EXHIBIT 99.1

Published on November 4, 2019

Exhibit 99.1 Axalta Coating Systems Ltd. Investor Presentation Fourth Quarter 2019 Sensitivity: Business Internal

Legal Notices Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to our 2019 financial projections, which include net sales, net sales excluding FX, Adjusted EBIT, depreciation and amortization, Adjusted EBITDA, interest expense, tax rate, as adjusted, Adjusted EPS, free cash flow, capital expenditures, diluted shares outstanding, impacts from acquisitions and divestitures, FX impacts, pricing actions and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, our previously announced review of strategic alternatives, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2018 and in our Quarterly Report on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX, Adjusted Net Income, Adjusted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, Free Cash Flow, tax rate, as adjusted, Net Debt, Net Operating Profit After Tax (NOPAT), and Return on Invested Capital (ROIC). Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA, Adjusted EBIT and Adjusted EPS consist of EBITDA, EBIT and Diluted EPS, respectively, adjusted for (i) certain non-cash items included within net income, (ii) certain items Axalta does not believe are indicative of ongoing operating performance or (iii) certain nonrecurring, unusual or infrequent items that have not occurred within the last two years or we believe are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Adjusted net income shows the adjusted value of net income attributable to controlling interests after removing the items that are determined by management to be items that we do not consider indicative of our ongoing operating performance unusual or nonrecurring in nature. Our use of the terms net sales excluding FX, Adjusted Net Income, Adjusted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, Free Cash Flow, tax rate, as adjusted, Net Debt, NOPAT, and ROIC may differ from that of others in our industry. Net sales excluding FX, Adjusted Net Income, Adjusted EPS, EBITDA, Adjusted EBITDA , EBIT, Adjusted EBIT and Free Cash Flow should not be considered as alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, Adjusted Net Income, Adjusted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, Free Cash Flow, tax rate, as adjusted, Net Debt, NOPAT, and ROIC have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, Adjusted EPS, Adjusted EBITDA, Adjusted EBIT, Free Cash Flow or tax rate, as adjusted, on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our GAAP results. Constant Currency Constant currency or ex-FX percentages are calculated by excluding the change in average exchange rates between the current and comparable period by currency denomination exposure of the comparable period amount. Segment Financial Measures Our primary measure of segment operating performance, as determined in accordance with GAAP, is Adjusted EBIT, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. A reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not required. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. Rounding Due to rounding the tables presented may not foot. PROPRIETARY Sensitivity: Business Internal 2

Axalta’s Customer Focused Organization PERFORMANCE COATINGS TRANSPORTATION COATINGS SEGMENTS $3.0 Billion, 65% of Sales $1.7 Billion, 35% of Sales Refinish $1.8 B SALES BY END (37%) Industrial Light MARKET $1.2 B Vehicle (27%) $1.3 B (28%) Comml Vehicle $0.4 B (8%) ▪ Powder ▪ Heavy duty truck (HDT) and ▪ Automotive exteriors ▪ Independent body shops ▪ General Industrial utility trucks END ▪ Automotive interiors ▪ Multi-shop operators (MSOs) ▪ Wood ▪ Rail, bus, machinery ▪ Coatings for plastics and MARKETS ▪ Auto dealership groups ▪ Electrical equipment ▪ Recreational vehicles composite materials ▪ Coil and extruded metals ▪ Marine 1. Financials for FY 2018, as revised to reclassify other revenue into net sales for all historical periods PROPRIETARY Sensitivity: Business Internal 3

Axalta is Focused on Shareholder Value Creation Significant Progress… …with More to Come A Transformation Story Axalta’s Value Creation Model ▪ Cultural shift; incentive alignment ▪ Drive profitable growth with innovation, customer focus ✓ Performance-based long-term compensation and solid core market drivers ▪ Organizational restructuring tightens accountability ✓ Mid-single digit organic net sales growth target ✓ Matrix structure, Americas consolidation ▪ Operating excellence and cost structure refinement ▪ Refining focus on growth ✓ $200 million Axalta Way II target ✓ Net sales CAGR 3.9% 2013-18 ex-FX ▪ Capital allocation with shareholder value focus ▪ Substantial ongoing productivity improvement ✓ IRRs typically target 20% or better ✓ $200 million Axalta Way savings ▪ Substantial coatings consolidation opportunity ▪ M&A transactions change business mix ✓ Robust pipeline of bolt-on targets ✓ 21 deals finalized from 2016 through Q3 2019 Axalta Continues to Evolve and Leverage Structurally Attractive Coatings Markets PROPRIETARY Sensitivity: Business Internal 4

Axalta’s Global Presence 14,000 People 47 Västervik Manufacturing Sites Darlington Farnham Moscow West Bromwich Zuidland Minneapolis Hilliard Houthwaite Wuppertal Ajax Tewksbury Changchun Cornwall Mechelen Guntramsdorf Mt. Clemens Sacramento Montbrison Landshut Ft. Madison Bulle Istanbul Orrville Jacksonville Front Royal Gebze 47 High Point Qingpu Riverside Houston Huntsville Jiading Customer Training Monterrey Savli Taipei Facilities Ocoyoacac Tlalnepantla Amatitlan Bangplee Kuala Lumpur Cartagena de Indias Cikarang Shah Alam 4 Technology Centers Guarulhos Port Elizabeth Buenos Aires Over 130 Countries We Sell Into Manufacturing Sites PROPRIETARY 5 Sensitivity: Business Internal 5

Why Invest in Axalta Today? Strong Free Focused End- Consolidation ROIC Growth Significant Axalta Way Cash Flow Markets, Opportunity with Focus, China Growth Driving Generation and Structural Proven M&A Shareholder Opportunity Productivity Allocation Volume Growth Strategy Value Alignment Process PROPRIETARY Sensitivity: Business Internal 6

We are Focused on Structurally Attractive Coatings End-Markets A $160 Billion Global Coatings Market Axalta’s Coatings Markets Coatings Industry Sales Coatings Industry Sales ($ Billions) Other Coil, Transportation, 2% Auto OEM Interior, Packaging, 3% 2% 1% CAGR 4.6% Marine, 3% Auto OEM, 5% Refinish, 5% 5.6% 44.5 Wood, 6% Decorative, 44% Industrial 35.8 Powder, 6% 4.1% Commercial Vehicle 2.9 3.4 1.2% Light Vehicle 9.0 9.4 IM and PC, 8% 3.6% General Industrial, Refinish 7.8 9.0 11% _____________________ _____________________ 2016A 2020E Source: Orr & Boss (2019) Source: Orr & Boss (2019) Long Term Alignment With Global Growth PROPRIETARY Sensitivity: Business Internal 7

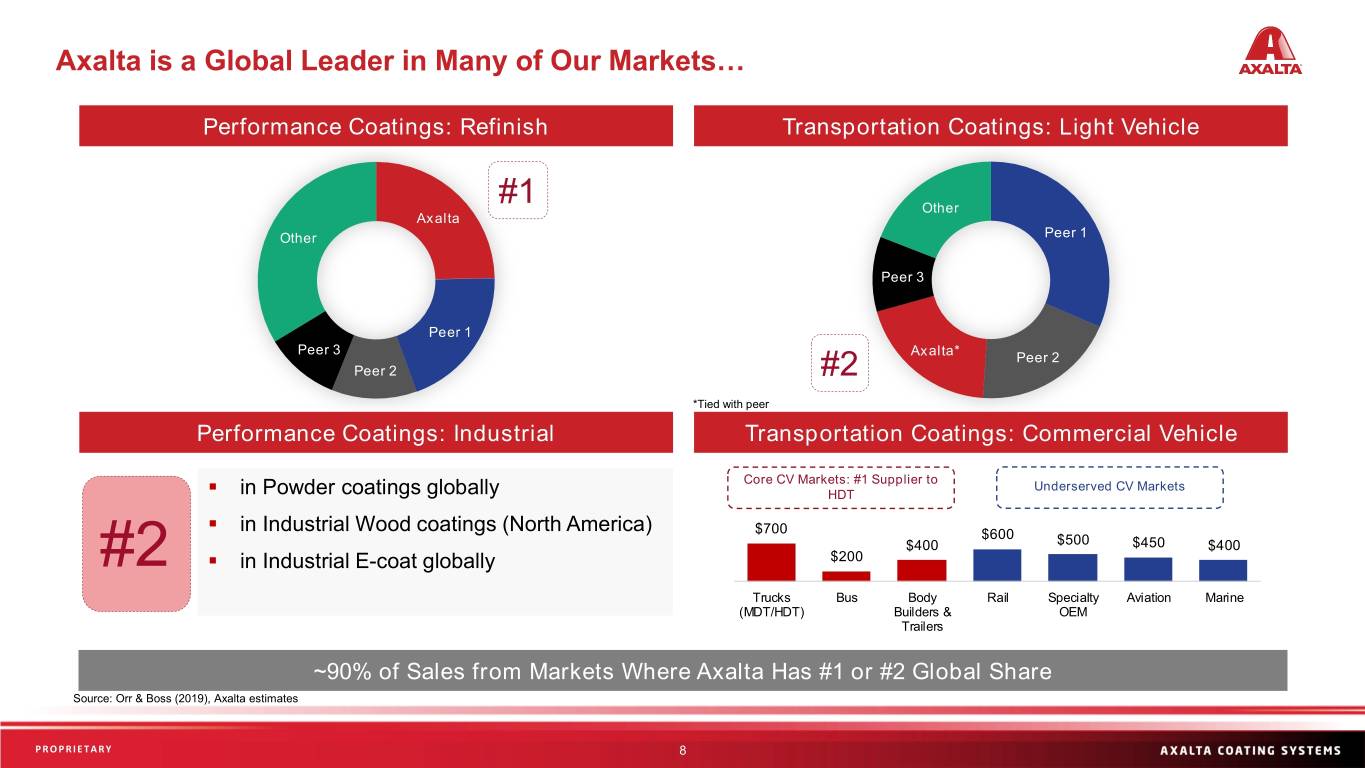

Axalta is a Global Leader in Many of Our Markets… Performance Coatings: Refinish Transportation Coatings: Light Vehicle #1 Other Axalta Other Peer 1 Peer 3 Peer 1 Peer 3 Axalta* Peer 2 Peer 2 #2 *Tied with peer Performance Coatings: Industrial Transportation Coatings: Commercial Vehicle Core CV Markets: #1 Supplier to Underserved CV Markets ▪ in Powder coatings globally HDT ▪ in Industrial Wood coatings (North America) $700 $600 $400 $500 $450 $400 #2 ▪ in Industrial E-coat globally $200 Trucks Bus Body Rail Specialty Aviation Marine (MDT/HDT) Builders & OEM Trailers ~90% of Sales from Markets Where Axalta Has #1 or #2 Global Share Source: Orr & Boss (2019), Axalta estimates PROPRIETARY Sensitivity: Business Internal 8

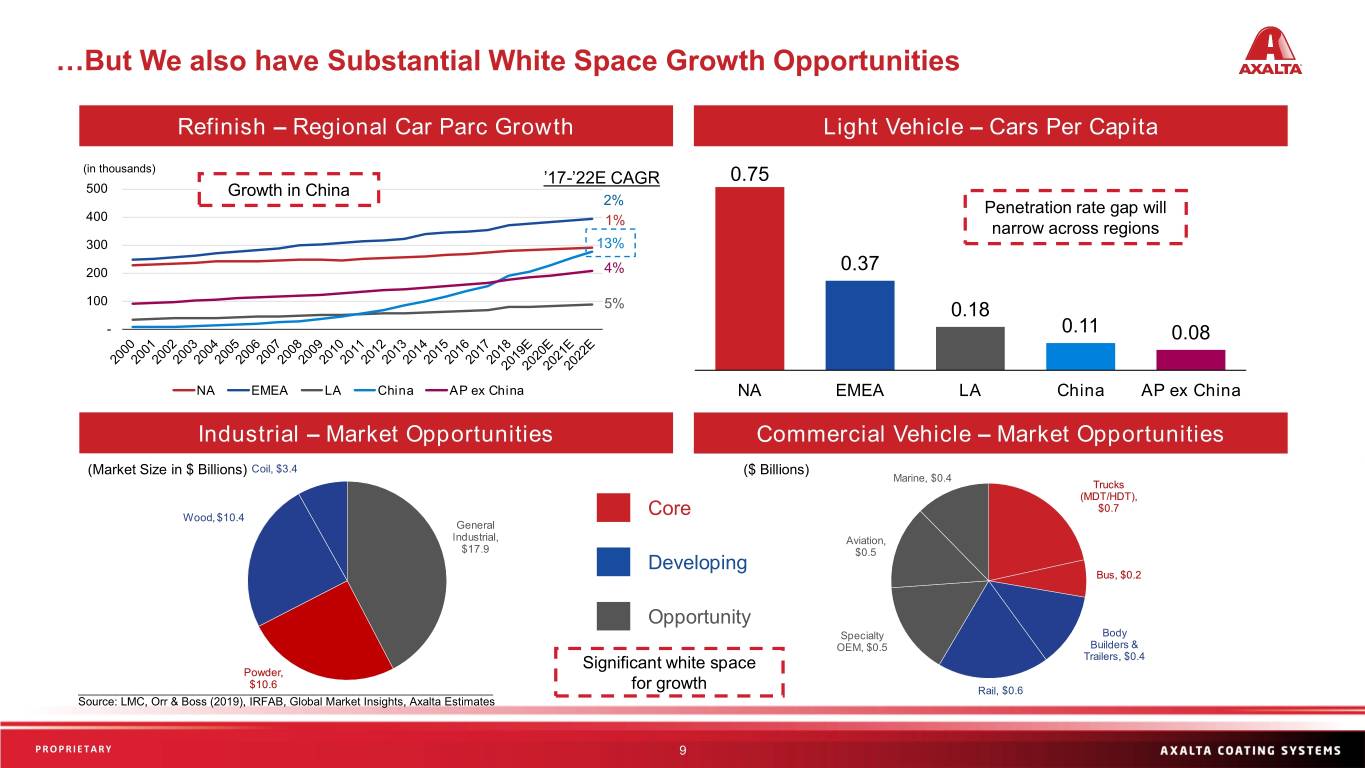

…But We also have Substantial White Space Growth Opportunities Refinish – Regional Car Parc Growth Light Vehicle – Cars Per Capita (in thousands) ’17-’22E CAGR 0.75 500 Growth in China 2% Penetration rate gap will 400 1% narrow across regions 300 13% 200 4% 0.37 100 5% 0.18 - 0.11 0.08 NA EMEA LA China AP ex China NA EMEA LA China AP ex China Industrial – Market Opportunities Commercial Vehicle – Market Opportunities (Market Size in $ Billions) Coil, $3.4 ($ Billions) Marine, $0.4 Trucks (MDT/HDT), $0.7 Wood, $10.4 Core General Industrial, Aviation, $17.9 $0.5 Developing Bus, $0.2 Opportunity Specialty Body OEM, $0.5 Builders & Significant white space Trailers, $0.4 Powder, $10.6 _________________________________________________________________ for growth Rail, $0.6 Source: LMC, Orr & Boss (2019), IRFAB, Global Market Insights, Axalta Estimates PROPRIETARY Sensitivity: Business Internal 9

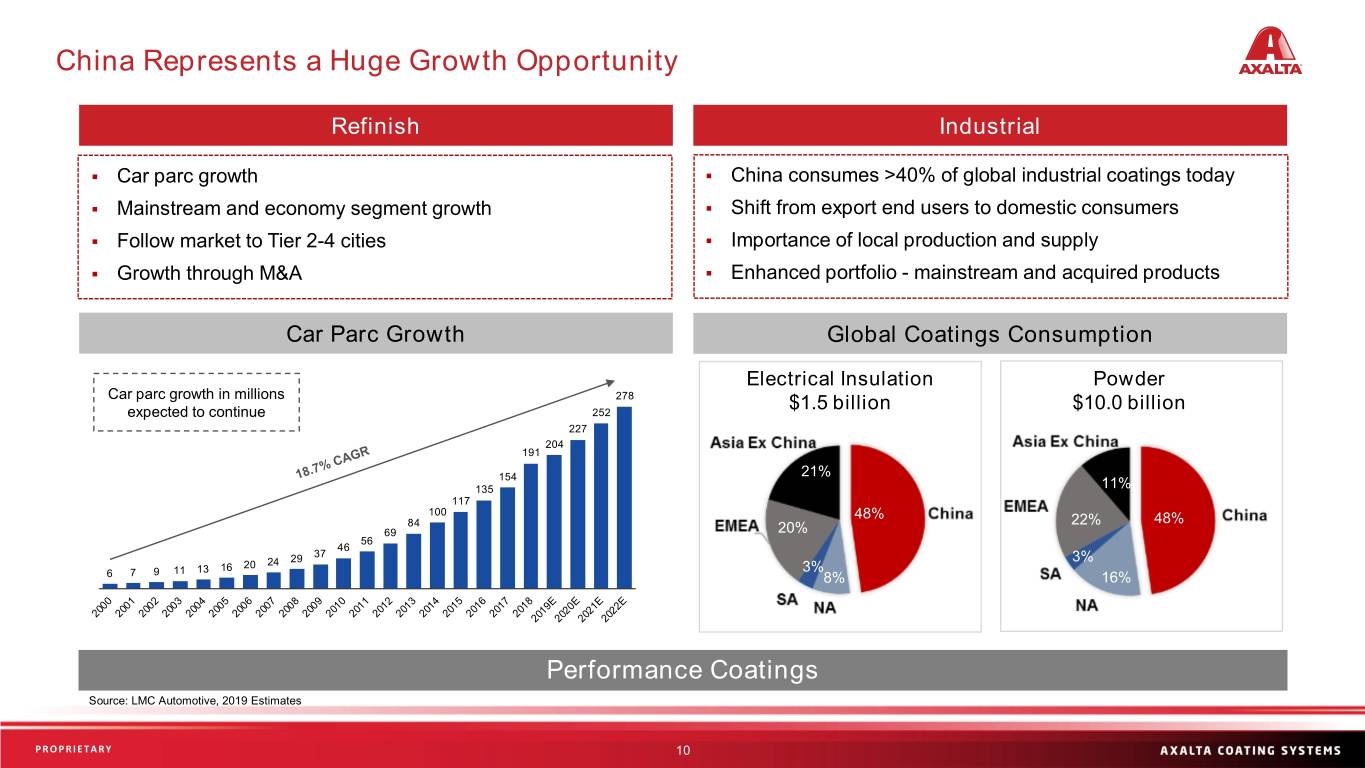

China Represents a Huge Growth Opportunity Refinish Industrial ▪ Car parc growth ▪ China consumes >40% of global industrial coatings today ▪ Mainstream and economy segment growth ▪ Shift from export end users to domestic consumers ▪ Follow market to Tier 2-4 cities ▪ Importance of local production and supply ▪ Growth through M&A ▪ Enhanced portfolio - mainstream and acquired products Car Parc Growth Global Coatings Consumption Electrical Insulation Powder Car parc growth in millions 278 $1.5 billion $10.0 billion expected to continue 252 227 204 191 154 21% 135 11% 117 100 48% 84 22% 48% 69 20% 56 46 37 24 29 3% 13 16 20 3% 6 7 9 11 8% 16% Performance Coatings Source: LMC Automotive, 2019 Estimates PROPRIETARY Sensitivity: Business Internal 10

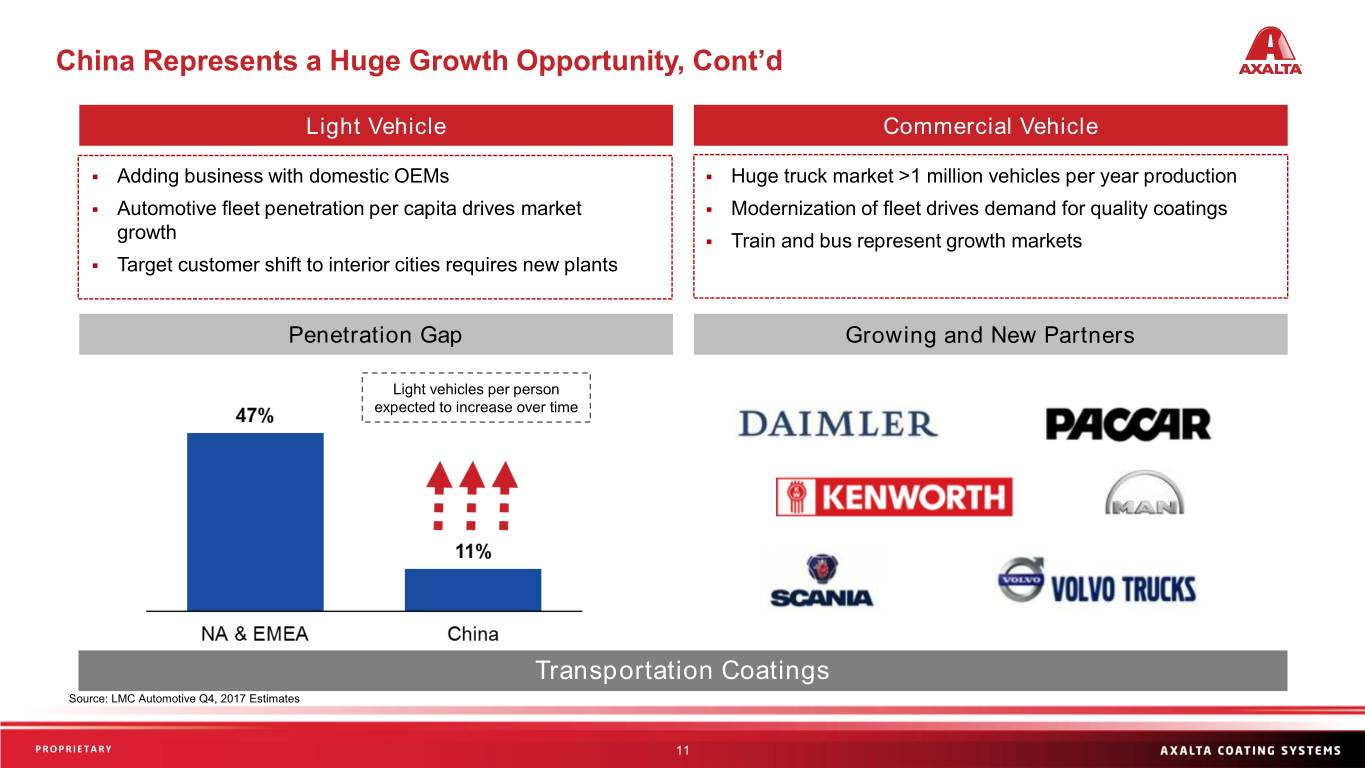

China Represents a Huge Growth Opportunity, Cont’d Light Vehicle Commercial Vehicle ▪ Adding business with domestic OEMs ▪ Huge truck market >1 million vehicles per year production ▪ Automotive fleet penetration per capita drives market ▪ Modernization of fleet drives demand for quality coatings growth ▪ Train and bus represent growth markets ▪ Target customer shift to interior cities requires new plants Penetration Gap Growing and New Partners Light vehicles per person expected to increase over time Transportation Coatings Source: LMC Automotive Q4, 2017 Estimates PROPRIETARY Sensitivity: Business Internal 11

Focus on Operating Excellence, Axalta Way Savings Continue with Phase II ▪ Achieved Phase I $200 million target achieved Axalta Way II ▪ Axalta Way II target: $200 million from 2018 through 2021 Axalta Operating ▪ Lean implementation in Wuppertal, Germany and Mt. Clemens, MI Excellence (AOE) ▪ Global rollout to drive substantial productivity improvement over time ▪ ~$190 million annual innovation investment (~4% of net sales) Innovation Investment ▪ >250 new products per year drive our organic growth ▪ New tools to manage customer relationships Salesforce Investment ▪ New leadership aligned key incentives to results ▪ S4 Hana project to globally align financial and supply chain systems Enhanced IT Tools ▪ Large majority of our Enterprise Data is now stored in the cloud Axalta Continues to Focus on Organizational Optimization PROPRIETARY Sensitivity: Business Internal 12

M&A: Leveraging a Consolidating Coatings Sector Target End-Market Geography Closed Company Overview Leading manufacturer/distributor of refinish and DuWest Performance Coatings Refinish Latin America 2015 architectural coating products in Central America North America Ohio-based refinish manufacturer focused on ChemSpec North America Refinish 2015 mainstream and economy market segments Producer of refinish coatings in Malaysia and High Performance Coatings Refinish Asia Pacific 2016 Indonesia United Paint (division) Light Vehicle North America 2016 Automotive interior coatings with strong position with North American OEM’s Dura Coat Products Industrial North America 2016 Leading independent supplier of coil coatings Ellis Paint Company Industrial North America 2017 Leading independent supplier of industrial paint Century Industrial Coatings Industrial North America 2017 Leading supplier of custom industrial coatings Industrial Wood Coatings Industrial North America 2017 Leading supplier of industrial wood coatings Leading supplier of industrial liquid coatings for Spencer Coatings Group Industrial EMEA 2017 drums/towers, ACE, pipelines, flooring & architectural Plascoat Systems Limited Industrial EMEA 2017 Leading supplier of thermoplastic coatings 21 deals finalized from 2016 through Q3 2019 PROPRIETARY Sensitivity: Business Internal 13

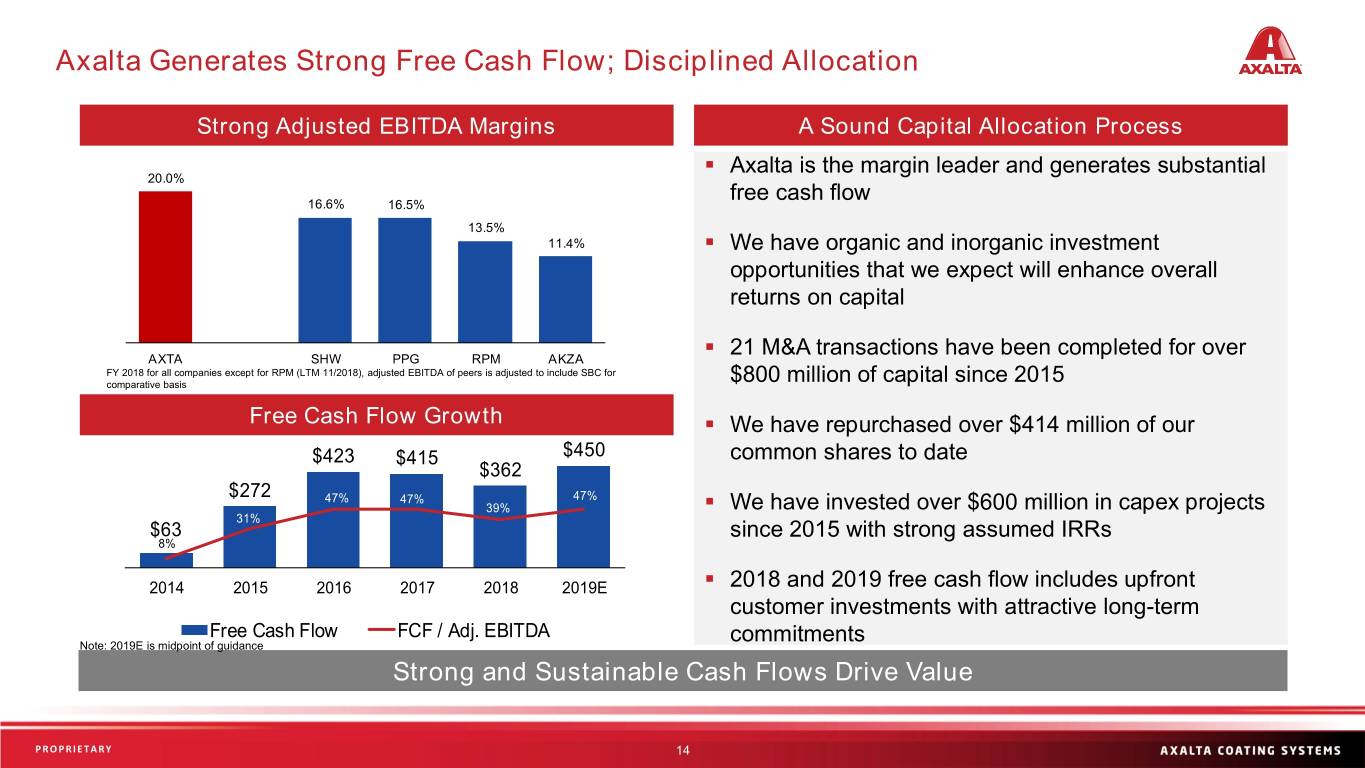

Axalta Generates Strong Free Cash Flow; Disciplined Allocation Strong Adjusted EBITDA Margins A Sound Capital Allocation Process ▪ Axalta is the margin leader and generates substantial 20.0% free cash flow 16.6% 16.5% 13.5% 11.4% ▪ We have organic and inorganic investment opportunities that we expect will enhance overall returns on capital ▪ 21 M&A transactions have been completed for over AXTA SHW PPG RPM AKZA FY 2018 for all companies except for RPM (LTM 11/2018), adjusted EBITDA of peers is adjusted to include SBC for comparative basis $800 million of capital since 2015 Free Cash Flow Growth ▪ We have repurchased over $414 million of our 100% $500 $423 $450 common shares to date $415 80% $400 $362 60% $300 $272 47% 47% 47% 39% ▪ We have invested over $600 million in capex projects 31% 40% $200 $63 since 2015 with strong assumed IRRs $100 8% 20% $0 0% 2014 2015 2016 2017 2018 2019E ▪ 2018 and 2019 free cash flow includes upfront customer investments with attractive long-term Free Cash Flow FCF / Adj. EBITDA commitments Note: 2019E is midpoint of guidance Strong and Sustainable Cash Flows Drive Value PROPRIETARY Sensitivity: Business Internal 14

Axalta is Squarely Focused on Shareholder Value Creation Growth Productivity ▪ Technology and innovation ▪ Axalta Way II drivers ▪ Axalta Operating Excellence ▪ Evolution of culture and (AOE) rollout incentives ▪ Inflation offset as starting point ▪ Clear strategies by end-market with accountability Shareholder Value Creation Capital M&A Allocation ▪ Coatings consolidation opportunity continues ▪ Target increased return on ▪ Strong track record to date invested capital (ROIC) ▪ Bolt-on deals minimize risk, ▪ At least 50% of FCF deployed to maximize returns M&A over time ▪ Add products, technology, market ▪ Share buyback opportunistically access ▪ Returns enhanced by synergies PROPRIETARY Sensitivity: Business Internal 15

Sustainability at Axalta Environment Social Governance ▪ Environment, Health & Safety policies well ▪ Supply chain initiatives including Supplier Code ▪ Environment, Health, Safety & Sustainability defined of Conduct and Supplier Sustainability Risk Committee of the Board Management Program ▪ Responsible Care® RC (ISO) 14001 certification ▪ Created sustainability function and team ▪ Enhancing product stewardship systems ▪ Next generation health & safety training ▪ Material issues and goal setting introduced ▪ Employee engagement ▪ Ethics & integrity compliance program ✓ Development and recruitment programs ▪ Production localization strategy reduces risk, cost and environmental impact ✓ Communications with Inside Axalta ▪ Cybersecurity initiatives intranet ▪ Bi-annual sustainability reporting cycle ▪ Targeting reduced environmental impact across ✓ Volunteerism supported multiple categories with specific goals in place ✓ Employee diversity supported with ▪ Engage OEM procurement sustainability teams ▪ Product sustainability benefits from low-to-no Axalta Women’s Network VOC or HAPs formulations and from new application technologies ▪ Corporate social responsibility programs ✓ STEM education ✓ Environmental stewardship PROPRIETARY Sensitivity: Business Internal 16

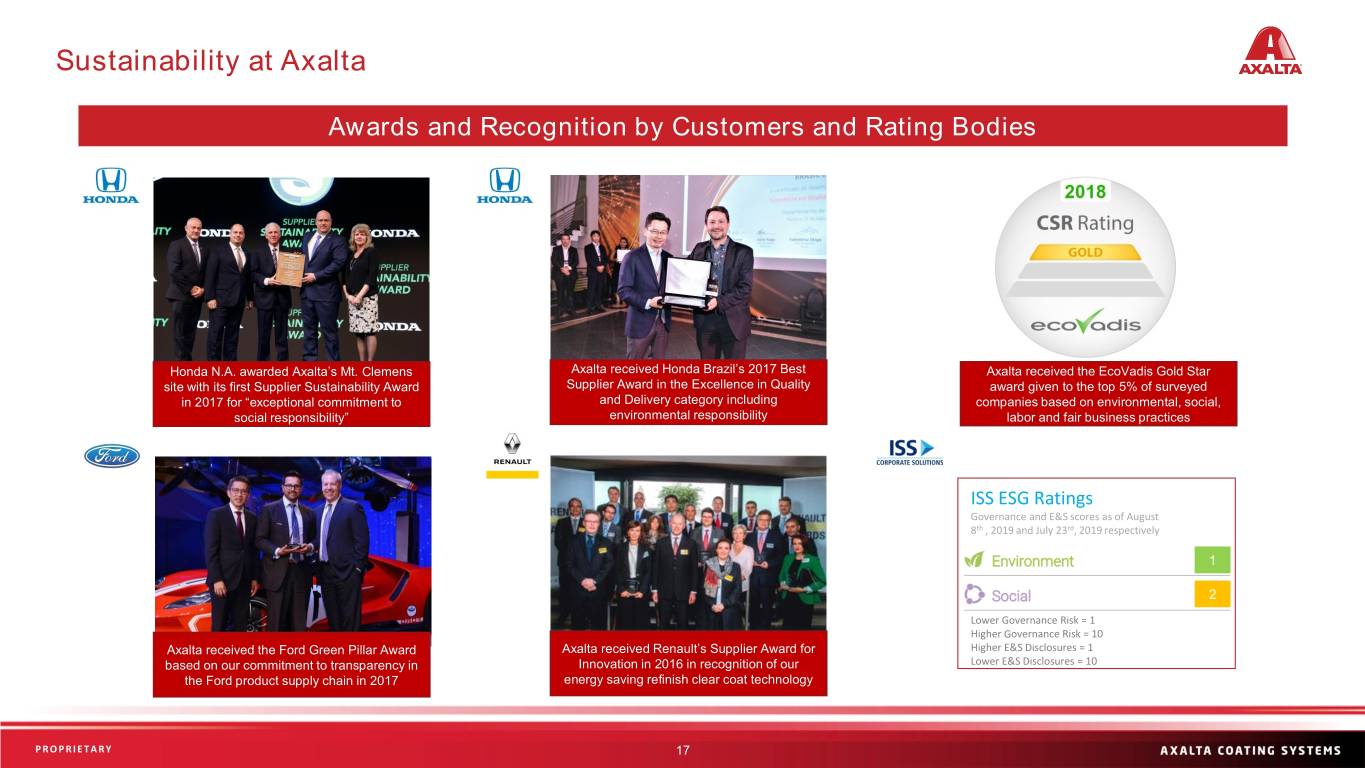

Sustainability at Axalta Awards and Recognition by Customers and Rating Bodies Honda N.A. awarded Axalta’s Mt. Clemens Axalta received Honda Brazil’s 2017 Best Axalta received the EcoVadis Gold Star site with its first Supplier Sustainability Award Supplier Award in the Excellence in Quality award given to the top 5% of surveyed in 2017 for “exceptional commitment to and Delivery category including companies based on environmental, social, social responsibility” environmental responsibility labor and fair business practices ISS ESG Ratings Governance and E&S scores as of August 8th , 2019 and July 23rd, 2019 respectively 1 2 Lower Governance Risk = 1 Higher Governance Risk = 10 Axalta received the Ford Green Pillar Award Axalta received Renault’s Supplier Award for Higher E&S Disclosures = 1 based on our commitment to transparency in Innovation in 2016 in recognition of our Lower E&S Disclosures = 10 the Ford product supply chain in 2017 energy saving refinish clear coat technology PROPRIETARY Sensitivity: Business Internal 17

Key Goals for 2019 Key Objectives for Growth and Value Creation Outgrow Our End-Markets ▪ Continued organic net sales growth Axalta Way II Execution ▪ Ongoing savings from optimizing our organization Incremental Cost Actions ▪ Closing any price-cost gap with focused actions Drive Product Innovation ▪ Over 250 new product launches Disciplined Capital ▪ M&A, share buybacks, ongoing internal projects Allocation Axalta’s To maximize our customers’ productivity and product functionality by Vision offering them innovative coatings solutions and best-of-class service PROPRIETARY Sensitivity: Business Internal 18

Financial Overview Sensitivity: Business Internal

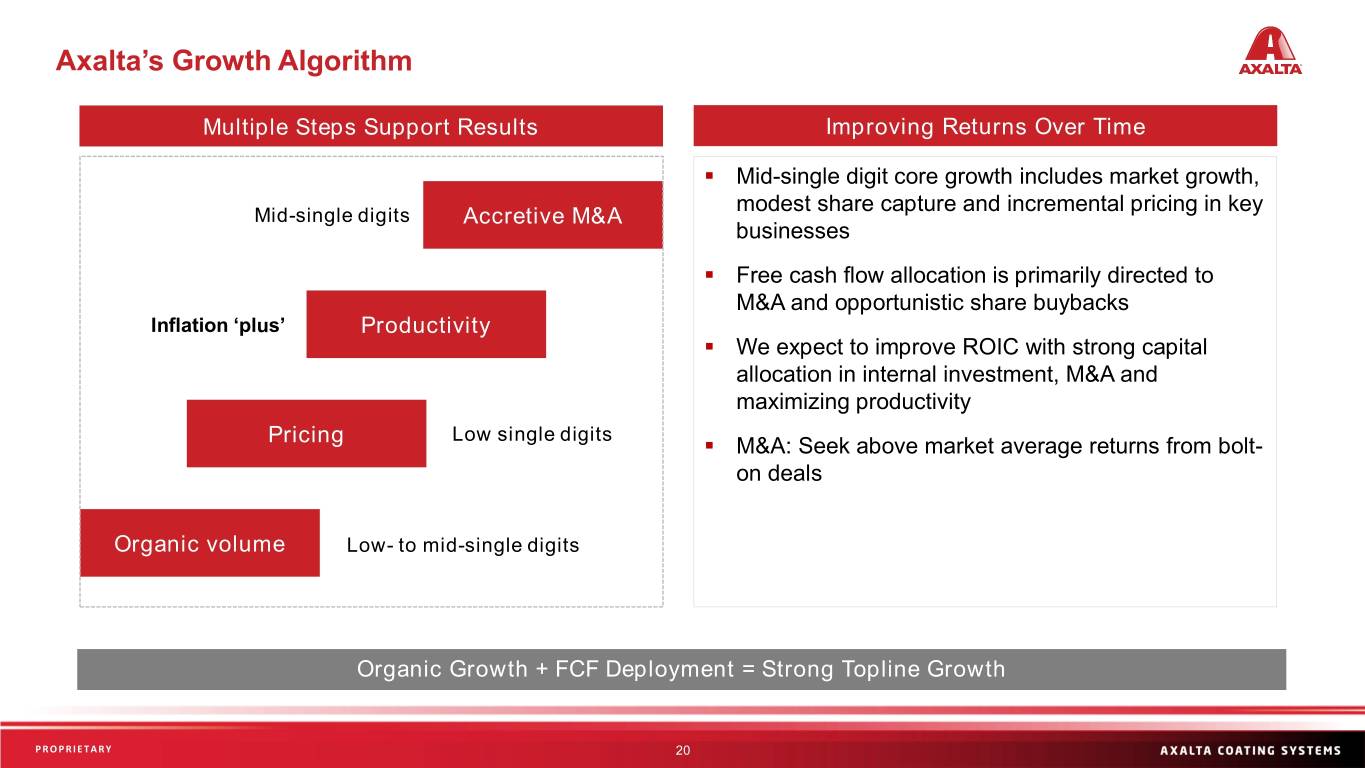

Axalta’s Growth Algorithm Multiple Steps Support Results Improving Returns Over Time ▪ Mid-single digit core growth includes market growth, modest share capture and incremental pricing in key Mid-single digits Accretive M&A businesses ▪ Free cash flow allocation is primarily directed to M&A and opportunistic share buybacks Inflation ‘plus’ Productivity ▪ We expect to improve ROIC with strong capital allocation in internal investment, M&A and maximizing productivity Low single digits Pricing ▪ M&A: Seek above market average returns from bolt- on deals Organic volume Low- to mid-single digits Organic Growth + FCF Deployment = Strong Topline Growth PROPRIETARY Sensitivity: Business Internal 20

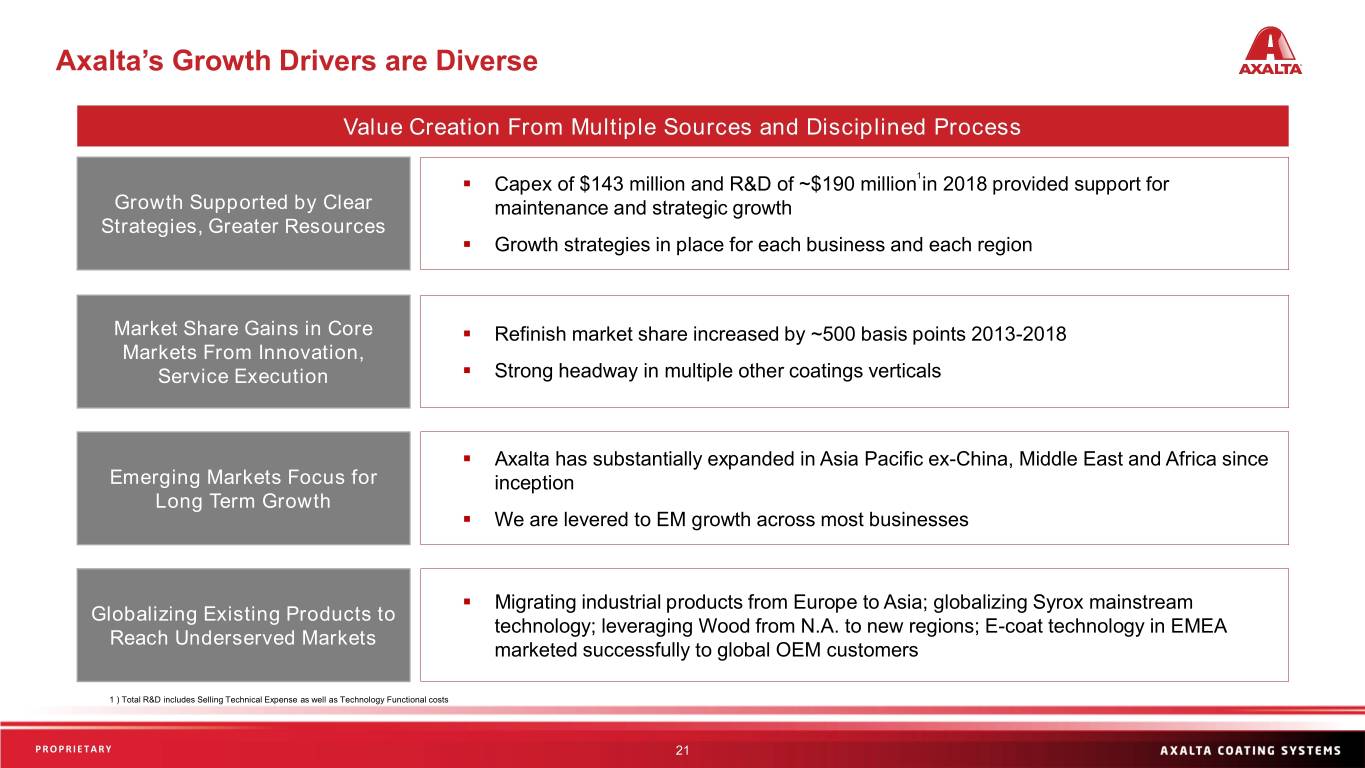

Axalta’s Growth Drivers are Diverse Value Creation From Multiple Sources and Disciplined Process ▪ Capex of $143 million and R&D of ~$190 million1 in 2018 provided support for Growth Supported by Clear maintenance and strategic growth Strategies, Greater Resources ▪ Growth strategies in place for each business and each region Market Share Gains in Core ▪ Refinish market share increased by ~500 basis points 2013-2018 Markets From Innovation, Service Execution ▪ Strong headway in multiple other coatings verticals ▪ Axalta has substantially expanded in Asia Pacific ex-China, Middle East and Africa since Emerging Markets Focus for inception Long Term Growth ▪ We are levered to EM growth across most businesses ▪ Migrating industrial products from Europe to Asia; globalizing Syrox mainstream Globalizing Existing Products to technology; leveraging Wood from N.A. to new regions; E-coat technology in EMEA Reach Underserved Markets marketed successfully to global OEM customers 1 ) Total R&D includes Selling Technical Expense as well as Technology Functional costs PROPRIETARY Sensitivity: Business Internal 21

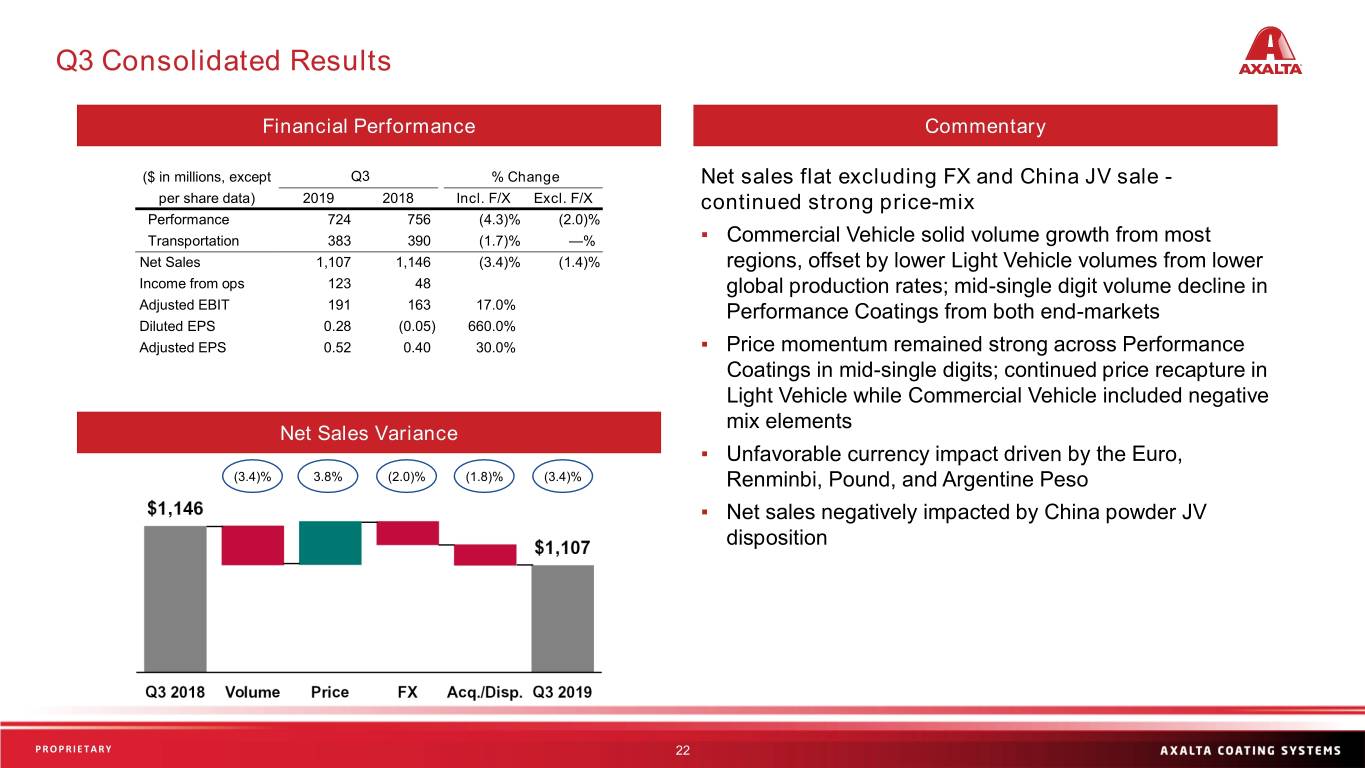

Q3 Consolidated Results Financial Performance Commentary ($ in millions, except Q3 % Change Net sales flat excluding FX and China JV sale - per share data) 2019 2018 Incl. F/X Excl. F/X continued strong price-mix Performance 724 756 (4.3)% (2.0)% Transportation 383 390 (1.7)% —% ▪ Commercial Vehicle solid volume growth from most Net Sales 1,107 1,146 (3.4)% (1.4)% regions, offset by lower Light Vehicle volumes from lower Income from ops 123 48 global production rates; mid-single digit volume decline in Adjusted EBIT 191 163 17.0% Performance Coatings from both end-markets Diluted EPS 0.28 (0.05) 660.0% Adjusted EPS 0.52 0.40 30.0% ▪ Price momentum remained strong across Performance Coatings in mid-single digits; continued price recapture in Light Vehicle while Commercial Vehicle included negative mix elements Net Sales Variance ▪ Unfavorable currency impact driven by the Euro, (3.4)% 3.8% (2.0)% (1.8)% (3.4)% Renminbi, Pound, and Argentine Peso ▪ Net sales negatively impacted by China powder JV disposition PROPRIETARY Sensitivity: Business Internal 22

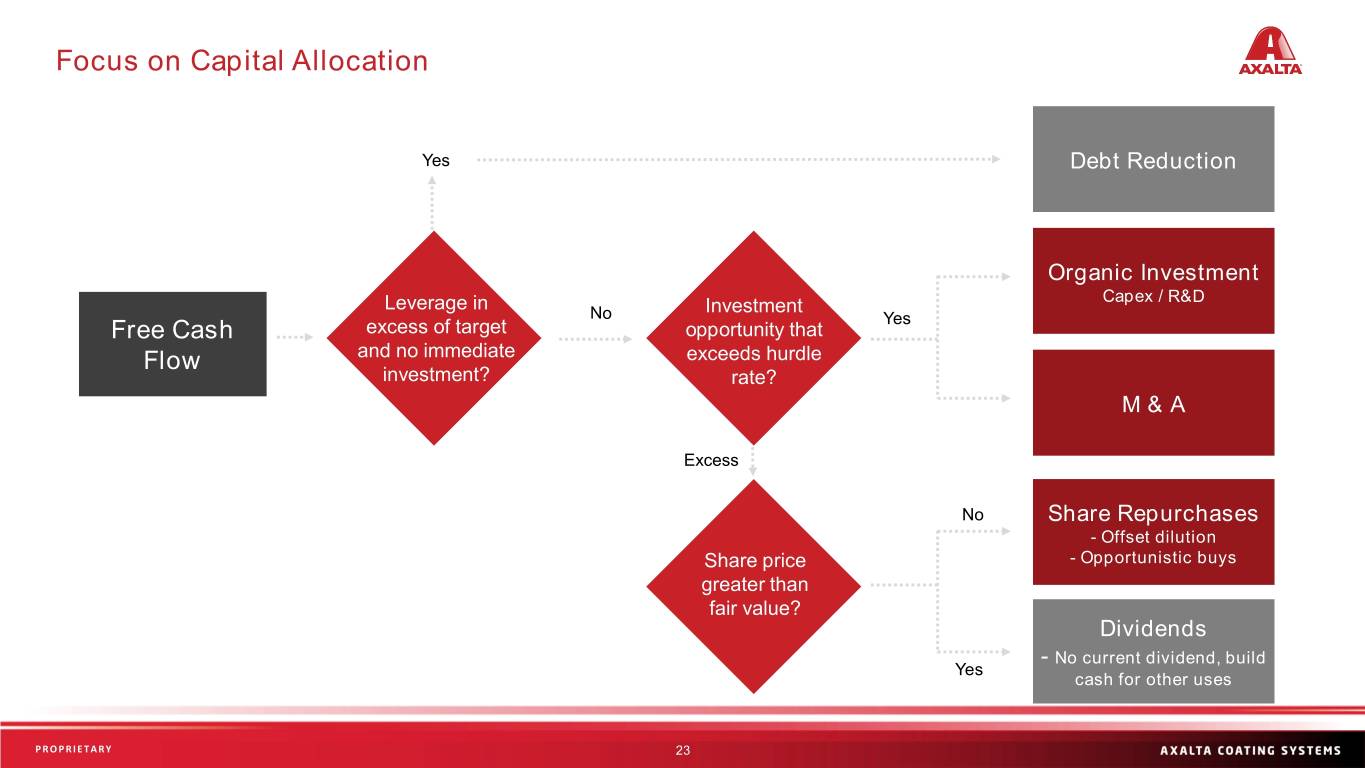

Focus on Capital Allocation Yes Debt Reduction Organic Investment Capex / R&D Leverage in Investment Capex / R&D No Yes Free Cash excess of target opportunity that Flow and no immediate exceeds hurdle investment? rate? M & A Excess No Share Repurchases - Offset dilution Share price - Opportunistic buys greater than fair value? Dividends - No current dividend, build Yes cash for other uses PROPRIETARY Sensitivity: Business Internal 23

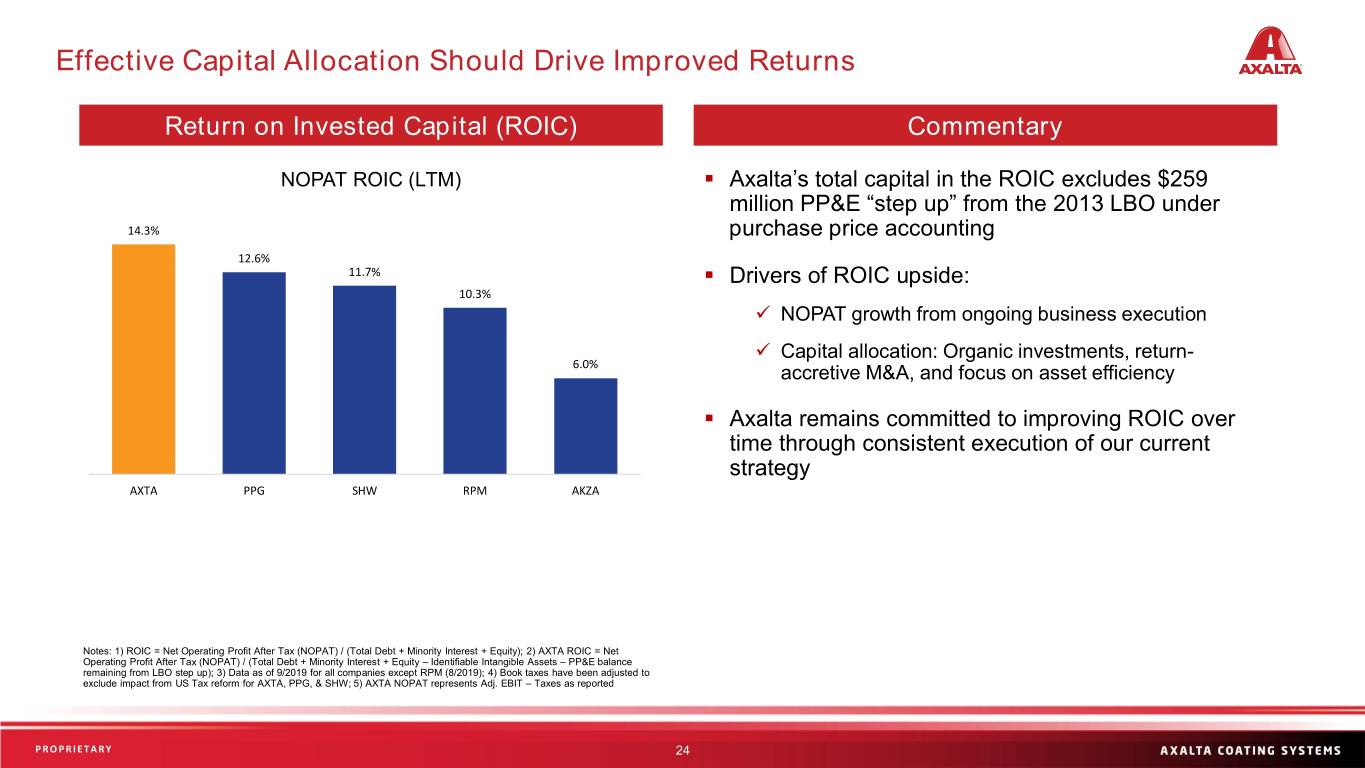

Effective Capital Allocation Should Drive Improved Returns Return on Invested Capital (ROIC) Commentary NOPAT ROIC (LTM) ▪ Axalta’s total capital in the ROIC excludes $259 million PP&E “step up” from the 2013 LBO under 14.3% purchase price accounting 12.6% 11.7% ▪ Drivers of ROIC upside: 10.3% ✓ NOPAT growth from ongoing business execution ✓ Capital allocation: Organic investments, return- 6.0% accretive M&A, and focus on asset efficiency ▪ Axalta remains committed to improving ROIC over time through consistent execution of our current strategy AXTA PPG SHW RPM AKZA Notes: 1) ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Minority Interest + Equity); 2) AXTA ROIC = Net Operating Profit After Tax (NOPAT) / (Total Debt + Minority Interest + Equity – Identifiable Intangible Assets – PP&E balance remaining from LBO step up); 3) Data as of 9/2019 for all companies except RPM (8/2019); 4) Book taxes have been adjusted to exclude impact from US Tax reform for AXTA, PPG, & SHW; 5) AXTA NOPAT represents Adj. EBIT – Taxes as reported PROPRIETARY Sensitivity: Business Internal 24

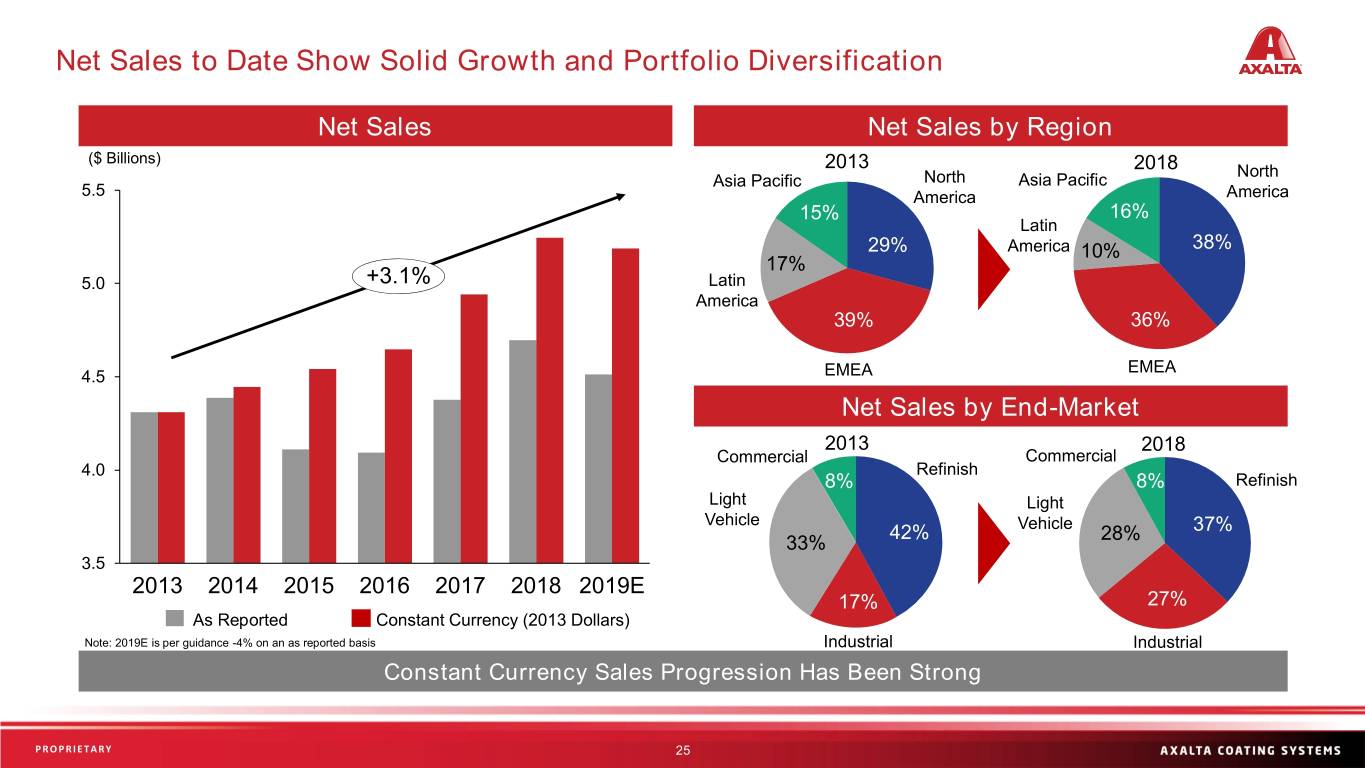

Net Sales to Date Show Solid Growth and Portfolio Diversification Net Sales Net Sales by Region ($ Billions) 2013 2018 North Asia Pacific North Asia Pacific 5.5 America America 15% 16% Latin 29% America 10% 38% 17% 5.0 +3.1% Latin America 39% 36% EMEA 4.5 EMEA Net Sales by End-Market 2013 2018 Commercial Commercial 4.0 Refinish 8% 8% Refinish Light Light Vehicle 42% Vehicle 37% 33% 28% 3.5 2013 2014 2015 2016 2017 2018 2019E 17% 27% As Reported Constant Currency (2013 Dollars) Note: 2019E is per guidance -4% on an as reported basis Industrial Industrial Constant Currency Sales Progression Has Been Strong PROPRIETARY Sensitivity: Business Internal 25

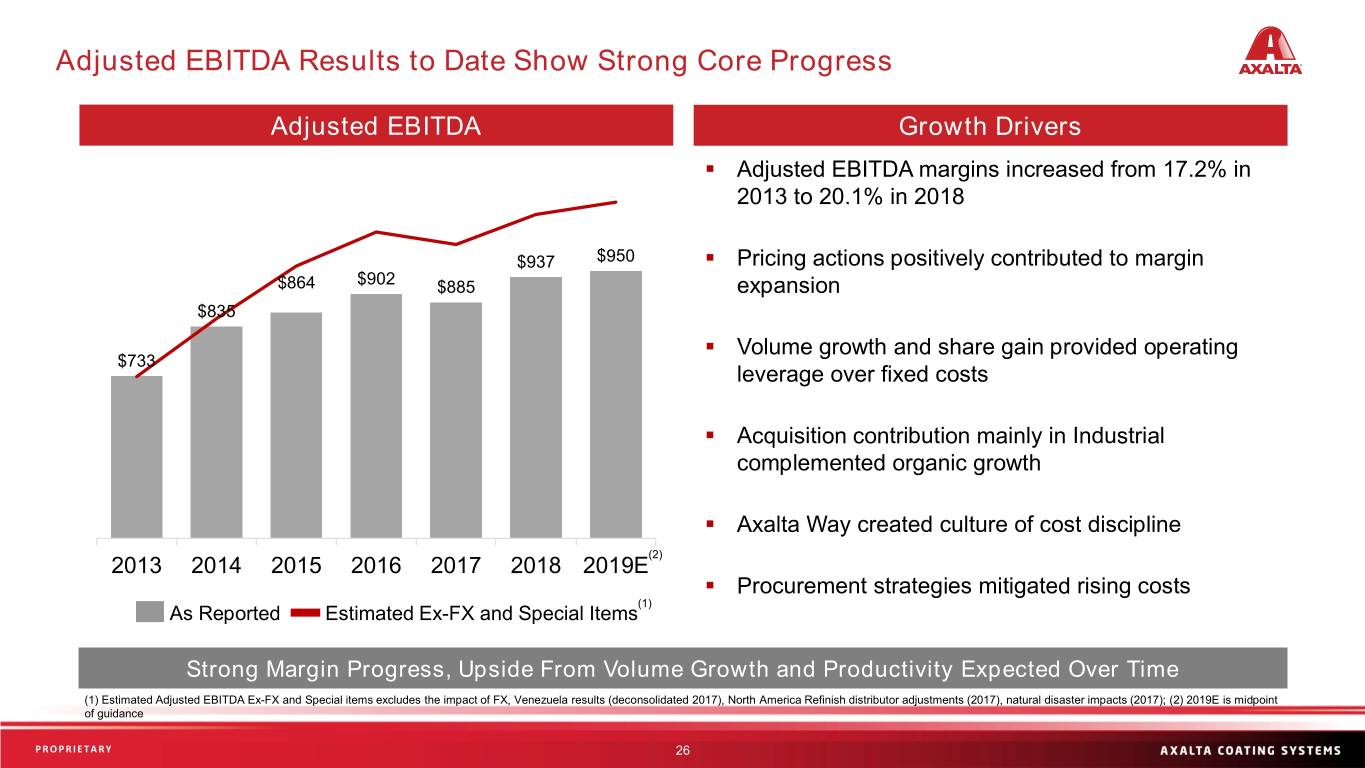

Adjusted EBITDA Results to Date Show Strong Core Progress Adjusted EBITDA Growth Drivers ▪ Adjusted EBITDA margins increased from 17.2% in 2013 to 20.1% in 2018 $937 $950 ▪ Pricing actions positively contributed to margin $864 $902 $885 expansion $835 ▪ Volume growth and share gain provided operating $733 leverage over fixed costs ▪ Acquisition contribution mainly in Industrial complemented organic growth ▪ Axalta Way created culture of cost discipline (2) 2013 2014 2015 2016 2017 2018 2019E ▪ Procurement strategies mitigated rising costs (1) As Reported Estimated Ex-FX and Special Items Strong Margin Progress, Upside From Volume Growth and Productivity Expected Over Time (1) Estimated Adjusted EBITDA Ex-FX and Special items excludes the impact of FX, Venezuela results (deconsolidated 2017), North America Refinish distributor adjustments (2017), natural disaster impacts (2017); (2) 2019E is midpoint of guidance PROPRIETARY Sensitivity: Business Internal 26

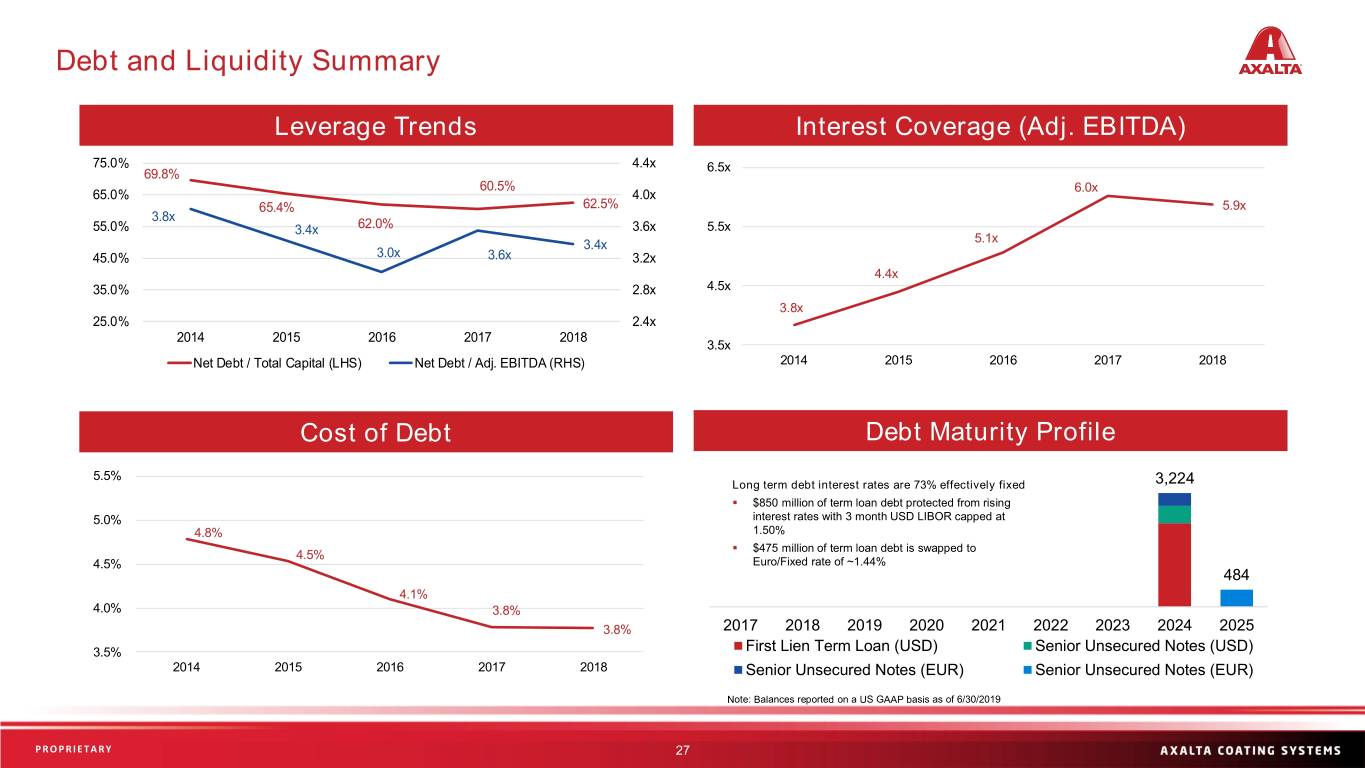

Debt and Liquidity Summary Leverage Trends Interest Coverage (Adj. EBITDA) 75.0% 4.4x 6.5x 69.8% 60.5% 6.0x 65.0% 4.0x 65.4% 62.5% 5.9x 3.8x 55.0% 3.4x 62.0% 3.6x 5.5x 3.4x 5.1x 45.0% 3.0x 3.6x 3.2x 4.4x 35.0% 2.8x 4.5x 3.8x 25.0% 2.4x 2014 2015 2016 2017 2018 3.5x Net Debt / Total Capital (LHS) Net Debt / Adj. EBITDA (RHS) 2014 2015 2016 2017 2018 Cost of Debt Debt Maturity Profile 5.5% Long term debt interest rates are 73% effectively fixed 3,224 ▪ $850 million of term loan debt protected from rising 5.0% interest rates with 3 month USD LIBOR capped at 4.8% 1.50% ▪ $475 million of term loan debt is swapped to 4.5% 4.5% Euro/Fixed rate of ~1.44% 484 4.1% 4.0% 3.8% 3.8% 2017 2018 2019 2020 2021 2022 2023 2024 2025 3.5% First Lien Term Loan (USD) Senior Unsecured Notes (USD) 2014 2015 2016 2017 2018 Senior Unsecured Notes (EUR) Senior Unsecured Notes (EUR) Note: Balances reported on a US GAAP basis as of 6/30/2019 PROPRIETARY Sensitivity: Business Internal 27

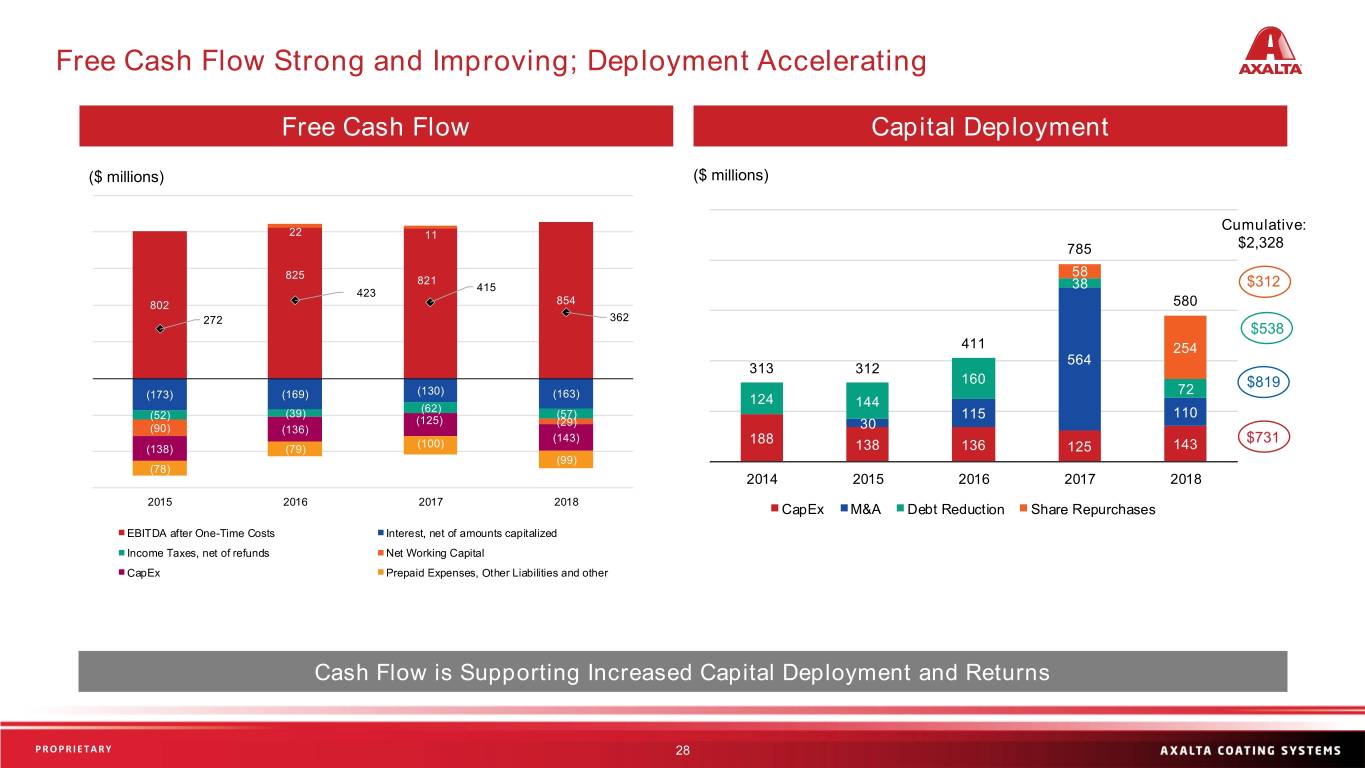

Free Cash Flow Strong and Improving; Deployment Accelerating Free Cash Flow Capital Deployment ($ millions) ($ millions) Cumulative: 22 11 785 $2,328 58 825 821 415 38 $312 423 802 854 580 272 362 $538 411 254 564 313 312 160 $819 (130) 72 (173) (169) (163) 124 (62) 144 (52) (39) (57) 115 110 (125) (29) (90) (136) 30 (143) (100) 188 $731 (138) (79) 138 136 125 143 (99) (78) 2014 2015 2016 2017 2018 2015 2016 2017 2018 CapEx M&A Debt Reduction Share Repurchases EBITDA after One-Time Costs Interest, net of amounts capitalized Income Taxes, net of refunds Net Working Capital CapEx Prepaid Expenses, Other Liabilities and other Cash Flow is Supporting Increased Capital Deployment and Returns PROPRIETARY Sensitivity: Business Internal 28

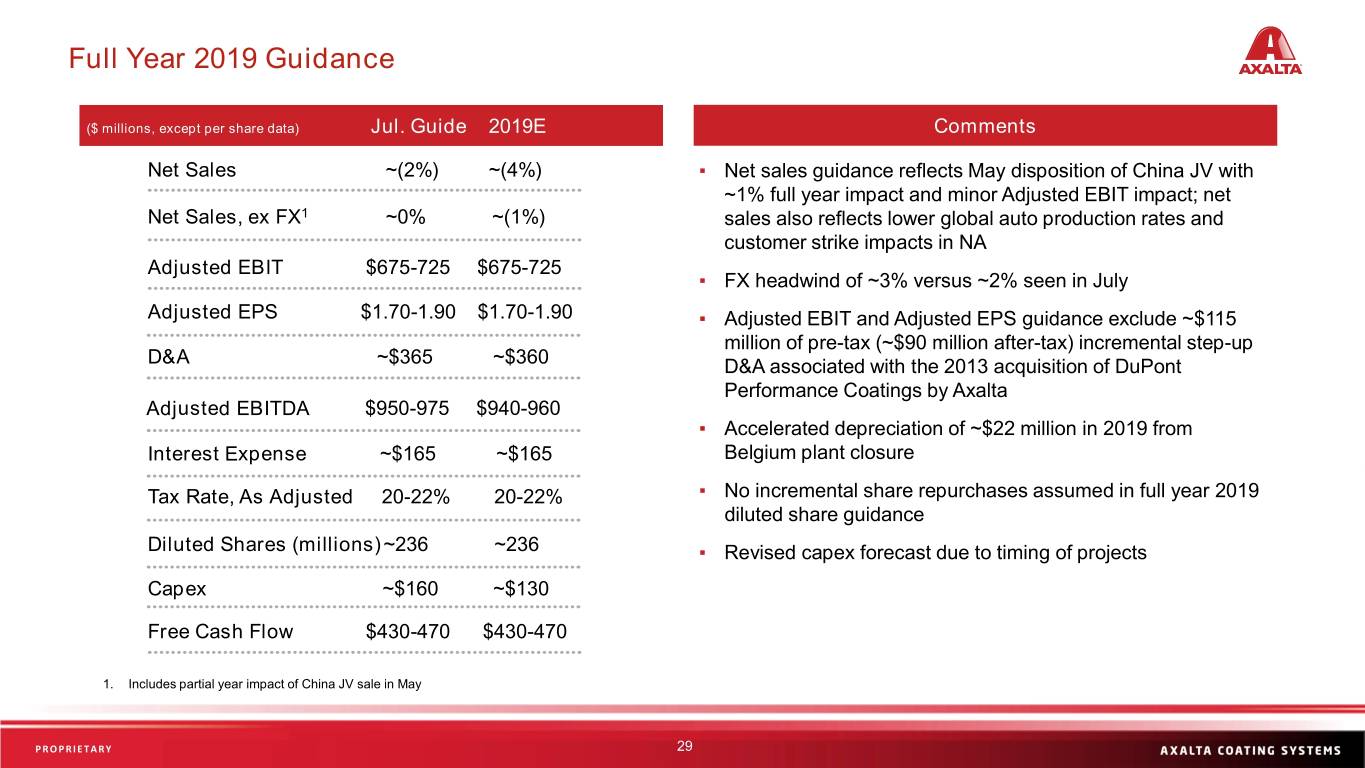

Full Year 2019 Guidance ($ millions, except per share data) Jul. Guide 2019E Comments Net Sales ~(2%) ~(4%) ▪ Net sales guidance reflects May disposition of China JV with ~1% full year impact and minor Adjusted EBIT impact; net Net Sales, ex FX1 ~0% ~(1%) sales also reflects lower global auto production rates and customer strike impacts in NA Adjusted EBIT $675-725 $675-725 ▪ FX headwind of ~3% versus ~2% seen in July Adjusted EPS $1.70-1.90 $1.70-1.90 ▪ Adjusted EBIT and Adjusted EPS guidance exclude ~$115 million of pre-tax (~$90 million after-tax) incremental step-up D&A ~$365 ~$360 D&A associated with the 2013 acquisition of DuPont Performance Coatings by Axalta Adjusted EBITDA $950-975 $940-960 ▪ Accelerated depreciation of ~$22 million in 2019 from Interest Expense ~$165 ~$165 Belgium plant closure Tax Rate, As Adjusted 20-22% 20-22% ▪ No incremental share repurchases assumed in full year 2019 diluted share guidance Diluted Shares (millions) ~236 ~236 ▪ Revised capex forecast due to timing of projects Capex ~$160 ~$130 Free Cash Flow $430-470 $430-470 1. Includes partial year impact of China JV sale in May PROPRIETARY 29 Sensitivity: Business Internal

Performance Coatings: Refinish Sensitivity: Business Internal

Axalta Refinish Investment Thesis ▪ The global automotive refinish market is stable, consolidated and growing ✓ Refinish is highly stable, linked to global miles driven and accident rates ✓ The top four Refinish players hold two-thirds of the global market ✓ End-market growth ~3-4% per year expected ▪ Axalta leads with the broadest and deepest technology and market reach ✓ We lead the global market with 25% share; higher share in developed regions ✓ Our deep portfolio of next-generation technology addresses wide-ranging customer needs ✓ Axalta has broad market reach across product and customer types globally ▪ Axalta continues to grow through an aggressive and disciplined strategy ✓ Organic and inorganic product introductions to increase reach and competitiveness ✓ Benefiting from consolidation and professionalization of body shop market ✓ Tailwind from growing car parc, especially in emerging markets ✓ Adding technology and services to solidify competitive moat and customer relationships PROPRIETARY Sensitivity: Business Internal 31

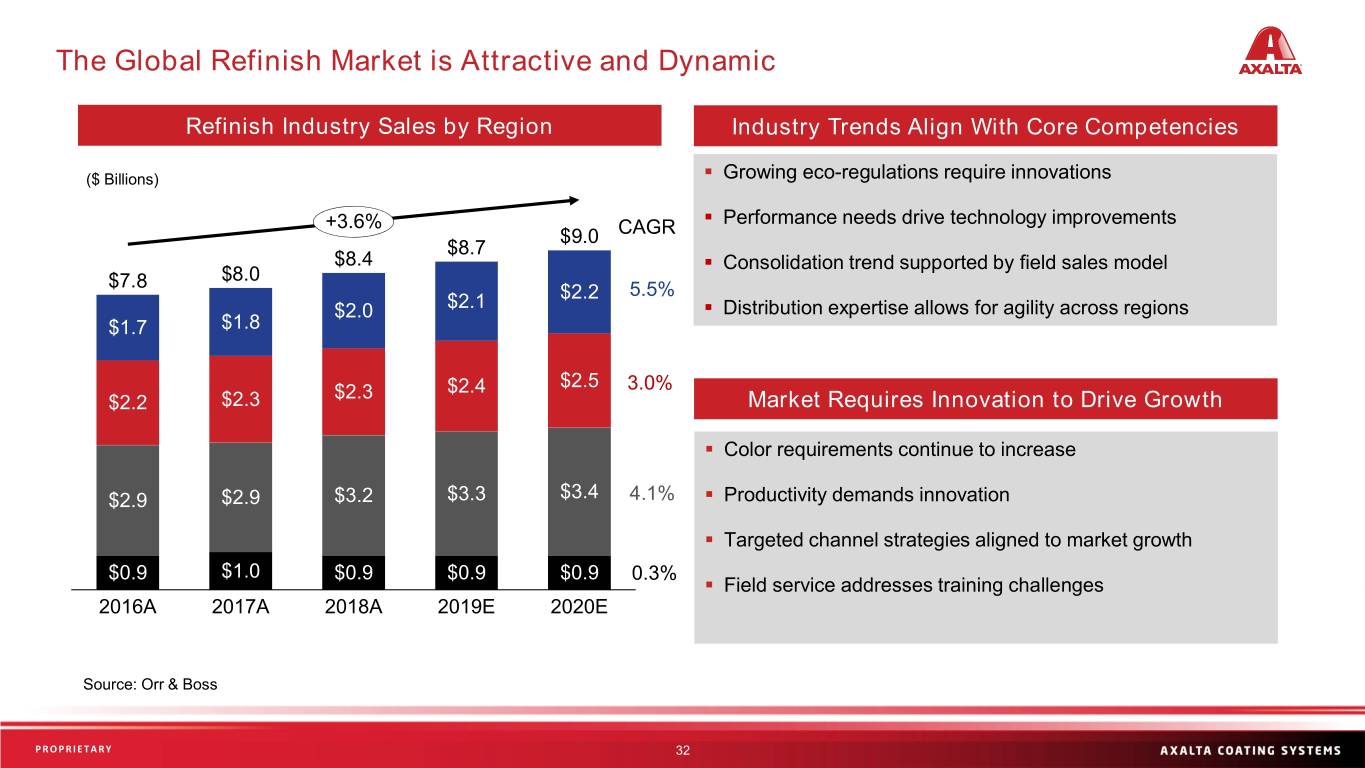

The Global Refinish Market is Attractive and Dynamic Refinish Industry Sales by Region Industry Trends Align With Core Competencies ($ Billions) ▪ Growing eco-regulations require innovations +3.6% ▪ Performance needs drive technology improvements $9.0 CAGR $8.7 $8.4 ▪ Consolidation trend supported by field sales model $7.8 $8.0 $2.2 5.5% $2.0 $2.1 ▪ Distribution expertise allows for agility across regions $1.7 $1.8 $2.5 $2.3 $2.4 3.0% $2.2 $2.3 Market Requires Innovation to Drive Growth ▪ Color requirements continue to increase $2.9 $2.9 $3.2 $3.3 $3.4 4.1% ▪ Productivity demands innovation ▪ Targeted channel strategies aligned to market growth $0.9 $1.0 $0.9 $0.9 $0.9 0.3% ▪ Field service addresses training challenges 2016A 2017A 2018A 2019E 2020E Source: Orr & Boss PROPRIETARY Sensitivity: Business Internal 32

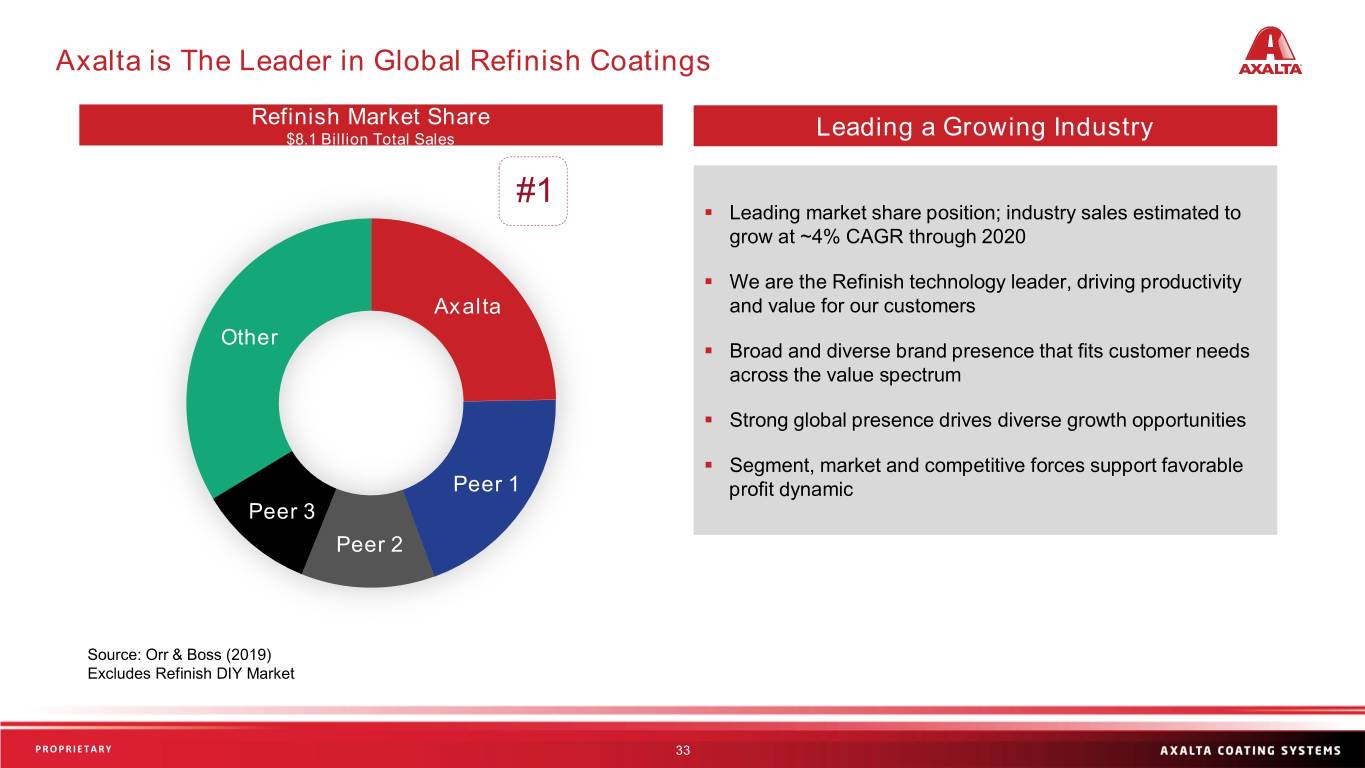

Axalta is The Leader in Global Refinish Coatings Refinish Market Share $8.1 Billion Total Sales Leading a Growing Industry #1 ▪ Leading market share position; industry sales estimated to grow at ~4% CAGR through 2020 ▪ We are the Refinish technology leader, driving productivity Axalta and value for our customers Other ▪ Broad and diverse brand presence that fits customer needs across the value spectrum ▪ Strong global presence drives diverse growth opportunities ▪ Segment, market and competitive forces support favorable Peer 1 profit dynamic Peer 3 Peer 2 Source: Orr & Boss (2019) Excludes Refinish DIY Market PROPRIETARY Sensitivity: Business Internal 33

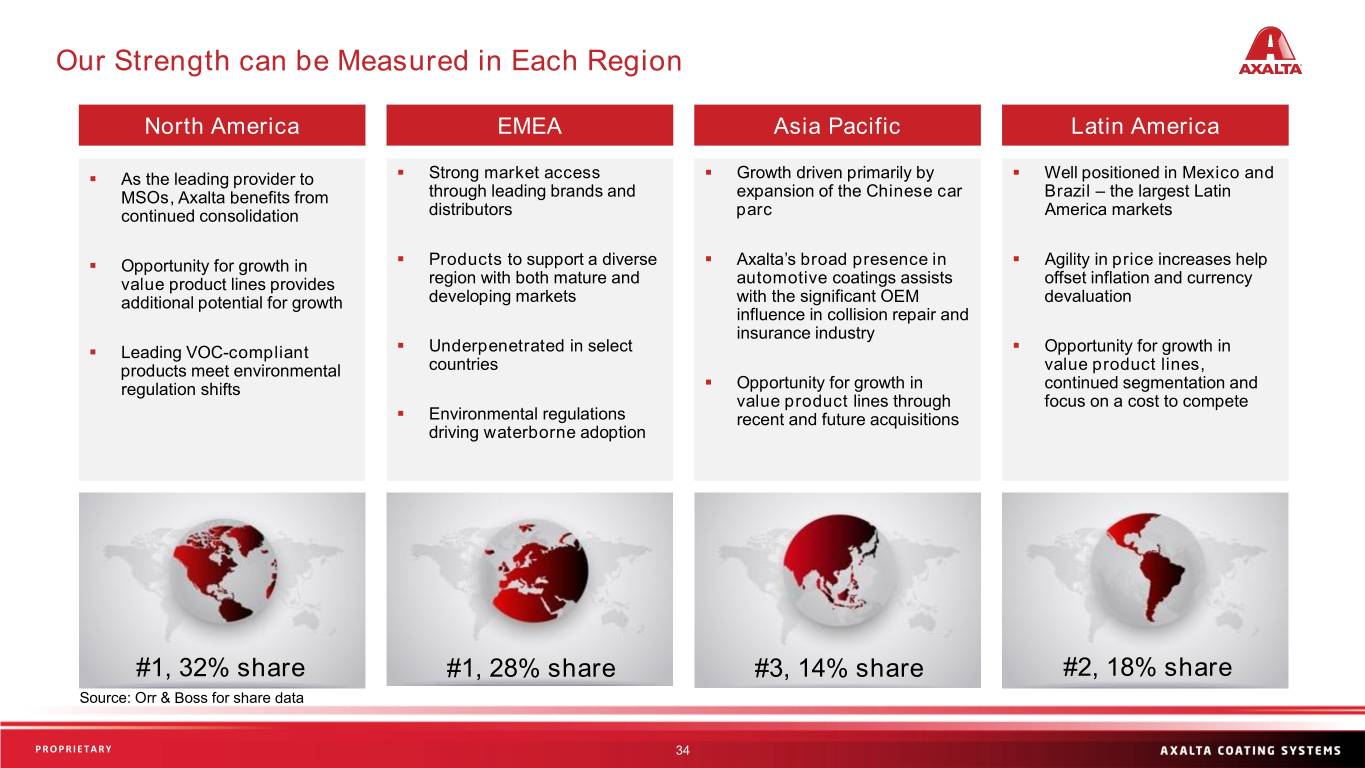

Our Strength can be Measured in Each Region North America EMEA Asia Pacific Latin America ▪ As the leading provider to ▪ Strong market access ▪ Growth driven primarily by ▪ Well positioned in Mexico and MSOs, Axalta benefits from through leading brands and expansion of the Chinese car Brazil – the largest Latin continued consolidation distributors parc America markets ▪ Opportunity for growth in ▪ Products to support a diverse ▪ Axalta’s broad presence in ▪ Agility in price increases help value product lines provides region with both mature and automotive coatings assists offset inflation and currency additional potential for growth developing markets with the significant OEM devaluation influence in collision repair and insurance industry ▪ Leading VOC-compliant ▪ Underpenetrated in select ▪ Opportunity for growth in products meet environmental countries value product lines, regulation shifts ▪ Opportunity for growth in continued segmentation and value product lines through focus on a cost to compete ▪ Environmental regulations recent and future acquisitions driving waterborne adoption #1, 32% share #1, 28% share #3, 14% share #2, 18% share Source: Orr & Boss for share data PROPRIETARY Sensitivity: Business Internal 34

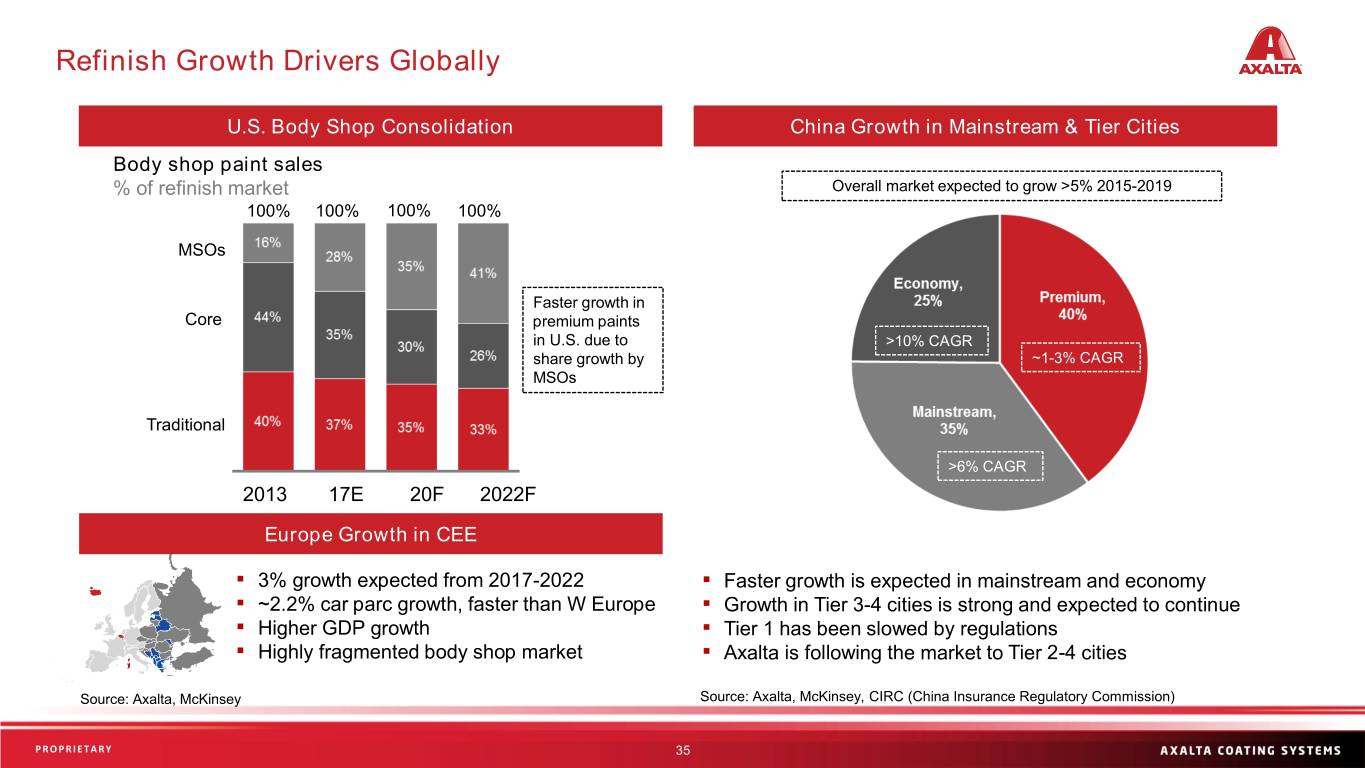

Refinish Growth Drivers Globally U.S. Body Shop Consolidation China Growth in Mainstream & Tier Cities Body shop paint sales % of refinish market Overall market expected to grow >5% 2015-2019 100% 100% 100% 100% MSOs Faster growth in Core premium paints in U.S. due to >10% CAGR share growth by ~1-3% CAGR MSOs Traditional >6% CAGR 2013 17E 20F 2022F Europe Growth in CEE ▪ 3% growth expected from 2017-2022 ▪ Faster growth is expected in mainstream and economy ▪ ~2.2% car parc growth, faster than W Europe ▪ Growth in Tier 3-4 cities is strong and expected to continue ▪ Higher GDP growth ▪ Tier 1 has been slowed by regulations ▪ Highly fragmented body shop market ▪ Axalta is following the market to Tier 2-4 cities Source: Axalta, McKinsey Source: Axalta, McKinsey, CIRC (China Insurance Regulatory Commission) PROPRIETARY Sensitivity: Business Internal 35

Performance Coatings: Industrial Sensitivity: Business Internal

Axalta Industrial: Where We Have Come From 2013 2016 - 2018 Industrial sales 2x since 2013 1960 - 2013 2014 - 2018 PROPRIETARY Sensitivity: Business Internal 37

Our Industrial Business Today Wood Coatings Powder Coatings Coil Coatings Energy Solutions General Industrial ▪ Kitchen cabinets ▪ Auto metal parts ▪ Commercial / ▪ Electrical vehicles ▪ ACE ▪ Building products ▪ Appliances residential siding ▪ Wind energy ▪ Oil and gas ▪ Flooring ▪ Architectural ▪ Garage doors equipment ▪ Structural steel ▪ Furniture extrusions ▪ Gutters, downspouts, ▪ Electrical equipment ▪ Metal components ▪ Furniture lighting housings (motors, ▪ Protective storage ▪ General Industrial ▪ Appliances transformers, coils) ▪ Automotive ▪ Heavy voltage components 13K 24 12 60 Customers Dedicated Manufacturing Shared Countries Plants Manufacturing Plants PROPRIETARY Sensitivity: Business Internal 38

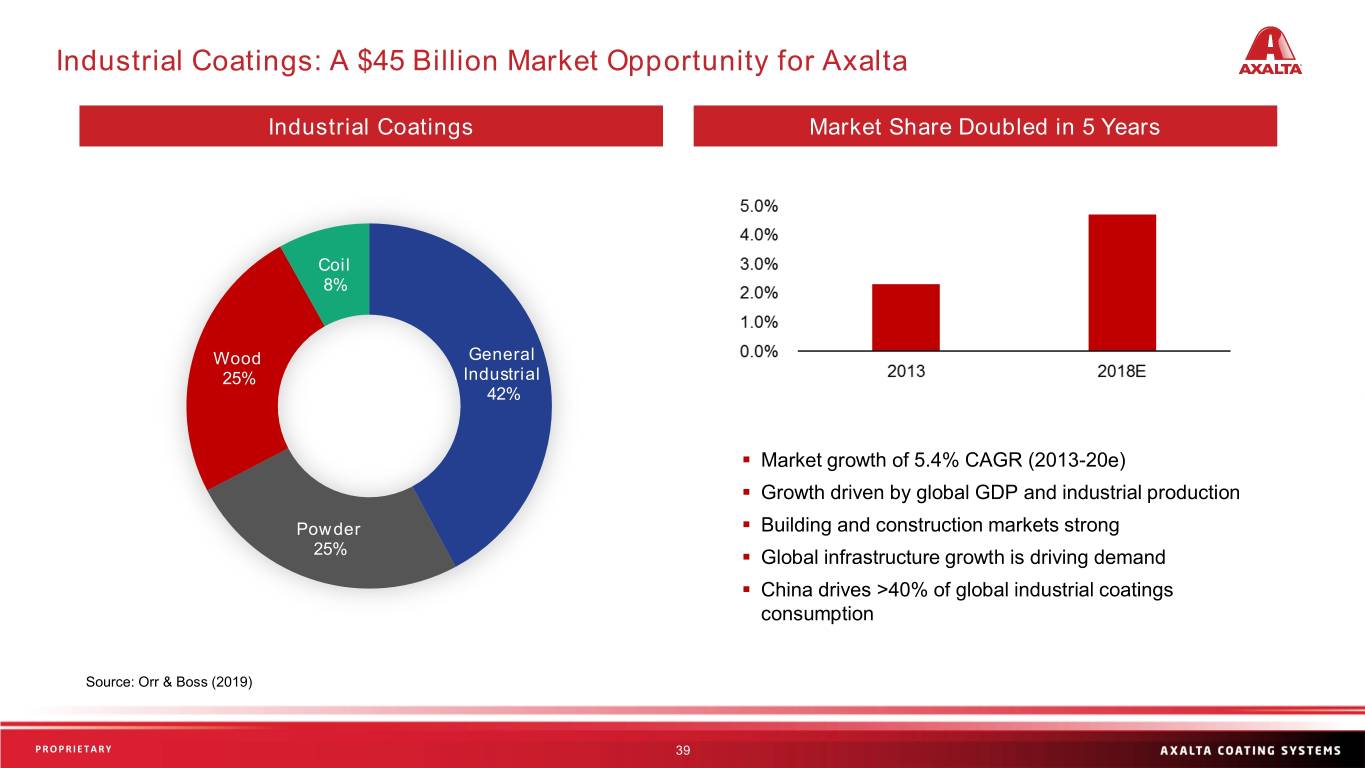

Industrial Coatings: A $45 Billion Market Opportunity for Axalta Industrial Coatings Market Share Doubled in 5 Years Coil 8% Wood General 25% Industrial 42% ▪ Market growth of 5.4% CAGR (2013-20e) ▪ Growth driven by global GDP and industrial production Powder ▪ Building and construction markets strong 25% ▪ Global infrastructure growth is driving demand ▪ China drives >40% of global industrial coatings consumption Source: Orr & Boss (2019) PROPRIETARY Sensitivity: Business Internal 39

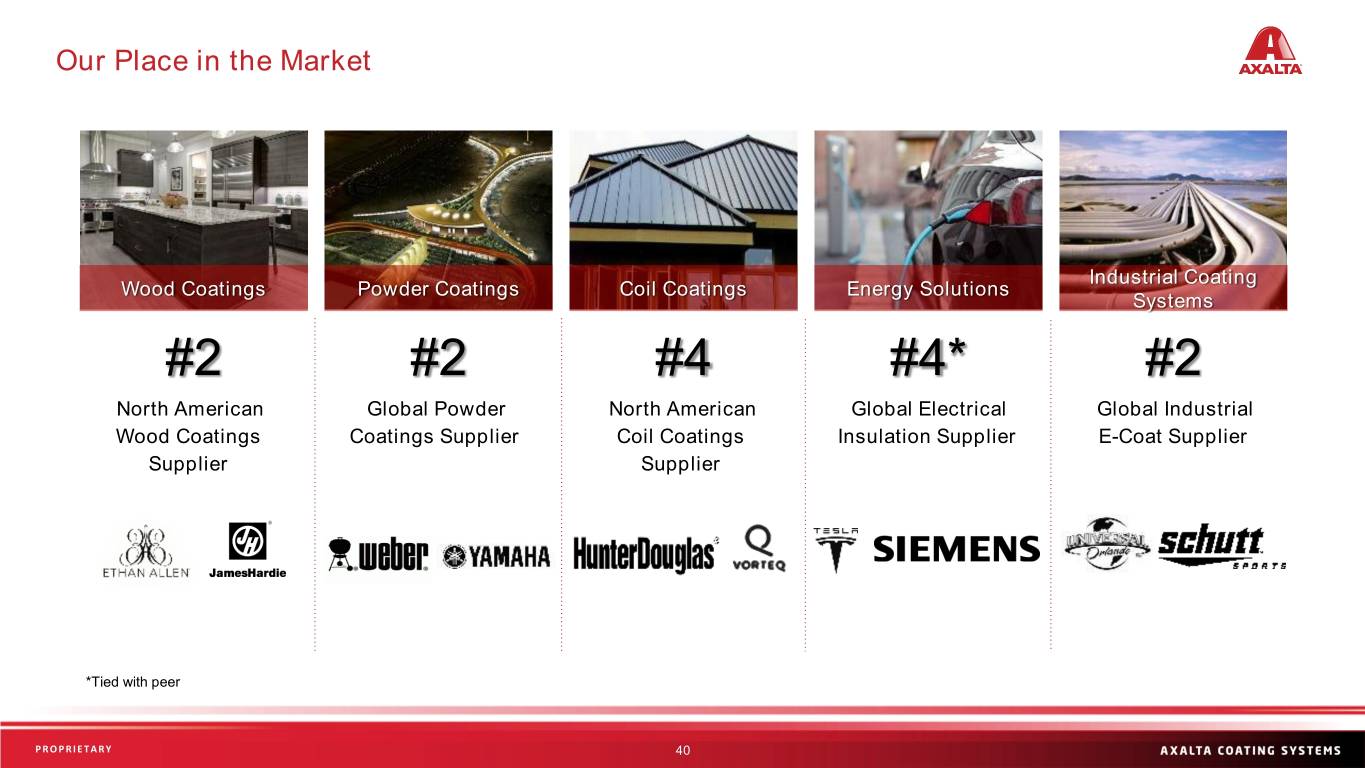

Our Place in the Market Industrial Coating Wood Coatings Powder Coatings Coil Coatings Energy Solutions Systems #2 #2 #4 #4* #2 North American Global Powder North American Global Electrical Global Industrial Wood Coatings Coatings Supplier Coil Coatings Insulation Supplier E-Coat Supplier Supplier Supplier *Tied with peer PROPRIETARY Sensitivity: Business Internal 40

Transportation Coatings Sensitivity: Business Internal

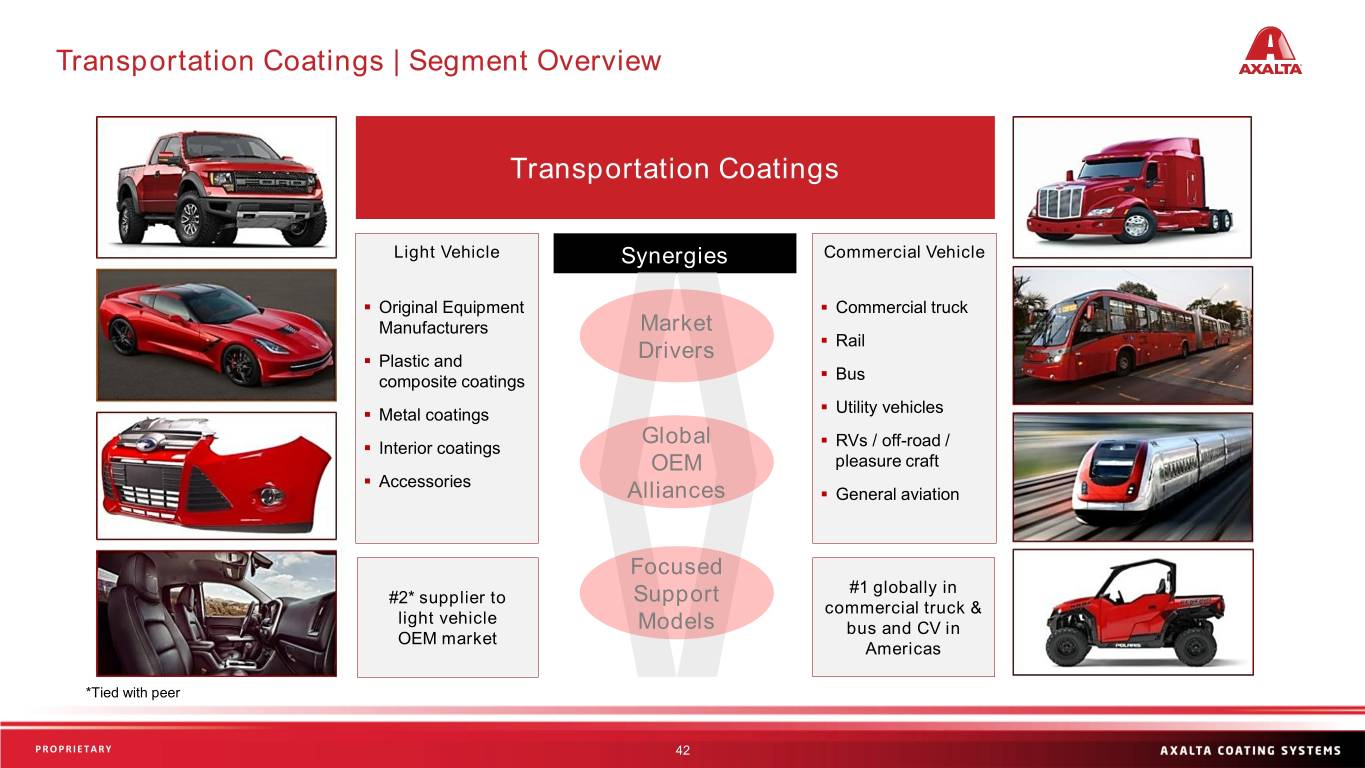

Transportation Coatings | Segment Overview Transportation Coatings Light Vehicle Synergies Commercial Vehicle ▪ Original Equipment ▪ Commercial truck Manufacturers Market ▪ Rail ▪ Plastic and Drivers composite coatings ▪ Bus ▪ Metal coatings ▪ Utility vehicles Global ▪ Interior coatings ▪ RVs / off-road / OEM pleasure craft ▪ Accessories Alliances ▪ General aviation Focused #1 globally in #2* supplier to Support commercial truck & light vehicle Models bus and CV in OEM market Americas *Tied with peer PROPRIETARY Sensitivity: Business Internal 42

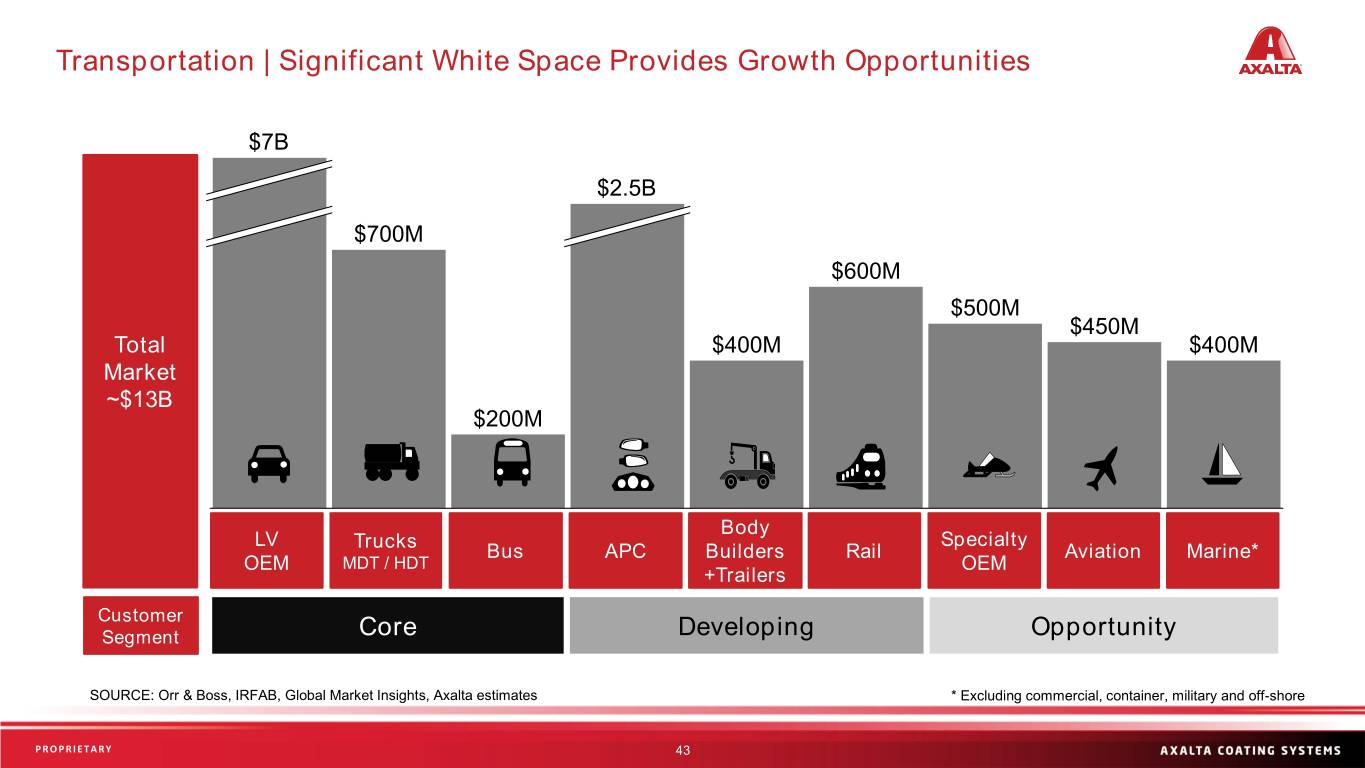

Transportation | Significant White Space Provides Growth Opportunities $7B ~ $2.5B $700M $600M $500M $450M Total $400M $400M Market ~$13B $200M Body LV Trucks Specialty Bus APC Builders Rail Aviation Marine* OEM MDT / HDT OEM +Trailers Customer Segment Core Developing Opportunity SOURCE: Orr & Boss, IRFAB, Global Market Insights, Axalta estimates * Excluding commercial, container, military and off-shore PROPRIETARY Sensitivity: Business Internal 43

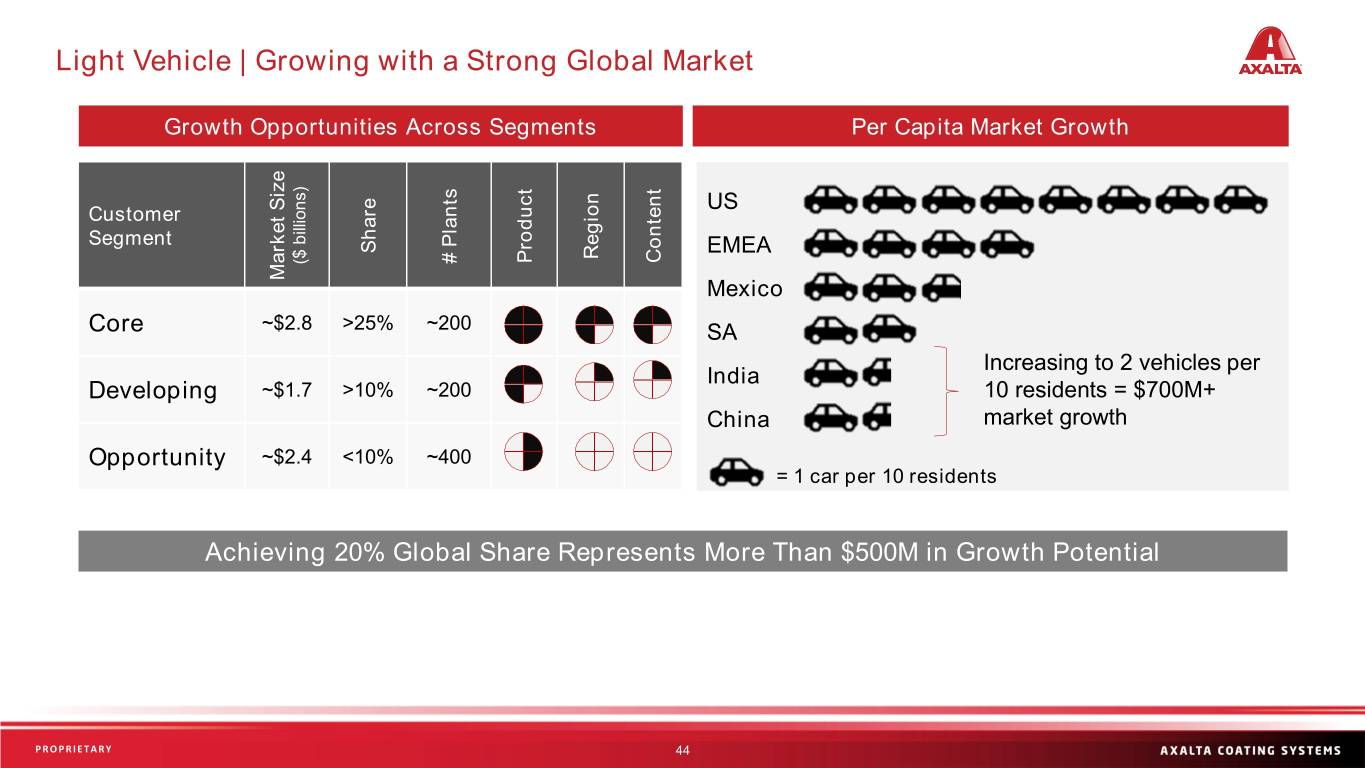

Light Vehicle | Growing with a Strong Global Market Growth Opportunities Across Segments Per Capita Market Growth US Customer Segment Share EMEA Region Content Product # Plants # ($ billions) ($ Market Size Market Mexico Core ~$2.8 >25% ~200 SA Increasing to 2 vehicles per India Developing ~$1.7 >10% ~200 10 residents = $700M+ China market growth Opportunity ~$2.4 <10% ~400 = 1 car per 10 residents Achieving 20% Global Share Represents More Than $500M in Growth Potential PROPRIETARY Sensitivity: Business Internal 44

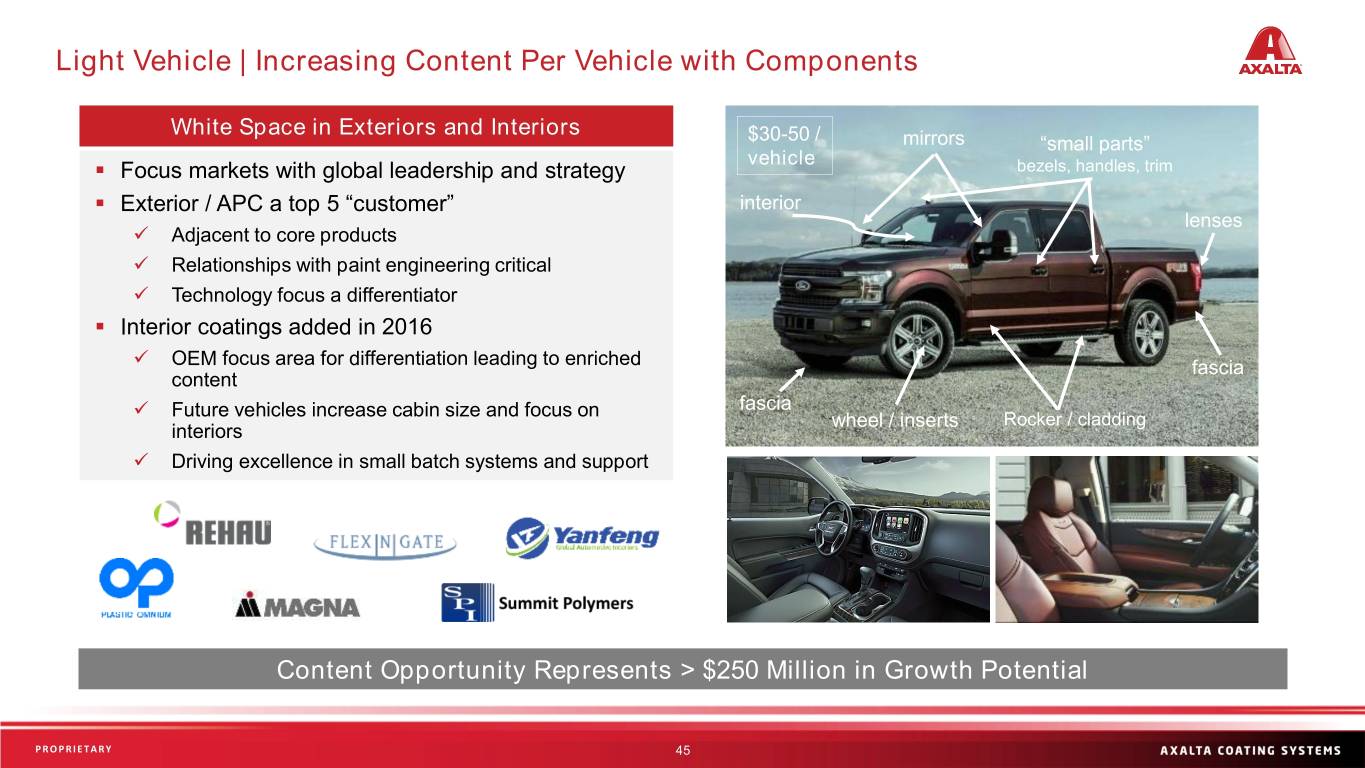

Light Vehicle | Increasing Content Per Vehicle with Components White Space in Exteriors and Interiors $30-50 / mirrors “small parts” vehicle ▪ Focus markets with global leadership and strategy bezels, handles, trim ▪ Exterior / APC a top 5 “customer” interior lenses ✓ Adjacent to core products ✓ Relationships with paint engineering critical ✓ Technology focus a differentiator ▪ Interior coatings added in 2016 ✓ OEM focus area for differentiation leading to enriched fascia content ✓ Future vehicles increase cabin size and focus on fascia wheel / inserts Rocker / cladding interiors ✓ Driving excellence in small batch systems and support Content Opportunity Represents > $250 Million in Growth Potential PROPRIETARY Sensitivity: Business Internal 45

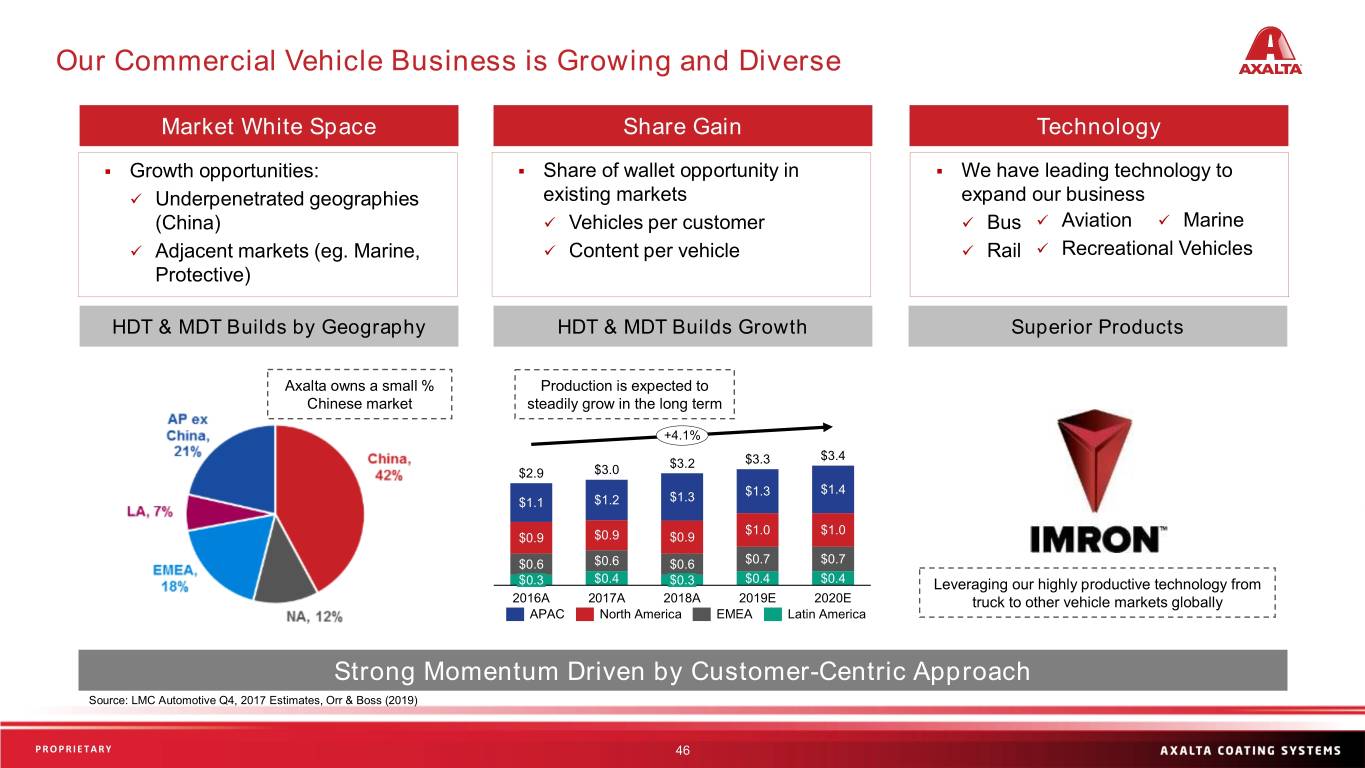

Our Commercial Vehicle Business is Growing and Diverse Market White Space Share Gain Technology ▪ Growth opportunities: ▪ Share of wallet opportunity in ▪ We have leading technology to ✓ Underpenetrated geographies existing markets expand our business (China) ✓ Vehicles per customer ✓ Bus ✓ Aviation ✓ Marine ✓ Adjacent markets (eg. Marine, ✓ Content per vehicle ✓ Rail ✓ Recreational Vehicles Protective) HDT & MDT Builds by Geography HDT & MDT Builds Growth Superior Products Axalta owns a small % Production is expected to Chinese market steadily grow in the long term +4.1% $3.4 $3.2 $3.3 $2.9 $3.0 $1.3 $1.4 $1.1 $1.2 $1.3 $1.0 $1.0 $0.9 $0.9 $0.9 $0.6 $0.6 $0.6 $0.7 $0.7 $0.3 $0.4 $0.3 $0.4 $0.4 Leveraging our highly productive technology from 2016A 2017A 2018A 2019E 2020E truck to other vehicle markets globally APAC North America EMEA Latin America Strong Momentum Driven by Customer-Centric Approach Source: LMC Automotive Q4, 2017 Estimates, Orr & Boss (2019) PROPRIETARY Sensitivity: Business Internal 46

No Matter Where the Market Goes, Coatings Play a Key Role Emerging OEMs Design & Consumer Advanced Sustainability Future Mobility and Geographies Preferences Manufacturing ▪ New entrants ▪ Styling trends ▪ Environmental ▪ Big data, line ▪ Autonomous ▪ Rising JVs ▪ Consumer requirements service driving ▪ Emerging OEMs choice ▪ Advanced ▪ Enhanced ▪ Ride sharing ▪ Personalization substrates productivity ▪ Changing ▪ Vehicle light- ▪ New technology ownership and weighting applications use patterns PROPRIETARY Sensitivity: Business Internal 47

Investor Contact: Chris Mecray - VP, Investor Relations, Treasury & Strategy christopher.mecray@axalta.com (215) 255-7970 Sensitivity: Business Internal

2018 Adjusted EBIT Reconciliation ($ in millions) Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Income from operations $ 120 $ 147 $ 48 $ 128 $ 442 Other (income) expense, net (2) 8 6 4 15 Total $ 122 $ 138 $ 42 $ 124 $ 427 A Debt extinguishment and refinancing related costs — 8 — 1 10 B Termination benefits and other employee related costs (1) (1) 82 2 82 C Offering and transactional costs — 0 1 0 1 D Accelerated depreciation — — 4 6 10 E Indemnity losses — 1 — 3 4 F Change in fair value of equity investments 0 0 — 0 1 G Step-up depreciation and amortization 38 35 34 34 140 Adjusted EBIT $ 159 $ 182 $ 163 $ 171 $ 675 Segment Adjusted EBIT: Performance Coatings $ 76 $ 109 $ 104 $ 111 $ 400 Transportation Coatings 45 38 26 26 135 Total $ 121 $ 147 $ 130 $ 137 $ 534 G Step-up depreciation and amortization 38 35 34 34 140 Adjusted EBIT $ 159 $ 182 $ 163 $ 171 $ 675 A. Represents expenses associated with the restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance B. Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs, which includes Axalta CEO recruitment fees. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance C. Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. D. Represents incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments, which we do not consider indicative of our ongoing operating performance. E. Represents indemnity losses associated with the acquisition by Axalta of the DuPont Performance Coatings business. F. Represents mark to market impacts of our equity investments, which we do not consider to be indicative of our ongoing operating performance. G. Represents the incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. PROPRIETARY 49 Sensitivity: Business Internal

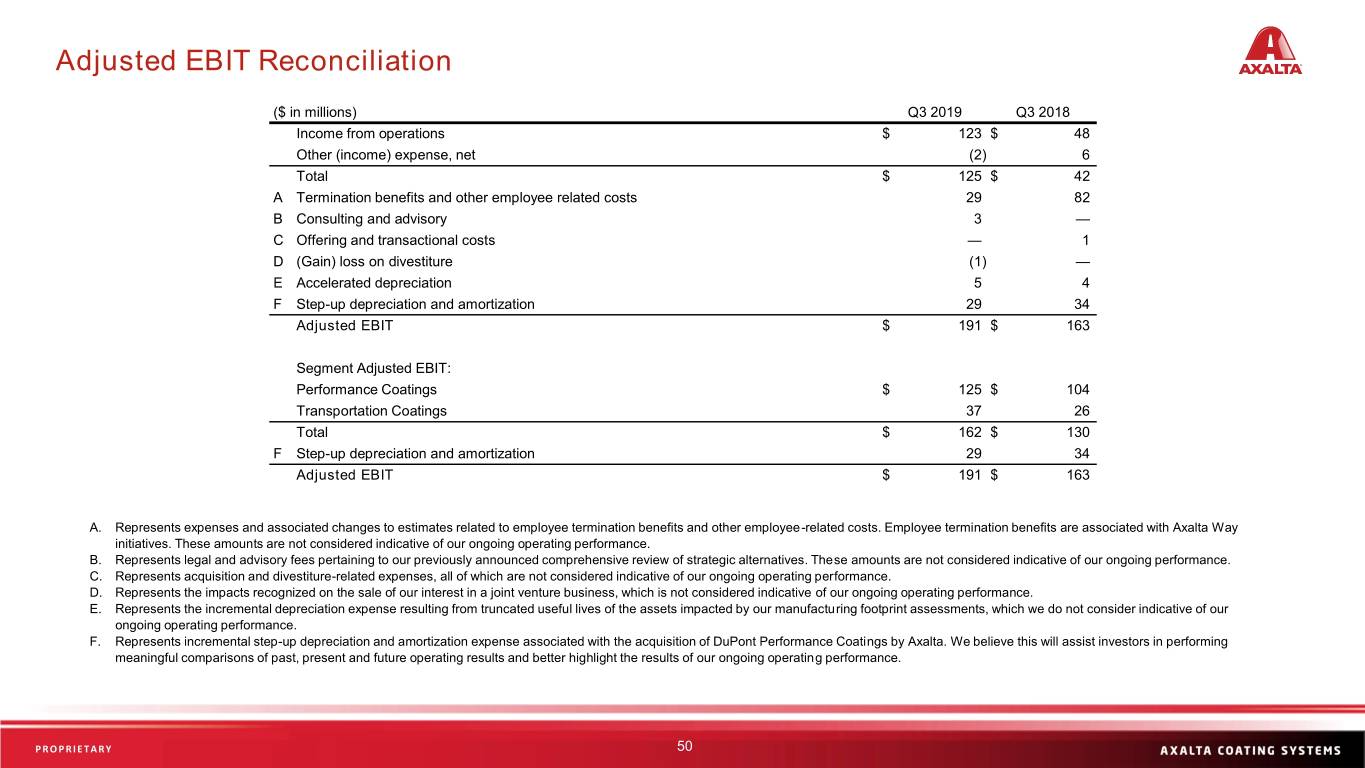

Adjusted EBIT Reconciliation ($ in millions) Q3 2019 Q3 2018 Income from operations $ 123 $ 48 Other (income) expense, net (2) 6 Total $ 125 $ 42 A Termination benefits and other employee related costs 29 82 B Consulting and advisory 3 — C Offering and transactional costs — 1 D (Gain) loss on divestiture (1) — E Accelerated depreciation 5 4 F Step-up depreciation and amortization 29 34 Adjusted EBIT $ 191 $ 163 Segment Adjusted EBIT: Performance Coatings $ 125 $ 104 Transportation Coatings 37 26 Total $ 162 $ 130 F Step-up depreciation and amortization 29 34 Adjusted EBIT $ 191 $ 163 A. Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. B. Represents legal and advisory fees pertaining to our previously announced comprehensive review of strategic alternatives. These amounts are not considered indicative of our ongoing performance. C. Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. D. Represents the impacts recognized on the sale of our interest in a joint venture business, which is not considered indicative of our ongoing operating performance. E. Represents the incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments, which we do not consider indicative of our ongoing operating performance. F. Represents incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. PROPRIETARY 50 Sensitivity: Business Internal

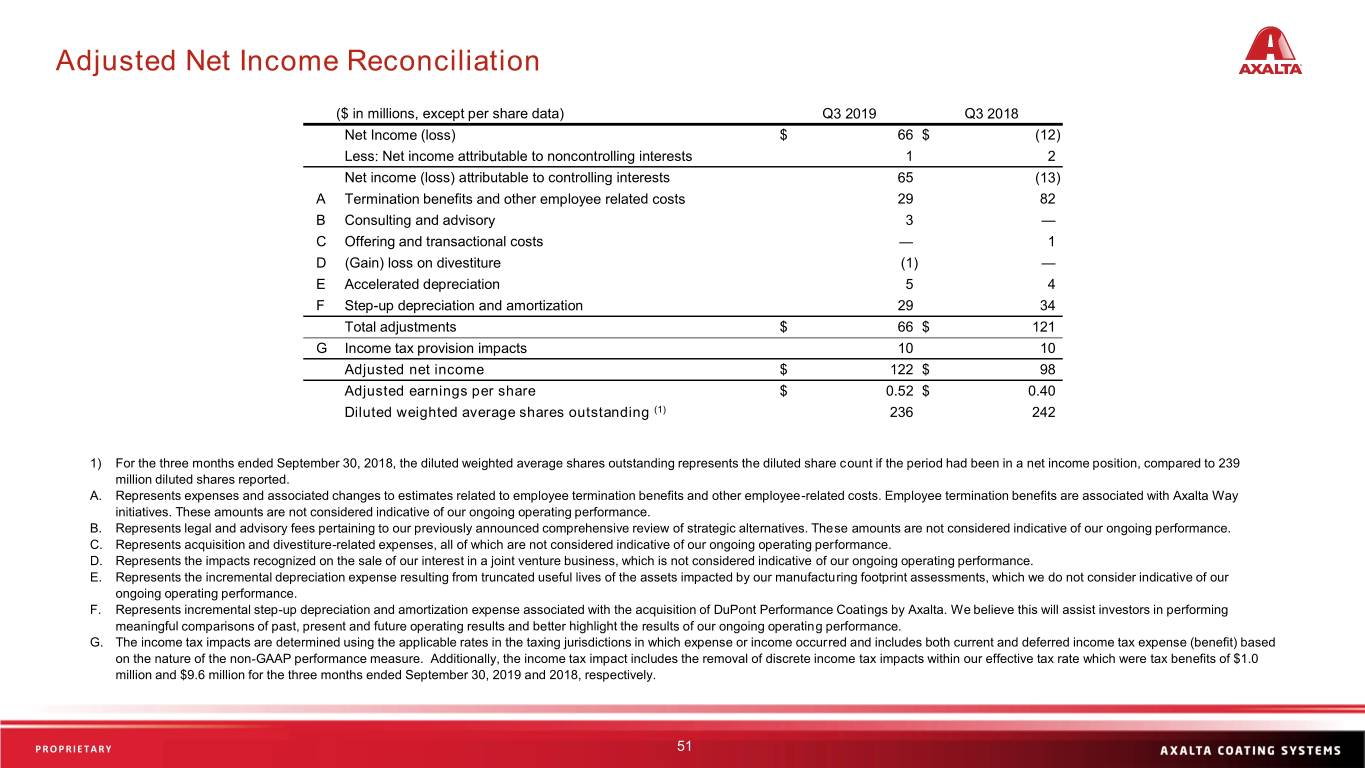

Adjusted Net Income Reconciliation ($ in millions, except per share data) Q3 2019 Q3 2018 Net Income (loss) $ 66 $ (12) Less: Net income attributable to noncontrolling interests 1 2 Net income (loss) attributable to controlling interests 65 (13) A Termination benefits and other employee related costs 29 82 B Consulting and advisory 3 — C Offering and transactional costs — 1 D (Gain) loss on divestiture (1) — E Accelerated depreciation 5 4 F Step-up depreciation and amortization 29 34 Total adjustments $ 66 $ 121 G Income tax provision impacts 10 10 Adjusted net income $ 122 $ 98 Adjusted earnings per share $ 0.52 $ 0.40 Diluted weighted average shares outstanding (1) 236 242 1) For the three months ended September 30, 2018, the diluted weighted average shares outstanding represents the diluted share count if the period had been in a net income position, compared to 239 million diluted shares reported. A. Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. B. Represents legal and advisory fees pertaining to our previously announced comprehensive review of strategic alternatives. These amounts are not considered indicative of our ongoing performance. C. Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. D. Represents the impacts recognized on the sale of our interest in a joint venture business, which is not considered indicative of our ongoing operating performance. E. Represents the incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments, which we do not consider indicative of our ongoing operating performance. F. Represents incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. G. The income tax impacts are determined using the applicable rates in the taxing jurisdictions in which expense or income occurred and includes both current and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure. Additionally, the income tax impact includes the removal of discrete income tax impacts within our effective tax rate which were tax benefits of $1.0 million and $9.6 million for the three months ended September 30, 2019 and 2018, respectively. PROPRIETARY 51 Sensitivity: Business Internal

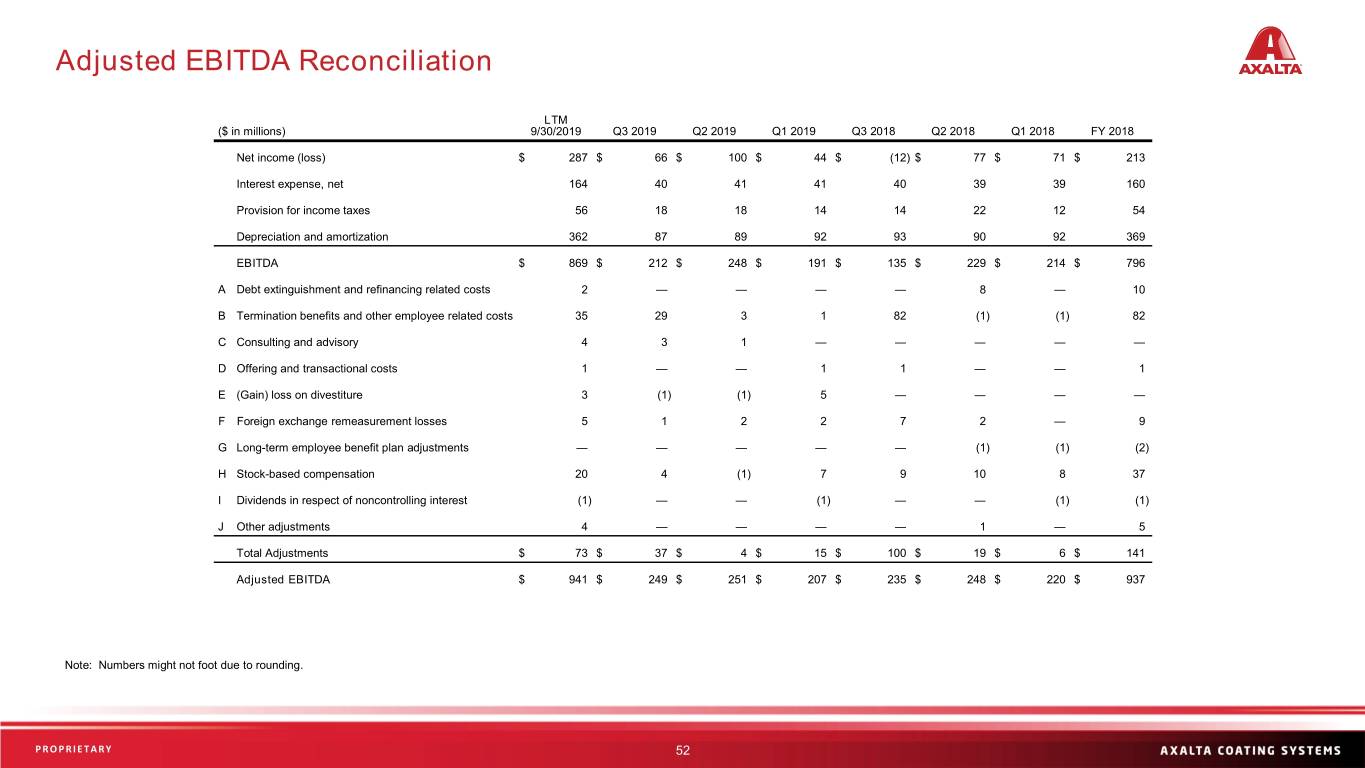

Adjusted EBITDA Reconciliation LTM ($ in millions) 9/30/2019 Q3 2019 Q2 2019 Q1 2019 Q3 2018 Q2 2018 Q1 2018 FY 2018 Net income (loss) $ 287 $ 66 $ 100 $ 44 $ (12) $ 77 $ 71 $ 213 Interest expense, net 164 40 41 41 40 39 39 160 Provision for income taxes 56 18 18 14 14 22 12 54 Depreciation and amortization 362 87 89 92 93 90 92 369 EBITDA $ 869 $ 212 $ 248 $ 191 $ 135 $ 229 $ 214 $ 796 A Debt extinguishment and refinancing related costs 2 — — — — 8 — 10 B Termination benefits and other employee related costs 35 29 3 1 82 (1) (1) 82 C Consulting and advisory 4 3 1 — — — — — D Offering and transactional costs 1 — — 1 1 — — 1 E (Gain) loss on divestiture 3 (1) (1) 5 — — — — F Foreign exchange remeasurement losses 5 1 2 2 7 2 — 9 G Long-term employee benefit plan adjustments — — — — — (1) (1) (2) H Stock-based compensation 20 4 (1) 7 9 10 8 37 I Dividends in respect of noncontrolling interest (1) — — (1) — — (1) (1) J Other adjustments 4 — — — — 1 — 5 Total Adjustments $ 73 $ 37 $ 4 $ 15 $ 100 $ 19 $ 6 $ 141 Adjusted EBITDA $ 941 $ 249 $ 251 $ 207 $ 235 $ 248 $ 220 $ 937 Note: Numbers might not foot due to rounding. PROPRIETARY Sensitivity: Business Internal 52

Adjusted EBITDA Reconciliation (cont’d) A. Represents expenses associated with the restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B. Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with our Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C. Represents legal and advisory fees pertaining to our previously announced comprehensive review of strategic alternatives. These amounts are not considered indicative of our ongoing performance. D. Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. E. Represents the impacts recognized on the sale of our interest in a joint venture business, which is not considered indicative of our ongoing operating performance. F. Eliminates foreign exchange losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of the impacts of our foreign currency instruments used to hedge our balance sheet exposures. G. Eliminates the non-cash, non-service cost components of long-term employee benefit costs. H. Represents non-cash impacts associated with stock-based compensation. I. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not 100% owned, which are reflected to show the cash operating performance of these entities on Axalta’s financial statements. J. Represents certain non-operational or non-cash gains and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including indemnity (income) losses associated with the acquisition by Axalta of the DuPont Performance Coatings business, gains and losses from the sale and disposal of property, plant and equipment, gains and losses from the remaining foreign currency derivative instruments and from non-cash fair value inventory adjustments associated with our business combinations. PROPRIETARY Sensitivity: Business Internal 53

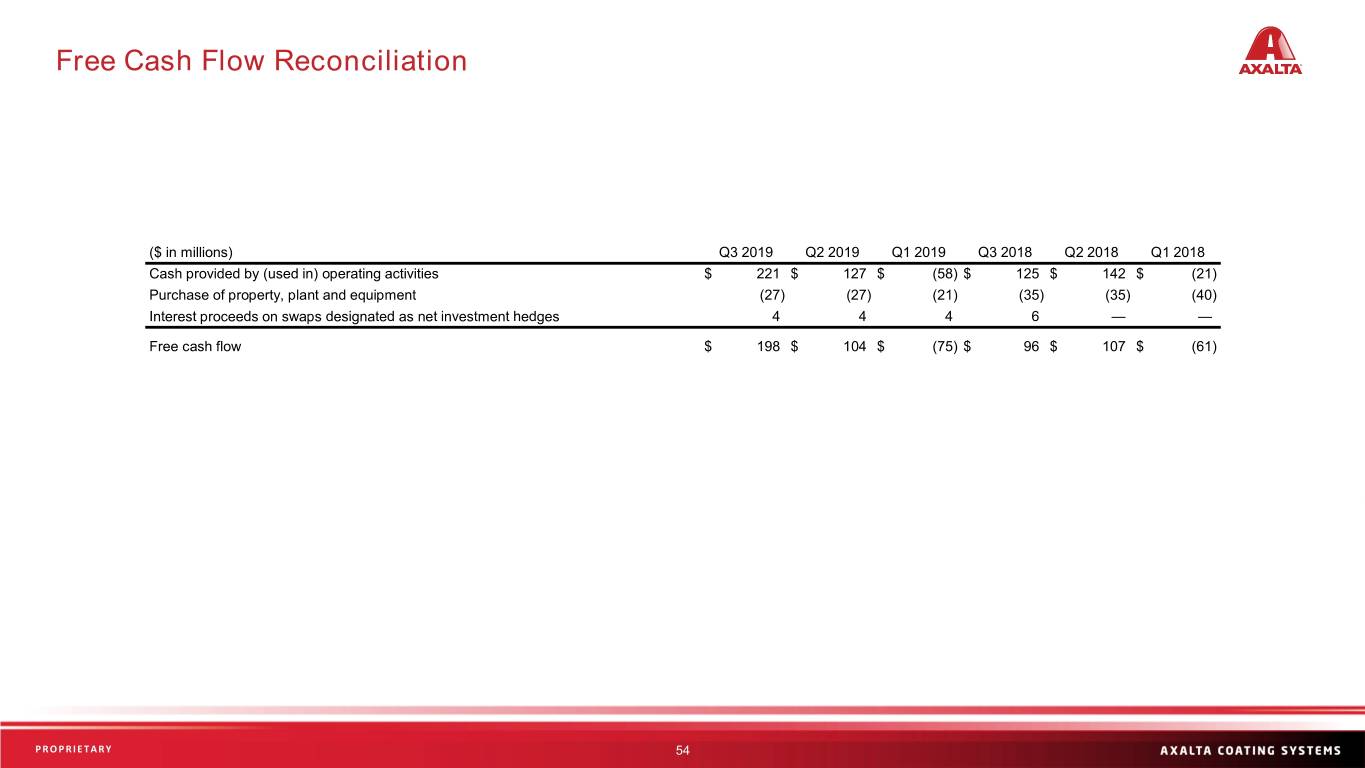

Free Cash Flow Reconciliation ($ in millions) Q3 2019 Q2 2019 Q1 2019 Q3 2018 Q2 2018 Q1 2018 Cash provided by (used in) operating activities $ 221 $ 127 $ (58) $ 125 $ 142 $ (21) Purchase of property, plant and equipment (27) (27) (21) (35) (35) (40) Interest proceeds on swaps designated as net investment hedges 4 4 4 6 — — Free cash flow $ 198 $ 104 $ (75) $ 96 $ 107 $ (61) PROPRIETARY Sensitivity: Business Internal 54

Thank You! Sensitivity: Business Internal