EX-99.2

Published on January 25, 2023

Sensitivity: Business Internal 1 Q4 & FY 2022 Financial Results January 25, 2023 Exhibit 99.2

2 Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain certain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 regarding Axalta and its subsidiaries including our outlook and/or guidance, which includes net sales growth, currency effects, Adjusted EBIT, Adjusted EBITDA, Adjusted diluted EPS, interest expense, income tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding and various assumptions noted in the presentation, the effects of COVID-19 on Axalta’s business and financial results, our and our customers’ supply chain constraints and our ability to offset the impacts of such constraints, the timing and amount of any future share repurchases, contributions from our prior acquisitions and our ability to successfully make future acquisitions. Axalta has identified some of these forward-looking statements with words “believe,” “expect,” “assumes,” “estimates,” “outlook,” “forecast,” “will,” “plans,” “guidance,” “to be,” “goal,” “could,” “should,” “anticipate,” “assumptions,” “looking ahead,” “look,” “view,” “into,” “future,” “ambitions,” “objectives,” “potential,” “opportunity,” “upside,” “line-of-sight,” “ahead,” and “we see” and the negative of these words or other comparable or similar terminology. All of these statements are based on management’s expectations as well as estimates and assumptions prepared by management that, although they believe to be reasonable, are inherently uncertain. These statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of Axalta’s control, including the effects of COVID-19, that may cause its business, industry, strategy, financing activities or actual results to differ materially. The impact and duration of COVID-19 on our business and operations is uncertain. Factors that will influence the impact on our business and operations include the duration and extent of COVID-19, the extent of imposed or recommended containment and mitigation measures, and the general economic consequences of COVID-19. More information on potential factors that could affect Axalta's financial results is available in “Forward-Looking Statements,” “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” within Axalta's most recent Annual Report on Form 10-K, and in other documents that we have filed with, or furnished to, the U.S. Securities and Exchange Commission. Axalta undertakes no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise. All fourth quarter and full year 2022 financial information in this presentation is preliminary, based on our estimates and subject to completion of our financial closing procedures. Final results for the full year, which will be reported in our Annual Report on Form 10-K for the year ended December 31, 2022, may vary from the information in this presentation. In particular, until our financial statements are issued in our Annual Report on Form 10-K, we may be required to recognize certain subsequent events (such as in connection with contingencies or the realization of assets) which could affect our final results. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including constant currency net sales growth, income tax rate, as adjusted, EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, Adjusted diluted EPS, free cash flow, net debt, Adjusted net income, Adjusted EBITDA to interest expense coverage ratio, net debt to Adjusted EBITDA ratio (net leverage), and Adjusted EBIT margin. Management uses these non-GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA, Adjusted EBIT and Adjusted diluted EPS consist of EBITDA, EBIT and Diluted EPS, respectively, adjusted for (i) certain non-cash items included within net income, (ii) certain items Axalta does not believe are indicative of ongoing operating performance or (iii) certain nonrecurring, unusual or infrequent items that have not otherwise occurred within the last two years or we believe are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Adjusted net income shows the adjusted value of net income (loss) attributable to controlling interests after removing the items that are determined by management to be items that we do not consider indicative of our ongoing operating performance or unusual or nonrecurring in nature. Our use of the terms constant currency net sales growth, income tax rate, as adjusted, EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, Adjusted diluted EPS, free cash flow, net debt, Adjusted net income, Adjusted EBITDA to interest expense coverage ratio, net debt to Adjusted EBITDA ratio (net leverage), and Adjusted EBIT margin may differ from that of others in our industry. Constant currency net sales growth, income tax rate, as adjusted, EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, Adjusted diluted EPS, free cash flow, net debt, Adjusted net income, Adjusted EBITDA to interest expense coverage ratio, net debt to Adjusted EBITDA ratio (net leverage), and Adjusted EBIT margin should not be considered as alternatives to net sales, net income (loss), income (loss) from operations or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Constant currency net sales growth, income tax rate, as adjusted, EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, Adjusted diluted EPS, free cash flow, net debt, Adjusted net income, Adjusted EBITDA to interest expense coverage ratio, net debt to Adjusted EBITDA ratio (net leverage), and Adjusted EBIT margin have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for constant currency net sales growth, Adjusted EBIT, Adjusted EBITDA, Adjusted diluted EPS, income tax rate, as adjusted, or free cash flow on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project these items and they may have a substantial and unpredictable impact on our GAAP results. Constant Currency Constant currency or ex-FX percentages are calculated by excluding the impact of the change in average exchange rates between the current and comparable period by currency denomination exposure of the comparable period amount. Organic Growth Organic growth or ex-M&A percentages are calculated by excluding the impact of recent acquisitions and divestitures. Segment Financial Measures The primary measure of segment operating performance is Adjusted EBIT, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on net income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not available. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the U.S. Securities and Exchange Commission. Rounding Due to rounding the tables presented may not foot. Public Dissemination of Certain Information We intend to use our investor relations page at ir.axalta.com as a means of disclosing material information to the public in a broad, non-exclusionary manner for purposes of the U.S. Securities and Exchange Commission’s Regulation Fair Disclosure (or Reg. FD). Investors should routinely monitor that site, in addition to our press releases, U.S. Securities and Exchange Commission filings and public conference calls and webcasts, as information posted on that page could be deemed to be material information. Legal Notices

3 Introducing Axalta's CEO and President COO, overseeing Global Truck and Aftermarket & Industrial business segments with significant operational & strategic focus Serves as a Director on the Board of Franklin Electric and Focus: HOPE, a Detroit- based, non-profit organization Earned bachelor’s degree of civil engineering at McMaster University and completed the Wharton Executive Education Advanced Finance Program 22 Years at Meritor: a leading global supplier of drivetrain, mobility, electric powertrain and other solutions for commercial vehicle and industrial markets CEO and President, member of Board of Directors Previous Industry Experience Chris Villavarayan Chief Executive Officer And President

4 Q4 2022 Key Messages Driving Improved Profitability Through Execution On Key Priorities 1 2 3 4 Earnings near top of guidance range driven by pricing momentum and volume growth with notable margin recovery from Mobility Coatings 12% price-mix growth YoY; 3% sequential price-mix growth reflects continued focus on margin recovery across every end-market 5 Delivered $206 million of Free Cash Flow; net leverage sequentially lower to 3.8x Adjusted EBIT margins improved 130 basis points YoY as pricing more than covered elevated, but stabilizing, raws and logistics environment 2% volume growth YoY as market recovery in Mobility Coatings more than offset pockets of softer Industrial demand and slower China recovery in Performance Coatings

5 Key Enablers Execution is Fundamental to Achieving our Goals Primary Focus Raw Materials & Productivity Price-Cost Recovery Operational & Supply Chain Excellence Improve Free Cash Flow and Deleveraging People and Culture Innovation & Technology Operational Excellence IT & Digital

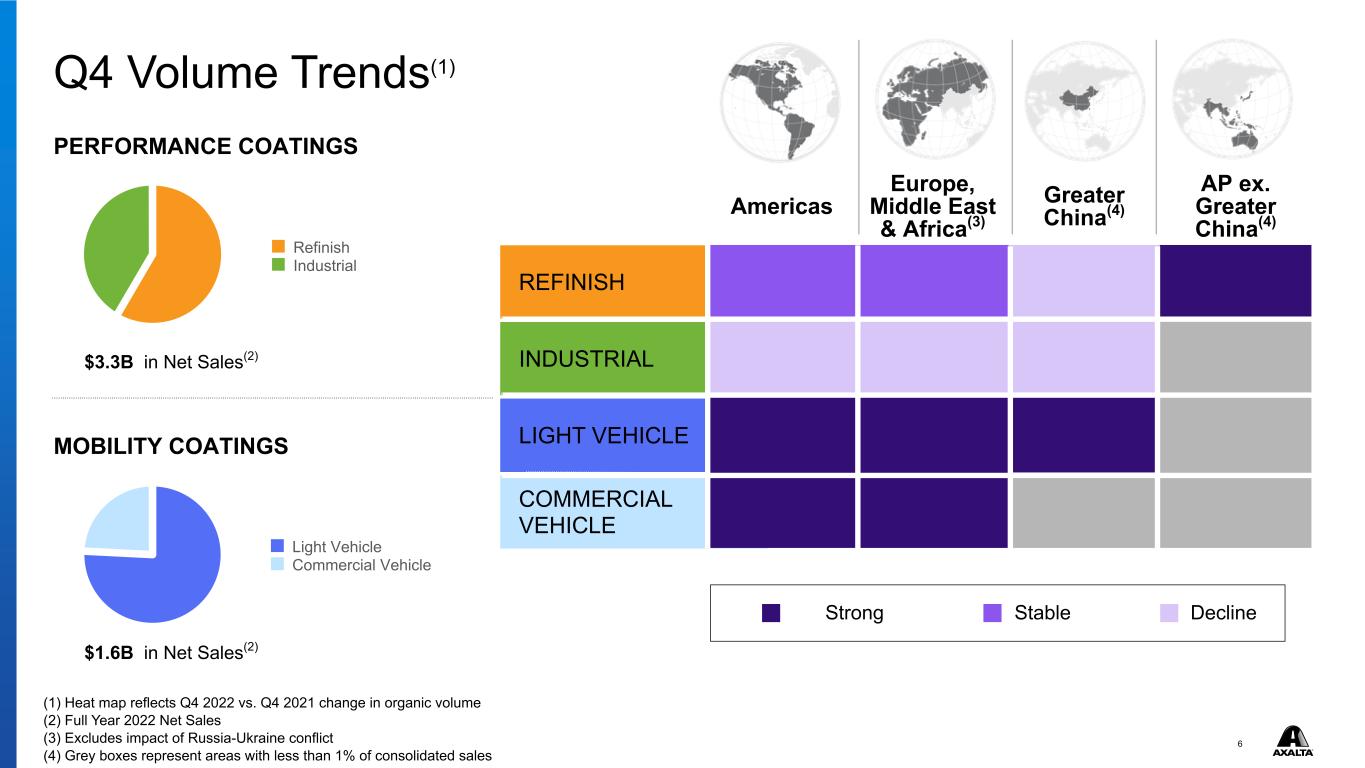

6 Light Vehicle Commercial Vehicle COMMERCIAL VEHICLE LIGHT VEHICLE INDUSTRIAL REFINISH Refinish Industrial Q4 Volume Trends(1) PERFORMANCE COATINGS PROPRIETARY Strong Stable Decline $3.3B in Net Sales(2) $1.6B in Net Sales(2) (1) Heat map reflects Q4 2022 vs. Q4 2021 change in organic volume (2) Full Year 2022 Net Sales (3) Excludes impact of Russia-Ukraine conflict (4) Grey boxes represent areas with less than 1% of consolidated sales Americas Europe, Middle East & Africa(3) Greater China(4) AP ex. Greater China(4) 2% (1.4)% (15.7)% 8.9% (6)% (16.4)% (1.6)% X 11% 23.7% 36.3% X 19% 2.6% X X MOBILITY COATINGS

7 ▪ Realized 12% year-over-year and 3% sequential price-mix growth ▪ Q4 volumes stable year-over-year as stronger North America activity was offset by modestly weaker EMEA, given Russia-Ukraine impacts and significant declines in China due to COVID-19 impacts ▪ Refinish continues to gain share and outpace industry growth rates: ▪ Continued to gain MSO share globally; most recently with Steer Automotive Group, the UK's largest independently owned MSO ▪ Added over 3,000 net body shops and more than 500 new points of distribution in 2022 ▪ 2022 Industry activity HSD% below 2019 versus LSD% volume growth for Axalta Refinish Business Review SHARE AMONG TOP 10 NORTH AMERICA MSO CUSTOMERS(1) GLOBAL LEADER IN AFTERMARKET AUTO COATINGS AND ACCESSORIES (1) Romans Report and Management Estimates Leveraging Industry Leading Value Proposition To Expand Premium Leadership 56% AXTA

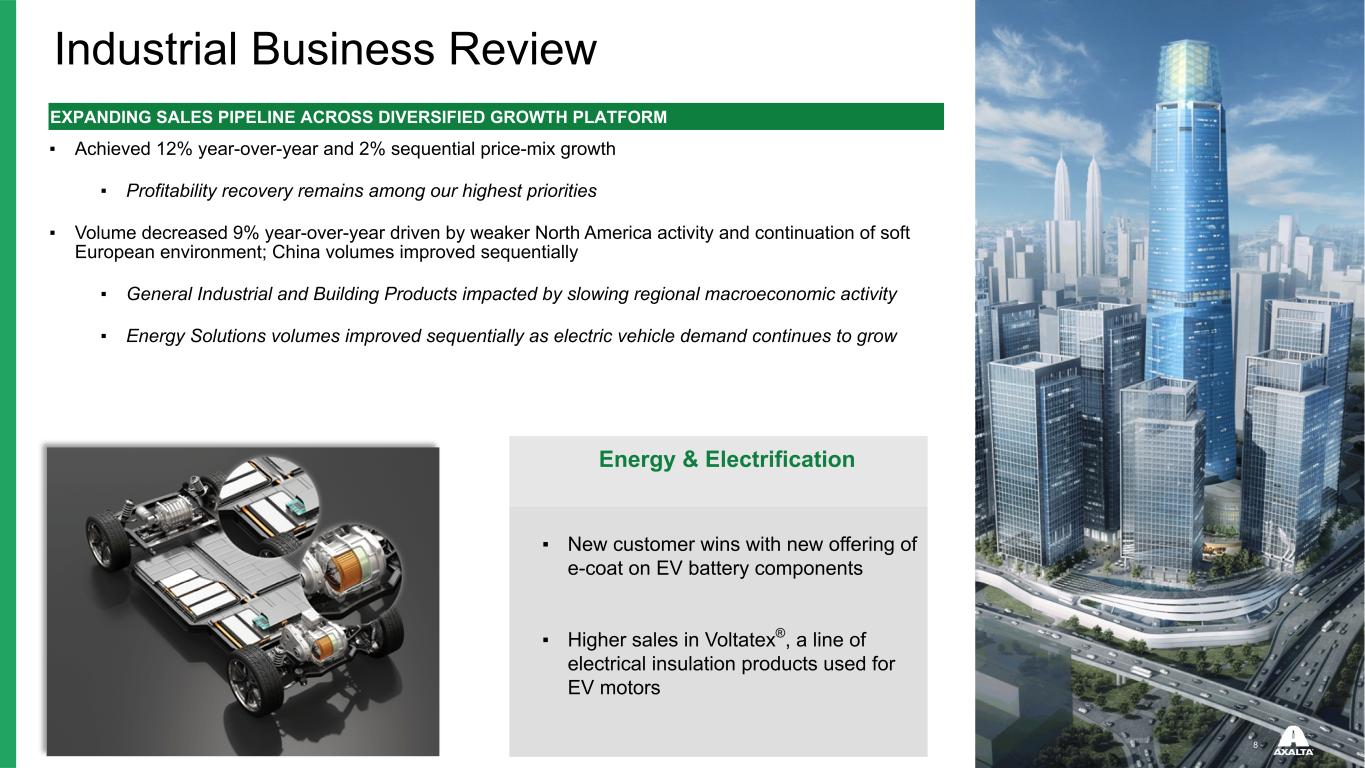

8 EXPANDING SALES PIPELINE ACROSS DIVERSIFIED GROWTH PLATFORM ▪ Achieved 12% year-over-year and 2% sequential price-mix growth ▪ Profitability recovery remains among our highest priorities ▪ Volume decreased 9% year-over-year driven by weaker North America activity and continuation of soft European environment; China volumes improved sequentially ▪ General Industrial and Building Products impacted by slowing regional macroeconomic activity ▪ Energy Solutions volumes improved sequentially as electric vehicle demand continues to grow Industrial Business Review Energy & Electrification ▪ New customer wins with new offering of e-coat on EV battery components ▪ Higher sales in Voltatex®, a line of electrical insulation products used for EV motors

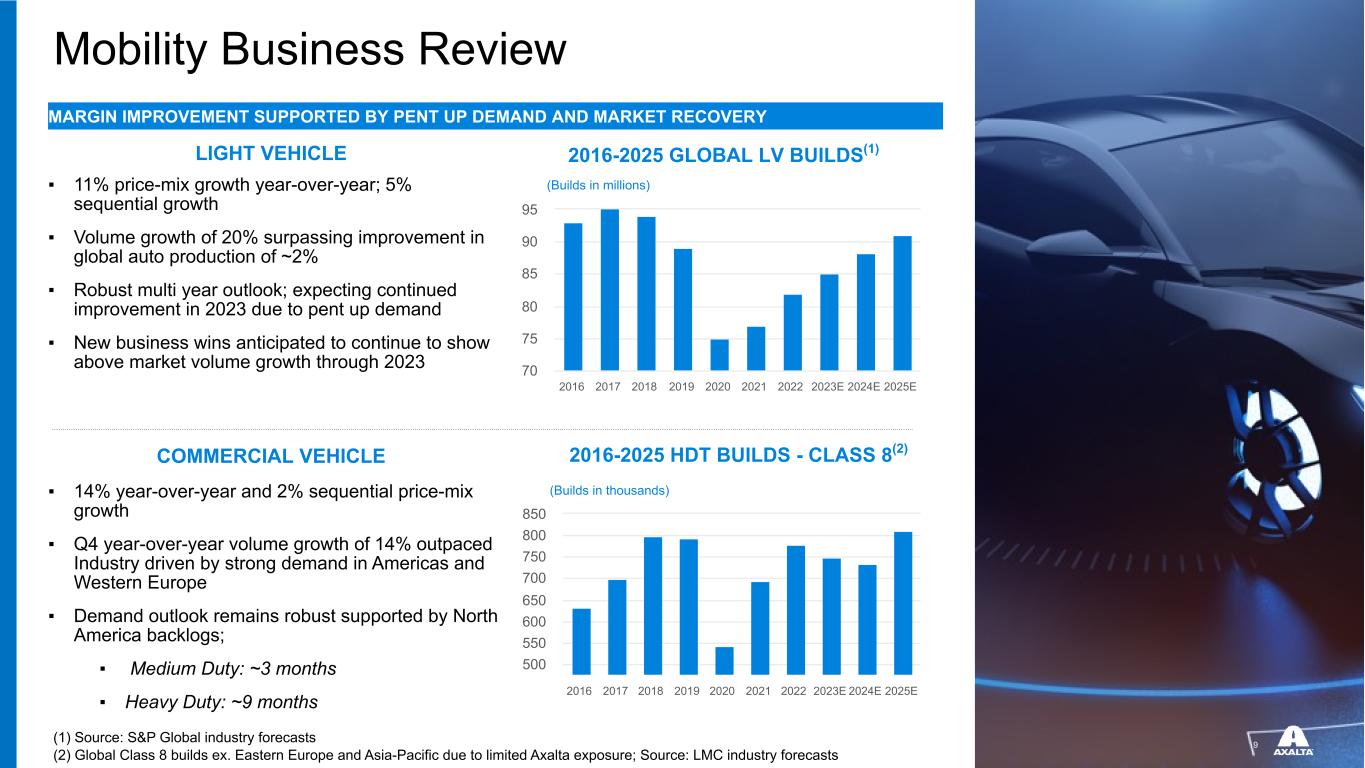

9 MARGIN IMPROVEMENT SUPPORTED BY PENT UP DEMAND AND MARKET RECOVERY LIGHT VEHICLE COMMERCIAL VEHICLE 2016-2025 GLOBAL LV BUILDS(1) 2016 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 70 75 80 85 90 95 (Builds in millions) 2016-2025 HDT BUILDS - CLASS 8(2) (Builds in thousands) 2016 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 500 550 600 650 700 750 800 850 ▪ 11% price-mix growth year-over-year; 5% sequential growth ▪ Volume growth of 20% surpassing improvement in global auto production of ~2% ▪ Robust multi year outlook; expecting continued improvement in 2023 due to pent up demand ▪ New business wins anticipated to continue to show above market volume growth through 2023 ▪ 14% year-over-year and 2% sequential price-mix growth ▪ Q4 year-over-year volume growth of 14% outpaced Industry driven by strong demand in Americas and Western Europe ▪ Demand outlook remains robust supported by North America backlogs; ▪ Medium Duty: ~3 months ▪ Heavy Duty: ~9 months (1) Source: S&P Global industry forecasts (2) Global Class 8 builds ex. Eastern Europe and Asia-Pacific due to limited Axalta exposure; Source: LMC industry forecasts Mobility Business Review

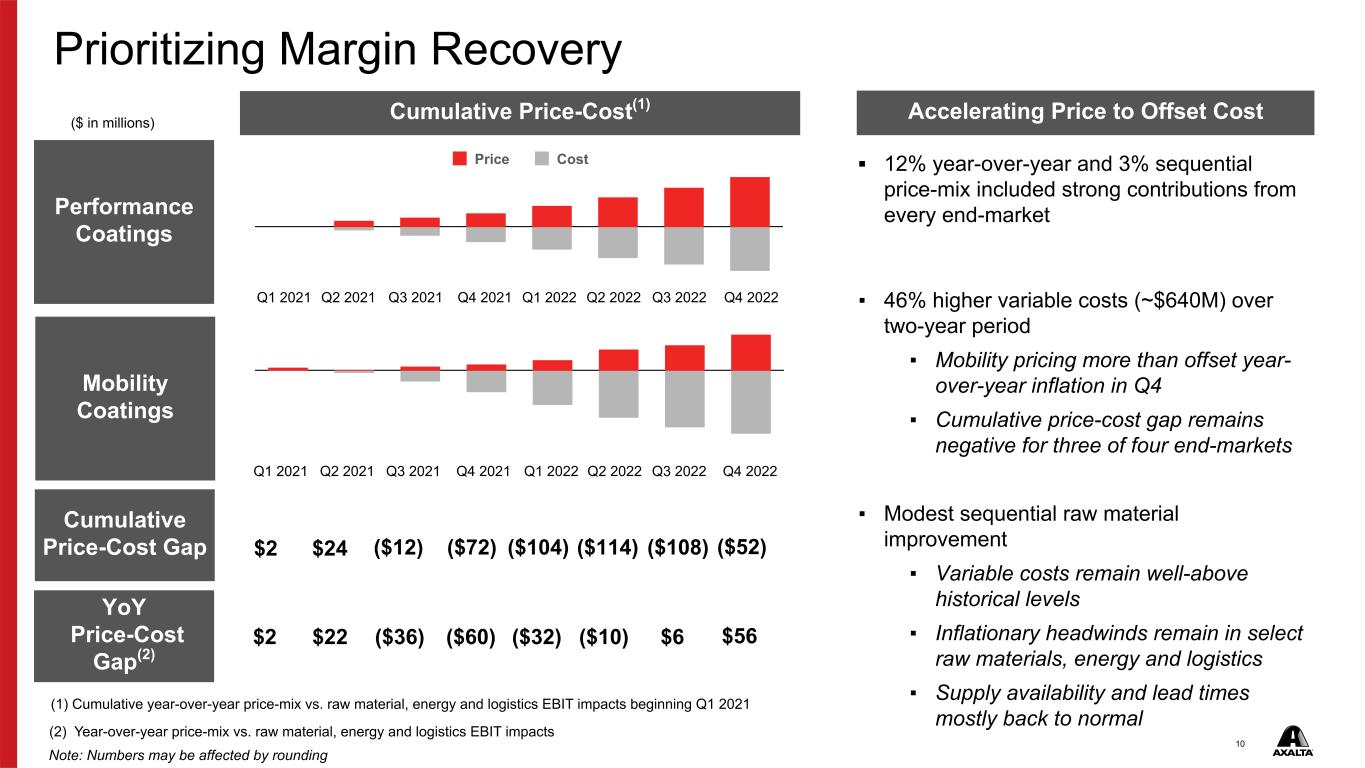

10 Price Cost ($ in millions) (1) Cumulative year-over-year price-mix vs. raw material, energy and logistics EBIT impacts beginning Q1 2021 $2 $24 ($12) ($72) ($104) Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 ($114) Q3 2022 ($108) ▪ 12% year-over-year and 3% sequential price-mix included strong contributions from every end-market ▪ 46% higher variable costs (~$640M) over two-year period ▪ Mobility pricing more than offset year- over-year inflation in Q4 ▪ Cumulative price-cost gap remains negative for three of four end-markets ▪ Modest sequential raw material improvement ▪ Variable costs remain well-above historical levels ▪ Inflationary headwinds remain in select raw materials, energy and logistics ▪ Supply availability and lead times mostly back to normal Cumulative Price-Cost(1) Accelerating Price to Offset Cost Performance Coatings Mobility Coatings Cumulative Price-Cost Gap $2 $22 ($36) ($60) ($32) ($10) $6 (2) Year-over-year price-mix vs. raw material, energy and logistics EBIT impacts Q4 2022 $56 ($52) Prioritizing Margin Recovery Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 YoY Price-Cost Gap(2) Note: Numbers may be affected by rounding

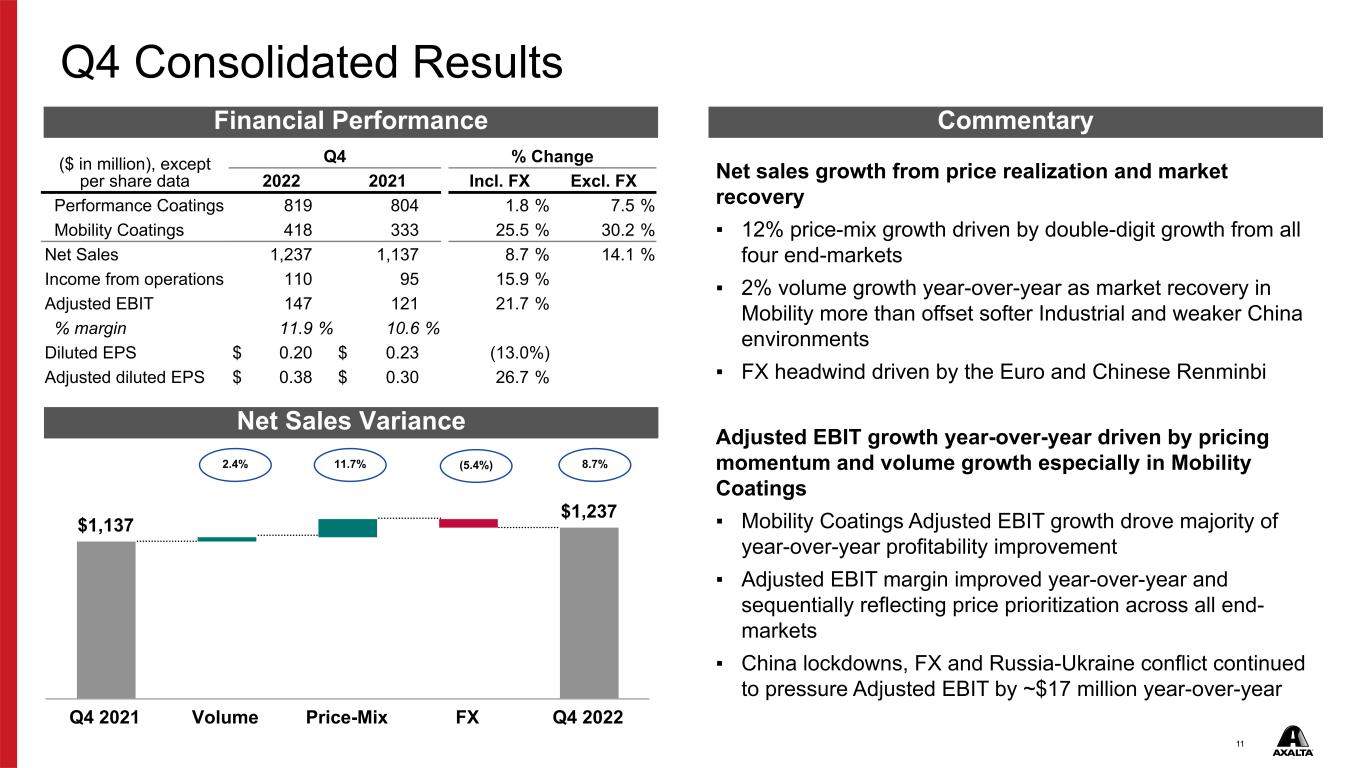

11 Net sales growth from price realization and market recovery ▪ 12% price-mix growth driven by double-digit growth from all four end-markets ▪ 2% volume growth year-over-year as market recovery in Mobility more than offset softer Industrial and weaker China environments ▪ FX headwind driven by the Euro and Chinese Renminbi Adjusted EBIT growth year-over-year driven by pricing momentum and volume growth especially in Mobility Coatings ▪ Mobility Coatings Adjusted EBIT growth drove majority of year-over-year profitability improvement ▪ Adjusted EBIT margin improved year-over-year and sequentially reflecting price prioritization across all end- markets ▪ China lockdowns, FX and Russia-Ukraine conflict continued to pressure Adjusted EBIT by ~$17 million year-over-year ($ in million), except per share data Q4 % Change 2022 2021 Incl. FX Excl. FX Performance Coatings 819 804 1.8 % 7.5 % Mobility Coatings 418 333 25.5 % 30.2 % Net Sales 1,237 1,137 8.7 % 14.1 % Income from operations 110 95 15.9 % Adjusted EBIT 147 121 21.7 % % margin 11.9 % 10.6 % Diluted EPS $ 0.20 $ 0.23 (13.0%) Adjusted diluted EPS $ 0.38 $ 0.30 26.7 % $1,137 $1,237 Q4 2021 Volume Price-Mix FX Q4 2022 2.4% 11.7% (5.4%) 8.7% Financial Performance Commentary Net Sales Variance Q4 Consolidated Results

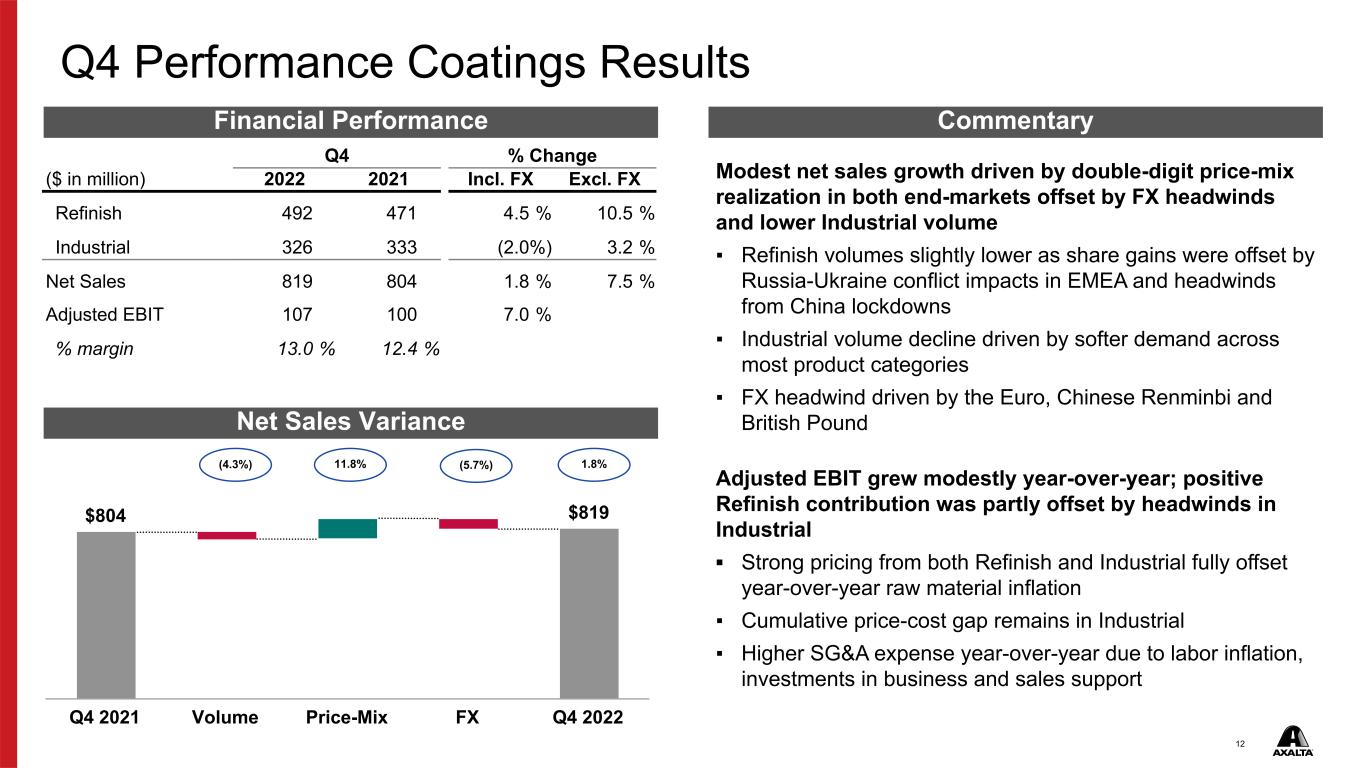

12 Q4 % Change ($ in million) 2022 2021 Incl. FX Excl. FX Refinish 492 471 4.5 % 10.5 % Industrial 326 333 (2.0%) 3.2 % Net Sales 819 804 1.8 % 7.5 % Adjusted EBIT 107 100 7.0 % % margin 13.0 % 12.4 % $804 $819 Q4 2021 Volume Price-Mix FX Q4 2022 (4.3%) 11.8% (5.7%) 1.8% Modest net sales growth driven by double-digit price-mix realization in both end-markets offset by FX headwinds and lower Industrial volume ▪ Refinish volumes slightly lower as share gains were offset by Russia-Ukraine conflict impacts in EMEA and headwinds from China lockdowns ▪ Industrial volume decline driven by softer demand across most product categories ▪ FX headwind driven by the Euro, Chinese Renminbi and British Pound Adjusted EBIT grew modestly year-over-year; positive Refinish contribution was partly offset by headwinds in Industrial ▪ Strong pricing from both Refinish and Industrial fully offset year-over-year raw material inflation ▪ Cumulative price-cost gap remains in Industrial ▪ Higher SG&A expense year-over-year due to labor inflation, investments in business and sales support Financial Performance Commentary Net Sales Variance Q4 Performance Coatings Results

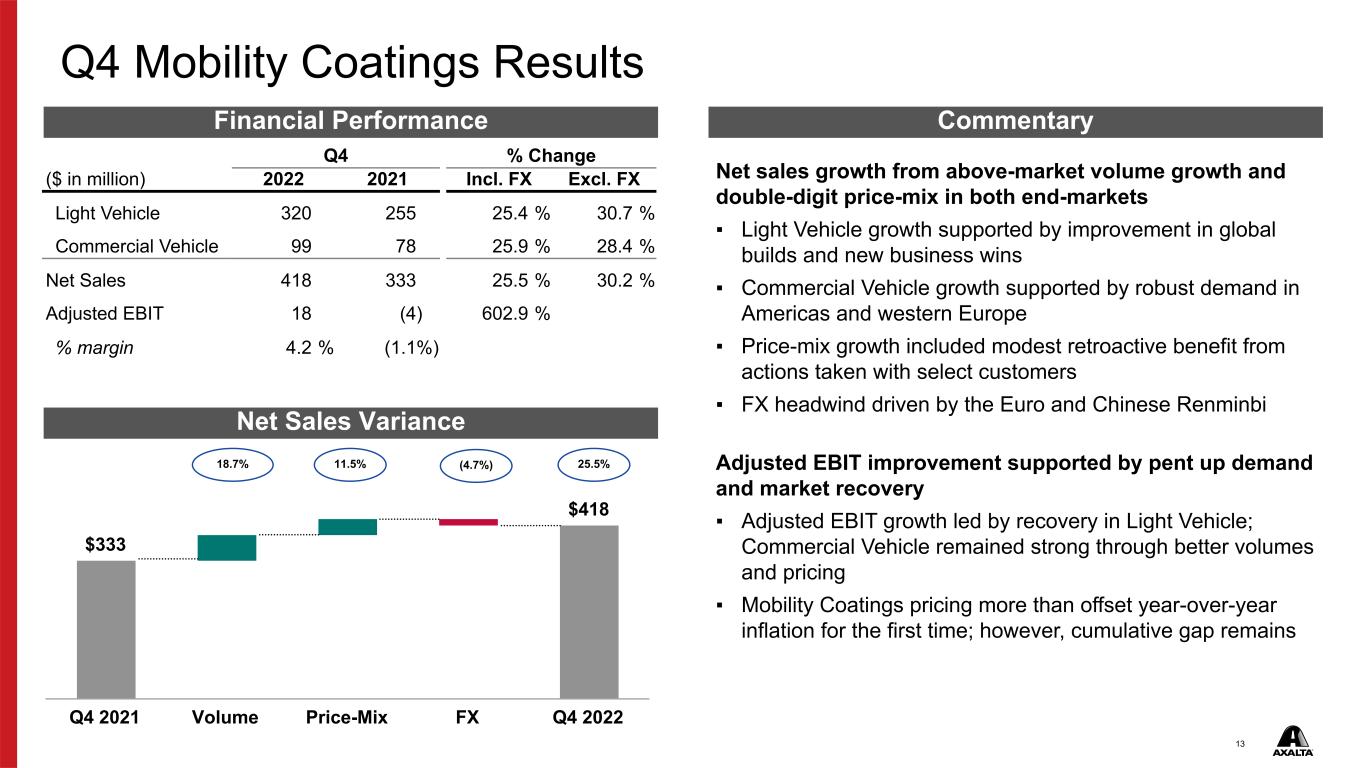

13 Q4 % Change ($ in million) 2022 2021 Incl. FX Excl. FX Light Vehicle 320 255 25.4 % 30.7 % Commercial Vehicle 99 78 25.9 % 28.4 % Net Sales 418 333 25.5 % 30.2 % Adjusted EBIT 18 (4) 602.9 % % margin 4.2 % (1.1%) $333 $418 Q4 2021 Volume Price-Mix FX Q4 2022 18.7% 11.5% (4.7%) 25.5% Net sales growth from above-market volume growth and double-digit price-mix in both end-markets ▪ Light Vehicle growth supported by improvement in global builds and new business wins ▪ Commercial Vehicle growth supported by robust demand in Americas and western Europe ▪ Price-mix growth included modest retroactive benefit from actions taken with select customers ▪ FX headwind driven by the Euro and Chinese Renminbi Adjusted EBIT improvement supported by pent up demand and market recovery ▪ Adjusted EBIT growth led by recovery in Light Vehicle; Commercial Vehicle remained strong through better volumes and pricing ▪ Mobility Coatings pricing more than offset year-over-year inflation for the first time; however, cumulative gap remains Financial Performance Commentary Net Sales Variance Q4 Mobility Coatings Results

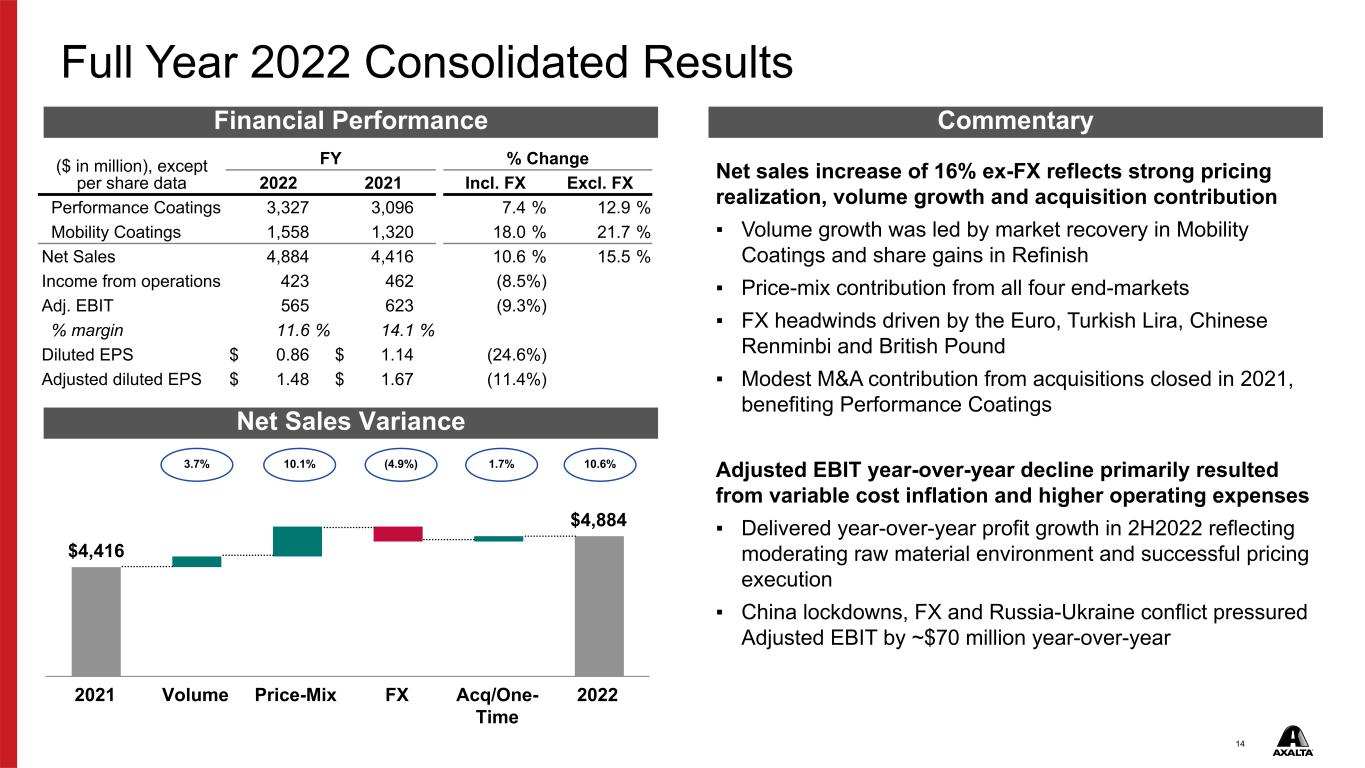

14 $4,416 $4,884 2021 Volume Price-Mix FX Acq/One- Time 2022 Net sales increase of 16% ex-FX reflects strong pricing realization, volume growth and acquisition contribution ▪ Volume growth was led by market recovery in Mobility Coatings and share gains in Refinish ▪ Price-mix contribution from all four end-markets ▪ FX headwinds driven by the Euro, Turkish Lira, Chinese Renminbi and British Pound ▪ Modest M&A contribution from acquisitions closed in 2021, benefiting Performance Coatings Adjusted EBIT year-over-year decline primarily resulted from variable cost inflation and higher operating expenses ▪ Delivered year-over-year profit growth in 2H2022 reflecting moderating raw material environment and successful pricing execution ▪ China lockdowns, FX and Russia-Ukraine conflict pressured Adjusted EBIT by ~$70 million year-over-year ($ in million), except per share data FY % Change 2022 2021 Incl. FX Excl. FX Performance Coatings 3,327 3,096 7.4 % 12.9 % Mobility Coatings 1,558 1,320 18.0 % 21.7 % Net Sales 4,884 4,416 10.6 % 15.5 % Income from operations 423 462 (8.5%) Adj. EBIT 565 623 (9.3%) % margin 11.6 % 14.1 % Diluted EPS $ 0.86 $ 1.14 (24.6%) Adjusted diluted EPS $ 1.48 $ 1.67 (11.4%) 3.7% 10.1% (4.9%) 1.7% 10.6% Financial Performance Commentary Net Sales Variance Full Year 2022 Consolidated Results

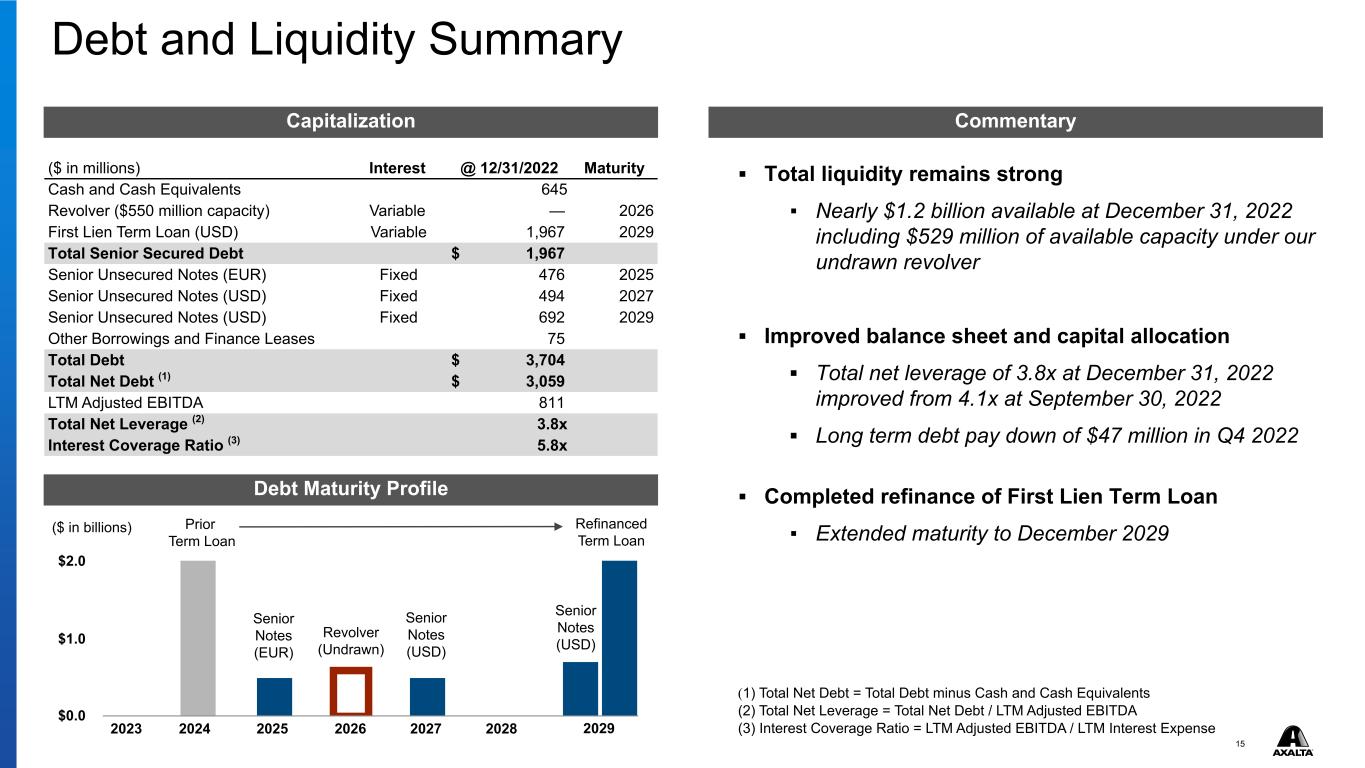

15 $0.0 $1.0 $2.0 Debt and Liquidity Summary ($ in millions) Interest @ 12/31/2022 Maturity Cash and Cash Equivalents 645 Revolver ($550 million capacity) Variable — 2026 First Lien Term Loan (USD) Variable 1,967 2029 Total Senior Secured Debt $ 1,967 Senior Unsecured Notes (EUR) Fixed 476 2025 Senior Unsecured Notes (USD) Fixed 494 2027 Senior Unsecured Notes (USD) Fixed 692 2029 Other Borrowings and Finance Leases 75 Total Debt $ 3,704 Total Net Debt (1) $ 3,059 LTM Adjusted EBITDA 811 Total Net Leverage (2) 3.8x Interest Coverage Ratio (3) 5.8x Capitalization Commentary ▪ Total liquidity remains strong ▪ Nearly $1.2 billion available at December 31, 2022 including $529 million of available capacity under our undrawn revolver ▪ Improved balance sheet and capital allocation ▪ Total net leverage of 3.8x at December 31, 2022 improved from 4.1x at September 30, 2022 ▪ Long term debt pay down of $47 million in Q4 2022 ▪ Completed refinance of First Lien Term Loan ▪ Extended maturity to December 2029 (1) Total Net Debt = Total Debt minus Cash and Cash Equivalents (2) Total Net Leverage = Total Net Debt / LTM Adjusted EBITDA (3) Interest Coverage Ratio = LTM Adjusted EBITDA / LTM Interest Expense Debt Maturity Profile Senior Notes (EUR) Revolver (Undrawn) Senior Notes (USD) Senior Notes (USD) Refinanced Term Loan Prior Term Loan 2023 2024 2025 2026 2027 2028 2029 ($ in billions)

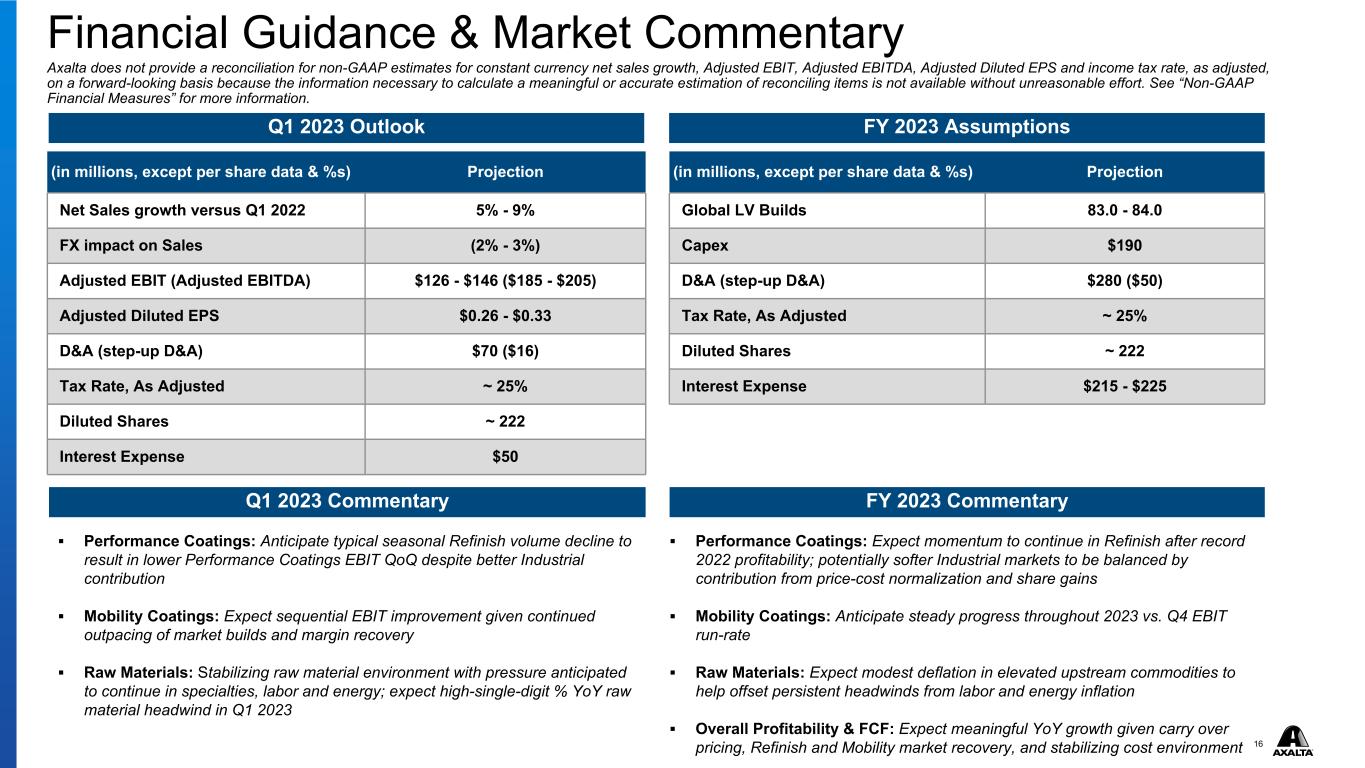

16 Financial Guidance & Market Commentary Axalta does not provide a reconciliation for non-GAAP estimates for constant currency net sales growth, Adjusted EBIT, Adjusted EBITDA, Adjusted Diluted EPS and income tax rate, as adjusted, on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. See “Non-GAAP Financial Measures” for more information. (in millions, except per share data & %s) Projection Global LV Builds 83.0 - 84.0 Capex $190 D&A (step-up D&A) $280 ($50) Tax Rate, As Adjusted ~ 25% Diluted Shares ~ 222 Interest Expense $215 - $225 ▪ Performance Coatings: Anticipate typical seasonal Refinish volume decline to result in lower Performance Coatings EBIT QoQ despite better Industrial contribution ▪ Mobility Coatings: Expect sequential EBIT improvement given continued outpacing of market builds and margin recovery ▪ Raw Materials: Stabilizing raw material environment with pressure anticipated to continue in specialties, labor and energy; expect high-single-digit % YoY raw material headwind in Q1 2023 Q1 2023 Outlook (in millions, except per share data & %s) Projection Net Sales growth versus Q1 2022 5% - 9% FX impact on Sales (2% - 3%) Adjusted EBIT (Adjusted EBITDA) $126 - $146 ($185 - $205) Adjusted Diluted EPS $0.26 - $0.33 D&A (step-up D&A) $70 ($16) Tax Rate, As Adjusted ~ 25% Diluted Shares ~ 222 Interest Expense $50 FY 2023 Assumptions Q1 2023 Commentary FY 2023 Commentary ▪ Performance Coatings: Expect momentum to continue in Refinish after record 2022 profitability; potentially softer Industrial markets to be balanced by contribution from price-cost normalization and share gains ▪ Mobility Coatings: Anticipate steady progress throughout 2023 vs. Q4 EBIT run-rate ▪ Raw Materials: Expect modest deflation in elevated upstream commodities to help offset persistent headwinds from labor and energy inflation ▪ Overall Profitability & FCF: Expect meaningful YoY growth given carry over pricing, Refinish and Mobility market recovery, and stabilizing cost environment

Sensitivity: Business Internal 17 Appendix

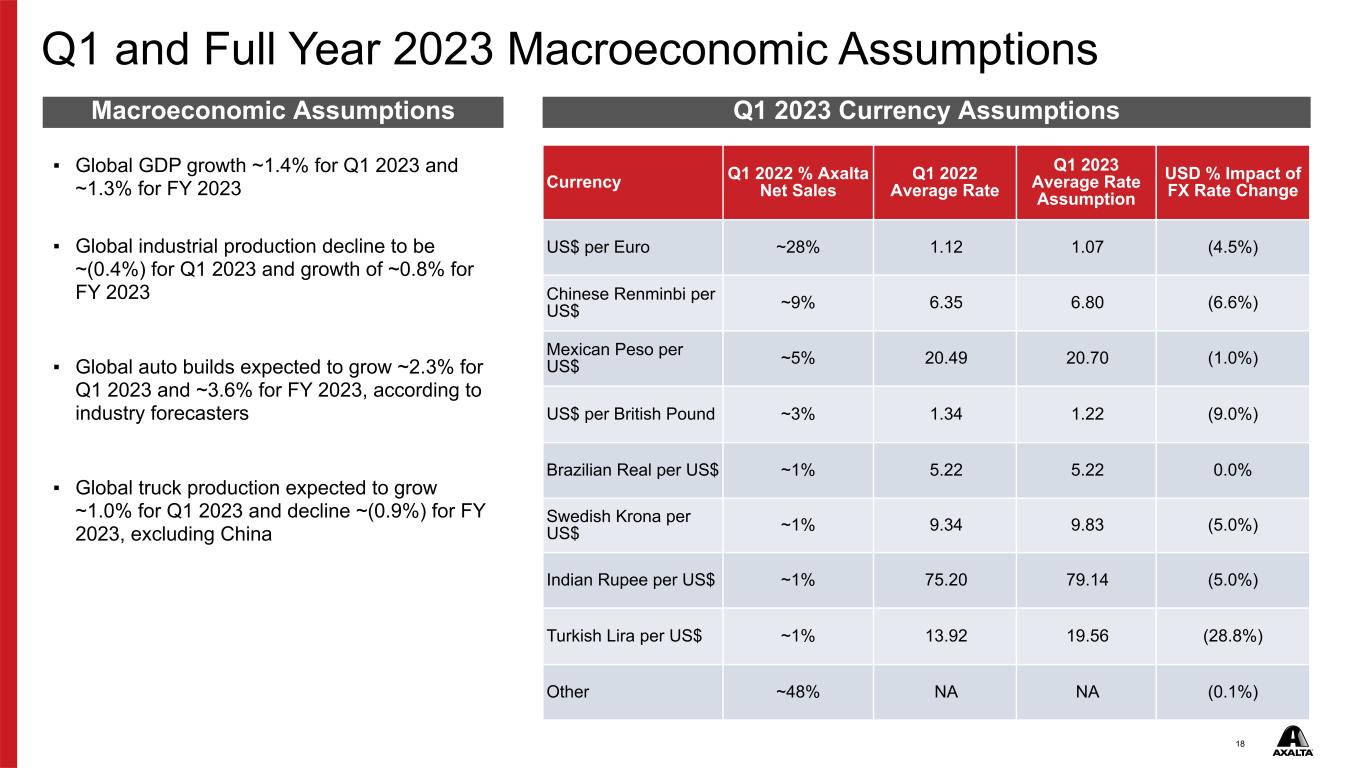

18 Q1 2023 Currency AssumptionsMacroeconomic Assumptions ▪ Global GDP growth ~1.4% for Q1 2023 and ~1.3% for FY 2023 ▪ Global industrial production decline to be ~(0.4%) for Q1 2023 and growth of ~0.8% for FY 2023 ▪ Global auto builds expected to grow ~2.3% for Q1 2023 and ~3.6% for FY 2023, according to industry forecasters ▪ Global truck production expected to grow ~1.0% for Q1 2023 and decline ~(0.9%) for FY 2023, excluding China Currency Q1 2022 % Axalta Net Sales Q1 2022 Average Rate Q1 2023 Average Rate Assumption USD % Impact of FX Rate Change US$ per Euro ~28% 1.12 1.07 (4.5%) Chinese Renminbi per US$ ~9% 6.35 6.80 (6.6%) Mexican Peso per US$ ~5% 20.49 20.70 (1.0%) US$ per British Pound ~3% 1.34 1.22 (9.0%) Brazilian Real per US$ ~1% 5.22 5.22 0.0% Swedish Krona per US$ ~1% 9.34 9.83 (5.0%) Indian Rupee per US$ ~1% 75.20 79.14 (5.0%) Turkish Lira per US$ ~1% 13.92 19.56 (28.8%) Other ~48% NA NA (0.1%) Q1 and Full Year 2023 Macroeconomic Assumptions

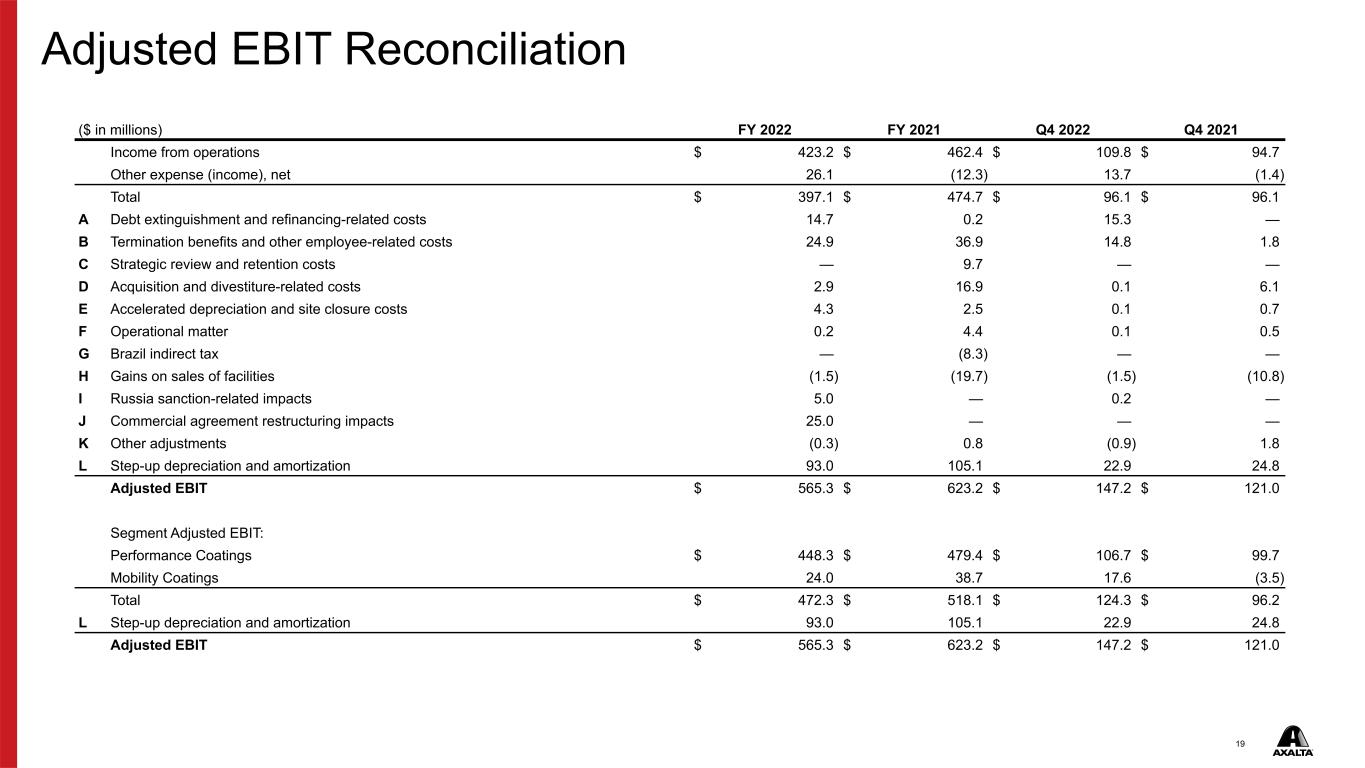

19 ($ in millions) FY 2022 FY 2021 Q4 2022 Q4 2021 Income from operations $ 423.2 $ 462.4 $ 109.8 $ 94.7 Other expense (income), net 26.1 (12.3) 13.7 (1.4) Total $ 397.1 $ 474.7 $ 96.1 $ 96.1 A Debt extinguishment and refinancing-related costs 14.7 0.2 15.3 — B Termination benefits and other employee-related costs 24.9 36.9 14.8 1.8 C Strategic review and retention costs — 9.7 — — D Acquisition and divestiture-related costs 2.9 16.9 0.1 6.1 E Accelerated depreciation and site closure costs 4.3 2.5 0.1 0.7 F Operational matter 0.2 4.4 0.1 0.5 G Brazil indirect tax — (8.3) — — H Gains on sales of facilities (1.5) (19.7) (1.5) (10.8) I Russia sanction-related impacts 5.0 — 0.2 — J Commercial agreement restructuring impacts 25.0 — — — K Other adjustments (0.3) 0.8 (0.9) 1.8 L Step-up depreciation and amortization 93.0 105.1 22.9 24.8 Adjusted EBIT $ 565.3 $ 623.2 $ 147.2 $ 121.0 Segment Adjusted EBIT: Performance Coatings $ 448.3 $ 479.4 $ 106.7 $ 99.7 Mobility Coatings 24.0 38.7 17.6 (3.5) Total $ 472.3 $ 518.1 $ 124.3 $ 96.2 L Step-up depreciation and amortization 93.0 105.1 22.9 24.8 Adjusted EBIT $ 565.3 $ 623.2 $ 147.2 $ 121.0 Adjusted EBIT Reconciliation

20 A Represents expenses and associated changes to estimates related to the prepayment, restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs, which includes costs related to the transition of our CEO. Employee termination benefits are primarily associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our review of strategic alternatives that was concluded in March 2020, as well as retention awards for certain employees that were earned over a period of 18-24 months, which ended in September 2021. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses and integration activities associated with our business combinations, all of which are not considered indicative of our ongoing operating performance. The amount for the year ended December 31, 2022 includes $1.9 million of due diligence and other related costs associated with unconsummated merger and acquisition transactions. E Represents incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments and costs related to the closure of certain manufacturing sites, which we do not consider indicative of our ongoing operating performance. F Represents expenses, changes in estimates and insurance recoveries for probable liabilities related to an operational matter in the Mobility Coatings segment, which is not indicative of our ongoing operating performance. G Represents non-recurring income related to a law change with respect to certain Brazilian indirect taxes which was recorded within other expense (income), net. H Represents non-recurring income related to the sale of previously closed manufacturing facilities. I Represents expenses related to sanctions imposed on Russia in response to the conflict with Ukraine as a result of incremental reserves for accounts receivable, inventory obsolescence and business incentive payments, inclusive of changes in estimates, which we do not consider indicative of our ongoing operating performance. J Represents a forgiveness of a portion of up-front customer incentives with repayment features upon our customer completing a recapitalization and restructuring of its indebtedness and the execution of a new long-term exclusive sales agreement with us. These amounts are not considered to be indicative of our ongoing operating performance. K Represents costs for certain non-operational or non-cash (gains) and losses, unrelated to our core business and which we do not consider indicative of ongoing operations. L Represents the incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. Adjusted EBIT Reconciliation (cont'd)

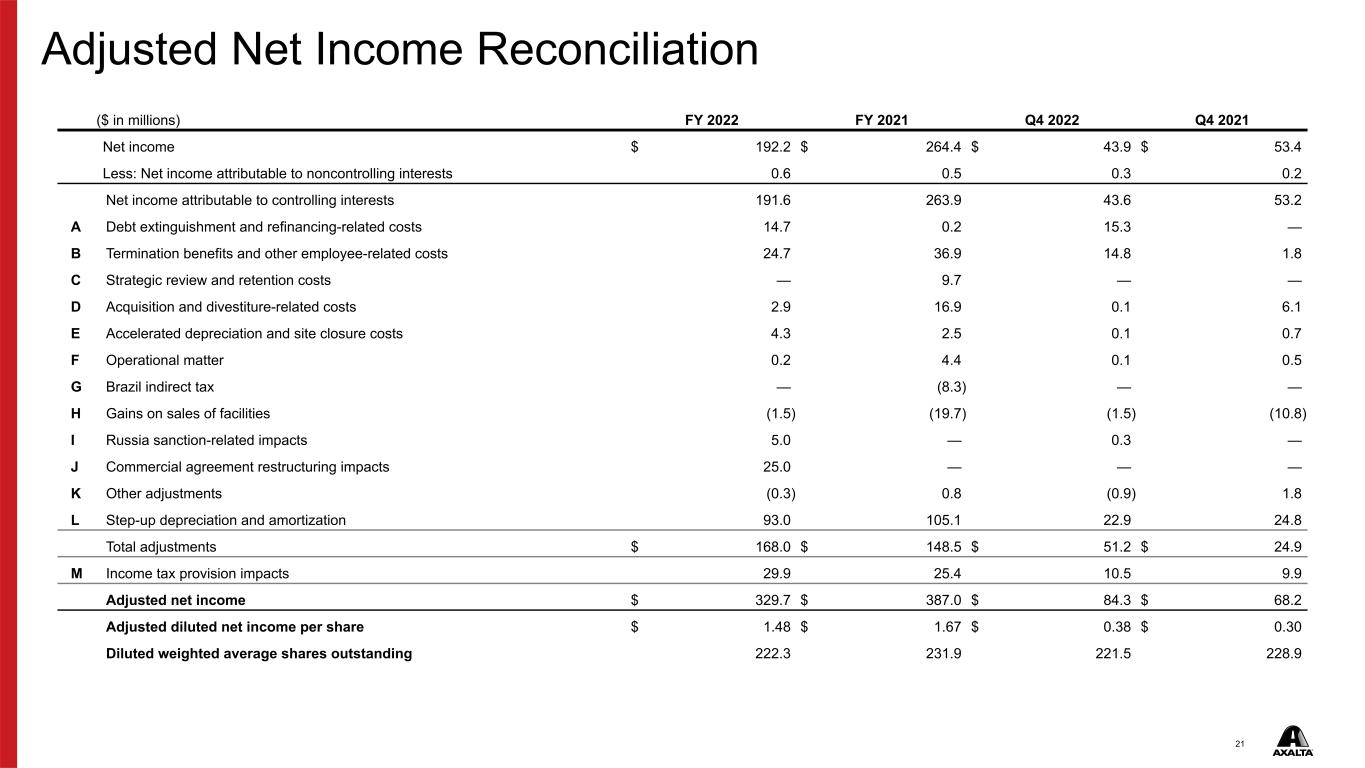

21 ($ in millions) FY 2022 FY 2021 Q4 2022 Q4 2021 Net income $ 192.2 $ 264.4 $ 43.9 $ 53.4 Less: Net income attributable to noncontrolling interests 0.6 0.5 0.3 0.2 Net income attributable to controlling interests 191.6 263.9 43.6 53.2 A Debt extinguishment and refinancing-related costs 14.7 0.2 15.3 — B Termination benefits and other employee-related costs 24.7 36.9 14.8 1.8 C Strategic review and retention costs — 9.7 — — D Acquisition and divestiture-related costs 2.9 16.9 0.1 6.1 E Accelerated depreciation and site closure costs 4.3 2.5 0.1 0.7 F Operational matter 0.2 4.4 0.1 0.5 G Brazil indirect tax — (8.3) — — H Gains on sales of facilities (1.5) (19.7) (1.5) (10.8) I Russia sanction-related impacts 5.0 — 0.3 — J Commercial agreement restructuring impacts 25.0 — — — K Other adjustments (0.3) 0.8 (0.9) 1.8 L Step-up depreciation and amortization 93.0 105.1 22.9 24.8 Total adjustments $ 168.0 $ 148.5 $ 51.2 $ 24.9 M Income tax provision impacts 29.9 25.4 10.5 9.9 Adjusted net income $ 329.7 $ 387.0 $ 84.3 $ 68.2 Adjusted diluted net income per share $ 1.48 $ 1.67 $ 0.38 $ 0.30 Diluted weighted average shares outstanding 222.3 231.9 221.5 228.9 Adjusted Net Income Reconciliation

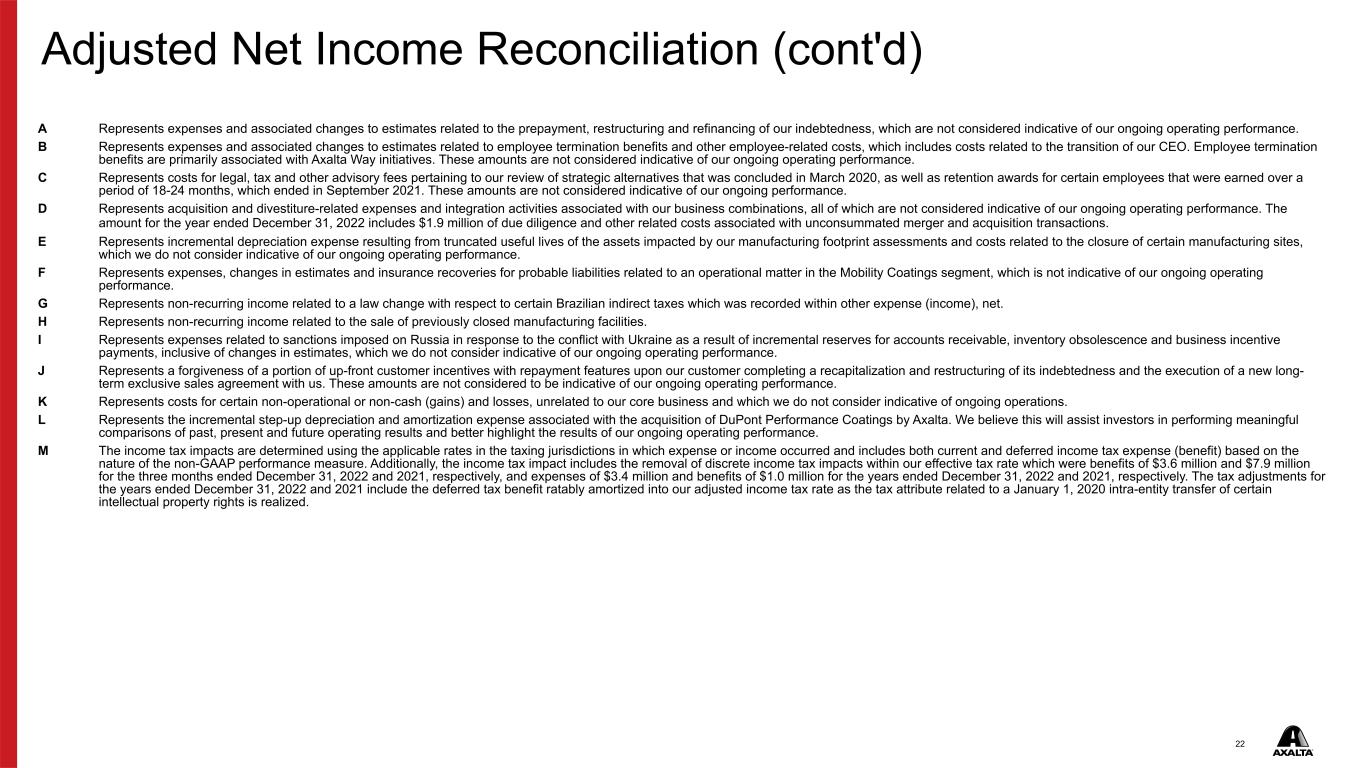

22 A Represents expenses and associated changes to estimates related to the prepayment, restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs, which includes costs related to the transition of our CEO. Employee termination benefits are primarily associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our review of strategic alternatives that was concluded in March 2020, as well as retention awards for certain employees that were earned over a period of 18-24 months, which ended in September 2021. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses and integration activities associated with our business combinations, all of which are not considered indicative of our ongoing operating performance. The amount for the year ended December 31, 2022 includes $1.9 million of due diligence and other related costs associated with unconsummated merger and acquisition transactions. E Represents incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments and costs related to the closure of certain manufacturing sites, which we do not consider indicative of our ongoing operating performance. F Represents expenses, changes in estimates and insurance recoveries for probable liabilities related to an operational matter in the Mobility Coatings segment, which is not indicative of our ongoing operating performance. G Represents non-recurring income related to a law change with respect to certain Brazilian indirect taxes which was recorded within other expense (income), net. H Represents non-recurring income related to the sale of previously closed manufacturing facilities. I Represents expenses related to sanctions imposed on Russia in response to the conflict with Ukraine as a result of incremental reserves for accounts receivable, inventory obsolescence and business incentive payments, inclusive of changes in estimates, which we do not consider indicative of our ongoing operating performance. J Represents a forgiveness of a portion of up-front customer incentives with repayment features upon our customer completing a recapitalization and restructuring of its indebtedness and the execution of a new long- term exclusive sales agreement with us. These amounts are not considered to be indicative of our ongoing operating performance. K Represents costs for certain non-operational or non-cash (gains) and losses, unrelated to our core business and which we do not consider indicative of ongoing operations. L Represents the incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. M The income tax impacts are determined using the applicable rates in the taxing jurisdictions in which expense or income occurred and includes both current and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure. Additionally, the income tax impact includes the removal of discrete income tax impacts within our effective tax rate which were benefits of $3.6 million and $7.9 million for the three months ended December 31, 2022 and 2021, respectively, and expenses of $3.4 million and benefits of $1.0 million for the years ended December 31, 2022 and 2021, respectively. The tax adjustments for the years ended December 31, 2022 and 2021 include the deferred tax benefit ratably amortized into our adjusted income tax rate as the tax attribute related to a January 1, 2020 intra-entity transfer of certain intellectual property rights is realized. Adjusted Net Income Reconciliation (cont'd)

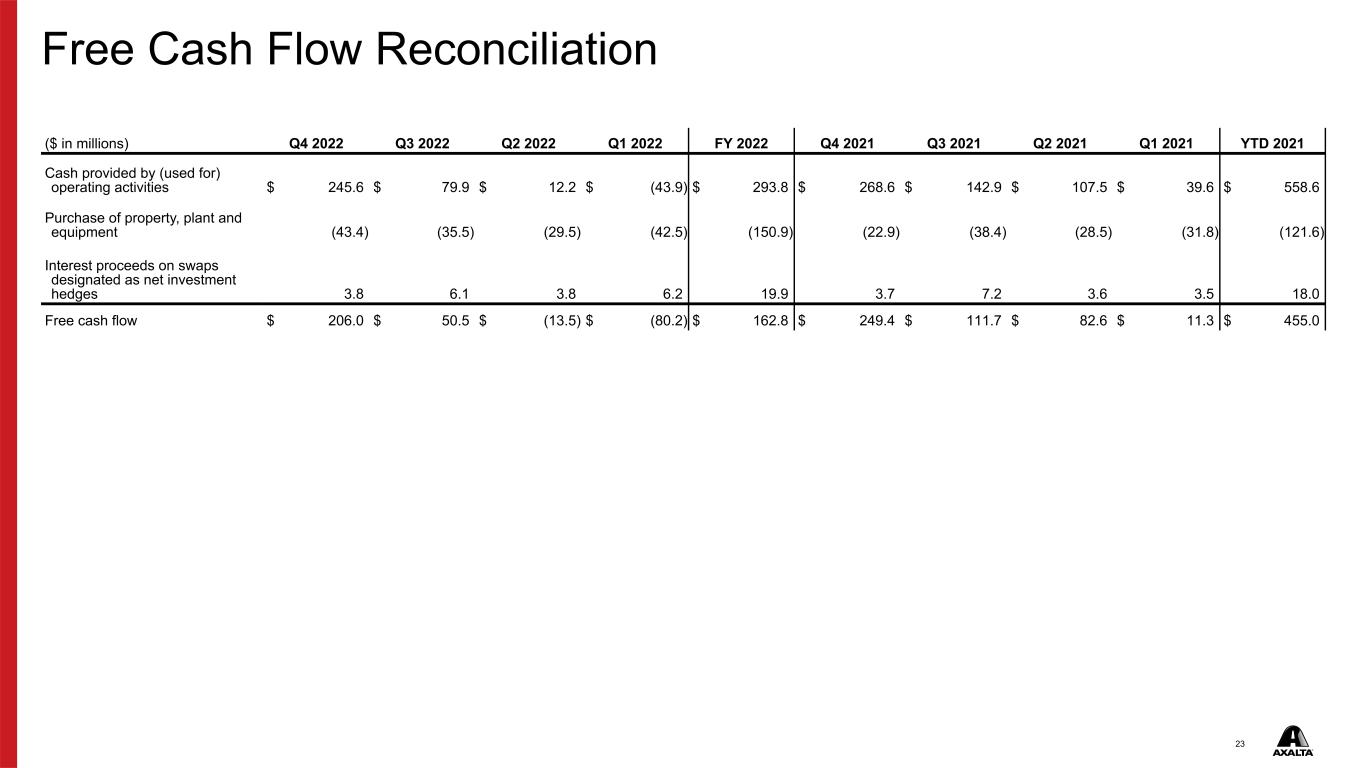

23 ($ in millions) Q4 2022 Q3 2022 Q2 2022 Q1 2022 FY 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021 YTD 2021 Cash provided by (used for) operating activities $ 245.6 $ 79.9 $ 12.2 $ (43.9) $ 293.8 $ 268.6 $ 142.9 $ 107.5 $ 39.6 $ 558.6 Purchase of property, plant and equipment (43.4) (35.5) (29.5) (42.5) (150.9) (22.9) (38.4) (28.5) (31.8) (121.6) Interest proceeds on swaps designated as net investment hedges 3.8 6.1 3.8 6.2 19.9 3.7 7.2 3.6 3.5 18.0 Free cash flow $ 206.0 $ 50.5 $ (13.5) $ (80.2) $ 162.8 $ 249.4 $ 111.7 $ 82.6 $ 11.3 $ 455.0 Free Cash Flow Reconciliation

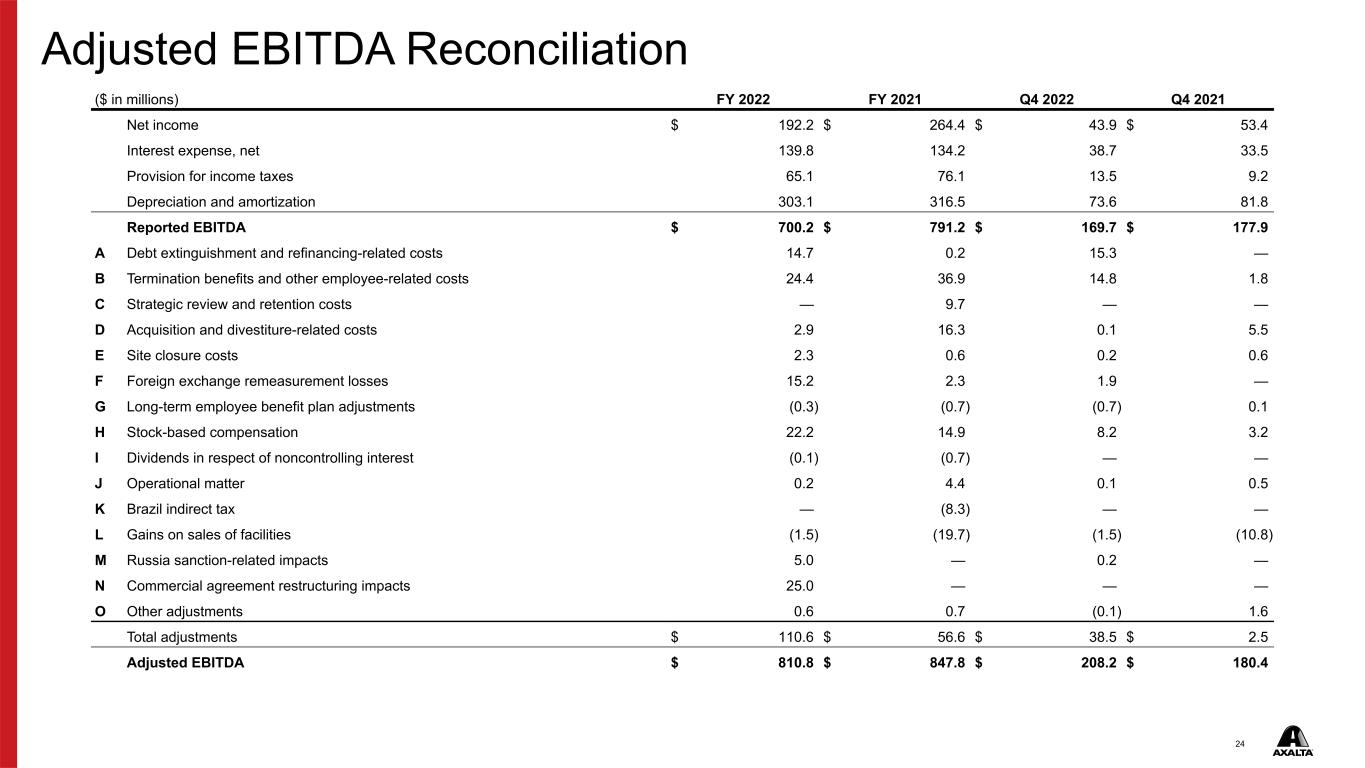

24 ($ in millions) FY 2022 FY 2021 Q4 2022 Q4 2021 Net income $ 192.2 $ 264.4 $ 43.9 $ 53.4 Interest expense, net 139.8 134.2 38.7 33.5 Provision for income taxes 65.1 76.1 13.5 9.2 Depreciation and amortization 303.1 316.5 73.6 81.8 Reported EBITDA $ 700.2 $ 791.2 $ 169.7 $ 177.9 A Debt extinguishment and refinancing-related costs 14.7 0.2 15.3 — B Termination benefits and other employee-related costs 24.4 36.9 14.8 1.8 C Strategic review and retention costs — 9.7 — — D Acquisition and divestiture-related costs 2.9 16.3 0.1 5.5 E Site closure costs 2.3 0.6 0.2 0.6 F Foreign exchange remeasurement losses 15.2 2.3 1.9 — G Long-term employee benefit plan adjustments (0.3) (0.7) (0.7) 0.1 H Stock-based compensation 22.2 14.9 8.2 3.2 I Dividends in respect of noncontrolling interest (0.1) (0.7) — — J Operational matter 0.2 4.4 0.1 0.5 K Brazil indirect tax — (8.3) — — L Gains on sales of facilities (1.5) (19.7) (1.5) (10.8) M Russia sanction-related impacts 5.0 — 0.2 — N Commercial agreement restructuring impacts 25.0 — — — O Other adjustments 0.6 0.7 (0.1) 1.6 Total adjustments $ 110.6 $ 56.6 $ 38.5 $ 2.5 Adjusted EBITDA $ 810.8 $ 847.8 $ 208.2 $ 180.4 Adjusted EBITDA Reconciliation

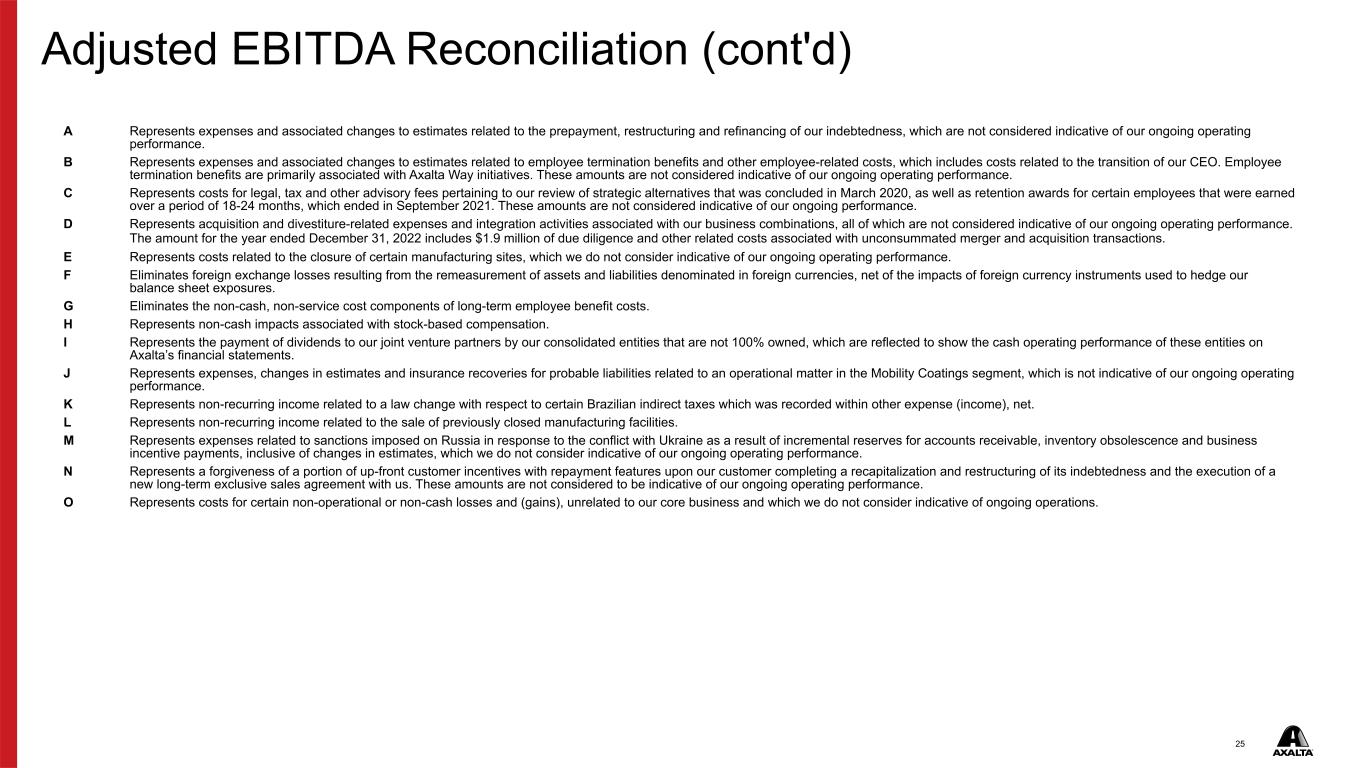

25 A Represents expenses and associated changes to estimates related to the prepayment, restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs, which includes costs related to the transition of our CEO. Employee termination benefits are primarily associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our review of strategic alternatives that was concluded in March 2020, as well as retention awards for certain employees that were earned over a period of 18-24 months, which ended in September 2021. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses and integration activities associated with our business combinations, all of which are not considered indicative of our ongoing operating performance. The amount for the year ended December 31, 2022 includes $1.9 million of due diligence and other related costs associated with unconsummated merger and acquisition transactions. E Represents costs related to the closure of certain manufacturing sites, which we do not consider indicative of our ongoing operating performance. F Eliminates foreign exchange losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of the impacts of foreign currency instruments used to hedge our balance sheet exposures. G Eliminates the non-cash, non-service cost components of long-term employee benefit costs. H Represents non-cash impacts associated with stock-based compensation. I Represents the payment of dividends to our joint venture partners by our consolidated entities that are not 100% owned, which are reflected to show the cash operating performance of these entities on Axalta’s financial statements. J Represents expenses, changes in estimates and insurance recoveries for probable liabilities related to an operational matter in the Mobility Coatings segment, which is not indicative of our ongoing operating performance. K Represents non-recurring income related to a law change with respect to certain Brazilian indirect taxes which was recorded within other expense (income), net. L Represents non-recurring income related to the sale of previously closed manufacturing facilities. M Represents expenses related to sanctions imposed on Russia in response to the conflict with Ukraine as a result of incremental reserves for accounts receivable, inventory obsolescence and business incentive payments, inclusive of changes in estimates, which we do not consider indicative of our ongoing operating performance. N Represents a forgiveness of a portion of up-front customer incentives with repayment features upon our customer completing a recapitalization and restructuring of its indebtedness and the execution of a new long-term exclusive sales agreement with us. These amounts are not considered to be indicative of our ongoing operating performance. O Represents costs for certain non-operational or non-cash losses and (gains), unrelated to our core business and which we do not consider indicative of ongoing operations. Adjusted EBITDA Reconciliation (cont'd)

Sensitivity: Business Internal 26 Thank You Investor Relations Contact: Chris Evans Christopher.Evans@axalta.com 484-724-4099