EXHIBIT 99.1

Published on December 14, 2017

December 14, 2017

2018 Preliminary Financial Outlook Call

Exhibit 99.1

2PROPRIETARY

Legal Notices

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of

1995, including those relating to 2018 financial projections, including net sales, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation

and amortization, diluted shares outstanding, contributions from acquisitions, working capital use, and related assumptions, as well as execution on our 2018 goals. Any forward-looking

statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,”

“forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the

industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date

hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on

these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should

understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements

contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our

control including, but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual

Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United

States (“GAAP”), including Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted. Management uses these non-GAAP financial measures in the analysis of our financial and

operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-operating income or expense,

(ii) the impact of certain non-cash, nonrecurring or other items that are included in net income and EBITDA that we do not consider indicative of our ongoing performance and (iii) certain

unusual or nonrecurring items impacting results in a particular period. We believe that making such adjustments provides investors meaningful information to understand our operating

results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted may differ from

that of others in our industry. Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net income, operating income or any other performance measures derived

in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted have

important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. Axalta does not provide a

reconciliation for non-GAAP estimates for Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information necessary to

calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of gains or losses

that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our

US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to

budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating

performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not

available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

3PROPRIETARY

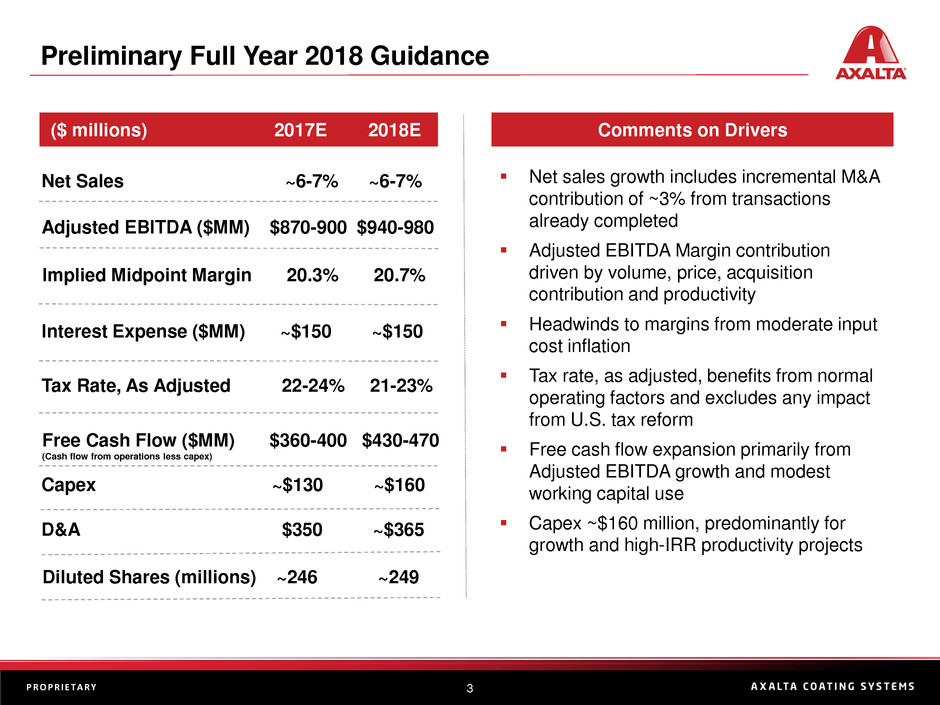

Preliminary Full Year 2018 Guidance

▪ Net sales growth includes incremental M&A

contribution of ~3% from transactions

already completed

▪ Adjusted EBITDA Margin contribution

driven by volume, price, acquisition

contribution and productivity

▪ Headwinds to margins from moderate input

cost inflation

▪ Tax rate, as adjusted, benefits from normal

operating factors and excludes any impact

from U.S. tax reform

▪ Free cash flow expansion primarily from

Adjusted EBITDA growth and modest

working capital use

▪ Capex ~$160 million, predominantly for

growth and high-IRR productivity projects

($ millions) 2017E 2018E

Tax Rate, As Adjusted 22-24% 21-23%

Free Cash Flow ($MM) $360-400 $430-470

(Cash flow from operations less capex)

Comments on Drivers

Interest Expense ($MM) ~$150 ~$150

Adjusted EBITDA ($MM) $870-900 $940-980

Net Sales ~6-7% ~6-7%

Capex ~$130 ~$160

Diluted Shares (millions) ~246 ~249

D&A $350 ~$365

Implied Midpoint Margin 20.3% 20.7%

4PROPRIETARY

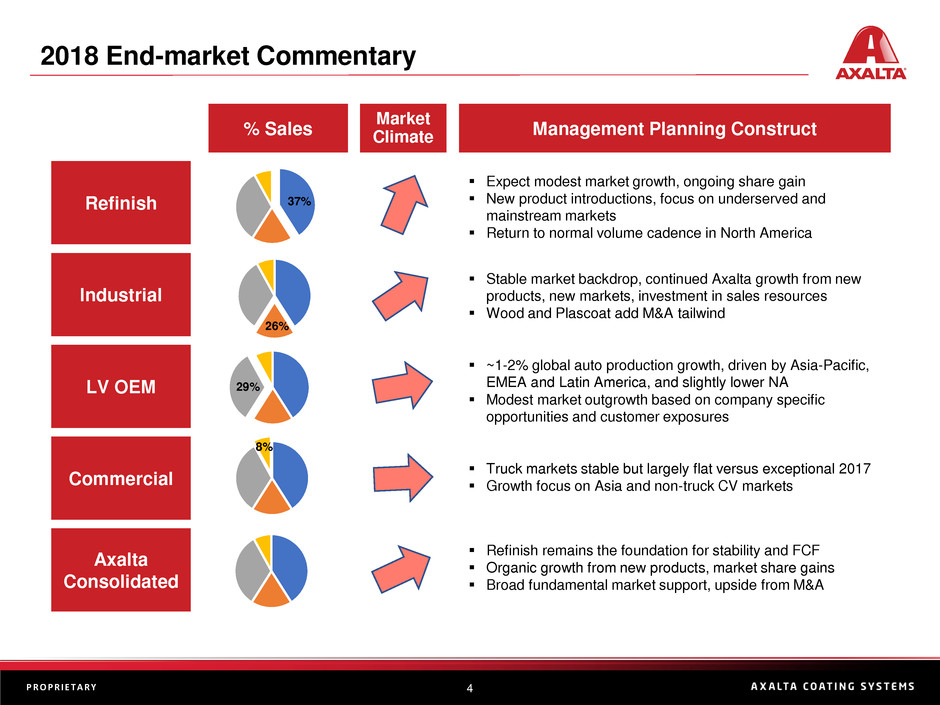

2018 End-market Commentary

Refinish

Industrial

LV OEM

Commercial

Axalta

Consolidated

% Sales

Market

Climate Management Planning Construct

▪ Expect modest market growth, ongoing share gain

▪ New product introductions, focus on underserved and

mainstream markets

▪ Return to normal volume cadence in North America

▪ Stable market backdrop, continued Axalta growth from new

products, new markets, investment in sales resources

▪ Wood and Plascoat add M&A tailwind

▪ ~1-2% global auto production growth, driven by Asia-Pacific,

EMEA and Latin America, and slightly lower NA

▪ Modest market outgrowth based on company specific

opportunities and customer exposures

▪ Truck markets stable but largely flat versus exceptional 2017

▪ Growth focus on Asia and non-truck CV markets

▪ Refinish remains the foundation for stability and FCF

▪ Organic growth from new products, market share gains

▪ Broad fundamental market support, upside from M&A

37%

29%

26%

8%

5PROPRIETARY

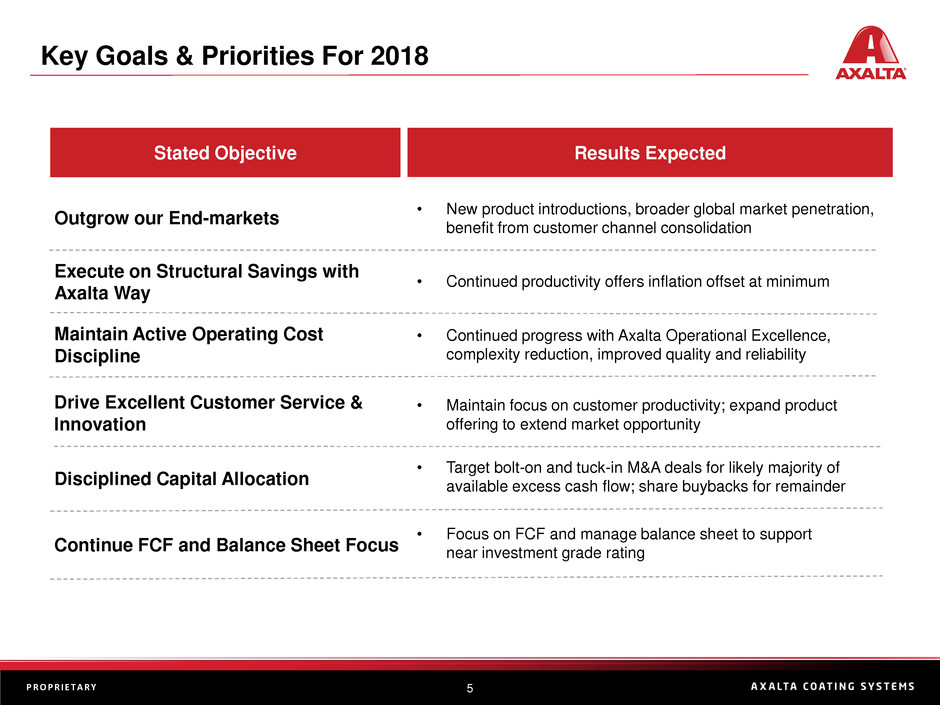

Key Goals & Priorities For 2018

Outgrow our End-markets

Drive Excellent Customer Service &

Innovation

Maintain Active Operating Cost

Discipline

Execute on Structural Savings with

Axalta Way

• New product introductions, broader global market penetration,

benefit from customer channel consolidation

• Continued progress with Axalta Operational Excellence,

complexity reduction, improved quality and reliability

• Continued productivity offers inflation offset at minimum

Disciplined Capital Allocation

• Target bolt-on and tuck-in M&A deals for likely majority of

available excess cash flow; share buybacks for remainder

Continue FCF and Balance Sheet Focus

• Focus on FCF and manage balance sheet to support

near investment grade rating

Stated Objective Results Expected

• Maintain focus on customer productivity; expand product

offering to extend market opportunity

Investor Contact:

Chris Mecray, VP of Investor Relations

215-255-7970

Christopher.Mecray@axaltacs.com