EXHIBIT 99.2

Published on March 8, 2018

2018 Capital Markets Day

March 8, 2018

Axalta Coating Systems Ltd.

Exhibit 99.2

2P R O P R I E T A R Y

Legal Notices

Forward-Looking Statements

This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2018

and longer term financial projections and goals, including with respect to net sales, constant currency net sales, Adjusted EBITDA, Adjusted EBITDA margins, free cash flow, return on invested capital, capital expenditures,

working capital, cost savings, pricing actions, product launches, acquisition opportunities, share repurchases, raw material cost increases, currency effects, and related assumptions. Any forward-looking statements involve

risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or

similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments

and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors

are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You

should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks

made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, the risks and uncertainties described in

"Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017.

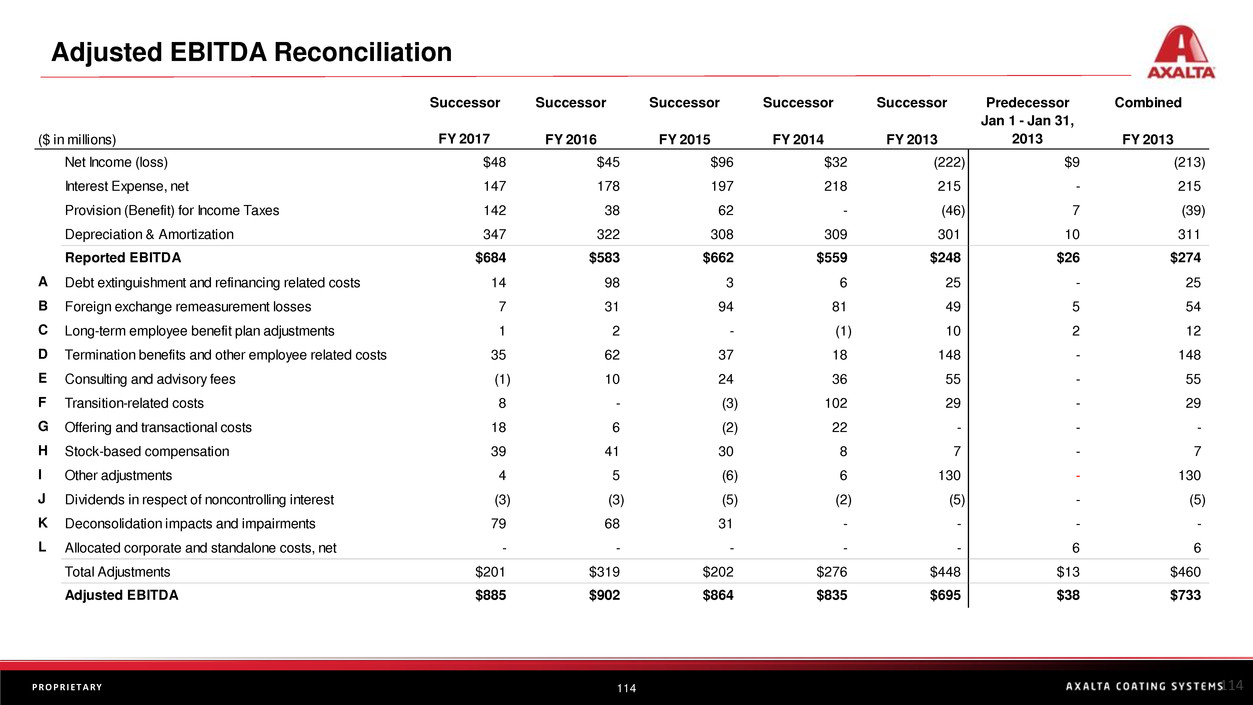

Non-GAAP Financial Measures

The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including

constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist

in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-cash items included within net income, (ii) items Axalta does not believe are indicative of ongoing operating

performance or (iii) nonrecurring, unusual or infrequent items that have not occurred within the last two years or Axalta believes are not reasonably likely to recur within the next two years. We believe that making such

adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms net constant currency net

sales, EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt may differ from that of others in our industry. Constant currency net sales, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as

alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity.

Constant currency net sales, EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as

reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a

reconciliation for non-GAAP estimates for constant currency net sales, EBITDA, Adjusted EBITDA or Free Cash Flow on a forward-looking basis because the information necessary to calculate a meaningful or accurate

estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or

nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results.

Segment Financial Measures

The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial

results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this non-GAAP financial

measure with the most directly comparable financial measure calculated in accordance with GAAP is not available.

Defined Terms

All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission.

3P R O P R I E T A R Y

Capital Markets Day Agenda

9:00 AM Introduction & Agenda Chris Mecray, VP, Strategy & Investor Relations

9:05 AM Axalta’s Value Creation Model Charlie Shaver, Chairman & CEO

9:40 AM Axalta’s Financial Progress & Outlook Robert Bryant, EVP & CFO

10:05 AM Performance Coatings: Refinish Joe McDougall, EVP, President, Global Refinish & EMEA

10:30 AM BREAK

10:50 AM Performance Coatings: Industrial Mike Cash, SVP, President, Industrial

11:15 AM Transportation Coatings Steve Markevich, EVP, President, Transportation & China

11:40 AM Operations, Procurement & Supply Chain Dan Key, SVP, Operations, Procurement & Supply Chain

12:05 PM Q&A

12:40 PM LUNCH

▪ Dr. Barry Snyder (SVP, Chief Technology Officer)

▪ Dr. Robert Roop (VP, Global Refinish Technology)

▪ Dave Heflin (VP, Global Industrial Coatings Systems)

▪ Matt Boland (VP, Global Transportation Technology)

Additional Axalta Attendees:

4P R O P R I E T A R Y

▪ Axalta is a high-performing, world-class global coatings company

▪ Axalta has established a strong track record over five years; we are building on that

▪ Axalta’s is focused on growth, improved productivity, and increased shareholder returns

▪ Effective capital deployment is central to our value creation model

▪ Axalta is a nimble, highly focused company committed to building value via organic and inorganic growth

Key Messages for the Day

Axalta’s Value Creation Model

Charlie Shaver

Chairman and CEO

6P R O P R I E T A R Y

Axalta’s Customer Focused Organization

SEGMENTS

END

MARKETS

▪ Automotive OEMs

▪ Coatings for plastic and

composite materials

▪ Automotive interiors

▪ Heavy duty truck, utility trucks

▪ Rail, bus, machinery

▪ Recreational vehicles

▪ Marine

▪ General industrial powders

▪ Wood coatings

▪ Electrical insulation

▪ Architectural and decorative

▪ Coil and extruded metals

▪ Independent body shops

▪ Multi-shop operators (MSOs)

▪ Auto dealership groups

TRANSPORTATION COATINGSPERFORMANCE COATINGS

$2.7 Billion, 62% of Sales $1.7 Billion, 38% of Sales

SALES BY

END

MARKET

______________________________________________

1. Financials for FY 2017, all sales data refers to Net Sales

7P R O P R I E T A R Y

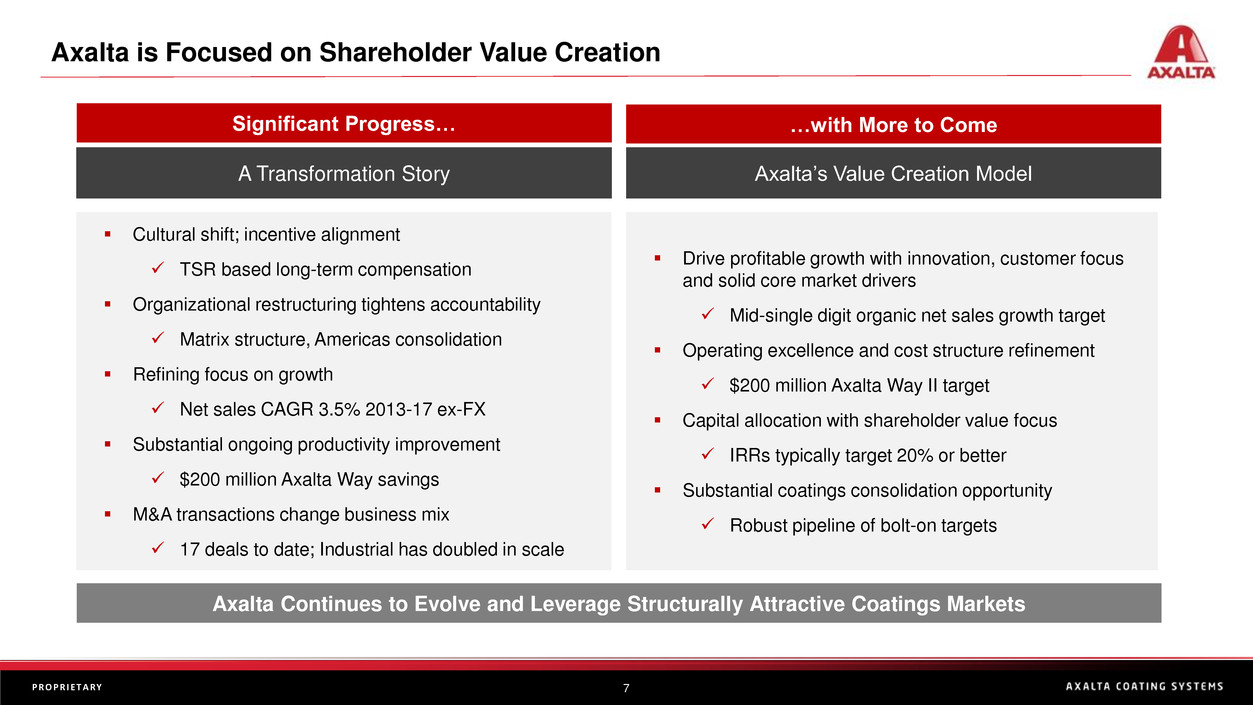

Axalta is Focused on Shareholder Value Creation

Axalta Continues to Evolve and Leverage Structurally Attractive Coatings Markets

Significant Progress…

A Transformation Story

▪ Cultural shift; incentive alignment

✓ TSR based long-term compensation

▪ Organizational restructuring tightens accountability

✓ Matrix structure, Americas consolidation

▪ Refining focus on growth

✓ Net sales CAGR 3.5% 2013-17 ex-FX

▪ Substantial ongoing productivity improvement

✓ $200 million Axalta Way savings

▪ M&A transactions change business mix

✓ 17 deals to date; Industrial has doubled in scale

Axalta’s Value Creation Model

…with More to Come

▪ Drive profitable growth with innovation, customer focus

and solid core market drivers

✓ Mid-single digit organic net sales growth target

▪ Operating excellence and cost structure refinement

✓ $200 million Axalta Way II target

▪ Capital allocation with shareholder value focus

✓ IRRs typically target 20% or better

▪ Substantial coatings consolidation opportunity

✓ Robust pipeline of bolt-on targets

8P R O P R I E T A R Y

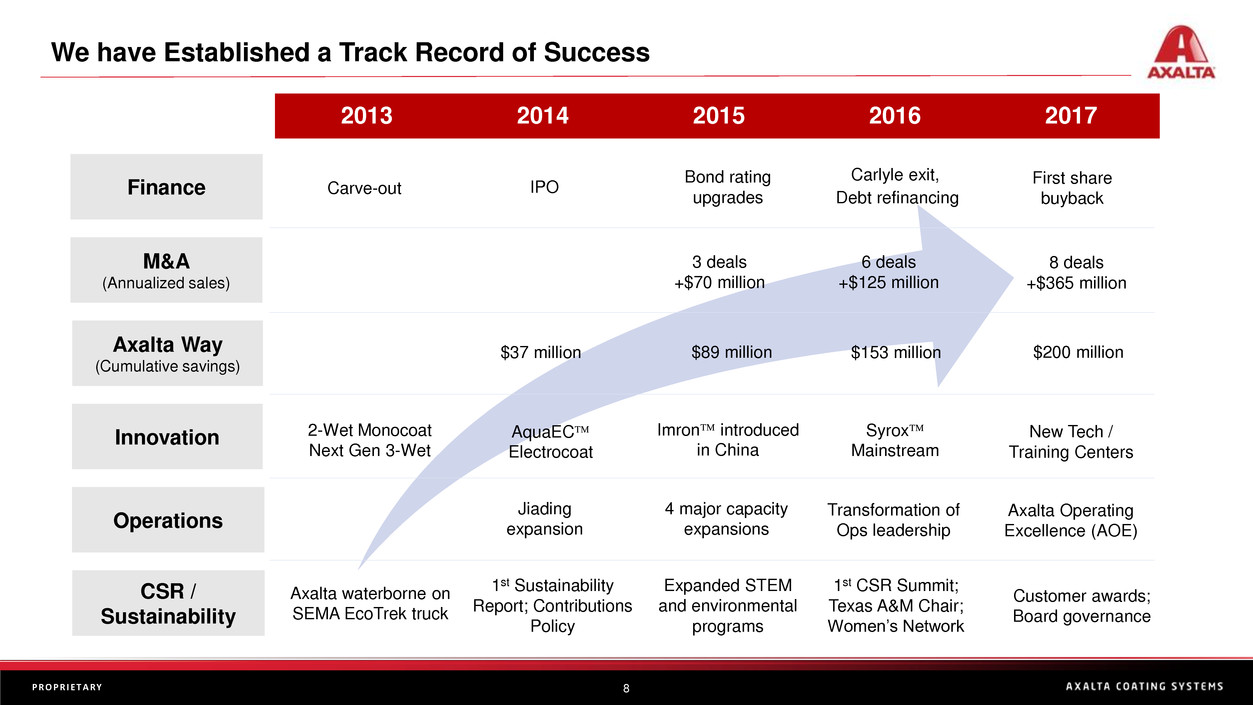

We have Established a Track Record of Success

Finance

M&A

(Annualized sales)

Operations

Axalta Way

(Cumulative savings)

Innovation

CSR /

Sustainability

2013 2014 2015 2016 2017

Carve-out IPO

Debt refinancing

Carlyle exit, First share

buyback

Axalta waterborne on

SEMA EcoTrek truck

1st Sustainability

Report; Contributions

Policy

Expanded STEM

and environmental

programs

Customer awards;

Board governance

3 deals

+$70 million

6 deals

+$125 million

8 deals

+$365 million

$37 million

2-Wet Monocoat

Next Gen 3-Wet

Imron introduced

in China

AquaEC

Electrocoat

Syrox

Mainstream

New Tech /

Training Centers

Jiading

expansion

4 major capacity

expansions

Axalta Operating

Excellence (AOE)

Transformation of

Ops leadership

1st CSR Summit;

Texas A&M Chair;

Women’s Network

$89 million $153 million $200 million

Bond rating

upgrades

9P R O P R I E T A R Y

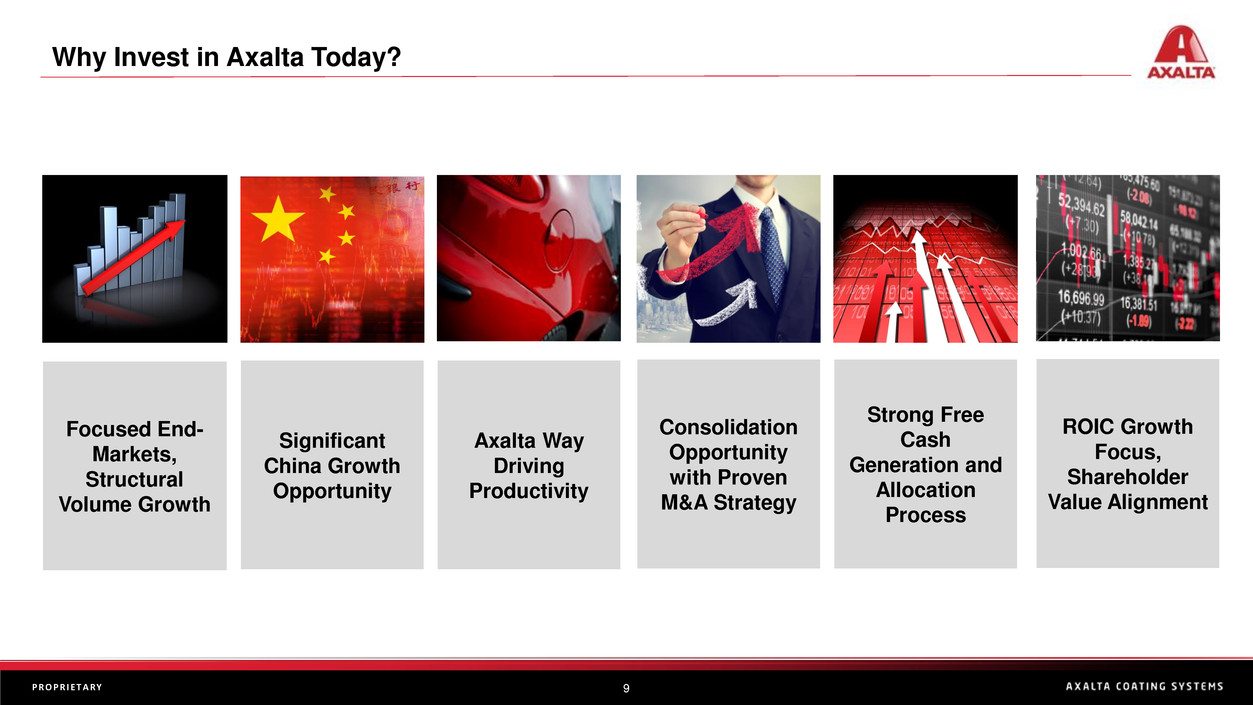

Significant

China Growth

Opportunity

Focused End-

Markets,

Structural

Volume Growth

Axalta Way

Driving

Productivity

Why Invest in Axalta Today?

Consolidation

Opportunity

with Proven

M&A Strategy

Strong Free

Cash

Generation and

Allocation

Process

ROIC Growth

Focus,

Shareholder

Value Alignment

10P R O P R I E T A R Y

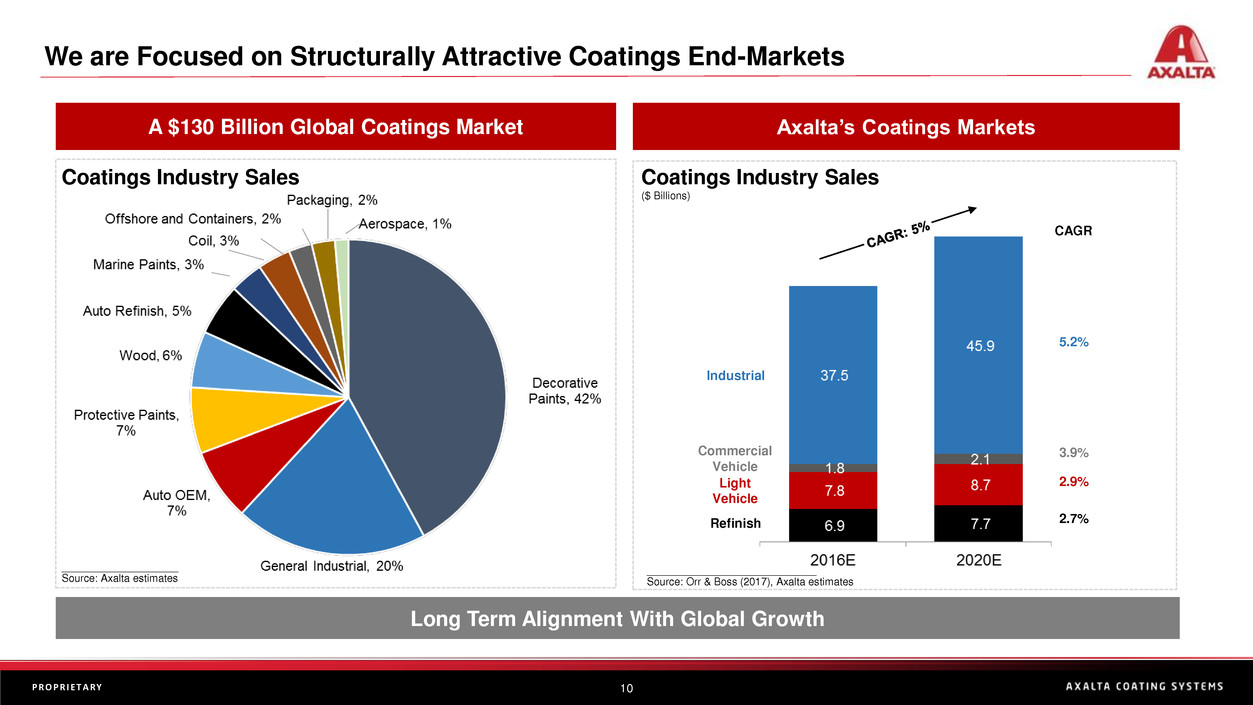

We are Focused on Structurally Attractive Coatings End-Markets

A $130 Billion Global Coatings Market

Long Term Alignment With Global Growth

Axalta’s Coatings Markets

Commercial

Vehicle

Light

Vehicle

Refinish

Industrial

5.2%

3.9%

2.9%

2.7%

CAGR

Coatings Industry Sales

($ Billions)

_____________________________

Source: Orr & Boss (2017), Axalta estimates

____________________

Source: Axalta estimates

Coatings Industry Sales

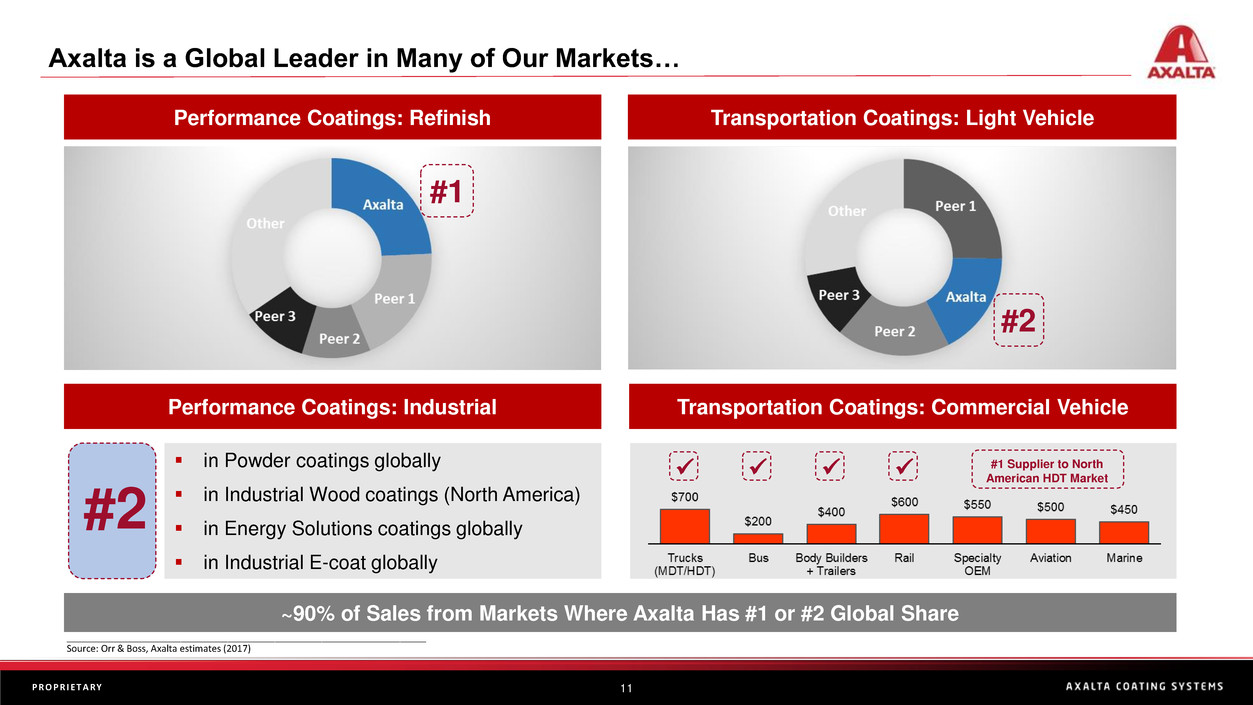

11P R O P R I E T A R Y

#1 Supplier to North

American HDT Market

Axalta is a Global Leader in Many of Our Markets…

~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share

Performance Coatings: Refinish Transportation Coatings: Light Vehicle

#1

_____________________________________________________________________

Source: Orr & Boss, Axalta estimates (2017)

#2

Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle

▪ in Powder coatings globally

▪ in Industrial Wood coatings (North America)

▪ in Energy Solutions coatings globally

▪ in Industrial E-coat globally

#2

✓ ✓✓✓

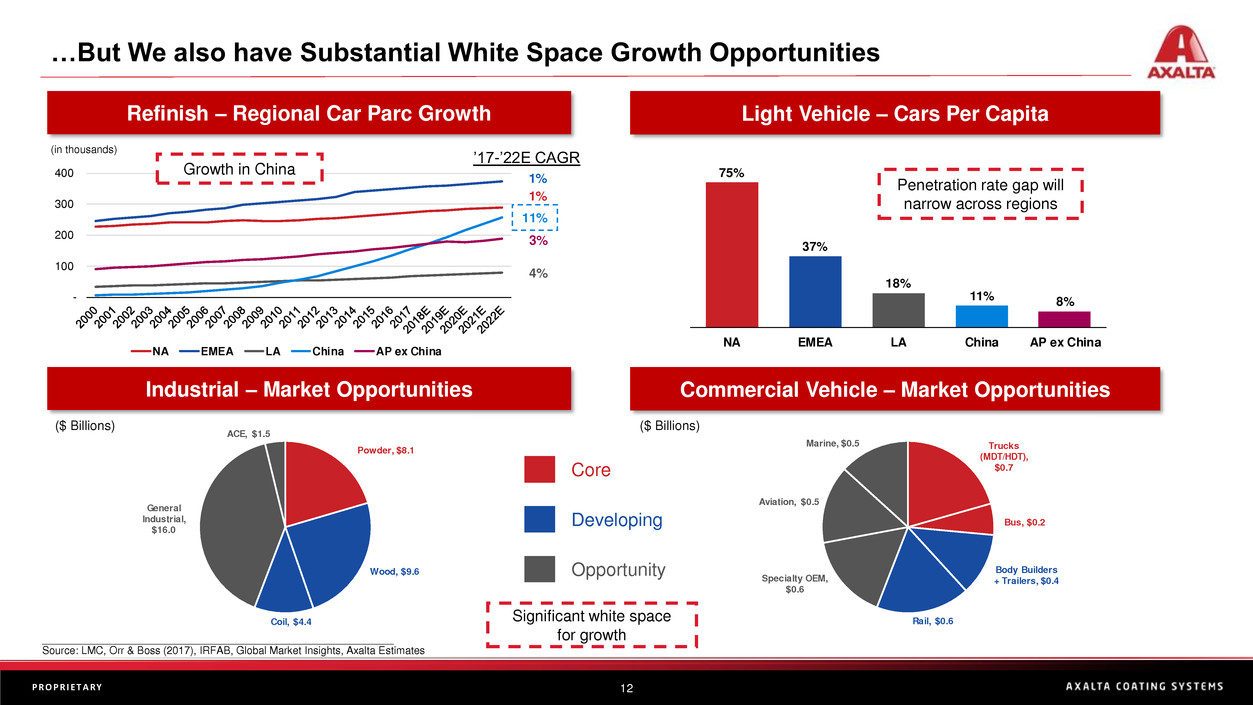

12P R O P R I E T A R Y

75%

37%

18%

11% 8%

NA EMEA LA China AP ex China

…But We also have Substantial White Space Growth Opportunities

Refinish – Regional Car Parc Growth Light Vehicle – Cars Per Capita

Industrial – Market Opportunities

-

100

200

300

400

NA EMEA LA China AP ex China

’17-’22E CAGR

1%

1%

11%

3%

4%

(in thousands)

Commercial Vehicle – Market Opportunities

Core

Developing

Opportunity

Penetration rate gap will

narrow across regions

Growth in China

Significant white space

for growth____________________________________________________________

Source: LMC, Orr & Boss (2017), IRFAB, Global Market Insights, Axalta Estimates

Powder, $8.1

Wood, $9.6

Coil, $4.4

General

Industrial,

$16.0

ACE, $1.5

Trucks

(MDT/HDT),

$0.7

Bus, $0.2

Body Builders

+ Trailers, $0.4

Rail, $0.6

Specialty OEM,

$0.6

Aviation, $0.5

Marine, $0.5

($ Billions) ($ Billions)

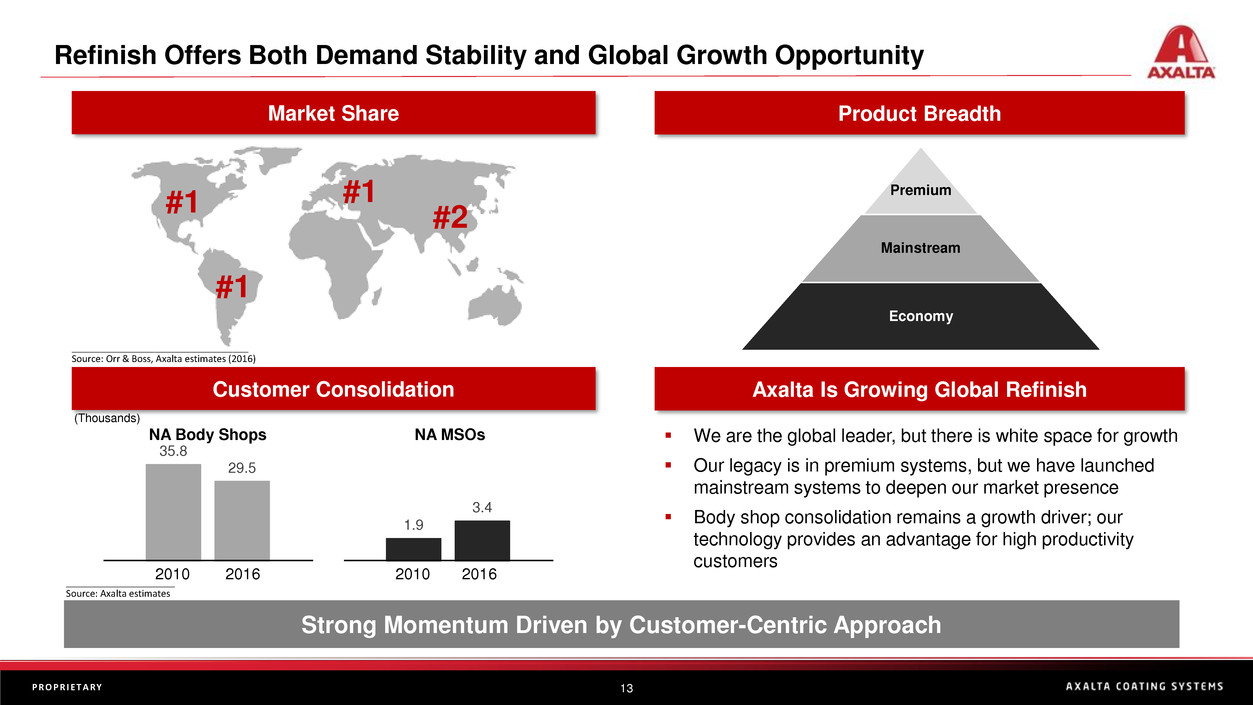

13P R O P R I E T A R Y

Refinish Offers Both Demand Stability and Global Growth Opportunity

Market Share Product Breadth

Customer Consolidation Axalta Is Growing Global Refinish

Strong Momentum Driven by Customer-Centric Approach

Premium

Mainstream

Economy

▪ We are the global leader, but there is white space for growth

▪ Our legacy is in premium systems, but we have launched

mainstream systems to deepen our market presence

▪ Body shop consolidation remains a growth driver; our

technology provides an advantage for high productivity

customers

#1

__________________________________

Source: Orr & Boss, Axalta estimates (2016)

#1

#1

#2

35.8

29.5

2010 2016

1.9

3.4

2010 2016

NA Body Shops NA MSOs

_____________________

Source: Axalta estimates

(Thousands)

14P R O P R I E T A R Y

Industrial Coating

Systems

Axalta’s Industrial End-Market is Rapidly Growing with Focused Strategies

Growth from Leveraging our Regional Product Portfolio Globally

▪ Significant infrastructure investment completed 2014-16

▪ Innovation drives 10%+ new customer adds 2015-17

▪ Mid-single digit net sales growth CAGR targeted

Axalta Has Doubled Industrial Sales Over Five Years

Powder Coatings EnergyCoilWood Coatings

Organic Growth Inorganic Growth

▪ Targeting significant M&A growth

▪ Completed 6 transactions with $420+ million in net sales

▪ Typical synergies: procurement, distribution and R&D

15P R O P R I E T A R Y

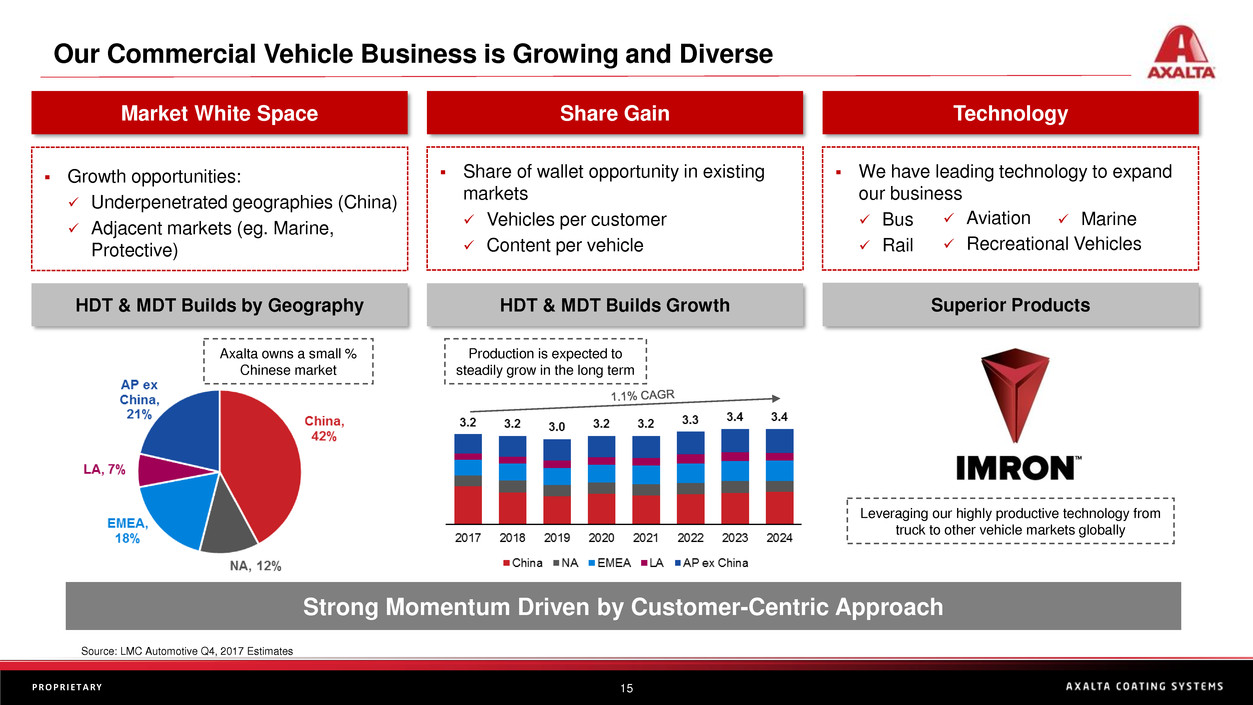

Our Commercial Vehicle Business is Growing and Diverse

Strong Momentum Driven by Customer-Centric Approach

Market White Space Share Gain Technology

▪ Growth opportunities:

✓ Underpenetrated geographies (China)

✓ Adjacent markets (eg. Marine,

Protective)

▪ Share of wallet opportunity in existing

markets

✓ Vehicles per customer

✓ Content per vehicle

▪ We have leading technology to expand

our business

✓ Bus

✓ Rail

Axalta owns a small %

Chinese market

HDT & MDT Builds by Geography

Source: LMC Automotive Q4, 2017 Estimates

HDT & MDT Builds Growth

Production is expected to

steadily grow in the long term

Superior Products

✓ Aviation

✓ Recreational Vehicles

✓ Marine

Leveraging our highly productive technology from

truck to other vehicle markets globally

16P R O P R I E T A R Y

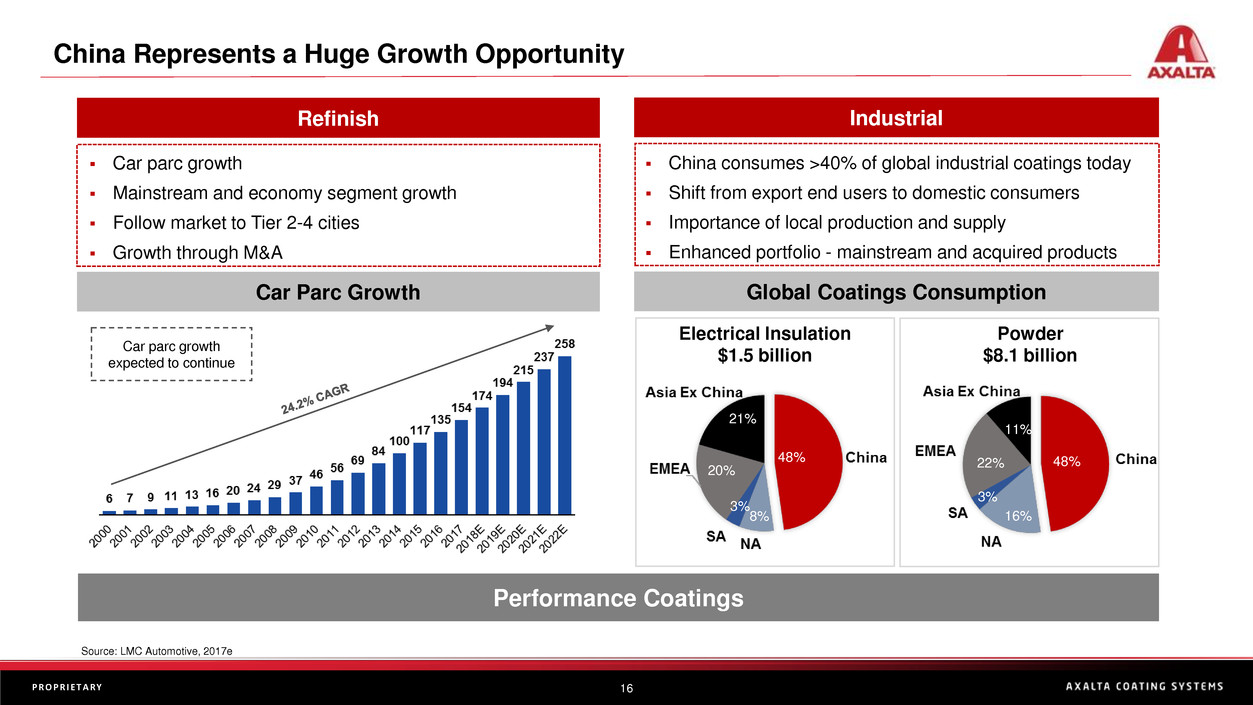

China Represents a Huge Growth Opportunity

Performance Coatings

▪ Car parc growth

▪ Mainstream and economy segment growth

▪ Follow market to Tier 2-4 cities

▪ Growth through M&A

Refinish Industrial

▪ China consumes >40% of global industrial coatings today

▪ Shift from export end users to domestic consumers

▪ Importance of local production and supply

▪ Enhanced portfolio - mainstream and acquired products

Car Parc Growth Global Coatings Consumption

Source: LMC Automotive, 2017e

Car parc growth

expected to continue

Electrical Insulation

$1.5 billion

Powder

$8.1 billion

48%

11%

22%

16%

3%

48%

20%

3%

8%

21%

17P R O P R I E T A R Y

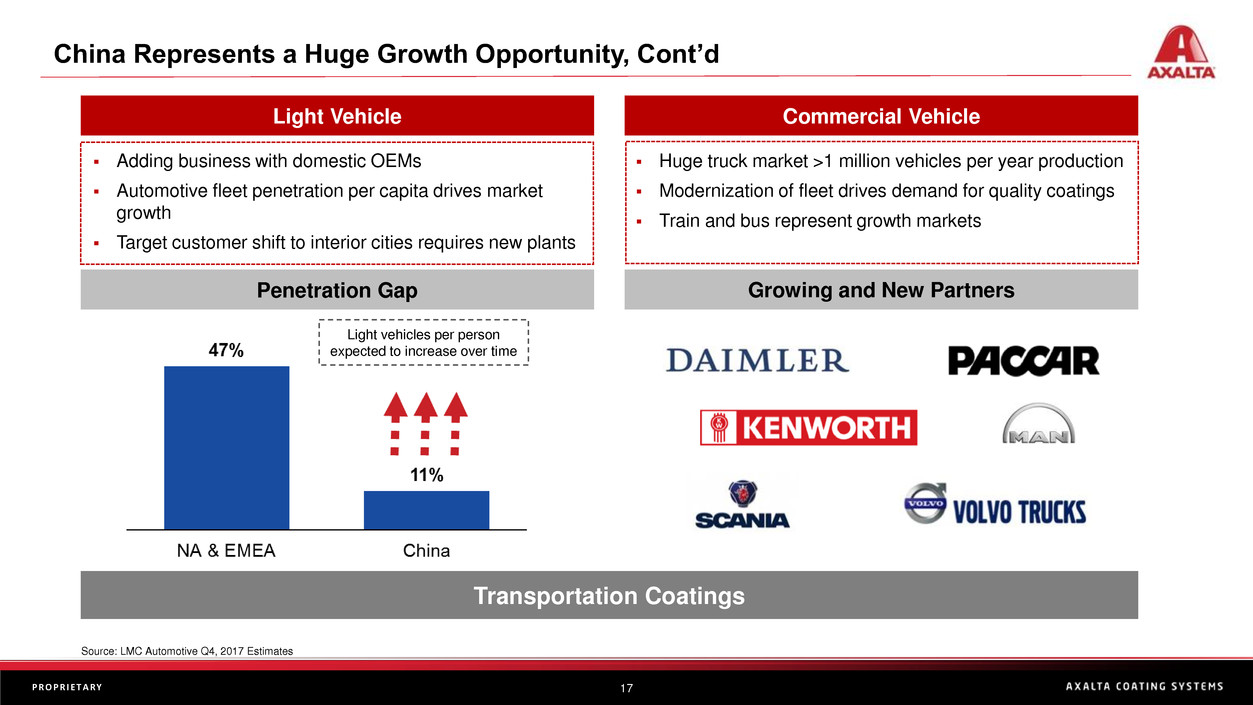

China Represents a Huge Growth Opportunity, Cont’d

Transportation Coatings

▪ Adding business with domestic OEMs

▪ Automotive fleet penetration per capita drives market

growth

▪ Target customer shift to interior cities requires new plants

Light Vehicle Commercial Vehicle

▪ Huge truck market >1 million vehicles per year production

▪ Modernization of fleet drives demand for quality coatings

▪ Train and bus represent growth markets

Penetration Gap Growing and New Partners

Source: LMC Automotive Q4, 2017 Estimates

Light vehicles per person

expected to increase over time

18P R O P R I E T A R Y

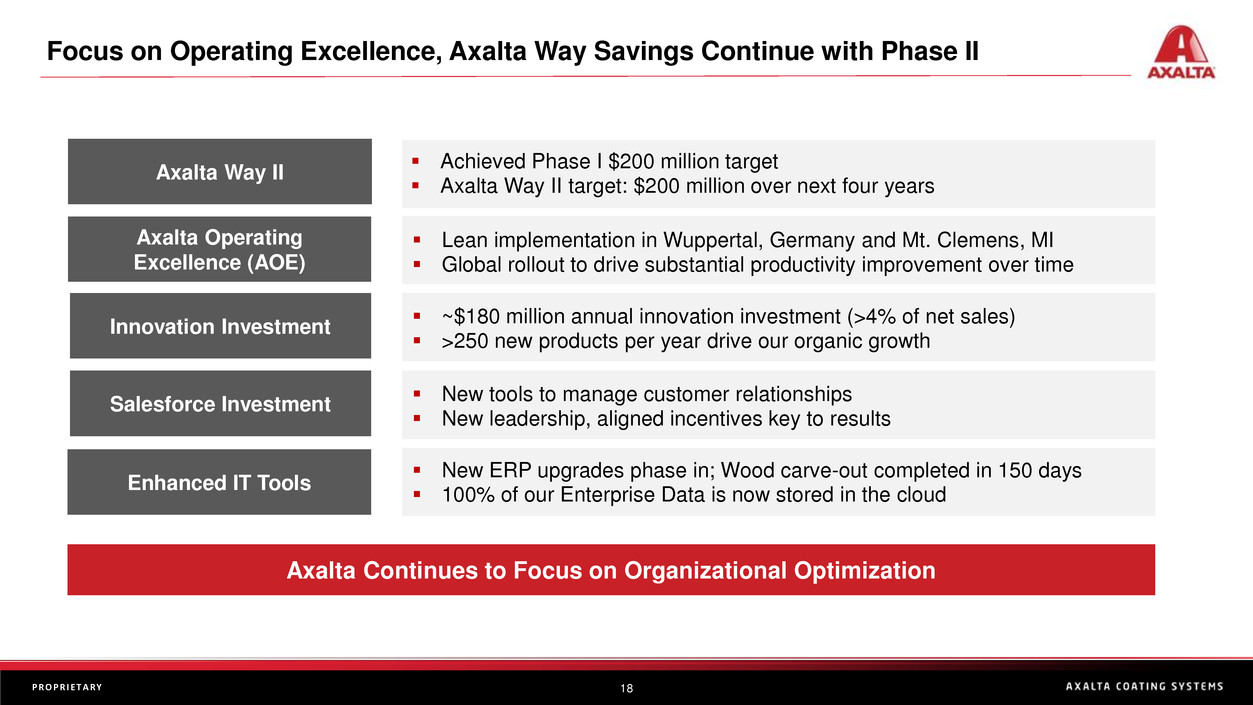

Focus on Operating Excellence, Axalta Way Savings Continue with Phase II

Axalta Continues to Focus on Organizational Optimization

Axalta Way II

Axalta Operating

Excellence (AOE)

Enhanced IT Tools

Innovation Investment

Salesforce Investment

▪ Achieved Phase I $200 million target

▪ Axalta Way II target: $200 million over next four years

▪ Lean implementation in Wuppertal, Germany and Mt. Clemens, MI

▪ Global rollout to drive substantial productivity improvement over time

▪ ~$180 million annual innovation investment (>4% of net sales)

▪ >250 new products per year drive our organic growth

▪ New tools to manage customer relationships

▪ New leadership, aligned incentives key to results

▪ New ERP upgrades phase in; Wood carve-out completed in 150 days

▪ 100% of our Enterprise Data is now stored in the cloud

19P R O P R I E T A R Y

Valspar Wood Coatings (N.A.)

North America

Industrial

Spencer Coatings

EMEA – U.K.

Industrial

Plascoat

EMEA

Industrial

M&A: Leveraging a Consolidating Coatings Sector

Benefits

▪ Provide access to new technologies,

products, customers, and markets

▪ Leverage combined supply chains and

distribution channels

▪ Develop process and marketing efficiencies

and globalize productsEllis Paint

North America

Refinish • Industrial

2017 Key Acquisitions

Century Industrial Coatings

North America

Industrial

Key Data

▪ 8 total transactions in 2017

▪ $564 million capital deployed

▪ Annual run-rate of ~$365 million in sales

We Have a Robust Pipeline and Will Continue to Leverage Market Consolidation

20P R O P R I E T A R Y

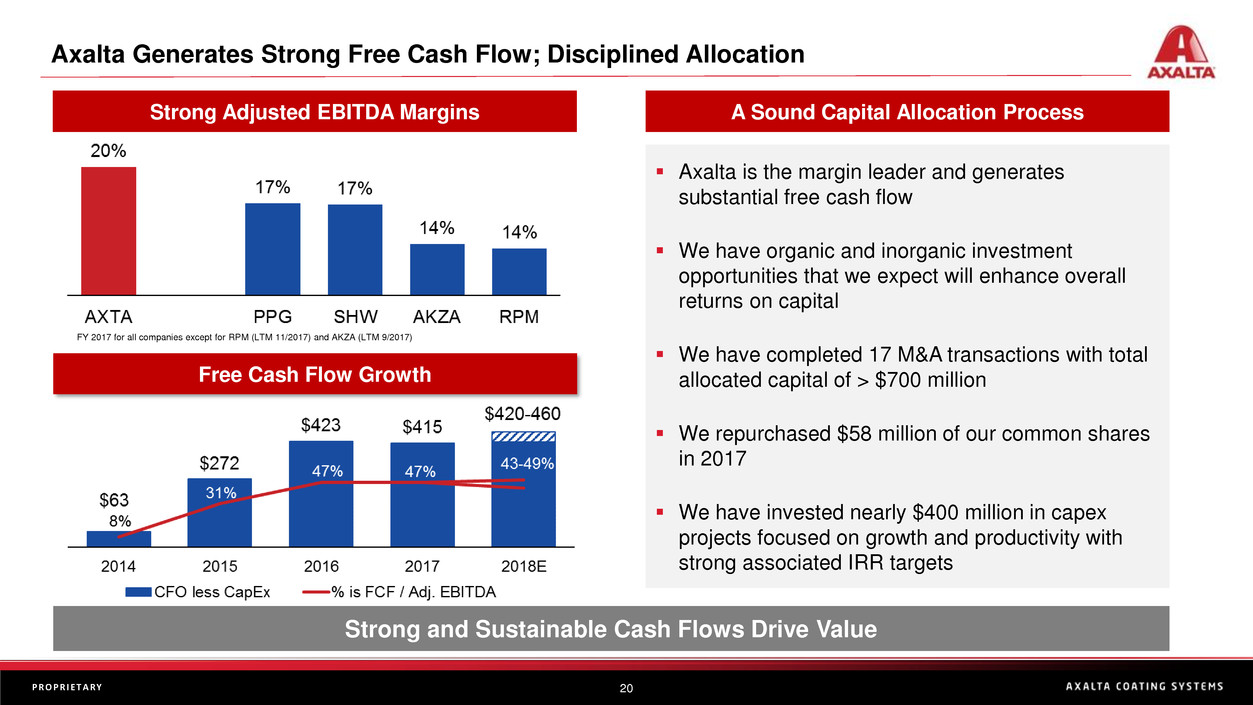

Axalta Generates Strong Free Cash Flow; Disciplined Allocation

Strong and Sustainable Cash Flows Drive Value

Strong Adjusted EBITDA Margins

Free Cash Flow Growth

A Sound Capital Allocation Process

FY 2017 for all companies except for RPM (LTM 11/2017) and AKZA (LTM 9/2017)

▪ Axalta is the margin leader and generates

substantial free cash flow

▪ We have organic and inorganic investment

opportunities that we expect will enhance overall

returns on capital

▪ We have completed 17 M&A transactions with total

allocated capital of > $700 million

▪ We repurchased $58 million of our common shares

in 2017

▪ We have invested nearly $400 million in capex

projects focused on growth and productivity with

strong associated IRR targets

21P R O P R I E T A R Y

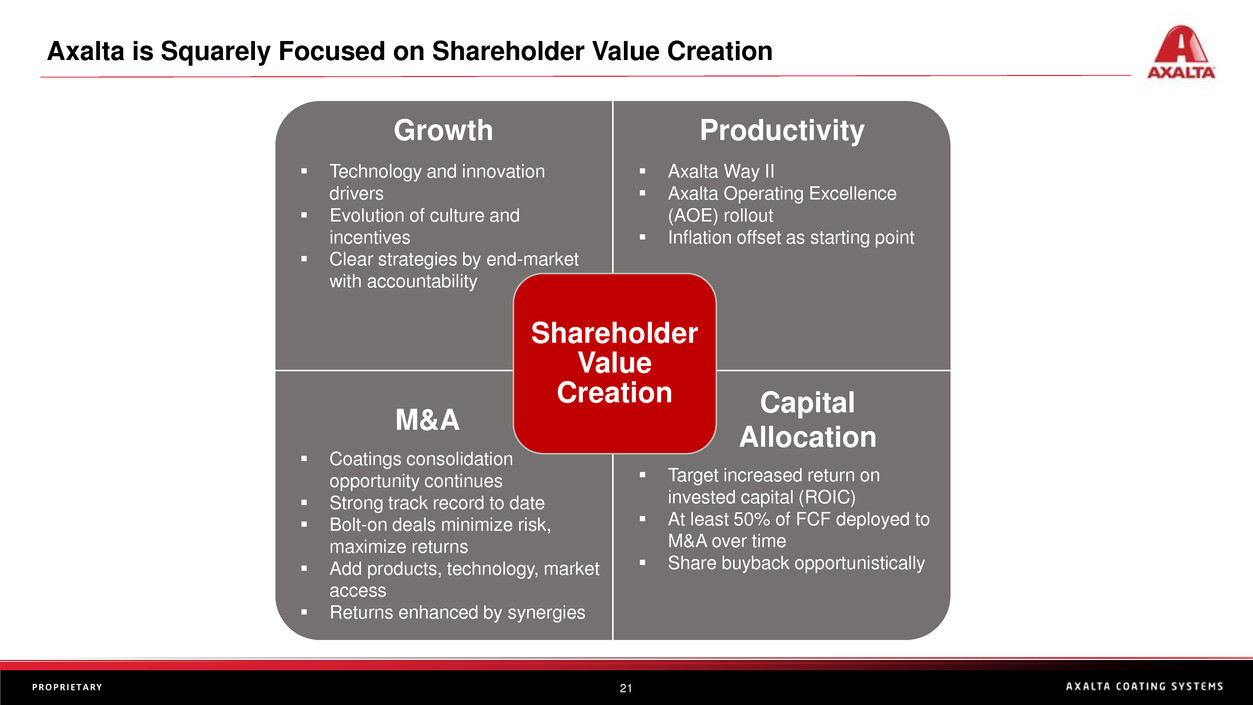

Growth Productivity

Shareholder

Value

Creation

▪ Technology and innovation

drivers

▪ Evolution of culture and

incentives

▪ Clear strategies by end-market

with accountability

▪ Axalta Way II

▪ Axalta Operating Excellence

(AOE) rollout

▪ Inflation offset as starting point

▪ Coatings consolidation

opportunity continues

▪ Strong track record to date

▪ Bolt-on deals minimize risk,

maximize returns

▪ Add products, technology, market

access

▪ Returns enhanced by synergies

▪ Target increased return on

invested capital (ROIC)

▪ At least 50% of FCF deployed to

M&A over time

▪ Share buyback opportunistically

Capital

Allocation

M&A

Axalta is Squarely Focused on Shareholder Value Creation

22P R O P R I E T A R Y

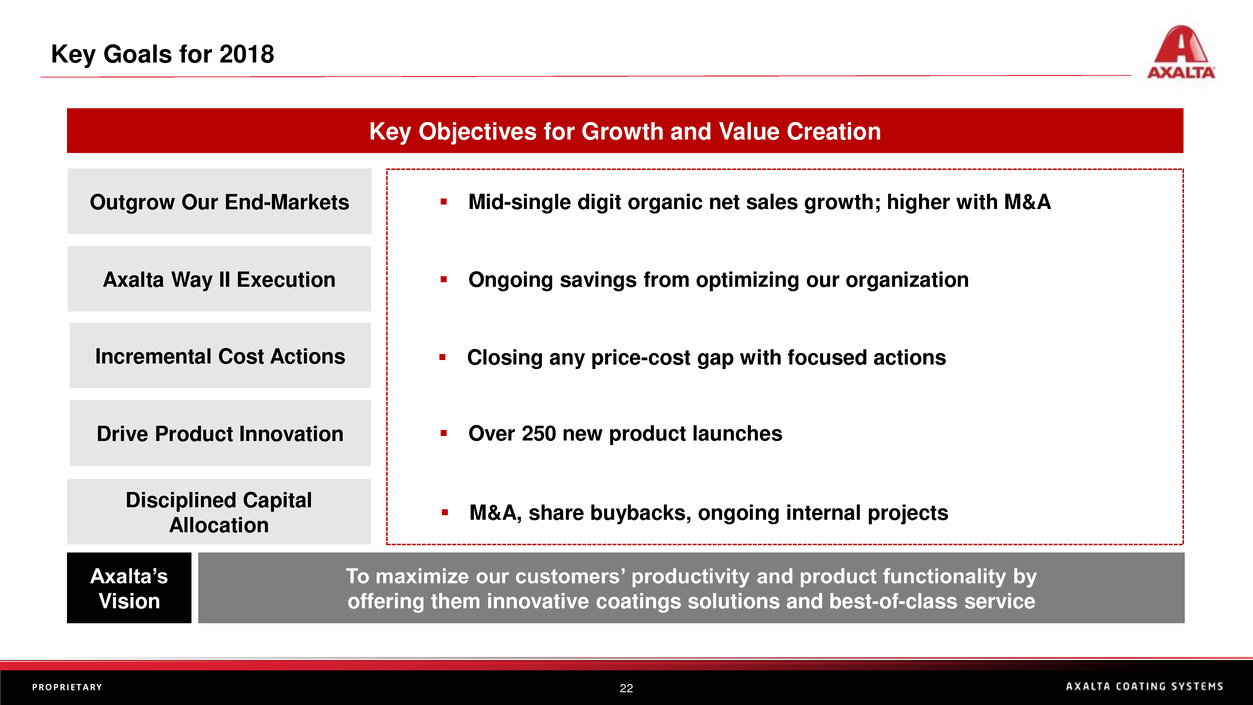

Key Goals for 2018

Key Objectives for Growth and Value Creation

To maximize our customers’ productivity and product functionality by

offering them innovative coatings solutions and best-of-class service

Outgrow Our End-Markets

Axalta Way II Execution

Disciplined Capital

Allocation

Incremental Cost Actions

Drive Product Innovation

▪ Mid-single digit organic net sales growth; higher with M&A

▪ Ongoing savings from optimizing our organization

▪ Closing any price-cost gap with focused actions

▪ Over 250 new product launches

▪ M&A, share buybacks, ongoing internal projects

Axalta’s

Vision

23P R O P R I E T A R Y

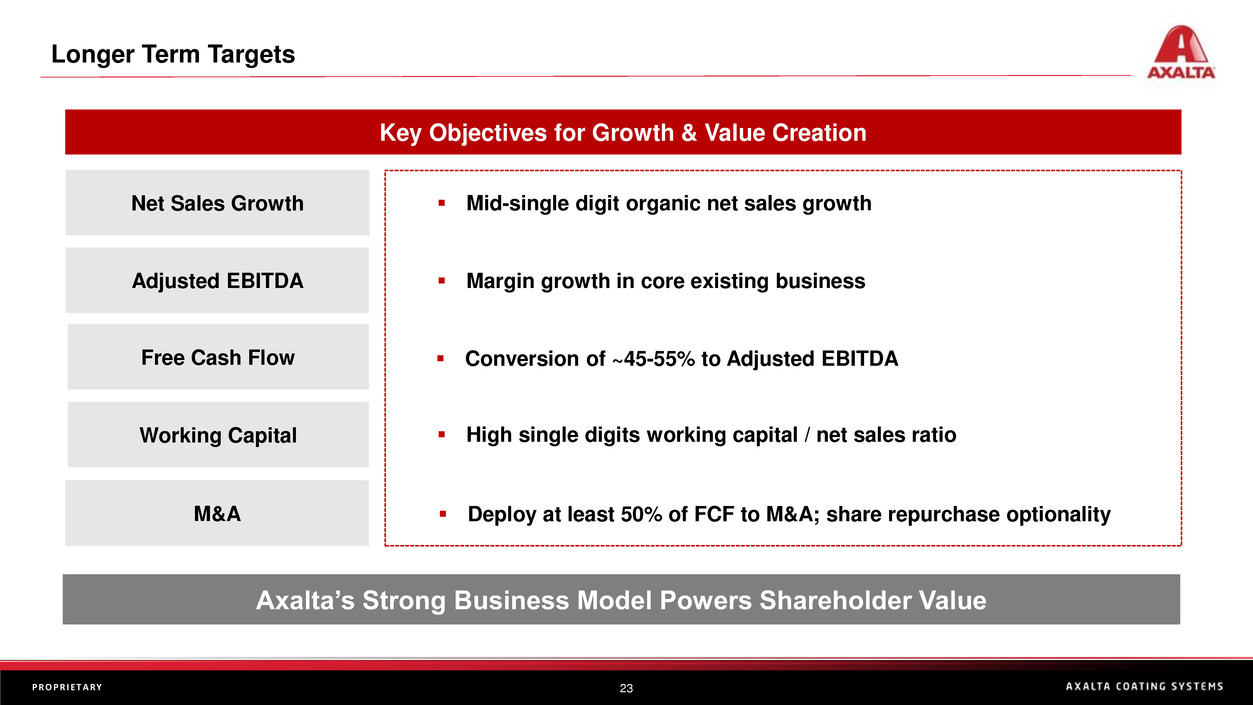

Longer Term Targets

Key Objectives for Growth & Value Creation

Axalta’s Strong Business Model Powers Shareholder Value

Net Sales Growth

Adjusted EBITDA

M&A

Free Cash Flow

Working Capital

▪ Mid-single digit organic net sales growth

▪ Margin growth in core existing business

▪ Conversion of ~45-55% to Adjusted EBITDA

▪ High single digits working capital / net sales ratio

▪ Deploy at least 50% of FCF to M&A; share repurchase optionality

24P R O P R I E T A R Y

Summary

▪ Axalta has developed a strong five year execution track record;

we see significant upside in sales and profit growth, cash flow

generation, and returns on capital

▪ We lead in growing, strong, and stable coatings segments and

are actively entering new close adjacent markets

▪ Our technologies and service differentiate Axalta in the

markets we serve

▪ Axalta has material growth opportunities in China, adjacent

coatings markets and ongoing industry consolidation

▪ We are targeting $200 million in incremental savings over four

years with Axalta Way Phase II

We Are 100% Focused on Shareholder Value Creation

Thank You!

Axalta’s Financial Progress and Outlook

Robert Bryant

EVP and CFO

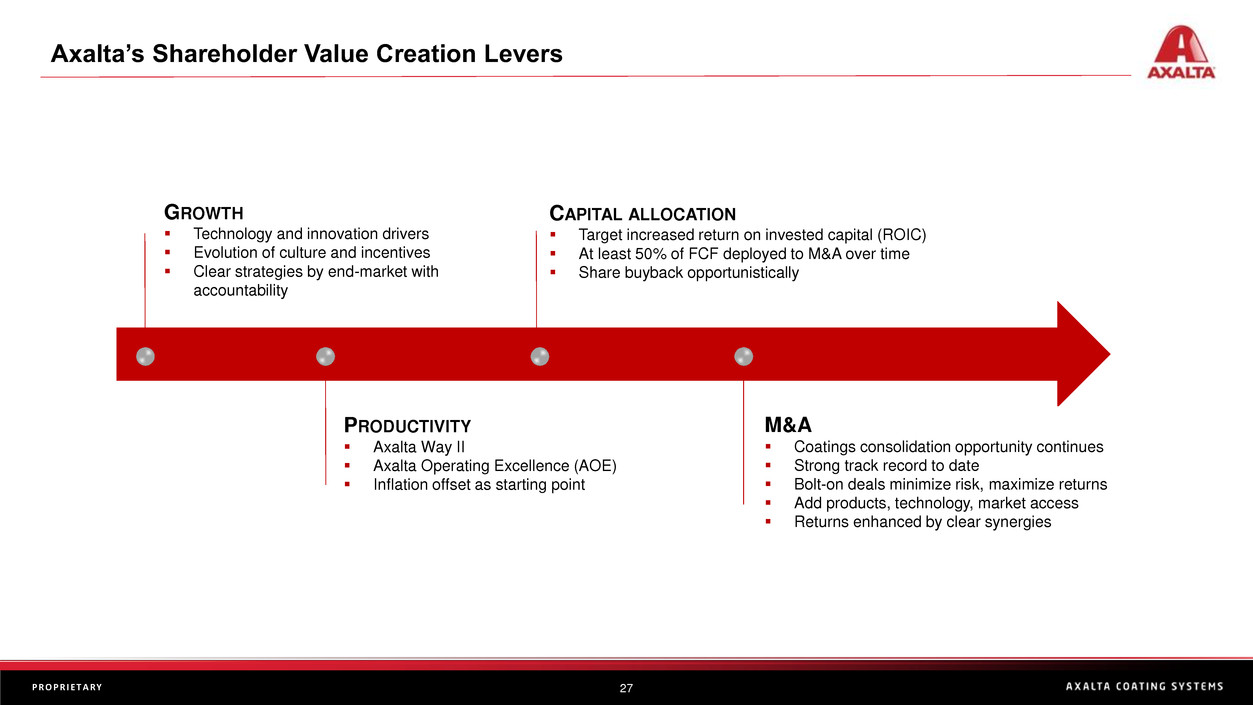

27P R O P R I E T A R Y

GROWTH

▪ Technology and innovation drivers

▪ Evolution of culture and incentives

▪ Clear strategies by end-market with

accountability

PRODUCTIVITY

▪ Axalta Way II

▪ Axalta Operating Excellence (AOE)

▪ Inflation offset as starting point

M&A

▪ Coatings consolidation opportunity continues

▪ Strong track record to date

▪ Bolt-on deals minimize risk, maximize returns

▪ Add products, technology, market access

▪ Returns enhanced by clear synergies

CAPITAL ALLOCATION

▪ Target increased return on invested capital (ROIC)

▪ At least 50% of FCF deployed to M&A over time

▪ Share buyback opportunistically

Axalta’s Shareholder Value Creation Levers

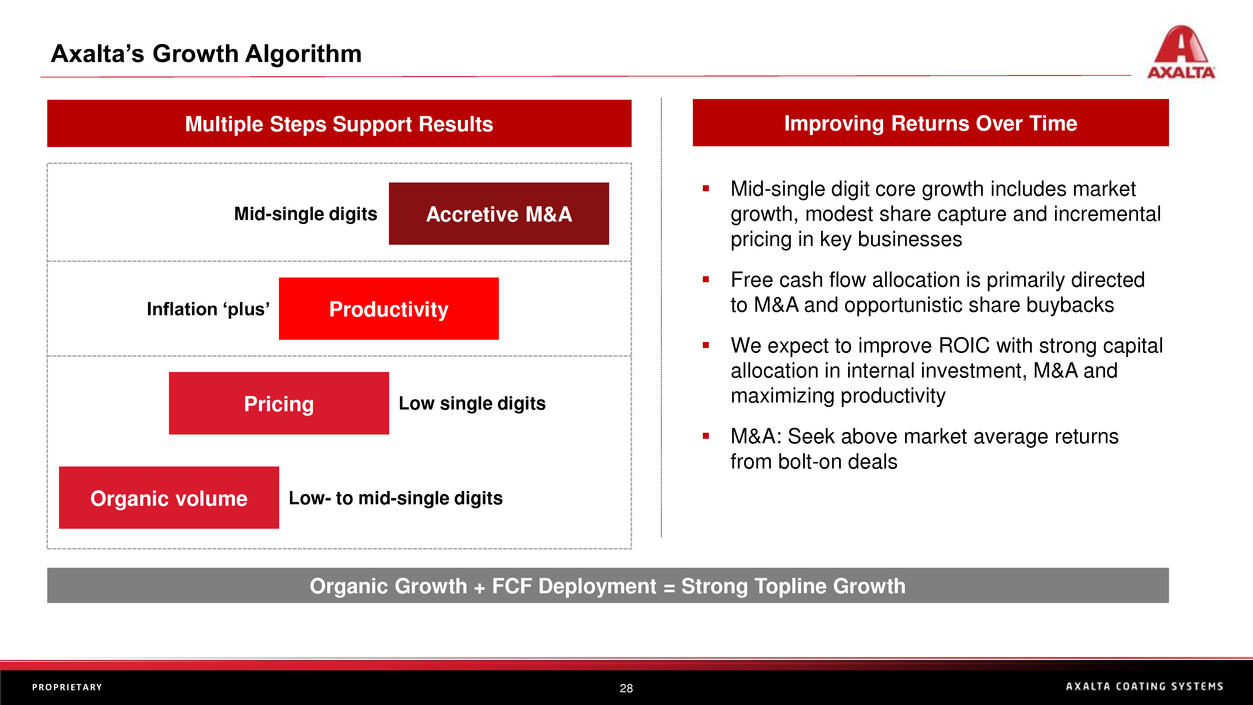

28P R O P R I E T A R Y

Organic Growth + FCF Deployment = Strong Topline Growth

▪ Mid-single digit core growth includes market

growth, modest share capture and incremental

pricing in key businesses

▪ Free cash flow allocation is primarily directed

to M&A and opportunistic share buybacks

▪ We expect to improve ROIC with strong capital

allocation in internal investment, M&A and

maximizing productivity

▪ M&A: Seek above market average returns

from bolt-on deals

Improving Returns Over TimeMultiple Steps Support Results

Organic volume

Pricing

Productivity

Accretive M&A

Low- to mid-single digits

Low single digits

Inflation ‘plus’

Mid-single digits

Axalta’s Growth Algorithm

29P R O P R I E T A R Y

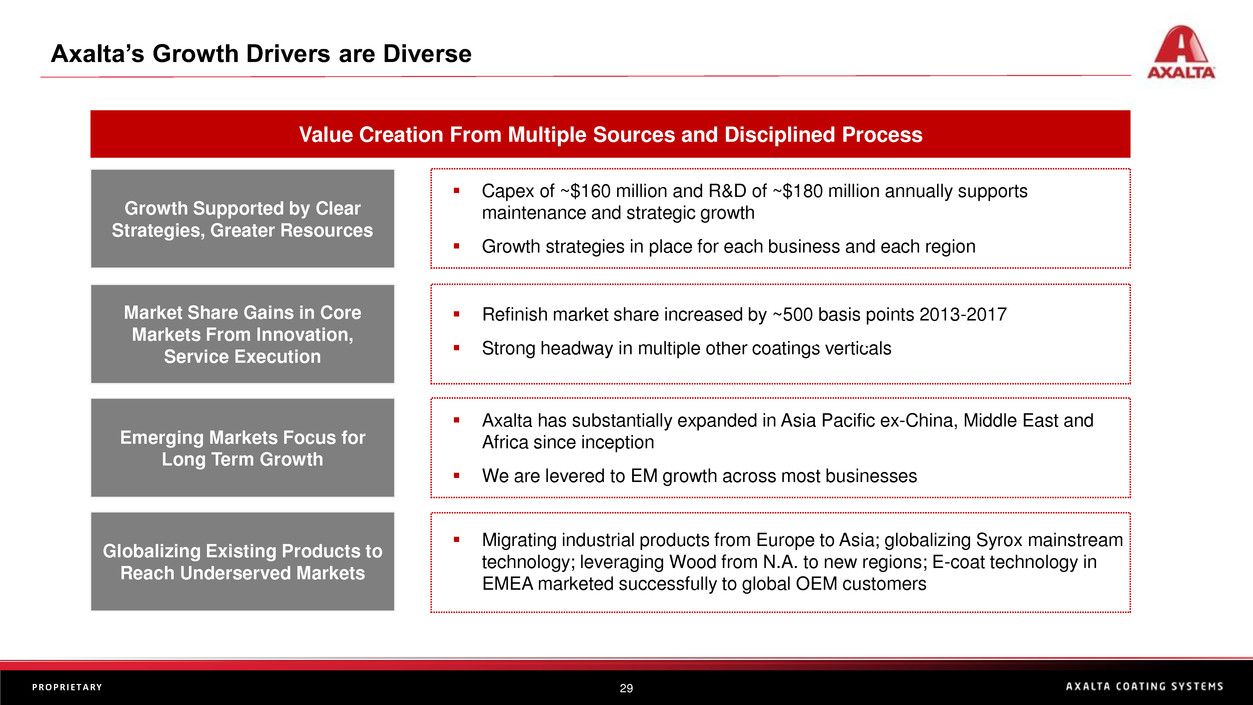

Axalta’s Growth Drivers are Diverse

Value Creation From Multiple Sources and Disciplined Process

Growth Supported by Clear

Strategies, Greater Resources

Market Share Gains in Core

Markets From Innovation,

Service Execution

Emerging Markets Focus for

Long Term Growth

Globalizing Existing Products to

Reach Underserved Markets

▪ Capex of ~$160 million and R&D of ~$180 million annually supports

maintenance and strategic growth

▪ Growth strategies in place for each business and each region

▪ Refinish market share increased by ~500 basis points 2013-2017

▪ Strong headway in multiple other coatings verticals

▪ Axalta has substantially expanded in Asia Pacific ex-China, Middle East and

Africa since inception

▪ We are levered to EM growth across most businesses

▪ Migrating industrial products from Europe to Asia; globalizing Syrox mainstream

technology; leveraging Wood from N.A. to new regions; E-coat technology in

EMEA marketed successfully to global OEM customers

I think we are go to go.

I think we are go to go.

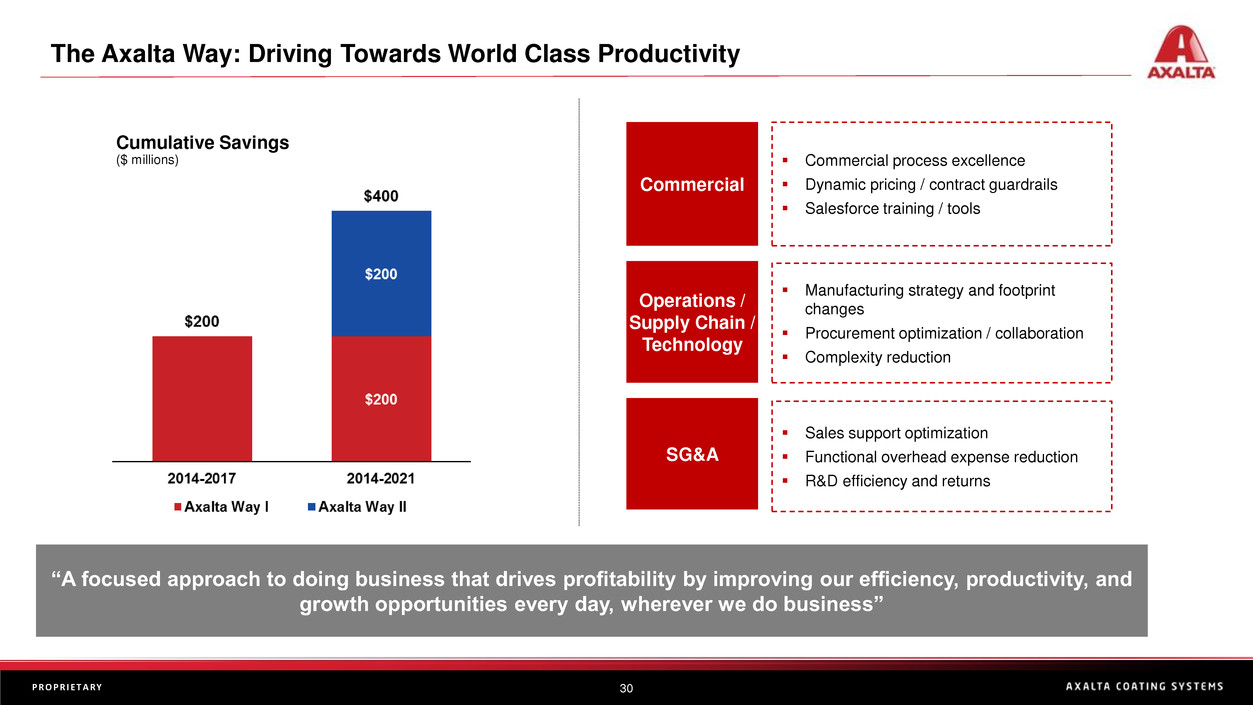

30P R O P R I E T A R Y

Cumulative Savings

($ millions)

“A focused approach to doing business that drives profitability by improving our efficiency, productivity, and

growth opportunities every day, wherever we do business”

Commercial

Operations /

Supply Chain /

Technology

SG&A

▪ Manufacturing strategy and footprint

changes

▪ Procurement optimization / collaboration

▪ Complexity reduction

▪ Sales support optimization

▪ Functional overhead expense reduction

▪ R&D efficiency and returns

▪ Commercial process excellence

▪ Dynamic pricing / contract guardrails

▪ Salesforce training / tools

The Axalta Way: Driving Towards World Class Productivity

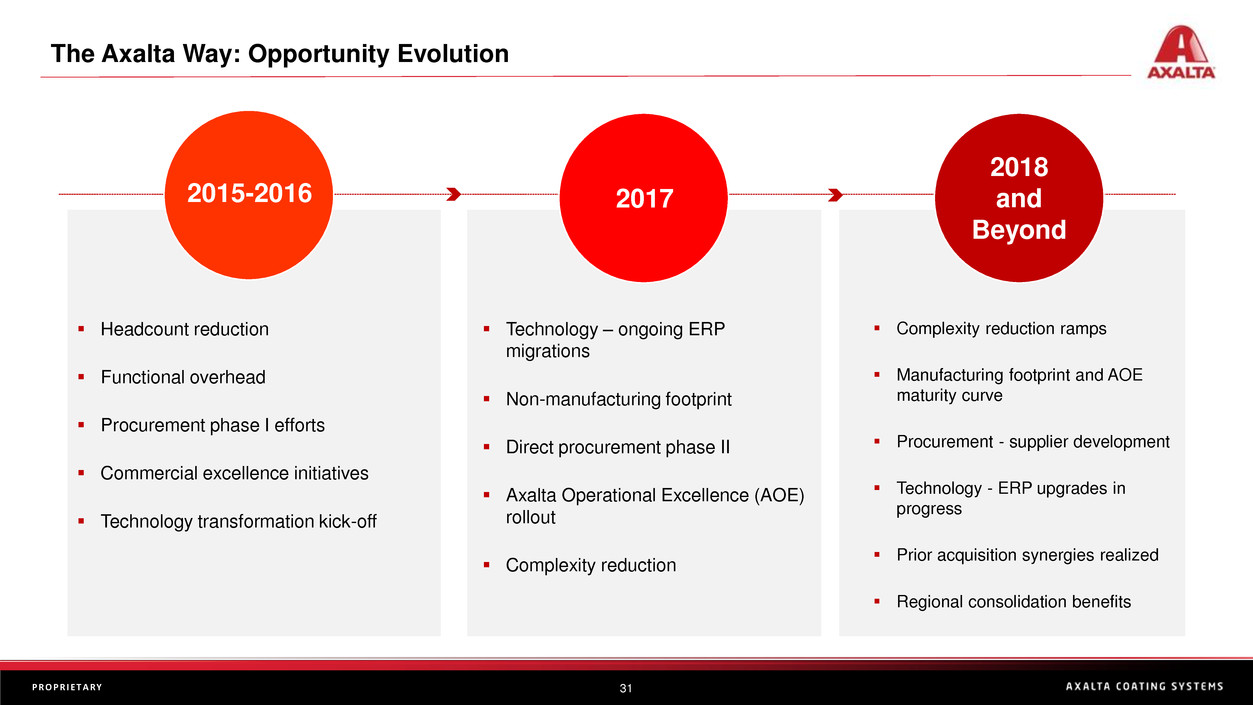

31P R O P R I E T A R Y

▪ Headcount reduction

▪ Functional overhead

▪ Procurement phase I efforts

▪ Commercial excellence initiatives

▪ Technology transformation kick-off

▪ Technology – ongoing ERP

migrations

▪ Non-manufacturing footprint

▪ Direct procurement phase II

▪ Axalta Operational Excellence (AOE)

rollout

▪ Complexity reduction

▪ Complexity reduction ramps

▪ Manufacturing footprint and AOE

maturity curve

▪ Procurement - supplier development

▪ Technology - ERP upgrades in

progress

▪ Prior acquisition synergies realized

▪ Regional consolidation benefits

2015-2016 2017

2018

and

Beyond

The Axalta Way: Opportunity Evolution

32P R O P R I E T A R Y

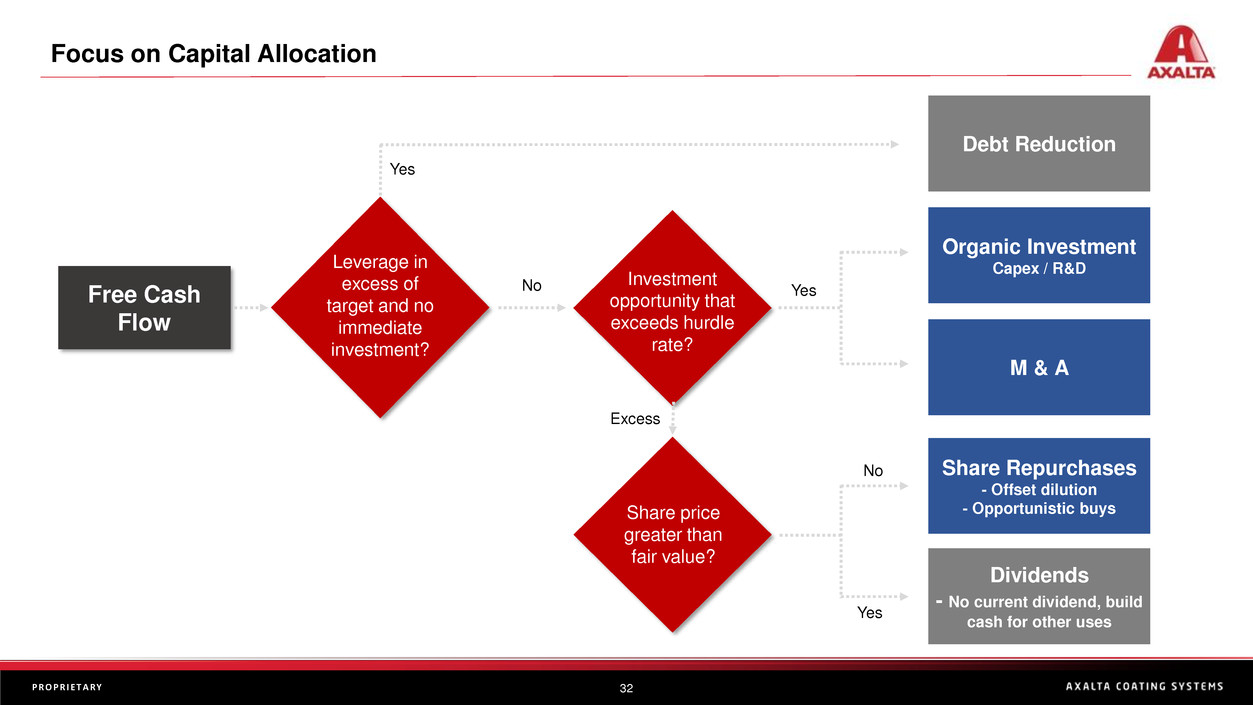

Debt Reduction

Organic Investment

Capex / R&D

M & A

Dividends

- No current dividend, build

cash for other uses

Share Repurchases

- Offset dilution

- Opportunistic buys

Leverage in

excess of

target and no

immediate

investment?

Investment

opportunity that

exceeds hurdle

rate?

Share price

greater than

fair value?

Free Cash

Flow

No

Excess

Yes

Yes

Yes

No

Focus on Capital Allocation

33P R O P R I E T A R Y

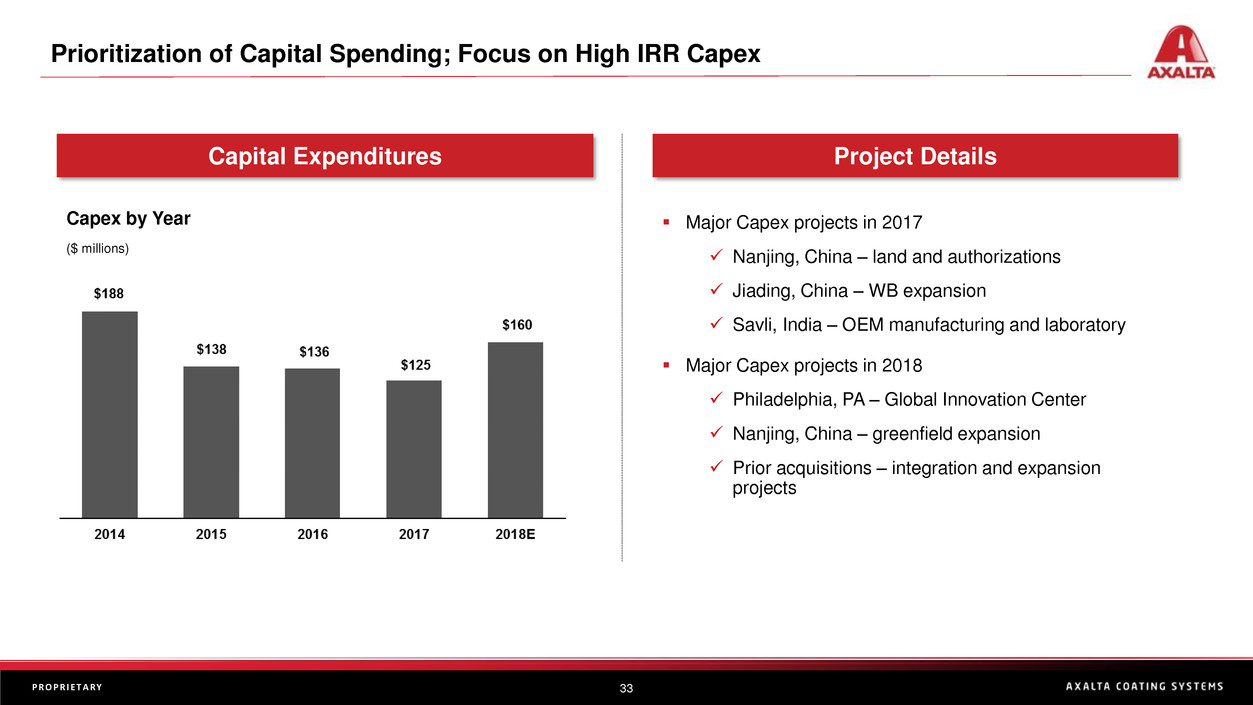

Capital Expenditures

Capex by Year

($ millions)

Project Details

▪ Major Capex projects in 2017

✓ Nanjing, China – land and authorizations

✓ Jiading, China – WB expansion

✓ Savli, India – OEM manufacturing and laboratory

▪ Major Capex projects in 2018

✓ Philadelphia, PA – Global Innovation Center

✓ Nanjing, China – greenfield expansion

✓ Prior acquisitions – integration and expansion

projects

Prioritization of Capital Spending; Focus on High IRR Capex

34P R O P R I E T A R Y

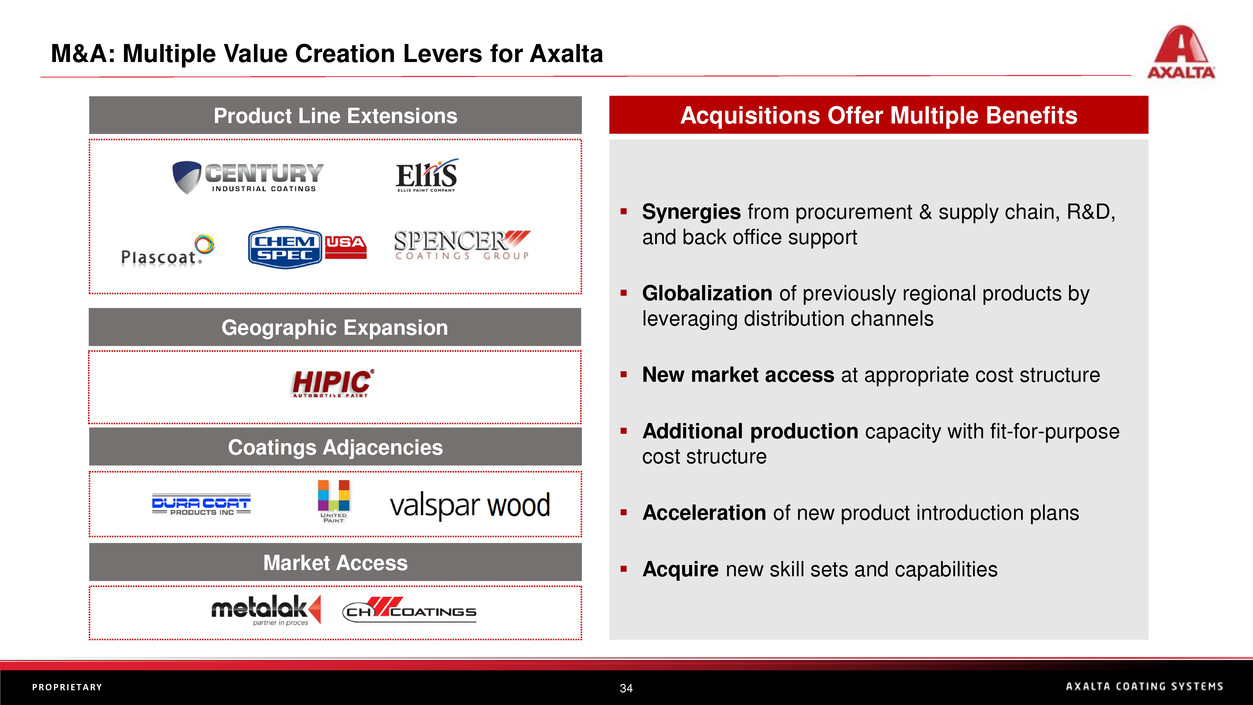

Acquisitions Offer Multiple BenefitsProduct Line Extensions

Geographic Expansion

Coatings Adjacencies

Market Access

▪ Synergies from procurement & supply chain, R&D,

and back office support

▪ Globalization of previously regional products by

leveraging distribution channels

▪ New market access at appropriate cost structure

▪ Additional production capacity with fit-for-purpose

cost structure

▪ Acceleration of new product introduction plans

▪ Acquire new skill sets and capabilities

.

.

.

.

M&A: Multiple Value Creation Levers for Axalta

35P R O P R I E T A R Y

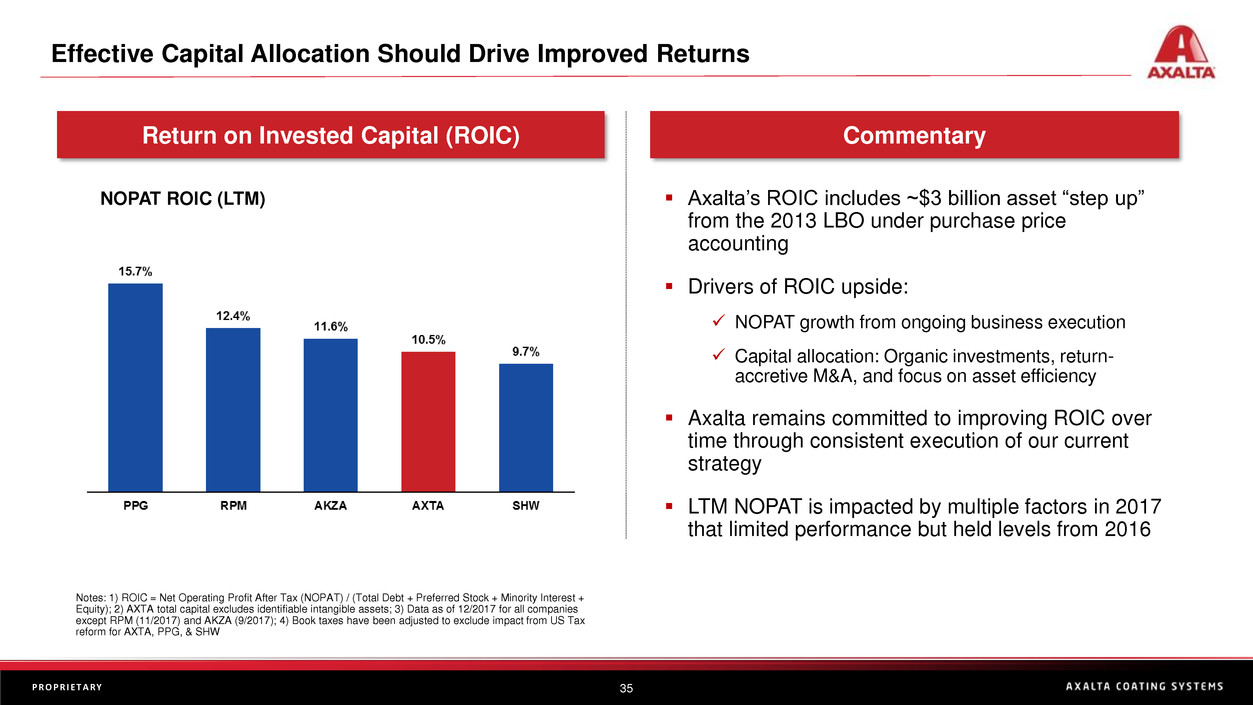

Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Preferred Stock + Minority Interest +

Equity); 2) AXTA total capital excludes identifiable intangible assets; 3) Data as of 12/2017 for all companies

except RPM (11/2017) and AKZA (9/2017); 4) Book taxes have been adjusted to exclude impact from US Tax

reform for AXTA, PPG, & SHW

Return on Invested Capital (ROIC) Commentary

NOPAT ROIC (LTM) ▪ Axalta’s ROIC includes ~$3 billion asset “step up”

from the 2013 LBO under purchase price

accounting

▪ Drivers of ROIC upside:

✓ NOPAT growth from ongoing business execution

✓ Capital allocation: Organic investments, return-

accretive M&A, and focus on asset efficiency

▪ Axalta remains committed to improving ROIC over

time through consistent execution of our current

strategy

▪ LTM NOPAT is impacted by multiple factors in 2017

that limited performance but held levels from 2016

Effective Capital Allocation Should Drive Improved Returns

36P R O P R I E T A R Y

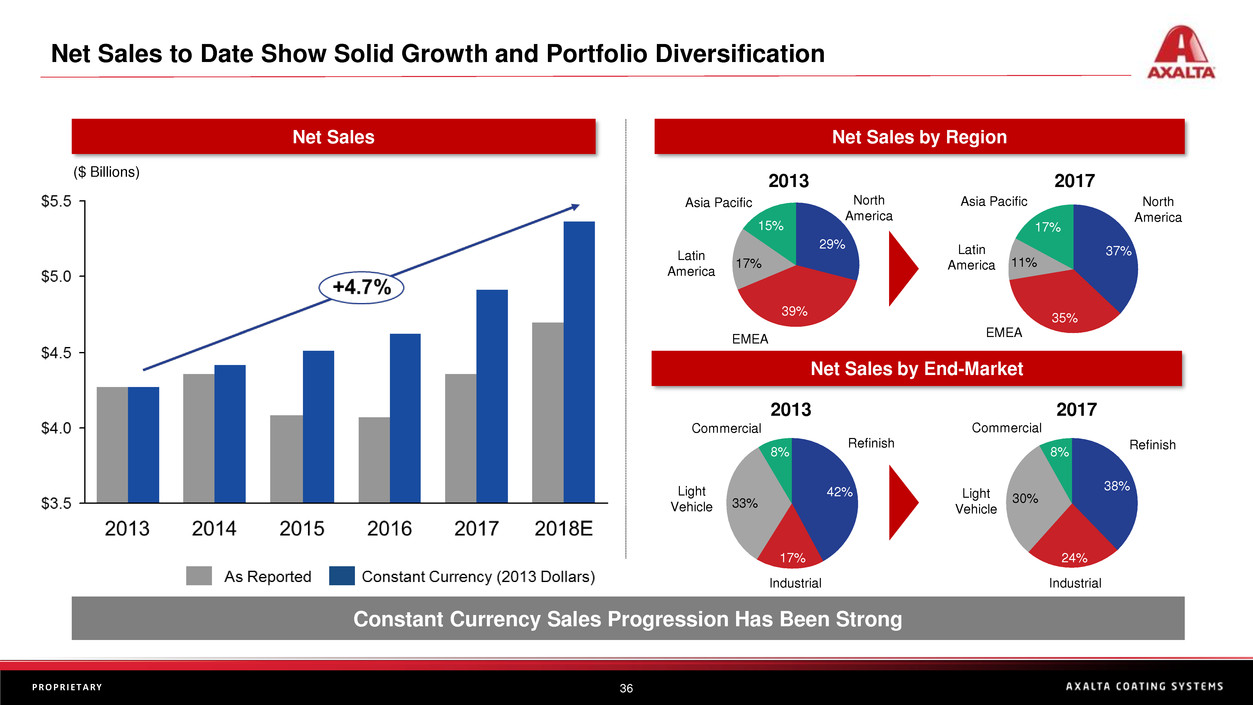

Constant Currency Sales Progression Has Been Strong

Net Sales Net Sales by Region

North

America

29%

15%

Asia Pacific

Latin

America

17%

EMEA

39%

17%

11%

EMEA

35%

Asia Pacific North

America

37%Latin

America

2013 2017

Light

Vehicle

Commercial

33%

8%

Refinish

17%

Industrial

42%

Industrial

38%

8%

24%

30%

Refinish

Commercial

Light

Vehicle

($ Billions)

Net Sales by End-Market

2013 2017

Net Sales to Date Show Solid Growth and Portfolio Diversification

37P R O P R I E T A R Y

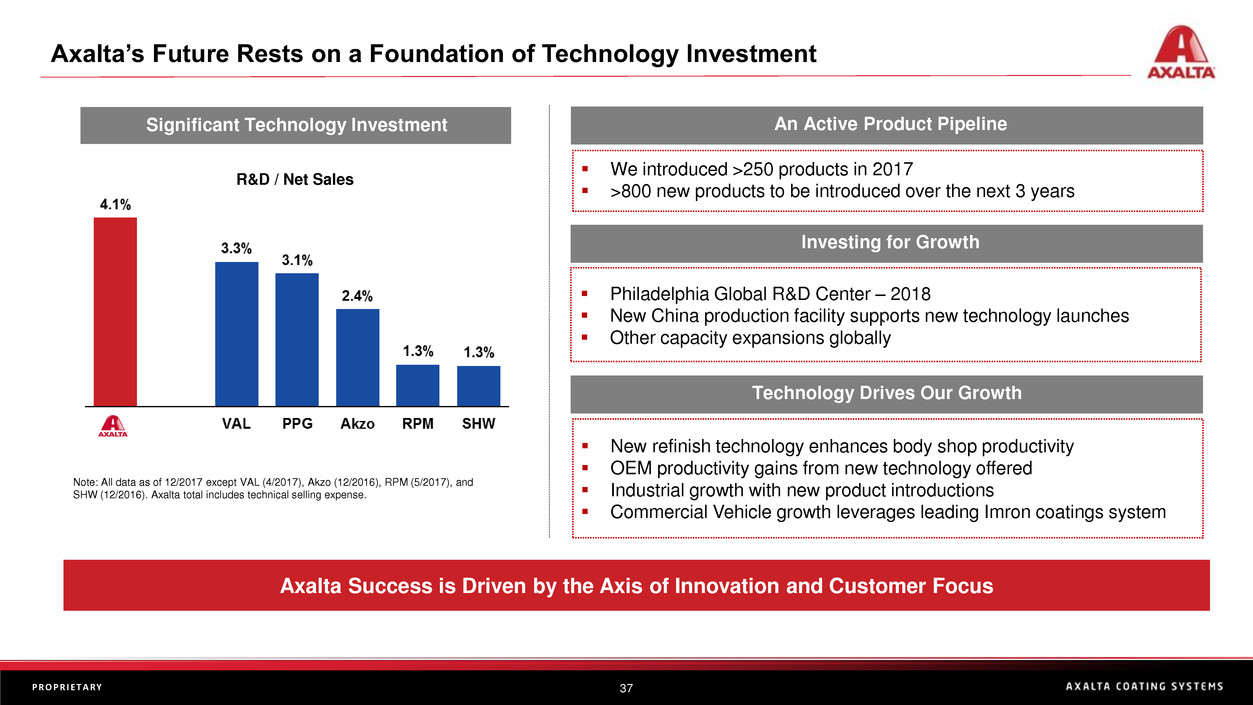

Axalta Success is Driven by the Axis of Innovation and Customer Focus

An Active Product PipelineSignificant Technology Investment

Note: All data as of 12/2017 except VAL (4/2017), Akzo (12/2016), RPM (5/2017), and

SHW (12/2016). Axalta total includes technical selling expense.

▪ We introduced >250 products in 2017

▪ >800 new products to be introduced over the next 3 years

▪ Philadelphia Global R&D Center – 2018

▪ New China production facility supports new technology launches

▪ Other capacity expansions globally

▪ New refinish technology enhances body shop productivity

▪ OEM productivity gains from new technology offered

▪ Industrial growth with new product introductions

▪ Commercial Vehicle growth leverages leading Imron coatings system

Investing for Growth

Technology Drives Our Growth

R&D / Net Sales .

.

.

Axalta’s Future Rests on a Foundation of Technology Investment

38P R O P R I E T A R Y

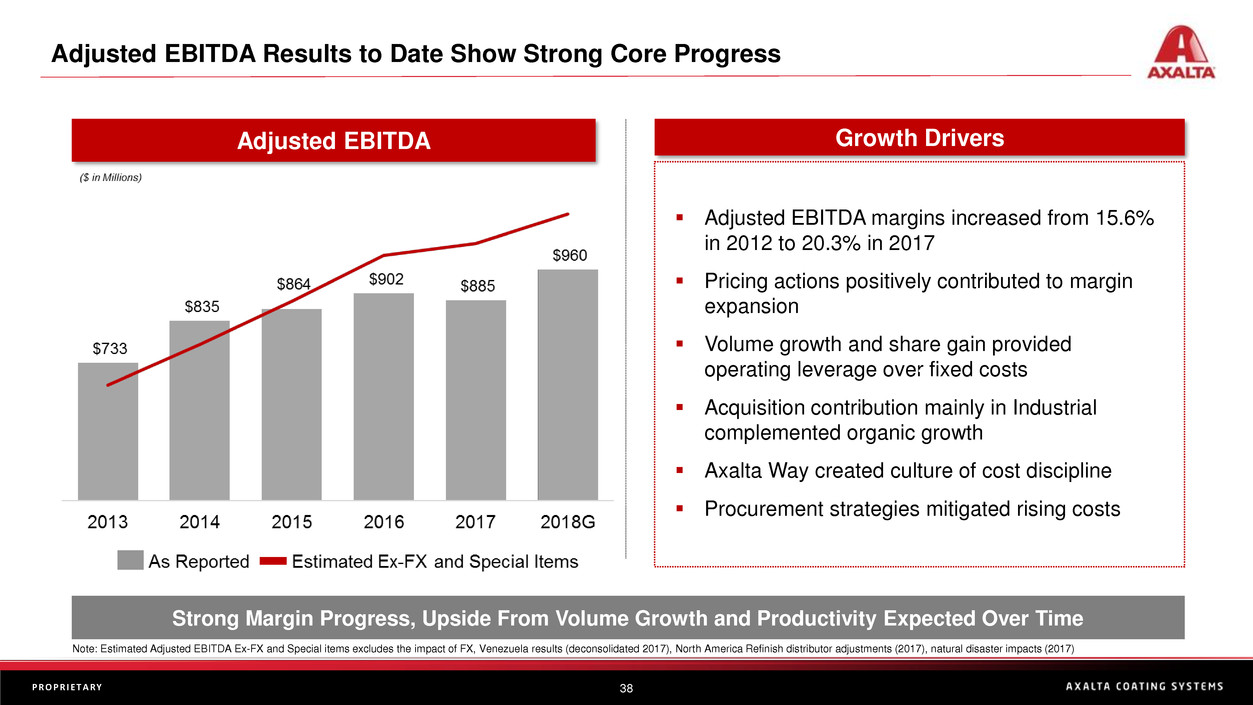

Strong Margin Progress, Upside From Volume Growth and Productivity Expected Over Time

Adjusted EBITDA Growth Drivers

▪ Adjusted EBITDA margins increased from 15.6%

in 2012 to 20.3% in 2017

▪ Pricing actions positively contributed to margin

expansion

▪ Volume growth and share gain provided

operating leverage over fixed costs

▪ Acquisition contribution mainly in Industrial

complemented organic growth

▪ Axalta Way created culture of cost discipline

▪ Procurement strategies mitigated rising costs

.

Adjusted EBITDA Results to Date Show Strong Core Progress

Note: Estimated Adjusted EBITDA Ex-FX and Special items excludes the impact of FX, Venezuela results (deconsolidated 2017), North America Refinish distributor adjustments (2017), natural disaster impacts (2017)

39P R O P R I E T A R Y

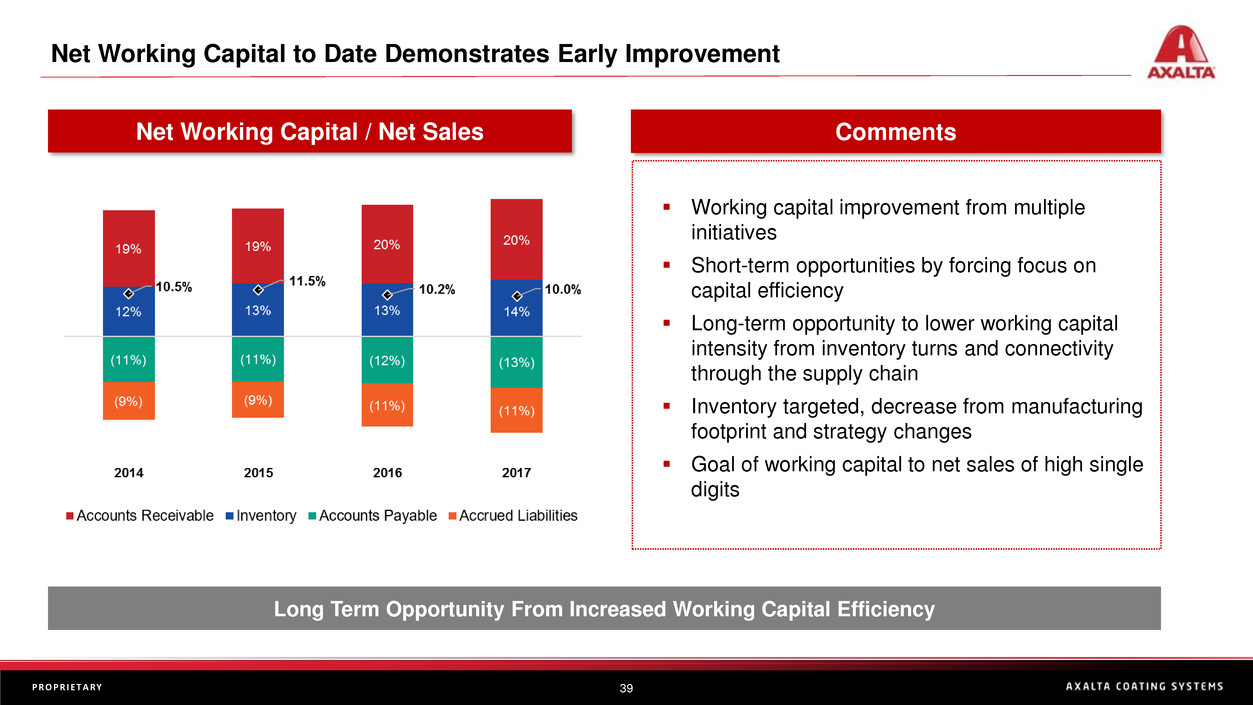

Long Term Opportunity From Increased Working Capital Efficiency

Net Working Capital / Net Sales Comments

▪ Working capital improvement from multiple

initiatives

▪ Short-term opportunities by forcing focus on

capital efficiency

▪ Long-term opportunity to lower working capital

intensity from inventory turns and connectivity

through the supply chain

▪ Inventory targeted, decrease from manufacturing

footprint and strategy changes

▪ Goal of working capital to net sales of high single

digits

.

Net Working Capital to Date Demonstrates Early Improvement

40P R O P R I E T A R Y

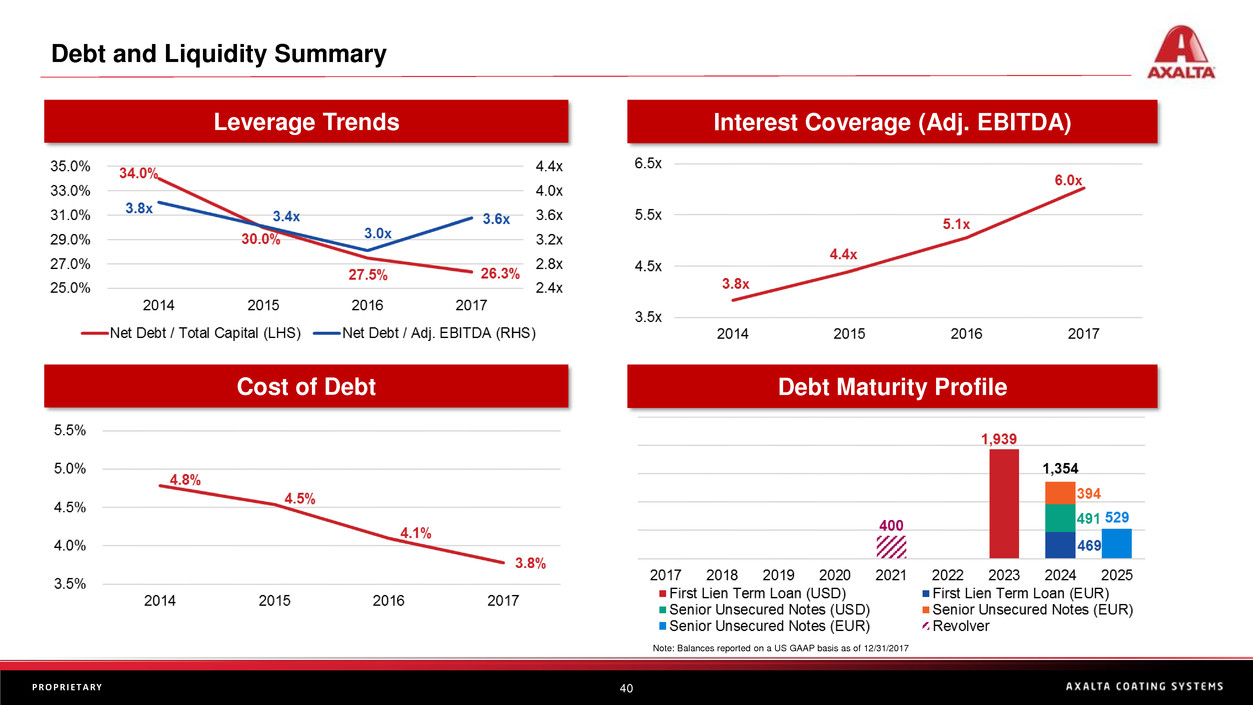

Leverage Trends Interest Coverage (Adj. EBITDA)

Cost of Debt Debt Maturity Profile

Note: Balances reported on a US GAAP basis as of 12/31/2017

Debt and Liquidity Summary

41P R O P R I E T A R Y

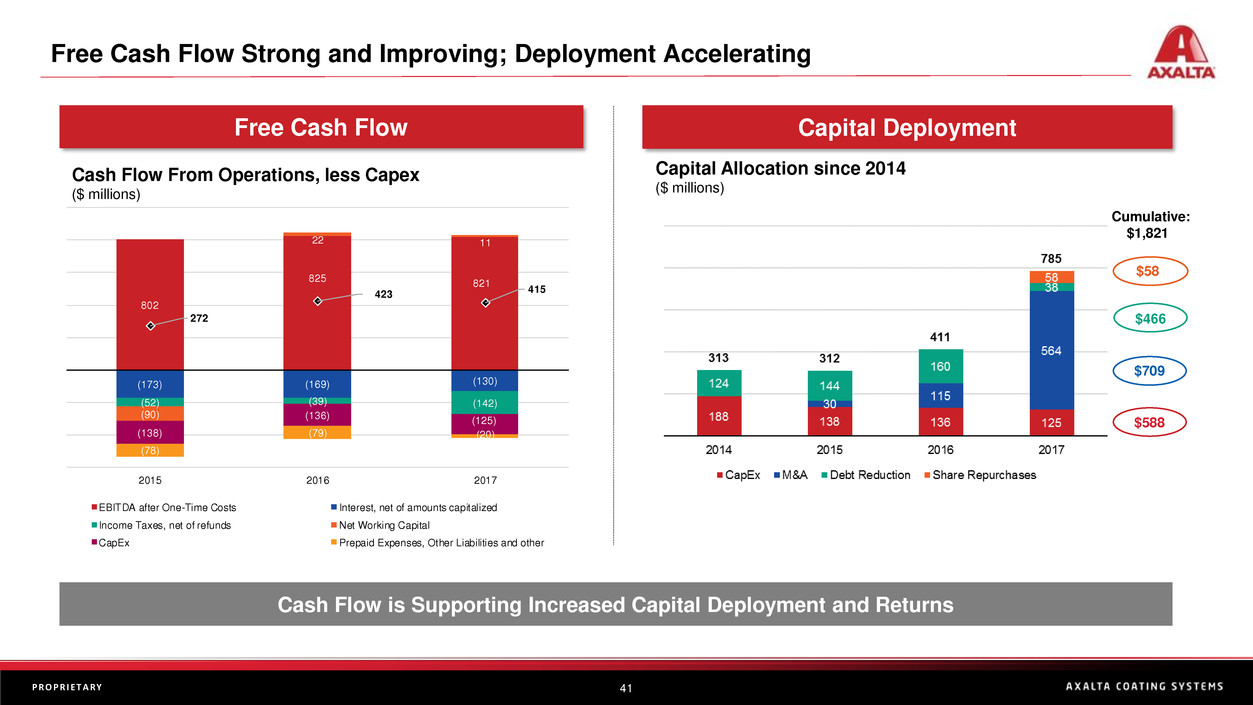

802

825 821

(173) (169) (130)

(52) (39) (142)

(90)

22 11

(138)

(136) (125)

(78)

(79) (20)

272

423 415

2015 2016 2017

EBITDA after One-Time Costs Interest, net of amounts capitalized

Income Taxes, net of refunds Net Working Capital

CapEx Prepaid Expenses, Other Liabilities and other

Cash Flow is Supporting Increased Capital Deployment and Returns

Free Cash Flow Capital Deployment

Cash Flow From Operations, less Capex

($ millions)

Capital Allocation since 2014

($ millions)

$58

$709

$588

$466

Cumulative:

$1,821

Free Cash Flow Strong and Improving; Deployment Accelerating

42P R O P R I E T A R Y

Grow The Business Grow Adjusted EBITDA

2018E Net Sales: +8-9%

▪ Refinish: Stable global market growth;

continued core market share gains; mainstream

segment penetration

▪ Industrial: Strong growth via new products;

execution on strategic growth plans; leveraging

M&A topline synergies

▪ Light Vehicle: Organic market share from

superior service and innovation; diversifying

customer base; broadening product depth

▪ Commercial Vehicle: Supportive truck demand;

growth in other non-truck customer base

2018E Adjusted EBITDA: $940-980 million

▪ Core growth drives incremental margin in most

businesses

▪ Price-cost gap narrowed by incremental cost

actions

▪ FX tailwind reflecting stronger emerging market

economies and stronger Euro-dollar rate

▪ Margins expected to be stable on current

assumption of ~10% raw material cost inflation

due to price actions and productivity offsets

Objective

Results

Hig

h

lig

h

ts

& Challen

g

e

s

Our Financial Scorecard is Focused on Profitable Growth

Guidance Maintained For 2018

43P R O P R I E T A R Y

▪ Axalta operates a very strong core business model

▪ We target solid organic growth and market outgrowth in each of our

businesses

▪ We seek enhanced productivity and core margin growth; Refinish

provides a stable foundation

▪ We still have years of self-help to execute to optimize our business

▪ Solid incremental investments, including M&A, to drive shareholder

returns

▪ Our cumulative efforts should drive steady improvement in ROIC

Summary of our Investment Case

Thank you!

Performance Coatings: Refinish

Joe McDougall

EVP, President, Global Refinish & EMEA

46P R O P R I E T A R Y

▪ The global automotive refinish market is stable, consolidated and growing

✓ Refinish is highly stable, linked to global miles driven and accident rates

✓ The top four Refinish players hold two-thirds of the global market

✓ End-market growth ~3-4% per year expected

▪ Axalta leads with the broadest and deepest technology and market reach

✓ We lead the global market with 25% share; higher share in developed regions

✓ Our deep portfolio of next-generation technology addresses wide-ranging customer needs

✓ Axalta has broad market reach across product and customer types globally

▪ Axalta continues to grow through an aggressive and disciplined strategy

✓ Organic and inorganic product introductions to increase reach and competitiveness

✓ Benefiting from consolidation and professionalization of body shop market

✓ Tailwind from growing car parc, especially in emerging markets

✓ Adding technology and services to solidify competitive moat and customer relationships

Axalta Refinish Investment Thesis

47P R O P R I E T A R Y

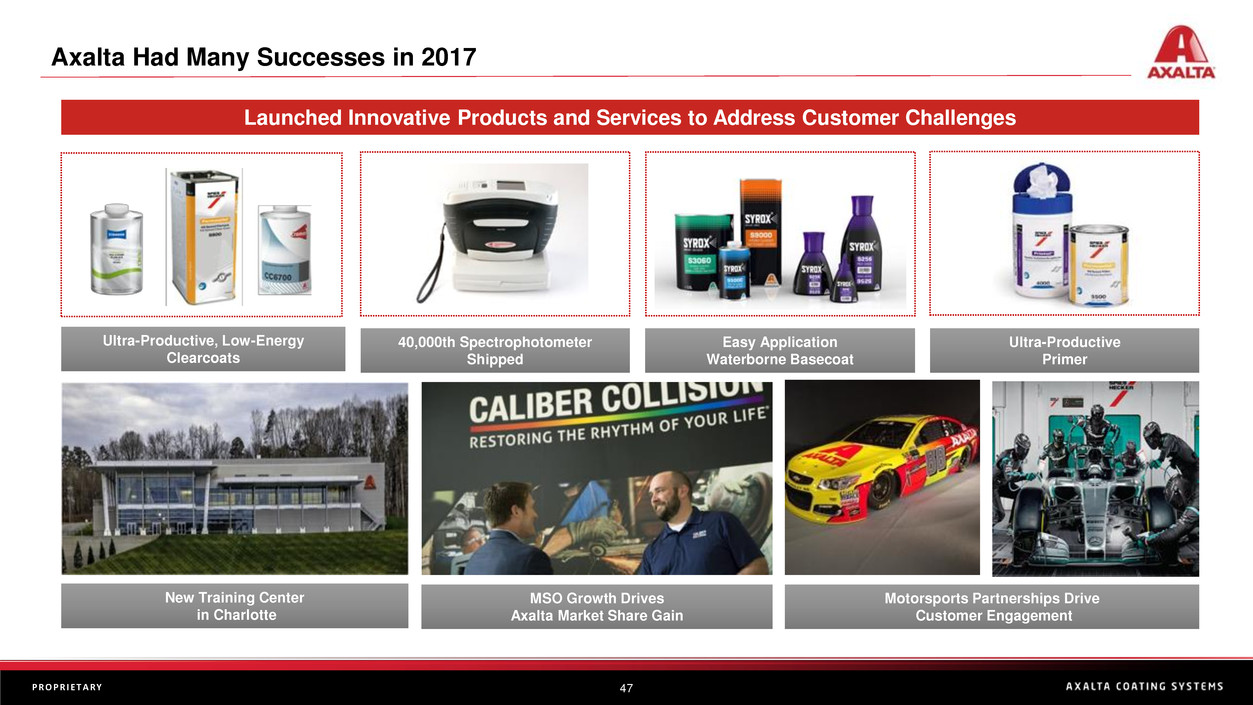

Axalta Had Many Successes in 2017

Ultra-Productive, Low-Energy

Clearcoats

Ultra-Productive

Primer

Easy Application

Waterborne Basecoat

40,000th Spectrophotometer

Shipped

MSO Growth Drives

Axalta Market Share Gain

New Training Center

in Charlotte

Motorsports Partnerships Drive

Customer Engagement

Launched Innovative Products and Services to Address Customer Challenges

48P R O P R I E T A R Y

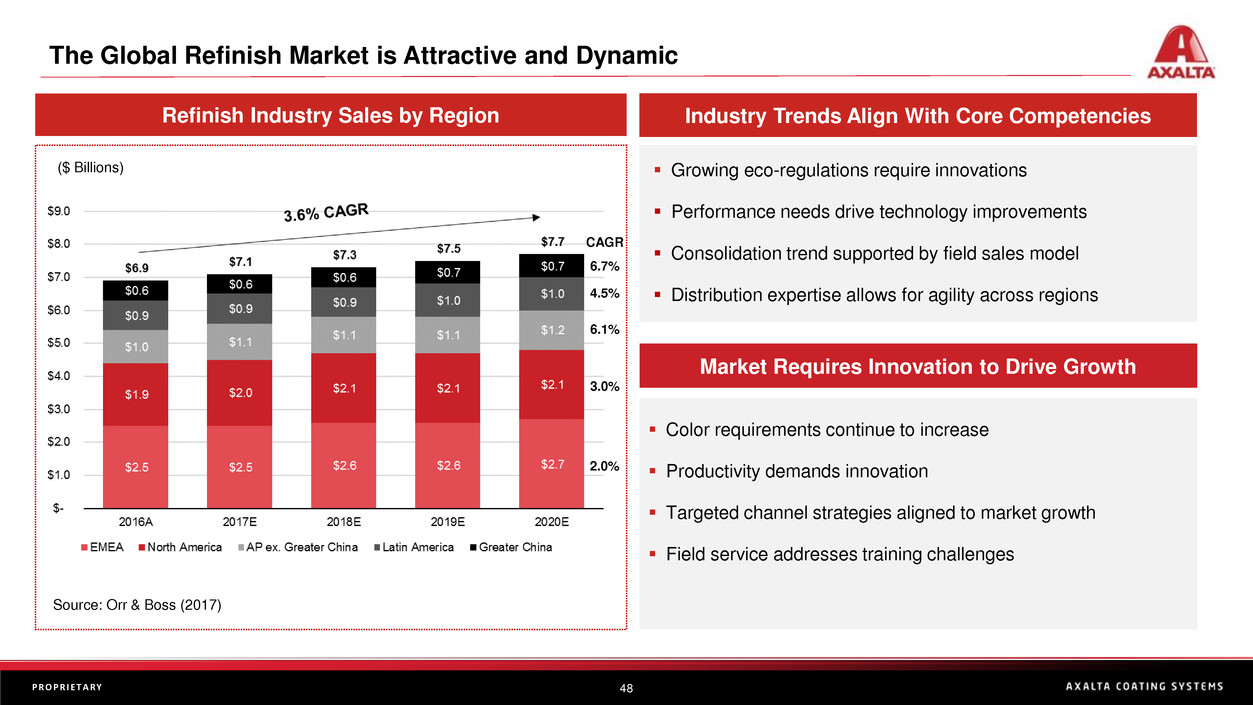

The Global Refinish Market is Attractive and Dynamic

▪ Growing eco-regulations require innovations

▪ Performance needs drive technology improvements

▪ Consolidation trend supported by field sales model

▪ Distribution expertise allows for agility across regions

Industry Trends Align With Core Competencies

Market Requires Innovation to Drive Growth

▪ Color requirements continue to increase

▪ Productivity demands innovation

▪ Targeted channel strategies aligned to market growth

▪ Field service addresses training challenges

Refinish Industry Sales by Region

Source: Orr & Boss (2017)

($ Billions)

CAGR

6.7%

4.5%

6.1%

3.0%

2.0%

49P R O P R I E T A R Y

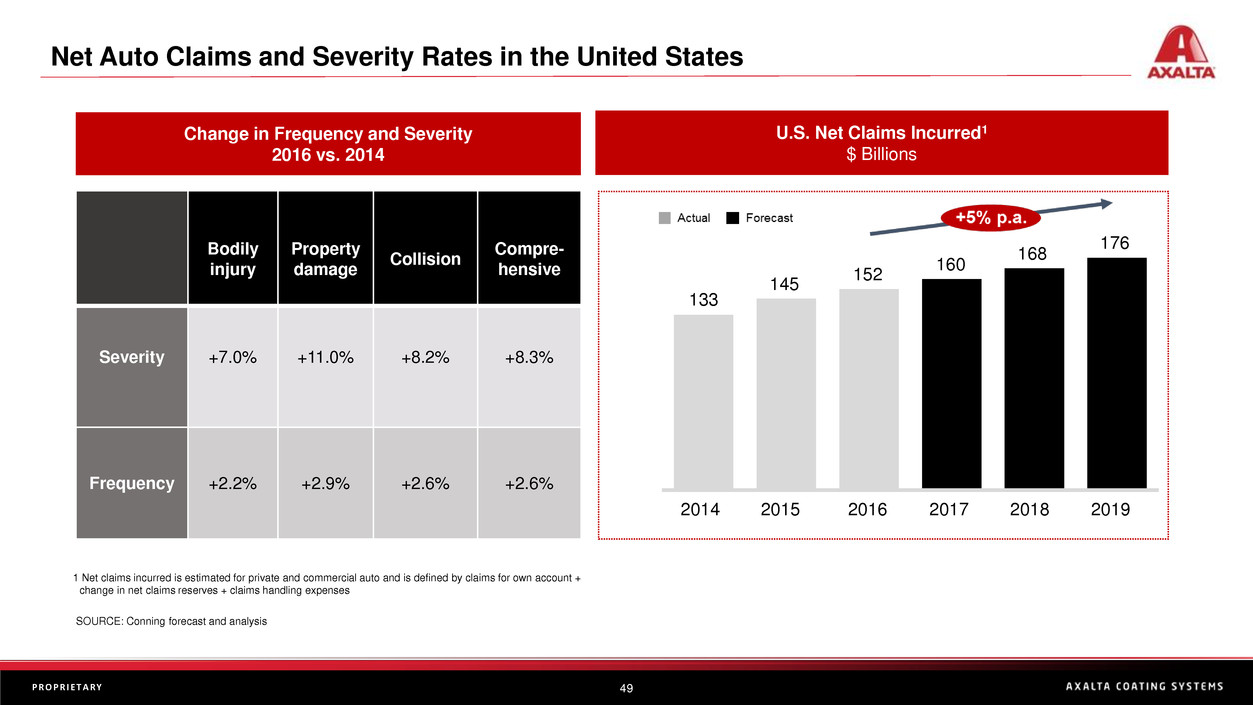

Net Auto Claims and Severity Rates in the United States

1 Net claims incurred is estimated for private and commercial auto and is defined by claims for own account +

change in net claims reserves + claims handling expenses

176

152

2019

168

160

20162015

145

20182014

133

2017

U.S. Net Claims Incurred1

$ Billions

Change in Frequency and Severity

2016 vs. 2014

SOURCE: Conning forecast and analysis

Bodily

injury

Property

damage

Collision

Compre-

hensive

Severity +7.0% +11.0% +8.2% +8.3%

Frequency +2.2% +2.9% +2.6% +2.6%

50P R O P R I E T A R Y

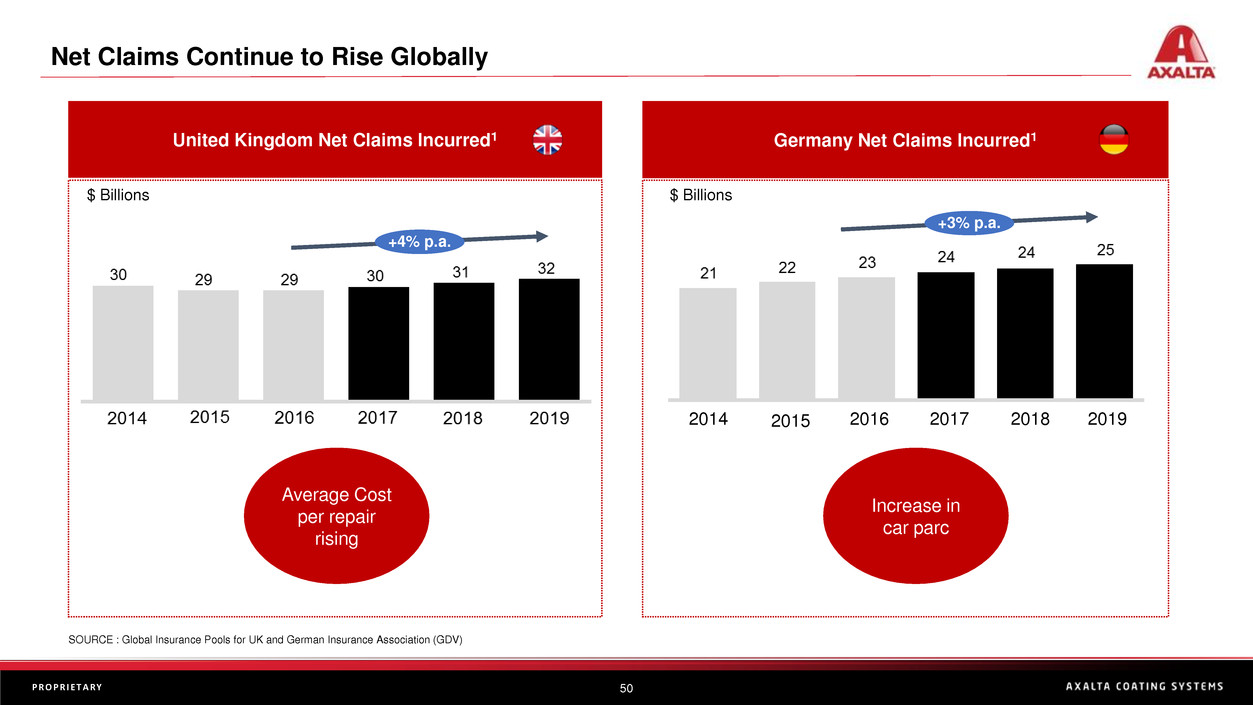

United Kingdom Net Claims Incurred1

+4% p.a.

+3% p.a.

2019

Germany Net Claims Incurred1

Average Cost

per repair

rising

Increase in

car parc

SOURCE : Global Insurance Pools for UK and German Insurance Association (GDV)

20162015 20182014 2017

$ Billions $ Billions

Net Claims Continue to Rise Globally

51P R O P R I E T A R Y

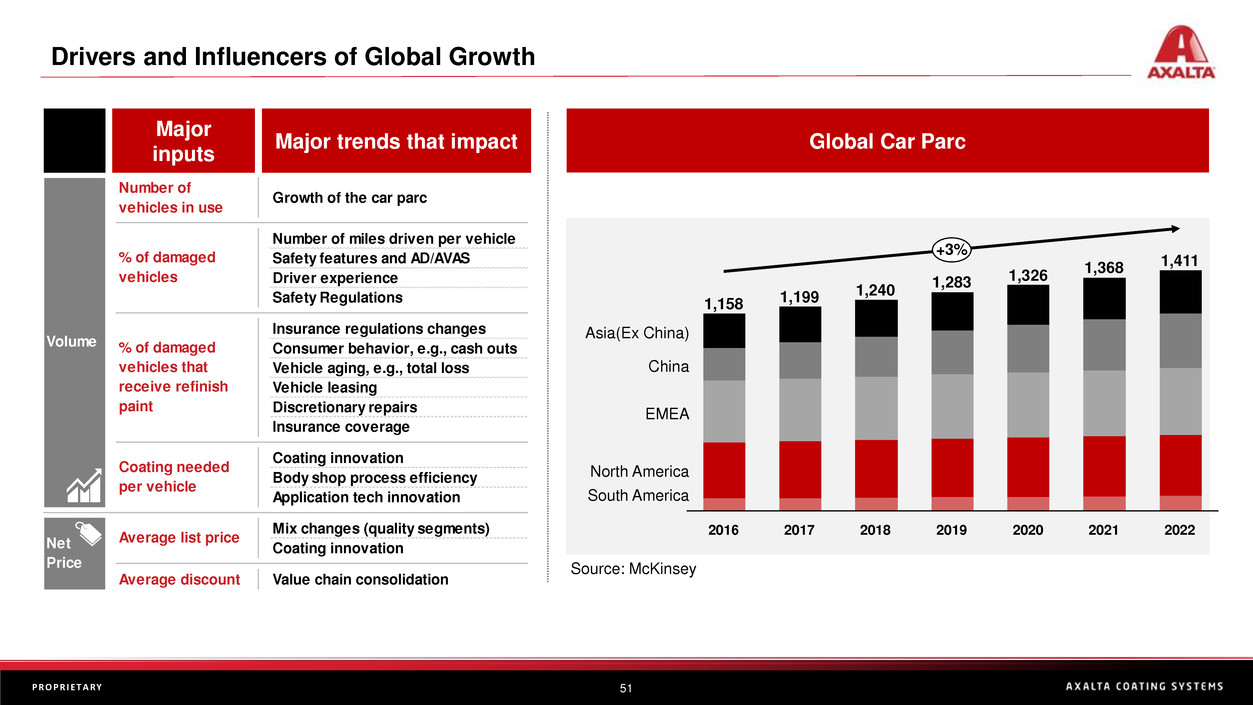

Drivers and Influencers of Global Growth

+3%

EMEA

1,368

1,283 1,326

South America

2020

North America

2021

1,411

2017

China

1,158

20182016

1,240

Asia(Ex China)

1,199

2019 2022

Major

inputs

Major trends that impact Global Car Parc

Source: McKinsey

Number of

vehicles in use

Growth of the car parc

Number of miles driven per vehicle

Safety features and AD/AVAS

Driver experience

Safety Regulations

Insurance regulations changes

Consumer behavior, e.g., cash outs

Vehicle aging, e.g., total loss

Vehicle leasing

Discretionary repairs

Insurance coverage

Coating innovation

Body shop process efficiency

Application tech innovation

Mix changes (quality segments)

Coating innovation

Averag discount Value chain consolidation

% of damaged

vehicles

% of damaged

vehicles that

receive refinish

paint

C ating needed

per vehicle

Volume

Net

Price

Average list priceNet price

Volume

% of damaged

vehicles

% of damaged

vehicles that

receive refinish

paint

Europe

Driver experience

Vehicle leasing

Discretionary repairs

Major trends that impact ChinaMajor inputs

Insurance coverage

Insurance regulations changes

United

States

Safety regulations

Number of miles driven per vehicle

Safety features and AD/AVAS

Consumer behavior, e.g., cash outs

Vehicle aging, e.g., total loss

Coating

needed per

vehicle

Number of

vehicles in use Growth of the car parc

Application tech innovation

Coating innovation

Body shop process efficiency

Average list price

Average discount Value chain consolidation

Coating i novation

Mix changes (quality segments)

Net

price

Volume

% of damaged

vehicles

% of damaged

vehicles that

receive refinish

paint

Europe

Driver experience

Vehicle leasing

Discretionary repairs

Major trends that impact ChinaMajor inputs

Insurance coverage

Insurance regulations changes

United

States

Safety regulations

Number of miles driven per vehicle

Safety features and AD/AVAS

Consumer behavior, e.g., cash outs

V hicle ging, e.g., total loss

Coating

needed per

vehicle

Number of

vehicles in use Growth of the car parc

Application tech innovation

Coating innovation

Body shop process efficiency

Average list price

Average discount Value chain consolidation

oating innovation

Mix cha ges (quality segments)

52P R O P R I E T A R Y

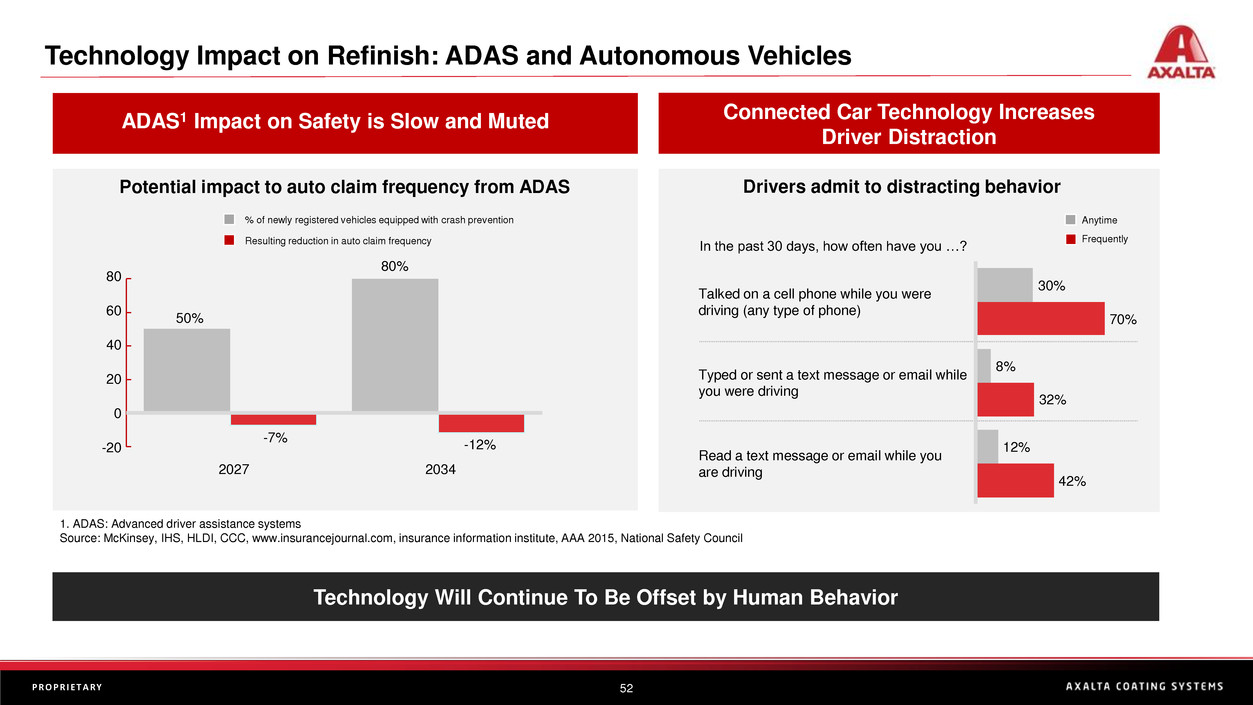

Technology Impact on Refinish: ADAS and Autonomous Vehicles

Technology Will Continue To Be Offset by Human Behavior

Potential impact to auto claim frequency from ADAS

ADAS1 Impact on Safety is Slow and Muted

80

0

40

20

-20

60

-7%

-12%

50%

2034

80%

2027

Resulting reduction in auto claim frequency

% of newly registered vehicles equipped with crash prevention

In the past 30 days, how often have you …?

Read a text message or email while you

are driving

42%

8%

70%

12%

Typed or sent a text message or email while

you were driving

32%

Talked on a cell phone while you were

driving (any type of phone)

30%

Connected Car Technology Increases

Driver Distraction

Drivers admit to distracting behavior

1. ADAS: Advanced driver assistance systems

Source: McKinsey, IHS, HLDI, CCC, www.insurancejournal.com, insurance information institute, AAA 2015, National Safety Council

Anytime

Frequently

53P R O P R I E T A R Y

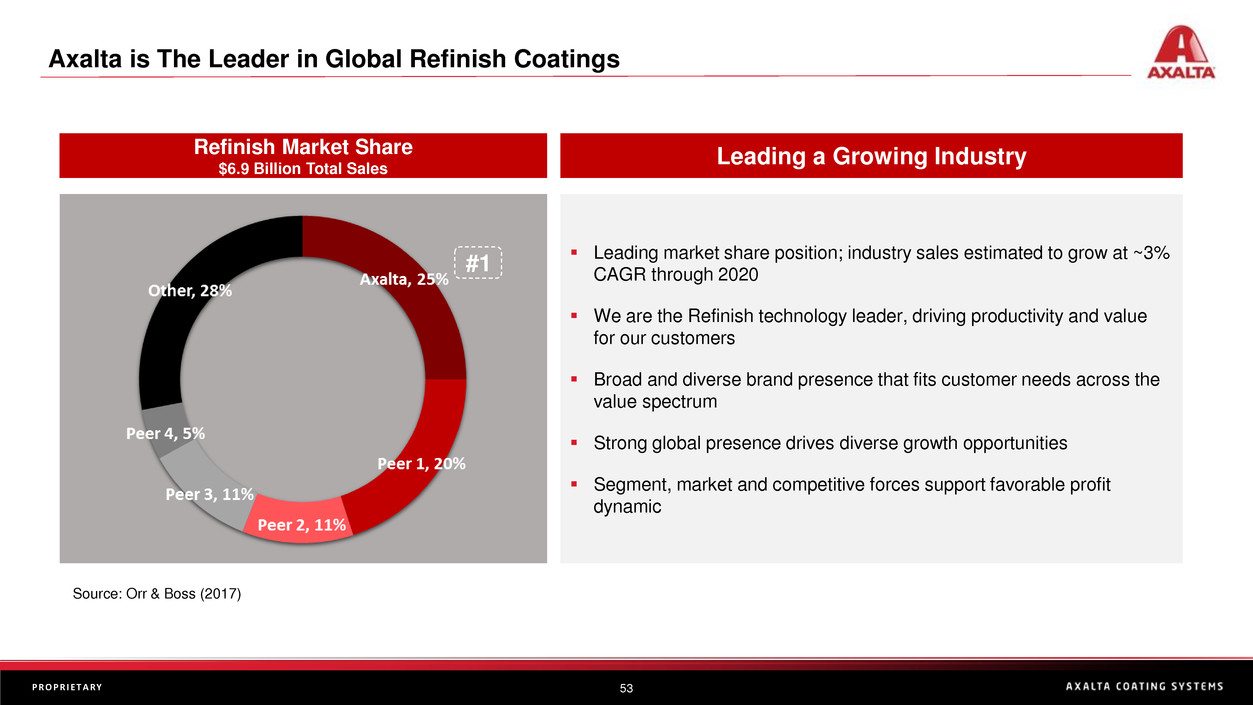

Axalta is The Leader in Global Refinish Coatings

▪ Leading market share position; industry sales estimated to grow at ~3%

CAGR through 2020

▪ We are the Refinish technology leader, driving productivity and value

for our customers

▪ Broad and diverse brand presence that fits customer needs across the

value spectrum

▪ Strong global presence drives diverse growth opportunities

▪ Segment, market and competitive forces support favorable profit

dynamic

#1

Refinish Market Share

$6.9 Billion Total Sales

Leading a Growing Industry

Source: Orr & Boss (2017)

54P R O P R I E T A R Y

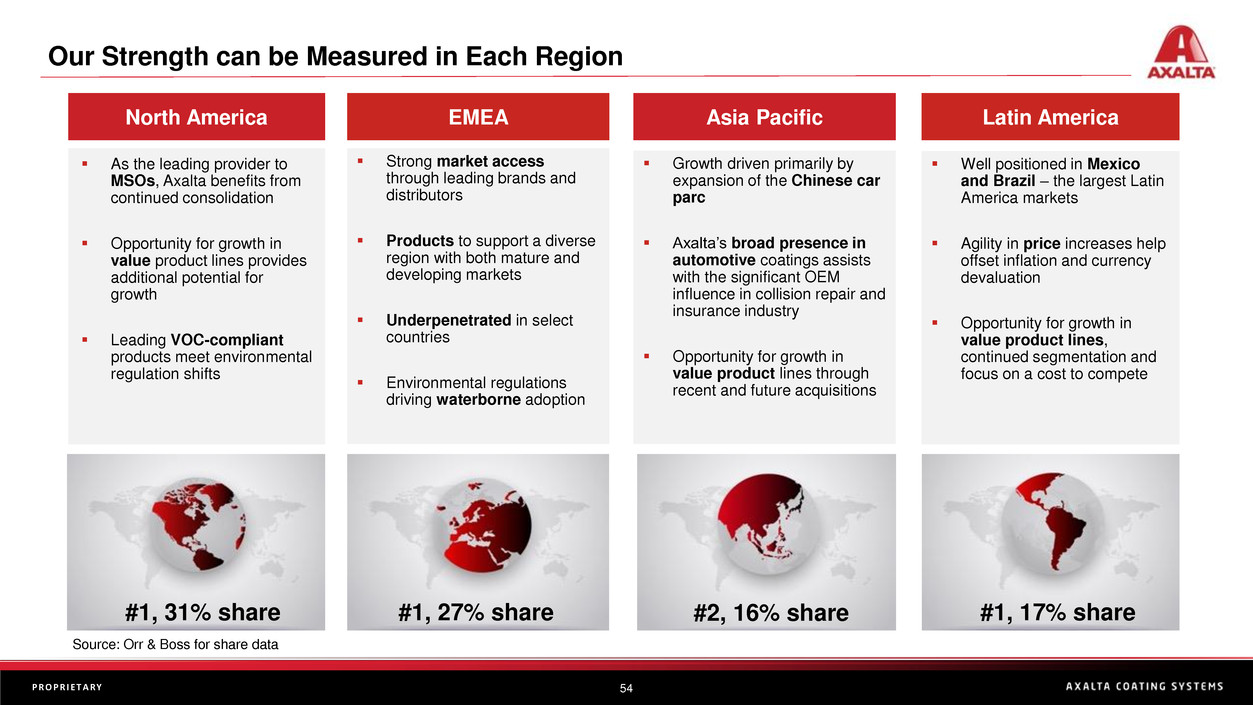

▪ Strong market access

through leading brands and

distributors

▪ Products to support a diverse

region with both mature and

developing markets

▪ Underpenetrated in select

countries

▪ Environmental regulations

driving waterborne adoption

North America EMEA

▪ As the leading provider to

MSOs, Axalta benefits from

continued consolidation

▪ Opportunity for growth in

value product lines provides

additional potential for

growth

▪ Leading VOC-compliant

products meet environmental

regulation shifts

▪ Growth driven primarily by

expansion of the Chinese car

parc

▪ Axalta’s broad presence in

automotive coatings assists

with the significant OEM

influence in collision repair and

insurance industry

▪ Opportunity for growth in

value product lines through

recent and future acquisitions

▪ Well positioned in Mexico

and Brazil – the largest Latin

America markets

▪ Agility in price increases help

offset inflation and currency

devaluation

▪ Opportunity for growth in

value product lines,

continued segmentation and

focus on a cost to compete

Asia Pacific Latin America

Our Strength can be Measured in Each Region

#1, 31% share #1, 27% share #2, 16% share #1, 17% share

Source: Orr & Boss for share data

55P R O P R I E T A R Y

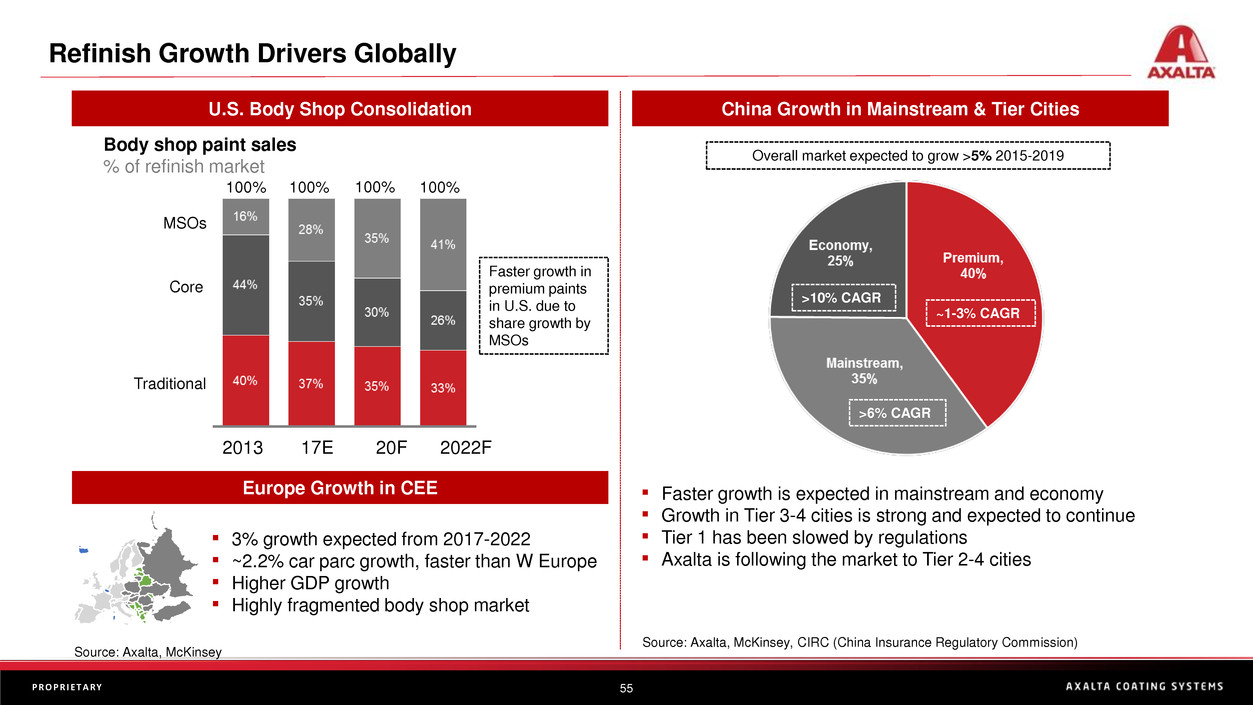

Refinish Growth Drivers Globally

U.S. Body Shop Consolidation China Growth in Mainstream & Tier Cities

Source: Axalta, McKinsey, CIRC (China Insurance Regulatory Commission)

100%

Core

2022F

Traditional

MSOs

100%

17E

100%

2013 20F

100%

Body shop paint sales

% of refinish market

Europe Growth in CEE

▪ 3% growth expected from 2017-2022

▪ ~2.2% car parc growth, faster than W Europe

▪ Higher GDP growth

▪ Highly fragmented body shop market

Faster growth in

premium paints

in U.S. due to

share growth by

MSOs

Source: Axalta, McKinsey

▪ Faster growth is expected in mainstream and economy

▪ Growth in Tier 3-4 cities is strong and expected to continue

▪ Tier 1 has been slowed by regulations

▪ Axalta is following the market to Tier 2-4 cities

Overall market expected to grow >5% 2015-2019

~1-3% CAGR

>6% CAGR

>10% CAGR

56P R O P R I E T A R Y

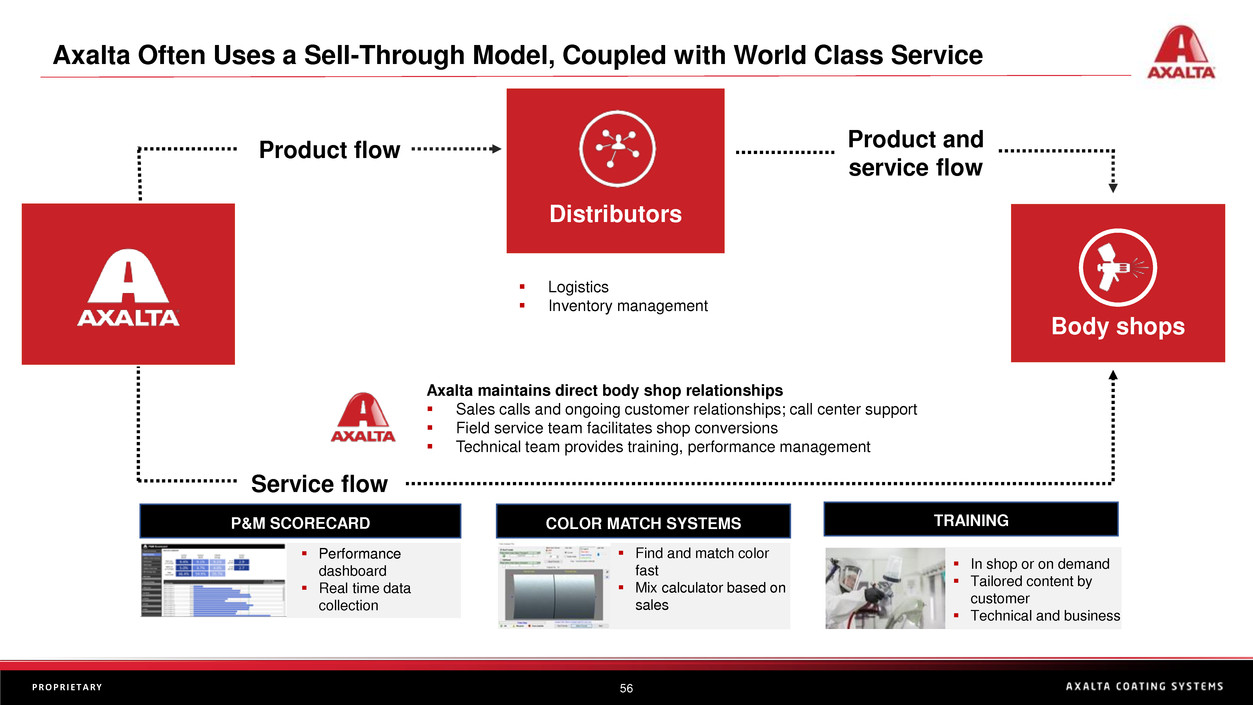

Axalta Often Uses a Sell-Through Model, Coupled with World Class Service

Axalta maintains direct body shop relationships

▪ Sales calls and ongoing customer relationships; call center support

▪ Field service team facilitates shop conversions

▪ Technical team provides training, performance management

Product flow

Service flow

Product and

service flow

Distributors

Body shops

▪ Logistics

▪ Inventory management

COLOR MATCH SYSTEMS

▪ Find and match color

fast

▪ Mix calculator based on

sales

TRAINING

▪ In shop or on demand

▪ Tailored content by

customer

▪ Technical and business

P&M SCORECARD

▪ Performance

dashboard

▪ Real time data

collection

57P R O P R I E T A R Y

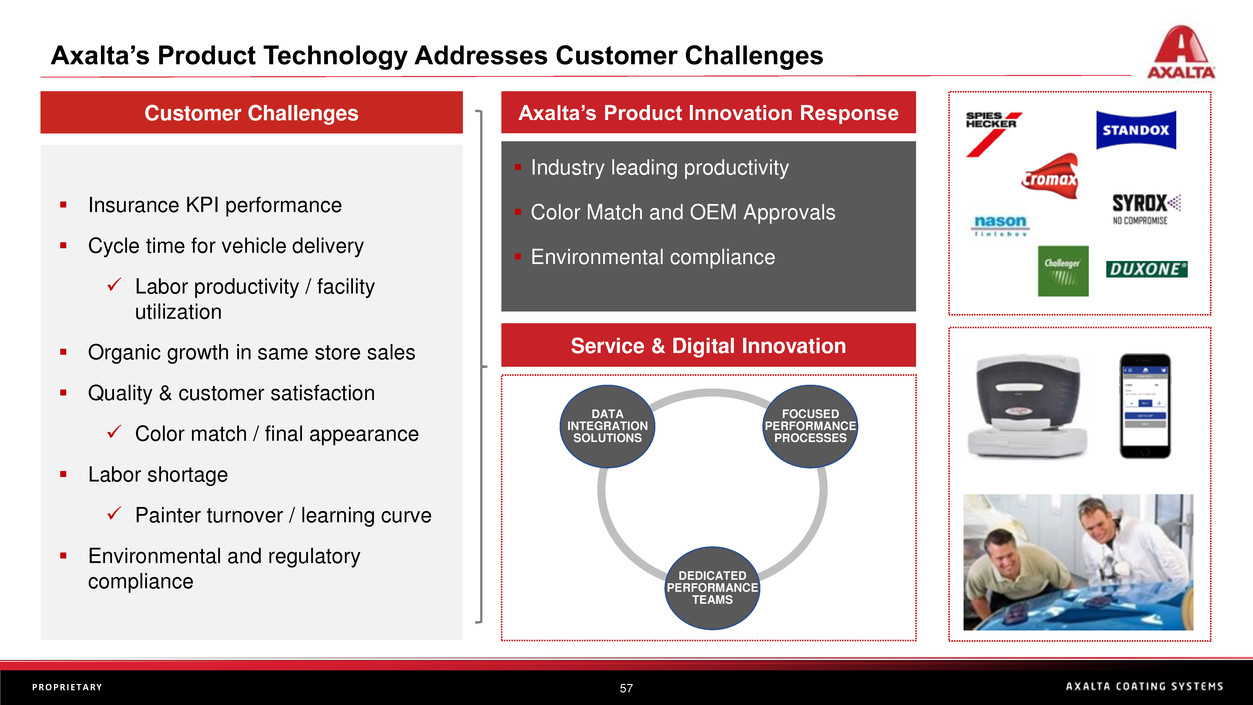

Customer Challenges Axalta’s Product Innovation Response

Axalta’s Product Technology Addresses Customer Challenges

▪ Industry leading productivity

▪ Color Match and OEM Approvals

▪ Environmental compliance

Service & Digital Innovation

DATA

INTEGRATION

SOLUTIONS

FOCUSED

PERFORMANCE

PROCESSES

DEDICATED

PERFORMANCE

TEAMS

▪ Insurance KPI performance

▪ Cycle time for vehicle delivery

✓ Labor productivity / facility

utilization

▪ Organic growth in same store sales

▪ Quality & customer satisfaction

✓ Color match / final appearance

▪ Labor shortage

✓ Painter turnover / learning curve

▪ Environmental and regulatory

compliance

58P R O P R I E T A R Y

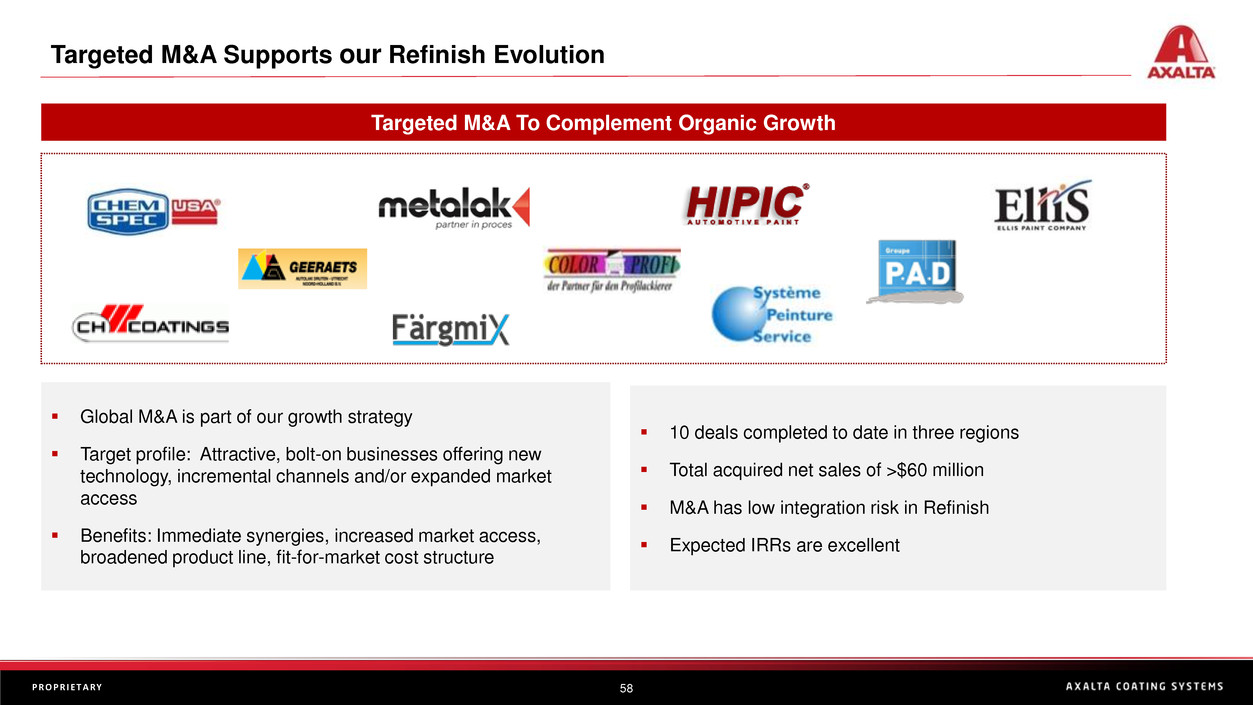

Targeted M&A Supports our Refinish Evolution

▪ Global M&A is part of our growth strategy

▪ Target profile: Attractive, bolt-on businesses offering new

technology, incremental channels and/or expanded market

access

▪ Benefits: Immediate synergies, increased market access,

broadened product line, fit-for-market cost structure

Targeted M&A To Complement Organic Growth

▪ 10 deals completed to date in three regions

▪ Total acquired net sales of >$60 million

▪ M&A has low integration risk in Refinish

▪ Expected IRRs are excellent

59P R O P R I E T A R Y

Refinish Summary

▪ Axalta is the undisputed global leader in the growing refinish

market

▪ Customer, technology and regulatory trends favor Axalta’s

products and services

▪ Axalta has the broadest and most productive product range in

the industry

▪ Axalta leads the industry in refinish technology, including the

world’s most productive waterborne system.

▪ Axalta has a multitude of M&A opportunities to complement

strong organic growth potential

Thank you!

Performance Coatings: Industrial

Mike Cash

SVP, President, Industrial Coatings

62P R O P R I E T A R Y

2016 - 2018

Axalta Industrial: Where We Have Come From

2013

1960 - 2013 2014 - 2018

Industrial sales

since 2013

2x

63P R O P R I E T A R Y

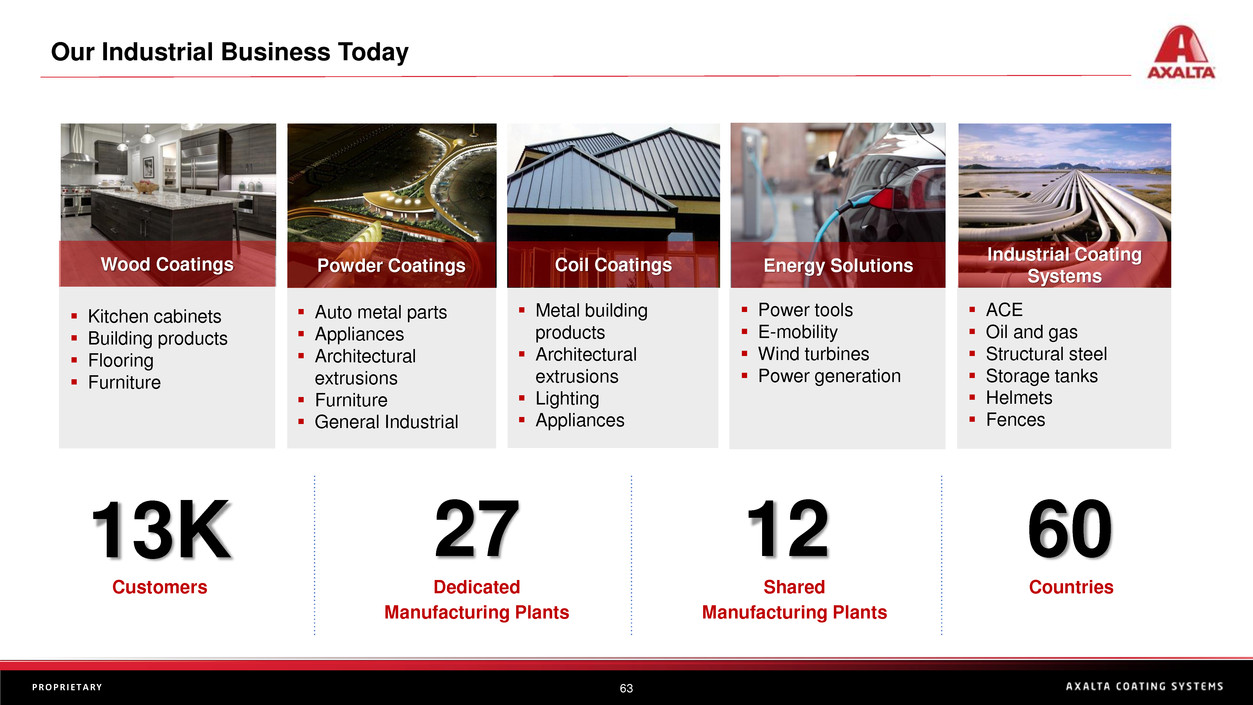

27

▪ Kitchen cabinets

▪ Building products

▪ Flooring

▪ Furniture

▪ Auto metal parts

▪ Appliances

▪ Architectural

extrusions

▪ Furniture

▪ General Industrial

▪ Metal building

products

▪ Architectural

extrusions

▪ Lighting

▪ Appliances

▪ Power tools

▪ E-mobility

▪ Wind turbines

▪ Power generation

▪ ACE

▪ Oil and gas

▪ Structural steel

▪ Storage tanks

▪ Helmets

▪ Fences

Wood Coatings Powder Coatings Coil Coatings Energy Solutions

Industrial Coating

Systems

Our Industrial Business Today

13K

Customers

60

Countries

12

Shared

Manufacturing Plants

Dedicated

Manufacturing Plants

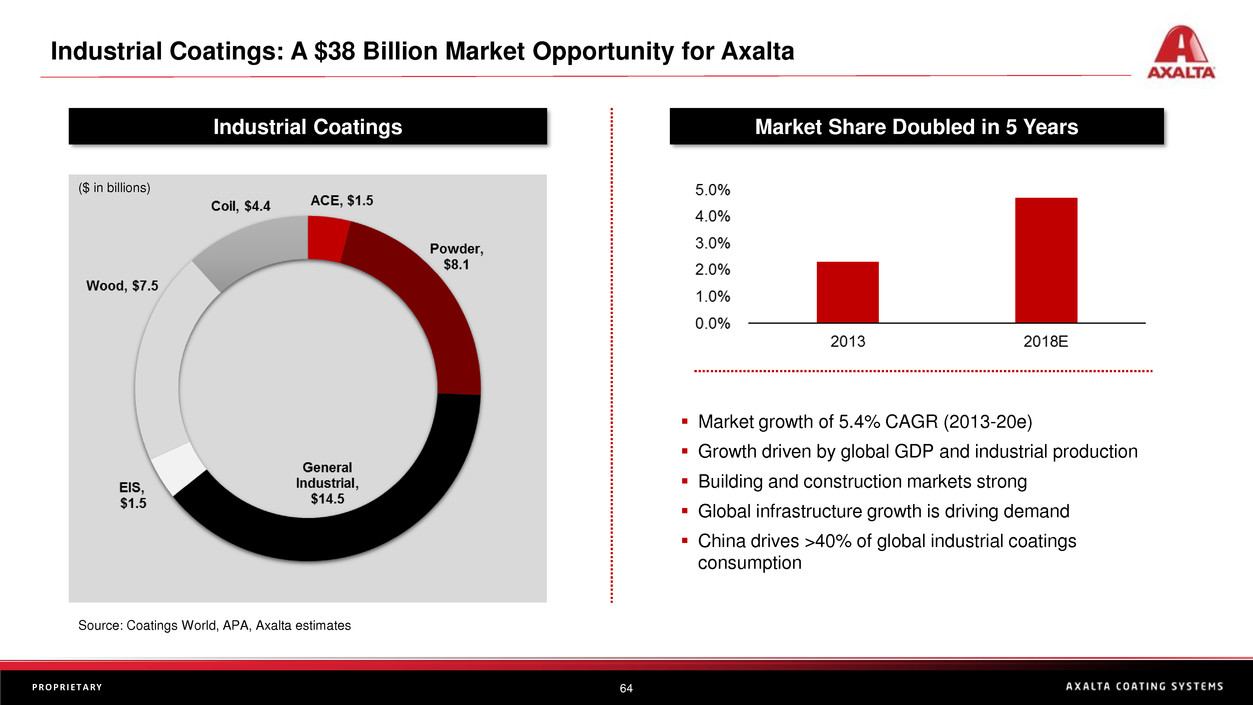

64P R O P R I E T A R Y

Market Share Doubled in 5 Years

Industrial Coatings: A $38 Billion Market Opportunity for Axalta

Source: Coatings World, APA, Axalta estimates

▪ Market growth of 5.4% CAGR (2013-20e)

▪ Growth driven by global GDP and industrial production

▪ Building and construction markets strong

▪ Global infrastructure growth is driving demand

▪ China drives >40% of global industrial coatings

consumption

Industrial Coatings

($ in billions)

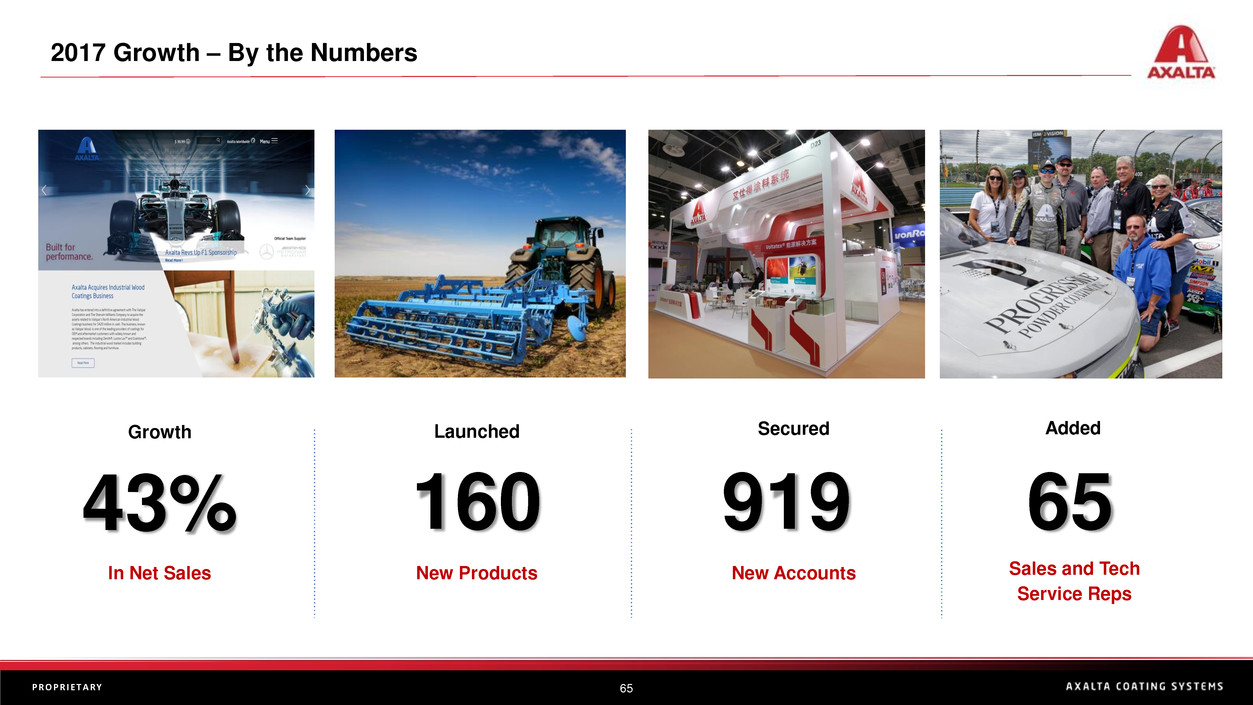

65P R O P R I E T A R Y

2017 Growth – By the Numbers

Growth

43%

In Net Sales

Added

65

Sales and Tech

Service Reps

Secured

919

New Accounts

Launched

160

New Products

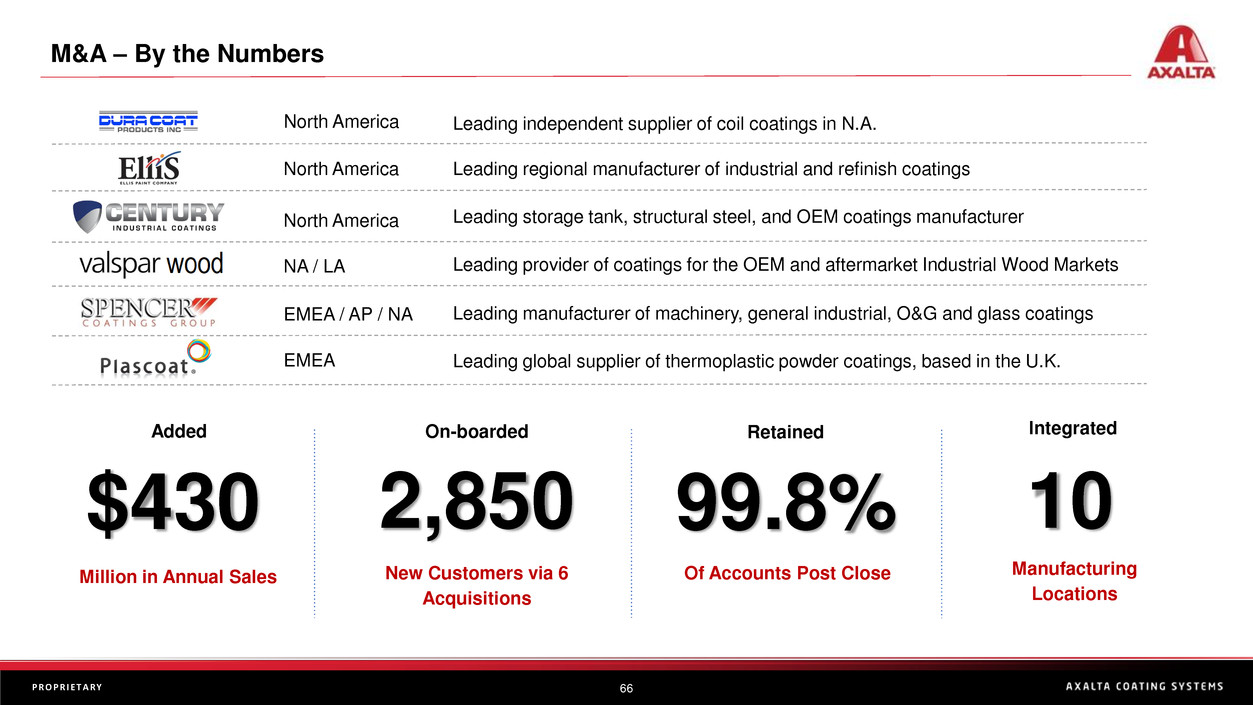

66P R O P R I E T A R Y

Leading global supplier of thermoplastic powder coatings, based in the U.K.

M&A – By the Numbers

Retained

99.8%

Of Accounts Post Close

Integrated

10

Manufacturing

Locations

Added

$430

Million in Annual Sales

On-boarded

2,850

New Customers via 6

Acquisitions

Leading independent supplier of coil coatings in N.A. North America

North America

North America

Leading regional manufacturer of industrial and refinish coatings

Leading storage tank, structural steel, and OEM coatings manufacturer

NA / LA Leading provider of coatings for the OEM and aftermarket Industrial Wood Markets

EMEA / AP / NA Leading manufacturer of machinery, general industrial, O&G and glass coatings

EMEA

67P R O P R I E T A R Y

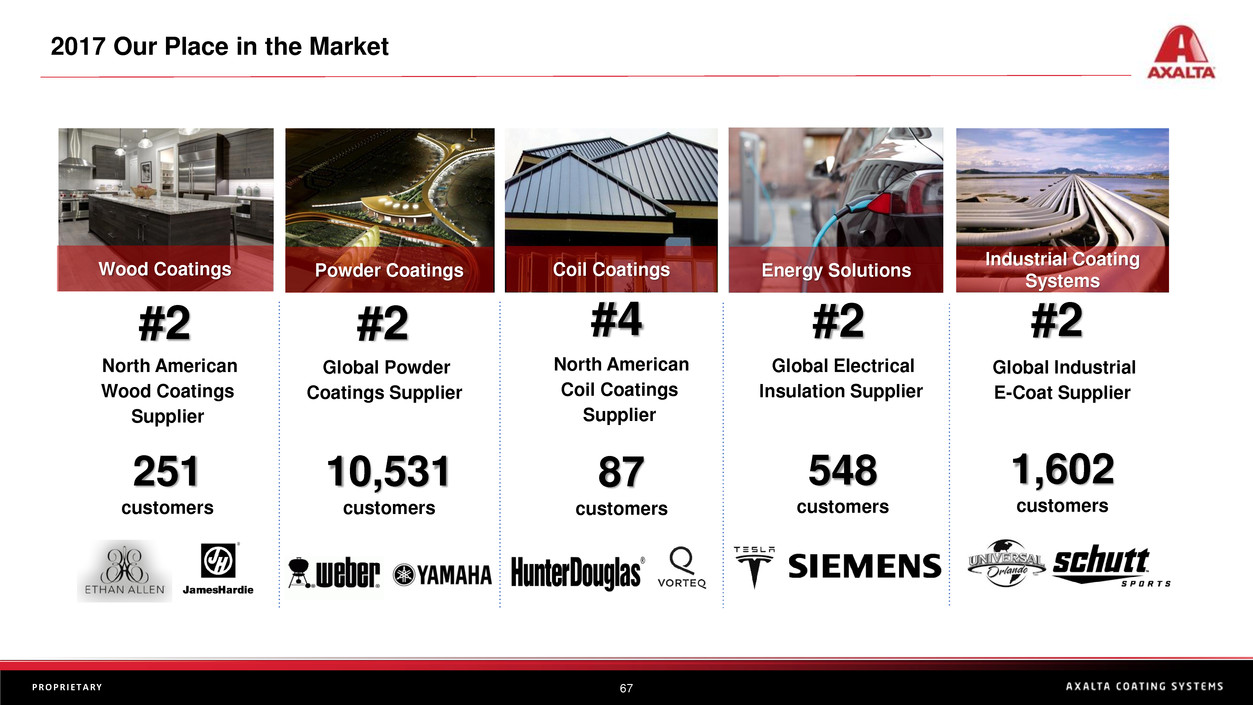

2017 Our Place in the Market

Wood Coatings Powder Coatings Coil Coatings Energy Solutions

Industrial Coating

Systems

#2

North American

Wood Coatings

Supplier

#2

Global Powder

Coatings Supplier

#4

North American

Coil Coatings

Supplier

#2

Global Electrical

Insulation Supplier

#2

Global Industrial

E-Coat Supplier

251

customers

10,531

customers

548

customers

1,602

customers

87

customers

68P R O P R I E T A R Y

Broader Portfolio Global Reach Playing Offense

Our Competitive Advantage: The Moat

▪ Newly acquired assets

and organically developed

technologies to fill product

portfolio gaps

▪ Global segment approach

▪ Fit-for-purpose

manufacturing capacity

enables access to new

markets

▪ Dedicated Industrial R&D

team driving innovation

and faster response to

opportunities

▪ Aggressive commercial

team focused on

identifying opportunities

and winning business

69P R O P R I E T A R Y

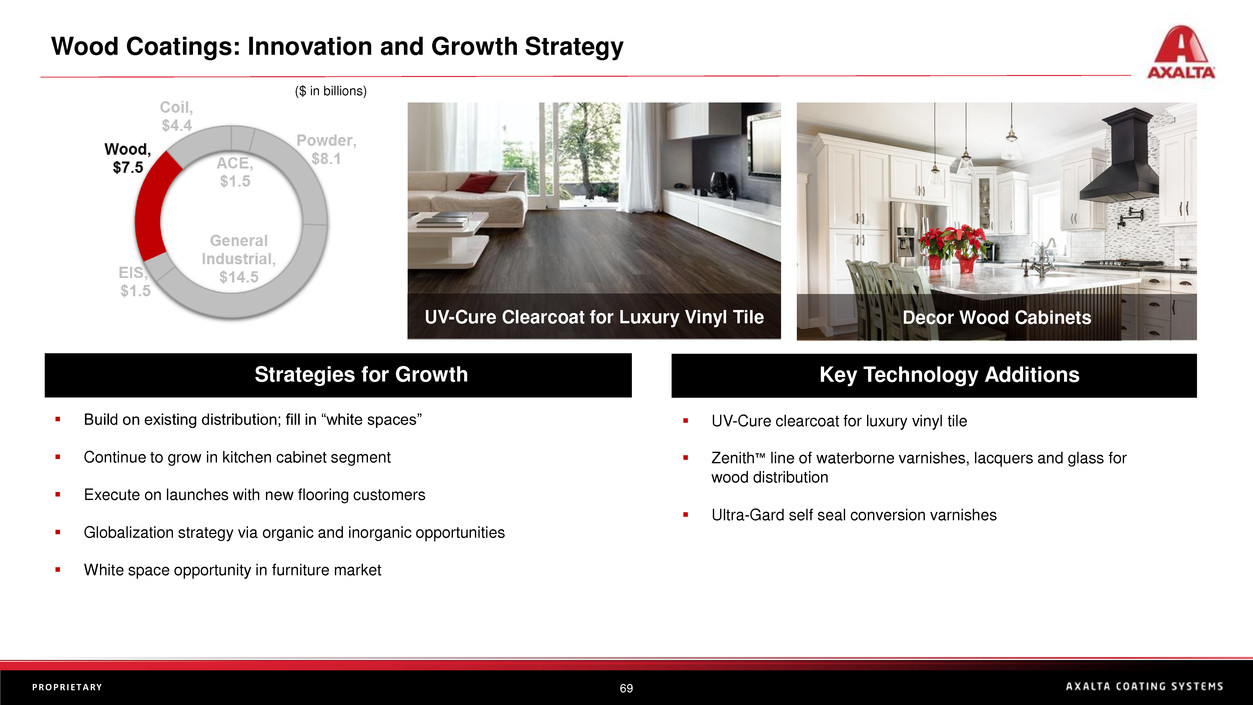

Wood Coatings: Innovation and Growth Strategy

UV-Cure Clearcoat for Luxury Vinyl Tile Decor Wood Cabinets

($ in billions)

▪ Build on existing distribution; fill in “white spaces”

▪ Continue to grow in kitchen cabinet segment

▪ Execute on launches with new flooring customers

▪ Globalization strategy via organic and inorganic opportunities

▪ White space opportunity in furniture market

▪ UV-Cure clearcoat for luxury vinyl tile

▪ Zenith™ line of waterborne varnishes, lacquers and glass for

wood distribution

▪ Ultra-Gard self seal conversion varnishes

Key Technologies Strategies for GrowthKey Technology AdditionsStrategies for Growth

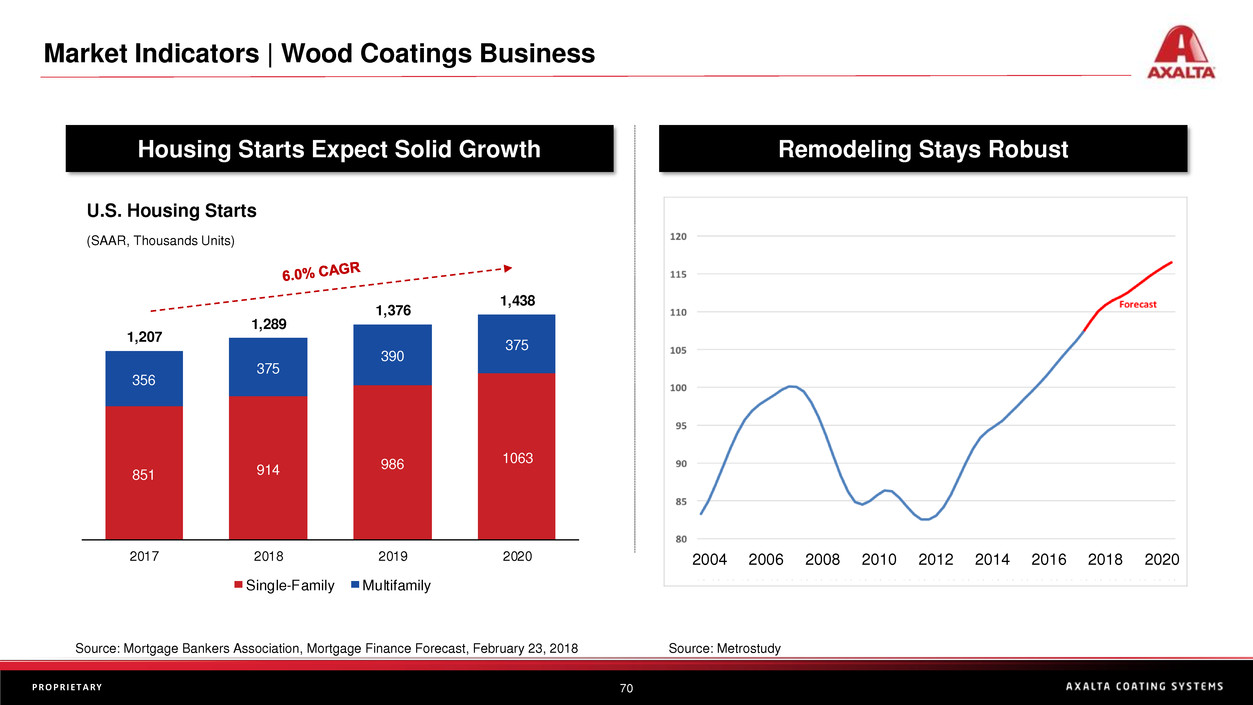

70P R O P R I E T A R Y

851 914

986 1063

356

375

390

375

1,207

1,289

1,376

1,438

2017 2018 2019 2020

Single-Family Multifamily

Source: Mortgage Bankers Association, Mortgage Finance Forecast, February 23, 2018

Housing Starts Expect Solid Growth Remodeling Stays Robust

Market Indicators | Wood Coatings Business

U.S. Housing Starts

(SAAR, Thousands Units)

Source: Metrostudy

2004 2006 2008 2010 2012 2014 2016 2018 2020

71P R O P R I E T A R Y

Powder Coatings: Innovation and Growth Strategy

ICONICA Collection San Francisco Transbay Transit Center

($ in billions)

▪ Continue to penetrate higher margin segments

▪ Architectural extrusions

▪ ACE/Auto components

▪ Thermoplastics

▪ Growth with job coaters in developed markets

▪ Global infrastructure growth in emerging markets

▪ Share-of-wallet opportunity with global customers

▪ Investment in sales excellence training programs

▪ New range of metallics - ICONICA

▪ Sprayable thermoplastic coatings

▪ Alesta® Cool to help lower energy consumption

▪ Alesta Speed to coat and cure at faster line speeds

▪ Alesta Lync Dry-on-Dry applications

▪ Matte and gloss versions of Alesta Anti-Graffiti coatings

Key Technologies Strategies for GrowthKey Technology AdditionsStrategies for Growth

72P R O P R I E T A R Y

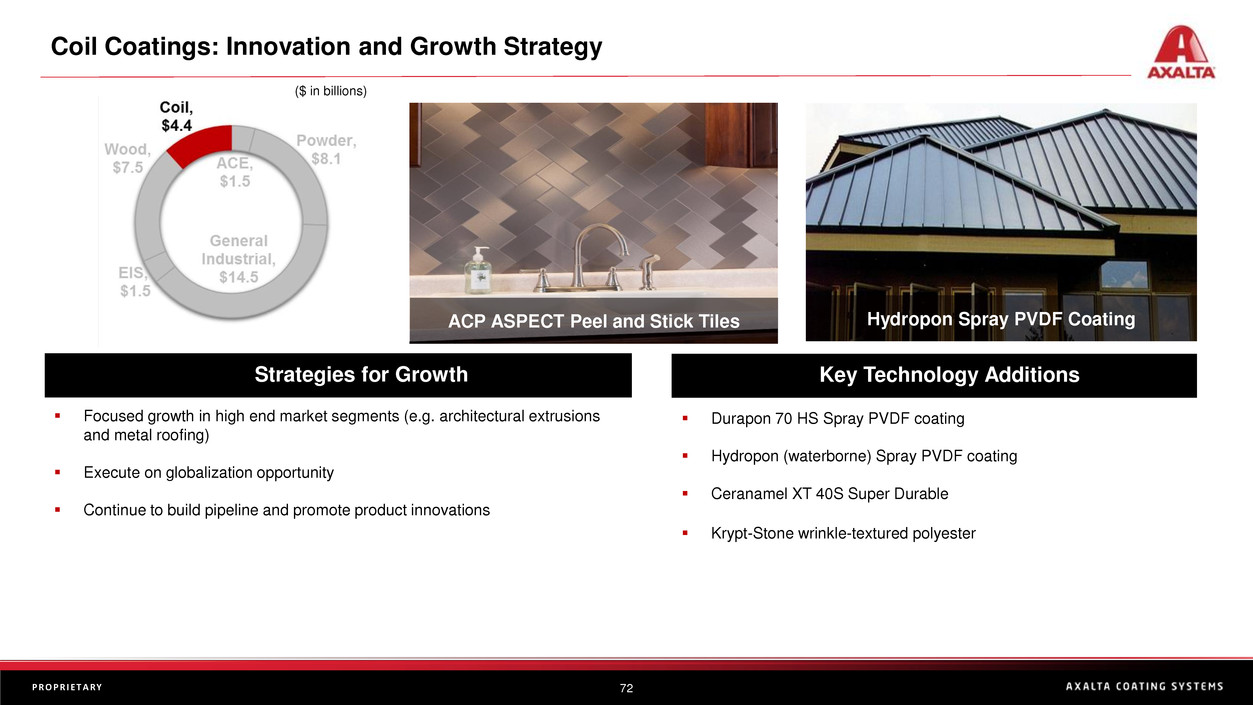

Coil Coatings: Innovation and Growth Strategy

ACP ASPECT Peel and Stick Tiles

($ in billions)

▪ Focused growth in high end market segments (e.g. architectural extrusions

and metal roofing)

▪ Execute on globalization opportunity

▪ Continue to build pipeline and promote product innovations

▪ Durapon 70 HS Spray PVDF coating

▪ Hydropon (waterborne) Spray PVDF coating

▪ Ceranamel XT 40S Super Durable

▪ Krypt-Stone wrinkle-textured polyester

Key Technologies Key Technology AdditionsStrategies for Growth

Key Technology AdditionsStrategies for Growth

Hydropon Spray PVDF Coating

73P R O P R I E T A R Y

Energy Solutions: Innovation and Growth Strategy

Voltahyd 2250 Waterborne series Lucid Motors

($ in billions)

▪ Leverage growth in EV market with high performance impregnating resins

▪ Continue to build and launch mainstream impregnating resin range

▪ New product lines to increase share of wallet in lubricants, potting

compounds, etc.

▪ “Developed in China, Made in China – For China”

▪ Cooperation with tape and metallic paper manufacturers

▪ Voltahyd 2250 waterborne series

▪ Voltabas high voltage impregnating resin for electric vehicles (EV)

▪ New wire lubricant and casting resin product lines

▪ Voltron corona-resistant wire enamels

▪ Anti-friction agent for wire enamel

Strategies for GrowthStrategies for GrowthKey Technologies Key Technology AdditionsStrategies for Growth

74P R O P R I E T A R Y

Industrial Coating Solutions: Innovation and Growth Strategy

Patented Anti-Shatter Glass Coating Atomic Skis

($ in billions)

▪ Push acquired products into all regions

▪ Leverage distribution to increase market flexibility

▪ Generate value from the Color Solution Center in EMEA

▪ Global connectivity – products and customers

▪ Use information technology to simplify customer experience

▪ Execute on progressively higher value wins in agriculture, construction and

earthmoving (ACE)

▪ Leverage liquid, powder and thermoplastics products into oil and gas

▪ 1K waterborne direct to metal topcoat for ACE

▪ 2K waterborne epoxy for metal components

▪ Fast cure Nap-Gard rebar coating

▪ 13 new ACE approved products for the Big 5

▪ New range of epoxy primers (Ellis)

▪ New line of internal pipe coatings

▪ Patented anti-shatter glass coating (Spencer)

Key Technologies Strategies for GrowthKey Technology AdditionsStrategies for Growth

75P R O P R I E T A R Y

Summary

▪ Axalta is a global leader in the industrial coatings segments we

serve, including the fast-growing electric motor market, the high-

performance powder coatings market, and the industrial e-coat

market

▪ We have leveraged M&A to create market leading positions in coil

and industrial wood coatings and are targeting new segments

▪ We are actively globalizing acquired technologies and leveraging our

global market access advantages

▪ We clearly differentiate with technology, service and speed to market

▪ Axalta has significant growth potential in Industrial given vast white

space opportunities Exchange 106 Tower in Malaysia

Thank you!

Transportation Coatings

Steve Markevich

EVP, President, Transportation Coatings and Greater China

78P R O P R I E T A R Y

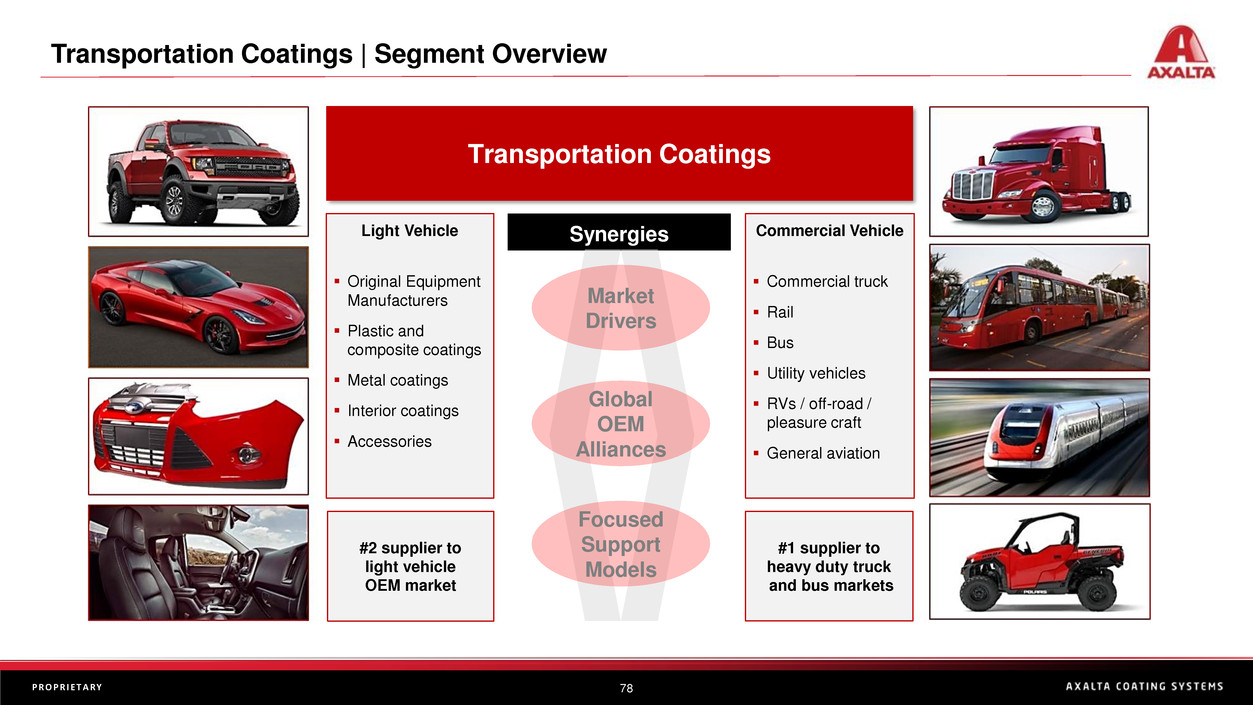

Transportation Coatings | Segment Overview

#2 supplier to

light vehicle

OEM market

Transportation Coatings

Light Vehicle

▪ Original Equipment

Manufacturers

▪ Plastic and

composite coatings

▪ Metal coatings

▪ Interior coatings

▪ Accessories

#1 supplier to

heavy duty truck

and bus markets

Commercial Vehicle

▪ Commercial truck

▪ Rail

▪ Bus

▪ Utility vehicles

▪ RVs / off-road /

pleasure craft

▪ General aviation

Synergies

Global

OEM

Alliances

Focused

Support

Models

Market

Drivers

79P R O P R I E T A R Y

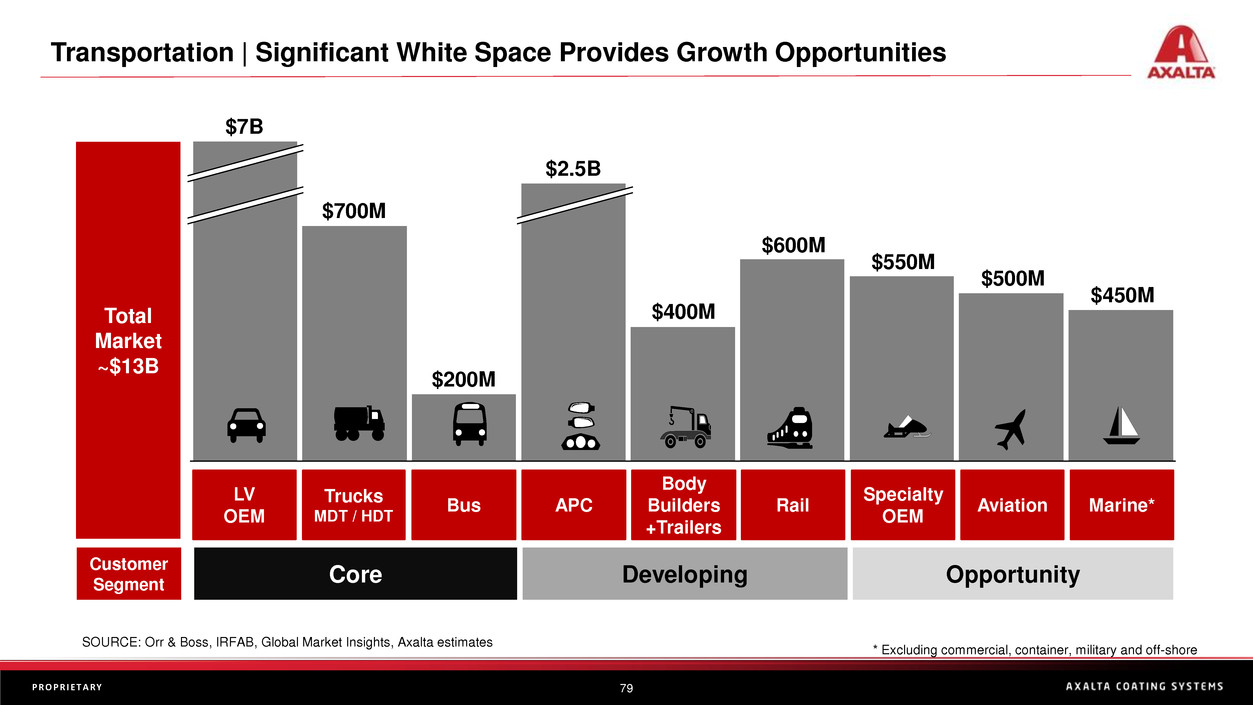

Transportation | Significant White Space Provides Growth Opportunities

~

Total

Market

~$13B

SOURCE: Orr & Boss, IRFAB, Global Market Insights, Axalta estimates

* Excluding commercial, container, military and off-shore

Core Developing Opportunity

Customer

Segment

$7B

$700M

$500M

$550M

$450M

$400M

$2.5B

$600M

$200M

LV

OEM

APC

Body

Builders

+Trailers

Rail

Specialty

OEM

Aviation Marine*

Trucks

MDT / HDT

Bus

80P R O P R I E T A R Y

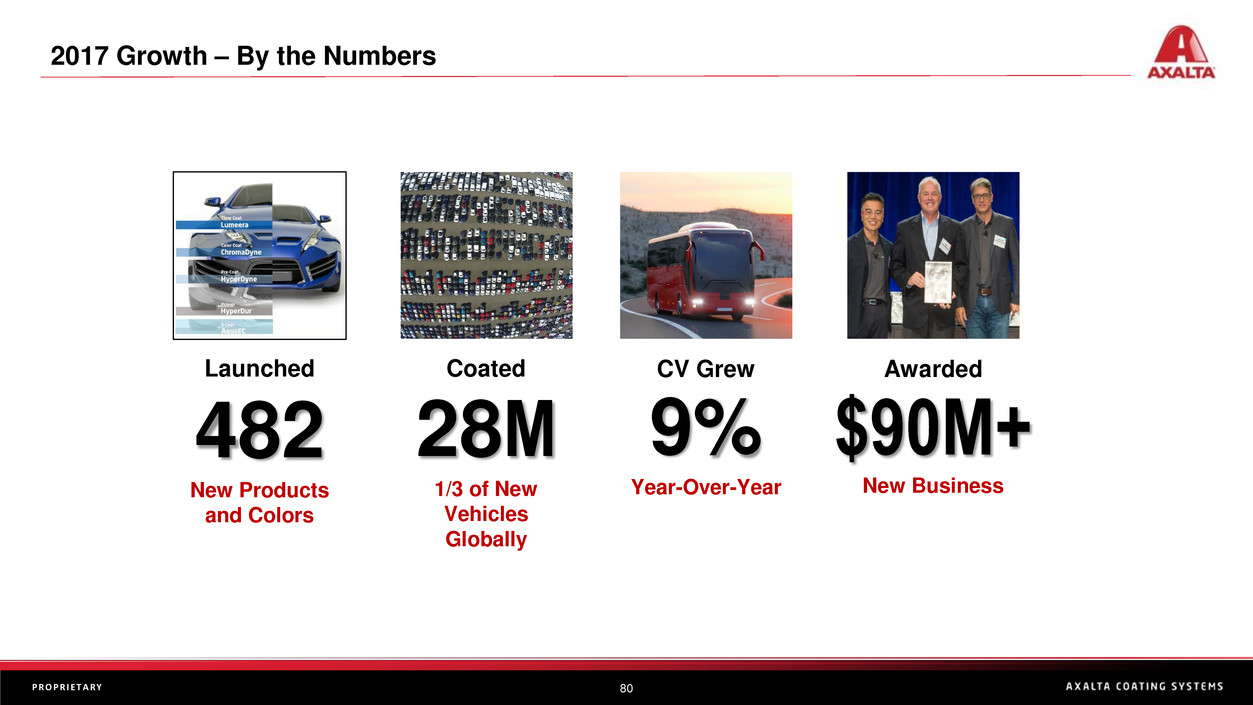

2017 Growth – By the Numbers

Launched Coated CV Grew Awarded

482

New Products

and Colors

28M

1/3 of New

Vehicles

Globally

9%

Year-Over-Year

$90M+

New Business

81P R O P R I E T A R Y

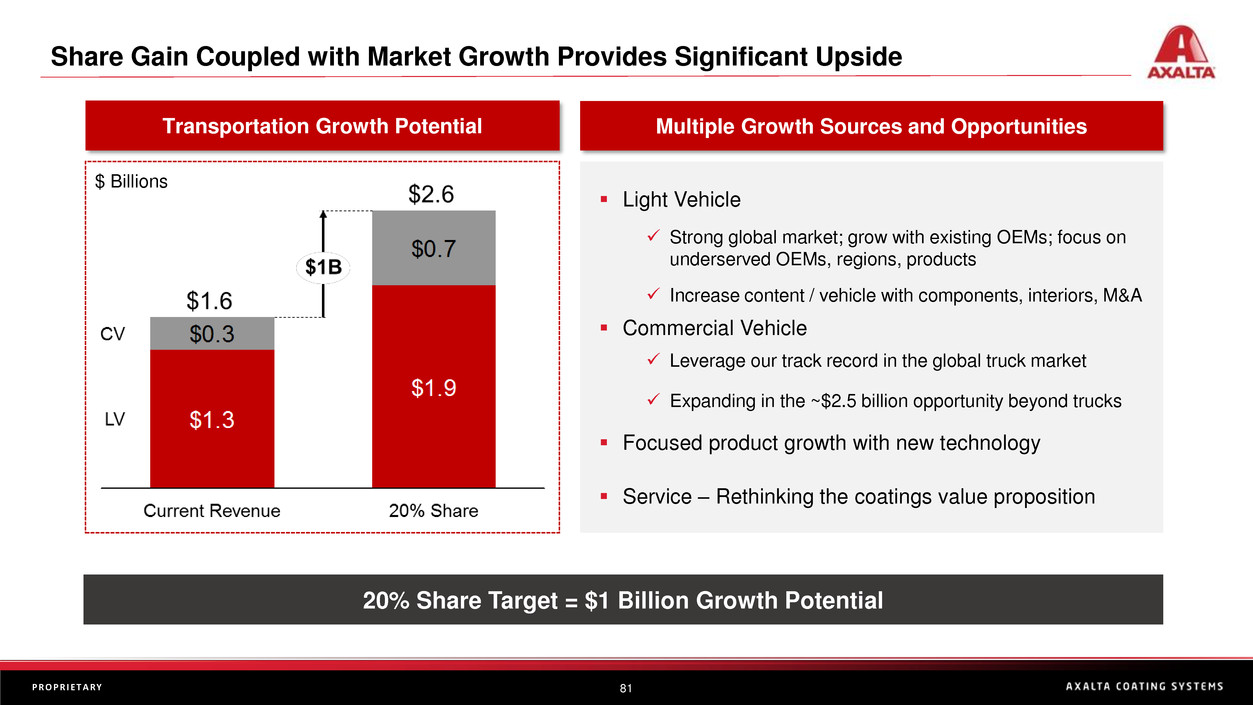

Share Gain Coupled with Market Growth Provides Significant Upside

▪ Light Vehicle

✓ Strong global market; grow with existing OEMs; focus on

underserved OEMs, regions, products

✓ Increase content / vehicle with components, interiors, M&A

▪ Commercial Vehicle

✓ Leverage our track record in the global truck market

✓ Expanding in the ~$2.5 billion opportunity beyond trucks

▪ Focused product growth with new technology

▪ Service – Rethinking the coatings value proposition

Multiple Growth Sources and OpportunitiesTransportation Growth Potential

20% Share Target = $1 Billion Growth Potential

$ Billions

82P R O P R I E T A R Y

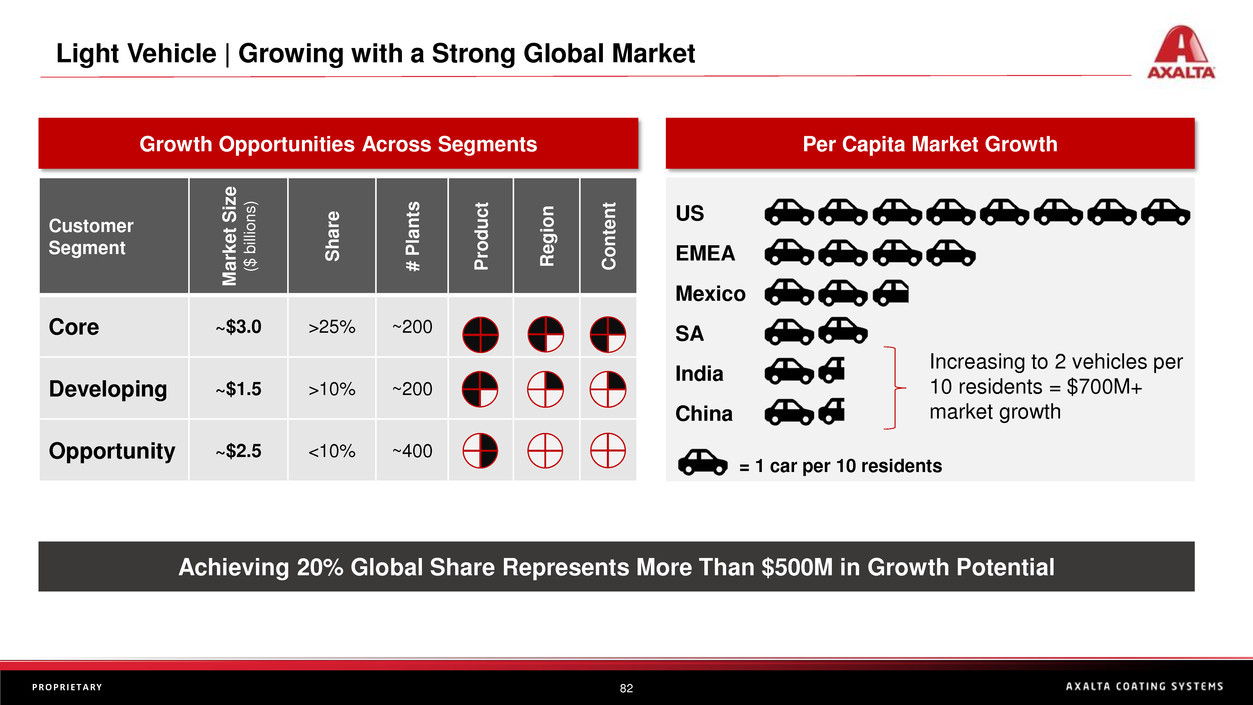

Light Vehicle | Growing with a Strong Global Market

US

EMEA

SA

China

Mexico

India

Per Capita Market Growth

Increasing to 2 vehicles per

10 residents = $700M+

market growth

= 1 car per 10 residents

Achieving 20% Global Share Represents More Than $500M in Growth Potential

Growth Opportunities Across Segments

Customer

Segment

M

a

rk

e

t

S

iz

e

($

b

ill

io

n

s

)

S

h

a

re

#

P

la

n

ts

P

ro

d

u

c

t

R

e

g

io

n

C

o

n

te

n

t

Core ~$3.0 >25% ~200

Developing ~$1.5 >10% ~200

Opportunity ~$2.5 <10% ~400

83P R O P R I E T A R Y

Light Vehicle | Increasing Content Per Vehicle with Components

▪ Focus markets with global leadership and strategy

▪ Exterior / APC a top 5 “customer”

✓ Adjacent to core products

✓ Relationships with paint engineering critical

✓ Technology focus a differentiator

▪ Interior coatings added in 2016

✓ OEM focus area for differentiation leading to enriched content

✓ Future vehicles increase cabin size and focus on interiors

✓ Driving excellence in small batch systems and support

mirrors

fascia

Rocker / cladding

interior

lenses

fascia

wheel / inserts

“small parts”

bezels, handles, trim

Content Opportunity Represents > $250 Million in Growth Potential

White Space in Exteriors and Interiors $30-50 /

vehicle

84P R O P R I E T A R Y

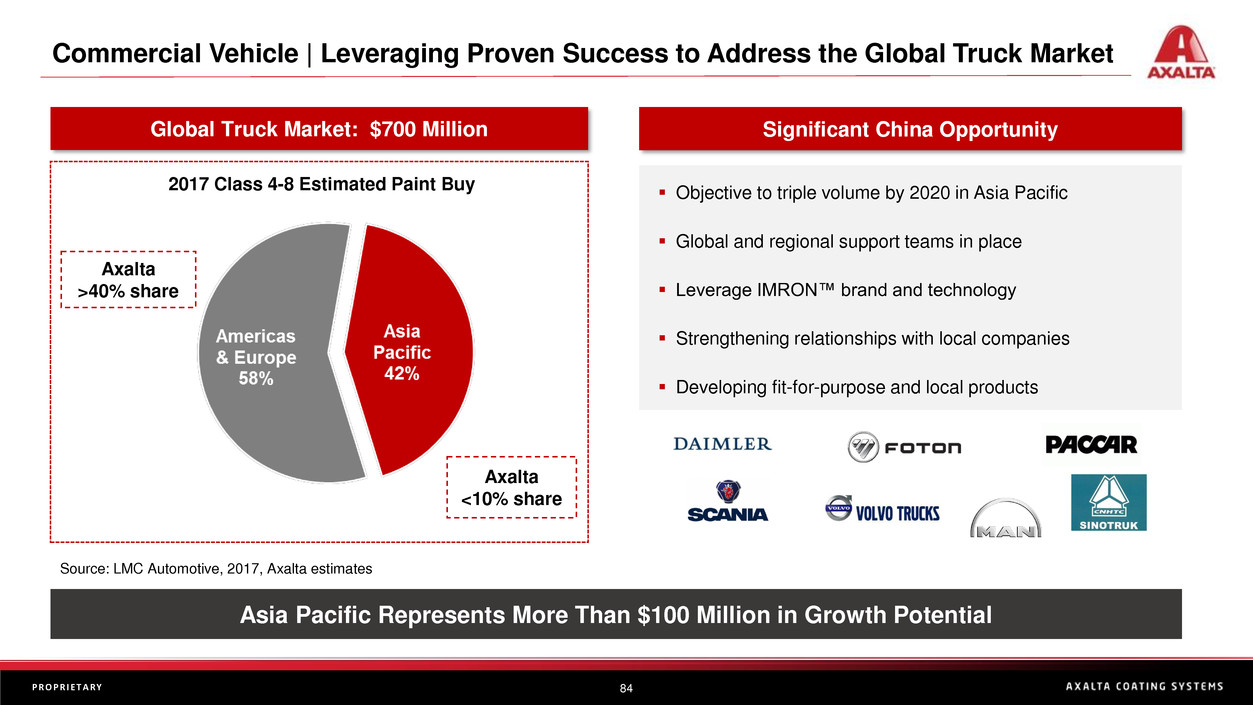

Global Truck Market: $700 Million Significant China Opportunity

2017 Class 4-8 Estimated Paint Buy

Source: LMC Automotive, 2017, Axalta estimates

Commercial Vehicle | Leveraging Proven Success to Address the Global Truck Market

Axalta

>40% share

Axalta

<10% share

▪ Objective to triple volume by 2020 in Asia Pacific

▪ Global and regional support teams in place

▪ Leverage IMRON™ brand and technology

▪ Strengthening relationships with local companies

▪ Developing fit-for-purpose and local products

Asia Pacific Represents More Than $100 Million in Growth Potential

85P R O P R I E T A R Y

Commercial Vehicle | Expanding in the ~$2.5 Billion Market Beyond Trucks

▪ Global strategy with local execution

▪ Leveraging long-term relationships and proven technology to

adjacent markets

▪ Key wins in bus, rail and recreational vehicles

▪ Moving from regional to global presence

▪ MRO provides annuity-like revenue streams

▪ M&A expedites paths to market access

Motorcycle

pic (honda)

Opportunities Represent More Than $200 Million in Growth Potential

Broad and Diverse Vehicle Markets

86P R O P R I E T A R Y

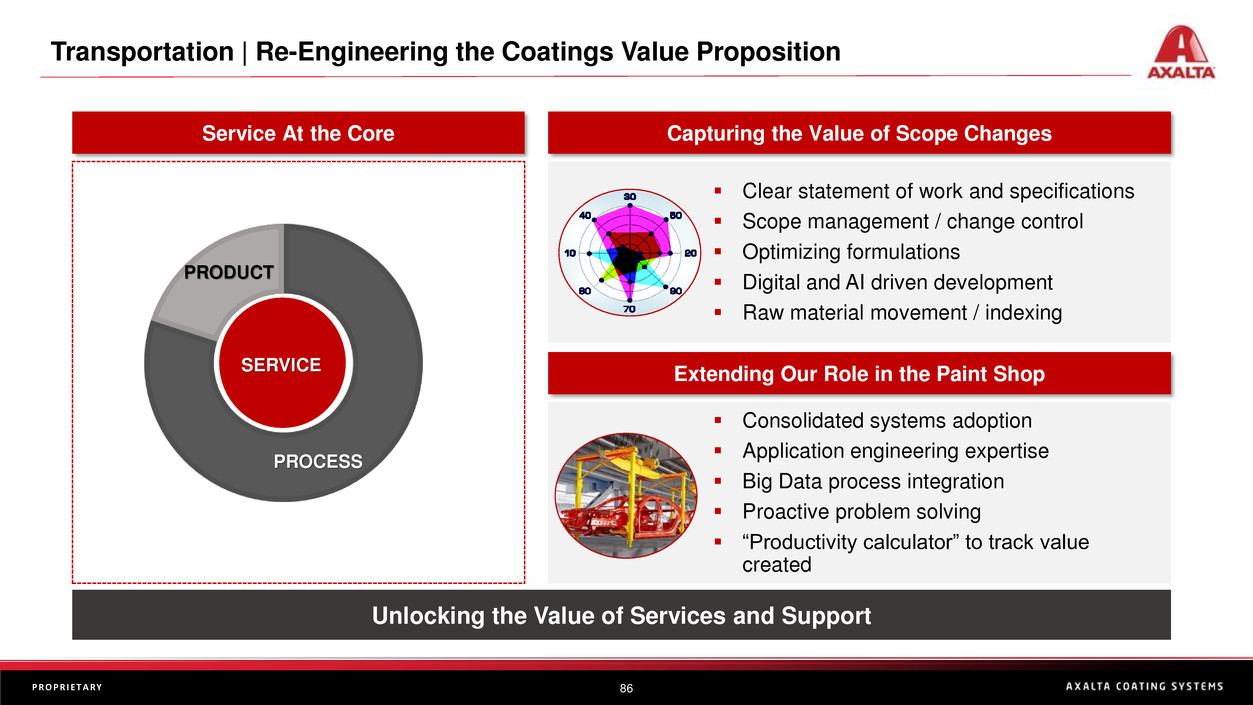

Transportation | Re-Engineering the Coatings Value Proposition

Capturing the Value of Scope Changes

Unlocking the Value of Services and Support

SERVICE

PROCESS

PRODUCT

▪ Clear statement of work and specifications

▪ Scope management / change control

▪ Optimizing formulations

▪ Digital and AI driven development

▪ Raw material movement / indexing

▪ Consolidated systems adoption

▪ Application engineering expertise

▪ Big Data process integration

▪ Proactive problem solving

▪ “Productivity calculator” to track value

created

Service At the Core

Extending Our Role in the Paint Shop

87P R O P R I E T A R Y

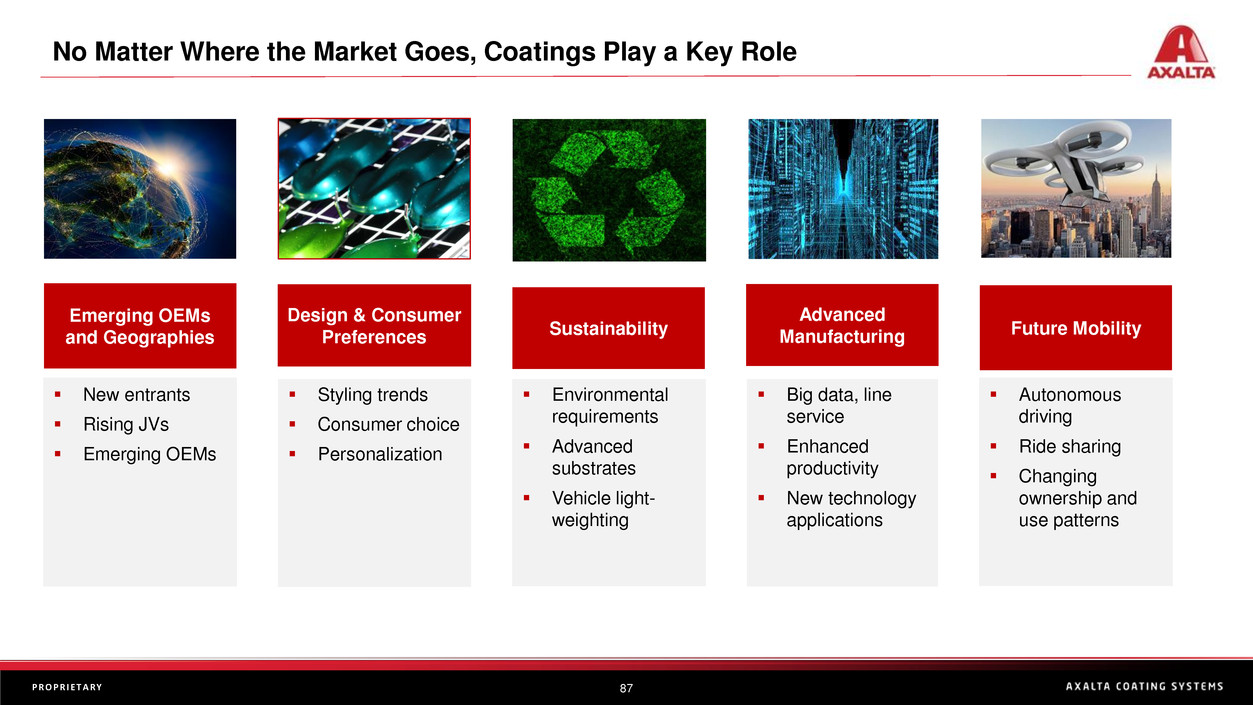

▪ Autonomous

driving

▪ Ride sharing

▪ Changing

ownership and

use patterns

Future Mobility

Emerging OEMs

and Geographies

Advanced

ManufacturingSustainability

Design & Consumer

Preferences

▪ New entrants

▪ Rising JVs

▪ Emerging OEMs

▪ Big data, line

service

▪ Enhanced

productivity

▪ New technology

applications

▪ Environmental

requirements

▪ Advanced

substrates

▪ Vehicle light-

weighting

▪ Styling trends

▪ Consumer choice

▪ Personalization

No Matter Where the Market Goes, Coatings Play a Key Role

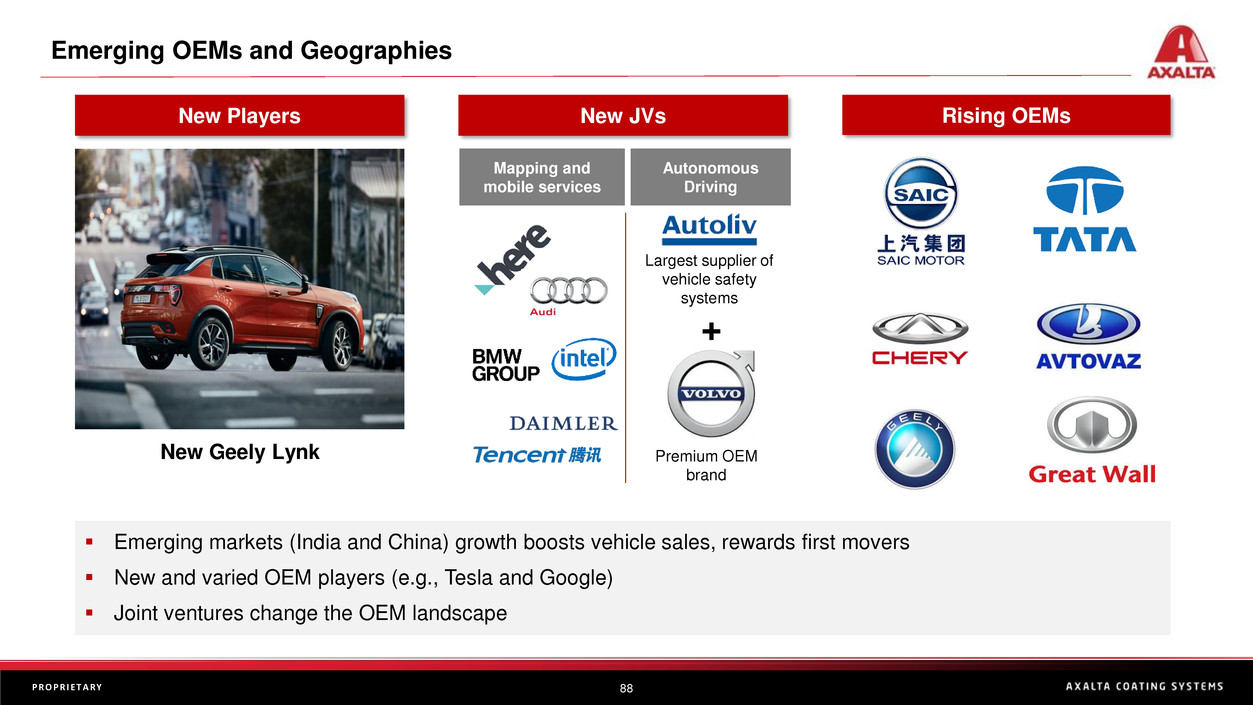

88P R O P R I E T A R Y

▪ Emerging markets (India and China) growth boosts vehicle sales, rewards first movers

▪ New and varied OEM players (e.g., Tesla and Google)

▪ Joint ventures change the OEM landscape

New Players New JVs

+

Largest supplier of

vehicle safety

systems

Premium OEM

brand

Autonomous

Driving

Mapping and

mobile services

Rising OEMs

Emerging OEMs and Geographies

New Geely Lynk

89P R O P R I E T A R Y

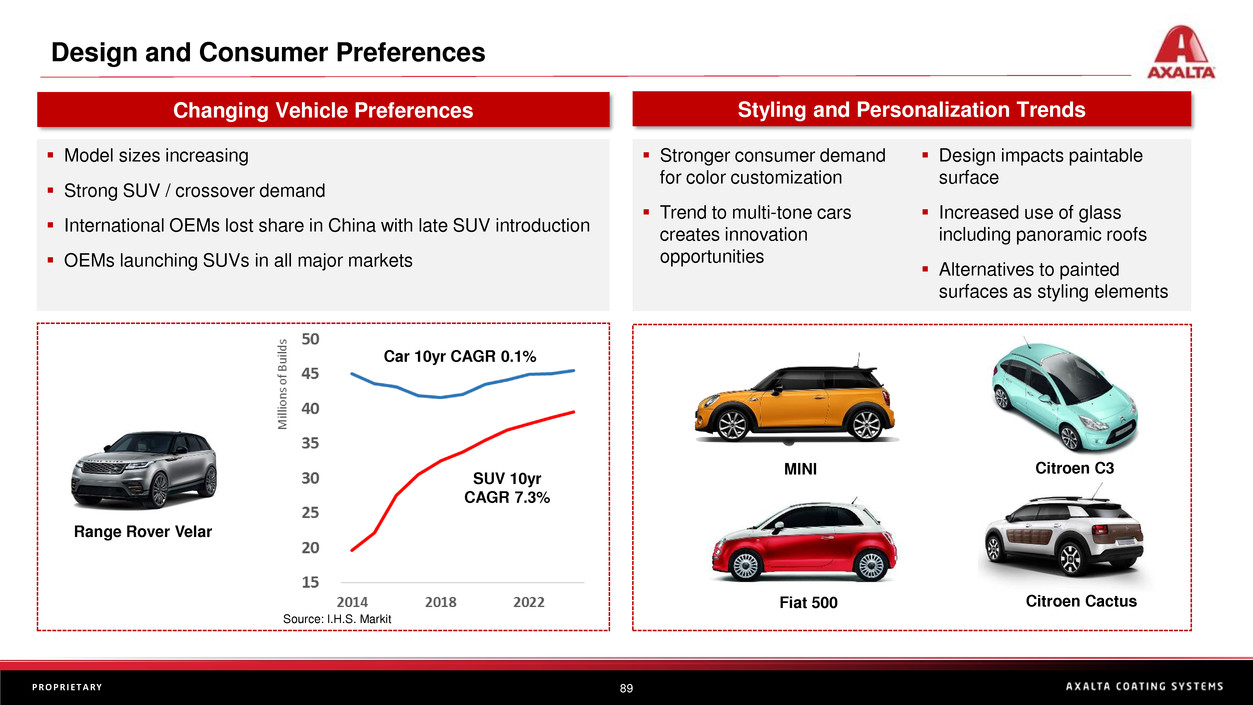

▪ Model sizes increasing

▪ Strong SUV / crossover demand

▪ International OEMs lost share in China with late SUV introduction

▪ OEMs launching SUVs in all major markets

Range Rover Velar

Changing Vehicle Preferences

Source: I.H.S. Markit

Styling and Personalization Trends

▪ Design impacts paintable

surface

▪ Increased use of glass

including panoramic roofs

▪ Alternatives to painted

surfaces as styling elements

▪ Stronger consumer demand

for color customization

▪ Trend to multi-tone cars

creates innovation

opportunities

Fiat 500

MINI

Citroen Cactus

Citroen C3

Design and Consumer Preferences

SUV 10yr

CAGR 7.3%

Car 10yr CAGR 0.1%

90P R O P R I E T A R Y

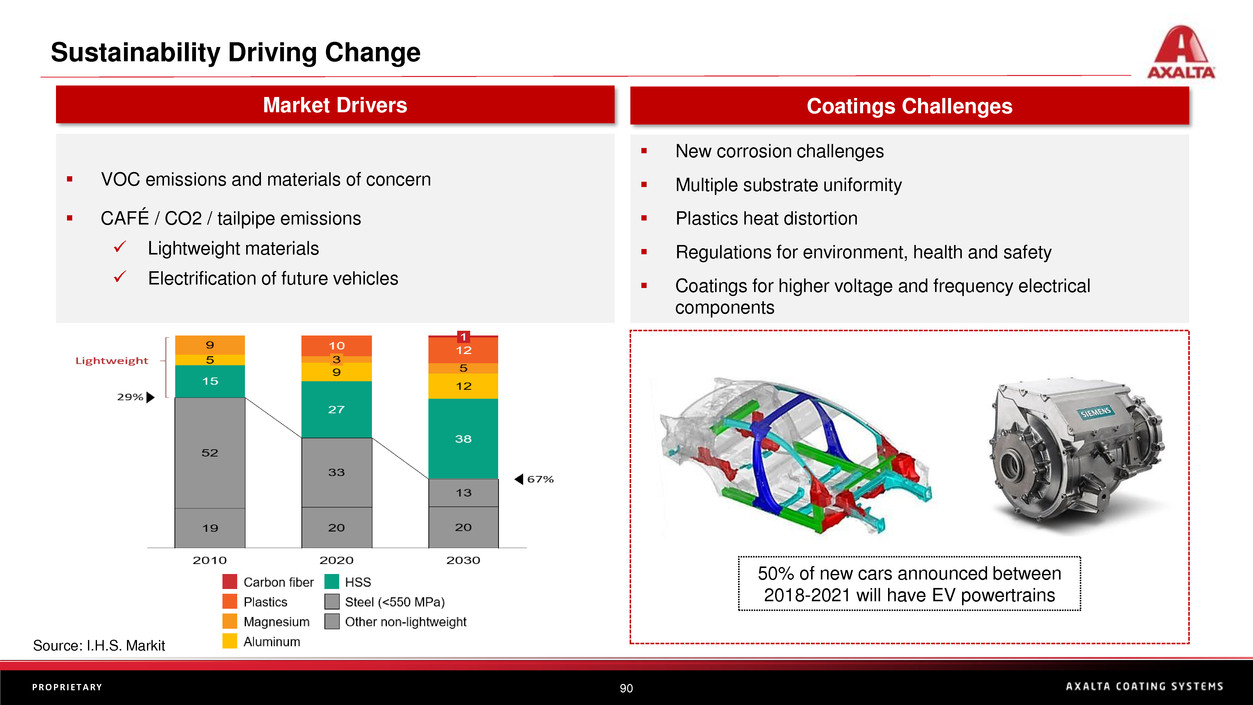

Source: I.H.S. Markit

Market Drivers

▪ New corrosion challenges

▪ Multiple substrate uniformity

▪ Plastics heat distortion

▪ Regulations for environment, health and safety

▪ Coatings for higher voltage and frequency electrical

components

▪ VOC emissions and materials of concern

▪ CAFÉ / CO2 / tailpipe emissions

✓ Lightweight materials

✓ Electrification of future vehicles

Coatings Challenges

50% of new cars announced between

2018-2021 will have EV powertrains

Sustainability Driving Change

91P R O P R I E T A R Y

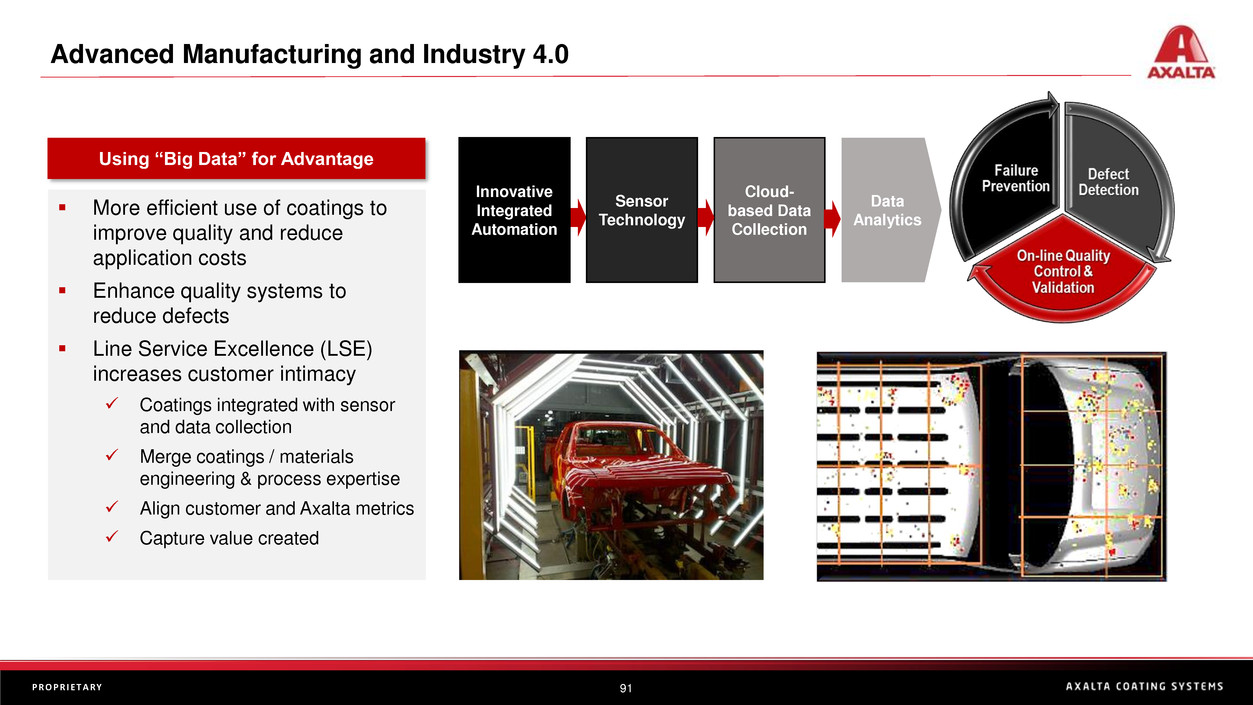

Data

Analytics

Innovative

Integrated

Automation

Sensor

Technology

Cloud-

based Data

Collection

Advanced Manufacturing and Industry 4.0

Using “Big Data” for Advantage

▪ More efficient use of coatings to

improve quality and reduce

application costs

▪ Enhance quality systems to

reduce defects

▪ Line Service Excellence (LSE)

increases customer intimacy

✓ Coatings integrated with sensor

and data collection

✓ Merge coatings / materials

engineering & process expertise

✓ Align customer and Axalta metrics

✓ Capture value created

92P R O P R I E T A R Y

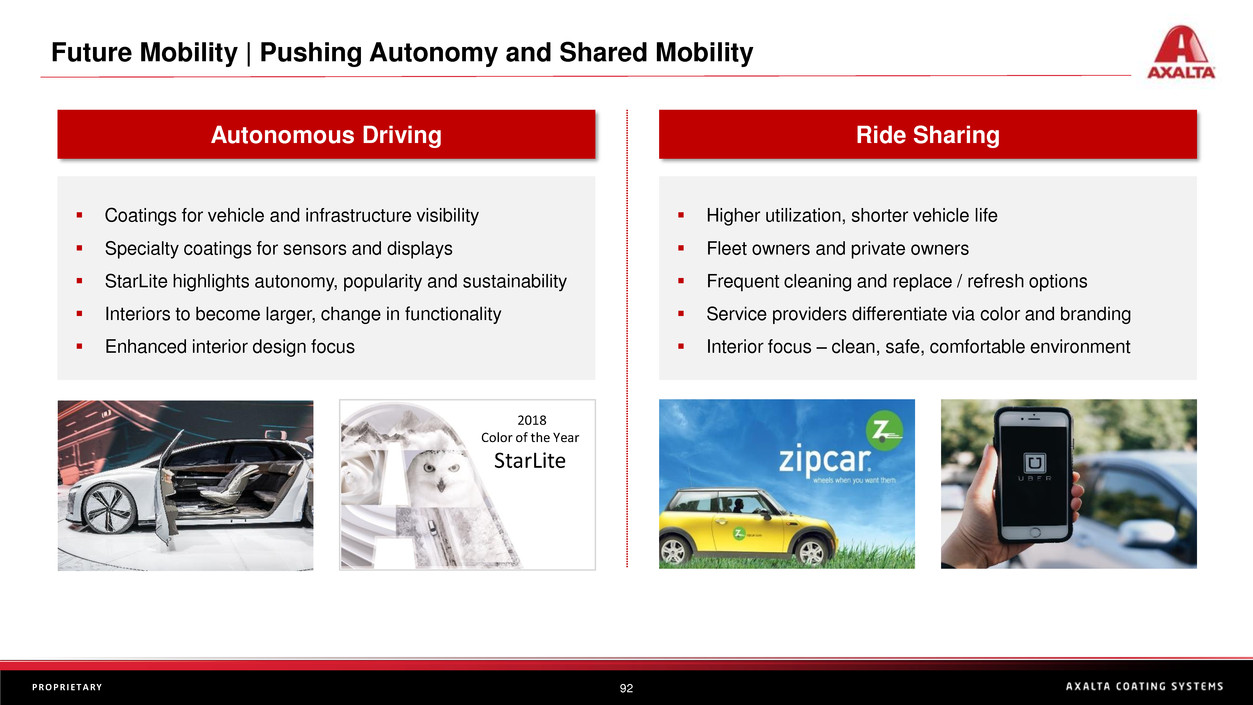

Autonomous Driving Ride Sharing

Future Mobility | Pushing Autonomy and Shared Mobility

2018

Color of the Year

StarLite

▪ Higher utilization, shorter vehicle life

▪ Fleet owners and private owners

▪ Frequent cleaning and replace / refresh options

▪ Service providers differentiate via color and branding

▪ Interior focus – clean, safe, comfortable environment

▪ Coatings for vehicle and infrastructure visibility

▪ Specialty coatings for sensors and displays

▪ StarLite highlights autonomy, popularity and sustainability

▪ Interiors to become larger, change in functionality

▪ Enhanced interior design focus

93P R O P R I E T A R Y

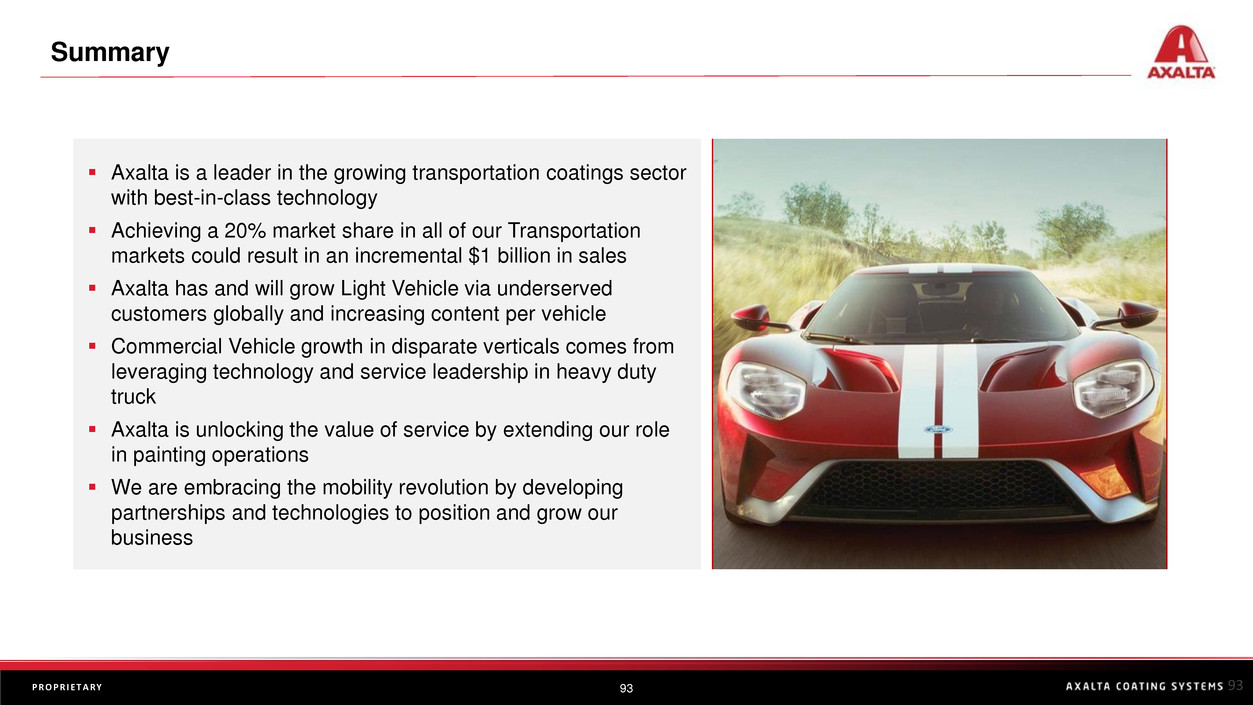

Summary

93

▪ Axalta is a leader in the growing transportation coatings sector

with best-in-class technology

▪ Achieving a 20% market share in all of our Transportation

markets could result in an incremental $1 billion in sales

▪ Axalta has and will grow Light Vehicle via underserved

customers globally and increasing content per vehicle

▪ Commercial Vehicle growth in disparate verticals comes from

leveraging technology and service leadership in heavy duty

truck

▪ Axalta is unlocking the value of service by extending our role

in painting operations

▪ We are embracing the mobility revolution by developing

partnerships and technologies to position and grow our

business

Thank you!

Operations, Procurement & Supply Chain

Dan Key

SVP, Operations, Procurement & Supply Chain

96P R O P R I E T A R Y

Kuala Lumpur

Savli

Jiading

Changchun

Gebze

Bulle

Guntramsdorf

Landshut

Wuppertal

Västervik

Darlington

Mechelen

Montbrison

Guarulhos

TlalnepantlaOcoyoacac

Monterrey

Ft. Madison

Hilliard

Front Royal

Ajax

Mt. Clemens

Riverside

Buenos Aires

Amatitlan

Port Elizabeth

Chengdu

Huangshan

Shangdong

Qingpu

Dongguan

Cikarang

Orrville

Taipei

Bangplee

Moscow

Shah Alam

Cartagena de Indias

Houston

Cornwall

High Point

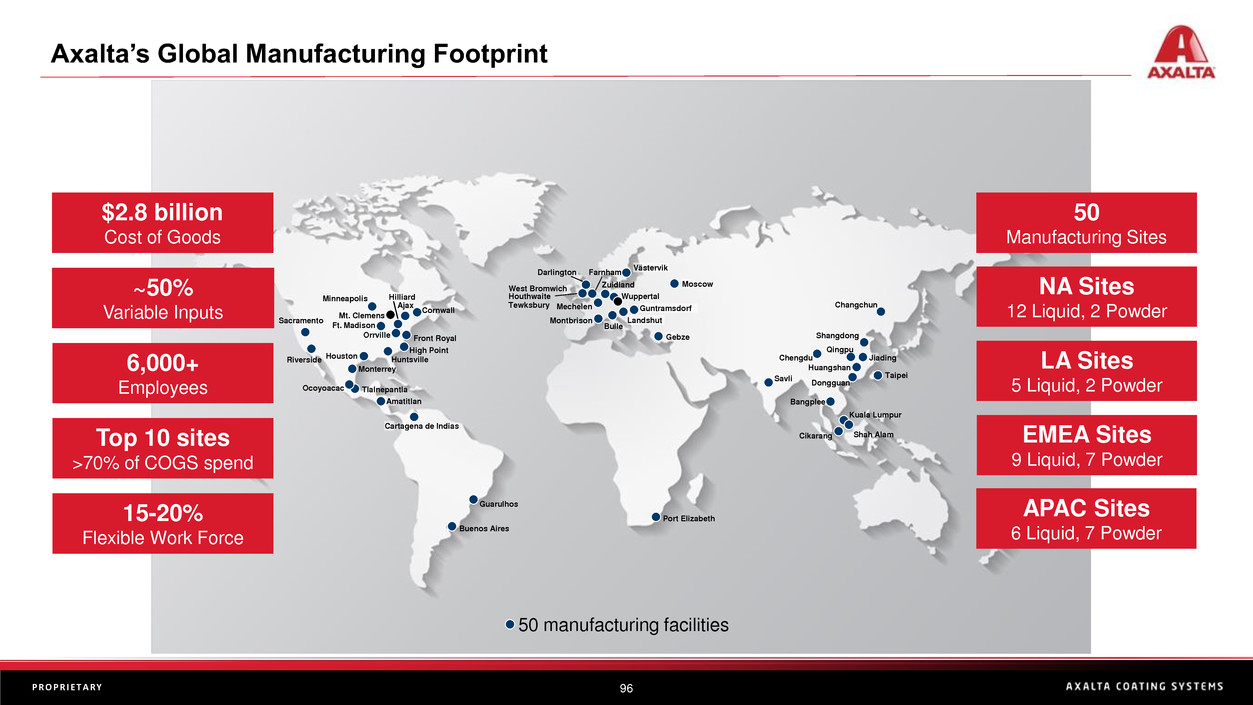

Axalta’s Global Manufacturing Footprint

96

50 manufacturing facilities

6,000+

Employees

50

Manufacturing Sites

Top 10 sites

>70% of COGS spend

LA Sites

5 Liquid, 2 Powder

NA Sites

12 Liquid, 2 Powder

$2.8 billion

Cost of Goods

~50%

Variable Inputs

EMEA Sites

9 Liquid, 7 Powder

APAC Sites

6 Liquid, 7 Powder

15-20%

Flexible Work Force

Houthwaite

West Bromwich

Tewksbury

Zuidland

Farnham

Huntsville

Sacramento

Minneapolis

97P R O P R I E T A R Y

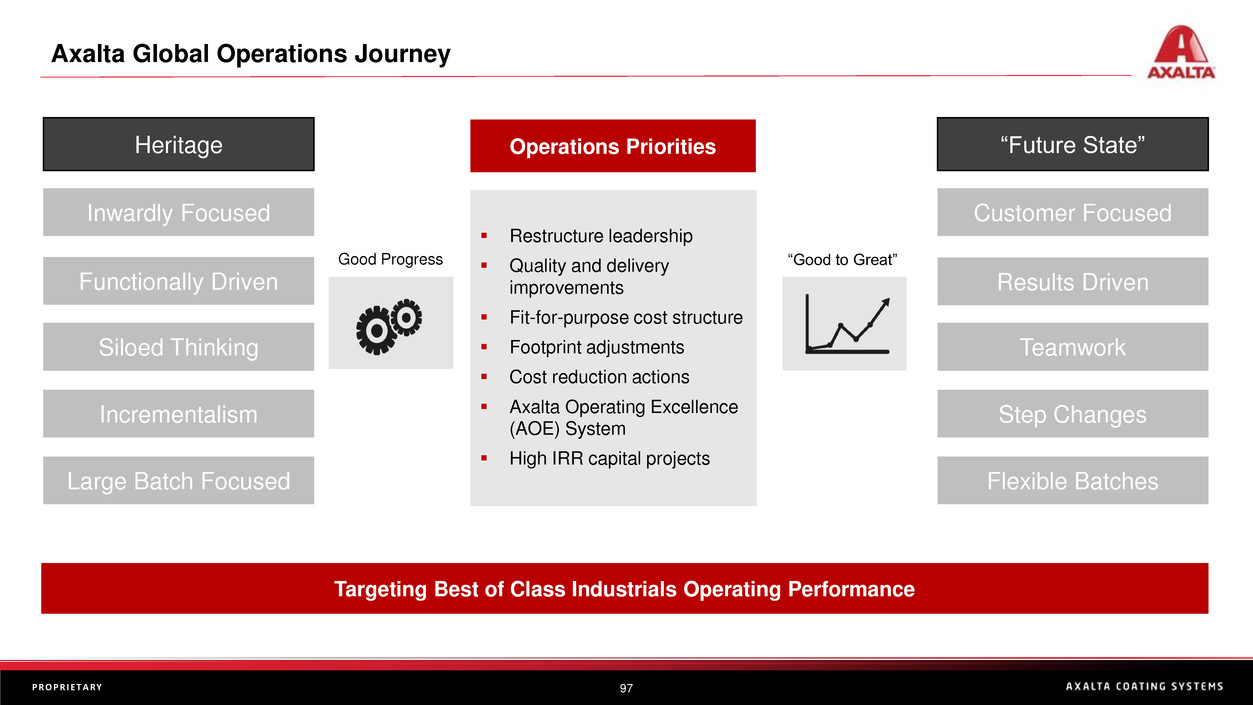

Axalta Global Operations Journey

Heritage “Future State”

Inwardly Focused Customer Focused

Functionally Driven Results Driven

Siloed Thinking Teamwork

Incrementalism Step Changes

Large Batch Focused Flexible Batches

Operations Priorities

▪ Restructure leadership

▪ Quality and delivery

improvements

▪ Fit-for-purpose cost structure

▪ Footprint adjustments

▪ Cost reduction actions

▪ Axalta Operating Excellence

(AOE) System

▪ High IRR capital projects

“Good to Great”Good Progress

Targeting Best of Class Industrials Operating Performance

98P R O P R I E T A R Y

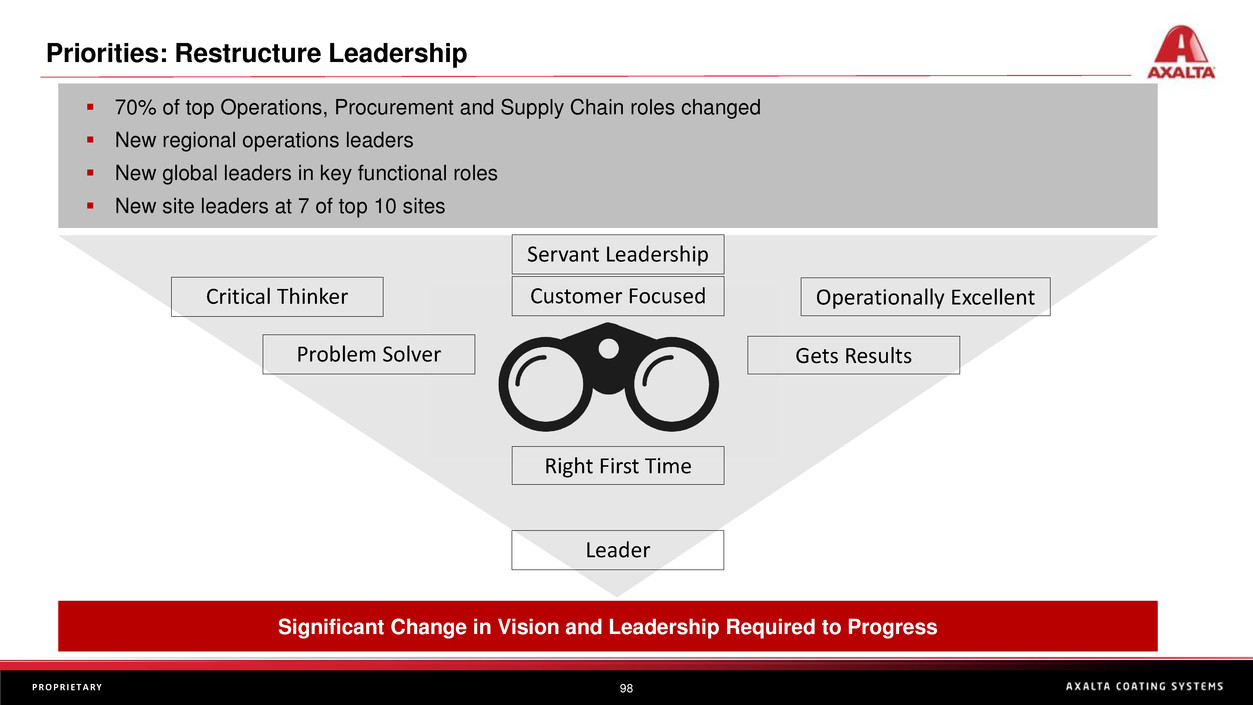

Priorities: Restructure Leadership

▪ 70% of top Operations, Procurement and Supply Chain roles changed

▪ New regional operations leaders

▪ New global leaders in key functional roles

▪ New site leaders at 7 of top 10 sites

Significant Change in Vision and Leadership Required to Progress

Servant Leadership

Customer Focused Operationally Excellent

Leader

Problem Solver Gets Results

Critical Thinker

Right First Time

99P R O P R I E T A R Y

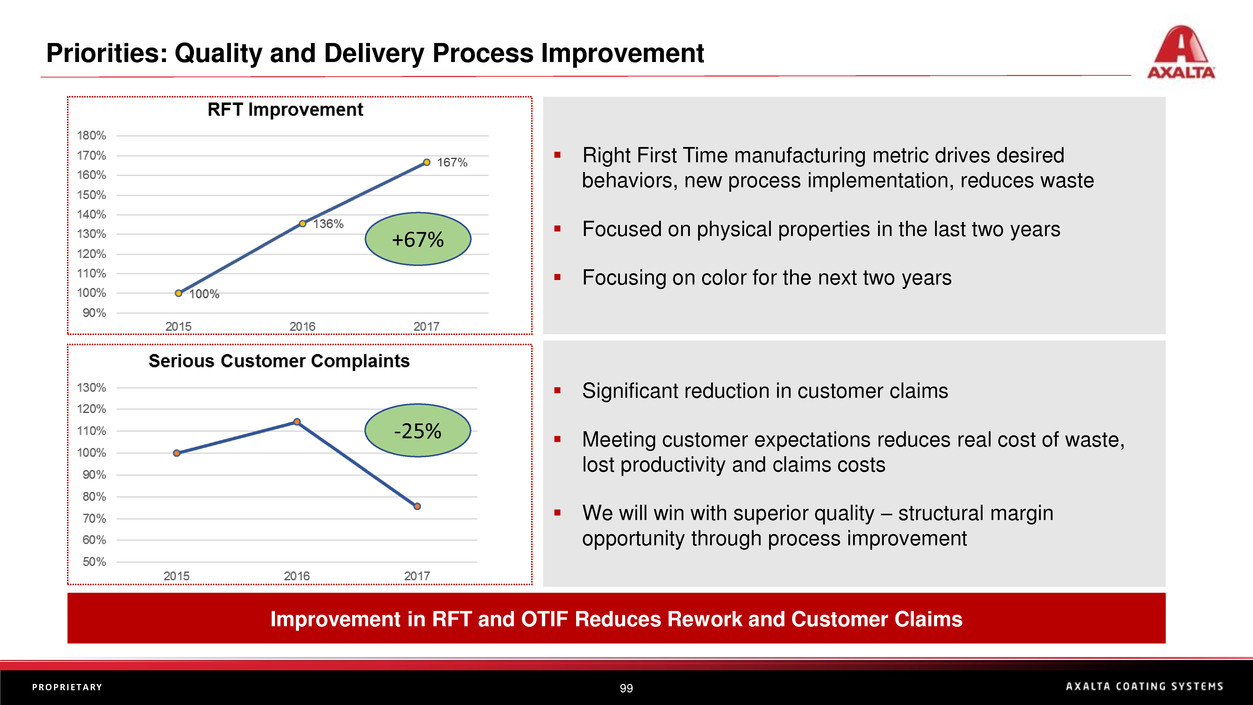

Priorities: Quality and Delivery Process Improvement

Improvement in RFT and OTIF Reduces Rework and Customer Claims

▪ Right First Time manufacturing metric drives desired

behaviors, new process implementation, reduces waste

▪ Focused on physical properties in the last two years

▪ Focusing on color for the next two years

▪ Significant reduction in customer claims

▪ Meeting customer expectations reduces real cost of waste,

lost productivity and claims costs

▪ We will win with superior quality – structural margin

opportunity through process improvement

+67%

-25%

100P R O P R I E T A R Y

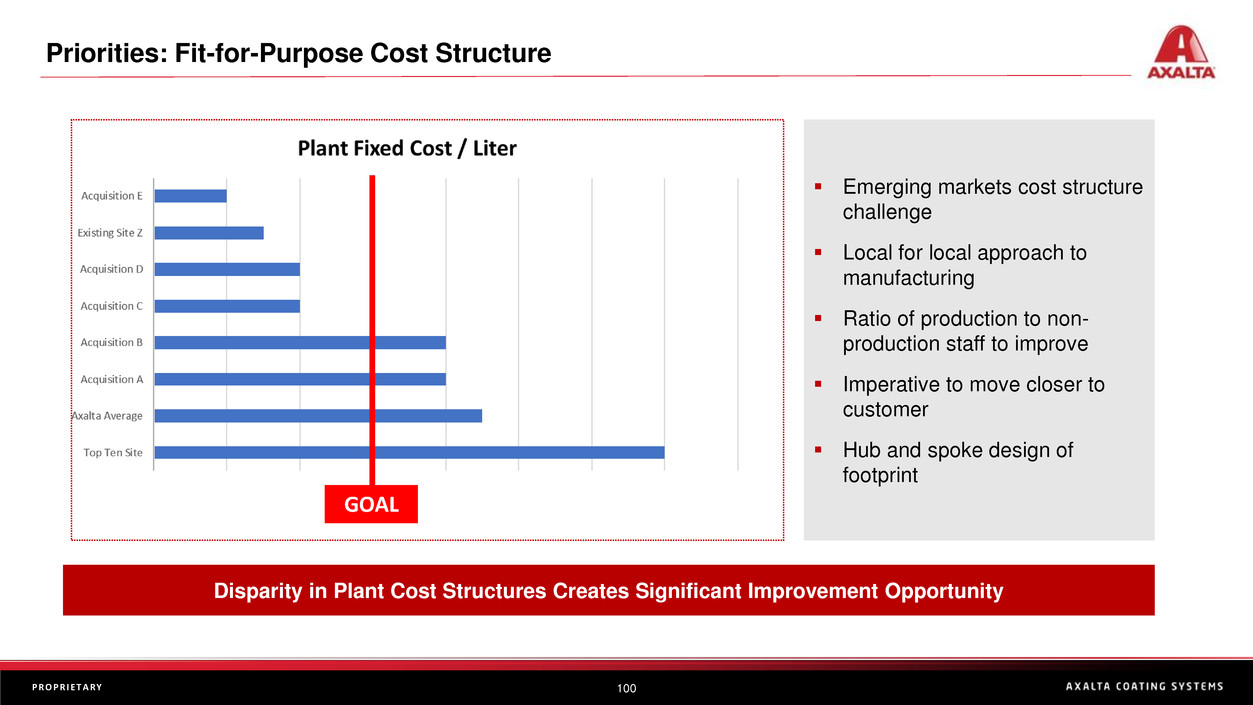

Priorities: Fit-for-Purpose Cost Structure

Disparity in Plant Cost Structures Creates Significant Improvement Opportunity

▪ Emerging markets cost structure

challenge

▪ Local for local approach to

manufacturing

▪ Ratio of production to non-

production staff to improve

▪ Imperative to move closer to

customer

▪ Hub and spoke design of

footprint

GOAL

101P R O P R I E T A R Y

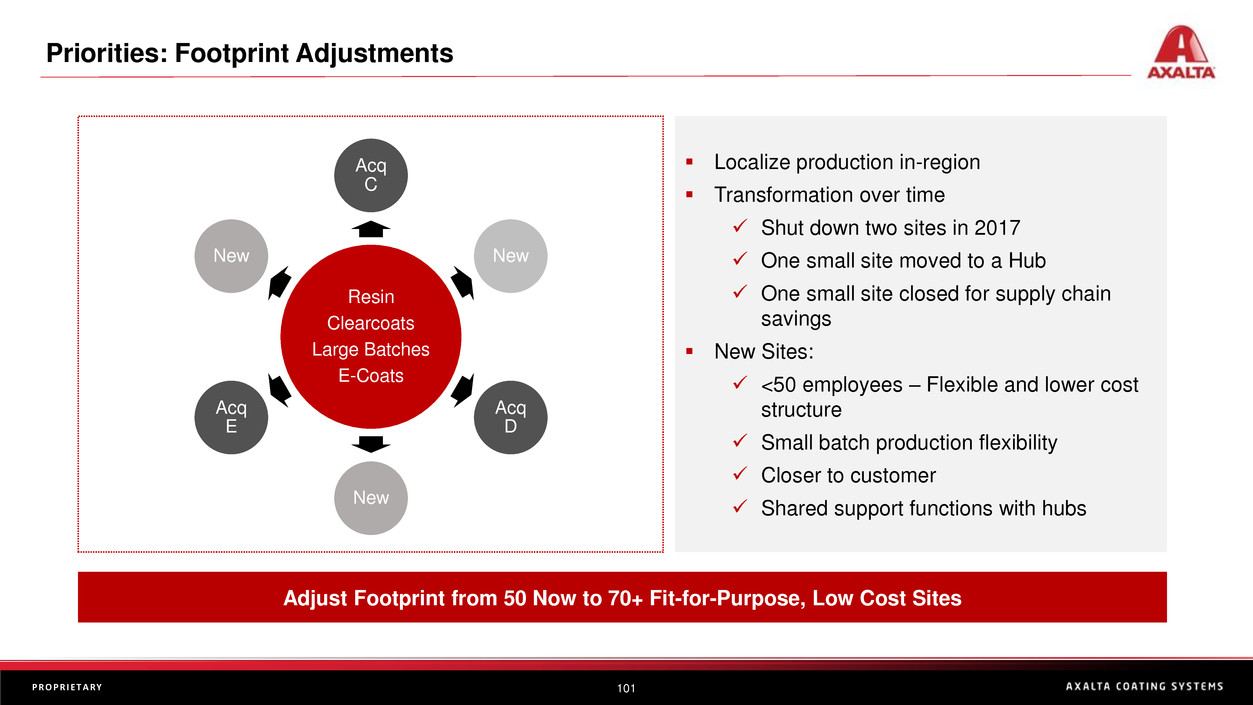

Priorities: Footprint Adjustments

Adjust Footprint from 50 Now to 70+ Fit-for-Purpose, Low Cost Sites

▪ Localize production in-region

▪ Transformation over time

✓ Shut down two sites in 2017

✓ One small site moved to a Hub

✓ One small site closed for supply chain

savings

▪ New Sites:

✓ <50 employees – Flexible and lower cost

structure

✓ Small batch production flexibility

✓ Closer to customer

✓ Shared support functions with hubs

Resin

Clearcoats

Large Batches

E-Coats

Acq

C

New

Acq

D

New

Acq

E

New

102P R O P R I E T A R Y

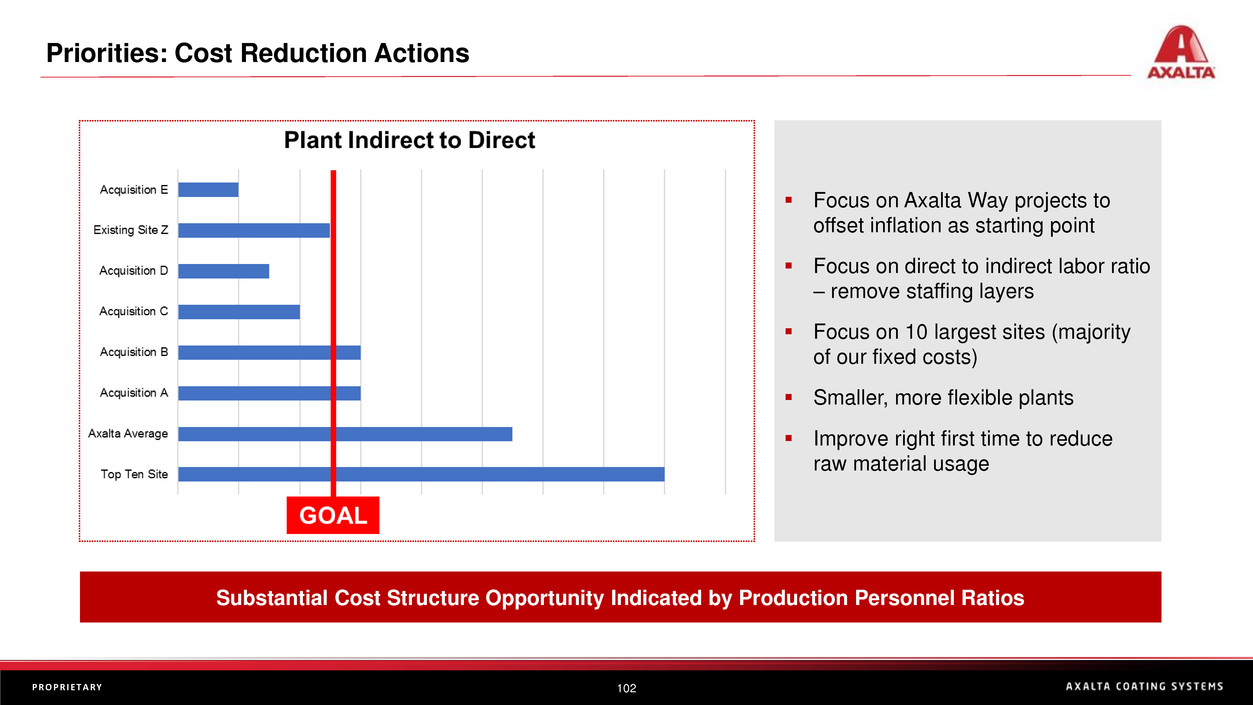

Priorities: Cost Reduction Actions

Substantial Cost Structure Opportunity Indicated by Production Personnel Ratios

▪ Focus on Axalta Way projects to

offset inflation as starting point

▪ Focus on direct to indirect labor ratio

– remove staffing layers

▪ Focus on 10 largest sites (majority

of our fixed costs)

▪ Smaller, more flexible plants

▪ Improve right first time to reduce

raw material usage

103P R O P R I E T A R Y

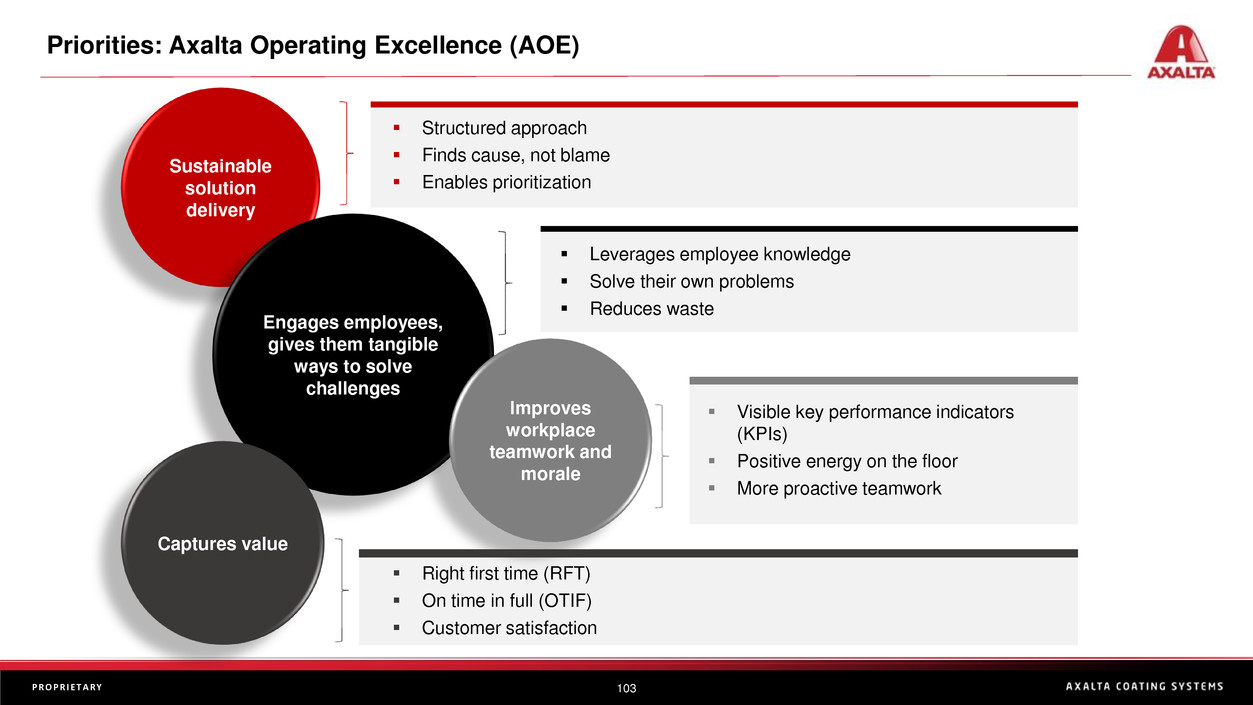

Priorities: Axalta Operating Excellence (AOE)

▪ Structured approach

▪ Finds cause, not blame

▪ Enables prioritization

Sustainable

solution

delivery

▪ Leverages employee knowledge

▪ Solve their own problems

▪ Reduces waste

Engages employees,

gives them tangible

ways to solve

challenges

Improves

workplace

teamwork and

morale

▪ Visible key performance indicators

(KPIs)

▪ Positive energy on the floor

▪ More proactive teamwork

Captures value

▪ Right first time (RFT)

▪ On time in full (OTIF)

▪ Customer satisfaction

104P R O P R I E T A R Y

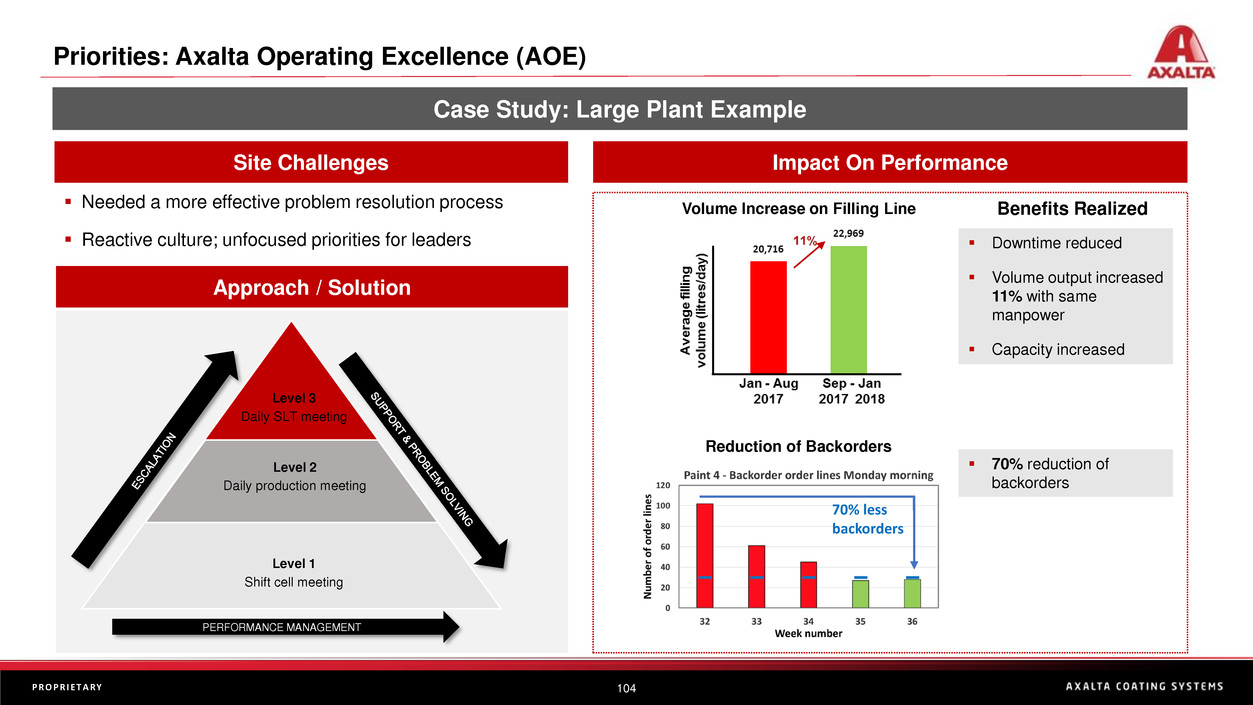

Site Challenges

Priorities: Axalta Operating Excellence (AOE)

Volume Increase on Filling Line▪ Needed a more effective problem resolution process

▪ Reactive culture; unfocused priorities for leaders ▪ Downtime reduced

▪ Volume output increased

11% with same

manpower

▪ Capacity increased

Benefits Realized

Case Study: Large Plant Example

70% less

backorders

Reduction of Backorders

Level 1

Shift cell meeting

Level 2

Daily production meeting

Level 3

Daily SLT meeting

PERFORMANCE MANAGEMENT

▪ 70% reduction of

backorders

Approach / Solution

Impact On Performance

105P R O P R I E T A R Y

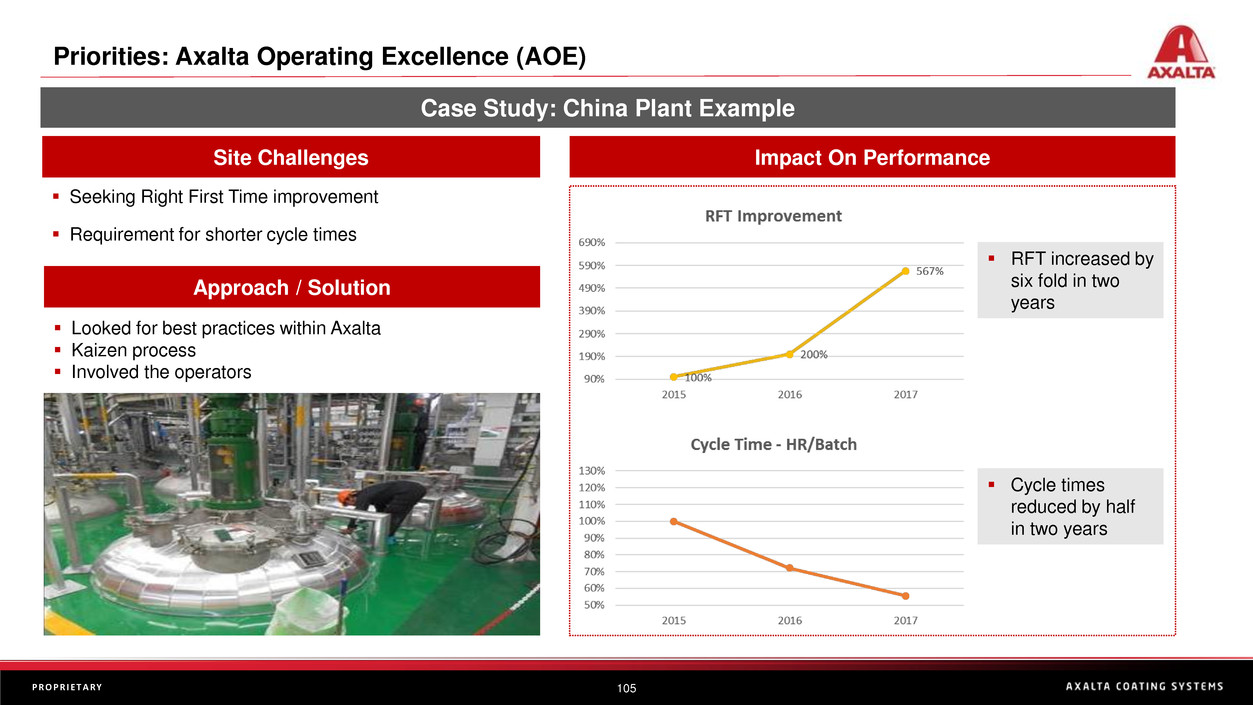

Site Challenges

Priorities: Axalta Operating Excellence (AOE)

▪ Seeking Right First Time improvement

▪ Requirement for shorter cycle times

▪ RFT increased by

six fold in two

years

Case Study: China Plant Example

Approach / Solution

Impact On Performance

▪ Looked for best practices within Axalta

▪ Kaizen process

▪ Involved the operators

▪ Cycle times

reduced by half

in two years

106P R O P R I E T A R Y

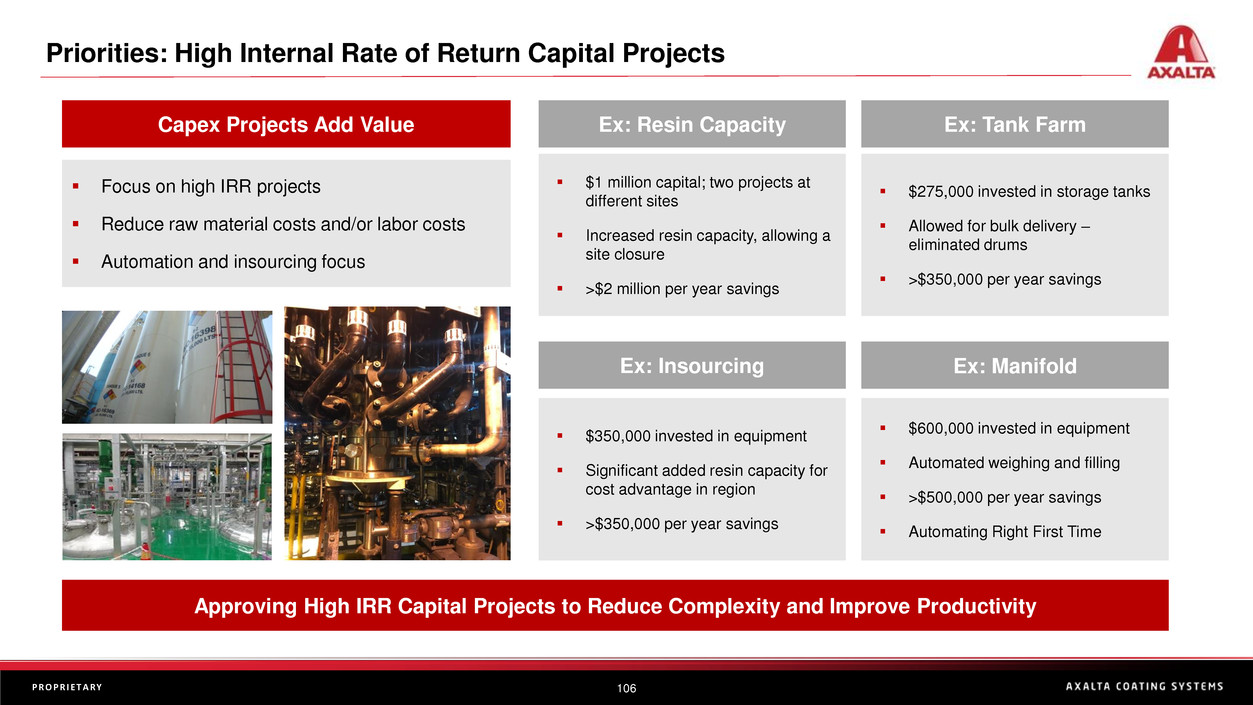

Priorities: High Internal Rate of Return Capital Projects

Approving High IRR Capital Projects to Reduce Complexity and Improve Productivity

▪ Focus on high IRR projects

▪ Reduce raw material costs and/or labor costs

▪ Automation and insourcing focus

Capex Projects Add Value Ex: Resin Capacity Ex: Tank Farm

Ex: Insourcing

▪ $1 million capital; two projects at

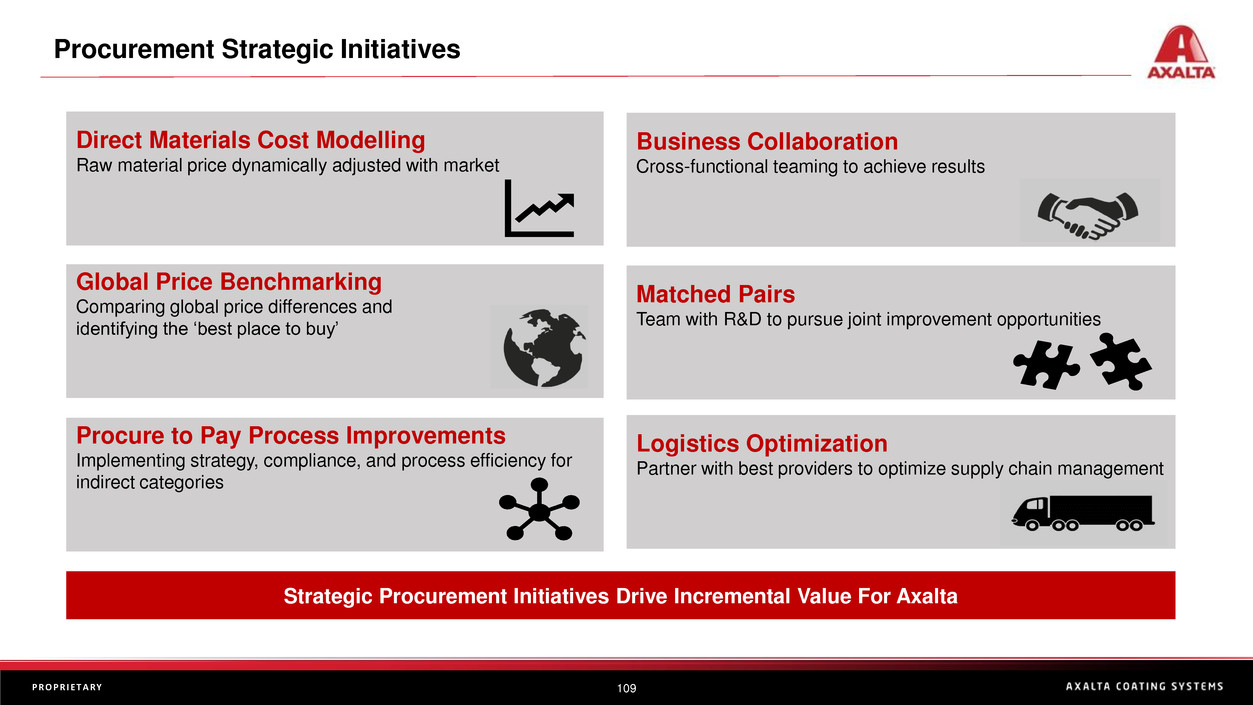

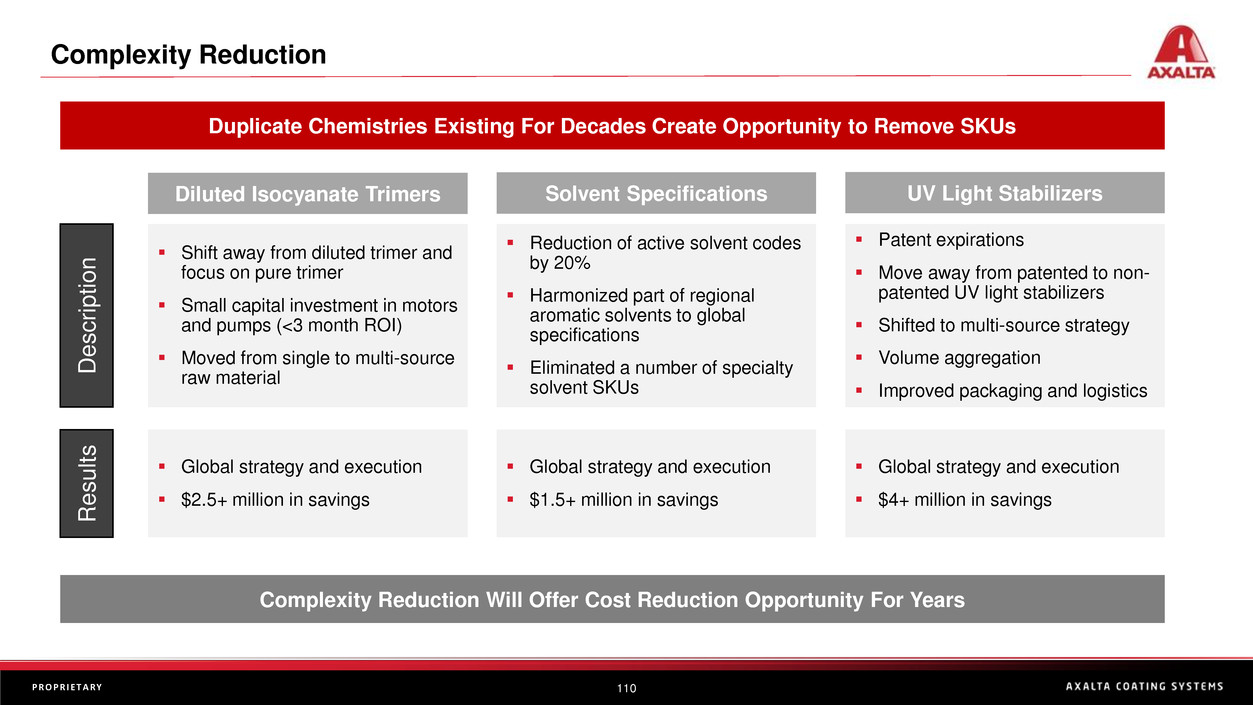

different sites