EXHIBIT 99.1

Published on February 22, 2018

Investor Presentation

First Quarter 2018

Axalta Coating Systems Ltd.

Exhibit 99.1

2P R O P R I E T A R Y

Legal Notices

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2018

financial projections, including net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding, cost

savings, contributions from acquisitions, raw material cost increases, and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as

“believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have

made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date

hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any

obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or

results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and

unknown risks and uncertainties, many of which are beyond our control including, but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk

Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017.

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales

excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they

assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-cash items included within net income, (ii) items Axalta does not believe are indicative of ongoing operating

performance or (iii) nonrecurring, unusual or infrequent items that have not occurred within the last two years or Axalta believes are not reasonably likely to recur within the next two years. We believe that making such

adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms net sales excluding FX, EBITDA,

Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales excluding FX, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as

alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net

sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our

results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not

provide a reconciliation for non-GAAP estimates for net sales excluding FX, EBITDA, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information necessary to

calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or

losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial

results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this non-GAAP financial

measure with the most directly comparable financial measure calculated in accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

3P R O P R I E T A R Y

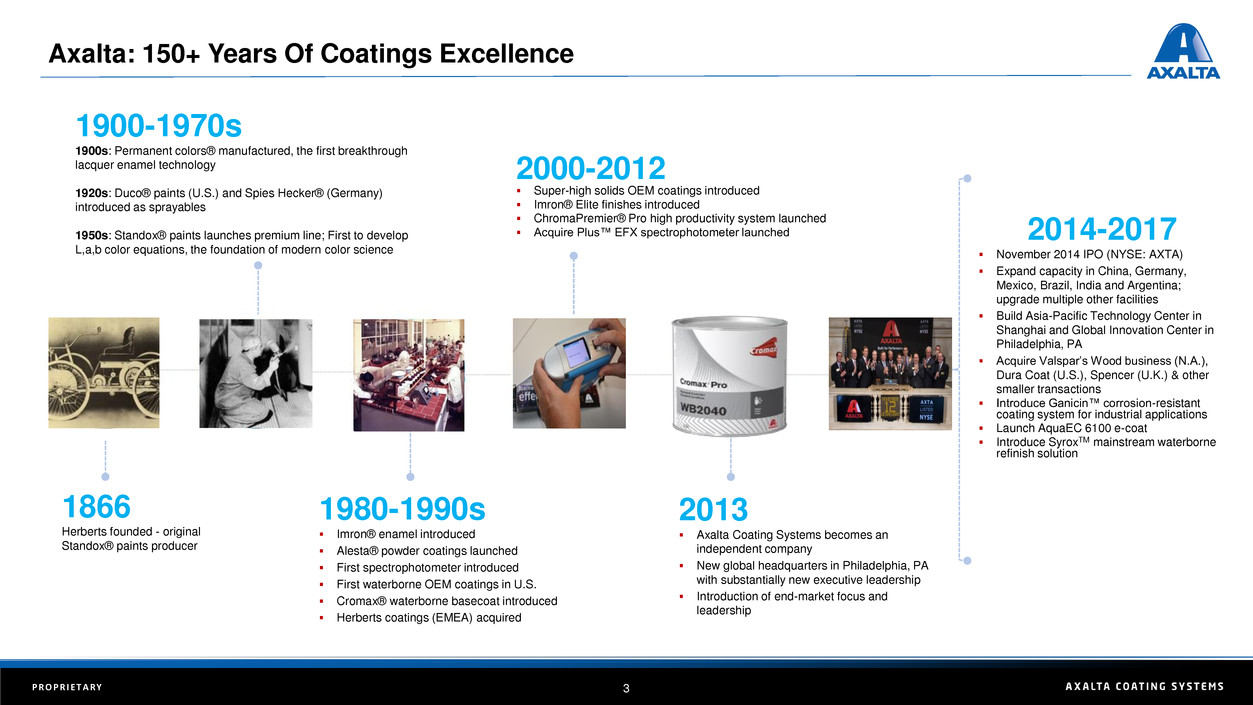

2014-2017

▪ November 2014 IPO (NYSE: AXTA)

▪ Expand capacity in China, Germany,

Mexico, Brazil, India and Argentina;

upgrade multiple other facilities

▪ Build Asia-Pacific Technology Center in

Shanghai and Global Innovation Center in

Philadelphia, PA

▪ Acquire Valspar’s Wood business (N.A.),

Dura Coat (U.S.), Spencer (U.K.) & other

smaller transactions

▪ Introduce Ganicin™ corrosion-resistant

coating system for industrial applications

▪ Launch AquaEC 6100 e-coat

▪ Introduce SyroxTM mainstream waterborne

refinish solution

1866

Herberts founded - original

Standox® paints producer

2000-2012

▪ Super-high solids OEM coatings introduced

▪ Imron® Elite finishes introduced

▪ ChromaPremier® Pro high productivity system launched

▪ Acquire Plus™ EFX spectrophotometer launched

1900-1970s

1900s: Permanent colors® manufactured, the first breakthrough

lacquer enamel technology

1920s: Duco® paints (U.S.) and Spies Hecker® (Germany)

introduced as sprayables

1950s: Standox® paints launches premium line; First to develop

L,a,b color equations, the foundation of modern color science

1980-1990s

▪ Imron® enamel introduced

▪ Alesta® powder coatings launched

▪ First spectrophotometer introduced

▪ First waterborne OEM coatings in U.S.

▪ Cromax® waterborne basecoat introduced

▪ Herberts coatings (EMEA) acquired

2013

▪ Axalta Coating Systems becomes an

independent company

▪ New global headquarters in Philadelphia, PA

with substantially new executive leadership

▪ Introduction of end-market focus and

leadership

Axalta: 150+ Years Of Coatings Excellence

2

0

1

4

4P R O P R I E T A R Y

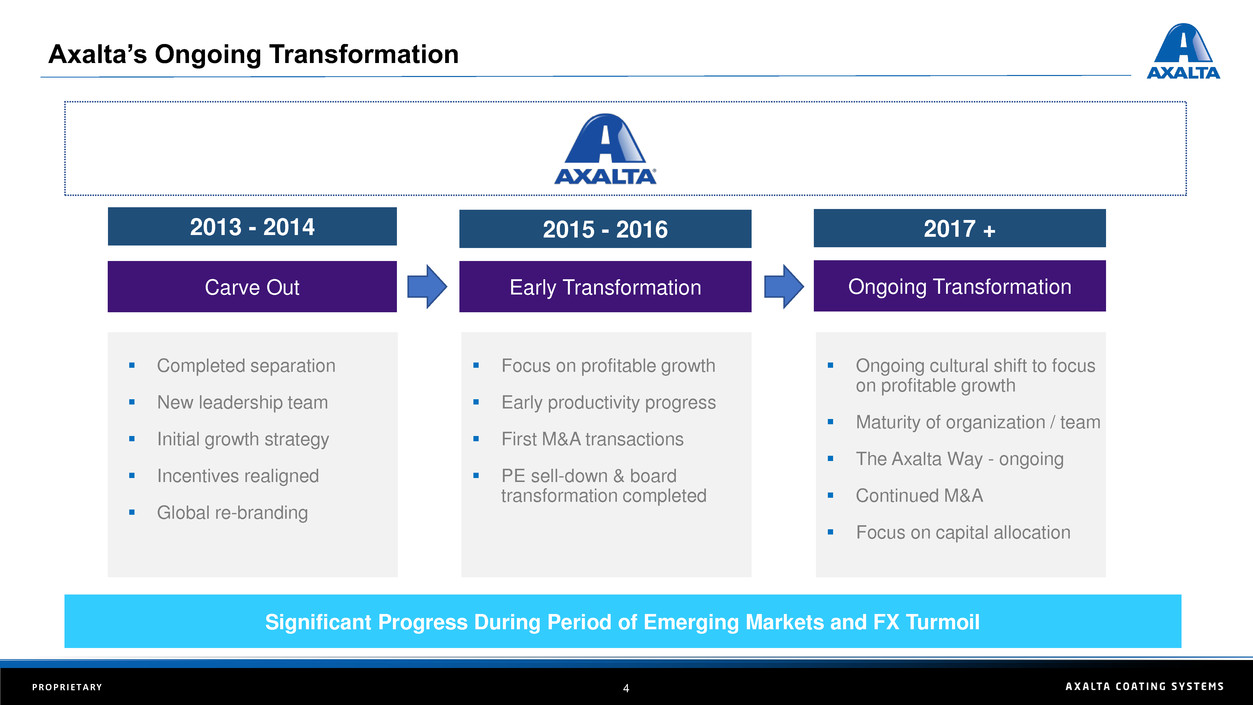

Axalta’s Ongoing Transformation

Early Transformation

2015 - 2016

Significant Progress During Period of Emerging Markets and FX Turmoil

2013 - 2014

Carve Out

▪ Completed separation

▪ New leadership team

▪ Initial growth strategy

▪ Incentives realigned

▪ Global re-branding

Ongoing Transformation

2017 +

▪ Focus on profitable growth

▪ Early productivity progress

▪ First M&A transactions

▪ PE sell-down & board

transformation completed

▪ Ongoing cultural shift to focus

on profitable growth

▪ Maturity of organization / team

▪ The Axalta Way - ongoing

▪ Continued M&A

▪ Focus on capital allocation

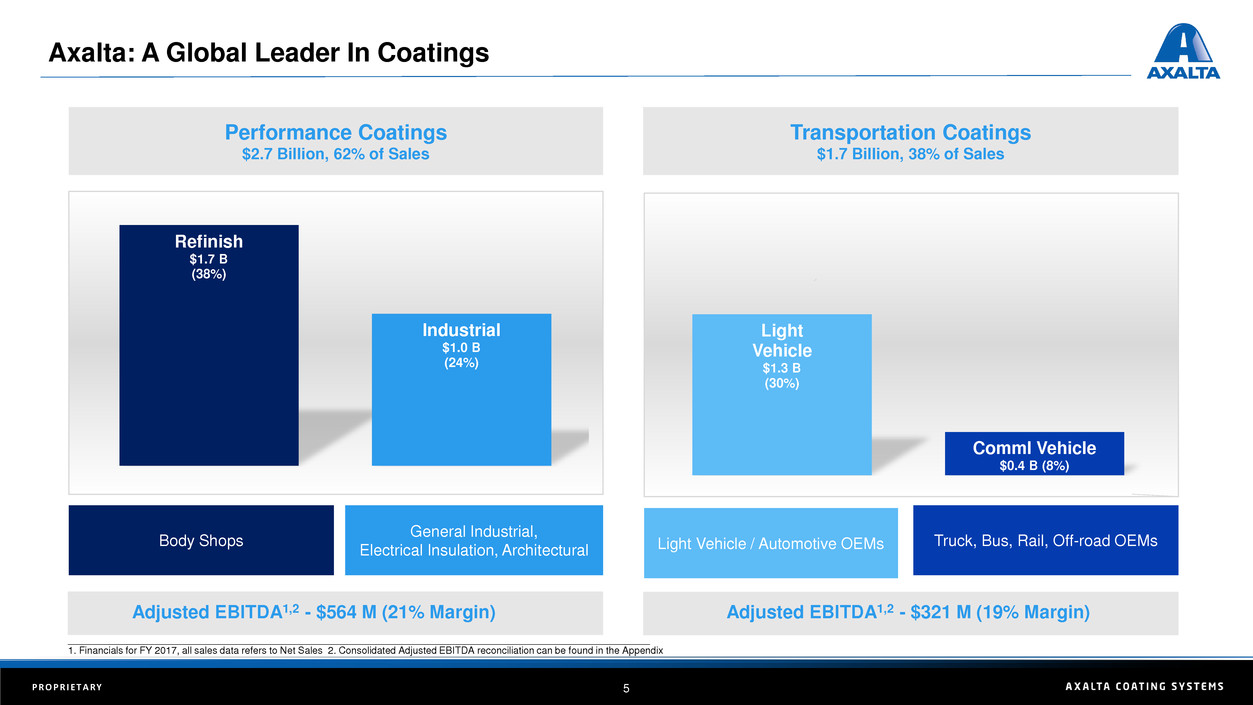

5P R O P R I E T A R Y

Refinish

$1.7 B

(38%)

Industrial

$1.0 B

(24%)

Body Shops

Light

Vehicle

$1.3 B

(30%)

Comml Vehicle

$0.4 B (8%)

Performance Coatings

$2.7 Billion, 62% of Sales

General Industrial,

Electrical Insulation, Architectural

Transportation Coatings

$1.7 Billion, 38% of Sales

Adjusted EBITDA1,2 - $564 M (21% Margin) Adjusted EBITDA1,2 - $321 M (19% Margin)

Light Vehicle / Automotive OEMs Truck, Bus, Rail, Off-road OEMs

____________________________________________________________________________________________________________

1. Financials for FY 2017, all sales data refers to Net Sales 2. Consolidated Adjusted EBITDA reconciliation can be found in the Appendix

Axalta: A Global Leader In Coatings

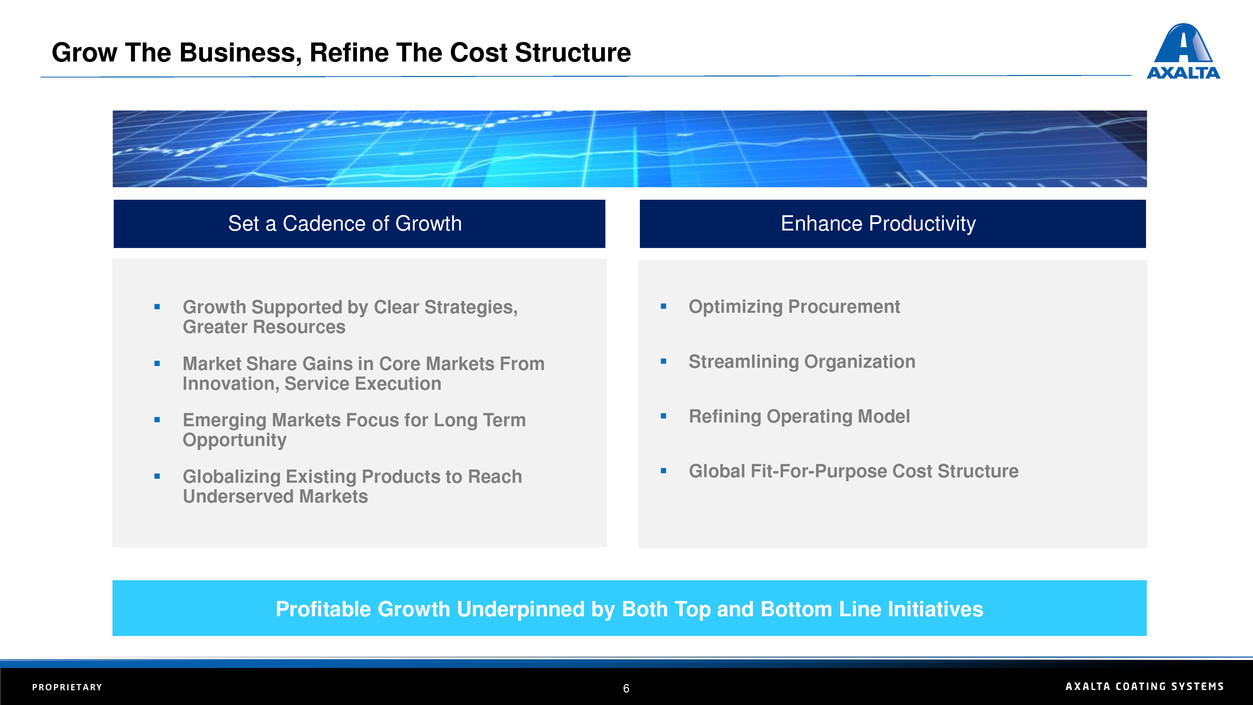

6P R O P R I E T A R Y

Grow The Business, Refine The Cost Structure

▪ Growth Supported by Clear Strategies,

Greater Resources

▪ Market Share Gains in Core Markets From

Innovation, Service Execution

▪ Emerging Markets Focus for Long Term

Opportunity

▪ Globalizing Existing Products to Reach

Underserved Markets

▪ Optimizing Procurement

▪ Streamlining Organization

▪ Refining Operating Model

▪ Global Fit-For-Purpose Cost Structure

Profitable Growth Underpinned by Both Top and Bottom Line Initiatives

Enhance ProductivitySet a Cadence of Growth

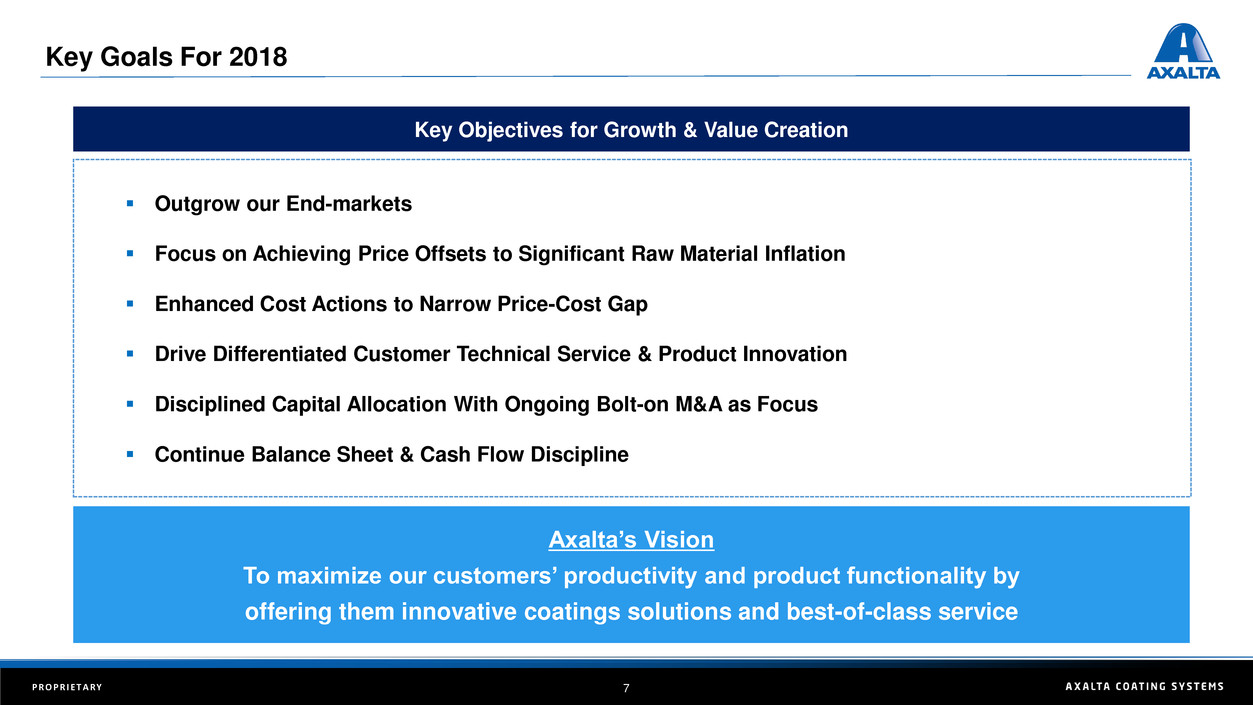

7P R O P R I E T A R Y

Key Goals For 2018

Key Objectives for Growth & Value Creation

Axalta’s Vision

To maximize our customers’ productivity and product functionality by

offering them innovative coatings solutions and best-of-class service

▪ Outgrow our End-markets

▪ Focus on Achieving Price Offsets to Significant Raw Material Inflation

▪ Enhanced Cost Actions to Narrow Price-Cost Gap

▪ Drive Differentiated Customer Technical Service & Product Innovation

▪ Disciplined Capital Allocation With Ongoing Bolt-on M&A as Focus

▪ Continue Balance Sheet & Cash Flow Discipline

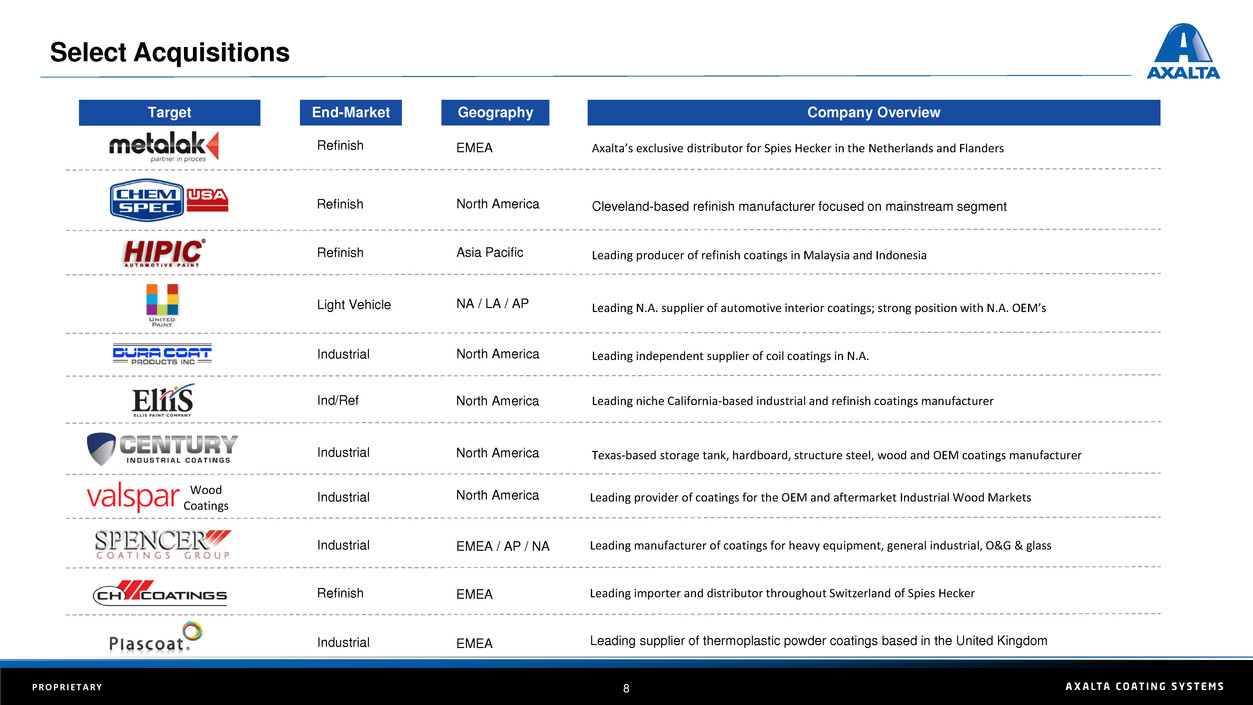

8P R O P R I E T A R Y

Select Acquisitions

GeographyEnd-Market Company OverviewTarget

Leading producer of refinish coatings in Malaysia and Indonesia

Leading N.A. supplier of automotive interior coatings; strong position with N.A. OEM’s

Leading independent supplier of coil coatings in N.A.

Refinish

Light Vehicle

Industrial

Asia Pacific

NA / LA / AP

North America

North AmericaInd/Ref

North AmericaIndustrial

Leading niche California-based industrial and refinish coatings manufacturer

Texas-based storage tank, hardboard, structure steel, wood and OEM coatings manufacturer

Industrial Leading provider of coatings for the OEM and aftermarket Industrial Wood Markets

EMEA / AP / NAIndustrial Leading manufacturer of coatings for heavy equipment, general industrial, O&G & glass

EMEARefinish Leading importer and distributor throughout Switzerland of Spies Hecker

Axalta’s exclusive distributor for Spies Hecker in the Netherlands and FlandersRefinish EMEA

EMEAIndustrial Leading supplier of thermoplastic powder coatings based in the United Kingdom

Cleveland-based refinish manufacturer focused on mainstream segmentNorth AmericaRefinish

Wood

Coatings

North America

9P R O P R I E T A R Y

Axalta Operates Fundamentally Strong Businesses

9

Global Market Leadership Positions

Significant Competitive Advantages

A Service-Led Business Model

Structurally Attractive Global End Markets

Highly Variable Cost Structure & Low Capital Intensity

10P R O P R I E T A R Y

Global Market Leadership Positions

Axalta’s Global Scale Enables Market Leadership

_______________________________________________

Net Sales as of FY 2017

1. Mexico is included in Latin America

2. Includes 13 JV facilities.

✓ 49 manufacturing

facilities

✓ 47 customer

training sites

✓ 4 technology

centers

✓ ~13,300 employees,

~130 countries

North America1

37% Sales

Latin America1

11% of Sales

Asia Pacific

17% of Sales

EMEA

35% of Sales

Manufacturing Facility2 Technology Center

11P R O P R I E T A R Y

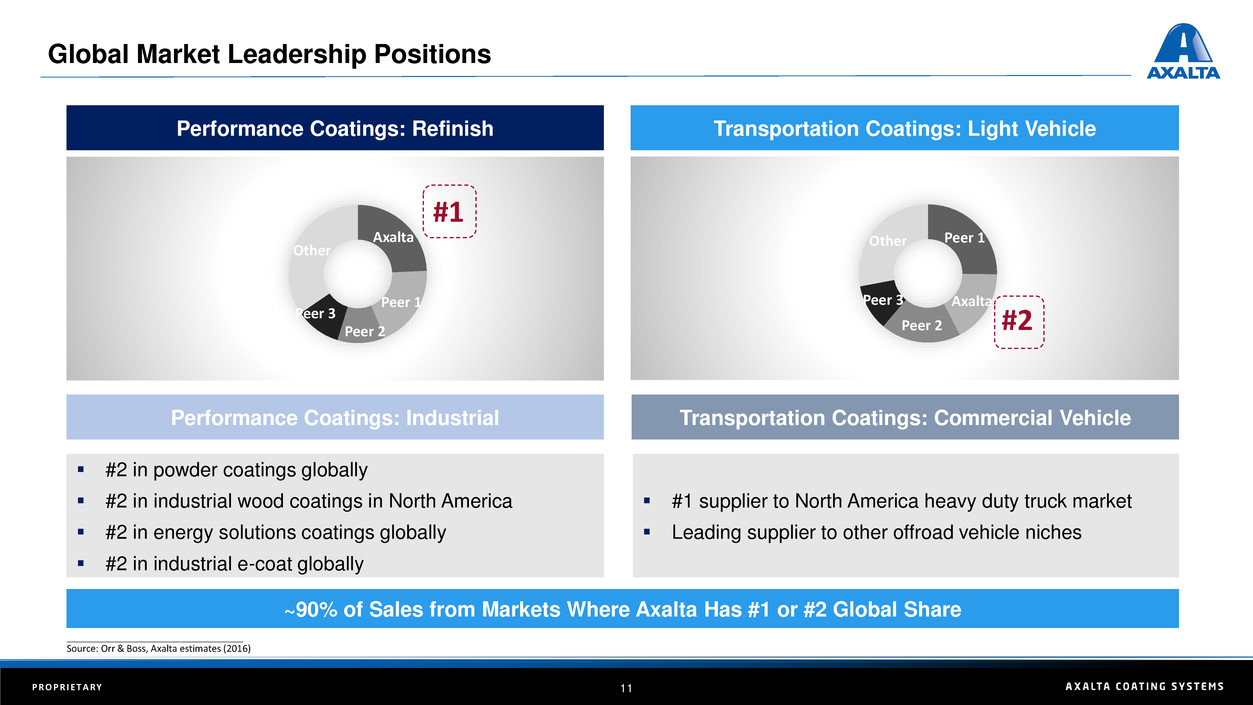

Global Market Leadership Positions

Peer 1

Axalta

Peer 2

Peer 3

Other

~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share

Axalta

Peer 1

Peer 2

Peer 3

Other

Performance Coatings: Refinish Transportation Coatings: Light Vehicle

#1

__________________________________

Source: Orr & Boss, Axalta estimates (2016)

#2

Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle

▪ #2 in powder coatings globally

▪ #2 in industrial wood coatings in North America

▪ #2 in energy solutions coatings globally

▪ #2 in industrial e-coat globally

▪ #1 supplier to North America heavy duty truck market

▪ Leading supplier to other offroad vehicle niches

12P R O P R I E T A R Y

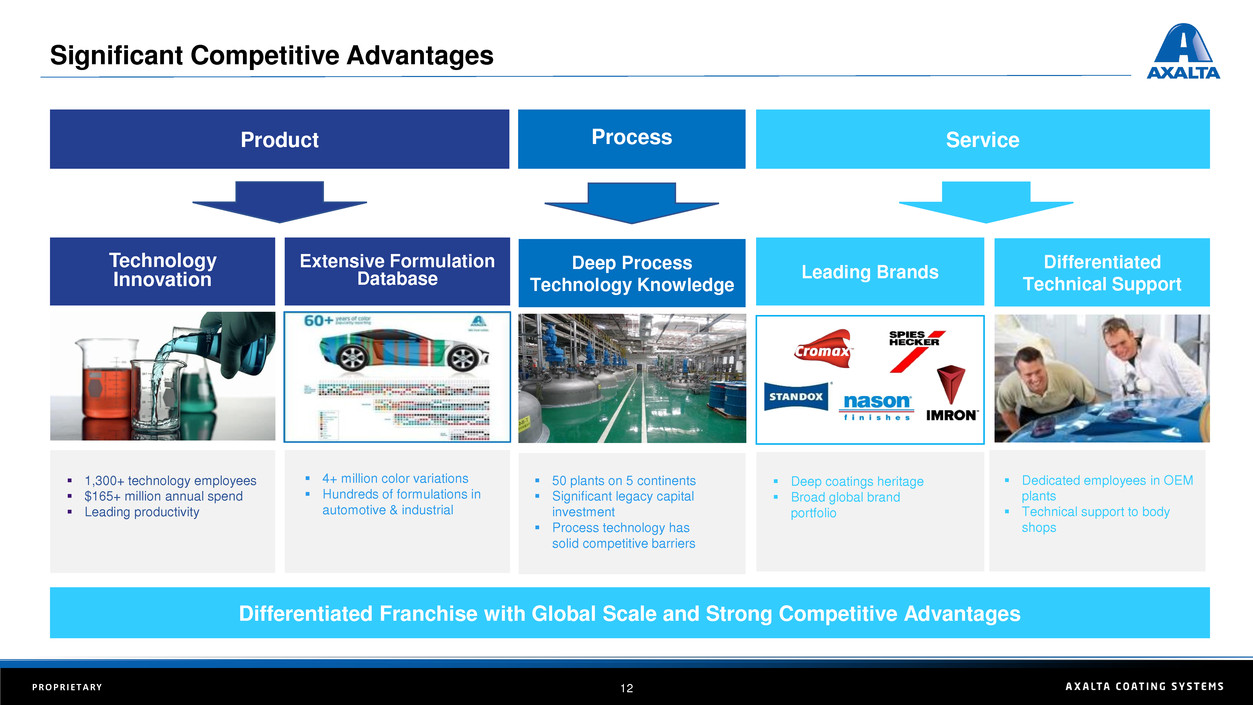

Significant Competitive Advantages

Differentiated Franchise with Global Scale and Strong Competitive Advantages

▪ 4+ million color variations

▪ Hundreds of formulations in

automotive & industrial

▪ Deep coatings heritage

▪ Broad global brand

portfolio

▪ 1,300+ technology employees

▪ $165+ million annual spend

▪ Leading productivity

▪ 50 plants on 5 continents

▪ Significant legacy capital

investment

▪ Process technology has

solid competitive barriers

▪ Dedicated employees in OEM

plants

▪ Technical support to body

shops

Technology

Innovation

Extensive Formulation

Database

Deep Process

Technology Knowledge

Leading Brands

Differentiated

Technical Support

Product Process Service

13P R O P R I E T A R Y

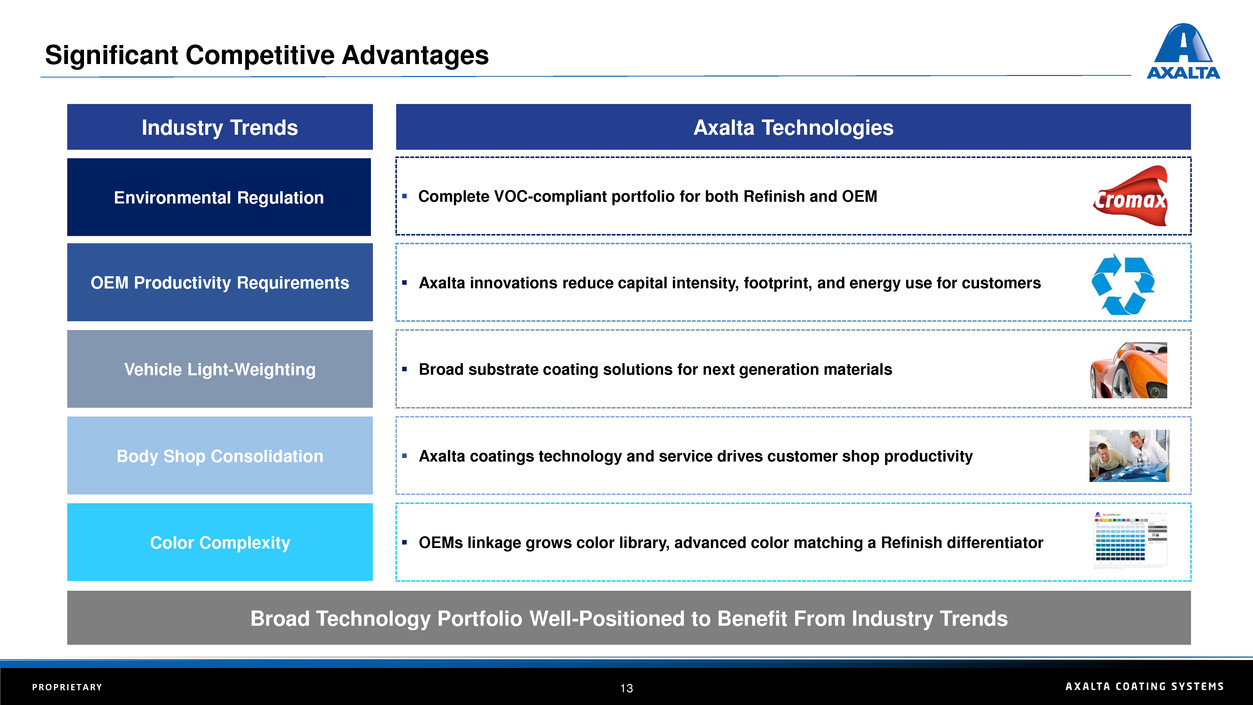

Industry Trends Axalta Technologies

Vehicle Light-Weighting ▪ Broad substrate coating solutions for next generation materials

Body Shop Consolidation ▪ Axalta coatings technology and service drives customer shop productivity

Significant Competitive Advantages

Color Complexity ▪ OEMs linkage grows color library, advanced color matching a Refinish differentiator

▪ Axalta innovations reduce capital intensity, footprint, and energy use for customersOEM Productivity Requirements

Environmental Regulation ▪ Complete VOC-compliant portfolio for both Refinish and OEM

Broad Technology Portfolio Well-Positioned to Benefit From Industry Trends

14P R O P R I E T A R Y

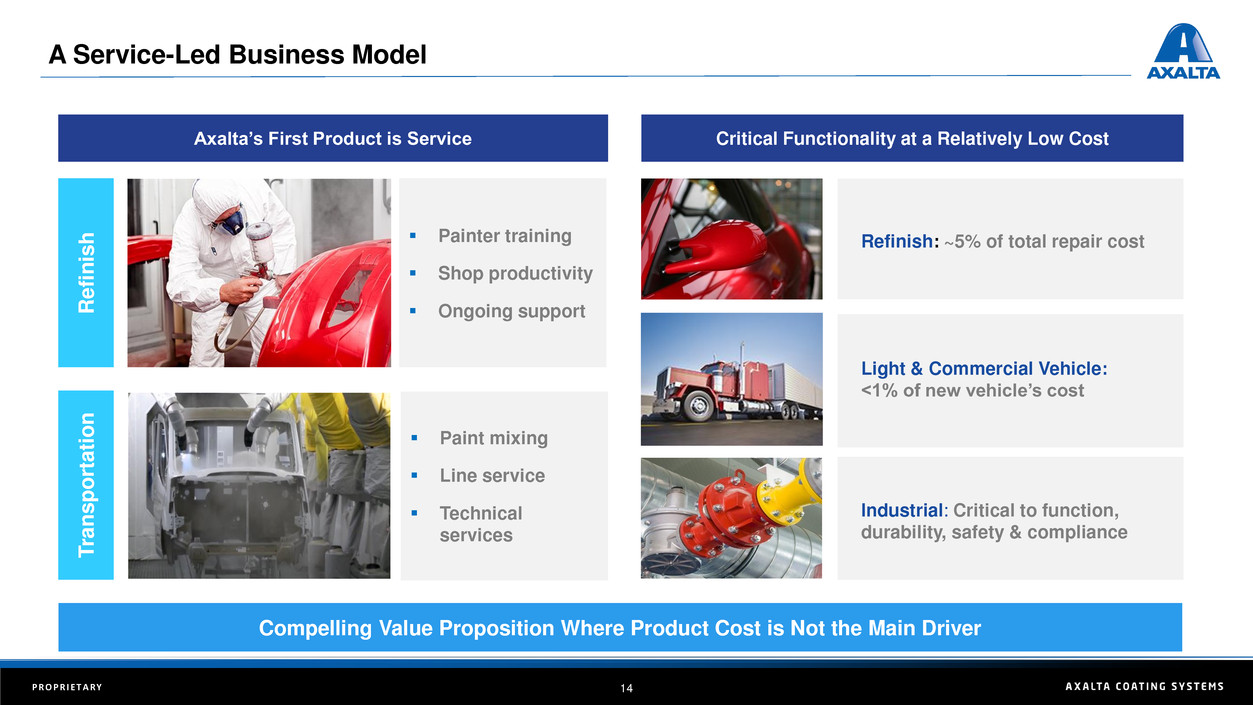

▪ Painter training

▪ Shop productivity

▪ Ongoing support

A Service-Led Business Model

Critical Functionality at a Relatively Low Cost

1

Compelling Value Proposition Where Product Cost is Not the Main Driver

Light & Commercial Vehicle:

<1% of new vehicle’s cost

Industrial: Critical to function,

durability, safety & compliance

Refinish: ~5% of total repair cost

Axalta’s First Product is Service

▪ Paint mixing

▪ Line service

▪ Technical

services

Refi

n

is

h

T

ranspo

rta

tio

n

15P R O P R I E T A R Y

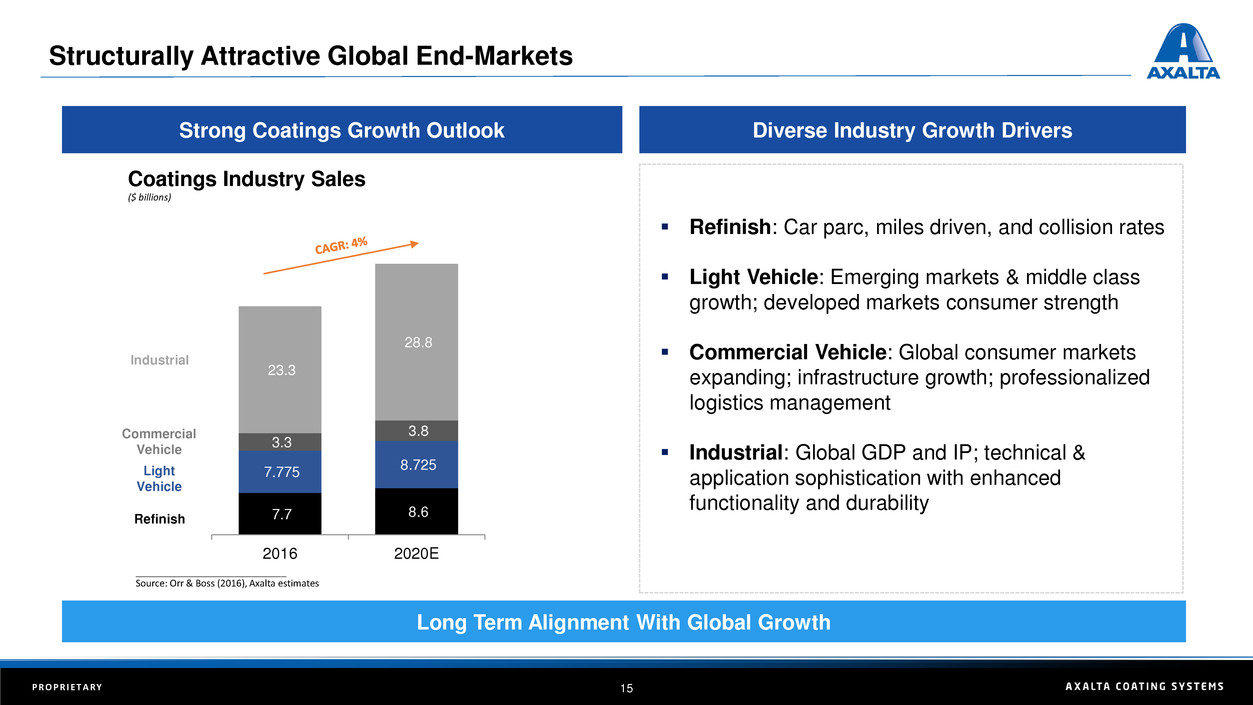

Structurally Attractive Global End-Markets

Strong Coatings Growth Outlook

Long Term Alignment With Global Growth

▪ Refinish: Car parc, miles driven, and collision rates

▪ Light Vehicle: Emerging markets & middle class

growth; developed markets consumer strength

▪ Commercial Vehicle: Global consumer markets

expanding; infrastructure growth; professionalized

logistics management

▪ Industrial: Global GDP and IP; technical &

application sophistication with enhanced

functionality and durability

Diverse Industry Growth Drivers

Commercial

Vehicle

Light

Vehicle

Refinish

Industrial

Coatings Industry Sales

($ billions)

_____________________________

Source: Orr & Boss (2016), Axalta estimates

7.7 8.6

7.775

8.725

3.3

3.8

23.3

28.8

2016 2020E

16P R O P R I E T A R Y

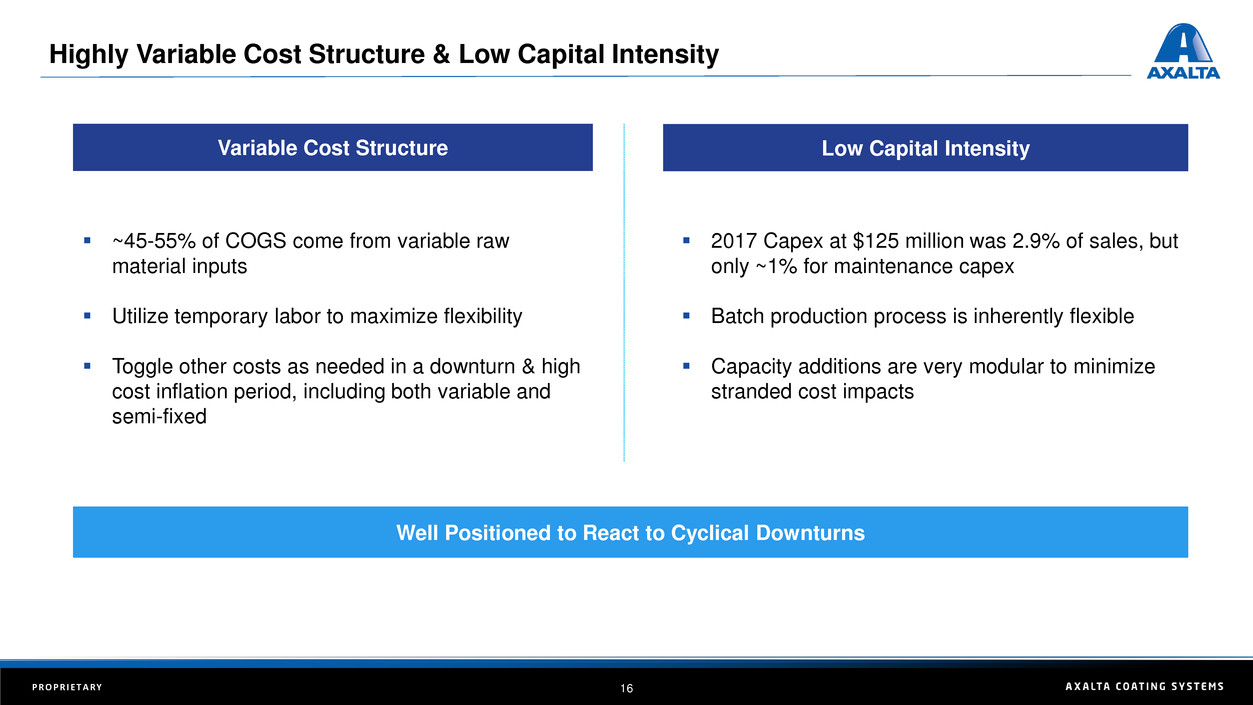

Highly Variable Cost Structure & Low Capital Intensity

▪ ~45-55% of COGS come from variable raw

material inputs

▪ Utilize temporary labor to maximize flexibility

▪ Toggle other costs as needed in a downturn & high

cost inflation period, including both variable and

semi-fixed

Low Capital Intensity

▪ 2017 Capex at $125 million was 2.9% of sales, but

only ~1% for maintenance capex

▪ Batch production process is inherently flexible

▪ Capacity additions are very modular to minimize

stranded cost impacts

Variable Cost Structure

Well Positioned to React to Cyclical Downturns

17P R O P R I E T A R Y

Axalta’s Evolution Is Grounded In Fundamental Goals

Focus on operational excellence and foster a culture of accountability

Axalta’s Strategy

Grow in targeted industrial coatings segments via organic growth and selective acquisitions

Move into attractive adjacencies by leveraging our global technology and service capabilities

Grow in existing markets with our industry-leading products and services

18P R O P R I E T A R Y

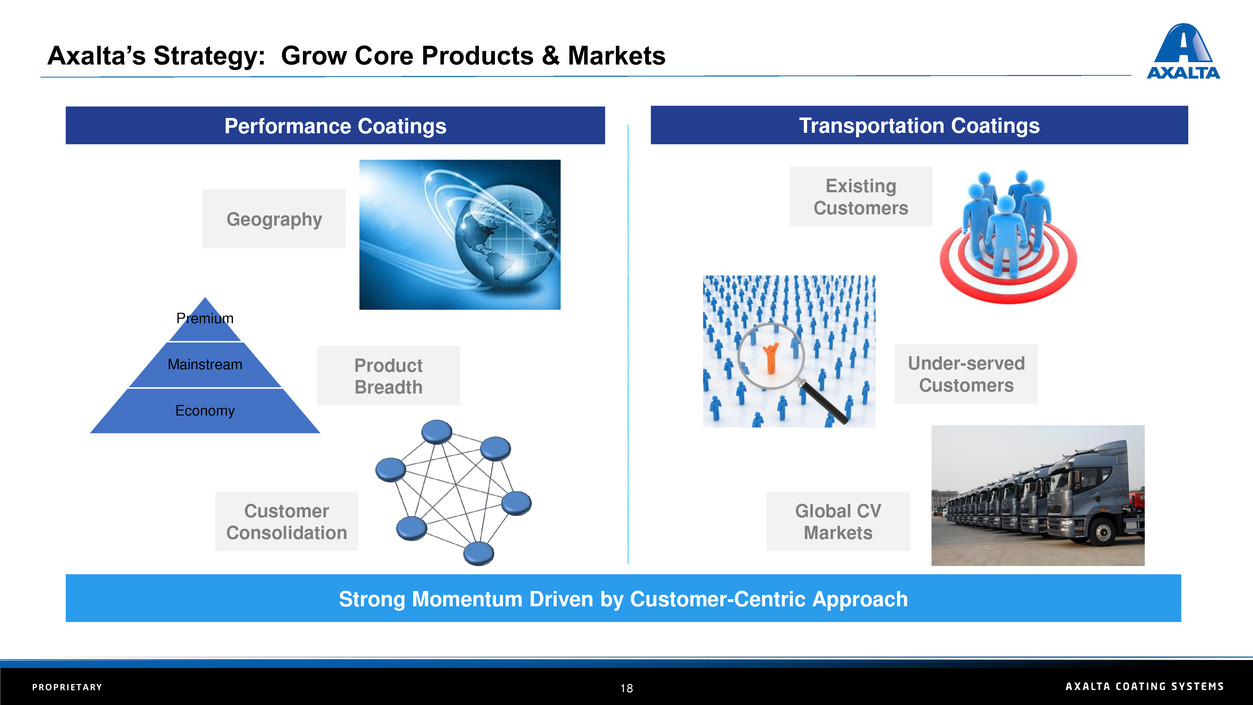

Axalta’s Strategy: Grow Core Products & Markets

Performance Coatings

Strong Momentum Driven by Customer-Centric Approach

Transportation Coatings

Geography

Product

Breadth

Customer

Consolidation

Premium

Mainstream

Economy

Existing

Customers

Under-served

Customers

Global CV

Markets

19P R O P R I E T A R Y

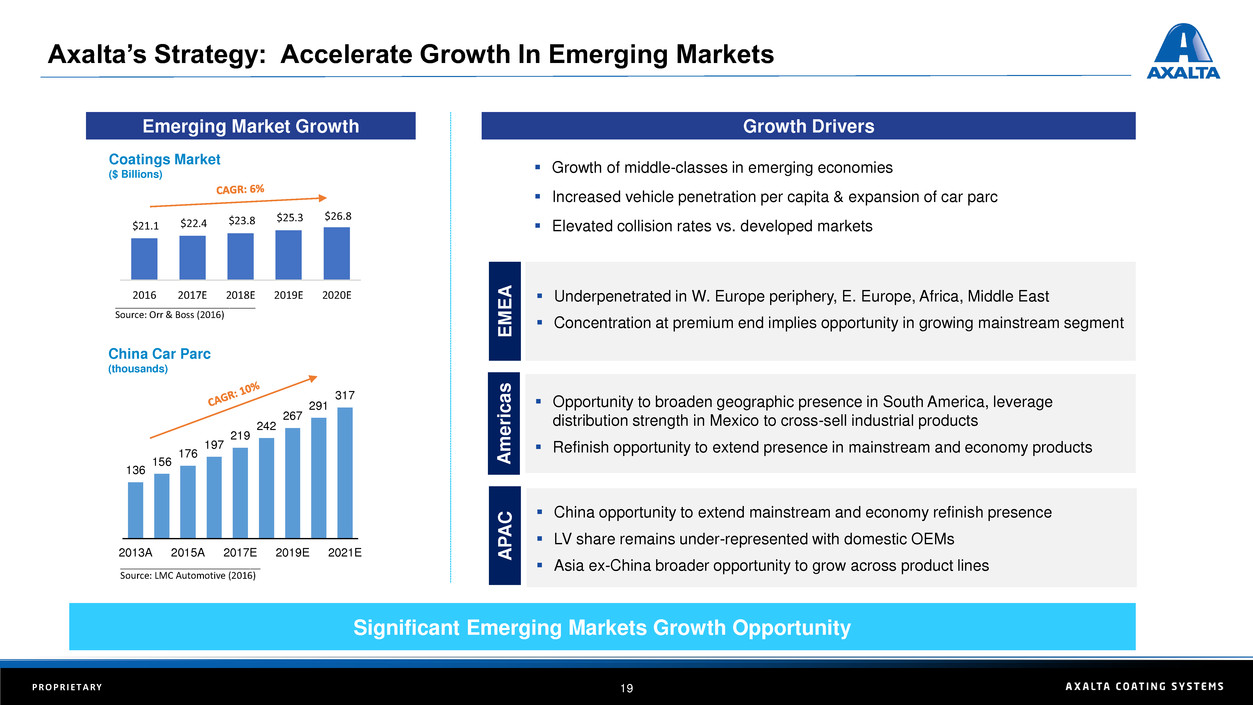

Axalta’s Strategy: Accelerate Growth In Emerging Markets

China Car Parc

(thousands)

Emerging Market Growth

Coatings Market

($ Billions)

Significant Emerging Markets Growth Opportunity

Growth Drivers

▪ Growth of middle-classes in emerging economies

▪ Increased vehicle penetration per capita & expansion of car parc

▪ Elevated collision rates vs. developed markets

___________________________

Source: Orr & Boss (2016)

___________________________

Source: LMC Automotive (2016)

$21.1 $22.4 $23.8

$25.3 $26.8

2016 2017E 2018E 2019E 2020E

136

156

176

197

219

242

267

291

317

2013A 2015A 2017E 2019E 2021E

▪ China opportunity to extend mainstream and economy refinish presence

▪ LV share remains under-represented with domestic OEMs

▪ Asia ex-China broader opportunity to grow across product lines

▪ Opportunity to broaden geographic presence in South America, leverage

distribution strength in Mexico to cross-sell industrial products

▪ Refinish opportunity to extend presence in mainstream and economy products

▪ Underpenetrated in W. Europe periphery, E. Europe, Africa, Middle East

▪ Concentration at premium end implies opportunity in growing mainstream segment

E

M

E

A

A

me

ri

ca

s

A

P

A

C

20P R O P R I E T A R Y

Architectural

Axalta’s Strategy: Targeted Industrial Coatings Expansion

Growth from Leveraging Our Product Portfolio in Underserved Markets

▪ Targeting mid-single digit growth CAGR

▪ Double digit growth in new customer adds 2015-17

▪ Added significant infrastructure and investment over 4 years

A Broad Industrial Portfolio

Electrical

Insulation

Agricultural,

Construction, &

Earthmoving (ACE)

Oil & Gas Coil

Industrial

Wood

Organic Growth Inorganic Growth

▪ Targeting significant growth from acquisitions

▪ Completed 6 transactions with ~$350+ million in net sales

▪ M&A leverages procurement, distribution and R&D resources

21P R O P R I E T A R Y

▪ Ongoing Axalta Way productivity

▪ Axalta Operating Excellence (AOS) rollout

▪ R&D / Innovation enablers

▪ Salesforce investment

▪ Manufacturing footprint balancing

▪ Enhanced IT tools

▪ Product complexity reduction

Leadership & Culture

▪ Tone set by senior leaders

▪ Independence with accountability

▪ Leadership stabilized across the matrix

▪ Supporting and educating our people

▪ Talent roadmaps to sustain and grow

▪ Refining the culture deeper in the company

Organization & Operations

Employees Feel the Effect of Our Focus and Accountability

Axalta’s Strategy: Focus On Operating Excellence

Financial Overview

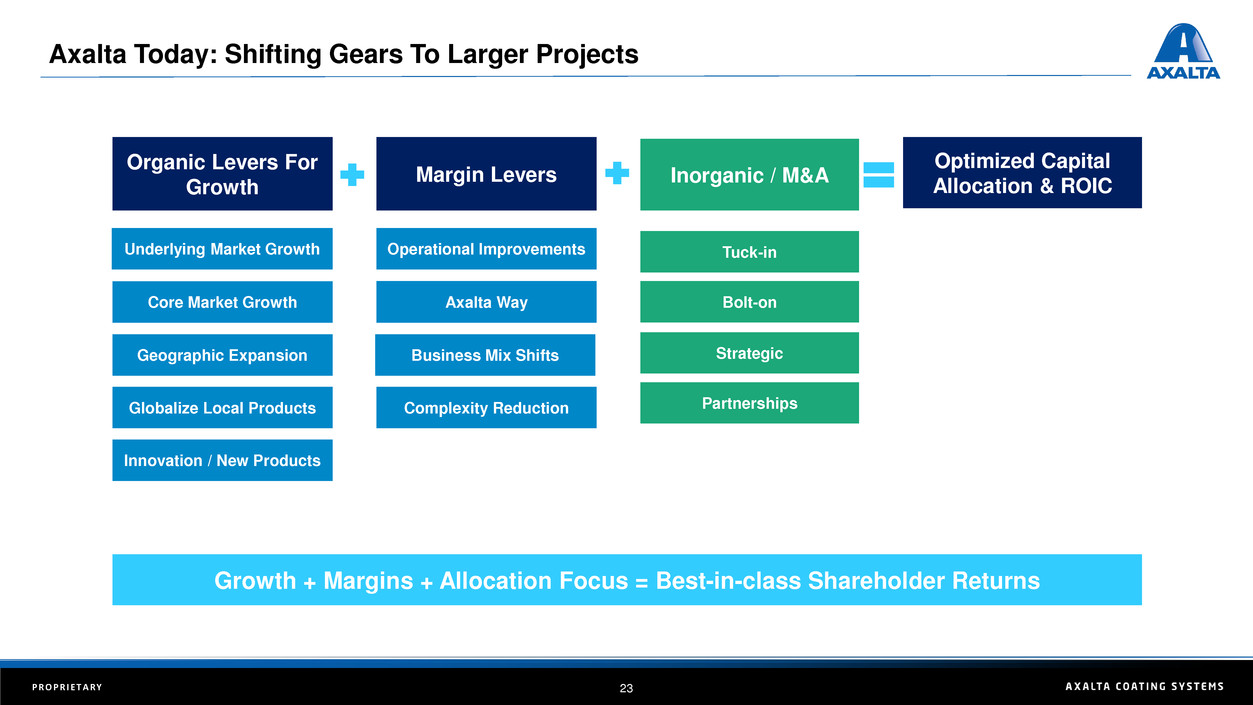

23P R O P R I E T A R Y

Axalta Today: Shifting Gears To Larger Projects

Underlying Market Growth

Core Market Growth

Operational Improvements Tuck-in

Organic Levers For

Growth

Inorganic / M&AMargin Levers

Growth + Margins + Allocation Focus = Best-in-class Shareholder Returns

Optimized Capital

Allocation & ROIC

Axalta Way Bolt-on

Strategic

Partnerships

Geographic Expansion

Globalize Local Products

Innovation / New Products

Business Mix Shifts

Complexity Reduction

24P R O P R I E T A R Y

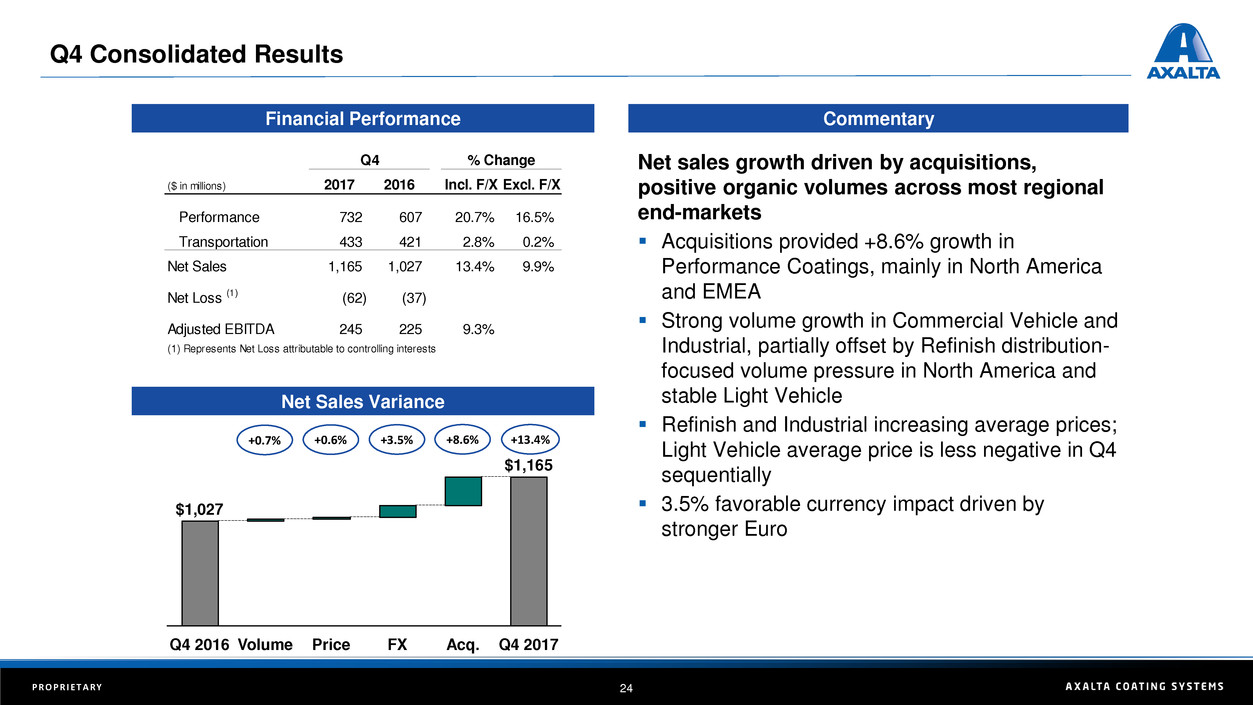

Q4 Consolidated Results

CommentaryFinancial Performance

Net Sales Variance

Net sales growth driven by acquisitions,

positive organic volumes across most regional

end-markets

▪ Acquisitions provided +8.6% growth in

Performance Coatings, mainly in North America

and EMEA

▪ Strong volume growth in Commercial Vehicle and

Industrial, partially offset by Refinish distribution-

focused volume pressure in North America and

stable Light Vehicle

▪ Refinish and Industrial increasing average prices;

Light Vehicle average price is less negative in Q4

sequentially

▪ 3.5% favorable currency impact driven by

stronger Euro

($ in millions) 2017 2016 Incl. F/X Excl. F/X

Performance 732 607 20.7% 16.5%

Transportation 433 421 2.8% 0.2%

Net Sales 1,165 1,027 13.4% 9.9%

Net Loss (1) (62) (37)

Adjusted EBITDA 245 225 9.3%

(1) Represents Net Loss attributable to controlling interests

Q4 % Change

$1,027

Q4 2017FX Acq.VolumeQ4 2016

$1,165

Price

+0.7% +0.6% +3.5% +8.6% +13.4%

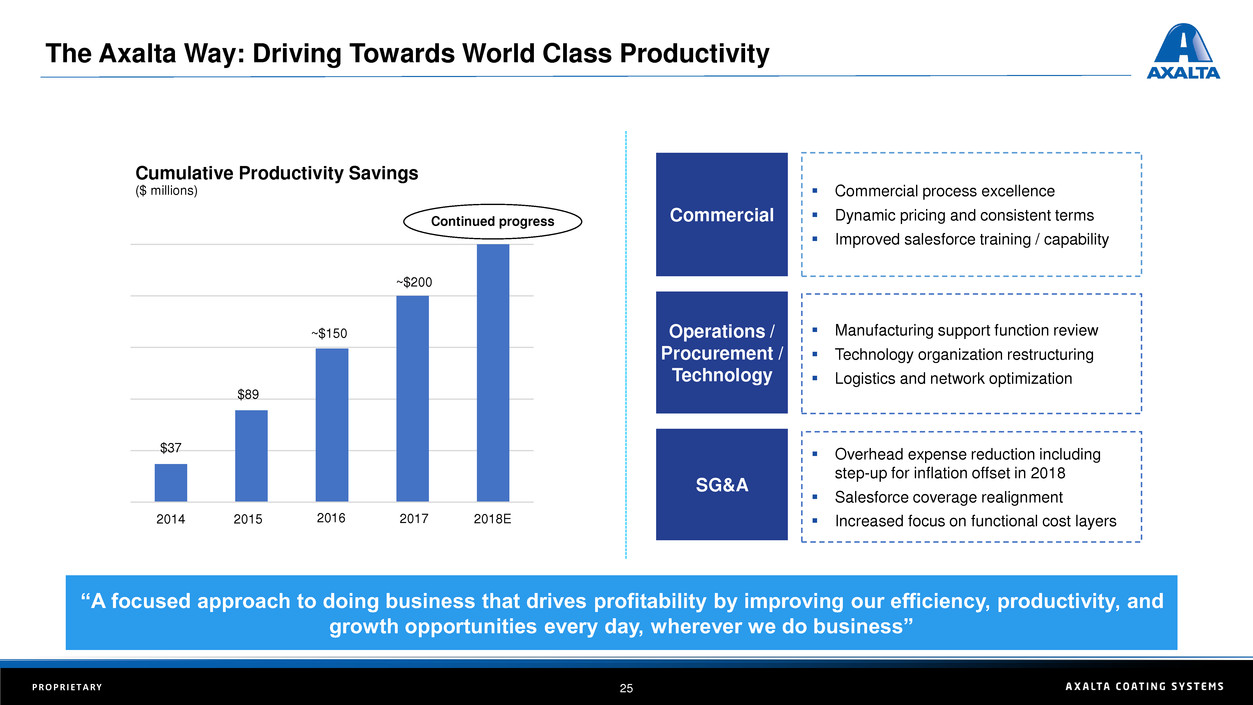

25P R O P R I E T A R Y

Cumulative Productivity Savings

($ millions)

“A focused approach to doing business that drives profitability by improving our efficiency, productivity, and

growth opportunities every day, wherever we do business”

201720162015 2018E2014

~$150

$89

~$200

$37

Continued progress

The Axalta Way: Driving Towards World Class Productivity

Commercial

Operations /

Procurement /

Technology

SG&A

▪ Manufacturing support function review

▪ Technology organization restructuring

▪ Logistics and network optimization

▪ Overhead expense reduction including

step-up for inflation offset in 2018

▪ Salesforce coverage realignment

▪ Increased focus on functional cost layers

▪ Commercial process excellence

▪ Dynamic pricing and consistent terms

▪ Improved salesforce training / capability

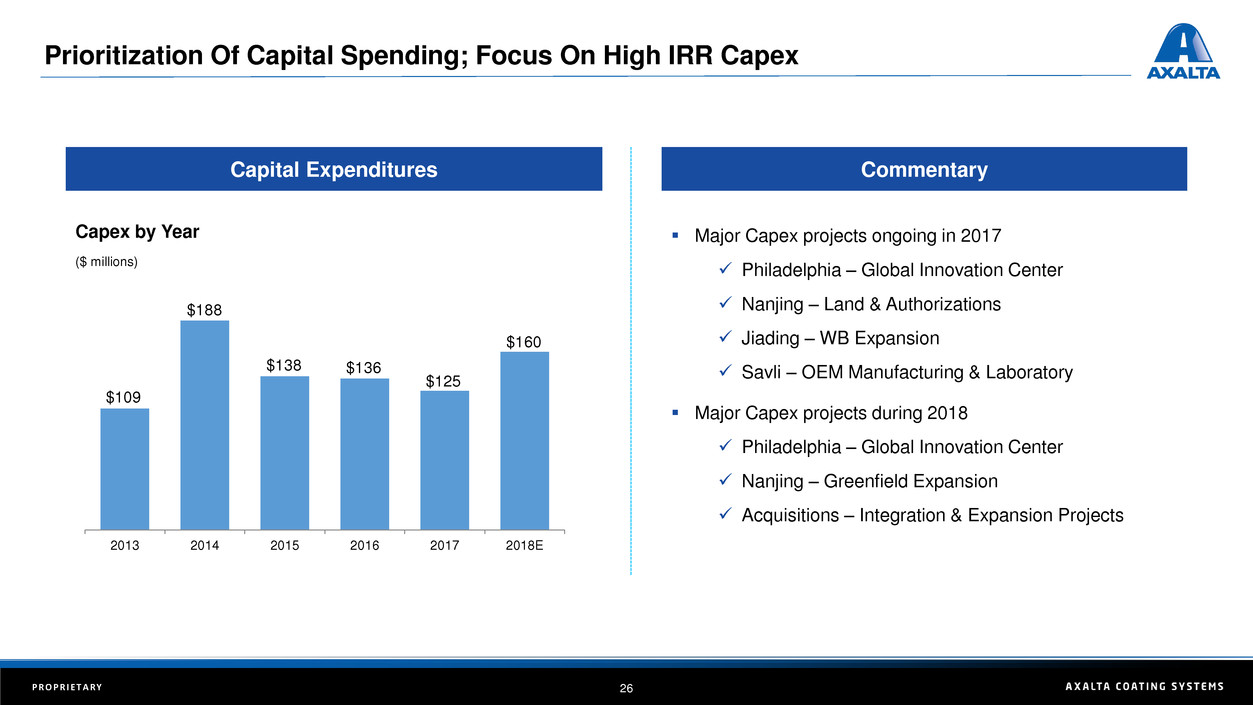

26P R O P R I E T A R Y

Capital Expenditures

Capex by Year

($ millions)

Commentary

2013 2014 2015 2016 2017 2018E

Prioritization Of Capital Spending; Focus On High IRR Capex

▪ Major Capex projects ongoing in 2017

✓ Philadelphia – Global Innovation Center

✓ Nanjing – Land & Authorizations

✓ Jiading – WB Expansion

✓ Savli – OEM Manufacturing & Laboratory

▪ Major Capex projects during 2018

✓ Philadelphia – Global Innovation Center

✓ Nanjing – Greenfield Expansion

✓ Acquisitions – Integration & Expansion Projects

$109

$188

$138 $136

$125

$160

27P R O P R I E T A R Y

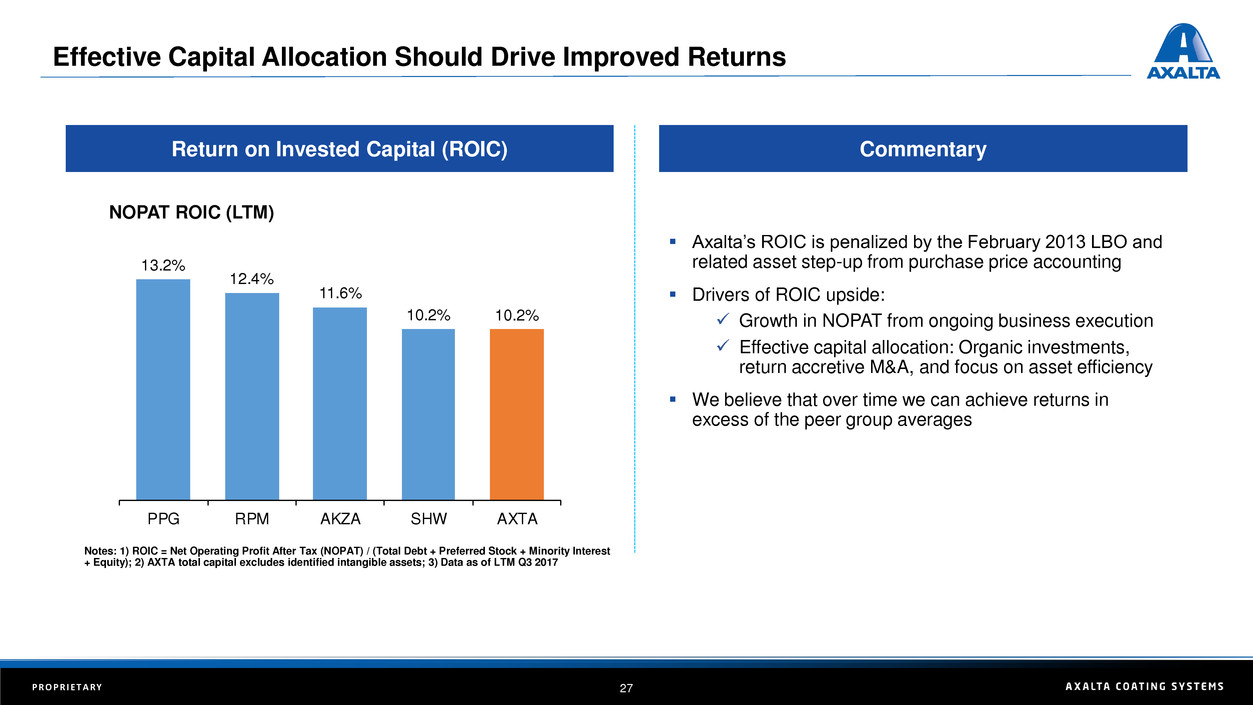

13.2%

12.4%

11.6%

10.2% 10.2%

PPG RPM AKZA SHW AXTA

Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred Stock + Minority Interest

+ Equity); 2) AXTA total capital excludes identified intangible assets; 3) Data as of LTM Q3 2017

▪ Axalta’s ROIC is penalized by the February 2013 LBO and

related asset step-up from purchase price accounting

▪ Drivers of ROIC upside:

✓ Growth in NOPAT from ongoing business execution

✓ Effective capital allocation: Organic investments,

return accretive M&A, and focus on asset efficiency

▪ We believe that over time we can achieve returns in

excess of the peer group averages

Return on Invested Capital (ROIC) Commentary

NOPAT ROIC (LTM)

Effective Capital Allocation Should Drive Improved Returns

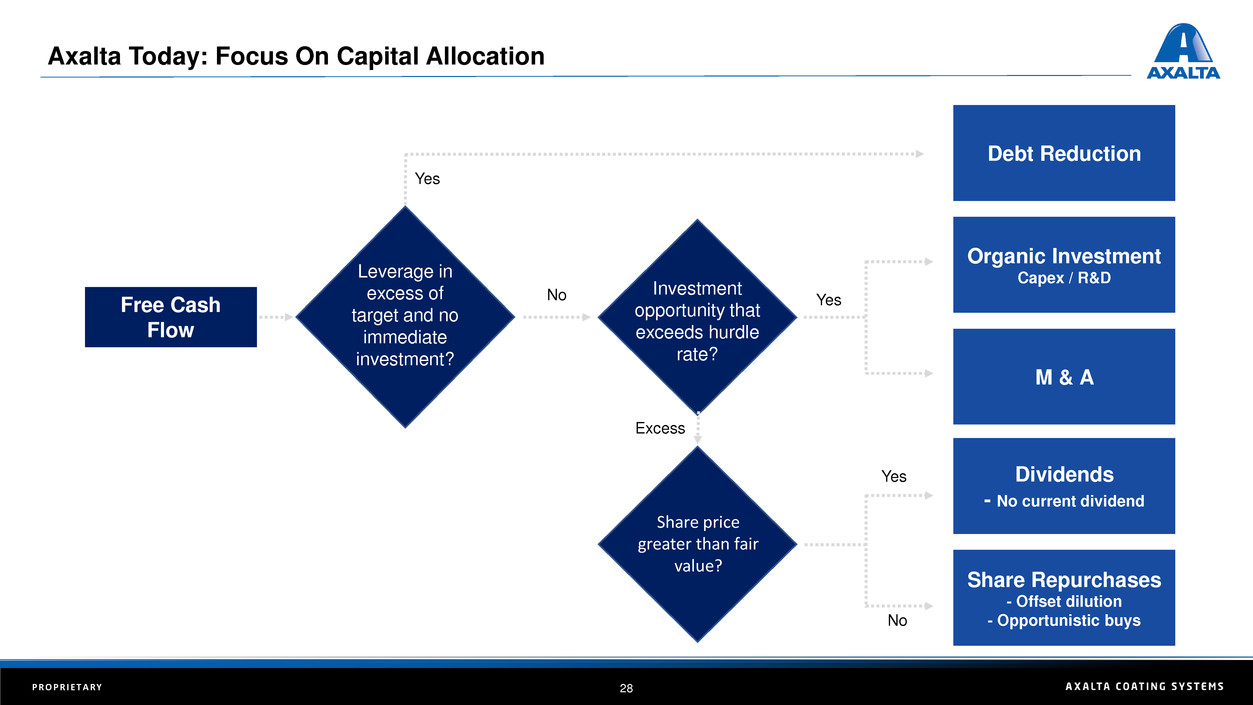

28P R O P R I E T A R Y

Debt Reduction

Organic Investment

Capex / R&D

M & A

Dividends

- No current dividend

Share Repurchases

- Offset dilution

- Opportunistic buys

Leverage in

excess of

target and no

immediate

investment?

Investment

opportunity that

exceeds hurdle

rate?

Share price

greater than fair

value?

Free Cash

Flow

No

Excess

Yes

Yes

Yes

No

Axalta Today: Focus On Capital Allocation

29P R O P R I E T A R Y

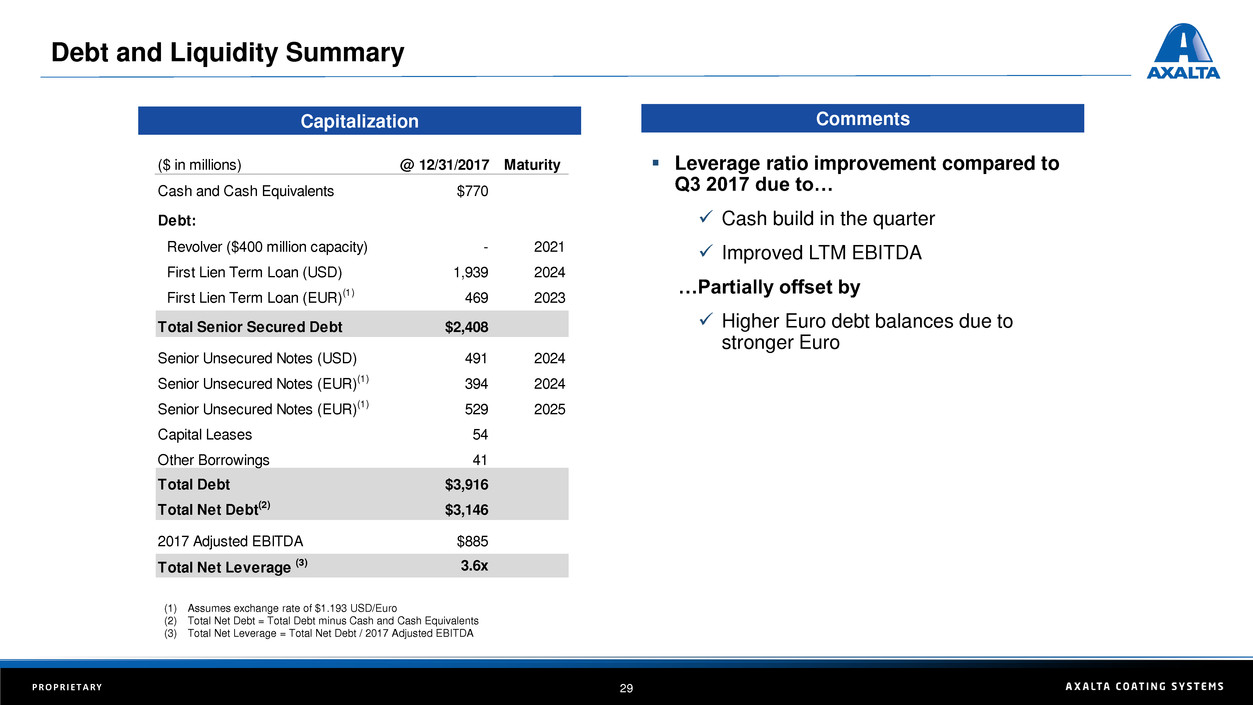

Debt and Liquidity Summary

Capitalization Comments

(1) Assumes exchange rate of $1.193 USD/Euro

(2) Total Net Debt = Total Debt minus Cash and Cash Equivalents

(3) Total Net Leverage = Total Net Debt / 2017 Adjusted EBITDA

($ in millions) @ 12/31/2017 Maturity

Cash and Cash Equivalents $770

Debt:

Revolver ($400 million capacity) - 2021

First Lien Term Loan (USD) 1,939 2024

First Lien Term Loan (EUR)(1) 469 2023

Total Senior Secured Debt $2,408

Senior Unsecured Notes (USD) 491 2024

Senior Unsecured Notes (EUR)(1) 394 2024

Senior Unsecured Notes (EUR)(1) 529 2025

Capital Leases 54

Other Borrowings 41

Total Debt $3,916

Total Net Debt(2) $3,146

2017 Adjusted EBITDA $885

Total Net Leverage (3) 3.6x

▪ Leverage ratio improvement compared to

Q3 2017 due to…

✓ Cash build in the quarter

✓ Improved LTM EBITDA

…Partially offset by

✓ Higher Euro debt balances due to

stronger Euro

30P R O P R I E T A R Y

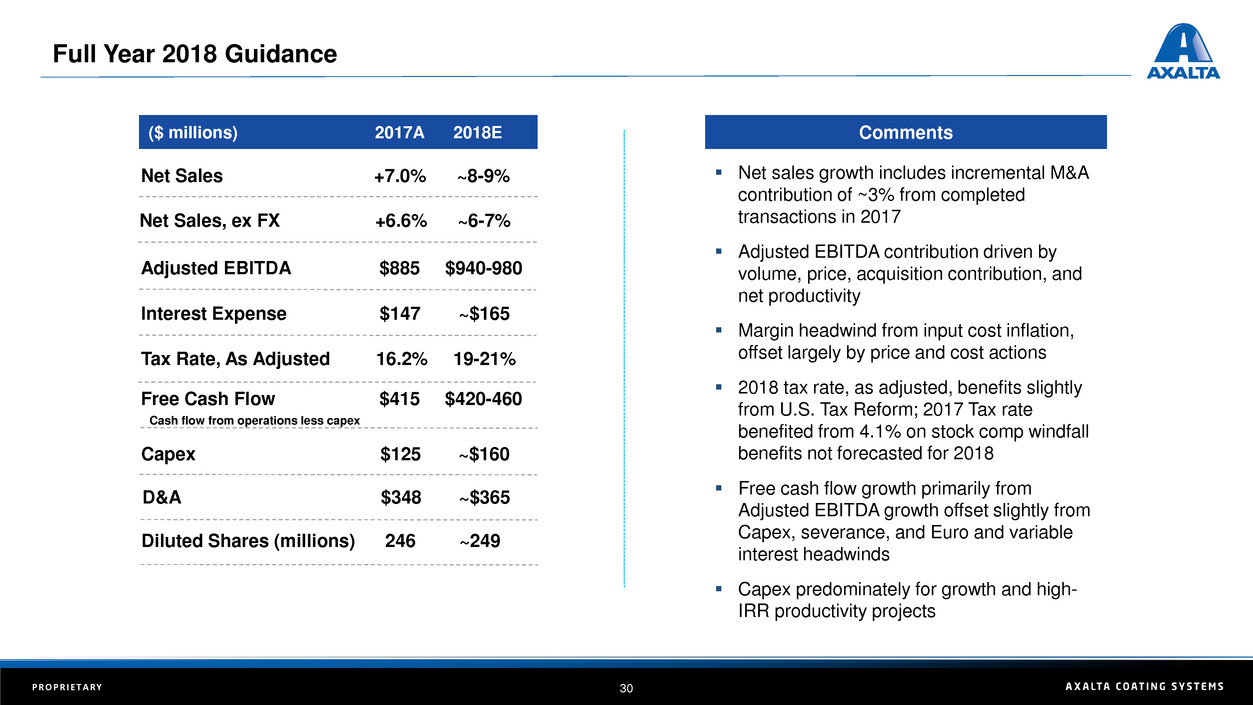

Full Year 2018 Guidance

Comments($ millions) 2017A 2018E

▪ Net sales growth includes incremental M&A

contribution of ~3% from completed

transactions in 2017

▪ Adjusted EBITDA contribution driven by

volume, price, acquisition contribution, and

net productivity

▪ Margin headwind from input cost inflation,

offset largely by price and cost actions

▪ 2018 tax rate, as adjusted, benefits slightly

from U.S. Tax Reform; 2017 Tax rate

benefited from 4.1% on stock comp windfall

benefits not forecasted for 2018

▪ Free cash flow growth primarily from

Adjusted EBITDA growth offset slightly from

Capex, severance, and Euro and variable

interest headwinds

▪ Capex predominately for growth and high-

IRR productivity projects

Net Sales, ex FX +6.6% ~6-7%

Tax Rate, As Adjusted 16.2% 19-21%

Free Cash Flow $415 $420-460

Cash flow from operations less capex

Interest Expense $147 ~$165

Adjusted EBITDA $885 $940-980

Net Sales +7.0% ~8-9%

Capex $125 ~$160

Diluted Shares (millions) 246 ~249

D&A $348 ~$365

Performance Coatings: Refinish

32P R O P R I E T A R Y

Refinish

Axalta Refinish Overview

25% Global

Market Share

Service Led

Business

Innovation

Drives

Leadership

Global Strategy

& Support

33P R O P R I E T A R Y

Projected Industry Sales

($ billions)

APAC

EMEA

N.A.

___________________________________

Source: Orr & Boss; Axalta estimates

Lat. Am.

2016 2017E 2018E 2019E 2020E

$7.7 $7.9

$8.2 $8.4

$8.6

The Global Refinish Market Is Growing

Key Market Trends

▪ Growing car fleet, miles driven, and accident rates

▪ Globally stable competitive dynamics

▪ Body shop consolidation & professionalization

▪ Environmental regulation drives high-productivity coatings adoption

▪ Extend leadership position in premium segments

▪ Increase share in under-represented markets

▪ Expand mainstream and economy products

▪ Leverage customer consolidation trends

▪ Focus on expanding our distribution partnerships

Axalta’s Strategies For Growth

34P R O P R I E T A R Y

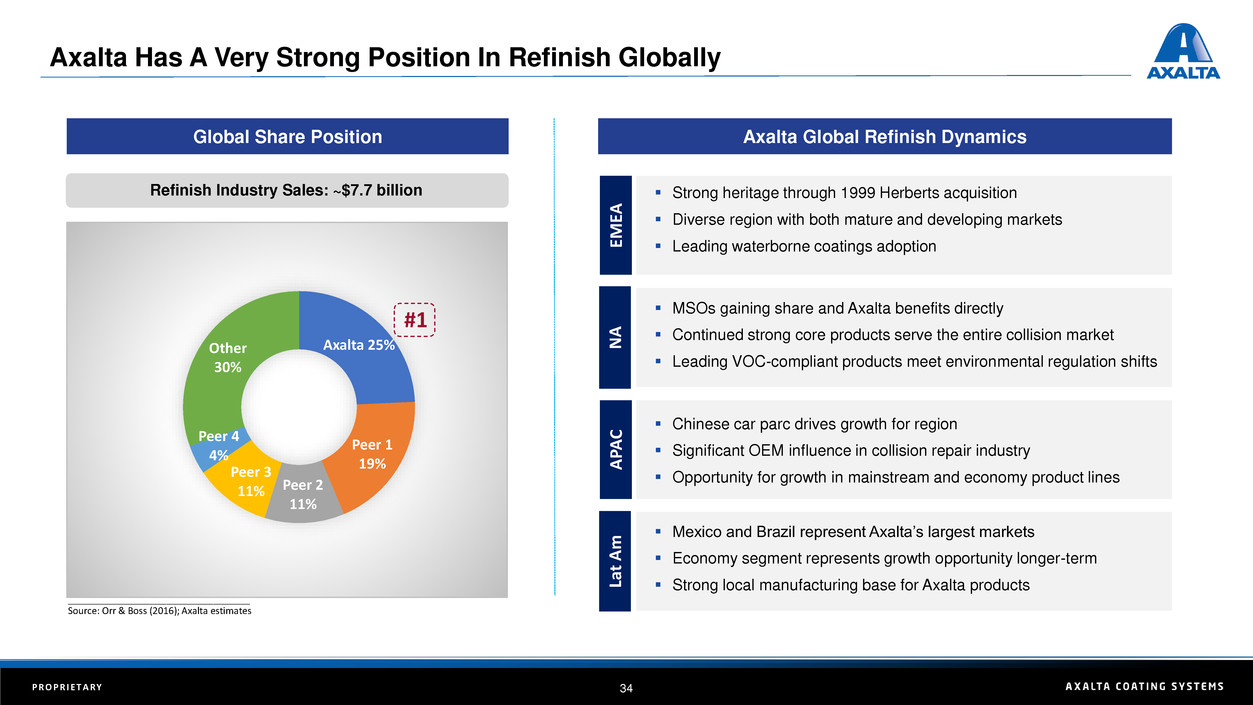

Global Share Position

Refinish Industry Sales: ~$7.7 billion

Axalta 25%

Peer 1

19%

Peer 2

11%

Peer 3

11%

Peer 4

4%

Other

30%

#1

Axalta Has A Very Strong Position In Refinish Globally

___________________________________

Source: Orr & Boss (2016); Axalta estimates

Axalta Global Refinish Dynamics

▪ Strong heritage through 1999 Herberts acquisition

▪ Diverse region with both mature and developing markets

▪ Leading waterborne coatings adoption

▪ MSOs gaining share and Axalta benefits directly

▪ Continued strong core products serve the entire collision market

▪ Leading VOC-compliant products meet environmental regulation shifts

▪ Chinese car parc drives growth for region

▪ Significant OEM influence in collision repair industry

▪ Opportunity for growth in mainstream and economy product lines

▪ Mexico and Brazil represent Axalta’s largest markets

▪ Economy segment represents growth opportunity longer-term

▪ Strong local manufacturing base for Axalta products

EM

EA

N

A

A

PA

C

La

t

A

m

35P R O P R I E T A R Y

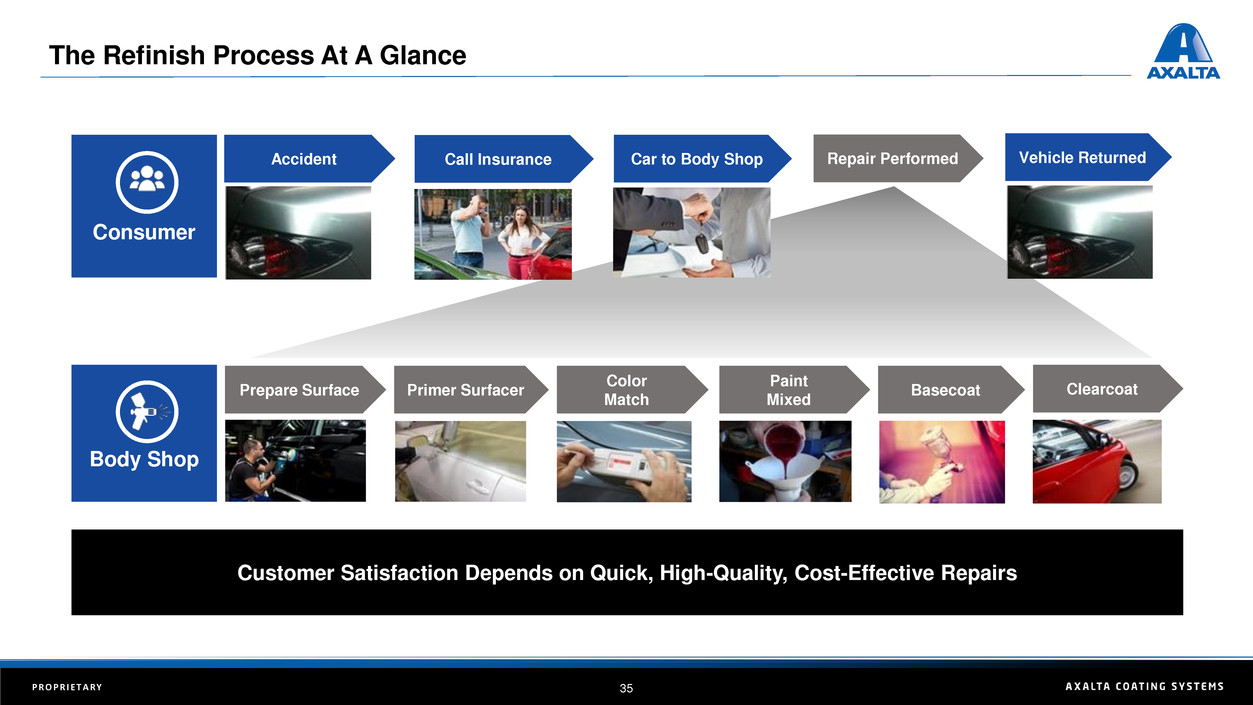

The Refinish Process At A Glance

Consumer

Body Shop

Accident Call Insurance Car to Body Shop Repair Performed Vehicle Returned

Prepare Surface Primer Surfacer

Color

Match

Basecoat Clearcoat

Paint

Mixed

Customer Satisfaction Depends on Quick, High-Quality, Cost-Effective Repairs

Performance Coatings: Industrial Coatings

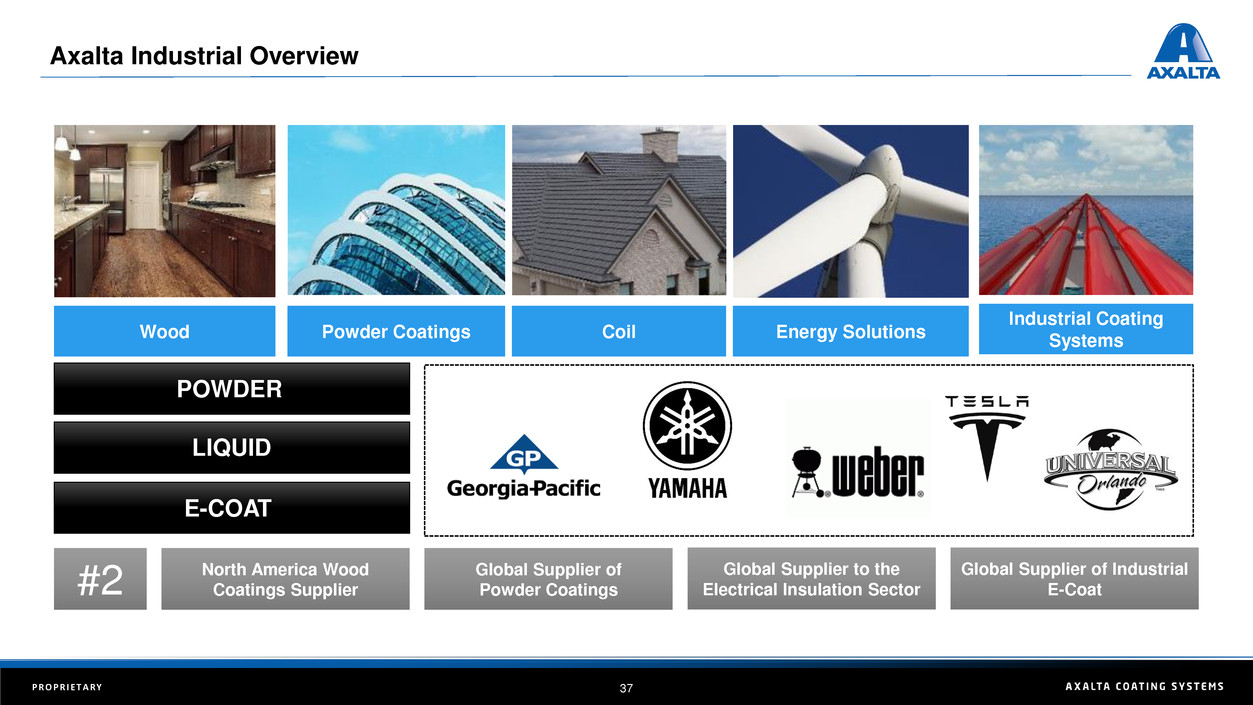

37P R O P R I E T A R Y

Axalta Industrial Overview

Wood Powder Coatings Coil Energy Solutions

Industrial Coating

Systems

#2 North America Wood Coatings Supplier Global Supplier of Powder Coatings

Global Supplier to the

Electrical Insulation Sector

Global Supplier of Industrial

E-Coat

POWDER

LIQUID

E-COAT

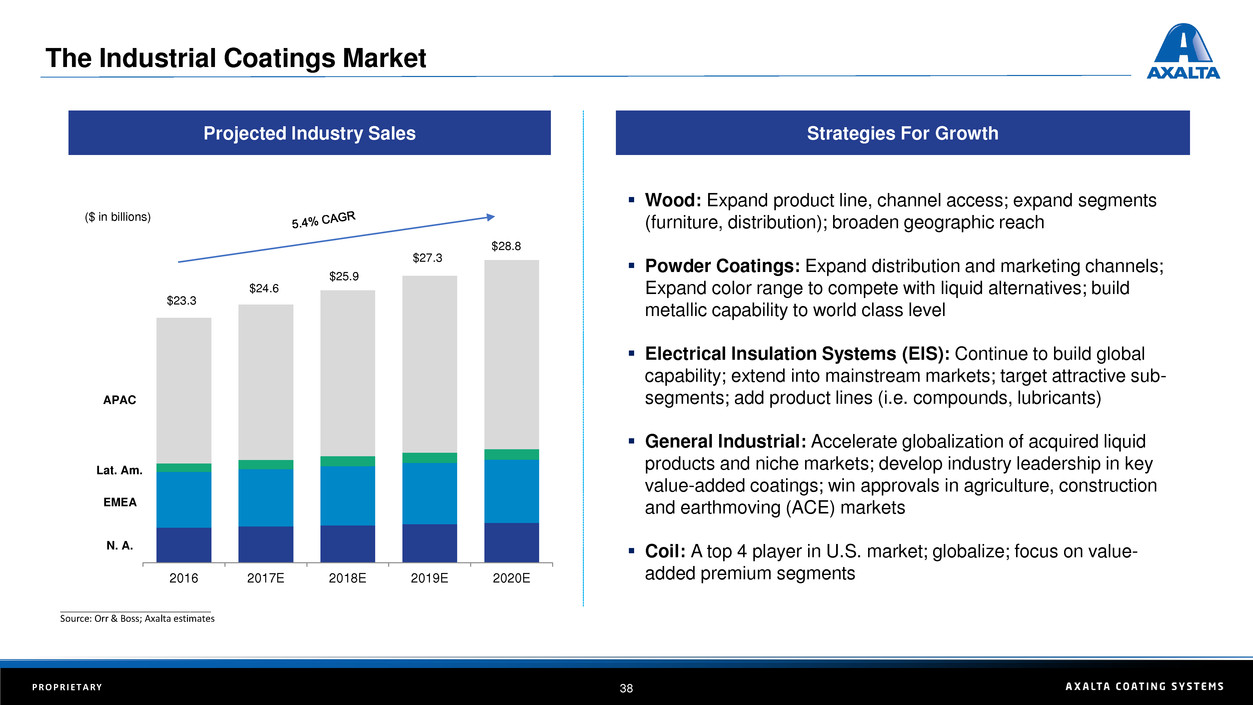

38P R O P R I E T A R Y

($ in billions)

APAC

EMEA

N. A.

_____________________________

Source: Orr & Boss; Axalta estimates

Lat. Am.

Projected Industry Sales

The Industrial Coatings Market

2016 2017E 2018E 2019E 2020E

$28.8

$27.3

$25.9

$23.3

$24.6

▪ Wood: Expand product line, channel access; expand segments

(furniture, distribution); broaden geographic reach

▪ Powder Coatings: Expand distribution and marketing channels;

Expand color range to compete with liquid alternatives; build

metallic capability to world class level

▪ Electrical Insulation Systems (EIS): Continue to build global

capability; extend into mainstream markets; target attractive sub-

segments; add product lines (i.e. compounds, lubricants)

▪ General Industrial: Accelerate globalization of acquired liquid

products and niche markets; develop industry leadership in key

value-added coatings; win approvals in agriculture, construction

and earthmoving (ACE) markets

▪ Coil: A top 4 player in U.S. market; globalize; focus on value-

added premium segments

Strategies For Growth

39P R O P R I E T A R Y

General

Industrial $12.0

Electrical

Insulation $2.0

Architectual

Extrusions $1.5

ACE $1.5

Oil & Gas $3.5

Coil $4.5

Wood $4.5

*Coil and Wood North America only

($ billions)

Industrial Coatings: A $28B Market Opportunity For Axalta

Volume growth driven by global GDP and Industrial Production

▪ China drives >40% of global industrial coatings consumption

▪ Building construction is a key driver

Coatings suppliers are consolidating

▪ Driven by scale advantages and globalization; some niches remain fragmented

Technology innovation is a catalyst for growth

▪ Global increase in demand for electric vehicles, alternative energy sources, and

environmentally friendly coatings across all end user segments

Customers are globalizing

▪ Local product must meet global specifications consistently

Global infrastructure growth is driving demand

▪ High temperature resistance required for energy applications

▪ Demand for electrical insulation products linked to infrastructure

▪ Increased construction in developing markets

Oil and gas pipeline expansion

▪ Boost in pipeline construction to connect existing infrastructure

Market DriversCurrently Served Sub-Markets

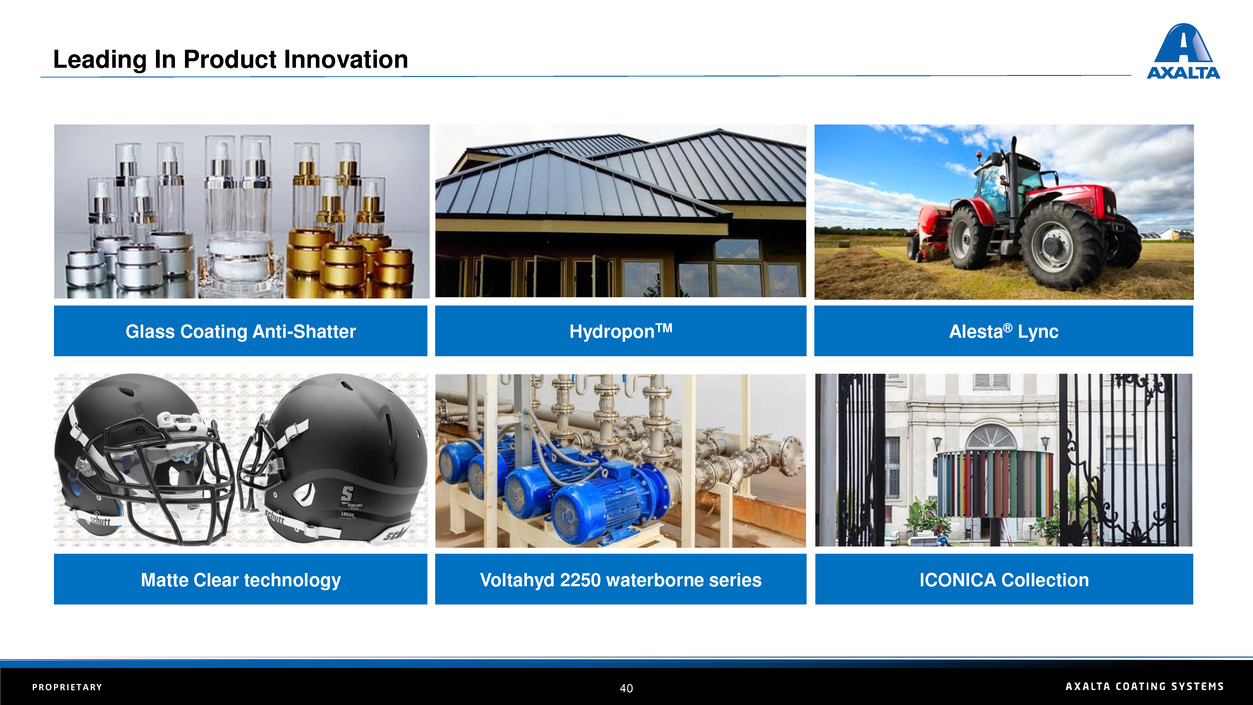

40P R O P R I E T A R Y

Leading In Product Innovation

HydroponTMGlass Coating Anti-Shatter Alesta® Lync

Matte Clear technology Voltahyd 2250 waterborne series ICONICA Collection

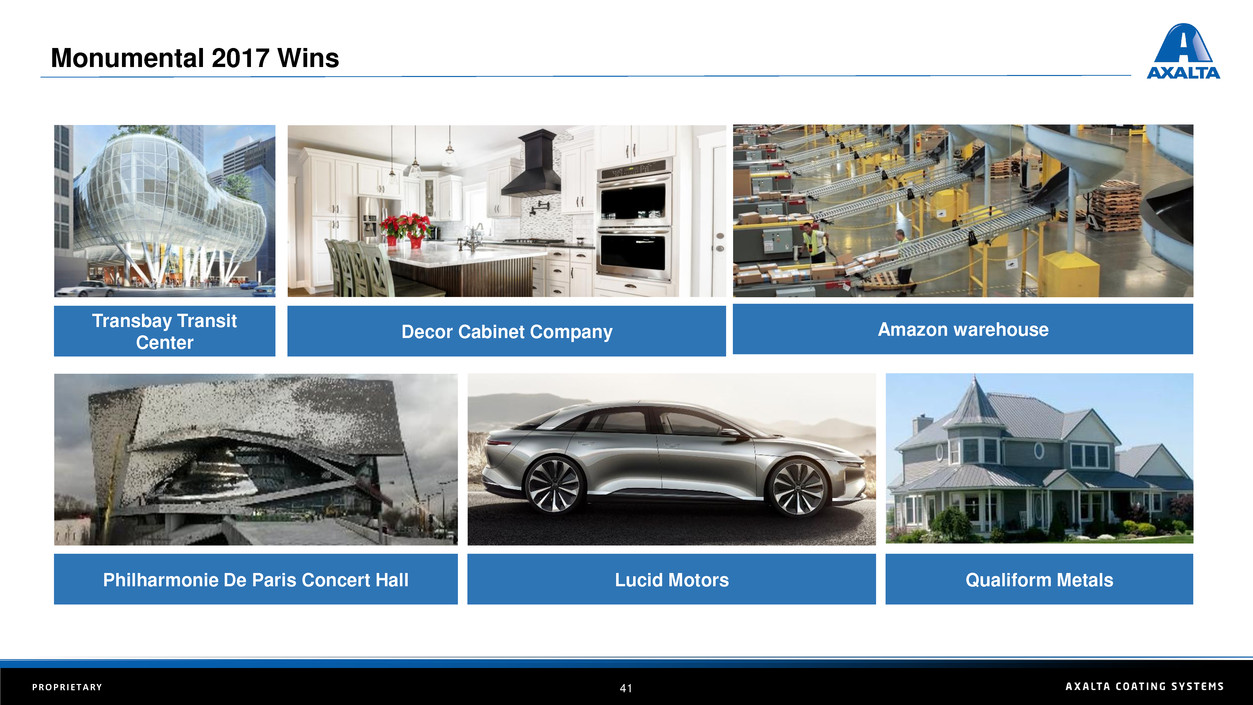

41P R O P R I E T A R Y

Monumental 2017 Wins

Transbay Transit

Center

Decor Cabinet Company Amazon warehouse

Philharmonie De Paris Concert Hall Lucid Motors Qualiform Metals

Transportation Coatings Overview

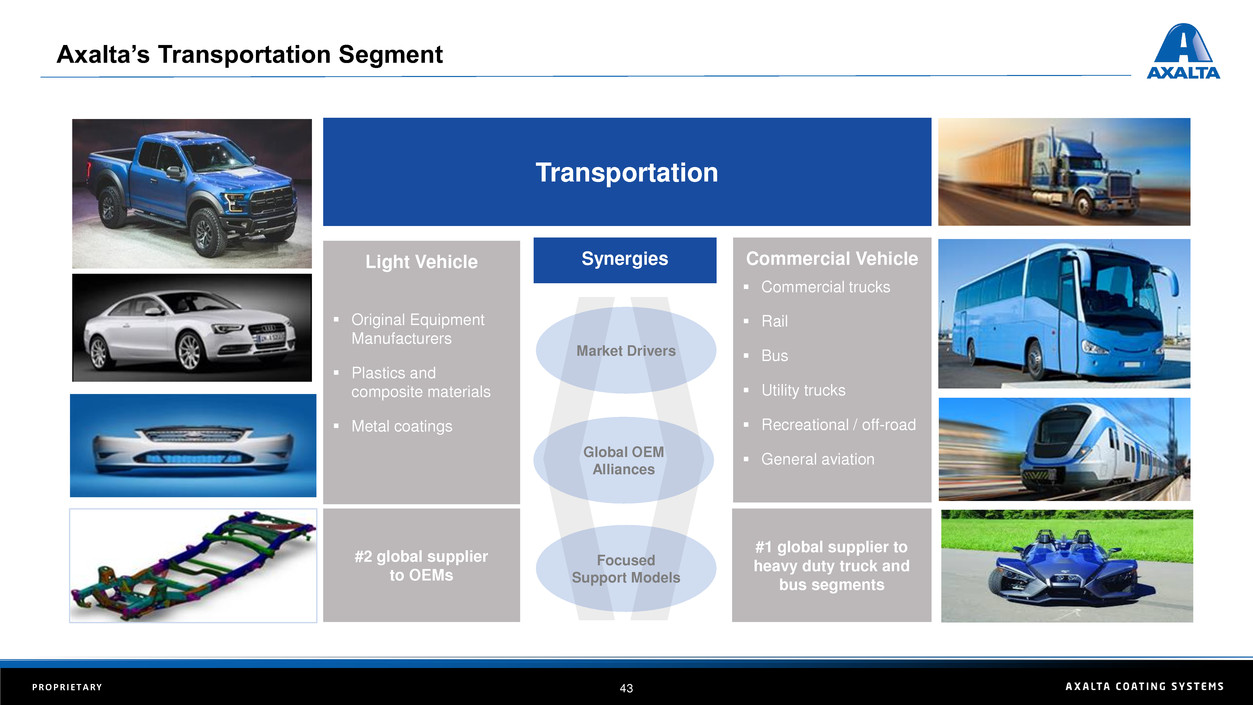

43P R O P R I E T A R Y

#2 global supplier

to OEMs

Transportation

Light Vehicle

▪ Original Equipment

Manufacturers

▪ Plastics and

composite materials

▪ Metal coatings

#1 global supplier to

heavy duty truck and

bus segments

Commercial Vehicle

▪ Commercial trucks

▪ Rail

▪ Bus

▪ Utility trucks

▪ Recreational / off-road

▪ General aviation

Synergies

Global OEM

Alliances

Focused

Support Models

Market Drivers

Axalta’s Transportation Segment

44P R O P R I E T A R Y

Projected Industry Sales: Light Vehicle Projected Industry Sales: Commercial Vehicle

_____________________________

Source: Orr & Boss; Axalta estimates

($ billions) ($ millions)

_____________________________

Source: Orr & Boss; Axalta estimates

$1.5 $1.5 $1.5 $1.6 $1.6

$2.3 $2.3 $2.4 $2.5

$2.5

$0.5 $0.5

$0.6 $0.6

$0.6

$3.5 $3.6

$3.7

$3.9 $4.0

2016 2017E 2018E 2019E 2020E

$8.7

$8.5

$8.2$8.0

$7.8

$781 $799 $830 $862 $896

$588 $602 $620

$639 $658

$378 $398

$424

$472 $475

$1,519

$1,576

$1,634

$1,695

$1,756

2016 2017E 2018E 2019E 2020E

$3,785

$3,668

$3,508

$3,375$3,265

Structurally Growing Markets

APAC

EMEA

N. A.

Lat. Am.

APAC

EMEA

N. A.

Lat. Am.

45P R O P R I E T A R Y

▪ 17% global light vehicle market

share with strong OEM

relationships in all regions

▪ #1 player globally in heavy duty

truck and bus

▪ Extensive portfolio of technologies

fit for purpose in each market

▪ Showing results to date through

business wins and global

launches

▪ Significant improvement in profit

contribution from restructuring

▪ Capacity investments to support

growth in all regions

▪ Technology & innovation progress

underlies our strategy

▪ Building capability and footprint in

high growth regions

▪ Expanding global brand strategy

▪ Solidifying global account

management

▪ Demand drivers include

✓ Global GDP

✓ Vehicle replacement cycles

✓ Growth in emerging markets

✓ Infrastructure spending

The global transportation market

is projected to grow ~2.9% CAGR

through 2020

Axalta is actively transforming its

business for profitable growth

Axalta is a leading global OEM

coatings provider

Progress to date has been

strong

Transportation Summary

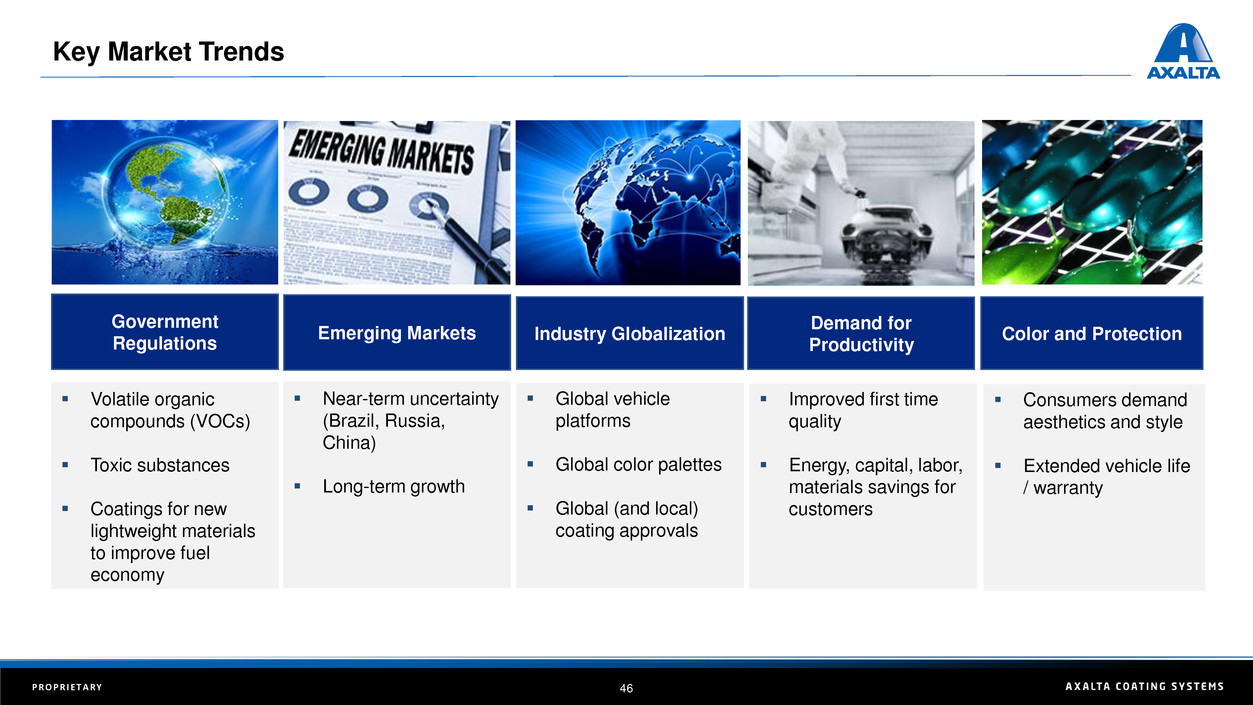

46P R O P R I E T A R Y

▪ Volatile organic

compounds (VOCs)

▪ Toxic substances

▪ Coatings for new

lightweight materials

to improve fuel

economy

Government

Regulations

Emerging Markets Industry Globalization

Demand for

Productivity

Color and Protection

▪ Near-term uncertainty

(Brazil, Russia,

China)

▪ Long-term growth

▪ Global vehicle

platforms

▪ Global color palettes

▪ Global (and local)

coating approvals

▪ Improved first time

quality

▪ Energy, capital, labor,

materials savings for

customers

▪ Consumers demand

aesthetics and style

▪ Extended vehicle life

/ warranty

Key Market Trends

47P R O P R I E T A R Y

Global Share Significant Progress Made…

Axalta

31%

HDT

and

Bus

Axalta

17%

Light

Vehicle

Transforming A Global OEM Coatings Supplier

▪ Must continue to align technology with customer needs in key target areas

▪ Axalta needs to continue to refine cost structure to meet future challenges

▪ Opportunity remains to penetrate underserved customers

▪ Axalta must focus on both quality and productivity to maximize returns

…But Opportunities Still Remain

▪ Successfully added share with existing customers

▪ Added significant business in China since carve-out

▪ Added interior coatings to portfolio

▪ Reduced cost structure substantially in lower margin areas

▪ Numerous capacity investments addressed bottlenecks

▪ Began implementation of Lean Enterprise

APPENDIX

49P R O P R I E T A R Y

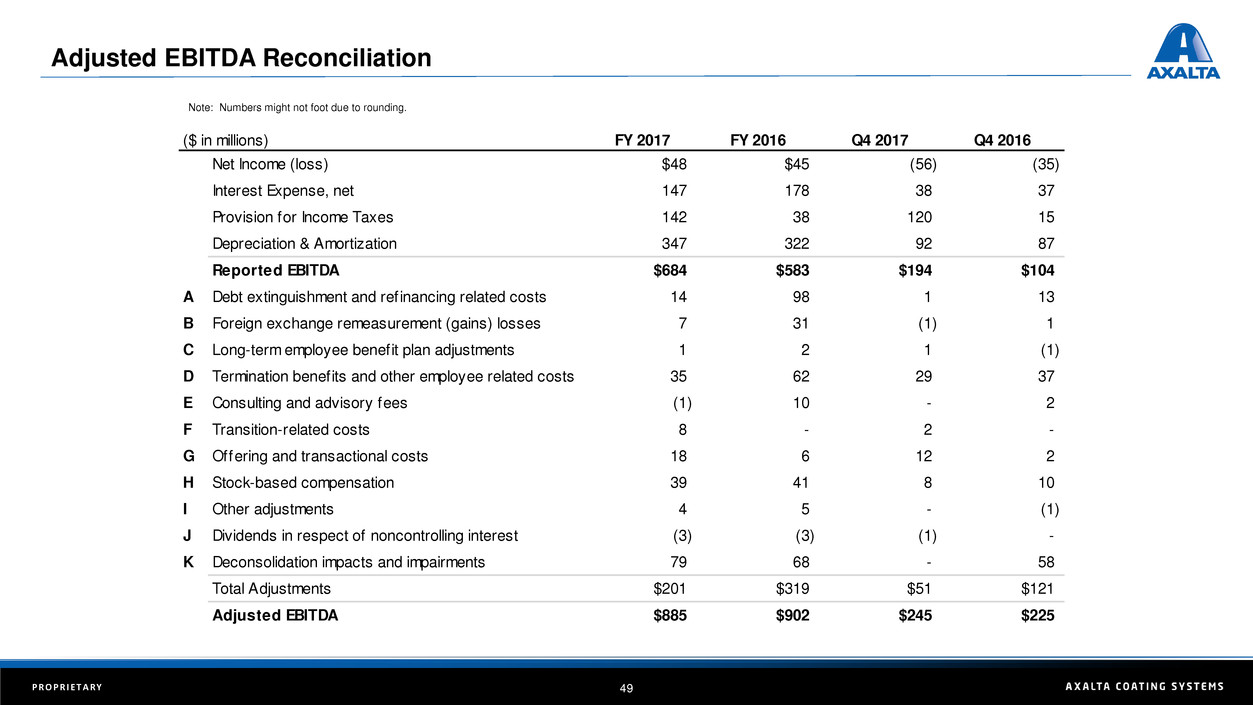

Adjusted EBITDA Reconciliation

Note: Numbers might not foot due to rounding.

($ in millions) FY 2017 FY 2016 Q4 2017 Q4 2016

Net Income (loss) $48 $45 (56) (35)

Interest Expense, net 147 178 38 37

Provision for Income Taxes 142 38 120 15

Depreciation & Amortization 347 322 92 87

Reported EBITDA $684 $583 $194 $104

A Debt extinguishment and refinancing related costs 14 98 1 13

B Foreign exchange remeasurement (gains) losses 7 31 (1) 1

C Long-term employee benefit plan adjustments 1 2 1 (1)

D Termination benefits and other employee related costs 35 62 29 37

E Consulting and advisory fees (1) 10 - 2

F Transition-related costs 8 - 2 -

G Offering and transactional costs 18 6 12 2

H Stock-based compensation 39 41 8 10

I Other adjustments 4 5 - (1)

J Dividends in respect of noncontrolling interest (3) (3) (1) -

K Deconsolidation impacts and impairments 79 68 - 58

Total Adjustments $201 $319 $51 $121

Adjusted EBITDA $885 $902 $245 $225

50P R O P R I E T A R Y

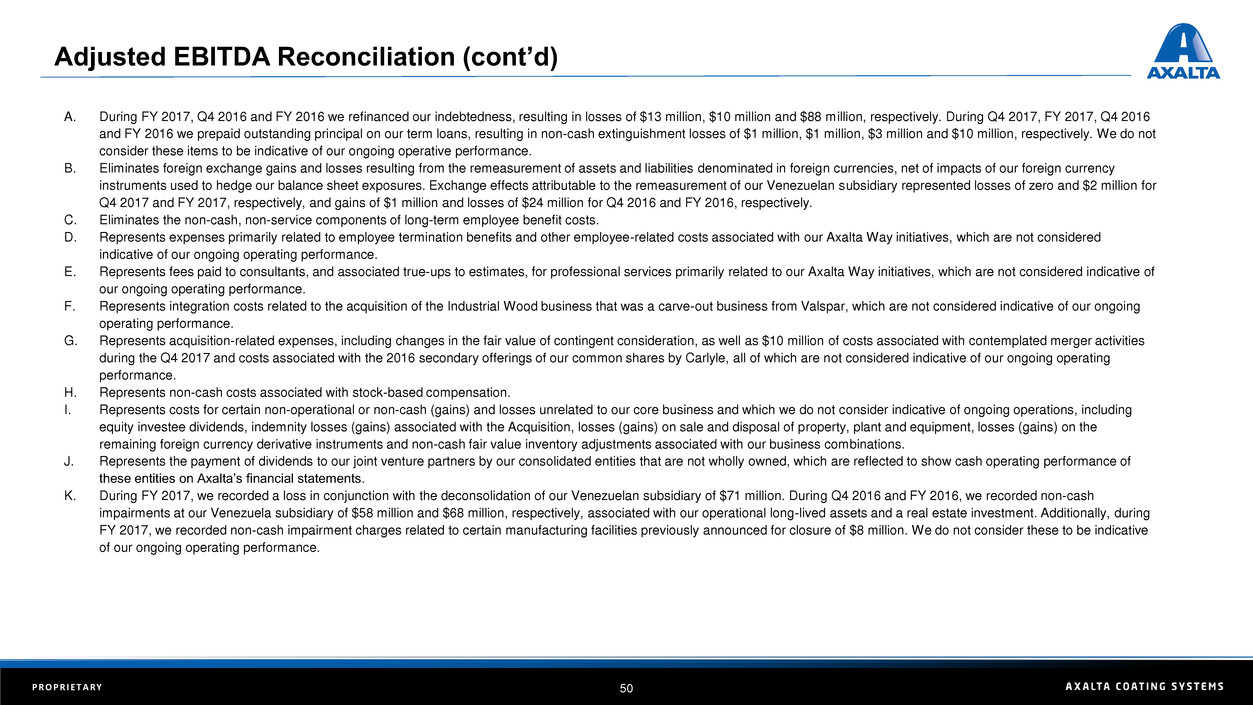

Adjusted EBITDA Reconciliation (cont’d)

A. During FY 2017, Q4 2016 and FY 2016 we refinanced our indebtedness, resulting in losses of $13 million, $10 million and $88 million, respectively. During Q4 2017, FY 2017, Q4 2016

and FY 2016 we prepaid outstanding principal on our term loans, resulting in non-cash extinguishment losses of $1 million, $1 million, $3 million and $10 million, respectively. We do not

consider these items to be indicative of our ongoing operative performance.

B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of our foreign currency

instruments used to hedge our balance sheet exposures. Exchange effects attributable to the remeasurement of our Venezuelan subsidiary represented losses of zero and $2 million for

Q4 2017 and FY 2017, respectively, and gains of $1 million and losses of $24 million for Q4 2016 and FY 2016, respectively.

C. Eliminates the non-cash, non-service components of long-term employee benefit costs.

D. Represents expenses primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which are not considered

indicative of our ongoing operating performance.

E. Represents fees paid to consultants, and associated true-ups to estimates, for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of

our ongoing operating performance.

F. Represents integration costs related to the acquisition of the Industrial Wood business that was a carve-out business from Valspar, which are not considered indicative of our ongoing

operating performance.

G. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, as well as $10 million of costs associated with contemplated merger activities

during the Q4 2017 and costs associated with the 2016 secondary offerings of our common shares by Carlyle, all of which are not considered indicative of our ongoing operating

performance.

H. Represents non-cash costs associated with stock-based compensation.

I. Represents costs for certain non-operational or non-cash (gains) and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including

equity investee dividends, indemnity losses (gains) associated with the Acquisition, losses (gains) on sale and disposal of property, plant and equipment, losses (gains) on the

remaining foreign currency derivative instruments and non-cash fair value inventory adjustments associated with our business combinations.

J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not wholly owned, which are reflected to show cash operating performance of

these entities on Axalta’s financial statements.

K. During FY 2017, we recorded a loss in conjunction with the deconsolidation of our Venezuelan subsidiary of $71 million. During Q4 2016 and FY 2016, we recorded non-cash

impairments at our Venezuela subsidiary of $58 million and $68 million, respectively, associated with our operational long-lived assets and a real estate investment. Additionally, during

FY 2017, we recorded non-cash impairment charges related to certain manufacturing facilities previously announced for closure of $8 million. We do not consider these to be indicative

of our ongoing operating performance.

Thank you!

Investor Contact:

Chris Mecray, VP IR

Christopher.Mecray@axaltacs.com

215-255-7970