EX-99.2

Published on July 7, 2021

1 U - P O L H o l d i n g s A c q u i s i t i o n Tr a n s a c t i o n S u m m a r y H i g h l i g h t s J u l y 7 , 2 0 2 1

2 Cautionary Statement Regarding Forward -Looking Statements This presentation may contain certain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 regarding Axalta and its subsidiaries, including those relating to U-POL’s 2021 net sales and adjusted EBITDA as well as the timing and expected benefits of Axalta’s acquisition of U-POL. Forward-looking statements are based on management’s expectations as well as estimates and assumptions prepared by management that, although they believe to be reasonable, are inherently uncertain. These statements may involve risks and uncertainties, including, but not limited to, the effects of COVID-19, the satisfaction of the closing conditions of the transaction, the parties’ ability to consummate the transaction on the anticipated terms and schedule, and Axalta’s ability to achieve the expected benefits of the transaction. Axalta undertakes no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Adjusted EBITDA of U-POL and adjusted EBITDA margin of Axalta are non-GAAP measures. We believe that such measures provide investors with meaningful information to understand our operating results and the ability to analyze financial and business trends on a period-to-period basis. Axalta does not provide a reconciliation for non-GAAP estimates on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort.

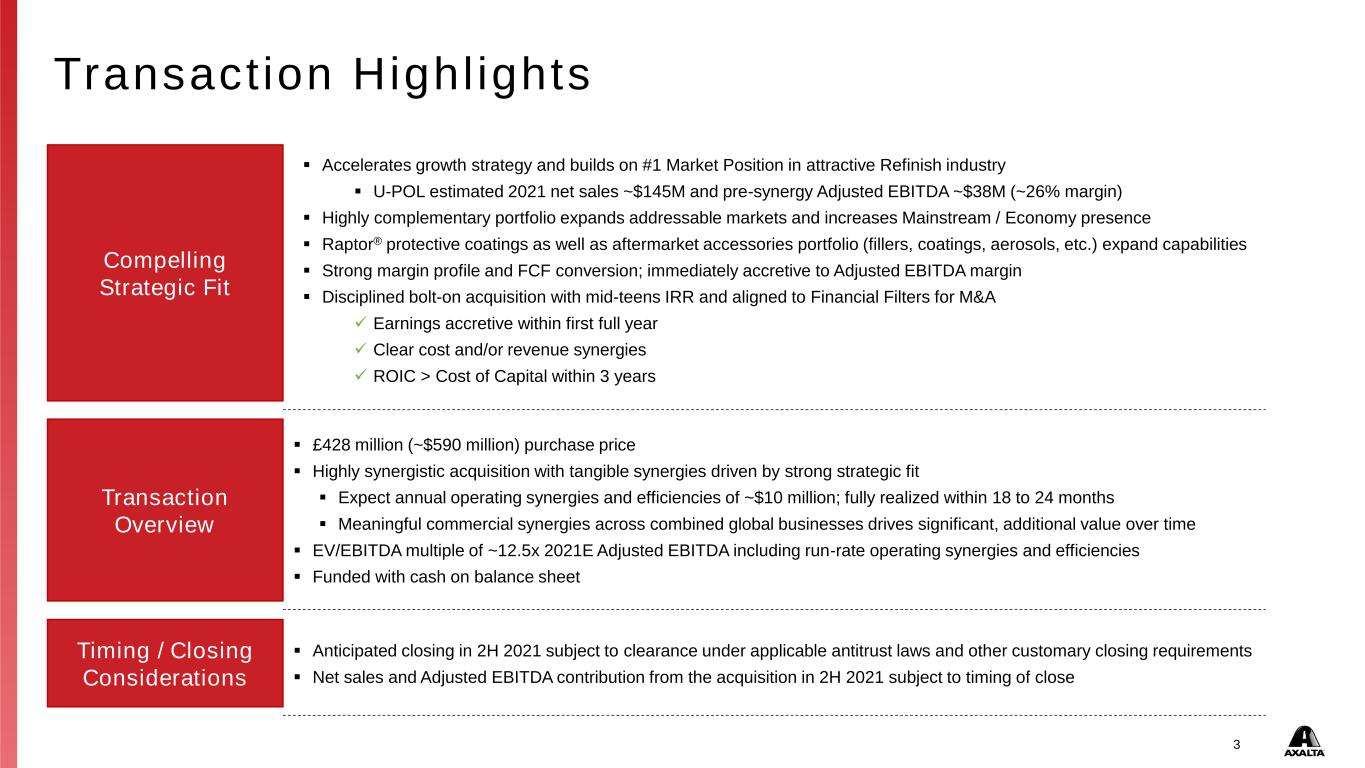

3 Transaction Highl ights Compelling Strategic Fit Transaction Overview Timing / Closing Considerations ▪ Anticipated closing in 2H 2021 subject to clearance under applicable antitrust laws and other customary closing requirements ▪ Net sales and Adjusted EBITDA contribution from the acquisition in 2H 2021 subject to timing of close ▪ £428 million (~$590 million) purchase price ▪ Highly synergistic acquisition with tangible synergies driven by strong strategic fit ▪ Expect annual operating synergies and efficiencies of ~$10 million; fully realized within 18 to 24 months ▪ Meaningful commercial synergies across combined global businesses drives significant, additional value over time ▪ EV/EBITDA multiple of ~12.5x 2021E Adjusted EBITDA including run-rate operating synergies and efficiencies ▪ Funded with cash on balance sheet ▪ Accelerates growth strategy and builds on #1 Market Position in attractive Refinish industry ▪ U-POL estimated 2021 net sales ~$145M and pre-synergy Adjusted EBITDA ~$38M (~26% margin) ▪ Highly complementary portfolio expands addressable markets and increases Mainstream / Economy presence ▪ Raptor® protective coatings as well as aftermarket accessories portfolio (fillers, coatings, aerosols, etc.) expand capabilities ▪ Strong margin profile and FCF conversion; immediately accretive to Adjusted EBITDA margin ▪ Disciplined bolt-on acquisition with mid-teens IRR and aligned to Financial Filters for M&A ✓ Earnings accretive within first full year ✓ Clear cost and/or revenue synergies ✓ ROIC > Cost of Capital within 3 years

4 U-POL Overview A G l o b a l G r o w t h P l a y ▪ Automotive Refinish: fillers, primers, clear-coats, aerosols and other products ▪ Protective Coatings: automotive aftermarket coatings marketed under Raptor brand name K e y P r o d u c t L i n e s Net Sales 2021E: ~$145M Adjusted EBITDA 2021E: ~$38M Adjusted EBITDA margin: ~26% (Net sales and Adjusted EBITDA pre-synergy) ▪ U-POL is a leading manufacturer of repair and refinish products, primarily for automotive refinish and aftermarket protective coatings applications ▪ Serves growing Mainstream / Economy and DIY segments with global customer base (sales in >100 countries) ▪ Headquartered in United Kingdom and founded in 1948 ▪ One manufacturing and R&D site in the UK with global distribution sites in the UK, North America, Russia, and South Africa

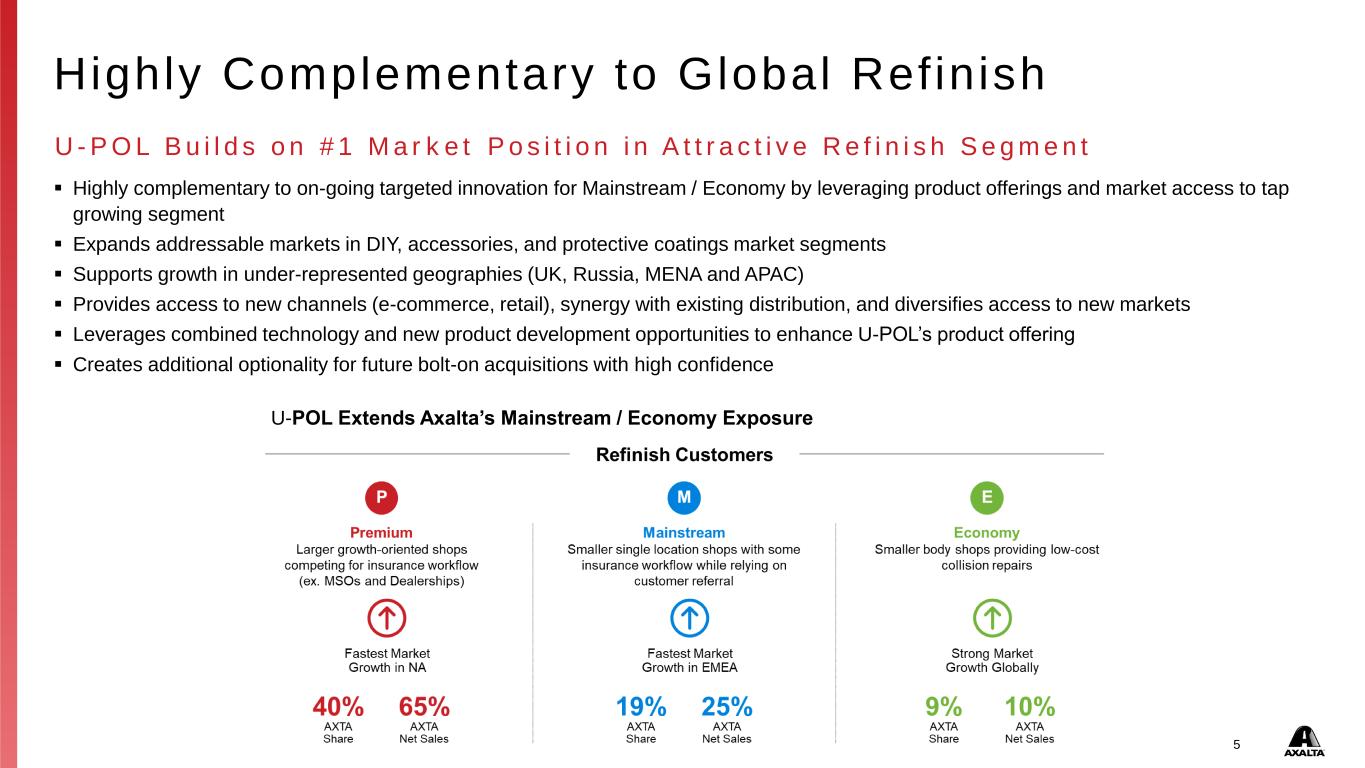

5 Highly Complementary to Global Refinish U - P O L B u i l d s o n # 1 M a r k e t P o s i t i o n i n A t t r a c t i v e R e f i n i s h S e g m e n t ▪ Highly complementary to on-going targeted innovation for Mainstream / Economy by leveraging product offerings and market access to tap growing segment ▪ Expands addressable markets in DIY, accessories, and protective coatings market segments ▪ Supports growth in under-represented geographies (UK, Russia, MENA and APAC) ▪ Provides access to new channels (e-commerce, retail), synergy with existing distribution, and diversifies access to new markets ▪ Leverages combined technology and new product development opportunities to enhance U-POL’s product offering ▪ Creates additional optionality for future bolt-on acquisitions with high confidence U-POL Extends Axalta’s Mainstream / Economy Exposure