EXHIBIT 99.1

Published on December 19, 2018

Exhibit 99.1 2019 Preliminary Financial Outlook Call December 19, 2018

Legal Notices Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to 2018 and 2019 financial projections, which include net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding, FX impacts, contributions from acquisitions, and related assumptions, as well as execution on our 2019 goals. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX, Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted. Management uses these non- GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-cash items included within net income, (ii) items Axalta does not believe are indicative of ongoing operating performance or (iii) nonrecurring, unusual or infrequent items that have not occurred within the last two years or Axalta believes are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Our use of the terms net sales excluding FX, Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted may differ from that of others in our industry. Net sales excluding FX, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, Adjusted EBITDA, Free Cash Flow and tax rate, as adjusted have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. Rounding Due to rounding the tables presented may not foot. PROPRIETARY 2

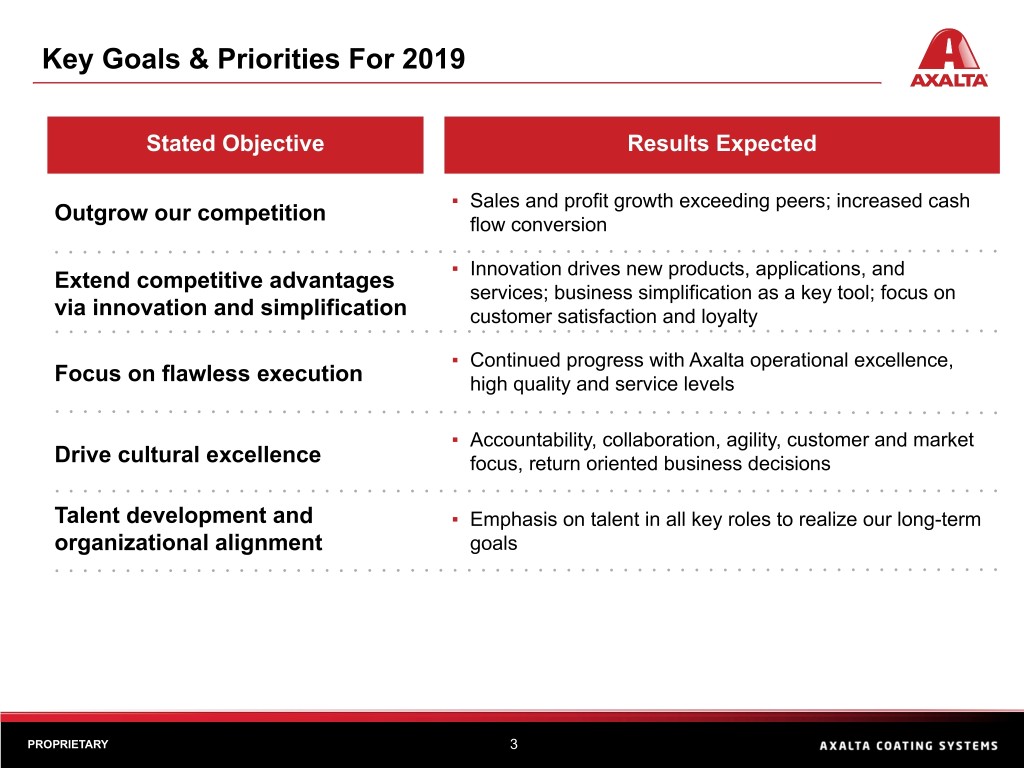

Key Goals & Priorities For 2019 Stated Objective Results Expected ▪ Sales and profit growth exceeding peers; increased cash Outgrow our competition flow conversion ▪ Innovation drives new products, applications, and Extend competitive advantages services; business simplification as a key tool; focus on via innovation and simplification customer satisfaction and loyalty ▪ Continued progress with Axalta operational excellence, Focus on flawless execution high quality and service levels ▪ Accountability, collaboration, agility, customer and market Drive cultural excellence focus, return oriented business decisions Talent development and ▪ Emphasis on talent in all key roles to realize our long-term organizational alignment goals PROPRIETARY 3

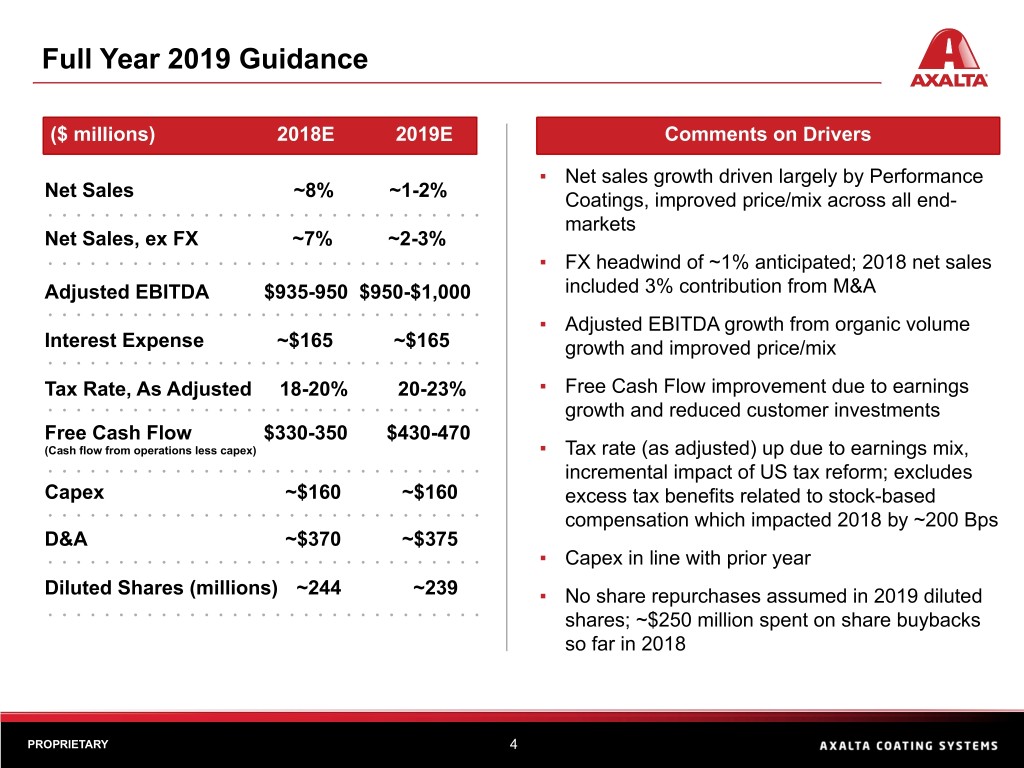

Full Year 2019 Guidance ($ millions) 2018E 2019E Comments on Drivers ▪ Net sales growth driven largely by Performance Net Sales ~8% ~1-2% Coatings, improved price/mix across all end- markets Net Sales, ex FX ~7% ~2-3% ▪ FX headwind of ~1% anticipated; 2018 net sales Adjusted EBITDA $935-950 $950-$1,000 included 3% contribution from M&A ▪ Adjusted EBITDA growth from organic volume Interest Expense ~$165 ~$165 growth and improved price/mix Tax Rate, As Adjusted 18-20% 20-23% ▪ Free Cash Flow improvement due to earnings growth and reduced customer investments Free Cash Flow $330-350 $430-470 (Cash flow from operations less capex) ▪ Tax rate (as adjusted) up due to earnings mix, incremental impact of US tax reform; excludes Capex ~$160 ~$160 excess tax benefits related to stock-based compensation which impacted 2018 by ~200 Bps D&A ~$370 ~$375 ▪ Capex in line with prior year Diluted Shares (millions) ~244 ~239 ▪ No share repurchases assumed in 2019 diluted shares; ~$250 million spent on share buybacks so far in 2018 PROPRIETARY 4

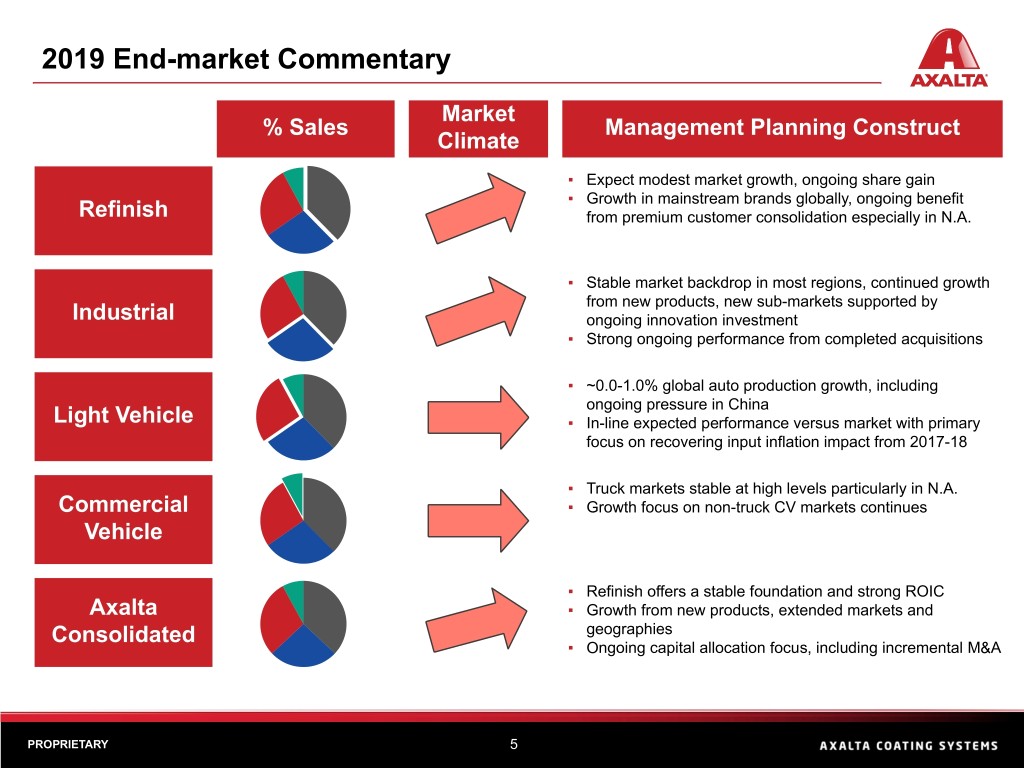

2019 End-market Commentary Market % Sales Management Planning Construct Climate ▪ Expect modest market growth, ongoing share gain ▪ Growth in mainstream brands globally, ongoing benefit Refinish from premium customer consolidation especially in N.A. ▪ Stable market backdrop in most regions, continued growth from new products, new sub-markets supported by Industrial ongoing innovation investment ▪ Strong ongoing performance from completed acquisitions ▪ ~0.0-1.0% global auto production growth, including ongoing pressure in China Light Vehicle ▪ In-line expected performance versus market with primary focus on recovering input inflation impact from 2017-18 ▪ Truck markets stable at high levels particularly in N.A. Commercial ▪ Growth focus on non-truck CV markets continues Vehicle ▪ Refinish offers a stable foundation and strong ROIC Axalta ▪ Growth from new products, extended markets and Consolidated geographies ▪ Ongoing capital allocation focus, including incremental M&A PROPRIETARY 5

Thank you Investor Relations Contact: Chris Mecray Christopher.Mecray@axalta.com 215-255-7970