EXHIBIT 99.2

Published on January 30, 2020

Exhibit 99.2 Q4 & FY 2019 Financial Results January 30, 2020

Legal Notices Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to our 2020 financial guidance, which include net sales, net sales excluding FX, Adjusted EBIT, depreciation and amortization, Adjusted EBITDA, interest expense, tax rate, as adjusted, Adjusted diluted EPS, free cash flow, capital expenditures, diluted shares outstanding, impacts from acquisitions and divestitures, FX impacts, pricing actions and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, our previously announced review of strategic alternatives, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2018 and in our Quarterly Report on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019, and September 30, 2019. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX, Adjusted Net Income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, tax rate, as adjusted, and Net Debt. Management uses these non- GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA, Adjusted EBIT and Adjusted diluted EPS consist of EBITDA, EBIT and Diluted EPS, respectively, adjusted for (i) certain non-cash items included within net income, (ii) certain items Axalta does not believe are indicative of ongoing operating performance or (iii) certain nonrecurring, unusual or infrequent items that have not occurred within the last two years or we believe are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Adjusted net income shows the adjusted value of net income attributable to controlling interests after removing the items that are determined by management to be items that we do not consider indicative of our ongoing operating performance unusual or nonrecurring in nature. Our use of the terms net sales excluding FX, Adjusted Net Income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales excluding FX, Adjusted Net Income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA , EBIT, and Adjusted EBIT should not be considered as alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, Adjusted Net Income, Adjusted EPS, EBITDA, Adjusted EBITDA, EBIT, Adjusted EBIT, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, Adjusted diluted EPS, Adjusted EBITDA, Adjusted EBIT, or tax rate, as adjusted, on a forward- looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our GAAP results. Constant Currency Constant currency or ex-FX percentages are calculated by excluding the change in average exchange rates between the current and comparable period by currency denomination exposure of the comparable period amount. Organic Growth Organic growth or ex-M&A percentages are calculated by excluding the impact of recent acquisitions and divestitures. Segment Financial Measures Our primary measure of segment operating performance, as determined in accordance with GAAP, is Adjusted EBIT, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. A reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not required. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. Rounding Due to rounding the tables presented may not foot. PROPRIETARY 2

Q4 & Full Year 2019 Highlights Q4 2019 financial results ▪ Net sales of $1,098 million decreased 5.8%; decreased 2.5% ex-FX and excluding a 2.0% impact from a JV interest sale in Q2 2019 ◦ Performance Coatings: Net sales increased 0.3% ex-FX and before JV sale impact ◦ Transportation Coatings: Net sales decreased 7.7% ex-FX from volume decrease ▪ Income from operations of $109 million versus $128 million in Q4 2018; Adjusted EBIT of $174 million increased 1.6% from Q4 2018 ▪ Diluted EPS of $0.18 versus $0.32 in Q4 2018; Adjusted diluted EPS of $0.42 versus $0.44 in Q4 2018 ▪ Cash flow from operations was $283 million in Q4 2019 compared to $251 million in Q4 2018; free cash flow of $248 million increased 13% from prior year FY 2019 financial results ▪ Net sales of $4,482 million decreased 4.6%; decreased 0.5% ex-currency and excluding a 1.1% impact from a JV interest sale ▪ Income from operations of $488 million versus $442 million in 2018; Adjusted EBIT of $706 million increased 4.7% from 2018 ▪ Diluted EPS of $1.06 versus $0.85 in 2018; Adjusted diluted EPS of $1.80 increased from $1.70 in 2018 ▪ Cash flow from operations was $573 million compared to $496 million in 2018 PROPRIETARY 3

Q4 & Full Year 2019 Highlights (cont'd) Quarterly end-market observations ▪ Refinish: Strong continued price-mix realization, positive volumes in North America ▪ Industrial: Strong price-mix partially offset lower volumes from weaker demand trends globally ▪ Light Vehicle: Continued price/mix recovery; pressure ongoing from global production slowdown and customer strike impact in North America ▪ Commercial Vehicle: Truck production (Class 4-8) down 10% globally in Q4 (per January IHS data), other non-truck vehicle demand also decreased in Q4 Balance sheet & cash flows ▪ Cash flows from operations of $573 million in 2019 versus $496 million in 2018 ▪ Free cash flow of $475 million in 2019 up 31% versus $362 million in 2018 ▪ Net leverage ratio down to 3.0x in Q4 2019 from 3.4x in Q4 2018 ▪ Strong cash flows resulting in cash balance of $1,018 million at year end versus $694 million at December 31, 2018 ▪ $105 million of share repurchases (average price of $25.47) completed in first half of 2019 PROPRIETARY 4

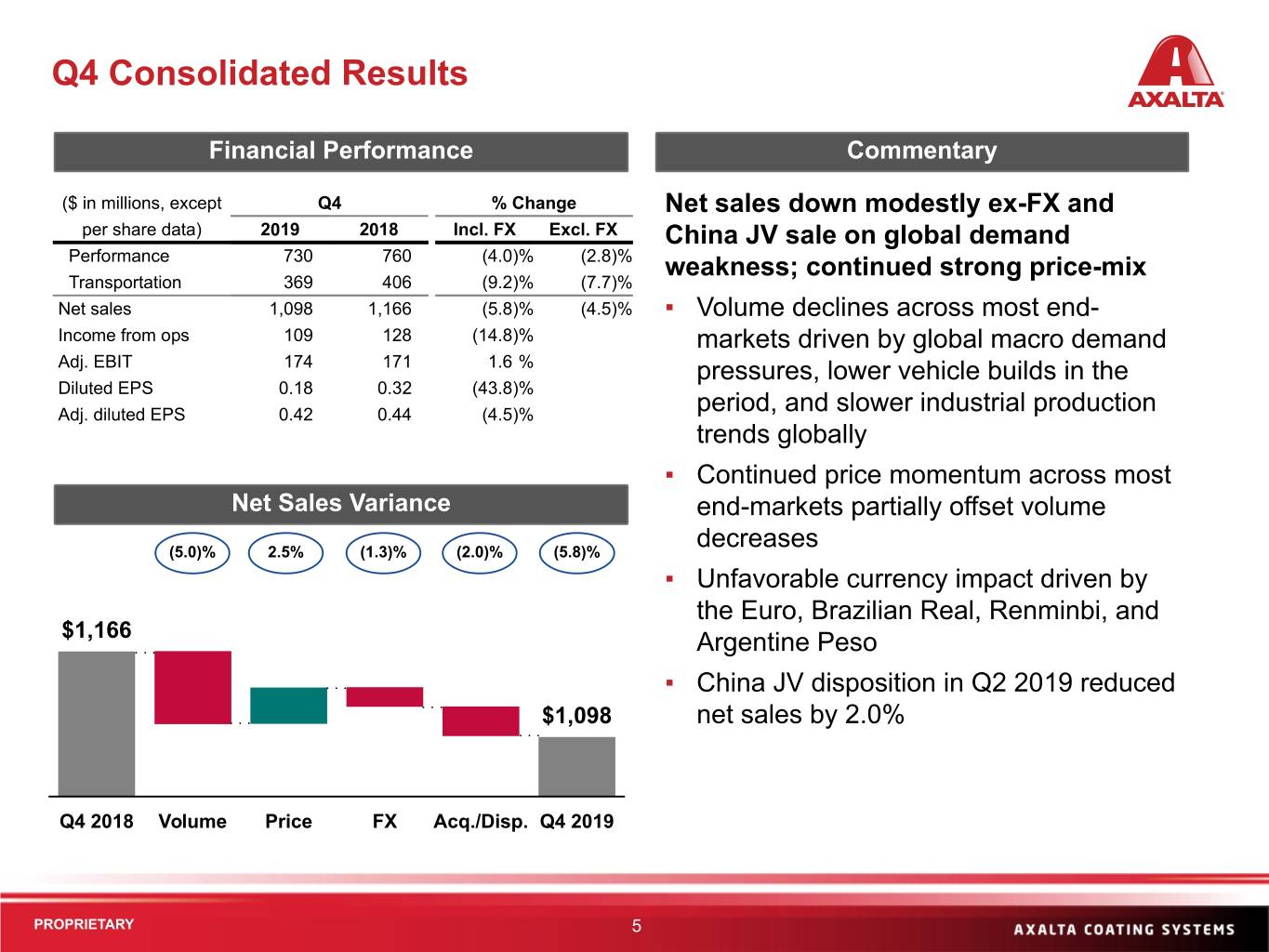

Q4 Consolidated Results Financial Performance Commentary ($ in millions, except Q4 % Change Net sales down modestly ex-FX and per share data) 2019 2018 Incl. FX Excl. FX China JV sale on global demand Performance 730 760 (4.0)% (2.8)% weakness; continued strong price-mix Transportation 369 406 (9.2)% (7.7)% Net sales 1,098 1,166 (5.8)% (4.5)% ▪ Volume declines across most end- Income from ops 109 128 (14.8)% markets driven by global macro demand Adj. EBIT 174 171 1.6 % pressures, lower vehicle builds in the Diluted EPS 0.18 0.32 (43.8)% Adj. diluted EPS 0.42 0.44 (4.5)% period, and slower industrial production trends globally ▪ Continued price momentum across most Net Sales Variance end-markets partially offset volume decreases (5.0)% 2.5% (1.3)% (2.0)% (5.8)% ▪ Unfavorable currency impact driven by the Euro, Brazilian Real, Renminbi, and $1,166 Argentine Peso ▪ China JV disposition in Q2 2019 reduced $1,098 net sales by 2.0% Q4 2018 Volume Price FX Acq./Disp. Q4 2019 PROPRIETARY 5

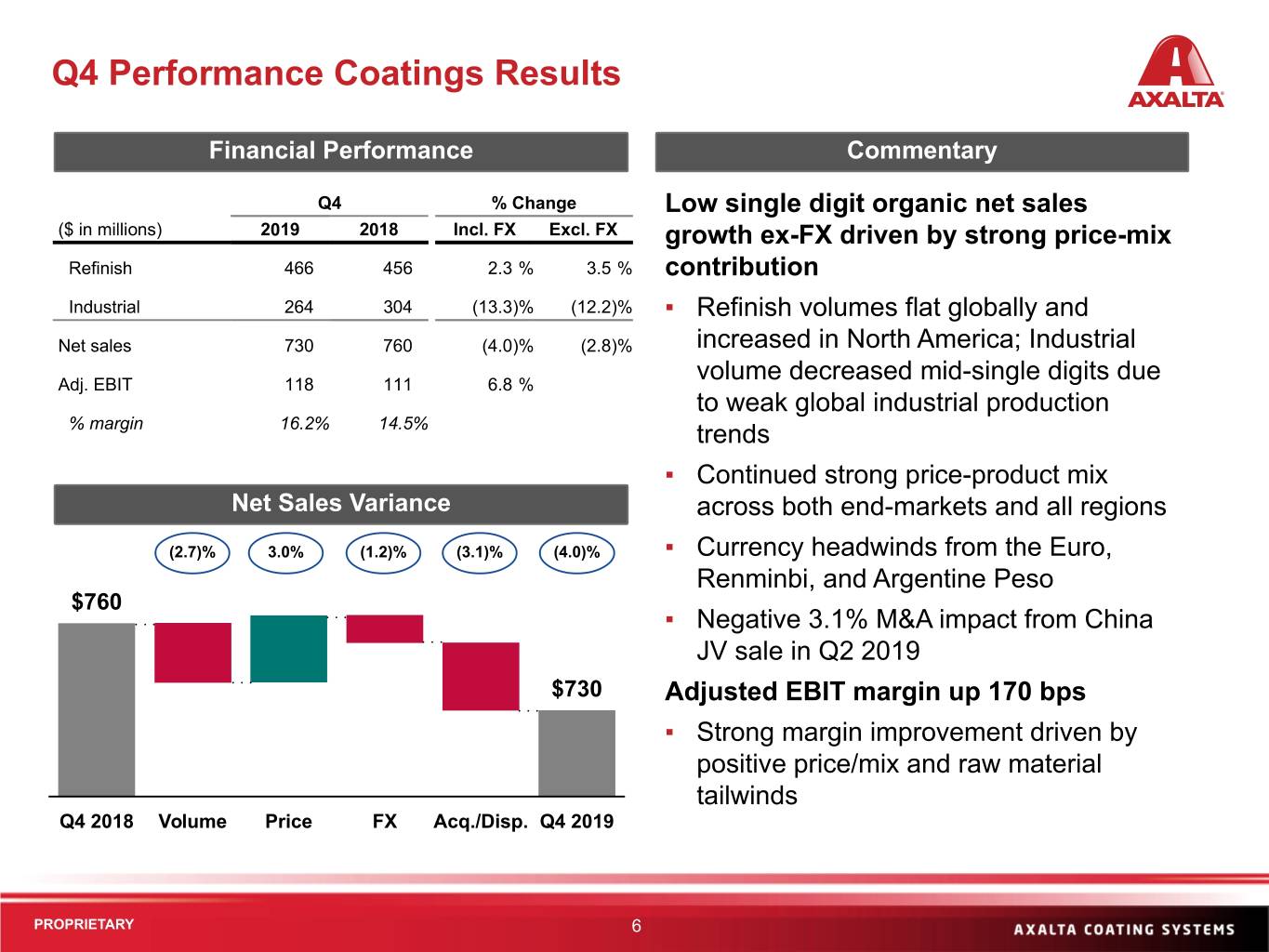

Q4 Performance Coatings Results Financial Performance Commentary Q4 % Change Low single digit organic net sales ($ in millions) 2019 2018 Incl. FX Excl. FX growth ex-FX driven by strong price-mix Refinish 466 456 2.3 % 3.5 % contribution Industrial 264 304 (13.3)% (12.2)% ▪ Refinish volumes flat globally and Net sales 730 760 (4.0)% (2.8)% increased in North America; Industrial volume decreased mid-single digits due Adj. EBIT 118 111 6.8 % to weak global industrial production % margin 16.2% 14.5% trends ▪ Continued strong price-product mix Net Sales Variance across both end-markets and all regions (2.7)% 3.0% (1.2)% (3.1)% (4.0)% ▪ Currency headwinds from the Euro, Renminbi, and Argentine Peso $760 ▪ Negative 3.1% M&A impact from China JV sale in Q2 2019 $730 Adjusted EBIT margin up 170 bps ▪ Strong margin improvement driven by positive price/mix and raw material tailwinds Q4 2018 Volume Price FX Acq./Disp. Q4 2019 PROPRIETARY 6

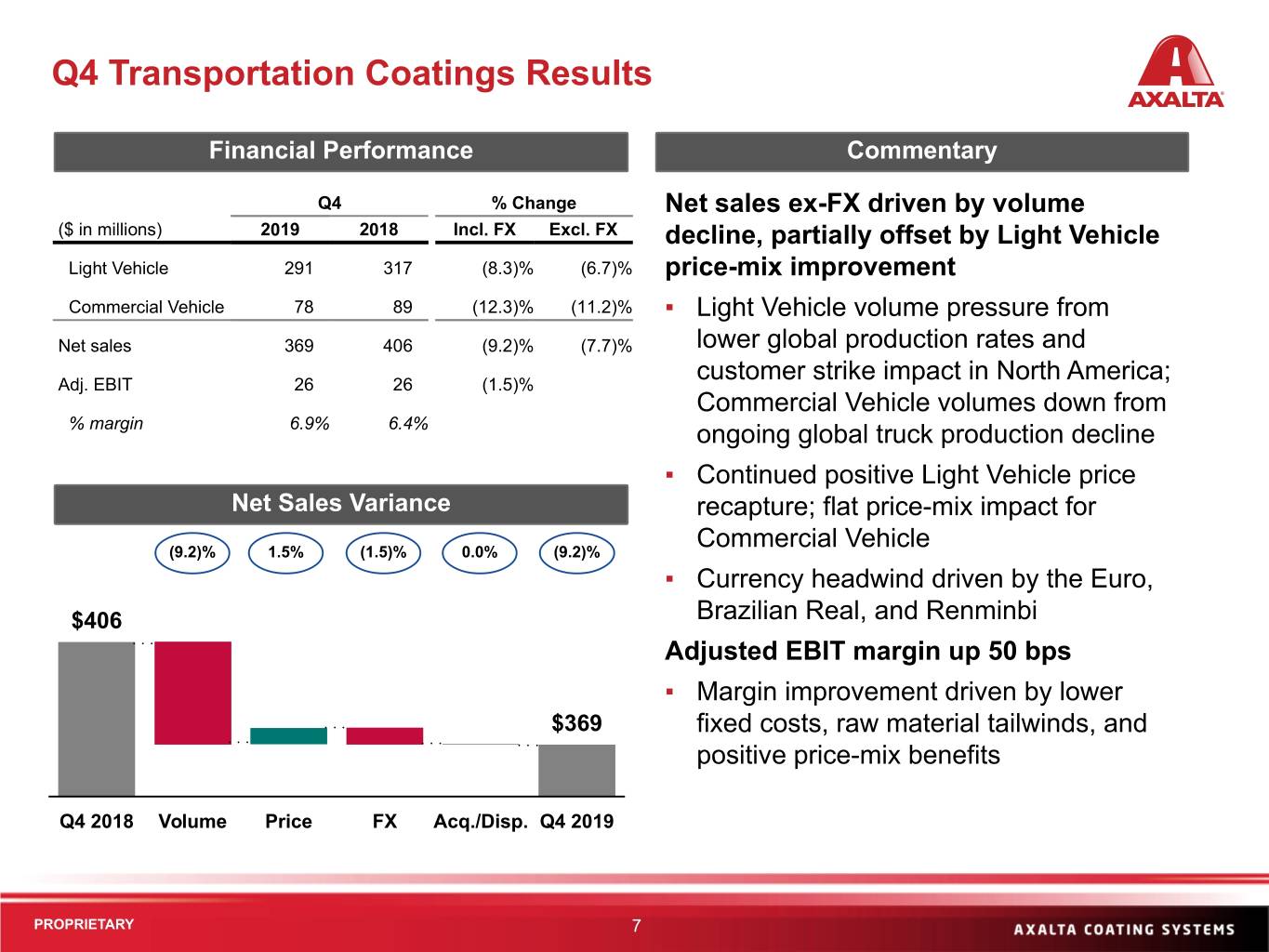

Q4 Transportation Coatings Results Financial Performance Commentary Q4 % Change Net sales ex-FX driven by volume ($ in millions) 2019 2018 Incl. FX Excl. FX decline, partially offset by Light Vehicle Light Vehicle 291 317 (8.3)% (6.7)% price-mix improvement Commercial Vehicle 78 89 (12.3)% (11.2)% ▪ Light Vehicle volume pressure from Net sales 369 406 (9.2)% (7.7)% lower global production rates and customer strike impact in North America; Adj. EBIT 26 26 (1.5)% Commercial Vehicle volumes down from % margin 6.9% 6.4% ongoing global truck production decline ▪ Continued positive Light Vehicle price Net Sales Variance recapture; flat price-mix impact for Commercial Vehicle (9.2)% 1.5% (1.5)% 0.0% (9.2)% ▪ Currency headwind driven by the Euro, $406 Brazilian Real, and Renminbi Adjusted EBIT margin up 50 bps ▪ Margin improvement driven by lower $369 fixed costs, raw material tailwinds, and positive price-mix benefits Q4 2018 Volume Price FX Acq./Disp. Q4 2019 PROPRIETARY 7

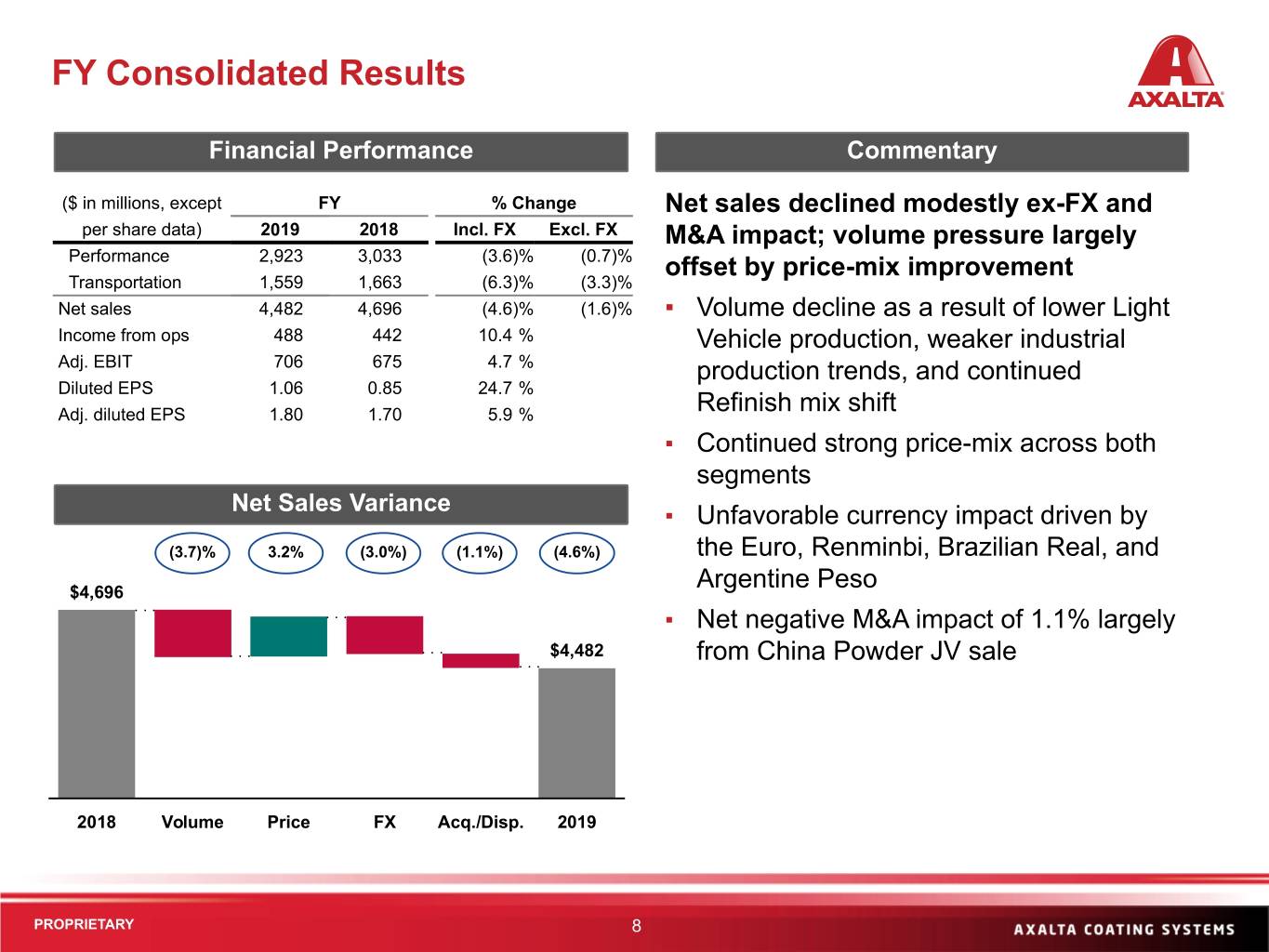

FY Consolidated Results Financial Performance Commentary ($ in millions, except FY % Change Net sales declined modestly ex-FX and per share data) 2019 2018 Incl. FX Excl. FX M&A impact; volume pressure largely Performance 2,923 3,033 (3.6)% (0.7)% offset by price-mix improvement Transportation 1,559 1,663 (6.3)% (3.3)% Net sales 4,482 4,696 (4.6)% (1.6)% ▪ Volume decline as a result of lower Light Income from ops 488 442 10.4 % Vehicle production, weaker industrial Adj. EBIT 706 675 4.7 % production trends, and continued Diluted EPS 1.06 0.85 24.7 % Adj. diluted EPS 1.80 1.70 5.9 % Refinish mix shift ▪ Continued strong price-mix across both segments Net Sales Variance ▪ Unfavorable currency impact driven by (3.7)% 3.2% (3.0%) (1.1%) (4.6%) the Euro, Renminbi, Brazilian Real, and Argentine Peso $4,696 ▪ Net negative M&A impact of 1.1% largely $4,482 from China Powder JV sale 2018 Volume Price FX Acq./Disp. 2019 PROPRIETARY 8

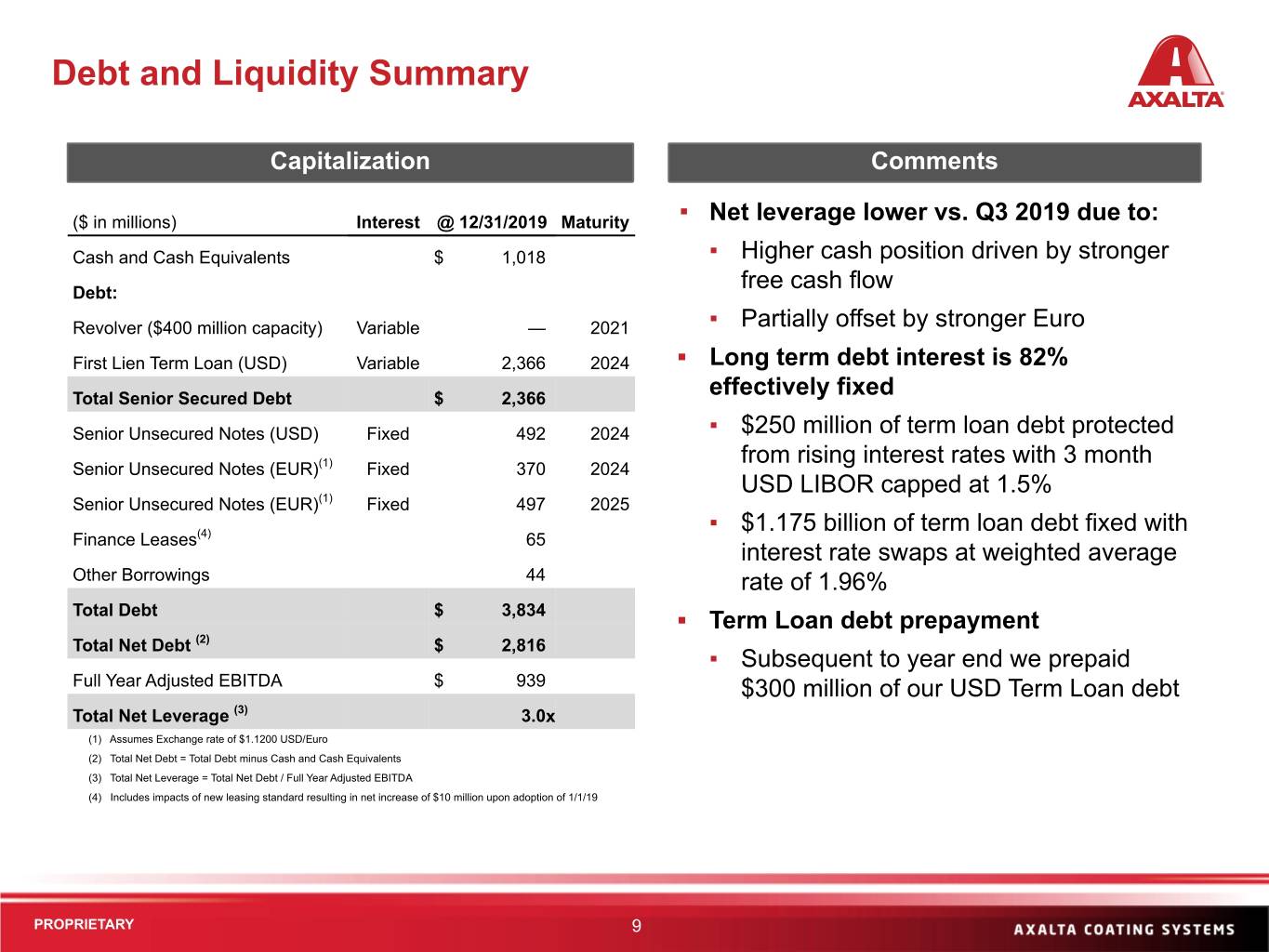

Debt and Liquidity Summary Capitalization Comments ($ in millions) Interest @ 12/31/2019 Maturity ▪ Net leverage lower vs. Q3 2019 due to: Cash and Cash Equivalents $ 1,018 ▪ Higher cash position driven by stronger free cash flow Debt: Revolver ($400 million capacity) Variable — 2021 ▪ Partially offset by stronger Euro First Lien Term Loan (USD) Variable 2,366 2024 ▪ Long term debt interest is 82% Total Senior Secured Debt $ 2,366 effectively fixed Senior Unsecured Notes (USD) Fixed 492 2024 ▪ $250 million of term loan debt protected from rising interest rates with 3 month Senior Unsecured Notes (EUR)(1) Fixed 370 2024 USD LIBOR capped at 1.5% Senior Unsecured Notes (EUR)(1) Fixed 497 2025 ▪ $1.175 billion of term loan debt fixed with Finance Leases(4) 65 interest rate swaps at weighted average Other Borrowings 44 rate of 1.96% Total Debt $ 3,834 ▪ Term Loan debt prepayment Total Net Debt (2) $ 2,816 ▪ Subsequent to year end we prepaid Full Year Adjusted EBITDA $ 939 $300 million of our USD Term Loan debt Total Net Leverage (3) 3.0x (1) Assumes Exchange rate of $1.1200 USD/Euro (2) Total Net Debt = Total Debt minus Cash and Cash Equivalents (3) Total Net Leverage = Total Net Debt / Full Year Adjusted EBITDA (4) Includes impacts of new leasing standard resulting in net increase of $10 million upon adoption of 1/1/19 PROPRIETARY 9

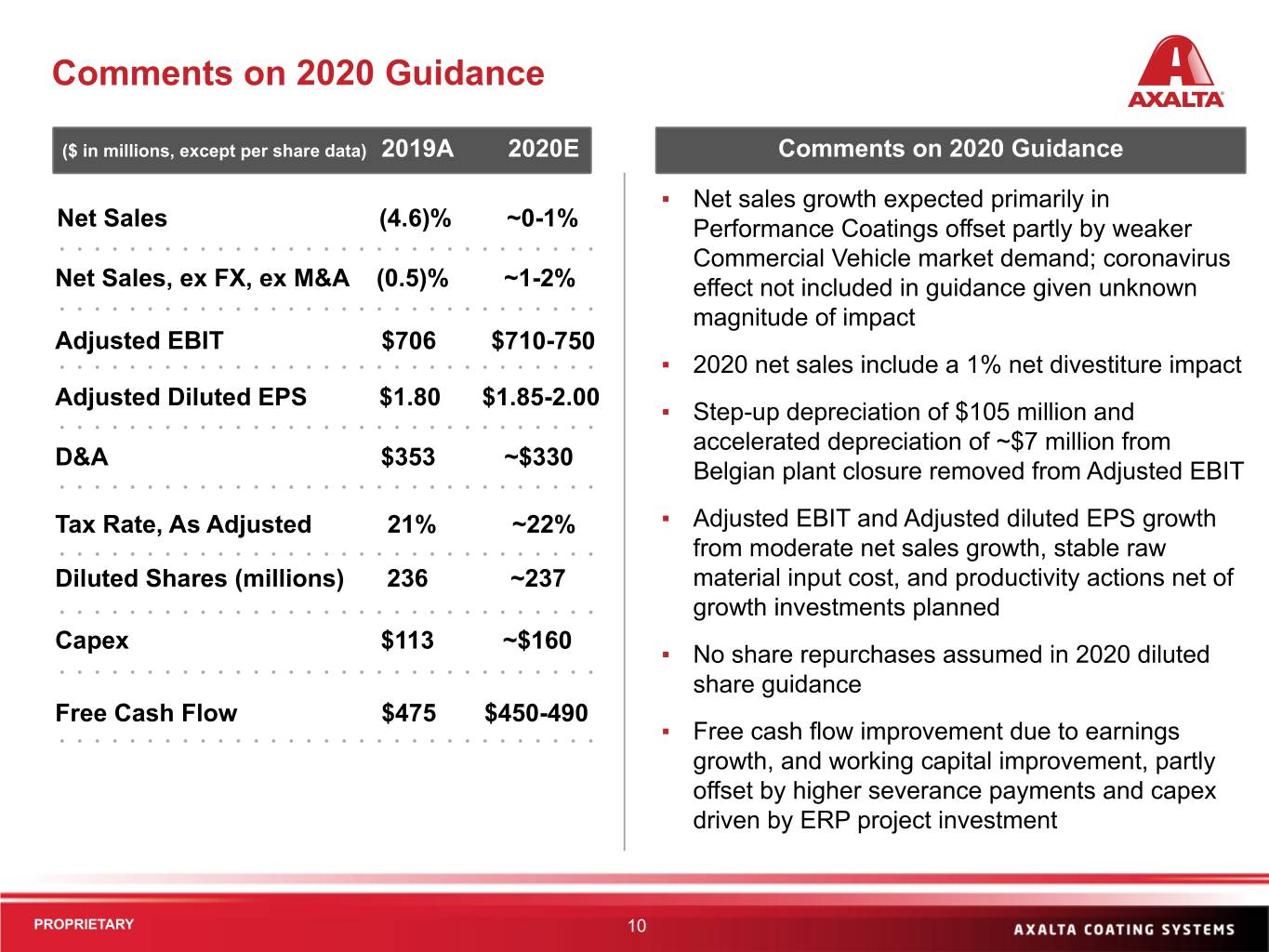

Comments on 2020 Guidance ($ in millions, except per share data) 2019A 2020E Comments on 2020 Guidance ▪ Net sales growth expected primarily in Net Sales (4.6)% ~0-1% Performance Coatings offset partly by weaker Commercial Vehicle market demand; coronavirus Net Sales, ex FX, ex M&A (0.5)% ~1-2% effect not included in guidance given unknown magnitude of impact Adjusted EBIT $706 $710-750 ▪ 2020 net sales include a 1% net divestiture impact Adjusted Diluted EPS $1.80 $1.85-2.00 ▪ Step-up depreciation of $105 million and accelerated depreciation of ~$7 million from D&A $353 ~$330 Belgian plant closure removed from Adjusted EBIT Tax Rate, As Adjusted 21% ~22% ▪ Adjusted EBIT and Adjusted diluted EPS growth from moderate net sales growth, stable raw Diluted Shares (millions) 236 ~237 material input cost, and productivity actions net of growth investments planned Capex $113 ~$160 ▪ No share repurchases assumed in 2020 diluted share guidance Free Cash Flow $475 $450-490 ▪ Free cash flow improvement due to earnings growth, and working capital improvement, partly offset by higher severance payments and capex driven by ERP project investment PROPRIETARY 10

Appendix

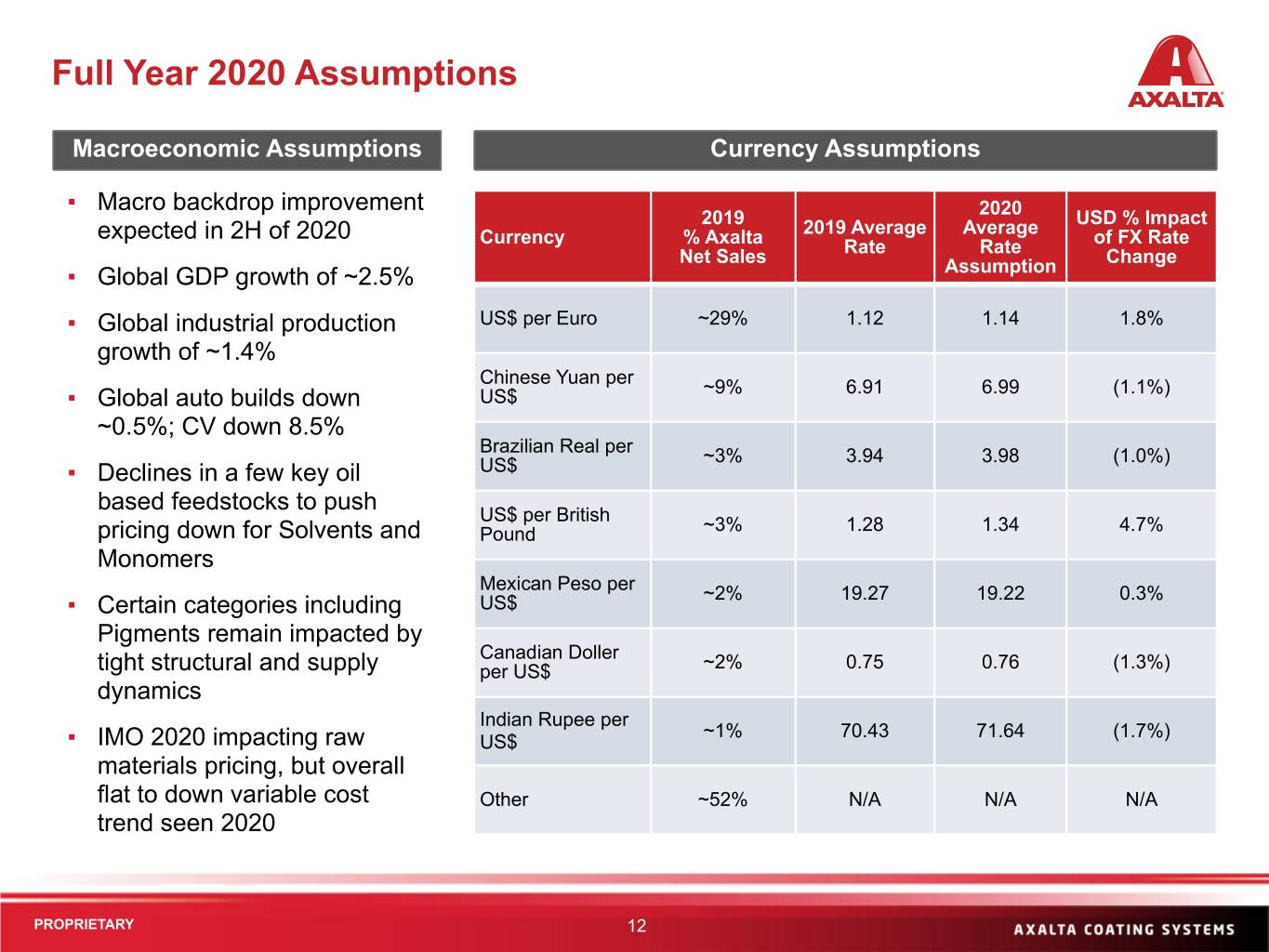

Full Year 2020 Assumptions Macroeconomic Assumptions Currency Assumptions ▪ Macro backdrop improvement 2019 2020 USD % Impact expected in 2H of 2020 Currency % Axalta 2019 Average Average of FX Rate Net Sales Rate Rate Change ▪ Global GDP growth of ~2.5% Assumption ▪ Global industrial production US$ per Euro ~29% 1.12 1.14 1.8% growth of ~1.4% Chinese Yuan per ▪ Global auto builds down US$ ~9% 6.91 6.99 (1.1%) ~0.5%; CV down 8.5% Brazilian Real per ~3% 3.94 3.98 (1.0%) ▪ Declines in a few key oil US$ based feedstocks to push US$ per British pricing down for Solvents and Pound ~3% 1.28 1.34 4.7% Monomers Mexican Peso per ▪ Certain categories including US$ ~2% 19.27 19.22 0.3% Pigments remain impacted by Canadian Doller tight structural and supply per US$ ~2% 0.75 0.76 (1.3%) dynamics Indian Rupee per ~1% 70.43 71.64 (1.7%) ▪ IMO 2020 impacting raw US$ materials pricing, but overall flat to down variable cost Other ~52% N/A N/A N/A trend seen 2020 PROPRIETARY 12

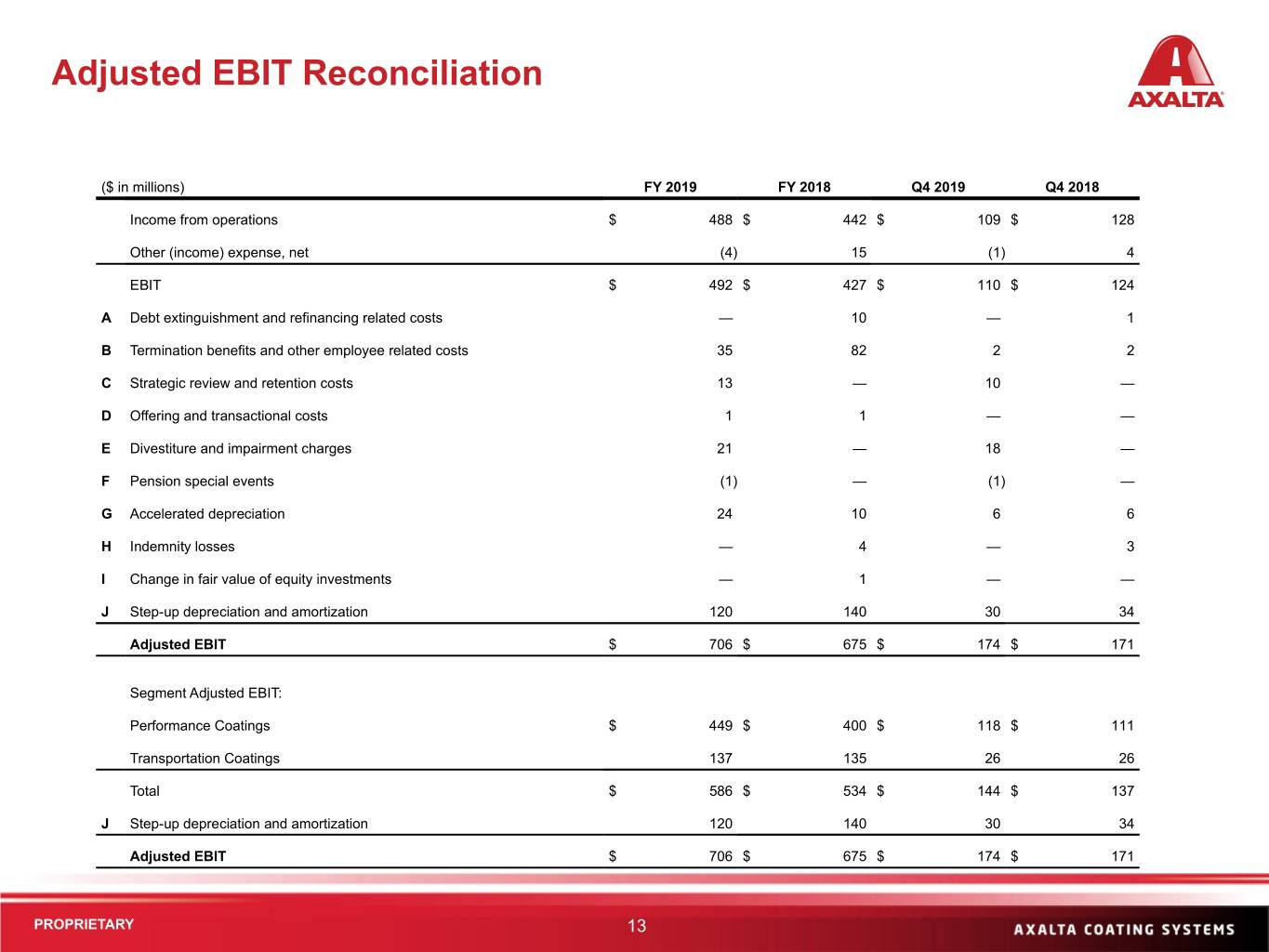

Adjusted EBIT Reconciliation ($ in millions) FY 2019 FY 2018 Q4 2019 Q4 2018 Income from operations $ 488 $ 442 $ 109 $ 128 Other (income) expense, net (4) 15 (1) 4 EBIT $ 492 $ 427 $ 110 $ 124 A Debt extinguishment and refinancing related costs — 10 — 1 B Termination benefits and other employee related costs 35 82 2 2 C Strategic review and retention costs 13 — 10 — D Offering and transactional costs 1 1 — — E Divestiture and impairment charges 21 — 18 — F Pension special events (1) — (1) — G Accelerated depreciation 24 10 6 6 H Indemnity losses — 4 — 3 I Change in fair value of equity investments — 1 — — J Step-up depreciation and amortization 120 140 30 34 Adjusted EBIT $ 706 $ 675 $ 174 $ 171 Segment Adjusted EBIT: Performance Coatings $ 449 $ 400 $ 118 $ 111 Transportation Coatings 137 135 26 26 Total $ 586 $ 534 $ 144 $ 137 J Step-up depreciation and amortization 120 140 30 34 Adjusted EBIT $ 706 $ 675 $ 174 $ 171 PROPRIETARY 13

Adjusted EBIT Reconciliation (cont’d) A Represents expenses related to the restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our previously announced comprehensive review of strategic alternatives, as well as retention awards for certain employees. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. E Represents the loss recognized on the sale of our interest in a joint venture business and the charges resulting from the abandonment of certain in progress capital projects which are not considered indicative of our ongoing operating performance. F Represents certain defined benefit pension costs associated with special events, including pension curtailments, settlements and special termination benefits, which we do not consider indicative of our ongoing operating performance. G Represents incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments, which we do not consider indicative of our ongoing operating performance. H Represents indemnity (income) losses associated with the acquisition by Axalta of the DuPont Performance Coatings business, which we do not consider indicative of our ongoing operating performance. I Represents mark to market impacts of our equity investments, which we do not consider to be indicative of our ongoing operating performance. J Represents the incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. PROPRIETARY 14

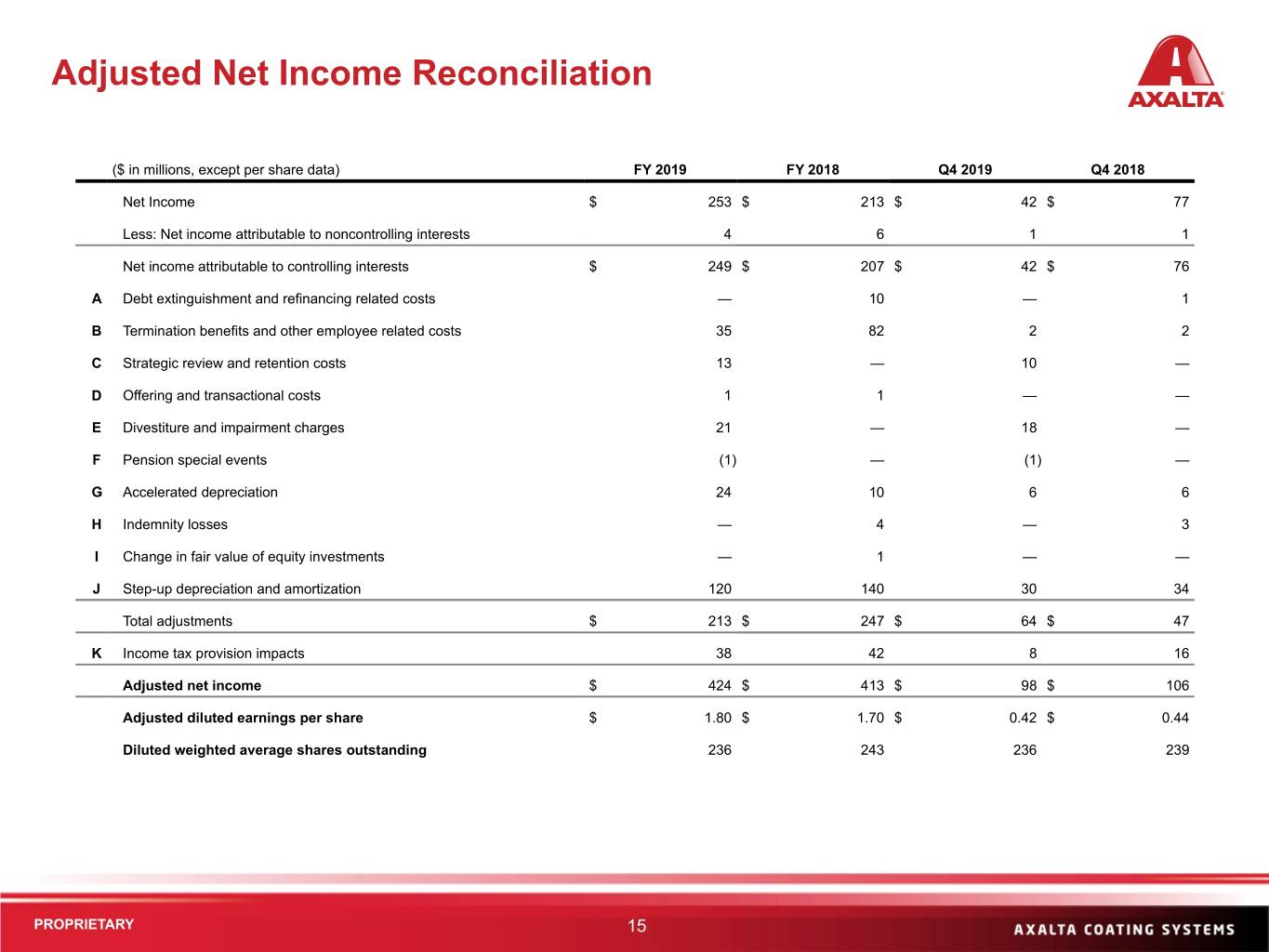

Adjusted Net Income Reconciliation ($ in millions, except per share data) FY 2019 FY 2018 Q4 2019 Q4 2018 Net Income $ 253 $ 213 $ 42 $ 77 Less: Net income attributable to noncontrolling interests 4 6 1 1 Net income attributable to controlling interests $ 249 $ 207 $ 42 $ 76 A Debt extinguishment and refinancing related costs — 10 — 1 B Termination benefits and other employee related costs 35 82 2 2 C Strategic review and retention costs 13 — 10 — D Offering and transactional costs 1 1 — — E Divestiture and impairment charges 21 — 18 — F Pension special events (1) — (1) — G Accelerated depreciation 24 10 6 6 H Indemnity losses — 4 — 3 I Change in fair value of equity investments — 1 — — J Step-up depreciation and amortization 120 140 30 34 Total adjustments $ 213 $ 247 $ 64 $ 47 K Income tax provision impacts 38 42 8 16 Adjusted net income $ 424 $ 413 $ 98 $ 106 Adjusted diluted earnings per share $ 1.80 $ 1.70 $ 0.42 $ 0.44 Diluted weighted average shares outstanding 236 243 236 239 PROPRIETARY 15

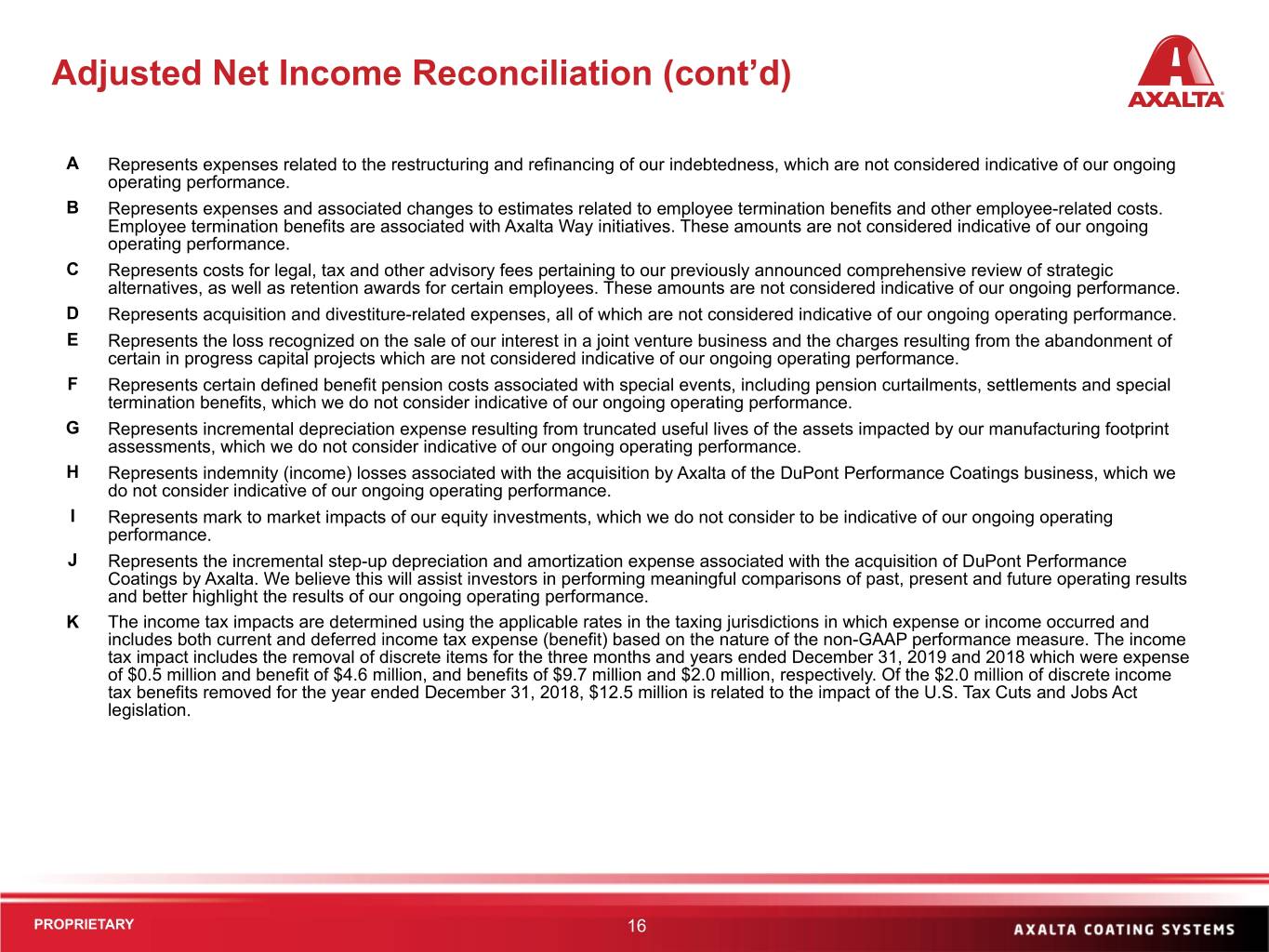

Adjusted Net Income Reconciliation (cont’d) A Represents expenses related to the restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our previously announced comprehensive review of strategic alternatives, as well as retention awards for certain employees. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. E Represents the loss recognized on the sale of our interest in a joint venture business and the charges resulting from the abandonment of certain in progress capital projects which are not considered indicative of our ongoing operating performance. F Represents certain defined benefit pension costs associated with special events, including pension curtailments, settlements and special termination benefits, which we do not consider indicative of our ongoing operating performance. G Represents incremental depreciation expense resulting from truncated useful lives of the assets impacted by our manufacturing footprint assessments, which we do not consider indicative of our ongoing operating performance. H Represents indemnity (income) losses associated with the acquisition by Axalta of the DuPont Performance Coatings business, which we do not consider indicative of our ongoing operating performance. I Represents mark to market impacts of our equity investments, which we do not consider to be indicative of our ongoing operating performance. J Represents the incremental step-up depreciation and amortization expense associated with the acquisition of DuPont Performance Coatings by Axalta. We believe this will assist investors in performing meaningful comparisons of past, present and future operating results and better highlight the results of our ongoing operating performance. K The income tax impacts are determined using the applicable rates in the taxing jurisdictions in which expense or income occurred and includes both current and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure. The income tax impact includes the removal of discrete items for the three months and years ended December 31, 2019 and 2018 which were expense of $0.5 million and benefit of $4.6 million, and benefits of $9.7 million and $2.0 million, respectively. Of the $2.0 million of discrete income tax benefits removed for the year ended December 31, 2018, $12.5 million is related to the impact of the U.S. Tax Cuts and Jobs Act legislation. PROPRIETARY 16

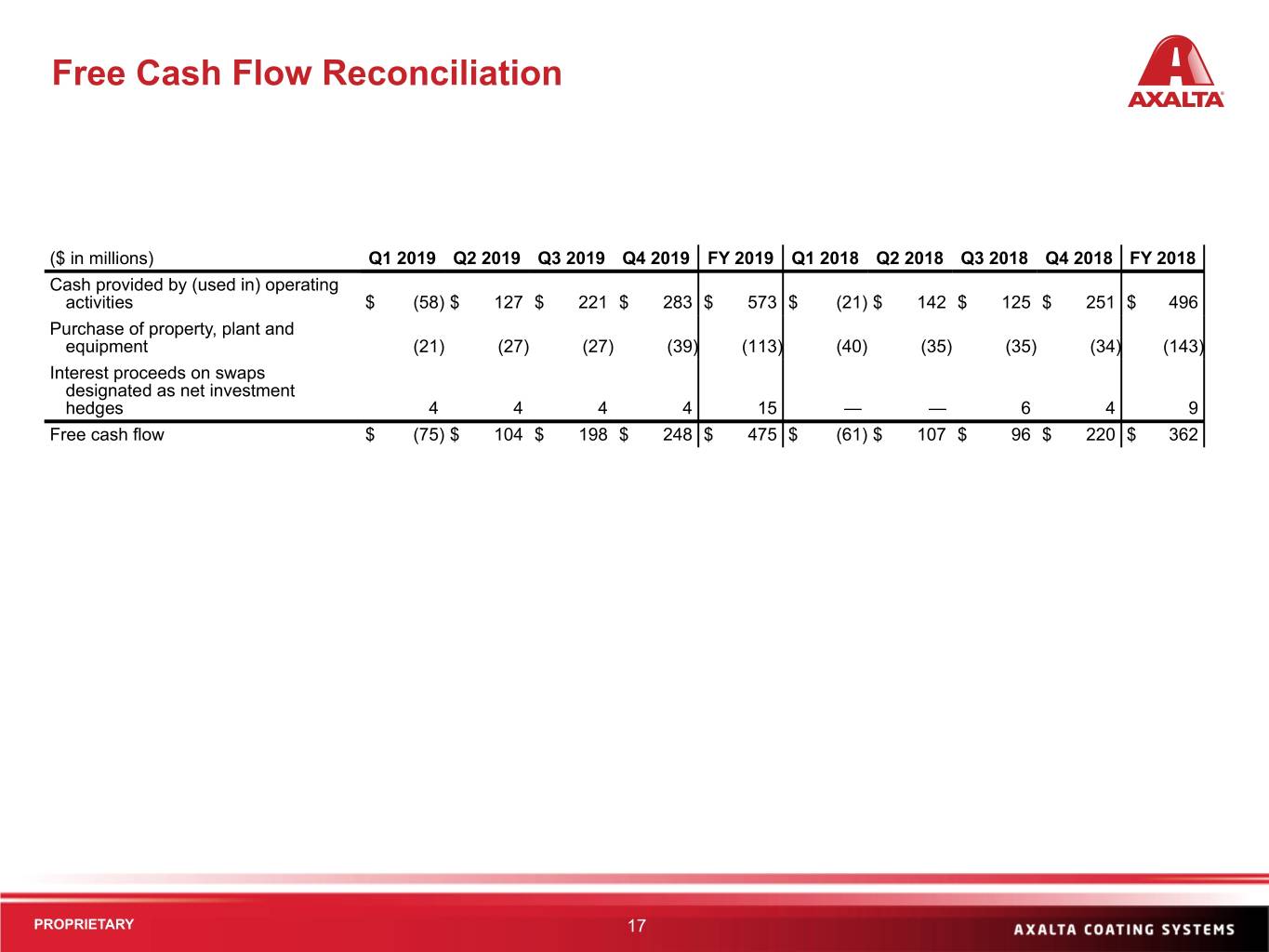

Free Cash Flow Reconciliation ($ in millions) Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Cash provided by (used in) operating activities $ (58) $ 127 $ 221 $ 283 $ 573 $ (21) $ 142 $ 125 $ 251 $ 496 Purchase of property, plant and equipment (21) (27) (27) (39) (113) (40) (35) (35) (34) (143) Interest proceeds on swaps designated as net investment hedges 4 4 4 4 15 — — 6 4 9 Free cash flow $ (75) $ 104 $ 198 $ 248 $ 475 $ (61) $ 107 $ 96 $ 220 $ 362 PROPRIETARY 17

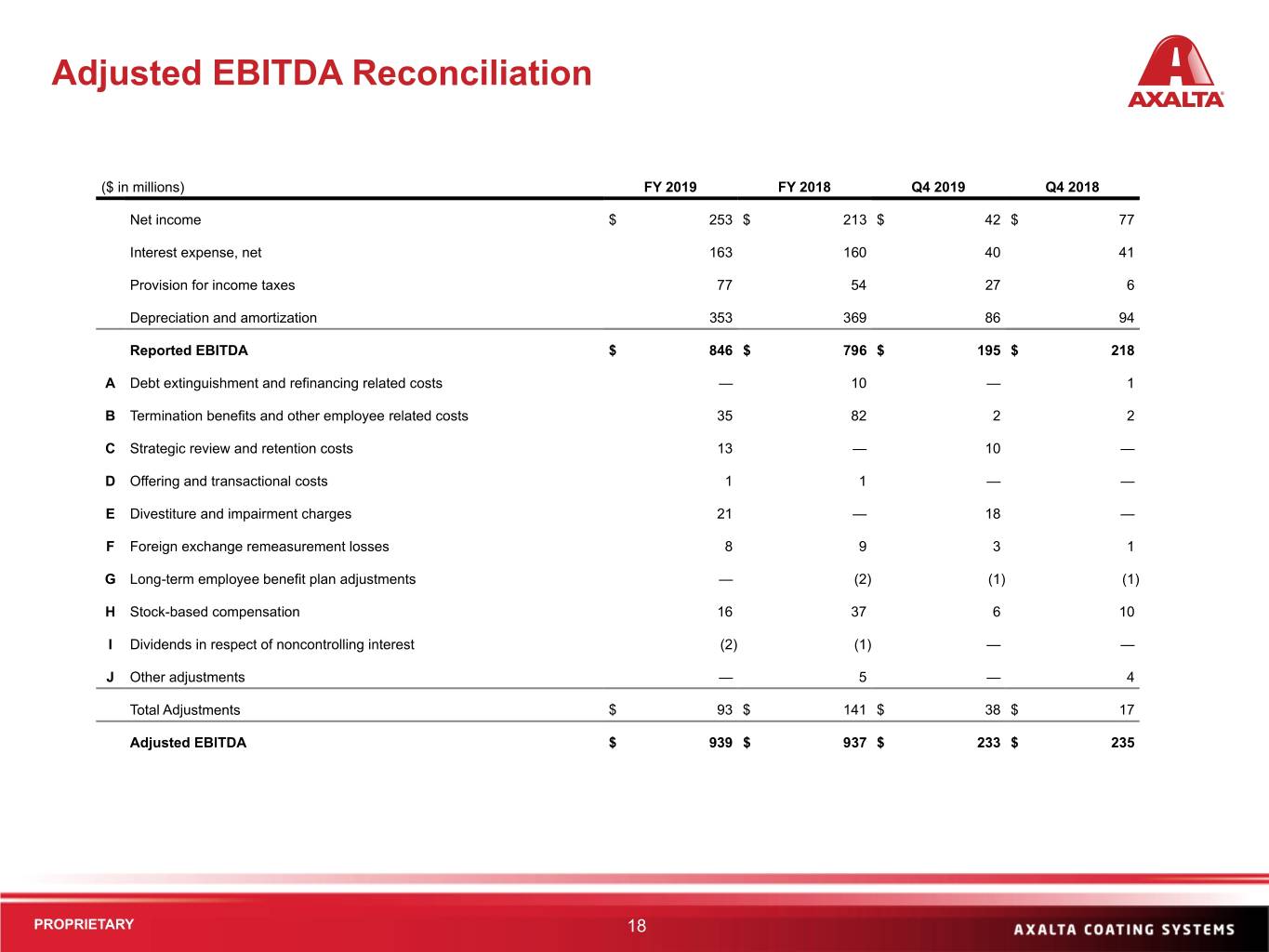

Adjusted EBITDA Reconciliation ($ in millions) FY 2019 FY 2018 Q4 2019 Q4 2018 Net income $ 253 $ 213 $ 42 $ 77 Interest expense, net 163 160 40 41 Provision for income taxes 77 54 27 6 Depreciation and amortization 353 369 86 94 Reported EBITDA $ 846 $ 796 $ 195 $ 218 A Debt extinguishment and refinancing related costs — 10 — 1 B Termination benefits and other employee related costs 35 82 2 2 C Strategic review and retention costs 13 — 10 — D Offering and transactional costs 1 1 — — E Divestiture and impairment charges 21 — 18 — F Foreign exchange remeasurement losses 8 9 3 1 G Long-term employee benefit plan adjustments — (2) (1) (1) H Stock-based compensation 16 37 6 10 I Dividends in respect of noncontrolling interest (2) (1) — — J Other adjustments — 5 — 4 Total Adjustments $ 93 $ 141 $ 38 $ 17 Adjusted EBITDA $ 939 $ 937 $ 233 $ 235 PROPRIETARY 18

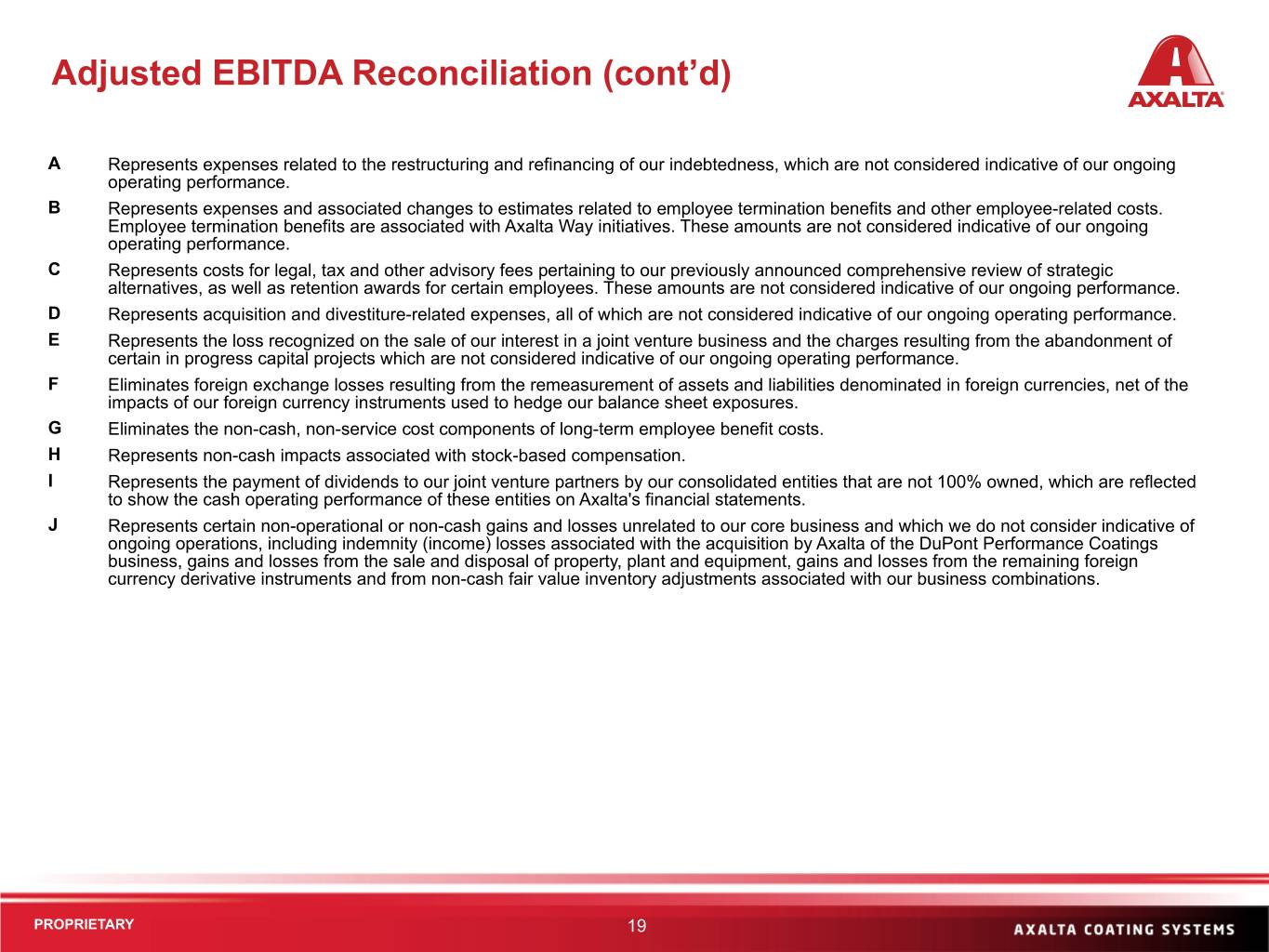

Adjusted EBITDA Reconciliation (cont’d) A Represents expenses related to the restructuring and refinancing of our indebtedness, which are not considered indicative of our ongoing operating performance. B Represents expenses and associated changes to estimates related to employee termination benefits and other employee-related costs. Employee termination benefits are associated with Axalta Way initiatives. These amounts are not considered indicative of our ongoing operating performance. C Represents costs for legal, tax and other advisory fees pertaining to our previously announced comprehensive review of strategic alternatives, as well as retention awards for certain employees. These amounts are not considered indicative of our ongoing performance. D Represents acquisition and divestiture-related expenses, all of which are not considered indicative of our ongoing operating performance. E Represents the loss recognized on the sale of our interest in a joint venture business and the charges resulting from the abandonment of certain in progress capital projects which are not considered indicative of our ongoing operating performance. F Eliminates foreign exchange losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of the impacts of our foreign currency instruments used to hedge our balance sheet exposures. G Eliminates the non-cash, non-service cost components of long-term employee benefit costs. H Represents non-cash impacts associated with stock-based compensation. I Represents the payment of dividends to our joint venture partners by our consolidated entities that are not 100% owned, which are reflected to show the cash operating performance of these entities on Axalta's financial statements. J Represents certain non-operational or non-cash gains and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including indemnity (income) losses associated with the acquisition by Axalta of the DuPont Performance Coatings business, gains and losses from the sale and disposal of property, plant and equipment, gains and losses from the remaining foreign currency derivative instruments and from non-cash fair value inventory adjustments associated with our business combinations. PROPRIETARY 19

Thank you Investor Relations Contact: Chris Mecray Christopher.Mecray@axalta.com 215-255-7970