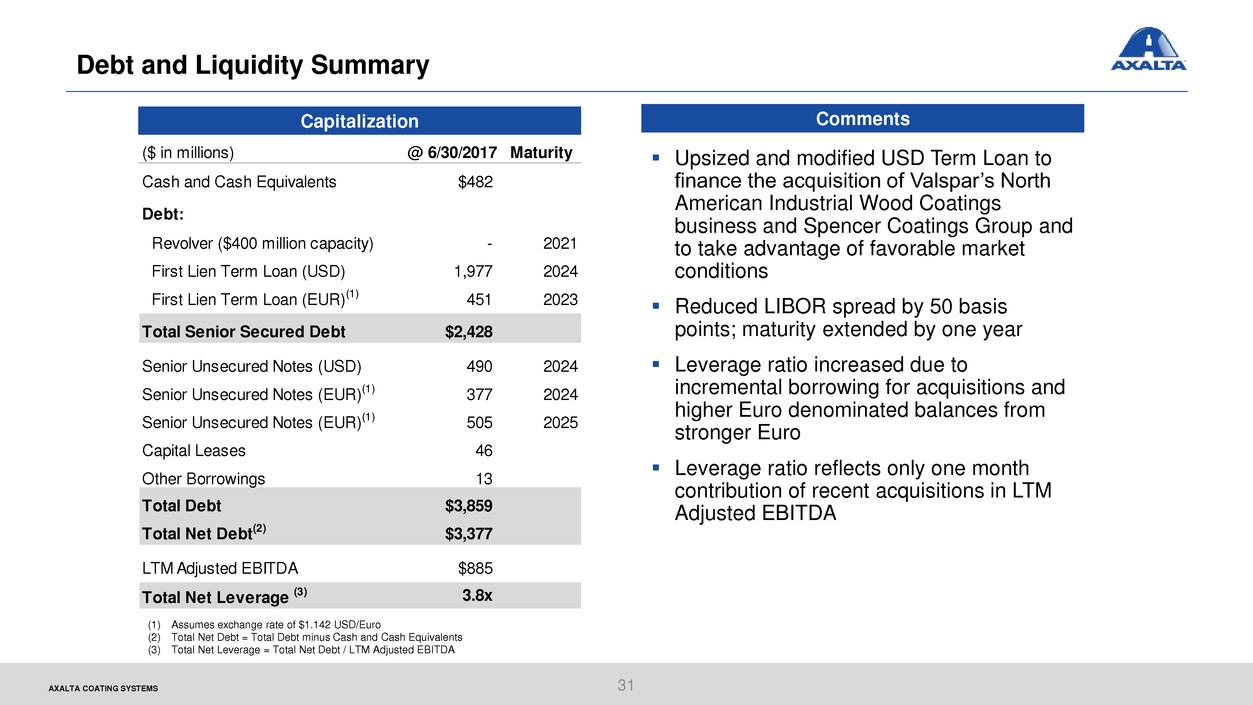

Debt and Liquidity Summary

Capitalization

31

Comments

Upsized and modified USD Term Loan to

finance the acquisition of Valspar’s North

American Industrial Wood Coatings

business and Spencer Coatings Group and

to take advantage of favorable market

conditions

Reduced LIBOR spread by 50 basis

points; maturity extended by one year

Leverage ratio increased due to

incremental borrowing for acquisitions and

higher Euro denominated balances from

stronger Euro

Leverage ratio reflects only one month

contribution of recent acquisitions in LTM

Adjusted EBITDA

(1) Assumes exchange rate of $1.142 USD/Euro

(2) Total Net Debt = Total Debt minus Cash and Cash Equivalents

(3) Total Net Leverage = Total Net Debt / LTM Adjusted EBITDA

($ in millions) @ 6/30/2017 Maturity

Cash and Cash Equivalents $482

Debt:

Revolver ($400 million capacity) - 2021

First Lien Term Loan (USD) 1,977 2024

First Lien Term Loan (EUR)(1) 451 2023

Total Senior Secured Debt $2,428

Senior Unsecured Notes (USD) 490 2024

Senior Unsecured Notes (EUR)(1) 377 2024

Senior Unsecured Notes (EUR)(1) 505 2025

Capital Leases 46

Other Borrowings 13

Total Debt $3,859

Total Net Debt(2) $3,377

LTM Adjusted EBITDA $885

Total Net Leverage (3) 3.8x

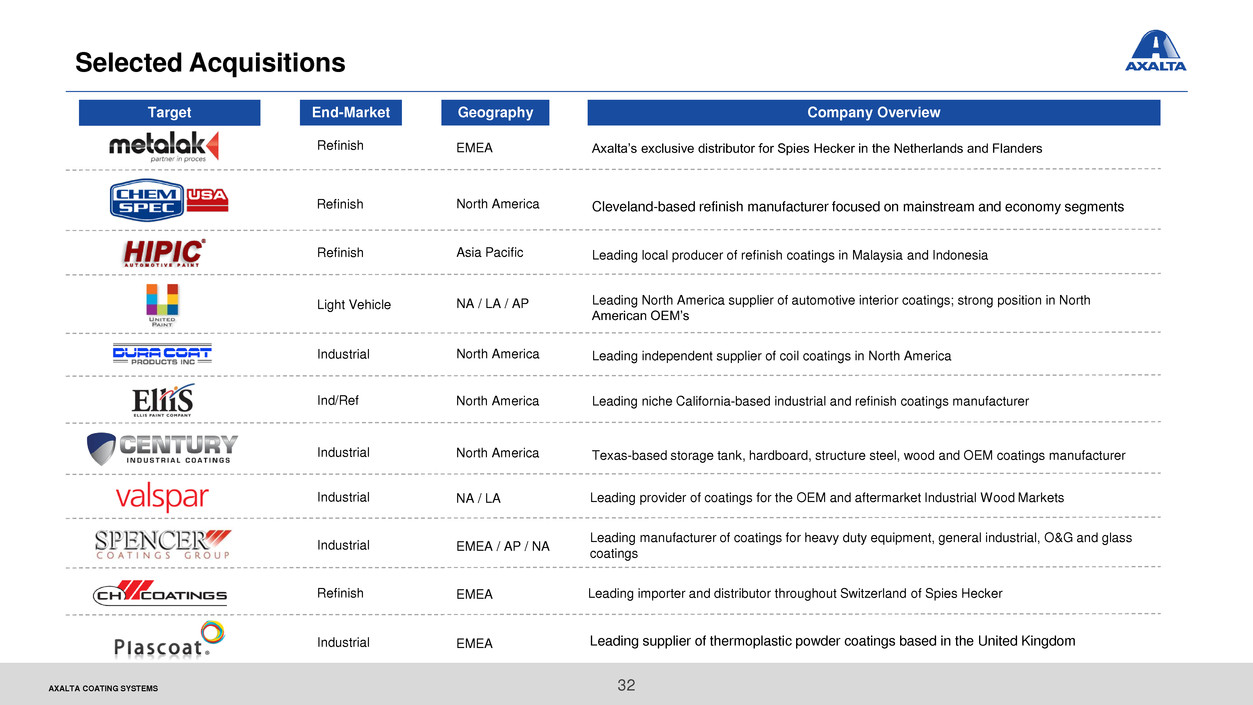

AXALTA COATING SYSTEMS 32

Selected Acquisitions

GeographyEnd-Market Company OverviewTarget

Leading local producer of refinish coatings in Malaysia and Indonesia

Leading North America supplier of automotive interior coatings; strong position in North

American OEM’s

Leading independent supplier of coil coatings in North America

Refinish

Light Vehicle

Industrial

Asia Pacific

NA / LA / AP

North America

North AmericaInd/Ref

North AmericaIndustrial

Leading niche California-based industrial and refinish coatings manufacturer

Texas-based storage tank, hardboard, structure steel, wood and OEM coatings manufacturer

NA / LAIndustrial Leading provider of coatings for the OEM and aftermarket Industrial Wood Markets

EMEA / AP / NAIndustrial

Leading manufacturer of coatings for heavy duty equipment, general industrial, O&G and glass

coatings

EMEARefinish Leading importer and distributor throughout Switzerland of Spies Hecker

Axalta’s exclusive distributor for Spies Hecker in the Netherlands and FlandersRefinish EMEA

EMEAIndustrial Leading supplier of thermoplastic powder coatings based in the United Kingdom

Cleveland-based refinish manufacturer focused on mainstream and economy segmentsNorth AmericaRefinish

AXALTA COATING SYSTEMS

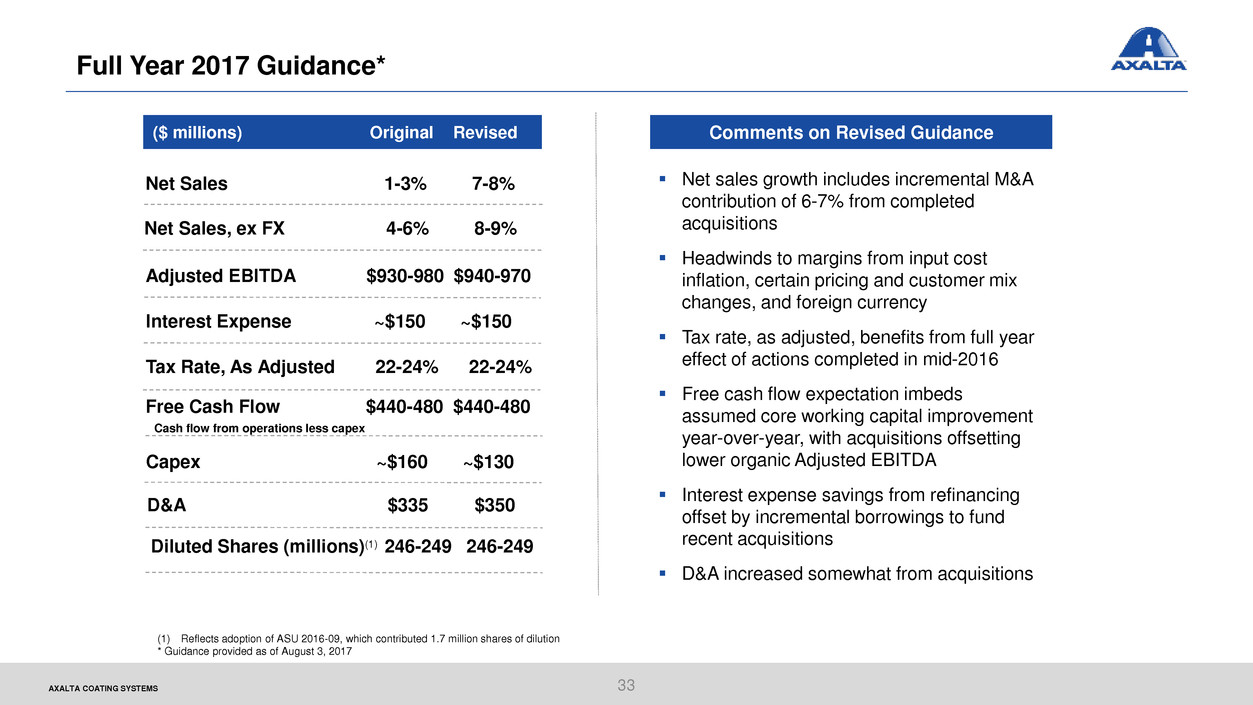

Full Year 2017 Guidance*

Net sales growth includes incremental M&A

contribution of 6-7% from completed

acquisitions

Headwinds to margins from input cost

inflation, certain pricing and customer mix

changes, and foreign currency

Tax rate, as adjusted, benefits from full year

effect of actions completed in mid-2016

Free cash flow expectation imbeds

assumed core working capital improvement

year-over-year, with acquisitions offsetting

lower organic Adjusted EBITDA

Interest expense savings from refinancing

offset by incremental borrowings to fund

recent acquisitions

D&A increased somewhat from acquisitions

Comments on Revised Guidance

33

(1) Reflects adoption of ASU 2016-09, which contributed 1.7 million shares of dilution

* Guidance provided as of August 3, 2017

($ millions) Original Revised

Net Sales, ex FX 4-6% 8-9%

Tax Rate, As Adjusted 22-24% 22-24%

Free Cash Flow $440-480 $440-480

Cash flow from operations less capex

Interest Expense ~$150 ~$150

Adjusted EBITDA $930-980 $940-970

Net Sales 1-3% 7-8%

Capex ~$160 ~$130

Diluted Shares (millions)(1) 246-249 246-249

D&A $335 $350

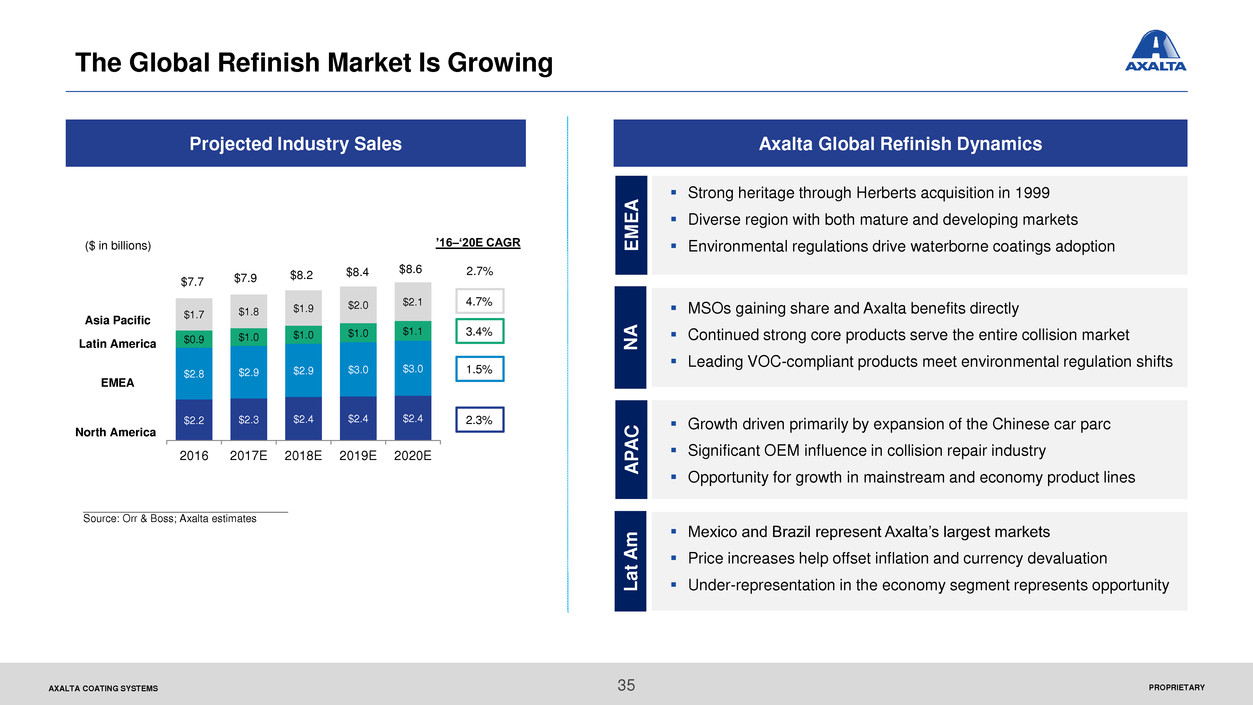

Performance Coatings: Refinish

PROPRIETARYAXALTA COATING SYSTEMS

Projected Industry Sales

($ in billions)

Asia Pacific

EMEA

North America

4.7%

3.4%

1.5%

2.3%

’16–‘20E CAGR

___________________________________

Source: Orr & Boss; Axalta estimates

Latin America

2.7%

Axalta Global Refinish Dynamics

Strong heritage through Herberts acquisition in 1999

Diverse region with both mature and developing markets

Environmental regulations drive waterborne coatings adoption

MSOs gaining share and Axalta benefits directly

Continued strong core products serve the entire collision market

Leading VOC-compliant products meet environmental regulation shifts

Growth driven primarily by expansion of the Chinese car parc

Significant OEM influence in collision repair industry

Opportunity for growth in mainstream and economy product lines

Mexico and Brazil represent Axalta’s largest markets

Price increases help offset inflation and currency devaluation

Under-representation in the economy segment represents opportunity

E

M

E

A

N

A

A

P

A

C

L

a

t

A

m

$2.2 $2.3 $2.4 $2.4 $2.4

$2.8 $2.9 $2.9 $3.0

$3.0

$0.9 $1.0 $1.0

$1.0 $1.1

$1.7 $1.8

$1.9 $2.0

$2.1

2016 2017E 2018E 2019E 2020E

$7.7 $7.9

$8.2 $8.4

$8.6

35

The Global Refinish Market Is Growing

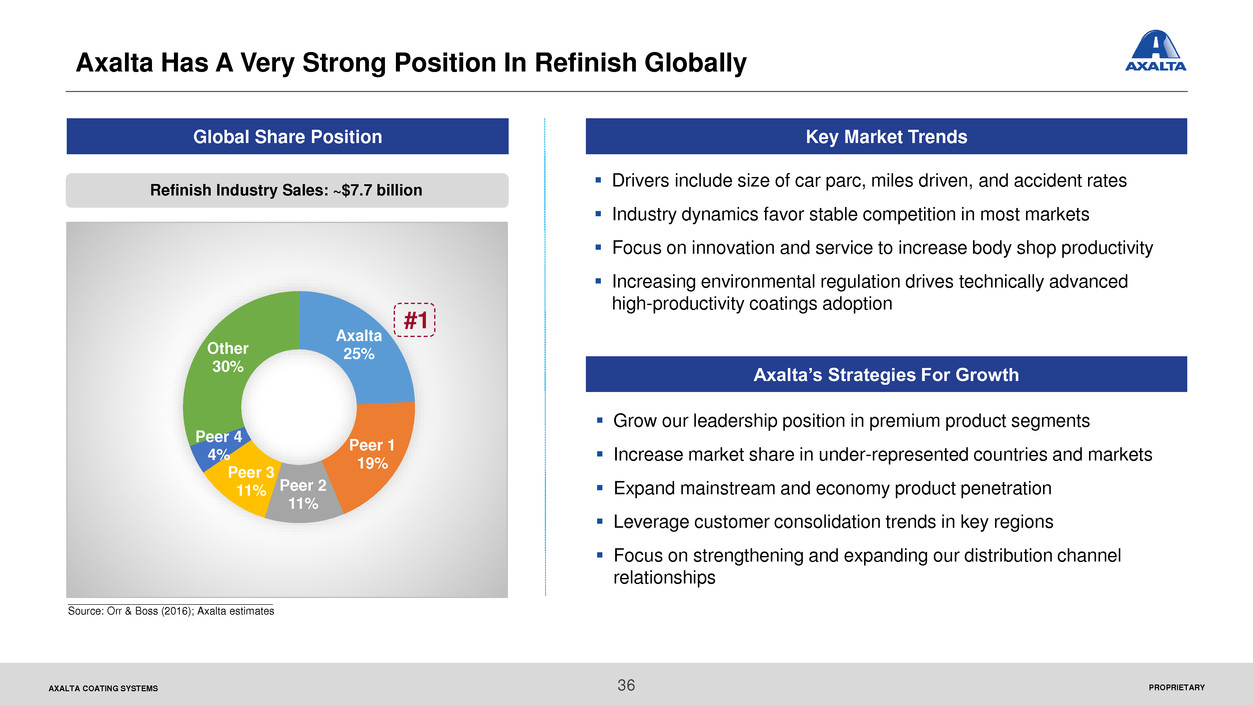

PROPRIETARYAXALTA COATING SYSTEMS

Global Share Position Key Market Trends

Refinish Industry Sales: ~$7.7 billion

Drivers include size of car parc, miles driven, and accident rates

Industry dynamics favor stable competition in most markets

Focus on innovation and service to increase body shop productivity

Increasing environmental regulation drives technically advanced

high-productivity coatings adoption

Grow our leadership position in premium product segments

Increase market share in under-represented countries and markets

Expand mainstream and economy product penetration

Leverage customer consolidation trends in key regions

Focus on strengthening and expanding our distribution channel

relationships

Axalta’s Strategies For Growth

Axalta

25%

Peer 1

19%

Peer 2

11%

Peer 3

11%

Peer 4

4%

Other

30%

#1

36

Axalta Has A Very Strong Position In Refinish Globally

___________________________________

Source: Orr & Boss (2016); Axalta estimates

PROPRIETARYAXALTA COATING SYSTEMS

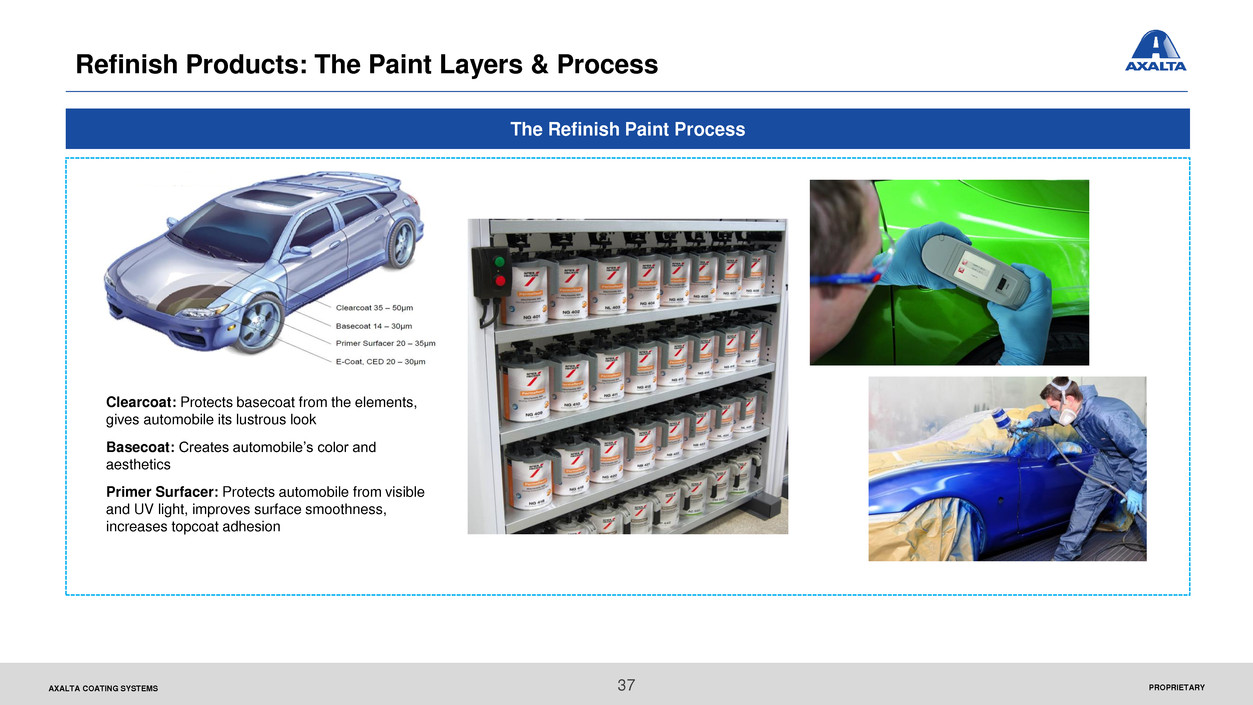

Refinish Products: The Paint Layers & Process

Clearcoat: Protects basecoat from the elements,

gives automobile its lustrous look

Basecoat: Creates automobile’s color and

aesthetics

Primer Surfacer: Protects automobile from visible

and UV light, improves surface smoothness,

increases topcoat adhesion

The Refinish Paint Process

37

Performance Coatings: Industrial Coatings

PROPRIETARYAXALTA COATING SYSTEMS

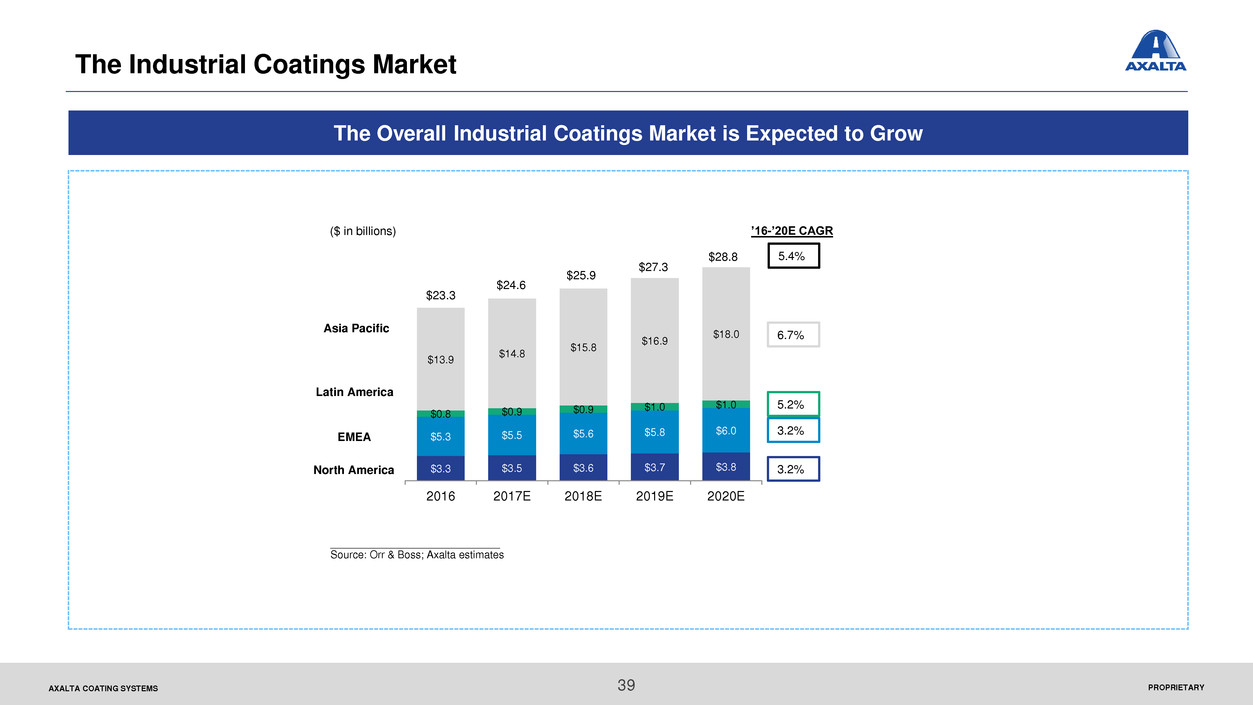

’16-’20E CAGR($ in billions)

Asia Pacific

EMEA

North America

6.7%

5.2%

3.2%

3.2%

5.4%

_____________________________

Source: Orr & Boss; Axalta estimates

Latin America

The Overall Industrial Coatings Market is Expected to Grow

39

The Industrial Coatings Market

$3.3 $3.5 $3.6 $3.7 $3.8

$5.3 $5.5 $5.6 $5.8

$6.0

$0.8 $0.9 $0.9

$1.0 $1.0

$13.9

$14.8

$15.8

$16.9

$18.0

2016 2017E 2018E 2019E 2020E

$28.8

$27.3

$25.9

$23.3

$24.6

PROPRIETARYAXALTA COATING SYSTEMS

General

Industrial

$15.0

Electrical

Insulation

$2.0

Architectual

$1.5

ACE $1.5

Coil $4.5

Oil & Gas

$3.5

Product Examples Market Drivers

General Industrial Metal furniture

Appliances

Shelving/ racking

Electrical boxes

GDP

Industrial production

Electrical Insulation Electric motors

Transformers

Electric motor production

Power transmission

production

Architectural Commercial building windows and

curtain walls

Residential windows and doors

Commercial construction

Residential construction

starts

ACE Construction equipment

Agricultural equipment

Mining equipment

GDP

Industrial production

Coil Commercial / residential siding

Garage doors

Gutters, downspouts, lighting

housings

Appliances

GDP

Construction

Oil & Gas Deep sea pipelines

Oil well conveyance lines

Infrastructure growth

Population growth

Pipeline projects

Source: Coatings World, Axalta estimates

($ billions)

40

Industrial Coatings: A $28B Market Opportunity For Axalta

PROPRIETARYAXALTA COATING SYSTEMS

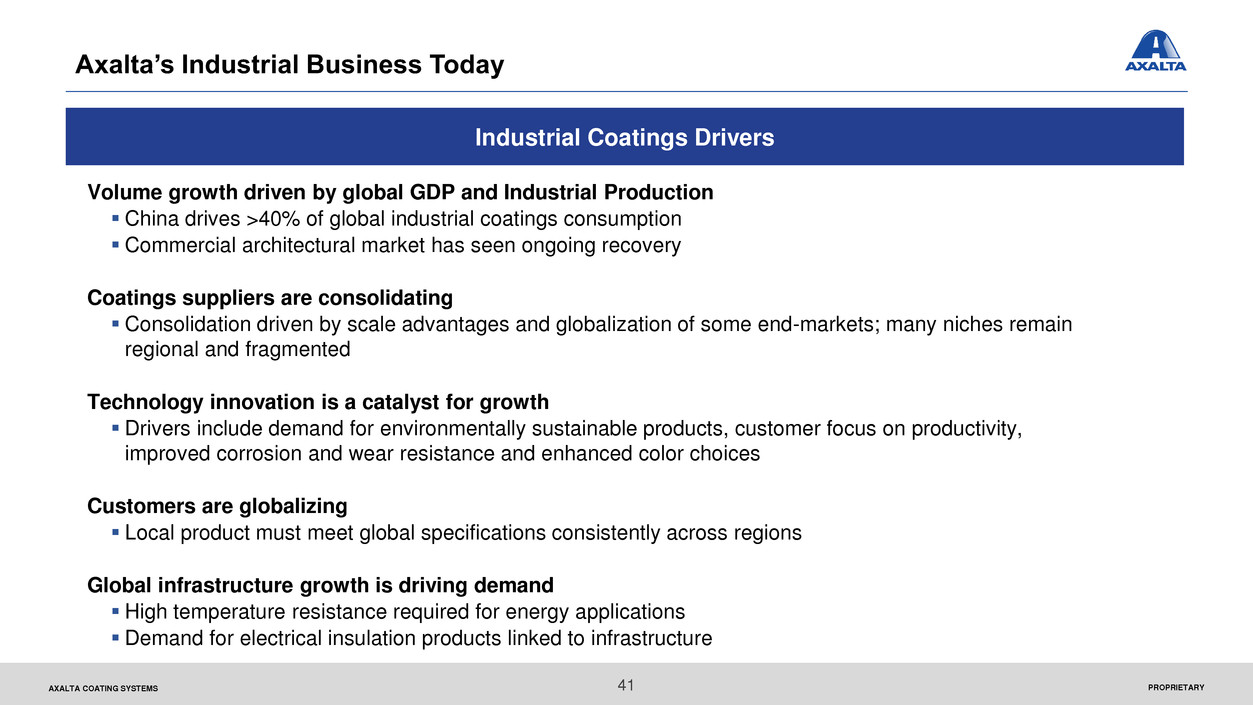

Industrial Coatings Drivers

Volume growth driven by global GDP and Industrial Production

China drives >40% of global industrial coatings consumption

Commercial architectural market has seen ongoing recovery

Coatings suppliers are consolidating

Consolidation driven by scale advantages and globalization of some end-markets; many niches remain

regional and fragmented

Technology innovation is a catalyst for growth

Drivers include demand for environmentally sustainable products, customer focus on productivity,

improved corrosion and wear resistance and enhanced color choices

Customers are globalizing

Local product must meet global specifications consistently across regions

Global infrastructure growth is driving demand

High temperature resistance required for energy applications

Demand for electrical insulation products linked to infrastructure

41

Axalta’s Industrial Business Today

PROPRIETARYAXALTA COATING SYSTEMS

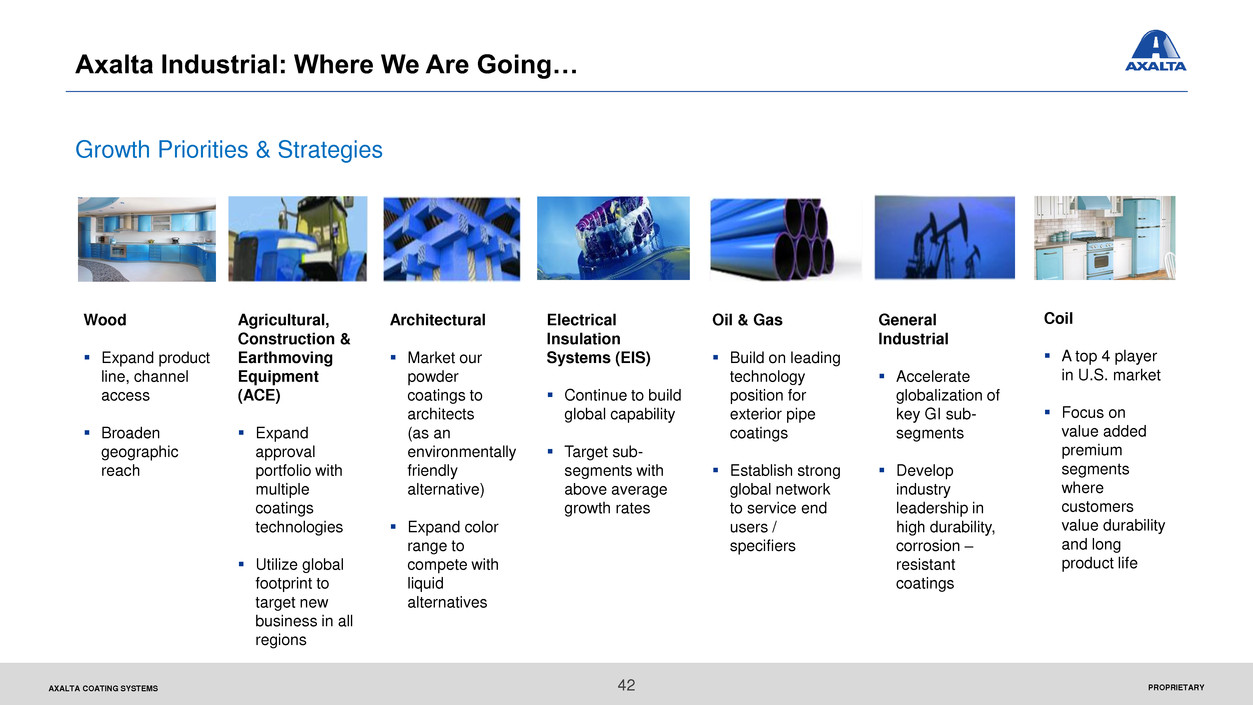

Growth Priorities & Strategies

Agricultural,

Construction &

Earthmoving

Equipment

(ACE)

Expand

approval

portfolio with

multiple

coatings

technologies

Utilize global

footprint to

target new

business in all

regions

Architectural

Market our

powder

coatings to

architects

(as an

environmentally

friendly

alternative)

Expand color

range to

compete with

liquid

alternatives

Electrical

Insulation

Systems (EIS)

Continue to build

global capability

Target sub-

segments with

above average

growth rates

Oil & Gas

Build on leading

technology

position for

exterior pipe

coatings

Establish strong

global network

to service end

users /

specifiers

General

Industrial

Accelerate

globalization of

key GI sub-

segments

Develop

industry

leadership in

high durability,

corrosion –

resistant

coatings

Coil

A top 4 player

in U.S. market

Focus on

value added

premium

segments

where

customers

value durability

and long

product life

42

Axalta Industrial: Where We Are Going…

Wood

Expand product

line, channel

access

Broaden

geographic

reach

Transportation Coatings Overview

PROPRIETARYAXALTA COATING SYSTEMS

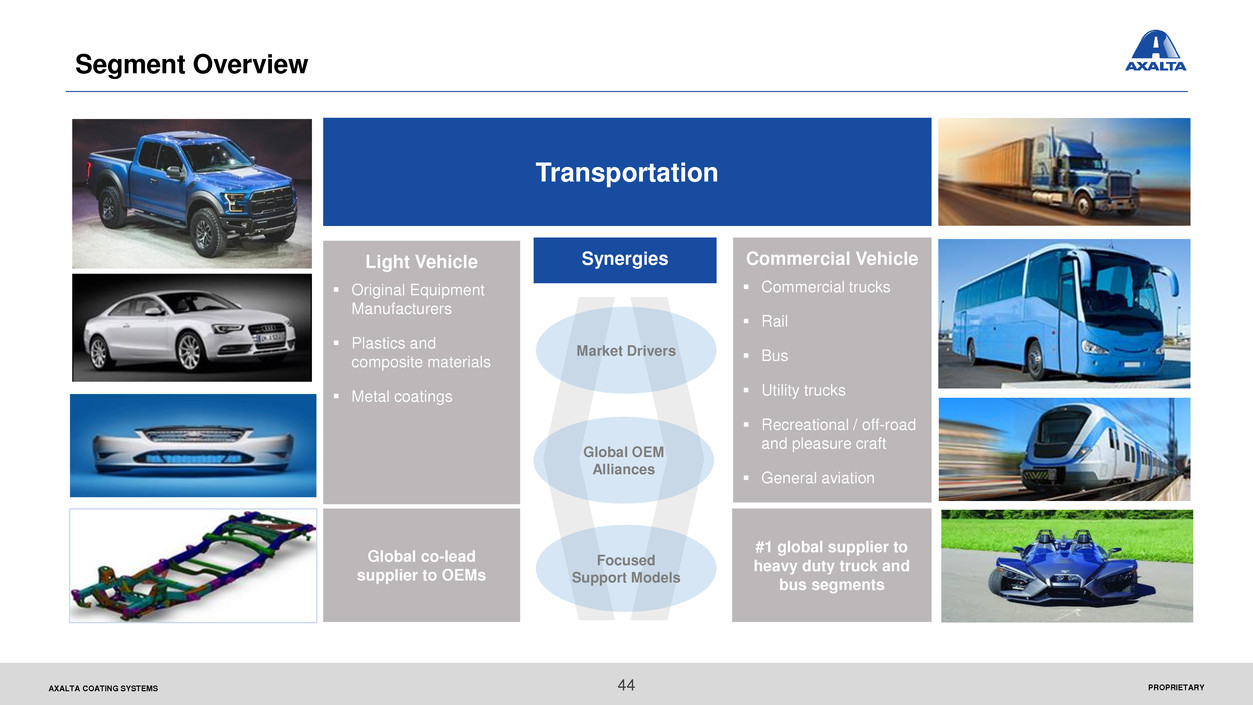

Global co-lead

supplier to OEMs

Transportation

Light Vehicle

Original Equipment

Manufacturers

Plastics and

composite materials

Metal coatings

#1 global supplier to

heavy duty truck and

bus segments

Commercial Vehicle

Commercial trucks

Rail

Bus

Utility trucks

Recreational / off-road

and pleasure craft

General aviation

Synergies

Global OEM

Alliances

Focused

Support Models

Market Drivers

44

Segment Overview

PROPRIETARYAXALTA COATING SYSTEMS

17% global light vehicle market

share with strong OEM

relationships in all regions

#1 player globally in heavy duty

truck and bus

Extensive portfolio of technologies

fit for purpose in each market

Showing results to date through

business wins and global

launches

Strong earnings contribution

underscores focus on profitable

growth

Capacity investments to support

growth in all regions

Moved from regional structure to

global leadership

Improved alignment with strategic

and underserved customers

Building capability and footprint in

high growth regions

Expanding global brand strategy

Demand drivers include

Global GDP

Vehicle replacement cycles

Growth in emerging markets

Infrastructure spending

The global transportation market

is projected to grow ~3.4% CAGR

through 2019

Axalta is actively transforming its

business for profitable growth

Axalta is a leading global OEM

coatings provider

Progress to date has been

strong

45

Transportation Summary

PROPRIETARYAXALTA COATING SYSTEMS

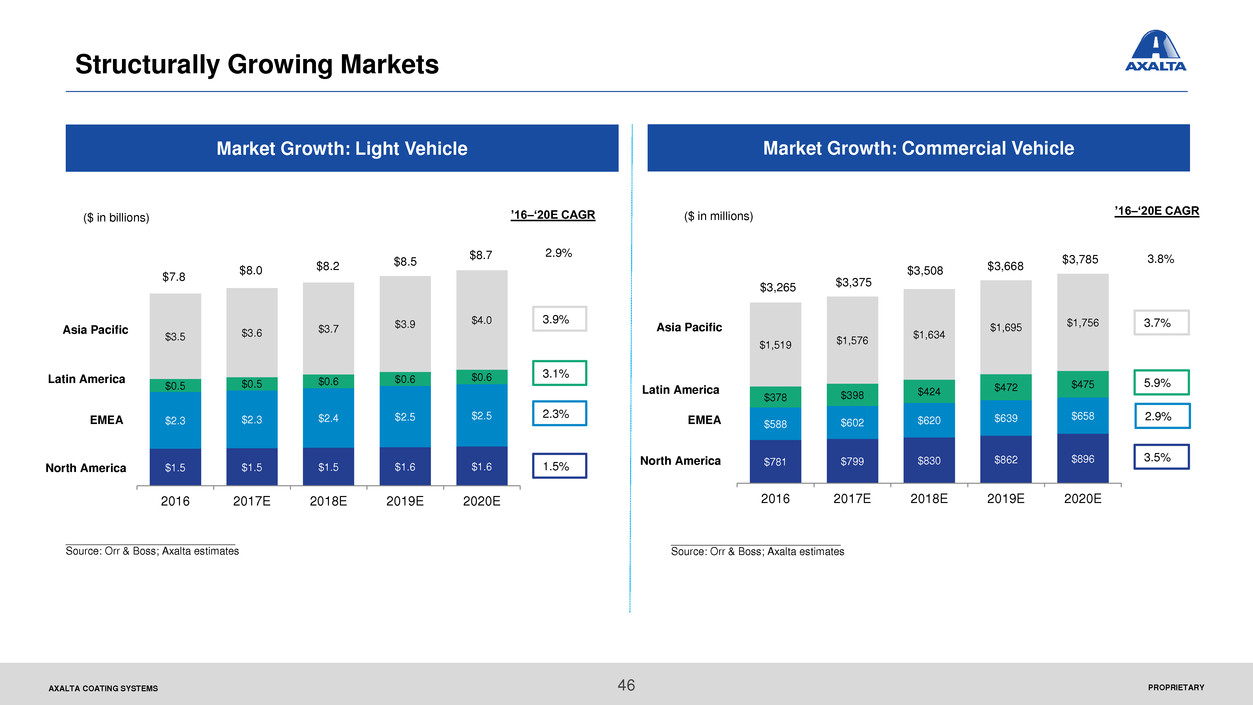

Market Growth: Light Vehicle Market Growth: Commercial Vehicle

_____________________________

Source: Orr & Boss; Axalta estimates

Asia Pacific

Latin America

EMEA

North America

3.9%

3.1%

2.3%

1.5%

2.9%

($ in billions) ’16–‘20E CAGR ($ in millions)

Asia Pacific

EMEA

North America

3.7%

5.9%

2.9%

3.5%

3.8%

’16–‘20E CAGR

_____________________________

Source: Orr & Boss; Axalta estimates

Latin America

$1.5 $1.5 $1.5 $1.6 $1.6

$2.3 $2.3 $2.4 $2.5 $2.5

$0.5 $0.5 $0.6

$0.6 $0.6

$3.5 $3.6

$3.7 $3.9

$4.0

2016 2017E 2018E 2019E 2020E

$8.7

$8.5$8.2$8.0

$7.8

$781 $799 $830 $862 $896

$588 $602 $620

$639 $658

$378 $398

$424 $472

$475

$1,519 $1,576

$1,634

$1,695 $1,756

2016 2017E 2018E 2019E 2020E

$3,785

$3,668$3,508

$3,375$3,265

46

Structurally Growing Markets

PROPRIETARYAXALTA COATING SYSTEMS

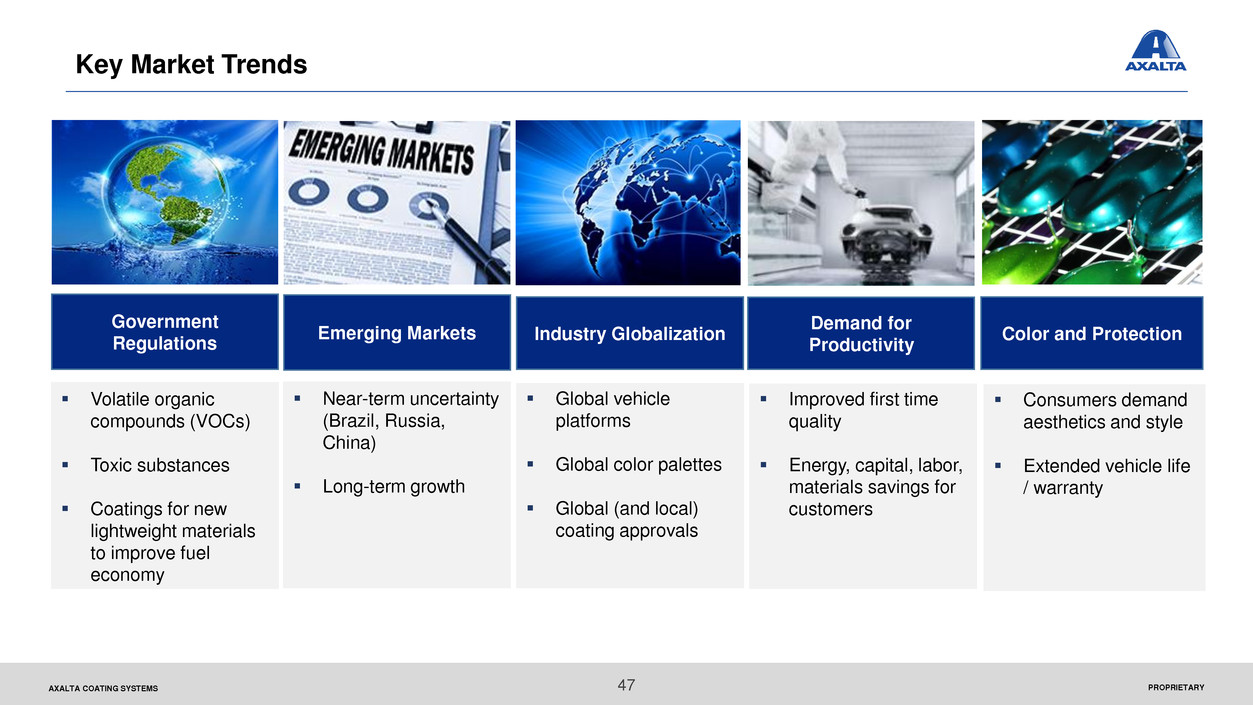

Volatile organic

compounds (VOCs)

Toxic substances

Coatings for new

lightweight materials

to improve fuel

economy

Government

Regulations

Emerging Markets Industry Globalization

Demand for

Productivity

Color and Protection

Near-term uncertainty

(Brazil, Russia,

China)

Long-term growth

Global vehicle

platforms

Global color palettes

Global (and local)

coating approvals

Improved first time

quality

Energy, capital, labor,

materials savings for

customers

Consumers demand

aesthetics and style

Extended vehicle life

/ warranty

47

Key Market Trends

PROPRIETARYAXALTA COATING SYSTEMS

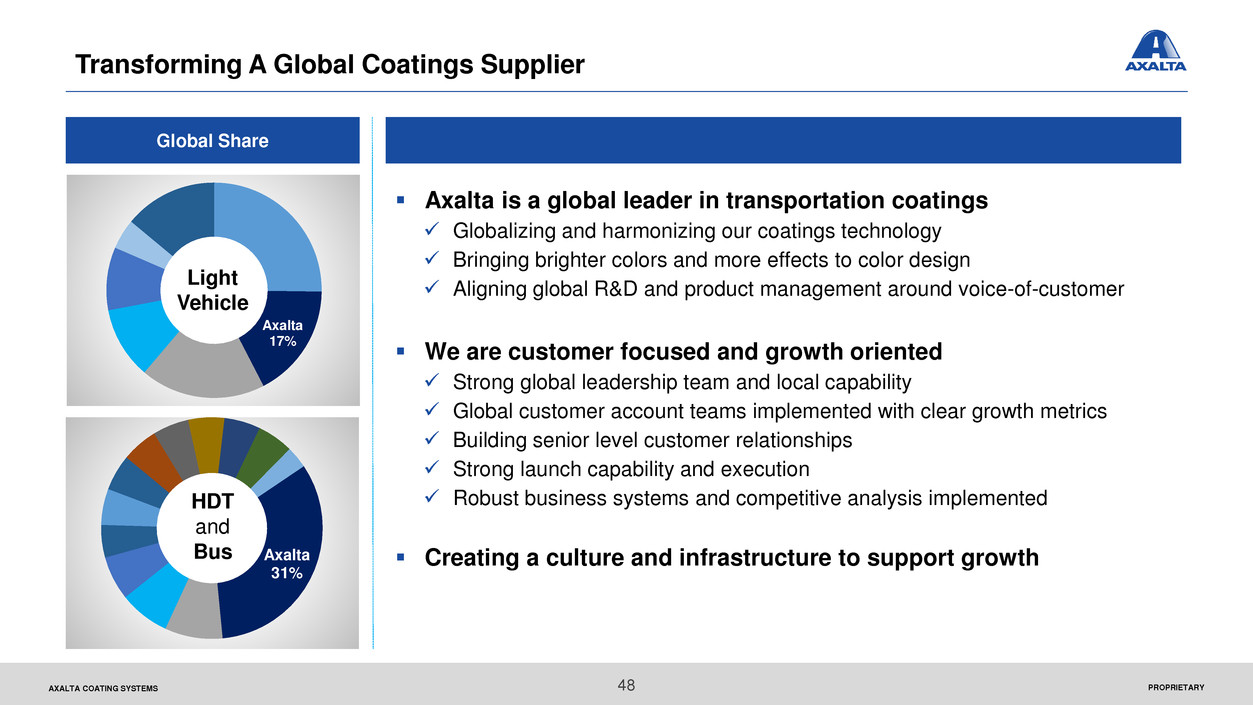

Global Share

Axalta

31%

Axalta is a global leader in transportation coatings

Globalizing and harmonizing our coatings technology

Bringing brighter colors and more effects to color design

Aligning global R&D and product management around voice-of-customer

We are customer focused and growth oriented

Strong global leadership team and local capability

Global customer account teams implemented with clear growth metrics

Building senior level customer relationships

Strong launch capability and execution

Robust business systems and competitive analysis implemented

Creating a culture and infrastructure to support growth

HDT

and

Bus

Axalta

17%

Light

Vehicle

48

Transforming A Global Coatings Supplier

PROPRIETARYAXALTA COATING SYSTEMS

Gain share with existing customers

Grow underserved customers and regions

Align product technology to evolving

customer and market needs

Increase content per vehicle

Leverage “what good looks like” into new

regions, customers, and markets

Strategies Key Tactics / Programs

Build capabilities in global and regional roles

Expand decorative and functional coatings

Best-in-class line service excellence

Localize supply chain ensuring competitive

cost structure

Drive complexity management discipline

The Axalta Way: “run it like we own it”

49

Vision Is Above-Market Growth

PROPRIETARYAXALTA COATING SYSTEMS

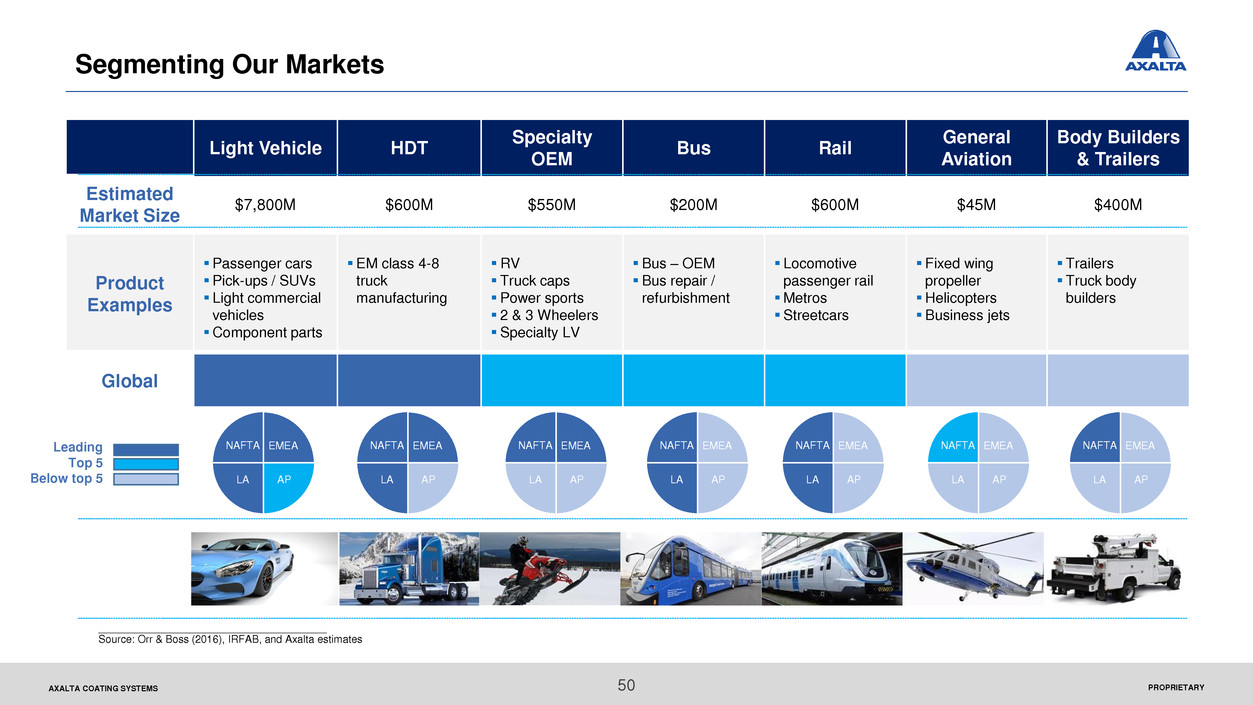

Light Vehicle HDT

Specialty

OEM

Bus Rail

General

Aviation

Body Builders

& Trailers

Estimated

Market Size

$7,800M $600M $550M $200M $600M $45M $400M

Product

Examples

Passenger cars

Pick-ups / SUVs

Light commercial

vehicles

Component parts

EM class 4-8

truck

manufacturing

RV

Truck caps

Power sports

2 & 3 Wheelers

Specialty LV

Bus – OEM

Bus repair /

refurbishment

Locomotive

passenger rail

Metros

Streetcars

Fixed wing

propeller

Helicopters

Business jets

Trailers

Truck body

builders

Global

EMEA

APLA

NAFTA EMEA

APLA

NAFTA EMEA

APLA

NAFTAEMEA

APLA

NAFTA

_______________________________________

Source: Orr & Boss (2016), IRFAB, and Axalta estimates

Leading

Top 5

Below top 5

EMEA

APLA

NAFTA EMEA

APLA

NAFTA EMEA

APLA

NAFTA

50

Segmenting Our Markets

PROPRIETARYAXALTA COATING SYSTEMS

China expansion to mainstream and economy

segments

Leverage high speed rail success

SprayFlex FSTM interior floor coatings

Leverage global accounts

Gain share in tier part suppliers

China growth via Kinlita JV

China HDT volume is three times NA

Leverage Imron® branded offering

Differentiation through strong HDT color leverage

Developing a segment-focused distribution

strategy

Grow in automotive parts market

China expansion through domestic OEMs

AP expansion beyond China

Gain approvals with underserved customers

Strengthen service capability

Expand 2-wheeler success in Brazil to other regions

Leverage Imron® branded offering

Segment-focused color strategy

Light Vehicle

Specialty OEM

General Aviation

Heavy Duty Truck (HDT)

Bus and Rail

Body Builders / Trailers

Leverage approvals with Textron, Gulfstream, etc.

Expand color palette for high value applications

Align Imron® brands and offerings to segment

Strategic alignments and capabilities

51

We Are Growing With Segment Specific Strategies In Our Target Markets

PROPRIETARYAXALTA COATING SYSTEMS

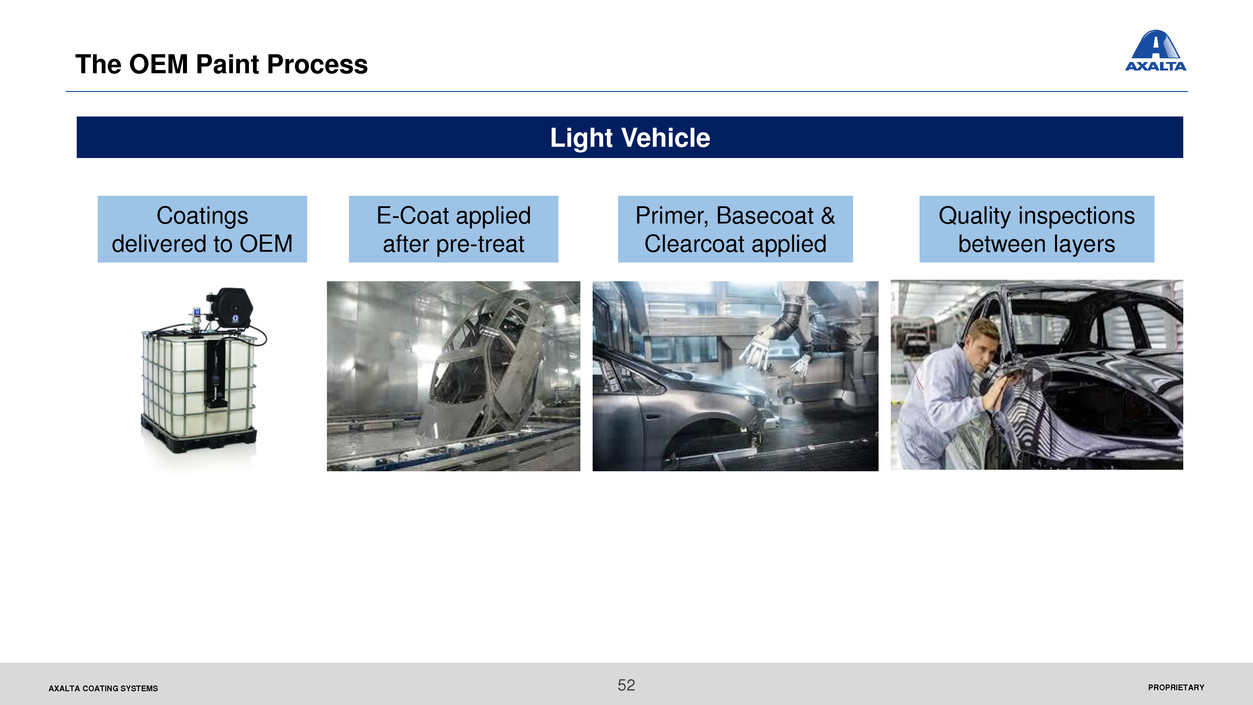

Light Vehicle

Coatings

delivered to OEM

E-Coat applied

after pre-treat

Primer, Basecoat &

Clearcoat applied

Quality inspections

between layers

52

The OEM Paint Process

APPENDIX

AXALTA COATING SYSTEMS

Adjusted EBITDA Reconciliation

Note: Numbers might not foot due to rounding.

54

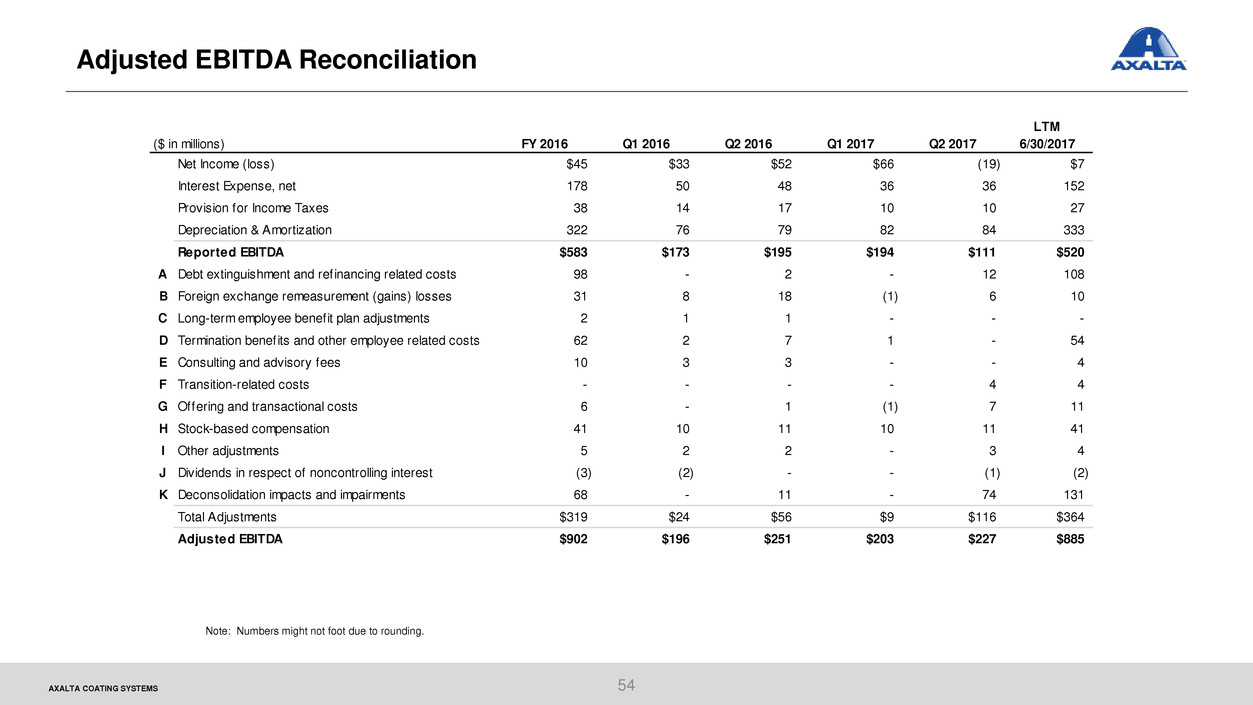

($ in millions) FY 2016 Q1 2016 Q2 2016 Q1 2017 Q2 2017

LTM

6/30/2017

Net Income (loss) $45 $33 $52 $66 (19) $7

Interest Expense, net 178 50 48 36 36 152

Provision for Income Taxes 38 14 17 10 10 27

Depreciation & Amortization 322 76 79 82 84 333

Reported EBITDA $583 $173 $195 $194 $111 $520

A Debt extinguishment and refinancing related costs 98 - 2 - 12 108

B Foreign exchange remeasurement (gains) losses 31 8 18 (1) 6 10

C Long-term employee benefit plan adjustments 2 1 1 - - -

D Termination benefits and other employee related costs 62 2 7 1 - 54

E Consulting and advisory fees 10 3 3 - - 4

F Transition-related costs - - - - 4 4

G Offering and transactional costs 6 - 1 (1) 7 11

H Stock-based compensation 41 10 11 10 11 41

I Other adjustments 5 2 2 - 3 4

J Dividends in respect of noncontrolling interest (3) (2) - - (1) (2)

K Deconsolidation impacts and impairments 68 - 11 - 74 131

Total Adjustments $319 $24 $56 $9 $116 $364

Adjusted EBITDA $902 $196 $251 $203 $227 $885

AXALTA COATING SYSTEMS

Adjusted EBITDA Reconciliation (cont’d)

55

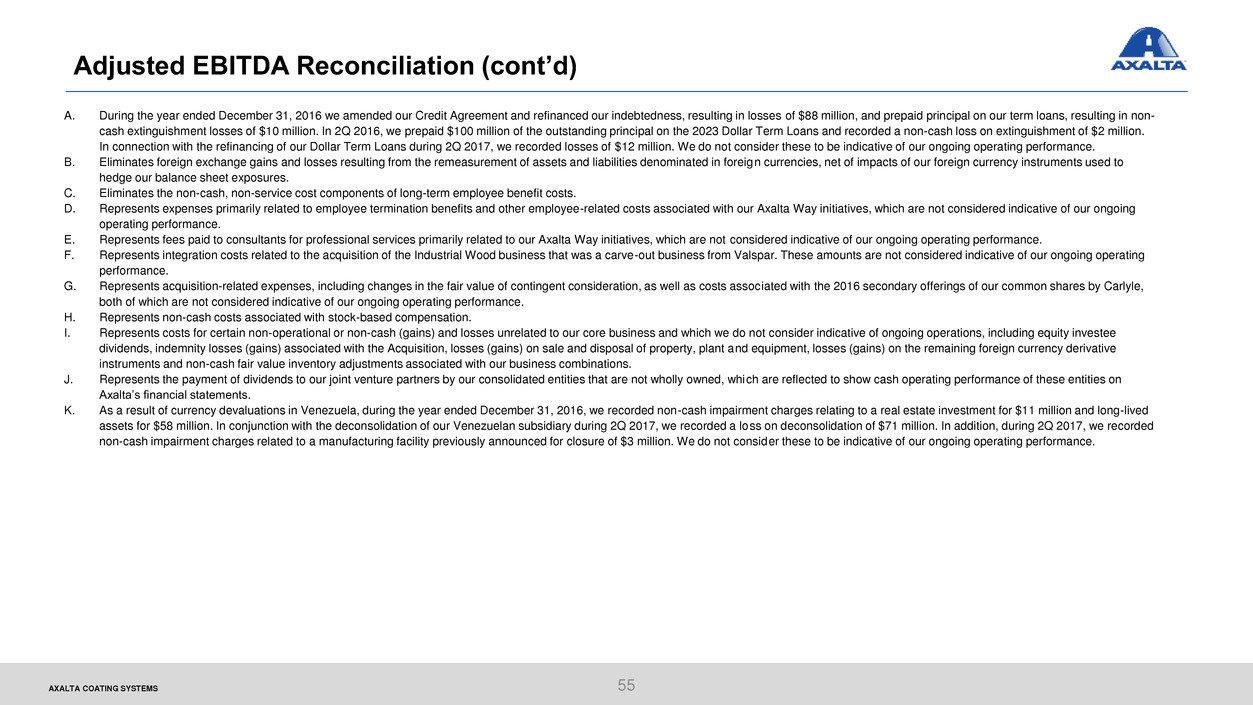

A. During the year ended December 31, 2016 we amended our Credit Agreement and refinanced our indebtedness, resulting in losses of $88 million, and prepaid principal on our term loans, resulting in non-

cash extinguishment losses of $10 million. In 2Q 2016, we prepaid $100 million of the outstanding principal on the 2023 Dollar Term Loans and recorded a non-cash loss on extinguishment of $2 million.

In connection with the refinancing of our Dollar Term Loans during 2Q 2017, we recorded losses of $12 million. We do not consider these to be indicative of our ongoing operating performance.

B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of our foreign currency instruments used to

hedge our balance sheet exposures.

C. Eliminates the non-cash, non-service cost components of long-term employee benefit costs.

D. Represents expenses primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which are not considered indicative of our ongoing

operating performance.

E. Represents fees paid to consultants for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance.

F. Represents integration costs related to the acquisition of the Industrial Wood business that was a carve-out business from Valspar. These amounts are not considered indicative of our ongoing operating

performance.

G. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, as well as costs associated with the 2016 secondary offerings of our common shares by Carlyle,

both of which are not considered indicative of our ongoing operating performance.

H. Represents non-cash costs associated with stock-based compensation.

I. Represents costs for certain non-operational or non-cash (gains) and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including equity investee

dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses (gains) on the remaining foreign currency derivative

instruments and non-cash fair value inventory adjustments associated with our business combinations.

J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned, which are reflected to show cash operating performance of these entities on

Axalta’s financial statements.

K. As a result of currency devaluations in Venezuela, during the year ended December 31, 2016, we recorded non-cash impairment charges relating to a real estate investment for $11 million and long-lived

assets for $58 million. In conjunction with the deconsolidation of our Venezuelan subsidiary during 2Q 2017, we recorded a loss on deconsolidation of $71 million. In addition, during 2Q 2017, we recorded

non-cash impairment charges related to a manufacturing facility previously announced for closure of $3 million. We do not consider these to be indicative of our ongoing operating performance.

Thank you!

Investor Contact:

Chris Mecray, VP IR

Christopher.Mecray@axaltacs.com

215-255-7970