10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 18, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended December 31 , 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from to .

Commission File Number: 001-36733

(Exact name of registrant as specified in its charter)

| 2851 | ||||||||||||||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

(855 ) 547-1461

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| (title of class) | (Trading symbol) | (Exchange on which registered) | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☒ Non-accelerated filer ☐ Accelerated filer ☐ Small reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2021, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $7,049.9 million (based on the closing sale price of the common stock on that date on the New York Stock Exchange).

As of February 10, 2022, there were 224,532,960 shares of the registrant’s common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

2

PART I

ITEM 1. BUSINESS

Axalta Coating Systems Ltd. ("Axalta," the "Company," "we," "our" and "us"), a Bermuda exempted holding company incorporated in 2012, is a leading global manufacturer, marketer and distributor of high-performance coatings systems. We have over a 150-year heritage in the coatings industry and are known for manufacturing high-quality products with well-recognized brands supported by market-leading technology and customer service. Over the course of our history, we have remained at the forefront of our industry by continually developing innovative coatings technologies designed to enhance the performance and appearance of our customers' products, while improving their productivity and profitability.

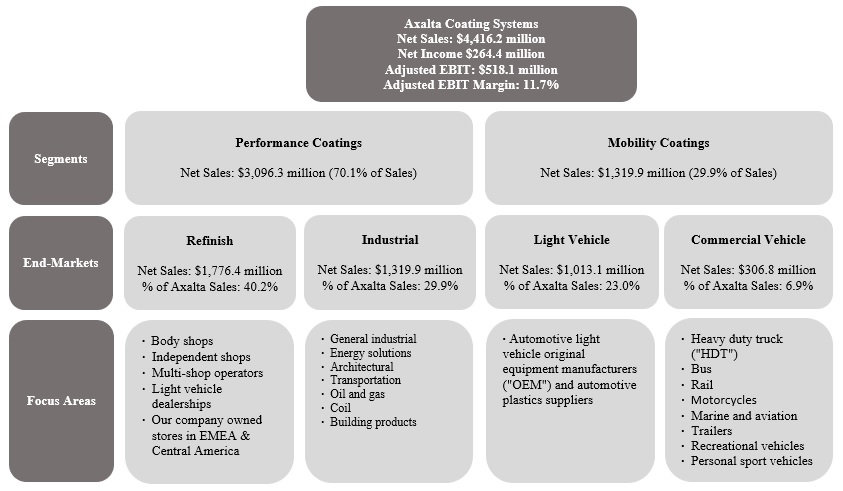

Our diverse global footprint allows us to meet the needs of our customer base through an extensive sales force and technical support organization, as well as independent, locally based distributors. Our scale and strong local presence are critical to our success, allowing us to leverage our technology portfolio and customer relationships globally while meeting customer demands locally. We operate our business in two operating segments, Performance Coatings and Mobility Coatings, serving four end-markets globally as highlighted below. See the discussion and reconciliation of segment Adjusted EBIT to income before income taxes in Note 20 to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

The table above reflects numbers for the year ended December 31, 2021. Adjusted EBIT Margin is calculated as Adjusted EBIT divided by net sales.

3

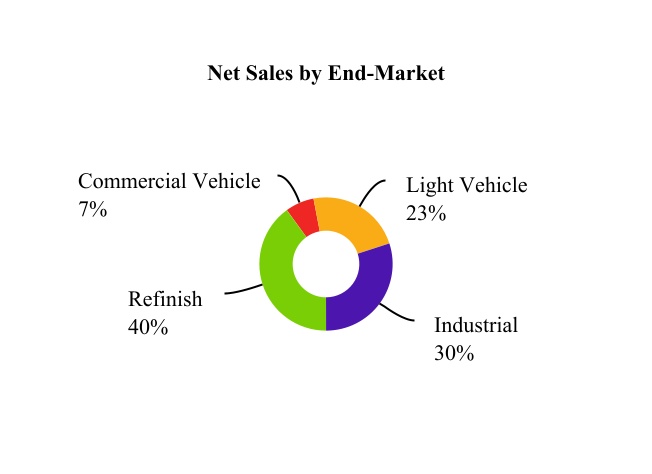

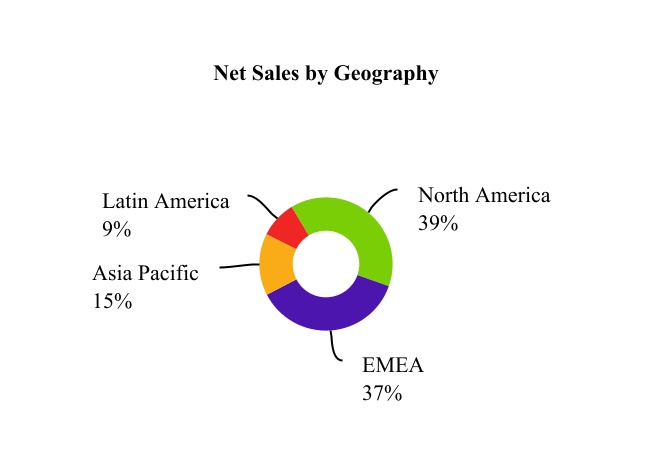

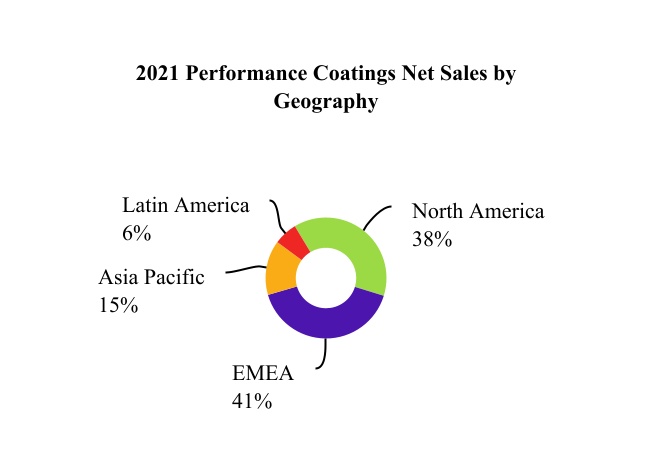

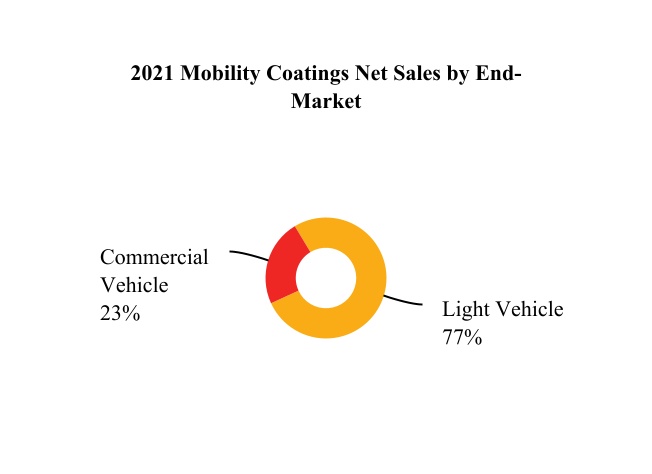

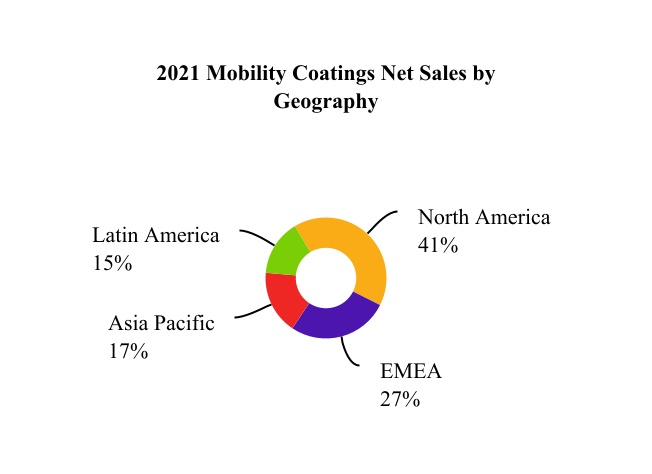

Net sales for our four end-markets and four regions for the year ended December 31, 2021 are highlighted below:

Note: Latin America includes Mexico. EMEA represents Europe, Middle East and Africa.

SEGMENT OVERVIEW

Performance Coatings

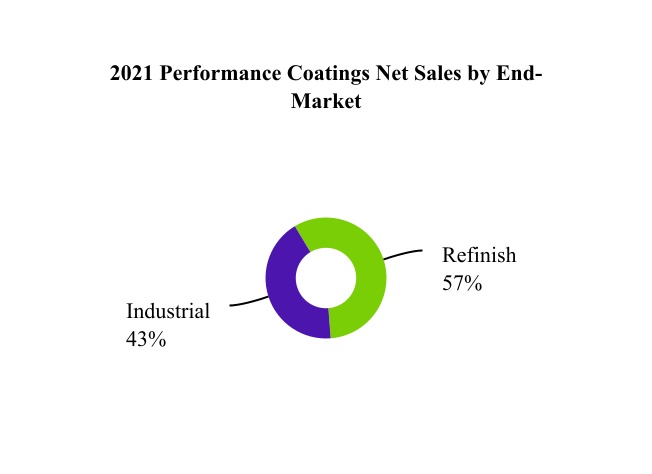

Through our Performance Coatings segment, we provide high-quality liquid and powder coatings solutions to both large regional and global original equipment manufacturers ("OEMs") and to a fragmented and local customer base. We are one of only a few suppliers with the technology to provide precise color matching and highly durable coatings systems. The end-markets within this segment are refinish and industrial.

Performance Coatings End-Markets

Refinish

Sales in the refinish end-market are driven by the number of vehicle collisions, owners' propensity to repair their vehicles, the number of miles vehicle owners drive and the size of the car parc. Although refinish coatings typically represent only a small portion of the overall vehicle repair cost, they are critical to the vehicle owner's satisfaction given their impact on appearance. As a result, body shop operators are most focused on coatings brands with a strong track record of performance and reliability. Body shops look for suppliers and brands with productivity enhancements, regulatory compliance, consistent quality, the presence of ongoing technical support and exact color match technologies. Color matching is a critical component of coatings supplier selection, since inexact matching adversely impacts vehicle appearance, and if repainting is required due to a poor match, it can reduce the speed and volume of repairs at a given shop.

We develop, market and supply a complete portfolio of innovative coatings systems and color matching technologies to facilitate faster automotive collision repairs relative to competing technologies. Our color matching technology provides Axalta-specific formulations that enable body shops to accurately match thousands of vehicle colors, regardless of vehicle brand, color, age or supplier of the original paint during production. It would be time consuming and costly for a new entrant to create such an extensive color inventory.

4

During 2021, we acquired U-POL Holdings Limited ("U-POL") a leading manufacturer of repair and refinish products used primarily for automotive refinish and aftermarket protective applications. The business produces a wide range of high-quality automotive refinishing products including fillers, aerosols, and adhesives as well as industry leading protective coatings. U-POL sells its products in over 100 countries and is widely known for its leading brands, including Raptor®, Dolphin®, and Gold™, among others. Axalta expects to accelerate the growth of U-POL's products by expanding market access through our existing sales and distribution channels while leveraging U-POL's distribution channels to extend the reach of its Refinish Coatings portfolio to new customers. U-POL's expertise in refinish accessories and protective coatings is highly complementary to Axalta's business and expands our addressable market into the important and growing mainstream and economy-based refinish segment as well as the consumer do-it-yourself aftermarket.

Industrial

The industrial end-market is comprised of liquid and powder coatings used in a broad array of end-business applications. Within the industrial end-market, we focus on the following:

•General Industrial: coatings for a wide and diverse array of applications, including racking and shelving, metal furniture, pipe and tube, metal enclosures and fencing, industrial components, and power storage and electrical boxes.

•Energy Solutions: liquid solutions to insulate copper wire used in motors and transformers and coatings to insulate sheets forming magnetic circuits of motors and transformers, computer elements and other electrical devices to provide increased motor and power efficiency, critical for today's automotive applications and focused on support for wind energy and new electric vehicles. Powder solutions provide motor and battery protection and insulation to enable engineering design.

•Architectural: powder and liquid coatings for applications such as window frames, curtain walls, and claddings, typically used in residential, industrial, commercial, and monumental buildings. Architects and designers can benefit from the advice of color experts and the latest trend collections available in our dedicated color experience rooms and online tools.

•Transportation: liquid and powder coatings for vehicle components, chassis, and wheels to protect against corrosion, provide increased durability and impart appropriate aesthetics. Total solutions to support agriculture, construction and earth moving market for protection and appearance requirements.

•Oil & Gas: liquid and powder products to coat tanks, pipelines, valves and fittings protecting against chemicals, corrosion and extreme temperatures in the oil & gas industry.

•Coil: coatings utilized in various applications such as metal building roof and wall panels, residential and commercial steel roofing, gutters, appliances, lighting, garage and entry doors, HVAC, office furniture and truck trailers.

•Building Products: coatings utilized in OEM and aftermarket industrial construction and building markets, including external building materials, cabinets, flooring and furniture.

Demand in this end-market is driven by a wide variety of macroeconomic factors, such as growth in GDP, new residential and commercial construction, as well as automotive and industrial production. There has also been an increase in demand for products that enhance environmental sustainability, corrosion resistance, productivity, and color aesthetics, which we provide through a combination of e-coat, waterborne, solventborne and powder technologies. Customers select industrial coatings based on protection, durability and appearance, with a drive for improved product and application sustainability.

With the increased global demand for electric vehicles skyrocketing, electric vehicle ("EV") manufacturers are designing and searching for solutions to power their vehicles, with innovation to extend performance and improve safety. Electric motors, batteries and EV powertrain components require protective coatings to maintain optimal temperatures, reduce the risk of fire and corrosion damage as well as to prevent electromagnetic interference. By leveraging Axalta's deep expertise in energy solutions coupled with our deep knowledge of the automotive industry and the eMobility market, Axalta has developed coating solutions tailored to the unique needs of the evolving EV industry.

Performance Coatings Products and Brands

We offer a comprehensive range of specially-formulated waterborne and solventborne products and systems used by the global automotive refinish industry to repair damaged vehicles. Our refinish products and systems comprise a range of coatings layers, including fillers, aerosols and adhesives acquired with the 2021 U-POL acquisition, required to match the vehicle's color and appearance, producing a repair surface indistinguishable from the adjacent surface.

5

We provide systems that enable body shops to match more than 200,000 color variations, using a database with more than four million formulations, in the global market. Our color technology is manifested in the pigment and dispersion technology that are utilized in our tints, one of the most technologically advanced parts of the refinish coatings system, which makes up most of our products in a body shop. We have a large color library and several well-known, long-standing premium brands, including Cromax®, Standox®, Spies Hecker®, Syrox™, and Raptor®, as well as other regional and local brands.

Our color matching and retrieval systems allow customers to quickly match any color, preventing body shop technicians from having to repeat the color matching process, saving time and materials. The color matching process begins with a technician scanning a damaged vehicle with one of our advanced color matching tools, such as our Acquire Plus EFX™ hand-held spectrophotometer. The Acquire Plus EFX reads the vehicle color, evaluating both the unique flake and color characteristics of the specific vehicle. These characteristics may vary significantly, even for vehicles of the same make, model and original color, due to a variety of factors, including a vehicle's age, plant at which it was assembled, weather conditions and operating history. The Acquire Plus EFX electronically connects with our ColorNet® database and generates for the body shop technician the precise mix of tints and colors needed to recreate that specific color for the part being repaired. In addition to the Acquire Plus EFX, we offer customers several other color matching tools, including our VINdicator® database, which identifies vehicle color based on its vehicle identification number, and traditional color matching fan decks.

We are also a leading global developer, manufacturer and supplier of functional and decorative liquid and powder coatings for a large number of diversified applications in the industrial end-market. Through an acquisition completed in 2017, we have also become a leading manufacturer and supplier of coatings sold into the building materials, cabinet, wood and luxury vinyl flooring and furniture markets in North America. Our liquid systems are used to provide insulation and thermo-mechanical protection for electrical conductors and devices, protect automotive parts and serve as primers, basecoats, and clearcoats for alloy and steel wheels, and provide weatherability and corrosion protection for metal building and infrastructure projects. Powder coatings, both thermoset and thermoplastic, products are an environmentally responsible, higher transfer efficiency alternative to liquid coatings. These coatings are typically electrostatically sprayed using a specialized spray gun and cured to create a uniform, high-quality finish. In the oil & gas industry, our powder and liquid products are used to protect components from corrosion and severe conditions such as extreme temperatures, pressures, and harsh chemicals.

Our major industrial brands include Imron® Industrial, Tufcote™ Industrial, Corlar™ Industrial, Strenex™ Industrial, PercoTop®, Voltatex®, AquaEC™, Durapon®, Hydropon™, UNRIVALED™, and Ceranamel® for liquid coatings and Alesta®, Teodur®, Nap-Gard®, Abcite® and Plascoat® for powder coatings.

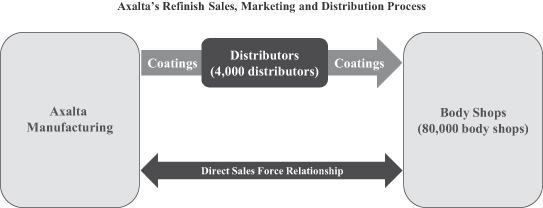

Performance Coatings Sales, Marketing and Distribution

We leverage a large global refinish sales and technical support team to effectively serve our broad refinish customer base of approximately 80,000 body shops. Most of our products are supplied by our network of approximately 4,000 independent local distributors. In select regions, including parts of Europe, we also sell directly to body-shop customers. Distributors maintain an inventory of our products to fill orders from body shops in their market and assume credit risk and responsibility for logistics, delivery and billing. In certain countries, we utilize importers that buy directly from us and actively market our products to body shops. Our relationships with our top ten distributors are longstanding and continue to contribute to our success in the global refinish market.

Our large sales force manages relationships directly with our end-customers to drive demand for our products, which in turn are purchased through customers in our distributor network. Due to the local nature of the refinish industry, our sales force operates on a regional/country basis to provide clients with responsive customer service and local insight. As part of their coverage efforts, salespeople introduce new products to body shops and provide technical support and ongoing training. We have 48 customer training centers established globally, which helps to deepen our customer relationships.

6

Our sales force also helps to drive shop productivity improvements and to install or upgrade body shop color matching and mixing equipment to improve shop profitability. Once a coating and color system is installed, a body shop almost exclusively uses its specific supplier's products. The proprietary nature of a coatings supplier's color systems, the substantial inventory needed to support a body shop and the body shop's familiarity with an established brand lead to high levels of customer retention. Our customer retention rate levels have been and continue to be strong.

Our large direct sales team in industrial serves the end customers, driving demand which is then primarily filled directly or through channels of distribution and e-commerce. We leverage this dedicated sales force and technical service team to provide regional support and focus global innovation projects to meet the evolving market needs. We are one of only three truly global powder coatings producers that can satisfy the needs and specifications of a customer in multiple regions of the world, while maximizing productivity from the broad scale and scope of our operations.

Performance Coatings Customers

Within our Performance Coatings segment, we sell coatings to customers in more than 140 countries. Our top ten customers accounted for approximately 18% of our Performance Coatings net sales during the year ended December 31, 2021.

In our industrial and refinish end-markets we serve both large OEMs and a broad, fragmented customer base. Our industrial end-market is comprised of a wide variety of industrial manufacturers, while our refinish end-market is primarily comprised of approximately 80,000 body shops, including:

•Independent Body Shops: Single location body shops that utilize premium, mainstream or economy brands based on the local market.

•Multi-Shop Operators ("MSOs"): Body shops with more than five locations focused on providing premium paint jobs with industry leading efficiency. MSOs use premium/mainstream coatings and state-of-the-art painting technology to increase shop productivity, allowing them to repair more vehicles faster.

•Original Equipment Manufacturer Dealership Body Shops: High-productivity body shops, located in OEM car dealerships, that operate like MSOs and provide premium services to customers using premium/mainstream coatings.

Performance Coatings Competition

Our primary competitors in the refinish end-market include AkzoNobel, BASF and PPG, but we also compete against local and regional players in local markets. Similarly, in the industrial end-market, we compete against multi-national suppliers, such as AkzoNobel, PPG and Sherwin-Williams, as well as a large number of local and regional players in local markets. We are one of the few performance coatings companies that can provide the customer service, total technology solutions, color design capability and the product performance necessary to deliver exceptional value to our customers.

Mobility Coatings

Through our Mobility Coatings segment, we provide coatings technologies while focusing on supporting the accelerating demand for e-mobility and the evolving coatings needs of established and emerging light and commercial vehicle OEMs, fleet owners and shared mobility providers. These global customers are faced with evolving megatrends in sustainability, personalization and autonomous driving that require a high level of technical support coupled with productive, environmentally responsible coatings systems that can be applied with a high degree of precision, consistency and speed.

7

Our solutions portfolio brings together the best of Axalta's experience and innovation into three categories: Core Mobility Solutions, Advanced Mobility Solutions and Axalta Advantage.

•Core Mobility Solutions comprises Axalta's best-in-class basecoats and clearcoats for color and beautification along with primers, electrocoats and powder applications for surface protection.

•Advanced Mobility Solutions encompasses products and applications for mass customization, two-tone and digital paint. It includes coatings with enhanced functionality that improve LiDAR and radar performance and exterior protection for electric vehicle platforms and components.

•Axalta Advantage features expert services and consulting to improve productivity in and outside the paint shop, including application design, process improvement, cost and CO2 modeling, and troubleshooting.

Mobility Coatings End-Markets

Light Vehicle

Demand for light vehicle products is driven by the production of light vehicles in a particular region. Light vehicle OEMs select coatings providers on the basis of their global ability to deliver core and advanced technological solutions that improve exterior appearance and durability and provide long-term corrosion protection. These customers also look for suppliers that offer sustainable solutions that aid in the customer portfolio transformation and can enhance process efficiency to improve productivity and provide superior technical service support. Rigorous environmental and durability testing as well as obtaining engineering approvals are also key criteria used by global light vehicle OEMs when selecting coatings providers. Globally integrated suppliers are important because they offer products with consistent standards across regions and are able to deliver high-quality products in sufficient quantity while meeting OEM service requirements. Our global scale, people expertise, innovative technology platforms, and customer focus, position us to be a global partner and solutions provider to the most discerning and demanding light vehicle OEMs. We are one of the few coatings producers that can provide OEMs with global product specifications, standardized color development, compatibility with an ever-increasing number of substrates, automotive plastics supplies, increasingly complex colors and environmentally responsible coatings while continuing to simplify and reduce steps in the coating application process.

Commercial Vehicle

Sales in the commercial vehicle end-market are generated from a variety of applications, including non-automotive transportation (i.e., HDT, bus and rail), motorcycles, marine and aviation, as well as related markets such as trailers, recreational vehicles and personal sport vehicles. This end-market is primarily driven by global commercial vehicle production, which is influenced by overall economic activity, government infrastructure spending, equipment replacement cycles and evolving environmental standards for sustainability.

Commercial vehicle OEMs select coatings providers on the basis of their ability to consistently deliver advanced technological solutions that improve exterior appearance, protection and durability and provide extensive color libraries and matching capabilities at the lowest total cost-in-use, while meeting stringent environmental requirements. Particularly for HDT applications, truck owners demand a significant variety of custom colors and advanced product technologies to enable custom designs. Our strong market position and growth are driven by our ability to provide customers with our market-leading brand, Imron®, as well as leveraging our global product lines, regional knowledge and service.

Mobility Coatings Products and Brands

We develop and supply a complete coatings product line for light vehicle OEMs. Our products are designed to enhance the styling and appearance of a vehicle's exterior while providing protection from the elements, extending the life of the vehicle. Widely recognized in the industry for our advanced and patented technologies, our products not only increase productivity and profitability for OEMs but also produce attractive and durable finishes. Our light vehicle coatings portfolio is one of the broadest in the industry.

The coatings operation is a critical component of the vehicle assembly process, requiring a high degree of precision, speed and productivity. The paint shop process typically includes a dip process, three application zones and three high-temperature ovens that cure each coating layer at temperatures ranging from 320°F to 400°F (i.e., "high bake"). Our key products consist of the four main coatings layers: electrocoat (AquaEC™), primer (HyperDur™), basecoat (ChromaDyne™) and clearcoat (Lumeera™).

The coatings process accounts for a majority of the total energy consumed during the vehicle manufacturing process. As a result, we have developed Harmonized Coating TechnologiesTM, including 3-Wet, Eco-Concept and 2-Wet Monocoat, that help our OEM customers lower costs by reducing energy consumption while increasing productivity.

8

In today's existing transportation ecosystem, coatings provide essential beauty and color to vehicle bodies while adding corrosion and impact protection. As the industry evolves, each dimension of mobility – electric vehicles, shared transportation and autonomous driving – requires coatings with advanced functionality that, in addition to aesthetics and protection, contributes to the efficiency of electrification, vehicle design, navigation and passenger safety, among other areas. The evolution of mobility creates tremendous opportunities for OEMs but requires them to undertake significant shifts in how they design and produce vehicles. OEMs are also increasingly looking to reduce the weight of vehicles in response to increasing vehicle emissions and fuel consumption regulations. As a result, OEMs are constructing vehicle platforms using a variety of new materials in addition to steel and plastic, including aluminum, carbon fiber and other substrates, LiDAR and Radar sensory, each of which requires specialized coatings formulations to create a uniform color and finish. We continue to innovate with our OEM customers in driving this trend, as evidenced by use of our coatings on their flagship vehicle platforms.

We also develop and supply a wide array of coatings systems for a broad range of commercial vehicle applications including HDT, bus and rail. These products simultaneously enhance aesthetic appearance and provide protection from the elements. We meet the demands of commercial vehicle customers with our extensive offering of over 75,000 different colors. In the HDT market, because the metal and composite components are painted simultaneously in an automatic process, most truck OEMs use low bake coatings to ensure that the plastic composite parts on a truck's exterior do not deform during the bake process. Truck owners demand a wide variety of custom colors that are formulated using a combination of on-site mixing machines at the OEM or direct shipments of premixed high-volume colors from us. Our commercial vehicle brands include Imron®, Imron Elite®, Centari®, Rival®, Corlar® epoxy undercoats and AquaEC™.

Mobility Coatings Sales, Marketing and Distribution

We have full-time technical representatives stationed at certain OEM facilities around the world. These on-site representatives provide customer support, monitor the painting process and track paint demand at each assembly plant. Monitoring OEM line performance in real-time allows our technical support teams to help improve paint department operating efficiency and provide performance feedback to our formulating chemists and paint manufacturing teams. Our customer technical support representatives also help OEMs manage their physical inventory by forecasting facility coatings demand based on the customer's build schedule.

We sell and ship products directly to light vehicle OEMs in each of our four regions coordinated via a global point of contact for each customer and assist OEMs with on-site customer support. Located in 11 countries, our manufacturing facilities provide a local presence that enables us to cultivate strong relationships, gain intimate customer knowledge, provide superior technical support to our key customers and maintain "just-in-time" product delivery capabilities critical to OEMs. Our local presence also allows us to quickly react to changing local dynamics, offer high-quality products and provide excellent customer service.

In the commercial vehicle end-market, we employ a dedicated sales and technical service team to support our diverse customer base, including a direct sales force supporting the HDT market. We ship our coatings directly to commercial vehicle OEMs and provide on-site technical service representatives that play an important role by helping to optimize the painting process and by providing responsive customer support.

Mobility Coatings Customers

We provide our products and services to light and commercial vehicle customers at over 200 assembly plants worldwide, including all of the top ten global automotive manufacturers. We have a stable customer base with several relationships dating back approximately 90 years and believe we are well positioned with the fastest growing OEMs in both the developed and emerging markets. Our top ten customers accounted for approximately 67% of our Mobility Coatings net sales during the year ended December 31, 2021.

Mobility Coatings Competition

We primarily compete against large multi-national suppliers such as PPG and BASF in the light and commercial vehicle end-markets. Additionally, we compete against certain regional players in Asia Pacific and EMEA. With our state-of-the-art coatings solutions and local presence in key OEM markets, we are one of the few competitors in the industry that offers global OEM manufacturers the combination of high-quality products, personalized, top-rate technical service and short lead-times for product delivery.

KEY RAW MATERIALS

We use thousands of different raw materials, which fall into seven broad categories: liquid resins, powder resins, pigments, solvents, monomers, isocyanates and additives. On average, our total raw material spend represents between 40% and 50% of our cost of sales, even during 2021 despite significant raw material inflation experienced throughout the year. We purchase raw materials from a diverse group of suppliers, with our top ten suppliers representing approximately 33% of our 2021 spending on raw materials.

9

Approximately 65% of the raw materials we procure are derived from crude oil and natural gas. While prices for these raw materials fluctuate with energy prices, such fluctuations are somewhat mitigated by the fact that the majority of our raw materials are fourth to sixth generation derivatives of crude oil and natural gas. The dynamics of supply and demand play a much more critical role in our cost of raw materials than just the price of crude oil. Non-petrochemical based inputs such as minerals that are used to manufacture coating pigments are not significantly affected by volatility in crude oil prices but tend to be impacted by the supply-demand dynamics of their industry.

Historically, to manage raw material volatility, we have used a combination of price increases to customers and, in certain limited circumstances, contractual raw material recovery mechanisms. Since 2001, our variable cost of sales has remained stable between 35% and 45% of net sales, even during 2021 despite significant raw material inflation experienced throughout the year.

RESEARCH AND DEVELOPMENT

Our focus on technology has allowed us to proactively provide customers with next-generation offerings that enhance product performance, improve productivity and satisfy increasingly strict environmental regulations. Since our entry into the coatings industry over 150 years ago, we believe we have consistently been at the forefront of coatings technology innovation. These innovations have played a fundamental role in our ability to maintain and grow our global market share as well as deliver substantial financial returns.

We believe that we are a technology leader well positioned to benefit from continued industry shifts in customer needs. Our markets are among the most demanding in the coatings industry with high levels of product performance that continuously evolves, with increasing expectations for productivity on customer lines and with environmentally responsible products. Our technology development is led by a highly experienced and educated workforce that is focused on new product development, color development, technical customer support and improving our manufacturing processes. As such, our technology development covers two critical interrelated aspects for us, research and development as well as technical support and manufacturing. In total, as of December 31, 2021, we have approximately 1,300 people dedicated to technology development. We operate four major technology centers throughout the world where we develop and align our technology investments with regional business needs complemented by approximately 28 regional laboratories which provide local connection to our global customer base. This includes our Global Innovation Center located in Philadelphia, Pennsylvania, which opened in 2018 for global research, product development and technology initiatives.

PATENTS, LICENSES AND TRADEMARKS

As of December 31, 2021, we had a global portfolio of approximately 740 issued patents and more than 480 trademarks. We actively apply for and obtain U.S. and foreign patents and trademarks on new products and process innovations and as of December 31, 2021, approximately 230 patent applications were pending throughout the world.

Our primary purpose in obtaining patents is to protect the results of our research for use in operations and licensing. We are also party to a substantial number of patent licenses and other technology agreements. We have a significant number of trademarks and trademark registrations in the United States and in other countries, as described below.

We own or otherwise have rights to the trademarks, service marks, copyrights and trade names used in conjunction with the marketing and sale of our products and services. These trademarks include Abcite®, Alesta®, AquaEC®, AudurraTM, Centari®, Ceranamel®, ChallengerTM, ChemophanTM, ColorNet®, Corlar®, Cromax®, Cromax Mosaic®, Durapon 70®, DuxoneTM, Harmonized Coating Technologies®, Hydropon®, Imron®, Imron EliteTM, Imron ExcelProTM, LutophenTM, Nap-Gard®, Nason®, Raptor®, Rival®, Spies Hecker®, Standox®, StollaquidTM, SyntopalTM, SyroxTM, U-POLTM, Vermeera® and Voltatex®, which are protected under applicable intellectual property laws and are the property of us and our subsidiaries.

Although we consider that our patents, licenses and trademarks in the aggregate constitute a valuable asset, we do not regard our business as being materially dependent on any single or group of related patents, licenses or trademarks.

JOINT VENTURES

At December 31, 2021 we were party to eight joint ventures, of which three were focused in the industrial end-market, three were focused in the light vehicle end-market and two were focused in the refinish end-market. At December 31, 2021 we were the majority shareholder, and/or exercise control, in six joint ventures, which we consolidated. Our fully consolidated joint venture-related net sales were $80.7 million, $76.3 million, and $254.7 million for the years ended December 31, 2021, 2020 and 2019, respectively. See Part I, Item 1A, "Risk Factors—Risks Related to our Business—Risks Related to Other Aspects of our Business—Our joint ventures may not operate according to our business strategy if our joint venture partners fail to fulfill their obligations".

10

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

During January 2022, we announced a new environmental, social and governance ("ESG") framework, which is structured under three key pillars and the related goals:

•Planet Solutions: Focused on ensuring a more sustainable future for the planet, this first pillar includes a series of goals aimed at improving the Company's environmental performance and reducing the impact of its global operations, including our goals to achieve an absolute reduction of 50 percent of Scope 1 and 2 greenhouse gas (GHG) emissions by 2030, as well as a goal to become carbon neutral in our operations by 2040 – one decade ahead of the deadline set by the Paris Agreement on Climate Change. In addition to these reduction targets, Axalta is taking steps towards our goal of a 10 percent reduction of VOC emissions, process waste, and water use from operations by 2030.

•Business Solutions: This second pillar concentrates on how Axalta's products, services, and technology can help customers design and manufacture their finished products to help accelerate their own sustainability initiatives and achievements. Axalta is committing to deliver sustainability benefits from 80 percent of its new technology and innovation developments by 2030 and increasing, by at least 20 percent, the total percentage of net sales derived from products, services, and tools that offer sustainability benefits.

•People Solutions: Building on Axalta's corporate culture, which is rooted in inclusivity, integrity, safety, and engagement, this third pillar will ensure that the Company continues operating and fostering an environment where all of our people can thrive. The Company is committing to creating a more diverse and inclusive environment that results in increasing the representation of women in management positions globally to at least 30 percent by 2030. Axalta will continue to support its local communities via its Bright Futures Program, which includes STEM and vocational scholarships.

HUMAN CAPITAL RESOURCES

Our success is realized through the engagement and commitment of our people. As of December 31, 2021, we had approximately 13,000 team members, including 12,000 employees and 1,000 contractors, with 25% of our team members based in the U.S. and 75% based in international locations. Our workforce is distributed globally, with approximately 44% in the Americas, 39% in EMEA and 17% in Asia Pacific.

Axalta's ability to attract, develop and retain highly skilled talent requires us to focus on the growth and well-being of each team member. As a global coatings manufacturer, we have a wide range of employees, including but not limited to management professionals, scientists, technicians, engineers, sales, technical, manufacturing operations, supply chain, administrative and customer service personnel. We drive to create a performance-driven culture where employees feel included and find a sense of belonging. It is also important that we provide an environment that fosters inclusivity and embraces diversity where everyone feels they have a voice and their contributions are valued. In support of this, our first all employee engagement survey took place in 2021. Capturing the voice of our employees through this survey provided actionable insights into the specific tools, processes, and other factors that enable our employees to perform at their best.

We strive to provide a wide variety of opportunities for growth for our employees, including online trainings, on-the-job experience, education tuition assistance and financial counseling. We also aim to provide competitive compensation and benefits across all of our global locations.

In addition, the health and well-being of our employees is foundational to Axalta's success. In 2020, we launched "Flex Your Work", a program that is intended to support the work-life balance of our office-based employees by allowing them to work from home up to two days a week. We are also committed to providing a workplace that enables team members to operate safely, including safety protocols to ensure the health and safety of our employees during the COVID-19 pandemic. Safety is ingrained in the way we do business and our safety program is structured on the foundation that every employee is engaged and committed to improving safe operating practices and eliminating injuries. When health and safety incidents do occur, we strive to determine the causes and eliminate the potential for future similar incidents. In 2021, Axalta's injury and illness performance resulted in a 0.24 OSHA Recordable Incident Rate ("TRIR"), compared to the 1.6 OSHA Recordable Incident Rate for the Paint and Coating Manufacturing Industry (according to the US Bureau of Labor Statistics 2020 data). An internal review revealed that, for 2017-2020, we had miscalculated our TRIR. Our TRIR for each of 2017, 2018, 2019 and 2020, as recalculated, was 0.40, 0.46, 0.30 and 0.16, respectively.

The Compensation Committee of our Board of Directors has oversight of the Company's human capital management efforts. The Environment, Health, Safety and Sustainability Committee of our Board of Directors has oversight of the Company's policies to protect the health and safety of our employees and contractors, and this committee regularly reviews data on our safety metrics and performance.

We encourage you to visit the sustainability section, and other sections, of our website for more detailed information regarding our human capital resources, programs, and initiatives. Nothing on our website shall be deemed incorporated by reference into this Annual Report on Form 10-K.

11

REGULATORY COMPLIANCE

Our business is subject to significant regulations in all of the markets that we operate and we are committed to operating our business in compliance with all applicable laws and regulations.

Environmental

We are subject to applicable federal, state, local and foreign laws and regulations relating to environmental protection and workers' safety, including those required by the U.S. Environmental Protection Agency. Our Environment, Health, Safety ("EHS") and Sustainability policies and standards are a key element of the foundation upon which we develop, market, manufacture, and distribute products and services to our global customers. In 2017, we established a Board-level committee responsible for the oversight of our EHS and Sustainability policies, performance, strategy and compliance matters. We operate our manufacturing facilities using a common set of internal standards. These standards support a consistent approach to EHS and Sustainability performance improvement. We strive to assure that all our manufacturing and distribution facilities are operated in compliance in all known material respects to applicable environmental requirements. Investigation, remediation, operation and maintenance costs associated with environmental compliance and management of sites are a normal recurring part of our operations. We do not expect outstanding remediation obligations to have a material impact on our financial position; however, the ultimate cost of remediation is subject to a number of variables and is difficult to accurately predict. We may also incur significant additional costs as a result of contamination that is discovered and/or government required remediation obligations that are imposed at these or other properties in the future.

Non-U.S. Sales

Our non-U.S. sales are subject to both U.S. and non-U.S. governmental regulations and procurement policies and practices, including regulations relating to import-export control, tariffs, investment, exchange controls, anti-corruption and repatriation of earnings. Non-U.S. sales are also subject to varying currency, political and economic risks.

Privacy Regulations

We are also subject to and comply with increasingly complex privacy and data protection laws and regulations in the United States and other jurisdictions. This includes the European Union's General Data Protection Regulation ("GDPR"), which enforces rules relating to the protection of processing and movement of personal data. The interpretation and enforcement of such regulations are continuously evolving and there may be uncertainty with respect to how to comply with them. Noncompliance with GDPR and other data protection laws could result in damage to our reputation and payment of significant monetary penalties.

WHERE YOU CAN FIND MORE INFORMATION

Our website address is www.axalta.com. We post, and shareholders may access without charge, our recent filings and any amendments thereto of our annual reports on Form 10-K, quarterly reports on Form 10-Q and proxy statements as soon as reasonably practicable after such reports are filed with the Securities and Exchange Commission ("SEC"). We also post all financial press releases, including earnings releases, to our website. All other reports filed or furnished to the SEC on the SEC's website, www.sec.gov, including current reports on Form 8-K, are available via direct link on our website. Reference to our and the SEC's websites herein do not incorporate by reference any information contained on those websites and such information should not be considered part of this Form 10-K.

12

ITEM 1A. RISK FACTORS

As a global manufacturer, marketer and distributor of high-performance coatings systems, we operate in a business environment that includes risks. These risks are not unlike the risks we have faced in the recent past nor are they unlike risks faced by our competitors. If any of the events contemplated by the following discussion of risks should occur, our business, results of operations, financial condition and cash flows could suffer materially and adversely. While the factors listed here are considered to be the more significant factors, they should not be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors, including those in other documents we file from time to time with the Securities and Exchange Commission, may materially and adversely affect our businesses, results of operations, financial condition and cash flows.

Risks Related to our Business

Risks Related to Execution of our Strategic and Operating Plans

Our business, results of operations, financial condition, cash flows and stock price has been, and may in the future be, adversely affected by the COVID-19 pandemic.

Axalta continues to monitor closely the impact of COVID-19 on all aspects of our business and geographies, including effects on customers, employees, suppliers, vendors and distribution channels, as well as macroeconomic consequences. COVID-19 has had and may continue to have an adverse impact on demand for our products and, thus, our income from operations. Although we have continued to operate our facilities to date, consistent with applicable governmental orders, the effects of COVID-19 may have a material adverse effect on our operations, supply chain, customers, labor availability and logistics networks, including business shutdowns, employee vaccination requirements or similar mandates and other disruptions. The extent to which COVID-19 may adversely impact our business depends on future developments, which are highly uncertain and unpredictable, the severity and duration of the virus, including novel variants, and the effectiveness of actions taken globally to contain or mitigate its effects, including any ongoing actions in response to changing health conditions over time. Any resulting financial impact cannot be estimated reasonably at this time, but may materially adversely affect our business, results of operations, financial condition and cash flows. Even after the COVID-19 pandemic has subsided, we may experience materially adverse impacts to our business due to any resulting economic recession or depression, as well as other resulting macroeconomic conditions. Additionally, concerns over the economic impact of COVID-19 have caused extreme volatility in financial and other capital markets which has and may continue to adversely impact our stock price and our ability to access to debt financing and capital markets.

Our financial position, results of operations and cash flows could be materially adversely affected by difficult economic conditions, and/or significant volatility in the capital, credit and commodities markets.

Several of the end-markets we serve are cyclical, and macroeconomic and other factors beyond our control could reduce demand from these end-markets for our products, including as a result of depressed demand for our customers' products or services, and materially adversely affecting our business, financial condition and results of operations and cash flows. For example, weak economic and other macroeconomic conditions, such as the semiconductor chip shortage during 2021, has in the past and could in the future depress new car sales and/or production, reducing demand for our light vehicle OEM coatings and limit the growth of the car parc. This could, in turn, cause a related decline in demand for our automotive refinish coatings because, as the age of a vehicle increases, the propensity of car owners to pay for cosmetic repairs generally decreases. Also, during difficult economic times, car owners may refrain from seeking repairs for their damaged vehicles. Similarly, periods of reduced global economic activity could hinder global industrial output, which could decrease demand for our industrial and commercial vehicle coating products.

Our global business is adversely affected by decreases in the general level of economic activity, such as decreases in business and consumer spending, construction activity and industrial manufacturing. Disruptions in the U.S., Europe or other economies, or weakening of emerging markets, such as China, could adversely affect our sales, profitability and/or liquidity.

Further, a tightening of credit in financial markets could adversely affect the ability of our customers and suppliers to obtain financing for significant purchases and operations, could result in a decrease in or cancellation of orders for our products and services and could impact the ability of our customers to make payments owed to us. Similarly, a tightening of credit in financial markets could adversely affect our supplier base and increase the potential for one or more of our suppliers to experience financial distress or bankruptcy.

Improved safety features on vehicles, commercialization of autonomous vehicles, insurance company influence, the introduction of new business models or new methods of travel, and weather conditions may reduce the demand for some of our products and could have a negative effect on our business, financial condition, results of operations and cash flows.

Vehicle manufacturers continue to develop new safety features such as collision avoidance technology and self-driving vehicles that may reduce the rate and amount of vehicle collisions, potentially negatively impacting demand for our refinish

13

coatings. Insurance companies may influence vehicle owners to use body shops that do not use our products, which could also negatively impact demand for our refinish coatings. In addition, through the introduction of new technologies, new business models or new methods of travel, such as ridesharing, the number of automotive OEM new-builds may decline, potentially reducing demand for our automotive OEM coatings. Furthermore, from time to time, weather conditions have an adverse effect on our sales of coatings and related products. For example, unusually mild weather during winter months may lead to fewer vehicle collisions, reducing market demand for our refinish coatings. Any resulting reduction in demand for our refinish coatings could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The loss of or reduced purchases by any of our largest customers, or the consolidation of MSOs, distributors and/or body shops, could adversely affect our business, financial condition, results of operations and cash flows.

We have some customers that purchase a large amount of products from us and we are also reliant on distributors to assist us in selling our products. Our largest single customer accounted for approximately 5% of our 2021 net sales and our largest distributor accounted for approximately 3% of our 2021 net sales. Consolidation of any of our customers, including MSOs, distributors and body shops, could decrease our customer base and impact our results of operations if the resulting business seeks different sales terms or chooses to use one of our competitors for the consolidated business. The loss of any of our large customers or significant changes in their level of purchases, as a result of changes in business conditions, working capital levels, product requirements, consolidation or otherwise, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We rely on our distributor network and third-party delivery services for the distribution and export of certain of our products. A significant disruption in these services or significant increases in prices for those services may disrupt our ability to export material or increase our costs.

We ship a significant portion of our products to our customers through our distributor network as well as independent third-party delivery companies. If any of our key distributors or third-party delivery providers experiences a significant disruption, our products may not be delivered in a timely fashion. In addition, if our key distributors or third-party delivery providers increase prices and we are not able to pass along these increases to customers, find comparable alternatives or adjust our delivery network, our business, financial condition, results of operations and cash flows could be adversely affected.

Price increases, business and supply chain interruptions, declines in the supply of raw materials or disruptions to our major tolling arrangements could have a significant impact on our ability to grow or sustain earnings.

Our manufacturing processes consume significant amounts of raw materials, the costs of which are subject to change based on fluctuations in worldwide supply and demand as well as other factors beyond our control, including inflationary pressures like those seen during 2021. We use a significant amount of raw materials derived from crude oil and natural gas. As a result, volatile oil and gas prices, as well as other unrelated factors, can cause significant variations in our raw materials costs, affecting our operating results. In rising raw material price environments, we may be unable to pass along these increased costs to our customers. In declining raw material price environments, customers may seek price concessions from us greater than any raw material cost savings we realize. If we are not able to fully offset the effects of higher raw materials costs, or if customers demand greater raw material price concessions than we obtain in low raw material cost environments, our financial results could deteriorate. Additionally, we obtain certain of our raw materials from selected key suppliers. If any sole source supplier of raw materials ceases supplying raw materials to us, or if any of our key suppliers is unable to meet its obligations in a timely fashion or at an acceptable price, or at all, we may be forced to incur higher costs to obtain the necessary raw materials elsewhere or, in limited instances, we may not be able to obtain the necessary raw materials. Additionally, in certain instances, we rely on third parties to toll manufacture certain of our intermediates and products. If any of our key tolling partners cease to provide toll manufacturing services to us, either permanently or temporarily, we would be required to procure alternative manufacturing arrangements, which we may not be able to arrange on a timely basis or at all.

In addition to the risks associated with raw materials prices, supplier capacity constraints, supplier production disruptions, including supply disruptions from our sole source or other key suppliers, supply chain and logistics congestion and disruptions, increasing costs for energy, the unavailability of certain raw materials or disruptions to our key tolling arrangements could result in harm to our manufacturing capabilities or supply imbalances that may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Failure to develop and market new products and manage product life cycles could impact our competitive position and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our operating results are largely dependent on our development and management of our portfolio of current, new and developing products and services as well as our ability to bring those products and services to market. Difficulties or delays in product development, such as the inability to identify viable new products, successfully complete research and development, obtain relevant regulatory approvals, effectively manage our manufacturing process or costs, obtain intellectual property protection, or gain market acceptance of new products and services could have a material adverse effect on our

14

business, financial condition, results of operations and cash flows. Because of the lengthy and costly development process, technological challenges and intense competition, we cannot assure you that any of the products we are currently developing, or that we may develop in the future, will achieve commercial success. For example, in addition to developing technologically advanced products, commercial success of those products will depend on customer acceptance and implementation of those products as well as the products and services offered and developed by our current and future competitors. A failure to develop commercially successful products or to develop additional uses for existing products could materially adversely affect our business, financial results, results of operations or cash flows. Further, sales of our new products could replace sales of some of our current products, offsetting the benefit of even a successful product introduction.

Risks Related to our Global Operations

As a global business, we are subject to risks associated with our non-U.S. operations that are not present in the United States.

We conduct our business on a global basis, with approximately 64% of our 2021 net sales occurring outside the United States. We anticipate that international sales will continue to represent a substantial portion of our net sales and that our strategy for continued growth and profitability will entail further international expansion, particularly in emerging markets. Changes in local and regional economic conditions could affect product demand in our non-U.S. operations. Specifically, our financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations. These conditions include, but are not limited to, changes in a country's or region's social, economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights, changes in the regulatory or legal environment, restrictions on currency exchange activities, burdensome taxes and tariffs and other trade barriers, as well as the imposition of economic or other trade sanctions, each of which could impact our ability to do business in certain jurisdictions or with certain persons. For example, the U.S. government has taken actions or made proposals that are intended to address trade imbalances or trade practices, specifically with China, among other countries, which include encouraging increased production in the United States. These actions and proposals have resulted or could result in increased customs duties and the renegotiation of some U.S. trade agreements, as well as other retaliatory actions.

Risks Related to Legal and Regulatory Compliance and Litigation

Our failure to comply with the anti-corruption laws of the United States and various international jurisdictions could negatively impact our reputation and results of operations.

Doing business on a global basis requires us to comply with the laws and regulations of the U.S. government and those of various international and sub-national jurisdictions, and our failure to successfully comply with these rules and regulations may expose us to liabilities which may be significant. These laws and regulations apply to companies, individual directors, officers, employees and agents, and may restrict our operations, trade practices, investment decisions and partnering activities. In particular, our international operations are subject to U.S. and foreign anti-corruption laws and regulations, such as the U.S. Foreign Corrupt Practices Act (the "FCPA"), the United Kingdom Bribery Act 2010 (the "Bribery Act") as well as anti-corruption laws of the various jurisdictions in which we operate. The FCPA, the Bribery Act and other laws prohibit us and our officers, directors, employees and agents acting on our behalf from corruptly offering, promising, authorizing or providing anything of value to foreign officials for the purposes of influencing official decisions or obtaining or retaining business or otherwise obtaining favorable treatment. As part of our business, we may, from time to time, deal with state-owned business enterprises, the employees and representatives of which may be considered foreign officials for purposes of the FCPA or the Bribery Act. We are subject to the jurisdiction of various governments and regulatory agencies outside of the U.S., which may bring our personnel into contact with foreign officials responsible for issuing or renewing permits, licenses or approvals or for enforcing or overseeing other governmental regulations. In addition, some of the international locations in which we operate lack a developed legal system and have elevated levels of corruption. Our global operations expose us to the risk of violating, or being accused of violating, the foregoing or other anti-corruption laws. Such violations could be punishable by criminal fines, imprisonment, civil penalties, disgorgement of profits, injunctions and exclusion from government contracts, as well as other remedial measures. Investigations of alleged violations can be very expensive, disruptive and damaging to our reputation. Although we have implemented anti-corruption policies and procedures and provide training on these matters, there can be no guarantee that these policies, procedures and training will effectively prevent violations by our employees or representatives in the future. Additionally, we face a risk that our distributors and other business partners may violate the FCPA, the Bribery Act or similar laws or regulations. Such violations could expose us to FCPA and Bribery Act liability and/or our reputation may potentially be harmed by their violations and resulting sanctions and fines.

Evolving environmental, safety or other regulations and laws could have a material adverse effect on our business and consolidated financial condition.

Our manufacturing activities and products, both in and outside of the U.S., are subject to regulation by various federal, state, provincial and local laws, regulations and government agencies, including the U.S. Environmental Protection Agency, as well

15

as other authorities both inside and outside of the U.S. In addition, legal and regulatory systems in emerging and developing markets may be less developed, and less certain. Laws and regulations, and the interpretation and enforcement thereof, may change as a result of a variety of factors, including political, economic, regulatory or social events. The specific impact of changing laws and regulations, or the interpretation or enforcement of current or future laws and regulations, on our business may vary depending on a number of factors. As a result of changing laws and regulations, or the interpretation or enforcement of current or future laws and regulations, we may be required to make expenditures to modify operations, relocate operations, perform site cleanups or other environmental remediation, or curtail or cease operations, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

As a result of our current and past operations and/or products, including operations and/or products related to our businesses prior to the Acquisition, we could incur significant environmental liabilities and costs.

We are subject to various laws and regulations around the world governing the protection of the environment and health and safety, including the discharge of pollutants to air and water and the management and disposal of hazardous substances. These laws and regulations not only govern our current operations and products, but also impose potential liability on us for our or our predecessors' past operations. We could incur fines, penalties and other sanctions as a result of violations of such laws and regulations. In addition, as a result of our operations and/or products, including our past operations and/or products related to our businesses prior to the acquisition of DuPont Performance Coatings ("DPC"), a business formerly owned by E. I. du Pont de Nemours and Company ("DuPont"), including certain assets of DPC and all of the capital stock and other equity interests of certain entities engaged in the DPC business (the "Acquisition"), we could incur substantial costs, including costs relating to remediation and restoration activities and third-party claims for property damage or personal injury. The ultimate costs under environmental laws and the timing of these costs are difficult to accurately predict. Our accruals for costs and liabilities at sites where contamination is being investigated or remediated may not be adequate because the estimates on which the accruals are based depend on a number of factors, including the nature of the matter, the complexity of the site, site geology, the nature and extent of contamination, the type of remedy, the outcome of discussions with regulatory agencies and, at multi-party sites, other Potentially Responsible Parties ("PRPs") and the number and financial viability of other PRPs. Additional contamination may also be identified, and/or additional cleanup obligations may be incurred, at these or other sites in the future. For example, periodic monitoring or investigation activities are ongoing at a number of our sites where contaminants have been detected or are suspected, and we may incur additional costs if more active or extensive remediation is required. In addition, in connection with the Acquisition, DuPont has, subject to certain exceptions and exclusions, agreed to indemnify us for certain liabilities relating to environmental remediation obligations and certain claims relating to the exposure to hazardous substances and products manufactured prior to our separation from DuPont. We could incur material additional costs if DuPont fails to meet its obligations, if the indemnification proves insufficient or if we otherwise are unable to recover costs associated with such liabilities. The costs of our current operations, complying with complex environmental laws and regulations, as well as internal voluntary programs, are significant and will continue to be so for the foreseeable future as environmental regulations become more stringent. We cannot predict the impact that changing climate conditions or more frequent and severe weather events, if any, will have on our business, results of operations, financial condition or cash flows. Moreover, we cannot predict how legal, regulatory and social responses to concerns about global climate change will impact our business.

We handle and transport certain materials that are inherently hazardous due to their toxic nature.

In our business, we handle and transport hazardous materials. If mishandled or released into the environment, these materials could cause substantial property damage or personal injuries resulting in significant legal claims against us. In addition, evolving regulations concerning the handling and transportation of certain materials could result in increased future capital or operating costs.

Our results of operations could be adversely affected by litigation and claims.

We face risks arising from various litigation matters and other claims that have been asserted against us or that may be asserted against us in the future, including, but not limited to, claims for product liability, patent and trademark infringement, antitrust, warranty, contract and third-party property damage or personal injury, including claims arising from the matters described in Note 6 to our consolidated financial statements included elsewhere in the Annual Report on Form 10-K. For instance, we have noted a nationwide trend in purported class actions against chemical manufacturers generally seeking relief such as medical monitoring, property damages, off-site remediation and punitive damages arising from alleged environmental torts without claiming present personal injuries. We have also noted a trend in public and private nuisance suits being filed on behalf of states, counties, cities and utilities alleging harm to the general public. In addition, various factors or developments can lead to changes in current estimates of liabilities such as a final adverse judgment, significant settlement or changes in applicable law. A future adverse ruling or unfavorable development could result in future charges that could have a material adverse effect on us. An adverse outcome in any one or more of these matters could be material to our business, financial condition, results of operations and cash flows. In particular, product liability claims, regardless of their merits, could be costly, divert management's attention and adversely affect our reputation and demand for our products.

16

Risks Related to Human Resources

If we are required to make unexpected payments to any pension plans applicable to our employees, our financial condition may be adversely affected.

We have defined benefit pension plans in which many of our current and former employees outside the U.S. participate or have participated. Many of these plans are underfunded or unfunded and the liabilities in relation to these plans will need to be satisfied as they mature from our operating reserves. In jurisdictions where the defined benefit pension plans are intended to be funded with assets in a trust or other funding vehicle, the liabilities exceed the corresponding assets in many of the plans. Various factors, such as changes in actuarial estimates and assumptions (including as to life expectancy, discount rates and rate of return on assets) as well as changes in asset allocations and actual return on assets, can increase the expenses and liabilities of the defined benefit pension plans. The assets and liabilities of the plans must be valued from time to time under applicable funding rules and as a result we may be required to increase the cash payments we make in relation to these defined benefit pension plans.

Our financial condition, results of operations and cash flows may be adversely affected to the extent that we are required to make any additional payments to any relevant defined benefit pension plans in excess of the amounts assumed in our current projections and assumptions or report higher pension plan expenses under relevant accounting rules.

We are subject to work stoppages, union negotiations, labor disputes and other matters associated with our labor force, which may adversely impact our operations and cause us to incur incremental costs.

Many of our employees globally are in unions or otherwise covered by labor agreements, including works councils. As of December 31, 2021, substantially all of our U.S. workforce was not unionized and approximately half of our workforce outside the U.S. was unionized or otherwise covered by labor agreements. Consequently, we may be subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes. Additionally, negotiations with unions or works councils in connection with existing labor agreements may result in significant increases in our cost of labor, limit our ability to restructure or manage our operations, divert management's attention away from operating our business or break down and result in the disruption of our operations. The occurrence of any of the preceding outcomes could impair our ability to manufacture our products and result in increased costs and/or worsened operating results. Further, we may be impacted by work stoppages at our suppliers or customers that are beyond our control.

We may not be able to recruit and retain the experienced and skilled personnel we need to compete.

Our future success depends on our ability to attract, retain, develop and motivate highly skilled personnel. We must have talented personnel to succeed and competition for management and skilled employees in our industry is intense. Our ability to meet our performance and growth goals depends upon the personal efforts and abilities of our management and skilled employees. We cannot assure you that we will retain or successfully recruit senior management, or that their services will remain available to us. We also cannot assure you that we will successfully respond to changing employee preferences spurred by the COVID-19 pandemic. Failures in these areas could adversely affect our business, financial condition, results of operations and cash flows.

Risks Related to Intellectual Property

Our inability to protect and enforce our intellectual property rights could adversely affect our financial results.

Intellectual property rights both in the U.S. and in foreign countries, including patents, trade secrets, confidential information, trademarks and trade names, are important to our business and will be critical to our ability to grow and succeed in the future. We make strategic decisions on whether to apply for intellectual property protection and what kind of protection to pursue based on a cost benefit analysis. While we endeavor to protect our intellectual property rights in certain jurisdictions in which our products are produced or used and in jurisdictions into which our products are imported, the decision to file for intellectual property protection is made on a case-by-case basis. Because of the differences in foreign trademark, patent and other laws concerning intellectual property rights, our intellectual property rights may not receive the same degree of protection in foreign countries as they would in the U.S. Our failure to obtain or maintain adequate protection of our intellectual property rights for any reason could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We have applied for patent protection relating to certain existing and proposed products, processes and services in certain jurisdictions. While we generally consider applying for patents in those countries where we intend to make, have made, use or sell patented products, we may not accurately assess all of the countries where patent protection will ultimately be desirable. If we fail to timely file a patent application in any such country, we may be precluded from doing so at a later date. Furthermore, we cannot assure you that our pending patent applications will not be challenged by third parties or that such applications will eventually be issued by the applicable patent offices as patents. We also cannot assure you that the patents issued as a result of our foreign patent applications will have the same scope of coverage as our U.S. patents. It is possible

17

that only a limited number of the pending patent applications will result in issued patents, which may have a materially adverse effect on our business and results of operations.

The patents we own could be challenged, invalidated or circumvented by others and may not be of sufficient scope or strength to provide us with any meaningful protection or commercial advantage. Furthermore, our existing patents are subject to challenges from third parties that may result in invalidations and will all eventually expire, after which we will not be able to prevent our competitors from using our previously patented technologies, which could materially adversely affect our competitive advantage stemming from the applicable products and technologies. We also cannot assure you that competitors will not infringe our patents, or that we will have adequate resources to enforce our patents.